Abstract

Quotas are frequently used in the management of renewable resources and emissions. However, in many industries there is concern about their basic effectiveness due to non-compliance. We develop an enforcement model of a quota-regulated resource and focus on a situation with significant non-compliance and exogenous constraints on fines and enforcement budget. We propose a new enforcement system based on self-reporting of excess extraction and explicit differentiation of inspection rates depending on compliance history. We use differentiated inspections to induce firms to self-report excess extraction. This system increases the effectiveness of the quota by allowing the regulator to implement a wider range of aggregate extraction targets than under traditional enforcement, while ensuring an efficient allocation of extraction. In addition, inspection costs can be reduced without reductions in welfare.

Similar content being viewed by others

Notes

Fines are typically constrained by the principle that the punishment should be proportional to the crime, which restricts the use of higher fines to combat illegal resource use. Furthermore, substantial increases in enforcement costs are often politically infeasible due to budgetary constraints.

Other explanations for high compliance rates in environmental regulation with low sanctions and inspection rates have been suggested. One explanation is the risk of repercussions on financial and output markets by violation of environmental regulations, which affect firm profits (see e.g. Hamilton 1995; Konar and Cohen 1997; Anton et al. 2004). If consumers or investors care about the firm’s environmental reputation, their reaction to disclosures of non-compliance with environmental regulations could be costly to the firm, which may explain higher compliance rates even though regulatory sanctions are small. Such effects may be important in the case of large differentiated firms that consumers and investors can identify in the market, but are presumably less important for smaller, undifferentiated firms that are not easily identified in the market, such as those operating in many resource industries. See also Helland (1998), Sandmo (2000), and Short and Toffel (2008).

In the environmental literature, compliance is usually a binary choice (to comply with or violate regulations). Hence, if one self-reports, there is no reason for such report to be untruthful.

As already noted, quotas are non-tradable in most regulated fisheries, and even if trade is allowed, it is usually restricted.

Accounting for transition dynamics would imply that the quota and other regulatory variables depend on the current stock size and therefore change as the system approaches its steady state.

It is straightforward to generalize the analysis presented in the following to a dynamic setting. However, this complicates derivations without affecting the general results or yielding additional insights into the functioning of the proposed enforcement system.

This would be the case if we have Allee effects (see Clark 1976).

Note that while we assume that all firms face the same individual quota, regulators typically differentiate quotas according to, for example, the type and size of the firm. Since this is not our focus, we disregard this to keep the analysis tractable. Extending the model accordingly is straightforward.

The inspection rate is constant across firms since firms are identical in every aspect apart from their harvesting cost, which is private information. Hence, ex ante all agents look identical to the regulator and are therefore equally likely to be inspected. We relax this assumption below, when we introduce state-dependent inspections.

While the assumption of a constant inspection cost is in line with previous theoretical work, it is likely that inspection costs in reality vary across firms depending on harvest quantities and other factors. However, as the regulator ex ante cannot distinguish high inspection cost firms from low inspection cost firms, and assuming a sufficiently high number of inspections, we can interpret \(c_m\) as the average inspection cost.

This is a standard assumption when sanctioning by fine. However, as pointed out by a referee, there may be situations in which sanctioning violators is costly. If the sanctioning cost is increasing in the punishment level, the regulator may choose not to impose the maximum fine if sanctioning costs are sufficiently high. However, such analysis is beyond the scope of this paper.

We disregard price or cost differences between fish extracted legally and illegally. The analysis easily generalizes to the case of price and/or cost differences between legal and illegal extraction.

In contrast, if firms were constrained by the uniform catch quota or by different expected fines, aggregate catch would be allocated inefficiently because the marginal shadow price of catches would differ across firms.

This implies spending the entire inspection budget, and consequently, a maximization of the inspection rate \(\gamma \).

This occurs when the marginal shadow cost of their quota exceeds the expected fine.

Differentiated inspection rates are not a formal part of the enforcement system in any fishery. However, we know that at least in some fisheries, inspectors target firms that are believed to be more likely to violate regulations based on previous inspections (see Kronbak and Jensen 2011).

There are several possibilities to make control hell even crueler and thereby strengthen its deterrence effect, such as by introducing quota reductions for firms in control hell or increasing the period of time a firm must spend in control hell.

