Abstract

This paper aims at to investigate the existence of multiple bubbles and specific corresponding events in Pakistan Stock Exchange across different industrial sectors using Generalized Sup Augmented Dickey Fuller (GSADF) test of right-tailed ADF as proposed by Philips et al. (Int Econ Rev 56:1043–1078, 2015a, Int Econ Rev 56:1079–1134, 2015b) by using monthly data for the period of 2007–2016. Findings of study confirm the existence of multiple bubbles in KSE-100 Index along with different industrial sectors. Empirical results depict that Investments, Chemicals and Textile Spinning were the only few sectors where no stock price bubbles were identified. The present study is expected to be pioneer in its nature to apply GSADF for the identification of multiple stock bubbles in emerging stock market of Pakistan which can be further used for comparison of stock bubbles in other regional markets such as BRICS or SAARC regions in order to find out the similarities and dissimilarities in the events causing stock market bubbles.

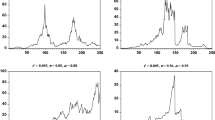

Source www.tradingeconomics.com

Similar content being viewed by others

References

Almudhaf F (2017) Speculative bubbles and irrational exuberance in African stock markets. J Behav Exp Finance 13:28–32

Anderson K, Brooks C (2014) Speculative bubbles and the cross-sectional variation in stock returns. Int Rev Financ Anal 35:20–31

Asako K, Liu Z (2013) A statistical model of speculative bubbles, with applications to the stock markets of the United States, Japan, and China. J Bank Finance 37(7):2639–2651

Bahmani-Oskooee M, Iqbal J, Khan SU (2017) Impact of exchange rate volatility on the commodity trade between Pakistan and the US. Econ Change Restruct 50(2):161–187

Balcilar M, Gupta R, Jooste C, Wohar ME (2016) Periodically collapsing bubbles in the South African stock market. Res Int Bus Finance 38:191–201

Bhanja N, Dar AB (2015) “The beauty of gold is, it loves bad news”: evidence from three major gold consumers. Econ Change Restruct 48(3–4):187–208

Bhattacharya N, Demers E, Joos P (2010) The relevance of accounting information in a stock market bubble: evidence from internet IPOs. J Bus Finance Acc 37(3–4):291–321

Brunnermeier MK, Nagel S (2004) Hedge funds and the technology bubble. J Finance 59(5):2013–2040

Campbell J, Lo AW, McKinlay A (1997) The econometrics of financial markets. Princeton University Press, Princeton

Chan HL, Lee SK, Woo KY (2003) An empirical investigation of price and exchange rate bubbles during the interwar European hyperinflations. Int Rev Econ Finance 12(3):327–344

Chang T, Chang T, Gil-Alana L, Aye GC, Gupta R, Ranjbar O (2016) Testing for bubbles in the BRICS stock markets. J Econ Stud 43(4):646–660

Creti A, Joëts M (2017) Multiple bubbles in the European union emission trading scheme. Energy Policy 107(8):119–130

Cuñado J, Gil-Alana LA, De Gracia FP (2005) A test for rational bubbles in the NASDAQ stock index: a fractionally integrated approach. J Bank Finance 29(10):2633–2654

Dar AB, Bhanja N (2018) Is China a safe haven for Asian Tigers? Econ Change Restruct 51(2):113–133

Dawn (2008) Dawn Newspaper dated 19 September 2008. https://www.dawn.com/news/983099/ftse-takes-pakistan-off-its-watch-list. Retrieved on 25 May 2017

Dawn (2017) Dawn newspaper dated 16 may 2017. https://www.dawn.com/news/1333488. Retrieved 25 May 2017

Diba BT, Grossman HI (1988) Explosive rational bubbles in stock prices? Am Econ Rev 78(3):520–530

Escobari D, Garcia S, Mellado C (2017) Identifying bubbles in Latin American equity markets: Phillips–Perron-based tests and linkages. Emerg Mark Rev. https://doi.org/10.1016/j.ememar.2017.09.001 (In press)

Evans GW (1991) Pitfalls in testing for explosive bubbles in asset prices. Am Econ Rev 81(4):922–930

Greenhalgh C (2016) Science, technology, innovation and IP in India: new directions and prospects. Econ Change Restruct 49(2–3):113–138

Hayek FA (1976) Preise und Produktion. Springer, Berlin

Iwasaki I, Suganuma K (2015) Foreign direct investment and regional economic development in Russia: an econometric assessment. Econ Change Restruct 48(3–4):209–255

Jiménez ÁJ (2011) Understanding economic bubbles, Programa Universitat-Empresa, Barcelona. www.eco.uab.es/ue/trabajos%20premi/tfc%2061%20Jim%C3%A9nez%201.pdf. Accessed 10 June 2017

Joarder MAM, Ahmed MU, Haque T, Hasanuzzaman S (2014) An empirical testing of informational efficiency in Bangladesh capital market. Econ Change Restruct 47(1):63–87

