Abstract

Green transition is in the core of the European policy agenda to achieve the ambitious goal of climate neutrality following the launch of the European Green Deal. The cornerstone of the new growth strategy of Europe is resource efficiency which focuses on shifting to a more sustainable production paradigm by conserving scarce resources and by prioritizing enhanced environmental performance. Scattered efforts to investigate the drivers of resource efficiency measures have shed light on the key drivers, however, those consider resource efficiency measures in isolation neglecting for feedback loops influencing green transition. Therefore, we develop a conceptual framework to study green transition as a system of resource efficiency measures affected by feedback loops, path dependence, green technologies, and green policy tools. We mobilize the analysis by devising a unique balanced panel covering the EU-28 from 2010 through 2019, including policy efforts paving the way for green transition. Econometric results based on a system of fractional probit models, indicate that resource efficiency measures are intertwined via feedback loops, especially in the case of environmental efficiency. Green technologies affect green transition, however, rebound effects emerge in the case of energy efficiency. Past performance affects current levels pushing towards divergence. Evidence suggests that green taxation fosters energy efficiency whereas hinders environmental efficiency. The asymmetric operation of feedback loops and green taxation on energy and environmental efficiency highlights that horizontal policies hinder rather than foster green transition. This study contributes to SDGs 7, 12, 13 and 16.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Green growth is not a newly found topic, however the launch of the European Green Deal (European Commission 2019) has renewed interest as the means towards reaching a sustainable trajectory. Nevertheless, prior to that, the Europe 2020 strategy (European Commission 2010) aimed to transform the European economy through promoting a more resource efficient, greener and more competitive economy by investing in eco-innovation and achieving climate and energy targets, setting 2010 as a starting point. That strategy endorsed individual policy directives such as the Resource Efficient Europe—Flagship Initiative (European Commission 2011a) to “support the shift towards a resource-efficient, low-carbon economy to achieve sustainable growth”, the Eco Innovation Action Plan (European Commission, 2011b) fostering eco-innovation in production through cutting-edge green technology as well as the Renewable Energy Directives (2009, 2018a, 2021a), “establishing common rules for the development of renewable energy across the economy”, which under the ongoing energy crisis in Europe regains special attention. Therefore, the narrative permeating the core of European policy milestones of the recent past is built around the promotion and support of resource efficiency to transit to a greener and more sustainable economy.

The production paradigm shift aspiration of the European economy is echoed in the long-term commitment in building a coherent framework to foster green transition via resource efficiency either by enhanced environmental performance (European Commission 2005, 2010, 2015, 2018b, 2019, 2011a, 2011b) or energy efficiency improvement implemented by the Energy Efficiency Directive (European Commission 2012, 2018c, 2023a) and the Clean Energy For All European package (European Commission 2016). Given the European policy framework, the technological capabilities in conjunction to the resource endowment of the member states, highlight the necessity to comprehend the mechanisms of resource efficiency measures, either captured by environmental or energy efficiency.

Thus, the attention shifts to energy and environmental efficiency as measures of the member state’s performance in transforming the same set of inputs to produce output(s), given technology. That is, resource efficiency measures derive from the same production process. Specifically, energy efficiency refers to the ability to produce the same level of output by conserving energy to align with the targets of policies, while environmental efficiency indicates the degree of achieving increases in output by reducing, equiproportionately, the level of emissions, following the emissions reduction targets. Efforts to trace what affects resource efficiency measures based on a production function framework exist, either focusing on environmental efficiency via the Directional Distance Function approach (Chatzistamoulou and Kouretas 2023; Chatzistamoulou and Koundouri 2022; Zhou et al. 2019; Yao et al. 2015) or placing energy efficiency in the centre of attention via the slack-based approach (Chatzistamoulou et al. 2019; Bi et al. 2014; Hu and Wang 2006).

Moreover, the knowledge stock regarding the drivers of resource efficiency and circularity principles promoting green transition has been accumulated as well. Such being the case, literature documents that the green transition supported by resource efficiency actions, e.g., actions saving energy and water, re-designing products to minimize waste or resources, and use of recycled materials among others, is affected by funding constraints (De Jesus and Mendonca 2018; Cuerva et al. 2014), the lack of specialized advice (Bodas-Freitas and Corrocher 2019), information availability on financing green activities (Chatzistamoulou and Tyllianakis 2022a) and micro-environment characteristics such as heterogeneity and turnover growth (Garrido-Prada et al. 2021; Bassi and Dias 2019; Demirel and Danisman 2019). Recent evidence shows that integration of new technological paradigms, collaboration networks and well-designed policy rules are considered as resource efficiency enhancers, facilitating the production paradigm shift (Chatzistamoulou and Tyllianakis 2022b).

It, therefore, becomes apparent that resource efficiency measures have been considered in isolation (Stern 2012; Zhang et al. 2011), even though the two measures interconnect either via the production technology structure, reflected on the technology set or the European policy framework, affecting resource allocation of all member states. In addition, a rather neglected aspect is that resource efficiency measures affect each other via feedback loops, given that European policy directives influence resource efficiency in an asymmetric breadth and depth. To this end, as individual resource efficiency processes (Esposito et al. 2018) and diffusion of resource efficient practices (Hötte 2020) generate innovation-related spillover effects, conveyed in feedback loops, affecting performance (Chatzistamoulou et al. 2022; Demena and Murshed 2018; Ning and Wang 2018; Iwasaki and Tokunaga 2016; Fracasso and Marzetti 2015; Golombek and Hoel 2005; Böhringer and Rutherford 2002). Moreover, the two measures are affected by common input complementarities, policy decisions at the national level, depth of commitment in fostering green transition as well as the strategic orientation of each member state.

Furthermore, evidence suggests that performance differentials exist as technological heterogeneity and inequality affect a country’s performance (Tsekouras et al. 2017) in conjunction to asymmetries in competitiveness which influence the ability to adopt, assimilate and transform knowledge and opportunities to internalize benefits of progress (Vlačić et al. 2019; Aldieri et al. 2018; Miguélez and Moreno 2015; Mukherji and Silberman 2013; Girma 2005). Moreover, recent studies suggest that the institutional framework and functionality of the economy also affect the efficient allocation of resources (Amankwah-Amoah et al. 2019, 2021; García-Quevedo et al. 2020). In addition, resource efficiency measures are affected by additional sources of variation such as time persistent performance patterns captured by path dependence (Tsekouras et al. 2016, 2017; David 1985, 1986), green technologies development (Li et al. 2022; Magazzino et al. 2022; Yan et al. 2020; Aslan and Ocal 2016) and green policies aiming at consolidating the European economy (European Commission 2003, 2019; Shi et al. 2019).

While recognizing the potential insights offered by a holistic approach that treats resource efficiency measures as an interconnected system through feedback loops, there is a notable absence of a conceptual framework that unifies these measures, elevating our understanding of the mechanisms driving green transition. This gap presents an opportunity for exploration and expansion. In response, this paper introduces a conceptual framework aimed at investigating whether green transition is propelled by (i) feedback loops in energy and environmental efficiency, (ii) path-dependent patterns, (iii) the integration of green technologies, and (iv) the influence of green taxation. This framework is designed to account for performance differentials and the distinctive characteristics of the production environment, filling a critical void in current research.

This paper makes a significant contribution by pioneering the development of a comprehensive conceptual framework designed to study green transition in the EU-28. Unlike existing literature that considers resource efficiency measures in isolation, we integrate these measures within a system of interrelated equations representing energy and environmental efficiency. This holistic approach aligns with the systematic promotion of green transition in the EU, as outlined in policy directives. Our contribution extends to the incorporation of feedback loops between these measures, providing a nuanced exploration of their potential interconnections. Furthermore, our conceptual framework acknowledges dynamic relationships in the quest of sustainability by encompassing time-persistent performance, green technologies, and green fiscal policies. This innovation allows us to delve into the mechanisms of green transition, offering a more comprehensive and insightful analysis than current approaches.

