Abstract

We analyze the impact of border adjustment policies on trade, pollution and welfare when firms, located in different countries, sell differentiated products in geographically-separated markets. Transportation of goods not only incurs a cost, but also generates emissions. We compare outcomes under competition and multimarket collusion. Cooperating governments can implement the first-best using appropriate border adjustments regardless of the market structure. When governments set policies non-cooperatively, the border adjustment tariffs exceed the marginal damage from emissions. While it is expected that colluding firms would reduce trade flows relative to competition, trade increases under collusion, resulting in higher welfare. This highlights the possibility of allowing firms to collude and taxing (part of) their profits, which can be redistributed to citizens or used to mitigate the effects of pollution.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

International transport accounts for 33% of total world trade-related emissions, while it also accounts for 75% of emissions for major manufacturing categories (Cristea et al. 2013). If shipping “were accounted for as a nation, [it] would rank as the world’s sixth biggest emitter” (BBC 2018). Further, emissions from shipping are estimated to increase by up to 250% and at least by 50% by 2050 (European Commission, 2019).Footnote 1 Many exporters and products that might seem “clean” from an output emission perspective turn out to be heavy emitters when pollution from transport is incorporated. Overall, the evidence highlights the importance of emissions from international transportation of goods in determining environmental outcomes.

The global prevalence of international cartels operating in multiple countries is known.Footnote 2 Bond (2004), Bond and Syropoulos (2008), Connor (2007) and Deltas et al. (2012) provide multiple examples of international cartels in various industries. While most international cartels involve cross-hauling of goods across markets, colluding firms are expected to reduce cross-hauling relative to oligopolistic competition to save on transport costs. Hence, given that international goods transportation is a major source of emissions, collusion is expected to have a positive impact on environmental outcomes. Simultaneously, cartels, in general, impose a social welfare cost by limiting output or increasing prices relative to perfectly competitive or oligopolistically competitive markets. Governments can use border adjustments not only to address the emission externality generated due to trade but also to improve welfare. This paper analyzes how these different aspects interact. It compares outcomes under oligopolistic competition (henceforth, competition for brevity) to collusion when firms located in different countries sell differentiated products in geographically-separated markets and transportation of products generates emissions, while governments implement border adjustments. We consider how border adjustments depend on the market structure, competition versus multimarket collusion, and have differential impacts on trade, emissions and welfare.

This paper has multiple contributions. Pollution generated by transportation of goods is modeled. The role of border adjustments in addressing this trade-generated externality is analyzed.Footnote 3 Note that, with production or consumption generated emissions, in general, border adjustments can only work as second-best instruments to internalize the effect of underregulated foreign-generated emissions. However, when trade is the source of emissions as in the case of international transport-generated emissions, border adjustments are direct instruments to target the source of emissions. Further, border adjustments can be implicitly used to address multiple policy objectives.Footnote 4 This paper compares how the effects of border adjustments on pollution and welfare differ with the market structure—competition versus multimarket collusion—since the governments’ incentives differ with the market structure.

Two countries (markets) have one firm each, which produce differentiated products sold in both markets. Apart from the transportation cost incurred in shipping goods across markets, cross-hauling also generates emissions. Consumers in each market have varied preferences—there is a continuum of consumers of unit mass uniformly placed on a Hotelling interval. Each firm produces one variety of product—each at one end of the interval. Each consumer purchases one of the two varieties and her disutility from consuming a variety other than her ideal variety depends on the distance on the Hotelling interval. Governments implement border adjustments. We compare trade volumes, pollution and welfare under different government behaviors (Pigovian, cooperative and non-cooperative) and under different market structures.

Deltas et al. (2012) compare competitive and collusive outcomes when two firms, located in different countries, produce differentiated products and cross-haul products across markets at a cost. There is no pollution externality nor government policies. They find that cross-hauling is too high under competition; colluding firms reduce cross-hauling to save on transport costs. While the underlying model is similar, the current paper is different from their study. Given the empirical evidence on transport emissions, we model pollution generated by international cross-hauling of goods. Further, we analyze border adjustments to address the pollution externality.

We find that all border adjustment tariffs are positive under both market structures (we do not place any a priori restriction on any of these). When governments cooperate, regardless of the market structure, the first-best market shares (trade flows), emissions and welfare can be implemented. However, when governments set policies non-cooperatively, trade (cross-hauling) is too low under competition and increases under collusion. This is driven by the difference in the government’s incentives to use border adjustments under competition and collusion. Border adjustment tariffs on exports or imports reduce trade (hence, pollution). Border adjustments on exports raise the domestic firm’s profits under competition, but this profit-shifting motive is absent when firms collude. Under competition, the export border adjustment payments are a transfer within the economy—from the domestic firm to the government; however, when firms collude, given profit sharing between firms, part of these payments are borne by the other country. Border adjustments on imports, under either market structure, reduce the consumer surplus of consumers who buy the imported variety. Under competition, these tariffs also lower the surplus of consumers who consume the domestic variety. However, the surplus of these latter consumers is increasing in the import tariffs under collusion; this is because colluding firms lower the price of the domestic variety to save on net transport costs (which include tariffs). There is no profit-shifting motive for imposing border adjustments on imports under collusion, while this effect is positive under competition. The revenue effect of import border adjustments is lower under collusion as part of the cost is borne by the domestic economy due to profit sharing by firms. Overall, these differential effects result in more restrictive border adjustments under competition relative to collusion, giving rise to the unexpected outcome of more trade (cross-hauling) under collusion than under competition. Furthermore, border adjustments exceed the own marginal damage from emissions such that there is too little cross-hauling/trade (relative to the first-best). Under collusion, despite firms’ tendency to reduce trade (cross-hauling), the overall reduced incentive of governments to restrict trade implies that trade volumes are higher, resulting in higher welfare than the competitive market structure. In contrast to the existing literature [for instance, Newbery and Stiglitz (1984), Eden (2007), Deltas et al. (2012)], which finds that autarky can be welfare-superior to trade, we find that trade is welfare-improving over autarky even with a pollution externality and non-cooperative border adjustment policies.

Related papers that study the impact of carbon taxes on international transportation and emissions from transportation are few. Shapiro (2016) shows that, with perfectly competitive firms, trade increases CO\(_2\) emissions. An exogenous tax on emissions from shipping increases (decreases) welfare in ‘wealthy’ (‘poor’) countries, while aggregate welfare increases. In contrast, we focus on firms with market power, and compare environmental and welfare outcomes under different market structures. Further, we consider strategic border adjustment policies rather than exogenous emission taxes. Avetisyan (2018) uses a modified GTAP-E model to analyze the effect of GHG taxes on the transportation sector, focusing on the choice of international mode of goods transportation. Since air transport is the most emission intensive, a GHG tax results in substitution from air towards water transport; this is driven by the higher substitutability between air and water transport, relative to air and land transport. Further, the tax affects goods with lower value to weight ratio more adversely and also negatively impacts the competitiveness of transport services from developing countries, which are relatively more emission intensive. Overall, transport emissions fall due to the tax. Mundaca et al. (2021) focuses on the effect of carbon taxes on international maritime transport of heavy products from 21 industries when exporters choose both export quantities and the distance to their trade partners. A global emission tax on CO\(_2\) of US$40 per ton reduces emissions; similar to Avetisyan (2018), the greatest (lowest) impact is on products with low (high) value to weight ratios. Unlike our study, neither of the above papers, however, analyze the use of border adjustments nor strategic policy setting by governments, nor do they compare different market structures.

