Abstract

External debt correlation and the sustainable economic development pathway within the South Asian sub-region is analysed in this research paper. The longitudinal root-analysis, the pooled ordinary least square, quantile estimation, and output estimation were utilized to evaluate the data obtained from the World Bank Development Indicators for the period of 2000–2018. We discovered that total external debt and external debt services affect 39% plus 31%, respectively, after the robust regression analysis was carried out. Besides that, the findings demonstrate direct expansionary impacts of fiscal policy crosswise in developing economies within the study timeframe. Remarkably, the advancements in state establishments encourage the “gathering impact” of fiscal policy implementation. The findings depict that the entire circumstances set a stiffer restraint on public expenditure, indicating a self-losing fiscal austerity situation which entails the impact of the company’s liabilities. Inversely, the unrestrained countercyclical policy bars the knock-on impact of external problems, resulting in an improved economic system activity performance as well as decreasing the probability of economic predicaments after COVID-19.

Similar content being viewed by others

1 Introduction

Fiscal policy explains a situation where governments utilize expenditure alongside taxation measures to determine how the economy is functioning. A government would ordinarily utilize fiscal policy to ensure a robust and sustainable economic system and cut down the incidence of poverty (Munir et al. 2019). The application of fiscal policy to achieve desired macroeconomic objectives have gained traction throughout the decades alongside the present economic downturn, as economies have intervened with policies to reignite growth with stimulus packages to ameliorate adverse effects of economic downturn among the vulnerable in society. Following a conference in London in April 2009, the G20 leadership from developing and industrial economies issued a statement to tell the world that they are embarking on an unprecedented and joint fiscal expansionary measure. The essence of this communication was that they see fiscal policy as an instrument that becomes the panacea of emerging out of economic predicaments. They see fiscal policy tools as a way to turbocharge the global economy. Furthermore, the precise fiscal reaction rests with the fiscal spending ability where governments can expend extra or reduce taxation. An example is the ability of the government to obtain extra funding at a reasonable cost or rely on special drawing rights (SDR) from Bretton Wood institutions, where emerging countries can access funding at no cost. Similarly, governments could react to economic predicaments via a stimulus that is unleashed by the pandemic due to extra spending or borrowing that may spike inflationary pressures, affect foreign exchange reserves, as well as crowd out the private sector through over spending, which eventually hinders the rapid economic uptake (Abdullah et al. 2019; Terzi and Anis 2018). Lending institutions equally have become sceptical about the government’s role in spending within their budgets, reversing stimulus plans once instituted, and in managing long-run structural imbalances resulting from feeble government financial position. This is due to reduced taxation due to poor tax composition, tax avoidance and evasion, poor oversight authority concerning public finance, increased public healthcare expenditure, or the growing population. Regarding different economies, they deemed it fit to reduce expenditure as a result of plunges in revenues levels. Thus, for nations that are associated with high-level inflation or external current account imbalances, fiscal stimulus may not be workable or advisable to be instituted.

The crises of Coronavirus (COVID-19) pandemic produce opportunities to rethink and rebuild our economic systems for speedy recovery after COVID-19. Therefore, governments must focus on ensuring debt sustainability (after COVID-19) and make it their primary objective. Fiscal debt and government debt ratio have grown substantially in many nations due to the effects of the economic crisis on the gross domestic product and tax revenues earnings plus the cost of fiscal reactions to economic predicaments, especially after COVID-19. Financial aid (during COVID-19) together with assurances to the financial and manufacturing segments of the economies have worsened the financial positions of governments (Terzi and Anis 2018). Several nations have the wherewithal to undertake reasonable fiscal imbalances for a long time by excluding domestic as well as international financial markets after COVID-19. Also, bilateral partners are assured in satisfying their current commitments and those of years to come (Sadiq et al. 2021b; Salma et al. 2016; Tsunga et al. 2020). Fiscal deficits that expand beyond the ability to be managed have dented the confidence that managers have on the economy. Taking cognizance of the current economic predicaments, the International Monetary Fund (IMF) in the later part of 2008 and the beginning of 2009 has urged governments to instate a four tiered approach on the fiscal policy plan of actions to ensure they are credit worthy. Stimulus packages ought not to have a long lasting impact on deficits, and medium-term models ought to entail the obligation to fiscal correcting when circumstances progress; thus structural changes ought to be recognized and executed to improve development. Additionally, nations that grapple with medium-term to long-term demographic challenges ought to resolve and set plans to deliver a sound public healthcare system and pension reforms to cater to the needs of the growing workforce (Al-Masaeed and Tsaregorodtsev 2018). As the economic impacts of the pandemic are gradually fading away, fiscal problems still persist, especially in developed economies in South Asia, which highlights the important of this approach (Mahmood and Sial 2011).

Also, external borrowing is bad for an economy only when it could produce greater economic benefits relative to the cost of borrowing, even if it happens in a life cycle and is not applied appropriately and judiciously (Mohsin et al. 2019, 2020a, 2021). Generally speaking, external borrowing has the potential to enhance capacity as well as productivity expansion, thus making the debt creative and plausible (Farooq and Yasmin 2017). Inversely, the debt could cause fiscal disequilibrium and extra foreign borrowing that might cause the nation to be exposed to various economic headwinds. Debts have reduced the efficacy of fiscal policies and constrains the ability of monetary regulators to increase interest rates for monetary reasons, since its impacts budget shortfalls and the debt level (Shihab 2014). Even though the likelihood of great government debts impacting productivity increment seem challenging for policy formulators within the viewpoint of the public, scientific analysis that tackles the debt-growth connection within the scenario of Bangladesh is woefully inadequate. Our analysis evaluates the challenges of the dynamic correlation amongst growth and external debts (Surugiu et al. 2012). This is considering the fact that Bangladesh has a minimal debt to gross domestic product rate, plus a reduced per head external debt within the South Asia subregion. Thus, it would be revealing to delve into the debt-gross domestic product nexus as well as ascertain how MEP influences this connection within the circumstances of Asia during the period of 1980 to 2017 (Nawaz and Idrees Khawaja 2019).

