Abstract

Though the magnitude of fossil fuel subsidies eclipses carbon pricing revenues, policies and economic literature focus on carbon taxation. This paper aims to show that removing fossil fuel subsidies can reduce emissions as much as carbon taxation without making producers and consumers worse off. Using a dynamic intertemporal CGE model of Ireland, we compare removing eight Irish fossil fuel subsidies and increasing the carbon tax to €100 per tonne by 2030. We find that both policies result in similar emission reductions. Carbon taxation results in lower negative GDP and investment impacts, whereas subsidy removal results in lower negative employment impacts, higher revenues, an improved trade balance and lower debt. The impacts across sectors and households are distributed more evenly under a carbon tax, where subsidy removal results in extreme impacts for specific sectors and households. Excluding households’ subsidies from removal can alleviate these household distributional impacts at no cost to emission reduction. With revenue recycling reducing tax rates, a double-dividend is found at the expense of worsened income distribution. The economic benefit of revenue recycling is greater when removing subsidies than with carbon taxation and results confirm the importance of fossil fuel subsidies in climate policy.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Increased emissions of greenhouse gases (GHGs) generate anthropogenic climate change, characterised by increased temperature, more variability in temperature and precipitation, increased extreme weather events and rising sea levels. Although the exact repercussions of these climatic changes on economies and societies are ambiguous, they are expected to reach at least a 2% annual reduction in global gross domestic product (GDP) for a 2.5 \(^\circ\)C increase in temperature (IPCC 2014). Due to the public good nature of climate change, global cooperation to reduce GHG emissions is needed. To this end, the Paris Agreement was ratified by 195 states and the European Union (EU) in 2015 to limit the increase in global temperature to 2\(^\circ\)C.

After ratifying the Paris Agreement, the EU set its Nationally Determined Contributions (NDCs): at least 40% reduction in GHG emissions (compared to 1990 levels), at least 32% share for renewable energy, and at least 32.5% improvement in energy efficiency. To achieve these targets, the EU introduced an EU-wide carbon allowance market, namely the Emissions Trading System (ETS), covering the emissions of large emitters such as international aviation and large industrial installations. Concerning emissions not covered in the EU ETS (non-ETS emissions), member state governments are responsible for meeting a legally binding emissions target. Ireland’s non-ETS emissions target for 2030 is a 30% decline compared to 2005 levels.Footnote 1

Carbon taxation is at the forefront of the discussions regarding non-ETS emissions reduction policies, where many EU member states have implemented carbon taxation over the past decades to disincentivise the use of fossil fuels not covered by the ETS (e.g. from land transportation and households). Carbon taxation puts a cost on carbon usage and ensures a cost-effective way of reducing emissions while raising revenues (Nordhaus 1993), which can be used to finance other policies. The Irish government introduced a carbon tax in 2009. The level of the carbon tax has been increased annually since 2019 in line with the government’s recent commitment to gradually increase the carbon tax reaching €100 in 2030 (Department of the Taoiseach 2020).

Despite the global commitment to decarbonisation, governments continue to incentivise fossil fuel use through support mechanisms, which have been put in place to assist producers and households. Though these supports have not been developed with the intention of subsidising fossil fuels, effectively, they do. The size of these subsidies is estimated at 6.8% of global GDP in 2020 (Parry et al. 2021), whereas global carbon pricing revenues amounted to a mere 0.07% of global GDP in the same year.Footnote 2 We refer to such supports here as fossil fuel subsidy (FFS) schemes. Political efforts tend to focus more on carbon taxation and green subsidies, where the removal of FFSs remains in the background.

The question then remains whether the removal of FFSs results in higher costs to producers and households compared to carbon taxation, warranting the inertia to remove FFSs. FFSs positively impact those who receive them but keep fossil fuel prices below their efficient levels determined by supply costs, revenue considerations and climate goals. An efficient and effective climate policy would not be complete without an analysis of FFSs and a comparison with carbon taxation, which constitutes the carbon pricing policy in Ireland, as well as around the globe. Literature concerning this issue remains scarce.

This paper analyses the economic and environmental impacts of both the removal of FFSs and increased carbon taxation in Ireland. Applying a dynamic intertemporal computable general equilibrium (CGE) model, namely Ireland Environment-Energy-Economy (I3E), we analyse the removal of eight Irish FFSs. These subsidies include FFSs for production sectors (peat, electricity, air transportation and land transportation); subsidies on energy commodities in the form of reduced excise duties on diesel (auto and marked), fuel oil and kerosene; and household energy allowances. A carbon tax trajectory reaching 100€by 2030 is introduced, and we make a comparison between FFS removal and increased carbon taxation.

This work contributes to the literature in several ways. Firstly, it examines an increase in a carbon tax and the removal of FFSs simultaneously, which has only been assessed in a few cases using a CGE modelling framework. This approach allows us to quantify the impacts of different environmental policy options on the economy, emissions and, more importantly, income distribution across households. Secondly, it distinguishes between FFSs based on the recipients of the subsidy, which allows for the examination of agent-specific implications of subsidy removal. Evaluating each subsidy type separately also allows for excluding particular agents, such as households, from the policy change. Lastly, we consider the impacts of revenue recycling schemes to compensate for the adverse economic consequences of taxation and/or subsidy removal. There are few examples of combining subsidy removal and revenue recycling schemes or compensation options in the literature, and these options are generally designed for a specific sector, e.g. transportation or households. In this paper, however, we analyse options in which the revenues of carbon taxation or subsidy removal are used to lower tax rates of non-subsidised sectors and labour accounts, which has direct repercussions for other producers, households and the government.

The remainder of this paper is structured as follows. Section 2 gives an overview of international FFSs and the current literature on their removal. Section 3 describes the technical details of the I3E model, and Sect. 4 describes the Irish FFSs and scenarios analysed. Section 5, in three subsections, provide the results of the main scenarios 5.1 and revenue recycling options 5.2, and discusses our results in the context of the related literature 5.3. Finally, Sect. 6 concludes.

2 Global Fossil Fuel Subsidies and Related Literature

FFSs are generally put into place to assist specific production sectors or households. Sectoral production subsidies intend to lower the cost of production, which lowers domestic prices and increases national firms’ profits and competitiveness in international markets. Commodity-related subsidies decrease the retail prices of energy commodities by lowering the excise tax burden, which lowers both the costs of production and home heating. Poorer households are supported through subsidies aimed at lowering their home heating costs. Despite these rationales, FFSs generate numerous unintended economic (e.g. discouraging investment in greener technologies), social (e.g. crowding out of public expenditures on infrastructure, health, and education), and environmental (e.g. higher emissions due to overconsumption) consequences (Rentschler and Bazilian 2017). Davis (2014) finds that each US$1 diesel and gasoline subsidy for road transportation generates US$0.4 deadweight loss due to inefficient pricing of these commodities.

In 2009, the G20 emphasised its commitment to “rationalise and phase out over the medium term inefficient FFSs that encourage wasteful consumption” (G20 2009). However, the active response has not tended to match this vocal support. IEA and OECD (2018) evaluate current G20 member states’ efforts to phase out inefficient FFSs. They estimate a decrease of around 18% in subsidies from 2015 to 2016, although large support mechanisms remain. Parry et al. (2021) estimate that global FFSs in 2020 exceeded US$5.9 trillion, representing an increase from the 2015 level, which was US$4.7 trillion, including the costs of environmental and social externalities. The authors further contend that relatively large economic and environmental benefits could have been realised had fuel pricing been set efficiently; in 2025, global carbon emissions could have decreased by 36%, and government revenue could have increased by 3.8% of GDP. Friends of Fossil Fuel Subsidy Reform (2015) claims that global level of FFSs (US$493 billion excluding the environmental and social costs) was almost four times higher than the government’s support for renewables in 2014.

There are two broad categories of FFSs used by both the OECD and the Irish Central Statistics Office (CSO). The first is “budgetary transfers”, which refers to direct funding made available to enterprises or households from a national budget. The second is “tax expenditures”, which is a relative measure indicating a preferential treatment of fossil fuels in the fiscal structure, assessed against a benchmark tax level for other activities and sectors within a country (OECD 2018).

