Abstract

We analyse the effects of unilateral climate policy in a two-country two-firm model, with endogenous plant location and heterogeneity in both country size and firm’s characteristics. The effectiveness of unilateral climate policy is shown to depend on the joint effect of country and firm heterogeneity, and on their impact on equilibrium location choice. For being effective and not leading to production relocation in the long-run, unilateral climate policy should be moderate, implemented by a sufficiently larger area and complemented by mechanisms promoting the international transfer of clean technologies. The model indicates that the smaller area cannot take the lead in global climate mitigation for a protracted time period. Finally, when the local community is not environmentally concerned, the unilateral policy unambiguously makes the society worse off.

Similar content being viewed by others

Notes

Carbon leakage takes place if a policy aimed to limit emissions in a area is the direct cause of an increase in emissions outside the area itself.

On the role of the technological gap as a driver of emissions reduction, see also Golombek and Hoel (2004).

As to the assumption that the highly regulated and cleaner area (country I) is the larger one, we follow previous literature such as Zeng and Zhao (2009). This assumption is due to the policy debate being framed in terms of industrialized versus emerging and developing countries. It also mirrors the Annex I (mainly industrialized countries) versus non-Annex I classification in the Kyoto Protocol. As of 1997, the Annex I countries (including the US) accounted for slightly more than 60 % of world GDP—based on purchasing-power parity valuation —, hence satisfying the assumption \(a_{I}>a_{II}\) and \(b_{I}<b_{II}\). Nevertheless, starting from 2011, a reverse asymmetry hypothesis would be appropriate to describe the relative sizes of the two areas, with the GDP of Annex I countries (including the US) amounting in 2013 to 47.1 % of world GDP. If China would enter a comprehensive and legally binding agreement, the world share of GDP of Annex I countries (including the US) plus China could be equal to 62.8 % (data from International Monetary Fund, World Economic Outlook Database, April 2015).

As the solution of the third stage of the game is in line with the traditional literature on quantity competition à la Cournot, we do not provide details on this.

Numerical simulations indicate that for admissible parameters values the direct centrifugal effect of the carbon tax differential always prevails on the indirect centripetal effect via abatement.

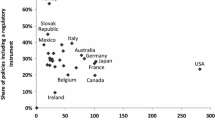

This variable captures also the effect of market size asymmetry since in Fig. 1 the size of country I is given.

We may also label as \(a_{II}^{\min }(s)\) the value of \(a_{II}\) such that, for any s, the equilibrium quantity sold by firm 1 in country \( II \) under NR is nil, say \(\widehat{q}_{1,II}^{NR}(a_{II}^{\min }(s))=0.\) The function \(a_{II}^{\min }(s)\) is increasing in s (see Fig. 1). For \(a_{II}<a_{II}^{\min }(s)\) we are in the No Export area (NE) in which serving the foreign market is not profitable.

Notice that \(\widehat{Q}_{i}^{L}=\widehat{q}_{i,I}^{L}+\widehat{q}_{i,II}^{L}\) with \(i=1,2\) and \(\widehat{q}_{1,I}^{L}\) (\(\widehat{q} _{1,II}^{L}\)) denoting equilibrium sales of producer i in country I (resp. II) in the market configuration L.

In the trade and the environment literature using two-sector general equilibrium models (see e.g. Copeland and Taylor 1994, 2003), it is usual to distinguish three effects of trade liberalisation on the environment, following Grossman and Krueger (1993). The scale effect captures the impact on the level of economic activity, with the composition of total production unchanged. The composition effect indicates the change in the sectoral composition of production due to the impact of trade liberalisation on the country specialization. The technique effect reflects that trade liberalisation may lead to a change in the technologies adopted, with a lowering in emissions for unit of output. Our model is different in various respects, since it is a partial equilibrium model and considers global instead of local pollution. The mechanisms we capture obviously present some similarities with the ones identified by the trade and environment literature. So the volume effect corresponds to the scale effect and the product mix effect captures some elements of both the composition and the technique effect. However, due to the differences in the models, there is no total comparability of these concepts. That is why we preferred adopting a different terminology.

It is worth remarking that, in the policy debate the focus is on the relationship between unilateral climate policy and its effects on domestic production. So, a “narrow” definition of \(\hat{\Pi }_{1}^{L}\) as profits coming from the output produced in the home market could be more appropriate to deal with the issue at hand.

