Abstract

We investigate whether and how government fiscal squeeze affects local firms’ pollution emissions. To establish causality, we introduce a policy shock in China, namely, the canceling of agricultural taxes in 2005, to document that governments’ fiscal squeeze due to sudden tax decreases substantially increases local firms’ emission by approximately 4%. Mechanism analyses show that local fiscal squeeze result in aggravating pollution emissions through inducing the reduction of firms’ efforts on green innovation and abatement activities. Cross-sectionally, the effects of local government fiscal squeeze on pollution emissions are mitigated by environmental regulation, marketization development, but strengthened by firm financial pressure.

Similar content being viewed by others

Notes

The share of agricultural tax on total fiscal revenue is 13.5% among the 2,945 counties on average. Panel B of Table 1 represents further details.

The data of CESD is from China Environment Yearbook, China Statistical Yearbook, China City Yearbook, provincial and municipal environmental Yearbook bulletins, national environmental statistics bulletins, and China Environmental Observatory.

The history of agricultural taxation in China can be traced back to the “Initial Tax-levy Cropland” implemented by the State of Lu during the Spring and Autumn Periods (594 BC). The agricultural tax system actually included agricultural tax, tax on special agricultural products, and livestock tax.

Official website of the Ministry of Agriculture of the People’s Republic of China: http://jiuban.moa.gov.cn/fwllm/jjps/200209/t20020919_5207.htm.

Before the 1980s, most agricultural products could not be traded in the free market, and the government used a system of expropriation to extract large amounts of agricultural surplus. The dark tax was five times as much as the open tax.

Official website of the Central Government of the People’s Republic of China: http://www.gov.cn/govweb/fwxx/sh/2005-12/20/content_131709.htm.

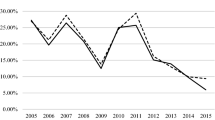

On the basis of Chen (2017), we conduct further investigation of firm tax burden after the abolition of agricultural taxes. In response to fiscal squeeze, local governments have managed to increase their revenue or explore alternative revenue sources to maintain existing public services. To compensate, stricter enforcement of tax laws is implemented (Chen 2017). One consequence of nurturing agriculture with industry is that revenue pressure on governments is passed on to industrial enterprises via tax enforcement. The actual tax burden interferes with resource allocation decisions in firm operation, and firms are less likely to pay additional cost for emission reduction. As shown in Appendix 4, the overall tax burden on businesses has increased by approximately 6.2%. Meanwhile, the proportion of tax costs to total assets has increased by 0.5%. These results implies that the fiscal stress are transferred to local firms, which may induce the changes in firm pollutant emission decisions.

SIPO includes information of patents International Patent Classification (IPC) code, agent, applications’ number, date, patent title, applicant name and location. SIPO had recorded innovation patent applications from domestic and foreign individuals, firms, and institutions since the first Chinese patent law was enforced in 1985.

First, we identify each patent’s IPC code information from SIPO. Second, we collect the information for the IPC codes under IPC Green Inventory, which is classified by WIPO from the website: https://www.wipo.int/classifications/ipc/en/green_inventory/ IPC Green Inventory specified the IPC code classifications that are related to environmentally sound technologies listed by the United Nations Framework Convention on Climate Change. Finally, we define a patent as the green patent if its IPC code is under seven categories of the IPC Green Inventory. These categories are as follows: alternative energy production, transportation, energy conservation, carbon capture and storage, nuclear power generation, reuse of waste materials, and administrative regulation.

Variable DID2 takes the value of one if the city wherein the industrial company is located has been affected by the government fiscal squeeze.

Variable Rate_DID2 is the interaction item between the proportion of agricultural taxes in the fiscal revenue of a city-level government in 2004 and the time indicator Post.