The literature on trade and environmental policies is also related to this current paper [see Copeland and Taylor (2004), for a comprehensive review], especially the work on strategic environmental policies in the presence of international oligopolies, building on the Brander and Spencer (1985) framework. In an international oligopolistic setting, without any pollution externality, governments can use export taxes and/or subsidies to shift profits in favor of domestic producers exporting their products [see, for instance, Eaton and Grossman (1986)]. Barrett (1994) applies this to the context of countries using weak environmental standards to implicitly subsidize domestic firms competing in oligopolistic international markets; however, the pollution is purely local. See, among others, Neary (2006) for details on the use of environmental policies as second-best instruments to subsidize domestic firms. Recent papers incorporating emissions in the Brander-Spencer framework, albeit with focus on the comparison of tradable versus nontradable emission permits, include Antoniou et al. (2014) and Lapan and Sikdar (2022). While the incentive to use environmental/trade policies to shift profits is also present in our setup, none of the above papers consider transport-generated emissions; the border adjustments are direct mechanisms to address this trade-generated externality. Nor do these papers consider the role of the market structure—competition versus collusion; the incentives to use environmental policies to shift profits in favor of the domestic firm differ dependent on whether the firms compete or collude.

The policy relevance of border adjustments is highlighted by the recently announced EU border adjustment mechanism (European Commission, 2021); its application to emissions generated from international transportation of goods, a significant source of international pollution, is the next logical step. Border adjustments are a direct mechanism to address the pollution externality generated by international transportation of products (a direct outcome of trade). We show that the Pigovian tax does not always guarantee efficiency—while it internalizes the pollution externality, the tax cannot internalize the welfare loss due to the firms’ market power. Cooperative governments, however, implement the first-best outcome through appropriate border adjustments, highlighting the importance and power of governments cooperating. Finally, the result that the collusive outcome is welfare-superior to competition provides some justification for allowing cartels to operate. Governments could tax part of the cartel’s profits and redistribute to citizens. The cartel tax revenue could be used to mitigate the effects of pollution or these revenues could be invested in R &D efforts for cleaner technology. Funds could also be used to further incentivize or part-fund efforts by organizations like the International Maritime Organization to encourage innovation and to improve the transfer of technology (International Maritime Organization, 2018). The legal literature [for instance, Monti (2002), and Townley (2009)] indicates that laws in the European courts and European treaties should take in to account public interests. In the context of our study, this would imply allowing multimarket collusion, which increases welfare.

The rest of the paper is organized as follows. In the next section, we present the model and derive the first-best and autarky outcomes. Section 3 derives the trading equilibrium in terms of the border adjustment tariffs and the equilibrium without any border adjustments. Section 4 compares competitive and collusive outcomes under Pigovian taxation and under cooperative governments, while Sect. 5 analyzes non-cooperative government policies. Section 6 concludes. An Appendix contains proofs of a Lemma and all Propositions. A Supplementary Appendix derives conditions under which trigger strategies can sustain collusion between firms.

2 The Model

Horizontally differentiated goods are produced by two firms, A and B, located in different countries, 1 and 2, respectively. We use the terms markets and countries interchangeably. Transportation of goods from country i to j, which are geographically separated, incurs unit cost, \(\gamma > 0\), \(i, j = 1, 2\), \(i \ne j\). Each market has a continuum of consumers, uniformly distributed over a unidimensional product characteristic space, over the interval [0, 1]. Consumer type is denoted by \(x \in [0,1]\). Firm A’s product is located at the left endpoint, while B’s is at the right endpoint, of this unit interval. Both firms face a constant marginal cost of production, \(c \ge 0\). Consumers choose to buy either one unit of one of the goods or none. Firms can price discriminate across markets but not within a market. Denote the prevailing product price in market i as \(p_i \equiv (p_{iA}, p_{iB})\). The reservation price for a consumer’s ideal variety is v and the disutility from consuming a variety different from the ideal variety is linear in the distance along the Hotelling interval, with slope \(\theta > 0\). This basic model follows (Deltas et al., 2012).

A consumer, \(x_i\), in market i chooses good A when \(U_A (p_{iA}; \, x_i) \equiv v - \theta x_i - p_{iA} \ge \max (U_B(p_{iB}; \, x_i),0)\), with \(U_B(p_{iB}; \, x_i) \equiv v - \theta (1 - x_i) - p_{iB}\). Good B is chosen if \(U_B(p_{iB}; \, x_i) > \max (U_A(p_{iA}; \, x_i),0)\). The marginal consumer, \({\hat{x}}_i\), is determined by \(U_A (p_{iA}; \, x_i) = U_B(p_{iB}; \, x_i)\), implying:

Hence, the market shares (in country i) for firms A and B are, respectively, \({\hat{x}}_i(p_i)\) and \(1 - {\hat{x}}_i(p_i)\). We will carry out our analysis in terms of market 1; outcomes in market 2 are analogous. Firm B exports/transports \((1-{\hat{x}}_1)\) to market 1, while firm A exports/transports \({\hat{x}}_2\) to market 2. Emissions are a by-product of transportation/cross-hauling of products. Pollution is a pure global public bad. Pollution damage in each country due to emissions from transportation of goods is:

Hence, the marginal pollution damage in country i from cross-hauling of its exports to (imports from) country j is:

We focus on the role of border adjustments when there is trade and consumers purchase one of the goods. Hence, we restrict the parameter space as follows:

Assumption 1

The cost of transportation is sufficiently low relative to the degree of consumers’ preference for the ideal variety, \(\gamma < \theta\).

Assumption 2

The reservation price for the consumer’s ideal variety is sufficiently high: \(v \ge c+ \frac{\gamma +3\theta }{2} + \frac{(2 \delta + \theta ) (3 \theta - \gamma ) + 6 \theta ^2}{4 (\delta + 2 \theta )}\).

Assumption 1 guarantees that the strength of the consumers’ preference for ideal variety, \(\theta\), is sufficiently great relative to the transport cost, \(\gamma\), so that there is trade and both firms serve both markets under either market structure; hence, \(0< {\hat{x}}_i < 1\), \(i = 1, 2\). Assumption 2 implies that the consumer’s reservation price for the ideal variety is sufficiently high such that under either competition or collusion, the consumer who is indifferent between the two varieties, A and B, will prefer these to the outside option. Hence, consumers buy one of the two varieties of the products, i.e., \(U_A(p_{iA}, {\hat{x}}_i) = U_B(p_{iB}, {\hat{x}}_i) > 0\).Footnote 5

Suppose each government, \(i = 1, 2\), implements a border adjustment policy comprised of an export tariff, \(\tau _i \lesseqgtr 0\), and an import tariff, \(t_i \lesseqgtr 0\). We do not impose any a priori restriction on the tariffs, i.e., we allow subsidies or zero tariffs also. The border adjustments imply the following net transportation cost for firms A and B, respectively: (\(\gamma + \tau _1 + t_2\)) and (\(\gamma + \tau _2 + t_1\)). Under competition, welfare in country 1 isFootnote 6:

The first and second terms represent the consumer surpluses from the consumption of the domestic and imported varieties, respectively. The third and fourth terms are, respectively, the domestic firm’s profits from selling to the home and foreign markets. The fifth and sixth terms are, respectively, the government’s export and import tariff revenues, while the last term is the pollution damage.

When firms maximize joint profits, welfare of each country depends on the profit-sharing rule between firms. We assume that firms share the total profits equally.Footnote 7 Welfare in country 1 is:

where the first and second terms, respectively, denote the consumer surplus from consuming the domestic and imported varieties. The sum of the third through sixth terms is the aggregate profit of the two firms—the third and fourth terms are the profits of the domestic firm (A) from selling in the home and foreign markets, respectively, while the fifth and sixth term together represent the total profit of the foreign firm (B). The seventh and eighth terms are, respectively, the government’s export and import tariff revenues; the last term reflects the welfare loss due to pollution.

2.1 Timing

The timing of the game is as follows:

-

1.

Governments simultaneously set their border adjustment policies, i.e., choose the export and import tariffs.

-

2.

Firms simultaneously choose product prices for domestic and foreign markets.

-

3.

Output is produced, cross-hauling of products occurs and consumption takes place.

