Abstract

In this study, the effects of open innovation practices on enterprise value were discussed based on the supply chain perspective. A nonlinear programming mode was constructed considering the uncertainty of open innovation effect. On this basis, the prototype was analyzed using a robust optimization approach with comprehensive considerations to the infeasible probability of constraint and goal accuracy. Findings show that parameter \(\Gamma \) could convert the nonlinear programming model with uncertainty into a robust model with a strong stability. Furthermore, \(\Gamma \) could be used to regulate the preference of the manufacturer to profit and the uncertainties in innovative practices. A small \(\Gamma \) indicates manufacturers can refer to more information, and the manufacturers are more inclined to a mass production, so the profit is larger. Meanwhile, a high \(\Gamma \) means that manufacturers can refer to less information, so that they pay more attention to making the product output adapt to the uncertainty of innovative effect. Manufacturers could select the appropriate \(\Gamma \) value and reasonably arrange the production outputs of different goods according to the technological level of open innovation subject and their preference to profit and uncertainty. These conclusions were verified by a case study. In this work, the uncertainty of the open innovation effect was investigated from the supply chain perspective, which is of important significance to the decision making on optimal supply chain output and innovation risk control under an uncertain environment.

Similar content being viewed by others

1 Introduction

Innovation and its effects on business performance are strategically vital deliberations for modern business organizations [1, 2]. Innovation is also broadly observed as an essential component of gaining sustainable competitive advantage and is regarded as the capacity of identifying and gaining value, which are embedded in the structures, processes, products, and services of an organization [3]. However, the traditional “closed” innovation pattern that only depends on the internal resources of an enterprise is difficult to adapt, such as in surging R&D costs, shortening the service life of products, and increasing global competition. Therefore, the open innovation model that breaks enterprise boundaries and gains external resources increases in response to appropriate time and conditions [4]. The open innovation practice offers enterprises an effective way to use external strengths and rebuilds the organization boundaries of enterprises. Therefore, the current cognition on enterprise innovation is gradually evolving from a closed to an “open” pattern.

In open innovation, enterprises can acquire advanced knowledge by depending on external innovative resources or market channels [4, 5] to gain cost or monopolistic advantages [6]. In open innovation practices, the foothold of many industrial innovations has exceeded the limits of the central R&D laboratory inside the organization and is migrating to external innovation bodies [4, 5], universities, research unions, or other external organizations, thus reflecting a more open innovation pattern and showing huge innovation ability and vitality [7]. A number of consumer goods, companies, or technology firms, such as, Procter & Gamble, Dell, and Intel, have successfully employed open innovation practices [7, 8]. The Hair Group is a local consumption tycoon and electronic enterprise in China that is devoted in creating the largest innovation ecosystem and full-process innovation interactive community in the world through the Hair Open Partnership Ecosystem. The open innovation pattern achieves innovation source and the optimal resource allocation in the transfer process, saves R&D cost, and shortens the R&D period, finally realizing the maximum benefits of all parties involved [9, 10]. Open innovation is widely applied even in defense-related science and technology [11]. For example, Gustetic et al. provided several case studies on the open innovation activities of NASA and mapped the results of those activities to a successful set of outcomes [12]. These successful outcomes could help solve various problems and increase the number of such outcomes.

Based on the literature, open innovation has great contributions in improving enterprise performance. For instance, based on a survey data in seven European countries, Yannis and Stavros reported that acquiring external innovative knowledge not only increases the R&D competitiveness of enterprises but also positively affects its performance [13]. Sisodiya et al. and Choi argued that open innovation is conducive in reducing product cost and improving the performance of enterprises [6, 14]. Based on a large-scale survey of high-tech firms, Wang et al., found that a well-developed open innovation can achieve superior performance [15].

Most research has focused on the important role of open innovation on sustainable competitive edges, cost advantages, or business performances of enterprises, which have achieved excellent results. However, only few scholars have explored the uncertainty risks caused by open innovation through mathematical modeling, except for some empirical analyses on its mechanism. Rosas et al. adopted the failure modes and effects analysis (FMEA) method in building adequate risk models on open innovation [16]. However, the FMEA method can only process the most important and the most probable risks by depending on the probability of constraint violations; the method also requires probability distribution in advance.