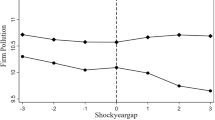

We examined whether the abolition of the agricultural tax has increased the fiscal imbalance (on/off budget gap) as a supplement to analyze the relationship between potential fiscal stress and agricultuaral tax reform. Specifically, we use the difference between fiscal expenditure and fiscal revenue (standardized by gross product or fiscal revenue) as the proxy of fiscal on/off budget gap according to previous studies (Ding et al. 2014; Jia et al. 2014; Liu 2018; Li and Du 2021). The regression model is as follows:

$$Fiscal\,gapl\,indocator{s}_{c,t}=\alpha +{\beta }_{1}DI{D}_{i,t}+{X}_{c,t}\Theta +CountyFE+YearFE+{\varepsilon }_{i,t}$$(A1)In Model A1, c denotes county, t denotes year. Dependent variable Fiscal stress indicators are FiscalStress1, FiscalGap2, FiscalGap3, and FiscalGap4. FiscalGap1 = (real total fiscal expenditure—real total fiscal tax revenue)/real total fiscal tax revenue. FiscalGap2 = (real total fiscal expenditure—real total fiscal tax revenue)/ total gross product. FiscalGap1 = (total budgetary fiscal expenditure—total budgetary fiscal tax revenue)/ total budgetary fiscal tax revenue. FiscalGap2 = (total budgetary fiscal expenditure—total budgetary fiscal tax revenue)/ total output value. X is the set of control variables as follows: LnGDP is the natural logarithm of the GDP of a county in a year. LnSalary is the natural logarithm of the average salary of a county in a year. SecRatio is the ratio of the output value of the secondary industry in the total output value of a county in a year. Urbanize is the ratio of urban to rural population. Density denotes population density (the unit is ten thousand people/square kilometers). In this specification the dependent variable is the gap of fiscal expenditure and revenue, and the independent variable is DID, which denotes whether the has been affected by the government fiscal squeeze arising from the abolition of the agricultural tax. All coefficients of DID is positively significant at 5% or 1% level, indicating that that the cancellation of agricultural tax does cause fiscal stress to local governments.

In Appendix 3, we also conduct alternative exclusion tests to support our main findings.

The Two-Control-Zones Policy is promoted by the State Council and implemented by the State Environmental Protection Agency, and is less likely to be interfered by local governments at the provincial, municipal, or county levels. Further details in the website of Ministry of Ecology and Environment of the People's Republic of China:http://www.mee.gov.cn/gkml/zj/wj/200910/t20091022_172231.htm.

Sixteen industries are identified as heavy pollution industries, including thermal power, iron and steel, cement, electrolytic aluminum, coal, metallurgy, chemical industry, petrochemical industry, building materials, paper making, brewing, pharmaceutical, fermentation, textile, tanning, and mining.

References

Bai J, Lu J, Li S (2019) Fiscal pressure, tax competition and environmental pollution. Environ Resource Econ 73(2):431–447

Bansal S, Gangopadhyay S (2003) Tax/subsidy policies in the presence of environmentally aware consumers. J Environ Econ Manag 45(2):333–355

Becker RA, Pasurka C Jr, Shadbegian RJ (2013) Do environmental regulations disproportionately affect small businesses? J Environ Econ Manag 66(3):523–538

Beltman JB, Hendriks C, Tum M, Schaap M (2013) The impact of large scale biomass production on ozone air pollution in Europe. Atmos Environ 71:352–363

Bertrand M, Mullainathan S (2003) Enjoying the quiet life? Corporate governance and managerial preferences. J Polit Econ 111(5):1043–1075

Blanchard O, Erceg CJ, Lindé J (2017) Jump-starting the euro-area recovery: would a rise in core fiscal spending help the periphery? NBER Macroecon Annu 31(1):103–182

Bovenberg AL, De Mooij RA (1994) Environmental levies and distortionary taxation. Am Econ Rev 84(4):1085–1089

Brandt L, Van Biesebroeck J, Wang L, Zhang Y (2017) WTO accession and performance of chinese manufacturing firms. American Econ Rev 107(6):2784–2820

Chen SX (2017) The effect of a fiscal squeeze on tax enforcement: evidence from a natural experiment in China. J Public Econ 147:62–76

Chen Y, Jin GZ, Kumar N, Shi G (2013) The promise of Beijing: evaluating the impact of the 2008 olympic games on air quality. J Environ Econ Manag 66(3):424–443