Evidence drawn from the EU-28 during the period 2010–2019 reveals a mutually influencing relationship between energy and environmental efficiency through feedback loops, facilitating the process of green transition. However, the impact varies depending on the specific measure under consideration, with energy efficiency systematically affecting only environmental efficiency. The introduction of dynamic effects, such as time-persistent performance in the form of path dependence, influences both resource efficiency measures. The influence of green technologies, represented by eco-innovation performance and clean energy, exhibits a differential effect on energy and environmental efficiency. Additionally, rebound effects are observed in the case of energy efficiency, with eco-innovation primarily fostering energy efficiency. Notably, green taxation contributes to green transition solely in the context of energy efficiency, while climate change taxes impede it.

This paper unfolds as follows. Section 2 presents the conceptual framework and research questions, Sect. 3 illustrates the material and methods, Sect. 4 presents the estimation results and policy implications while Sect. 5 concludes the paper.

2 Conceptual Framework and Research Hypotheses

The new growth strategy of Europe materializing via the European Green Deal (European Commission 2019) sets the scene for a new era as regards green transition. The latter is surrounded and supported by a dynamically evolving policy framework including green technologies represented by the promotion of environmental innovation via the Eco-Innovation Action Plan (European Commission 2011b), the Resource Efficient Europe—Flagship Initiative (European Commission 2011a) focusing on the efficient use of scarce resources along with a line of directives on clean energy use via the Renewable Energy directives, consistently updating the targets for energy efficiency and environmental performance paving the way to a low-carbon economy (European Commission 2009, 2018a, 2021a).

The green transition and climate action have been prioritized in European policy directives such as in the Clean Energy for All Europeans package (European Commission 2016), highlighting the necessity for increasing energy efficiency and environmental protection. However, the urge to modernize the energy profile of the member states to reach a sustainable trajectory has been acknowledged long ago via the Energy Efficiency Directive in 2012, amended regularly with the latest taking place in September 2023 (European Commission 2012, 2018c, 2023a). Furthermore, green transition is argued to be facilitated via green taxation, a form of fiscal consolidation, according to the revision of the energy taxation directive stating that it provides the means to “both EU and member state level to reach climate policy goals by encouraging a socially fair green transition” (European Commission 2021b).

In the policy framework outlined above energy and environmental efficiency indicate how efficiently resources are transformed into output based on the production process of the member states, playing a pivotal role in fostering green transition. However, the interlinkages between the two are only vaguely traced. This endeavor becomes more prominent under the European Green Deal (European Commission 2019) where resource efficiency is an integral part of green transition. It therefore becomes apparent that the design of a mechanism to monitor as well as explore green transition cannot consider energy and environmental efficiency in isolation, but as co-evolving intertwined parts of the same system.

Such being the case, we develop a conceptual framework to explore whether green transition is fostered by (i) energy and environmental efficiency feedback loops, (ii) path dependent patterns, (iii) green technologies and (iv) green taxation. Although there are attempts to study performance measures associations (Liu et al. 2018), energy efficiency determinants (Chen et al. 2021; Sun et al. 2019; Stern 2012) and environmental efficiency patterns (Chatzistamoulou and Kounetas 2023), a systematic attempt to study green transition as a system of resource efficiency measures affected by feedback loops has not been surfaced yet. Feedback loops circulate best practices and technological developments generated by specialization and innovation diffused by spillover effects, affecting performance and thus, green transition. Therefore, we form and test the following hypothesis:

H1

Energy and environmental efficiency intertwine via positive feedback loops fostering green transition.

There is accumulated literature on the effect of past performance on current levels bringing to the forefront path dependence phenomena i.e., time persistent behavior reflected on current performance levels (Tsekouras et al. 2016, 2017; Kasy 2011). Such being the case, a positive effect indicates divergence highlighting that current levels of resource efficiency are impacted by previous decisions on resource allocation and poorly accumulated policy directives hindering green transition (Allen and Donaldson 2020; David 1985, 1986). In the event of a negative and systematic effect, the system experiences convergence of the member states towards achieving the targets set. Thus, in the form of a testable hypothesis, we have:

H2

Energy and environmental efficiency exhibit path dependent patters hindering green transition.

Green technologies are of immense importance to the green growth agenda to achieve the objectives of the European Green Deal (European Commission 2019). This block includes the eco-innovation performance and the use of clean energy. The former is part of the Eco-Innovation Action Plan (European Commission 2011b) captured by the eco-innovation index, a composite index embracing five dimensionsFootnote 1 aiming to reduce environmental impacts and enhance resilience to environmental pressure and eventually promote green transition. Thus, we expect a positive impact of green transition. It is the official index of the European Commission launched in 2010 to measure the eco-innovativeness level of the member states and is considered as a sustainability measure (European Commission 2023b). Although recent literature and policy documents provide evidence on its influence on promoting resource efficiency (Chatzistamoulou 2023; Chatzistamoulou and Koundouri 2022; Chatzistamoulou and Tyllianakis 2022b) and circularity (Science for Environment Policy 2022), the investigation of its contribution is still relatively scarce, as more studies focus on patent-related aspects (Valero-Gil et al. 2023; Razzaq et al. 2023; Mahmood et al. 2022).

Clean energy is captured by the renewable energy use which is used to monitor progress towards carbon-neutrality (European Commission 2019) as well as indicate successful implementation of the Renewable Energy Directives (European Commission 2009, 2018a). Literature appears to be mixed as there is evidence on a positive effect on green growth (Li et al. 2022; Magazzino et al. 2022; Hao et al. 2021) or for a specific group of European countries only (Aslan and Ocal 2016), for specific country income levels (Yan et al. 2020), while other provide evidence of a rebound effect i.e., a negative effect of clean energy use on green growth and sustainability transition (Ocal and Aslan 2013) or even a non systematic effect (Waheed et al. 2023). Considering the above evidence, we form and test the following research hypothesis:

H3

Green technologies foster green transition.

Fiscal consolidation via green taxation, is argued to foster green transition and promote sustainable growth (European Commission 2019). The latter has been introduced by the Energy Taxation Directive (European Commission 2003) and its revision (European Commission 2021b) to help “both EU and member state level to reach climate policy goals by encouraging a socially fair green transition”. In this line, the influence of green taxation on green growth is mixed, with evidence indicating that it contributes to green growth (Shi et al. 2019) while others showcase that consumer welfare reduces as prices increase (Mahmood et al. 2022). Considering the above, we form and test the following hypothesis:

H4

Green taxation does not inhibit green transition.

Furthermore, we include a set of controls related to performance differentials as literature acknowledges the effect of productivity differentials on resource efficiency (Chatzistamoulou and Kounetas 2023; Chatzistamoulou et al. 2019; Montalbano and Nenci 2019), the production environment characteristics such as the country’s competitiveness level (Gkypali et al. 2019; Tsekouras et al. 2016, 2017), the structure of the economy affecting the allocation of resources (Amankwah-Amoah et al. 2019, 2021) as well as the economic freedom affecting the overall functionality of the economy (Fraser Institute 2023).

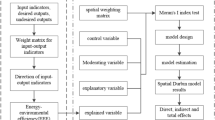

To facilitate understanding of the conceptual framework we introduce a visual representation illustrated in Scheme 1 below. More specifically, the framework introduced is developed around the concept that green transition in Europe materializes through resource efficiency measures captured by energy and environmental efficiency which are intertwined through feedback loops (Hypothesis 1). Moreover, resource efficiency measures are affected by past performance via dynamic effects captured by path dependence (Hypothesis 2), green technologies captured by eco-innovation performance and clean energy use (Hypothesis 3), as well as the green taxation paving the way towards green transition, as an integral part of the European policy agenda (Hypothesis 4). Moreover, we control for performance differentials and asymmetric effects attached to the production environment such as the competitiveness level and functionality of the economy.