The impact of the fiscal policy on economic expansion is underpinned by several parameters in the form of employment within the economy, the openness of the government, and the composition of government spending. Within empirical research that relates to causal factors’ fiscal policy potency, a number of research have taken into account the performance of institutional models, namely corruption that prevails in a country, market economy, and democracy. In the interim, the problem of external debts on the sustainability of fiscal policy are equally worrying. As a case in point, Amato and Tronzano (2000) discovered that debt maturity and the proportion of foreign dominated debt are important contributing factors of the steadiness of exchange rates in Italy. Also, (Nursini 2017) discovered that the Indian economic development is influenced by the central government’s debt, total factory output expansion, as well as the debt-services within the short term (Mohsin et al. 2021).

In reference to the absolute advantage theory, resources are sent to more efficient factors of production, resulting in a well-organized resource distribution. In addition, trade improves enterprises’ innovation capacity so that a high level of generating forms grow tier exports as well as the domestic market, which spurs economic activity. Experimentally, research contends with the analysis which indicates that trade openness directly influences economic expansion (Nurfatriani et al. 2015). Global trade openness is said to be a conduit via which foreign indirect investment, capital key-ins, and goods plus services move into the recipient nations or territory. On the other hand, classical development and balanced growth theories have debated that global trade deprives emerging countries of wealth whilst giving more wealth to the advanced world. Likewise, scholars have asserted that persistent reliance on the export of raw materials in unpredictable world markets with commodity price volatility are inclined to vary incomes from exports of manufacturing goods significantly (Igwe et al. 2015).

The contribution of this research lies in the following ways. This research seeks to fill the void of the paucity of frameworks that deal with the external debts and how global efforts are instituted to bounce back from the pandemic, especially in emerging economies like Pakistan, Sri Lanka, Nepal, Afghanistan and Nepal. This influences the kindness of countries that donate goods, where it impacts the borrowing nations alongside appropriate debt control procedures at a macroeconomic stage.

2 Literature review

2.1 Fiscal policy and economic growth

A current research by Pham and Pham (2019) found that external debt borrowing gives a negative effect on the expansion in dual settings at one and zero. Yet, nonetheless, public debt has greater impacts on the economic system expansion plus development. Hence, they draw the conclusion that a curvature correlation exists amongst economic growth and borrowing parameters. Nevertheless, there is not enough research that examines this aspect in terms of the effectiveness of fiscal policy coupled with the role of institutions and external debts in an all-encompassing manner. Hence, this research is done by drawing heavily on the study of Alm and Rogers (2011) to examine the potency of fiscal policy on the economic system activity growth within the correlation alongside variations in institutions as well as problems of external debt within the setting of developing economies.

Also, fiscal policy is considered an expanse literature, whereas long-term sustainable development and economic growth impact are noticed within the effectiveness of fiscal policy. Concerning scholarly works on the effectiveness of fiscal policy, the natural instinct is to fall on the Keynesian theory. Again, within the Keynesian equation, the sticky price together with the excess capacity presume that prices and wages react gradually to changes in supply and demand, thus creating shortages and surplus (Tiep et al. 2021). Thus the effectiveness of fiscal policy is contrary to classical economists, where the cumulative demand influences demand and public spending and attains a multiplier impact on demand and supply (Falade and Folorunso 2015). This viewpoint is equally called the crowding-impact of fiscal policy, where the government ought to do more spending during economic depression to put money into the hands of the citizens due to scarcity of private spending and consumption (Yang et al. 2021; He et al. 2020; Mohsin et al. 2020b). Nonetheless, certain expansions of the Keynesian equation create room for the crowding out impacts of fiscal policy, which implies that the increases in public spending take out the private sector demand. This then adversely impacts productivity via the variations in interest rate regarding open economies (Hlongwane et al. 2018). Alongside the presumptions that self-investment is adversely influenced by the spike of interest rate, the growth fiscal policy supports borrowing results in the reduced private investment as result of an increased interest rate (Makohon and Adamenko 2020). Also, the neo-classical school of thought is centred on the ascertaining of goods, productivity, as well as earnings supplies in markets via the distribution and demand fronts, by coupling the presumption of utility maximizing of earnings-restrained persons plus enterprises within the broader parameters in generation as well as information accessibility where neo-classical economics increase the plausible anticipations in Keynesian economics. This brings to the fore the modification in economic factors that has occurred increasingly as fiscal policy is relevant neither in the long term nor the short term. Thus, the long-lasting fiscal variations could cause crowding out impacts due to the private sector’s anticipation of consistent variations in interest rates as well as exchange rates on this scenario (Alemzero et al. 2020a, b; Sun et al. 2020).

