Abstract

We analyze, in a game-theoretic model, the strategic interaction between competing firms that source their inputs from either primary or recycled material. Because the manufacturers’ primary production today serves as input for the recyclers’ production tomorrow, manufacturers can limit the recyclers’ scale of operation by reducing their output. Improving the recycling process generates then two opposite effects: it reduces primary production tomorrow by exposing manufacturers to stronger competition from recyclers, but it also lowers the manufacturers’ incentives to reduce their primary production today. If primary production exerts a negative externality on the environment, then making the recycling process too efficient might be counterproductive. This intuition equally applies to remanufacturing.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Research question. Authorities worldwide have committed to scaling up the collection of scraps for recycling. The expectation is that, by increasing the inputs for the recycling sector, they can reduce the volume of primary production and hence, lower the economy’s impacts on the environment.Footnote 1 The European Commission, for instance, announced in November 2022 proposals to reduce packaging waste by introducing new targets for reuse and recycling.

While recycling can reduce the negative impact of the economy on the environment, one may ask to which extent an improvement in the collection of scraps for recycling can reduce the volume of primary production. To answer this question properly, we need to analyse the strategic interaction between competing firms that source their inputs from either primary or recycled material. What makes this competition peculiar is that the firms producing from primary material (which we call the ‘ manufacturers’) also supply inputs for the firms producing from recycled material (which we call the ‘recyclers’). Consequently, the manufacturers can control the scale at which the recyclers can operate; in particular, they may want to reduce their current production to limit the competition that recyclers will exert in the future. It is thus crucial to take this possibility into account when evaluating the impacts of improving the recycling process.Footnote 2

Main result. Our analysis establishes that an intensification of the recycling process may be counter-productive from an environmental—and even societal—point of view. The intuition behind this result is the following. Improving the recycling process generates two opposite effects. On the one hand, it reduces primary production (and the negative externality associated with the use of primary resources) once recyclers enter the market; this is so because the competition they exert on manufacturers gets stronger as recycling is improved. On the other hand, the better the recycling process, the lower the incentives for manufacturers to reduce their primary production before recyclers enter. The benefit for manufacturers of limiting the recyclers’ future entry must indeed be assessed against the cost of forgoing current profits. An improvement of the recycling process worsens the benefit/cost ratio of this strategy because it forces manufacturers to accept a larger decrease in their current primary production to reach a given reduction in the recyclers’ scale of entry.

To establish this result, we consider a game-theoretic model with two periods. In period 1, manufacturers extract primary material and use it to produce some final products. In period 2, recyclers enter the market; they produce the final product using recycled material while manufacturers continue to produce from primary material. Periods are linked as follows: the available recycled material in period 2 is a fraction of what manufacturers produced in period 1. To isolate the effects of strategic interaction, we assume in our baseline model that the manufacturer does not internalize the scarcity of the primary material.Footnote 3

Related literature. Motivated by the notorious Alcoa case (Walter 1951),Footnote 4 the early literature on recycling focuses on the price path and the respect of Hotelling rule in the extraction of exhaustible resources with the existence of a recycling sector.Footnote 5 For this objective, the natural approach taken by most papers in this strand of literature is to relate steady-state outcomes (prices, market shares, etc.) to fundamentals (demand, recycling rate, production costs, etc.). In contrast, our approach borrows from industrial organization and focuses on two periods only (no steady-state is contemplated). Therefore, we do not consider the “recycling problem” as such, because there is no third period to anticipate. Instead, we analyze more sharply the impact of the fundamentals on the strategic interaction between primary and secondary producers.

Also motivated by the structure of the aluminium market and the nature of extracting and recycling industries, the literature is largely dominated by the twin assumptions that (i) the recyclers are perfectly competitive and (ii) resources are exhaustible. The assumption of a competitive recycling industry imposes that, by setting the price for the current period, the primary producer determines in advance the output of the recyclers since it knows that the recyclers will equate their marginal cost to the given price. By eliminating the possibility of a strategic reaction from the recyclers, this assumption allows the previously mentioned studies to focus on the price path of the resource and the primary producer’s market power. To the contrary, we differ by allowing the recyclers to exercise market power. This assumption lets us analyze how dynamic incentives interact with future changes in market structure.

We are not the first to explore the dynamic effects of recycling in an oligopoly competition. However, to the best of our knowledge, such studies either focus on the primary firm’s foreclosure incentive (Hollander and Lasserre 1988; Ba et al. 2020; Ba 2022) or assume that firms can commit to supply paths (Gaudet and Van Long 2003; de Beir et al. 2023). We extend this literature by considering how strategic behaviour interacts with environmental policy in a dynamic setting. This extension is necessary to discuss the interaction between strategic incentives and policies designed with environmental-friendly objectives.

Concerning the relationship between the exhaustibility of resources and the strategic reaction of firms, previous studies show that imposing this assumption leads to specific channels of reaction. For instance, Ba and Mahenc (2019) demonstrate that, by producing less in the first period, the primary producer signals that it will flood the market with primary products in the second period, hence, deterring the entry of the recyclers. In other studies, de Beir et al. (2023) and Ba (2022) assume a cost function of primary production that is convex with respect to the resource left unextracted. In such a setting, firms want to reduce primary production initially to save on future costs and, thereby, compete more aggressively against recyclers. In contrast, we abstract from exhaustibility in our baseline model and focus on the primary producer’s control of the recycling input to constrain the recycler’s scale of entry. Nevertheless, in Sect. 4.3, we extend our baseline model to account for resource exhaustibility. We show that the two motivations for reducing first-period production (future cost saving and entry limitation) reinforce one another.

Another assumption typically used in the literature is the existence of a technology threshold for the recycler to enter the market. Under this assumption, Ba and Mahenc (2019) and de Beir et al. (2023) establish a setting in which the primary producer can deter or accommodate the recycler by reducing its production before the recycler’s entry. In our setting, we assume that the technology/availability of scraps is good enough so that the recycler can always enter the market. As a result, only two strategies are possible for the primary producer: limit the recycler’s competition or let it exist. In both cases, the manufacturer and the recycler interact strategically.

Furthermore, the literature generally integrates the collection decision into the recycling entities. In reality, while reprocessing entities are mostly private, the collection system relies heavily on the government’s effort to scale it up. Playing a significant role in organizing the curb-side collection and subsidizing the collection entities, the government’s commitments influence the recycling rate beyond the market-based mechanism. Therefore, we extend the literature by examining the impacts of exogenous variations of the recycling rate. To the best of our knowledge, Fabre et al. (2020) is the only other study doing this kind of analysis. However, they only consider an efficient recycling rate and a setting with a social planner’s problem.Footnote 6 In contrast, we study the optimal recycling rate with a setting allowing for strategic interaction among firms.

As mentioned above, the literature studying the problem of “remanufacturing” is also closely related to our work. In this strand of literature, extant studies focus mainly on the impact that remanufacturing has on the primary manufacturers’ profitability. For instance, Atasu et al. (2008) investigate the conditions for the benefits of remanufacturing to outweigh the losses from cannibalization when manufacturers conduct remanufacturing themselves. They show that remanufacturing is more beneficial under competition than under monopoly. In another paper, Ferguson and Toktay (2009) analyze the competition between a manufacturer and a remanufacturing firm. They discuss the conditions for the manufacturer to choose to remanufacture its products or not. They also compare two entry-deterrent strategies: remanufacturing and preemptive collection. Webster and Mitra (2007) and Mitra and Webster (2008) develop two-period models where they consider a monopolist on the original market that competes with a remanufacturer. Assuming a fixed level of remanufacturability, they show the conditions under which take-back regulations as well as subsidies encourage remanufacturing activities. Örsdemir et al. (2014) study the competition between a manufacturer and a remanufacturer, incorporating the constraint that the remanufactured product quantity cannot exceed the quantity of the original product. Their model shares some features with ours but differs in important aspects: competition takes place in a single period and public policy is not considered.

In a broader view, our study also echoes recommendations from empirical studies that recycling should not be pushed too far. Kinnaman et al. (2014) use data in Japan to estimate the average social cost of waste management as a function of the recycling rate. Defining the social cost as the sum of all municipal costs and revenues, costs to recycling households, external disposal costs and external benefits of recycling, the authors suggest that the recycling rate that minimizes the average social costs in Japan should only be 10% and concluded that “the 20% recycling rate in Japan is higher than the socially optimal rate” and that “the current recycling rates in the United States (35%) and the EU27 (34%) may also be too high.” In another study, Dijkgraaf and Gradus (2014) estimate the cost function resulting from different policies in waste recycling in the Netherlands and find that it seems nearly impossible for the Netherlands to reach the EU goal of 70% recycling rate because of the high cost of the recycling system.Footnote 7

In Sect. 2, we analyse a baseline model with one manufacturer, one recycler, and linear demand and costs. In Sect. 3, we use this model to characterize the first-best allocation and the second-best policy. In Sect. 4, we show that our key results hold in more general settings with a general demand, product and cost differentiation, resource scarcity, several manufacturers and recyclers, manufacturers using their own scrap, or a for-profit scrap collector. We conclude in Sect. 5.

2 A Baseline Model

We analyze here a setting with one manufacturer, one recycler, and simple specifications for demand, costs, and recycling technology. This parsimonious model allows us to focus on the main strategic trade-off while leaving out unnecessary details. In Sect. 4, we discuss our assumptions and show the robustness of our results by extending the model in several directions.

