Abstract

In this paper we present a Stackelberg differential game to study the dynamic interaction between a polluting firm and a regulator who sets pollution limits overtime. At each time, the firm settles emissions taking into account the fine for non-compliance with the pollution limit, and balances current costs of investments in a capital stock which allows for future emission reductions. We derive two main results. First, we show that the optimal pollution limit decreases as the capital stock increases, while both emissions and the level of non-compliance decrease. Second, we find that offering fine discounts in exchange for firm’s capital investment is socially desirable. We numerically obtain the optimal value of such discount, which crucially depends on the severity of the fine. In the limiting scenario with a very large severity of the fine, the optimal discount implies that no penalties are levied, since the firm shows adequate adaptation progress through capital investment.

Similar content being viewed by others

Notes

Consult the Environmental Protection Agency (EPA)’s webpage for additional information (http://cfpub.epa.gov/npdes/).

The first one has been progressively tightened in 2000, 2008 and 2013, since the initial issuance on September 29, 1995 (http://cfpub.epa.gov/npdes/home.cfm?program_id=6 for details). The second one was issued initially in 2008, and then reissued in 2013 (http://cfpub.epa.gov/npdes/home.cfm?program_id=350).

Incentives for self-policing: discovery, disclosure, correction and prevention of violations—Final Policy Statement, 60 Fed. Reg. 66,706 (December 22, 1995), revised on April 11, 2000.

In a static framework, Arguedas (2013) finds three critical conditions for the social convenience of penalty reductions: (1) administrative costs of sanctioning, (2) imperfect compliance, and (3) fines progressive in the degree of non-compliance. We confirm that such penalty discounts are socially convenient in a dynamic setting as well. Arguedas (2013) does not calculate the value of the optimal discount. In contrast, we numerically obtain that value, and we find that it crucially depends on the severity of the fine.

In the case of tradable permits, only Innes (2003), Stranlund et al. (2005) and Lappi (2013) jointly consider enforcement issues and intertemporal permit trading, although neither of them jointly considers the endogeneity of the permits and the possibility of non-compliance with these permits overtime. Both Innes (2003) and Stranlund et al. (2005) constrain the analysis to enforcement policies that induce full compliance, such that the former assumes an enforcement strategy which consists only of a costly penalty for permit violations, while the second considers the reporting and monitoring functions of enforcement altogether. Lappi (2013) allows for the possibility of non-compliance, assuming that the auditing probability is subjective and, therefore, compliance decisions are made according to the firms’ beliefs about that probability. However, emission permits are also exogenous in that setting.

Copeland and Taylor (1994) and some other papers cited therein also consider emissions as an input in the production process.

As mentioned in the Introduction, in this paper we do not consider cumulative pollution effects.

The assumption \(f\ge d\) allows us to concentrate on the subset of most intuitive results. In particular, this assumption ensures a non-negative optimal standard.

For tractability reasons, we abstract from specifically modeling monitoring issues.

Consult the Criminal Provisions of the Clean Water Act in the EPA webpage (http://www2.epa.gov/enforcement/criminal-provisions-clean-water-act) for more information on this issue.

An example of the use of the stagewise feedback Stackelberg solution for the case of a continuum of followers can be found in Long (2010, p. 217).

Considering a continuum of firms defined over the unit interval, the firm’s capital stock and the aggregate capital stock coincide.

The time argument is omitted here and henceforth when no confusion can arise. As a general principle, upper-case letters denote time-dependent (either state or control) variables, while lower-case letters denote time-independent parameters.

We assume that the administrative costs of imposing sanctions are increasing in the level of non-compliance. Sanctioning costs may increase with this level (and eventually, with the level of the fine) since individuals can strongly resist to the imposition of larger fines, engage in avoidance activities,etc., see Polinsky and Shavell (1992). Stranlund (2007) or Arguedas (2008, (2013) also consider sanctioning costs dependent on the level of the fines.

For tractability, in this model and also in the extended model presented in the following section we substitute the piecewise fine by the quadratic expression \(F(E,L)=f[E-L]^{2}/2\), both under non-compliance and over-compliance. This assumption artificially rules out all the solutions that imply over-compliance, since their opposed solutions with non-compliance lead to the same penalty but higher production. However this is not problematic if (as we will prove) we find strict non-compliance along the optimal trajectory at any time. That being true, perfect compliance is never optimal under this artificial specification. Under the real piecewise fine, over-compliance would imply the same (null) penalty but lower production, and hence it could not be optimal either. In consequence the optimal solution obtained under the artificial specification of the fine coincides with the optimal solution for the real piecewise fine. In Sect. 5, we discuss on the possibility of over-compliance with alternative penalty-subsidy schemes.