Probability method has been the traditional way to address innovation uncertainties [17]. The postmortem analysis method mainly discusses the quality of a solution. Another method is the materialization of the uncertainty. Uncertain data are assumed to satisfy a certain probability distribution and are then viewed as random variables or processes. Both methods hypothesize the probability distribution of random parameters. However, accurate data and density distribution are difficult to acquire in this problem. In actual problems, acquiring the probability distribution of random parameters is significantly difficult because of the complicated and diversified uncertainty forms, as well as difficult accessibility to historical data. Hence, completely depicting a problem using probability theory is difficult.

Robust optimization is one of the most effective methods in solving current uncertainty problems [18]. Robust optimization is used to search for the solution that is insensitive to data disturbance. This method mainly studies the uncertainty problem of parameters to acquire the worst value in some uncertainty set, and the uncertainty of the model is considered in advanced when solving the uncertainty problem. The method hypothesizes that the data belongs to a bounded set rather than obeying a random distribution. The uncertainty is introduced into the constraint conditions and is considered in advance, and the gained decision scheme meets any realizations in a given set [19]. When robust optimization faces the worst situation, it represents a conservative opinion. In other words, the gained solution might be suboptimal and could not ensure the optimization of the target value; however, this optimization method is always feasible when parameters change in a given uncertainty set, making the uncertainty optimization model adapt to influences caused by few parameter changes [20].

Numerous scholars continue to explore and develop robust optimization methods. Soyster first suggested that robust optimization method is based on a linear optimization model, making it feasible for all data in a convex set [19]. However, this method is relatively conservative, and it sacrifices the optimal solution of primal problem to some extent [19]. Therefore, Ben-Tal and Nemirovski [21,22,23] and Ghaoui et al. [24] proposed the approximation of the uncertainty data set by choosing appropriate spheroids to avoid conservative disadvantages and then solved the problem using second-order cone programming. However, this computing method is relatively complicated. On this basis, Bertsimas and Sim [25, 26] introduced parameters for the comprehensive consideration of infeasible probability of constraints and influences on the target function value. They presented a linear optimization model that could regulate conservation degree of solutions. The robust optimization method is widely used in many different fields to solve uncertainty problems, such as in finance [27], energy [28, 29] and scheduling [30, 31].

More related works to robust optimization (RO) have applied in supply chain management [32]. Aalaei and Davoudpour present a new robust model for a cellular manufacturing system into supply chain design with labor assignment, which assumes that the market demand is uncertainty and find a best solution developed by RO approach [33]. Zhang and Jiang apply RO approach to develop a sustainable biodiesel supply chain model under price uncertainty [34]. Kisomi et al. present an integrated mathematical programming model based on RO approach to tackle the uncertain environment in supply chain configuration and supplier selection [35]. Mohammaddust et al., develop a robust model for alternative risk mitigation strategies in supply chain designs [36]. MA et al., propose a multi-objective mixed integer nonlinear programming model for environmental closed-loop supply (ECLSC) with uncertainty [37]. Talaei et al., proposed a mixed-integer linear programming model capable of reducing the network total costs, which using a robust fuzzy programming approach to investigate the effects of uncertainties of the variable costs, as well as the demand rate, on the network design [38].

Although robust optimization is extensively used, no scholar has discussed the robustness of open innovation practices on value creation of enterprises under uncertain conditions. Open innovation practices in enterprises are complicated and nonlinear from the supply chain perspective; thus, searching the solution to the nonlinear optimization mode of enterprise value creation under uncertain open innovation effect is crucial. Bertsimas and Sim proposed a linear optimization model that can adjust the conservation of solution by introducing parameters in the nonlinear model, which provides the method in solving the problem considered in the current study [25].

This study focused on the modeling of enterprise value creation under uncertain open innovation effect based on the supply chain perspective. The robust optimization method of the model was analyzed, and the optimal decision that satisfies the appeal of all stakeholders was searched from the perspective of the principal decision maker–manufacturer in the supply chain.