As in Fig. 1, which illustrates the case of market asymmetry, the size of the larger country is kept constant. Thus the two figures have different variables on the vertical axis.

In the NR equilibrium location choice, the key findings in Sect. 5 still hold, since the change in global emissions is not affected by the relative size of a country.

References

Abe K, Zhao L (2005) Endogenous international joint ventures and the environment. J Int Econ 67:221–240

Albornoz F, Cole MA, Elliot RJR, Ercolani MG (2009) In search of environmental spillovers. World Econ 32:136–163

Bayindir-Upmann T (2003) Strategic environmental policy under free entry of firms. Rev Int Econ 11:379–396

Branger F, Quirion P (2014) Climate policy and the ‘carbon haven’ effect. Wiley Interdiscip Rev Clim Change 5:53–71

Cole MA, Elliot RJR, Fredriksson G (2006) Endogenous pollution havens: does FDI influence environmental regulations? Scand J Econ 108:157–178

Cole MA, Elliot RJR, Fredriksson G (2009) Institutionalized pollution havens. Ecol Econ 68:1239–1256

Copeland BR, Taylor MR (1994) North–South trade and the environment. Q J Econ 109:755–787

Copeland BR, Taylor MR (2003) Trade and the environment: theory and evidence. Princeton University Press, Princeton

Dijkstra BR, Mathew AJ, Mukherjee A (2011) Environmental regulation: an incentive for foreign direct investment. Rev Int Econ 19:568–578

Douglas S, Nishioka S (2012) International differences in emissions intensity and emissions content of global trade. J Dev Econ 99:415–427

Ederington J, Levinson A, Minier J (2005) Footloose and pollution-free. Rev Econ Stat 87:92–99

Eerola E (2006) International trade agreements, environmental policy, and relocation of production. Resour Energy Econ 28:333–350

Eichner T, Pethig R (2015) Unilateral consumption-based carbon taxes and negative leakage. Resour Energy Econ 40(C):127–142

Elhadj NB, Tarola O (2015) Relative quality-related (dis)utility in a vertically differentiated oligopoly with an environmental externality. Environ Dev Econ 20(3):354–379

Elliot R, Zhou Y (2013) Environmental regulation induced foreign direct investment. Environ Resour Econ 55:141–158

Eskeland GS, Harrison AE (2003) Moving to greener pastures? Multinationals and the pollution haven hypothesis. J Dev Econ 70:1–23

Frondel M, Horbach J, Renning K (2007) End-of-pipe or cleaner production? An empirical comparison of environmental innovation decisions across OECD countries. In: Johnstone N (ed) Environmental policy and corporate behaviour, OECD. Edward Elgar, Cheltenham

Golombek R, Hoel M (2004) Unilateral emission reductions and cross-country technology spillovers. BE J Econ Anal Policy 3:1–27

Grossman GM, Krueger AB (1993) Environmental impacts of a North America free trade agreement. In: Garber PM (ed) The U.S.—Mexico free trade agreement. MIT Press, Cambridge, pp 13–56

Ikefuji M, Itaya J, Okamura M (2015) Optimal emission tax with endogenous location choice of duopolistic firms. Environ Resour Econ. doi:10.1007/s10640-015-9914-0

Javorcik BS, Wei S-J (2004) Pollution havens and foreign direct investment: dirty secret or popular myth? Contrib Econ Anal Policy 3:1–32

Kayalica O, Lahiri S (2005) Strategic environmental policies in the presence of foreign direct investment. Environ Resour Econ 30:1–21

Lahiri S, Symeonidis G (2007) Piecemeal multilateral environmental policy reforms under asymmetric oligopoly. J Public Econ Theory 9:885–899

Manderson E, Kneller R (2012) Environmental regulation, outward FDI and heterogeneous firms: are countries used as pollution havens? Environ Resour Econ 51:317–352

Markusen JR, Morey ER, Olewiler ND (1993) Environmental policy when market structure and plant location are endogenous. J Environ Econ Manag 24:69–86

Motta M, Thisse JF (1994) Does environmental dumping lead to delocation? Eur Econ Rev 38:563–576

Petrakis E, Xepapadeas A (2003) Location decisions of a polluting firm and the time consistency of environmental policy. Resour Energy Econ 25:197–214

