Abstract

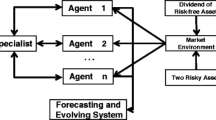

The widespread application of algorithmic trading (AT) will have a lasting and profound effect on the financial market. This paper uses the multi-agent model to construct a multi-asset artificial stock market that can trade multiple assets simultaneously. The simulation results show that the multi-asset market can reproduce the stylized facts of the actual stock market. Then, the effects of an institutional trader using the four different AT strategies on the market containing the three risky assets are studied. The results are as follows: (1) The two types of implementation shortfall (IS) strategies can help the institutional trader achieve the smaller total liquidation costs; (2) the liquidation behavior of the institutional trader using the different strategies has significant negative impacts on the most market indicators of the liquidity, the volatility, the price discovery efficiency and the long memory of absolute returns on the whole, while the individual market indicators are improved in a few cases; (3) compared with the other three strategies, the portfolio IS strategy considering both the optimal liquidation time and the correlation of the stocks is better in terms of the execution effects and the impacts on the market.

Similar content being viewed by others

References

Abergel, F., Huré, C., & Pham, H. (2020). Algorithmic trading in a microstructural limit order book model. Quantitative Finance, 20(8), 1263–1283.

Admati, A. R., & Pfleiderer, P. (1988). A theory of intraday patterns: Volume and price variability. The Review of Financial Studies, 1(1), 3–40.

Almgren, R. F. (2003). Optimal execution with nonlinear impact functions and trading-enhanced risk. Applied Mathematical Finance, 10(1), 1–18.

Almgren, R., & Chriss, N. (2001). Optimal execution of portfolio transactions. Journal of Risk, 3, 5–40.

Ammar, I. B., Hellara, S., & Ghadhab, I. (2020). High-frequency trading and stock liquidity: An intraday analysis. Research in International Business and Finance, 53, 101235.

Baldauf, M., & Mollner, J. (2020). High-frequency trading and market performance. The Journal of Finance, 75(3), 1495–1526.

Barger, W., & Lorig, M. (2019). Optimal liquidation under stochastic price impact. International Journal of Theoretical and Applied Finance, 22(02), 1850059.

Battiston, S., Farmer, J. D., Flache, A., et al. (2016). Complexity theory and financial regulation[J]. Science, 351(6275), 818–819.

Bayraktar, E., & Ludkovski, M. (2014). Liquidation in limit order books with controlled intensity. Mathematical Finance, 24(4), 627–650.

Bernales, A. (2019). Make-take decisions under high-frequency trading competition. Journal of Financial Markets, 45, 1–18.

Bertsimas, D., & Lo, A. W. (1998). Optimal control of execution costs. Journal of Financial Markets, 1(1), 1–50.

Biais, B., Foucault, T., & Moinas, S. (2015). Equilibrium fast trading. Journal of Financial Economics, 116(2), 292–313.

Bismuth, A., Guéant, O., & Pu, J. (2019). Portfolio choice, portfolio liquidation, and portfolio transition under drift uncertainty. Mathematics and Financial Economics, 13(4), 661–719.

Boehmer, E., Fong, K., & Wu, J. J. (2021). Algorithmic trading and market quality: International evidence. Journal of Financial and Quantitative Analysis, 56(8), 2659–2688.

Bookstaber, R., Paddrik, M., & Tivnan, B. (2018). An agent-based model for financial vulnerability. Journal of Economic Interaction and Coordination, 13(2), 433–466.

Brogaard, J., & Garriott, C. (2019). High-frequency trading competition. Journal of Financial and Quantitative Analysis, 54(4), 1469–1497.

Brogaard, J., Hendershott, T., & Riordan, R. (2014). High-frequency trading and price discovery. The Review of Financial Studies, 27(8), 2267–2306.

Carmona, R., & Webster, K. (2019). The self-financing equation in limit order book markets. Finance and Stochastics, 23(3), 729–759.

Cheng, X., Di Giacinto, M., & Wang, T. H. (2017). Optimal execution with uncertain order fills in almgren-chriss framework. Quantitative Finance, 17(1), 55–69.

Chiarella, C., He, X. Z., & Pellizzari, P. (2012). A dynamic analysis of the microstructure of moving average rules in a double auction market. Macroeconomic Dynamics, 16(4), 556–575.

