Abstract

This paper aims at casting a new light on the persistence of underemployment in emerging economies, by examining the relationship between labour market imperfections and longevity changes. For that purpose, we develop a two-period OLG model where longevity depends positively on the real wage, but negatively on the underemployment level, which both result from wage negotiations between a trade-union, representing workers (i.e. young generation), and the management, representing capital-holders (i.e. old generation). The existence, uniqueness and stability of a non-trivial steady-state equilibrium are studied. The distribution of bargaining power is shown to be a major determinant of the short run and long run dynamics of employment, production and longevity. The dynamics is also shown to be significantly sensitive to the precise form under which job quality affects longevity.

Similar content being viewed by others

Notes

Sources: ILO, Key Indicators of the Labour Market, KILM8, box 8b.

Note that underemployment is also large in many African economies. For instance, Denu et al. (2005) estimated that underemployment in rural Ethiopia can be as high as 40% for males.

Underemployment exists also, but to a smaller extent, in advanced economies, such as Australia (see Wilkins 2004).

That relation is bidirectional: while underemployment prevents economic expansion, a stagnant economy, by preventing any reform, makes underemployment persist (Bowden et al. 2006).

See Kornai (2000) on the role of that dimension.

Note that, if poverty traps exist, such a virtuous cycle can turn into a vicious cycle for economies with very bad initial conditions.

The unemployed and the involuntary part-timer are victims of the voluntary exchange condition on the labour market, because they would like to work more, but cannot force the firm to make them work more, because the firm has a veto right, as on any market transaction.

Such a setting is realistic in an economy without bequests.

Carter and Sutch (1990) emphasized such a behaviour of firms in the late ninteenthth century U.S.

As it is stressed by the ILO (2001, p. 60): ‘Worldwide, probably not more than one-quarter of the 150 million unemployed people are covered by unemployment benefits, and they are mainly concentrated in the industrialized countries. But for those who work in the rural or urban informal sectors in the developing countries hardly any unemployment protection exists.’

On the impact of risky behaviours, see Vallin et al. (2001).

Capital-holders have a second period of length 0 ≤ h t ≤ 1, whereas production takes place during the entire period (of unitary length). Hence, some system of payment of capital-holders in advance must be set up to allow them to consume their whole savings income before dying.

Actually, before the introduction of a strong unemployment insurance system in the mid-twentieth century, firms preferred to reduce working time of everyone rather than lay off some workers.

Note that the assumption h e t+1 = h t can be deduced from the usual adaptive expectations formula h e t+1 = h e t + χ(h t −h e t ), where the correction parameter χ equals 1 [fixed expectations (i.e. \( h_{t+1}^{e}=h_{t}^{e}=\bar{h}\)) are obtained under χ equal to 0].

That structure is based on Benassy (2002, Chap. 5).

Those two constraints are imposed by the voluntary exchange condition: no buyer is forced to buy more than what he demands, and no seller is forced to sell more than what he supplies.

As shown in Binmore et al. (1986), the asymmetric Nash bargaining solution can be regarded as the solution of a noncooperative sequential bargaining process, provided both parties react very quickly to each other’s proposal.

As this is stressed in Binmore et al. (1986), the bargaining power parameter should not be regarded as reflecting asymmetries in the preferences of parties (which are captured by U w and U c), or in the disagreement points (which are modelled as \(\bar{U}^{w}\) and \(\bar{U}^{c} \)), but, rather, as resulting from asymmetries either in the bargaining procedure (e.g. different time lags before reactions), or in the beliefs about a risk of breakdown of negotiations.

The asymmetric influence of longevity on the utility of the young and the old—and the resulting asymmetric impact of longevity on the agreement reached—follows from the functional form representing lifetime welfare, and might not hold for other functional forms. However, other forms would yield the same outcome, provided these reflect the fact that a given longevity gain is not regarded in an equivalent way by a young and an old individual.

Actually, unions do not internalize the impact of wage negotiations on longevity, and, thus, the wage resulting from negotiations may not correspond to what a well-informed, fully-rational union would have negotiated.