Figure 1 provides the total FFSs-to-GDP ratio for selected countries in 2018, distinguishing between budgetary transfers and tax expenditures, where GDP data is sourced from the UN database.Footnote 3 As can be seen, almost all major economies subsidise fossil fuels, with levels of up to 0.6% of their GDPs. Finland has the highest subsidies-to-GDP ratio, which is 0.17% for Ireland.Footnote 4 In many countries, most fossil fuel support relates to fuel prices and excise rate reductions. However, note that given the variation in fiscal systems and accounting methods in each country, a direct comparison of this measure should be made with a degree of caution.

Carbon taxation is discussed in the literature as a tool to reduce carbon emissions by increasing the price of fossil fuels. There is a strong consensus in the literature that carbon tax reduces emissions and has an environmental benefit. There is also a relative consensus that carbon taxation without additional policies dampens economic activity, decreases the welfare of households, and worsens income distribution.Footnote 5 Furthermore, the literature suggests that additional policies such as revenue recycling through reduced taxation or transfers to households can dampen these impacts and even create a double dividend, where economic activity increases or income distribution improves alongside the environmental benefits. Since the impacts of carbon taxation are widely discussed in the literature, we focus on the impacts of FFSs in the remainder of this section.

The literature on the FFSs is clear that, as with carbon taxation, the removal of FFSs reduces emissions and is beneficial for the environment. However, there are mixed findings regarding the economic impacts of FFSs. Studies find that the removal of FFSs yields increases in GDP (Ellis 2010; Willenbockel and Hoa 2011; Verme and El-Massnaoui 2015), where the positive impact is attributed either to the improvement in the competition across industries (Steenblik and Coroyannakis 1995) or to efficiency gains of resource re-allocation (Dennis 2016). On the other hand, based on the development level and energy intensity of the economy, removing FFSs can reduce GDP and household welfare Jiang and Lin 2014; Wesseh et al. 2016. Not compensating for these negative impacts could be detrimental for some industries or households, where poor households are identified as particularly vulnerable (Rentschler 2016; Adekunle and Oseni 2021). In order to reduce the negative impacts of FFS removal, a partial removal strategy, such as 10% of the total in China (Ouyang and Lin 2014) and a quarter of the total in Indonesia (Dartanto 2013), can be considered. In the case of a one-shot removal strategy, however, even modest fiscal redistribution in the form of cash transfers to households would allow economies to experience positive growth impacts (Cockburn et al. 2017). Besides cash transfers to households, governments can consider supporting domestic production of petroleum products (Siddig et al. 2014), as the largest impacts are found with oil-related subsidies (Jiang and Tan 2013), or increasing public transport infrastructure to make transportation more affordable for poorer households (Henseler and Maisonnave 2018).

It should also be noted that although national efforts are crucial, international coordination of policies is very important. For instance, Aryanpur et al. (2022) show that a five-year delay in removing subsidies on electricity production in Iran can lead to an increase in global energy-related \({{\textrm{CO}}_2}\) emissions by around 0.3%. When subsidy removal is not coordinated across countries, the national positive environmental impacts can turn to be negative globally by dampening competitiveness (Lin and Li 2012) or by generating carbon leakages (Burniaux and Chateau 2014; Jewell et al. 2018). Burniaux and Chateau (2014) argue that fossil fuel importing countries, in general, benefit more in terms of welfare gains than oil-exporting countries in case of a global FFS reform since these countries heavily subsidise fossil fuels. Magné et al. (2014) argue that a globally applied FFS reform would reduce international prices of fossil fuels due to the reduction in their demand, but the reform has substantial adverse impacts on the use of those fuels. Their results also show the importance of the simultaneous introduction of a carbon tax (applied to electricity production and energy-intensive sectors but excludes households) and subsidy removal: the combined impact triples the emission reduction compared to subsidy removal alone.

3 The I3E Model

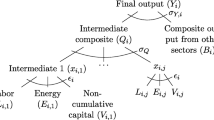

The I3E model is the first fully dynamic, i.e. intertemporal, computable generable equilibrium (CGE) model for the Irish economy. Figure 2 gives an overview of the interlinkages in the I3E model. The technical details of the model economy are provided in de Bruin and Yakut (2021b), and the data sources and the details of the construction process of the energy social accounting matrix (ESAM) are available in de Bruin and Yakut (2021a). The I3E model has a detailed representation of the Irish economy and the associated energy use and emissions. It includes several distinct features that allow for detailed policy results and contributes to the general CGE literature.Footnote 6

The household sector from the national accounts is disaggregated by area of residence and disposable income into ten groups in the model. Such heterogeneity allows for analyses of not only distributional impacts across households based on income but also concerning urban and rural residency. In addition, the labour account is disaggregated into three skill groups, and the composition of wage income of households by skill types is introduced based on the available micro-level data. Moreover, each labour account endogenously allocates its labour supply across sectors by solving a wage income maximisation problem. The model also incorporates international migration to represent the Irish labour market more accurately. All these dynamic features allow the model to distinguish the policy impacts on different labour types and thus on different households. For instance, in the case of the COVID-19 crisis, low-skilled-labour-intensive sectors are affected largely negatively which, in turn, affected poorer households more compared to richer ones. The model economy is amenable to quantifying those impacts across households and labour types without making any alterations in its structure.

Another important feature of the model is the incorporation of the dynamic investment behaviour of firms via dividend maximisation. The intertemporal investment decision of firms allows the I3E model to explore economic dynamics in a more realistic framework. In the absence of such a feature, the model dynamics would rely solely on the consumption smoothing of households. The distinction between ETS and non-ETS emissions of production activities and the explicit modelling of a carbon tax exemption for ETS emissions are other indigenous characteristics of the model’s production sectors. The model allows firms to internalise the changes in the carbon prices (carbon tax and EU ETS price) in a direct and endogenous manner which, in turn, allow them to alter the level and composition of their energy demand.

The government sets tax rates, including the level of the carbon tax, exogenously, but its policy stance plays two important roles in the economy. Firstly, it determines the nominal value of the total welfare budget based on the changes in both the unemployment rate and the consumer price index (CPI). In CGE models, the total welfare budget in nominal terms is generally indexed only to the CPI by keeping its real value constant. However, according to the EUROSTAT and CSO, almost a quarter of the total welfare payments to households are unemployment benefits, which means that the welfare system plays a cushioning role in the case of increased unemployment (Doorley et al. 2021). Secondly, if the government savings-to-GDP ratio deteriorates, i.e. if government dissaves more, the risk premium increases and thus, the difference between the domestic and foreign interest rates widens.

4 Irish Fossil Fuel Subsidies and Scenario Definitions

In this paper, we only consider the eight most significant FFSs in Ireland (Central Statistics Office 2018) for modelling purposes. These eight subsidies constituted approximately 96% of the €2.75 billion worth of FFSs in the Irish economy in 2014, the base year of our model.Footnote 7 In this analysis, 15 scenarios are applied as summarised in Table 1: a baseline, 11 FFS removal scenarios, a carbon tax scenario and two combined carbon tax and subsidy removal scenarios. We do not discuss the results of the scenarios involving the removal of individual subsidies but present these in Appendix D for the interested reader.

Along the baseline business-as-usual (BaU) scenario, the realised changes in international prices and energy policies, which are reflected in the energy balance tables, between the base year (2014) and 2020 are implemented, as well as the impacts of the recent COVID-19 crisis. The changes in the composition of intermediate input demand of electricity production are also introduced.Footnote 8 The realised increase in the carbon tax (from €20 in 2019 to €33.5 in 2021). In addition, declining EU ETS allowances in the third (2013–2020) and fourth phases (2021–2030) and the positive trend in the EU ETS price are also included in BaU. All FFS remain in place in the BaU scenario.

