Abstract

In the 1990s there was a great deal of interest in the study of the role of endogenous market structure under oligopoly in the characterization of emission taxes. This interest was instrumental in providing policy guidance on the design of emission taxes based on market characteristics. However, the literature has been silent on offering policy recommendations on the design of emission taxes under endogenous market structure in the presence of new firm acquisitions. We build a model where new firms enter the market where some are acquired by an incumbent multi-plant firm, altering the initial market structure. In this framework, we characterize the second-best emission tax and examine the role of the resulting market structure, in particular the role of acquiring more/fewer of the new firms, in the optimal design of emission tax. We argue that, under certain conditions, the acquisition of new firms may lead to higher taxation consistent with the Pigouvian rule or even exceed marginal damages. Our contribution is at the intersection of emission tax design and M &A (new firm acquisition) literature.

Similar content being viewed by others

Availability of Data and Material

Not applicable.

Data Availability

Not applicable.

References

Blair RD, Haynes JS (2011) The efficiencies defense in the 2010 horizontal merger guidelines. Rev Ind Organ 39(1–2):57–68

Cabral LM (2003) Horizontal mergers with free-entry: why cost efficiencies may be a weak defense and asset sales a poor remedy. Int J Ind Organ 21(5):607–623

Carraro C, Katsoulacos Y, Xepapadeas A (1996) Environmental policy and market structure. Kluwer Academic Publishers, Dordrecht

Creti A, Sanin ME (2017) Does environmental regulation create merger incentives? Energy Policy 105:618–630

Davidson C, Mukherjee A (2007) Horizontal mergers with free entry. Int J Ind Organ 25:157–172

Erkal N, Piccinin D (2010) Welfare reducing mergers in differentiated oligopolies with free entry. Econ Rec 86(273):178–184

Farrell J, Shapiro C (1990) Horizontal mergers: an equilibrium analysis. Am Econ Rev 107–126

Fikru M, Gautier L (2016) Mergers in Cournot markets with environmental externality and product differentiation. Resour Energy Econ 45:65–79

Fikru M, Gautier L (2017) Environmental policy and mergers in oligopoly markets with product differentiation. J Econ 122(1):45–65

Fikru M, Gautier L (2020) Cross-country emission tax effect of mergers. Arthaniti J Econ Theory Pract 22(1)

Fikru MG, Lahiri S (2013) Can a merger take place among symmetric firms? Stud Microecon 1(2):155–162

Garcia R, Lessard D, Singh A (2014) Strategic partnering in oil and gas: a capabilities perspective. Energ Strat Rev 3:21–29

Gelves JA (2014) Differentiation and cost asymmetry: solving the merger paradox. Int J Econ Bus 21(3):321–340

Gomes M, Marsat S (2018) Does CSR impact premiums in M &A transactions? Financ Res Lett 26:71–80

Jacqz IB (2020) Essays on air toxics: distribution, drivers, and consequences. The University of Wisconsin-Madison

Kao T, Menezes F (2010) Welfare-enhancing mergers under product differentiation. Manch Sch 78(4):290–301

Katsoulacos Y, Xepapadeas A (1995) Environmental policy under oligopoly with endogenous market structure. Scand J Econ 97:411–420

Kumar BR (2012) Mergers and acquisitions in the energy sector. In: Mega mergers and acquisitions. Palgrave Macmillan, London

Kwon O, Lim S, Lee DH (2018) Acquiring startups in the energy sector: a study of firm value and environmental policy. Bus Strateg Environ 27(8):1376–1384

Lee SH (1999) Optimal taxation for polluting oligopolists with endogenous market structure. J Regul Econ 15:293–308

Lu J (2021) Can the green merger and acquisition strategy improve the environmental protection investment of listed company? Environ Impact Assess Rev 86:106470

Matsumura T, Okumura Y (2014) Comparison between specific taxation and volume quotas in a free entry Cournot oligopoly. J Econ 113:125–132

Nocke V, Whinston MD (2013) Merger policy with merger choice. Am Econ Rev 103(2):1006–33