We consider the market for some homogenous good (think of, e.g., aluminium cans). The manufacturer produces the good from primary material, whereas the recycler does so by using a reprocessed fraction of the manufacturer’s end-of-life products. The two firms play the following two-stage game. In period 1, the manufacturer chooses the quantity of production for this period, \(q_{1}\); by the end of the period, all products in use wear out and a fraction \(\tau \in [0,1]\) of the scraps is collected and reprocessed (the rest of the scraps is dumped). In period 2, the recycler enters the market and uses the reprocessed scraps as input to compete with the manufacturer à la Cournot; we denote by r the quantity produced by the recycler and by \(q_{2}\) the quantity produced by the manufacturer. In what follows, we call \(\tau\) the recycling rate and we take it as a measure of the efficiency of the recycling system.Footnote 8 Note that \(\tau\) is common knowledge (in particular, it is known by the manufacturer in period 1). The other ingredients of the baseline model are as follows.

Demand. The inverse demand for the good is \(p_{1}=1-q_{1}\) in period 1 and \(p_{2}=1-q_{2}-r\) in period 2. That is, we assume for now that consumers perceive the manufacturer’s and the recycler’s products as homogenous, and that the recycler’s entry does not contribute to increasing total demand (i.e., the maximum price that consumers are willing to pay is the same in both periods and is normalized to 1).

Production costs. We assume that both firms have a constant marginal cost of production and no fixed cost. Without loss of generality, we normalize the manufacturer’s production cost to zero. Meanwhile, the total cost to produce a quantity r of recycled products from reprocessed scrap is equal to cr. We assume in the baseline model that \(c\ge 0\), meaning that recycling is at least as expensive as primary production. Before the recycler’s entry, the manufacturer does not know precisely the value of c; it expects c to be drawn from a uniform distribution over the interval [0, 1/2].Footnote 9

We solve the game for its subgame-perfect equilibrium, assuming that the manufacturer does not discount its future profit when choosing its quantity in period 1.Footnote 10 Before doing so, we briefly outline the benchmark case with no possibility of recycling. This is so, in our setting, when the recycling rate \(\tau\) is equal to zero: with no scrap collected and/or reprocessed, the recycler cannot enter the market. In this case, the manufacturer would simply behave as an unconstrained monopolist in both periods: it would choose \(q_{1}\) and \(q_{2}\) to maximize \(\pi =(1-q_{1})q_{1}+(1-q_{2})q_{2}\), which yields \(q_{1}=q_{2}=q^{m}=1/2\). Over the two periods, the manufacturer would then produce a total quantity of primary products \(2q^{m}=1\) and earn a total profit of \(\Pi (1/2, 1/2)=1/2\).

We now turn to the situations in which \(\tau >0\): scraps are collected and reprocessed so that the recycler can enter the market in period 2. Solving the game backwards, we first analyse the Cournot competition in period 2; we then move to the manufacturer’s choice in period 1.

2.1 Competition Between Manufacturer and Recycler

In period 2, the two firms simultaneously choose their quantity. The manufacturer chooses \(q_{2}\) to maximize \(\pi _{2}=\left( 1-q_{2}-r\right) q_{2}\); we derive the manufacturer’s best-response function from the first-order condition:

The recycler chooses r to maximize \(\pi _{r}=(1-q_{2}-r)r-cr\) under the constraint \(r\le \tau q_{1}\) (as it cannot produce more than the amount of reprocessed scrap, i.e., \(\tau q_{1}\)). Solving the constrained maximization program, we find that the recycler’s best-response function is kinked:

Crossing the two best-response functions, we can identify two possible Cournot-Nash equilibria in period 2, depending on the amount of reprocessed scrap (\(\tau q_{1}\)) and the recycler’s unit cost (c): an ‘unconstrained equilibrium’ in which scraps are in large supply and/or the recycler is not efficient enough to reprocess them all, and a ‘constrained equilibrium’ in which scraps are in short supply and/or the recycler is efficient enough to be bounded by the input availability. These two equilibria are characterized as follows:

-

Quantities at the unconstrained equilibrium are found by solving the system of equations made of (1) and the top branch of ( 2):

$$\begin{aligned} q_{2}^{u}=\tfrac{1}{3}\left( 1+c\right) \text { and }r^{u}=\tfrac{1}{3}\left( 1-2c\right) , \end{aligned}$$(with \(r^{u}\ge 0\) as we assume \(c\le 1/2\)). The equilibrium profits are then computed as:

$$\begin{aligned} \pi _{2}^{u}=\tfrac{1}{9}\left( 1+c\right) ^{2}\text { and }\pi _{r}^{u}= \tfrac{1}{9}\left( 1-2c\right) ^{2}. \end{aligned}$$ -

In the constrained equilibrium, the recycler’s quantity is bounded by the input constraint and the manufacturer reacts according to ( 1), so that:

$$\begin{aligned} q_{2}^{c}=\tfrac{1}{2}\left( 1-\tau q_{1}\right) \text { and }r^{c}=\tau q_{1}; \end{aligned}$$equilibrium profits are then equal to:

$$\begin{aligned} \pi _{2}^{c}\left( q_{1}\right) =\tfrac{1}{4}\left( 1-\tau q_{1}\right) ^{2} \text { and }\pi _{r}^{c}\left( q_{1}\right) =\tfrac{1}{2}\tau q_{1}\left( 1-2c-\tau q_{1}\right) . \end{aligned}$$

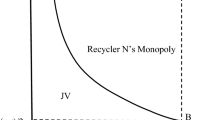

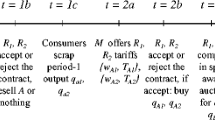

Figure 1 depicts the two possible equilibria in period 2. Due to the input constraint, the recycler’s reaction function is kinked at \(r=\tau q_{1}\). If the scrap supply is large and/or the recycler is not efficient enough, we obtain the unconstrained equilibrium \((q_{2}^{u},r^{u})\) in which \(r^{u}<\tau q_{1}\) (Fig. 1a). Because the input constraint is not binding, the firms’ outputs are independent of the recycling rate \(\tau\) and the quantity of primary product in the first period (\(q_{1}\)). Instead, they depend on the marginal recycling cost c (a higher marginal cost c leads to lower recycling \(r^{u}\) and higher primary production \(q_{2}^{u}\) in period 2). In contrast, if the scrap supply is small and/or the recycler is efficient enough, its best-response function is shifted upward, as in Fig. 1b. Here, the quantity of recycled product is constrained by the initial primary production \(q_{1}\). The market then reaches the equilibrium \((q_{2}^{c},r^{c})\) in which the recycler uses all the reprocessed scrap (\(r^{c}=\tau q_{1}\)), whereas the manufacturer produces a larger quantity \(q_{2}^{c}\) than if the recycler was not constrained (denoted by \(\tilde{q}\)). In this case, the manufacturer can control the scale of the recycler through its initial production \(q_{1}\) (a lower \(q_{1}\) leads to a lower \(r^{c}\) and a larger \(q_{2}^{c}\)).

In sum, the unconstrained equilibrium occurs if the quantity of reprocessed scrap is large enough, i.e., \(\tau q_{1}>r^{u}\); the constrained equilibrium occurs otherwise. Equivalently, for a given \(\tau q_{1}\), the unconstrained equilibrium occurs if \(r^{u}\) is small enough. Since \(r^{u}\) decreases with the recycler’s marginal cost c, a larger value of this cost makes the unconstrained equilibrium more likely, as formalized in the following lemma.

Lemma 1

(1) For a given quantity of reprocessed scrap \(\tau q_{1}\), the unconstrained equilibrium (\(r^{u}<\tau q_{1}\)) obtains if the recycler’s marginal cost c is above \(\tilde{c}\equiv \left( 1-3\tau q_{1}\right) /2\) and the constrained equilibrium (\(r^{c}=\tau q_{1}\)) obtains otherwise. (2) As the threshold \(\tilde{c}\) decreases with \(\tau\) and \(q_{1}\), only the unconstrained equilibrium can occur if \(\tau q_{1}\ge 1/3\).

Proof

(1) The threshold \(\tilde{c}\) is the value of c that separates the two types of equilibrium; that is, \(\tilde{c}\) is such that \(r^u(\tilde{c})=r^c\), which is equivalent to \(\tfrac{1 - 2\tilde{c}}{3}=\tau q_1\). For \(c >\tilde{c}\), we have \(r^u< \tau q_1\). (2) Given that \(c \ge 0\), only the unconstrained equilibrium can occur if \(\tilde{c} \le 0\), which is equivalent to \(\tau q_1 \ge \tfrac{1}{3}\); for instance, if \(q_1=q_{1}^{m}=\tfrac{1}{2}\), then the condition becomes \(\tau \ge \tfrac{2}{3}\). \(\square\)

2.2 Manufacturer’s ‘Limit Entry’ Strategy

We now analyse whether and how the manufacturer wants to follow a ‘limit entry’ strategy, whereby the firm reduces its production in period 1 so as to limit the quantity of input that the recycler will be able to use in period 2. We are also interested in evaluating how the level of the recycling rate affects the manufacturer’s decision.

