Abstract

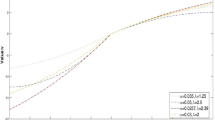

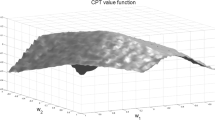

The paper proposes a portfolio selection approach based on cumulative prospect theory (CPT) that integrates data envelopment analysis (DEA). The CPT-based model has emerged as the best model in behavioral portfolio theory for incorporating decision-maker behavior in risk and uncertainty. We are using the quadratic value function suggested in the study of Gazioğlu and Çalışkan (Appl Financ Econom 21(21):1581–1586, 2011), which is the best alternative to the value function proposed by Kahneman and Tversky (Handbook of the fundamentals of financial decision making: Part I, World Scientific, 2013) in the literature. Based on the CPT value of each asset, we bifurcate the assets into two groups, top CPT value assets and bottom CPT value assets. To assess the cross-efficiency of the assets, we consider the CPT value and long-term return of each asset as outputs and the variance of the return as an input. We combine cumulative prospect theory with cross-efficiency and examine the psychological aspects of decision-makers in portfolio selection. The study used thirty listed stocks from the Nifty-50, the National Stock Exchange, India for empirical investigation. The empirical findings elucidate that the portfolios generated by the highest CPT value surpass those generated by the lowest CPT value. We demonstrate that the proposed approach can be a potential tool for portfolio selection by exhibiting that the selected portfolio delivers greater risk-adjusted returns in the financial markets.

Similar content being viewed by others

Notes

We are considering ten assets in both the groups, top CPT value assets, and bottom CPT value assets, in our study. The user can choose how many assets are included in each group, and this choice will have no impact on the results.

References

Amin, G. R., & Hajjami, M. (2021). Improving dea cross-efficiency optimization in portfolio selection. Expert Systems with Applications, 168, 114280.

Anderson, T. R., Hollingsworth, K., & Inman, L. (2002). The fixed weighting nature of a cross-evaluation model. Journal of Productivity Analysis, 17(3), 249–255.

Bansal, P., & Mehra, A. (2022). Integrated dynamic interval data envelopment analysis in the presence of integer and negative data. Journal of Industrial and Management Optimization, 18(2), 1339.

Basso, A., & Funari, S. (2001). A data envelopment analysis approach to measure the mutual fund performance. European Journal of Operational Research, 135(3), 477–492.

Bernard, C., & Ghossoub, M. (2010). Static portfolio choice under cumulative prospect theory. Mathematics and Financial Economics, 2(4), 277–306.

Charnes, A., Cooper, W. W., & Rhodes, E. (1978). Measuring the efficiency of decision making units. European Journal of Operational Research, 2(6), 429–444.

Chen, X., Liu, X., Wang, W., & Gong, Z. (2020). Behavioral dea model and its application to the efficiency evaluation of manufacturing transformation and upgrading in the yangtze river delta. Soft Computing, 24(14), 10721–10738.

Consigli, G., Hitaj, A., & Mastrogiacomo, E. (2019). Portfolio choice under cumulative prospect theory: sensitivity analysis and an empirical study. Computational Management Science, 16(1), 129–154.

De Giorgi, E., & Hens, T. (2006). Making prospect theory fit for finance. Financial Markets and Portfolio Management, 20(3), 339–360.

Deng, L., Liu, Z., & Tan, J. (2022). Optimal portfolio and consumption choices of retirees with uncertain lifetimes under cumulative prospect theory. Applied Economics, 1–27

Doyle, J., & Green, R. (1994). Efficiency and cross-efficiency in dea: Derivations, meanings and uses. Journal of the Operational Research Society, 45(5), 567–578.

d Gong, C., Xu, C., Ando, M., & Xi, X. (2018). A new method of portfolio optimization under cumulative prospect theory. Tsinghua Science and Technology, 23(1), 75–86.

Emrouznejad, A., Amin, G. R., Thanassoulis, E., & Anouze, A. L. (2010). On the boundedness of the sorm dea models with negative data. European Journal of Operational Research, 206(1), 265–268.

Emrouznejad, A., Anouze, A. L., & Thanassoulis, E. (2010). A semi-oriented radial measure for measuring the efficiency of decision making units with negative data, using dea. European Journal of Operational Research, 200(1), 297–304.

Essid, H., Ganouati, J., & Vigeant, S. (2018). A mean-maverick game cross-efficiency approach to portfolio selection: An application to paris stock exchange. Expert Systems with Applications, 113, 161–185.