PricewaterhouseCoopers (2012) The integration of environmental, social and governance issues in mergers and acquisitions transaction. Trade buyers survey result. December 2012. Prepared by PricewaterhouseCoopers with support from Principles for Responsible Investment

Qiu LD, Zhou W (2006) International mergers: incentives and welfare. J Int Econ 68(1):38–58

Requate T (1997) Green taxes in oligopoly if the number of firms is endogenous. Finanzarchiv Public Finance Anal 54:261–280

Requate T (2006) Environmental policy under imperfect competition. In: Tietenberg T, Folmer H (eds) The international yearbook of environmental and resource economics 2006/2007. Edward Elgar Publishing Limited, UK, pp 120–207

Salant SW, Switzer S, Reynolds RJ (1983) Losses from horizontal merger: the effects of an exogenous change in industry structure on Cournot–Nash equilibrium. Q J Econ 98(2):185–199

Spector D (2003) Horizontal mergers, entry, and efficiency defenses. Int J Ind Organ 21:1591–1600

Xiao B, Fan Y, Guo X (2021) Dynamic interactive effect and co-design of SO2 emission tax and CO2 emission trading scheme. Energy Policy 152:112212

Yu P (2020) Carbon tax/subsidy policy choice and its effects in the presence of interest groups. Energy Policy 147:111886

Zheng D, Yuan Z, Ding S, Cui T (2021) Enhancing environmental sustainability through corporate governance: the merger and acquisition perspective. Energy Sustain Soc 11(1):1–15

Acknowledgements

Luis Gautier would like to thank the Ministerio de Universidades, Spain and Next Generation EU for financial support through the fellowship Ayudas María Zambrano. The authors would like to thank the anonymous reviewers and guest editors for valuable comments and suggestions.

Funding

Funding for open access publishing: Universidad Málaga/CBUA. No funding was received for this study.

Author information

Authors and Affiliations

Contributions

All authors contributed to the study conception, design, investigation, formal analysis, methodology. Material preparation and analysis were performed by M. Fikru and L. Gautier. The first draft of the manuscript was written between M. Fikru and L. Gautier. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare they have no competing interests.

Ethical Approval

Not applicable.

Consent to Participate

Not applicable.

Consent for Publication

Not applicable.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendices

Appendix A: Comparative Statics

We first characterize the equilibrium via backward induction. First, from Eqs. (1)–(4) we obtain \(q^{o}(k,m,t)\), q(k, m, t). Second, from equation \(\pi ={\hat{\pi }}\) and using \(q^{o}(k,m,t)\), q(k, m, t), we characterize k(m, t). Third, from equation \(\pi ^{o}=0\) along with \(q^{o}(k,m,t)\), q(k, m, t), k(m, t) we characterize m(t). Finally, substituting m(t) back into k(m, t) yields k(t); and substituting m(t) and k(t) into \(q^{o}(k,m,t)\), q(k, m, t) characterizes the equilibrium level of number of new firms, share of new firm acquisition and output of each insider and outsider.

With this equilibrium in mind, differentiation of (1)–(4), \(\pi ={\hat{\pi }}\), \(\pi ^{o}=0\), the two inverse demand functions under symmetry (\(P=\alpha -\beta q (N+1+km)-\gamma q^{o}(M+m(1-k)) \) and \(P^{o}=\alpha -\beta q^{o}(M+m(1-k)) -\gamma q(N+1+km)\)) and using the market clearing conditions, \(D=q(N+1+km)\) and \(D^{o}=q^{o}(M+(m(1-k))\), gives four equations in four unknowns, \(dD^{o}\), dD, dm, dk:

where \(\mu = M+(1-k)m\) represents the total number of outsiders.

