Abstract

In this paper, we develop a multi-stage stochastic programming model for dynamic international portfolio risk management with options in an integrated view. Upon scenario trees, the model can automatically compute the optimal hedging strategies, which provides rolling and dynamic decisions for how much option positions should be established and how much should be liquidated, while simultaneously allocating the corresponding underlying assets. Extensive numerical analyses strongly verify the effectiveness of the model, especially in market downturns, and support the computational feasibility and performance of the model.

Similar content being viewed by others

Notes

Rasmussen and Clausen (2007) point out that arbitrage opportunity may arise when using scenario reduction in portfolio optimization problems. Moreover, Geyer et al. (2011) also show that even if the scenario trees generated by scenario reduction are arbitrage-free, the solutions to the approximate optimization problem represented by the reduced tree are highly variable. By contrast, they both find that when using a simple problem with a known analytic solution, moment matching method accompanied by arbitrage-free check can exactly replicates this solution.

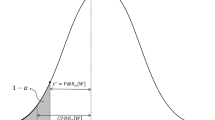

The tests aim to verify that the scenario does not contain a feasible costless, self-financing decision that can generate a riskless profit (i.e., a non-positive initial endowment yield non-negative payoffs for all scenarios, or a strictly positive profit at least for one scenario).

It should be noted that other option pricing methods which rely on specific distribution assumptions for the stochastic process of the underlying asset are unrealistic and are not met in the empirical tests in our paper. The scenario sets generated by moment-matching method capture skewness and excess kurtosis characteristics of the underlying asset that do not conform to the assumptions on which popular option pricing methods are based.

Source: Closing price for S&P500 options are obtained from http://www.cmegroup.com, closing price for Nikke225 options are obtained from http://www.sgx.com, closing price for FTSE100 options are obtained from https://globalderivatives.nyx.com/stock-indices/nyse-liffe, closing price for DAX30 options are obtained from http://www.eurexchange.com/exchange-en/trading/.

We introduce the upside potential and downside risk ratio (UP ratio) proposed by Sortino and Van der Meer (1991), which is a more appropriate measure for risk-adjusted performance. This ratio contracts the average excess return over some target with a measure of shortfall from the same benchmark, as suggested by Sortina et al. (1999). Here we use the log return of MSCI Stock Index as the benchmark. Let \(r_t \) be the realized return of a portfolio in month \(t=1,2,\ldots ,T\) of the simulation period 10/2007–12/2009. Let \(\rho _t \) be the return of the benchmark (risk-free asset) at the same period. Then the UP ratio can be measured as follows:

$$\begin{aligned} \text{ UP } \;\text{ ratio }=\frac{\text{1 }}{\text{ T }}\sum _{t=1}^T {\frac{\max \left( {0,r_t -\rho _t } \right) }{\sqrt{\frac{\text{1 }}{\text{ T }}\sum _{t=1}^T {\left[ {\max \left( {0,\rho _t -r_t } \right) } \right] ^{2}}}}.} \end{aligned}$$The last two measures serve as assessment metrics for dynamic investment process based on information about the compositions of the evaluated portfolios, which are discussed extensively in Grinblatt and Titman (1993). The ESM reflects the realized excess returns of the actively managed portfolio in comparison to its unconditional expected return. The PCM quantifies the return resulting from the portfolio revision at the each decision stage. The intuition is that an effective strategy adjusts the portfolio structure in favor of assets that achieve higher returns and away from assets with lower returns. The \(ESM_t \) and \(PCM_t \) measures at each month \(t=1,2,\ldots ,T\) of the simulation period are computed as follows:

$$\begin{aligned} ESM_t =\sum _{\kappa \in K} {\varpi _{\kappa ,t} \left( {\vartheta _{\kappa ,t} -\overline{\vartheta _t } } \right) } ,\quad PCM_t =\sum _{\kappa \in K} {\vartheta _{\kappa ,t} \left( {\varpi _{\kappa ,t} -\varpi _{\kappa ,t-1} } \right) } , \end{aligned}$$where, \(K\) is the set of all available investment instruments (stock indices and options). \(\varpi _{\kappa ,t} \) denotes the proportion of funds in instrument \(\kappa \in K\)of the portfolio at time \(t\), with respect to the total value of the portfolio, \(\vartheta _{\kappa ,t} \) represents the market return of instrument \(\kappa \in K\) of the portfolio at time \(t, \overline{\vartheta _t } =\frac{1}{T}\sum _{t=1}^T {\vartheta _{\kappa ,t} } \), is an estimate of the unconditional expected return of the investment instrument.