Kasman A, Kasman S, Torun E (2009) Dual long memory property in returns and volatility: evidence from the CEE countries’ stock markets. Emerg Mark Rev 10(2):122–139

Koustas Z, Serletis A (2005) Rational bubbles or persistent deviations from market fundamentals? J Bank Finance 29(10):2523–2539

Li C, Xue H (2009) A Bayesian’s bubble. J Finance 64(6):2665–2701

Liu W, Nishijima S (2013) Productivity and openness: firm level evidence in Brazilian manufacturing industries. Econ Change Restruct 46(4):363–384

McAleer M, Suen J, Wong WK (2016) Profiteering from the Dot-Com bubble, subprime crisis and asian financial crisis. Jpn Econ Rev 67(3):257–279

Misati RN, Nyamongo EM (2012) Financial liberalization, financial fragility and economic growth in Sub-Saharan Africa. J Financ Stab 8(3):150–160

Nartea GV, Cheema MA (2014) Bubble footprints in the Malaysian stock market: are they rational? Int J Acc Inf Manag 22(3):223–236

NAFA Fund Manager Report (2017) Is it time to exit the stock market? Investment Outlook by Dr. Amjad Waheed CEO NAFA, August 2017, NBP Fullerton Asset Management Limited. https://www.nafafunds.com/downloads/ceo-writeup/August2017.pdf Accessed on 22 Sep 2017

Nusair SA (2012) Nonlinear adjustment of Asian real exchange rates. Econ Change Restruct 45(3):221–246

Pástor L, Veronesi P (2006) Was there a Nasdaq bubble in the late 1990s? J Financ Econ 81(1):61–100

Pavlidis E, Yusupova A, Paya I, Peel D, Martínez-García E, Mack A, Grossman V (2016) Episodes of exuberance in housing markets: in search of the smoking gun. J Real Estate Finance Econ 53(4):419–449

Pavlidis EG, Paya I, Peel DA (2017) Testing for speculative bubbles using spot and forward prices. Int Econ Rev 58(4):1191–1226

Phillips PC, Yu J (2011) Dating the timeline of financial bubbles during the subprime crisis. Quant Econ 2(3):455–491

Phillips PC, Wu Y, Yu J (2011) Explosive behavior in the 1990s Nasdaq: when did exuberance escalate asset values? Int Econ Rev 52(1):201–226

Phillips PC, Shi S, Yu J (2015a) Testing for multiple bubbles: historical episodes of exuberance and collapse in the S&P 500. Int Econ Rev 56(4):1043–1078

Phillips PC, Shi S, Yu J (2015b) Testing for multiple bubbles: limit theory of real-time detectors. Int Econ Rev 56(4):1079–1134

Reza BSM (2010) Literatures about asset price bubbles and monetary policies. In: Proceedings of international conference on applied economics, pp 695–703

Roubini N (2006) Why central banks should burst bubbles. Int Finance 9(1):87–107

Schnabl G, Hoffmann A (2008) Monetary policy, vagabonding liquidity and bursting bubbles in new and emerging markets: an overinvestment view. World Econ 31(9):1226–1252

Schumpeter J (1983) The theory of economic development. Harvad University Press, Cambridge

The Express Tribune (2015a) https://tribune.com.pk/story/940353/investigating-the-2008-crash/. Accessed 2 July 2017

The Express Tribune (2015b) 2008 stock market crash: Report blames former SECP chief for taking unilateral decisions. https://tribune.com.pk/story/936418/2008-stock-market-crash-report-blames-former-secp-chief-for-taking-unilateral-decisions/, Retrieved on 15 Mar 2018

The Express Tribune (2015c) The Express Tribune Newspaper dated 03 June, 2015. https://tribune.com.pk/story/896886/kse-worlds-best-performing-frontier-stock-market-report/, Retrieved on 25 May 2017

Tirole J (1985) Asset bubbles and overlapping generations. Econom J Econom Soc 53(4):1071–1100

Wang M, Wong MS (2015) Rational speculative bubbles in the US stock market and political cycles. Finance Res Lett 13(2):1–9

Wicksell K (2005) Geldzins und Güterpreise. Univ.-Bibl, München

Yao S, Luo D (2009) The economic psychology of stock market bubbles in China. World Econ 32(5):667–691

Yu JS, Kabir Hassan M (2010) Rational speculative bubbles in MENA stock markets. Stud Econ Finance 27(3):247–264 (Almudhaf, 2016)(Andreas, 2009)(Andreas, 2009)

Acknowledgements

The authors would like to thank anonymous reviewers and the editor for their helpful suggestions and constructive comments that contributed to enhancing the final version of this paper.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Liaqat, A., Nazir, M.S. & Ahmad, I. Identification of multiple stock bubbles in an emerging market: application of GSADF approach. Econ Change Restruct 52, 301–326 (2019). https://doi.org/10.1007/s10644-018-9230-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10644-018-9230-0