Abstract

Passenger car transportation is a major contributor to global carbon emissions. Despite a range of policy measures, the European passenger car fleet remains largely running on fossil fuels. It is questionable whether the lack of emission reductions can be attributed to a lack of consumer preferences for low-emission cars because consumers may have imperfect information about cars’ emissions and the availability of clean cars remains limited. This paper investigates the preferences of consumers for emission reductions in passenger car transport. We estimate the willingness to pay of passenger car buyers for \(\hbox {CO}_2\) emission reductions by means of a choice experiment amongst a sample of 1471 individuals that represents the Dutch adult population with the intention to buy a car. The main results are that the mean willingness to pay for emission reductions equals €199 per tonne, and that the majority of individuals is willing to pay more than the current market premium for two selected hybrid types. These results suggest there is a large market potential for emission reductions in passenger car transport. Our findings imply that providing consumers with trustworthy information can be considered a key policy tool for achieving emission reductions in passenger car transport.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

More and more, a consensus is emerging on the need to reduce greenhouse gas emissions. Failing to do so will result in climate change, associated with significant economic and social damages (e.g. IPCC 2014; Nordhaus 2006; Stern 2007). Acknowledgement by governments of the need to reduce emissions has recently resulted in an international agreement to limit the average temperature increase to two degree Celsius above pre-industrial levels (United Nations 2015).

Passenger car transportation is a major contributor of harmful emissions. As the fleet of passenger cars remains running predominantly on gasoline and diesel, the sector accounted for 12% of total emissions in the European Union in 2016 (EEA 2018). Moreover, while total emissions have fallen since 1990 in every other sector, emissions in transport have increased by 17% since then (EEA 2018).

In order to reverse this trend, governments in many parts of the world have implemented a number of policy measures. Within the EU, \(\hbox {CO}_2\) standards are imposed on car manufacturers and a \(\hbox {CO}_2\)-labelling scheme has been introduced to inform car buyers about the emissions of cars. On a national level, governments have introduced a variety of measures, including \(\hbox {CO}_2\) taxes on the purchase of cars, taxes on fossil fuels, fuel-blending requirements for renewable fuels and subsidies on alternative-fuel cars, often combined with each other. Despite all these measures, 97% of the existing EU fleet in 2016 and 91% of the new cars in the Netherlands in 2018 were gasoline and diesel cars (ACEA 2018).

It is clear that the market for clean cars remains underdeveloped but the question is to what extent this can be attributed to the preferences of consumers for polluting cars. At least two other reasons hamper the development of the market for clean cars. The first is an information asymmetry problem. In the EU, consumers obtain information about the level of a car’s emissions through \(\hbox {CO}_2\) labels, which are based on laboratory measurements (Haq and Weiss 2016). It is becoming increasingly apparent that real-world emissions of cars deviate from lab-tested emissions and that this gap has increased over time (Fontaras et al. 2017), partly caused by cheating behaviour on the emission measurements by some car manufacturers (Paton 2015). As a result, these labels are untrustworthy and, therefore, consumers may not express their intrinsic willingness to pay (WTP) for clean cars in the market. The second reason is caused by the fact that alternative-fuel cars remain emerging technologies. In addition to a limited number of models to choose from, consumers worry about the unavailability of refuelling stations for alternative fuels (Ziegler 2012; Hackbarth and Madlener 2016) and long refuelling times in case of electric vehicles (Egbue and Long 2012; Hackbarth and Madlener 2016). This leads these type of cars not to be considered as serious alternatives to many consumers. To be able to assess the potential for emission reductions in passenger car transport, the intrinsic willingness to pay of consumers needs to be understood.

Studies that have assessed the WTP of consumers for cars with lower emissions find a wide range of estimates. These studies include Hackbarth and Madlener (2016), Achtnicht (2012), Tanaka et al. (2014) and Hidrue et al. (2011), where the last two focus only on electric cars. These studies report a WTP a one-time premium ranging from €5 to €1432 to reduce a vehicles emissions by 1% (Hackbarth and Madlener 2013, 2016; Tanaka et al. 2014; Hidrue et al. 2011) or from €13 to €127 to reduce a vehicles emissions with 1g of \(\hbox {CO}_2\) per kilometre for the median person (Achtnicht 2012). This translates to minimum estimates of the WTP per tonne of \(\hbox {CO}_2\) of €89 and €256 for two reference groups (Achtnicht 2012). Also related to this paper are studies that use various other applications to study the valuation of consumers for climate change mitigation. These include Alberini et al. (2018) and Longo et al. (2008) (policy scenarios), Roe et al. (2001) (green electricity), Brouwer et al. (2008) and MacKerron et al. (2009) (airfare), and Löschel et al. (2013) and Diederich and Goeschl (2014) (EU ETS). The estimates of these studies for the WTP to reduce \(\hbox {CO}_2\) emissions by one tonne range from €6 to $967 (approximately €780).Footnote 1 An overview of the estimates for \(\hbox {CO}_2\) emission reductions in the stated-preference literature is included in Alberini et al. (2018). In contrast to the previously mentioned studies, Bigerna et al. (2017) estimate the WTP for emissions based on revealed preference data (converted from elasticities of demand for conventional fuels) and find a mean WTP of €7 per tonne.

Almost all papers that study the WTP within transport estimate the WTP for clean cars, except for Achtnicht (2012). From a policy perspective, however, it is more relevant to know the WTP for emission reductions because it are the emissions that lead to climate change and should therefore be targeted by policies. Not surprisingly, the benefits of climate change mitigation policies are typically denoted as the avoided damages in euros/dollars per tonne of emissions (i.e. the social cost of carbon).

This paper investigates the preferences of consumers for emission reductions in passenger car transport. Our main research question is: how much are consumers willing to pay to reduce \(\hbox {CO}_2\) emissions in passenger car transport? In addition, based on our WTP estimates, we specifically investigate the distribution of the WTP for hybrids, a promising clean car type. Lastly, we want to understand the socio-economic factors that contribute to the heterogeneity in preferences for emissions, and the implied required pay-back period for lower fuel costs.

The contribution of this paper is the estimation of the WTP for emission reductions in passenger car transport, expressed in euros per tonne of emissions (which is the conventional unit of measure in the climate policy debate). We follow a similar approach as Achtnicht (2012) but this paper uses a somewhat different method to translate the WTP for clean cars into WTP for emission reductions. Also, this paper makes an important different assumption about the distribution of the WTP for emissions, generally leading to more realistic WTP estimates. In addition, we have detailed socio-economic information about respondents that we relate to preferences for emission reductions, including income, age, gender and education. Lastly, we investigate the stated preferences for hybrids based on two real-life cars and compare the stated preferences with actual vehicle sales records.

We analyse preferences by adopting a discrete-choice experiment. Participants make trade-offs between cars that differ in four attributes: the purchase price, emissions, fuel type and fuel costs. Our sample consists of 1471 participants that represent the Dutch adult population with the intention to buy a passenger car. Participants were confronted with 10 choice questions, resulting in 14,638 observed choices. Choices are modelled based on a mixed logit approach to take into account that preferences may vary between individuals (Train 1998). In addition, the paper uses the WTP estimates to analyse the driving costs of and WTP for two real-life hybrids that are also available in a nearly identical gasoline version.

We find a strong preference for emission reductions in passenger car transport. Our main estimate of the WTP for emission reductions equals €199 per tonne. In addition, the majority of consumers appears to be willing to pay at least the prevailing market premium for two selected hybrid cars. This implies a large potential for emission reductions in passenger car transport. We also find considerable differences in preferences amongst socio-economic groups along the lines of age, gender and education but not income. Finally, the results suggest that the average consumer has a short implicitly required pay-back period for expenditure on a vehicle’s fuel cost attribute. For government policy, our findings suggest that policies that successfully reduce information asymmetry in passenger car transport can make a considerable contribution to achieving emission reductions.

The remaining of this paper is structured as follows. Section 2 discusses the theoretical framework. In Sect. 3, we describe the methods that we applied, particularly the set-up of the choice experiment, survey design and data. Section 4 provides the result. Finally, Sect. 5 provides the discussion and conclusion.