Falagario, M., Sciancalepore, F., Costantino, N., & Pietroforte, R. (2012). Using a dea-cross efficiency approach in public procurement tenders. European Journal of Operational Research, 218(2), 523–529.

Fan, J., Liu, J., & Wu, M. (2019). Improvement of cross-efficiency based on prospect theory. Journal of Intelligent and Fuzzy Systems, 37(3), 4391–4404.

Fang, L., & Yang, J. (2019). An integrated ranking approach using cross-efficiency intervals and the cumulative prospect theory. Computers and Industrial Engineering, 136, 556–574.

Gardijan, M., & Škrinjarić, T. (2015). Equity portfolio optimization: A dea based methodology applied to the zagreb stock exchange. Croatian Operational Research Review, 6(2), 405–417.

Gazioğlu, Ş, & Çalışkan, N. (2011). Cumulative prospect theory challenges traditional expected utility theory. Applied Financial Economics, 21(21), 1581–1586.

Green, R. H., Doyle, J. R., & Cook, W. D. (1996). Preference voting and project ranking using dea and cross-evaluation. European Journal of Operational Research, 90(3), 461–472.

Grishina, N., Lucas, C. A., & Date, P. (2017). Prospect theory-based portfolio optimization: an empirical study and analysis using intelligent algorithms. Quantitative Finance, 17(3), 353–367.

Gupta, S., Bandyopadhyay, G., Bhattacharjee, M., & Biswas, S. (2019). Portfolio selection using dea-copras at risk-return interface based on nse (india). International Journal of Innovative Technology and Exploring Engineering (IJITEE), 8(10), 4078–4086.

Gurevich, G., Kliger, D., & Levy, O. (2009). Decision-making under uncertainty - a field study of cumulative prospect theory. Journal of Banking and Finance, 33(7), 1221–1229.

Hatami-Marbini, A., Emrouznejad, A., & Agrell, P. J. (2014). Interval data without sign restrictions in dea. Applied Mathematical Modelling, 38(7–8), 2028–2036.

Hens, T., & Mayer, J. (2017). Cumulative prospect theory and mean-variance analysis: a rigorous comparison. Journal of Computational Finance, 21(3), 47–73.

Huang, C., Chiou, C., Wu, T., & Yang, S. (2015). An integrated dea-modm methodology for portfolio optimization. Operational Research, 15(1), 115–136.

Joro, T., & Na, P. (2006). Portfolio performance evaluation in a mean-variance-skewness framework. European Journal of Operational Research, 175(1), 446–461.

Kahneman, D. & Tversky A. (2013). Prospect theory: An analysis of decision under risk. In Handbook of the fundamentals of financial decision making: Part I, (pp. 99–127). World Scientific

Kao, C., & Liu, S. (2020). A slacks-based measure model for calculating cross efficiency in data envelopment analysis. Omega, 95, 102192.

Lim, S., Oh, K. W., & Zhu, J. (2014). Use of DEA cross-efficiency evaluation in portfolio selection: An application to Korean stock market. European Journal of Operational Research, 236(1), 361–368.

Lim, S., & Zhu, J. (2015). Dea cross-efficiency evaluation under variable returns to scale. Journal of the Operational Research Society, 66(3), 476–487.

Lin, R. (2020). Cross-efficiency evaluation capable of dealing with negative data: A directional distance function based approach. Journal of the Operational Research Society, 71(3), 505–516.

Liu, H., Song, Y., & Yang, G. (2019). Cross-efficiency evaluation in data envelopment analysis based on prospect theory. European Journal of Operational Research, 273(1), 364–375.

Liu, S., Xu, X., Grant, L., Strong, J., & Fang, Z. (2017). Professional standards and performance evaluation for principals in china: A policy analysis of the development of principal standards. Educational Management Administration and Leadership, 45(2), 238–259.

Lu, W. M., & Lo, S. F. (2007). A closer look at the economic-environmental disparities for regional development in china. European Journal of Operational Research, 183(2), 882–894.

Markowitz, H. (1952). Portfolio selection. The Journal of Finance, 7(1), 77–91.

Mashayekhi, Z., & Omrani, H. (2016). An integrated multi-objective markowitz-dea cross-efficiency model with fuzzy returns for portfolio selection problem. Applied Soft Computing, 38, 1–9.

Matin, R. K., Amin, G. R., & Emrouznejad, A. (2014). A modified semi-oriented radial measure for target setting with negative data. Measurement, 54, 152–158.

Morey, M. R., & Morey, R. C. (1999). Mutual fund performance appraisals: a multi-horizon perspective with endogenous benchmarking. Omega, 27(2), 241–258.

