Abstract

This paper develops a principal-agent model with adverse selection to analyse firms’ decisions between an existing carbon-intensive technology and a new low-carbon technology requiring an externally funded initial investment. We find that a Pigouvian emission tax alone may result in credit rationing and under-investment in low-carbon technologies. Combining the Pigouvian tax with interest subsidies or loan guarantees resolves credit rationing and yields a first-best outcome. An emission tax set above the Pigouvian level can also resolve credit rationing and, in some cases, yields a first-best outcome. If a carbon price is (politically) not feasible, intervention on the credit market alone can promote low-carbon development. However, such a policy yields a second-best outcome. The issue of credit rationing is temporary if the risks of low-carbon technologies decline. However, there are social costs of delay if credit rationing is not addressed.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Climate change has been recognised as one of the greatest challenges in the 21st century. Limiting global warming to well below \(2^{\circ }\)C, as agreed under the Paris Agreement (UN 2015), will only be possible with a climate policy that is substantially more ambitious than current policies (Nordhaus 2018; Stern 2018). Without ambitious policies, the private sector lacks sufficient incentives for required investments to achieve the transition to a low-carbon economy. Emission externalities and spillovers from low-carbon innovation are the frequently discussed market failures impeding low-carbon development (Bennear and Stavins 2007; Jaffe et al. 2005; Jaffe and Stavins 1995). More recently, scholars have stressed the role of functioning financial markets for enabling low-carbon investments (Ghisetti et al. 2017; Kempa and Moslener 2017; Pahle and Schweizerhof 2016; Polzin 2017; Steckel and Jakob 2018). Financial market failures are largely caused by information asymmetries between the borrower (agent) and the lender (principal), which may result in unfavourable loan conditions or completely deter socially desirable transactions (Jaffee and Stiglitz 1993). This leads to non-optimal allocation of capital in the economy (Akerlof 1970; Stiglitz and Weiss 1981; Stiglitz 1993).

Despite the increasing evidence for deterring effects of financing constraints on low-carbon investments (see Sect. 2), theoretical analyses of this issue are lacking. However, to reach the ambitious climate targets, it is essential to understand how low-carbon investments are affected by financial markets. Can frictions on credit markets, such as information asymmetries, deter firms’ investment in low-carbon innovation and thus favour existing carbon-intensive technologies? What are the options for policymakers to address this issue? We offer a novel theoretical framework that addresses these questions.

This paper is not the first theoretical analysis considering the role of financial markets within an environmental context. Several studies focus on the effect of external financing on environmental performance of firms. Andersen (2017) analyses firms’ investments in different assets that require external borrowing. The findings indicate that credit constraints affect the asset composition of polluting firms and ultimately result in higher emission intensities. Andersen (2016, 2020) use general equilibrium frameworks to analyse the effect of credit constraints and default risks. The effect on emissions, however, is not clear from a theoretical perspective due to several confounding effects.Footnote 1 Other studies analyse the effectiveness of taxes on externalities in the presence of financial frictions (Hoffmann et al. 2017; Heider and Inderst 2022; Döttling and Rola-Janicka 2023). They show that the government can improve efficiency by combining a Pigouvian tax with a grant scheme or by setting a tax rate that differs from the Pigouvian level. A different methodological approach is chosen by D’Orazio and Valente (2019). Using a computational agent-based model, the authors find that government intervention through a public bank can reduce financing constraints and lead to more environmental innovation.

This paper contributes to the literature by proposing a novel theoretical approach that explicitly models firms’ choice between a clean and a dirty production technology with external borrowing. Rather than adding lending to an environmental model framework, we build on credit market models from the finance literature (Arping et al. 2010; Besanko and Thakor 1987; Gale 1990; Philippon and Skreta 2012). Based on Janda (2011), we develop a principal-agent model, where firms can choose between two technologies: a carbon-intensive (dirty) technology and a low-carbon (clean) technology, which requires external funding for an initial risky investment.Footnote 2 Due to asymmetric information, the lender (bank) cannot distinguish between different firm types, which might induce credit rationing, i.e., some firm types do not receive financing for the socially desirable investment in low-carbon technology. Another major contribution is our comparative analysis of different individual policy instruments and policy mixes. We analyse environmental policy (Pigouvian emission tax) and its combination with an intervention on the credit market through interest rate subsidies and loan guarantees. We then investigate whether either an emission tax or credit market interventions alone can effectively address both the environmental externality and credit rationing.

Our main findings are as follows. A Pigouvian emission tax incentivises high emission firms to switch to the clean technology. However, a Pigouvian tax might not be sufficient, as credit rationing may occur, which leads to a socially undesirably low level of low-carbon investment. Introducing an interest rate subsidy or a loan guarantee can successfully eliminate credit rationing, which resembles the findings of the theoretical finance literature (Arping et al. 2010; Gale 1990; Janda 2011; Minelli and Modica 2009; Philippon and Skreta 2012). Combining the Pigouvian tax with an intervention on the credit market can always yield the first-best outcome. The policymaker further has some flexibility: the tax rate can be lowered if expenditures for credit market interventions are increased and vice versa. Using only the emission tax can resolve credit rationing if the tax rate is set above the Pigouvian level and, in some cases, yields a first-best outcome. For the situation without emission tax, we show that an interest rate subsidy can promote low-carbon investment but cannot yield a first-best outcome.

The paper is structured as follows. Section 2 reviews the empirical literature on low-carbon investments and external financing (constraints). Section 3 presents the model setup and the laissez-faire and full information outcomes. Section 4 introduces information asymmetry, analyses different policy interventions, and compares their welfare impacts. Section 5 discusses the findings and derives policy recommendations before Sect. 6 concludes.

2 Financing Low-Carbon Investment

Empirical evidence suggests that access to external financing and the development of the finance sector are core drivers of low-carbon investments such as renewable energy (Ang et al. 2017; Best 2017; Brunnschweiler 2010; Haščič et al. 2015; Kim and Park 2016) or energy efficiency (Apeaning and Thollander 2013; Fleiter et al. 2012; Kostka et al. 2013). Furthermore, innovative high-tech firms face financing constraints (Carpenter and Petersen 2002), in particular clean technology firms (Howell 2017; Kempa et al. 2021; Nanda et al. 2015; Noailly and Smeets 2021; Olmos et al. 2012).

Due to their capital intensity, renewable energy investments highly rely on financial markets, in particular debt provision (Evans et al. 2009; Painuly 2001; Wiser et al. 1997).Footnote 3 Non-recourse project finance structures, where debt typically covers 65–80% of the investment expenditure (McCrone et al. 2017; Pollio 1998), are frequently used to finance renewable energy investments (Steffen 2018).Footnote 4 Long amortisation periods of 15 years or more (Couture and Gagnon 2010) foster the susceptibility to financing constraints that increases with the time horizon of the lending contract (Stiglitz 1993).

Similar to renewable energy, energy efficiency investments have high up-front costs and long amortisation periods (Gillingham et al. 2009). Information asymmetries can prevent the lender from distinguishing investments with high from those with low potential energy savings (Gillingham and Palmer 2014). Thus, credit constraints might contribute to the energy efficiency gap (Golove and Eto 1996). Access to external financing for energy efficiency investments seems less problematic in developed countries (Fleiter et al. 2012; Trianni et al. 2016), while credit rationing can be an issue in developing and emerging economies with typically less developed financial sectors (Apeaning and Thollander 2013; Kostka et al. 2013).

Clean technology firms require access to external funds to finance the initial technology investment, e.g., R&D or initial production capacities. Empirical evidence suggests that young firms using new technologies face difficulties to source debt financing (Carpenter and Petersen 2002; Guiso 1998; Revest and Sapio 2012). This is mainly driven by lenders’ information asymmetries concerning the new technologies, who may find it too costly or even impossible to assess the firms through screening. In the absence of a carbon price, new clean technologies have a double disadvantage compared to incumbent dirty technologies. In addition to information asymmetries, clean technologies’ positive externalities for the climate are often not priced appropriately (Howell 2017). Moreover, the lender is likely to be hesitant to finance innovation involving assets that are firm-specific and intangible and thus difficult to collateralise (Berger and Udell 2002; De Haas and Popov 2019). These issues are particularly pronounced in the case of clean technology firms (Erzurumlu et al. 2010; Nanda et al. 2015). Noailly and Smeets (2021) show that innovative firms specialising in clean technology are substantially more vulnerable to financing constraints than fossil fuel firms.

Transactions between lender and borrower reduce the information asymmetry. Thus, credit constraints are more likely if the borrowing firm does not have a lending relationship with a bank (Bharath et al. 2011; Jiménez and Saurina 2004; Petersen and Rajan 1995). Innovative clean energy firms tend to be rather small (Noailly and Smeets 2015) and do not have such a relationship with a lender, which renders securing debt financing more difficult.Footnote 5 A closely related issue is the banks’ technological conservatism. If the information gathered by banks is technology specific, technological progress will erode their knowledge on mature (carbon-intensive) technologies (Minetti 2010). Hence, the lender may have an incentive not to finance new (low-carbon) technologies.