The remainder of this paper is organized as follows. Section 2 constructs the model of enterprise value creation considering the uncertainty of open innovation effect based on the supply chain perspective. Section 3 considers the infeasible probability of constraints and target accuracy comprehensively and then analyzes the prototype using robust optimization method. Section 4 discusses the probability assurance of a solution using the robust model. Section 5 verifies the conclusions through empirical analysis. Section 6 summarizes and concludes the paper and indicates future research topics.

2 Enterprise value creation model considering open innovation

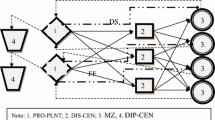

A supply chain model composed of subjects outside and inside the chain was studied. The subjects inside the chain include one manufacturer and one retailer. The subjects outside the chain consists of N OISs. This supply chain produces N kinds of heterogeneous products, which will be sold to the final consumer (Fig. 1).

In open innovation practices, manufacturers often issue the request for innovative technology to the ith product on an open innovation platform to increase the R&D level and reduce the production cost of the product. Open innovation transaction is formed when OIS answers innovation requests voluntarily. Innovation creates unit revenues by reducing the unit cost of products. Therefore, \(c_{i}\) is the unit production cost of the ith product is; \(u_{i}\) is the percentage of unit cost reduction of the ith product caused by the provided innovation technology; \(\alpha _{i}\) is the unit remuneration of the OIS provided by the manufacturer for the ith product; \(m_{i}\) is the R&D cost of the OIS for the ith product without loss of generality and meets \( m_{i} <\alpha _{i} x_i \) and \(\alpha _{i} <u_{i}c_{i} \).

Suppose that the order quantity of the ith product of the retailer is \(x_i \). For the convenience of modeling in this study, the retailer only sold out the product under the premise of ensuring basic conclusions without any surplus and additional demands. In other words, the order quantity of the retailer is equal to the sales volume and the output of the supply chain. \(q_{i}\) is the retailing price of the ith product. According to the market inverse demand function, the wholesale price is determined by \(p_{i}=a-bx_i \) without loss of generality. \(p_{i}\) must meet \(c_{i} \le a-bx_i \le q_{i} \).

The real cost reduction by the open innovation practices can only be determined in the actual production; however, manufacturers should make decisions on the production plan before the production. Therefore, \(u_{i}\) is uncertain when manufacturers are making output decisions. The uncertainty variable of this open innovation effect is recorded \({\tilde{u}}_i \). Hence, this variable can only make a reasonable estimation on cost reduction before the production according to the available data of practical production. Based on every innovation technology estimation of OIS, the cost reduction of these N products could be recorded as \(u_1^0 ,u_2^0 ,\ldots ,u_N^0 \). When \({\tilde{u}}_i \) has a reasonable fluctuation range, \({\tilde{u}}_i \in [u_i^0 -{\hat{u}}_i ,u_i^0 +{\hat{u}}_i ]\), where \({\hat{u}}_i \) is the fluctuation range of cost reduction, the influences of production by external factors are further considered.

First, as the producer of the supply chain, the manufacturer plays the dominant role in the output of supply chain. The manufacturer will pursue the maximum of total benefits, as expressed as follows:

As the rational subject, the retailer has a psychological bottom line during the entire consumption process—expected revenues \(M^{rv} \). When the total benefits in the entire process is higher than the expected revenues, the retailer will sell these products; otherwise, it will reject the products, which is expressed as

For every OIS, the retailer has to ensure that his profit reaches the expected target profit \(M_i \) during the technological innovation process, as expressed as follows:

Meanwhile, the order quantity should meet the non-negative constraint: \(x_i \ge 0\), \(\forall i=1,2,\ldots N\).

Therefore, the basic model of the supply chain under the open innovation pattern is

where the maximum profit of the manufacturer is used as the goal; the expected profit of the retailer and OIS is ensured; \(x_i \) is the decision-making variable; and \(c_{i} ,u_{i},\alpha _{i} ,m_{i},q_{i} ,a,b\), \(M_i \), and \(M^{rv} \) are known variables.

The objective function and constraint conditions in Model (4) are nonlinear in relation to \(x_i \).

The manufacturer should consider the profit of the retailer and OIS when pursuing the maximum profits; thus, the manufacturer’s profit could not be increased infinitely. A manufacturer only aims to maximize the satisfying value \(M^{rv} \). In other words, the model can be converted into

In comparison with Model (4), the target function in Model (5) is linear and only the constraint condition is the quadratic nonlinear constraints. Model (5) simplifies the solving process.

