Abstract

The overlapping generations (OLG) model is an important framework for analyzing any type of question in which age cohorts are affected differently by exogenous shocks. However, as the dimensions and degree of heterogeneity in these models increase, the computational burden imposed by rational expectations solution methods for nonstationary equilibrium transition paths increases exponentially. As a result, these models have been limited in the scope of their use to a restricted set of applications and a relatively small group of researchers. In addition to providing a detailed description of the benchmark rational expectations computational method, this paper presents an alternative method for solving for equilibrium transition paths in OLG life cycle models that is new to this class of model. The key insight is that even naïve limited information forecasts within the model produce aggregate time series similar to full information rational expectations time series as long as the naïve forecasts are updated each period. We find that our alternate model forecast method reduces computation time by 85 percent, and the approximation error is small.

Similar content being viewed by others

Notes

See Weil (2008) for a careful description of the mechanism in OLG models that causes competitive equilibria to not be Pareto-optimal, in general.

We detail in Appendix 1 the fundamental difference between the OLG and infinite horizon models with idiosyncratic uncertainty but no aggregate uncertainty.

This borrowing constraint is not too restrictive given the OLG environment. Some type of borrowing constraint must be imposed either exogenously or endogenously in order to constrain borrowing at the end of life. We set our exogenous constraint arbitrarily at zero, but it could be negative and age-dependent without changing the computation speed of the equilibrium. The nonnegativity constraint on bonds is consistent with holding physical capital instead of financial capital.

Wendner (2004) provides an analytical proof for the existence and uniqueness of the steady-state rational expectations equilibrium.

A detailed description of the algorithm for computing the steady-state distribution is given in Appendix 2.

A person’s lifespan here is defined as the duration from the period they start working until the period they die. We ignore childhood. The exact calibration of \(n(s)\) is reported in Appendix 2.

Note that the \(\Gamma \) and \(\Omega \) that usually appear in the policy functions \(\phi \) have been dropped because they are assumed in the guess of the transition path \(\mathbf{K}^i\).

A check here for whether \(T\) is large enough is if \(K_T^{i^{\prime }}=\bar{K}\left(\bar{\Gamma }\right)\) as well as \(K_{T+1}^{i^{\prime }}\) and \(K_{T+2}^{i^{\prime }}\). If not, then \(T\) needs to be larger.

More specifically, we assumed a uniform initial distribution of savings across all types, which resulted in an initial aggregate capital stock of \(K_1=5.45\). The steady-state distribution \(\bar{\Gamma }\) that results in \(\bar{K}=7.62\) is not uniform.

As an example, 1,000 simulations of the TPI transition path in main calibration presented in Sect. 3.1 would take 3.65 computer years. The same simulations would take only 0.55 computer years using the AMF method.

Christiano and Fisher (2000) detail a parameterized expectations algorithm for solving infinite horizon DSGE models with occasionally binding constraints. But it is not a linearization method.

References

Aruoba, S. B., Fernández-Villaverde, J., & Rubio-Ramírez, J. F. (2006). Comparing solution methods for dynamic equilibrium economies. Journal of Economic Dynamics and Control, 30(12), 2477–2508.

Auerbach, A. J., & Lawrence, J. K. (1987). Dynamic fiscal policy. New York: Cambridge University Press.

Benhabib, J., & Day, R. H. (1982). A characterization of erratic dynamics in the overlapping generations model. Journal of Economic Dynamics and Control, 4, 37–55.

Chatterjee, S. (1994). Transitional dynamics and the distribution of wealth in a neoclassical growth model. Journal of Public Economics, 54(1), 97–119.

Chen, H.-J., Li, M.-C., & Lin, Y.-J. (2008). Chaotic dynamics in an overlapping generations model with myopic and adaptive expectations. Journal of Economic Behavior and Organization, 67(1), 48–56.

Christiano, L. J. (2002). Solving dynamic general equilibrium models by a method of undetermined coefficients. Computational Economics, 20(1–2), 21–55.

Christiano, L. J., & Fisher, J. D. M. (2000). Algorithms for solving dynamic models with occasionally binding constraints. Journal of Economic Dynamics and Control, 24(8), 1179–1232.

Fernández-Villaverde, J., & Rubio-Ramírez, J. F. (2006). Solving DSGE models with perturbation methods and a change of variables. Journal of Economic Dynamics and Control, 30(12), 2509–2531.

