Abstract

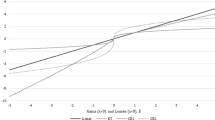

Prospect theory postulates that the utility function is characterized by a kink (a point of non-differentiability) that distinguishes gains from losses. In this paper we present an algorithm that efficiently solves the linear version of the kinked-utility problem. First, we transform the non-differentiable kinked linear-utility problem into a higher dimensional, differentiable, linear program. Second, we introduce an efficient algorithm that solves the higher dimensional linear program in a smaller dimensional space. Third, we employ a numerical example to show that solving the problem with our algorithm is 15 times faster than solving the higher dimensional linear program using the interior point method of Mosek. Finally, we provide a direct link between the piece-wise linear programming problem and conditional value-at-risk, a downside risk measure.

Similar content being viewed by others

Notes

Throughout this paper, prime (\(^{\prime }\)) is used to denote matrix transposition and any unprimed vector is a column vector.

The proposed algorithm works under the milder assumption of \(\pi _s,\,s=1, \ldots , S\) being non-negative.

Unboundedness may be a problem with bilinear, linear or mean-variance utility. It can occur even in a simple problem with one risky asset and limitless risk-free borrowing. Siegmann and Lucas (2005) highlight such problems in financial planning models under loss-averse preferences. He and Zhou (2011) as well as Fortin and Hlouskova (2011) address the problem in a continuous version of (1), where there is a risky and a risk-free asset. We do not expect unboundedness to be a problem with reasonable constraints.

In the present context, it might seem more natural to assume that the utility functions for each state are identical so that no state subscript is required for \(f_s,\,p_s\) and \(q_s\). However, in Sect. 5 we will show that conditional value-at-risk (CVaR) optimization is a special case of (1)–(2) and thus can be solved by the efficient algorithm presented in Sect. 3. Showing CVaR is a special case of (1)–(2) requires the utility functions to differ for each state.

Note that adding a scalar to the objective function does not change the solution.

Throughout this paper the kink point or the reference point are used interchangeably.

Mosek is optimization software designed to solve large-scale mathematical optimization problems. The software exploits problem sparsity and structure automatically to achieve the best possible efficiency. It is a well known state-of-the-art package and in the case of the interior point methods its execution times seem to be better than the ones when using the interior point solver in Cplex for instance.

References

Artzner, P., Delbaen, F., Eber, J. M., & Heath, D. (1999). Coherent measures of risk. Mathematical Finance, 9(3), 203–228.

Barberis, N., & Huang, M. (2001). Mental accounting, loss aversion, and individual stock returns. The Journal of Finance, 56(4), 1247–1292.

Barberis, N., Huang, M., & Santos, T. (2001). Prospect theory and asset prices. The Quarterly Journal of Economics, 116(1), 1–53.

Benartzi, S., & Thaler, R. H. (1995). Myopic loss aversion and the equity premium puzzle. The Quarterly Journal of Economics, 110(1), 73–92.

Berkelaar, A. B., Kouwenberg, R., & Post, T. (2004). Optimal portfolio choice under loss aversion. Review of Economics and Statistics, 86(4), 973–987.

Best, M. J., & Grauer, R. R. (2011a). A comparison of prospect-theory, power-utility and mean-variance portfolios. Technical report : Simon Fraser University.

Best, M. J., & Grauer, R. R. (2011b). Prospect theory and portfolio selection. Technical report : Simon Fraser University.

Best, M. J., & Hlouskova, J. (2005). An algorithm for portfolio optimization with transaction costs. Management Science, 51(11), 1676–1688.

Best, M. J., & Hlouskova, J. (2007a). An algorithm for portfolio optimization with variable transaction costs, part 1: Theory. Journal of Optimization Theory and Applications, 135(3), 563–581.

Best, M. J., & Hlouskova, J. (2007b). An algorithm for portfolio optimization with variable transaction costs, part 2: Computational analysis. Journal of Optimization Theory and Applications., 135(3), 531–547.

Best, M. J., & Ritter, K. (1985). Linear programming: Active set analysis and computer programs. Engelwood Cliffs, NY: Prentice-Hall.

Best, M. J., & Zhang, X. L. (2011). Degeneracy resolution for linear utility functions. Journal of Optimization Theory and Applications, 150(3), 615–634.

Cremers, J. H., Kritzman, M., & Page, S. (2005). Optimal hedge fund allocations: Do higher moments matter? Journal of Portfolio Management, 31(3), 70–81.

De Giorgi, E., Hens, T., & Mayer, J. (2007). Computational aspects of prospect theory with asset pricing applications. Computational Economics, 29(3), 267–281.

Fortin, I., & Hlouskova, J. (2011). Optimal asset allocation under linear loss aversion. Journal of Banking & Finance, 35(11), 2974–2990.

Fourer, R. (1985). A simplex algorithm for piecewise-linear programming i: Derivation and proof. Mathematical Programming, 33(2), 204–233.

Fourer, R. (1988). A simplex algorithm for piecewise-linear programming ii: Finiteness, feasibility and degeneracy. Mathematical Programming, 41(1), 281–315.

Fourer, R. (1992). A simplex algorithm for piecewise-linear programming iii: Computational analysis and applications. Mathematical Programming, 53(1), 213–235.

Grüne, L., & Semmler, W. (2008). Asset pricing with loss aversion. Journal of Economic Dynamics and Control, 32(10), 3253–3274.

He, X. D., & Zhou, X. Y. (2011). Portfolio choice under cumulative prospect theory: An analytical treatment. Management Science, 57(2), 315.

Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica: Journal of the Econometric Society, 47(2), 263–291.

Kliger, D., & Levit, B. (2009). Evaluation periods and asset prices: Myopic loss aversion at the financial marketplace. Journal of Economic Behavior & Organization, 71(2), 361–371.

Rockafellar, R. T., & Uryasev, S. (2000). Optimization of conditional value-at-risk. Journal of Risk, 2(3), 21–42.

Siegmann, A., & Lucas, A. (2005). Discrete-time financial planning models under loss-aversepreferences. Operations Research, 53(3), 403–414.

Sutter, M. (2007). Are teams prone to myopic loss aversion? An experimental study on individual versus team investment behavior. Economics Letters, 97(2), 128–132.

Tversky, A., & Kahneman, D. (1992). Advances in prospect theory: Cumulative representation of uncertainty. Journal of Risk and Uncertainty, 5(4), 297–323.

Acknowledgments

This research was supported by the Austrian National Bank (Jubiläumsfonds Grant No. 12806), the National Science and Engineering Research Council of Canada, the Toronto Dominion Bank-University of Waterloo Computational Finance Research Partnership Agreement and the Social Sciences, Humanities Research Council of Canada, the Humanity and Social Science Youth foundation of Ministry of Education of China (No. 13YJC630227), Zhejiang Provincial Natural Science Foundation of China (No. LQ13G010001) and the Fundamental Research Funds for the Central Universities of China.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Best, M.J., Grauer, R.R., Hlouskova, J. et al. Loss-Aversion with Kinked Linear Utility Functions. Comput Econ 44, 45–65 (2014). https://doi.org/10.1007/s10614-013-9391-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-013-9391-x