Source Authors' elaboration - Chatzistamoulou, N. & Koundouri, Ph. “Is Green Transition in Europe Fostered by Energy and Environmental Efficiency Feedback Loops? The Role of Eco-Innovation, Renewable Energy and Green Taxation”

The conceptual framework of green transition through feedback loops of resource efficiency measures.

3 Material and Methods

3.1 Resources and Data

The paper utilizes a unique dataset by coordinating, matching, and harmonizing several complementary publicly available databases covering the EU-28Footnote 2 over a ten-year period from 2010 through 2019. Therefore, the panel consists of 280 observations. During the selected period sophisticated and intensified efforts from the European Commission have taken place to promote green transition, envisaged in the European Green Deal (European Commission 2019) such as the Eco-Innovation Action Plan in 2011 (European Commission 2011b), a series of updates on the Renewables Directives (European Commission 2009, 2018a) as well as action on climate change mitigation policy (European Commission 2015, 2018b). Moreover, the time window encapsulates all the available information on the required data to estimate the necessary production functions.

The dependent variables of interest correspond to energy efficiency and environmental efficiency, two resource efficiency measures reflecting the ability of each member state to follow sustainable production path. We argue that those resource efficiency measures are shaped by the following sources. More precisely, (i) feedback loops captured by lagged values of each resource efficiency measure, (ii) past performance i.e., path dependence pushing towards divergence (Tsekouras et al. 2016), (iii) green technologies captured by the eco-innovation (Park et al. 2017) and renewable energy use, (iv) green taxation (Carattini et al. 2017) captured by energy- and climate change-related tax revenues. Moreover, we acknowledge the effect of performance differentials captured by lagged values of productive performance (Chatzistamoulou et al. 2022) and production environment characteristics such as competitiveness and economic freedom.

Resource efficiency measures estimation require data on two outputs and three inputs. The desired output is captured by the gross domestic product, while the undesired by the carbon dioxide emissions (CO2). Inputs are captured by the capital stock, labor, proxied by the number of persons engaged, and the energy use. All monetary values are in constant 2011 prices. Data on the gross domestic product, capital stock, and labor was collected through the Groningen Growth and Development Centre (Feenstra et al. 2015). Data on energy Footnote 3 and CO2, and through the World Bank database (World Bank 2023).

The green technologies block includes the eco-innovation index and the renewable energy use. As regards the former, it is a multi-layeredFootnote 4 composite index capturing the performance of the EU-28 on eco-innovativeness produced by the Eco-Innovation Observatory and Eurostat DG Environment (Eco-innovation index 2022). The latter has been acknowledged by the literature as key contributor of green growth and sustainability transition (Chatzistamoulou and Tyllianakis 2022a, b; Science for Environment Policy 2022). Literature indicates that it adequately accounts for eco-innovation differences as it has theory-driven structure (Park et al. 2017) facilitating comparisons across the member states. Data was collected through Eurostat (2022). Renewable energy use is the share of renewable energy in total final energy consumption contributes to understanding SDGs 7 “Affordable and Clean Energy” and 13 “Climate Action”. It was collected via the World Bank (2023).

The block of green taxation includes the energy-related and climate change-related tax revenue. The former is the percentage of environmentally related tax revenue and has been collected via the OECD (2017). The latter is the percentage of total tax revenue, including taxes, fees and charges, tradable permits, deposit-refund systems, subsidies, and voluntary approaches related to the domain of climate change (Povitkina et al. 2021). Data has been collected via the Quality of Governance (QoG) Institute (Quality of Governance 2023). Table 1 below illustrates information on the basic variables employed.

Finally, the block of production environment characteristics includes data on competitiveness, the structure of the economy and economic freedom of each member state. Competitiveness is captured by the global competitiveness index which is a composite multi-faceted index including twelve pillarsFootnote 5 common across countries facilitating comparisons (Chatzistamoulou and Kounetas 2023; Tsekouras et al. 2017). It captures production capabilities, market functions, institutions, and dynamism of each country economy (Sala-i-Martin et al. 2008; Sala-i-Martin and Artadi 2004). The paper benefits by hand-collected data through various editions of the Global Competitiveness Report produced by the World Economic Forum, annually. The economy structure is captured by the share of agriculture, manufacturing and services over the gross domestic product collected by the World Bank (2023). The economic freedom indexFootnote 6 accounts for the effect of the institutional base and functionality of the economy capturing organizational inequality and institutional discrepancies at the country level 2023produced by the Economic Freedom-Fraser Institute (Fraser Institute ). Table 1 below presents the descriptives and description of the main variables of interest.

3.2 Empirical Strategy

3.2.1 Performance Assessment and Resource Efficiency Measures: a Non-Technical Description

In this paper we explore the interplay of resource efficiency, captured by energy and environmental efficiency, and performance measures captured by productive performance within a production function framework. That being said, we benchmark the decision making units (DMUs), here member states’ efficiency based on the ability to combine inputs and transform them into outputs, given technology. To estimate the performance measures and benchmark the member states, a production function—representing the European technology level—of the form \(y = f\left( {k,l,e} \right)\), where \(y\, = \,Gross \,\,Domestic \,\,Product,\,\, k\, = \,Capital \,\,stock, \,\,l\, = \,Labor,\, and\,\, E\, = \,Energy \,\,use\), is defined and estimated by the Data Envelopment AnalysisFootnote 7 (DEA), under the input orientation—since the interest is on contracting the input set since those represent scarce resources—and variable returns to scale. Thus, a piece-wise linear frontier is estimated as the most realistic scenario (Banker et al. 1984).

Routed in Production Theory and efficiency measurement, the DEA is a linear programming i.e., non-parametric methodology to estimate a production function, on an annual basis, where the objective is to calculate the optimal performance given a set of constraints shaped by the inputs and the selection of returns to scale. Thus, the European technology i.e., frontier is shaped by transforming the set of inputs into output (Battese et al. 2004). DEA is defined as the ratio between the weighted sum of output(s) to the weighted sum of inputs where these weights are varied and optimized for each DMU, enabling each one to achieve its best possible efficiency score (Cooper et al. 2007). The DEA algorithm is solved for each DMU in the sample while member states (DMUs) are benchmarked against each other getting an efficiency score between 0 and 1. The fully efficient DMUs are found on the frontier (efficiency score of 1) while those found below are considered not fully efficient (efficiency score less than 1).

Since reducing energy is crucial for green transition and sustainability, the DEA can be used to derive the energy efficiency. Hu and Wang (2006) based on the slacks attached to the energy input and the actual use i.e., reported energy used to calculate the energy efficiency score. Varying between 0 and 1 as well, this resource efficiency measure identifies the DMUs using the proper amount of energy and the ones that could contract and still produce the same amount of output.

Furthermore, another linear programming methodology based on the DEA, the Directional Distance Function-DDF (Färe and Grosskopf 2000; Chung et al. 1997; Chambers et al. 1996) employs the same input set but augments the output set to include the undesirable (or bad) output of the production process i.e., the carbon dioxide emissions along with the desirable (or good) output i.e., the Gross Domestic Product. Following the idea to produce more with fewer pollution and waste, based on the DDF, the environmental efficiency score, between 0 and 1 as well, is the outcome of the constituted power of the augmentation of the good output and the contraction of the bad, equi-proportionately.

3.2.2 Econometric Approach

In this paper, to explore whether green transition is fostered by (i) energy and environmental efficiency feedback loops, (ii) path dependent patterns, (iii) green technologies and (iv) green taxation. In the case examined herein, the key issue is the importance of estimating the equations with fractional dependent variables jointly, using a system.Footnote 8 Additionally, the empirical strategy towards investigating the interplay of resource efficiency measures’ needs (i) to handle the bounded nature the energy and environmental efficiency scores since those vary between 0 and 1 i.e., are fractions (Ramalho et al. 2010; Papke and Wooldridge 1996, 2008), and (ii) to allow for joint estimation of two fractional regression models with potentially correlated error processes.