In period 1, the manufacturer chooses the quantity \(q_{1}\) to maximize its expected profits over the two periods. There are two possible courses of action. First, we know from Lemma 1 that if the manufacturer sets a sufficiently large quantity—namely, \(q_{1}\ge 1/\left( 3\tau \right)\)—it can make sure that the equilibrium in period 2 will be unconstrained irrespective of the marginal cost drawn by the recycler. In that case, the manufacturer’s profit in period 2 is \(\pi _{2}^{u}=\left( 1+c\right) ^{2}/9\), which is independent of \(q_{1}\). Hence, the manufacturer’s optimal quantity in period 1 is \(q_{1}^{m}=1/2\). This quantity satisfies the constraint as long as \(q_{1}^{m}\ge 1/\left( 3\tau \right)\), or \(\tau \ge 2/3\).

Alternatively, the manufacturer can choose \(q_{1}<1/\left( 3\tau \right)\). Then, the equilibrium prevailing in period 2 depends on the cost drawn by the recycler: the manufacturer obtains the profit \(\pi _{2}^{c}\) in the constrained equilibrium if \(c<\tilde{c}\), and obtains the profit \(\pi _{2}^{u}\) in the unconstrained equilibrium if \(c>\tilde{c}\). Consequently, if \(q_{1}<1/\left( 3\tau \right)\), the manufacturer’s expected profit function can be written as

where \(\pi _{1}\left( q_{1}\right) =q_{1}\left( 1-q_{1}\right)\) and, given the uniform distribution of c over the interval \(\left[ 0,1/2\right]\),

Because \(\tilde{c}\) decreases with \(q_{1}\), the manufacturer faces a tradeoff when increasing \(q_{1}\). From (5), we observe that \(\hat{ \pi }_{2}^{u}\left( q_{1}\right)\) increases with \(q_{1}\) as the probability that the unconstrained equilibrium occurs increases with \(q_{1}\) while the manufacturer’s profit remains constant. In contrast, we observe from (4) that \(\hat{\pi }_{2}^{c}\left( q_{1}\right)\) decreases with \(q_{1}\) for two reasons: not only does the constrained equilibrium become less likely but also the manufacturer gets a smaller profit (as \(q_{2}^{*}(\tau q_{1})\) decreases with \(q_{1}\) because of strategic substitutability).

Clearly, the level of the recycling rate \(\tau\) affects the balance between these two conflicting forces. As we now show, it does so in a non-monotonic way. Denote by \(q_{1}^{*}\left( \tau \right)\) the quantity that maximizes expression (3) for a given \(\tau\). Note first that if \(\tau\) is close to zero, the unconstrained equilibrium is very unlikely (as \(\tilde{c}\) is close to 1/2) and the manufacturer is hardly affected by the small scale of the recycler’s operation in the constrained equilibrium. It follows that the manufacturer’s choice of quantity \(q_{1}^{*}\left( \tau \right)\) tends to \(q_{1}^{m}=1/2\) as \(\tau\) tends to zero. Note also that we have just established that the manufacturer chooses \(q_{1}^{m}=1/2\) as well for \(\tau \ge 2/3\). To understand how \(q_{1}^{*}\left( \tau \right)\) evolves with \(\tau\) for \(0<\tau <2/3\), we use the implicit function theorem to write:

Because \(q_{1}^{*}\left( \tau \right)\) maximizes the firm’s expected profit, \(\partial ^{2}\pi ^{e}(q_{1}^{*})/\partial q_{1}^{2}<0\) by the second-order condition. So \(dq_{1}^{*}(\tau )/d\tau\) takes the sign of

As \(\tau\) only influences the first-period profit via its impact on \(q_{1}\), the first term is equal to zero. The variation of \(q_{1}\) with respect to \(\tau\) depends then on two factors: (i) the marginal impact of \(\tau\) on the expected loss following an increase in \(q_{1}^{*}\) under the constrained equilibrium and (ii) the marginal impact of \(\tau\) on the expected gain following an increase in \(q_{1}^{*}\) under the unconstrained equilibrium. Therefore, the profit-maximizing quantity in period 1, \(q_{1}^{*}\), decreases with \(\tau\) if the first impact dominates the second and increases with \(\tau\) otherwise. As noted above, the former case certainly occurs when \(\tau\) is close to zero (as the second impact vanishes), while the latter case certainly occurs when \(\tau\) is close to 2/3 (as the first impact vanishes). We expect thus \(q_{1}^{*}\left( \tau \right)\) to be a U-shaped function of \(\tau\).

We now confirm our intuition by computing the exact value of \(q_{1}^{*}\left( \tau \right)\). The first-order condition for profit-maximization is:

At \(\tau =0\), it is equivalent to \(1-2q_{1}=0\), which confirms that \(q_{1}^{*}\left( 0\right) =1/2=q_{1}^{m}\). For \(\tau >0\), the solution to Equation (6) isFootnote 11:

We check that \(q_{1}^{*}\left( \tau \right) <1/\left( 3\tau \right)\) if and only if \(\tau <2/3\). We also observe that for \(\tau <2/3\), \(q_{1}^{*}\left( \tau \right) <1/2\) (while \(q_{1}^{*}\left( 2/3\right) =1/2\)). As represented in Fig. 2, \(q_{1}^{*}\left( \tau \right)\) is a U-shaped function of \(\tau\): \(q_{1}^{*}=1/2\) at the two extreme values of the interval (\(\tau =0\) and \(\tau =2/3\)), it decreases with \(\tau\) for \(0<\tau <\tilde{\tau }\approx 0.326\) and increases with \(\tau\) for \(\tilde{\tau }<\tau <2/3\). For \(\tau \ge 2/3\), \(q_{1}^{*}\left( \tau \right) =1/2\): as explained above, the manufacturer can no longer constrain the recycler’s input once the recycling rate becomes too large; it therefore maintains the monopolistic production \(q_{1}^{m}\) to maximize its profits in period 1.

The next proposition records our results.

Proposition 1

(1) If the recycling rate \(\tau\) is lower than 2/3, then the manufacturer contracts its period 1 production, \(q_{1}^{*}\left( \tau \right) <q_{1}^{m}\), to limit the recycler’s scale of operation in period 2; the contraction is the largest for \(\tau =\tilde{\tau }\approx 0.326\). (2) If the recycling rate \(\tau\) is larger than 2/3, then the manufacturer maintains the monopolistic production level in period 1, \(q_{1}^{*}\left( \tau \right) = q_{1}^{m}\).

Intuitively, when the recycling rate is small, the manufacturer can constrain the recycler’s scale by reducing slightly its production in period 1. Hence, in this case, the manufacturer finds it profitable to sacrifice part of its period-1 profits to increase its expected period-2 profits. As long as the recycling rate remains smaller than \(\tilde{\tau }\), the manufacturer reduces further its initial production. Yet, once the recycling rate becomes larger than \(\tilde{\tau }\), the manufacturer continues to apply the limit entry strategy, but it does so by reducing its initial production by smaller amounts; in fact, as the recycler can access a larger share of the initial production, the manufacturer must forgo more profits in period 1 to reach a given increase in expected profits in period 2. Eventually, the limit entry strategy becomes unprofitable (or is simply no longer a feasible option) when the recycling rate gets larger than 2/3; the manufacturer, then, is no longer willing to contract its initial production and prefers to produce the monopoly output in period 1, as though the recycler was not to enter in period 2.

3 Policy Implications

We now address our research question: How far should we go in improving recycling? The policy instrument that we study is the recycling rate \(\tau\).Footnote 12 There are different ways through which public authorities can increase the recycling rate. For instance, the authorities can manage a centralized collection system and implement policies to encourage consumers and firms to participate in scrap collection. As a companion tool to enforce a given intended collection rate, authorities can also run a system of returnable goods with deposits (as is done for glass bottles in some European countries).Footnote 13Negative environmental externalities can result from four sources in our setting: (i) the extraction of the primary resource, (ii) the production of primary goods by the manufacturer; (iii) the production of recycled goods by the recycler, and (iv) the accumulation of disposed waste. Following the literature (see, e.g., Örsdemir et al. (2014) and the references therein), we assume that externalities are constant per unit of output. Accordingly, we define \(e_{p}\ge 0\), \(e_{r}\ge 0\), and \(e_{w}\ge 0\) as the per-unit externality of, respectively, primary production (including the externality of primary production and primary resource extraction), r ecycled production, and waste. The total environmental impact can then be defined asFootnote 14:

The other two components of the social welfare function are the consumer surplus (CS) and the firms’ profits (\(\Pi\)). In our setting, they are computed as follows:

As is also usually assumed in the literature, the social planner maximizes the unweighted sum of the three components, that is, \(W=CS+\Pi -E\).Footnote 15

3.1 First-Best Allocation

In a first-best world, the social planner chooses the quantities to be produced (\(q_{1}\), \(q_{2}\), r) as well as the recycling rate (\(\tau\)) to maximize total welfare. The social planner’s program is:

Using expression (8)-(10) and deriving W with respect to r, we find:

The left-hand side is the price of goods in period 2, while the right-hand side is the social cost of recycling (that is, the private cost c plus the net externality—one unit of recycled product entails an environmental impact of \(e_{r}\) but reduces waste by \(e_{w}\)). To give room to recycling in our setting, we assume that this inequality is satisfied. It follows that the social planner chooses to set \(r=\tau q_{1}\). The social welfare function then becomes:

Solving for the first-order conditions with respect to \(q_{1}\) and \(q_{2}\) yieldsFootnote 16:

Substituting these values into the welfare function and deriving with respect to \(\tau\) gives:

As the first bracketed term is equal to \(q_{1}^{*}>0\), we see that the derivative is either positive or negative, depending on the sign of the second bracketed term. This allows us to state the following result.