2 Theoretical Framework

To analyse consumer preferences, we depart from the microeconomic theory of consumer behaviour and utility maximization. The central idea in this theory is that consumers choose a good within a set of alternatives that maximizes their utility. Basically, a budget-constrained consumer chooses the good that is most valuable to him.

Lancaster (1966) proposes that the utility someone derives from consuming a good is not driven by the good itself but by the good’s attributes. Accordingly, selected alternatives represent the ‘best’ combinations of attributes to the decision maker in the sense that they yield the highest utility.

Choice experiments involve asking respondents to choose their preferred alternative out of a set of alternative options. The alternatives typically represent the same good (e.g. cars) that differ in certain attributes (e.g. emissions). By asking individuals to choose between alternatives that differ in attributes, the trade-offs that respondents make between these attributes are revealed.

The observed choices from the respondents are modelled according to Random Utility Theory (RUT). RUT posits that consumers maximize their utility (derived from a good’s attributes), but exhibits a random component in the utility function to consider that the true utility functions of the observed decision makers are unknown. The utility function (U) therefore consists of two parts, a systematic part V and a random part \(\epsilon\). Utility of individual i for alternative j can be written as:

Assuming a linear utility function, the systematic part can be written as:

where X is a vector of product attributes. Together with (1) and the assumption that \(\epsilon _{ij}\) is I.I.D. extreme value type 1 distributed, this yields the mixed logit model:Footnote 2

Importantly, this model considers that decision makers differ in their taste parameters (the \(\beta\)’s) (Train 1998), as indicated by the subscript i. Intuitively, this reflects that individuals differ from each other and have their own respective utility function. Other studies confirm that people differ in their preferences for environmental goods, such as renewable electricity (Bollino 2009). However, we do not observe exactly how preferences differ between individuals, i.e. the true distributions of the taste parameters \(f(\beta |\theta )\) are unknown. Therefore, to estimate a model based on (3), the researcher has to assume a distribution for the random parameters. The chosen distributions can significantly affect the results of the model (Hensher and Greene 2003). For a given distribution, the probability that alternative j is chosen out of the k available alternatives is given by (see e.g. Train 2009):

No closed-form solution exists for this expression but an option is to estimate an approximate solution using simulated maximum likelihood.

Train and Weeks (2005) propose a reformulation of the model in (3) such that the researcher can assume distributions directly for the WTP coefficients rather than for the coefficients of the utility function. This reformulated model is referred to as the model in WTP space. An important advantage of this WTP-space model is that it enables specifying the distribution of the WTP directly, resulting in more convenient (Train and Weeks 2005) and less “counter-intuitive” (Scarpa et al. 2008) distributions for the WTP. Additional conveniences of the WTP-space model is that the estimates can be directly interpreted as marginal WTPs and that the standard errors of the WTP need not be simulated or approximated (Scarpa and Willis 2010). For these reasons we estimate the model in WTP space rather than in preference space. The WTP-space reformulation is now briefly discussed.

To arrive from (3) at the model in WTP space, Train and Weeks (2005) assume \(\epsilon _{ij}\) is extreme value distributed with variance equal to \(\mu _i^2(\pi ^2/6)\), where \(\mu _i\) is referred to as the individual-specific scale parameter. This scale parameter reflects that different individuals with the same preference parameters may be associated with different degrees of variance in the random part of the utility function. As an example, Train and Weeks (2005) note that in a repeated choice situation, unobserved factors may differ for each choice question. Separating the product attributes into a price attribute p (with taste parameter \(\delta\)) and non-price attributes x (with taste parameters \(\alpha\)) and dividing (3) by the scale parameter, which leaves behaviour unaffected (Train and Weeks 2005), results in the utility function:

which has a new error term \(\varepsilon\) which is I.I.D. extreme value type 1 distributed and has constant variance \(\pi ^2/6\). Let \(c_i=(\frac{\alpha _i}{\mu _i})\) and \(\lambda _i=\frac{\delta _i}{\mu _i}\), then this utility function (still in preference space) can be written as:

Here, the WTP for an attribute is given by the marginal rate of substitution between the non-price attribute and the price attribute, i.e. the ratio of the attribute’s coefficient to the price coefficient: \(w_i=c_i/\lambda _i\). Finally, this definition of the WTP is used in Eq. (6) to arrive at the model in WTP space:

3 Methods

3.1 Choice Experiment

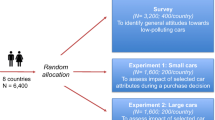

In this choice experiment, participants choose between two alternative cars that differ in four attributes. The survey was randomly administered to 2395 adult-aged Dutch persons. Prior to the actual choice questions, participants encountered a short text explaining the goal of the survey, the choice questions, and the attributes and corresponding levels.

The four attributes in the survey are the (1) purchase price, (2) fuel type, (3) \(\hbox {CO}_2\) emissions per kilometre and (4) fuel costs per 100 km. The \(\hbox {CO}_2\) emissions attribute is our main attribute of interest. The survey includes the purchase price as this enables estimating the WTP for the other attributes in monetary terms. The survey includes the fuel type and fuel costs per 100 km because we are interested in the intrinsic preferences for emissions and want to exert explicit control over these two attributes in order to prevent respondents from associating low emissions with certain fuel types (e.g. electric) or low/high fuel costs.

Table 1 lists the attributes and corresponding levels. The levels of the purchase price depend on the participant’s self-declared reference price for a new vehicle, as is common practice in the transportation literature (e.g. Ito et al. 2013). This ensures that the survey offers prices which the respondent would consider in practice. We include seven fuel types including the dominating fossil fuels and five primary alternative fuels that are currently on the market in the Netherlands. Five levels of emissions are shown, which are in line with papers from the transportation literature (e.g. Achtnicht 2012). During pre-testing, some participants struggled with combinations between positive emissions and full-electric or hydrogen. Therefore, the survey clearly explains to participants that emissions from fuel production and transport are included (i.e. are based on a well-to-wheel approach). The levels of fuel costs per 100 km are also based on the literature (e.g. Hackbarth and Madlener 2016).

Regarding our experimental design, we only restrict combinations between zero emissions and the fuel types gasoline and diesel in order to display realistic combinations. This results in a total possible number of combinations of \(4\times (7\times 5\times 3)+1\times (5\times 5\times 3)=495\), which were all included in the final experiment. Figure 4 in Appendix 1 provides a screenshot of one of the choice sets.

Many relevant car attributes for car purchases are not included in this survey, such as reliability, size, body type and power (e.g. Train and Winston 2007). If respondents would make implicit assumptions about omitted attributes in relation to attributes that are included (for instance that hydrogen vehicles are always large and luxurious), our estimates for the attribute associated to such omitted attributes would be biased. To prevent this, the introductory text of the survey and the actual choice questions contain explicit instructions to regard the alternatives as identical beyond the described characteristics. A transcript of these instructions can be found in “Appendix 1”.

Frequently, an attribute or one of its levels represents a number of (omitted) inherently related attributes or characteristics. While it prevents associations with omitted non-inherently related attributes (e.g. body type, power, colour, reliability, brand, transmission type or size), the survey’s instruction to regard cars as identical beyond the described attributes does not prevent respondents from making assumptions about omitted inherently related characteristics. For example, diesel is inherently associated to more harmful \(\hbox {NO}_x\) emissions and full-electric to a currently relatively limited refuelling-station availability. The trade-offs by respondents are expected to reflect the preferences of consumers for inherently related characteristics. Importantly, by explicitly including fuel types and fuel costs as attributes, the survey design prevented respondents from making assumptions about fuel types and fuel costs and their inherently related characteristics when they encountered different levels of emissions. Moreover, beyond mitigating climate change, there appear to be no other inherently related characteristics of \(\hbox {CO}_2\) emissions in passenger car transport. As a result, the estimates for the WTP for emission reductions reflect the consumer preferences for climate-change mitigation. This was verified during survey pre-testing, as interviews did not suggest that participants were choosing on the basis of implicit assumptions about (non-inherently related) omitted characteristics. “Appendix 2” provides details on the pre-test procedure of the survey.