The outbreak of COVID-19 has triggered a global health crisis and a subsequent economic crisis due to the restrictions put in place to limit the spread of the virus. The pandemic is expected to continue to have economic repercussions in the coming decade; the level of Irish real GDP is estimated to be 0.3% lower in 2030, compared to the case of no pandemic (de Bruin et al. 2020). In order to better understand the costs and benefits of any change in environmental policies, the impacts of the COVID crisis should be explicitly taken into account in the BaU scenario, which also includes several changes in the structure of the Irish economy.Footnote 9

Three out of eight subsidies considered in this paper are received by production sectors directly. Removing a sectoral subsidy will increase the sector’s production tax rate which, in turn, increases the cost of production. The Public Service Obligation (PSO) Levy is a flat monthly standing charge aimed at promoting renewable energy, which is applied to electricity users. The proceeds of the levy are subsequently distributed to energy producers to subsidise any shortfall in the price charged to consumers and the international market price of energy. This subsidy applies to the electricity and peat sectors. Moreover, sectoral fuel subsidies are in place for the air and land transportation (hauliers) sectors.Footnote 10

Four of the FFSs concern the government subsidising specific commodities. These subsidies lower the commodity’s tax rate, i.e. the government forgoes tax revenue. In this case, removing the subsidy affects the sales tax rate of the subsidised commodity, which pushes the retail price of the commodity paid by all agents in the economy up. Once the new equilibrium is restored after the shock, the equilibrium price in the market is endogenously determined in the model based on, among others, the supply conditions and the price elasticity of demand. The subsidised commodities in Ireland consist of auto diesel, marked diesel, fuel oil, and kerosene, for which a reduced excise rate is applied.

The final subsidy concerns households in the form of energy allowances paid by the government. This subsidy consists of an electricity allowance, gas allowance, fuel allowance, and other supplements (heating allowance). As the eligibility of these allowances is means-tested (and not related to actual energy usage), we assume that the two lowest quintiles in both areas of residence receive this subsidy. We assume that each of these four RHGs faces an equal decrease in government transfers in real terms. In other words, we lower the amount of the government transfers received by the two poorest rural and two poorest urban quintiles by the sum of the subsidies and then re-calibrate the share parameters of each household group in the total transfers. Hence this subsidy is not on the use of carbon directly and its removal will not directly decrease the incentive to use carbon.

Generally, in the scenarios, the subsidy is removed entirely in 2022. However, for some sectors, the subsidies are extremely high and need to be removed in a gradual manner to avoid excessively large shocks to the sectors. For instance, removing the entire subsidy (€119 million) paid to the peat sector increases the production tax rate by 2,245%, given the initial low net tax rate for the sector. A gradual increase is also implemented for the transportation sectors, as the COVID-19-related containment measures hardest hit these. All other policy variables are assumed to be constant at their BaU calibrated values. In discussing the results, we focus on six scenarios, BaU, FFS, CT, FFS_CT, FFS-HH, and FFS-HH_CT. However, we have also analysed the removal of each of the eight FFSs individually in nine scenarios, and the results of these scenarios are provided in Appendix E.

In the FFS scenario, the combined impacts of removing all subsidies are evaluated. The scenario FFS-HH includes the removal of all subsidies but the energy allowances of households. In the CT scenario, following the new government’s plan, the level of the carbon tax increases by €7.5 annually between 2021 and 2029, then increases by €6.5, reaching €100 in 2030 and remains constant thereafter. FFS_CT assumes that all FFSs are removed, and the carbon tax is increased, and FFS-HH_CT assumes an increased carbon tax and all subsidies except household energy allowances are removed.

In the model (without implementing additional policy measures), the government uses its additional income to finance its expenditures. If its revenues exceed its expenditures, higher public saving reduces the government’s debt stock. However, the policies impact the macroeconomic environment in such a way as to suppress the increase in tax revenues to the degree that the debt stock-to-GDP ratio is adversely affected. To explore the impacts of alternative policies, the results of six additional scenarios are presented in Sect. 5.2. In these scenarios, the Irish government uses its additional income to reduce sectoral production or wage income tax rates.

5 Results and Discussion

5.1 Main Scenarios

5.1.1 Prices

We first discuss price impacts, as price changes drive the behavioural responses in the model, on which the other results depend. Figure 3 shows the percentage change in the consumer price indices (energy, non-energy and overall) in the five main policy scenarios compared to BaU in 2030.

The removal of a FFS directly affects the cost of production or the retail price of the commodity, which was subject to the removed subsidy. The removal of all FFSs (FFS scenario) increases the level of energy prices by 10% in 2030, compared to BaU, Fig. 3a. The carbon tax applies to all energy commodities, leading to a higher energy CPI increase of 18% (CT scenario). In the combined policy option (FFS_CT), energy prices are impacted even more, rising by 30%. As the cost of production increases, so do the prices of non-energy commodities. This effect, however, is dampened by switching demand from domestically produced commodities to imported commodities thanks to the strong trade links of the Irish economy with the rest of the world. The price index of non-energy commodities increases up to 1.9%, Fig. 3b, resulting in an increase in the overall price index of 3.3% in CT, compared to BaU in 2030, Fig. 3c. The exclusion of household’s energy allowances from removal makes the changes in CPIs higher as relatively higher household income puts upward pressure on prices.

Table 2 shows the change in the consumer price-to-producer price ratio in 2030 compared to BaU. No change in this ratio would represent that the financial burden of a policy is shared equally among producers and consumers. An increase in the ratio indicates that the financial burden of the policy change(s) is borne more by consumers, whereas a decrease indicates that producers bear a higher share of the cost. Removing all subsidies will affect the prices of diesel, fuel oil and kerosene.

Here we see a larger increase in consumer prices compared to producer prices (i.e. a positive change in the ratio), conveying that consumers bear more of the costs of the policy. The price ratio for other energy commodities remains virtually unchanged as these commodities did not receive a subsidy. In the CT scenario, we see similar results, where the ratio increases for all energy commodities, with the exception of electricity, which falls under the EU ETS and hence is excluded from carbon taxation. The degree to which the policy costs are passed on to consumers appears to be higher with FFS removal. Overall, the results show that the policy impacts are passed on to consumers, who will bear a larger share of the costs of policies than producers.

5.1.2 Economy-Wide Emissions

The emission results show that both a carbon tax increase and the removal of FFSs have the potential to remove a significant amount of emissions. Figure 4 shows total Irish emissions (ETS and non-ETS, excluding non-combustion agricultural emissions, such as methane) over time for the main scenarios. For the BaU case, the figure shows a decline in emissions in 2020 due to the COVID-19 crisis but steady growth in emissions after 2020.Footnote 11 As can be seen in the figure, the removal of FFSs results in a larger decrease in emissions compared to an increased carbon tax in the short run.

After 2030 (once the carbon tax has reached €100 per tonne), removing FFSs and increasing the carbon tax have similar impacts on emissions reduction (approximately 16% in 2030), where FFS removal results in slightly lower emissions. The combined impact of the two policy options results in substantial emissions reduction (30% in 2030). These results highlight the degree to which fossil fuel usage is being subsidised, where the removal of subsidies leads to slightly lower emissions than the recently developed (and hotly debated) carbon tax trajectory.

The non-ETS emissions target for Ireland is 32.9 million tonnes in 2030, i.e. a 30% reduction compared to 2005 and includes agricultural non-combustion emissions. To compare our emission projections with this target, we include agricultural non-combustion emissions as projected by the Environmental Protection Agency (EPA 2019). Figure 5 depicts the path of non-ETS emissions, the sum of I3E-modelled non-ETS emissions, and EPA-estimated agricultural non-combustion emissions. In the BaU case, total non-ETS emissions will reach 56.3 million tonnes in 2030. Removing all FFSs would reduce this to 51.2 million tonnes, whereas an increased carbon tax would reduce this to 49.4 million. Though the removal of FFSs has higher total emission reduction impacts, a carbon tax has higher non-ETS emissions impacts as the tax only applies to these emissions. Applying both a carbon tax increase and the removal of subsidies reduces non-ETS emissions to 45.3 million tonnes, still falling short of the target, given no further decreases in agricultural non-energy emissions or additional climate policies.

5.1.3 Sectoral Impacts

Table 3 shows the sectoral value added, ETS and non-ETS emissions reduction for aggregate production sectors. Despite the similar impacts of carbon taxation and FFS removal on economy-wide emissions, sectoral emissions reductions differ significantly. These differences are based firstly on the nature of the subsidy, where sector-specific FFSs significantly affect the corresponding sector’s emission more. Secondly, as ETS emissions are exempted from carbon taxation, the coverage of ETS in a sector (the ETS emissions-to-total-emissions ratio) will also factor in.