Superscript b stands for base model.

This is the interesting case, in which the firm faces the dilemma between adaptation through capital investment or paying the fine for non-compliance. The alternative case where \(k_{0}>\bar{K}^{b}\) would lead the firm to destroy capital along the optimal trajectory.

In the particular case with \(h=0\), the regulator could induce the firm to act as in the first-best scenario, if the severity of the fine were \(f=d,\) which then implies \(L^{*b}(K)=0\) at any time. Note that under this strict liability specification, the firm’s maximization problem is identical to the first-best maximization problem. This particular case is out of the scope of this paper.

\(K^{i}(t),E^{i}(t),I^{i}(t)\) refer to the optimal capital stock, emissions and investment time paths for the different scenarios, \(i\in \{ NR , FB ,b\}\).

The subscript f denotes partial derivative with respect to f.

For this specification \(h\in (h_{\min },h_{\max })=(0.2083,0.625).\)

For \(f\in [0,\hat{f}_{L}^{b}),\) and for the vast majority of the values for h, \(\bar{L}^{b}\) decreases monotonously with f. However, for h close to \(h_{\min }\), \(\bar{L}^{b}\) either always increases or it increases within a first period and decreases henceforth.

In the example, \(\hat{f}_{L}^{b}<d\), although for greater values of h (for example \(h=0.5\)), \(\hat{f}_{L}^{b}>d\), and \(\bar{L}^{b}\) would be U-shaped within the interval we are interested in, that is, \(f\in [d,\infty )\).

The parameter values presented in (20) result in \(\hat{f}_{L}^{b}=0.18223<\hat{f}_{K}^{b}=1.84615<\hat{f}_{E}^{b}=2.6723<\hat{f}^{b}=2.73391\). The numerical result \(\hat{f}^{b}>\hat{f}_{K}^{b}\) is robust to parameter changes, as long as \(h\in (h_{\min },h_{\max })\).

Numerical simulations show that as h decreases, \(V_{{{\mathrm{R}}}}^b(k_0)\) reaches a higher maximum at a lower \(\hat{f}^b\), and hence social welfare increases as the social costs associated with imposing penalties decrease.

Applying the same reasoning as in footnote 15, the equilibrium is characterized substituting the piecewise fine by the quadratic expression. For this extended model we will show a positive degree of non-compliance at any moment in time through numerical simulations.

See the proof of Proposition 4 in the “Appendix” for the detailed expressions.

From now on since our results have been generated numerically, but cannot be proven analytically, we state them as claims rather than propositions.

We cannot characterize analytically the value of \(\beta \) above which an infinite punishment for non-compliance would be socially desirable. For the values in (20) it holds that this threshold (0.217) is smaller than the marginal rate of technical substitution \(1/\sigma =0.5\) between capital and emissions.

We have considered the same parameter values as in (20), and also \(f=2>d=1,\beta =\hat{\beta }=0.807.\)

We have numerically computed a rise in the maximum value of \(V_{{{\mathrm{R}}}}(k_{0})\) when switching from \(f=10^{12}\) to \(f=10^{13}\). Interestingly, the value of \(\beta \) that maximizes social welfare when the severity of the fine tends to infinity converges to a strictly positive finite value, \(\hat{\beta }\).

From now on, superscript S refers to the scenario with the subsidy.

It represents the level of over-compliance at which the subsidy reaches its maximum (further emissions reductions will decrease the total subsidy).

The solution without subsidy is characterized by non-compliance and hence \(|N^{{{\mathrm{S}}}}(K,0)|=N^{{{\mathrm{S}}}}(K,0)\) for any \(K\le \bar{K}^{b}\).

If \(h>(d+\sigma ^{2})/(2\sigma ^{2})=h_{\max }\) the sign in (33) would be positive for all \(f\ge 0\).