The survey starts by announcing the goal of the survey (to study consumer preferences for different types of cars) and asking several preliminary questions. We ask (1) to indicate a reference price for the next vehicle, (2) to indicate the type of car (e.g. small or SUV) that is owned (or driven most in case they own more than one), and (3) to indicate the approximate annual mileage.Footnote 3 As we are interested in car purchases, we discarded respondents that indicated they do not intend to buy a car again at question (1) in our statistical analysis (n = 252). Therefore, our final sample represents the Dutch adult population with the intention to buy a car. Summary statistics of the responses to question (1) are included in Table 2. We used the second question to investigate a possible relationship between car types and preferences for emissions.

In the introductory text, we also briefly discuss the relation between fuel types, fuel costs and emissions. In addition, we explain the attributes and the levels. The survey then explains that the respondent is asked to choose ten times between two cars that differ in these four attributes. We also explain to the respondents that some of the fuel types are not yet widely available (e.g. hydrogen) but may become so in the near future. The actual choice question asks the respondent which car he/she would buy, taking into consideration his/her own budget. The last part is added as “cheap talk” strategy to minimize the hypothetical bias, referring to the tendency of people to overstate their true WTP in stated-preference research (e.g. List and Gallet 2001).

Another concern with stated-preference surveys is that the questions are not incentive compatible because, depending on the type of good (public/private), payment obligation, question format and (expected) reaction of the relevant agency to the responses, respondents may have an incentive to respond strategically and not according to their true preferences (Carson and Groves 2007). Particularly important is how the respondent expects the survey results will be used. We note that, although the survey is administered by a university, car manufacturers in particular have a great interest in consumer preferences. Therefore, if respondents anticipated this, they may have felt that they exerted influence over the type of cars that will be produced in the future. In our binary choice setting, in case the choice questions were regarded independently, no incentive compatibility problem would have been present because participants chose between two private goods and may have expected that selecting an alternative resulted in a higher probability of the selected type being produced in the future. Respondents probably have not regarded the choice questions independently such that our repeated structure could imply some scope for making strategic choices. However, two reasons as discussed by Carson and Groves (2007) suggest this was not highly problematic in our survey. Firstly, car manufacturers are likely to produce a range of vehicle types such that respondents may have expected that only a few alternatives will not be produced. Secondly, strategic behaviour requires knowledge about the distribution of preferences and we believe that expectations about this distribution are highly uncertain. Carson and Groves (2007) note that meeting one of these two conditions is sufficient to induce responses close to the true preferences.

The survey is randomly administered to 2395 members of age 18 and above of the CentERpanel in December 2017. The CentERpanel is a high-quality sample, representing the Dutch population (CentERdata 2018).Footnote 4 Out of 2395 invites, 1736 persons responded (72.5%) to the survey. Because socio-economic characteristics of all individuals in the sample are known to the research institute administering the CentERpanel, we do not need to ask additional questions.

Table 2 describes socio-economic characteristics of our sample and the Dutch adult population. The gender structure of our sample is similar to that of the adult population. The age structure of our sample tends to resemble the Dutch adult population as well, although the age group 65–79 years is somewhat overrepresented. The educational structure of the sample is also quite close to the structure of the population, although the share of higher educated people is about nine percentage points higher in the sample.Footnote 5 Finally, the income structure of our sample is not very different from the income structure of the Dutch population. For 6% of the respondents, income is unknown.

Table 3 provides several key characteristics of Dutch households and their cars, and the Dutch passenger car fleet. The majority of households owns at least one car and the average household dedicates 10% of expenditure on cars. Regarding Dutch vehicle sales in 2018, hybrid and full-electric have reached market shares of 6% and 4%, respectively. Other alternative fuel technologies remain without significant market shares. The share of fossil fuel cars in sales remained high at 91%. Regarding the existing car fleet, hybrids and full-electric cars have higher shares amongst older people when compared to younger generations.

3.2 Model Specification

In order to analyse the observed choices, several specification choices need to be made. We need to determine which parameters are randomly distributed and we need to assume a distribution for those parameters.

To determine the random parameters, we applied Lagrange Multiplier tests as proposed by McFadden and Train (2000) and log-likelihood ratio tests (as in e.g. Wang et al. 2007). These tests unambiguously suggest including all parameters as random coefficients. However, when we estimate the model with all random parameters, the simulated-maximum likelihood estimator does not converge to a global maximum, a known problem within simulated-maximum likelihood estimation that comes without a generally accepted solution (e.g. Myung 2003). We overcome this by estimating the final model with only the coefficients of the purchase price, \(\hbox {CO}_2\) emissions and hybrid fuel type as random. Inclusion of more random parameters is computationally not possible with simulated maximum likelihood estimation. The analysis retains the emissions parameter as random because it is the main parameter of interest. We retain the price attribute as random because fixing the price coefficient would imply that the scale parameter is constant over individuals (Train and Weeks 2005). If in fact scale varies between individuals, and one fixes the price coefficient, the variation in scale would be “erroneously attributed to variation in WTP” for the other attributes (Scarpa et al. 2008). The coefficient for hybrid is allowed to be random to be able to analyse the driving costs and distribution of WTP for hybrid vehicles. The drawback of this solution is that we will not derive distributions for the WTP coefficients of the fuel cost and other fuel type attributes.Footnote 6

After selecting the random coefficients, a distribution has to be assumed for these parameters. For our random coefficients, we considered the two most commonly applied distributions in practice, the normal and log-normal distributions (Train 2009). The log-normal distribution is often assumed for coefficients that have a strong a priori assumption on the sign, typically following from economic theory (e.g. the price coefficient). This way, the coefficients are forced to be either strictly positive or negative. In contrast to the coefficient for hybrid, for both the signs of the coefficients of the purchase price and \(\hbox {CO}_2\) emissions we have prior expectations. A negative coefficient is expected for the purchase price because utility decreases if the price of an ordinary good rises.Footnote 7 With respect to emissions, the environmental benefits of reducing emissions provide reasons to expect that some people prefer lower emissions. In contrast, it is hard to justify an expectation that some people prefer higher emissions since there appear to be no benefits at all.Footnote 8 Hensher and Greene (2003) propose an empirical approach to guide the decision on which distributions to assume. Their approach involves estimating empirical distributions for each of the random parameters based on kernel density plots and inspecting the shape of these distributions. Appendix 3 discusses this approach in more detail and provides the kernel density plots (Fig. 5) and two descriptive measures (Table 7). From these plots, the hybrid coefficient appears to be normally distributed, the price coefficient appears to be log-normally distributed and the distribution for emissions is not unambiguously normal or log-normal. Considering our reservations to assume a log-normal distribution for the emissions parameter (see Appendix 3), we assume a normal distribution for this coefficient.

Our final specification of the utility function is:

where \(\mathbf{F }\) is a vector of fuel type dummies (excluding hybrid), HY refers to the fuel type hybrid, \(CO_2\) refers to \(\hbox {CO}_2\) emissions, PP refers to the purchasing price and CKM refers to fuel costs. The dummy for gasoline is omitted in the estimation procedure and serves as reference case for the other fuel types. Random coefficients are denoted with a subscript i. The subscript t represents the panel structure of our data, i.e. that respondents choose repeatedly. We estimate the model with the user-written Stata command mixlogitwtp, using 600 Halton draws.

In order to investigate the relationship between socio-economic characteristics and preferences for emissions, we estimate a second model that includes interactions of \(\hbox {CO}_2\) emissions with gender (female = 1), age, education, income and car-type dummy variables. Regarding age, we divide the sample in three groups: 18–39, 40–64 and 65+. Regarding education, individuals are assigned to groups representing lower, medium and higher education based on the ISCED classifications. Regarding income, we distinct between five (gross yearly) income groups: low (€0–€19,999), medium (€20,000–€39,999), high (€40,000–€59,999), very high (€60,000–€79,999) and top (€80,000+). Lastly, we investigate a potential relationship between the car type someone owns and preferences for emissions. Based on self-reported information about the car type owned, respondents are assigned to one of three car segment groups: small segment (A, B and C segments), upper segment (D, E and M) or luxury segment (F, J and S). For each of these interaction variables, the first group is omitted in the estimation stage (18–39 years old, lower education, low income and small car segment respectively). Variance inflation factors do not suggest the presence of multicollinearity in the interaction variables (not reported here, factors are below 3.6), which could be a worry due to an expected relationship between income and car type ownership.