Among the non-ETS sectors, construction and services-related sectors show a larger emission reduction with a carbon tax than the removal of FFSs. On the other hand, mining (which includes peat production) and agriculture show higher emission reduction when FFSs are removed compared to an increased carbon tax due to the high level of FFSs in place in these sectors, outweighing the non-ETS impact. Manufacturing, other services and transport fall partially under the ETS. Due to the large subsidies for aviation and the diesel rebate scheme, transportation is particularly affected by FFS removal, whereas the former two sectors are impacted more by an increase in the carbon tax. For electricity production, which falls completely under ETS, FFS removal has a higher impact. The increase in the carbon tax has impacts on emissions even for sectors that do not pay high amounts of the carbon tax (i.e. with high ETS coverage) due to price impacts on the sectoral intermediate inputs. If the removal of the subsidies is accompanied by an increase in the carbon tax (FFS_CT), the level of emissions declines further.

Economic impacts on sectors follow the same trends as emission impacts. In terms of value-added, the removal of all FFSs hits the mining, transportation, and electricity production sectors hardest, Table 3. On the other hand, the impacts on the agriculture and manufacturing sectors are very small. The impacts of an increased carbon tax are more evenly spread across sectors, but electricity production, transportation, mining and construction remain the most impacted sectors. When both carbon tax is increased and FFSs are removed, sectors face the highest reduction in value-added. Overall, it is clear that different sectors face very different impacts depending on whether the carbon tax is increased or FFSs removed. In particular, the mining and transportation sectors see significant decreases in value-added with FFS removal. As these sectors benefit significantly from FFSs, their removal could be politically challenging.

5.1.4 Macroeconomic Impacts

As opposed to the similar impacts on economy-wide emission reduction, carbon taxation and FFS removal affect the macroeconomic environment differently. The level of real GDP in 2030 will shrink by 1.6% if all FFSs are removed, whereas by 1.3% when the carbon tax is increased, compared to BaU, Table 4. The joint impact of the two policies will reduce real GDP by 2.8% in 2030, compared to BaU. Since the total level of subsidies is much larger than that of the total carbon tax collection, removing all subsidies leads to a higher increase in the cost of production and hence, a larger decrease in economic activity. Excluding the removal of households’ energy allowances has limited impacts on the macroeconomic environment while it has substantial distributional implications (which will be discussed in the next section).

The removal of subsidies or increase in carbon tax increases domestic energy prices and thus the cost of production which, in turn, lowers the total exports of Irish firms. On the other hand, higher domestic energy prices substantially lower demand for (imported) energy commodities, and the slowdown in economic activity further reduces the overall import demand. As a result, the trade balance and thus its ratio to (nominal) GDP improves in all scenarios, compared to BaU, Table 4. A higher real GDP impact of a policy change increases the trade balance and thus its ratio to GDP. If energy allowances of households are excluded from the removal of subsidies, slightly better overall economic activity and higher household disposable income invoke import demand, and the improvement in the trade-balance-to-GDP slightly drops, compared to FFS.

The lower economic activity also decreases the investment expenditure of Irish firms on sectoral capital stock. The total real investment expenditure decreases more in FFS than in CT, compared to BaU. As the total amount of subsidies is much larger than that of the carbon tax collection along BaU, the removal of all subsidies increases government revenues and leads to a decline in government indebtedness (in nominal terms) despite the decline in economic activity.Footnote 12 However, the decline in economic activity results in an increase in the ratio of the government debt stock-to-GDP by 2.3% compared to BaU in 2030 in the FFS scenario. In the CT scenario, however, the government debt stock (in nominal terms) increases and leads to a slightly higher increase in the debt stock-to-GDP ratio than FFS in 2030. Excluding households’ energy allowances from the subsidy removal policy has negligible impacts on public indebtedness.

Total employment declines in both the CT and FFS scenarios, but the impact is larger in the former. In line with the declines in employment and economic activity, the real wage rate shrinks which, in turn, lowers the real wage income of households and thus net migration to Ireland. The level of aggregate unemployment, as a per cent of the total labour force, increases by up to 2 percentage points in FFS_CT in 2030, compared to BaU. The larger labour market impacts in CT than FFS can be attributed to the Irish economy’s openness and trade composition. In the FFS scenario, labour demand of the main exporter sectors (chemical products and basic pharmaceutical products) increases, whereas it declines in the CT scenario, which, in turn, lowers the employment further and thus increases the unemployment rate,Footnote 13 The exclusion of household allowances from the removal of FFSs has an insignificant impact on the aggregate labour market outcomes.

5.1.5 Household Impacts

An important aspect of any policy is its impact on households, particularly concerning the distribution of impacts across households. A CGE model is unable to reflect the impacts on the within-group size distribution (vertical distribution) of income as all individuals within a household group are assumed to be identical. It can, however, examine the diverse impacts across aggregate household types. Here we examine the impacts on household disposable income. In the I3E model, we distinguish between 10 household types based on income and location (rural vs urban). Rural (urban) households are denoted by r1–r5 (u1–u5), where r1 (u1) is the poorest household and r5 (u5) is the richest. We also display the average of all households in the green bar in Fig. 6.

If the government removes all FFSs, the decline in the average household disposable income will be 1.4%, whereas the exclusion of household energy allowances from a subsidy removal policy reduces this decline to 1.2% in 2030, compared to BaU, see the green bar in Fig. 6. Similarly, CT results in a decrease of 1.1%. If the subsidy removal accompanies an increase in the carbon tax, FFS_CT, the decline in total disposable income reaches 2.5% in 2030, compared to BaU. Although the difference between FFS and CT, on average, is in line with the real GDP impact, these two policy options substantially differ regarding their impacts on income distribution. FFS generates strongly regressive impacts in rural areas. In urban areas, the poorest and richest households are impacted most, whereas middle-income households are less affected. CT, on the other hand, has a more balanced (and progressive) impact across households. The changes in dividend/capital income, transfers, pensions, and income from asset holdings, are uniform across households as the aggregate values are distributed across households based on the fixed shares calibrated based on micro-level data sets. However, the wage income declines regressively in rural and urban areas and drives the impacts of the policy changes on disposable income across households. The main reason for a progressive impact on disposable income is the automatic stabilising role that the welfare transfer structure in the I3E model plays. The government in the model will increase its welfare transfers with respect to the changes in both the unemployment rate and the overall CPI, of which response coefficients are calibrated based on historical data. Transfers are increased across household types in line with their original share of household transfers, which are progressive, where poorer households receive a higher portion of the transfers. In the CT scenario, we saw higher increases in both CPI and unemployment, increasing transfers and hence, the progressivity of the policy.

Though the removal of FFSs is regressive, as shown in Fig. 6, excluding household energy allowances (FFS-HH) reduces the negative income impacts for poorer households dramatically, e.g. from − 6.8% to − 0.7% for the rural poorest. This exclusion corrects the regressivity of the policy to a large extent.

5.2 Additional Policy Intervention: Revenue Recycling

The results presented in previous sections assume that the additional government revenues from increased carbon tax collection and/or reduced FFSs are not earmarked for a specific purpose (recycled) but used to finance government expenditures. With revenue recycling, a carbon tax increase or the removal of FFSs has the potential to both reduce emissions and boost the economy, creating a double dividend. In this section, we examine the economic and environmental impacts of assuming the additional revenues are used to reduce other distortionary taxes (production and wage taxes) in the economy. To this end, we examine six scenarios in which the Irish government recycles either the total carbon tax collection (CT scenarios) or the increased revenues resulting from the removal of FFSs except for households’ energy allowances (FFS-HH scenarios), or the total of the carbon tax revenues and increased revenues due to the removal of FFSs (FFS-HH_CT). Table 5 summarises these scenarios. In the case of additional revenues being used to reduce production taxes, the production tax rates of activities are reduced apart from those activities where subsidies have been removed.