Reinaud J (2008) Issues behind competitiveness and carbon leakage under uneven climate policies—Focus on heavy industry. IEA Information Paper

Sanna-Randaccio F, Sestini R (2012) The impact of unilateral climate policy with endogenous plant location and market size asymmetry. Rev Int Econ 20:580–599

Sanna-Randaccio F, Sestini R, Tarola O (2014) Unilateral climate policy and foreign direct investment with firm and country heterogeneity. Note di Lavoro FEEM 55.2014, Milan: Fondazione ENI Enrico Mattei

Sugeta H, Matsumoto S (2005) Green tax reform in an oligopolistic industry. Environ Resour Econ 31:253–274

Ulph A (1996) Environmental policy and international trade when governments and producers act strategically. J Environ Econ Manag 30:265–281

Ulph A, Valentini L (2001) Is environmental dumping greater when plants are footloose? Scand J Econ 103:673–688

Wagner U, Timmins C (2009) Agglomeration effects in foreign direct investment and the pollution haven hypothesis. Environ Resour Econ 43:231–256

Xing Y, Kolstad C (2002) Do lax environmental regulations attract foreign investment? Environ Resour Econ 21:1–22

Zeng D-Z, Zhao L (2009) Pollution havens and industrial agglomeration. J Environ Econ Manag 58:141–154

Author information

Authors and Affiliations

Corresponding author

Additional information

The authors thank the editor, two anonymous referees and participants to WCERE Istanbul 2014, EARIE Milan 2014, EIBA Uppsala 2014 for valuable suggestions. Funding provided by MIUR (Italian Ministry for Education, University and Research) under the research programme “Climate Change in the Mediterranean Region: Evolutionary Scenarios, Economic Impacts, Mitigation Policies and Technological Innovation” (PRIN project 2010–2011) is gratefully acknowledged. The usual disclaimer applies.

Appendix 1

Appendix 1

Considering for lack of space only firm 1’s objective functions, we have:

1.1 Appendix 2

Let us remind that \(A_{I}=[ a_{I}-c-\phi _{1}t_{I}+(\phi _{2}-\phi _{1})t_{II}]\) and \(A_{II}=[ a_{II}-c-\phi _{1}t_{I} +(\phi _{2}-\phi _{1})t_{II}]\), with \(A_{I}>0\) because of \(\hat{q}_{1,I}^{NR}+\hat{q}_{1,I}^{TR}>0\), and \((A_{II}-s)>0\), due to \(\hat{q}_{1,II}^{NR}+\hat{q}_{1,II}^{TR}>0\). Also, notice that Eq. (5) may be written as:

It immediately follows that, in the low transport cost case, namely in the case where \(s<\phi _{1}(t_{I}-t_{II})\), then \(\hat{\Pi }_{1}^{NR} -\hat{\Pi }_{1}^{TR}<0\) for a sufficiently low taxation gap \((t_{I}-t_{II}),\) namely when the centripetal effect of abatement is weak. Numerical simulations show that \(\hat{\Pi }_{1}^{NR}-\hat{\Pi }_{1}^{TR}<0\) for most admissible parameters values (see Fig. 1).

We prove now that: (i) \(\breve{a}_{II}(s)\) is an increasing function of s; (ii) there exists a value of \(G_{\min }\) s.t., for any \(G\eqslantgtr G_{\min }=\max \{ \frac{t_{I}^{2}}{2},\frac{4}{9} \frac{[ s+\phi _{1}( t_{I}-t_{II})] ^{2}}{b_{II} }+\frac{t_{II}^{2}}{2}\} ,\) \(\bar{a}_{II}(s)\) is a decreasing function of s ; (iii) \(\bar{a}_{II}\mid _{s=0}>\breve{a}_{II}\mid _{s=0}.\)

Finally, we derive the value of s, say \(s^{*}\), such that \(\breve{a}_{II}(s^{*})\) \(=\) \(\bar{a}_{II}(s^{*})\).