3 The Model

For our analysis, we use a principal-agent model with adverse selection. The idea of the model in a nutshell is as follows. The economy consists of three types of actors: firms, the lender (bank) providing loans for firms, and the government. The firms can choose between either an immature low-carbon (clean) or a mature carbon-intensive (dirty) technology for production. Their choice depends on the expected returns from producing with the respective technology. The immature clean technology requires an initial risky investment, which can be thought of as R&D expenditures or other costs of introducing it. This investment is financed through a loan from a bank, which has all the bargaining power in the model.Footnote 6 The dirty technology is mature and does not require such an initial investment.Footnote 7

Agents in the economy make the following decisions. Firms decide which technology to choose based on expected profits. Firms that chose the clean technology apply for a bank loan to finance their initial expenditure. However, firms are heterogeneous with respect to their risk, i.e., their probability of successfully introducing the clean technology, which the lender does not observe. By designing loan contracts, the bank then selects which firms to lend to. Firms that do not receive a bank loan use the dirty technology for production. In the model, all these decisions are made simultaneously.

3.1 Model Setup

In the model, the lender faces a perfectly elastic supply of funds at unit cost \(\rho\). Each firm has both a dirty and a clean production technology. There are two types of clean technologies, indexed as type \(c \in \left\{ s, u\right\}\), with identical output \(y_{c}\). Skilled firms with s-type technologies have a higher probability of successfully investing into the clean technology compared to unskilled firms with u-type technologies: \(0<\delta _{ u}<\delta _{ s}\equiv 1\).Footnote 8 The required loan for investing is normalised to 1. \(\theta _u \in (0,1)\) is the proportion of firms with u-type technologies and \(1-\theta _u\) is the proportion of firms with s-type technologies in the economy. Similarly, there are two types of dirty technologies, indexed as type \(d \in \left\{ l, h\right\}\). Outputs of both types are identical, \(y_{d}\), but lead to different carbon emission levels. Firms with l-type technologies have lower emission levels compared to firms with h-type technologies, \(e_{l}<e_{h}\). Emissions are associated with social per unit costs of \(\kappa\), which we normalise to one, \(\kappa \equiv 1\). \(\theta _h \in (0,1)\) is the proportion of firms with h-type technologies and \(1-\theta _h\) is the proportion of firms with l-type technologies. Table 1 depicts the overall four types of firms differing in their clean and dirty technologies, i.e., uh-, ul-, sh-, and sl-firms.

We assume that the private net present value of using the clean technology is below the returns to using the dirty technology. From social planer’s perspective, i.e., also considering emission externalities associated with dirty production, high-emission firms (H-firms) should rather choose the clean technology, while low-emission firms (L-firms) should use the dirty technology. This setup is captured by the following assumption:

Assumption 1

\(y_{d}>y_{d}-e_{ l}>\delta _c y_{c}-\rho>y_{d}-e_{ h}> 0\).

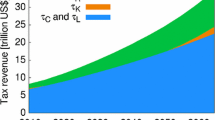

Figure 1 illustrates this setup. Panel (a) depicts the private perspective: expected private returns from using the dirty technology (\(y_{d}\)) exceed those from the clean technology for all firm types, which corresponds to the left inequality in Assumption 1. The difference in expected returns from using the clean technology is due to the difference in success probabilities. Panel (b) in Fig. 1 depicts the societal perspective: here, the social costs of emissions (\(e_d\)) lead to lower returns from using the dirty technology. This results in higher relative returns to clean investments for H-firms, while returns from using the dirty technology are still higher for L-firms, which corresponds to the inner inequalities in Assumption 1.

Firms (borrowers) are risk neutral and have full information. The lender and the government do not observe firms’ clean and dirty technologies, and thus cannot distinguish between the types of borrowers. This information asymmetry can lead to adverse selection. Other than that, all parameters are known to all actors in the economy.

A contract between a borrowing firm and a lender comprises two parts, \(\pi _k\) and \(R_k\), with \(k \ \in \lbrace uh, u l, s h, sl\rbrace\), where \(\pi _k\in [0,1]\) is the probability of receiving the loan and \(R_k>0\) denotes the loan repayment (1+interest rate).Footnote 9 Like Besanko and Thakor (1987), we assume that both technology alternatives (clean or dirty) are mutually exclusive, such that the returns from dirty production represent the opportunity costs of choosing the clean technology. The expected profit of a borrower of type cd who applies for a contract designed for a borrower k is the difference between the expected profit from using the clean technology and the opportunity cost of not using the dirty technology:

The lender’s expected profit of a loan to a borrower of type k is the difference between the loan repayment, given that the borrower is successful and hence able to repay the loan, and the bank’s marginal cost to obtain funds:

Following Janda (2011), we assume that, in the case of indifference between providing and not providing the loan, the bank chooses to provide the loan. When the borrower is indifferent between accepting the loan contract to finance the clean technology investment and choosing the dirty technology, they will decide in favour of the loan contract. The lender can observe the technology choice such that the firm cannot take a loan and then use the dirty technology to repay it. In order to conduct welfare analyses, expected social welfare is defined as the sum of firms’ profits, bank profits, and government budget, less social costs of emissions.

3.2 Laissez–Faire and Full Information Outcome

We first characterise the equilibrium under laissez-faire, i.e., an economy without government intervention, and then the socially optimal equilibrium under full information. The latter serves as a baseline comparison for the subsequent main analyses of different policy interventions under asymmetric information.

The bank maximises its benefits from lending to the respective borrower of type k. The lender is subject to the borrowers’ participation constraints, i.e. their expected profits using the clean technology after repaying the loan are at least as high as their returns from dirty production (\(P_{cd,k}\ge 0\)). All potential borrowers know the bank’s per unit cost to obtain funds for lending, \(\rho\) and hence the minimum interest \(R_k\) the bank has to set in order to break even. In laissez-faire, the firms’ returns from dirty production are very high compared to using the clean technology, as firms do not internalise the social costs (\(e_d\)). All firms know that the lender cannot offer interest rates that are low enough to raise the profits from clean over those of dirty production without the lender incurring losses. Thus, all firms favour the dirty technology. This outcome is not socially optimal, as H-firms use their emission-intensive dirty technology instead of the clean technology. Lemma 1 summarises the laissez-faire equilibrium.

Lemma 1

Without government intervention, all firms use the dirty technology.

Proof

See Appendix 7.1. \(\square\)

We now turn to the socially optimal equilibrium under full information. The government introduces policy addressing the externalities of carbon emissions, namely a Pigouvian tax \(\tau\) on emissions that equals their per unit social costs \(\kappa \equiv 1\), such that firms internalise the true social costs of their decisions (Knittel and Sandler 2018). Following from this and Assumption 1, L-firms will not apply for a loan. Those firms know that the bank cannot offer them a loan contract that makes the clean investment more attractive and, at the same time, allows the bank to break even. This is due to these firms’ ability to produce the dirty output at a low emission level \(e_{l}\): despite the emission tax, using the dirty technology is still more profitable than investing in the clean technology, independent of the success probability \(\delta _c\). Hence, only H-firms have an incentive to invest in the clean technology.

The group of H-firms applying for a loan to fund the initial investment for the clean technology contains both firms with a low and firms with a high success probability. The bank maximises its benefits from lending subject to the participation constraint (PC) of the respective type of borrower. The lender’s maximisation problem can be written as:

With full information, the solution to this problem is given by:

The bank can identify each type and offers them different contracts. Lemma 2 sums up the results of the baseline case.

Lemma 2

With Pigouvian emission tax and perfect information, H-firms use the clean technology and L-firms use the dirty technology.

Proof

See Appendix 7.2. \(\square\)

4 Policy Interventions Under Information Asymmetry

We now introduce information asymmetry between lender (principal) and borrower (agent): the lender cannot distinguish between borrower types. We show that, in contrast to the full information outcome, a Pigouvian tax may not be sufficient to achieve a first-best allocation, as credit rationing might occur. We then investigate how interest subsidies or loan guarantees can resolve this issue. Subsequently, we analyse whether one instrument can effectively address both market failures. We consider alternative tax rates (higher than the Pigouvian tax) and the case where an emission tax is (politically) not feasible and only credit market interventions are available. Finally, we compare welfare levels of all policy mixes.

4.1 Pigouvian Emission Tax and Credit Market Instruments

In an economy with a Pigouvian tax, the bank maximises its expected benefit from lending subject to the participation constraints (PCs) and incentive compatibility constraints (ICs) of both borrower types:

The solution to this problem is given by:

Like in the case with full information, H-firms prefer the clean technology and hence apply for a loan. There are two possible equilibrium outcomes: in the first equilibrium, both the skilled and the unskilled firms receive the same loan contract for their low-carbon investments and get served by the lender. In the second equilibrium, only the skilled firms receive a loan, as the lender offers a contract that only skilled firms are willing to accept, whereas unskilled firms with a low success probability \(\delta _{ u}\) do not receive a loan. The latter outcome is referred to as credit rationing and occurs if the condition for \(\pi ^*_{ uh}=0\) holds.