Chen Z, Kahn ME, Liu Y, Wang Z (2018) The consequences of spatially differentiated water pollution regulation in China. J Environ Econ Manag 88:468–485

Chu J, Fang J (2020) Economic policy uncertainty and firms’ labor investment decision. Chin Financ Rev Int 11:73–91

Ding C, Niu Y, Lichtenberg E (2014) Spending preferences of local officials with off-budget land revenues of Chinese cities. China Econ Rev 31:265–276

Deng Y, Wu Y, Xu H (2020) Political connections and firm pollution behaviour: an empirical study. Environ Resource Econ 75(4):867–898

Fan G, Wang X, Zhu H (2011) NERI index of marketization of China’s provinces 2011 report. Economic Sciences Press, Beijing, China

Forslid R, Okubo T, Ulltveit-Moe KH (2018) Why are firms that export cleaner? J Environ Econ Manag 91:166–183

Fullerton D, Kim SR (2008) Environmental investment and policy with distortionary taxes, and endogenous growth. J Environ Econ Manag 56(2):141–154

Hart SL, Ahuja G (1996) Does it pay to be green? An empirical examination of the relationship between emission reduction and firm performance. Bus Strateg Environ 5(1):30–37

He G, Wang S, Zhang B (2020) Watering down environmental regulation in China. Q J Econ 135(4):2135–2185

Hettige H, Mani M, Wheeler D (2000) Industrial pollution in economic development: the environmental Kuznets curve revisited. J Dev Econ 62(2):445–476

Jia J, Guo Q, Zhang J (2014) Fiscal decentralization and local expenditure policy in China. China Econ Rev 28:107–122

Jia J, Shao L, Sun Z, Zhao F (2020) Corporate cash savings and discretionary accruals. Chin Financ Rev Int 10:429–445

Jouvet PA, Michel P, Rotillon G (2005) Optimal growth with pollution: how to use pollution permits? J Econ Dyn Control 29(9):1597–1609

Kahn ME, Li P, Zhao D (2015) Water pollution progress at borders: the role of changes in China’s political promotion incentives. Am Econ J Econ Pol 7(4):223–242

Kong D, Qin N (2021) Does Environmental regulation shape entrepreneurship? Environ Resource Econ 80(1):169–196

Laffont JJ, Tirole J (1996) Pollution permits and environmental innovation. J Public Econ 62(1–2):127–140

Li L, Liu Q, Wang J, Hong X (2019) Carbon information disclosure, marketization, and cost of equity financing. Int J Environ Res Public Health 16(1):150

Li T, Du T (2021) Vertical fiscal imbalance, transfer payments, and fiscal sustainability of local governments in China. Int Rev Econ Financ 74:392–404

Liu Z, Shen H, Welker M, Zhang N, Zhao Y (2021) Gone with the wind: an externality of earnings pressure. J Account Econ 72:101403

Liu M, Tan R, Zhang B (2021) The costs of “blue sky”: Environmental regulation, technology upgrading, and labor demand in China. J Dev Econ 150:102610

Liu Y (2018) Government extraction and firm size: local officials’ responses to fiscal distress in China. J Comp Econ 46(4):1310–1331

López R, Galinato GI, Islam A (2011) Fiscal spending and the environment: theory and empirics. J Environ Econ Manag 62(2):180–198

Iqbal S, Bilal AR (2021) Energy financing in COVID-19: how public supports can benefit? Chin Financ Rev Int. https://doi.org/10.1108/CFRI-02-2021-0046

Macho-Stadler I, Perez-Castrillo D (2006) Optimal enforcement policy and firms’ emissions and compliance with environmental taxes. J Environ Econ Manag 51(1):110–131

Newell P (2008). The marketization of global environmental governance. The crisis of global environmental governance: towards a new political economy of sustainability, London: Routledge, pp. 77–95.