The appropriate empirical strategy to estimate a system of fractional regression models allowing for correlated error terms and the presence of the linear functional (XB in the general form) in the right-hand side of each equation, is the conditional mixed process estimator (Roodman 2011). Moreover, to alleviate endogeneity concerns control variables are included in lags in both equations. Therefore, we specify and estimate the following system of fractional probit models:

The parameters to be estimated are \({\varvec{\beta}}, \,\,{\varvec{\gamma}},\,\,{ \delta },\,\,{ \zeta },\,\,{\varvec{\theta}},\,\,{\varvec{\kappa}},\,\,{ \lambda },{ }\,\,{\varvec{\mu}}\) while \(u_{it}\) and \(\upsilon_{it}\) are the error processes.

4 Results and Discussion

4.1 Do feedback Loops Foster Green Transition?

In this paper, to explore whether green transition is fostered by (i) energy and environmental efficiency feedback loops, (ii) path dependent patterns, (iii) green technologies and (iv) green taxation by considering the resource efficiency measures as a co-evolving system. Tables 2 and 3 below present the coefficients with the robust standard errors and the average marginal effects of the fractional probit models we estimated via the mixed process estimator (Roodman 2011), respectively. We present the estimation results for two versions of the system regarding the presence of the feedback effect. In what follows, we focus on the models with the feedback loop.

As far as the energy efficiency equation is concerned, evidence indicates that the environmental efficiency feedback loop appears to exert a positive yet non-systematic influence on energy efficiency (H1 is not accepted for the energy efficiency equation). Environmental efficiency feedback loop could be considered as a form of green spillover effect towards energy efficiency. The latter is two-fold though. From the one hand, improvements in environmental efficiency do not seem to enhance energy efficiency while on the other, in the event of a fallback in performance, the shock is not transmitted in energy efficiency. Past levels of energy efficiency appear to exert a positive and systematic effect on current levels (H2 is not rejected for the energy efficiency equation). More precisely, energy efficiency exhibits time persistent patterns indicating that divergence phenomena are in operation deepening discrepancies among the member states, in line with recent evidence from European industries and sectors (Tsekouras et al. 2016, 2017).

Findings indicate that eco-innovation exerts a positive and significant effect on energy efficiency indicating that European environmental innovativeness fosters green transition (H3 is partly not rejected for the energy efficiency equation). This finding is in line with the European policy directives (European Commission 2011b, 2019), the recent literature where eco-innovation is a key contributor in sustainability transition (Chatzistamoulou 2023; Chatzistamoulou and Tyllianakis 2022a, 2022b) as well as with other recent studies advocating in favor of the positive effect of eco-innovation on energy efficiency (Chen et al. 2021; Sun et al. 2019). In the case of clean energy use, a negative and significant effect is documented signifying the existence of a rebound effect in this case (H3 is partly not accepted for the energy efficiency equation), in line with the relevant literature (Gillingham et al. 2016; Koesler et al. 2016; Ocal and Aslan 2013). Brännlund et al. (2007) argue that the rebound effect could be neutralized by increasing CO2 emissions taxes, while recent evidence from countries of the OECD indicates a positive relationship between domestic energy efficiency and investment in renewable energy adoption (Dato 2018). Nevertheless, mixed evidence exists documenting a positive (Li et al. 2022; Magazzino et al. 2022; Hao et al. 2021; Chien and Hu 2007, 2008) or no effect as well (Waheed et al. 2023). It is therefore apparent that rebound effects should be cautiously examined (Turner 2013).

As regards the contributors in the environmental efficiency equation, evidence supports the existence of a positive and systematic energy efficiency feedback loop of on environmental efficiency (H1 is not rejected for the environmental efficiency equation). In this case, we document that green spillover effects related to energy efficiency are transmitted to environmental efficiency, fostering green transition. That latter however uncovers the complexity of the interrelationships between resource efficiency measures and the impact on green transition. The latter is particularly relevant to policy makers as positive feedback loops appear to be in operation depending on the target resource efficiency measure. Path dependence phenomena are in operation in the environmental efficiency equation as well (H2 is not rejected for the environmental efficiency equation). Findings indicate that green technologies have a differential effect on environmental efficiency. More precisely, eco-innovation exerts a negative yet non-systematic effect on environmental efficiency. This counter-intuitive finding however showcases the complexity of the mechanisms surrounding resource efficiency measures (H3 is partly not accepted for the environmental efficiency equation) and could be attributed to technological discrepancies inhibiting eco-innovation across the EU-28 member states (Chatzistamoulou and Koundouri 2021). Renewable energy use exerts a positive and systematic effect on environmental efficiency (H3 is partly not rejected for the environmental efficiency equation). The latter is in line with literature indicating it promotes performance (Böhringer and Rutherford 2013; Wei et al. 2010; Chien and Hu 2007, 2008) as well as with recent evidence considering European industries and sectors, where clean technologies implementation exerts a positive and systematic influence on industrial environmental efficiency, however, only for low competitiveness countries (Chatzistamoulou and Kounetas 2023).

The set of control variables appears to exert a differential effect on resource efficiency measures. Productive performance exerts a positive and systematic effect on energy efficiency while a negative and systematic effect arises in the case of environmental efficiency. The latter supports the conceptual framework introduced herein suggesting that resource efficiency measures are affected by performance differentials. These findings are in line with recent global evidence documenting a U-shaped relationship between energy efficiency and productive performance, indicating that only increased productive performance exerts a positive effect on energy efficiency (Chatzistamoulou et al. 2019). Recent evidence shows that a negative effect is documented for the European industries’ environmental efficiency (Chatzistamoulou and Kounetas 2023). Competitiveness appears to foster energy efficiency only, while recent evidence finds a negative effect on environmental efficiency (Chatzistamoulou and Kounetas 2023). Economy structure and economic freedom have a merit in explaining green transition, with evidence suggesting that institutional discrepancies deepen existing differences (Bianchi et al. 2020; Caravella and Crespi 2020).

Overall, it has become apparent that energy and environmental efficiency respond in an asymmetric heterogeneous manner to the same set of factors, operating through different channels. The two however, are not entirely detached. Resource efficiency measures intertwine through feedback loops, only in the case where environmental efficiency is the outcome of interest. Evidence indicates that energy efficiency follows an autonomously evolving path. The lower part of Table 2 provides support for the rejection of the null hypothesis regarding the errors’ correlation between energy and environmental efficiency equations, indicating there are no systematic unobserved factors simultaneously affecting the two (Roodman 2011).The latter means that those are not endogenous in line with recent literature on performance measures (Chatzistamoulou et al. 2019; Liu et al. 2018).

4.2 Policy Implications: Green Taxation as a Policy Instrument Towards Green Transition

Delivery of the European Green Deal includes, among other policies, green taxation to reduce net greenhouse gas emissions by at least 55% by 2030 (European Commission 2019). A long sequence of systematic efforts such as the Renewable Energy Directives (European Commission 2009, 2018a, 2021a), the Eco-Innovation Action Plan (European Commission 2011b), the Resource Efficient Europe-Flagship Initiative (European Commission 2011a), the Energy Efficiency Directive (European Commission 2012, 2018c, 2023a), the Clean Energy For All European package (European Commission 2016) and the Energy Taxation Directive (European Commission 2003, 2021b) pave the way to the implementation and support of green transition. The latter policy directive acknowledges climate, and energy taxes as effective tools to promote green transition, while green taxation is argued to have positive fiscal consolidation effects on a country’s economy (European Commission 2019).

In the line with the above policy directives, we explore the effect of green taxation towards green transition by including specific green policy instruments related to each resource efficiency measure. More precisely, we include the percentage of the energy-related and the climate change related tax revenues in the energy and environmental efficiency equation respectively. Tables 4 and 5 below present the estimation results and marginal effects respectively.