Proposition 2

If the social cost of recycling (\(c+e_{r}-e_{w}\)) is lower than the social cost of primary production (\(e_{p}\)), then the first-best allocation is such that the first-period production is entirely recycled. Otherwise, there is no role for recycling at the first best.

The intuition behind this result is straightforward. As the first-best is achieved by producing at the marginal social cost, one must choose, for the second period, the technology (primary production or recycling) with the lowest marginal social cost.

3.2 Second-Best Policy

We now consider a world in which quantities are not directly chosen by the social planner but, instead, by the manufacturer (\(q_{1}\) and \(q_{2}\)) and the recycler (r). The planner can, nevertheless, influence the chosen quantities indirectly through the recycling rate. We saw indeed in the previous section that the recycling rate impacts the degree of competition in period 2 and, thereby, the manufacturer’s decision in period 1. As recalled in Table 1, the quantities chosen by the two firms at the subgame-perfect equilibrium of the game depend on \(\tau\), and so do the various components of the social welfare function.Footnote 17

The social planner’s objective is now written as:

An immediate observation from Table 1 is that \(\bar{W}\left( \tau \right)\) is constant for values of the recycling rate above 2/3. Recall that if \(\tau \ge 2/3\), the competition between the manufacturer and the recycler always leads to the unconstrained equilibrium, in which scrap is only partially recycled. In this case, the equilibrium quantities are independent of the recycling rate and so are all components of the social welfare function.

For smaller values of the recycling rate, we cannot solve analytically for the maximum of \(\bar{W}\left( \tau \right)\). However, we can draw useful insights by examining the impact of the recycling rate on the components of the social welfare function.

3.2.1 Impacts of Recycling on Firms and Consumers

Firms. Unsurprisingly, the firms’ preferences regarding the level of the recycling rate are completely at odds with one another. It is easily shown that the manufacturer’s profit is the largest for \(\tau =0\), while the recycler’s profit reaches its maximum level at \(\tau =2/3\). If we take the point of view of total industry profits, we see in Panel (A) of Fig. 3 that they decrease with \(\tau\); this follows from the fact that, in our model, the manufacturer earns profit over one more period than the recycler.Footnote 18

Consumers. As the baseline model assumes homogeneous products, the consumer surplus increases with the level of total production (primary and recycled). A priori, recycling has ambiguous impacts on the consumer surplus: on the one hand, the recycler’s entry in period 2 benefits consumers (because in a homogeneous product market, duopolists produce together a larger equilibrium quantity than a monopolist does); on the other hand, the prospect of the recycler’s entry induces the manufacturer to (weakly) decrease its production in period 1. Panel (B) of Fig. 3 shows that the former effect always outweighs the latter, and even more so as the recycling rate increases. Hence, consumer surplus increases with the recycling rate \(\tau\), which means that consumers would vote for pushing the improvement of the recycling process to \(\tau =2/3\).

Social surplus. Combining the previous results, we can evaluate the impacts of recycling on the social surplus, defined as the sum of the firms’ profits and the consumer surplus. We see in Panel (C) of Fig. 3 that the social surplus first decreases and then increases with the recycling rate. Comparing the values of the social surplus at \(\tau =0\) and \(\tau =2/3\), we find:

Hence, a second-best social planner with no concern for the environment (that is, only focused on the well-being of firms and consumers) would choose a recycling rate equal to 2/3.Footnote 19 This finding follows from the pro-competitive effect of recycling in our setting.

3.2.2 Impacts of Recycling on Environmental Externalities

Using the results recorded in Table 1 to compute the total environmental externality and deriving it with respect to the recycling rate, we obtain:

Some lines of computations establish the following findings: (i) as \(\tau\) tends to zero, \(\omega _{p}\left( \tau \right)\), \(\omega _{r}\left( \tau \right)\), and \(\omega _{w}\left( \tau \right)\) tend, respectively, to \(- \frac{1}{2}\), \(\frac{1}{2}\), and \(-\frac{3}{4}\); (ii) \(\omega _{p}\left( \tau \right)\) and \(\omega _{w}\left( \tau \right)\) increase with \(\tau\), while \(\omega _{r}\left( \tau \right)\) decreases with \(\tau\); (iii) \(\omega _{p}\left( \tau \right)\), \(\omega _{r}\left( \tau \right)\), and \(\omega _{w}\left( \tau \right)\) are all positive at \(\tau =\frac{2}{3}\). Hence, the function \(E\left( \tau \right)\) is either increasing or U-shaped in \(\tau\). It is increasing in \(\tau\) if the derivative is positive in the vicinity of \(\tau =0\), which occurs if \(-\frac{1}{2}e_{p}+\frac{1}{2}e_{r}- \frac{3}{4}e_{w}>0\), which is equivalent to \(e_{r}>e_{p}+\frac{3}{2}e_{w}\). Otherwise, \(E\left( \tau \right)\) reaches a minimum at \(\hat{\tau }\) such that \(\omega _{p}\left( \hat{\tau }\right) e_{p}+\omega _{r}\left( \hat{ \tau }\right) e_{r}+\omega _{w}\left( \hat{\tau }\right) e_{w}=0\), with \(0< \hat{\tau }<\frac{2}{3}\).

In sum, if the social planner only cares about the environment, it chooses ‘partial recycling’ (that is, the recycling rate is positive but strictly lower than 2/3), unless the externality from recycling is very large compared to the other two sources of externality (precisely, if \(e_{r}>e_{p}+\frac{3}{2}e_{w}\)), in which case the best is not to recycle at all.

The intuition is simple. Partial recycling induces the manufacturer to reduce its first-period production to limit the recycler’s scale of entry. From an environmental point of view, this has the advantage of reducing the extraction of primary resources, as well as the production of primary and recycled products.

3.2.3 Combined Impacts of Recycling

Finally, we look at how the second-best social welfare function evolves with the recycling rate. We focus on values of \(\tau\) comprised between 0 and \(\frac{2}{3}\) (as \(\bar{W}\left( \tau \right)\) is constant for \(\frac{2}{3} \le \tau \le 1\)). Recall that \(\bar{W}\left( \tau \right) =SS\left( \tau \right) -E\left( \tau \right)\), where \(SS\left( \tau \right) =\pi _{m}\left( \tau \right) +\pi _{r}\left( \tau \right) +CS\left( \tau \right)\). For \(0\le \tau \le \frac{2}{3}\), we just found that \(SS\left( \tau \right)\) reaches its maximum at \(\tau =\frac{2}{3}\), while \(-E\left( \tau \right)\) reaches its maximum at a lower value of \(\tau\) (possibly \(\tau =0\) ). Hence, in the presence of externalities (\(E\left( \tau \right) >0\)), \(\bar{W}\left( \tau \right)\) cannot be maximum at \(\tau =\frac{2}{3}\). We check indeed that the derivative of \(\bar{W}\left( \tau \right)\) with respect to \(\tau\) is negative when evaluated at \(\tau =\frac{2}{3}\):

This means that there exist \(\bar{\tau }\) in the vicinity of \(\frac{2}{3}\), such that \(\bar{W}\left( \bar{\tau }\right) >\bar{W}\left( \tfrac{2}{3} \right)\). Moreover, comparing the value of \(\bar{W}\left( \tau \right)\) at the extremes, we find:

Hence, if the latter condition is fulfilled, we have that \(\bar{W}\left( \bar{\tau }\right)>\bar{W}\left( \tfrac{2}{3}\right) =\bar{W}\left( 1\right) >\bar{W}\left( 0\right)\), with \(0<\bar{\tau }<\frac{2}{3}\). Figure 4 illustrates this result. It depicts the social welfare function in the second-best, assuming that \(e_{p}=e_{r}=0.1\) and \(e_{w}=0.05\). As \(e_{r}<e_{p}/2+e_{w}+1/18\), we see that the maximum is reached at a value of \(\tau\) that is inferior to 2/3. We have thus proved the following result.

Proposition 3

From a second-best perspective, partial recycling is optimal if the negative externality stemming from recycled production is relatively smaller than the externalities stemming from primary production and waste (precisely if \(e_{r}<\tfrac{1}{2} e_{p}+e_{w}+\tfrac{1}{18}\)).

The rationale underlying this result can be succinctly articulated as follows. The second-best social planner faces a delicate trade-off stemming from the divergent effects that changes in the recycling rate exert on social surplus and environmental externalities. In striving to maximize social surplus, the planner is inclined to enhance recycling to the fullest extent feasible, given that the benefits accruing to consumers and recyclers outweigh the drawbacks experienced by manufacturers. Nonetheless, the imperative to mitigate environmental externalities necessitates a nuanced approach, wherein partial recycling emerges as preferable. This preference arises from the incentivization of manufacturers to curtail primary resource extraction, thereby limiting the recycler’s entry. Insofar as recycling yields relatively lower environmental harm compared to the utilization of primary resources and waste disposal, the planner’s prioritization is directed towards mitigating the latter effects, leading to a propensity to constrain recycling enhancements. Consequently, from a second-best perspective, the response to our initial question “Recycling: How far should we go?” is aptly articulated as “Not too far!”.

