Abstract

This paper measures the impact of multi-market institutions, renewable energy consumption, and infrastructure on sustainable development in 76 selected countries over the period 2000–2015. To this end, we applied a dynamic Ordinary Least Square method with fixed effects, which has the advantage of further addressing cross-section heterogeneity in the sample. Our findings contribute two significant findings to the literature. First, we point to the importance of multi-market institutions in driving sustainable development. Second, we find that renewable energy, economic and social infrastructure can boost sustainable development, while financial infrastructure has a reverse effect. This finding is useful to target the most effective drivers for sustainable development.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

While economic growth refers to a quantitative increase in GDP, economic development reflects a more qualitative improvement in macroeconomic variables and the economic environment, with a focus on economic growth, life expectancy, human development, education, poverty, inequality, etc. Sustainable development is a branch of economic development that covers various aspects related to human life, poverty, health, social inclusiveness, environmental sustainability, logistics system efficiency, etc. The drivers of sustainable development have long been questioned and several economists have noted that geographical location, labor, institutions, and capital, plus a few other factors appear to be the main players. In this context, the role of institutions in achieving durable and lasting development has also been discussed, without any conclusive answers (Bhattacharyya, 2009; Bhattacharya et al., 2015 among others). One of the difficulties in assessing the role of institutions is linked to institution measurement, which is either determined in isolation or quantified using diverse proxies.

To address this issue, our paper investigates the effect of institutions on sustainable development by looking at a set of institutions to reveal which ones matter in this respect. The advantage of this approach is that it takes the heterogeneity of institutions into account. In particular, when proceeding in this way, it is possible to pinpoint which institutions are consistently helpful in protecting the property rights of domestic and foreign entities working within an economy, as well as less well-performing institutions that might be less efficient and even responsible for poverty, inequality, etc. (Yildirim & Gokalp, 2015).

From a theoretical point of view, institutions should provide rules, control measures, and regulations that help to boost the economic system and regulate human interactions. Thus, the resulting improvements to multi-market institutions support property rights that promote natural resource protection and a reduction in transactional costs (Chen, 2012). Further, a good institutional structure emphasizes the importance of human capital in sustainable infrastructure development. This improvement occurs in different ways. Indeed, institutional market development increases the availability of liquidity for sustainable infrastructure development and investment, as well as enhancing equity for growth and development. Further, foreign direct investment inflows accelerate the benefits of knowledge transfer by means of high-tech transformation from developed to developing countries, which in turn improves technical efficiency in the form of resource savings in local economies thanks to the support of institutions. However, the quality of multi-market institutions cannot be observed without a truly sustainable infrastructure. In fact, a lack of institutional quality may help inform officials with regard to corruption, whereas a lack of multi-market institutional quality limits opportunities for sustainable growth.

This paper examines an important issue, namely, the relationship between multi-market institutions and sustainable development. To this end, we first analyze multi-market institutions with regard to new institutional economics strategies that can be split into four major categories: market-creating institutions, market-regulating institutions, market-stabilizing institutions, and market-legitimizing institutions. Our paper then examines the role of renewable energy in explaining growth and development. Finally, while the role of infrastructure has previously been examined in explanations regarding sustainable development, our paper uses a fixed-effect (FE) method and dynamic ordinary least square (DOLS) to capture the country-specific effect and ensure its robustness. Interestingly, our modeling is designed to control further heterogeneity across the data and to provide unbiased estimators.

Our main results point to two interesting findings. First, we identify the role played by multi-market institutions in sustainable development. Second, we find that renewable energy and economic and social infrastructure can also lead to sustainable development, while financial infrastructure reverses the effect.

The paper is organized into five sections. Section 2 discusses the theoretical background related to dynamic institutions and sustainable development relations. Section 3 briefly recalls the related literature and its limitations. Section 4 describes the econometric methodology, while the main empirical results are discussed in Sect. 5. The last section concludes.

2 The Relationship Between Dynamic Institutions and Sustainable Development: A Theoretical Framework

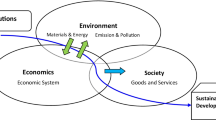

Several channels can be considered when analyzing the relationship between institutions and sustainable development. Indeed, market-based institutions include (1) market-creating institutions, (2) market-regulating institutions, (3) market-stabilizing institutions and (4) market-legitimizing institutions. Market-supporting institutions establish property rights, for example, deal with market failures, reduce transaction costs, etc. These institutions can be related to sustainable development by way of market-creating institutions and can influence sustainability via financial institutions (Dalei et al., 2021). Institutions that generate markets can also influence sustainable development by lowering transaction costs (Espinosa et al., 2021). This includes negotiating and managing expenses and market and administrative charges that underpin institutional administration. Indeed, the absence of a formal institutional structure leads to high transaction costs, which may in turn result in resource exploitation with a negative impact on sustainability. Market-sustaining institutions can influence sustainable development via market regulatory institutions (Alshbili et al., 2021; Yang et al., 2021). Market-regulating institutions are those which prevent market failure and help support development to sustain market growth momentum. Indeed, market failures occur when members take part in deceitful conduct or work against fully engaged conduct, which can happen when transaction costs disguise technology and other non-financial externalities.