2.2 First-best

The first-best market shares, \({\hat{x}}_1\) and \({\hat{x}}_2\), are chosen to maximize aggregate welfare of the two countries, \(W = W_1 + W_2\):

The first-order necessary conditions for aggregate welfare maximization imply the first-best market shares and trade flows (the superscript \(^*\) denoting the first-best):

the first-best domestic market shares, \({\hat{x}}_1^*\) and \(1 - {\hat{x}}_2^*\), are increasing in the transport cost (\(\gamma\)) and the marginal damage from pollution (\(\delta\)), while they are decreasing in the degree of consumers’ preference for ideal variety (\(\theta\)). Higher transport cost or pollution damage lowers the gains from trade and, thus, shifts the consumption pattern in favor of the home variety, while stronger preference for the ideal variety increases trade as it increases the gains from trade. Naturally, the socially optimal cross-hauling levels are decreasing in the transport cost and the marginal damage from emissions, while they are increasing in the strength of the consumers’ preference for the ideal variety. Aggregate emission, \(Z^* = 1 - {\hat{x}}_1^* + {\hat{x}}_2^* = \frac{\theta - \gamma }{2\delta +\theta }\), is decreasing in \(\gamma\) and \(\delta\), while it is increasing in \(\theta\). This follows as the former reduce trade (hence, emissions), while the latter increases trade (and emissions).

2.3 Autarky

Autarky welfare in country 1 can be written as:

where the superscript a denotes autarky. Note that, given that there is no cross-hauling of goods in autarky, there is no emission from transportation of goods.

Under autarky, if the consumers’ reservation price is sufficiently high, i.e., if \(v \ge c + 2 \theta\), there is complete market coverage by the domestic firm. Assumptions 1 and 2 imply that there is complete market coverage under autarky, i.e., \({\hat{x}}_1^a = 1\).Footnote 8 Then, firm A sets price such that the surplus of the marginal consumer is zero, i.e., \(v - \theta - p_{1A}^a = 0\), implying \(p_{1A}^a = v - \theta\).Footnote 9

3 Trade

We, now, derive the decentralized prices and market shares in terms of the tariffs—we will use these to derive the equilibria under different assumptions on government behavior. Recall that \(\tau _i\) and \(t_i\) are, respectively, the export and import tariffs imposed by government i, \(i = 1, 2\).

3.1 Competition

Given the location of the marginal consumer in country 1, \({\hat{x}}_1 (p_1)\), firm A’s problem is: \(\max _{p_{1A}} \; (p_{1A} - c) \ {\hat{x}}_1 (p_1) = (p_{1A} - c) \left[ \frac{1}{2} + \frac{p_{1B} - p_{1A}}{2 \theta }\right]\), implying the following best-response function: \(p_{1A} = \frac{1}{2} (c + \theta + p_{1B})\). Similarly, firm B’s problem, \(\max _{p_{1B}} \ (p_{1B} - c - (\gamma + \tau _2 + t_1)) (1 - {\hat{x}}_1 (p_1))\), yields its best-response function: \(p_{1B} = \frac{1}{2} (c + \theta + (\gamma + \tau _2 + t_1) + p_{1A})\). Solving the best-response functions yields the prices and market shares in terms of the tariffs:

Note that an increase in the transport cost (\(\gamma\)) or the strength of consumers’ preference for their ideal variety (\(\theta\)) increases all prices. This occurs because an increase in \(\gamma\) increases the transport cost component of prices, while an increase in \(\theta\) increases consumer’s willingness to pay for their ideal variety. An increase in \(\gamma\) makes cross-hauling of products more expensive and reduces trade, thereby decreasing the market shares of the imported varieties (\(1 - {\hat{x}}_1^C, {\hat{x}}_2^C\)) while increasing the domestic firms’ market shares (\({\hat{x}}_1^C, 1 - {\hat{x}}_2^C\)). However, stronger preference for the ideal variety (\(\theta \uparrow\)) increases trade and market share of the imported variety, thereby reducing the domestic firm’s market share. When firms compete, an increase in the relevant border adjustment tariff (say, \(\tau _j\) or \(t_i\)) increases prices of both varieties in market i, (\(i, j = 1, 2\), \(i \ne j\)). Restricting trade (by increasing tariffs) directly increases the price of the imported variety due to increased net cost of the cross-hauling (including the tariff); this allows the domestic producer to charge a higher price. The market share of the foreign firm in, say, country 1 (\(1 - {\hat{x}}_1\)), is decreasing in the export tariff of country 2, \(\tau _2\), and the import tariff of country 1, \(t_1\); these tariffs increase the net price (inclusive of tariffs) of imports to country 1 (\(p_{1B}^C\)), thereby reducing the market share of imports. On the other hand, the domestic market share in country 1 (\({\hat{x}}_1\)) is increasing in the import tariff of that country, \(t_1\), and export tariff of the other country, \(\tau _2\); these tariffs increase the price of the imported product, thereby, increasing \({\hat{x}}_1^C\).

3.2 Collusion

When firms collude to maximize joint profits, they act as a monopolist. Firms set prices such that the marginal consumer’s surplus is zero, i.e., \(U_A (p_{1A}, {\hat{x}}_1 (p_1)) = v - \theta {\hat{x}}_1 - p_{1A} = v - \theta (\frac{1}{2} + \frac{p_{1B} - p_{1A}}{2 \theta }) - p_{1A} = 0\), implying \(p_{1B} = 2 v - \theta - p_{1A}\). The cartel’s maximization problem for market 1 can, thus, be written as: \(\max _{p_{1A},p_{1B}} \ (p_{1A} - c) \ {\hat{x}}_1(p_1) + (p_{1B} - c - (\gamma + \tau _2 + t_1))(1 - {\hat{x}}_1(p_1))\) such that \(U_A (p_{1A}, {\hat{x}}_1 (p_1)) = 0\), which simplifies to: \(\max _{p_{1A},p_{1B}} \ (p_{1A} - c) \ \frac{v - p_{1A}}{\theta } + (2v - \theta - p_{1A} - c - (\gamma + \tau _2 + t_1))\left( 1 - \frac{v - p_{1A}}{\theta }\right)\). The first-order conditions for this problem imply:

Higher \(\gamma\) results in a higher price of the imported variety due to higher transportation cost. To save on the higher transportation cost, the colluding firms reduce the price of the domestic variety to incentivize consumers to buy the domestic variety. Hence, a higher \(\gamma\) increases the domestic market share and reduces that of the imported variety. A stronger preference for the ideal variety (\(\theta \uparrow\)) raises consumers’ disutility from not consuming their ideal variety; hence, colluding firms reduce the prices of both varieties to incentivize consumers to be more willing to purchase their non-ideal variety. Higher \(\theta\) results in a lower market share for the domestic firm (\({\hat{x}}_1\)) and a higher market share for the imported product (\(1 - {\hat{x}}_1\)) in market 1. An increase in the export tariff of country 2 (\(\tau _2\)) or the import tariff of country 1 (\(t_1\)) increases the price of the imported variety in country 1 (\(p_{1B}\)) due to the higher (net) cost of cross-hauling. The colluding firms reduce the price of the domestic variety (\(p_{1A}\)) to save on these higher (net) cross-hauling costs. This, in turn, increases the domestic market share (\({\hat{x}}_1\)) and reduces the market share of the imported variety (\(1-{\hat{x}}_1\)) in market 1.

Before proceeding further, it is worth noting the followingFootnote 10:

Lemma 1

Welfare is concave in the domestic market share, i.e., \(W_1\) is concave in \({\hat{x}}_1\).

Welfare (\(W_1\)) can be written in terms of the domestic market share, \({\hat{x}}_1\). Since the welfare function is concave in \({\hat{x}}_1\), provided both the competitive and collusive market shares are either higher or lower than the first-best market share, \({\hat{x}}_1^*\), whichever market structure results in market shares closer to the first-best results in higher welfare.

3.3 No Border Adjustments

Suppose governments do not implement any policy, i.e., \(\tau _i = t_i = 0\), \(i = 1, 2\).