4 Extensions

In this section, we show that the results obtained in our baseline model continue to hold in more general settings. We first stick to the ‘one manufacturer/one recycler’ setting but we generalize the demand function (4.1), allow for differentiated products and costs (4.2), or introduce resource scarcity (4.3). Next, we complexify the strategic interaction by assuming an arbitrary number of manufacturers and recyclers (4.4), letting the manufacturer be present in the recycling market (4.5), and introducing an independent scrap collector (4.6). For each extension, we present the modified model and focus on the results and economic intuition, leaving most of the technical analysis in the appendix.

4.1 General Demand Function

In the baseline model, the demand for the products was, for simplicity, assumed to be linear. We take now a general demand function, \(P=P(Q)\). This function is strictly decreasing, twice differentiable in \(\mathbb {R}^{+}\), and satisfies the following assumptions: (i) \(P(Q)=0\) for a finite Q; (ii) \(P^{\prime \prime }(Q)Q+P^{\prime }(Q)<0\) for all \(Q>0\); and (iii) \(P(Q)>0\). Under these assumptions, the best-response functions are downward sloping with the slope belonging to the interval \((-1,0]\). These are the sufficient conditions to assure the existence of a unique and locally stable Cournot equilibrium in period 2.Footnote 20 These conditions also ensure that products are substitutes so that per-firm outputs decrease with the number of firms in the symmetric equilibrium.Footnote 21

In Appendix 6.2, we characterize the subgame-perfect Nash equilibrium of the game. We show that the results of Lemma 1 and Proposition 1 still hold with the general demand \(P\left( Q\right)\). In particular, we establish that \(q_{1}^{*}=q^{m}\) for \(\tau \ge \bar{\tau }\) and \(q_{1}^{*}<q^{m}\) for \(\tau < \bar{\tau }\), with \(q_{1}^{*}\) decreasing with \(\tau\) when \(\tau\) is close to zero, and increasing in \(\tau\) when \(\tau\) is close to \(\bar{\tau }\).Footnote 22 We also show that the expected quantity produced by the manufacturer in period 2 decreases with \(\tau\). This allows us to state that the results of Proposition 1 continue to hold in the general case, and so do the policy implications of Sect. 3.

4.2 Product and Cost Differentiation

In the baseline model, we suppose for simplicity that the products of the recycler and the manufacturer are perfect substitutes. This relies on two related assumptions: the two products have the same technical properties and consumers are indifferent between them. Arguably, both assumptions can be verified in some contexts but certainly not in general. For certain materials such as glass, paper, and some metals, it is reasonable to consider that recycled and primary products can be used in the same way. Yet, recycled materials may also produce goods of inferior quality or, simply, other goods (for instance, plastic from recycled bottles is used for certain textiles or garden furniture). Moreover, even if recycled and primary products are similar from a technical viewpoint, it is not clear whether consumers will perceive them as equivalent. For some products (such as cars, electronic goods, or domestic appliances), consumers may be reluctant to trust recycled products or components. Conversely, environmentally conscious consumers may be attracted to recycled products of other types (such as textiles, packaging, or luggage). As for costs, we postulate in the baseline model that recycling is at least as expensive as primary production. This assumption is also restrictive, as in some industries, more energy is needed for primary production than for recycling (think, for instance, of the aluminium industry).

We show here that our model can be extended to account for these alternative scenarios while preserving the main results. On the demand side, we now let recycled and primary products be differentiated (vertically and horizontally). In period 2 (when both products are on the market), consumers are assumed to have the following net utility:

Maximizing with respect to \(q_{2}\) and r yields the inverse demands for two goods: \(p_{2}=a_{m}-q_{2}-\gamma r\) and \(p_{r}=a_{r}-r-\gamma q_{2}\). In this formulation, \(a_{k}\) is the maximum price that consumers are willing to pay for product k (\(k=m,r\)); this parameter can also be interpreted as an indicator of perceived quality. Hence, any difference between \(a_{m}\) and \(a_{r}\) denotes vertical differentiation. For instance, \(a_{m}>a_{r}\) means that consumers are willing to pay more for the primary product than for the recycled one, other things being equal. The parameter \(\gamma\) is an inverse measure of horizontal differentiation between the two products: if \(\gamma =0\), the two products are seen as completely different; if \(\gamma =1\), they are seen as perfect substitutes. In period 1, as only the manufacturer’s product is available, the inverse demand is simply \(p_{1}=a_m-q_{1}\).

On the supply side, we denote the constant unit costs by \(c_{m}>0\) for the manufacturer and by \(c_{r}\ge 0\) for the recycler. Under this formulation, producing from recycled material can be more or less expensive than producing from primary material. Note that we can recover the baseline model by setting \(a_{m}=a_{r}=1\), \(\gamma =1\), \(c_{m}=0\) and \(c_{r}=c\).

In Appendix 6.3, we repeat the analysis of Sect. 2. We characterize the equilibrium quantity of the manufacturer in the constrained equilibrium, which depends not only on the recycling rate \(\tau\) but also on the demand and cost parameters (\(a_r,a_m,\gamma ,c_r,c_m\)). To gain additional insights, we perform two comparative statics exercises. We consider first the effect of horizontal differentiation between the primary and the recycled products. To this end, we set \(a_{r}=a_{m}=1\), \(c_{m}=0\) (as in the baseline model) but let \(\gamma\) vary. We examine next the effect of vertical differentiation: What happens if consumers are environmentally conscious and value the recycled product relatively more than the primary product? Here, we set \(a_{m}=1\), \(c_{m}=0\), and \(\gamma =1\) (as in the baseline model) but we let \(a_{r}\) be larger than \(a_{m}=1\).

The numerical simulations that we perform suggest that the manufacturer reduces further its first-period output to limit entry as products become more substitutable (\(\gamma\) increases) or as the recycled product becomes more valuable for consumers (\(a_{r}\) increases). The intuition is clear: in both cases, the manufacturer faces stronger competition from the recycler and finds it more profitable to limit the recycler’s scale in period 2. From a policy point of view, one observes that the recycling rate that generates the largest output reduction becomes smaller as \(\gamma\) increases but larger as \(a_{r}\) increases.

4.3 Resource Scarcity

As we noted in the introduction, we implicitly assume in the baseline model that the manufacturer does not internalize the scarcity of the resource that it uses in its production process. To account for resource scarcity, we extend the baseline model in the following way. We let the manufacturer’s total cost of production be given by \(c_mq_1\) in period 1 and \(c_m\left( \theta q_{1}+q_{2}\right)\) in period 2, with \(c_m, \theta >0\). The formulation of the costs in period 2 captures the idea that the cost of exploiting the scarce resource increases over time with the stock of what has been used so far (in the baseline model, \(c_m=\theta =0\)). In the benchmark case with no recycling, the manufacturer’s maximization programme is:

The profit-maximizing quantities are found as:

We observe that in the absence of any competition, the manufacturer already has an incentive to reduce its first-period production. As underlined by, e.g., Ba and Mahenc (2019), reducing production (extraction) in the first period contributes to lowering the cost of production (extraction) in the second period.

Consider now the entry of the recycler in the second period. As we show in the baseline model, this entry may also incentivize the manufacturer to reduce its production in the first period. We want to know (i) how the two channels (scarcity costs and entry limitation) interact and (ii) how the equilibrium is affected by a change in the recycling rate. In Appendix 6.4, we show that (i) the two channels reinforce one another and (ii) the manufacturer’s first-period production continues to be U-shaped in the recycling rate. In sum, resource scarcity does not challenge our main results. In fact, resource scarcity gives the manufacturer another motive to decrease its first-period quantity: on top of reducing the recycler’s entry potential, the manufacturer also wants to save on second-period costs.

To conclude this section, let us note that the baseline model remains a reasonable approximation if we consider a local market. Within this local market, the firms (manufacturer and recycler) are (relatively) large, which explains why they enjoy market power. However, from a global perspective, these firms are very small players. As a result, the manufacturer does not perceive that its production contributes to the exhaustion of the resource. This does not prevent the local authority from taking into account the negative global externality that resource exhaustion exerts (see the parameter \(e_p\) that we introduced in Sect. 3). A case in point is the recycling of plastics in Belgium. First, the market for plastic recycling is increasingly local.Footnote 23 Second, Belgium is a small producer of plastics at the global level.Footnote 24 Finally, the Belgian government cares about plastic recycling.Footnote 25

4.4 Several Manufacturers and Recyclers

We consider now an arbitrary number of symmetric firms in each sector: m identical manufacturers and n identical recyclers. We adjust our notation as follows. First, we let \(q_{i1}\) and \(q_{i2}\) denote the quantities produced by manufacturer \(i=1\ldots m\) in period 1 and 2 respectively; \(Q_{1}\) and \(Q_{2}\) are the corresponding total quantities, summing over all m manufacturers. Second, we let \(r_{j}\) denote the quantity produced by recycler \(j=1\ldots n\) in period 2; R denote the total quantity produced by the n recyclers, with \(R\le \tau Q_{1}\). Finally, the inverse demand is written as \(P=1-Q_{1}\) in period 1 and \(P=1-Q_{2}-R\) in period 2.