Table 6 compares the percentage changes in macroeconomic variables with and without revenue recycling. When additional revenues are used to reduce other taxes, we see that GDP increases in most cases compared to BaU. In the FFS-HH_WageTax scenario, real GDP increases up to 3.4% in 2030, compared to BaU, which corresponds to a 4.9 percentage point increase compared to the no-revenue recycling scenario (FFS-HH). Such an outcome occurs due to the increase in all households’ real disposable income, which boosts the economy. Recycling revenues to reduce production taxes also boosts GDP but to a lesser degree than reducing wage taxes. There are two driving factors. Firstly, since production tax rates are very low, their elimination generates limited impacts. Secondly, and more importantly, the major sectors of the Irish economy are excluded from the tax reduction scheme as they were recipients of FFSs. Although the boost in the overall economic activity due to the revenue recycling scheme allows these excluded sectors to increase their production, they are still largely negatively affected.

In the absence of revenue recycling, carbon taxation performed better regarding GDP impacts. This remains true for recycling to reduce production taxes. However, when wage taxes are reduced, the removal of FFSs has a much larger (positive) impact than a carbon tax increase (1.2% in CT_WageTax vs. 3.4% in FFS-HH_WageTax). In the FFS-HH_CT_WageTax scenario, the GDP impact is similar to that of a carbon tax increase alone. In other words, adding FFSs removal to a carbon tax policy with a revenue recycling scheme that reduces impacts for households (in this case, reduced wage taxes) will not result in any reduction in GDP.

The last column of Table 6 shows the resulting emission changes compared to BaU in 2030. The revenue recycling scheme does not result in substantial changes in the emission reduction results relative to the no-revenue recycling scenarios. The FFS-HH_WageTax scenario leads to the most significant difference compared to its no revenue recycling counterpart due to the sizeable economic boost generated by the revenue recycling scheme. The results clearly indicate that recycling the carbon tax and/or FFS revenues back to the economy can generate a strong double dividend in the case of Ireland. Emission reduction follows from the substantial reduction in energy demand due to higher prices and the increase in the share of renewables in energy production (4.7% in the FFS-HH and 5.6% in the FFS-HH_CT scenarios, compared to BaU) due to the increase in the cost of electricity production from conventional, i.e. fossil resources. Even in the revenue recycling scenarios, the price impact drives down energy demand such that households become less energy-dependent and devote a larger share of their disposable income to non-energy commodities to maximise their utility. Similarly, as the investment figures show, sectors substitute capital for energy commodities to maximise their dividends, i.e. the value of their firms. In other words, agents are incentivised to reduce emissions but are not made worse off.

Concerning households, in line with the GDP results, the largest improvement in the total household real disposable income is recorded in the FFS-HH_WageTax scenario; a 10.9% increase, compared to BaU, as depicted by the green column in Fig. 7. In this scenario, the government gives almost 7% of its total wage income tax collection to households, compared to BaU.

The revenue recycling scheme reducing production tax rates of selected activities also has positive but negligible impacts on the total household real disposable income. The real disposable income of households in the wage tax reduction scenarios improves in a largely regressive manner, especially across urban resident households. The reason is that the equiproportional decline in the wage tax rates generates the highest impact on the high-skilled labour’s wage tax rate of which richer households hold the majority. Therefore, the increase in the wage income of richer households is larger than that of poorer households. In FFS-HH_CT_WageTax, the increase in real GDP and the average disposable income is lower than that of FFS-HH_WageTax, but it generates a much larger reduction in emissions and hence is more beneficial for the environment.

In conclusion, we find that recycling revenues can lead to both emission reduction and economic benefits. However, this comes at a cost in terms of household distributional impacts, which are regressive. Since the distortion in the income distribution is significant in the revenue recycling scenarios, especially when the government reduces the wage tax rates of labour, it does not seem that the policy option is politically feasible. A more appropriate revenue recycling scheme, including increased transfers to households or a differentiated wage tax reduction across labour skill types, could be designed, which would ensure both positive economic and distributional impacts.

5.3 Results in Context

Here, we try to place our results in the context of the body of literature concerning fossil fuel subsidy reduction and double dividends of environmental policies. As mentioned, literature concerning the impacts of FFS removal is limited. Global studies suggest that removing FSS could result in large economic and emission benefits. Parry et al. (2021)’s estimates based on (constant elasticity) fuel demand functions show that in 2025, global carbon emissions could have decreased by 36%, and government revenue could have increased by 3.8% of GDP if fossil fuels are efficiently priced. On the other hand Jewell et al. (2018), by comparing the results of five integrated assessment models, estimate limited emission impacts of less than 4%, though the authors argue that the annual fluctuations in subsidies are related to the volatility of energy prices rather than a policy change. The reason for the limited decline is that coal, the most carbon-emitting commodity per unit of energy, is subsidised far less than oil, and the subsidy removal shifts the consumption from oil and coal to natural gas rather than to renewables (Jewell et al. 2018; Parry 2018).

The analysis of Burniaux and Chateau (2014) applying a global CGE model shows that if 37 countries remove their FFSs gradually from 2013 to 2020 and governments recycle their raised income to households in a lump sum manner, economic benefits can be found; with welfare (measured by equivalent variation) improving by around 4% in the oil-exporting countries and 1% in the EU. Noi (2012) applying a single country CGE model finds that the removal of FFSs in Viet Nam leads to a 1% increase in real GDP with a 9% reduction in emissions. However, when subsidy removal is accompanied by an increase in the carbon tax under the assumption that the additional government income is used to increase investment expenditures, a 1.5% increase in GDP with a 13.5% reduction in emissions is found. The results are slightly sensitive to the choice of revenue recycling scheme: redirecting the additional income to high-return investment or low-carbon development investment is superior to using those incomes for household transfers or cutting personal and enterprise taxes regarding their impacts on GDP and investment. However, in all scenarios, private consumption decreases due to higher prices. Our results are in line with these limited estimates, where we also find emission reduction with economic benefits when recycling revenue.

Given the lack of CGE analyses of FFS removal, we also compare our results with the CGE literature on carbon taxation double dividend. Maxim et al. (2019) undertake a meta-analysis of CGE studies on the double dividend. It finds that in all CGE studies of EU countries, a strong double dividend is found with revenue recycling.Footnote 14 The double dividends found in the carbon taxation literature range up to 1% of GDP in EU countries (e.g., Ghafour et al. 1983; Pereira et al. 2016; Mayer et al. 2021). Given the larger amount of revenue involved in FFSs, one can argue that FFS removal has the potential to lead to even larger economic benefits than carbon taxation.

In the case of Ireland, Conefrey et al. (2013) find that imposing a €20 carbon tax and recycling revenues to decrease income tax or as lump sum transfers to households would result in a double dividend. Their macroeconomic model results show a decrease in emissions of 1.5% and an increase in GDP of 0.4%. Wissema and Dellink (2010) apply a static CGE model and finds an increase in capital and labour income but a decrease in welfare. Given that the base year of this model was 1998, it is not surprising that our results are different given the developments in the Irish economy since then.

In conclusion, we find, in line with the literature, economic and environmental benefits of FFS removal. The question then arises why, given the benefits, these subsidies have not been removed. We argue that there are several reasons for this. Firstly, the sectors that receive these subsidies have had a strong voice in the political arena, making it politically hard to remove them. Secondly, the limited amount of research on FFS removal means that the view remains that these subsidies are vital for the economy. Finally, Ireland follows a global trend where most countries are reluctant to remove FFS.

6 Conclusion and Policy Implications

Climate policies generally revolve around carbon taxation, and Ireland is no exception to this, where a heated policy debate on carbon taxation has taken place in past years. Recently, the Irish government has committed to an increasing carbon tax trajectory to incentivise the decrease in carbon usage by increasing its costs. However, an alarming amount of fossil fuel subsidies (FFSs) are still in place around the globe, which increases their use through reduced costs. In the case of Ireland, the current magnitude of FFSs is nearly six times greater than that of carbon tax revenues. FFSs and their removal are not given much attention both in policy and economic research at global and national levels. This paper addresses this research gap by investigating the environmental and economic impacts of removing Irish FFSs, comparing these to the impacts of a carbon tax increase by applying an intertemporal computable general equilibrium model for Ireland; the Irish environment-energy-economy (I3E).