This assumption makes the analysis more tractable. However, this is just a normalization since lower inspection rates in group 2 corresponds with increasing the time period firms must stay in group 2 and proportionally increasing the inspection rate in group 1.

Note that if \(r=1\), then there is no rebate for self reporting, while if \(r\) is close to zero, the rebate for self reporting is large.

The inspection probability is assumed to be positive and strictly below one.

In general, the following must hold: \(1\ge \gamma _2 > \gamma _1 >0\). In addition, the inspection budget cannot be exceeded, which implies that \(\gamma _1 \le \frac{m - \gamma _2 n_2}{n - n_2}\), where \(n_2\) is the number of firms in inspection group 2. Thus, if too many firms end up in group 2, this drains group 1 for inspection resources.

For more complex punishment schemes in repeated games, see Abreu (1988) and the literature that followed on optimal penal codes.

Another approach to deal with this issue is to introduce more inspection groups, where each group is more unattractive than the previous.

The quadratic cost function given by the second term of Eq. (12) is equivalent to the production function \(y = a_0 E^{0.5} X^{0.5}\), where \(E\) is fishing effort and \(a_0\) is a productivity parameter. Hence, the implied stock-output elasticity is 0.5. This is close to parameter estimates for the most cost insensitive types of fisheries; schooling fisheries. See e.g. Bjørndal (1987), who estimates production functions for herring.

The MSY target and the focus on sustainable states facilitate parsimonious comparisons of enforcement systems. However, the results presented are in fact simulated using a dynamic model and generalize to the dynamic setting and to other policy objectives than the MSY target, including that of maximizing economic yield (MEY). Note that the MEY differs from the MSY when costs are as in (12). However, when the objective is MSY, the target stock level is independent of the intrinsic growth rate, which we vary in the following. The target stock level under an MSY objective is half of the pristine stock level.

For a given parametrization of the model, \(\bar{h}\) is a constant. See Appendix 1.1 for details.

Alternatively, we could look at fisheries that differ in output price rather than growth rate. The higher the output price, all else constant, the stronger the incentives to violate quotas and the more enforcement we need to ensure that aggregate catches meet the target catch level.

We assume that the full inspection budget is used under all cases considered. Hence, it is appropriate to compare welfare before deduction of inspection costs.

We do not allow the regulator to adjust inspection costs (i.e., the number of inspections). For the self-report based system there is a trade-off between inspection rates and time spent in control hell. We therefore want to focus on welfare from other sources since it may not be feasible in real-world situations to have very high values of \(u\).

As noted, this represents the best possible outcome in terms of achieving the MSY target by use of differentiated inspection rates. In real industries, regulators do not have perfect information on firm-level costs and must settle with imperfect differentiation of inspection rates.

As noted, when \(u\) is constrained, it is no longer necessarily optimal to set policy parameters so that all firms are induced to choose strategy A (self-reporting). To keep things tractable, we assume in the simulations that the self-report rebate factor \(r\) is set just low enough to induce all firms to choose strategy A. The \(r\) value can be calculated from Eq. (21) in the Appendix 1, by setting \(\alpha _0=\underline{\alpha }\). Thus, the simulations in the table reflect a lower bound on this system’s performance.

To improve the performance of a constrained self-report based system, we can introduce quota reductions for firms in group 2. In general, any strategy can be used that makes control hell more hellish and thereby further deters firms from choosing strategy B.

We assume that firms take the current level of the stock, as well as all policy variables, as given when considering future operations and profits.