Fuster, A., Laibson, D., & Mendel, B. (2010). Natural expectations and macroeconomic fluctuations. Journal of Economic Perspectives, 24(4), 67–84.

Huang, K. X. D., Liu, Z., & Zha, T. (2009). Learning, adaptive expectations, and technology shocks. The Economic Journal, 119(536), 377–405.

Judd, K. L., Maliar, L., & Maliar, S. (2011). Numerically stable and accurate stochastic simulation approaches for solving dynamic economic models. Quantitative Economics, 2(2), 173–210.

Krueger, D., & Kubler, F. (2004). Computing equilibrium in OLG models with stochastic production. Journal of Economic Dynamics and Control, 28(7), 1411–1436.

Krusell, P., & Smith, A. A, Jr. (1998). Income and wealth heterogeneity in the macroeconomy. Journal of Political Economy, 106(5), 867–896.

Krusell, P., & Ríos-Rull, J.-V. (1999). On the size of U.S. government: Political economy in the neoclassical growth model. American Economic Review, 89(5), 1156–1181.

Mankiw, N. G., & Reis, R. (2002). Sticky information versus sticky prices: A proposal to replace the New Keynesian Phillips curve. Quarterly Journal of Economics, 117(4), 1295–1328.

Michel, P., & de la Croix, D. (2000). Myopic and perfect foresight in the OLG model. Economics Letters, 67(1), 53–60.

Nishiyama, S., & Smetters, K. (2007). Does social security privatization produce efficiency gains? Quarterly Journal of Economics, 122(4), 1677–1719.

Samuelson, P. A. (1958). An exact consumption-loan model of interest with or without the social contrivance of money. Journal of Political Economy, 66(6), 467–482.

Sims, C. A. (2003). Implications of rational inattention. Journal of Monetary Economics, 50(3), 665–690.

Solow, R. M. (2006). Overlapping generations. In M. Szenberg, L. Ramrattan, & A. G. Aron (Eds.), Samuelsonian economics and the Twenty-First century (pp. 34–41). Oxford: Oxford University Press.

Stokey, N. L., & Lucas, R. E, Jr. (1989). Recursive methods in economic dynamics. Cambridge: Harvard University Press.

Taylor, J. B., & Uhlig, H. (1990). Solving nonlinear stochastic growth models: A comparison of alternative solution methods. Journal of Business and Economic Statistics, 8(1), 1–17.

Uhlig, H. (1999). A toolkit for analyzing nonlinear dynamic stochastic models easily. In M. Ramon & S. Andrew (Eds.), Computational methods for the study of dynamic economies (pp. 30–61). New York: Oxford University Press.

Weil, P. (2008). Overlapping generations: The first jubilee. Journal of Economic Perspectives, 22(4), 115–134.

Wendner, R. (2004). Existence, uniqueness, and stability of equilibrium in an OLG economy. Economic Theory, 23(1), 165–174.

Williams, N. (2003, January). Adaptive learning and business cycles, mimeo.

Acknowledgments

We thank Shinichi Nishiyama for helpful comments and code. We also thank Harald Uhlig, Russell Cooper, Laurence Kotlikoff, Kent Smetters, Glenn Hubbard, and Alexander Ludwig for comments and suggestions. We are grateful to participants at the Society for Computational Economics–2011 International Conference on Computating in Economics and Finance, the Quantitative Society for Pension and Savings 2009 Summer Workshop, and Brigham Young University \(R^2\) Seminar Series for constructive comments. Matthew Yancey provided helpful research assistance. All errors are our own.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Description of Differences Between OLG and Infinite Horizon Models

In this section, we describe the difference between the OLG model with idiosyncratic uncertainty and no aggregate uncertainty and its infinite horizon counterpart. Chatterjee (1994) and Krusell and Ríos-Rull (1999) show that infinite horizon models with standard period utility functions and only idiosyncratic uncertainty with no aggregate uncertainty exhibit an aggregation theorem. That is, the law of motion for the aggregate capital stock, which is a function of the entire distribution of capital among idiosyncratically heterogeneous households, can be derived as a function solely of aggregate variables in the current information set.

This means that the infinite horizon analogue of our OLG model with idiosyncratic uncertainty has no need of adaptive expectations. Household beliefs about future interest rates and wages in the rational expectations infinite horizon model are simply a function of the aggregate capital stock in the current period. No alternate model forecast rule can be used here because the exact rational expectations law of motion can already be calculated with limited information.