3.3.1 Competition

Eqs. (7)–(10) imply the following prices and market shares:

\({\hat{x}}_1^C \in (0, 1)\) provided \(0< \gamma < 3 \theta\), which holds given Assumption 1; hence, there is cross-hauling under competition when governments do not implement any border adjustments.

3.3.2 Collusion

Setting \(\tau _i = t_i = 0\), \(i = 1, 2\), in Eqs. (11)–(14), we have:

It can be checked that \({\hat{x}}_1^{JM} < 1\), i.e., there is cross-hauling under collusion, provided \(\gamma < 2 \theta\) which is guaranteed by Assumption 1.

Using Eqs. (6), (15) and (16), it is straightforward to verify that \({\hat{x}}_1^*> {\hat{x}}_1^{JM} > {\hat{x}}_1^C\), implying \(1 - {\hat{x}}_1^*< 1 - {\hat{x}}_1^{JM} < 1 - {\hat{x}}_1^C\), i.e., relative to the first-best, there is too much cross-hauling when governments do not implement any policy. However, the market shares and trade volumes are closer to the first-best outcome under collusion than under competition. Hence, Lemma 1 implies that welfare is higher under collusion than under competition, but both are lower than the first-best level, i.e., \(W_1^C< W_1^{JM} < W_1^*\). For the rest of the paper, we focus on policy-active governments.

4 Government Policy

Suppose both governments implement border adjustment policies, (\(\tau _i, t_i\)), \(i = 1, 2\).

4.1 Pigovian Border Adjustments

To begin with, suppose governments set tariffs at the Pigovian levels, equal to the own marginal damages of emissions from cross-hauling products. Using Eq. (2): \(\tau _1 = t_2 = MD_{{\hat{x}}_2} (1 - {\hat{x}}_1 + {\hat{x}}_2) = \delta (1 - {\hat{x}}_1 + {\hat{x}}_2)\) and \(t_1 = \tau _2 = MD_{1-{\hat{x}}_1} (1 - {\hat{x}}_1 + {\hat{x}}_2) = \delta (1 - {\hat{x}}_1 + {\hat{x}}_2)\). The following Proposition compares outcomes under different market structures:

Proposition 1

(Pigovian Border Adjustments) Suppose governments implement Pigovian border adjustments to internalize the impact of emissions on own welfare. Then:

-

1.

The border adjustments are higher under competition than under collusion: \(\tau ^C = t^C = \frac{\delta (3 \theta -\gamma )}{3\theta + 2 \delta } > \frac{\delta (2\theta -\gamma )}{2(\theta +\delta )} = \tau ^{JM} = t^{JM}\).

-

2.

The domestic and foreign market shares under competition and collusion are, respectively:

$$\begin{aligned}{} & {} {\hat{x}}_1^C = \frac{\gamma +4\delta +3\theta }{2(2\delta +3\theta )},\; 1-{\hat{x}}_1^C = \frac{3\theta -\gamma }{2(2\delta +3\theta )} \quad \text {and} \quad \\{} & {} {\hat{x}}_1^{JM} = \frac{\gamma +4\delta +2\theta }{4(\delta +\theta )}, \; 1-{\hat{x}}_1^{JM} = \frac{2\theta -\gamma }{4(\delta +\theta )}. \end{aligned}$$Trade is lower under collusion than under competition: \(1 - {\hat{x}}_1^C> 1 - {\hat{x}}_1^{JM}> 1 - {\hat{x}}_1^* > 0.\)

-

3.

Pollution is lower under collusion relative to competition: \(Z^{JM} = \frac{2\theta -\gamma }{2(\delta +\theta )} < \frac{3\theta - \gamma }{2\delta + 3 \theta } = Z^C\).

-

4.

Welfare is higher under collusion than under competition, but both are lower than the first-best welfare.

-

5.

Autarky welfare can exceed those under the Pigovian policy rule if the degree of consumers’ preference for their ideal variety, \(\theta\), is not too large relative to the marginal damage from pollution, \(\delta\), and the transport cost, \(\gamma\).

There is too much trade (cross-hauling) relative to the first-best under either market structure. However, under collusion, firms reduce cross-hauling relative to competition to save on transportation costs. Given that governments set Pigovian tariffs to internalize the own marginal damage from emissions and since cross-hauling falls under collusion relative to competition, we have: \(\tau ^{JM} < \tau ^C\) and \(t^{JM} < t^C\). Note that the Pigovian rule of setting border adjustments to internalize the own marginal damage from emissions is the same under both market structures; the levels of border adjustments are different since the trade volumes (hence, emissions) are different under competition and collusion. The Pigovian border adjustments are decreasing in the transportation cost (\(\gamma\)) as the latter reduces cross-hauling and, hence, emissions, thereby reducing the marginal damage. An increase in \(\delta\) increases the marginal damage from pollution and, thus, the Pigovian tariffs. Stronger preference for the ideal variety makes trade more beneficial with accompanying increase in emissions; hence, the Pigovian border adjustments are increasing in \(\theta\). Pollution is decreasing in transport cost (\(\gamma\)) and the marginal damage from pollution (\(\delta\)), but is increasing in the degree of consumer’s preference for the ideal variety (\(\theta\)). Higher \(\gamma\) reduces cross-hauling of products, thereby reducing emissions; a higher \(\delta\) increases the border adjustment tariffs, resulting in lower trade and pollution. Higher \(\theta\) makes trade more desirable, resulting in more trade and higher pollution. Trade volumes (domestic market shares) under either market structure are too high (low) under Pigovian policies relative to the first-best. Collusion results in lower cross-hauling relative to competition bringing the market shares and trade volumes closer to the first-best levels and result in higher welfare than under competition. Hence, \({\hat{x}}_1^C< {\hat{x}}_1^{JM} < {\hat{x}}_1^*\) implies \(W_1^C< W_1^{JM} < W_1^*\) (Lemma 1). Proposition 1.5 follows since the loss from the inability to trade is lower if \(\theta\) is relatively low, while the damage from pollution (due to cross-hauling) is high when \(\delta\) is relatively high. Of course, higher transport cost (\(\gamma\)) increases the inefficiency from cross-hauling.

Remark 1

The Pigovian border adjustments internalize the overall impact of the pollution externality but do not guarantee efficiency due to the firms’ market power.

When governments use Pigovian border adjustments to internalize own marginal damages from pollution, the overall impact of pollution is internalized as the sum of the tariffs equals the joint marginal damage from pollution.Footnote 11 In the absence of any other market failure, this would generate an efficient outcome. However, in our setup, this does not happen due to the firms’ market power; the Pigovian adjustments, while internalizing the emissions externality, do not internalize the impact of the firm’s market power on welfare.

4.2 Cooperative Government Policies

Suppose governments cooperatively choose border adjustments to maximize the sum of welfare of the two countries, i.e., to maximize \(W_{coop} = W_1 + W_2\). The following Proposition summarizes the results under cooperative governments:

Proposition 2

(Cooperative Government Policies) Suppose governments cooperate and set policies to maximize the joint welfare of the two countries:

-

1.

The cooperative outcomes under competition and collusion, respectively, can be supported by different combinations of border adjustment tariffs:

$$\begin{aligned} \tau ^C_{1,coop} + t_{2,coop}^C = \tau ^C_{2,coop} + t_{1,coop}^C= & {} \frac{2\delta (\theta -\gamma ) + 2\theta (2\delta +\gamma )}{2\delta +\theta } > 0, \end{aligned}$$(17)$$\begin{aligned} \text {and} \quad \tau ^{JM}_{1,coop} + t_{2,coop}^{JM} = \tau ^{JM}_{2,coop} + t_{1,coop}^{JM}= & {} \frac{2\delta (\theta - \gamma ) + \theta (2 \delta + \gamma )}{2\delta +\theta } > 0. \end{aligned}$$(18) -

2.