To this aim, let us first consider that

and

-

As far as (i), the derivative of \(\breve{a}_{II}(s)\) w.r.t. s writes as:

$$\begin{aligned} \frac{2b_{II}A_{I}\phi _{1}\left( t_{I}-t_{II}\right) }{b_{I}\left( s+\phi _{1}\left( t_{I}-t_{II}\right) \right) ^{2}}+1-\frac{9b_{II} (t_{I}-t_{II})(t_{I}+t_{II})}{8\left( s+\phi _{1}\left( t_{I}-t_{II}\right) \right) ^{2}}. \end{aligned}$$In order to evaluate the sign of this expression, we proceed as follows. As to the denominator, it is immediate to see that it is strictly positive. As to the numerator, it may be rewritten as a univariate quadratic function of the form: \(as^{2}+bs+c\), with \(a>0,\) \(b>0\). The sign of the discriminant is thus crucial to assess whether \(\frac{\partial \breve{a}_{II}(s)}{\partial s}>0,\) being this discriminant given by: \(\Delta =\) \(2(t_{I}-t_{II})b_{I}b_{II} [9b_{I}(t_{I}+t_{II})-16\phi _{1}A_{I}].\) To ensure that \(\frac{\partial \breve{a}_{II}(s)}{\partial s}>0\) it has to hold that \(\Delta <0,\) namely \(16\phi _{1}A_{I}>9b_{I}(t_{I}+t_{II}).\) First, consider that \([9b_{I}(t_{I}+t_{II})-16\phi _{1}A_{I}]=9(t_{I}+t_{II})-24\phi _{1}(\hat{q}_{1,I}^{NR}+\hat{q}_{1,I}^{TR}).\) Since total net emissions by firm 1 in NR (resp. TR) location equilibrium are such that \(\phi _{1}(\hat{q} _{1,I}^{NR}+\hat{q}_{1,II}^{NR})> t_{I},\) (resp. \(\phi _{1}(\hat{q}_{1,I} ^{TR}+\hat{q}_{1,II}^{TR})> t_{II}\)) it has to hold that \(2\phi _{1}\hat{q}_{1,I}^{NR}>t_{I}\) and \(2\phi _{1}\hat{q}_{1,I}^{TR}>t_{II}.\) Therefore, from these inequalities, we obtain that \(2\phi _{1}(\hat{q}_{1,I}^{NR}+\phi _{1}\hat{q}_{1,I}^{TR})>t_{I}+t_{II}.\) Hence, \(24\phi _{1}(\hat{q}_{1,I} ^{NR}+\phi _{1}\hat{q}_{1,I}^{TR})>12(t_{I}+t_{II})>9(t_{I}+t_{II}).\) Q.E.D.

-

As far as (ii), given that

$$\begin{aligned} \frac{\partial \bar{a}_{II}(s)}{\partial s}=1-\frac{9}{4}\frac{b_{II} [G-t_{II}^{2}/2]}{\left[ s+\phi _{1}\left( t_{I}-t_{II}\right) \right] ^{2}}, \end{aligned}$$(20)we obtain that \(\bar{a}_{II}(s)\) is a decreasing function of s iff \(G\eqslantgtr \frac{4}{9}\frac{\left[ s+\phi _{1}\left( t_{I}-t_{II}\right) \right] ^{2}}{b_{II}}+\frac{t_{II}^{2}}{2}.\) Q.E.D.

-

Finally, concerning (iii), the difference between \(\bar{a}_{II}\mid _{s=0}\) and \(\breve{a}_{II}\mid _{s=0}\) can be written as

$$\begin{aligned} \frac{1}{8}b_{II}\frac{9b_{I}(2G-t_{I}^{2})+8A_{I}\phi _{1}(t_{I}-t_{II} )}{b_{I}\phi _{1}\left( t_{I}-t_{II}\right) } \end{aligned}$$(21)If \(G\eqslantgtr G_{\min }=\max \left\{ \frac{t_{I}^{2}}{2},\frac{4}{9} \frac{\left[ s+\phi _{1}\left( t_{I}-t_{II}\right) \right] ^{2}}{b_{II} }+\frac{t_{II}^{2}}{2}\right\} \), we can conclude that \(\bar{a}_{II} \mid _{s=0}>\breve{a}_{II}\mid _{s=0}\). Q.E.D.