Petersen MA (2009) Estimating standard errors in finance panel data sets: comparing approaches. Rev Financ Stud 22(1):435–480

Popp D (2006) International innovation and diffusion of air pollution control technologies. J Environ Econ Manag 51(1):46–71

Salike N, Huang Y, Yin Z, Zeng DZ (2021) Making of an innovative economy: a study of diversity of Chinese enterprise innovation. Chin Financ Rev Int. https://doi.org/10.1108/CFRI-10-2020-0135

Song M, Zhu S, Wang J, Wang S (2019) China’s natural resources balance sheet from the perspective of government oversight. J Environ Manag 248:109232

Stranlund JK, Murphy JJ, Spraggon JM, Zirogiannis N (2019) Tying enforcement to prices in emissions markets. J Environ Econ Manag 98:102246

Van der Kamp D, Lorentzen P, Mattingly D (2017) Racing to the bottom or to the top? Decentralization, revenue pressures, and governance reform in China. World Dev 95:164–176

Wang X, Fan G, Yu J (2017) Marketization index of China’s provinces: NERI report 2016. Social Sciences Academic Press, Beijing, China

Zhang Q, Yu Z, Kong D (2019) The real effect of legal institutions: Environmental courts and firm environmental protection expenditure. J Environ Econ Manag 98:102254

Acknowledgements

We thank Bing Zhang (the co-editor), two referees, Shasha Liu, Gaowen Kong, Jian Zhang, Qi Zhang, Yanan Wang, and seminar participants at Fudan University, Huazhong University of Science and Technology, Jinan University, Sun Yat-sen University, Tongji University, Wuhan University, Xiamen University, and Zhongnan University of Economics and Law for helpful comments. We acknowledge the financial support of the National Natural Science Foundation of China (grant no. 71772178; 71991473) and the Major Project of National Social Science Foundation of China (Grants: 21ZDA010). Dongmin Kong and Ling Zhu contributed equally to this study. All errors are our own.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1: Variable Definition

This table provides detailed definition for all the variables used in the analysis. Variables are categorized into three groups, namely, (1) emissions of the pollutants, (2) fiscal squeeze, and (3) firm characteristics.

Variable | Definition | Source |

|---|---|---|

Emissions of the pollutants | ||

LnSO2 | Natural logarithm of the SO2 emissions of a firm in a year. The SO2 emission is measured in kilogram | PIFD |

LnGas | Natural logarithm of the waste gas emissions of a firm in a year. The waste gas emission is measured in 10,000 cubic meters | PIFD |

LnSoot | Natural logarithm of the soot emissions of a firm in a year. The soot emission is measured in kilogram | PIFD |

Fiscal squeeze | ||

Treat | Government fiscal squeeze indicator, dummy variable Treat equals to one if the proportion of agricultural tax in the fiscal revenue of county-level government in year 2004 is above the median level, otherwise, 0 | Manual collection |

RateTreat | The proportion of agricultural tax in the fiscal revenue of county-level government in year 2004 | Manual collection |

Treat2 | Government fiscal squeeze indicator, dummy variable Treat2 equals to one if the proportion of agricultural tax in the fiscal revenue of city-level government in year 2004 is above the median level, otherwise, 0 | Manual collection |

RateTreat2 | The proportion of agricultural tax in the fiscal revenue of city-level government in year 2004 | Manual collection |

Post | Time indicator, dummy variable Post equals one after the agricultural tax is cancelled (the year after or in 2006), otherwise, 0 | Manual collection |

DID | The interaction term between Treat and Post | |

Rate_DID | The interaction term between RateTreat and Post | |

DID2 | The interaction term between Treat2 and Post | |

Rate_DID2 | The interaction term between RateTreat2 and Post | |

Firm Characteristics | ||

GreenInnov_t1 | Natural logarithm of the total green patent applications plus one of a firm in year t + 1. We use IPC code to identify the green patent according to the IPC Green Inventory issued by World Intellectual Property Organization (WIPO) | SIPO |

GreenInnov_t2 | Natural logarithm of the total green patent applications plus one of a firm in year t + 2. We use IPC code to identify the green patent according to the IPC Green Inventory issued by World Intellectual Property Organization (WIPO) | SIPO |

DisPollutant | The ratio the ratio of total expense on pollutant abatement over total assets of a firm in a year | PIFD |

DisSO2 | The amount of sulfur dioxide removed divided by the amount of sulfur dioxide produced of a firm in a year. The amount of sulfur dioxide is measured in kilogram | PIFD |