This credit rationing condition holds if the difference between the success probabilities of both borrowers, \(1-\delta _{ u}\), is large enough. This means that credit rationing is more likely for immature and risky clean technologies. When the credit rationing condition holds, it is more profitable for the lender to only serve the sh-firms by setting a high interest rate \(R^*_{ s h}= y_{c}- \left( y_{d}-\tau e_{ h}\right)\), which the uh-firms cannot afford, than setting a low the interest rate and offering loans to both firm types. Figure 2 panel (a) depicts the resulting technology choices of firms. Proposition 1 sums up the results.

Proposition 1

With Pigouvian tax and if the credit rationing condition holds, L-firms use the dirty production technology. H-firms prefer the clean technology, but only sh-firms use the clean technology, as uh-firms do not receive a loan and hence use the dirty technology.

Proof

See Appendix 7.3. \(\square\)

The outcome with credit rationing is socially inferior to the full information baseline. In the next step, we consider two alternative instruments the government can use to address the friction on the financial market resulting in credit rationing: interest rate subsidies or credit guarantees. These policy instruments are typically suggested in the theoretical literature on financial market failures (Arping et al. 2010; Gale 1990; Janda 2011; Minelli and Modica 2009; Philippon and Skreta 2012) and frequently used to support low-carbon investment (Buchner et al. 2019; Kempa and Moslener 2017). In order to enable socially optimal clean technology investments of H-firms, the government defines an overall budget for its intervention on credit markets based on the optimal level of the interest subsidy or the loan guarantee. The key difference between both instruments is the event triggering the associated payment. The interest rate subsidy lowers the repayment of the borrower by driving a wedge between the market interest rate and the interest rate the borrower must pay. Thus, we model it as a payment to the borrower. As the interest repayment only occurs in the case of a successful investment, the interest rate subsidy is only paid in this case. With an interest subsidy \(\sigma >0\), the expected profit of a borrower, Eq. (1), changes to:

In contrast, a loan guarantee \(\gamma \in (0,\rho /(1-\delta _u))\) is only paid if an investment is unsuccessful and the borrower cannot repay the loan.Footnote 10 As the loan guarantee is the share of the loan that is recovered in the case of clean investment failure, the lender’s expected profit changes to:

With a given interest rate subsidy \(\sigma\) or a loan guarantee \(\gamma\), the bank maximises its expected benefit subject to the participation and incentive compatibility constraints of both borrowersFootnote 11:

The solution to this problem is given by:

Figure 2 panel (b) illustrates the results. As in Fig. 2 panel (a), the low-risk borrowers (sh-firms) always receive a loan. For the borrowers with a lower success probability, we can derive conditions for \(\gamma\) and \(\sigma\), under which this borrower receives a loan as well. Solving the credit rationing condition, i.e. the condition for \(\pi ^*_{ uh}=0\), for \(\sigma\) yields the minimum interest rate subsidy assuring that also uh-firms receive a loan and hence no credit rationing occurs. Similarly, there is a minimum share of the loan that has to be covered by the guarantee, \(\gamma\), such that all H-firms receive a loan. The following proposition sums up the results for both cases.

Proposition 2

With Pigouvian tax combined with either an interest rate subsidy of \(\sigma \ge \sigma ^*= \frac{\rho +\left( y_{d}-\tau e_{ h}\right) \left[ 1+\frac{1-\theta _u}{\theta _u}\frac{1-\delta _{ u}}{\delta _{ u}}\right] }{\delta _{ u}}-y_{c}\) or a loan guarantee of \(\gamma \ge \gamma ^*=\frac{\rho +\left( y_{d}-\tau e_{ h}\right) \left[ 1+\frac{1-\theta _u}{\theta _u}\frac{1-\delta _{ u}}{\delta _{ u}}\right] }{1-\delta _{ u}}\), there is no credit rationing of uh-firms. H-firms use the clean technology, L-firms use the dirty technology. The government expenditures for \(\sigma ^*\) are higher than for \(\gamma ^*\).

Proof

See Appendix 7.3. \(\square\)

One difference between both instruments is that the applicability of the loan guarantee is limited, i.e. it cannot be used if the required guarantee is above its upper limit of \(\rho /(1-\delta _u)\). The interest rate subsidy can always achieve the first-best outcome. However, the government budget required to fund the guarantee programme is smaller than for interest rate subsidies. Hence, the combination of the Pigouvian tax with the loan guarantee is the preferable option for the government in most cases. Only if the guarantee cannot yield a first-best outcome, the government should use the interest rate subsidy.

The policymaker further has some flexibility when combining an emission tax with a credit market instrument. In equilibrium, the tax and loan guarantee or interest subsidy have an inverse relationship. The government can yield a first-best outcome by reducing the tax below the Pigouvian level if it increases the guarantee or the subsidy, and vice versa.

Lemma 3

The two combined policy instruments required for the outcome characterised in Proposition 2have an inverse relationship, \(d\sigma ^*/d\tau <0\) and \(d\gamma ^*/d\tau <0\).

Proof

See Appendix 7.3. \(\square\)

4.2 Non-Pigouvian Emission Taxes

We now turn to the cases, where not all first-best policy instruments are available. First, we consider the case of an emission tax and build on the literature on optimal environmental taxes with more than one externality. Previous studies found that a tax rate equal to the social costs of the emission may not be optimal in the presence of different other market failures, such as consumption externalities (Diamond 1973), knowledge externalities (Acemoglu et al. 2012; Fischer et al. 2021), imperfect competition (Baumol and Oates 1988), or constraints and frictions on financial markets (Hoffmann et al. 2017; Heider and Inderst 2022; Döttling and Rola-Janicka 2023). If the government can substitute an emission tax for other taxes, tax rates above or below the Pigouvian level can be optimal (Lee and Misiolek 1986).

Based on these findings, we explore whether tax rates above the Pigouvian level can effectively address the emission externality and the issue of credit rationing. Increasing the tax reduces the profits of dirty production, which is the outside option of a firm applying for a loan for the clean technology investment. Hence, it increases the incentives of firms to choose the clean technology. At the same time, it becomes more attractive for the lender to offer loans. Due to the reduced value of firms’ outside options, the lender has, ceteris paribus, higher profits from lending, as the borrowers’ opportunity costs, which the lender has to compensate, are lower (recall Eq. 1). We distinguish two relevant cases: first, a tax rate above the Pigouvian tax can resolve credit rationing and the first-best outcome is achieved. Second, in addition to the H-firms, some of the L-firms, in particular those with a higher success probability (sl-firms), successfully apply for loans and produce with the clean instead of their low-emission dirty technology, which is social undesirable. To analyse these cases, we assume that \([y_{d}-(\delta _u y_{c}-\rho )]/e_l>y_{d}/e_h\). If this assumption holds, ul-firms cannot successfully apply for a loan and hence always use the low-emission dirty technology. This assumption does not affect our analysis of the two relevant cases, while it reduces the complexity of the maximisation problem.Footnote 12

With \(\tau >1\), the bank maximises its expected benefit from lending subject to the participation and incentive compatibility constraints of three borrowersFootnote 13:

The solution to this problem is given by:

with \(\tau _{uh} \equiv \frac{y_{d}-A\left( \delta _uy_{c}-\rho \right) }{e_h}\), \(A\equiv \frac{\theta _h\theta _u\delta _u}{\theta _h\theta _u\delta _u+\theta _h(1-\theta _u)\left( 1-\delta _u\right) }\), \(\tau _{sl} \equiv \frac{\left[ 1-B\left( (1-\delta _u)/\delta _u\right) \right] y_{d}-\left( y_{c}-\rho \right) }{\left[ 1-B\left( (e_h-e_l\delta _u)/(e_l\delta _u)\right) \right] e_l}\), \(B\equiv \frac{\theta _h(1-\theta _u)+\theta _h\theta _u\delta _u}{(1-\theta _h)(1-\theta _u)}\).

Like in the case of the Pigouvian tax, H-firms always have an incentive to use the clean technology and the firms with the high success probability (sh-firms) always receive a loan. For uh- and sl-firms, we obtain two credit rationing conditions. Solving those conditions for \(\tau\) yields the tax rates to resolve credit rationing of the respective firm type.

Whether a first- or a second-best outcome can be achieved depends on the ratio of both tax rates. If \(\tau _{uh}<\tau _{sl}\), the government can set the tax equal to \(\tau _{uh}\) resolve socially undesirable credit rationing of uh-firms and all high-emission firms use the clean technology, whereas the low-emission firms use the dirty technology. If \(\tau _{uh}\ge \tau _{sl}\), also sl-firms successfully apply for a loan and use the clean technology. This yields a second-best outcome, as it would be optimal if those firms used their low-emission dirty technology instead.