Model (5) is the enterprise value creation model that considers the uncertainty of open innovation effect.

3 Robust analysis of enterprise value under uncertainty of open innovation effect

In Model (5), Constraint (5.2) contains the uncertain parameter \({\tilde{u}}_i \). Uncertainty information plays the critical role in the decision making of manufacturers. For the nonlinear Constraint (5.2) that contains the uncertainty data, Bertsimas and Sim [25] converted the model into a nonlinear robust optimization model, which is easy to be processed by introducing a parameter. This parameter can consider the optimality and robustness of the solution comprehensively. In other words, if the manufacturer concerns the adaptability of the product output to the uncertainty, then the manufacturer shall choose a high value of the parameter to gain a conservative model of the profit cost. Conversely, if the manufacturer concerns more on profit maximization, then the relatively relaxed model can be selected to gain the robust solution that conforms to their profits.

To determine the quantity of products that \({\tilde{u}}_i \) changes, the parameter \(\Gamma \) (\(\Gamma \in [0,N])\) is introduced. \(\Gamma \) may not be an integer. In practical problems, not all values of \({\tilde{u}}_i \) change. \(\left\lfloor \Gamma \right\rfloor \quad u_{i}\) changing at the most may be hypothesized, and the deviation of \({\tilde{u}}_{tl} \) from \(u_{tl}^0 \) is \((\Gamma -\left\lfloor \Gamma \right\rfloor ){\hat{u}}_{tl} \). This study aims to optimize the worst situation that \(\Gamma \)\(u_{i}\) change and find the optimal solution of the model. If \(\Gamma =0\), then the changes of cost reduction can be neglected completely and that all cost reduction amplitudes are consistent with OIS estimation. The model is a problem of certain programming. If \(\Gamma =N\), then all cost reduction amplitudes have a reasonable fluctuation range based on OIS the estimation. These scenarios are extreme situations, and the decision makers concern more on the general situations when \(\Gamma \in [0,N]\).

Under the worst situation with changes of \(\Gamma \)\({\tilde{u}}_{i}(\Gamma \in [0,N])\), the robust form of Constraint (5.2) can be rewritten as

Equation (\(5.2^{\prime }\)) is difficult to be directly solved because it contains the subset S and the maximum function. Simplifying Eq. (\(5.2^{\prime }\)) is discussed as follows.

First, a lemma is provided.

Lemma

The dual program of the linear programming \(\begin{array}{l} \max c^{\prime }x \\ \hbox {s.t.}\left\{ \begin{array}{l} Ax\le b \quad \quad \quad \quad \quad \quad \quad \quad is \\ x_i \ge 0,i=1,2,\ldots n \\ \end{array}\right. \\ \end{array}\)\(\begin{array}{l} \min b^{\prime }x \\ \hbox {s.t.}\left\{ \begin{array}{l} y{\prime }A\ge c \\ y_i \ge 0,\forall i=1,2,\ldots m \\ \end{array}\right. \\ \end{array}\). If the original linear programming has the optimal solution, then its dual program has the optimal solution, and the objective function values are equal;

where \(c=(c_{1} ,c_{2} ,\ldots ,c_{n} )^{\prime }\),\(x=(x_{1} ,x_{2} ,\ldots ,x_{n} )^{\prime }\),\(b=(b_{1} ,b_{2} ,\ldots ,b_{m})^{\prime }\),\(A=\left[ \begin{array}{lll} {a_{11} }&{} \ldots &{} {a_{1n}} \\ \vdots &{} \ddots &{} \vdots \\ {a_{m1}} &{} \cdots &{} {a_{mn}} \\ \end{array}\right] \).

Next, a theorem is given.