4 Results

4.1 Estimation Results

Table 4 reports the estimation results. The estimated coefficients can be directly interpreted as mean estimates of the WTP, except for the coefficient of the purchase price, which is the estimated mean of the log of the price coefficient. The estimates are in line with economic theory. A higher price, higher fuel costs or higher emissions are associated with lower levels of utility. The associated coefficients of these attributes are all statistically significant.

Regarding fuel types, the coefficients for diesel, CNG, biofuel and hydrogen are negative and statistically significant. This implies that these fuel types are, on average, valued less than gasoline (the reference fuel type). The least preferred fuel type is diesel with a WTP per vehicle that is €3230 lower than gasoline.Footnote 9 The coefficient for full-electric is negative but insignificant while only the coefficient for hybrid-electric is positive and significant. The mean WTP for a hybrid-electric vehicle, the most favoured fuel type, is €812 higher than a gasoline counterpart. The estimated standard deviation for hybrid of €3272 suggests there exists a very large degree of heterogeneity in preferences. Overall, consumers appear to favour gasoline and electric fuel types. These results may be driven by factors that are inherently related to (and therefore represented by) the respective fuel type but omitted in our model, such as harmful \(\hbox {NO}_x\) emissions for diesel or the relatively limited availability of refuelling stations for full-electric and hydrogen cars.

Regarding fuel costs, the average respondent values a decrease of €1 in fuel costs per 100 km at €434 at the moment of vehicle purchase. At an average annual mileage of 13,000 km, this implies a required pay-back period of only 3.3 years. It appears that car buyers with respect to fuel costs do not display far-forward looking behaviour, apply very high discount rates or use decision rules that are not based on valuation principles which a rational agent would use. This finding is very much in line with the mean required pay-back periods for US car drivers estimated by Greene et al. (2013). On the other hand, the results of Espey and Nair (2005) imply that US car buyers apply much lower discount rates, more accurately reflecting the outcome of valuation based on the (discounted) net present value. Compared to the results of Achtnicht (2012) and Hackbarth and Madlener (2013, 2016) for German car buyers, our estimates for the WTP to reduce fuel costs are somewhat lower. The subsequent driving cost analysis in Sect. 4.3 further illustrates the short implicitly required pay-back periods in the context of driving a hybrid car.

The mean WTP to reduce a vehicle’s emissions with 1 g per kilometre is €36.70. This coefficient is highly significant. All else equal, the average consumer prefers a car with lower emissions. The degree of preference heterogeneity in emissions is large, considering the estimated standard deviation of €30.81.

The estimation results of the second model yield insights in the relationship between socio-economic characteristics and preferences for emission reductions. Particularly, we find differences in WTP along the lines of gender, age and education but not income and car segment. The mean WTP to reduce a vehicle’s emissions with 1 g per kilometre of the reference group in this model is €21.62 (male, age 19–39, low education and a small segment car; the group with the lowest WTP). Females have a significantly higher WTP than males. Regarding age, we do not find differences between groups 19–39 and 40–64 while the WTP amongst individuals older than 64 is €17.19 higher. With respect to education, we do not find a significant difference between lower and medium education groups while the higher education group has a significantly higher WTP. Regarding income, we do not find statistically significant differences between groups. Finally, we do not find a statistically significant relationship between car segment and the WTP for emissions.Footnote 10

4.2 Willingness to Pay for Emission Reductions

To translate the WTP for emission reductions per kilometre into the WTP for emission reductions, we need to consider the effect of the purchase on the car’s emissions.Footnote 11 From the perspective of the car buyer, there is a direct effect on emissions during the period of ownership over the car. After re-selling the car, future owners are accountable for the car’s reduced emissions. This complicates estimating the WTP for emission reductions based on the WTP for emissions per kilometre because we do not know after how many kilometres the car is sold and the emission-attribute’s resale value at that point in time. By making the assumption that, during its entire lifetime, a car bought by individual i is owned by individuals that have the same WTP as individual i (and this WTP is fully paid), we can obtain an estimate for the WTP for emission reductions. Under this assumption, the WTP for emission reductions (\(WTP^{tonne}\)) equals the WTP for emission reductions per kilometre (\(-WTP^{attribute}\) i.e. minus the emissions parameter estimate), divided over the car’s expected lifetime mileage E[Tkm], which in turn is divided by one million to transform grams into tonnes:

Assuming an expected total mileage of 184,000 km for cars (Ricardo-AEA 2015), this results in a mean WTP per tonne of emission reductions of €199 and, since equation five is distributed according to the distribution of \(WTP^{attribute}\), a standard deviation of €167.

Based on the method proposed by Revelt and Train (2000), we calculate individual-level coefficients for the emissions parameter. Figure 1 provides a graphical description of the WTP distribution using kernel density estimates, based on these individual level-estimates and equation nine. As a result of assuming a normal distribution for the emissions attribute and the fact that equation nine does not affect the shape of this distribution, the distribution of WTP for emission reductions appears normal, has a mean of €199 and a minimum and maximum of − €94 and €562, respectively.Footnote 12 This highlights the considerable heterogeneity in preferences for emissions that we estimate.

In practice, people will not sell cars to others with a similar WTP because they have no incentive to do so nor can they differentiate between buyers on the basis of their WTP. Taking this into account, we could determine the WTP for emission reductions according to:

where \(E[P^{attribute}_{E[km_i]}]\) refers to the expected resale value of the attribute after buyer i’s expected mileage \(E[km_i]\). This equation says that the WTP for emissions reductions is equal to the net WTP for the attribute, divided over the individual’s mileage, which in turn is divided by one million to transform grams into tonnes. Unfortunately, information about individual mileage and expected resale value of the attribute is unavailable. By making several assumptions, we can get an estimate of the WTP for emission reductions based on this equation. For the expected mileage, we take the average annual mileage in the Netherlands (13,000 km) and multiply by the average ownership duration (4.1 years) to arrive at an assumption for E[km] equal to 53,300 km (CBS 2017). Considering that we have very little information about the resale value of the attribute after 53,300 km, our assumptions for this parameter are arbitrary. Suppose the resale value of the attribute decreases linearly in the mileage.Footnote 13 Let us further assume that the value of the attribute after 0 km (i.e. with 184,000 km remaining) is equal to €36.70, the mean WTP for the attribute. The expected resale value after 53,300 km then equals €26.07.Footnote 14 According to (10), the mean WTP under these assumptions equals €199.Footnote 15 The most pessimistic assumption for the attribute’s resale value would be to set it equal to €0 at any remaining mileage, resulting in an estimated mean WTP for emission reductions equal to €689.Footnote 16

4.3 A Driving Cost and WTP Comparison of Hybrid and Gasoline Types

While there appears to be a latent preference for lower emissions, reductions will only materialise if actually available clean car types will be purchased. In that respect, hybrid cars seem to be promising considering that they generally emit less \(\hbox {CO}_2\) and have lower fuel cost. Moreover, compared to gasoline, hybrid is the only fuel type for which we estimate a positive WTP. In addition, the number of actually available hybrid models in the Netherlands has increased from 13 in 2011 to 71 at this moment (November 2019). This subsection aims to further the understanding of the preferences for (non-plug-in) hybrid cars and of the degree of forward looking behaviour of buyers of hybrids. We make pair-wise comparisons of the driving costs and WTP of two actually available models that are sold with both a hybrid and gasoline engine. Importantly, the hybrid and gasoline types that we compare are nearly identical in the attributes for which we did not estimate the WTP.