References

Andreoni J (1991) Reasonable doubt and the optimal magnitude of the fines: should the penalty fit the crime? RAND J Econ 22:385–395

Arguedas C (2008) To comply or not to comply? Pollution standard setting under costly monitoring and sanctioning. Environ Resour Econ 41:155–168

Arguedas C (2013) Pollution investment, technology choice and fines for non-compliance. J Regul Econ 44:156–176

Başar T, Olsder GK (1982) Dynamic non-cooperative game theory. Academic Press, New York

Beavis B, Dobbs IM (1986) The dynamics of optimal environmental regulation. J Econ Dyn Control 10:415–423

Benford FA (1998) On the dynamics of the regulation of pollution: incentive compatible regulation of a persistant pollutant. J Environ Econ Manag 36:1–25

Conrad M (1992) Stopping rules and the control of stock pollutants. Nat Resour Model 6:315–327

Copeland BR, Taylor MS (1994) North–South trade and the environment. Q J Econ 109:755–787

Decker CS (2007) Flexible enforcement and fine adjustment. Regul Gov 1:312–328

Dockner EJ, Jørgensen S, Long NV, Sorger G (2000) Differential games in economics and management science. Cambridge University Press, Cambridge

Downing PB, Watson WD (1974) The economics of enforcing air pollution controls. J Environ Econ Manag 1:219–236

Downing PB, White LJ (1986) Innovation in pollution control. J Environ Econ Manag 13:18–29

Falk I, Mendelsohn R (1993) The economics of controlling stock pollutants: an efficient strategy for greenhouse gases. J Environ Econ Manag 25:76–88

Feenstra T, Kort PM, de Zeeuw A (2001) Environmental policy instruments in an international duopoly with feedback investment strategies. J Econ Dyn Control 25:1665–1687

Friesen L (2003) Targeting enforcement to improve compliance with environmental regulations. J Environ Econ Manag 46:72–85

Harford JD (1978) Firm behavior under imperfectly enforceable pollution standards and taxes. J Environ Econ Manag 5:26–43

Harford J, Harrington W (1991) A Reconsideration of enforcement leverage when penalties are restricted. J Public Econ 45:391–395

Harrington W (1988) Enforcement leverage when penalties are restricted. J Public Econ 37:29–53

Hartl RF (1992) Optimal acquisition of pollution control equipment under uncertainty. Manag Sci 38:609–622

Haurie A, Krawczyk JB, Zaccour G (2012) Games and dynamic games. World Scientific, Singapore

Heyes A, Rickman N (1999) Regulatory dealing: revisiting the Harrington paradox. J Public Econ 72:361–378

Innes R (2003) Stochastic pollution, costly sanctions, and optimality of emission permit banking. J Environ Econ Manag 45(3):546–568

Insley MC (2003) On the option to invest in pollution control under a regime of tradable emissions allowances. Can J Econ 36:860–883

Jaffe AB, Newell RG, Stavins RN (2003) Technological change and the environment. In: Mäler KG, Vincent JR (eds) Handbook of environmental economics. North-Holland, Amsterdam, pp 461–516

Jones CA (1989) Standard setting with incomplete enforcement revisited. J Policy Anal Manag 8(1):72–87

Jones CA, Scotchmer S (1990) The social cost of uniform regulatory standards in a hierarchical government. J Environ Econ Manag 19:61–72

Kambhu J (1989) Regulatory standards, non-compliance and enforcement. J Regul Econ 1:103–114

Keeler A (1995) Regulatory objectives and enforcement behavior. Environ Resour Econ 6:73–85

Krysiac FC (2011) Environmental regulation, technological diversity and the dynamics of technological change. J Econ Dyn Control 35:528–544

Laffont JJ, Tirole J (1996a) Pollution permits and compliance strategies. J Public Econ 62:85–125

Laffont JJ, Tirole J (1996b) Pollution permits and environmental innovation. J Public Econ 62:127–140

Lappi P (2013) Emissions trading, non-compliance and bankable permits. Mimeo, New York

Livernois J, Mckenna CJ (1999) Truth or consequences: enforcing pollution standards with self reporting. J Public Econ 71:415–440

Long NV (2010) A survey of dynamic games in economics. World Scientific, Singapore

Maia D, Sinclair-Desgagné B (2005) Environmental regulation and the eco-industry. J Regul Econ 28:141–155

Milliman SR, Prince R (1989) Firm incentives to promote technological change in pollution control. J Environ Econ Manag 17:247–265

Nishide K, Nomi EK (2009) Regime uncertainty and optimal investment timing. J Econ Dyn Control 33:1796–1807

Polinsky AM, Shavell S (1992) Enforcement costs and the optimal magnitude and probability of fines. J Law Econ 35:133–148

Raymond M (1999) Enforcement leverage when penalties are restricted: a reconsideration under asymmetric information. J Public Econ 73:289–295

Requate T (2005) Dynamic incentives by environmental policy instruments: a survey. Ecol Econ 54:175–195

Requate T, Unold W (2003) On the incentives of environmental policy to adopt advanced abatement technology–will the true ranking please stand up? Eur Econ Rev 47:125–146