The behavior of the system, after we control for the effect of green taxation, preserves coherence, as inferences drawn so far are still valid. This is a form of validation and robustness of the analysis presented. Focusing on the models where the feedback loop is included, the energy taxes exert a positive and significant effect on the energy efficiency, contributing to green transition (H4 is not rejected for the energy efficiency equation). This finding is in line with the literature supporting that energy taxes facilitate green growth (Wang et al. 2018), even though evidence is inconclusive about the effect of this green policy tool (Mahmood et al. 2022; Shi et al. 2019; Aydin and Esen 2018). Findings remain in favour of the rebound effect, in contrast to the literature suggesting the rebound effect could be neutralized by increasing CO2 emissions (Brännlund et al. 2007). This rebound effect could be attributed to intensified renewable energy use, which given technology level, will increase the demand for energy leading to a reallocation of resources with a negative effect on energy efficiency (Gillingham et al. 2016; Sorrell et al. 2009). However, Hertwich (2005) argues that focusing exclusively on rebound effects is myopic suggesting that the analysis should be augmented to include spillovers and co-benefits stemming from other efficiency measures. The latter justifies the narrative adopted herein regarding the transmission mechanism via the feedback loops.

Shifting the attention to the environmental efficiency equation, the main findings remain unchanged, after controlling for the effect of green taxation. Climate change taxes exert a negative and significant effect on environmental efficiency indicating that under this contractionary green fiscal policy scheme, such instrument hinders green transition (H4 is not accepted for the environmental efficiency equation). In contrast to the results presented herein, there is evidence that such taxes facilitate sustainability and have been associated with higher environmental quality alleviating externalities (Safi et al. 2021; Shi et al. 2019) increasing public awareness at the household level (Ekins et al. 2011) and reducing energy from fossil fuels (Xie and Jamaani 2022). However, it is noticeable that the effect of renewable energy appears to be stronger after controlling for the effect of climate taxes on environmental efficiency. The latter could incentivise the adoption of a greener production paradigm, as adopting new technological paradigms boosts resource efficiency (Chatzistamoulou and Tyllianakis 2022b).

All in all, controlling for green taxation on resource efficiency measures brings to the forefront their intrinsic differences, in shaping the behavior of the system. Even though the evidence presented indicates that there is a transmitting channel via feedback loops, this is only documented for the case of the environmental efficiency equation. Thus, findings indicate that the idea of a one-size-fits-all policy may not be the appropriate strategy but rather, a tailored design would pave the way towards green transition, based on the targeted resource efficiency measure as those appear to respond in a heterogeneous and asymmetric way to external stimulus. Table 6 summarizes the main findings and policy implications drawn from the above analysis.

5 Concluding Remarks

Green transition is in the core of the European policy agenda to achieve the ambitious goals of climate neutrality following the launch of the European Green Deal, the workhorse for such transition. The cornerstone of the latter is resource efficiency which translates into the alternation of the production paradigm into a more sustainable one by saving or using existing resources more efficiently. Such being the case, to monitor progress as well as the effect of key contributors of such transition, the spotlight should be turned to resource efficiency measures.

Efforts have been dedicated in documenting the importance of energy and environmental efficiency i.e., resource efficiency measures, however those have been examined in isolation and there is no systematic attempt to conceptualize those as a system, so far. Treating resource efficiency measures as a system allows us to focus on feedback effects and explore whether there is heterogeneity and asymmetries of the effectiveness and implementation of policy instruments. We contribute to the literature by developing a conceptual framework that serves as the foundation of a comprehensive and flexible approach to monitor and explain resource efficiency discrepancies among the European countries towards green transition, considering the European policy agenda and countries’ production capabilities.

In this paper, we fill this gap by investigating whether resource efficiency measures are intertwined through feedback loops devising a unique dataset including EU-28 over the last decade, from 2010 through 2019. We follow a two-stage analysis. In the first stage energy and environmental efficiency are calculated based on a production function framework by employing the Data Envelopment Analysis and Directional Distance Function respectively. In the second stage, we explore the interconnections of resource efficiency measures by adopting a system of fractional probit models, which we estimate via the conditional mixed process estimator allowing for correlation of unobserved factors to account for the fractional nature of the efficiency scores, to explore the effect of feedback loops, path dependencies of resource efficiency measures, green taxation and the production environment characteristics, on the evolution of the system.

Findings indicate resource efficiency measures intertwine via feedback loops, but only in case where environmental efficiency is the target. Path dependencies push towards divergence in the European Union indicating that special attention is required to design green policies. Green technologies also operate in an asymmetric manner on energy and environmental efficiency. Specifically, eco-innovation exerts and asymmetric effect on the two while a rebound effect in the case of green energy arises for the case of energy efficiency. Evidence shows that green taxation operates quite distinctively as well, with energy taxes stimulating efforts to increase energy efficiency and climate taxes hindering efforts to promote environmental efficiency.

However, this study is not limitations independent. As time goes by, the accumulation of data and the availability of more related indicators could shed additional light on the complex mechanisms surrounding resource efficiency measures. Moreover, as such monitoring is a dynamic process, the effectiveness of new policies to accelerate green transition could be incorporated into the suggested conceptual framework.

Notes

Eco-innovation Inputs, Activities and Outputs, Socio-economic Outcomes, Resource efficiency Outcomes.

Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, and United Kingdom.

Series growth rates complement for missing data

Eco-innovation Inputs, Activities and Outputs, Socio-economic Outcomes, Resource efficiency Outcomes.

Pillars include Institutions, Infrastructure, Macroeconomic Environment, Health and Primary Education, Higher Education and Training, Goods market efficiency, Financial market development, technological readiness, market size, business sophistication and innovation.

Ranks countries based on size of government, legal structure and property rights, access to sound money, freedom to trade internationally, regulation of credit, labor and business.

We are indebted to the two anonymous reviewers’ suggestions.

References

Aldieri L, Sena V, Vinci CP (2018) Domestic R&D spillovers and absorptive capacity: some evidence for US, Europe and Japan. Int J Prod Econ 198:38–49

Allen T, Donaldson D (2020) Persistence and path dependence in the spatial economy (No. w28059). National Bureau of Economic Research

Amankwah-Amoah J, Chen X, Wang X, Khan Z, Chen J (2019) Overcoming institutional voids as a pathway to becoming ambidextrous: the case of China’s Sichuan Telecom. Long Range Plan 52(4):101871

Amankwah-Amoah J, Khan Z, Wood G (2021) COVID-19 and business failures: the paradoxes of experience, scale, and scope for theory and practice. Eur Manag J 39(2):179–184

Aslan A, Ocal O (2016) The role of renewable energy consumption in economic growth: evidence from asymmetric causality. Renew Sustain Energy Rev 60:953–959

Aydin C, Esen Ö (2018) Reducing CO2 emissions in the EU member states: do environmental taxes work? J Environ Planning Manag 61(13):2396–2420

Banker RD, Charnes A, Cooper WW (1984) Some models for estimating technical and scale inefficiencies in data envelopment analysis. Manag Sci 30(9):1078–1092

Bassi F, Dias JG (2019) The use of circular economy practices in SMEs across the EU. Resour Conserv Recycl 146:523–533

Battese GE, Rao DP, O’donnell CJ (2004) A metafrontier production function for estimation of technical efficiencies and technology gaps for firms operating under different technologies. J Prod Anal 21(1):91–103

Bi GB, Song W, Zhou P, Liang L (2014) Does environmental regulation affect energy efficiency in China’s thermal power generation? Empirical evidence from a slacks-based DEA model. Energy Policy 66:537–546

Bianchi M, del Valle I, Tapia C (2020) Measuring eco-efficiency in European regions: evidence from a territorial perspective. J Clean Prod 276:123246

Bodas-Freitas IM, Corrocher N (2019) The use of external support and the benefits of the adoption of resource efficiency practices: an empirical analysis of european SMEs. Energy Policy 132:75–82

Bogetoft P, Otto L (2010) Benchmarking: R Package

Bogetoft P, Otto L (2010a) Benchmarking with Dea, Sfa, and R. Springer

Böhringer C, Rutherford TF (2002) Carbon abatement and international spillovers. Environ Resource Econ 22:391–417