LnTax | Natural logarithm of the total tax of a firm in a year | NBS |

Tax_Asset | The ratio of total added-value tax over total assets of a firm in a year | NBS |

ROA | The ratio of total profits over total assets of a firm in a year | NBS |

ROE | The ratio of total profits over total capital of a firm in a year | NBS |

AllSale | Natural logarithm of the total sales of a firm in a year | NBS |

Age | Natural logarithm of firm age measured as the number of years since its establishment | NBS |

Size | Natural logarithm of the total assets | NBS |

Staff | Natural logarithm of the number of employees of a firm in a year | NBS |

Leverage | The ratio of total liabilities to total assets | NBS |

State | A dummy variable that equals one if firm’s state-owned paid-in capital that exceeds 50% of total capital or its majority shareholder is a state-owned firm, and 0 otherwise | NBS |

Capital | The ratio of fixed assets and the number of employees of a firm in a year | NBS |

Appendix 2: Alternative measurement of fiscal squeeze shock

Note. This estimates the effects of agricultural tax reform on pollution through using the measurement of fiscal squeeze estimated by Chen’s approach (Chen 2017). As the fiscal revenue and agricultural tax revenue information of prefecture-level cities and counties from NPCCFSY has not been disclosed since 2007, we do not use Chen’s approach to construct the proxy of fiscal squeeze. In Panel A, the sample period is 2000–2011. In Panel B, the sample period is 2000–2007. The dependent variables are as follows: LnSO2 is the natural logarithm of the SO2 emissions of a firm in a year. LnGas is the natural logarithm of the waste gas emissions of a firm in a year. LnSoot is the natural logarithm of the soot emissions of a firm in a year. The core independent variable is Shock*Post, which is the interaction term between Shock and Post. Shock is given by the following equation:

where AgrTaxc,2000–2004 denotes the average agricultural tax revenue of county c from 2000 to 2004 before the abolition of agricultural tax, Subsidyc,2000–2004 is the average amount of subsidies for rural tax reform from 2000 to 2004, Revenuec,2000–2004 is the average tax revenue from 2000 to 2004. Similarly, Subsidyc,2005–2007 is the average amount of subsidies for rural tax reform from 2005 to 2007 after the abolition of agricultural tax, Revenuec,2005–2007 is the average tax revenue from 2005 to 2007. Shock is the degree of fiscal shock due to the agricultural tax reform. Post is the time indicator, which equals one after the agricultural tax is cancelled (the year after or in 2006), otherwise, 0. All control variables are consistent with baseline results shown in Table 1. All regressions control for the firm, industry-year and province-year fixed effects. All standard errors are corrected for clustering at the province and year level. T-statistics are reported in parentheses. *, **, and *** indicate significance at the 10%, 5%, and 1% level, respectively. All related variables are defined in Appendix 1.

(1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

LnSO2 | LnSO2 | LnGas | LnGas | LnSoot | LnSoot | |

Panel A: All sample | ||||||

Shock*Post | 0.047*** (3.10) | 0.047*** (3.14) | 0.030** (2.31) | 0.030** (2.35) | 0.080*** (3.55) | 0.081*** (3.59) |

Controls | No | Yes | No | Yes | No | Yes |

Firm FE | Yes | Yes | Yes | Yes | Yes | Yes |

Industry*Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

Province*Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

N | 264744 | 264744 | 261963 | 261963 | 226826 | 226826 |

Adj. R 2 | 0.846 | 0.848 | 0.893 | 0.895 | 0.823 | 0.825 |

Panel B: Sub-Sample | ||||||

Shock*Post | 0.064*** (3.05) | 0.062*** (3.01) | 0.042* (1.90) | 0.039* (1.82) | 0.095*** (3.04) | 0.094*** (3.06) |