Specifically, for the two hybrid-gasoline pairs, we estimate the (distribution of the) willingness to pay a premium for the hybrid versus the gasoline type based on the WTP estimates for emissions, fuel costs and fuel type. Consequently, we compare the WTP for the hybrid with (i) the estimated savings from lower fuel costs, and (ii) the actual market premium and vehicle sales records. By comparing the WTP for the hybrid with the estimated fuel savings we gain further insight into the degree of forward looking behaviour of car buyers. By comparing the distribution of the WTP for the hybrid with the actual market premium and vehicle sales records we obtain anecdotal evidence of whether our stated-preference results appear aligned with revealed-preference data.

We compare the hybrid and gasoline types of a Toyota C-HR and Toyota Yaris.Footnote 17 These models are available with highly comparable gasoline and hybrid engines and are nearly identical in other respects. This analysis assumes that consumers regard the hybrid and gasoline types as identical, except for the fuel type, fuel costs and emissions. A drawback of using real-life models is that the reported emissions and fuel consumption levels are based on laboratory tests, which cannot be trusted. This is further complicated by the difference in accuracy of lab-tests for hybrid and gasoline types (ICCT 2019). However, the differences in fuel consumption and emissions of the models in our comparison are somewhat reflective of the real-world performance increase of hybrids compared to gasoline cars of 23% in the EU, as estimated by Emissions Analytics (2019). The hybrid’s reported emissions and fuel consumption are 36% and 15% lower for the C-HR and Yaris, respectively. In addition to the results presented in the current subsection, we have repeated the analysis for two hypothetical hybrid-gasoline pairs. The results of this sensitivity analysis are reported in Table 8 and Figs. 6 and 7 in “Appendix 4”. The outcomes are comparable to the results reported here.

Table 5 and Fig. 2 report the results of the driving cost comparison for the Toyota C-HR (first column) and Toyota Yaris (second column). The calculation of the WTP for the hybrid’s lower fuel cost, lower emissions and hybrid fuel type attributes are based on the estimated mean WTP for those attributes, as reported in Table 4. For example, the WTP for the improvement in the hybrid C-HR’s fuel cost (row b) is calculated as the estimated mean WTP for a decrease in fuel costs of €1 per 100 km (€433.84) multiplied by the difference in fuel costs (in € per 100 km) between the gasoline and hybrid types (i.e. €\(1.65/l\times (6.1-3.8)l/100\,{\mathrm{km}}\)), which equals €1646. The bottom of Table 5 shows the annual fuel savings at various annual mileages and reports the implied pay-back period of the WTP for the hybrid’s fuel cost attribute (corresponding to row (b)), and the emissions and hybrid fuel type attributes (corresponding to row (c)) in between brackets. For example, at an annual mileage of 13,000 km, the annual fuel savings of the C-HR hybrid are calculated as the difference in litres of fuel consumption per 100 km (i.e \((6.1-3.8)l/100\,{\mathrm{km}}\)) times the fuel price per litre (€1.65/l), multiplied by the annual mileage (13,000 km), which equals €493.35. This implies a required pay-back period of 3.3 and 5.5 years for the fuel cost (row b), and fuel type and emissions attributes (row c), respectively.

For the Yaris, one important difference in the gasoline and hybrid type is the higher monthly vehicle tax (MRB) of the hybrid type (€7.33 per month) due to its slightly higher weight (+ 35 kg).Footnote 18 The reported annual fuel savings for the Yaris are net of these higher taxes. Panel a and b of Fig. 2 show the implied pay-back period in mileage terms for the hybrid C-HR and for the Yaris at an annual mileage of 13,000 km (this only matters for the Yaris due to the difference in fixed monthly taxes).

The results for the C-HR display the short required pay-back period from fuel savings. For the mean respondent, the WTP for lower fuel costs is earned back after 43,300 km or 3.3. years. The total premium (fuel costs, fuel type and emissions) is earned back after 115,000 km, well below the expected lifetime mileage of a gasoline car (184,000 km). For the Toyota Yaris, pay-back from ‘gross’ fuel savings takes slightly longer. When accounting for the higher MRB taxes, pay-back takes much longer.Footnote 19

On the basis of the method proposed by Revelt and Train (2000), we can use the WTP estimates for the various characteristics from Sect. 4.1 to estimate the approximate distribution of the WTP for the hybrids. For the Yaris, we use the estimates for the WTP for fuel costs to control for the higher MRB taxes.Footnote 20 Figure 3 shows kernel density estimates of the distribution of the WTP for the hybrid types of the C-HR (panel a) and Yaris (panel b), respectively. The solid lines provide the distribution for the full sample whereas the dotted lines provide the distribution for individuals that currently own a similarly sized vehicle and indicated a reference price in the neighbourhood of the listing price, i.e. this concerns individuals who appear likely to be in the market for the respective vehicle. The vertical dash-dotted line indicates the actual price premium for the hybrid type.

Taking the actual price premium in consideration, our results indicate that nearly all respondents (98%) prefer the hybrid type of the C-HR over the gasoline type. In case of the Yaris, approximately two-thirds (67%) of the respondents prefers the hybrid over the gasoline type. Based on this, we would expect the share of hybrids in actual total sales to be higher for the C-HR than for the Toyota Yaris, which is also observed. Interestingly, despite that our model and results are not tailored for analysing revealed preferences, the actual share of the hybrid types in total sales (97% for the C-HR and 74% for the Yaris; see Table 5) quite closely matches the estimated share of respondents who are WTP at least the hybrid’s actual premium. It is particularly interesting to note that, despite the higher purchase price and MRB taxes for the hybrid Yaris, which cause long pay-back periods, it is still the preferred type by most consumers, both in practice and based on this stated-preference analysis. For these two highly specific cases, the stated-preference results do not appear to be misaligned with revealed-preference data.

Distribution of individual-level WTP for hybrid instead of gasoline type of a Toyota C-HR (a) and Toyota Yaris (b), compared with the actual market premium. Note: Subsamples consist of respondents who indicated a reference price similar to the actual price and who currently own a similarly-sized vehicle: between €20k–€40k and medium-sized car for the C-HR (a); and below €40k and small car for the Yaris (b)

5 Discussion and Conclusion

Passenger car transport is a major contributor to greenhouse gas emissions and the only key sector where emissions have not fallen since 1990 (EEA 2018). Whether this can be attributed to a lack of WTP for lower emissions from car buyers is questionable for two reasons: (1) consumers cannot observe emissions themselves and emissions reported in \(\hbox {CO}_2\) labels do not accurately reflect the true level of emissions (Fontaras et al. 2017), and (2) alternative-fuel cars remain very much emerging technologies. This paper analyses the WTP for emission reductions from passenger car buyers on the basis of a choice experiment amongst a sample of Dutch adults with the intention to buy a passenger car.

We find that people prefer cars with lower emissions per kilometre (mean WTP of €36.70 per g/km). Translated to emission reductions, we find that Dutch passenger car buyers are willing to pay €199 to reduce \(\hbox {CO}_2\) emissions by one tonne and that there is a very considerable degree of heterogeneity in preferences amongst individuals. Our estimates appear to be in the lower range of the reported WTP estimates in Achtnicht (2012). The relatively lower estimates in this paper may be the result of studying a different population (Dutch vs. German passenger car buyers) and due to a number of different modelling decisions: this paper assumes a normally instead of a log-normally distributed emissions parameter, assumes a random instead of a fixed price coefficient, and estimates the model in WTP instead of preference space.

Despite our somewhat lower WTP estimates, our findings still indicate a considerable WTP for emission reductions. Based on these findings, we conclude that there is a large potential for voluntary contributions to emission reductions in passenger car transport in the Netherlands. This conclusion is confirmed by our analysis of preferences for two real-life cars that are available with very similar hybrid and gasoline engines. The majority of respondents is willing to pay more than the actual market premiums of the two existing hybrid types. This finding is reflected in actual vehicle sales of the two models.

This paper also analysed to what extent the WTP is related to personal characteristics. We find differences in the WTP for emission reductions along the lines of gender, age and education but not income. The results show that females have a higher WTP than males; people aged 65+ have a higher WTP than people aged 18–64; and that individuals with higher education have a higher WTP than individuals with lower or medium education.