Next, we offer a detailed derivation of (A.1)–(A.4). But first, consider \(D=q(N+1+km)\) and \(D^{o}=q^{o}(M+(m(1-k))\). Hence,

Hence,

Next, to derive (A.1) combine (1) and (2), and impose \(D=q(N+1+km)\) and \(D^{o}=q^{o}(M+(m(1-k))\). This gives \(\alpha -\beta q^{o} -\beta D^{o}-\gamma D-\sigma ^{o}t=0\). Differentiation gives

where substituting (A.7) into (A.9) and collecting terms gives Eq. (A.1).

Next, to derive (A.2) combine (3) and (4), and impose \(D=q(N+1+km)\) and \(D^{o}=q^{o}(M+(m(1-k))\). This gives \(\alpha -2\beta D -\gamma D^{o}-\sigma t=0\). Differentiation gives

This is (A.2).

Next, to derive (A.4) consider \({\hat{\pi }}=\pi \), where \(\pi _{j}=\pi \), \(\forall j\). Impose \(D=q(N+1+km)\) and \(D^{o}=q^{o}(M+(m(1-k))\) into profits \(\pi \). Simplifying profits gives \({\hat{\pi }}=(\alpha -\beta D -\gamma D^{o}-\sigma t)q+t^2/2-F\). Differentiation gives

where (i) imposing first-order-condition \(\beta q(N+1+km) =\alpha -\beta D -\gamma D^{o}-\sigma t\), where \(\beta q(N+1+km)=\beta D\); (ii) simplifying \(-\sigma dt +tdt\) using \(e=\sigma q -t\); and (iii) substituting (A.8) gives

This is Eq. (A.4).

Next, to derive (A.3) consider \(\pi ^{o}=0\). Impose \(D=q(N+1+km)\) and \(D^{o}=q^{o}(M+(m(1-k))\) into profits \(\pi ^{o}\). Simplifying profits gives \(\pi ^{o}=(P^{o}-c-\sigma ^{o}t)q^{o}+t^2/2-F\). Differentiation and imposing first-order condition \(\beta ^{o}q^{o}\) gives

where substituting (A.7) and simplifying gives (A.3).

We assume \(d{\hat{\pi }}\) is zero; that is, each insider’s reservation profit is small relative to the market and thus \({\hat{\pi }}\) constant. Using (A.1)–(A.4) yields \(\rho dD^{o}=[t\beta /q^{o}-(2\beta \sigma ^{o}-\gamma \sigma )]dt <0\), \(\rho dD=[t\gamma /2q^{o}-(\beta ^{o}\sigma -\gamma \sigma ^{o})]dt<0\). In addition, \(\rho dm = \left[ \left( \frac{-2(\beta ^{o}\sigma -\gamma \sigma ^{o})}{q} - \frac{(2\beta \sigma ^{o}-\gamma \sigma )}{q^{o}} \right) + t \eta _{m}\right] dt\), \(\rho m dk=\left[ (2\beta \sigma ^{o}-\gamma \sigma )(qk-(1-k)q^{o})+t\eta _{k}\right] dt\) where \(\rho =2\beta \beta ^{o}-\gamma ^{2}>0\), \(\eta _{m}>0\) and \(\eta _{k}>0\) are complicated expressions, which denote the abatement effect; for example, \(\eta _{k} = 2\beta \beta ^{o}\left( 2\beta ^{o}q^{{o}^{2}}(1-k)-(\mu +1)\beta q^{2}k\right) -\gamma ^{2}\left( 2\beta ^{o}q^{{o}^{2}}(1-k)-\beta q^{2}k\right) \).

The effect of the tax on total emissions is given by \(\frac{\partial E}{\partial t} = \sigma \frac{\partial D}{\partial t} + \sigma ^{o} \frac{\partial D^{o}}{\partial t} - (N+1+km) - (M+ (1-k)m) - t\frac{\partial m}{\partial t}<0\) by Assumption 2.1 (i.e., the last term is small).