For this reason, we only use our AMF approximation solution method for the OLG model with idiosyncratic uncertainty. The aggregation theorem does not hold in the OLG model with only idiosyncratic uncertainty, because each agent type within each generation cannot perfectly smooth consumption over its lifetime. This is the reason that the fundamental welfare theorems of economics do not hold in OLG models, in general. It is also the reason that the aggregation theorem does not hold, and forecasts of the aggregate capital stock remain a function of the entire distribution of capital rather than just a summary statistic (the aggregate capital stock) in the current information set.

For heterogeneous agent models with both idiosyncratic and aggregate uncertainty, other solution methods have been developed, such as Krusell and Smith (1998), Krueger and Kubler (2004), and Judd et al. (2011). But the OLG model with only idiosyncratic uncertainty remains important for answering many economic questions. Therefore, solution methods for this class of models are relevant.

Appendix 2: Computational Algorithm for Steady-State Equilibrium

The computation of the steady-state equilibrium described in Definition 1 requires the following steps. The MatLab code for this steady-state computation is available upon request.

-

1.

Calibrate the exogenous parameters of the model \(S, \beta , \sigma , \alpha , A, \delta \), the computation parameter \(\rho \), the distribution of the ability shock \(f_s(e)\), and the inelastic labor supply function as a function of age \(n(s)\).

-

We chose the parameter values \([S,\beta ,\sigma ,\alpha ,\rho ,A,\delta ]=[60,0.96,3,0.35, 0.2,1,0]\).

-

The inelastic labor supply function of age \(n(s)\) was calibrated to match the average labor supply by age reported in the CPS monthly survey, where the maximum average hours worked is normalized to unity.

$$\begin{aligned} n(s) = {\left\{ \begin{array}{ll} \left[0.87,0.89,0.91,0.93,0.96,0.98\right] \quad \text{ for}\quad 1\le s\le 6 \\ 1 \quad \quad \quad \quad \quad \quad \quad \quad \quad \quad \quad \quad \quad \quad \quad \quad \quad \quad \,\text{ for}\quad 7\le s\le 40 \\ \bigl [0.95,0.89,0.84,0.79,0.73,0.68,0.63,0.57,0.52, \ldots \\ \quad 0.47,0.40,0.33,0.26,0.19,0.12,0.11,0.11,0.10,0.10,0.09\bigr ] \\ \quad \quad \quad \quad \quad \quad \quad \quad \quad \quad \quad \quad \quad \quad \quad \quad \quad \quad \,\,\,\text{ for}\quad 41\le s\le 60 \end{array}\right.} \end{aligned}$$ -

The discretized approximation of the ability shock is the following seven ability types \(e_{s,t} \in \{0.1,0.5,0.8,1.0,1.2,1.5,1.9\}\) with a mass function \(f_s(e) = \{0.04,0.09,0.20,0.34,0.20,0.09,0.04\}\) for all \(s\). We could have just as easily made the probability distribution be conditional on \(s\) but that does not increase the computation time.

-

-

2.

Discretize the space of possible wealth levels into \(B\) possible values such that \(b\in \{b_1,b_2, \ldots b_B\}\), where \(b_1=0\) and \(b_B<\infty \).

-

We chose a discretized support of \(B=350\) equally spaced points between \(b_1=0\) and \(b_B=15\).

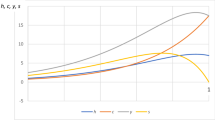

-

Note that we have to impose a savings maximum constraint due to there being some states in which the household wants to save more than their current wealth level. Setting \(b_{max}=15\) is high enough to minimize the number of states in which the upper bound binds. The smoothness of Fig. 1 at its peak shows that the upper bound creates a minimal distortion.

-

-

3.

Choose an arbitrary initial guess for the steady-state distribution of wealth \(\bar{\Gamma }_0 = \bar{\gamma }_0(s,e,b)\) such that \(\bar{\gamma }_0(s,e,b)\in [0,1]\) and \(\sum _s\sum _e\sum _b\bar{\gamma }_0(s,e,b)=1\).

-

Our initial guess was simply the distribution across abilities by age spread across each possible wealth level \(\gamma _0(s,e,b) = f_s(e)/\left[(S-1)B\right]\) for all \(s, e\), and \(b\).

-

-

4.

Use \(\bar{\Gamma }_0\) to calculate steady-state values for \(\bar{K}_0, \bar{Y}_0, \bar{r}_0\) and \(\bar{w}_0\) using Eqs. (2.11), (2.13), (2.14), (2.15), and (2.16).