Ruggeri G (1999) The marginal cost of public funds in closed and small open economies. Fiscal Stud 20:41–60

Saha A, Poole G (2000) The economics of crime and punishment: an analysis of optimal penalty. Econ Lett 68:191–196

Shavell S (1991) A note on marginal deterrence. Int Rev Law Econ 12:345–355

Shavell S (1992) Specific versus general enforcement of law. J Polit Econ 99:1088–1108

Stafford S (2005) Does self-policing help the environment? EPA’s audit policy and hazardous waste compliance. Vermont J Environ Law 6:1–22

Stranlund JK (2007) The Regulatory choice of non-compliance in emission trading programs. Environ Resour Econ 38:99–117

Stranlund JK, Costello C, Chávez CA (2005) Enforcing emissions trading when emissions permits are bankable. J Regul Econ 28:181–204

Veljanovski CG (1984) The economics of regulatory enforcement. In: Hawkins K, Thomas JM (eds) Enforcing regulation. Kluwer-Nijhoff Publishing, Boston

Zhao J (2003) Irreversible abatement investment under cost uncertainties: tradable emission permits and emission charges. J Public Econ 87:2765–2789

Author information

Authors and Affiliations

Corresponding author

Additional information

The authors wish to thank Hassan Benchekroun, Michael Finus, María José Gutiérrez, Santiago Rubio, Georges Zaccour and two anonymous referees for very helpful comments and suggestions on earlier drafts. The authors also acknowledge financial support from the Spanish Government under research projects ECO2011-25349 and ECO2014-52372-P (Carmen Arguedas), and ECO2011-24352 and ECO2014-52343-P (Francisco Cabo and Guiomar Martín-Herrán). The second and third authors acknowledge the support by COST Action IS1104 “The EU in the new economic complex geography: models, tools and policy evaluation”.

Appendix

Appendix

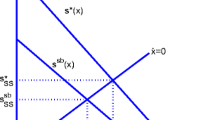

1.1 Proof of Proposition 1

This proof characterizes the stagewise feedback Stackelberg equilibrium strategies (see, for example Haurie et al. 2012, p. 278). Under the assumption of stationary strategies, it involves the resolution of two Hamilton–Jacobi–Bellman equations:

where \((\varvec{\phi _{{{\mathrm{F}}}}}(K),\phi _{{{\mathrm{R}}}}(K)) \) is a feedback strategy pair, with \(\varvec{\phi _{{{\mathrm{F}}}}}(K)=(\phi ^{{{\mathrm{E}}}}(K),\phi ^{{{\mathrm{I}}}}(K))\) and \(\phi _{{{\mathrm{R}}}}(K)=\phi ^{{{\mathrm{L}}}}(K)\). To obtain this pair, we first compute the best reaction functions of the firm as the solution to:

In view of the linear-quadratic structure of the problem we conjecture a quadratic value function for the firm in K:

Therefore, the best-response functions of the firm are then given by:

Knowing the best-reaction functions of the firm presented in (28), now the regulator fixes the pollution limit, to maximize:

Notice, however that \(I^{{{\mathrm{L}}}b}=0\) and therefore, \(\hat{I} ^{b}(K;L)\) does not actually depend on L. The regulator cannot directly influence investment, and hence behaves as a static player. His optimal strategy is then to set an emission limit which satisfies:

From this condition, the optimal emission limit is the affine function of the stock of capital, \(L^{*b}(K)\), given in (5). As long as \(h<1\), it follows that \(\left( L_{0}^{*b}\right) _{f}>0\).

From the optimal emission limit in (5) and the best-response functions of the firm, the optimal emissions and investment are given by the expressions in (6) and (7). And it is easy to see that \(\left( E_{0}^{*b}\right) _{f}<0 \) for all f. Further, from the Riccati equations the coefficients which define the firm’s value function, \(V_{{{\mathrm{F}}}}^{b}(K)\), defined in (27) can now be computed and are given by (8) and:

Once the optimal investment strategy is known, integrating the differential equation which defines the capital stock dynamics, the optimal time path of the capital stock is given by (10).

1.2 Proof of Proposition 2

We first characterize the optimal strategies for the case of no regulation and the first-best scenario, and then we compare these two cases with the stagewise feedback Stackelberg equilibrium characterized in Proposition 1.