We now turn to the comparative statics exercise for the case where the cost function is general. Consider a cost function C(q, e), which satisfies (subscripts denote partial derivatives) \(C_{q}>0\), \(C_{qq}>0\), \(-C_{e}>0\), \(C_{ee}>0\), \(-C_{eq}=-C_{qe}>0\), \(C_{qq}C_{ee}-C_{qe}C_{eq}\ge 0\). These are standard properties of the cost function with abatement (see Requate 2006, p. 126). Similar to the comparative statics exercise explained earlier (but now with a more general cost function) we obtain the following system of equations:

where \(\lambda =(C_{ee}C_{qq}-C_{eq}C_{qe})/C_{ee}\), \(\sigma =-C_{eq}/C_{ee}\), \(\lambda ^{o}=(C^{o}_{e^{o}e^{o}}C^{o}_{q^{o}q^{o}}-C^{o}_{e^{o}q^{o}}C^{o}_{q^{o}e^{o}})/C^{o}_{e^{o}e^{o}}\), \(\sigma ^{o}=-C^{o}_{e^{o}q^{o}}/C^{o}_{e^{o}e^{o}}\). It is noteworthy that (i) in the case of end-of-pipe \(\lambda =0\) in which case we obtain Eqs. (A.1) and (A.2), and (ii) the last two equations in the system are identical to (A.3) and (A.4) so the presence of a general cost function does not play any role. To illustrate the role of the general cost function in the comparative statics we show the expression for \(dD^{o}\):

where \(H>0\) is the determinant of the coefficient matrix and \(\mu =M+(1-k)m\) is defined as before. The first line in (A.14) is the same as in the case of an end-of-pipe cost function, which we consider to be negative to capture the standard case where the tax lowers output i.e., small abatement effect, \(t\beta /q^{o}\). And the second and third lines capture the role of the general cost function, where the second and third lines are negative. The second and third lines vanish in the case of an end-of-pipe cost function since \(\lambda =0\), \(\lambda ^{o}=0\). As a result, the presence of a general cost function does not change the qualitative results of \(dD^{o}/dt\). An analogous expression is obtained for dD/dt.

Appendix B: Derivation of Fig. 3

We first argue the condition under which \(\partial m/\partial k>0\). This is the case we consider in Fig. 3 i.e., acquisitions generate profits so that more firms enter the market. This happens if \(\pi ^{o^{\prime }}_{k}+\pi _{k}>0\). In other words, acquisitions of firms by the incumbent offsets any profits loss of the outsiders which induces more firms into the market. Formally, differentiation of \(\pi (m,k) +\pi ^{o^{\prime }}(m,k)=0\) gives \(dm/dk = -(\pi ^{o^{\prime }}_{k}+\pi _{k})/(\pi ^{o^{\prime }}_{m}+\pi _{m})>0\), where the denominator is negative.

Part (i)—Intersection point of solid lines at \({\hat{t}}\) in Fig. 3 requires \(\partial k/\partial t\) to be bounded. That is, the effect of the tax on the acquisition of new firms can’t be too large. This is because with too large an effect the emission tax at the intersection point in the figure would not be possible since the number of firms determined via the zero-profit condition would be too large (too many firms would be attracted by \(\partial k/\partial t\)) relative to the second-best optimal one. First, we show that \(\partial k/\partial t<\eta _{1}\), where \(\eta _{1}\) is defined below. (a) Consider \(\pi ^{o^{\prime }}(m,t,k)\), whence \(-dm/dt=(\pi ^{o^{\prime }}_{t}/\pi ^{o^{\prime }}_{m})+(\pi ^{o^{\prime }}_{k}/\pi ^{o^{\prime }}_{m})k_{t}\), where \(k_{t}=\partial k/\partial t\). (b) Consider \(W^{\prime }_{m}(m,t,m(k))\), whence \(-dm/dt=(W^{\prime }_{mt}/W^{\prime }_{mm})+(m_{k})k_{t}\). Then, intersection point in Fig. 3 requires the absolute value of dm/dt from (a) to exceed that from (b). That is,

Part (ii)—The welfare-maximizing tax in the presence of acquisitions, \(t^{*}\), lies between one (i.e., marginal damages, which is equal to one in the case of Fig. 3) and the tax that equates the welfare-maximizing number of firms and the free-entry number of firms, \({\hat{t}}\). The condition which ensures \(t^{*}>1\) is given by (7) where \(\varphi ^{\prime }=1\) and we label the RHS as \(\eta _{2}\). Hence, \(1<t^{*}<{\hat{t}}\), if \(\eta _{2}<\partial k/\partial t<\eta _{1}\); that is, \(\partial k/\partial t\) is large but not too large i.e., \(\partial k/\partial t\) is bounded.