Market-stabilizing institutions guarantee macroeconomic stability, but do not attempt distortionary strategies that could help speculators. They are consequently likewise useful for development. Following Keynes (1936), we can note that entrepreneur-based economies are not really self-balancing. A variety of institutions thus help stabilize the market and stimulate demand. Accordingly, we could consider financial restrictions imposed by governments with regard to tax collection as helpful in boosting sustainability through budgetary channels, providing the financial capacity to attain economic sustainability goals (Hu et al., 2021). Market-legitimizing institutions are those that handle redistribution, oversee social clashes, and offer social and other protection in the event of shocks. Rodrik (2005) views democracy as an indicator of market-legitimizing institutions since there is a positive link between the adequacy of democratic institutions offering social protection. Such institutions can thus be linked to sustainable development by way of good governance. The latter is applied through law and order, monitoring activities, and imposing punishments that reduce the struggle and enhance the efficiency of various factors fundamental to sustainable development. Market-legitimizing institutions therefore help reveal ways that can support a productivity framework through responsibility and introducing the limitations needed for better coordination. All these aspects of institutional functions are conceptually summarized in Fig. 1.

3 The Literature

Several studies have explored the relationship between institutional quality and economic growth, but this is more challenging when institutions and sustainable development are taken into consideration (Corazza et al., 2017). Earlier studies have tried to integrate sustainable development with environmental improvement and economic development, referring to sustainability that takes economic, social, and ecological dimensions into consideration. Further, it also challenge the relationship between sustainable development and multi-market institutions. Indeed, Bhattacharyya et al. (2017) examined the impact of market institutions on CO2 emissions and concluded that improved market institutions play an important role in regulating CO2 emissions. Das and Quirk (2010) also commented that institutions are important to growth and development. Bhattacharyya (2009) reached the same conclusion, arguing that institutions matter in the growth and development process. Abid (2017) pointed to the direct and indirect impact of institutions on CO2 emissions since they contribute to clean production systems and provide more sustainable growth to counter carbon emissions. In the same vein, Afonso (2020), Ahmad and Aziz (2018), Giorgis (2017), Siddiqui and Ahmed (2013) also showed that institutions can play a key role in stimulating an economy’s growth and development. Indeed, institutions may invest in infrastructure that plays a crucial role in sustainable development, while facilitating trade, and promoting economic activities such as railways, roads, telecommunications, air transport, etc. (Calderon and Serven, 2003; Estache, 2006; Seethepalli et al., 2008). However, institutions are also helpful as they can boost the finance sector, thereby promoting sustainable development (Ceres, 2016) by influencing its capital across the globe.

Institutions can also promote renewable energy consumption to stimulate sustainable development and counter CO2 emissions. For example, Bhattacharyya (2017) argued that renewable energy consumption reduces CO2 emissions from 85 developed and developing countries. Tian et al. (2021) also noted the importance of renewable energy in stimulating economic growth and reducing CO2 emissions.

However, the above conclusions are not unanimously shared since other studies present different conclusions. Indeed, Oladipo (2018) did not find economic infrastructure useful for economic development. Favara (2003) showed that the financial service sector has a very weak relation with growth and development. Finance companies have begun to play a role with regard to sustainability by providing credit to private investors for investment in clean technologies, but only a small number have shown their commitment to sustainability by investing in clean technology.

Overall, related studies on institutions’ impact on sustainable development are somewhat inconclusive. Indeed, while institutions appear to play a key role in maintaining and achieving a certain level of sustainable development and improving wealth distribution and fairness, the effectiveness of their policies and rules seems to depend on the period and the sample under consideration, as well as the measures used to proxy institutions’ measures.

Our study aims to clarify the relationship between sustainable development and institutions for a large sample of 76 countries over the period 2000–2015. To this end, we examined disaggregated measures related to renewable energy consumption and infrastructure to assess their impact on sustainable development. Our methodology and data are concisely described in the next section.

4 The Econometric Methodology

4.1 The Data

We used annual data for 76 countries, available over the period 2000–2015.Footnote 1 The selection of countries was based on data availability for the variables used in the study. For example, in line with Rodrik (2005), four multi-market institution measures were included: sound money index (SM) to reflect market-stabilizing institutions, index of regulation in business and market (REG) to capture market-regulating institutions, polity II index (polity II) to reflect market-legitimizing institutions, and regulatory quality (RQ) to reflect market-creating institutions. We used Rodrik’s (2005) four-way classification to present the four institutional categories: market-creating, market-regulating, market-stabilizing, and market-legitimizing institutions, and then identified the proxy for each category to estimate its impact on sustainable development. Interestingly, market-creating institutions help secure property rights and ensure contract enforcement, while market-regulating institutions help to prevent market failure and support sustainable market growth. Market-stabilizing institutions ensure macroeconomic soundness and a quality response to external shocks, while also reducing inflationary pressure and financial crises. Market-legitimizing institutions manage redistribution, direct social conflict, and provide social insurance and assurance in the event of a shock.