First, with no regulator the Hamilton–Jacobi–Bellman equation for problem (17) is:

We again conjecture a quadratic value function in K, denoted by \(V_{{{\mathrm{F}}}}^{{{\mathrm{NR}}}}(K)\):

and \(a_{{{\mathrm{F}}}}^{{{\mathrm{NR}}}},b_{{{\mathrm{F}}}}^{{{\mathrm{NR}}}},c_{{{\mathrm{F}}}}^{{{\mathrm{NR}}}}\) are unknowns to be determined. The only feasible solution for these unknowns associated with a convergent time path of the capital stock is: \(a_{{{\mathrm{F}}}}^{{{\mathrm{NR}}}}=b_{{{\mathrm{F}}}}^{{{\mathrm{NR}}}}=0,c_{{{\mathrm{F}}}}^{{{\mathrm{NR}}}}=1/(2\rho )\). Therefore, the solution under no regulation is the following:

where the optimal time path of capital is obtained by solving (2) once the optimal investment strategy has been replaced.

In the particular case \(k_{0}=0\), then \(K(t)=0\), \(E(t)=1/\sigma \) for any \(t\ge 0\) and the social welfare is \(V^{{{\mathrm{NR}}}}(0)=1/(2\rho )-d/(2\rho \sigma ^{2})\).

The first-best solution to problem (18) can be found by solving the following Hamilton–Jacobi–Bellman equation:

where \(V^{{{\mathrm{FB}}}}(K)\) denotes the value function of the problem. Following the same procedure as above, we then easily obtain the following optimal strategies:

where \(V^{{{\mathrm{FB}}}}(K)=a^{{{\mathrm{FB}}}}K^{2}/2+b^{{{\mathrm{FB}}}}K+c^{{{\mathrm{FB}}}}\), with

and the optimal time-path of the capital stock is:

where \(\bar{K}^{{{\mathrm{FB}}}}\) is the long-run value of the capital stock, and \(|\theta ^{{{\mathrm{FB}}}}|\) is the speed of convergence towards this value.

The corresponding long-run values of emissions and investment read:

Finally, we compare the optimal time paths under no regulation, the first best and the base model.

-

1.

Since \(f\ge d,\) it follows that \(\bar{K}^{{{\mathrm{FB}}}}> \bar{K}^{b}\) and both are positive. Moreover, under this condition it is also true that \(\Delta ^{{{\mathrm{FB}}}}>\Delta ^{b}>0\), hence inequality \(\theta ^{{{\mathrm{FB}}}}<\theta ^{b}\) follows. It is immediate to verify that \(\theta ^{b}<-\delta \). Then \(K^{{{\mathrm{FB}}}}(t)>K^{b}(t)>K^{{{\mathrm{NR}}}}(t)\) for all \(t>0\) follows.

-

2.

\(\bar{I}^{{{\mathrm{FB}}}}>\bar{I}^{b}>0\) follows straightforwardly from part (1). Since \(f\ge d\), then \(a^{{{\mathrm{FB}}}}<a_{{{\mathrm{F}}}}^{b}<0\) immediately follows from \(\Delta ^{{{\mathrm{FB}}}}>\Delta ^{b}\). Moreover, proving \(b^{{{\mathrm{FB}}}}>b_{{{\mathrm{F}}}}^{b}\) is equivalent to proving:

$$\begin{aligned} \frac{\Delta ^{{{\mathrm{FB}}}}-c^{2}(\rho +2\delta )^{2}}{2cd(c\rho + \sqrt{\Delta ^{{{\mathrm{FB}}}}})}>\frac{\Delta ^{b}-c^{2}(\rho +2\delta )^{2}}{2cd(c\rho +\sqrt{\Delta ^{b}})}. \end{aligned}$$Provided that \(f(x)=(x-c^{2}(\rho +2\delta )^{2})/(c\rho +\sqrt{x})\) is an increasing function and \(\Delta ^{{{\mathrm{FB}}}}>\Delta ^{b}\), \(b^{{{\mathrm{FB}}}}>b_{{{\mathrm{F}}}}^{b}\) follows. Thus, \(I^{*{{\mathrm{FB}}}}(0)=b^{{{\mathrm{FB}}}}/c>b_{{{\mathrm{F}}} }^{b}/c=I^{*b}(0)>0\). However, nothing can be said of the comparison between \(I^{b}(t)\) and \(I^{{{\mathrm{FB}}}}(t)\) for \(t>0\).

-

3.

The results immediately follow from part (1), the expressions of \(E^{*{{\mathrm{NR}}}}(K),\) \(E^{*{{\mathrm{FB}}}}(K)\), \(E^{*b}(K) \), and inequalities:

$$\begin{aligned} \frac{1}{\sigma }>\frac{\sigma (f+h\sigma ^{2})}{\Psi }>\frac{\sigma }{d+\sigma ^{2}}. \end{aligned}$$

1.3 Proof of Proposition 3

-

1.