Despite numerous research on scientific studies concerning the effectiveness of fiscal policy, not much has been researched regarding the short-term impacts in emerging nations as a result of data inaccessibility, and the structural or institutional parameters in the last hundred years (Nursini 2017). For example, Safdari et al. (2011) found that the Ricardian equivalence is not backed in emerging nations as a result of liquidity challenges. Ebimobowei (2010) goes the extra mile by applying the Mundell–Fleming equation alongside logical anticipations plus employment in full capacity in thirty-one nations, in addition to growing public spending which tightens short- and medium-term impacts. In the past, Khan and Knight (1981) detected a direct nominal earnings elasticity of public spending plus taxes as well as near to one in twenty-nine nations. Also, different empirical research by Easterly and Schmidt-Hebbel (1991) proved that fiscal policy attains crowding-out impacts on private financing via proofs that interest rates movements have on emerging nations. In the interim, experimental research equally backs the existence of the presence of the Ricardian equivalence in emerging countries, according to Scott (2019). Nonetheless, the economic progress in developing nations which is a novel explanation of their economic advancement increases their significance in the global economy. Furthermore, the issue of data availability has reemphasised the thought-provoking evaluation concerning the effectiveness of fiscal policy to include extra approaches as well as circumstances into the model within this category. For instance, Raihan and Anjum (2020) posit that developing nation markets ordinarily show a pro-cyclical fiscal policy, where public spending increases in economic growth and taxes increased in periods of economic difficulties. This prevailing condition falls in line alongside the features of counter-cyclic default perils within the business cycle. It is equally observed that partial markets as well as sovereign defaults risk premium attainment of vital functions in elucidating the pro-cyclicality of government spending plus tax rates within these economies. For this reason, the presumptions of the Ricardian view did not oppose the Keynesian or neoclassical view of fiscal policy and that the reaction either in the way of Richardia or Keynesian is partially determined by the correlation of external ratio of the government. Hence, the importance and the potency of fiscal policy are hotly debated in scholarly works and in pragmatism. Presently, Tomljanovich (2004) observes that recent development within macroeconomics seem to relegate to the background the importance of fiscal policy to monetary policy because it is not effective in achieving set goals. In combing different strands of research and upon further deliberation regarding present happenings within the body of fiscal policy, some scholars believe that fiscal policy has an important role via its redistribution and allocation functions, thus affecting the effectiveness of fiscal policy and the stabilization impact. Nonetheless, researchers as well as regulators ponder over the presumptions of economic theories of fiscal policy effectiveness as Ricardian and Keynesian economists, liquidity restraints, and the endogenization of labour distribution as well as capital aggregation are present. More so, different characteristics of the economy ought to take into account future studies concerning the potency of fiscal policy vis-à-vis institutional models plus the burden of debts (Onifade et al. 2020).

Murshed (2020) pioneered the debt overhanging theory, which shows that the situation of an entity debt is heavily indebted where the entity cannot afford to borrow even when the opportunity presents itself. Likewise, Myers said that high debts devalue firms’ investment positions and cause viable firms to be unviable. Again, there exists an under-investment phenomena conundrum regarding agency costs among debt holders as well as investors, leading to debt overhang. As a result of debt overhang, investors are adamant to invest in firms where their debt holders dilute the enterprise’s asset, thus not granting equity financing for such companies to undertake new projects (Topcu and Tugcu 2020). Therefore, the adverse debt-investment correlation is attractable to capital market distortions, where enterprises that have minimal liquidity are faced with greater costs of external capital which dissuades financing. Higher debt levels serve as bottlenecks to economic growth and development. They stifle total factor productivity expansion (Muhanji et al. 2019; Khan et al. 2019). To comprehend fully the underlying parameters that determine sustainable economic expansion, as well as comprehend the manner of economic progress associated to external debt, an econometric equation is grouped into three expressive equations. As shown in the figure, the gross domestic product depicts gross domestic product per head in various estimations, as stated below. Figure 1 shows the conceptual framework of the study.

Source: Qureshi and Liaqat (2020)

Conceptual model.

3 Research methodology

A sample of data covering South Asian nations was deployed by analysing the parameters from 2000 to 2018. The data were sourced from the World Bank Development Indicators, where the external debt per cent of gross national income, external debt stock and aggregate external debt service per cent of gross national debt income. On the other hand, actual gross domestic product expansion as well as gross domestic product per head are the explained parameters.

3.1 Research design

There is a direct correlation of economic growth and productivity. Hence, earnings and economic expansion, equally known as export-led growth, are improved via good export performance (Pesaran et al. 2001) and are stimulated by an increase in productivity and economic growth expansion due to the long run output. Nonetheless, the impact of debt growth is yet uncertain, and has an adverse impact on growth or deficit investment, where fiscal policy is probably to influence economic expansion directly, according to the Keynesian viewpoint (Barati and Fariditavana 2020). More so, econometric approximation is used to evaluate how economic expansion is influenced through balanced and disproportionate impacts, whether long term or short term, bearing in mind the circumstances aforementioned. This in turn produces spurious long run results as a result of the inability to tackle the problem of co-integration. Hence, the subsequent cross-sectional regression equation of the type is proposed as follows:

In model (1) External debt (Y) has been used to evaluate the effect of external debt on expansion as the key direction of the study. Here, investment as well as economic growth negatively influence a country that is exposed to a high-level of debt compared to other countries’ repayment capabilities, in the view of the debt overhanging theory. Clearly, exports are thought to be a control parameter, other than external debts, in conforming to the view that expresses export as a catalyst for gross domestic product support (Makun 2021). Additionally, economic expansion is equally said to directly impact efficiency, whereas an economic expansion considered as γ, whereas the independent variables \(x\)1…\(x\)n, clarify the theatrical model of econometric approach. The existence of an endogeneity challenge within the non-static longitudinal data equation makes the application of conventional static approximation approaches cumbersome. Thus, we thought it prudent to apply a different generalized mean moment as well as system generalized mean moment as two variables to give direction of the large N and small. This has the ability to correct the inherent inconsistencies of the endogenous parameters via the techniques of instrumentation. Sovacool (2017) deployed a differencing approach to take away the single impacts before formulating the generalized mean moment approximates and applied the lag-terms as the parameter of instrumentation, which is stated as follows:.

Now, α denotes the intercept, and β, γ and θ are coefficients for estimation. Furthermore, EC connotes the consumption of energy and research development depicts the cumulative research and development expenditure of country “i” in year “t − 2”or education, which is for the head research and development expenditure for head Educ expenditure. The initial lagging designate GEPI is GEPIi, t − 1; it is added because we are certain that the green performance indicator in the last period attained a robust impact on the present green performance index. The control variable set is shown to be\({X}_{it}\). Ultimately, \({u}_{t}\) represents the fixed time impact, \({v}_{i}\) depicts a one-time fixed-impact, and \({\varepsilon }_{it}\) represents the stochastic term. Put differently, the slope and the intercept crosswise nations are said to be the same via the pooled mean group method, as well as the explicit approximation applied to derive the long-term variables (Younsi and Nafla 2019).