Böhringer C, Rutherford TF (2013) Transition towards a low carbon economy: a computable general equilibrium analysis for Poland. Energy Policy 55:16–26

Brännlund R, Ghalwash T, Nordström J (2007) Increased energy efficiency and the rebound effect: effects on consumption and emissions. Energy Econ 29(1):1–17

Carattini S, Baranzini A, Thalmann P, Varone F, Vöhringer F (2017) Green taxes in a post-Paris world: are millions of nays inevitable? Environ Resource Econ 68:97–128

Caravella S, Crespi F (2020) Unfolding heterogeneity: the different policy drivers of different eco-innovation modes. Environ Sci Policy 114(August):182–193

Chambers RG, Chung Y, Färe R (1996) Benefit and distance functions. J Econ Theory 70(2):407–419

Chatzistamoulou N (2023) Is digital transformation the Deus ex Machina towards sustainability transition of the European SMEs? Ecol Econ 206:107739

Chatzistamoulou N, Koundouri P (2021) SDGs patterns across the globe: from theory to practice. In: Leal FW, Azul AM, Brandli L, Lange SA, Wall T (eds) Decent work and economic growth: encyclopedia of the un sustainable development goals. Springer, Cham. https://doi.org/10.1007/978-3-319-95867-5_81

Chatzistamoulou N, Kounetas K (2023) Tracing green growth through industrial resource efficiency patterns: the role of competitiveness and clean technologies. Manag Decis Econ 44(7):4011–4026. https://doi.org/10.1002/mde.3937

Chatzistamoulou N, Tyllianakis E (2022a) Commitment of European SMEs to resource efficiency actions to achieve sustainability transition: a feasible reality or an elusive goal? J Environ Manag 321:115937

Chatzistamoulou N, Tyllianakis E (2022b) Green growth & sustainability transition through information: are the greener better informed? Evidence from European SMEs. J Environ Manag 306:114457

Chatzistamoulou N, Kounetas K, Tsekouras K (2019) Energy efficiency, productive performance and heterogeneous competitiveness regimes: does the dichotomy matter? Energy Econ 81:687–697

Chatzistamoulou N, Kounetas K, Tsekouras K (2022) Technological hierarchies and learning: spillovers, complexity, relatedness, and the moderating role of absorptive capacity. Technol Forecast Soc Chang 183:121925

Chatzistamoulou N, Koundouri P (2022) Sustainability transition through awareness to promote environmental efficiency. In: Advances in econometrics, operational research, data science and actuarial studies: techniques and theories. 345

Chen M, Sinha A, Hu K, Shah MI (2021) Impact of technological innovation on energy efficiency in industry 4.0 era: moderation of shadow economy in sustainable development. Technol Forecast Social Change 164:120521

Chien T, Hu JL (2007) Renewable energy and macroeconomic efficiency of OECD and non-OECD economies. Energy Policy 35(7):3606–3615

Chien T, Hu JL (2008) Renewable energy: an efficient mechanism to improve GDP. Energy Policy 36(8):3045–3052

Chung YH, Färe R, Grosskopf S (1997) Productivity and undesirable outputs: a directional distance function approach. J Environ Manag 51(3):229–240

Coelli TJ, Rao DSP, O’Donnell CJ, Battese GE (2005) An introduction to efficiency and productivity analysis. Springer

Cooper WW, Ruiz JL, Sirvent I (2007) Choosing weights from alternative optimal solutions of dual multiplier models in DEA. Eur J Oper Res 180(1):443–458

Cuerva MC, Triguero-Cano Á, Córcoles D (2014) Drivers of green and non-green innovation: empirical evidence in Low-Tech SMEs. J Clean Prod 68:104–113

Dato P (2018) Investment in energy efficiency, adoption of renewable energy and household behavior: evidence from OECD countries. Energy J 39(3):213

David PA (1985) Clio and the economics of QWERTY. Am Econ Rev 75(2):332–337

David PA (1986) Understanding the economics of QWERTY: the necessity of history. Econ History Mod Econ. 30–49

De Jesus A, Mendonça S (2018) Lost in transition? Drivers and barriers in the eco-innovation road to the circular economy. Ecol Econ 145:75–89

Demena BA, Murshed SM (2018) Transmission channels matter: Ideifying spillovers from FDI. J Int Trade Econ Dev 27(7):701–728

Demirel P, Danisman GO (2019) Eco-innovation and firm growth in the circular economy: Evidence from European small-and medium-sized enterprises. Bus Strateg Environ 28(8):1608–1618

Dervaux B, Leleu H, Minvielle E, Valdmanis V, Aegerter P, Guidet B (2009) Performance of French intensive care units: a directional distance function approach at the patient level. Int J Prod Econ 120(2):585–594.

Eco-Innovation index (2022). https://www.eco-innovation.eu/eco-innovation-index/

Ekins P, Pollitt H, Barton J, Blobel D (2011) The implications for households of environmental tax reform (ETR) in Europe. Ecol Econ 70(12):2472–2485

Esposito M, Tse T, Soufani K (2018) Introducing a circular economy: new thinking with new managerial and policy implications. Calif Manag Rev 60(3):5–19

Eurostat, (2022). Accessible via https://ec.europa.eu/eurostat

European Commission (2003) Council Directive 2003/96/EC of 27 October 2003 restructuring the Community framework for the taxation of energy products and electricity. Available at https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex%3A32003L0096

European Commission (2005) Communication from the Commission to the Council, the European Parliament, the European Economic and Social Committee and the Committee of the Regions—Thematic Strategy on the sustainable use of natural resources {SEC(2005) 1683} {SEC(2005) 1684}/* COM/2005/0670 final */. Available at https://eur-lex.europa.eu/legal-content/en/TXT/?uri=CELEX%3A52005DC0670

European Commission (2009) Directive 2009/28/EC of the European Parliament and of the Council of 23 April 2009 on the promotion of the use of energy from renewable sources and amending and subsequently repealing Directives 2001/77/EC and 2003/30/EC. Available at: https://eur-lex.europa.eu/legal-content/EN/ALL/?uri=CELEX%3A32009L0028

European Commission (2010) EUROPE 2020 A strategy for smart, sustainable and inclusive growth/*COM/2010/2020 final*/. Available at https://eur-lex.europa.eu/legal-content/EN/ALL/?uri=celex:52010DC2020

European Commission (2011a) Communication from the commission to the European parliament the council, the European economic and social committee and the committee of the regions Roadmap to a Resource Efficient Europe/*COM/2011/0571 Final */ Available at: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:52011DC0571

European Commission (2011b) Communication from the commission to the European parliament, the council, the European economic and social committee and the committee of the regions Innovation for a sustainable. Future—The Eco-innovation Action Plan (Eco-AP) /* COM/2011/0899 final */. Available at https://eur-lex.europa.eu/legal-content/EN/ALL/?uri=CELEX%3A52011DC0899

European Commission (2012) Directive 2012/27/EU of the European Parliament and of the Council of 25 October 2012 on energy efficiency, amending Directives 2009/125/EC and 2010/30/EU and repealing Directives 2004/8/EC and 2006/32/EC Text with EEA relevance. Available at https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex%3A32012L0027

European Commission, (2015). Communication from the commission to the European parliament, the council, the European economic and social committee, the committee of the regions and the European investment bank a Framework Strategy for a Resilient Energy Union with a Forward-Looking Climate Change Policy/* COM/2015/080 final */. Available at https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:52015DC0080

European Commission (2016) Communication from the commission to the European parliament, the council, the European economic and social committee, the committee of the regions and the European investment bank Clean Energy For All Europeans/. Available at https://eur-lex.europa.eu/legal-content/en/TXT/?uri=CELEX:52016DC0860

European Commission (2018a) Directive (EU) 2018/2001 of the European Parliament and of the Council of 11 December 2018 on the promotion of the use of energy from renewable sources (Text with EEA relevance.) PE/48/2018/REV/. Available at: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=uriserv:OJ.L_.2018.328.01.0082.01.ENG&toc=OJ:L:2018:328:TOC