The likelihood of the latter, second-best outcome depends on the uncertainty related to clean technologies and the emission levels of the two dirty technologies. If \(1-\delta _{u}\) is large, credit rationing of uh-firms is very strong, i.e. the lender has low incentives to offer a loan to this firm type. Hence, the policymaker needs to set a rather high tax \(\tau _{uh}\) to resolve credit rationing. If the emission level of sl-firms \(e_l\) is rather high, then the tax required to induce a successful switch from the dirty towards the clean technology \(\tau _{sl}\) is rather small. Hence, the larger \(1-\delta _{u}\) and the smaller \(e_h-e_l\), the higher is the likelihood that resolving credit rationing of uh-firms also induces a welfare-reducing switch towards clean technologies by sl-firms. The following proposition sums up the results.

Proposition 3

With \(\tau \ge \min \left\{ \tau _{uh};\tau _{sl}\right\}\), there is no credit rationing of uh-firms. If \(\tau _{uh}<\tau _{sl}\), H-firms use the clean technology, L-firms use the dirty technology. However, if \(\tau _{uh}\ge \tau _{sl}\), sl-firms also successfully apply for a loan and use the clean instead of the low-emission technology.

Proof

See Appendix 7.4. \(\square\)

4.3 Credit Market Instruments

We now analyse an economy without (a sufficiently high) emission tax. In practice, emission taxes often cannot be imposed. If policymakers rely on votes, it is more attractive to support clean technologies rather than impose additional costs for the dirty technologies (Bowen 2011; Green and Yatchew 2012; Ito 2015). Lobbying can also deter taxation (Fredriksson 1997).

As shown in Sect. 3.2, there is no incentive for firms to use the clean technology without an appropriate price on carbon emissions. Here, we show that the government can alternatively use the interest rate subsidy, which is paid to the borrower, to incentivise firms to switch to low-carbon technologies. As argued in Sect. 4.1, the bank cannot offer an interest rate that is low enough to render the low-carbon investment more attractive for firms without incurring losses. The government can use the interest rate subsidy to fill this gap, such that (at least some) firms choose the clean technology, while the lender is able to break even.

There are two relevant levels of the interest rate subsidy \(\sigma\). Figure 3 illustrates both cases. If the interest rate subsidy reaches the first threshold \(\sigma _{S}\), it becomes profitable for all skilled firms (S-firms) to switch from the dirty to the clean technology, while unskilled firms (U-firms) still prefer the dirty technology (see Fig. 3 panel (a)). Hence, only S-firms apply for loans. As S-firms are identical in the absence of an emission tax, there are no information asymmetries and credit rationing cannot occur. However, new inefficiencies are introduced. Recall that the emission tax incentivises high-emission firms (H-firms) to switch to the clean technology, while low-emission firms (L-firms) keep using the dirty technology. Without tax, there is no self-selection of H-firms into choosing the clean technology. Instead, a fraction \(\theta _h\theta _u\) of H-firms, the uh-firms, uses the dirty technology, resulting in overall higher emissions compared to the economy with emission tax. At the same time, the subsidy incentivises a fraction \(\left( 1-\theta _h\right) \left( 1-\theta _u\right)\) of L-firms, the sl-firms, to choose the low-carbon technology, whereas it would be preferable if those firms chose their low-emission dirty technology. Proposition 4 summarises the results.

Proposition 4

Without emission tax and with an interest subsidy \(\sigma =\sigma _{S}= y_{d}-y_{c}+\rho\), S-firms use the clean technology and U-firms use the dirty technology.

Proof

See Appendix 7.5. \(\square\)

At the second, relevant and higher threshold of the interest subsidy, denoted as \(\sigma _{SU}\), all firms choose the clean technology (see Fig. 3 panel (b)). An advantage of \(\sigma _{SU}\) is the abatement of emissions produced by emission-intensive uh-firms, which use the dirty technology at lower subsidies levels. At the same time, however, \(\sigma _{SU}\) also incentivises all L-firms to use the clean technology, although it would have been socially desirable if ul-firms used the dirty technology. As all firms choose the clean technology for \(\sigma _{SU}\), firms with both low and high success probabilities now apply for a loan. Hence, with \(\sigma _{SU}\) credit rationing is a potential issue that does not exist for \(\sigma _{S}\). Credit rationing can be resolved by either increasing \(\sigma\) above \(\sigma _{SU}\) or combining it with a loan guarantee, where the latter is the preferable option (see Proposition 2). Proposition 5 sums up the results.

Proposition 5

Without emission tax and with an interest subsidy \(\sigma =\sigma _{SU}= \frac{y_{d}}{\delta _{ u}}-\left( y_{c}-\rho \right)\) and a loan guarantee \(\gamma _{n\tau }^*=\frac{1-\theta _u}{\theta _u}\frac{1}{\delta _{ u}}\left( \delta _{ u}y_{c}-\rho \right)\), all firms use the clean technology.

Proof

See Appendix 7.5. \(\square\)

4.4 Comparative Welfare Analysis

The welfare levels under laissez-faire and under full information with Pigouvian tax represent the lower and the upper bound of total welfare, respectively. If an emission tax is introduced, firms internalise the social costs of emissions, which increases welfare. With information asymmetries, credit rationing may occur, and some firms are deterred from using low-carbon technologies and thus use carbon-intensive technologies, which results in a welfare below the welfare-maximum. Credit rationing can be effectively addressed by a loan guarantee or an interest rate subsidy. This combination of Pigouvian tax and intervention on the credit market resembles the first-best outcome under full information and thus yields the welfare maximum.

An emission tax level above the Pigouvian tax can also resolve socially undesirable credit rationing. If clean technology risks and emission levels of low-emission firms are low, a tax alone can yield the welfare optimum. Alternatively, the tax can induce a reallocation of some low-emission firms towards the clean technology.

If an emission tax is (politically) not feasible, emission externalities are not internalised, but can be indirectly addressed by financial instruments. There are two relevant subsidy levels, as outlined in Propositions 4 and 5. Their ordering with respect to welfare depends on two factors. Firstly, the order is driven by the share of the H-firms in the economy and their actual emission levels \(e_{h}\): the larger the share of H-firms and the higher \(e_{h}\), the higher are the social costs of emissions if those firms use the dirty technology. The higher these social costs of emissions, the higher is the welfare resulting from the high subsidy \(\sigma _{SU}\) that incentivises all firms to use the clean technology. Secondly, relative welfare is affected by the success probability of U-firms, \(\delta _{ u}\), that are incentivised to use the clean technology by \(\sigma _{SU}\). The higher their success probability, the higher is the resulting welfare compared to \(\sigma _{S}\), where those firms use the dirty technology. However, if emission levels of dirty technologies and thus their social costs are relatively low, while low-carbon alternatives are relatively risky, it is socially optimal if the government does not intervene at all.Footnote 14

The following corollary sums up the core results of the comparative welfare analysis:

Corollary 1

The reference scenario with Pigouvian tax and full information yields the welfare optimum (upper bound) \(\tilde{W}_{P}\). Laissez-faire yields the lower bound, \(W_L\). With Pigouvian tax, welfare is higher than in laissez-faire and can resemble the welfare optimum if no credit rationing occurs, \(W_L<W_{P}\le \tilde{W}_{P}\). The combined use of Pigouvian tax and a credit market instrument, \(\sigma ^*\) or \(\gamma ^*\), can resemble the welfare optimum, \(W_{P \gamma }=W_{P \sigma }=\tilde{W}_{P}\). Without credit market intervention and with an emission tax above the Pigouvian level, welfare can be lower or equal to the welfare optimum, \(W_{\tau _{sl}}<W_{\tau _{uh}}=\tilde{W}_{P}\). Without emission tax, either low interest rate subsidy \(\sigma _{S}\) or the combination of high interest rate subsidy \(\sigma _{SU}\) and \(\gamma _{n\tau }^*\) cannot resemble the first-best outcome, \(W_{\sigma _{S}},W_{\sigma _{SU}}<\tilde{W}_{\tau }\), with \(W_{\sigma _{S}}\gtreqqless W_{\sigma _{SU}}\Leftrightarrow y_{d}-\left[ \left( 1-\theta _h\right) e_{ l}+\theta _h e_{ h}\right] \gtreqqless \delta _{ u}y_{c}-\rho\).