4 Results and discussion

4.1 Econometric analysis

Our analysis discovers that the Keynesian school of thought, where the proponents advocated increased government expenditure and reduced taxes in order to reboot the economy during a depression, could act as a catalyst to encourage private participation in the economy while sustaining the economy. Thus, the more a government spends, the more the returns on such investments made. Hence, the Keynesian multiplier effect growth. This is as a result of the Keynesian multiplier theory, which states that the economy would boom with any extra spending that the government undertakes. This ultimately grows the private sector’s participation and grows total demand, considering that the existence of unused factors of production causes the growth of economic activity and spurs private financings.

The findings in Table 1 corroborate the assertion that better institutional settings assist to increase the performance of fiscal policy. This analysis implies that good institutional quality limits the crowding-out (neo-classical) impacts and encourages the crowding-in (Keynesian) impact of fiscal policy in developing economies. The findings add robustly to the literature of fiscal policy and pragmatism in the implementation of fiscal policy within the setting of developing countries. Important necessary conditions for an effective fiscal policy are macro-measures to advance the prevailing environment of institutions. The findings equally propose that the empirical analysis within the field of fiscal policy ought to consider the institutional models of countries to be a probable independent variable. Next, we dovetail the external debt onto the economic expansion equation to analyse the curvature correlation. The findings are given in Table 2. The meaningful direct coefficient of external debt level as well as meaningful negative coefficient of square of external debt level imply that the external debt economic expansion attains a curvature correlation. The finding equally needs a profounder evaluation for the means of the curvature correlation.

Our analysis grouped the sample into a dual category (minimal indebted nations and high indebted nations) and estimate the effects of public expenditure institutions on economic expansion. Furthermore, our analysis discovered that growing government spending in Group One attained a direct impact on economic expansion, which has a nonsignificant negative effect on the other category. The findings imply that the fiscal policy is potent in invigorating the economic expansion where nations obtain low debt burden. Nonetheless, the effectiveness is low when nations are confronted with a high level burden of debts. These results conform with several scholarly works as well as claims. The findings also mean that heavily indebted nations have limited fiscal space to operate with harsh terms in patronizing the global financial systems, whereas the high degree of external debt restrains the private sector’s participation, thus, their fiscal policies lead to an environment of crowding-out impacts. It is our firm belief that the results have meaningful implications for the scholarly community, particularly for the pragmatism of fiscal. Furthermore, the findings in Table 3 presents other fascinating facts. Where the fiscal policy is effectiveness within minimally indebted nations, the institutions are additionally effective in encouraging economic expansion in maximum indebted nations. This finding implies a very important approach for high indebted nations that ought not to encourage the utilization of fiscal policy to invigorate economic expansion if it does not improve the institutional model.

4.2 Fiscal policy analysis

From the analysis, the long-term coefficient approximate of spending is 0.752, which is meaningful at a one per cent level. This connotes that each single rupee spike in spending earnings spikes to only 0.75 rupees. Put differently, the public earnings expand at a reduced percentage in exceeding spending. Thus, this circumstance shows that South Asia’s fiscal disequilibrium is on a trajectory of fragile sustainability.

The impact of autonomous investment with the long term trajectory is precisely linked to innovation and is meaningful only when a high level-technological evolvement is presumed where the financial restraint is eliminated. Likewise, autonomous consumption is correlated with product innovation. Inversely, it plays a crucial part within the innovation space. Also, net exports that are in line with anticipation attained a positive effect when they are expected to increase at a direct percentage. Given that the ratio is stochastic, it equally inclines to obtain some procyclical impact. Regarding the microdynamic impacts of the benchmark replications, certain vital findings include the impacts of product differentiation plan of action regarding market intensity, growing the margins, as well as impacts on earnings supply. Because price competition assumes lesser prominence relative to product differential, there is a meaningful expansion in costs and mark ups in addition to the proportion of profit of earnings. Table 4 shows pooled and random effects results.

Here, the coefficient is positive for instability and is statistically meaningful. The direct statistic shows that within the circumstance of skyrocketing war spending requirements, the government strived to garner earnings to obtain economic steadiness Rathnayake (2020). Obviously, a long-term correlation amongst government earnings plus spending is backed by an econometric evaluation. In addition, the term γ1 depicts a rapid meaningful reversion of 62.2% per annum to revert to the long-term equilibrium condition after a stochastic term presence.

4.3 Fiscal policy and growth

Growth resumes a growth trajectory after a crisis hits the economy. Another vital observation correlated to no actual growth rule of thumb is that primary excesses expand unabated due to government incomes expansion that reduced compared to earnings in addition to the gross domestic product growth. In addition, concerning the vital observation connected to primary excess paths, in scenarios S1 and S5, there is a reduction in primary excess since the government expands spending. Nonetheless, tax revenues are pragmatically similar to previous situations, where there is also a reduction in gross domestic product level. Inversely, within all other situations, the reductions in tax incomes illustrate the reduction in primary surplus. The ultimate finding is correlated to the self-defeating fiscal tightening. This is plausible to comprehend that the greater the economic expansion percentage, the more the extra resources in the form of capital as well as incentives for an economic system activity. Meanwhile, the meaningful negative impact of log gross domestic product per head alongside economic expansion implies the convergence trajectory within an economy between the developing market category and different control parameters that entail capital development. Table 5 shows fiscal policy analysis.

