Abstract

Exchange rate uncertainty measured by its volatility is said to affect trade flows in either direction. A limited number of recent studies show that the response of trade flows to exchange rate volatility could be asymmetric, mostly due to change in traders’ expectations. In this paper, we test the symmetric and asymmetric effects of exchange rate volatility on Tunisia’s bilateral trade with each of its 16 partners. We find that Tunisia’s trade flows to each partner are affected asymmetrically in the short run but not in the long run. In almost half of the sample, the long-run effects were symmetric.

Similar content being viewed by others

Notes

Some recent studies since last review article are Hall et al. (2010) who considered the experience of emerging economies and Asteriou et al. (2016) who included MINT countries in their sample. Example of studies that use commodity level data include Bahmani-Oskooee and Hegerty (2009), (2011), Wong and Tang (2008), Bahmani-Oskooee et al. (2015), Bahmani-Oskooee and Durmaz (2016), Bahmani-Oskooee et al. (2017) and Belke et al. (2013, 2015).

The models and methods follow closely Bahmani-Oskooee and Aftab (2017).

If these income elasticities are negative, economic growth could be due to increased production of import substitute goods (Bahmani-Oskooee 1986).

Once the long-run estimates are normalized, we will have \(\frac{{\hat{\theta }_{1} }}{{ -\, \hat{\theta }_{0} }} = \hat{\alpha }_{1} ,\quad \frac{{\hat{\theta }_{2} }}{{ -\, \hat{\theta }_{0} }} = \hat{\alpha }_{2} \quad {\text{and }}\frac{{\hat{\theta }_{3} }}{{ - \,\hat{\theta }_{0} }} = \hat{\alpha }_{3}\) in (1) and \(\frac{{\hat{\rho }_{1} }}{{ - \,\hat{\rho }_{0} }} = \hat{\beta }_{1} ,\quad \frac{{\hat{\rho }_{2} }}{{ - \,\hat{\rho }_{0} }} = \hat{\beta }_{2} \quad {\text{and}}\quad \frac{{\hat{\rho }_{3} }}{{ -\, \hat{\rho }_{0} }} = \hat{\beta }_{3}\) in (2).

The third advantage of this method is that since short-run dynamic adjustment process is included in estimating long-run coefficients, the adjustment process allows feedback effects among variables to be accounted for and this reduces multicolinearity and endogeneity issues (Pesaran et al. 2001, p. 299).

Of course, this channel will be less effective if there exists a forward market for currencies that traders are holding.

The two partial sum variables are generated as \({\text{POS}}_{t} = \sum\nolimits_{j = 1}^{t} {\hbox{max} (\Delta \ln V_{j} } ,0),\quad {\text{NEG}}_{j} = \sum\nolimits_{j = 1}^{t} {\hbox{min} (\Delta { \ln }V_{j} ,0)} .\)

Note that Shin et al. (2014, p. 291) argue that the two partial sum variables in the nonlinear model should be treated as a single entry so that the critical values of the F test stay at high and conservative level when we move from the linear model to nonlinear model. For more on some other applications of these methods, see Halicioglu (2007, 2008), Kisswani and Nusair (2014), Gogas and Pragidis (2015), Durmaz (2015), Baghestani and Kherfi (2015), Al-Shayeb and Hatemi (2016), Lima et al. (2016), Aftab et al. (2017), Gregoriou (2017) and Bahmani-Oskooee et al. (2018, 2019).

There is now clear evidence that for small samples such as ours, the ARDL approach performs better than other approaches (Panopoulou and Pittis 2004).

Note that Banerjee et al. (1998) who introduced this test with Engle and Granger (1987) approach called this the t test for cointegration. Pesaran et al. (2001) extended it to ARDL model, and since variables could be combination of I(0) and I(1), they provide upper and lower bound critical values. However, the critical values are for large sample. For small samples such as ours, we rely upon Banerjee et al. (1998). For large samples, both sources report the same critical values.

Other diagnostic statistics are similar to those in Table 2 and need no repeat here.

Other diagnostics are similar to those in Table 6 and need no repeat here.

See also Zemami and Ben-Salha (2015).