Irrespective of the market structure, the first-best trade flows and market shares can be implemented: \({\hat{x}}_{1,coop}^C = {\hat{x}}_{1,coop}^{JM} = {\hat{x}}_1^* = \frac{\gamma +4\delta +\theta }{2(2\delta +\theta )}\) and \(1-{\hat{x}}_{1,coop}^C = 1-{\hat{x}}_{1,coop}^{JM} = 1-{\hat{x}}_1^* = \frac{\theta -\gamma }{2(2\delta +\theta )}\).

-

3.

Pollution is at the first-best level: \(Z^C = Z^{JM} = Z^* = \frac{\theta -\gamma }{2\delta +\theta }\).

-

4.

The border adjustments on both products exceed the marginal damage from emissions: \((\tau ^C_{1,coop} - MD^C) + (t_{2,coop}^C - MD^C) = (\tau ^C_{2,coop} - MD^C) + (t_{1,coop}^C - MD^C) = \frac{2\theta (2\delta +\gamma )}{2\delta +\theta }> \frac{\theta (2\delta +\gamma )}{2\delta +\theta } = (\tau ^{JM}_{1,coop} - MD^{JM}) + (t_{2,coop}^{JM} - MD^{JM}) = (\tau ^{JM}_{2,coop} - MD^{JM}) + (t_{1,coop}^{JM} - MD^{JM})> 0\).

-

5.

Welfare under either market structure equals the first-best welfare.

Cooperating governments, regardless of the market structure, through appropriate use of border adjustments, can implement the first-best outcomes. Note that the aggregate world welfare, Eq. (5), can be expressed in terms of the market shares, \({\hat{x}}_1\) and \({\hat{x}}_2\). By appropriately choosing combinations of border adjustment tariffs, (\(\tau _2+t_1\)) and (\(\tau _1+t_2\)), cooperating governments can implement the first-best market shares and, hence, the first-best outcomes under either the competitive or collusive market structure. Note that, given cooperation between governments, there exist different combinations of border adjustments which can implement the first-best market shares to maximize joint welfare. However, all such combinations must satisfy condition (17) or (18) depending on the market structure. Furthermore, governments cooperatively set tariffs higher than the marginal damages to reduce trade (cross-hauling) to the first-best levels; apart from internalizing the emissions externality, the tariffs also address the excessive cross-hauling that the firms undertake. Firms reduce cross-hauling under collusion relative to competition to save on transport costs; hence, lesser overregulation is required under collusion as cross-hauling needs to be reduced less than that under competition.

5 Non-cooperative Government Policy

Now, suppose that governments non-cooperatively choose border adjustments to maximize own welfare. This is in contrast to Proposition 1 above, where the Pigovian rule was followed to internalize the pollution externality imposed on its own citizens.

5.1 Competition

To better understand the difference in strategic incentives between the competitive and collusive market structures, it is useful to write the government’s best-response functions in general terms. To begin with, we explicitly write the effects of changes in the tariffs on the distribution of welfare among different types of consumers, the firms and the government. However, as some of these are transfers within the country, they do not matter from the country’s aggregate welfare perspective. Using Eq. (3), government 1’s best-response functions of can be written as:

The border adjustment export tariff (\(\tau _1\)) is used to shift profits in favor of the domestic firm (A) by raising the price of its product in the export market (i.e., in market 2). There is no net export tariff revenue effect as these payments are transfers within the country. The export tariffs also reduce pollution by restricting cross-hauling, specifically exports. The border adjustment import tariff (\(t_1\)) lowers the consumer surplus of both types of consumers in market 1. The profit of firm A in market 1 (the home market) increases due to the restriction on imports; the latter increases the domestic firm’s market share and the price of its product in the home market. The import revenue effect is positive, while the import tariff also reduces imports and hence, pollution. Note that the border adjustment tariffs are strategic substitutes.

Writing the market shares and prices in terms of the tariffs and solving the best-response functions for the two countries simultaneously, we have the non-cooperative border adjustment tariffs under competition:

Although we have not imposed any a priori restriction on the border adjustments, i.e., we allow positive, negative or no adjustment, the non-cooperative border adjustments turn out to be in the form of positive import and export tariffs.

5.2 Collusion

When firms maximize joint profits, using Eq. (4), government 1’s best-response functions can be written as:

When firms collude to maximize joint profits, there is no net profit-shifting incentive since governments care about the joint profits, not just the domestic firm’s profits. Also, note the difference in the net revenue effect of export border adjustments (\(\tau _1\)) under the different market structures. Under competition, this revenue is a transfer from the domestic firm to the government, so there is no net revenue effect on welfare, but under joint profit maximization, this revenue effect is positive as part of this cost is borne by the foreign country. The export border adjustment tariff also reduces pollution by lowering the volume of exports. Note that the import border adjustment tariff (\(t_1\)) increases consumer surplus for those consuming the domestic variety, i.e., variety A; this is driven by colluding firms lowering the price of the domestic variety (A) as the net transport cost (inclusive of the border adjustment tariff on imports) increases with \(t_1\). This import tariff reduces the consumer surplus for those consuming the imported variety (B). The net revenue effect of import border adjustments is lower under collusion than under competition; this is because part of this payment is borne by the domestic country when firms share profits. Finally, the import border adjustment tends to reduce pollution by reducing cross-hauling. Once again, the border adjustment tariffs are strategic substitutes.

Writing the best-response functions in terms of the tariffs and solving these functions for the two countries simultaneously, we have the non-cooperative border adjustment tariffs under collusion:

The following Proposition summarizes our findings:

Proposition 3

(Non-cooperative Government Policies) When governments set border adjustment policies non-cooperatively:

-

1.

The border adjustment tariffs under competition and collusion are given by Eqs. (19) and (20), respectively.

-

2.

The domestic market shares and trade flows under competition and collusion are, respectively:

$$\begin{aligned}{} & {} {\hat{x}}_1^C = \frac{\gamma +4\delta +7\theta }{4(\delta +2\theta )}, \; 1-{\hat{x}}_1^C = \frac{\theta -\gamma }{4(\delta +2\theta )} \quad \text {and} \quad \\{} & {} {\hat{x}}_1^{JM} = \frac{\gamma +4\delta +5\theta }{2(2\delta +3\theta )}, \; 1-{\hat{x}}_1^{JM} = \frac{\theta -\gamma }{2(2\delta +3\theta )}. \end{aligned}$$Trade (cross-hauling) is higher when firms collude than when firms compete: \(1- {\hat{x}}_1^*> 1 - {\hat{x}}_1^{JM} > 1 - {\hat{x}}_1^C\).

-

3.

Pollution is higher under multimarket collusion: \(Z^C = \frac{\theta -\gamma }{2(\delta +2\theta )} < \frac{\theta -\gamma }{2\delta +3\theta } = Z^{JM}\).

-

4.

The border adjustments exceed the own marginal damage from emissions:

$$\begin{aligned}{} & {} \tau ^C - MD^C> 0, t^C - MD^C> 0, \tau ^{JM} - MD^{JM}> 0, t^{JM} - MD^{JM}> 0,\\{} & {} \quad \text {and} \quad \left( \tau ^C - MD^C \right) + \left( t^C - MD^C\right)> \left( \tau ^{JM} - MD^{JM}\right) + \left( t^{JM} - MD^{JM}\right) > 0. \end{aligned}$$ -

5.

Welfare is higher when firms collude rather than compete, but both are lower than the first-best welfare.

-

6.

Welfare under non-cooperative government policies always exceeds the autarky welfare.