As in the baseline model, we assume that all firms produce at a constant marginal cost; this cost is normalized to zero for manufacturers and equal to c for all recyclers, with c drawn from a uniform distribution over \(\left[ 0,1/\left( m+1\right) \right]\). In Appendix 6.5, we solve the game by backward induction for its subgame-perfect equilibrium. We sketch the main results here.

Define:

The Nash equilibrium at the second stage of the game is characterized as follows: for \(Q_{1}<Q_{1}^{\lim }\), all recyclers are constrained while for \(Q_{1}\ge Q_{1}^{\lim }\), no recycler is constrained. The condition for the unconstrained equilibrium (\(Q_{1}\ge Q_{1}^{\lim }\)) can be rewritten as:

We observe that \(\tilde{c}\left( m,n\right)\) decreases with m and increases with n, implying that, other things being equal, the unconstrained equilibrium is more likely if there are more manufacturers or fewer recyclers. We also note that the unconstrained equilibrium is the only possible equilibrium if \(Q_{1}\) is sufficiently large, that is:

If this equilibrium prevails, the manufacturers’ profits in the two periods are independent of one another. It follows that the equilibrium in period 1 is the classic Cournot-Nash equilibrium. In the present setting, each firm produces a quantity \(q_{1}=1/\left( m+1\right)\). Then, condition (11) is satisfied as long as

We note that (i) \(\tilde{\tau }\left( 1,1\right) =2/3\) (as we found in the baseline model), (ii) \(\tilde{\tau }\left( m,n\right)\) decreases with m and increases with n, and (iii) \(\tilde{\tau }\left( m,n\right) <1\) if and only if \(n<m\left( m+1\right)\). We can thus conclude that the symmetric ‘unconstrained equilibrium’ occurs if the recycling rate is above some threshold and becomes more likely as the number of manufacturers increases and the number of recyclers decreases.

In the symmetric ‘limit equilibrium’, we show that each manufacturer produces a quantity \(q_{1}^{*}\left( \tau ,m,n\right) <1/\left( m+1\right)\). We can then compute the value of \(\tau\) that minimizes \(q_{1}^{*}\left( \tau ,m,n\right)\) and assess how this value, which we denote \(\tilde{\tau }\left( m,n\right)\), changes with the numbers of manufacturer and recyclers in the market. Given the complexity of the expressions, we only consider cases with one or two firms in each group; we find:

which suggests that \(\tilde{\tau }\left( m,n\right)\) decreases with m and increases with n.

4.5 Manufacturer Using Its Own Scrap

In the baseline model, we assume that the manufacturer produces the good in both periods by using primary material exclusively. To relax this assumption, suppose now that the manufacturer is forced to use its scrap along with primary material to produce in period 2. The reuse of scrap entails two contrasting effects on the manufacturer’s profits. On the one hand, there is a direct negative effect stemming from the increase in the unit cost of production in period 2. Supposing for simplicity that the production process mixes a share \(\alpha\) of scrap (which costs c per unit) with a share \(\left( 1-\alpha \right)\) of primary material (which costs 0 per unit), the manufacturer’s unit cost is now equal to \(\alpha c>0\). On the other hand, there is potentially a positive strategic effect as the manufacturer can further limit the recycler’s capacity by using part of the scrap for its own production. Now, the quantity r that the recycler can produce cannot be larger than \(\tau q_{1}-\alpha q_{2}\).Footnote 26

In Appendix 6.6, we analyse the manufacturer’s limit entry strategy under these new assumptions. We compute the manufacturer’s profit-maximizing quantity in period 1, \(q_{1}^{*}\left( \tau ,\alpha \right)\), and we analyse its sensitivity to changes in \(\alpha\). We observe first that \(q_{1}^{*}\left( \tau ,\alpha \right)\) continues to be U-shaped in \(\tau\) even for \(\alpha >0\), meaning that our main result is preserved. The additional insight that we can draw from this extension of the model is the following: If the manufacturer must include a larger ratio of reprocessed scrap in its production, it tends to decrease its first-period production further and the recycling rate that induces the lowest first-period production becomes larger. This indicates that the positive effect of constraining further the recycler’s entry outweighs the negative effect of facing a larger production cost in period 2.

4.6 Independent Scrap Collector

In the baseline model (and its extensions so far), we assume a direct link between the manufacturer’s scrap production in the first period and the recycler’s activity in the second period. In reality, this link is less direct: between scrap production and recycling, there is the intermediary step of scrap collection. Another useful extension of the model consists thus in introducing a third type of actors, namely scrap collectors, who first retrieve discarded material from manufacturers and/or consumers and, next, sell it to recyclers. As these intermediaries act strategically, they affect the manufacturer’s behavior.

In this more realistic context, is the manufacturer still willing to reduce its first-period production now that it no longer directly controls how much scrap is available for recycling? And if it still does, how is its behavior affected by public policy? We show here that our previous results carry over if we introduce an independent, for-profit, scrap collector in the model. In particular, the manufacturer still reduces its first-period production below the myopic optimum to limit entry and this reduction is still a non-monotonic function of the efficiency of the collection/recycling process.

To account for scrap collection and resell, let us divide period 1 into two sub-periods. In period 1a, the manufacturer produces \(q_{1}\); in period 1b, the scrap collector chooses the intensity of scrap collection \(\phi \in \left[ 0,1\right]\) to produce a quantity of scrap \(s=\phi q_{1}\) and sell it to the recycler at a price c per unit. As before, in period 2, the recycler produces r from scrap at cost c and the manufacturer produces \(q_{2}\) from primary material at cost 0. We assume that the scrap collector’s cost function is concave in \(\phi\) and increasing in \(q_{1}\): \(C\left( \phi ,q_{1}\right) =\frac{1}{2}\sigma \phi ^{2}q_{1}\), where \(\sigma >0\) can be seen as an inverse measure of the efficiency of the collection process (the lower \(\sigma\), the lower the cost of scrap collection for any intensity \(\phi\) and any production \(q_{1}\)). We also assume that the recycler can produce a quantity of final good \(r=\mu s\) from a quantity s of scrap, where \(0<\mu \le 1\) measures the efficiency of the recycling process. In this extended model, a public authority can use two instruments to improve recycling: it can decrease \(\sigma\) to have a larger share of discarded products being collected and/or improve \(\mu\) to have a larger share of collected scrap being transformed into final goods.

In Appendix 6.7, we demonstrate that the manufacturer can improve its second-period profit by decreasing its first-period output below the myopic optimum. In other words, the manufacturer is still able to limit the recycler’s entry even if the quantity of available scrap is now chosen by an intermediary. We also show that the profit-maximising quantity in period 1 first decreases and eventually increases with \(\tau\) (with \(\tau \equiv \mu ^2/\sigma\) measuring the global efficiency of the collection/recycling process). This non-monotonicity is similar to the one we find in the baseline model.

5 Conclusion

We show in this paper that increasing the rate of scrap collection/reprocessing for recycling (or the degree of product repairability to foster remanufacturing) does not reduce monotonically the quantity of primary production. This is due to the strategic reaction of manufacturers when anticipating the entry by recyclers (or remanufacturers). In fact, increasing the recycling rate from a low level reduces the quantity of primary production as manufacturers constrain the recyclers’ scale of operation to soften competition in the next period. However, if the initial recycling rate is higher than a certain threshold, increasing the rate will lead to an increase in the quantity of primary production as constraining the recyclers’ entry becomes too expensive for manufacturers (because they need to reduce further their current production—and thus their current profit). Consequently, it may be counterproductive from an environmental point of view (and even a societal point of view) to make the recycling process too efficient because, above some level, manufacturers would prefer to increase their extraction of primary material.

Although we show that our results continue to hold in richer settings, future research should aim at extending our model further. An interesting direction would be to abandon the simplifying assumption of symmetry within the two categories of firms (manufacturers and recyclers). If manufacturers are different (for instance, because they have different costs of production), it is unclear how the efforts to reduce the recyclers’ entry would be allocated among them. Manufacturers would indeed tend to free-ride and let other firms bear the cost of reducing their production.Footnote 27 Also, given the manufacturers’ first-period decisions, the recyclers’ entry could be affected not only on the intensive margin (each entrant producing less) but also on the extensive margin (the less efficient recyclers staying out altogether). Additional insights could then be gained regarding the impacts of changes in the recycling rate.

Notes

Recycling of aluminium products, for example, requires as little as 5% of the energy and emits as little as 5% of greenhouse gas compared to the production of primary aluminium (International Aluminium Institute 2009). Recycling can also reduce the negative impact of waste on the environment (arguably better than landfills and incineration).

The same intuition applies to remanufacturing, which is “a specific type of recycling in which used durable goods are repaired to a like-new condition” (Bernard 2011, p. 337). The difference is that, after a product’s first life, recycled material can be redirected towards any industry; on the contrary, the remanufactured products go back to the same industry. Nevertheless, both remanufacturing and recycling firms rely on the used products from the primary producers as input for their business. Hence, remanufacturers compete with manufacturers of primary products in the same way as recyclers do, meaning that the basic mechanisms of our analysis are also present in the case of remanufacturing. As an illustration, Örsdemir et al. (2014) explain that manufacturers have the incentive to reduce the competitive threat exerted by remanufacturers “through limiting quantity, specifically by creating a scarcity of cores available for remanufacturing.” They give the example of Lexmark, which made cores ineligible for remanufacturing (see https://archive.grrn.org/lexmark/background.html, last accessed April 4, 2024).