From (8), (29) and (11) it follows that sign\(|\theta ^{b}|_{f}=\)sign\((\bar{K}^{b})_{f}=\)sign\((\bar{I}^{b})_{f}\) is given by:

$$\begin{aligned} \hbox {sign}(h\sigma ^{2}(2f+\sigma ^{2})-(d+\sigma ^{2})f)= \hbox {sign}(2h\sigma ^{2}(f+\sigma ^{2})-\Psi ). \end{aligned}$$(33)Here and henceforth we will be assuming \(d+\sigma ^{2}(1-2h)>0\), i.e. \(h<(d+\sigma ^{2})/(2\sigma ^{2})=h_{\max }\). Under this condition, the sign in (33) is positive for \(f\in [d,\hat{f}_{K}^{b})\), and negative for \(f>\hat{f}_{K}^{b}\), with \(\hat{f}_{K}^{b}\) given in (19).Footnote 37

The effect on emissions is obtained from (13),

$$\begin{aligned} (\bar{E}^{b})_{f}=-\frac{dh\sigma ^{3}}{\Psi ^{2}}\left( 1-\bar{K}^{b}\right) -\frac{\sigma (f+h\sigma ^{2})}{\Psi }(\bar{K}^{b})_{f}. \end{aligned}$$In consequence, if \((\bar{K}^{b})_{f}>0\) then \((\bar{E}^{b})_{f}<0\), implying \(\hat{f}_{E}^{b}>\hat{f}_{K}^{b}>0\) for all \(h>0\). To prove that \(\hat{f}_{E}^{b}\) is finite it is sufficient to see than \((\bar{E}^{b})_{f}\) is positive for sufficiently large values of f: \(\lim _{f\rightarrow \infty }(\bar{E}^{b})_{f}=\infty \).

-

2.

The effect of f on the emission limits can be computed from (12):

$$\begin{aligned} (\bar{L}^{b})_{f}=\frac{d\sigma (d+(1-h)\sigma ^{2})}{\Psi ^{2}}\left( 1-\bar{K}^{b}\right) -\frac{\sigma (-d+f+h\sigma ^{2})}{\Psi }(\bar{K}^{b})_{f}, \end{aligned}$$(34)where \(1-\bar{K}^{b}\) can be written as a function of \((\bar{K}^{b})_{f}\), and then:

$$\begin{aligned} (\bar{L}^{b})_{f}=\left\{ \frac{[d+(1-h)\sigma ^{2}][d^{2}f(f+\sigma ^{2})+c\delta (\delta +\rho )\Psi ^{2}]}{\Psi d\sigma (2h\sigma ^{2}(f+\sigma ^{2})-\Psi )}-\frac{\sigma (f+h\sigma ^{2}-d)}{\Psi }\right\} (\bar{K}^{b})_{f}. \end{aligned}$$We know that \((\bar{K}^{b})_{f}<0\) if and only if \(f>\hat{f}_{K}^{b}\), i.e. \(2h\sigma ^{2}(f+\sigma ^{2})-\Psi <0\). Then, a sufficient condition for the expression in brackets to be negative is \(f+h\sigma ^{2}-d>0\). In consequence, if \(\hat{f}_{K}^{b}>d\), then \((\bar{K}^{b})_{f}<0\) implies \((\bar{L}^{b})_{f}>0\) and therefore \(\hat{f}_{L}^{b}<\hat{f}_{K}^{b}\). It is easy to prove that

$$\begin{aligned} \hat{f}_{K}^{b}>d\Leftrightarrow h>\frac{2d}{2d+\sigma ^{2}}\frac{d+\sigma ^{2}}{2\sigma ^{2}}\equiv h_{min}. \end{aligned}$$Thus \((\bar{L}^{b})_{f}>0\) for all \(f>\hat{f}_{L}^{b}\). To study the sign of \((\bar{L}^{b})_{f}\) for \(f\in [0,\hat{f}_{L}^{b})\), expression (34) can be re-written as an expression which sign is given by a second-order convex polynomial in f. Depending on whether this polynomial has no real roots or it has two roots with different or equal sign, the different behaviour in footnote 23 appear.

-

3.

The derivative \((\bar{E}^{b}-\bar{L}^{b})_{f}\) can be computed and proved negative for any positive h.