Our results show that removing all Irish FFSs has similar emissions reduction impacts as the government’s carbon tax trajectory (reaching €100 by 2030). Each policy option has a similar impact on emissions, and their simultaneous implementation doubles the emission reduction. Though emissions impacts are very similar, the economic impacts of these policies differ. Removing FFSs has a greater negative impact on real GDP and investment than the increased carbon tax since their monetary value is almost six times higher than that of the carbon tax. On the other hand, the removal of FFSs has lower impacts on total employment and public indebtedness since it affects a set of sectors/commodities. Impacts across sectors are more evenly spread under a carbon tax as fossil fuel subsidies target specific sectors or inputs. Hence FFS removal will result in high impacts for specific production sectors. FFS removal leads to larger decreases in disposable income and larger increases in inequality across households, where the poor are hit the hardest. Both the level impacts and the regressivity of this policy can be mitigated by excluding household energy allowances from removal. These allowances have little impact on emissions reductions but lead to significant benefits in terms of disposable income and income distribution.

This paper adds to the discussion on FFS removal and illustrates the significance of both the economic and environmental impacts of FFSs. From a policy perspective, the removal of FFSs will not have significantly greater impacts on the economy than a carbon tax increase, and there is no economic argument for keeping these subsidies in place. The European Union and the Member States have well-defined targets for many aspects of their climate policy, from the share of renewable resources in energy production to the electrification of transportation. The missing element is a clear commitment to how governments should and will phase out the FFSs. This paper’s main conclusion and thus recommendation is that FFS removal must be included in climate action plans and be an integral part of the climate change policy and commitments.

A further policy recommendation of this paper is that governments should recycle their FFSs budget, in addition to their carbon tax revenues, to alleviate the adverse impacts of the policy change on the most vulnerable agents. Recycling revenues can lead to a double dividend both in the case of FFSs removal and carbon taxation. Our results indicate that the majority of the cost of policy change will be passed by producers to households via the changes in purchaser prices. Hence, the results can be used as evidence to support households rather than firms in the case of FFS removal. Using increased revenues to reduce wage tax has the highest positive economic impact. Due to the large FFS budget, recycling this budget leads to the highest positive impacts on the economy. FFS removal, however, generates equiproportional impacts across economic agents and hits specific previously subsidised production sectors and households extremely hard. This makes removing subsidies problematic, meaning additional policies would need to be designed to compensate those negatively affected while still disincentivising fossil fuel usage overall. Given the large economic gains found in our analysis when additional revenues from FFS removal are recycled, there appears to be an amble budget for such additional policies. In this paper, we only consider the exclusion of households’ energy allowances as a means of limiting the adverse impacts of FFS removal on specific groups of people. However, we do not consider any other compensating options for production sectors or households affected by the removal of FFSs. Analysing other revenue recycling options, especially supporting specific sectors, would be a useful exercise in further research.

Though this analysis can provide valuable insights concerning the impacts of FFS removal in Ireland and allow for recommendations to be drawn for the Irish case as well as other countries, there are limitations to this analysis. Firstly, though the I3E model includes international trade, applying a trade model would allow for more detailed insights into the impacts of FFS removal on Irish competitiveness. The second caveat is related to the applied methodology. The main restrictive feature of CGE modelling is working with a representative agent; it assumes that all firms operating in, for instance, the food, beverage and tobacco sector are represented by one sector defined in the model. The same applies to households as well; the poorest rural resident household is representative of all households living in rural areas with a disposable income below a certain level. This assumption does not allow us to quantify the impacts across different households within a group of households. For instance, removing the energy allowances would affect some households more than others, even within a group. We propose excluding these allowances to reduce the negative impacts of the policy change, and the removal of other subsidies has similar impacts across households. Therefore, although we limited the restriction of this assumption to some extent, a micro-simulation analysis fed by our results would provide more insights regarding poverty implications. However, the same does not apply to firms because, depending on the size of the firm operating, for instance, in the land transportation sector, the impacts would be different. Due to the limitation of the methodology applied, our analyses cannot differentiate firms operating in a sector. A partial equilibrium or firm-level analysis should be conducted to better understand the impacts of policy change across firms with different characteristics. Furthermore, this would allow for the explicit modelling of mitigation options. In the cases of the air transportation and electricity production sectors, the oligopolistic market structure should also be taken into account.

Notes

In July 2021, the EU Commission announced a proposal which sets the emission reduction target to 55% in 2030, compared to 1990 levels. The new policy tools announced in the plan, among others, are a minimum tax on aviation fuels, an increase in the linear reduction rate of free ETS allowances of aviation (from 2.2% to 4.2%) starting in 2023 and setting free allowances of the sector to zero by 2026, emissions of the maritime and land transportation sectors become subject to the EU ETS.

Budgetary transfers are payments made by governments to individual recipients and include direct spending, e.g., for specific support programmes and government ownership (fully or through equity shares) of energy-related enterprises. Tax expenditures, on the other hand, are tax concessions that are typically provided through lower rates, exemptions, or rebates of consumption taxes on fossil fuels (mainly value-added taxes and excise taxes) or measures to reduce the cost of the extraction of fossil fuels (including accelerated-depreciation allowances for capital expenditure, investment tax credits, deductions for exploration and development expenses, and preferential capital-gains treatment). For more info, see https://www.oecd.org/fossil-fuels/methodology/.

This data is retrieved from the OECD database on fossil fuel supports, available at https://www.oecd.org/fossil-fuels/data/. It should be noted that, for the same year, CSO data for the total Irish FFSs is €2.4bn, whereas OECD data is €0.57bn. If CSO data is used, Ireland’s ratio of FFSs-to-GDP is 0.74%, making Ireland the country with the highest total FFSs-to-GDP ratio among OECD members.

Appendix A provides a non-technical summary.

For reference, the total FFSs in 2019 (the latest available data) was €2.4 billion (CSO 2019).

We implemented two major changes by using the energy balance tables. The first is the decline in peat supply (production and inventory changes) by 46.2%. The peat-related emissions constituted 10.1% of all \({{\textrm{CO}}_2}\) emissions in Ireland in 2014. The second is the share of renewable resources in total electricity production, which increased from 25.3% in 2014 to 42.1% in 2020 (SEAI 2021). The electricity production from wind makes a significant (70%) contribution among renewable resources and is followed by hydro, biomass, and waste.

Appendix B provides the COVID-related assumptions incorporated along BaU. For further details, see de Bruin et al. (2020).

Some subsidy schemes with a negligible budgetary cost are excluded from our analysis, including a programme for promoting hydrocarbon exploration (PIP 2018), the PSO Air Services Scheme to subsidise two internal flight routes (Lee 2016), Vehicle Registration Tax (VRT) relief for leased cars; general VRT exemptions; and a Disabled Drivers and Disabled Passengers Scheme, related to VRT exemptions for specially-adapted vehicles. In 2014, the total cost of these allocated subsidies was less than €62 million.

As de Bruin et al. (2020) state, since the COVID-19 crisis leads to a circumstantial reduction in emissions, it will be short-lived. For instance, the level of total cumulative emissions in 2040 will be just 3.6 million tonnes lower than its level without COVID.

The carbon tax collection of the government increases along BaU due to both economic growth and higher carbon tax by around 70% cumulatively until 2030. Even if the Irish government keeps the subsidies constant at their 2014 levels, the total subsidy-to-carbon tax collection ratio will be 3.6 in 2030.

More than two-thirds of the domestically produced output of these two sectors were exported in 2014. In the scenario of FFS only the exports of these two sectors are affected positively. See (McQuinn et al. 2020, Box 2) for the contributions of the basic pharmaceuticals production sector during the global financial crisis.

The main reason for the lower prices was the price war between OPEC+ members. As of 13 April 2020, the war seems to have subsided as the members have agreed to cut the oil production by 9.7 million barrels per day (bpd) in May–June. The reduction in daily production will be 7.6 million bpd until the end of the year, and 5.6 million bpd in 2021 Economic Times 2020.