Further, in line with Güney (2019), adjusted net saving (ANS) as a percentage of GNI was proxied to measure the level of sustainable development (SD). Adjusted net saving is the most reliable sustainable development indicator (Castro & Lopes, 2022; Koirala & Pradhan, 2019) as calculated by the World Bank. It measures the “true rate of savings in an economy after taking investments in human capital, depletion of natural resources, and damage caused by pollution” into account (World Bank, 2012). The World Bank (2020) has shown the importance of adjusted net saving by noting that adjusted net saving was specifically designed as a reliable sustainable development proxy to assess the country’s economic, social, and environmental development dimensions (Van & Manuel, 2008). Thus, given the advantages and importance of adjusted net saving, we consider it a reliable proxy to measure sustainable development.

Three indicators were used to measure the dynamics of infrastructure, including people using basic sanitation service as a percentage of total population (SEINF) to capture social infrastructure; domestic credit by banks to private sectors (as a % of GDP) to measure financial infrastructure (DCP), and gross domestic product per capita (GDP) annual growth to measure economic infrastructure (Bhattacharya et al., 2015). Renewable energy (REC) consumption is considered as a percentage of total energy use. Other control variables such as the life expectancy ratio at birth as a percentage of total population (LXP), foreign direct investment (FDI), net inflows as a percentage of GDP, and urban population as a percentage of total population (URBN) were included in the analysis to counter omitted variables bias. The data were gathered from different sources that include the World Development Indicators (WDI), Polity II (INSCR) database, the International Country Risk Guide (ICRand G), and the Economic Freedom of the World database, as well as energy-related data collected from the U.S. Energy Information Administration.

4.2 Econometric Specification

To test the impact of multi-market institutions, the dynamics of infrastructure, and renewable energy consumption on sustainable development, we specified the following multiple regression model:

where i is number of countries in panel; t the time period used in the study; µ a white noise error term; SD denotes sustainable development; SM denotes sound money; REG is an index of regulation; POLITY II is political index and RQ is a regulatory quality index. SEINF refers to sanitation service; DCP measures domestic credit to the private sector; and GDP denotes gross domestic product per capita. People using basic sanitation service as a percentage of total population is denoted by SEINF; REC denotes the renewable energy consumption, and \(Z_{it}\) represents the set of control variables. \(\alpha_{0}\) is a constant, \(\alpha_{1}\) to \(\alpha_{8}\) are the coefficients of the corresponding variable.

Next, we double-checked the stationarity of the above series, and estimated model (1).

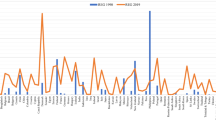

5 Empirical Analysis

First, we analyzed the stationarity of our variables. To this end, we applied Im et al. (2003) and Levin et al. (2002)’s panel unit root tests. Levin et al. (2002)’s test considers homogeneity across the sample while Im et al. (2003)’s test is more suitable for unbalanced panel data. We applied and reported the main results of these tests in Table 1. From the table, we can identify variables that are I(1) and those that are stationary or I(0). Second, we checked whether our variables exhibit a cointegration relationship. To this end, we applied Pedroni residual co-integration tests (1999; 2004). Pedroni (1999; 2004) posited the idea of seven co-integration test statistics that assume heterogeneity in the panel data. The Pedroni model representation is:

Here we consider \(y_{it}\) as the \((N \times T) \times 1\) dimension of the variable, while \(X_{i}\) is a \((N \times T) \times K\) dimension variable and \(K\) is a number of regressors. Pedroni considers the null hypothesis of no cointegration relationship against the alternative hypothesis of the existence of cointegration among variables in all seven statistics. Pedroni’s four tests are within the dimension under null hypothesis \(H_{0} :\theta_{i} = 1,i = 1,2,...,N\) and the alternative hypothesis \(H_{1}^{1} : - 1 < \theta_{i} < 1\).

The mathematical representation of the within dimension four test statistics is given as:

On the other hand, the three tests are between the groups, and their mathematical representation is given in Eq. 4:

Pedroni’s null hypothesis for all seven tests is the no long run co-integration relation among variables against the alternative hypothesis of the existence of co-integration. We report the main results of these tests in Table 2, where we show that three Pedroni tests reject the null of no cointegration among variables in each equation, suggesting that the variables under consideration exhibit a cointegration relationship.

The main concern was the estimation of Eq. 1. However, the paper utilizes more regression Eqs. (5–8) to check the impact of individual institutions on sustainable development for robust policies.