Colaneri, K., Eksi, Z., Frey, R., & Szölgyenyi, M. (2020). Optimal liquidation under partial information with price impact. Stochastic Processes and Their Applications, 130(4), 1913–1946.

Dieci, R., & He, X. Z. (2018). Heterogeneous agent models in finance. Handbook of Computational Economics, 4, 257–328.

Ding, D. K., & Lau, S. T. (2001). An analysis of transactions data for the stock exchange of Singapore: Patterns, absolute price change, trade size and number of transactions. Journal of Business Finance & Accounting, 28(1–2), 151–174.

Egginton, J. F., Van Ness, B. F., & Van Ness, R. A. (2016). Quote stuffing. Financial Management, 45(3), 583–608.

Farjam, M., & Kirchkamp, O. (2018). Bubbles in hybrid markets: How expectations about algorithmic trading affect human trading. Journal of Economic Behavior & Organization, 146, 248–269.

Farmer, J. D., & Foley, D. (2009). The economy needs agent-based modelling. Nature, 460(7256), 685–686.

Forsyth, P. A. (2011). A Hamilton–jacobi–bellman approach to optimal trade execution. Applied Numerical Mathematics, 61(2), 241–265.

Forsyth, P. A., Kennedy, J. S., Tse, S. T., & Windcliff, H. (2012). Optimal trade execution: A mean quadratic variation approach. Journal of Economic Dynamics and Control, 36(12), 1971–1991.

Frino, A., Garcia, M., & Zhou, Z. (2020). Impact of algorithmic trading on speed of adjustment to new information: Evidence from interest rate derivatives. Journal of Futures Markets, 40(5), 749–760.

Gatheral, J., & Schied, A. (2013). Dynamical models of market impact and algorithms for order execution. Handbook on Systemic Risk, Jean-Pierre Fouque, Joseph A. Langsam, eds, 579–599.

Gatheral, J., & Schied, A. (2011). Optimal trade execution under geometric Brownian motion in the Almgren and Chriss framework. International Journal of Theoretical and Applied Finance, 14(03), 353–368.

Gatheral, J., Schied, A., & Slynko, A. (2012). Transient linear price impact and Fredholm integral equations. Mathematical Finance: An International Journal of Mathematics, Statistics and Financial Economics, 22(3), 445–474.

Gomber, P., & Zimmermann, K. (2018). Algorithmic trading in practice. Oxford University Press.

Glosten, L. R., & Harris, L. E. (1988). Estimating the components of the bid/ask spread. Journal of financial Economics, 21(1), 123–142.

Graewe, P., & Horst, U. (2017). Optimal trade execution with instantaneous price impact and stochastic resilience. SIAM Journal on Control and Optimization, 55(6), 3707–3725.

Gsell, M. (2008). Assessing the impact of Algorithmic Trading on markets: A simulation approach (No. 2008/49). CFS Working Paper.

Guéant, O., & Lehalle, C. A. (2015). General intensity shapes in optimal liquidation. Mathematical Finance, 25(3), 457–495.

Hansen, K. B. (2020). The virtue of simplicity: On machine learning models in algorithmic trading. Big Data & Society, 7(1), 2053951720926558.

He, H., & Mamaysky, H. (2005). Dynamic trading policies with price impact. Journal of Economic Dynamics and Control, 29(5), 891–930.

Hendershott, T., Jones, C. M., & Menkveld, A. J. (2011). Does algorithmic trading improve liquidity? The Journal of Finance, 66(1), 1–33.

Hisata, Y., & Yamai, Y. (2000). Research toward the practical application of liquidity risk evaluation methods (pp. 83–128). Tokyo, Japan: Institute for Monetary and Economic Studies, Bank of Japan.

Jain, P. K. (2005). Financial market design and the equity premium: Electronic versus floor trading. The Journal of Finance, 60(6), 2955–2985.

Jin, Y. (2017). Optimal execution strategy and liquidity adjusted value-at-risk. Quantitative Finance, 17(8), 1147–1157.

Johnson, K., Pasquale, F., & Chapman, J. (2019). Artificial intelligence, machine learning, and bias in finance: Toward responsible innovation. Fordham l. Rev., 88, 499.

Kelejian, H. H., & Mukerji, P. (2016). Does high frequency algorithmic trading matter for non-AT investors? Research in International Business and Finance, 37, 78–92.