-

5.

Taking \(\bar{r}_0\) and \(\bar{w}_0\) as given each period, solve for the optimal policy rule of each agent \(b^{\prime }=\phi (s,e,b|\Omega )\) by backward induction.

-

6.

Use \(b^{\prime }=\phi (s,e,b|\Omega )\) and \(\bar{\Gamma }_0\) to calculate the distribution of wealth in the next period \(\bar{\Gamma }^{\prime }_0\).

-

7.

Generate a new guess for the steady-state distribution of wealth \(\bar{\Gamma }_1\) as a convex combination of the two distributions from the previous step \(\bar{\Gamma }_1 = \rho \bar{\Gamma }^{\prime }_0 + (1-\rho )\bar{\Gamma }_0\), where \(\rho \in (0,1)\).

-

8.

Repeat steps (4) through (7) until the distance between \(\bar{\Gamma }_i\) and \(\bar{\Gamma }^{\prime }_i\) is arbitrarily close to zero, where \(i\) is the index of the iteration number. Let \(|\cdot |\) be the sup norm and let \(\varepsilon >0\) be some scalar arbitrarily close to zero. Then the steady state \(\bar{\Gamma }\) is found when \(\left|\bar{\Gamma }_i - \bar{\Gamma }^{\prime }_i\right| < \varepsilon \).

In our example, the computation of the steady-state equilibrium took 3 h, 5 min, and 25 s. Figure 1 shows the steady-state aggregate capital stock \(\bar{K}\) and the average wealth \(\bar{b}_s\) as a function of age \(s\).

Appendix 3: Computational Algorithm for TPI Transition Path

The computation of the TPI transition path described in Sect. 3.1 requires the following steps. The MatLab code for this TPI transition path computation is available upon request.

-

1.

Using the parameterization from the steady-state computation, and choose the value for \(T\) at which the non-steady-state transition path should have converged to the steady state. We used \(T=60\).

-

2.

Choose an initial state of the aggregate capital stock \(K_1\). Choose an initial distribution of capital \(\Gamma _1\) consistent with \(K_1\) according to (2.16).

-

We chose an initial capital stock of \(K_1=5.45\), which is consistent with a simple initial distribution of wealth—the distribution of ability by age spread across all possible wealth levels \(\gamma _1(s,e,b)= f_s(e)/\left[(S-1)B\right]\) for all \(s, e\), and \(b\).

-

-

3.

Conjecture a transition path for the aggregate capital stock \(\mathbf{K}^i=\{K^i_t\}_{t=1}^\infty \) where the only requirements are that \(K^i_1=K_1\) is your initial state and that \(K^i_t=\bar{K}\) for all \(t\ge T\). The conjectured transition path of the aggregate capital stock \(\mathbf{K}^i\), along with the exogenous aggregate labor supply from (2.15), implies specific transition paths for the real wage \(\mathbf{w}^i=\{w^i_t\}_{t=1}^\infty \) and the real interest rate \(\mathbf{r}^i=\{r^i_t\}_{t=1}^\infty \) through expressions (2.11), (2.13), and (2.14).

-

4.

With the conjectured transition paths \(\mathbf{w}^i\) and \(\mathbf{r}^i\), one can solve for the lifetime policy functions of each household alive at time \(t=1\) by backward induction using the Euler equations of the form (3.3). Rows 1 through 5 of Table 2 illustrate this process.

-

The first line is solving for the solution of the individual who is age \(S-1\) at time \(t=1\) obtaining \(b_{2,2}=\phi _1(S-1,e,b)\) from Eq. (3.1).

-

Each subsequent row from Table 2 represents the solution of the lifetime savings policy functions of an individual with more years remaining in their life at time \(t=1\), down the the person who is age \(s=1\) at time \(t=1\) and has the entire set of \(S-1\) policy functions characterized by (3.3).

-

-

5.

In similar fashion to step (4), solve for the lifetime policy functions by backward induction for the age \(s=1\) household at times \(2\le t \le T\). In Table 2, this means solving for the policy functions in the last two rows down to the age \(s=1\) household at time \(t=T\).

-

6.

