Abstract

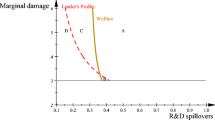

This paper considers the combination of pollution taxes and abatement subsidies when some polluting firms procure their abatement goods and services from an oligopolistic eco-industry. The regulator must here cope with two simultaneous price distortions: one that comes from pollution and the other which is caused by the eco-industry’s market power. In this context, we show that taxing emissions while subsidizing polluters’ abatement efforts cannot lead to first-best, but the opposite occurs provided it is the eco-industry’s output which is subsidized. When public transfers also create distortions, welfare can be higher if the regulator uses only an emission tax, but subsidizing abatement suppliers while taxing emissions remains optimal when the eco-industry is concentrated.

Similar content being viewed by others

References

Barde JP, Honjatukia O (2004) Environmentally harmful subsidies, Chap 7. In: Tietenberg T, Folmer H (eds) The international yearbook of environmental and resource economics 2004/2005. Edward Elgar, Michigan

Canton J, Soubeyran A, Stahn H (2008) Environmental taxation and vertical Cournot oligopolies: how eco-industries matter. Environ Resour Econ 40: 369–382

Carraro C, Metcalf GE (2001) Behavioral and distributional effects of environmental policy. NBER conference reports. University of Chicago Press

Conrad K (1993) Taxes and subsidies for pollution-intensive industries as trade policy. J Environ Econ Manag 25: 121–135

David M, Sinclair-Desgagné B (2005) Environmental regulation and the eco-industry. J Regul Econ 28(2): 141–155

Environmental Business International (2006) Global market review. Environ Bus J, 19: 5–6

Ernst and Young (2006) Eco-industry: its size, employment, perspectives and barriers to growth in an enlarged EU. Final report to the DG environment of the European commission

European Commission (1999) The EU eco-industry’s export potential: final report to DGXI of the European commission, Brussels

Fredriksson PG (1998) Environmental policy choice: pollution abatement subsidies. Resour Energy Econ 20: 51–63

Fullerton D, Mohr RD (2002) Suggested subsidies are suboptimal unless combined with an output tax. NBER working paper no. 8723

Kohn RE (1991) Porter’s combination of tax and subsidy for controlling pollution. J Environ Syst 20(3): 179–188

Kohn RE (1992) When subsidies for pollution abatement increase total emissions. South Econ J 59(1): 77–87

Laffont JJ, Tirole J (1994) A theory of incentives in procurement and regulation. MIT Press, Cambridge

Lerner AP (1972) Pollution abatement subsidies. Am Econ Rev 62(5): 1009–1010

Organization for Economic Cooperation and Development (1992) The environmental industry in OECD countries: situation, perspectives and governmental policies. OECD Editions, Paris

Organization for Economic Cooperation and Development (1996) The global environmental goods and services industry. OECD Editions, Paris

Organization for Economic Cooperation and Development/Eurostat (1999) The environmental services industry: manual for data collection and analysis. OECD Editions, Paris

Parry IWH (1997) A second-best analysis of environmental subsidies. Working paper. Resources for the future

Pigou AC (1920) The economics of welfare. Macmillan, London

Requate T (2005) Timing and commitment of environmental policy, adoption of new technologies and repercussions on R&D. Environ Resour Econ 31: 175–199

Sinclair-Desgagné B (2008) The environmental goods and services industry. Int Rev Environ Resour Econ 2: 69–99

Stranlund JK (1997) Public technological aid to support compliance to environmental standards. J Environ Econ Manag 34: 228–239

United States International Trade Commission (2005) Air and noise pollution abatement services: an examination of US and foreign markets. Investigation report no. 332–461

Wang H (2002) Pollution regulation and abatement efforts: evidence from China. Ecol Econ 41: 85–94

World Trade Organization (1998) Environmental services. Chapter IX of the committee on trade and environment’s note on environmental benefits of removing trade restrictions and distortions

Author information

Authors and Affiliations

Corresponding author

Additional information

We are grateful to Joan Canton, Henk Folmer, Anthony Heyes, Alain-D販ré Nimubona, and Tom Tietenberg for valuable conversations and insights on this topic. We also acknowledge useful comments and suggestions from Sangeeta Bansal, Brian Copeland, Timo Goeschl, Timothy Swanson, and seminar participants at the Universities of Toulouse 1 and Paris 1, McGill University, HEC Montreal, l’Ecole polytechnique de Paris, University College of London, the EAERE 2005 annual conference in Bremen, and the 2006 World Congress of Environmental and Resource Economists in Kyoto.

This paper has not been submitted elsewhere in identical or similar form, nor will it be during the 3 months after its submission to the Publisher.

Rights and permissions

About this article

Cite this article

David, M., Sinclair-Desgagné, B. Pollution Abatement Subsidies and the Eco-Industry. Environ Resource Econ 45, 271–282 (2010). https://doi.org/10.1007/s10640-009-9315-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-009-9315-3