Abstract

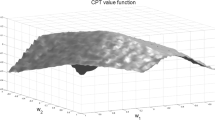

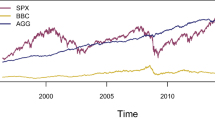

The modeling of risk and uncertainty in finance requires the consideration of several factors. One of the main factors in modeling is the decision-maker’s attitude towards risk. Cumulative prospect theory (CPT) has emerged as an important approach for assessing the actions of decision-makers under uncertainty with ambiguity. Considerable experimental evidence indicates that human behavior can differ significantly from the conventional expected utility maximization paradigm. CPT has the ability to model the irrationality of the decision makers’ behavior in real complex situations. This paper studies the portfolio selection problem based on the cumulative prospect theory (CPT) risk criterion. We encounter two types of risks during problem handling, first internal (imposed by risk management departments) and second external (accredited regulatory institutions). Therefore, we propose a new CPT-based model for the portfolio selection problem under uncertainty with ambiguity. By taking some listed stocks from Nifty-50, the National Stock Exchange, India, as the study sample, the efficient frontier for the proposed CPT-based model is generated. The empirical analysis compares the classical Markowitz’s mean-variance efficient frontier with mean-variance values obtained by the proposed CPT-based efficient frontier. We also compare the investment performance of the behavioral investor with that of a rational investor. A detailed numerical illustration is presented to substantiate the proposed approach.

Similar content being viewed by others

References

Artzner P, Delbaen F, Eber JM, Heath D (1999) Coherent measures of risk. Math Finance 9(3):203–228

Barber BM, Odean T (1999) The courage of misguided convictions. Financ Anal J 55(6):41–55. https://doi.org/10.2469/faj.v55.n6.2313

Barberis N, Huang M (2008) Stocks as lotteries: the implications of probability weighting for security prices. Am Econ Rev 98(5):2066–2100

Barberis N, Huang M, Santos T (2001) Prospect theory and asset prices. Q J Econ 116(1):1–53

Benartzi S, Thaler RH (1995) Myopic loss aversion and the equity premium puzzle. Q J Econ 110(1):73–92

Bernard C, Ghossoub M (2010) Static portfolio choice under cumulative prospect theory. Math Financ Econ 2(4):277–306

Coelho LAG, Pires CMP, Dionísio AT, Serrão AJdC (2012) The impact of cap policy in farmer’s behavior—a modeling approach using the cumulative prospect theory. J Policy Model 34(1):81–98

De Giorgi E, Hens T (2006) Making prospect theory fit for finance. Financ Mark Portf Manag 20(3):339–360

Gazioğlu Ş, Çalışkan N (2011) Cumulative prospect theory challenges traditional expected utility theory. Appl Financ Econ 21(21):1581–1586

Gong C, Xu C, Ando M, Xi X (2018) A new method of portfolio optimization under cumulative prospect theory. Tsinghua Sci Technol 23(1):75–86

Gurevich G, Kliger D, Levy O (2009) Decision-making under uncertainty—a field study of cumulative prospect theory. J Bank Finance 33(7):1221–1229

Hens T, Mayer J (2017) Cumulative prospect theory and mean-variance analysis: a rigorous comparison. J Comput Finance 21(3):47–73

Kahneman D, Tversky A (2018) Prospect theory: an analysis of decision under risk. Exp Environ Econ 1:143–172

Konno H, Yamazaki H (1991) Mean-absolute deviation portfolio optimization model and its applications to Tokyo stock market. Manag Sci 37(5):519–531

Linsmeier TJ, Pearson ND (1996) Risk measurement: an introduction to value at risk. In: Working paper vol 6153, pp 1–45

Markowitz H (1952) Portfolio selection. J Finance 7(1):77–91

Markowitz H (1952) The utility of wealth. J Pol Econ 60(2):151–158

Pirvu TA, Schulze K (2012) Multi-stock portfolio optimization under prospect theory. Math Financ Econ 6(4):337–362

Quiggin J (1982) A theory of anticipated utility. J Econ Behav Organ 3(4):323–343

Rabin M (2019) Diminishing marginal utility of wealth cannot explain risk aversion. In: Kahneman Daniel, Tversky Amos (eds) Choices, values, and frames. Cambridge University Press, New York, pp 202–208

Rockafellar RT, Uryasev S (2000) Optimization of conditional value-at-risk. J Risk 2(3):21–41

Rockafellar R, Uryasev S (2002) Conditional value-at-risk for general loss distributions. J Bank Finance 26(7):1443–1471

Schmidt U, Zank H (2008) Risk aversion in cumulative prospect theory. Manag Sci 54(1):208–216

Sharpe WF (1971) Mean-absolute-deviation characteristic lines for securities and portfolios. Manag Sci 18(2):1–13

Simo-Kengne BD, Ababio KA, Mba J, Koumba U (2018) Behavioral portfolio selection and optimization: an application to international stocks. Financ Mark Portf Manag 32(3):311–328

Tversky A, Kahneman D (1992) Advances in prospect theory: cumulative representation of uncertainty. J Risk Uncertain 5(4):297–323

Wang T, Li H, Zhang L, Zhou X, Huang B (2020) A three-way decision model based on cumulative prospect theory. Inf Sci 519:74–92

Zhao M, Wei G, Wei C, Wu J (2021) Improved todim method for intuitionistic fuzzy magdm based on cumulative prospect theory and its application on stock investment selection. Int J Mach Learn Cybern 12(3):891–901

Acknowledgements

The authors are extremely thankful to the referees for their valuable comments. The authors are thankful to Professor Suresh Chandra, Ex-faculty, Department of Mathematics, IIT Delhi, India, for his suggestions on this work. Further, the author, Sweksha Srivastava, is supported by the Indraprastha Research Fellowship for Ph.D. candidates granted by Guru Gobind Singh Indraprastha University, New Delhi, India vide letter no. GGSIPU/DRC/2019/91/1798.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Srivastava, S., Aggarwal, A. & Mehra, A. Portfolio selection by cumulative prospect theory and its comparison with mean-variance model. Granul. Comput. 7, 903–916 (2022). https://doi.org/10.1007/s41066-021-00302-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41066-021-00302-1