References

Aftab M, Shah Syed K, Katper NA (2017) Exchange-rate volatility and Malaysian-Thai bilateral industry trade flows. J Econ Stud 44:99–114

Ali H (2019) Does downside risk matter more in asset pricing? Evidence from China. Emerg Mark Rev. https://doi.org/10.1016/j.ememar.2019.05.001

Al-Shayeb A, Al-Hatemi J (2016) Trade openness and economic development in the UAE: an asymmetric approach. J Econ Stud 43:587–597

Arize AC, Osang T, Slottje DJ (2000) Exchange-rate volatility and foreign trade: evidence from thirteen LDCs. J Bus Econ Stat 18:10–17

Arize AC, Malindretos J, Igwe EU (2017) Do exchange rate changes improve the trade balance: an asymmetric nonlinear cointegration approach. Int Rev Econ Finance 49:313–326

Asteriou D, Masatci K, Pılbeam K (2016) Exchange rate volatility and international trade: international evidence from the MINT countries. Econ Model 58:133–140

Baghestani H, Kherfi S (2015) An error-correction modeling of US consumer spending: are there asymmetries? J Econ Stud 42:1078–1094

Bahmani-Oskooee M (1986) Determinants of international trade flows: case of developing countries. J Dev Econ 20:107–123

Bahmani-Oskooee M, Aftab M (2017) On the asymmetric effects of exchange rate volatility on trade flows: new evidence from US-Malaysia trade at industry level. Econ Model 63:86–103

Bahmani-Oskooee M, Durmaz N (2016) Exchange rate volatility and commodity trade between the U.S. and Turkey. Econ Change Restruct 49:1–21

Bahmani-Oskooee M, Fariditavana H (2016) Nonlinear ARDL approach and the J-curve phenomenon. Open Econ Rev 27:51–70

Bahmani-Oskooee M, Harvey H (2011) Exchange-rate volatility and industry trade between the US and Malaysia. Res Int Bus Finance 25:127–155

Bahmani-Oskooee M, Hegerty SW (2007) Exchange rate volatility and trade flows: a review article. J Econ Stud 34:211–255

Bahmani-Oskooee M, Hegerty SW (2009) The effects of exchange-rate volatility on commodity trade between the U.S. and Mexico. South Econ J 75:1019–1044

Bahmani-Oskooee M, Ltaifa N (1992) Effects of exchange rate risk on exports: cross-country analysis. World Dev 20:1173–1181

Bahmani-Oskooee M, Hegerty S, Hpsny A (2015) The effects of exchange-rate volatility on industry trade between the U.S. and Egypt. Econ Change Restruct 48:93–117

Bahmani-Oskooee M, Igbal J, Khan S (2017) Impact of exchange rate volatility on the commodity trade between Pakistan and the U.S. Econ Change Restruct 50:161–187

Bahmani-Oskooee M, Halicioglu F, Mohammadian A (2018) On the asymmetric effects of exchange rate changes on domestic production in Turkey. Econ Change Restruct 51:97–112

Bahmani-Oskooee M, Hadj Amor T, Harvey H, Karamelikli H (2019) Is there a J-curve in Tunisia’s bilateral trade with her largest partners? New evidence from asymmetry analysis. Econ Change Restruct 52:1–18

Banerjee A, Dolado J, Mestre R (1998) Error-correction mechanism tests in a single equation framework. J Time Ser Anal 19:267–285

Belke A, Goecke M (2005) Real options effects on employment: Does exchange rate uncertainty matter for aggregation? Ger Econ Rev 6:185–203

Belke A, Gros D (2001) Real impacts of intra-european exchange rate variability: a case for EMU? Open Econ Rev 12:231–264

Belke A, Gros D (2002) Designing EU-US monetary relations: the impact of exchange rate variability on labor markets on both sides of the Atlantic. World Econ 25:789–813

Belke A, Goecke M, Guenther M (2013) Exchange rate bands of inaction and play-hysteresis in german exports—sectoral evidence for some OECD destinations. Metroeconomica 64:152–179

Belke A, Goecke M, Werner L (2015) Exchange rate volatility and other determinants of hysteresis in exports: empirical evidence for the euro area. Rev Econ Anal 7:24–53

De Grauwe P (1988) Exchange rate variability and the slowdown in growth of international Trade. IMF Staff Pap 35:63–84

Durmaz N (2015) Industry level J-curve in Turkey. J Econ Stud 42–4:689–706

Engle RF, Granger CWJ (1987) Cointegration and error correction: representation, estimation, and testing. Econometrica 55:251–276

Gogas P, Pragidis I (2015) Are there asymmetries in fiscal policy shocks? J Econ Stud 42:303–321

Gregoriou A (2017) Modelling non-linear behavior of block price deviations when trades are executed outside the bid-ask quotes. J Econ Stud 44:206–213

Halicioglu F (2007) The J-curve dynamics of turkish bilateral trade: a cointegration approach. J Econ Stud 34:103–119