European Commission, (2018b). Communication from the commission to the European parliament, the European council, the council, the European economic and social committee, the committee of the regions and the European investment bank A Clean Planet for all A European strategic long-term vision for a prosperous, modern, competitive and climate neutral economy COM/2018/773 final. Available at https://eur-lex.europa.eu/legal-content/EN/ALL/?uri=COM%3A2018%3A773%3AFIN

European Commission (2018c) Directive (EU) 2018/2002 of the European Parliament and of the Council of 11 December 2018 amending Directive 2012/27/EU on energy efficiency (Text with EEA relevance.). Available at https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=uriserv:OJ.L_.2018.328.01.0210.01.ENG

European Commission (2019) Communication from the commission to the European parliament the European council, the council (2019) the European economic and social committee and the committee of the regions The European Green Deal COM/2019/640 final. Available at: https://eur-lex.europa.eu/legal-content/EN/TXT/?qid=1588580774040&uri=CELEX%3A52019DC0640

European Commission (2021a) Proposal for a directive of the European parliament and of the council amending Directive (EU) 2018/2001 of the European Parliament and of the Council, Regulation (EU) 2018/1999 of the European Parliament and of the Council and Directive 98/70/EC of the European Parliament and of the Council as regards the promotion of energy from renewable sources, and repealing Council Directive (EU) 2015/652. COM/2021/557 final. Available at: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:52021PC0557

European Commission (2021b) Proposal for a COUNCIL DIRECTIVE restructuring the Union framework for the taxation of energy products and electricity (recast). Available at https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52021PC0563

European Commission (2023a). Directive of the European parliament and of the council on energy efficiency and amending Regulation (EU) 2023/955 (recast) PE 15 2023 INIT. Available at https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CONSIL%3APE_15_2023_INIT&qid=1691999531020

European Commission (2023b). Eco-innovation. Available at https://green-business.ec.europa.eu/eco-innovation_en

Färe R, Grosskopf S (2000) Theory and application of directional distance functions. J Prod Anal 13(2):93–103

Feenstra RC, Inklaar R, Timmer MP (2015) The Next generation of the Penn world table. Am Econ Rev 105(10):3150–3182

Fraser Institute, accessible via https://www.fraserinstitute.org/

Fracasso A, Marzetti GV (2015) International trade and R&D spillovers. J Int Econ 96(1):138–149

García-Quevedo J, Jové-Llopis E, Martínez-Ros E (2020) Barriers to the circular economy in European small and medium-sized firms. Bus Strateg Environ 29(6):2450–2464

Garrido-Prada P, Lenihan H, Doran J, Rammer C, Perez-Alaniz M (2021) Driving the circular economy through public environmental and energy R&D: evidence from SMEs in the European Union. Ecol Econ 182:106884

Gillingham K, Rapson D, Wagner G (2016) The rebound effect and energy efficiency policy. Rev Environ Econ Policy 10(1):68–88

Girma S (2005) Absorptive capacity and productivity spillovers from FDI: a threshold regression analysis. Oxford Bull Econ Stat 67(3):281–306

Gkypali A, Kounetas K, Tsekouras K (2019) European countries’ competitiveness and productive performance evolution: unraveling the complexity in a heterogeneity context. J Evol Econ 29(2):665–695

Golombek R, Hoel M (2005) Climate policy under technology spillovers. Environ Resource Econ 31:201–227

Groningen Growth and Development Centre, accessible via https://www.rug.nl/ggdc/?lang=en

Hao LN, Umar M, Khan Z, Ali W (2021) Green growth and low carbon emission in G7 countries: How critical the network of environmental taxes, renewable energy and human capital is? Sci Total Environ 752:141853

Hertwich EG (2005) Consumption and the rebound effect: an industrial ecology perspective. J Ind Ecol 9(1–2):85–98

Hötte K (2020) How to accelerate green technology diffusion? Directed technological change in the presence of coevolving absorptive capacity. Energy Economics 85:104565

Hu JL, Wang SC (2006) Total-factor energy efficiency of regions in China. Energy Policy 34(17):3206–3217

Iwasaki I, Tokunaga M (2016) Technology transfer and spillovers from FDI in transition economies: a meta-analysis. J Comp Econ 44(4):1086–1114

Jiao J, Chen C, Bai Y (2020) Is green technology vertical spillovers more significant in mitigating carbon intensity? Evidence from Chinese industries. J Clean Prod 257:120354

Kasy M (2011) A nonparametric test for path dependence in discrete panel data. Econ Lett 113(2):172–175

Koesler S, Swales K, Turner K (2016) International spillover and rebound effects from increased energy efficiency in Germany. Energy Econ 54:444–452

Kumar, S, Khanna, M (2009) Measurement of environmental efficiency and productivity: a cross-country analysis. Enviro Devel Eco 14(4):473–495

Li X, Du K, Ouyang X, Liu L (2022) Does more stringent environmental regulation induce firms’ innovation? Evidence from the 11th Five-year plan in China. Energy Econ 112:106110

Liu H, Li J, Long H, Li Z, Le C (2018) Promoting energy and environmental efficiency within a positive feedback loop: insights from global value chain. Energy Policy 121:175–184

Magazzino C, Toma P, Fusco G, Valente D, Petrosillo I (2022) Renewable energy consumption, environmental degradation and economic growth: the greener the richer? Ecol Ind 139(April):108912

Mahmood N, Zhao Y, Lou Q, Geng J (2022) Role of environmental regulations and eco-innovation in energy structure transition for green growth: evidence from OECD. Technol Forecast Soc Chang 183:121890

Miguélez E, Moreno R (2015) Knowledge flows and the absorptive capacity of regions. Res Policy 44(4):833–848

Montalbano P, Nenci S (2019) Energy efficiency, productivity and exporting: firm-level evidence in Latin America. Energy Econ 79:97–110

Mukherji N, Silberman J (2013) Absorptive capacity, knowledge flows, and innovation in US metropolitan areas. J Reg Sci 53(3):392–417

Ning L, Wang F (2018) Does FDI bring environmental knowledge spillovers to developing countries? The role of the local industrial structure. Environ Resource Econ 71(2):381–405

Ocal O, Aslan A (2013) Renewable energy consumption-economic growth nexus in Turkey. Renew Sustain Energy Rev 28:494–499

OECD (2017) Green growth indicators 2017

Oh DH, Oh MDH (2022) Package ‘nonparaeff’

Papke LE, Wooldridge JM (1996) Econometric methods for fractional response variables with an application to 401 (k) plan participation rates. J Appl Econ 11(6):619–632

Papke LE, Wooldridge JM (2008) Panel data methods for fractional response variables with an application to test pass rates. J Econ 145(1–2):121–133

Park MS, Bleischwitz R, Han KJ, Jang EK, Joo JH (2017) Eco-innovation indices as tools for measuring eco-innovation. Sustainability 9(12):2206

Picazo-Tadeo AJ, Gómez-Limón JA, Reig-Martínez E (2011) Assessing farming eco-efficiency: a data envelopment analysis approach. J Environ Manag 92(4):1154–1164.