References

Abreu D (1988) On the theory of infinitely repeated games with discounting. Econometrica 56:383–396

Agnew D, Pearce J, Pramod G, Peatman T, Watson R, Beddington J, Pitcher T (2009) Estimating the worldwide extent of illegal fishing. PLoS One 4(2):e4570

Anderson L, Lee D (1986) Optimal governing instrument, operation level, and enforcement in natural resource regulation: the case of the fishery. Am J Agric Econ 68(3):678–690

Anton W, Deltas G, Khanna M (2004) Incentives for environmental self-regulation and implications for environmental performance. J Environ Econ Manag 48(1):632–654

Bjørndal T (1987) Production economics and optimal stock size in a North Atlantic fishery. Scand J Econ 89(2):145–164

Charles AT, Mazany RL, Cross ML (1999) The economics of illegal fishing: a behavioural model. Marine Resour Econ 14:95–110

Chavez C, Salgado H (2005) Individual transferable quota markets under illegal fishing. Environ Resour Econ 31:303–324

Clark CW (1976) Mathematical Bioeconomics. Wiley, New York

Evans M, Gilpatric S, Liu L (2009) Regulation with direct benefits of information disclosure and imperfect monitoring. J Environ Econ Manag 57(3):284–292

Furlong W (1991) The deterrent effect of regulatory enforcement in the fishery. Land Econ 67:116–129

Greenberg J (1984) Avoiding tax avoidance: a(repeated) game-theoretic approach. J Econ Theory 32(1):1–13

Hamilton JT (1995) Pollution as news: media and stock market reactions to the toxics release inventory data. J Environ Econ Manag 28(1):98–113

Harrington W (1988) Enforcement leverage when penalties are restricted. J Public Econ 37:29–53

Helland E (1998) The enforcement of pollution control laws: inspections, violations, and self-reporting. Rev Econ Stat 80(1):141–153

Heyes A, Rickman N (1999) Regulatory dealing—revisiting the Harrington paradox. J Public Econ 72(3):361–378

Innes R (1999) Remediation and self-reporting in optimal law enforcement. J Public Econ 72(3):379–393

Innes R (2001) Violator avoidance activities and self-reporting in optimal law enforcement. J Law Econ Organ 17(1):239

Kaplow L, Shavell S (1994) Optimal law enforcement with self-reporting of behavior. J Polit Econ 102(3):583–606

Konar S, Cohen M (1997) Information as regulation: the effect of community right to know laws on toxic emissions. J Environ Econ Manag 32(1):109–124

Kronbak L, Jensen F (2011) An empirical investigation of compliance and enforcement problems: the case of mixed trawl fishery in Kattegat and Skagerrak. Food Econ 8(1):59–73

Livernois J, McKenna C (1999) Truth or consequences-enforcing pollution standards with self-reporting. J Public Econ 71(3):415–440

Macho-Stadler I, Pérez-Castrillo D (2006) Optimal enforcement policy and firms’ emissions and compliance with environmental taxes. J Environ Econ Manag 51(1):110–131

Malik A (1993) Self-reporting and the design of policies for regulating stochastic pollution. J Environ Econ Manag 24(3):241–257

Milliman S (1986) Optimal fishery management in the presence of illegal activity. J Environ Econ Manag 13(4):363–381

Sandmo A (2000) The public economics of the environment. Oxford University Press, Oxford

Short J, Toffel M (2008) Coerced confessions: self-policing in the shadow of the regulator. J Law Econ Organ 24(1):45–71

Smith V (1969) On models of commercial fishing. J Polit Econ 77(2):181–198

Sumaila UR, Alder J, Keith H (2006) Global scope and economics of illegal fishing. Marine Policy 30:696–703

Sutinen JG, Andersen P (1985) The economics of fisheries law enforcement. Land Econ 61(4):387–397

Author information

Authors and Affiliations

Corresponding author

Additional information

We are grateful to Peder Andersen, Heather Eckert, Rögnvaldur Hannesson, John Livernois and two anonymous referees for helpful comments and suggestions on earlier versions of the paper.

Appendix 1

Appendix 1

1.1 Deriving Aggregate Catch Levels

We start out by presenting the parametrization of the theoretical model used in the simulations. In the following subsections, we show how aggregate catch levels are calculated under traditional and self-report based enforcement.

1.2 Model Parametrization

The parameter values used in the simulations are given in Table 3.

Recall that the cost parameter \(\alpha \) is uniformly distributed over the interval \([\underline{\alpha }, \bar{\alpha }]\). Based on the parameter values from Table 3, there are \(n=100\) agents with cost parameters ranging from \(\underline{\alpha }=75\) to \(\bar{\alpha }=125\).