Proof

See Appendix 7.6.\(\square\)

5 Discussion and Policy Recommendations

In this section, we elaborate when credit rationing is likely to occur, discuss how risk aversion would affect our results, and derive policy recommendations. Our results show that the likelihood of credit rationing increases with the level of low-carbon technology risk, i.e., the difference between investment success probabilities. Empirical evidence supports this prediction. Firms face issues to source debt for their renewable energy investments when using new technologies, as banks are largely unfamiliar with their risks (Geddes et al. 2018). However, when clean technologies mature and are perceived as less risky, firms have less or no issues to access debt for their investments (Egli et al. 2018; Geddes et al. 2018; Mazzucato and Semieniuk 2018). This process is further enhanced by learnings in the financial sector (Egli et al. 2019). As outlined in Sect. 2, the development of the financial sector is of key importance. The more developed a country’s financial sector, the better is the ability of lenders to initially screen firms and assess risks of low-carbon investments. This reduces information asymmetries and thus the likelihood of credit rationing. Consequently, the more mature a low-carbon technology and the more developed an economy’s financial sector, the lower is the likelihood of credit rationing impeding low-carbon investments.

In the model, we assume risk neutral actors. One might argue that firms or, in particular, banks might be risk averse, which would affect our results as follows. Risk aversion of banks would lead to higher interest rates and hence loan repayments, as banks would request a higher compensation for a specific risk than in the case of risk neutrality. Risk averse firms would be less likely to decide in favour of the risky low-carbon technology vis-à-vis the risk-free dirty one. As a consequence, risk aversion could increase the likelihood of socially undesirable credit rationing.Footnote 15 In general, all the policy mixes analysed above would still be suitable to resolve the issue of credit rationing. Interventions on credit markets, however, would be more costly for the government, as higher interest rate subsidies or loan guarantees would be required to incentivise the risk-averse bank to offer a loan to high-risk firms. Furthermore, the applicability of an emission tax as the sole instrument would be limited. Due to the penalisation of high risks by a risk-averse bank, the required tax rate to prevent socially undesirable credit rationing of high-emission firms, \(\tau _{uh}\), is higher to make sure that also high-risk firms receive loans. Consequently, it is less likely that the condition \(\tau _{uh}<\tau _{sl}\) holds, which guarantees that none of the L-firms receive loans, but rather use their low-emission dirty technology. Overall, the issue of credit rationing would be more severe in case of risk aversion and resolving it would be more difficult and costly for the policymaker.

We now turn to the key insights for policymakers. Our analysis shows that combining environmental policy with an intervention on credit markets can resolve credit rationing and thus induce higher low-carbon investments. This finding is in line with empirical evidence. Access to public funding is an important driver for low-carbon innovations, in particular for SMEs (Cecere et al. 2020), and renewable energy investments (Haščič et al. 2015). Public guarantees and interest subsidies reduce credit rationing and have de-risking effect on low-carbon investments (Cowling et al. 2018; Geddes et al. 2018). Hence, combining an environmental policy that internalises the externality with an interest rate subsidy or a loan guarantee is the preferred option for the policymaker. An additional advantage of this policy mix is that policymakers have some flexibility in combining an emission tax with credit market interventions and still reach a first-best outcome. If setting a tax at the Pigouvian level is, e.g., politically difficult, the government can lower the emission tax and instead increase its financial support through subsidies or loan guarantees. Alternatively, the government can lower the latter as long as this goes along with an emission tax above the Pigouvian level. The second option might be relevant if the government wants to reduce the burden for its budget.

We further find that only using an emission tax can also result in a first-best outcome if it is set above the Pigouvian level. From a political economy perspective, however, it might be difficult to introduce such a policy if the emission tax rate required to resolve credit rationing is high. It may also introduce an additional distortion if clean technology risk and the emission intensity of low-emission firms are rather high. In the case of the former, the required tax rate to resolve socially undesirable credit rationing is rather high. If the emission intensity of low-emission firms is too high, some of these firms might choose to also invest in the low-carbon technology, although it would be socially desirable if they used their efficient dirty technology. This means that an emission tax above the Pigouvian level bears the risk of welfare-reducing over-investment in low-carbon technologies. Hence, using an emission tax alone seems to be a good option for the policymaker if clean technologies are rather mature and not too risky and if emission-levels of low-emission dirty technologies are rather low. Otherwise, the government should rather combine a Pigouvian tax with a loan guarantee or an interest rate subsidy.

Given that technological progress reduces the risk of low-carbon technologies, our findings indicate that credit rationing is only a temporary issue.Footnote 16 In our setup, this would mean that the difference between the success probabilities of low-carbon innovations of skilled and unskilled firms diminishes. As long as there is an emission tax that incentivises high-emission firms to choose the clean technology, socially undesirable credit rationing ultimately disappears if this difference gets sufficiently small. Until that point, however, there are welfare losses if credit rationing is not addressed by interventions on the credit market or an emission tax above the Pigouvian tax level. The main reason is that some high-emission firms, i.e., those that do not receive a loan for their clean technology investment, use their dirty technology. Hence, not addressing credit rationing results in social costs of delay.

In addition, it is worth noting that our results are not specific to an emission tax. Consider, e.g., an emission standard: the government sets a firm-level emission standard somewhere between the emission levels of high- and low-emission firms. In this case, high-emission firms would incur some costs to reduce their emissions to comply with the standard.Footnote 17 If these costs reach a threshold, then, like in the case of the Pigouvian tax, high-emission firms would choose to apply for a loan to invest in a low-carbon technology and credit rationing could occur. Alternatively, these firms would have to reduce their dirty output if they do not have any abatement options, which would also make the clean investment more attractive. Overall, other environmental policy instruments should lead to results similar to an emission tax, as long as they increase high-emission firms’ incentives to switch to clean technologies.

Finally, our results offer insights for policymakers if an emission tax is (politically) not available. Although the coverage of carbon prices has been increasing over time, they only cover around 23% of global emissions (World Bank 2022). At the same time, an increasing public involvement in financing for low-carbon investment can be observed. Currently, there are 160 loan/debt financing or guarantee programmes mainly for renewable energy and energy efficiency in force worldwide.Footnote 18 According to Buchner et al. (2021), annual average public climate finance flows increased from USD 300 billion in 2017 and 2018 to USD 321 billion in 2019 and 2020. For this current scenario with a limited global price coverage of carbon emissions, our model offers valuable guidelines on the choice of finance instruments to incentivise low-carbon investments. The socially optimal choice of financial market interventions largely depends on the risk profiles of low-carbon technologies and the emission intensities of dirty technologies. High subsidies are the preferable option if clean technology risks are rather low and dirty technologies are very emission intensive. However, if clean technologies are still immature, whereas dirty alternatives are not too emission-intensive, the government should refrain from using too high subsidies as inducing too high levels of clean technology investments can actually be welfare reducing.

6 Conclusion

This paper offers a novel theoretical framework to analyse firms’ decisions between low-carbon (clean) and carbon-intensive (dirty) technologies that explicitly models external financing. We show how information asymmetries between lender and firms might induce credit rationing and thus a socially undesirably low level of investments and analyse how different policy interventions might resolve this issue. We find that a Pigouvian emission tax alone may not be sufficient to achieve a first-best outcome, as credit rationing occurs if the low-carbon technology is immature and risky. Introducing interest rate subsidies or loan guarantees can solve the issue of credit rationing and achieve a first-best outcome, which is consistent with the Tinbergen rule (Tinbergen 1956). Credit market instruments have an inverse relationship with the emission tax in equilibrium and allow some flexibility. The government can reduce the emission tax below the Pigouvian level if it increases the interest rate subsidy or loan guarantee and vice versa.

We further analyse the effectiveness of using only one instrument, i.e., either an emission tax or an intervention on credit markets. We find that setting an emission tax above the Pigouvian tax level can resolve the issue of credit rationing. A tax alone might even yield a first-best outcome, if the risks of clean technologies are rather low and hence the issue of credit rationing is not too severe. Alternatively, a second-best outcome is achieved. Given the low coverage of carbon pricing worldwide, we also consider the relevant case, where an emission tax is (politically) not feasible. In this scenario, an interest rate subsidy can be used as an alternative to the emission tax to induce a switch to low-carbon technologies. We find that, independent of the size of the interest subsidy or its combination with a loan guarantee, credit market interventions alone cannot resemble the fist-best outcome. This finding stresses the importance of a price on emissions. Using only finance instruments bears the risk of substantially increasing the social costs of the transition to a low-carbon economy and should be only considered if an emission price is (politically) not feasible.

Finally, we discuss some dynamic aspects of credit rationing. As ongoing technological progress results in decreasing risks of low-carbon technologies over time, e.g., due to innovation spillovers, the issue of credit rationing eventually vanishes. While this happens even without policy intervention on the credit market, there are, however, costs of delay if the government does not intervene if credit rationing occurs.

There are relevant aspects that are not covered in this paper and might be valuable directions of future research. A promising approach would be a dynamic analysis considering learning effects on the part of the firms or learning effects for the lender that could reduce information asymmetries. In the model, we consider risks to be exogenous. Realistically, the level of risk is at least partly endogenous to firm’s choice, e.g., if projects with high risks also have higher returns. Alternatively, firm outcomes might depend on effort. This could be analysed in an alternative principal-agent setup with moral hazard, as opposed to our model with adverse selection. Finally, a general equilibrium approach modelling consumers and a budget constraint for the government may provide additional insights.