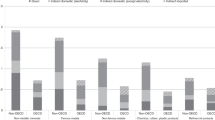

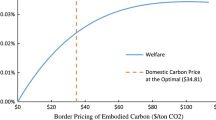

When border adjustments are implemented non-cooperatively, the outcomes are very different from what would be expected. In general, one would expect that trade (cross-hauling) would be lower under collusion as colluding firms try to save on transport cost, while government policies would be expected to further restrict trade to reduce emissions. However, we find that, with non-cooperative government policies, trade flows are higher when firms collude as compared to the situation in which firms compete; domestic market coverage is lower under collusion relative to competition. Our results are in contrast to the previous literature [for instance, Deltas et al. (2012)] which shows that trade flows are lower under collusion relative to competition without government policies. Further, they find that there is too much trade (cross-hauling), compared to the first-best, under either market structure. However, with non-cooperative government policies, we find that there is too little trade, relative to the first-best, under both market structures. The collusive market structure results in increased trade (cross-hauling) relative to competition. This is driven by the differential strategic incentives of governments under competition and collusion despite firms’ tendency to lower cross-hauling/trade under collusion. The profit-shifting motive is positive under competition but absent under collusion; hence, a weaker incentive to restrict trade under collusion. Under competition, there is no net export tariff revenue effect as it is a transfer within the economy, while the effect is positive under collusion as part of this cost is borne by the foreign country. On the other hand, the net import tariff revenue effect is stronger under competition relative to collusion due to profit sharing under the latter. While the surplus of consumers purchasing the domestic variety is decreasing in the import tariff under competition, this surplus increases with the import tariff under collusion; the latter is driven by colluding firms lowering the price of the domestic variety to reduce net transport costs (which increases due to the border adjustment import tariff). Overall, the above effects together increase border adjustment tariffs beyond the own marginal damage from emissions under either market structure. However, the lack of profit-shifting motive results in lower overregulation (and hence, more cross-hauling) under collusion than under competition. It is straightforward to verify that, under both market structures, pollution is decreasing in transport cost (\(\gamma\)) and marginal pollution damage (\(\delta\)), while it is increasing in the degree of consumer’s preference for the ideal variety (\(\theta\)). The welfare ranking in Proposition 3 follows from the outcome that, although cross-hauling is too low (i.e., the domestic market share is too high) under non-cooperative policy setting, relative to the first-best, the collusive outcomes are closer to the first-best levels than those under competition; see Fig. 1. The governments’ weaker incentives to restrict trade when firms collude than when they compete results in increased cross-hauling and market shares closer to the first-best under collusion, which, in turn, results in higher welfare under collusion relative to competition. Furthermore, in contrast to the previous literature [for instance, Newbery and Stiglitz (1984), Eden (2007), and Deltas et al. (2012)], who find that, in the absence of government policies, autarky can be welfare superior to trade, we find that, even with non-cooperative border adjustment policies and a pollution externality, trade is welfare-improving relative to autarky.

6 Concluding Remarks

We analyzed border adjustment policies when firms sell differentiated products across different countries and transportation of goods generates pollution.The vast empirical evidence suggests that international transportation of goods is a major source of emissions. However, the fairly large literature on trade and pollution, and that on border tax adjustments has focused on the case of production-related emissions, as has the literature on non-cooperative environmental policies. Given the recent move by the EU laying out plans to impose border adjustments on ‘dirty’ products to prevent carbon leakage, it is likely that the next logical step is to turn to emissions generated from transportation. Further, in the case of emissions generated from international transport of goods, border adjustments are direct instruments to address the externality.

We also look at the role of the market structure in determining environmental and welfare outcomes under border adjustments. It would be expected that, combined with government policies to tackle pollution from international transportation of goods, a collusive market structure would result in lower trade (hence, lower pollution). However, we find the unexpected result that multimarket collusion increases trade (cross-hauling) relative to competition, bringing it closer to the first-best level. This means that, despite having higher pollution under collusion relative to competition, welfare is higher when firms collude. This indicates the scope for redistributive transfers to citizens. This could be done through a tax on firms for the right to collude and using these revenues as transfers to citizens. Although beyond the scope of the current paper, part of these revenues could also be invested in cleaner technology or emission abatement. Supporting efforts to increase innovation and technology transfer by organizations like the International Maritime Organization is another plausible use of such revenues. Allowing multimarket collusion which increases welfare is also in keeping with the case made in the legal literature [for instance, Monti (2002), and Townley (2009)] that laws in the European courts and European treaties should take in to account public interests.

We allow governments to condition border adjustments on the market structure. However, in practice collusion is often tacit and may be difficult to detect. We have focused on a Hotelling framework with no aggregate demand effects (i.e., the markets are always covered) to highlight the role of strategic border adjustments to address a transport-generated externality. Border adjustments to address pollution externalities have usually been considered by countries with mature markets (for instance, within the European Union and in the United States under the Waxman-Markey Bill) where abstraction from such aggregate volume effects do not seem a restrictive assumption. The findings from this model should apply as one brings in aggregate demand effects, provided the latter are not too strong. Nonetheless, the strategic motives and forces we highlight would be applicable in any case. Further, to keep the analysis tractable and intuitive, we focused on a symmetric model. By continuity, the findings of this model should apply to situations in which the countries are asymmetric provided they are sufficiently similar. These are some avenues for future research.

Change history

30 October 2023

A Correction to this paper has been published: https://doi.org/10.1007/s10640-023-00823-0

Notes

Hummels and Schaur (2013) explains the increase in relatively more expensive and pollution intensive air transport of goods as compared to sea transport as a result of the time cost of shipping delays.

Connor (2009) highlights 516 “formal official investigations” of suspected international cartels operating in multiple countries between 1990 and 2008. The total known affected sales by these international cartels is estimated to be US$16 trillion. Masoudi (2007) discusses that “[o]f the nearly $1.38 billion in criminal fines imposed in Antitrust Division cases during the past five years, more than ninety percent were imposed in connection with the prosecution of international cartel activity”.

Note that, depending on the situation, the restrictions on parameters are different—here, we impose the strictest ones so that there is trade and consumers purchase one of the products in all the scenarios considered.

The superscripts C and JM denote the competitive and collusive (joint profit maximization) regimes, respectively.

Such a multimarket profit-sharing arrangement can be supported using trigger strategies—this is presented in a Supplementary Appendix. Note that an alternate arrangement between firms could be where they maximize joint profits, but each firm retains its own profit. Then, it would be only the domestic firm’s profit rather than half the sum of the profits of both firms that would enter a country’s welfare function even under joint profit maximization. The main results under the current profit-sharing assumption would hold under the alternate assumption.

Assumption 2 implies \(v \ge c + \frac{3}{2} \theta + \frac{\gamma }{2} + \frac{9 \theta ^2 + 6 \delta \theta - \gamma \theta - 2 \delta \theta }{2 (\delta + 2 \theta )}\). It can be checked that \(v \ge c + 2 \theta\) if \(\frac{\gamma }{2} + \frac{9 \theta ^2 + 6 \delta \theta - \gamma \theta -2 \delta \theta }{2 (\delta + 2 \theta )} \ge \frac{\theta }{2}\), i.e., if \(7 \theta ^2 + 4 \delta \theta + \gamma \theta + \delta (\theta - \gamma ) \ge 0\), which is always satisfied since \(\gamma < \theta\) (Assumption 1).

Note that a possible market sharing arrangement between colluding firms could be that each firm serves only its domestic market. Such an arrangement would result in the autarky outcomes with no transportation of goods and, hence, no emissions externality. However, as shown later (Proposition 3), autarky results in lower welfare than the cross-hauling market sharing arrangement considered.

All proofs are relegated to the Appendix.

We focus on outcomes from the perspective of the two policy-active countries. If there is a policy-inactive third country (or rest of the world) which is affected by the pollution generated in these countries, the above border adjustment rule would not fully internalize the global impact of pollution.