Concerning the sensitivity analysis, we carried out the analysis a step further by breaking the ground into current debts levels beneath 54.71%, and some to timeframe debt levels that surpass 54.71% from the causality test analysis, as the two points are worthy of note. First, the one-way directional causality referred to earlier is discovered to be factual if the debt is beneath 54.71%. Second, we separate feedback causality among debts as well as growth, when the debt is more than the 54.7% upper limit level. Tax earnings as well as government spending were inclined to be a purpose of economic expansion, and growth is to attain the likelihood to cut the deficit/gross domestic product and debt/gross domestic product percentage. However, high debt equally leads to minimal expansion in a vicious path. In addition, the analyses corroborate that there is an obvious upper limit over which economic advancement is side-lined and debt is needful in economic expansion.

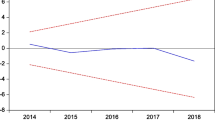

Table 6 depicts the results of the split ones-step and two-step generalized mean method analysis. Additionally, the autoregression two analysis plus the Sargan analysis confirmed that the evaluation was right. Table 5 highlights that the lag coefficient of the explained parameter is negative. Within the two samples, it is equally statistically vital, hence affirming the volatility of the ecological control parameter. The sanguine structure as well as the technological impacts on green expansion that are of different scales and substantial amounts could be discovered in the break-up analysis. Within the equation one(a), the standard economic expansion determinants are the control parameters. The approximate of the debt upper limit figure is 51.65% of gross domestic product alongside a matching 95%. As shown in Table 7, it suggests that the threshold approximate is statistically meaningful, implying that the likelihood ratio statistic is greater than the critical figure. The approximates threshold figure is reduced compared to the pre-existing upper limit within the literature: 90 per cent in advanced nations, 77 per cent in advanced and emerging nations, 64 per cent in developing nations. The results of the 51.65% debt upper limit is around 20% and 60% according to Égert (2015) in applying the Ferraro and Peretto (2020) static longitudinal upper limit approximation. In addition, the various upper limit stages may be as a result of the application of a square term in addition to a static upper limit equation within the literature, which makes the dynamic threshold estimation less consistent. This is due to the nondynamic upper limit modelling trajectories that is inclined to overlook the endogeneity of the income, which is probably left out within the approximation or completely not taken into account. Furthermore, we cannot explicitly draw parallels of the upper limits due to the sample nations, years, and varied control parameters applied within the past analysis that are not similar.

4.4 Robustness analysis

Even though the initial control parameter illustrates a direct and a meaningful effect within the long-run, the findings regarding the dual ordinary least square and pooled approximation depict an unsupported effect for the second control parameter (human development). The robust analysis proves that fiscal policy managers implement steps to cut down long-term debt to gross domestic product ratio when the ratio increases. This method may be used to change the increase in the debt to gross domestic product percentage to an unparallel stage. The short-term negative is mathematically unsupported where the coefficient falls to (− 0.043).

In addition, the predictability ability of the asymmetric FRF is at a high level as depicted in the R-squared of 93.7% as well as the adjusted R-squared of 80.9%, even though the adjusted R-squared may be consistent considering the minute sample size of 58 data intensities. To note, several researches have analysed the sustainability circumstance of Davig and Leeper (2011), which showed greater adjusted R-squared figures Cavallaro and Maggi (2016) concerning the sustainability of South Asia’s government debt which gives an adjusted R-squared of 93%.

From the analysis, the nations were demanded to implement sweeping economic reforms and poverty alleviation strategies as requirements for debt relief. The majority of the Sub-Saharan Africa satisfied these requirements by 2005 and had their external debts forgiven. Furthermore, due to the comparatively reduced rates of interest on external loans, relative to the interest rate on domestic loans, soon after the debt relief, the majority of the countries again embarked on heavy external borrowing. Similarly, in response to the spike in external borrowing, the Bretton Wood Institutions gave an early caution on the possibility of the danger of aggregating an unsustainable external debt level. The admonition was specifically aimed at nations faced with unbridled corruption and fragile public institutions. Again, the trajectory of external borrowing has ignited concerns among economists and financial experts regarding the probability of the long-term impacts of these debts on the economies. In addition, experimental research endeavoured to study the trends where the evaluations only centred on the underpinning occurrences of external borrowing, neglecting the likely peril of economic expansion. The results from these first analyses assign the increasing external debt to domestic and external circumstances. One of the domestic factors is the need for policy formulators to accelerate the process of economic advancement, given insufficient domestic funds availability. This has brought about increased external borrowing, which is thought to be preferable to increasing taxation. The external factors responsible for increased borrowing are the readiness of external creditors to grant loans and cut interest rate on external loans (Sánchez-Fung 2006).

From the analysis, the nations were demanded to implement sweeping economic reforms and poverty alleviation strategies to be the requirements for debt relief. The majority of the South Asian nations satisfy the requirements, and their overseas debts were forgiven. Soon after the debt relief, the majority of the nations undertook heavy external borrowing as result of minimal interest rate on external loans relative to the interest rate on domestic loans. Similarly, in response to the spike in external borrowing, the Bretton Wood Institutions gave an early caution on the possibility of danger of aggregating unsustainable external debt levels. The admonition was specifically aimed at nations faced with unbridled corruption and fragile public institutions (Ehrmann et al. 2003).

To understand the prevailing public debt-economic growth nexus for emerging nations, Makhoba et al. (2019) conducted a longitudinal data analysis on low- and middle-income nations over the period of 1990 to 2007. The experimental analysis illustrates that the public debt attained a negative effect on output until it attained 90 per cent gross domestic product. The effect of public debt on growth became irrelevant beyond a certain upper limit. As debt overhanging is a growth constraint only in nations with sound macroeconomic policies and institutional quality, the nonlinear impact could be explained in country-specific impacts. Because the sample period of Abdullah et al. (2019) is only until 2007, this is a vital up to the date and re-evaluation of the public debt upper limit in emerging nations. More so, the analysis of Osuala and Jones (2014) entailed 92 low-, lower-middle, and upper-middle-income nations. Furthermore, the public debt dataset was derived from Kim et al. (2021). Nonetheless, our analysis applies the public debt dataset from the IMF database. Agu et al. (2015) set a quadratic functional form to identify a hump-form correlation amongst debt and economic expansion, plus a parametric method. Simon (2012) applied the square terms in assessing the curvature of the earnings disparity model. As a result, in terms of the approximation approach, our analysis varies from the analysis of Bystrov and Mackiewicz (2020) in applying an extra improved approach to ascertain the public debt upper limit discovered by likelihood ratio statistics.