In Sect. 4.3, we show that our results continue to hold when the manufacturer internalizes the scarcity of the primary material in its profit-maximization program. We also propose a scenario in which it might be plausible that the manufacturer ignores resource scarcity.

In 1945, Alcoa, the producer of primary aluminium, was found in a monopolistic position by virtue of its control over 90% of primary aluminium output, limiting the competitiveness of the recycling industry, which captured roughly 20% of the total aluminium market. Judge Learned Hand concluded that Alcoa constituted an illegal monopoly, in violation of the Sherman Antitrust Act: Alcoa was found to control strategically the recycling sector’s supply by manipulating the primary aluminium production.

Ba and Soubeyran (2023) also share a similar idea. However, their setting does not allow for a full static comparison. As a result, they only conduct numerical simulations with certain recycling rates.

To adapt the model to the case of remanufacturing, we can simply interpret the parameter \(\tau\) as the degree of product repairability. A larger value of \(\tau\) means then that the primary product is easier to repair, which increases the remanufacturing possibilities. Policies promoting the repairability of goods aim to foster this process. For instance, in February 2024, the Council and the European Parliament reached a provisional deal on the so-called right-to-repair (or R2R) directive, which promotes the repair of broken or defective goods (see https://tinyurl.com/bduacnx3, last accessed April 4, 2024.)

We make this assumption of stochastic costs purely for convenience, as it allows us to make the manufacturer’s optimization problem continuous in period 1. We can establish our result equally—though less elegantly—if we assume instead that the manufacturer knows the recycler’s cost with certainty. As we assume no entry cost, \(c\le 1/2\) guarantees that the recycler enters the market. For \(c>1/2\), the recycler stays out because entry is not profitable even when the manufacturer produces the monopoly quantity. Using the terminology of Bain (1956), we say that entry is ‘blockaded’ in this case. In our setting, the manufacturer cannot ‘deter’ entry and must ‘accommodate’ it when \(c<1/2\).

A discount factor strictly lower than 1 would attenuate the manufacturer’s incentives to reduce production in the first period (as second-period profits would weigh relatively less). It is easily shown, however, that this would not affect our results.

It can easily be checked that the other root is negative and that the second-order condition is satisfied.

As our objective is to demonstrate the counter-intuitive impacts of modifying the recycling rate, we limit our analysis to this policy instrument, abstracting away other instruments—such as taxes on primary products or subsidies on recycled products—that the government could use to limit environmental damages. For a survey on the economics of environmental policy instruments, see, e.g., Sterner and Robinson (2018).

In this two-period model, we do not consider the potential waste externality of second-period production (\(q_{2}+r\)).

All along, we assume that improving recycling is costless. This allows us to isolate the role of the strategic interaction described in the previous section (otherwise, a limited improvement of the recycling process could be attributed to cost reasons).

It is easily checked that the second-order conditions are satisfied.

The detailed computations can be found in Appendix 6.1.

Even if the manufacturer had to bribe the recycler not to enter the market, it would push for the total absence of recycling.

In fact, the planner is indifferent between any \(\tau \in \left[ 2/3,1\right]\). Yet, if we introduce a tiny cost of improving recycling, choosing \(\tau =2/3\) is the dominant option.

In fact, Amir and Lambson (2000) prove that the necessary condition can be weaker: P(Q) is log-concave, i.e. \(P^{\prime \prime }(Q)P(Q)-P^{\prime 2}<0\). However, the existence of a unique Cournot equilibrium requires strictly increasing, convex cost functions. Therefore, we use the assumption of declining marginal revenue to cover the case with zero production cost.

The threshold \(\bar{\tau }<1\) is such that \(r^{u}(0)=\bar{\tau }\) and hence, \(r^{u}(c)<\bar{\tau }q^{m}\) for all \(c\in [0,\bar{c})\). (In the linear case, we had \(\bar{\tau }=2/3\).)

For instance, a new recycling plant has recently started to operate in Belgium. This “new recycling centre is the last of five new facilities being built across Belgium, with three new operational—the simultaneous efforts of all five are expected to see a 75% domestic recycling rate for plastic packaging from 2025. (...) [The operator] plans to provide the centre with 24,000 tonnes of PMD waste sourced from Belgian households. (...) These will be converted into recycled plastic granules to be used in the production of new packaging. It is hoped that the recyclate will be of such high quality that it can be reused in its entirety and that it will be supplied to the local Belgian market as much as possible (see Packaging Europe, 21 March 2023, https://tinyurl.com/yckmmdpa; emphasis added; last accessed April 4, 2024).

We can roughly estimate that Belgium accounts for 0.6% of global plastic materials production (Belgium’s GDP is about 4% of EU-27 GDP and EU-27 accounted for 15% of global plastic materials production in 2021; see Statista.com).

“Overall, the country is particularly performant in the collection, sorting and recycling of household packaging with Belgium firmly taking on more ambitious targets than the EU itself, establishing a target of 70% plastics recycling rate for 2030 (compared to 55% for the EU) and a 95% household packaging recycling rate (vs. 65% for the EU)” (see The Brussels Time, 15 June 2023, https://tinyurl.com/3322fymj; emphasis added; last accessed April 4, 2024).

The available scrap from period 1, \(\tau q_{1}\), is reduced by the scrap that the manufacturer uses for its second-period production, \(\alpha q_{2}\).

See, e.g., Gilbert and Vives (1986).

By definition, \(\bar{c}\) is such that \(\pi _{r}^{u}(r^{u}(\bar{c}),q_{2}^{u}( \bar{c}))=0\); in a Cournot competition without degeneration following our assumption, this is equivalent to \(r^{u}(\bar{c})=0\).

See Amir and Lambson (2000).

We also assume that \(\gamma >0\) so that the two firms interact strategically.

References

Amir R, Lambson V (2000) On the effects of entry in Cournot markets. Rev Econ Stud 67(2):235–254

Atasu A, Sarvary M, Van Wassenhove LN (2008) Remanufacturing as a marketing strategy. Manag Sci 54(10):1731–1746

Ba BS (2022) Recyclage d’une ressource primaire et pouvoir de marché?: le cas Alcoa. Revue économique 73(2):303–324

Ba BS, Mahenc P (2019) Is recycling a threat or an opportunity for the extractor of an exhaustible resource? Environ Resour Econ 73(4):1109–1134

Ba BS, Motel PC, Schwartz S (2020) Challenging pollution and the balance problem from rare earth extraction: how recycling and environmental taxation matter. Environ Dev Econ 25(6):634–656

Ba BS, Soubeyran R (2023) Hotelling and recycling. Resour Energy Econ 72(C)

Bain JS (1956) Barriers to new competition: their character and consequences. Harvard University Press, Cambridge

Beatty TKM, Berck P, Shimshack JP (2007) Curbside recycling in the presence of alternatives. Econ Inq 45(4):739–755

Bernard S (2011) Remanufacturing. J Environ Econ Manag 62:337–351

Bohm RA, Folz DH, Kinnaman TC, Podolsky MJ (2010) The costs of municipal waste and recycling programs. Resour Conserv Recycl 54(11):864–871

Callan SJ, Thomas JM (2001) Economies of scale and scope: a cost analysis of municipal solid waste services. Land Econ 77(4):548–560

Dastidar KG (2000) Is a unique Cournot equilibrium locally stable? Games Econom Behav 32(2):206–218

de Beir J, Ha-Huy T, Sourisseau S (2023) Recycling vs mining: competition for market shares, collusion for market power. Revue économique 74(1):81–113

Dijkgraaf E, Gradus RHJM (2014) The effectiveness of Dutch municipal recycling policies. SSRN Electron J

Eichner T (2005) Imperfect competition in the recycling industry. Metroeconomica 56(1):1–24

Fabre A, Fodha M, Ricci F (2020) Mineral resources for renewable energy: optimal timing of energy production. Resour Energy Econ 59:101131

Ferguson ME, Toktay LB (2009) The effect of competition on recovery strategies. Prod Oper Manag 15(3):351–368

Fullerton D, Kinnaman TC (1995) Garbage, recycling, and illicit burning or dumping. J Environ Econ Manag 29:78–91

Gaskins DW (1974) Alcoa revisited: the welfare implications of a secondhand market. J Econ Theory 7(3):254–271

Gaudet G, Van Long N (2003) Recycling redux: a Nash–Cournot approach. Jpn Econ Rev 54(4):409–419

Gilbert R, Vives X (1986) Entry deterrence and the free rider problem. Rev Econ Stud 53(1):71–83

Grant D (1999) Recycling and market power: a more general model and re-evaluation of the evidence. Int J Ind Org 22

Hamilton SF, Sproul TW, Sunding D, Zilberman D (2013) Environmental policy with collective waste disposal. J Environ Econ Manag 66(2):337–346

Hoel M (1984) Extraction of a resource with a substitute for some of its uses. Can J Econ 17(3):593

Hollander A, Lasserre P (1988) Monopoly and the preemption of competitive recycling. Int J Ind Organ 6(4):489–497

Honma S, Chang M-C (2010) A model for recycling target policy under imperfect competition with and without cooperation between firms. Working Paper 45, Kyushu Sangyo University, Faculty of Economics