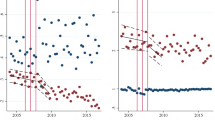

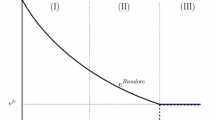

The interval for the intrinsic growth rate \(h\) given in Table 3, represents the range of growth rates we analyze. Note that there is no variation in the growth rate, instead we evaluate the performance of the self-report based system over a range of intrinsic growth rates representing different types of fisheries. At low growth rates, there is a high need for enforcement to meet the aggregate catch objective. As we increase the growth rate, the need for enforcement declines until \(h=\bar{h}=1.0217\), when no enforcement is needed. In this case, the aggregate catch target is reached under open access.

1.3 Traditional Enforcement System

Profits for compliant and non-compliant firms are given by Eqs. (4) and (12). By solving the profit maximization problem of the firm for any value of \(\alpha _i\), it can be shown that firm level harvest is:

where \(\hat{\alpha }\) is the value of the firm-specific cost parameter \(\alpha \) for which a firm would be indifferent between compliance and non-compliance.

1.4 Self-Report Based Enforcement System

To calculate aggregate harvest as a function of the self-reporting rebate when firms choose strategies A and B, we start out by analyzing optimal firm-level behavior. By maximizing the profit functions given above, we find that optimal catches are as follows:

where subscripts \(a\), \(b1\), and \(b2\) denote a firm choosing strategy A (in group 1), a firm choosing strategy B currently in group 1, and a firm choosing strategy B currently in group 2, respectively. By substituting catch response functions from Eqs. (14–16) into Eq. (3) and adjusting for the long-run shares of strategy B firms that are in groups 1 and 2, an expression for aggregate catch can be found.

We can now calculate the value of \(\alpha \) for which a firm is indifferent between strategies A and B, which we denote \(\alpha _0\). Strategy B, is relatively more attractive to more productive firms (low \(\alpha _i\)) because their gains from not self-reporting excess catches in group 1 are greater than for less productive firms (with high \(\alpha _i\)). Thus, if some firms prefer strategy B to strategy A it must be firms with low values of \(\alpha _i\).

We now derive the value of \(\alpha \) that makes a firm indifferent between strategies A and B, which we denote \(\alpha _0\). The present value of all future payoffs for a firm following strategy A is:

which can be rewritten:

Correspondingly, the expected present value of all future payoffs for a firm following strategy B is:

This can be rewritten as follows:Footnote 33

The value of \(\alpha _i\) that separates firms choosing strategy A from firms choosing strategy B can be identified by equating the present values of the two strategies (\(EV_a = EV_b\)) and is denoted \(\alpha _0\). We substitute in for the maximized profit functions, \(\pi _{a}^* = \frac{X}{2\alpha } \left( p - rf\right) ^2 + r f q\) and \(\pi _{b1}^* = \frac{X}{2\alpha } \left( p - \gamma _1 f\right) ^2 + \gamma _1 fq\), and obtain:

Rearranging the expression yields the following second order equation in \(\alpha _0\):

Solving Eq. (22) gives the following:

where \(A\) , \(B\) and \(D\) are defined as follows:

Firms with \(\alpha _i \ge \alpha _0\) find it optimal to use strategy A, while firms with lower production costs (\(\alpha _i\)) choose strategy B.

Finally, we calculate the aggregate catch response function under the assumption that \(u\) can be set high enough to ensure that all firms chose strategy A. This requires that \(u\) is set high enough for the inequality \(\underline{\alpha } \ge \alpha _0(u)\) to hold, where \(\alpha _0(u)\) is given by Eq. (23). We use the reaction function of strategy A firms from Eq. (14). In addition we know the probability density function of the uniformly distributed variable \(\alpha \), which is \(\frac{1}{\bar{\alpha }-\underline{\alpha }}\) (for \(\underline{\alpha } \le \alpha \le \hat{\alpha }\)). Given that there is a continuum of firms, total catches can be expressed as:

Rights and permissions

About this article

Cite this article

Hansen, L.G., Jensen, F. & Nøstbakken, L. Quota Enforcement in Resource Industries: Self-Reporting and Differentiated Inspections. Environ Resource Econ 58, 539–562 (2014). https://doi.org/10.1007/s10640-013-9709-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-013-9709-0