Povitkina M, Alvarado N, Dalli CM (2021) QoG Environmental indicators dataset 2021

Quality of Governance (2023) The QoG environmental indicators dataset 2021, codebook. https://www.gu.se/en/quality-government

Ramalho EA, Ramalho JJ, Henriques PD (2010) Fractional regression models for second stage DEA efficiency analyses. J Prod Anal 34(3):239–255

Razzaq A, Sharif A, Ozturk I, Skare M (2023) Asymmetric influence of digital finance, and renewable energy technology innovation on green growth in China. Renew Energy 202:310–319

Roodman D (2011) Fitting fully observed recursive mixed-process models with cmp. Stand Genom Sci 11(2):159–206

Safi A, Chen Y, Wahab S, Zheng L, Rjoub H (2021) Does environmental taxes achieve the carbon neutrality target of G7 economies? Evaluating the importance of environmental R&D. J Environ Manage 293:112908

Sala-i-Martin X, Artadi E (2004) The global competitiveness index. In: Porter M et al (eds) The global competitiveness report: 2004–05. Oxford University Press, Oxford

Sala-i-Martin X, Blanke J, Drzeniek Hanouz M, Geiger T, Mia I, Paua F (2008) The global competitiveness index: prioritizing the economic policy agenda. In: The global competitiveness report 2008–2009 eds PORTER, M.E. and SCHWAB, K. (Geneva, World Economic Forum)

Science for Environment Policy, (2022) Factors promoting green growth include access to information on funding opportunities, European Commission DG Environment News Alert Service, edited by SCU, The University of the West of England, Bristol. Available via https://environment.ec.europa.eu/news/factors-promoting-green-growth-include-access-information-funding-opportunities-2022-08-23_en

Shi H, Qiao Y, Shao X, Wang P (2019) The effect of pollutant charges on economic and environmental performances: evidence from Shandong Province in China. J Clean Prod 232:250–256

Sorrell S, Dimitropoulos J, Sommerville M (2009) Empirical estimates of the direct rebound effect: a review. Energy Policy 37(4):1356–1371

Stern DI (2012) Modeling international trends in energy efficiency. Energy Econ 34(6):2200–2208

Sun H, Edziah BK, Sun C, Kporsu AK (2019) Institutional quality, green innovation and energy efficiency. Energy Policy 135:111002

Tsekouras K, Chatzistamoulou N, Kounetas K, Broadstock DC (2016) Spillovers, path dependence and the productive performance of European transportation sectors in the presence of technology heterogeneity. Technol Forecast Soc Chang 102:261–274

Tsekouras K, Chatzistamoulou N, Kounetas K (2017) Productive performance, technology heterogeneity and hierarchies: Who to compare with whom. Int J Prod Econ 193:465–478

Turner K (2013) “Rebound” effects from increased energy efficiency: a time to pause and reflect. Energy J 34(4):25

Valero-Gil J, Surroca JA, Tribo JA, Gutierrez L, Montiel I (2023) Innovation vs standardization: the conjoint effects of eco-innovation and environmental management systems on environmental performance. Res Policy 52(4):104737

Vlačić E, Dabić M, Daim T, Vlajčić D (2019) Exploring the impact of the level of absorptive capacity in technology development firms. Technol Forecast Soc Chang 138:166–177

Waheed R, Sarwar S, Alsaggaf MI (2023) Relevance of energy, green and blue factors to achieve sustainable economic growth: empirical study of Saudi Arabia. Technol Forecast Social Change 187:122184

Wang B, Liu B, Niu H, Liu J, Yao S (2018) Impact of energy taxation on economy, environmental and public health quality. J Environ Manag 206:85–92

Wei M, Patadia S, Kammen DM (2010) Putting renewables and energy efficiency to work: how many jobs can the clean energy industry generate in the US? Energy Policy 38(2):919–931

World Bank databank (2023) Accessible via https://databank.worldbank.org/home.aspx

World Economic Forum, accessible via https://www.weforum.org/

Xie P, Jamaani F (2022) Does green innovation, energy productivity and environmental taxes limit carbon emissions in developed economies: implications for sustainable development. Struct Chang Econ Dyn 63:66–78

Yan Z, Zou B, Du K, Li K (2020) Do renewable energy technology innovations promote China’s green productivity growth? Fresh evidence from partially linear functional-coefficient models. Energy Econ 90:104842

Yao X, Zhou H, Zhang A, Li A (2015) Regional energy efficiency, carbon emission performance and technology gaps in China: a meta-frontier non-radial directional distance function analysis. Energy Policy 84:142–154

Zhang XP, Cheng XM, Yuan JH, Gao XJ (2011) Total-factor energy efficiency in developing countries. Energy Policy 39(2):644–650

Zhou Z, Wu H, Song P (2019) Measuring the resource and environmental efficiency of industrial water consumption in China: a non-radial directional distance function. J Clean Prod 240:118169

Acknowledgements

This paper has been supported by the Athens University of Economics and Business Research Centre in the context of the Action II Research Support to Post-doctoral Researchers Program 2018-2019 with project code ΕΡ-2992-01. Authors also acknowledge funding from the European Research Council (ERC) under the ERC Synergy Grant Water-Futures (Grant agreement No. 951424).

Funding

Open access funding provided by HEAL-Link Greece.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Performance Assessment; A Short Technical Note

A country \(i = 1,2, \ldots ,n\) is an entity transforming inputs \(x = \left( {x_{1i} ,x_{2i} ,, \ldots ,x_{Ni} ,} \right) \in \Re_{ + }^{N}\) into outputs \(y = \left( {y_{1i} ,y_{2i} ,, \ldots \,,y_{Mi} ,} \right) \in \Re_{ + }^{M}\) under a technology set \(S\) defined as \(S \equiv \left\{ {\left( {x,y} \right):x \,\,can \,\,produce \,\,y} \right\}\). For the input-oriented case, the technology is represented by its production possibility set \(L\left( y \right) = \left\{ {x \in \Re_{ + }^{N} :\left( {x,y} \right) \in S} \right\}\), while for assessing productive performance, the input distance function defined as \(D_{I} \left( {x,y} \right) = sup\left\{ {\theta > 0:x/\theta \in L\left( y \right)} \right\}\) could be used under the input conservation approach. The technology set at the European level, denoted as \(T^{M}\), is represented as \(T^{M} = \left\{ {\left( {x,y:x \ge 0,y \ge 0} \right) x\,\, can\,\, produce \,\,at \,least \,\,y} \right\}\) (Batesse et al. 2004).

Regarding the productivity differentials across countries, the productive performance, with respect to the European technology is calculated employing the input-oriented Data Envelopment Analysis (DEA) technique under variable returns to scale (Bogetof and Otto 2010a; b) to account for size effects (Tsekouras et al. 2017) is employed. Thus, the bias corrected productive performance of each country, is calculated using the following formula on an annual basis:such that

The resource efficiency measures are captured by the energy and environmental efficiency, which are calculated as follows. The slack-based energy efficiency of the i-th country, at year t (Hu and Wang 2006), is calculated as follows:

while the environmental efficiency of each country is calculated through the Directional Distance Function (Oh and Oh 2023) approach (Färe and Grosskopf 2000; Chung et al. 1997; Chambers et al. 1996), a representation of a multi-input, multi-output distance function discerning two types of outputs, the desirable output \(y = \left( {y_{1} ,y_{2} \ldots , y_{k} } \right) \in \Re_{ + }^{K}\) and the undesirable output \(b = \left( {b_{1} ,b_{2} \ldots , b_{l} } \right) \in \Re_{ + }^{L}\) respectively (Kumar and Khanna 2009). The underlying production process is constrained by the technology set \(T\) defined as \(T^{M} = \left\{ {\left( {y,b} \right):x \,can \,produce \,\left( {y,b} \right)} \right\}\) (Picazo-Tadeo et al. 2011; Dervaux et al. 2009) and thus the DDF on technology \(T^{M}\) with the \(\left( {g_{y} , - g_{b} } \right)\) direction allowing desirable output to be proportionally increased, whereas undesired output to be proportionally decreased, is defined as:

Then, the environmental efficiency of the i-th country, at year t, is calculated as follows:

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Chatzistamoulou, N., Koundouri, P. Is Green Transition in Europe Fostered by Energy and Environmental Efficiency Feedback Loops? The Role of Eco-Innovation, Renewable Energy and Green Taxation. Environ Resource Econ 87, 1445–1472 (2024). https://doi.org/10.1007/s10640-024-00849-y

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-024-00849-y

Keywords

- Green growth and resource efficiency

- Environmental and energy efficiency

- Green taxation

- Eco-innovation

- Feedback loops