International Aluminium Institute (2009) Global aluminium recycling: a cornerstone of sustainable development. Technical report

Kinnaman T (2013) Waste disposal and recycling. In: Encyclopedia of energy, natural resource, and environmental economics, pp 109–113. Elsevier

Kinnaman TC (2006) Policy watch: examining the justification for residential recycling. J Econ Perspect 20(4):219–232

Kinnaman TC (2010) The costs of municipal curbside recycling and waste collection. Resour Conserv Recycl 54(11):864–871

Kinnaman TC, Fullerton D (2000) Garbage and recycling with endogenous local policy. J Urban Econ 48(3):419–442

Kinnaman TC, Shinkuma T, Yamamoto M (2014) The socially optimal recycling rate: evidence from Japan. J Environ Econ Manag 68(1):54–70

Kolstad CD, Mathiesen L (1987) Necessary and sufficient conditions for uniqueness of a Cournot equilibrium. Rev Econ Stud 54(4):681

Mitra S, Webster S (2008) Competition in remanufacturing and the effects of government subsidies. Int J Prod Econ 111(2):287–298

Novshek W (1985) On the existence of Cournot equilibrium. Rev Econ Stud 52(1):85–98

Örsdemir A, Kemahlioğlu-Ziya E, Parlaktürk AK (2014) Competitive quality choice and remanufacturing. Prod Oper Manag 23(1):48–64

Sterner T, Robinson EJ (2018) Selection and design of environmental policy instruments. In: Dasgupta P, Pattanayak SK, Smith VK (Eds.) Handbook of Environmental Economics, Volume 4, Chapter 8, pp. 231–284. Amsterdam: Elsevier

Suslow VY (1986) Estimating monopoly behavior with competitive recycling: an application to Alcoa. Rand J Econ 17(3):389

Swan PL (1977) Product durability under monopoly and competition: comment. Econometrica 45(1):229

Viscusi WK, Huber J, Bell J (2012) Alternative policies to increase recycling of plastic water bottles in the United States. Rev Environ Econ Policy 6(2):190–211

Vives X (2001) Oligopoly pricing: old ideas and new tools. MIT Press Books, The MIT Press

Walter A (1951) The aluminum case: legal victory—economic defeat. Am Econ Rev 41(5):915–922

Webster S, Mitra S (2007) Competitive strategy in remanufacturing and the impact of take-back laws. J Oper Manag 25(6):1123–1140

Acknowledgements

The authors gratefully acknowledge financial support from the Belgian Science Policy, Research Project BR/143/A5/IECOMAT. They thank Thierry Bréchet, Johan Eyckmans, Johannes Johnen, Sandra Rousseau, Bernard Sinclair-Desgagné, and four anonymous reviewers for useful comments on earlier drafts.

Funding

When writing this paper, both authors were employed by Université catholique de Louvain, Belgium; they also both received financial support from Belgian Science Policy, Research project BR/143/A5/IECOMAT.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

Both authors certify that they have no affiliations with or involvement in any organization or entity with any financial interest or non-financial interest in the subject matter or materials discussed in this manuscript.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Second Best

Recall:

-

Unconstrained equilibrium (for \(c\ge \tilde{c}\equiv \left( 1-3\tau q_{1}\right) /2\)):

$$\begin{aligned} q_{2}^{u}=\tfrac{1}{3}\left( 1+c\right) ,r^{u}=\tfrac{1}{3}\left( 1-2c\right) ,\pi _{2}^{u}=\tfrac{1}{9}\left( 1+c\right) ^{2},\pi _{r}^{u}= \tfrac{1}{9}\left( 1-2c\right) ^{2} \end{aligned}$$ -

Constrained equilibrium (for \(c\le \tilde{c}\equiv \left( 1-3\tau q_{1}\right) /2\)):

$$\begin{aligned} q_{2}^{c}=\tfrac{1}{2}\left( 1-\tau q_{1}\right) ,r^{c}=\tau q_{1},\pi _{2}^{c}=\tfrac{1}{4}\left( 1-\tau q_{1}\right) ^{2},\pi _{r}^{c}=\tfrac{1}{2 }\tau q_{1}\left( 1-2c-\tau q_{1}\right) . \end{aligned}$$

Equilibrium quantities

-

Manufacturer

-

Period 1

$$\begin{aligned} q_{1}=\left\{ \begin{array}{ll} \frac{1}{2} &{} \text {if }\tau =0 \\ \frac{\sqrt{4-8\tau ^{2}+6\tau ^{3}+\tau ^{4}}-2\left( 1-\tau ^{2}\right) }{ 3\tau ^{3}} &{} \text {if }0<\tau <\frac{2}{3} \\ \frac{1}{2} &{} \text {if }\frac{2}{3}\le \tau \le 1 \end{array} \right. \end{aligned}$$ -

Period 2

$$\begin{aligned} q_{2}=\left\{ \begin{array}{ll} \frac{1}{2} &{} \text {if }\tau =0 \\ \begin{array}{l} \int _{0}^{\frac{1}{2}\left( 1-3\tau q_{1}\right) }2\left( \tfrac{1}{2}\left( 1-\tau q_{1}\right) \right) dc \\ +\int _{\frac{1}{2}\left( 1-3\tau q_{1}\right) }^{\frac{1}{2}}2\left( \tfrac{1 }{3}\left( 1-2c\right) \right) dc \\ =\frac{1}{2}\left( 6\tau ^{2}q_{1}^{2}-4\tau q_{1}+1\right) \end{array} &{} \text {if }0<\tau <\frac{2}{3} \\ \int _{0}^{\frac{1}{2}}2\left( \tfrac{1}{3}\left( 1-2c\right) \right) dc= \frac{1}{6} &{} \text {if }\frac{2}{3}\le \tau \le 1 \end{array} \right. \end{aligned}$$

-

-

Recycler

$$\begin{aligned} r=\left\{ \begin{array}{ll} 0 &{} \text {if }\tau =0 \\ \begin{array}{l} \int _{0}^{\frac{1}{2}\left( 1-3\tau q_{1}\right) }2\left( \tau q_{1}\right) dc+\int _{\frac{1}{2}\left( 1-3\tau q_{1}\right) }^{\frac{1}{2}}2\left( \tfrac{1}{3}\left( 1-2c\right) \right) dc \\ =\frac{1}{2}\tau q_{1}\left( 2-3\tau q_{1}\right) \end{array} &{} \text {if }0<\tau <\frac{2}{3} \\ \int _{0}^{\frac{1}{2}}2\left( \tfrac{1}{3}\left( 1-2c\right) \right) dc= \frac{1}{6} &{} \text {if }\frac{2}{3}\le \tau \le 1 \end{array} \right. \end{aligned}$$

Equilibrium profits

-

Manufacturer: \(\pi _{m}=\left( 1-q_{1}\right) q_{1}+\left( 1-q_{2}-r\right) q_{2}\)

$$\begin{aligned} \pi _{m}=\left\{ \begin{array}{ll} \left( 1-\frac{1}{2}\right) \frac{1}{2}+\left( 1-\frac{1}{2}\right) \frac{1}{ 2}=\frac{1}{2} &{} \text {if }\tau =0 \\ \begin{array}{l} \left( 1-q_{1}\right) q_{1}+\int _{0}^{\frac{1}{2}\left( 1-3\tau q_{1}\right) }2\left( \frac{1}{4}\left( 1-\tau q_{1}\right) ^{2}\right) dc \\ +\int _{\frac{1}{2}\left( 1-3\tau q_{1}\right) }^{\frac{1}{2}}2\left( \frac{1 }{9}\left( 1+c\right) ^{2}\right) dc \\ =\tfrac{1}{4}\left( 1+2\left( 2-\tau \right) q_{1}-4\left( 1-\tau ^{2}\right) q_{1}^{2}-2\tau ^{3}q_{1}^{3}\right) \end{array} &{} \text {if }0<\tau <\frac{2}{3} \\ \left( 1-\frac{1}{2}\right) \frac{1}{2}+\int _{0}^{\frac{1}{2}}2\left( \frac{1 }{9}\left( 1+c\right) ^{2}\right) dc=\frac{23}{54} &{} \text {if }\frac{2}{3} \le \tau \le 1 \end{array} \right. \end{aligned}$$ -

Recyler: \(\pi _{r}=\left( 1-q_{2}-r-c\right) r\)

$$\begin{aligned} \pi _{r}=\left\{ \begin{array}{ll} 0 &{} \text {if }\tau =0 \\ \begin{array}{l} \int _{0}^{\frac{1}{2}\left( 1-3\tau q_{1}\right) }2\left( \frac{1}{2}\tau q_{1}\left( 1-2c-\tau q_{1}\right) \right) dc \\ +\int _{\frac{1}{2}\left( 1-3\tau q_{1}\right) }^{\frac{1}{2}}2\left( \frac{1 }{9}\left( 1-2c\right) ^{2}\right) dc =\frac{1}{4}\tau q_{1}\left( 1-\tau q_{1}\right) ^{2} \end{array} &{} \text {if }0<\tau <\frac{2}{3} \\ \int _{0}^{\frac{1}{2}}2\left( \frac{1}{9}\left( 1-2c\right) ^{2}\right) dc= \frac{1}{27} &{} \text {if }\frac{2}{3}\le \tau \le 1 \end{array} \right. \end{aligned}$$

Consumer surplus