Kirilenko, A. A., & Lo, A. W. (2013). Moore’s law versus murphy’s law: Algorithmic trading and its discontents. Journal of Economic Perspectives, 27(2), 51–72.

Luo, Q., Shi, Y., & Li, H. (2021a). Research on Portfolio Liquidation Strategy under Discrete Times. arXiv preprint arXiv:2103.15400.

Luo, Q., Shi, Y., Zhou, X., & Li, H. (2021b). Research on the effects of institutional liquidation strategies on the market based on multi-agent model. Computational Economics, 58(4), 1025–1049.

Ma, G., Siu, C. C., Zhu, S. P., & Elliott, R. J. (2020). Optimal portfolio execution problem with stochastic price impact. Automatica, 112, 108739.

Mandelbrot, B. (1972). Statistical methodology for nonperiodic cycles: From the covariance to R/S analysis. In Annals of economic and social measurement, (Vol 1, no 3, pp 259–290). NBER.

McGroarty, F., Booth, A., Gerding, E., & Chinthalapati, V. L. (2019). High frequency trading strategies, market fragility and price spikes: An agent based model perspective. Annals of Operations Research, 282(1), 217–244.

McMillan, J. (2003). Reinventing the bazaar: A natural history of markets. WW Norton & Company.

Mizuta, T., & Horie, S. (2019). Mechanism by which active funds make market efficient investigated with agent-based model. Evolutionary and Institutional Economics Review, 16(1), 43–63.

Moazeni, S., Coleman, T. F., & Li, Y. (2013). Optimal execution under jump models for uncertain price impact. Journal of Computational Finance, 16(4), 1–44.

Obizhaeva, A. A., & Wang, J. (2013). Optimal trading strategy and supply/demand dynamics. Journal of Financial Markets, 16(1), 1–32.

Perold, A. F. (1988). The implementation shortfall: Paper versus reality. Journal of Portfolio Management, 14(3), 4.

Ponta, L., Pastore, S., & Cincotti, S. (2018). Static and dynamic factors in an information-based multi-asset artificial stock market. Physica a: Statistical Mechanics and Its Applications, 492, 814–823.

Reznik, N., & Pankratova, L. (2018). High-Frequency Trade as a Component of Algorithmic Trading: Market Consequences. In ICTERI Workshops (pp. 73–83).

Schied, A., & Schöneborn, T. (2009). Risk aversion and the dynamics of optimal liquidation strategies in illiquid markets. Finance and Stochastics, 13(2), 181–204.

Schmitt, N., & Westerhoff, F. (2017). Herding behaviour and volatility clustering in financial markets. Quantitative Finance, 17(8), 1187–1203.

Scholtus, M., Van Dijk, D., & Frijns, B. (2014). Speed, algorithmic trading, and market quality around macroeconomic news announcements. Journal of Banking & Finance, 38, 89–105.

Sornette, D., & Von der Becke, S. (2011). Crashes and high frequency trading. Swiss Finance Institute Research Paper, (11–63).

Tse, S. T., Forsyth, P. A., & Li, Y. (2014). Preservation of scalarization optimal points in the embedding technique for continuous time mean variance optimization. SIAM Journal on Control and Optimization, 52(3), 1527–1546.

Virgilio, G. (2017). Is high-frequency trading tiering the financial markets? Research in International Business and Finance, 41, 158–171.

Virgilio, G. P. M. (2019). High-frequency trading: A literature review. Financial Markets and Portfolio Management, 33(2), 183–208.

Weller, B. M. (2018). Does algorithmic trading reduce information acquisition? The Review of Financial Studies, 31(6), 2184–2226.

Yang, X., Zhang, J., & Ye, Q. (2020). Tick size and market quality: Simulations based on agent-based artificial stock markets. Intelligent Systems in Accounting, Finance and Management, 27(3), 125–141.

Funding

The authors have not disclosed any funding.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors report no conflicts of interest. The authors alone are responsible for the content and writing of the paper.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix

See Tables 13, 14, 15 and 16

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Luo, Q., Song, S. & Li, H. Research on the Effects of Liquidation Strategies in the Multi-asset Artificial Market. Comput Econ 62, 1721–1750 (2023). https://doi.org/10.1007/s10614-022-10316-9

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-022-10316-9