1.4 Proof of Proposition 4

For the dynamic maximization problem for the firm described in (3), assuming a quadratic value function for the firm, \(V_{{{\mathrm{F}}}}(K)\) in (24), and following the same reasoning as in the proof of Proposition 1, the best-response functions of the firm are given by:

where \((\varvec{\zeta _{{{\mathrm{F}}}}}(K),\zeta _{{{\mathrm{R}}}}(K))\) is a feedback strategy pair, with \(\varvec{\zeta _{{{\mathrm{F}}}}}(K)=(\zeta ^{{{\mathrm{E}}}}(K),\zeta ^{{{\mathrm{I}}}}(K))\) and \(\zeta _{{{\mathrm{R}}}}(K)=\zeta ^{{{\mathrm{L}}}}(K)\) and:

with \(\Omega =cf+(c+f\beta ^{2})\sigma ^{2},\) \(E^{{{\mathrm{L}}}}\in (0,1) \), and \(I^{{{\mathrm{L}}}}<0\). This last inequality is the main difference with the base model with \(\beta =0\) where \(I^{{{\mathrm{L}}}b}=0\) (see (28)). Therefore, the regulator, taking into account the best-response functions in (35), now behaves as a dynamic player. It fixes the pollution limit in order to maximize:

Assuming a quadratic value function for the regulator, \(V_{{{\mathrm{R}}}}(K)\) in (24), the optimal emission standard strategy, \(L^*(K)\) in (23) follows. The optimal emissions and investment strategies, \(E^*(K)\) and \(I^*(K)\) in (23) immediately follow from the best-response functions in (35) once \(L^*(K)\) is known.

From the optimal investment strategy in (23) and the capital stock dynamics in (2), the optimal time path of the capital stock can be written as in (25).

1.5 Proof of Proposition 5

For \(g(f,\eta )=f\), the optimal strategies of the problem in Sect. 5 are:

with \(V_{{{\mathrm{F}}}}^{{{\mathrm{S}}}}(K)\) being the value function of the firm when a subsidy for over-compliance exists. The optimal time path of the capital stock reads:

The capital stock grows higher than in the case without a subsidy, and the speed of convergence is identical, \(\theta ^{b}\). Assuming the same initial value, \(k_{0}\), it follows that \(K^{b}(t)<K^{{{\mathrm{S}}}}(t)<\bar{K}^{{{\mathrm{S}}}}\) for all \(t>0\).

From (36), an upper bound for \(\eta \) ensures non-negative emissions. This bound is minimum for the long-run capital stock. Hence, a necessary and sufficient condition which guarantees positive emissions along the whole planning horizon is:

with \(\bar{\eta }\) being the value of \(\eta \) for which emissions are null at the steady state. This condition also ensures that \(\bar{K}^{{{\mathrm{S}}}}<1\).

Focusing on the starting date, we define \(\eta ^0\) as the value of \(\eta \) for which full compliance initially holds, that is, \(N(k_0,\eta ^0)=0\):

Since \(N^{{{\mathrm{S}}}}_\eta <0\), then the firm initially over-complies if \(\eta >\eta ^0\) and vice versa. Furthermore, since \(N^{{{\mathrm{S}}}}_K<0\) and K grows with time, then if the firm initially over-complies, \(\eta >\eta ^0\), it will over-comply henceforth.

Focusing on the steady state, \(\bar{K}^{{{\mathrm{S}}}}(\eta )\), we define \(\tilde{\eta }\) as the value of \(\eta \) for which full compliance holds, that is, \(N(\bar{K}^{{{\mathrm{S}}}}({\tilde{\eta }}),{\tilde{\eta }})=0\):

Since \(dN^{{{\mathrm{S}}}}/d\eta <0\), then at the steady state the firm over-complies if \(\eta >{\tilde{\eta }}\) and vice versa. Further, since \(N^{{{\mathrm{S}}}}_K<0\) and K grows with time, then if the firm ends-up with non-compliance, \(\eta \le {\tilde{\eta }}\), the firm does not comply along the whole period.

From the behaviour at the initial time and at the steady state, and the fact that \({\tilde{\eta }}<\min \left\{ \eta ^0,\bar{\eta }\right\} \), the results in Proposition 5 follow.