References

Abdelaziz, F. B., Aouni, B., & Fayedh, R. E. (2007). Multi-objective stochastic programming for portfolio selection. European Journal of Operational Research, 177(3), 1811–1823.

Aliprantis, C., Brown, D., & Werner, J. (2000). Minimum-cost portfolio insurance. Journal of Economic Dynamics and Control, 24(11–12), 1703–1719.

Blomvall, J., & Lindberg, P. (2003). Back-testing the performance of an actively managed option portfolio at the Swedish stock market, 1990–1999. Journal of Economic Dynamics and Control, 27(6), 1099–1112.

Brennan, M., & Cao, H. (1996). Information, trade, and derivative securities. Review of Financial Studies, 9(1), 163–208.

Dupacová, J., Gröwe-Kuska, N., & Römisch, W. (2003). Scenario reduction in stochastic programming: An approach using probability metrics. Mathematical Programming, Series A, 95, 493–511.

Ferstl, R., & Weissensteiner, A. (2010). Cash management using multi-stage stochastic programming. Quantitative Finance, 10(2), 209–219.

Ferstl, R., & Weissensteiner, A. (2011). Asset-liability management under time-varying investment opportunities. Journal of Banking and Finance, 35(1), 182–192.

Follmer, H., & Sondermann, D. (1986). Hedging of non-redundant contingent claims. In W. Hildenbrand & A. Mas-Colell (Eds.), Contributions to mathematical economics (pp. 205–223). Amsterdam: North-Holland.

Gaivoronski, A. A., Krylov, S., & Van der Wijst, N. (2005). Optimal portfolio selection and dynamic benchmark traking. European Journal of Operational Research, 163(1), 115–131.

Gao, P. W. (2009). Options strategies with the risk adjustment. European Journal of Operation Research, 192, 975–980.

Geyer, A., Hanke, M., & Weissensteiner, A. (2011). Scenario tree generation and multi-asset financial optimization problems. Working paper. Available at SSRN. http://ssrn.com/abstract=1857411 or http://dx.doi.org/10.2139/ssrn.1857411.

Gondzio, J., Kouwenberg, R., & Vorst, T. (2003). Hedging options under transaction costs and stochastic volatility. Journal of Economic Dynamics and Control, 27(6), 1045–1068.

Grinold, R. C. (1999). Mean-variance and scenario-based approaches to portfolio selection. The Journal of Portfolio Management, 25(2), 10–22.

Grinblatt, M., & Titman, S. (1993). Performance measurement without benchmarks: An examination of mutual fund returns. Journal of Business, 66(1), 47–68.

Harrison, J. M., & Pliska, S. R. (1981). Martingales and stochastic integrals in the theory of continuous trading. Stochastic Processes and their Applications, 11, 215–260.

Haugh, M., & Lo, A. (2001). Asset allocation and derivatives. Quantitative Finance, 1(1), 45–72.

Heitsch, H., & Römisch, W. (2003). Scenario reduction algorithms in stochastic programming. Computational Optimization and Applications, 24, 187–206.

Hochreiter, R., & Pflug, G. Ch. (2007). Financial scenario generation for stochastic multi-stage decision processes as facility location problems. Annals of Operations Research, 152(1), 257–272.

Horasanh, M. (2008). Hedging strategy for a portfolio of options and stocks with linear programming. Applied Mathematics and Computation, 199, 804–810.