Appendix C: Illustration of the Condition in Lemma 2.2 and the Case Where Abatement Effects are Large

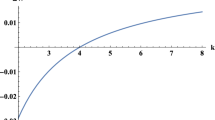

Consider parameter values i.e., \(\alpha =1\), \(c=0\), \(\beta =\beta ^o=\gamma =1\), \(M=4\), \(N=1\), \({\hat{\pi }}=1/12\), \(F=1/1000\). We use Mathematica to solve the model via backward induction (as explained at the beginning of Appendix A) and illustrate the condition in Lemma 2.2. For given range of the emission tax, m is a decreasing function of the emission tax (which is the case we focus on the paper, where abatement effects are small), while k can be an increasing or decreasing function of the emission tax for this same range. Using the solution of the model we derive the share \(q^o/(q+q^o)\) as a function of the emission tax, which we find to be approximately \(30\%\). This is our threshold output share referred to in the paper. With these in mind and using the condition \(k> q^o/(q+q^o)\) in Lemma 2.2, our results indicate that for given range of the emission tax, k increases with the emission tax and so \(k> q^o/(q+q^o) = 30\)%. But k decreases with the emission tax and so \(k< q^o/(q+q^o) = 30\)%. See the Figure below.

Figure 4 shows that for \(t\in (.01,0.2)\), \(\partial m/\partial t<0\) i.e., abatement effect is small. For this very same range of t, \(\partial k/\partial t\) can be either positive of negative as discussed in the main body of the article.

Now, for \(t\in (0.2,0.4)\), abatement effects are large enough and so \(\partial m/\partial t>0\), \(\partial k/\partial t>0\). A large enough abatement effect implies that additional firms enter the market via an increase in the emission tax and, also, an increase in the share of new firm acquisitions. The reason for this is that higher profits (via the large abatement effect) prompts firms to enter the market and the incumbent firm to acquire a larger share of the now more profitable firms.

Next, we describe the solution to the model we used to derive the above figures and share \(q^o/(q+q^o) = 30\%\). First, we combine first-order conditions (1) and (2) into one equation; we also substitute the demand function, P, into this newly derived equation. Second, we do the same with Eqs. (3) and (4), where we substitute \(P^{o}\). From these two equations we solve simultaneously for q(m, k, t), \(q^{o}(m,k,t)\). Second, we substitute the expressions for q(m, k, t), \(q^{o}(m,k,t)\) obtained in the previous step into equation \({\hat{\pi }}=\pi \) (where \(\pi _{j}=\pi \), \(\forall j\)). This yields k(m, t). Third, we simplify the zero-profit condition, \(\pi ^{o}=0\), using Eqs. (3) and (4); then, we substitute \(q^{o}(m,k,t)\) and k(m, t), which yields m(t). Fourth, substituting m(t) back into k(m, t) gives k(t). Subsequently, we substitute m(t) and k(t) back into q(m, k, t), \(q^{o}(m,k,t)\), which gives q(t) and \(q^{o}(t)\). We then use q(t) and \(q^{o}(t)\) to calculate the share \(q^{o}/(q^{o}+q)\) for range \(t\in (.01,0.3)\). This share is approximately at \(30\%\).

Rights and permissions

About this article

Cite this article

Gautier, L., Fikru, M.G. The Design of Emission Taxes in Markets with New Firm Acquisitions. Environ Resource Econ (2024). https://doi.org/10.1007/s10640-024-00845-2

Accepted:

Published:

DOI: https://doi.org/10.1007/s10640-024-00845-2