Controls | No | Yes | No | Yes | No | Yes |

Firm FE | Yes | Yes | Yes | Yes | Yes | Yes |

Industry*Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

Province*Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

N | 172586 | 172586 | 170670 | 170670 | 156207 | 156207 |

Adj. R 2 | 0.857 | 0.859 | 0.909 | 0.911 | 0.835 | 0.836 |

Appendix 3: Alternative Exclusion Tests

Note. This table presents the results of alternative exclusion tests. Column 1 shows the result of a placebo test taking into account the interference caused by China’s accession to the World Trade Organization (WTO). The sample period is from year 2000 to year 2004 (the period before real agricultural tax reform). Column 2 represents the result estimated by excluding confounding factors from the financial crisis after 2008. Correspondingly, the sample period is from year 2000 to year 2008. The dependent variable LnSO2 is the natural logarithm of the SO2 emissions of a firm in a year. FakeEventDID2 is an indicator variable which equals to 1 if the counties where the industrial company is located have been affected by the government fiscal squeeze after pseudo-event-window (in year 2001). DID denotes whether the county in which the industrial company is located has been affected by the government fiscal squeeze. All control variables are consistent with baseline results in Table 1. All regressions control for the firm, industry-year and province-year fixed effects. Heteroskedasticity-robust standard errors are in parentheses. T-statistics are reported in parentheses. *, **, and *** indicate significance at the 10%, 5%, and 1% level, respectively. All related variables are defined in Appendix 1.

Dep. Var | (1) | (2) |

|---|---|---|

LnSO2 | LnSO2 | |

FakeEventDID2 | 0.011 (0.64) | |

DID | 0.032** (1.99) | |

Controls | Yes | Yes |

Firm FE | Yes | Yes |

Industry*Year FE | Yes | Yes |

Province*Year FE | Yes | Yes |

N | 94662 | 199691 |

Adj. R2 | 0.886 | 0.857 |

Appendix 4: Transmission of fiscal pressure

Note. This table implies that the potential consequence of the agricultural tax reform is that revenue pressure on governments is passed on to industrial enterprises. All control variables are consistent with baseline results in Table 1. All regressions control for the firm, industry-year and province-year fixed effects. Heteroskedasticity-robust standard errors are in parentheses. T-statistics are reported in parentheses. *, **, and *** indicate significance at the 10%, 5%, and 1% level, respectively. All related variables are defined in Appendix 1.

Dep. Var | (1) | (2) |

|---|---|---|

LnTax | Tax_Asset | |

DID | 0.062*** (5.75) | 0.005*** (3.87) |

Controls | Yes | Yes |

Firm FE | Yes | Yes |

Industry*Year FE | Yes | Yes |

Province*Year FE | Yes | Yes |

N | 234199 | 242833 |

Adj. R2 | 0.856 | 0.580 |

Appendix 5: Two Control Zones of environmental regulation

Province | City, County, or District |

|---|---|

Panel A: acid rain control zones | |

Shanghai | Shanghai City |

Jiangsu | Nanjing, Yangzhou, Nantong, Zhenjiang, Changzhou, Wuxi, Suzhou, Taizhou |

Zhejiang | Hangzhou, Ningbo, Wenzhou (urban aera and Ruian, Yongjia County, Cangnan County), Jiaxing, Huzhou, Shaoxing, Jinhua, Quzhou (urban aera and Jiangshan, Quxian County, Longyou County), Taizhou |

Anhui | Wuhu, Tongling, Ma 'anshan, Huangshan, Chaohu Area, Xuancheng Area |

Fujian | Fuzhou, Xiamen, Sanming, Quanzhou, Zhangzhou, Longyan |

Jiangxi | Nanchang, Pingxiang, Jiujiang, Yingtan, Fuzhou area, Ji 'an, Ganzhou |

Hubei | Wuhan, Huangshi, Jingzhou, Yichang, Jingmen, Ezhou, Qianjiang, Xianning area |

Hunan | Changsha, Zhuzhou, Xiangtan, Hengyang, Yueyang, Changde, Zhangjiajie, Chenzhou, Yiyang, Loudi Area, Huaihua, Jishou |

Guangdong | Guangzhou,Shenzhen, Zhuhai, Shantou, Shaoguan, Huizhou, Shanwei, Dongguan, Zhongshan, Jiangmen, Foshan, Zhanjiang, Zhaoqing,Yunfu, Qingyuan, Chaozhou, Jieyang |