Murthi, B. P. S., Choi, Y. K., & Desai, P. (1997). Efficiency of mutual funds and portfolio performance measurement: A non-parametric approach. European Journal of Operational Research, 98(2), 408–418.

Oral, M., Kettani, O., & Lang, P. (1991). A methodology for collective evaluation and selection of industrial randd projects. Management science, 37(7), 871–885.

Pirvu, T. A., & Schulze, K. (2012). Multi-stock portfolio optimization under prospect theory. Mathematics and Financial Economics, 6(4), 337–362.

Portela, M. C. A. S., Thanassoulis, E., & Simpson, G. (2004). A directional distance approach to deal with negative data in DEA: An application to bank branches. Journal of Operational Research Society, 55(10), 1111–1121.

Quiggin, J. (1982). A theory of anticipated utility. Journal of Economic Behavior and Organization, 3(4), 323–343.

Ruiz, J. L. (2013). Cross-efficiency evaluation with directional distance functions. European Journal of Operational Research, 228(1), 181–189.

Ruß, J., & Schelling, S. (2018). Multi cumulative prospect theory and the demand for cliquet-style guarantees. Journal of Risk and Insurance, 85(4), 1103–1125.

Sexton, T. R., Silkman, R. H., & Hogan, A. J. (1986). Data envelopment analysis: Critique and extensions. New Directions for Program Evaluation, 1986(32), 73–105.

Shao, X., & Wang, M. (2022). Two-stage cross-efficiency evaluation based on prospect theory. Journal of the Operational Research Society, 73(7), 1620–1632.

Sharp, J. A., Meng, W., & Liu, W. (2007). A modified slacks-based measure model for data envelopment analysis with “natural’’ negative outputs and inputs. Journal of the Operational Research Society, 58(12), 1672–1677.

Sharpe, W. F. (1966). Mutual fund performance. The Journal of business, 39(1), 119–138.

Simo-Kengne, B. D., Ababio, K. A., Mba, J., & Koumba, U. (2018). Behavioral portfolio selection and optimization: an application to international stocks. Financial Markets and Portfolio Management, 32(3), 311–328.

Srivastava, S., Aggarwal, A., & Mehra, A. (2022). Portfolio selection by cumulative prospect theory and its comparison with mean-variance model. Granular Computing. https://doi.org/10.1007/s41066-021-00302-1

Tohidi, G., and Razavyan, S. (2012). Cross efficiency of decision making units with the negative data in data envelopment analysis. Proceedings of the 2012 International Conference on Industrial Engineering and Operations Management Istanbul, Turkey

Tversky, A., & Kahneman, D. (1992). Advances in prospect theory: Cumulative representation of uncertainty. Journal of Risk and Uncertainty, 5(4), 297–323.

Wang, L., Wang, Y., & Martínez, L. (2017). A group decision method based on prospect theory for emergency situations. Information Sciences, 418, 119–135.

Wu, D. (2016). Robust decision support system for asset assessment and management. IEEE Systems Journal, 11(3), 1486–1491.

Wu, J., Chu, J., Sun, J., Zhu, Q., & Liang, L. (2016). Extended secondary goal models for weights selection in dea cross-efficiency evaluation. Computers and Industrial Engineering, 93, 143–151.

Wu, J., Liang, L., & Chen, Y. (2009). DEA game cross-efficiency approach to olympic rankings. Omega, 37(4), 909–918.

Yu, Y., Zhu, W., Shi, Q., & Zhuang, S. (2021). Common set of weights in data envelopment analysis under prospect theory. Expert Systems, 38(1), 12602.

Acknowledgements

The authors are thankful to Professor Suresh Chandra, Ex-faculty, Department of Mathematics, IIT Delhi, India, for his suggestions on this work. The first author, Sweksha Srivastava, is supported by the Indraprastha Research Fellowship for Ph.D. candidates granted by Guru Gobind Singh Indraprastha University, New Delhi, India vide letter no. GGSIPU/DRC/2019/91/1798. We would like to thank the editor and the anonymous referees for their valuable suggestions, which helped us to improve the quality of the paper substantially. The authors are responsible for any remaining errors.

Funding

Funding was provided by guru gobind singh inderprastha university (Grant Number GGSIPU/DRC/2019/91/1798)

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Srivastava, S., Aggarwal, A. & Bansal, P. Efficiency Evaluation of Assets and Optimal Portfolio Generation by Cross Efficiency and Cumulative Prospect Theory. Comput Econ 63, 129–158 (2024). https://doi.org/10.1007/s10614-022-10334-7

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-022-10334-7