Notes

The respective empirical analyses find that lower credit constraints and default risks are overall associated with lower emissions.

Janda (2011) considers one technology with two types of agents and does not consider environmental externalities. We extend it to two technologies, a clean and a dirty technology, and hence four types of agents.

While capital costs only account for around 11% of total life cycle costs of an oil power plant, they can reach 95% in the case of solar PV (Kannan et al. 2007).

This is also the case for renewable energy project developers and independent power producers (Butler and Neuhoff 2008).

An alternative would be competitive credit markets. However, similar models analysing competitive markets yield similar results with respect to credit rationing, but typically require to include collateral as part of the lending contracts (see, e.g., Besanko and Thakor (1987) and Gale (1990)). Our assumption is in line with the empirical evidence outlined above, i.e., that innovative clean-technology firms are typically small and do not have a lending relationship with a bank and that assets of clean-tech firms are difficult to collateralise.

Alternatively, we could have also introduced an initial investment with external funding for the dirty investment. However, as there are no information asymmetries as the technology is mature and well known, no credit rationing could occur on the loan market. This alternative modelling does not offer any additional insights and does not change the results in the model. Hence, we refrain from doing so for the sake of simplicity.

This normalisation does not affect our results that do not directly depend on the two probabilities, but rather on their distance.

As we show below, \(\pi _k\) is either 0 or 1 in equilibrium.

The upper limit assures that the assumption \(R_k>0\) is not violated.

Relaxing the assumption would require to include participation and incentive compatibility constraints of all four firm types in the maximisation problem, whereas the only (potential) additional result would be a lower welfare level in the second-best outcome if ul-firms successfully apply for a loan.

This holds if \(y_{d}-\left[ \left( 1-\theta _h\right) e_{ l}+\theta _h e_{ h}\right] > \left( 1+\delta _{ u}\right) y_{c}-\rho\).

Assume a firm’s preferences can be represented by a utility function \(u(P_{cd})\), with \(u'(\cdot )>0\), \(u''(\cdot )<0\). Applying the utility function to Eq. (3), it can be derived that if the participation constraint of a risk-averse firm of type cd is binding, it is strictly positive (non-binding) for a risk-neutral firm of the same type: \(u[E(P_{cd})]>E[u(P_{cd})]\Leftrightarrow u\left( \delta _c(y_c-R_k-y_d+\tau e_d)+(1-\delta _c)(-y_d + \tau e_d)\right) >\delta _c u\left( y_c-R_k-y_d+\tau e_d\right) +(1-\delta _c) u\left( -y_d + \tau e_d\right)\), which holds for \(u''(\cdot )<0\) and \(\exists \delta _c \ne 0, 1\). Consequently, a smaller parameter space exists where credit rationing does not occur if firms exhibit risk aversion.

One important driver are innovation spillovers that do not only occur at the invention or innovation stage, but also during the deployment and diffusion of new technologies on the relevant market (Popp 2010). These spillovers are particularly pronounced in the case of low-carbon technologies (Ang et al. 2017; Braun et al. 2010; Dechezleprêtre et al. 2017).

Consider, e.g., that a firm-level emission cap of \(\overline{e}\) would lead to abatement costs \(a_e\) based on the emissions that need to be cut, such that a firm’s profit in the dirty sector would be \(y_{d}-a_e\) with \(a_e \equiv \min \left\{ 0;a(e_d-\overline{e})\right\}\).

IEA Policies database: https://www.iea.org/policies (last accessed 29 July 2022).

As a result of the incompatibility of \(PC_{cl}\) with profit maximisation of the bank, we do not explicitly consider L-firms in the profit maximisation problem.

For brevity, we omit \(IC_{uh,sh}\) in the analysis as it always holds, i.e. uh-firms will never prefer contracts for sh-firms over contracts for uh-firms.

References

Acemoglu D, Aghion P, Bursztyn L, Hemous D (2012) The environment and directed technical change. Am Econ Rev 102(1):131–66

Akerlof GA (1970) The market for lemons: quality uncertainty and the market mechanism. Q J Econ 84(3):488

Andersen DC (2016) Credit constraints, technology upgrading, and the environment. J Assoc Environ Resour Econ 3(2):283–319

Andersen DC (2017) Do credit constraints favor dirty production? Theory and plant-level evidence. J Environ Econ Manag 84:189–208

Andersen DC (2020) Default risk, productivity, and the environment: theory and evidence from us manufacturing. Environ Resour Econ 75(4):677–710

Ang G, Röttgers D, Purli P (2017) The empirics of enabling investment and innovation in renewable energy. OECD Environment Working Paper No 48

Apeaning RW, Thollander P (2013) Barriers to and driving forces for industrial energy efficiency improvements in African industries—a case study of Ghana’s largest industrial area. J Clean Prod 53:204–213

Arping S, Lóránth G, Morrison AD (2010) Public initiatives to support entrepreneurs: credit guarantees versus co-funding. J Financ Stabil 6(1):26–35

Baumol WJ, Oates WE (1988) The theory of environmental policy. Cambridge University Press, Cambridge

Bennear LS, Stavins RN (2007) Second-best theory and the use of multiple policy instruments. Environ Resour Econ 37(1):111–129

Berger AN, Udell GF (2002) Small business credit availability and relationship lending: the importance of bank organisational structure. Econ J 112(477):F32–F53

Besanko D, Thakor AV (1987) Collateral and rationing: sorting equilibria in monopolistic and competitive credit markets. Int Econ Rev 28(3):671–689

Best R (2017) Switching towards coal or renewable energy? The effects of financial capital on energy transitions. Energ Econ 63:75–83

Bharath ST, Dahiya S, Saunders A, Srinivasan A (2011) Lending relationships and loan contract terms. Rev Financ Stud 24(4):1141–1203

Bowen A (2011) Raising climate finance to support developing country action: some economic considerations. Clim Policy 11(3):1020–1036

Braun FG, Schmidt-Ehmcke J, Zloczysti P (2010) Innovative activity in wind and solar technology: empirical evidence on knowledge spillovers using patent data. DIW Berlin Discussion Paper No 993

Brunnschweiler CN (2010) Finance for renewable energy: an empirical analysis of developing and transition economies. Environ Dev Econ 15(03):241–274

Buchner B, Naran B, Fernandes P, Padmanabhi R, Rosane P, Solomon M, Stout S, Strinati C, Tolentino R, Wakaba G, Zhu Y, Meattle C, Guzmán S (2021) Global landscape of climate finance 2021. Climate Policy Initiative, Venice

Buchner BK, Clark A, Falconer A, Macquarie R, Meattle C, Wehterbee C, Tolentino R (2019) Global landscape of climate finance 2019. Climate Policy Initiative, London

Butler L, Neuhoff K (2008) Comparison of feed-in tariff, quota and auction mechanisms to support wind power development. Renew Energ 33(8):1854–1867

Carpenter RE, Petersen BC (2002) Capital market imperfections, high-tech investment, and new equity financing. Econ J 112(477):F54–F72

Cecere G, Corrocher N, Mancusi ML (2020) Financial constraints and public funding of eco-innovation: empirical evidence from European SMEs. Small Bus Econ 54(1):285–302

Couture T, Gagnon Y (2010) An analysis of feed-in tariff remuneration models: implications for renewable energy investment. Energ Policy 38(2):955–965

Cowling M, Ughetto E, Lee N (2018) The innovation debt penalty: cost of debt, loan default, and the effects of a public loan guarantee on high-tech firms. Technol Forecast Soc 127:166–176

De Haas R, Popov A (2019) Finance and carbon emissions. ECB Working Paper No 2318

Dechezleprêtre A, Martin R, Mohnen M (2017) Knowledge spillovers from clean and dirty technologies. Grantham Research Institute on Climate Change and the Environment Working Papers 135

Diamond PA (1973) Consumption externalities and imperfect corrective pricing. Bell J Econ Manag Sci 4(2):526–538

D’Orazio P, Valente M (2019) The role of finance in environmental innovation diffusion: an evolutionary modeling approach. J Econ Behav Organ 162:417–439

Döttling R, Rola-Janicka M (2023) Too levered for pigou: Carbon pricing, financial constraints, and leverage regulation. SSRN Electronic J

Egli F, Steffen B, Schmidt TS (2018) A dynamic analysis of financing conditions for renewable energy technologies. Nat Energy 3(12):1084–1092

Egli F, Steffen B, Schmidt TS (2019) Learning in the financial sector is essential for reducing renewable energy costs. Nat Energy 4(10):835–836

Erzurumlu SS, Tanrisever F, Joglekar N (2010) Operational hedging strategies to overcome financial constraints during clean technology start-up and growth. Boston University School of Management Research Paper Series No 2010-28

Evans A, Strezov V, Evans TJ (2009) Assessment of sustainability indicators for renewable energy technologies. Renew Sustain Ener Rev 13(5):1082–1088

Fischer C, Hübler M, Schenker O (2021) More birds than stones—a framework for second-best energy and climate policy adjustments. J Public Econ 203(104):515