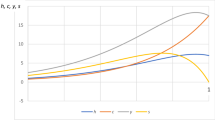

On Fig. 3, A = 20, α = 0.5, β = 0.5, δ = 0.1, ψ = 0.2, ϕ = 0.1, Z = 0.2.

On Fig. 4a, A = 20, α = 0.5, β = 0.5, δ = 0.1, ψ = 0.2, ϕ = 0.1, Z = 0.05.

On Fig. 4b, A = 20, α = 0.5, β = 0.5, δ = 0.5, ψ = 0.2, ϕ = 0.1, Z = 0.2.

In Fig. 4c, A = 20, α = 0.7, β = 0.5, δ = 0.5, Z = 0.02, ψ = 0.3, ϕ = 0.2.

The proofs of those claims are presented in the Appendix.

Thus, that condition states that the maximum longevity cannot be overtaken, which is a quite tautological requirement.

A proof of that statement is presented in the Appendix.

G(h t ) gives us the value of h t+1 as a function of h t provided k t remains constant.

On Fig. 5, A = 20, α = 0.5, β = 0.5, ψ = 0.2, ϕ = 0.1, Z = 0.2.

On Fig. 6a, A = 20, α = 0.5, β = 0.5, δ = 0.5, ψ = 0.2, ϕ = 0.1, Z = 0.2.

On Fig. 6b, A = 20, α = 0.8, β = 0.5, δ = 0.1, ψ = 0.42, ϕ = 0.85, Z = 0.2.

On Fig. 6c, A = 25, α = 0.9, β = 0.5, δ = 0.9, ψ = 0.15, ϕ = 0.14, Z = 0.75.

Given the discontinuity of the wage function, we confine ourselves here to a non-formal study of stability, whose conclusions cannot have the generality of the ones of a formal study.

We focus here on cases where there is a unique steady-state equilibrium.

On Fig. 10a and b, A = 20, α = 0.5, β = 0.5, ρ = 2, Z = 0.2, ψ = 0.2, ϕ = 0.1.

On Fig. 10c, A = 5, α = 0.5, β = 0.5, ρ = 2, Z = 0.2, ψ = 0.1, ϕ = 0.9.

On Fig. 10d, A = 5, α = 0.5, β = 0.5, ρ = 2, Z = 0.2, ψ = 0.2, ϕ = 0.1.

On Fig. 11a, A = 20, α = 0.5, β = 0.5, δ = 0.1, ρ = 2, Z = 0.2, ϕ = 0.1. ψ takes the values 0.1, 0.2 and 0.3.

On Fig. 11b, A = 20, α = 0.5, β = 0.5, δ = 0.3, ρ = 2, Z = 0.2, ϕ = 0.1. ψ takes the values 0.1, 0.2 and 0.4.

On Fig. 11c, A = 20, α = 0.5, β = 0.5, δ = 0.3, ρ = 2, Z = 0.2, ψ = 0.2. ϕ takes the values 0.1, 0.2 and 0.8.

On Fig. 11d, A = 20, α = 0.5, β = 0.5, δ = 0.3, ρ = 2, ψ = 0.1, ϕ = 0.1 Z takes the values 0.2, 0.3 and 0.4.

That observation holds also when δ = 0.5: under ψ = 0.2 and ϕ = 0.1, steady-state underemployment is about 10%, whereas it is, under ψ = 0.1 and ϕ = 0.2, about 12%.

But this gap is less sizeable than under δ = 0.1, and also smaller than the gap at t = 0.

Note that the impact of δ on convergence is robust to the calibration of the longevity function (e.g. ψ = 0.1 < ϕ = 0.2).

In this subsection, ‘high’ and ‘low’ initial capital mean respectively: k 0 = 1 and k 0 = 0.1, while ‘high’ and ‘low’ initial longevity correspond to h 0 = 0.25 and h 0 = 0.05.

On Figure 15a–c, A = 20, α = 0.35, β = 0.6, δ = 0.5, ρ = 2, Z = 0.3.