-

By simple algebra it is found that \(\exists s :\breve{a}_{II}(s) =\bar{a}_{II}(s)\). Denote this value of s as \(s^{*}\), where

$$\begin{aligned} s^{*}=\frac{9}{4A_{I}}b_{I}\left( G-\frac{t_{I}^{2}}{2}\right) +\phi _{1}(t_{I}-t_{II}). \end{aligned}$$Since \(s^{*}\) is such that \(\hat{\Pi }_{1}^{NR}(s^{*})=\hat{\Pi }_{1} ^{TR}(s^{*})\) and \(\hat{\Pi }_{1}^{NR}(s^{*})=\hat{\Pi }_{1}^{PR}(s^{*}),\) it follows that also \(\hat{\Pi }_{1}^{PR}(s^{*})=\hat{\Pi }_{1} ^{TR}(s^{*})\), with \(\hat{\Pi }_{1}^{PR}-\hat{\Pi }_{1}^{TR}>(<)\) 0 for \(s>(<)\) \(s^{*}\).

1.2 Appendix 3

When the equilibrium location choice is NR, we find:

and

When the equilibrium location choice is TR, we find:

and

1.3 Appendix 4

As far as consumer surplus variation under tighter environmental measures, we find that \(\widehat{CS}_{I}^{NR}-\widetilde{CS}_{I}\) \(=\frac{b_{I}}{2}[(\hat{Q}_{I}^{NR}+\tilde{Q}_{I})(\hat{Q}_{I}^{NR}-\tilde{Q}_{I})].\) So, the sign of \((\widehat{CS}_{I}^{NR}-\widetilde{CS}_{I})\) is determined by sign \((\hat{Q}_{I}^{NR}-\tilde{Q}_{I}^{NR})=-\frac{1}{3b_{I}}( t_{I}-t_{II}) \phi _{1}<0.\) In the NR case, the effect on government revenue from a unilateral tax in country I is given by\(:\hat{T}_{I} ^{NR}-\tilde{T}_{I}=t_{I}[\phi _{1}(\hat{q}_{1,I}^{NR}+\hat{q}_{1,II} ^{NR})-t_{I}]-t_{II}[\phi _{1}(\tilde{q}_{1,I}^{NR}+\tilde{q}_{1,II} ^{NR})-t_{II}]\) namely \((t_{I}-t_{II})[ \phi _{1}\left( \hat{q} _{1,I}^{NR}-\frac{2t_{II}\phi _{1}}{3b_{II}}\right) +\phi _{1}( \hat{q}_{1,II}^{NR}-\frac{2t_{II}\phi _{1}}{3b_{I}}) -(t_{I}+t_{II})] \). The sign of this expression is ambiguous. However, assuming that \(t_{II}=0\) implies that \(\hat{T}_{I}^{NR}-\tilde{T}_{I}>0\) holds, since \([ \phi _{1}(\hat{q}_{1,I}^{NR}+\hat{q}_{1,II}^{NR}) -t_{I}] \) are net emissions in country I. In general, we find that \(\hat{T}_{I}^{NR}-\tilde{T}_{I}>0\) whenever

As shown in Sect. 5, a higher unilateral carbon tax reduces global emissions (\(\hat{E}_{W}^{NR}\)) with respect to the baseline scenario (\(\tilde{E}_{W}\)) whenever \(\phi _{1}\ge \frac{\phi _{2}}{2}\). The same condition applies when one examines the effect on damage.

Then, let us consider the aggregate consumers’ welfare. Focusing on the scenario with \(\phi _{1}\ge \frac{\phi _{2}}{2}\), in order to conclude whether aggregate consumers’ welfare raises under NR, we evaluate the sign of the following expression: \(\frac{b_{I}}{2}[(\hat{Q}_{I}^{NR}+\tilde{Q}_{I} )(\hat{Q}_{I}^{NR}-\tilde{Q}_{I})]+\hat{T}_{I}^{NR}-\tilde{T}_{I}\). It emerges that \([(\hat{Q}_{I}^{NR}+\tilde{Q}_{I})(\hat{Q}_{I}^{NR}-\tilde{Q}_{I})]<0\) always holds while \(\hat{T}_{I}^{NR}-\tilde{T}_{I}>0\) may occur. From standard computations, we find that aggregate consumers’ welfare under a unilateral policy in the NR equilibrium is higher than in the baseline, namely \(\frac{b_{I}}{2}[(\hat{Q}_{I}^{NR}+\tilde{Q}_{I})(\hat{Q}_{I}^{NR}-\tilde{Q}_{I})]+\hat{T}_{I}^{NR}-\tilde{T}_{I}>0\) whenever:

Finally, when moving to producers’surplus—evaluated in terms of global profits—we have that:

The sign of \(\hat{\Pi }_{1}^{NR}-\tilde{\Pi }_{1}^{NR}\) depends on one hand on the terms in curly brackets: this component is negative since \((\hat{q} _{1,I}^{NR}-\tilde{q}_{1,I}^{NR})=-\frac{2}{3b_{I}}\phi _{1}( t_{I}-t_{II}) <0\) and \((\hat{q}_{1,II}^{NR}-\tilde{q}_{1,II} ^{NR})=-\frac{1}{3b_{II}}2( t_{I}-t_{II}) \phi _{1}<0\). On the other hand, the abatement effort exerted in NR under unilateral climate policy boosts the corresponding profits. It is reasonable to conclude that the first negative component in curly brackets prevails over the second positive one, namely \(\frac{( t_{I}+t_{II})}{2}.\) Therefore, \(\hat{\Pi }_{1}^{NR}-\tilde{\Pi }_{1}^{NR}<0.\) Q.E.D.

1.4 Appendix 5

Consider the function

In order to evaluate the sign of \(\frac{\partial \widehat{W}_{I}^{NR}}{\partial t_{I}},\) we first remind that

Thus we find that:

Moreover,

Denoting by \(\Gamma =[ -(2\phi _{1}-\phi _{2})\frac{\phi _{1}}{3}\left( \frac{1}{b_{I}}+\frac{1}{b_{II}}\right) ]\) and considering that global net emissions under the NR equilibrium are positive, or \(\phi _{1}(\hat{q}_{1,I}^{NR}+\hat{q}_{1,II}^{NR})+\phi _{2}(\hat{q}_{2,I} ^{NR}+\hat{q}_{2,II}^{NR})-(t_{I}+t_{II}) >0\), it follows that

with \(\Gamma \) concave in \(\phi _{1}\) and positive for any \(\phi _{1}\in ]0,\frac{\phi _{2}}{2}[.\) Therefore, we obtain that the condition \(\phi _{1}<\frac{\phi _{2}}{2}\) is necessary for \(\frac{\partial \widehat{D}_{I}^{NR} }{\partial t_{I}}>0\) to occur and thus for \(\frac{\partial \widehat{W}_{I} ^{NR}}{\partial t_{I}}<0.\) Viceversa, for any \(\phi _{1}\ge \frac{\phi _{2}}{2}\), the function \(\Gamma \) is negative or null and thus damage unambigously falls. In this scenario, it may happen that \(\frac{\partial \widehat{W}_{I}^{NR}}{\partial t_{I}}>0.\) Q.E.D.

1.5 Appendix 6

As to the comparison between the welfare properties of equilibria under NR and under TR, let us consider first that \(\widehat{CS}_{I}^{NR}-\widehat{CS}_{I}^{TR}\) \(=\frac{b_{I}}{2}[(\hat{Q}_{I}^{NR}+\hat{Q}_{I}^{TR})(\hat{Q}_{I}^{NR}-\hat{Q}_{I}^{TR})].\) Since it is most likely to observe either NR or TR equilibrium location choice in the high transport cost scenario, we focus on this case thereby stating that \(\widehat{CS}_{I}^{NR}-\widehat{CS}_{I}^{TR}>0\), due to \((\hat{Q}_{I}^{NR}-\hat{Q}_{I}^{TR})=\left[ \frac{s-\phi _{1}(t_{I}-t_{II})}{3b_{I}}\right] >0.\) Further, it is straightforward that \(\widehat{T}_{I}^{NR}>\widehat{T}_{I}^{TR}\), being \(\widehat{T}_{I}^{TR}=0\) and \(\widehat{T}_{I}^{NR}>0.\) As to producer surplus, if one considers only firm \(1^{\prime }\)s domestic profits, it comes out that \(\widehat{\pi }_{1I}^{NR}>\widehat{\pi }_{1I}^{TR}\) as \(\widehat{\pi }_{1I}^{TR}\) is nil. As to the difference in damage under the two equilibrium location choices, this is given by \(\frac{\gamma _{_{I}}}{2}[(\hat{E} _{W}^{NR})^{2}-(\hat{E}_{W}^{TR})^{2}].\) Thus the sign of this difference is determined by \(sign(\hat{E}_{W}^{NR}-\hat{E}_{W}^{TR})\). It comes out that