5 Conclusion and policy implication

South Asia is faced with an increasing budget deficit and an ever burdensome public debt, thus increasing the awareness of the issue of fiscal policy sustainability. In order to evaluate the sustainability of fiscal policy disequilibrium and public debt, the existing literature gives different measures, where the findings which are robust to the presumptions covered. Thus, for this research, initially, the modification in public earnings to a government income spending shock centred on an intertemporal budget constraint. Secondly, the adjustment within the primary fiscal balance to exogenous shocks centred on Bohn’s fiscal response function. The equations were utilized to yearly data for South Asia for the period of 1961–2018 to analyse the sustainability of the fiscal disequilibrium in addition to public debt-to-gross domestic product ratio.

The asymmetry is contained in the modelling through a positive and negative part addition decomposition of the regressors of the fiscal response equation. In addition, the addition of asymmetry onto the equation overwhelms the indirect misspecification in the symmetric equation. Approximation findings corroborate that neglecting these curvatures in modelling may result in misleading deductions. Hence, the robust indicators show that fiscal authorities endeavour to steady the debt-to-gross domestic product ratio via fiscal tightening when the ratio increases. Specifically, the authorities are concerned with the debt-to-gross domestic product to prevent it from attaining unparalleled levels. This analysis goes in contravention to the universally agreed viewpoint that Sri Lanka’s public debt is on an unsustainable pathway. Nonetheless, in line with typical comments, the analysis sees that South Asia’s austerity commitment depicts an insufficient commitment and the likelihood to dally excluding severe burden. Hence, a fragile type of sustainability of public debt may make sense for the South Asian subregion. Furthermore, the analysis identified fascinating indications concerning external debt, which obtained a non-straight-line impact on economic expansion, while the heterogenous impacts of fiscal policy on economic expansion attained a direct influence in minimal indebted nations, as well as an adverse effect at the maximum indebted stage, thus elucidating the patterns of this curvature correlation.

Moreover, aiming for growth based on high debts levels is not a plausible strategy to adopt. In addition, the reduction in high debt levels benefit the nations’ economic performance where the Malaysian data on the mean debt-to-gross domestic product backs this viewpoint. Furthermore, the cuts in subsidies could make extra fiscal space on the budget whilst concurrently sending subsidies to the vulnerable. Thirdly, the debt has a direct impact on economic system activity expansion and the correlation amongst public debt and growth persists. Also, our findings affirm that the high levels of debts may cause a reduced economic advancement. Nevertheless, there is no indication to imply that fragile growth is the reason behind so much debt. Thus, it is vital for policy formulators in Malaysia to comprehend the debt-expansion connection so as to craft robust macroeconomic policies for the advancements of nature predications.

The correlation may elucidate the means for the curvature correlation among external debt and economic expansion. Thirdly, we detect indications that advancements in state establishments spur the potency of fiscal policy. This remarkable finding attains a very important contribution to existing literature and the ramifications for pragmatism in the case of developing nations. Here, an institution given in different parts of government effectiveness, regulatory environment, and control of corruption improve the direct effects of government spending on economic growth. Additionally, the analyses imply that vital steps for the nations in the conundrum of fiscal policy futility are quite high when nations are heavily indebted, thus, they should endeavour to improve institutional quality and improve the effectiveness of fiscal policy as well as explicitly bear economic expansion in another way.

We proposed a policy framework based on above findings.

-

I.

Hence, the policymakers should consistently enforce innovation-driven approaches and move towards more enhanced ability to innovate; this can enhance performance through research and development commercialization after COVID-19.

-

II.

Furthermore, countries play the role of supporting the region for the ecological environment, but it is also the most polluted province in the country’s region. Hence, South Asian countries need to implement shared avoidance, controls and laws for ecological environments completely enforcing laws for environmental protection and curbing pollution. This would fully enhance environmental quality, hence becoming more robust to assist and assure superior economic development after COVID-19.

-

III.

While industrial transfer demonstration zones should contribute positively towards economic efficiency, those in small, medium-sized and mega-cities which can strengthen economic growth after COVID-19.

-

IV.

In order to be able to reap the benefits of the policy-making related to the industrial transfer and economic demonstration zone, the policy welfare related to the zone should be improved constantly after COVID-19.

-

V.

There is a dire need to promote latest E-commerce business strategies to cope with economic downturn situation due to COVID-19.

References

Abdullah H, Yien LC, Khan MA (2019) The impact of fiscal policy on economic growth in ASEAN-5 countries. Int J Supply Chain Manag 8:754

Agu SU, Okwo IM, Ugwunta OD, Idike A (2015) Fiscal policy and economic growth in Nigeria. SAGE Open. https://doi.org/10.1177/2158244015610171

Alemzero DA, Iqbal N, Iqbal S et al (2020a) Assessing the perceived impact of exploration and production of hydrocarbons on households perspective of environmental regulation in Ghana. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-020-10880-3

Alemzero DA, Sun H, Mohsin M et al (2020b) Assessing energy security in Africa based on multi-dimensional approach of principal composite analysis. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-020-10554-0

Alm J, Rogers J (2011) Do state fiscal policies affect state economic Growth? Public Financ Rev. https://doi.org/10.1177/1091142110373482