Equation 5 investigates the impact of regulatory quality (RQ), basic sanitation service (SEINF), domestic credit by banks to the private sector (DCP), economic growth (GDP), and renewable energy consumption (REC) on sustainable development (SD). Equation 6 considers the impact of the sound money index (SM), basic sanitation service (SEINF), domestic credit by banks to the private sector (DCP), economic growth (GDP), and renewable energy consumption (REC) on sustainable development (SD). Equation 7 investigates the impact of regulations in business and markets (REG), basic sanitation service (SEINF), domestic credit by banks to the private sector (DCP), economic growth (GDP), and renewable energy consumption (REC) on sustainable development (SD). Equation 8 investigates the impact of the polity II index (POLITYII), basic sanitation service (SEINF), domestic credit to the private sector by banks (DCP), economic growth (GDP), and renewable energy consumption (REC) on sustainable development (SD). In each equation, the subscript i is number of countries, t the time period used in the study, µ is a white noise error term, and \(Z_{it}\) represents the set of control variables that help to counter omitted variables bias in the analysis. \(\alpha_{0}\) is constant, and \(\alpha_{1}\) to \(\alpha_{5}\) are the coefficients of corresponding variables in each equation that will be interpreted in elasticities.

Third, we estimate the regression model (Eq. 1) under the assumption of fixed effects using the dynamic ordinary least square (DOLS) method. For linear panel regression, the fixed effect method is popular as the constant term is cross-section specific and the coefficient slope is the same for each cross section, enabling us to capture further heterogeneity in the data. Further, fixed effects deal with time-invariant heterogeneity across the cross section. It is important to consider the time effect as most of the variables, including multi-market institutions and economic growth, vary over time. Subsequently, to check for robustness, our paper uses the dynamic OLS (DOLS) method as it takes further autocorrelation across error terms into consideration. Kao and Chiang (2001) proved that DOLS estimators are robustly significant when considering small samples. Further, the DOLS method can counter the serial correlation and endogeneity issue with the leads and lags of explanatory variables in the system. DOLS representation is given below, taking the co-integration relationship into consideration:

\(i = 1,2,...,N\) number,\(Z_{i,t} = (Y_{i,t} ,X_{i,t} )^{\prime } \sim I(1)\),\(\chi_{i,t} = (e_{i,t} ,\varepsilon_{i,t} )^{\prime } \sim I(0)\) depicts the long-run relation between non-stationary series where the coefficient matrix \(\beta\) is the co-integration coefficient. DOLS considers the leads and lags differential variable of the explanatory variable to be considered in the regression equation, and Eq. (10) can be expanded as:

Based on Eq. (11), \(\beta\) of cointegration can be reported as:

\(\hat{\beta }_{GD} = N^{ - 1} \sum\limits_{i = 1}^{N} {(\sum\limits_{t = 1}^{T} {Z_{i,t} Z_{i,t}^{\prime } } )^{ - 1} (\sum\limits_{t = 1}^{T} {Z_{i,t} Y_{i,t} } )} Z_{i,t} = (X_{i,t} - \overline{X}_{i} ,\Delta X_{i,t - k} , \ldots ,\Delta X_{i,t + k} )\) is the regression vector of \(2(K + 1) \times 1\),\(\tilde{Y}_{i,t} = Y_{i,t} - \overline{Y}_{i}\).

Interestingly, to better apprehend the effects of multi-market institutions, renewable energy, consumption, and financial infrastructure on sustainable development, we estimated different specifications driven from model (1). We present the main empirical results in Table 3.

From Table 3, we can note several interesting results. First, multi-market institutions have a positive impact on sustainable development except for POLITY II, suggesting that efficient multi-market institutions could boost sustainable development. In particular, market-creating institutions have a strong positive impact on sustainable development (suggesting that some countries can switch to a sustainable path by strengthening market-creating institutions. Indeed, strong enforcement of market regulations is adjusted to secure intellectual property rights that produce and guarantee production and consumption efficiency for socio-economic systems based on intellectual property rights.

Second, the coefficients of the sound money index (SM) and the regulation (REG) index also have a positive and significant impact on sustainable development. In line with Bhattacharya (2017), this finding supports the notion that great benefits can potentially be expected from market-stabilizing and market-regulating institutions. The economic reasoning is that a higher level of market-stabilizing institutions leads to macroeconomic stability. In fact, market-regulating institutions encourage effectiveness in a regulatory institutions framework to help operate efficient socio-economic sustainability. Further, market-legitimizing institutions have an insignificant effect on sustainable development. This ineffectiveness may be due to the weaker participation of democracies in enhancing social welfare that ultimately leads to social safety network failure (Ross, 2006).

In fact, we live on a planet with finite resources, and human existence on earth depends on the provision of these limited resources. Thus, the continuance of human life depends on better management of these reserves (Spindler, 2013) and multi-market institutions can play a key role in improving the division and allocation of the finite resources available. It can thus be concluded that better institutions not only promote growth and development, but also help resolve environmental issues and encourage the implementation of policies for environmental correction and thus, overall, help make economies sustainable. Indeed, the healthy relations between business and government are important for an economy’s growth and development, and here institutions play a key role in establishing long-term public–private partnerships in the public interest. The stress is on strengthening multi-market institutions. In the same vein, Kumssa and Mbeche (2004) showed that well-functioning institutions play a key role in the economic growth of African economies.