Our results regarding the relationship with personal characteristics are both supportive and contradictory to the results of several other papers. For a comparison with other findings in the literature, see Diederich and Goeschl (2014) for an overview. Particularly noteworthy is that our finding for the positive effect of age on the WTP for emission reductions contrasts the findings of most other studies on the WTP for emission reductions or climate-policy support. However, our results seem to be in line with a study into the attitudes of the Dutch population by the Institute for Social Research (SCP). The SCP finds that older and younger generations in the Netherlands are equally worried about climate change but older generations are more inclined to behave environmentally friendly and have a higher probability to contribute to a better environment (Verbeek and Boelhouwer 2010).

Several caveats of this paper need to be mentioned. First, we tried to eliminate the hypothetical bias, referring to the tendency of people to overstate their true WTP in stated-preference research, by means of a “cheap talk” strategy (e.g. List and Gallet 2001). We are not able to measure the hypothetical bias and, therefore, if our cheap talk did not fully eliminate the hypothetical bias, our WTP estimates may be biased upwards. Secondly, as we do not possess data for all relevant aspects (e.g. for the future resale value of a car’s emission attribute), we required a number of assumptions to calculate the WTP for emission reductions. While we mostly based our assumptions on findings of others, changing the assumptions affects the WTP estimates.

From a policy perspective, our findings imply that providing consumers with trustworthy information can be considered a key policy tool for achieving emission reductions in passenger car transport. Given that a large portion of the Dutch passenger car buyers has a considerable WTP for emission reductions, there appears to be a substantial market potential for voluntary contributions to emission reductions. If the information asymmetry in the passenger car market can be reduced, less financial support is required to promote the use of cars with lower carbon emissions.

Notes

Using the average annual US dollar/euro exchange rate in 2005, the study’s (Longo et al. 2008) survey year, according to Eurostat.

In a setting where individuals make repeated choices, an additional subscript (t) in the utility function is appropriate: \(U_{ijt} = \beta _i'X_{ijt} + \epsilon _{ijt}\).

Specifically, in the survey, people are asked to indicate what segment their car belongs to based on the following car segmentation proposed by the European Commission: A: mini cars, B: small cars, C: medium cars, D: large cars, E: executive cars, F: luxury cars, J: sport utility cars (including off-road vehicles), M: multi-purpose cars, S: sports cars (CEC 1999). For each car segment, three (popular) example cars are shown based on the segment’s Wikipedia pages (see https://en.wikipedia.org/wiki/Euro_Car_Segment).

Members are not included based on self-selection but are randomly drawn from the pool of national addresses and invited to join the panel. Panel members are not required to own a computer or have an internet connection.

Classification according to the ISCED (International Standard Classification of Education): lower education represents primary education and lower secondary education (basisonderwijs, VMBO and havo/vwo klas 1–3); middle education represents higher secondary education and post-secondary non-tertiary education (havo/vwo klas 4–6, MBO); and higher education represents bachelor’s, master’s and doctoral (HBO and WO).

Another solution would be to assume a constant coefficient for the price and link this attribute to income. This would facilitate including random coefficients for the fuel types and fuel costs and accommodate differences in the marginal utility of money to differ between income levels. The latter implies differences in scale between but not within income groups. However, as the marginal utility of money probably also differs in other respects than income, including “factors that are independent of observed socioeconomic covariates” (Scarpa et al. 2008), the drawback of this approach is that variation in scale due to these other factors may still affect our estimates for the (distribution of the) WTP for emission reductions. Given our focus on estimating the WTP for emission reductions, we opted for the current WTP-space model with a random price parameter.

We assume cars are ordinary goods, i.e. that, conditional upon a set of characteristics, the probability that someone will buy a car decreases if the price increases.

Based on anecdotal evidence, it appears that, in certain parts of the US, some individuals prefer polluting vehicles as a form of protest against liberalism. For the Dutch population, we are not aware of such preferences amongst subgroups of the population.

In practice, diesel cars tend to be more expensive than gasoline cars in the Netherlands. However, despite the higher price and a lower WTP, diesel cars still have a market share of 14% in new car sales 2018. This may be explained by the considerably lower fuel price for diesel than gasoline in the Netherlands due to differences in fuel tax. I.e. in practice, the fuel type diesel is combined with low fuel costs. In addition, the estimate reflects the mean WTP for diesel whereas the distribution for this fuel type may be highly dispersed.

These results are robust to omitting the interactions between emissions and car segments or specifying the marginal utility of emissions to depend linearly on income rather than the reported dummy specification.

Archsmith et al. (2017) report a substitution effect between the emissions of different vehicles within a household, i.e. an indirect effect of the purchase of a vehicle with certain emissions on the total emissions of the household’s vehicle portfolio. We do not explicitly consider this indirect effect in our paper but we have tested whether there is an impact of the number of vehicles in the household on the WTP for the emissions attribute and there appears to be no statistically significant effect. In addition, this substitution effect does not influence our proposed translations of the WTP for the emissions attribute into WTP for emission reduction (Eqs. 9 and 10).

A negative WTP for emission reductions is not in accordance with economic theory. However, we estimate a negative WTP for less than 1.4% of the individuals in the sample. This is the result of selecting the normal distribution for the emissions parameter, which does not force the parameter to be of a particular sign. Given that it concerns only a very small number of people, we are not highly worried about the relevance of our WTP estimates.

For example, if the market price of the attribute is €10 at an expected remaining mileage of 184,000 km, the resale value at an expected remaining mileage of 92,000 km equals €5.

The car is sold with 71% of the expected mileage left (\(\frac{184,000\,{\mathrm{km}}{-}53,300\,{\mathrm{km}}}{184,000\,{\mathrm{km}}}\)). \(0.71\times\) €36.70 = €26.07.

These assumptions yield the same outcome as the WTP estimate based on (9) as they imply scaling the numerator and denominator by the same factor of 53,300 km/184,000 km.

This follows from (10): with emissions, we do not attribute the (expected) future revenue from reselling the attribute to someone else to the individual’s WTP for emission reductions. If you have a positive WTP only because you can sell the attribute at a later point to someone else for the same amount as your WTP, then this can hardly be considered a willingness to contribute to the environment. Therefore, (10) does not attribute the expected resale value to the individual’s willingness to pay for the emission reductions that materialised during the period of ownership.

Vehicle selection is based on a case-by-case inspection of all available hybrid models with a price below €60,000 (96% of respondents indicated a reference price below €60,000). Ideally, two models are identical except for the hybrid engine, which is why hybrid models that are not available with a gasoline engine do not qualify (e.g. Ford Mondeo, Kia Niro, Toyota Prius, Hyundai Ioniq). These two restrictions yield 8 potential models to be analysed. Consequently, hybrid models for which no comparable gasoline engine in terms of performance is available are excluded (Citroen C5 Aircross). Hybrid models for which a comparable gasoline engine is available but which are only available with different transmission or drive types are also excluded (Hyundai Kona). Further, as it appears more interesting to compare a hybrid alternative that is more expensive than the gasoline alternative, models for which vice versa is true are excluded (Honda CR-V). Finally, hybrid models with officially reported \(\hbox {CO}_2\) emissions below 50 g/km based on laboratory tests are not considered as it is generally acknowledged that these values greatly exaggerate the true level of emissions, and because (despite that fact) these models qualify for a 50% reduction in the Dutch fixed monthly vehicle tax (Audi A3). This results in four models to be considered for inclusion, all Toyota’s: C-HR, Corolla, RAV4 and Yaris. The Corolla and RAV4 are excluded because the vehicle sales records are annual figures and the Corolla hybrid has only been on the market for a few months (as opposed to the Corolla gasoline) whereas the RAV4 was completely updated in the middle of 2019. This leaves the Toyota C-HR and Yaris to be included in the analysis.

The C-HR hybrid is also slightly heavier than the gasoline version but falls in the same weight-dependent tax bracket as the gasoline type.

For the Toyota Yaris, the total WTP premium in the graph excludes the negative WTP for higher MRB taxes to facilitate readability and to demonstrate the implied required pay-back periods under the assumption that the hybrid and gasoline types are identical beyond emissions and fuel consumption.