References

Adekunle IA, Oseni IO (2021) Fuel subsidies and carbon emission: evidence from asymmetric modelling. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-12384-0

Aryanpur V, Ghahremani M, Mamipour S, Fattahi M, Gallach’oir BO, Bazilian MD, Glynn J (2022) Ex-post analysis of energy subsidy removal through integrated energy systems modelling. Renew Sustain Energy Rev 158:112116. https://doi.org/10.1016/j.rser.2022.112116

Burniaux JM, Chateau J (2014) Greenhouse gases mitigation potential and economic efficiency of phasing-out fossil fuel subsidies. Int Econ 140:71–88. https://doi.org/10.1016/j.inteco.2014.05.002

Central Statistics Office (2018) Fossil fuel and similar subsidies 2012–2016. https://www.cso.ie/en/media/csoie/releasespublications/documents/rp/fossilfuelandsimilarsubsidies/Fossil_Fuel_and_Similar_Subsidies.pdf

Cockburn J, Robichaud V, Tiberti L (2017) Energy subsidy reform and poverty in Arab countries: a comparative CGE-microsimulation analysis of Egypt and Jordan. Rev Income Wealth 64(S1):S249–S273. https://doi.org/10.1111/roiw.12309

Conefrey T, FitzGerald JD, Valeri LM, Tol RSJ (2013) The impact of a carbon tax on economic growth and carbon dioxide emissions in Ireland. J Environ Plan Manag 56(7):934–952. https://doi.org/10.1080/09640568.2012.709467

CSO (2019) Fossil fuel subsidies. https://www.cso.ie/en/releasesandpublications/er/ffes/fossilfuelsubsidies2019/

Dartanto T (2013) Reducing fuel subsidies and the implication on fiscal balance and poverty in Indonesia: a simulation analysis. Energy Policy 58:117–134. https://doi.org/10.1016/j.enpol.2013.02.040

Davis LW (2014) The economic cost of global fuel subsidies. Am Econ Rev Pap Proc 104(5):581–585. https://doi.org/10.1257/aer.104.5.581

de Bruin KC, Monaghan E, Yakut AM (2020) The environmental and economic impacts of the COVID-19 crisis on the Irish economy: an application of the I3E model. ESRI Research Series 106. Economic and Social Research Institute (ESRI). https://doi.org/10.26504/rs106

de Bruin KC, Yakut AM (2021a) Construction of the energy social accounting matrix for Ireland, v2.0. ESRI survey and statistical report series 108, Economic and Social Research Institute (ESRI). https://doi.org/10.26504/sustat108

de Bruin KC, Yakut AM (2021b) Technical documentation of the I3E model, v4.0. ESRI survey and statistical report series 109. Economic and Social Research Institute (ESRI). https://doi.org/10.26504/sustat109

Dennis A (2016) Household welfare implications of fossil fuel subsidy reforms in developing countries. Energy Policy 96:597–606. https://doi.org/10.1016/j.enpol.2016.06.039

Department of the Taoiseach (2020) Programme for government: our shared future. https://www.gov.ie/en/publication/7e05d-programme-for-government-our-shared-future/

Doorley K, Callan T, Savage M (2021) What drove income inequality in EU crisis countries during the Great Recession? Fisc Stud 42(2):319–343. https://doi.org/10.1111/1475-5890.12250

Economic Times (2020) Oil price war ends with historic OPEC+ deal to cut production. https://economictimes.indiatimes.com/markets/commodities/news/opec-russia-approve-biggest-ever-oil-cut-amid-coronavirus-pandemic/articleshow/75113586.cms

Ellis J (2010) The effects of fossil-fuel subsidy reform: a review of modelling and empirical studies. https://doi.org/10.2139/ssrn.1572397

EPA (2019) Ireland’s greenhouse gas emissions projections 2018–2040. Report, Environmental Protection Agency (EPA)

Freire-González J (2018) Environmental taxation and the double dividend hypothesis in CGE modelling literature: a critical review. J Policy Model 40(1):194–223. https://doi.org/10.1016/j.jpolmod.2017.11.002

Friends of Fossil Fuel Subsidy Reform (2015) Fossil fuel subsidy reform and the communiqué

G20 (2009) G20 leaders statement from the Pittsburgh summit. http://www.g20.utoronto.ca/2009/2009communique0925.html

Ghafour IM, Allan D, Foulds WS (1983) Common causes of blindness and visual handicap in the west of Scotland. Br J Ophthalmol 67(4):209–2013. https://doi.org/10.1136/bjo.67.4.209

Henseler M, Maisonnave H (2018) Low world oil prices: a chance to reform fuel subsidies and promote public transport? A case study for South Africa. Transp Res Part A Policy Pract 108:45–62. https://doi.org/10.1016/j.tra.2017.12.009

IEA and OECD (2018) Update on recent progress in reform of inefficient fossil fuel subsidies that encourage wasteful consumption. Technical report, International Energy Agency (IEA) and Organisation for Economic Co-operation and Development (OECD)

IPCC (2014) Climate change 2014: synthesis report. Contribution of Working Groups I, II and III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change. Intergovernmental Panel on Climate Change, Geneva, Switzerland

Jewell J, McCollum D, Emmerling J, Bertram C, Gernaat DEHJ, Krey V, Paroussos L, Berger L, Fragkiadakis K, Keppo I, Saadi N, Tavoni M, van Vuuren D, Vinichenko V, Riahi K (2018) Limited emission reductions from fuel subsidy removal except in energy-exporting regions. Nature 554:229–233. https://doi.org/10.1038/nature25467

Jiang Z, Lin B (2014) The perverse fossil fuel subsidies in China-the scale and effects. Energy 70:411–419. https://doi.org/10.1016/j.energy.2014.04.010

Jiang Z, Tan J (2013) How the removal of energy subsidy affects general price in China: a study based on input–output model. Energy Policy 63:599–606. https://doi.org/10.1016/j.enpol.2013.08.059

Lee J (2016) Public Service Obligation (PSO) Air Services Routes North and South. https://flyinginireland.com/2016/11/public-service-obligation-pso-air-services-routes-north-and-south/

Lin B, Li A (2012) Impacts of removing fossil fuel subsidies on China: how large and how to mitigate? Energy 44:741–9. https://doi.org/10.1016/j.energy.2012.05.018

Magné B, Chateau J, Dellink R (2014) Global implications of joint fossil fuel subsidy reform and nuclear phase-out: an economic analysis. Clim Change 123:677–690. https://doi.org/10.1007/s10584-013-1030-y

Maxim MR, Zander KK, Patuelli R (2019) Green tax reform and employment double dividend in European and non-European countries: a meta-regression assessment. Int J Energy Econ Policy 9(4):342–355. https://doi.org/10.32479/ijeep.7776

Mayer J, Dugan A, Bachner G, Steininger KW (2021) Is carbon pricing regressive? Insights from a recursive-dynamic CGE analysis with heterogeneous households for Austria. Energy Econ. https://doi.org/10.1016/j.eneco.2021.1056

McQuinn K, O’Toole C, Allen-Coghlan M, Coffey C (2020) Quarterly economic commentary. ESRI forecasting series summer 2020, Economic and Social Research Institute (ESRI). https://doi.org/10.26504/qec2020sum

Noi H (2012) Fossil fuel fiscal policies and greenhouse gas emissions in Vietnam. Technical report, UNDP

Nordhaus W (1993) Reflection on the economics of climate change. J Econ Perspect 7(4):11–25. https://doi.org/10.1257/jep.7.4.11

OECD (2018) OECD-IEA fossil fuel support and other analysis—methodology. https://www.oecd.org/fossil-fuels/methodology/

Ouyang X, Lin B (2014) Impacts of increasing renewable energy subsidies and phasing out fossil fuel subsidies in China. Renew Sustain Energy Rev 37:933–42. https://doi.org/10.1016/j.rser.2014.05.013

Parry I (2018) Fossil-fuel subsidies assessed. Nature 554:175–176. https://doi.org/10.1038/d41586-018-01495-3

Parry I, Black S, Vernon N (2021) Still not getting energy prices right: a global and country update of fossil fuel subsidies. Working paper WP/21/236, International Monetary Fund

Pereira AM, Pereira RM, Rodrigues PG (2016) A new carbon tax in Portugal: a missed opportunity to achieve the triple dividend? Energy Policy 93:110–118. https://doi.org/10.1016/j.enpol.2016.03.002