References

Arnsperger C, de la Croix D (1993) Bargaining and equilibrium unemployment. Narrowing the gap between New Keynesian and ‘disequilibrium’ theories. Eur J Polit Econ 9:163–190

Benassy J-P (2002) The macroeconomics of imperfect competition and nonclearing markets. The MIT Press

Bhattacharya J, Qiao X (2005) Public and private expenditures on health in a growth model. Iowa State University Working Paper #05020

Binmore K, Rubinstein A, Wolinsky A (1986) The Nash bargaining solution in economic modelling. RAND J Econ 17(2):176–188

Bowden S, Higgins DM, Price C (2006) A very peculiar practice: underemployment in Britain during the interwar years. Eur Rev Econ Hist 10(1):89–108

Carter S, Sutch R (1990) The labor market in the 1890s: evidence from Connecticut manufacturing. In: Aerts E, Eichengreen B (eds) Unemployment and Underemployment in a Historical Perspective. Leuven University Press, Leuven

Chakraborty S (2004) Endogenous lifetime and economic growth. J Econ Theory 116:119–137

Denu B, Tekeste A, van der Deijl H (2005) Characteristics and determinants of youth unemployment, underemployment and inadequate employment in Ethiopia, employment strategy papers, Employment Strategy Department, 2005-07

Devereux M, Lockwood B (1991) Trade unions, non-binding wage agreements, and capital accumulation. Eur Econ Rev 35:1411–1426

Eichengreen B (1990) Unemployment and underemployment in historical perspective. In: Aerts E, Eichengreen B (eds) Unemployment and Underemployment in a Historical Perspective. Leuven University Press, Leuven

Friedland D, Price R (2003) Underemployment: consequences for the health and well-being of workers. Am J Community Psychol 32(1/2):33–45

Gerdtham UG, Johannesson M (2003) A note on the effect of unemployment on mortality. J Health Econ 22:505–518

International Labour Organization (2001) Social security: a new consensus. International Labour Office, Geneva

International Labour Organization (2006) Key indicators of labour market KILM12: time-related underemployment, available at http://www.ilo.org/public/english/employment/strat/kilm/download/kilm12.pdf

Kornai J (2000) The socialist system. Oxford University Press, Oxford

Mesrine A (2001) La surmortalité des chômeurs: un effet catalyseur du chômage?. Econ Stat 334(4):33–47

Nylén L, Voss M, Floderus B (2001) Mortality among women and men relative to unemployment, part time work, overtime work, and extra work: a study based on data from the Swedish twin registry. Occup Environ Med 58:52–57

Pestieau P, Ponthiere G, Sato M (2008) Longevity, health spending and pay-as-you-go pensions. Finanzarchiv 64(1):1–18

Rutkowski J (2006) Labour market developments during economic transitions. World Bank Policy Research Working Paper 3894

Tasçi M (2005) Recent trends in underemployment and determinants of underemployment in Turkey. Department of Economics, Middle East Technical University, Ankara

Vallin J, Caselli G, Surault P (2001) Comportements, styles de vie et facteurs socioculturels de la mortalité. In: Caselli G, Vallin J, Wunsch G (eds) Démographie: analyse et synthèse, vol III. INED, Paris, pp 1–2

Wilkins R (2004) The extent and consequences of underemployment in Australia. Melbourne Institute of Applied Economics and Social Research Working Paper 16-04

Acknowledgements

The author would like to thank Nicola Coniglio, Dennis Goerlich, Joël Hellier, Pierre Pestieau, and two anonymous referees for their helpful comments. The usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Existence of a non-trivial steady-state The case where \(\delta > \frac{(1-\alpha)(1-\beta)}{\alpha \beta +(1-\beta)}\) can be treated as follows.