The GDP per capita coefficient is positive and statistically significant, confirming that an increase in economic infrastructure development boosts sustainable development. These results are important as they show that economic growth is on the right track to encourage sustainable development and that economic growth does not necessarily come at the cost of environmental pollution. Steve Cohen (2021) reported that some political and business leaders reject the idea that economic growth can cause environmental pollution, while others believe that economic growth is not possible without environmental damage. Our results imply that economic growth does not cause environmental pollution, but instead contributes to sustainable development and should thus be encouraged. Consequently, we do not recommend a growth reduction strategy to counter environmental pollution, but argue instead that the focus should be on identifying the factors that cause environmental pollution, since climate change and global warming are less to do with economic growth, and more to do with inadequate and ineffective environmental policies to reduce greenhouse gases. SDG 8 talked about decent work and economic growth. We follow this line, showing the progress of countries where economic growth and sustainable development are on track. Social infrastructure also has a positive and significant impact on sustainable development since it can help guarantee basic human rights and ultimately further social infrastructure development, thereby supporting sustainable development. In the same context, the findings show a significant negative impact of financial infrastructure on sustainable development. Unlike Bhattacharya (2017), however, our findings indicate that financial infrastructure development encourages less sustainable development.

In addition, renewable energy consumption has a positive and significant impact on sustainable development. It suggests that clean affordable energy activities are helpful in achieving the sustainable development targets for 2030. Our findings corroborate the recent increase in renewable deployment associated with sustainable development as suggested in the Bloomberg New Energy Finance (BNEF, 2015) report. While sustainable development is a significant concern and renewable energy plays an important role in meeting the need for energy and reducing pollution, there is insufficient evidence regarding the complex issues that hamper acceptance of sustainable development initiatives, including renewable energy projects. Our results show the need to focus on the introduction and implementation of renewable energy projects. This requires better planning in the long run, with government support needed for substantial investment in the R&D required to produce more energy from solar, wind, biomass, hydropower, etc. Certainly, by allocating and mobilizing resources, better institutions play a key role in the development of renewable energy projects. According to the Intergovernmental Panel on Climate Change (IPCC), fossil fuel energy contributes significantly to global environmental degradation. In emerging nations, the switch from oil and fuel to alternative sources is an institutional issue—that of climate inequity in developing countries, where renewable energy development should be the primary focus of government policies (Meya & Neetzow, 2021), which is why SDG 7 largely focuses on the introduction of accessible, clean and sustainable energy. Renewable energy can help to combat rises in global temperatures and thus stem climate change. Climate is not the only target, however, as renewable energies can give economies a strong boost. Thus, more focus should be put on developing renewable energy sources.

FDI inflows have a positive and statistically significant effect on sustainable development, indicating that they have great potential for cleaner technological transfer (Demena & van Bergeijk, 2019). Indeed, foreign direct investment is regarded as a growth engine that can generate employment opportunities for local people, although a frequently raised issue regarding this type of investment is the environmental concern as the main aim of business organizations is to optimize profit. Thus, it is possible that economic gain comes at the cost of environmental degradation. Researchers like Pao and Tsai (2011) have signaled that FDI’s impact on the environment can be ignored given its growth performance strategy. Thus, despite controversial views regarding FDI performance, it has been included in the analysis to test its performance with respect to sustainable development. Our results indicate that foreign investors are on the right track in the given sample economies regarding respect for local government environmental policies, and thus they contribute to the economies’ overall sustainable development. Schemes to attract more foreign investment should not only contribute to growth and development, but also help to reduce environmental pollution. More investment in clean technology and renewable energy sources will go a long way towards boosting the renewable and clean technology agenda, in other words, green FDI will be more acceptable with respect to support for environmental pollution reduction.

Life expectancy is statistically significant, but our results point to a negative effect. Human capital theory advocates that an increase in life expectancy can enhance educational investment and labor supply in line with faster income growth, in turn leading to more debt for the country, with ambiguous effects on future generations and consequently on sustainable development. In addition, a significant effect of education and income on decreasing infant mortality was noted. Human capital has a positive impact on economic growth that may be encouraged by population age. For example, parents may spend more time on their own education and reduce their work time to fight mortality (Cervellati & Sunde, 2005). Finally, the urbanization coefficients have a significant and negative impact on sustainable development. This result can be justified by the Malthusian trap idea that became evident as urban populations grew, leading to a low level of productivity and higher costs in urban areas. Thus, we suggest that urban populations should put more focus on sustainable projects that inject fewer emissions into the atmosphere and provide more prosperity for societies.

Overall, our results show that multi-market institutions have a positive significant impact on sustainable development, suggesting that the efficiency of such institutions can provide more sustainability in the selected economies. GDP per capita shows a positive significant impact on sustainable development, indicating that economic expansion leads to sustainable and lasting development. Our findings also show the positive and significant impact of social infrastructure on sustainable development. Further, we observe the positive significant impact of renewable energies that calls for further investment in renewable energy consumption projects for the sustainable development path of given economies.