Then, if the condition \(\phi _{1}\ge \frac{\phi _{2}}{2}\) holds, then \(\hat{E}_{W}^{TR}>\hat{E}_{W}^{NR}\) provided \(b_{II}<\breve{b}_{II} =\frac{( b_{I}s+b_{I}\phi _{1}(t_{I}-t_{II})) }{s-\phi _{1} (t_{I}-t_{II}){}_{}}.\)

Moving to the PR equilibrium location choice, first notice that the sign of the difference \(\widehat{CS}_{I}^{NR}-\widehat{CS}_{I}^{PR}\) depends on \(sign(\hat{Q}_{I}^{NR}-\hat{Q}_{I}^{PR}).\) Since \(\hat{Q}_{I}^{NR}=\hat{Q} _{I}^{PR}\), it immediately follows that consumer surplus in country I in the NR scenario coincides with that observed in the PR one. As far as the government revenue in the PR case, we find that \(\hat{T}_{I}^{PR}=t_{I} (\phi _{1}\hat{q}_{1,I}^{PR}-t_{I}),\) while \(\hat{T}_{I}^{NR}=\) \(t_{I}(\phi _{1}(\hat{q}_{1,I}^{NR}+\hat{q}_{1,II}^{NR})-t_{I}).\) Since \(\hat{q} _{1,I}^{PR}=\hat{q}_{1,I}^{NR},\) it immediately follows that \(\hat{T}_{I} ^{NR}>\) \(\hat{T}_{I}^{PR}.\) Moreover, as to producer surplus, it results that \(\widehat{\pi }_{1I}^{NR}>\widehat{\pi }_{1I}^{PR}\), since (i) \(\hat{q}_{1,II}^{PR}\) is not included in firm 1’s domestic profits, while \(\hat{q}_{1,I}^{PR}=\hat{q}_{1,I}^{NR}\) , (ii) the abatement at equilibrium is the same for firm 1 in country I both in NR and PR. Finally, when considering global emissions, it emerges that

Assuming that \(\phi _{1}>\frac{\phi _{2}}{2}\) holds—which is a sufficient condition for global emissions to decrease both in the NR case and in the PR one–, then \((\hat{E}_{W}^{PR}-\hat{E}_{W}^{NR})>0\) for \(b_{II} <\widetilde{b_{II}},\) with \(\widetilde{b_{II}}=\frac{(s+\phi _{1}(t_{I} -t_{II}))\left( 2\phi _{1}-\phi _{2}\right) }{3t_{II}}.\) Q.E.D.

1.6 Appendix 7

In line with the findings emerged when country I is larger than country II, we get that under reverse asymmetry in the low transport cost case TR always dominates PR (see Eq. 7). As to the high transport cost case, the benefits of partial over total relocation are lower, the smaller the size of country I (see Eq. 7). Indeed, for a given size of the world market, the parameter \(A_{I}\) (resp. \(b_{I})\) is lower (resp. higher) under reverse market asymmetry than under the traditional assumption of market asymmetry. Also, reminding that \(s^{*}\) is the value of s satisfying \(\hat{\Pi }_{1}^{PR}(s^{*})=\hat{\Pi }_{1}^{TR}(s^{*})\ \) under market asymmetry, and defining by \(s^{**}\) the value of unit transport cost s.t. \(\hat{\Pi }_{1}^{PR}(s^{**})=\hat{\Pi }_{1}^{TR}(s^{**})\) under reverse market asymmetry, we can borrow from the analysis developed in “Appendix 2”. In particular, we can state that the incentive to total relocation dominates the one to partial relocation whenever \(s<s^{**},\) while it is dominated otherwise, namely when \(s\ge s^{**}\). Finally, since both \(s^{*}\) and \(s^{**}\) are decreasing (resp. increasing) in \(a_{I}\) (resp. \(b_{I})\), as a by-product, \(s^{**}>s^{*}\) . Accordingly, there exists a set of parameters such that, under market asymmetry, firm 1 does not totally relocate (thereby choosing PR), while preferring total relocation under reverse market asymmetry.

Rights and permissions

About this article

Cite this article

Sanna-Randaccio, F., Sestini, R. & Tarola, O. Unilateral Climate Policy and Foreign Direct Investment with Firm and Country Heterogeneity. Environ Resource Econ 67, 379–401 (2017). https://doi.org/10.1007/s10640-015-9990-1

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-015-9990-1