We use the model’s estimates of the WTP for savings of €1/100 km in fuel costs and combine this with self-reported information about individuals’ annual mileage. Specifically, we (2) estimate a separate model with the fuel costs as random parameter (due to the earlier mentioned convergence issue we are not able to obtain these estimates from a single model), (2) use this to generate individual-level estimates of the WTP to reduce fuel costs by €1 per 100 km, and (3) combine this with information about respondents self-reported annual mileage to obtain an estimate of the WTP for a reduction in monthly taxes. For example, if an individual’s WTP to reduce fuel costs by €1 per 100 km is €400 and this individual drives 1000 km per month, this analysis imputes that the individual is WTP €40 to reduce monthly taxes by €1.

References

ACEA (2018) European Automobile Manufacturers Association—passenger car fleet by fuel type. http://www.acea.be/statistics/tag/category/passenger-car-fleet-by-fuel-type

Achtnicht M (2012) German car buyers’ willingness to pay to reduce CO2 emissions. Clim Change 113(3–4):679–697

Alberini A, Bigano A, Ščasnỳ M, Zvěřinová I (2018) Preferences for energy efficiency vs. renewables: What is the willingness to pay to reduce CO2 emissions? Ecol Econ 144:171–185

Archsmith J, Gillingham K, Knittel CR, Rapson DS (2017) Attribute substitution in household vehicle portfolios. NBER Working Paper No. 23856, pp 1–42

Bigerna S, Bollino CA, Micheli S, Polinori P (2017) Revealed and stated preferences for CO2 emissions reduction: the missing link. Renew Sustain Energy Rev 68:1213–1221

Bollino CA (2009) The willingness to pay for renewable energy sources: the case of Italy with socio-demographic determinants. Energy J 30(2):81–96

Brouwer R, Brander L, Van Beukering P (2008) “A convenient truth”: air travel passengers’ willingness to pay to offset their CO2 emissions. Clim Change 90(3):299–313

Carson RT, Groves T (2007) Incentive and informational properties of preference questions. Environ Resour Econ 37(1):181–210

CBS (2017) Nederlanders en hun auto. Een overzicht van de afgelopen 10 jaar. Centraal Bureau voor de Statistiek

CEC (1999) Commission of the European Communities Case No IV/M.1406. Hyundai/KIA, Regulation (EEC) No 4064/89. Merger Procedure

CentERdata (2018) The CentERpanel. https://www.centerdata.nl/en/projects-by-centerdata/the-center-panel

Diederich J, Goeschl T (2014) Willingness to pay for voluntary climate action and its determinants: field-experimental evidence. Environ Resour Econ 57(3):405–429

EEA (2018) EEA greenhouse gas—data viewer. http://www.eea.europa.eu/data-and-maps/data/data-viewers/greenhouse-gases-viewer

Egbue O, Long S (2012) Barriers to widespread adoption of electric vehicles: an analysis of consumer attitudes and perceptions. Energy Policy 48:717–729

Emissions Analytics (2019) Hybrids are 14 times better than battery electric vehicles at reducing real-world carbon dioxide emissions. https://www.emissionsanalytics.com/news/hybrids-are-better

Espey M, Nair S (2005) Automobile fuel economy: What is it worth? Contemp Econ Policy 23(3):317–323

Fontaras G, Georgios Zacharof N, Ciuffo B (2017) Fuel consumption and CO2 emissions from passenger cars in Europe-laboratory versus real-world emissions. Prog Energy Combust Sci 60:97–131

Greene DL, Evans DH, Hiestand J (2013) Survey evidence on the willingness of US consumers to pay for automotive fuel economy. Energy Policy 61:1539–1550

Hackbarth A, Madlener R (2013) Consumer preferences for alternative fuel vehicles: a discrete choice analysis. Transp Res D Transp Environ 25:5–17

Hackbarth A, Madlener R (2016) Willingness-to-pay for alternative fuel vehicle characteristics: a stated choice study for Germany. Transp Res A Policy Pract 85:89–111

Haq G, Weiss M (2016) CO2 labelling of passenger cars in Europe: status, challenges, and future prospects. Energy Policy 95:324–335

Hensher DA, Greene WH (2003) The mixed logit model: the state of practice. Transportation 30(2):133–176

Hidrue MK, Parsons GR, Kempton W, Gardner MP (2011) Willingness to pay for electric vehicles and their attributes. Resour Energy Econ 33(3):686–705

ICCT (2019) From laboratory to road: a 2018 update of official and “real-world” fuel consumption and CO2 values for passenger cars in Europe. White paper

IPCC (2014) Climate Change 2014: synthesis report. In: Core Writing Team, Pachauri RK, Meyer LA (eds) Contribution of Working Groups I, II and III to the fifth assessment report of the intergovernmental panel on climate change. IPCC

Ito N, Takeuchi K, Managi S (2013) Willingness-to-pay for infrastructure investments for alternative fuel vehicles. Transp Res D Transp Environ 18:1–8

Lancaster KJ (1966) A new approach to consumer theory. J Polit Econ 74(2):132–157

List JA, Gallet CA (2001) What experimental protocol influence disparities between actual and hypothetical stated values? Environ Resour Econ 20(3):241–254

Longo A, Markandya A, Petrucci M (2008) The internalization of externalities in the production of electricity: willingness to pay for the attributes of a policy for renewable energy. Ecol Econ 67(1):140–152

Löschel A, Sturm B, Vogt C (2013) The demand for climate protection-empirical evidence from Germany. Econ Lett 118(3):415–418

MacKerron GJ, Egerton C, Gaskell C, Parpia A, Mourato S (2009) Willingness to pay for carbon offset certification and co-benefits among (high-) flying young adults in the UK. Energy Policy 37(4):1372–1381

McFadden D, Train KE (2000) Mixed MNL models for discrete response. J Appl Econom 15(5):447–470

Murdock J (2006) Handling unobserved site characteristics in random utility models of recreation demand. J Environ Econ Manag 51(1):1–25

Myung IJ (2003) Tutorial on maximum likelihood estimation. J Math Psychol 47(1):90–100

Nordhaus WD (2006) Geography and macroeconomics: new data and new findings. Proc Natl Acad Sci USA 103(10):3510–3517

Paton G (2015) Petrol vehicles are sucked into VW emissions scandal. The Times

Revelt D, Train KE (2000) Customer-specific taste parameters and mixed logit: households’ choice of electricity supplier. Working Paper No. E00-274, Department of Economics, University of California, Berkeley

Ricardo AEA (2015) Improvements to the definition of lifetime mileage of light duty vehicles. Report for European Commission—DG Climate Action

Roe B, Teisl MF, Levy A, Russell M (2001) US consumers’ willingness to pay for green electricity. Energy Policy 29(11):917–925

Scarpa R, Willis K (2010) Willingness-to-pay for renewable energy: primary and discretionary choice of British households’ for micro-generation technologies. Energy Econom 32(1):129–136

Scarpa R, Thiene M, Train KE (2008) Utility in willingness to pay space: a tool to address confounding random scale effects in destination choice to the alps. Am J Agric Econ 90(4):994–1010

Sillano M, de Dios Ortúzar J (2005) Willingness-to-pay estimation with mixed logit models: some new evidence. Environ Plan A 37(3):525–550

Stern N (2007) The economics of climate change. The Stern review. Cambridge University Press, Cambridge

Tanaka M, Ida T, Murakami K, Friedman L (2014) Consumers’ willingness to pay for alternative fuel vehicles: a comparative discrete choice analysis between the US and Japan. Transp Res A Policy Pract 70:194–209

Train KE (1998) Recreation demand models with taste differences over people. Land Econ 47(2):230–239

Train KE (2009) Discrete choice methods with simulation. Cambridge University Press, Cambridge

Train KE, Weeks M (2005) Discrete choice models in preference space and willingness-to-pay space. Springer, Berlin

Train KE, Winston C (2007) Vehicle choice behavior and the declining market share of US automakers. Int Econ Rev 48(4):1469–1496

United Nations (2015) Paris agreement. Report, 2015

Verbeek D, Boelhouwer J (2010) Milieu van later, wiens zorg nu. In: van den Broek A, Bronneman-Helmers R, Veldheer V (eds) Wisseling van de Wacht: Generaties in Nederland. Sociaal en Cultureel Rapport

Wang X, Bennett J, Xie C, Zhang Z, Liang D (2007) Estimating non-market environmental benefits of the conversion of cropland to forest and grassland program: a choice modeling approach. Ecol Econ 63(1):114–125

Ziegler A (2012) Individual characteristics and stated preferences for alternative energy sources and propulsion technologies in vehicles: a discrete choice analysis for Germany. Transp Res A Policy Pract 46(8):1372–1385

Acknowledgements

We thank in particular two anonymous referees, as well as Adriaan Soetevent and other participants at the 2019 SOM PhD conference for very valuable comments and suggestions.