6 Conclusion and Policy Implications

This study investigates the effect of multi-market institutions, infrastructure, and renewable energy consumption on sustainable development for 76 selected countries over the period 2000–2015. To this end, sustainable development was measured using adjusted net saving % of GNI, while we used various institutional indicators, namely, market-creating institutions, market-regulating institutions, market-stabilizing institutions, and market-legitimizing institutions. Three indicators were used to measure the infrastructure dynamic: i.e., social, economic, and financial infrastructure, while renewable energy consumption was examined to investigate its impact on sustainable development. Our main results show that multi-market institutions have a positive and significant impact on sustainable development, Renewable energy consumption also supports sustainable development, as does economic and social infrastructure. Financial development, on the other hand, has a negative impact on sustainable development.

Accordingly, our study finds that market-creating institutions, market-regulatory institutions, and market-stabilizing institutions have a positive impact on sustainable development, while market-legitimizing institutions have an insignificant impact on sustainable development. This result is relevant and suggests that sustainable development cannot be achieved without the interference of multi-market institutions. Indeed, the presence of high-quality multi-market institutions is fundamental to sustainable development since weak multi-market institutions imply substantial costs for the economy and resource distortions. As multi-market institutions highlight legislators’ responsibility, an effective institutional mechanism is required to increase productivity. In fact, the inefficiency of market-legitimizing institutions in sustainable development encourages legislators to back suitable programs that encourage democratic sustainability processes. This suggests a fundamental shift from primitive resource infrastructures to sustainable development infrastructure. Otherwise, our study offers further evidence of the importance of renewable energy as an alternative source of energy for sustainable growth.

This study offers several implications for policymakers, governments, and institutions by highlighting the importance of multi-market institutions, renewable energy consumption, economic growth, and infrastructure. It shows that multi-market institutions can have a significant positive impact on sustainable development where the latter is a real concern. Thus, they point to the need to strengthen institutions that can offer fruitful outcomes in terms of greater sustainability. Good governance is important to efficiently manage resources and divert them to where they are needed in a more effective way. Renewable energy is important for growth and development, and the results show that increasing the share of renewable energy consumption in the energy strategy mix will lead to positive outcomes in terms of economic sustainable development. The results support the introduction of more renewable energy such as the installation of solar power plants, biogas plants, wind energy farms, etc. that will meet the need for energy to drive economies, injecting no pollution emissions into the environment, which will further help to meet the Paris agreement targets for 2050. The economic growth results are important as they show that economic growth is on the right track to help boost sustainable development, and does not come at the cost of environmental pollution. Thus, in this situation, an economic growth reduction policy is not helpful. Instead, investment should be targeted at driving sustainable development and the prosperity of economies. Similarly, the results show the significant positive impact of social infrastructure on sustainable development, highlighting the need to focus on social infrastructures such as healthcare, education, housing, etc. On the other hand, we found that financial development had an adverse impact on sustainable development, probably because it can add to pollution emissions and thus curb the pace of sustainable development. Financial development thus needs to align with pollution reduction agendas to support sustainable development. Countries should try to attract investment that encourages pollution limitation mechanisms, such as more spending in the renewable energy sector to help limit environmental pollution. Similarly, investment in research and development is crucial to improve quality of life.

However, this study only considers the direct impact of various institutions on sustainable development and does not detail the mechanisms and channels through which they have an impact. Future research could attempt to describe such factors. Further, sustainable development includes different aspects, such as the human development index (HDI) which covers aspects such as education, life expectancy, standard of living, health, etc. The HDI can be used to investigate institutions’ impact on sustainable development. More countries and years can be added in future research, and/or separate developing and developed world analyses can be conducted to investigate institutions’ impact on sustainable development. Due to the lack of data availability, the paper did not take into consideration the impact of the COVID-19 pandemic on sustainability. It would thus be interesting to investigate the impact of the pandemic and institutions on sustainable development in future research.

Notes

The countries were selected according to data availability. They include: Albania, Australia, Bahamas, Bangladesh, Belgium, Botswana, Brazil, Bulgaria, Cameroon, Canada, Chile, China, Colombia, Cyprus, Czech Rep. Denmark, Dominican Republic, Ecuador, Egypt, Estonia, Finland, France, Ghana, Greece, Guatemala, Guyana, Haiti, Honduras, Hungary, India, Indonesia, Israel, Italy, Jamaica, Japan, Jordan, Kenya, Latvia, Luxembourg, Madagascar, Malawi, Malaysia, Mali, Mexico, Morocco, Namibia, Netherlands, New Zealand, Nicaragua, Nigeria, Norway, Pakistan, Panama, Paraguay, Peru, Philippines, Poland, Portugal, Romania, Russia, Senegal, Slovak Rep, Spain, Sri Lanka, Sweden, Switzerland, Tanzania, Thailand, Togo, Tunisia, Turkey, Uganda, the United-Kingdom, the United-States, Uruguay and Venezuela.