References

Antoniou F, Hatzipanayotou P, Koundouri P (2014) Tradable permits vs. ecological dumping when governments act non-cooperatively. Oxf Econ Pap 66:188–208

Avetisyan M (2018) Impacts of global carbon procong on international trade, modal choice and emissions from international transport. Energy Econ 76:532–548

Barrett S (1994) Strategic environmental policy and international trade. J Pub Econ 54:325–38

BBC (2018) Global shipping in ‘historic’ climate deal. https://www.bbc.co.uk/news/science-environment-43759923

Bond EW (2004) Antitrust policy in open economies: price fixing and international cartels. In Hartigan J and Choi EK (eds). Handbook of international trade, volume ii: economic and legal analyses of trade policy and institutions. Blackwell Handbooks in Economics

Bond EW, Syropoulos C (2008) Trade costs and multimarket collusion. RAND J Econ 39:1080–1104

Brander JA, Spencer BJ (1985) Export subsidies and international market share rivalry. J Int Econ 18:83–100

Connor JM (2009) Cartels and antitrust portrayed: numbers, size, and location: private international cartels. Available at http://ssrn.com/abstract=1367843

Connor JM (2007) Glob Price Fix. Springer, Verlag

Copeland BR, Taylor MS (2004) Trade, growth and the environment. J Econ Liter 42(1):7–71

Cristea A, Hummels D, Puzzello L, Avetisyan M (2013) Trade and the greenhouse gas emissions from international freight transport. J Environ Econ Manag 65:153–173

Deltas G, Salvo A, Vasconcelos H (2012) Consumer-surplus-enhancing collusion and trade. RAND J Econ 43:315–328

Eaton J, Grossman GM (1986) Optimal trade and industrial policy under oligopoly. Q J Econ 101:383–406

Eden B (2007) Inefficient trade patterns: excessive trade, cross-hauling and dumping. J Int Econ 73:175–188

Ederington J, Minier J (2003) Is environmental policy a secondary trade barrier? An empirical analysis. Canad J Econ 36:137–154

Eisenbarth S (2017) Is Chinese trade policy motivated by environmental concerns? J Environ Econ Manag 82:74–103

European Commission (2019). Reducing emissions from the shipping sector. https://ec.europa.eu/clima/policies/transport/shipping_en

European Commission (2021). Carbon border adjustment mechanism: questions and answers. https://ec.europa.eu/commission/presscorner/detail/en/qanda_21_3661

Fischer C, Fox AK (2011) The role of trade and competitiveness measures in US climate policy. Am Econ Rev 101:258–262

Hummels DL, Schaur G (2013) Time as a trade barrier. Am Econ Rev 103(7):2935–2959

International Maritime Organization (2018) Low carbon shipping and air pollution control. http://www.imo.org/en/MediaCentre/HotTopics/GHG/Pages/default.aspx

Keen M, Kotsogiannis C (2014) Coordinating climate and trade policies: pareto efficicency and the role of border tax adjustments. J Int Econ 94:119–128

Lapan HE, Sikdar S (2022) Strategic environmental policy and international market share rivalry under differentiated Bertrand oligopoly. Oxf Econ Pap 74(1):215–235

Masoudi GF (2007) Cartel enforcement in the United States (and beyond). Department of Justice, U.S

Mehling MA, van Asselt H, Das K, Droege S (2018) Beat protectionism and emissions at a stroke. Nature 559:321–324

Monti G (2002) Article 81 EC and public policy. Common Market Law Rev 39:1057–1099

Mundaca G, Strand J, Young IR (2021) Carbon pricing of international transport fuels: Impacts on carbon emissions and trade activity. J Eviron Econ Manag 110:102517

Neary PJ (2006) International trade and the environment: theoretical and policy linkages. Environ Resour Econ 33:95–118

Newbery DMG, Stiglitz JE (1984) Pareto inferior trade. Rev Econ Stud 51:1–12

Shapiro JS (2016) Trade costs, CO\(_2\), and the environment. Am Econ J Econ Policy 8(4):220–254

Stiglitz JE (2006) A new agenda for global warming. Econ Voice 3:1–4

Townley C (2009) Article 81 EC and public policy. Hart Publishing, Oxford

Acknowledgements

I am thankful to the Editor, Mireille Chiroleu-Assouline, and two anonymous referees for their comments and suggestions, which significantly improved the paper. I thank Harvey Lapan, Alberto Salvo, participants at seminars at IIT, India, Leeds Business School, the Annual Conference on Contemporary Issues in Development Economics, Jadavpur University, India, the International Conference on Issues in Economic Theory and Policy, Presidency University, India, and the Annual Conference of the European Association of Environmental and Resource Economics for helpful comments. This paper is dedicated to the memory of a dear friend, Yuki. The usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Appendix

Appendix

Proof of Lemma 1

Aggregate world welfare, Eq. (5), can be written in terms of \({\hat{x}}_1\) (hence, the volume of trade): \(W = 2 (v - c) - \theta - 2 \gamma - 4 \delta + 2 {\hat{x}}_1 (\gamma + \theta + 4 \delta ) - 2 {\hat{x}}_1^2 (\theta + 2 \delta ) (\text {since} \ {\hat{x}}_2 = 1 - {\hat{x}}_1)\). Given symmetry, in equilibrium, \(W_1 = W_2 = W/2\). It can be checked that \(\frac{\partial W_1}{\partial {\hat{x}}_1} = \gamma + \theta (1-2{\hat{x}}_1) + 4 \delta (1-{\hat{x}}_1) \gtreqqless 0\) as \({\hat{x}}_1 \lesseqqgtr {\hat{x}}_1^*\), \(\frac{\partial ^2 W_1}{\partial {\hat{x}}_1^2} = - 2(\theta +2\delta ) < 0\) and welfare is concave in \({\hat{x}}_1\). \(\square\)

Proof of Proposition 1

Competition

Governments set Pigovian border adjustments equal to the own marginal damage from emissions generated by the transportation of exports by the domestic firm and of imports from the foreign country, taking the other government’s policies and firms’ behavior as given [using Eq. (2)]:

Country 2’s tariffs can be found in a similar manner. Solving these simultaneously, we have:

Collusion

Given government 2’s policy and firms’ collusive behavior, government 1 sets its tariffs equal to the own marginal damage from emissions, Eq. (2):

Similarly, country 2’s tariffs can be derived. Solving these simultaneously, we have:

Using Eqs. (21) and (22), it is straightforward to verify that:

i.e., the export and import tariffs are lower under collusion than under competition.

Using Eqs. (7), (8) and (21), we can write the market shares, domestic and foreign variety prices under competition as, respectively,

Similarly, using Eqs. (11), (12) and (22), we have, under collusion:

The marginal consumer under competition and collusion can be compared as follows [using Eqs. (24) and (25)]:

i.e., \({\hat{x}}_1^{JM} > {\hat{x}}_1^C\) implying \(1 - {\hat{x}}_1^{JM} < 1 - {\hat{x}}_1^C\) and \({\hat{x}}_2^{JM} < {\hat{x}}_2^C\). Thus, cross-hauling is lower under collusion relative to competition. It can be checked, using Eq. (6), that:

Pollution is lower under collusion as compared to competition: \(Z^C = 1 - {\hat{x}}_1^C + {\hat{x}}_2^C = \frac{3\theta - \gamma }{2\delta +3\theta }\) and \(Z^{JM} = 1 - {\hat{x}}_1^{JM} + {\hat{x}}_2^{JM} = \frac{2\theta - \gamma }{2(\delta +\theta )}\) \(\Rightarrow\) \(Z^{JM} < Z^C\).

The first-best welfare can be written as [using Eqs. (5) and (6)]:

Under autarky, welfare is (since \({\hat{x}}_1^a = 1\)): \(W_1^a = \int _0^1 (v - \theta x - c) dx = v - c - \frac{\theta }{2}\), implying:

i.e., welfare is lower under autarky relative to the first-best.