Al-Masaeed AA, Tsaregorodtsev E (2018) The impact of fiscal policy on the economic growth of Jordan. Int J Econ Financ. https://doi.org/10.5539/ijef.v10n10p145

Amato A, Tronzano M (2000) Fiscal policy debt management and exchange rate credibility: lessons from the recent Italian experience. J Bank Finance 24(6):921–943. https://doi.org/10.1016/S0378-4266(99)00112-0

Barati M, Fariditavana H (2020) Asymmetric effect of income on the US healthcare expenditure: evidence from the nonlinear autoregressive distributed lag (ARDL) approach. Empir Econ. https://doi.org/10.1007/s00181-018-1604-7

Bystrov V, Mackiewicz M (2020) Recurrent explosive public debts and the long-run fiscal sustainability. J Policy Model. https://doi.org/10.1016/j.jpolmod.2019.10.002

Cavallaro E, Maggi B (2016) State of confidence, overborrowing and macroeconomic stabilization in out-of-equilibrium dynamics. Econ Model. https://doi.org/10.1016/j.econmod.2016.06.015

Davig T, Leeper EM (2011) Monetary-fiscal policy interactions and fiscal stimulus. Eur Econ Rev. https://doi.org/10.1016/j.euroecorev.2010.04.004

Easterly W, Schmidt-Hebbel K (1991) The macroeconomics of public sector deficits: a synthesis. Policy Research Working Paper Series 775. The World Bank

Ebimobowei A (2010) The relationship between fiscal policy and economic growth in Nigeria (1991–2005). Int J Econ Dev Res Invest 1:37–46

Égert B (2015) Public debt, economic growth and nonlinear effects: myth or reality? J Macroecon. https://doi.org/10.1016/j.jmacro.2014.11.006

Ehrmann M, Gambacorta L, Martinez-Pagés J et al (2003) The effects of monetary policy in the euro area. Oxford Rev Econ Policy. https://doi.org/10.1093/oxrep/19.1.58

Falade OE, Folorunso BA (2015) Fiscal and monetary policy instruments and economic growth sustainability in Nigeria. Am J Econ 5:587–594

Farooq A, Yasmin B (2017) Fiscal policy uncertainty and economic growth in Pakistan: role of financial development indicators. J Econ Coop Dev 38:1

Ferraro D, Peretto PF (2020) Innovation-led growth in a time of debt. Eur Econ Rev. https://doi.org/10.1016/j.euroecorev.2019.103350

He W, Abbas Q, Alharthi M et al (2020) Integration of renewable hydrogen in light-duty vehicle: Nexus between energy security and low carbon emission resources. Int J Hydrogen Energy. https://doi.org/10.1016/j.ijhydene.2020.06.177

Hlongwane TM, Mongale IP, Tala L (2018) Analysis of the Impact of Fiscal Policy on Economic Growth in South Africa: VECM Approach. J Econ Behav Stud. https://doi.org/10.22610/jebs.v10i2.2232

Igwe A, Emmanuel EC, Ukpere WI (2015) Impact of fiscal policy variables on economic growth in Nigeria (1970–2012): a managerial economics perspective. Invest Manag Financ Innov 38:1

Khan MS, Knight MD (1981) Stabilization programs in developing countries: a formal framework. Staff Pap 28(1):1–53

Khan MK, Teng JZ, Khan MI, Khan MO (2019) Impact of globalization, economic factors and energy consumption on CO2 emissions in Pakistan. Sci Total Environ 688:424–436. https://doi.org/10.1016/j.scitotenv.2019.06.065

Kim J, Wang M, Park D, Petalcorin CC (2021) Fiscal policy and economic growth: some evidence from China. Rev World Econ. https://doi.org/10.1007/s10290-021-00414-5

Mahmood T, Sial MH (2011) The relative effectiveness of monetary and fiscal policies in economic growth: a case study of Pakistan. Asian Econ Financ Rev 1:236

Makhoba BP, Kaseeram I, Greyling L (2019) Assessing the impact of fiscal policy on economic growth in South Africa. African J Bus Econ Res. https://doi.org/10.31920/1750-4562/2019/v14n1a1

Makohon V, Adamenko I (2020) The impact of tax and budget policy on the level of economic growth. Univ Econ Bull. https://doi.org/10.31470/2306-546x-2020-44-179-187

Makun K (2021) External debt and economic growth in Pacific Island countries: a linear and nonlinear analysis of Fiji Islands. J Econ Asymmetries. https://doi.org/10.1016/j.jeca.2021.e00197

Mohsin M, Rasheed AK, Sun H et al (2019) Developing low carbon economies: an aggregated composite index based on carbon emissions. Sustain Energy Technol Assess. https://doi.org/10.1016/j.seta.2019.08.003

Mohsin M, Nurunnabi M, Zhang J et al (2020a) The evaluation of efficiency and value addition of IFRS endorsement towards earnings timeliness disclosure. Int J Financ Econ. https://doi.org/10.1002/ijfe.1878

Mohsin M, Taghizadeh-Hesary F, Panthamit N et al (2020b) Developing low carbon finance index: evidence from developed and developing economies. Financ Res Lett. https://doi.org/10.1016/j.frl.2020.101520

Mohsin M, Hanif I, Taghizadeh-Hesary F et al (2021) Nexus between energy efficiency and electricity reforms: a DEA-based way forward for clean power development. Energy Policy. https://doi.org/10.1016/j.enpol.2020.112052

Mohsin M, Ullah H, Iqbal N, Iqbal W, Taghizadeh-Hesary F (2021) How external debt led to economic growth in South Asia: a policy perspective analysis from quantile regression. Econ Anal Policy. https://doi.org/10.1016/j.eap.2021.09.012

Muhanji S, Ojah K, Soumaré I (2019) How do natural resource endowment and institutional quality influence the nexus between external indebtedness and welfare in Africa? Econ Syst. https://doi.org/10.1016/j.ecosys.2018.08.005