Each column in Table 2 represents a complete set of policy functions for the corresponding period. Using the initial distribution of wealth \(\Gamma _1\) and all the period \(t=1\) policy functions \(\phi _1(s,e,b)\) for the households alive at time \(t=1\), the next period distribution of wealth \(\Gamma _2\) and the corresponding aggregate capital stock \(K^{i^{\prime }}_2\) can be calculated. Consecutively repeat this procedure for each time period (column of Table 2) until a new transition path for the aggregate capital stock has been computed \(\mathbf{K}^{i^{\prime }}=\{K^{i^{\prime }}_t\}_{t=1}^T\).

-

7.

Generate a new guess for the transition path of the aggregate capital stock \(\mathbf{K}^{i+1}\) as a convex combination of the initially conjectured transition path \(\mathbf{K}^{i}\) and the newly generated transition path \(\mathbf{K}^{i^{\prime }}\).

$$\begin{aligned} \mathbf{K}^{i+1} = \rho \mathbf{K}^{i^{\prime }} + (1-\rho )\mathbf{K}^i \quad \text{ where}\quad \rho \in (0,1) \end{aligned}$$ -

8.

Repeat steps (4) through (7) until the distance between \(\mathbf{K}^{i^{\prime }}\) and \(\mathbf{K}^{i}\) is arbitrarily close to zero, where \(i\) is the index of the iteration number. Let \(|\cdot |\) be the sup norm and let \(\varepsilon >0\) be some scalar arbitrarily close to zero. Then the rational expectations equilibrium transition path of the economy is found when when \(\left|\mathbf{K}^{i^{\prime }} - \mathbf{K}^i\right| < \varepsilon \).

In our example, the computation of the TPI transition path took 31 h, 59 min, and 39 s. Figure 2 shows the transition path of the aggregate capital stock from its initial state at \(K_1\) to the steady state \(\bar{K}\). The aggregate capital stock arrived at its steady state in about 60 periods.

Appendix 4: Computational Algorithm for AMF Transition Path

The computation of the AMF transition path described in Definition 3 requires the following steps. The MatLab code for this AMF transition path computation is available upon request.

-

1.

Conjecture an alternative model forecast method \(\Omega _a.\)

-

We use a linear trend from the current state \(K_t\) to the steady state \(\bar{K}.\)

$$\begin{aligned} K_{t+1} = \Omega _a\left(K_t\right) \Rightarrow K_{t+1} = K_t + \frac{\bar{K}-K_t}{T-t} \end{aligned}$$(3.7) -

Our specific alternative model is written as a law of motion for the aggregate capital stock, but it implies a law of motion for the average wealth. From (2.16) we know that aggregate capital \(K_t\) is just a function of the average wealth.

$$\begin{aligned} K_t = \frac{S-1}{S}\bar{b}_t \end{aligned}$$(8.1)So the alternative model \(\Omega _a\) implies a similar linear law of motion for the moments by combining (3.7) with (4.1).

$$\begin{aligned} \bar{b}_{t+1} = \Omega _a\left(\bar{b}_t\right) \Rightarrow \bar{b}_{t+1} = \bar{b}_t + \frac{\bar{b}_{ss}-\bar{b}_t}{T-t} \end{aligned}$$(8.2)

-

-

2.

Solve the lifetime savings policy functions \(\phi (s,e,b)\) for each agent alive at time \(t\) by backward induction using the alternate model forecast method (3.6) to obtain the forecasted series of prices over those lifetimes. (This step is the same as step 4 in Appendix 4.)

-

3.

Use the complete set of policy functions for the current period in order to calculate the next period’s distribution of wealth \(\Gamma _{t+1}\) and the corresponding aggregate capital stock \(K_{t+1}\).

-

4.

Repeat this process until the distribution of wealth \(\Gamma _T\) and the aggregate capital stock \(K_T\) have been computed for time \(T.\) Make sure that \(\Gamma _T = \bar{\Gamma }\) and \(K_T = \bar{K}\).

In our example, the computation of the AMF transition path took 4 h, 50 min, and 9 s. Figure 3 shows the transition path of the aggregate capital stock from its initial state at \(K_1\) to the steady state \(\bar{K}\) as compared to the benchmark TPI transition path. The aggregate capital stock arrived at its steady state in about 60 periods.

Rights and permissions

About this article

Cite this article

Evans, R.W., Phillips, K.L. OLG Life Cycle Model Transition Paths: Alternate Model Forecast Method. Comput Econ 43, 105–131 (2014). https://doi.org/10.1007/s10614-012-9359-2

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-012-9359-2

Keywords

- Computable general equilibrium models

- Heterogeneous agents

- Overlapping generations model

- Distribution of savings