Welfare under the competitive and collusive regimes can be written as, respectively: \(W_1^C = v - c - \frac{\theta (8\delta ^2 + 30 \delta \theta + 9\theta ^2) + 2 \gamma \theta (2\delta +9\theta ) - \gamma ^2 (2\delta +5\theta )}{4(2\delta +3\theta )^2}\) and \(W_1^{JM} = v - c - \frac{4\theta (2\delta ^2+4\delta \theta +\theta ^2) + 4\gamma \theta (\delta +2\theta ) - \gamma ^2 (2\delta +3\theta )}{16(\delta +\theta )^2}\), implying:

We can also compare the above welfare to those under autarky and the first-best:

It is likely that \(W_1^a > W_1^{JM}\) if \(\theta\) is not too large relative to \(\delta\) and \(\gamma\). □

Proof of Proposition 2

Under competition, using the prices and market shares in terms of the strategic variables, Eqs. (7)–(10), we can write the aggregate welfare, Eq. (5), as:

Governments cooperatively choose the border adjustments tariffs, \(\tau _i\) and \(t_i\), \(i = 1, 2\), to maximize the above aggregate welfare, \(W_{coop}^C\). The necessary conditions with respect to \(\tau _1\) and \(t_1\) are, respectively:

Similarly, the necessary conditions for government 2 can be derived. Inspection of the above conditions reveal that, under cooperation, it is the sum of the border adjustments, (\(\tau _1 + t_2\)) and (\(t_1 + \tau _2\)), that matter. Cooperating governments implement the first-best welfare by choosing the first-best market shares; it is the sum of the appropriate export and import tariffs that determine these market shares. The conditions \(d W_{coop}^C/d \tau _1 = 0\), \(d W_{coop}^C/d t_1 = 0\), \(d W_{coop}^C/d \tau _2 = 0\) and \(d W_{coop}^C/d t_2 = 0\) imply the following necessary condition for joint welfare maximization, Eq. (17):

When firms collude, the joint welfare of the two countries, Eq. (5), can be written as [using Eqs. (11)–(14)]:

Setting \(d W_{coop}^{JM}/d \tau _1 = 0\) and \(d W_{coop}^{JM}/d t_1 = 0\), and simplifying we have:

Similarly, the necessary conditions for government 2 can be derived. Note that, as in the case of competition, governments cooperatively maximize welfare by implementing the optimal market shares, in this case, the first-best market shares, so the sum of border adjustment tariffs matter under cooperation, rather than the individual tariffs. The necessary conditions for joint welfare maximization under collusion imply Eq. (18):

Equations (17) and (18) imply \({\hat{x}}_{1,coop}^C = {\hat{x}}_{1,coop}^{JM} = \frac{\gamma +4\delta +\theta }{2(\theta +2\delta )}\). Comparing these to Eq. (6), it is clear that \({\hat{x}}_{1,coop}^C = {\hat{x}}_{1,coop}^{JM} = {\hat{x}}_1^*\). Further, \(1 - {\hat{x}}_{1,coop}^C = 1 - {\hat{x}}_{1,coop}^{JM} = 1- {\hat{x}}_1^* = \frac{\theta -\gamma }{2(2\delta +\theta )}\). Pollution is, hence, \(Z^C = Z^{JM} = Z^* = 1 - {\hat{x}}_1^* + {\hat{x}}_2^* = \frac{\theta -\gamma }{2\delta +\theta }\).

The own marginal damage from emission, Eq. (2), can be written as (since the cooperative tariffs implement the first-best market shares given by Eq. (6)): \(MD_{1-{\hat{x}}_1}^C = MD_{{\hat{x}}_2}^C = MD^C = MD_{1-{\hat{x}}_1}^{JM} = MD_{{\hat{x}}_2}^{JM} = MD^{JM} = MD^* = \delta (1-{\hat{x}}_1^*+{\hat{x}}_2^*) = \frac{\delta (\theta -\gamma )}{\theta +2\delta }\). Using Eqs. (17) and (18), we have: \((\tau ^C_{1,coop} - MD^C) + (t_{2,coop}^C - MD^C) = (\tau ^C_{2,coop} - MD^C) + (t_{1,coop}^C - MD^C) = \frac{2\theta (2\delta +\gamma )}{2\delta +\theta } > 0\) and \((\tau ^{JM}_{1,coop} - MD^{JM}) + (t_{2,coop}^{JM} - MD^{JM}) = (\tau ^{JM}_{2,coop} - MD^{JM}) + (t_{1,coop}^{JM} - MD^{JM}) = \frac{\theta (2\delta +\gamma )}{2\delta +\theta } > 0\). Hence, \((\tau ^C_{1,coop} - MD^C) + (t_{2,coop}^C - MD^C) = (\tau ^C_{2,coop} - MD^C) + (t_{1,coop}^C - MD^C)> (\tau ^{JM}_{1,coop} - MD^{JM}) + (t_{2,coop}^{JM} - MD^{JM}) = (\tau ^{JM}_{2,coop} - MD^{JM}) + (t_{1,coop}^{C} - MD^{JM})\).

Welfare under cooperative government policies can be compared as follows [using Assumptions (1) and (2) and Eq. (27)]:

\(\square\)

Proof of Proposition 3

When governments set tariffs non-cooperatively, the prices and market shares can be written as [using Eqs. (7), (8) and (19), and Eqs. (11), (12) and (20) under competition and collusion, respectively]:

Comparing Eqs. (29), (31) and (6), we can see that [using Assumption 1]:

Equations (29) and (31) imply the following pollution levels: \(Z^C = 1 - {\hat{x}}_1^C + {\hat{x}}_2^C = \frac{\theta -\gamma }{2(\delta +2\theta )}\) and \(Z^{JM} = 1 - {\hat{x}}_1^{JM} + {\hat{x}}_2^{JM} = \frac{\theta -\gamma }{2\delta +3\theta }\) \(\Rightarrow\) \(Z^C < Z^{JM}\).

Country 1’s marginal damages from transport emissions under competition and collusion are, respectively, \(MD_{1-{\hat{x}}_1}^C = MD_{{\hat{x}}_2}^C = MD^C = \delta Z^C = \frac{\delta (\theta -\gamma )}{2(\delta +2\theta )}\) and \(MD_{1-{\hat{x}}_1}^{JM} = MD_{{\hat{x}}_2}^{JM} = MD^{JM} = \delta Z^{JM} = \frac{\delta (\theta -\gamma )}{(2\delta +3\theta )}\), implying \(MD^{JM} > MD^C\). Furthermore, Eqs. (19) and (20) imply: \(\tau ^C - MD^C = \frac{\theta (\theta -\gamma )}{2(\delta +2\theta )} > 0\), \(t^C - MD^C = 2\theta > 0\), \(\tau ^{JM} - MD^{JM}= \frac{\theta (\theta -\gamma )}{(2\delta +3\theta )} > 0\) and \(t^{JM} - MD^{JM} = \theta > 0\). It can be checked that \([(\tau ^C - MD^C) + (t^C - MD^C)] - [(\tau ^{JM} - MD^{JM}) + (t^{JM} - MD^{JM})] = \frac{\theta (11 \theta ^2 + 4 \delta ^2 + 14 \delta \theta + t \theta )}{2(\delta + 2 \theta )(2\delta +3\theta )} > 0\), i.e., there is greater overregulation under competition than under collusion.

Welfare under the competitive and collusive regimes are: \(W_{1}^C = v - c - \frac{\theta (2\delta +5\theta )(4\delta +5\theta ) +2\gamma \theta (2\delta +7\theta ) - \gamma ^2(2\delta +7\theta )}{16(\delta +2\theta )^2}\) and \(W_1^{JM} = v - c - \frac{\theta (8\delta ^2+22\delta \theta +13\theta ^2)+2\gamma \theta (2\delta +5\theta )-\gamma ^2(2\delta +5\theta )}{4(2\delta +3\theta )^2}\), implying:

Welfare under non-cooperative policy setting can be compared to the first-best and autarky levels:

\(\square\)

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Sikdar, S. Trade, Transport Emissions and Multimarket Collusion with Border Adjustments. Environ Resource Econ 86, 407–432 (2023). https://doi.org/10.1007/s10640-023-00799-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-023-00799-x

Keywords

- Transport pollution

- Cross-hauling

- Strategic government policy

- Border adjustments

- Multimarket collusion

- Differentiated goods