Halicioglu F (2008) The bilateral J-curve: Turkey versus her 13 trading partners. J Asian Econ 19(3):236–243

Hall S, Hondroyiannis G, Swamy PAVB, Tavlas G, Ulan M (2010) Exchange-rate volatility and export performance: Do emerging market economies resemble industrial countries or other developing countries? Econ Model 27:1514–1521

Kisswani KM, Nusair SA (2014) Nonlinear convergence in Asian interest and inflation rates. Econ Change Restruct 47:155–186

Lima L, Foffano Vasconcelos C, Simão J, de Mendonça H (2016) The quantitative easing effect on the stock market of the USA, the UK and Japan: an ARDL approach for the crisis period. J Econ Stud 43:1006–1021

Narayan PK (2005) The saving and investment nexus for China: evidence from cointegration tests. Appl Econ 37:1979–1990

Nusair SA (2012) Nonlinear adjustment of Asian real exchange rates. Econ Change Restruct 45:221–246

Nusair SA (2017) The J-curve phenomenon in European transition economies: a nonlinear ARDL approach. Int Rev Appl Econ 31:1–27

Panopoulou E, Pittis N (2004) A comparison of autoregressive distributed lag and dynamic ols cointegration estimators in the case of a serially correlated cointegration error. Econom J 7:585–617

Peree E, Steinherr A (1989) Exchange rate uncertainty and foreign trade. Eur Econ Rev 33:1241–1264

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econom 16:289–326

Sauer C, Bohara AK (2001) Exchange rate volatility and exports: regional differences between developing and industrialized countries. Rev Int Econ 9(1):133–152

Shin Y, Yu B, Greenwood-Nimmo M (2014) Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. In: Festschrift in honor of Peter Schmidt, Springer, New York, pp 281–314

Wong KN, Tang TC (2008) The effects of exchange rate variability on Malaysia’s disaggregated electrical exports. J Econ Stud 35:154–169

Zemami M, Ben-Salha O (2015) Exchange rate movements and manufacturing employment in Tunisia: Do different categories of firms react similarly? Econ Change Restruct 48:137–167

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Valuable comments of two anonymous referees are greatly appreciated.

Appendix

Appendix

1.1 Data definitions and sources

Annual data over the period 1987–2016 are used to carry out the empirical analysis with each partner of Tunisia except that due to unavailability of some data, the study period was reduced to 1991–2016 for Germany. The data come from the following sources (Table 9):

-

a.

Direction of Trade Statistics (DOT) of the IMF.

-

b.

International Financial statistics (IFS) of the IMF.

-

c.

OANDA Web site.

-

d.

World Bank’s World Development Indicators.

1.1.1 Variables

\(X_{t}^{\text{TU}}\) = export volume of Tunisia to a partner. In the absence of export price index at bilateral level, following Bahmani-Oskooee and Hegerty (2009) we use and the aggregate export price index of Tunisia to deflate nominal exports. While nominal exports come from source a, export price index comes from source b.

\(M_{t}^{\text{TU}}\) = import volume of Tunisia from a partner. Again, in the absence of import price index at bilateral level, we relied upon Tunisia’s aggregate import price index to deflate nominal imports.

While nominal imports come from source a, import price index comes from source b.

YTU = Tunisia economic activity. We use real GDP as measure of economic activity. Data come from source d.

YP = Trading partner’s economic activity measured by real GDP. Data come from source d.

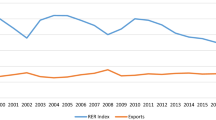

REX = The real bilateral exchange rate of the currency of a partner and Tunisian dinar. It is defined as (REX= PTUNEX/P) where NEX is the nominal exchange rate defined as number of units of a partner’s currency per Tunisian dinar (source c). PTU is the price level in Tunisia (measured by CPI) and P is the price level in a partner (also measured by CPI), source d. Thus, a decline in REX reflects a real depreciation of Tunisian dinar against a partner’s currency.

V = volatility measure of REX. Following Bahmani-Oskooee and Hegerty (2009), we use standard deviation of 12 monthly real bilateral exchange rates within each year as measure of volatility for that year. All monthly nominal exchange rates and monthly price level data come from source b.

Rights and permissions

About this article

Cite this article

Bahmani-Oskooee, M., Nouira, R. On the impact of exchange rate volatility on Tunisia’s trade with 16 partners: an asymmetry analysis. Econ Change Restruct 53, 357–378 (2020). https://doi.org/10.1007/s10644-019-09250-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10644-019-09250-y