Høyland, K., Kaut, M., & Stein, W. (2003). A heuristic for moment-matching scenario generation. Computational Optimization and Applications, 24(2–3), 169–185.

Høyland, K., & Wallance, S. W. (2001). Generating scenario trees for multistage decision problems. Management Science, 47(2), 295–307.

Huang, D. S., Zhu, S. S., Fabozzi, F. J., & Fukushima, M. (2008). Portfolio selection with uncertain exit time: A robust CVaR approach. Journal of Economic Dynamics and Control, 32(2), 594–623.

Huang, D. S., Zhu, S. S., Fabozzi, F. J., & Fukushima, M. (2010). Portfolio selection under distributional uncertainty: A relative robust CVaR approach. European Journal of Operational Research, 203(1), 185–194.

Klaassen, P. (2002). Comment on “Generating scenario trees for multistage decision problems”. Management Science, 48(11), 1512–1516.

Korn, R., & Trautmann, S. (1999). Optimal control of option portfolios and applications. OR Spektrum, 21, 123–146.

Liu, J., & Pan, J. (2003). Dynamics derivative strategies. Journal of Financial Economics, 69(3), 401–430.

Merton, R., Scholes, M., & Gladstone, M. (1978). The return and risk of alternative call option portfolio investment strategies. Journal of Business, 51, 183–242.

Muck, M. (2010). Trading strategies with partial access to the derivatives market. Journal of Banking and Finance, 34(6), 1288–1298.

Neuberger, A., & Hodges, S. (2002). How large are the benefits from using options? Journal of Financial and Quantitative Analysis, 37(2), 202–220.

Papahristodoulou, C. (2004). Option strategies with linear programming. European Journal of Operation Research, 157, 246–256.

Pflug, G. C. (2001). Optimal scenario tree generation for multiperiod financial planning. Mathematical Programming, 89(2), 251–271.

Rasmussen, K. M., & Clausen, J. (2007). Mortgage loan portfolio optimization using multi-stage stochastic programming. Journal of Economic Dynamics and Control, 31(3), 742–766.

Scheuenstuhl, G., & Zagst, R. (2008). Integrated portfolio management with options. European Journal of Operational Research, 185(3), 1477–1500.

Sortino, F. A., & Van der Meer, R. (1991). Downside risk: Capturing what’s at stake in investment situations. Journal of Portfolio Management, 17(4), 27–31.

Sinha, P., & Johar, A. (2010). Hedging Greeks for a portfolio of options using linear and quadratic programming. The Journal of Prediction Markets, 4(1), 17–26.

Sortina, F., Van der Meer, R., & Plantinga, A. (1999). The Dutch triangle—A framework to measure upside potential relative to downside risk. Journal of Portfolio Management, 26(1), 50–58.

Topaloglou, N., Vladimirou, H., & Zenios, S. A. (2002). CVaR models with selective hedging for international asset allocation. Journal of Banking and Finance, 26(7), 1535–1561.

Topaloglou, N., Vladimirou, H., & Zenios, S. A. (2008a). A dynamic stochastic programming model for international portfolio management. European Journal of Operational Research, 185, 1501–1524.

Topaloglou, N., Vladimirou, H., & Zenios, S. A. (2008b). Pricing options on scenario trees. Journal of Banking and Finance, 32(2), 283–298.

Topaloglou, N., Vladimirou, H., & Zenios, S. A. (2011). Optimizing international portfolios with options and forwards. Journal of Banking and Finance, 35(12), 3188–3201.

Zhao, Y., & Ziemba, W. (2008). Calculating risk neutral probabilities and optimal portfolio policies in a dynamic investment model with downside risk control. European Journal of Operational Research, 185(3), 1525–1540.

Acknowledgments

The authors would like to thank the National Natural Science Foundation of China for financially supporting under Contract No. 70831001 and 71173008.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Yin, L., Han, L. International Assets Allocation with Risk Management via Multi-Stage Stochastic Programming. Comput Econ 55, 383–405 (2020). https://doi.org/10.1007/s10614-013-9365-z

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-013-9365-z