Abstract

We investigate whether, in the early 1990s in China, trade credit changed gradually, from a socially problematic Triangle Debt situation to a financially sound situation to which existing theories of trade credit are applicable. Econometric modeling confirms anecdotal observations of a Triangle Debt problem in the early stage of our sample period. It is also confirmed that the problem vanished and the nature of trade credit in China moved so as to approximate that in developed or Western economies by the later stage of our sample period. Our models also show that intensified market competitiveness in the early 1990s was likely to be the factor leading to the change.

Similar content being viewed by others

Notes

Better would be to extending the time period for research to more recent years. Availability of data (1992–1994) does not allow us to do so, however. We have access to trade credit data for only very few firms after 1995. Thus, the present paper focuses on whether the changes really took place in the early 1990s just before the change might have been completed already.

Their empirical observations do not support the hypothesis, however.

In calculating the ratio of current assets to gross assets, we exclude accounts receivable from the current asset. We do this to control the endogeneity caused by inclusion of the accounts receivable in the original current asset data. Similar treatment is applied to current assets included in variables.

The amount of trade credit received, namely accounts payable, is an endogenous variable in our models.

A similar approach is taken by Petersen and Rajan (1997).

In this paper, a province or city government is defined as an urban government, and a county government as a rural government. Consequently, “urban–rural” here can be interpreted as “upper-lower” in a hierarchy of governments in China. Also, the “urban–rural” dummy variable (indicating “upper-lower” level of government) can be taken to represent the government’s political power.

Diamond (1989) argues that the relationship with banks is itself a measure of a firm's reputation in debt markets.

Investment for fixed assets generally needs to be financed by long-term funds, whereas most trade credit is short-term. Trade credit seldom directly finances investment. It can finance investment indirectly, however, since a firm which receives trade credit can save internal cash and redirect the cash to investment.

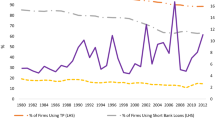

Petersen and Rajan (1997) attach importance to credit from banks as determinants of demand for trade credit. They do use not the volume of bank loans, but several indexes for availability of credit from banks; these include the length of relationship with banks, since Petersen and Rajan (1994) found that relations between firms and financial institutions led to relaxation of credit rationing in USA. Our data do not permit the use of indexes for credit availability from banks, so we adopt the volume of bank loans as our bank credit availability variable.

An over-identifying restrictions test (the Sagan test) confirms the exogeneities for instrumental variables used by us; it accepts the null hypothesis that the instrumental variables are exogenous.

For the insignificant estimated coefficients of number of employees, we suspect that the interpretation of the variable should be reconsidered.

The insignificant estimated coefficients of depreciation/gross assets could be because depreciation was merely an accounting figure and did not measure the correct amount of funds retained in a firm for reconstructive investment, since some of the depreciation reported in accounting was actually paid to government.

We find that market competitiveness has far stronger explanatory power than all of the other variables we have investigated relating to the changing nature of trade credit. We are unable to use a competitiveness variable and the variables representing other causes as simultaneous independent variables in an empirical model, because of multicollinearity.

Also, it is known that the Chinese government began to implement policies aimed at solving the Triangle Debt problem in 1993 and 1994. The present investigation can be seen as clarifying which factors made that policy effective.

Their theoretical expectation is supported by empirical evidence from their African data.

References

Biais B, Gollier C (1997) Trade credit and credit rationing. Rev Financ Stud 10(4):903–937

Brandt L, Li H (2003) Bank discrimination in transition economies: ideology, information, or Incentives? J Comp Econ 31(3):387–413

Cull R, Xu LC, Zhu T (2009) Formal finance and trade credit during China’s transition. J Financ Intermed 18(2):173–192

Demirgüc-Kunt A, Maksimovic V (2001) Firms as financial intermediaries: evidence from trade credit data. Policy research working paper 2696, World Bank

Diamond DW (1989) Reputation acquisition in debt markets. J Pol Econ 97(4):828–861

Emery GW (1984) A pure financial explanation for trade credit. J Financ Quant Anal 19(3):271–285

Emery GW (1988) Positive theories of trade credit. Adv Work Cap Manage 1:115–130

Fafchamps M (2004) Market institutions in sub-saharan Africa: theory and evidence. MIT Press, Cambridge (Massachusetts)/London

Fisman R, Love I (2003) Trade credit, financial intermediary development, and industry growth. J Financ 58(1):353–374

Fisman R, Raturi M (2004) Does competition encourage credit provision?: evidence from African trade credit relationships. Rev Econ Stat 86(1):345–352

Garnaut R, Song L, Yao Y, Wang X (2001) Private enterprises in China. Asia Pacific Press and China Center for Economic Research, Canberra/Beijing

Ge Y, Qiu J (2007) Financial development, bank discrimination and trade credit. J Bank Financ 31(2):513–530

Hyndman K, Serio G (2010) Competition and inter-firm credit: theory and evidence from firm-level data in Indonesia. J Dev Econ (forthcoming)

Ingves S (1984) Aspects of trade credit. The Economic Research Institute, Stockholm School of Economics, Stockholm

Kaplan RM (1967) New technique for optimising-credit risks and opportunities. Harv Bus Rev 65(2):83–88

Liu G (2001) Loans for small and medium-sized enterprises (zhongxiao qiye rongzi). Minzhuyujianshechubanshe, Beijing (Chinese)

McMillan J, Woodruff C (1999) Interfirm relationships and informal credit in vietnam. Q J Econ 114(4):1285–1320

Nadiri MI (1969) The determinants of trade credit in the US total manufacturing sector. Econometrica 37(3):408–423

Neale CW, Shipley D (1985) An international comparative study of credit strategy. Eur J Manage 19(6):24–38

Ng CK, Smith JK, Smith RL (1999) Evidence on the determinants of credit terms used in interfirm trade. J Financ 54(3):1109–1129

Nilsen JH (2002) Trade credit and the bank lending channel of monetary transmission. J Money Credit Bank 34(1):226–253

Petersen MA, Rajan RG (1994) The benefits of lending relationships: evidence from small business data. J Financ 49(1):3–37

Petersen MA, Rajan RG (1997) Trade credit: theories and evidence. Rev Financ Stud 10(3):661–691

Schwartz RA (1974) An economic model of trade credit. J Financ Quant Anal 9(4):643–657

Schwartz RA, Whitcomb DK (1978) Implicit transfer in the extension of trade credit. In: Boulding KE, Wilson TF (eds) Redistribution through the financial system: the grants economics of money and credit. Praeger Special Studies, New York, pp 191–208

Vandenberg P (2003) Adapting to the financial landscape: evidence from small firms in nairobi. World Dev 31(11):1829–1843

White H (1980) A heteroskedasticity-consistent covariance matrix estimator and a direct test for heteroskedasticity. Econometrica 48(4):817–838

Acknowledgments

We thank Haiging Hu and anonymous referees for helpful comments; all views and errors remain our own. This work was funded by Grants-in-Aid for Young Scientists (B) No. 21730229 and No. 21730233 from the Ministry of Education, Science, Sports, and Culture of Japan (MESSC); Go Yano and Maho Shiraishi acknowledge these financial supports.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Shiraishi, M., Yano, G. Trade credit in China in the early 1990s. Econ Change Restruct 43, 221–251 (2010). https://doi.org/10.1007/s10644-010-9086-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10644-010-9086-4

Keywords

- Trade credit in China

- The nature of trade credit

- Triangle debt problem

- Intensified market competitiveness