Substituting the kk locus within the hh locus allows us to derive an expression giving us h t+1 as a function G(h t ):

where \(\Uplambda \equiv \left(\frac{(1-\alpha)\left(\delta \beta +(1-\beta)h_{t}\right) }{\delta \rho }\right) ^{\frac{-\alpha }{\rho }}\) and \(\Uptheta \equiv \frac{\delta \left(\frac{\beta +(1-\beta)h_{t}}{\rho }\right) ^{\frac{-\alpha }{\rho }}\left(\beta +(1-\beta)h_{t}\right) }{(1-\alpha)(\delta \beta +(1-\beta)h_{t})}.\)

Under \(\delta > \frac{(1-\alpha)(1-\beta)}{\alpha \beta +(1-\beta)},\) we know that Λ < Θ, and that:

so that we can rewrite G(h t ) as:

Given that G(h t ) ≥ 0, it can be shown that G(h t ) has necessarily a fixed point, that is, a value of h t such that G(h t ) = h t , if the following three conditions are satisfied:

-

(i)

G(0) = 0

-

(ii)

\(\lim_{h\rightarrow 1}G(h_{t})/h_{t} < 1\)

-

(iii)

\(\lim_{h\rightarrow 0}G^{\prime }(h_{t})=+\infty \)

Regarding (i), it is easy to check that:

Regarding (ii),

so that the constraint imposed is:

Regarding (iii), G(h t ) can be rewritten as:

the derivative G′(h t ) is:

Thus, \(\lim_{h\rightarrow 0}G^{\prime }(h)\) is:

which tends to +∞ when \(\frac{\alpha \varphi }{1-\alpha } < 1\) .

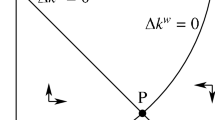

The three conditions garantee that the function G(h t ) will cross the 45degree line at least once on the interval [0,1]: actually, G(0) is 0, but for higher values of h t , the G(h t ) curve starts above the 45 line by condition (iii), but must be lower than 1 when h t tends to 1 by condition (ii) so that it must cross the 45line somewhere.

The case where \(0 < \delta\leq\frac{(1-\alpha)(1-\beta)}{\alpha \beta+(1-\beta)}\) can be discussed by following those lines of arguments.

Actually, in that general case, (i) is still true, as:

Regarding (ii), one should notice that, if δ ≤ \(\frac{(1-\alpha)(1-\beta )}{\alpha \beta +(1-\beta)},\) the economy cannot remain in underemployment when h t tends to 1. Therefore, the condition under which \(\lim_{h_{t}\rightarrow 1}G(h_{t})/h_{t} < 1\) becomes:

Regarding (iii), one should notice that, when h t tends to 0, the economy must, given δ > 0, tend to excess labour supply, so that the above condition \(\frac{\alpha \psi }{1-\alpha } < 1\) must remain true.

The case where δ is zero is trivial. Under δ = 0, the negotiated wage is zero, so that workers will not be able to consume nor to save anything. Hence, given the full depreciation of capital, the capital stock at the next period will be zero, so that the production can no longer take place, whatever initial conditions are.

Uniqueness If the steady-state exhibits no underemployment, G(h t ) becomes:

However, it follows from this that the derivative of G(h t ) at such a steady-state must be non-positive. Indeed, G′(h t ) can be rewritten as the product:

whose first factor is positive, whereas the second factor is necessarily non-positive.

Actually, a non-positive second factor is equivalent to:

which, in terms of δ, is equivalent to: \(\delta \leq \frac{(1-\beta)(1-\alpha)h}{\alpha \beta +h(1-\beta)}.\)

But there is no underemployment here, so that \(\delta \leq \frac{(1-\beta)(1-\alpha)h}{\alpha \beta +h(1-\beta)}\) is necessarily satisfied.

Hence, under that constraint, G′(h) ≤ 0. In other words, the slope of G(h) in the full employment area (i.e. on the right of the vertical dotted line) is non-positive. It follows from that inequality that the non-trivial steady-state must here be unique. Actually, given that G(h) is decreasing with h for h > h*, it is hard to see how G(h) could cross the 45° line another time on the interval [h*,1], so that the non-trivial steady-state must be unique.

Rights and permissions

About this article

Cite this article

Ponthiere, G. Can underemployment persist in an expanding economy? Clues from a non-Walrasian OLG model with endogenous longevity. Econ Change Restruct 41, 97–124 (2008). https://doi.org/10.1007/s10644-008-9043-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10644-008-9043-7