Fleiter T, Schleich J, Ravivanpong P (2012) Adoption of energy-efficiency measures in SMEs—an empirical analysis based on energy audit data from Germany. Energ Policy 51:863–875

Fredriksson PG (1997) The political economy of pollution taxes in a small open economy. J Environ Econ Manag 33(1):44–58

Gale W (1990) Collateral, rationing, and government intervention in credit markets. National Bureau of Economic Research, Cambridge

Geddes A, Schmidt TS, Steffen B (2018) The multiple roles of state investment banks in low-carbon energy finance: an analysis of Australia, the UK and Germany. Energ Policy 115:158–170

Ghisetti C, Mancinelli S, Mazzanti M, Zoli M (2017) Financial barriers and environmental innovations: evidence from EU manufacturing firms. Clim Policy 17(sup1):S131–S147

Gillingham K, Palmer K (2014) Bridging the energy efficiency gap: policy insights from economic theory and empirical evidence. Rev Env Econ Policy 8(1):18–38

Gillingham K, Newell RG, Palmer K (2009) Energy efficiency economics and policy. Annu Rev Resour Econ 1(1):597–620

Golove WH, Eto JH (1996) Market barriers to energy efficiency: a critical reappraisal of the rationale for public policies to promote energy efficiency. University of California, Berkeley

Green R, Yatchew A (2012) Support schemes for renewable energy: an economic analysis. Econ Energ Env Pol 1(2):83–98

Guiso L (1998) High-tech firms and credit rationing. J Econ Behav Organ 35(1):39–59

Haščič I, Rodríguez MC, Jachnik R, Silva J, Johnstone N (2015) Public interventions and private climate finance flows: empirical evidence from renewable energy financing. OECD Environment Working Paper No 80

Heider F, Inderst R (2022) A corporate finance perspective on environmental policy. SAFE Working Paper No 345

Hoffmann F, Inderst R, Moslener U (2017) Taxing externalities under financing constraints. Econ J 127(606):2478–2503

Howell ST (2017) Financing innovation: evidence from R&D grants. Am Econ Rev 107(4):1136–64

Ito K (2015) Asymmetric incentives in subsidies: evidence from a large-scale electricity rebate program. Am Econ J-Econ Polic 7(3):209–37

Jaffe AB, Stavins RN (1995) Dynamic incentives of environmental regulations: The effects of alternative policy instruments on technology diffusion. J Environ Econ Manag 29(3):S43–S63

Jaffe AB, Newell RG, Stavins RN (2005) A tale of two market failures: technology and environmental policy. Ecol Econ 54(2–3):164–174

Jaffee D, Stiglitz J (1993) Chapter 16 credit rationing. In: Friedman BM, Hahn FH (eds) Handbook of monetary economics, vol 2. Elsevier, Amsterdam, pp 837–888

Janda K (2011) Inefficient credit rationing and public support of commercial credit provision. J Inst Theor Econ 167(2):371–391

Jiménez G, Saurina J (2004) Collateral, type of lender and relationship banking as determinants of credit risk. J Bank Financ 28(9):2191–2212

Johnston A, Kavali A, Neuhoff K (2008) Take-or-pay contracts for renewables deployment. Energ Policy 36(7):2481–2503

Kann S (2009) Overcoming barriers to wind project finance in Australia. Energ Policy 37(8):3139–3148

Kannan R, Leong KC, Osman R, Ho HK (2007) Life cycle energy, emissions and cost inventory of power generation technologies in Singapore. Renew Sustain Ener Rev 11(4):702–715

Kempa K, Moslener U (2017) Climate policy with the chequebook: an economic analysis of climate investment support. Econ Energ Env Pol 6(1):111–129

Kempa K, Moslener U, Schenker O (2021) The cost of debt of renewable and non-renewable energy firms. Nat Energy 6(2):135–142

Kim J, Park K (2016) Financial development and deployment of renewable energy technologies. Energ Econ 59:238–250

Knittel CR, Sandler R (2018) The welfare impact of second-best uniform-Pigouvian taxation: evidence from transportation. Am Econ J-Econ Polic 10(4):211–42

Kostka G, Moslener U, Andreas J (2013) Barriers to increasing energy efficiency: evidence from small-and medium-sized enterprises in China. J Clean Prod 57(15):59–68

Lee DR, Misiolek WS (1986) Substituting pollution taxation for general taxation: some implications for efficiency in pollutions taxation. J Environ Econ Manag 13(4):338–347

Mazzucato M, Semieniuk G (2018) Financing renewable energy: who is financing what and why it matters. Technol Forecast Soc 127:8–22

McCrone A, Moslener U, d’Estais F, Grüning C (2017) Global Trends in Renewable Energy Investment 2017. Frankfurt School—UNEP Collaborating Centre for Climate and Sustainable Energy Finance and Bloomberg New Energy Finance, Frankfurt/London

Minelli E, Modica S (2009) Credit market failures and policy. J Pub Econ Theory 11(3):363–382

Minetti R (2010) Informed finance and technological conservatism. Rev Financ 15(3):633–692

Nanda R, Younge K, Fleming L (2015) Innovation and entrepreneurship in renewable energy. In: Jaffe AB, Jones BF (eds) The changing frontier: rethinking science and innovation policy. University of Chicago Press, Chicago, pp 199–232

Noailly J, Smeets R (2015) Directing technical change from fossil-fuel to renewable energy innovation: an application using firm-level patent data. J Environ Econ Manag 72:15–37

Noailly J, Smeets R (2021) Financing energy innovation: internal finance and the direction of technical change. Environ Resour Econ 83:145–169

Nordhaus W (2018) Projections and uncertainties about climate change in an era of minimal climate policies. Am Econ J-Econ Polic 10(3):333–60

Olmos L, Ruester S, Liong SJ (2012) On the selection of financing instruments to push the development of new technologies: application to clean energy technologies. Energ Policy 43(4):252–266

Pahle M, Schweizerhof H (2016) Time for tough love: towards gradual risk transfer to renewables in Germany. Econ Energ Env Pol 5(2):117–134

Painuly J (2001) Barriers to renewable energy penetration; a framework for analysis. Renew Energ 24(1):73–89

Petersen MA, Rajan RG (1995) The effect of credit market competition on lending relationships. Q J Econ 110(2):407–443

Philippon T, Skreta V (2012) Optimal interventions in markets with adverse selection. Am Econ Rev 102(1):1–28

Pollio G (1998) Project finance and international energy development. Energ Policy 26(9):687–697

Polzin F (2017) Mobilizing private finance for low-carbon innovation—a systematic review of barriers and solutions. Renew Sustain Ener Rev 77:525–535

Popp D (2010) Innovation and climate policy. Annu Rev Resour Econ 2(1):275–298

Revest V, Sapio A (2012) Financing technology-based small firms in Europe. What do we know? Small Bus Econ 39(1):179–205

Steckel JC, Jakob M (2018) The role of financing cost and de-risking strategies for clean energy investment. Int Econ 155:19–28

Steffen B (2018) The importance of project finance for renewable energy projects. Energ Econ 69:280–294

Stern N (2018) Public economics as if time matters: climate change and the dynamics of policy. J Public Econ 162:4–17

Stiglitz JE (1993) The role of the state in financial markets. World Bank Econ Rev 7(suppl 1):19–52

Stiglitz JE, Weiss A (1981) Credit rationing in markets with imperfect information. Am Econ Rev 71(3):393–410

Tinbergen J (1956) Economic policy: principles and design. North-Holland, Amsterdam

Trianni A, Cagno E, Farné S (2016) Barriers, drivers and decision-making process for industrial energy efficiency: a broad study among manufacturing small and medium-sized enterprises. Appl Energy 162(15):1537–1551

UN (2015) Paris agreement. United Nations Framework Convention on Climate Change, Paris

Wiser R, Pickle S, Goldman C (1997) Renewable energy and restructuring: policy solutions for the financing dilemma. Electricity J 10(10):65–75

World Bank (2022) State and trends of carbon pricing 2022. World Bank, Washington, DC

Acknowledgements

We thank Jürgen Meckl, Ulf Moslener, Oliver Schenker, Alessandro Spiganti, and the participants of the 6th International Symposium on Environment and Energy Finance Issues (Paris), the 8th Atlantic Workshop on Energy and Environmental Economics (A Toxa), the 6th World Congress of Environmental and Resource Economists (Gothenburg), the 41st IAEE International Conference (Groningen), the Annual Conference 2018 of the Verein für Socialpolitik (Freiburg), the 16th MAGKS Colloquium (Marburg), the FSR Climate Annual Conference 2018 (Florence), the Annual Summer Conference of the Association of Environmental and Resource Economists 2019 (Lake Tahoe), the Annual Conference 2019 of the European Economic Association (Manchester), the 4th AIEE Energy Symposium (Rome), and the Annual Conference of the European Association of Environmental and Resource Economists 2022 (Rimini) for fruitful comments. Karol Kempa is grateful for the support of the Robert Bosch Foundation and acknowledges funding from Stiftung Mercator for a project entitled ’Sustainable Finance Research Platform’ (Rahmenprogramm Sustainable Finance, Grant Number 19026202).