Munir S, Rao ZUR, Sana S (2019) Financial development, fiscal policy and economic growth: the role of institutional quality in Pakistan. J Financ Account Res. https://doi.org/10.32350/jfar/0102/02

Murshed M (2020) Are trade liberalization policies aligned with renewable energy transition in low and middle income countries? An instrumental variable approach. Renew Energy. https://doi.org/10.1016/j.renene.2019.11.106

Narayan PK, Singh B (2007) Modelling the relationship between defense spending and economic growth for the Fiji islands. Def Peace Econ. https://doi.org/10.1080/10242690600807924

Nawaz S, Idrees Khawaja M (2019) Fiscal policy, institutions and growth: new insights. Singapore Econ Rev. https://doi.org/10.1142/S0217590816500296

Nurfatriani F, Darusman D, Nurrochmat DR et al (2015) Redesigning Indonesian forest fiscal policy to support forest conservation. For Policy Econ 61:39–50. https://doi.org/10.1016/j.forpol.2015.07.006

Nursini N (2017) Effect of fiscal policy and trade openness on economic growth in Indonesia: 1990–2015. Int J Econ Financ Issues 7(1):358–364

O’Sullivan C, Papavassiliou VG (2020) On the term structure of liquidity in the European sovereign bond market. J Bank Financ. https://doi.org/10.1016/j.jbankfin.2020.105777

Onifade ST, Çevik S, Erdoğan S et al (2020) An empirical retrospect of the impacts of government expenditures on economic growth: new evidence from the Nigerian economy. J Econ Struct. https://doi.org/10.1186/s40008-020-0186-7

Osuala AE, Jones E (2014) Empirical analysis of the impact of fiscal policy on economic growth of Nigeria. Int J Econ Financ. https://doi.org/10.5539/ijef.v6n6p203

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econom 16:289–326. https://doi.org/10.1002/jae.616

Pham NS, Pham TKC (2019) Foreign aid, recipient government’s fiscal behavior, and economic growth. Econ Bull 39:2457–2466

Pochea MM, Niţoi M (2021) The impact of prudential toolkits on loan growth in Central and Eastern European banking systems. Econ Syst. https://doi.org/10.1016/j.ecosys.2020.100767

Qureshi I, Liaqat Z (2020) The long-term consequences of external debt: revisiting the evidence and inspecting the mechanism using panel VARs. J Macroecon 63(C)

Raihan S, Anjum I (2020) Effectiveness of fiscal policy in stimulating economic growth: an empirical study on Bangladesh. Bangladesh’s macroeconomic policy: trends, determinants and impact. Springer, Singapore

Rathnayake ASK (2020) Sustainability of the fiscal imbalance and public debt under fiscal policy asymmetries in Sri Lanka. J Asian Econ. https://doi.org/10.1016/j.asieco.2019.101161

Safdari M, Mehrizi MA, Elahi M (2011) Impact of fiscal policy on economic growth in Iran. Eur J Econ Finance Adm Sci 87–92

Salma S, Idriss EA, Said T (2016) Threshold effects of fiscal policy on economic growth in developing countries. J Econ Financ Stud. https://doi.org/10.18533/jefs.v4i3.225

Sánchez-Fung JR (2006) Money, income, prices, and exchange rates in the Dominican Republic. Sav Dev 30(1):31–38

Scott M (2019) Components of public finance and public debt management. Int J Tax Econ Manag. https://doi.org/10.35935/tax/25.3828

Shihab RA (2014) The causal relationship between fiscal policy and economic growth in Jordan. Int J Econ Finance 10(10):145. https://doi.org/10.5539/ijef.v10n10p145

Simon M (2012) Effectiveness of fiscal policy in economic growth: the case of Zimbabwe. Int J Econ Res 3:93–99

Sovacool BK (2017) Contestation, contingency, and justice in the Nordic low-carbon energy transition. Energy Policy 102:569–582. https://doi.org/10.1016/j.enpol.2016.12.045

Sun H, Pofoura AK, Adjei Mensah I et al (2020) The role of environmental entrepreneurship for sustainable development: Evidence from 35 countries in Sub-Saharan Africa. Sci Total Environ. https://doi.org/10.1016/j.scitotenv.2020.140132

Surugiu MR, Surugiu C, Nica M (2012) Fiscal policy and economic growth: explanation with empirical analysis. Actual Probl Econ 134:476–481

Terzi C, Anis EA (2018) Fiscal Policy and Economic Growth in Tunisia. J Bus Financ Aff. https://doi.org/10.4172/2167-0234.1000325

Tiep NC, Wang M, Mohsin M et al (2021) An assessment of power sector reforms and utility performance to strengthen consumer self-confidence towards private investment. Econ Anal Policy. https://doi.org/10.1016/j.eap.2021.01.005

Tomljanovich M (2004) The role of state fiscal policy in state economic growth. Contemp Econ Policy 3:318

Topcu M, Tugcu CT (2020) The impact of renewable energy consumption on income inequality: evidence from developed countries. Renew Energy 151:1134–1140. https://doi.org/10.1016/j.renene.2019.11.103

Yang Z, Abbas Q, Hanif I et al (2021) Short- and long-run influence of energy utilization and economic growth on carbon discharge in emerging SREB economies. Renew Energy. https://doi.org/10.1016/j.renene.2020.10.141

Younsi M, Nafla A (2019) Financial stability, monetary policy, and economic growth: panel data evidence from developed and developing countries. J Knowl Econ. https://doi.org/10.1007/s13132-017-0453-5

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

We have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Chien, F., Chau, K.Y., Aldeehani, T.M. et al. Does external debt as a new determinants of fiscal policy influence sustainable economic growth: implications after COVID-19. Econ Change Restruct 55, 1717–1737 (2022). https://doi.org/10.1007/s10644-021-09365-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10644-021-09365-1