Guangxi | Nanning, Liuzhou, Guilin, Wuzhou, Yulin, Guigang, Nanning area (Shanglin County, Chongzuo County, Binyang County, Heng County), Liuzhou Region (Heshan, Laibin County, Luzhai County), Guilin Region (Lingchuan County, Quanzhou County, Xing 'an County, Lipu County, Yongfu County), Hezhou Region (Hezhou, Zhongshan County), Hechi Region (Hechi, Yizhou) |

Chongqing | Yuzhong District, Jiangbei District, Shapingba District, Nan 'an District, Jiulongpo District, Dadukou District, Yubei District, Beibei District, Banan District and Wansheng District, Shuangqiao District, Fuling District, Yongchuan, Hechuan, Jiangjin, Changshou County, Rongchang County, Dazu County, Qijiang County, Bishan County, Tongliang County, Tongnan County |

Sichuan | Chengdu, Zigong, Panzhihua, Luzhou, Deyang, Mianyang, Suining, Neijiang, Leshan, Nanchong, Yibin, Guang 'an and Meishan |

Guizhou | Guiyang, Zunyi, Anshun Area, Xingyi, Kaili, Duyun |

Yunnan | Kunming, Qujing, Yuxi, Zhaotong, Gejiu, Kaiyuan, Chuxiong |

Panel B: sulfur dioxide pollution control zones | |

Beijing | Dongcheng District, Xicheng District, Xuanwu District, Chongwen District, Chaoyang District, Haidian District, Fengtai District, Shijingshan District, Mentougou District, Tongzhou District, Fangshan District, Changping County, Daxing County |

Tianjin | Tianjin |

Hebei | Shijiazhuang, Xinji, Gaocheng, Jinzhou, Xinle, Luquan, Handan, Wu'an, Xingtai, Nangong, Shahe, Baoding, Zhuozhou, Dingzhou, Anguo, Gaobeidian, Zhangjiakou, Chengde, Tangshan, Zunhua, Fengnan, Hengshui |

Shanxi | Taiyuan, Gujiao, Datong, Yangquan, Shuozhou, Jiezhou, Yuci, Linfen, Yuncheng |

Inner Mongolia | Hohhot, Baotou, Shiguai Mining Area, Tumert Right Banner, Wuhai, Chifeng |

Liaoning | Shenyang, Xinmin, Dalian, Anshan, Haicheng, Fushun, Benxi, Jinzhou, Linghai, Huludao, Xingcheng, Fuxin, Liaoyang |

Jilin | Jilin, Huadian, Jiaohe, Shulan Siping, Gongzhuling, Tonghua, Meihekou, Ji 'an Yanji |

Jiangsu | Xuzhou, Pizhou, Xinyi |

Shandong | Jinan, Zhangqiu, Qingdao, Jiaonan, Jiaozhou, Laixi, Zibo, Zaozhuang, Tengzhou, Weifang, Qingzhou, Gaomi, Changyi,Yantai, Longkou, Laiyang, Laizhou, Zhaoyuan, Haiyang, Jining, Zoucheng, Tai’an, Xintai, Feicheng, Laiwu, Dezhou, Leling, Yucheng Qufu, Yanzhou |

Henan | Zhengzhou, Gongyi, Luoyang, Yanshi, Mengjin County, Jiaozuo, Qinyang, Mengzhou, Xiuwu County, Wen County, Wuling County, Boai County, Anyang, Linzhou, Sanmenxia, Yima, Lingbao, Jiyuan |

Shaanxi | Xi 'an, Tongchuan, Weinan, Hancheng, Huayin, Shangzhou |

Gansu | Lanzhou, Jinchang, Baiyin, Zhangye |

Ningxia | Yinchuan, Shizuishan |

Xinjiang | Urumqi |

Rights and permissions

About this article

Cite this article

Kong, D., Zhu, L. Governments’ Fiscal Squeeze and Firms’ Pollution Emissions: Evidence from a Natural Experiment in China. Environ Resource Econ 81, 833–866 (2022). https://doi.org/10.1007/s10640-022-00656-3

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-022-00656-3