PIP (2018) Petroleum infrastructure programme. https://www.pip.ie/page/1

Rentschler J (2016) Incidence and impact: the regional variation of poverty effects due to fossil fuel subsidy reform. Energy Policy 96:491–503. https://doi.org/10.1016/j.enpol.2016.06.025

Rentschler J, Bazilian M (2017) Reforming fossil fuel subsidies: drivers, barriers and the state of progress. Clim Policy 17(7):891–914. https://doi.org/10.1080/14693062.2016.1169393

SEAI (2021) Energy balances since 1990. https://www.seai.ie/publications/Energy-Balances-1990-2020-(1st-October-2021).xlsx

Siddig K, Aguiar A, Grethe H, Minor P, Walmsley T (2014) Impacts of removing fuel import subsidies in Nigeria on poverty. Energy Policy 69:165–178. https://doi.org/10.1016/j.enpol.2014.02.006

Steenblik RP, Coroyannakis P (1995) Reform of coal policies in western and central Europe: implications for the environment. Energy Policy 23(6):537–553

Takeda S, Arimura T (2021) A computable general equilibrium analysis of environmental tax reform in Japan with a forward-looking dynamic model. Sustain Sci 16:503–521. https://doi.org/10.1007/s11625-021-00903-4

Timilsinas GR (2018) Where is the carbon tax after thirty years of research? Policy research working paper, 8493, The World Bank

Verme P, El-Massnaoui K (2015) An evaluation of the 2014 subsidy reforms in Morocco and a simulation of further reforms. Policy research working paper 7224, World Bank Group

Wesseh PKJ, Lin B, Atsagli P (2016) Environmental and welfare assessment of fossil-fuels subsidies removal: a computable general equilibrium analysis for Ghana. Energy 116:1172–9. https://doi.org/10.1016/j.energy.2016.10.053

Willenbockel D, Hoa HC (2011) Fossil fuel prices and taxes: effects on economic development and income distribution in Vietnam. Technical report, Institute of Development Studies at the University of Sussex (UK)

Wissema W, Dellink R (2010) AGE assessment of interactions between climate change policy instruments and pre-existing taxes: the case of Ireland. Int J Glob Environ Issues 10:46–62. https://doi.org/10.1504/IJGENVI.2010.042091

Xu J, Wei W (2021) Would carbon tax be an effective policy tool to reduce carbon emission in China? Policies simulation analysis based on a CGE model. Appl Econ 10(1080/00036846):2021

Acknowledgements

The research carried out in this paper was funded by the Department of Environment, Climate and Communications (DECC) and is part of an ongoing modelling project.

Funding

Open Access funding provided by the IReL Consortium. Department of Environment, Climate and Communications, Dr. Kelly Chloe de Bruin.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A Model Economy in a Nutshell

This section describes the agents defined in the model in a non-technical manner.

1.1 A.1 Households

The household sector consists of ten representative Ramsey-type household groups (RHGs) based on area of residence (urban and rural) and disposable income. Households choose the optimal level of composite consumption by maximising their utilities subject to their budget constraint. The budget constraints of RHGs equate the disposable income—the sum of wage income, dividend income, welfare transfers and pension income from the government, and asset income from foreign asset holdings—to the sum of total consumption expenditures and savings. The composition of disposable income across income items is retrieved from the Survey on Income and Living Conditions (SILC), and the composition of consumption expenditures by commodities are calibrated using the Household Budget Survey (HBS). All households in the survey are are divided into groups by equal size.

1.2 A.2 Production Sectors and Commodities

There are 37 representative activities/firms which represent the main producers in the Irish economy regarding value-added, labour demand, and sectoral emissions. Thirty-three out of 37 activities determine the level of physical investment by maximising the value of the firm in an intertemporal manner. A share of combustion-related emissions in some sectors are subject to the EU ETS legislation, and these sectors are exempted from paying the Irish carbon tax on their ETS emissions. The I3E model has an explicit representation of the ETS: each activity pays the same purchaser, i.e. retail, price to buy an energy commodity but the final cost of unit demand is a function of the EU ETS price, which is an exogenous variable, and the activity-specific ETS coverage, free allowances, and carbon tax exemptions. The main data source for sectoral interlinkages is the Supply and Use Tables (SUTs) provided by the CSO. The Labour Force Survey (LFS) is used to disaggregate the sectoral labour demand into types of labour.

There are 42 commodities in the model of which 11 are energy/carbon commodities: peat, coal, natural gas, diesel, gasoline, kerosene, LPG, crude oil, fuel oil, other petroleum products and electricity. Firms can produce multiple products by solving a revenue maximisation problem. Total final demand is met by domestically produced commodities and imported commodities, which are assumed to be imperfect substitute of each other.

1.3 A.3 Labour

The model includes low-, medium- and high-skilled labour. The SILC and LFS are utilised to get the compositions of wage income of households and labour demand of sectors, respectively. In order to better model the dynamics of the Irish labour market, the I3E model also includes international migration and involuntary unemployment. The level of net migration is a function of per employee net-of-tax real wage income differential between Ireland and the rest of the world. Higher domestic economic activity increases wage income and attracts more people to migrate to Ireland. Higher net migration increases the supply of labour and lowers wage rates and allows Irish firms to hire more employees without further increase in labour costs. As half of immigrants are high-skilled labour (according to LFS data), the increase in migration affects the high-skilled labour more, which in turn, puts downward pressures on the wage rates of the other labour types as labour types are imperfect substitutes.

1.4 A.4 Government

The government collects direct taxes on labour incomes and sectoral profits (corporate tax), indirect taxes on sales of commodities, a carbon tax on energy commodities, an export tax on exported electricity, a production tax on production activities, and half the ETS permit costs as per EU legislation. The carbon tax, which is exogenously determined by the government, is implemented as a fixed price of per-tonne equivalent of carbon and collected on the domestic consumption of energy commodities. The government allocates its total revenue to the consumption of commodities, welfare transfers (dependent on CPI and unemployment levels) and pension payments to households (dependent on CPI), and interest payments over the outstanding foreign debt stock. The difference between total revenues and expenditures of the government is public saving, which drives changes in the foreign debt stock, i.e. as public saving increases (decreases), the government debt stock becomes lower (higher).

1.5 A.5 Equilibrium

As a dynamic model, the equilibrium in I3E is characterised by both intratemporal and intertemporal equilibrium. The former requires that there is no excess demand (or supply) in all markets, i.e. the Walras law holds in every period. In other words, demand and supply in all markets, including factor markets are equal to each other. The intertemporal equilibrium, on the other hand, is achieved by imposing the following restrictions on the terminal period.

where \(DIV_{DM,T}\) is the amount of dividend of a dividend maximiser (DM) firm in the terminal period T, \(DR_T\) is the domestic interest rate, grw is the economic growth rate along the balanced growth path, \(q_{DM,T}\) is the Tobin’s q, \(FD_{DM,K,T}\) is the capital demand of firm, \(PSI_{A,T}\) is the pyhsical investment of activity A, \(\delta _{A,T}\) is the depreciation rate of physical capital, \(GSAV_{T}\) is the government savings (the difference between its revenues and expenditures), \(BF_T\) is the foreign asset holdings of the Irish economy, \(FBOR_T\) is the foreign borrowing, and \(rf_T\) is the foreign interest rate.

The equations given above imply that the four variables (the value of firm, capital stock, government debt stock, and foreign asset holdings) that govern the model’s intertemporal dynamics must remain constant in the terminal period. For instance, Eq. A.3 is the transversality, i.e. insolvency constraint on the government indebtedness: if the government has a positive debt stock, the terminal period’s budget surplus must be equal to its interest payment over the existing debt stock.

Appendix B Assumptions for 2020 and 2021

The COVID-19 pandemic has led to changes in the structure of the economy in several aspects. These realisations are incorporated, and it is assumed that all those changes will be 50% effective in 2021 as the country was in the lockdown during the first half of the year. In this respect, all structural variables of the Irish economy will go back to their original values, which have been calibrated by using the Irish ESAM, in 2022.