Funding

This project has received funding from the European Union’s Horizon 2020 research and innovation programme under Grant Agreement No. 691797 and GasTerra.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1: Example Choice Question and Transcript of Survey Instructions

Instruction in introductory text:

“In this survey, we ask you to choose between two cars that differ in four characteristics. The four characteristics are:

- 1

Fuel type

- 2

\(\hbox {CO}_2\) emissions per kilometre (including emissions from fuel production)

- 3

Fuel costs per 100 km

- 4

Purchase price

There are probably other characteristics than the four previously mentioned that are important to you when choosing a car. You should assume that the presented cars in this survey are, except for the described characteristics, identical to each other” (Fig. 4).

The choice question, including instructions:

“Imagine you are about to buy a car. Which car would you choose, car A or car B? Please, mind your own budget. You should assume that the presented cars are, except for the described characteristics, identical to each other.”

Appendix 2: Pre-test Procedure and Post-Survey Evaluation

The pre-testing of this survey consisted of three waves of one-to-one interviews, corresponding to three iterated versions of the survey. The first version was discussed with four other university staff members, including two colleagues with extensive experience in choice experiments.

In the second and third rounds, respectively nine and fourteen individuals participated, which were invited either personally or through acquaintances and relatives. Invitees were selected such that the groups reflected heterogeneity in age, education, income, profession and place of residence in the Netherlands.

The invitation to participate in the second and third pre-test rounds indicated to the participant that it concerned a pre-test and that the goal was to solicit feedback about the survey from the perspective of the respondent. Feedback was solicited face-to-face or via email or telephone, depending on the participant. The invitation further asked the respondent to pay particular attention to anything that is unclear, ambiguous or vague. Following the survey, we first gathered their general comments. Consequently, we specifically asked:

Whether the task was sufficiently clear.

What they thought the goal of the survey was.

If the language in the survey in general and the questions in particular were clear, and if any specific words or terms were unclear.

Whether it was difficult to answer the questions.

Whether they had enough information to answer the choice questions.

What they thought of the number of choices they had to make.

Why they made the specific choice for A or B for several of their choices.

Whether they thought the combinations were realistic.

If they though it was realistic that they were forced to choose between two alternatives.

If they regarded full-electric or hydrogen with zero emissions as a realistic combination (only the third round).

In addition, the survey was language-checked by an external communication expert and a survey researcher from the university administering the LISS panel with a focus on clarity and comprehensibility.

After the second round of pre-testing, three participants indicated that they did not understand why combinations of full-electric (all three participants) or hydrogen (one participant) with zero emissions were provided. To clarify this, the explanation of the emissions attribute more pronouncedly discussed that emissions from fuel production were included and the name of the attribute was changed to “\(\hbox {CO}_2\) emissions per kilometre (including emissions from fuel production)” everywhere, where the part between parentheses was added. In the third pre-test round, this issue appeared resolved. Furthermore, after the second round of pre-testing, a participant indicated that the page that introduced the four attributes, together with the instruction to regard vehicles as identical in other respects and an explanation of the attributes and their levels contained a lot of information. The subsequent version of the survey split this into two pages, one containing the introduction of the four attributes and the instruction to regard vehicles as identical in other respects, and a separate page that explained the attributes and the levels. Another participant indicated after the second round that she thought it would be helpful if the attribute definitions and levels were visible while answering the choice questions. To accommodate this, the subsequent version showed the attribute and levels information when participants clicked on the respective attribute name (these were blue and underlined to highlight that they could be clicked on). Based on the suggestions of the communication and survey experts, several language adaptations were done. The interviews with the pre-test participants gave no further reasons to change the survey.

Upon completion of the choice questions, the survey finally asked the following five evaluation questions:

“Finally; what did you think of this questionnaire?

- 1

Was it difficult to answer the questions? [1 Certainly not; 2; 3; 4; 5 Certainly yes]

- 2

Were the questions sufficiently clear? [1 Certainly not; 2; 3; 4; 5 Certainly yes]

- 3

Did the questionnaire get you thinking about things? [1 Certainly not; 2; 3; 4; 5 Certainly yes]

- 4

Was it an interesting subject? [1 Certainly not; 2; 3; 4; 5 Certainly yes]

- 5

Did you enjoy answering the questions? [1 Certainly not; 2; 3; 4; 5 Certainly yes]”

Table 6 provides summary statistics of the responses to these questions. In particular, most respondents thought the questions were not very difficult, thought the questions were clear and did not seem to derive dissatisfaction from participating in the survey.

Appendix 3: Determining distributions for the random parameters

Hensher and Greene (2003) propose an empirical approach to guide the decision on which distributions to assume for the random parameters in a mixed logit model. They suggest to inspect the profile of preference heterogeneity by estimating n + 1 models, where n is the number of individuals in the sample. Apart from the full model, the model is estimated n times where each time a different individual is removed. The difference between the parameter estimate of the full model and the estimates of the reduced models represents the contribution of a specific individual to the mean parameter estimates. Consequently, kernel-density plots of the estimates of the reduced models are estimated to obtain an idea of the empirical profile of the parameters.

Figure 5 provides these graphical descriptions of the empirical profiles of the price, hybrid and emissions parameters. Table 7 reports two descriptive measures of the empirical distributions. The price coefficient appears to be log-normally distributed with an early peak and a very long tail. The hybrid coefficient appears normally distributed. The distribution for emissions is less apparent from this figure. The distribution is quite symmetric, while it also appears to have a somewhat longer tail. Both the normal and log-normal distributions do not appear to represent the true distribution. However, because we are somewhat reluctant to assume the log-normal distribution for the emissions parameter we assume it is normally distributed. Our reluctance is for two reasons: Firstly, a log-normally distributed coefficient takes strictly positive values and hence not zero. A number of papers find that (sometimes a considerable) part of the population is not willing to contribute anything to reducing emissions (e.g. Diederich and Goeschl 2014). From that perspective, excluding zero as possible value of the coefficient is undesirable. Second, the log-normal distribution is characterized by a long right tail, possibly resulting in a too-large standard deviation and a mean that is biased upward (Sillano and de Dios Ortúzar 2005). The drawback of assuming a normal distribution for a parameter with a strong expectation about the sign is that this quite commonly results in WTP estimates for some individuals that have the ‘incorrect’ sign (Murdock 2006).

Appendix 4: Driving Cost Comparison for Two Hypothetical Hybrid-Gasoline Pairs

Table 8 and Fig. 6 report the results of a replication of the driving cost/WTP analysis in Sect. 4.3 for two hypothetical gasoline-hybrid vehicle pairs. The first column (Hypothetical Model X) compares an otherwise-identical gasoline type with a hybrid type that has 23% lower fuel consumption, emissions and fuel costs. This corresponds to the average real-world performance increase of existing hybrid engines compared to their closest gasoline equivalent in the EU (Emissions Analytics 2019). The level of emissions are chosen such that the average level of emissions of a new Dutch passenger car (109 g/km) is approximately in between the levels of the hybrid and gasoline type. The second column (Hypothetical Model Y) calibrates the levels of emissions, fuel consumption and fuel costs at the reported levels of a Toyota Prius hybrid model and the most comparable Volkswagen Golf gasoline model in terms of engine performance. For both vehicles, the reported fuel consumption levels are 0.3 lower than the real-world levels according to Emissions Analytics (2019), which means that the outcome of this analysis based on the real-world estimates would be identical.