References

Abid, M. (2017). Does economic, financial and institutional developments matter for environmental quality? A comparative analysis of EU and MEA countries. Journal of Environmental Management, 188(2), 183–194. https://doi.org/10.1016/j.jenvman.2016.12.007

Afonso, O. (2020). The impact of institutions on economic growth in OECD countries. Applied Economics Letters, 00(00), 1–5. https://doi.org/10.1080/13504851.2020.1855304

Alshbili, I., Elamer, A. A., & Moustafa, M. W. (2021). Social and environmental reporting, sustainable development and institutional voids: Evidence from a developing country. Corporate Social Responsibility and Environmental Management. https://doi.org/10.1002/csr.2096

Aziz & Ahmad (2018). Institutions and economic growth: Does income level matter? MPRA working paper: https://mpra.ub.uni-muenchen.de/83684/.

Bhattacharya, A., Oppenheim, J., & Stern, N. (2015). Driving sustainable development through better infrastructure: Key elements of a transformation program. Brookings Global Working Paper Series.

Bhattacharya, M., Awaworyi Churchill, S., & Paramati, S. R. (2017). The dynamic impact of renewable energy and institutions on economic output and CO2 emissions across regions. Renewable Energy, 111, 157–167. https://doi.org/10.1016/j.renene.2017.03.102

Bhattacharyya, S. (2009). Unbundled institutions, human capital and growth. Journal of Comparative Economics, 37(1), 106–120. https://doi.org/10.1016/j.jce.2008.08.001

Bota-Avram, C., Grosanu, A., Rachisan, P.-R., & Gavriletea, M. D. (2018). The bidirectional causality between country-level governance, economic growth, and sustainable development: a cross-country data analysis. Sustainability, 10(2), 1–24. https://doi.org/10.3390/su10020502

Calderón, C., & Servén, L. (2003). The output cost of latin America’s infrastructure gap. In W. Easterly & L. Servén (Eds.), The limits of stabilization: infrastructure, public deficits, and growth in latin America. Stanford University Press.

Castro, C., & Lopes, C. (2022). Digital government and sustainable development. Journal of the Knowledge Economy, 2022(13), 880–903.

Ceres (2016). The Ceres roadmap for sustainability: Financial services. Available at http://www.ceres.org/roadmap-assessment/sector-analyses/financial-services.

Cervellati, M., & Sunde, U. (2005). Human capital formation, life expectancy, and the process of development. The American Economic Review, 95, 1653–1672.

Chen, C.J.J. (2012). Transforming rural China: How local institutions shape property rights in China. Routledge.

Steve Cohen (2021). Economic growth and environmental sustainability. https://news.climate.columbia.edu/2020/01/27/economic-growth-environmental-sustainability/

Corazza, L., Scagnelli, S. D., & Mio, C. (2017). Simulacra and sustainability disclosure: analysis of the interpretative models of creating shared value. Corporate Social Responsibility and Environmental Management, 24, 414–434.

Dalei, N. N., Chourasia, A. S., Sethi, N., Balabantaray, S. R., & Pani, U. (2021). Roles of policies, regulations and institutions in sustainability of ocean tourism. Journal of Infrastructure, Policy and Development, 23, 36–145. https://doi.org/10.24294/JIPD.V5I2.1295

Das, & Quirk. (2010). Which instituions promote growth? Revisiting the evidence. Economic Papers: A Journal of Applied Economics and Policy, 35(1), 37–58.

Demena, B. A., & van Bergeijk, P. A. (2019). Observing FDI spillover transmission channels: Evidence from firms in Uganda. Third World Q, 40(9), 1–22.

Espinosa, V. I., Neira, M. A. A., & de Soto, J. H. (2021). Principles of sustainable Economic Growth and Development: A call to Action in a Post-Covid-19 World. In Sustainability (switzerland). https://doi.org/10.3390/su132313126

Estache, A. (2006). Infrastructure: A survey of recent and upcoming issues. The World Bank: Washington D.C.

Favara (2003). An empirical reassessment of the relationship between finance and growth, IMF Working Paper, wp/03/123

Finance, B. N. E. (2015). New energy outlook 2015: Long-term projections of the global energy sector. New York: The report Bloomberg New Energy Finance.

Giorgis, K.G. (2017). The impact of institutions on economic growth in Sub-Saharan Africa: Evidence from a panel data approach, pp. 63–78. https://doi.org/10.1007/978-981-10-4451-9_4

Güney, T. (2019). Renewable energy, non-renewable energy and sustainable development. International Journal of Sustainable Development and World Ecology, 26(5), 389–397. https://doi.org/10.1080/13504509.2019.1595214

Hanley, N., Dupuy, L., & McLaughlin, E. (2015). Genuine savings and sustainability. Journal of Economic Surveys, 29(4), 779–806. https://doi.org/10.1111/joes.12120

Hu, D., Qiu, L., She, M., & Wang, Y. (2021). Sustaining the sustainable development: How do firms turn government green subsidies into financial performance through green innovation? Business Strategy and the Environment. https://doi.org/10.1002/bse.2746

Im, K. S., Pesaran, M. H., & Shin, Y. (2003). Testing for unit roots in heterogeneous panels. J Econom, 115, 53–74.