Funding

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

None.

Statement of exclusive submission

This paper has not been submitted elsewhere in identical or similar form, nor will it be during the first three months after its submission to the Publisher.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

7. Appendix

7. Appendix

1.1 7.1. Laissez-Faire

Profit maximisation of firms requires the expected profit from investing in the clean technology to be non-negative, i.e. (1) \(\ge 0\). Furthermore, profit maximisation of the bank requires the expected profit from lending to a firm to be non-negative. Solving (2) \(\ge 0\) for \(R_k\) yields the minimum loan repayment for loans that are provided with positive probability: \(R_k\ge \rho /\delta _c \in (\rho ,\infty )\). We use the lower limit and define \(R^{min}_k\equiv \rho\). Substituting \(R^{min}_k\) into (2) reveals that under Assumption 1 expected profit from the clean investment of a firm can only be positive if expected profit of the bank is negative and vice versa. Therefore, without an emission tax and without credit market instruments, profit maximising behaviour of the bank and the firms is only compatible with the bank providing no loans and all firms choosing the dirty technology.

1.2 7.2. Full Information Outcome

With a Pigouvian tax \(\tau =1\) (and \(\sigma =\gamma =0\)), there exists no contract with a positive probability that fulfils the PCs of L-firms, i.e. (1) \(\ge 0\). This can be shown by substituting the minimum loan repayment (solving (2) \(=0\) for \(R_k\)) into the expected profit of L-firms, (1). Hence, the reducedFootnote 19 Lagrangian to the profit maximisation problem of the bank is:

The (first-order) Kuhn–Tucker conditions for this problem are:

With \(R_{ch}>0\) it follows that \(\partial L(\cdot )/\partial R_{ch}=0\) (follows from complementary slackness) and hence \(\lambda _1=0\); with \(\pi _{ch}>0\) it follows that \(\partial L(\cdot ) / \partial \pi _{ch}=0\) (follows with complementary slackness) and hence \(\lambda _3>0\) (see Assumption 1). From this it follows that \(\pi _{ch}=1\) and with this and \(\partial L(\cdot )/\partial \lambda _1\) it follows (for a global maximum) that \(R_{ch}=y_{c}-\frac{y_{d}-\tau e_{ h}}{\delta _c}\).

1.3 7.3. Imperfect Information with Pigouvian Tax and Credit Market Instruments

In this subsection, we derive equilibrium contracts and the associated allocation of firms in a scenario with the combined use of a Pigouvian tax (\(\tau =1\)) and a credit market instrument and under the assumption of information asymmetries between borrowers, the lender, and the government. Given the four types of firms, we distinguish between 16 technical (groups of) regimes based on their respective allocation of the firm types. We restrict the presentation of the analysis to a set of regimes that are economically interesting, describe the local maxima in these regimes and under what conditions they apply, and show that they are global maxima.

The relevant (group of) regimes are characterised by:

Regime 1

(under-investment): \(\pi _{sh}>0\), \(\pi _{uh}=0\), \(\pi _{sl}=0\), \(\pi _{ul}=0\),

Regime 2

(optimal investment): \(\pi _{sh}>0\), \(\pi _{uh}>0\), \(\pi _{sl}=0\), \(\pi _{ul}=0\).

1.3.1 7.3.1. Maximisation Problem

The bank maximises its expected benefit from lending subject to the participation (PCs) and incentive compatibility constraints (ICs) of two types of borrowers. The reduced maximisation problem isFootnote 20:

1.3.2 7.3.2. Kuhn–Tucker Approach

The Lagrangian to the maximisation problem (5) is given by:

The (first-order) Kuhn–Tucker conditions for this problem are given by:

1.3.3 7.3.3. Analysis of Regimes

Regime 1: \(\pi _{sh}>0,\ \pi _{uh}=0,\ \pi _{sl}=0,\ \pi _{ul}=0\).

\(R_{ch}>0\) if \(\pi _{ch}>0\). With \(\pi _{ s h}>0 \ \Rightarrow \ \lambda _5=0\) and \(\partial L(\cdot )/\partial \pi _{ s h}=0\) (both follow from complementary slackness) and with \(R_{ s h}>0\ \Rightarrow \ \partial L(\cdot )/\partial R_{ uh}=0\) (follows from complementary slackness). From that \(\lambda _2=\left( 1-\theta _u\right)\). With \(\lambda _2>0 \ \Rightarrow \ \partial L(\cdot ) / \partial \lambda _2=0\). Together with \(\pi _{ uh}=0\) and \(\pi _{ s h}>0\) it follows that \(R_{ s h}=y_{c}+\sigma -y_{d}+\tau e_{ h}\). Furthermore, with \(\lambda _2>0, \ \lambda _5=0, \ \pi _{ s h}>0, \ \partial L(\cdot )/\partial \pi _{ s h}=0 \ \Rightarrow \lambda _6>0\) and hence \(\partial L(\cdot ) / \partial \lambda _6=0 \ \Rightarrow \ \pi _{ s h}=1\) (follows from complementary slackness). Regime 2: \(\pi _{sh}>0,\ \pi _{uh}>0,\ \pi _{sl}=0,\ \pi _{ul}=0\).

With \(\pi _{ uh}>0 \ \Rightarrow \ \lambda _3=0\) and \(\pi _{ s h}>0 \ \Rightarrow \ \lambda _5=0\) (both follow from complementary slackness). With \(R_{uh}>0 \ \Rightarrow \ \partial L(\cdot ) / \partial R_{ uh}=0\) and \(R_{ s h}>0 \ \Rightarrow \ \partial L(\cdot ) / \partial R_{ s h}=0\) (both follow from complementary slackness). With \(\partial L(\cdot ) / \partial R_{ s h}=0, \ \pi _{ s h}>0 \ \Rightarrow \lambda _2=\left( 1-\theta _u\right) >0\) and together with \(\lambda _5=0, \ \partial L(\cdot ) / \partial \pi _{ s h}=0 \Rightarrow \ \lambda _6>0 \ \Rightarrow \ \ \pi _{ s h}=1\) (follows from complementary slackness). With \(\partial L(\cdot ) / \partial R_{ uh}=0, \ \lambda _2=\left( 1-\theta _u\right) \ \Rightarrow \ \lambda _1=\theta _u+\left( 1-\theta _u\right) /\delta _{ u}\). Together with \(\partial L(\cdot ) / \partial \pi _{ uh}=0\) it follows that:

Note that (in)equality of the RHS of (6) determines the sign of \(\lambda _4\). It follows that if \(\delta _{ u}\left( y_{c}+\sigma \right) -y_{d}+\tau e_{ h}-\rho> \frac{1-\theta _u}{\theta _u}\left( y_{d}-\tau e_{ h}\right) \left( \frac{1}{\delta _{ u}}-1\right) -\left( 1-\delta _{ u}\right) \gamma \ \Rightarrow \lambda _{4}>0\) and hence \(\pi _{ uh}= 1\) (follows from complementary slackness). If \(\delta _{ u}\left( y_{c}+\sigma \right) -y_{d}+\tau e_{ h}-\rho = \frac{1-\theta _u}{\theta _u}\left( y_{d}-\tau e_{ h}\right) \left( \frac{1}{\delta _{ u}}-1\right) -\left( 1-\delta _{ u}\right) \gamma \ \Rightarrow \lambda _{4}=0\) and hence \(\pi _{ uh}\in [0,1]\) is compatible with complementary slackness. If \(\delta _{ u}\left( y_{c}+\sigma \right) -y_{d}+\tau e_{ h}-\rho< \frac{1-\theta _u}{\theta _u}\left( y_{d}-\tau e_{ h}\right) \left( \frac{1}{\delta _{ u}}-1\right) -\left( 1-\delta _{ u}\right) \gamma \ \Rightarrow \lambda _{4}<0\) and hence does not fulfil the first order conditions. That is, (6) yields the credit rationing condition for type uh:

If (7) holds, uh-firms will not receive a loan and Regime 1 applies. If (7) does not hold, it follows: With \(\partial L(\cdot ) \partial \lambda _2=0, \ \pi _{ s h}=1, \ R_{ uh}=y_{c}+\sigma -\frac{y_{d}-\tau e_{ h}}{\delta _{ u}}\ \Rightarrow \ R_{ s h}=y_{c}+\sigma -\left( \pi _{ uh}\left( (1-\delta _{ u})/\delta _{ u}\right) +1\right) \left( y_{d}-\tau e_{ h}\right)\). For \(\pi _{ uh}=1\ \Rightarrow R_{ s h}=y_{c}+\sigma -\frac{y_{d}+-\tau e_{ h}}{\delta _{ u}}\).