1.6 Proof of Proposition 6

This proof distinguishes two cases depending on the value of \(\eta :\)

-

(a)

\(\eta \le \tilde{\eta }\quad \) (Non-compliance for all \(t\ge 0\))

$$\begin{aligned} m(K^{b}(t),K^{{{\mathrm{S}}}}(t),\eta )=N^{{{\mathrm{S}}}}(K^{b}(t),0)-N^{{{\mathrm{S}}}}(K^{{{\mathrm{S}}}}(t),\eta )=\frac{d\sigma (K^{{{\mathrm{S}}}}(t)-K^{b}(t))}{\Psi }+\eta \frac{f(d+\sigma ^{2})}{\Psi }. \end{aligned}$$Since \(K^{{{\mathrm{S}}}}(t)>K^{b}(t)\) for all \(t>0\), then \(m(K^{b}(t),K^{{{\mathrm{S}}}}(t),\eta )>0\) for all \(t\ge 0\) and the consideration of the subsidy increases the effectiveness of the enforcement mechanism along the whole period.

-

(b)

\({\tilde{\eta }}<\eta \)

-

(b1)

\(\tilde{\eta }<\eta <\eta ^{0}\) (Non-compliance for \(t\in [0,\hat{t})\) and over-compliance for \(t\ge \hat{t}\))Within the interval \([0,\hat{t})\) effectiveness increases following the argument in case a).

Within the interval \([\hat{t},\infty )\) function m reads:

$$\begin{aligned} m(K^{b}(t),K^{{{\mathrm{S}}}}(t),\eta )= & {} N^{{{\mathrm{S}}}}(K^{b}(t),0)+N^{{{\mathrm{S}}}}(K^{{{\mathrm{S}}}}(t),\eta )\nonumber \\= & {} \frac{d\sigma (2-K^{{{\mathrm{S}}}}(t)-K^{b}(t))}{\Psi }-\eta \frac{f(d+\sigma ^{2})}{\Psi }. \end{aligned}$$(39)At time \(\hat{t}\), \(N^{{{\mathrm{S}}}}(K^{{{\mathrm{S}}}}(\hat{t}),\eta )=0\) and therefore, \(m(K^{b}(\hat{t}),K^{{{\mathrm{S}}}}(\hat{t}),\eta )>0\). Taking into account (10) and (38), it immediately follows that \(m(K^{b}(t),K^{{{\mathrm{S}}}}(t),\eta )\) is monotonously decreasing with time. Finally, at the steady state \(m(\bar{K}^{b},\bar{K}^{{{\mathrm{S}}}}(\eta ),\eta )\) is a decreasing function of \(\eta \) which vanishes for \(\eta =2\tilde{\eta }\). Therefore:

-

1.

If \(\eta \le 2{\tilde{\eta }}\), then \(m(\bar{K}^{b},\bar{K}^{{{\mathrm{S}}}}(\eta ),\eta )\ge 0\) and since m is decreasing with time, \(m(\bar{K}^{b},\bar{K}^{{{\mathrm{S}}}}(\eta ),\eta )>0\) for all \(t\in [\hat{t},\infty )\). In consequence, the effectiveness of the enforcement mechanism increases for the whole period.

-

2.

If \(\eta >2\tilde{\eta }\), then \(m(\bar{K}^{b},\bar{K}^{{{\mathrm{S}}}}(\eta ),\eta )<0\) but, at time \(\hat{t},\) \(m(K^{b}(\hat{t}),K^{{{\mathrm{S}}}}(\hat{t}),\eta )>0\). In consequence, the effectiveness is improved within a first interval longer than \([0,\hat{t})\), but worsens from a given time on.

-

1.

-

(b2)

\({\tilde{\eta }}<\eta ^0\le \eta \quad \)(Over-compliance for all \(t> 0\))

Function m is given in Eq. (39). At time 0, \(m(k_{0},k_{0},\eta )\) is positive if and only if \(\eta <2\eta ^{0}\). Under this condition, the same reasoning as in the case b1) for the interval \([\hat{t},\infty )\) now applies for \([0,\infty )\). Therefore either the effectiveness of the enforcement mechanism increases for the whole period if \(\eta \le 2\tilde{\eta }\), or it increases within a first period but worsens henceforth, if \(\eta >2\tilde{\eta }\).Finally, \(\eta >2\eta ^{0}\) implies \(m(k_{0},k_{0},\eta )<0\) and since this function decreases with time it will remain negative. Therefore, the consideration of the subsidy would imply a reduction in the effectiveness of the enforcement mechanism along the whole period.

-

(b1)

Rights and permissions

About this article

Cite this article

Arguedas, C., Cabo, F. & Martín-Herrán, G. Optimal Pollution Standards and Non-compliance in a Dynamic Framework. Environ Resource Econ 68, 537–567 (2017). https://doi.org/10.1007/s10640-016-0031-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-016-0031-5