Institutional frameworks and labor market performance. (2021). In Institutional frameworks and labor market performance. https://doi.org/10.4324/9780203982501-6.

Kao, C., & Chiang, M. H. (2001). On the estimation and inference of a cointegrated regression in panel data. Advances in Econometrics, 15, 179–222.

Koirala, B., & Pradhan, G. (2019). Determinants of sustainable development: Evidence from 12 Asian countries. Sustainable Development. https://doi.org/10.1002/sd.1963

Kumssa, et al. (2004). The role of institutions in the development process of African countries. International Journal of Social Economics, 31(9), 840–854. https://doi.org/10.1108/03068290410550638

Levin, A., Lin, C. F., & Chu, C. (2002). Unit root tests in panel data: Asymptotic and finite sample properties. Journal of Economics, 108, 1–24.

Meya, J. N., & Neetzow, P. (2021). Renewable energy policies in federal government systems. Energy Economics. https://doi.org/10.1016/j.eneco.2021.105459

Nwosu, E. O., Ajibo, C. C., Nwoke, U., & Okoli, I. (2020). Legal and institutional frameworks for capital market regulation in Nigeria: Recasting the agendas beyond compliance-based regulation. Journal of Financial Crime. https://doi.org/10.1108/JFC-07-2020-0142

Oladipo, S. O. (2018). Dynamic interactions among road transport infrastructure development, economic growth and poverty level in Nigeria. African Journal of Applied Research (AJAR), 3(2), 97–113.

Pao, H.-T., & Tsai, C.-M. (2011). Multivariate granger causality between CO2 emissions, energy consumption, FDI (foreign direct investment) and GDP (gross domestic product): Evidence from a panel of BRIC (Brazil, Russian federation, India, and China) countries. Energy, 36(1), 685–693.

Pedroni, P. (1999). Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxford Bulletin of Economics and Statistics, 61, 653–670.

Pedroni, P. (2004). Panel cointegration: Asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis: New results. Economic Theory, 20, 597–627.

Rodrik, D. (2005). Growth strategies. Handbook of Economic Growth, 1(1), 967–1014.

Ross, D. (2006). Evolutionary game theory and the normative theory of institutional design: Binmore and behavioral economics. Politics, Philosophy & Economics, 5(1), 51–79.

Sato, M., Samreth, S., & Sasaki, K. (2018). The impact of institutional factors on the performance of genuine savings. International Journal of Sustainable Development and World Ecology, 25(1), 56–68. https://doi.org/10.1080/13504509.2017.1289990

Seethepalli, K., Bramati, M.C., & Veredas, D. (2008). How relevant is infrastructure to growth in East Asia. World bank policy research working paper series. No. 4597. Washington, DC: World Bank.

Siddiqui, D. A., & Ahmed, Q. M. (2013). The effect of institutions on economic growth : A global analysis based on GMM dynamic panel estimation. Structural Change and Economic Dynamics, 24(1), 18–33. https://doi.org/10.1016/j.strueco.2012.12.001

Spindler, E. (2013). The history of sustainability the origins and effects of a popular concept. In: Ian, J., Roland, S., (Eds.). Sustainability in tourism. Wiesbaden: Springer.

Tian, X.-L., Bélaïd, F., & Ahmad, N. (2021). Exploring the nexus between tourism development and environmental quality: Role of renewable energy consumption and income. Structural Change and Economic Dynamics. https://doi.org/10.1016/j.strueco.2020.10.003

United Nations. (2018). United Nations e-government survey 2018-E-government in support of sustainable development. United Nations.

Van de Kerk, G., & Manuel, A. (2008). A comprehensive index for a sustainable society: The SSI: The sustainable society index. Ecological Economics, 66(2–3), 228–242. https://doi.org/10.1016/j.ecolecon.2008.01.029

World Bank (2012). Beyond GDP–measuring progress, true wealth, and the well-being of the nations. https:// ec.europa.eu/environment/beyond_gdp/download/factsheets/bgdp-ve-ans.pdf. Accessed 1 June 2022.

World Bank (2020). World development indicators. Adjusted net savings. https://databank.worldbank.org/reports.aspx?source=World-Development-Indicators Accessed 5 January 2020.

Yang, L., Zhang, J., & Zhang, Y. (2021). Environmental regulations and corporate green innovation in china: The role of city leaders’ promotion pressure. International Journal of Environmental Research and Public Health. https://doi.org/10.3390/ijerph18157774

Yildirim, & Gokalp. (2015). Institutions and economic performance: A review on the developing countries. Procedia Economics and Finance, 38, 347–359.

Funding

The authors have not disclosed any funding

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have no conflict of interest to declare.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Ahmad, N., Jawadi, F. & Azam, M. Do Multi-Market Institutions and Renewable Energy Matter for Sustainable Development: A Panel Data Investigation. Comput Econ 62, 1393–1411 (2023). https://doi.org/10.1007/s10614-022-10302-1

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-022-10302-1