Theorem 1

If \(\beta (x_i ,\Gamma )=\mathop {\max }\limits _{\{S\cup \{t\}|S\subseteq N,|S|=\left\lfloor \Gamma \right\rfloor ,t\in N\backslash S\}} \{\sum _{i\in S} {{\hat{u}}_i c_{i} |x_i |+(\Gamma -\left\lfloor \Gamma \right\rfloor ){\hat{u}}_t \mathop c\nolimits _t |x_i |} \}\), then \(\beta (x_i ,\Gamma )\) is equivalent to the optimal value of the following constraint optimization problem:

Proof

According to the definition of \(\beta (x_i ,\Gamma )\), the appropriate subset \(\{S\cup \{t\}|S\subseteq N,|S|=\left\lfloor \Gamma \right\rfloor ,t\in N\backslash S\}\) is selected to achieve the maximum \(\sum _{i\in S} {{\hat{u}}_i c_{i} |x_i |+(\mathop \Gamma \nolimits _i -\left\lfloor {\Gamma _{i}} \right\rfloor ){\hat{u}}_t c_{t} |x_i |} \). Hence, the variable \(z=(z_{1} ,z_{2} ,\ldots ,z_{N} ),0\le z_{i} \le 1\) is introduced to obtain the optimal solution: \(\left\lfloor \Gamma \right\rfloor \) components is 1, and 1 component is \(\Gamma -\left\lfloor \Gamma \right\rfloor \), whereas the remaining components are 0.

Thus, \(\beta (x_i ,\Gamma )\) is equal to the following constraint optimization problem:

According to the lemma, the dual program problem of Eq. (7) is

that is, Problem (6).

Equation (7) is feasible and bounded; thus Eq. (6) is feasible with respect to \(\forall \Gamma \in [0,N]\) according to the lemma, and the objective function is consistent with Eq. (7). The theorem is proven.

Therefore, \(\beta (x_i ,\Gamma )\) can be replaced by Eq. (7). However, \(\max \sum \nolimits _{i\in N} {{\hat{u}}_i c_{i} |x_i |z_i } \) is the nonlinear form relative to the decision-making variables \(x_i ,z_i \), which increases the difficulty to solve the problem. It is considered to be replaced by Eq. (6). At this moment, Constraint (\(5.2^{\prime }\)) is expressed as

This constraint still involves the problem of calculating the maximum value, because any solution that meets \(\sum \nolimits _{i=1}^N {((a-c_{i} -\alpha _{i} +u_i^0 c_{i} )x_i -(\Gamma z_0 +\sum \nolimits _{i\in N} {y_i } )-bx_i^2 } \ge M^{mv} \) must satisfy \(\sum \nolimits _{i=1}^N ((a-c_{i} -\alpha _{i} +u_i^0 c_{i} )x_i -\min \{\Gamma z_0 +\sum \nolimits _{i\in N} {y_i } \}-bx_i^2 \ge M^{mv} \); thus, the two equations above are equal.

Therefore, Theorem 2 can be formulated. \(\square \)

Theorem 2

The supply chain model of the open innovation uncertainty is equal to the following certainty programming:

For the constraint \(\sum \nolimits _{i=1}^N {(q_{i} -(a-bx_i ))x_i } \ge M^{rv} \), \(\sum \nolimits _{i=1}^N {bx_i^2 +(q_{i} -a)x_i } -M^{rv} \ge 0\) with solution forms of \(x_i \in (-\infty ,x_i^1 )\cup (x_i^2 ,+\infty )\) are a non-convex set.

4 Probability assurance of robust analysis

In the aforementioned robust analysis, the parameter \(\Gamma \) is used to control the conservative degree of the solution. \(\left\lfloor \Gamma \right\rfloor \) uncertainty parameters are changing, and the deviation of one parameter is \(\Gamma -\left\lfloor \Gamma \right\rfloor \). Then, if more than \(\left\lfloor \Gamma \right\rfloor \) uncertainty parameters change or the deviation of some parameters exceeds \(\Gamma -\left\lfloor \Gamma \right\rfloor \), then the feasibility of the robust model becomes questionable.

The solution of the robust model still has high feasible probability.

Theorem 3

If \(x^*\) is the optimal solution of Eq. (8), and \(\mathop S\nolimits ^*,\mathop t\nolimits ^*\) are the subset and the corresponding subscripts to achieve the optimal solution of \(\beta (x^*,\Gamma )\), \({\tilde{u}}_i \in [u_i^0 -{\hat{u}}_i ,u_i^0 +{\hat{u}}_i ]\), then the probability of violating the constraint conditions is

where \(\gamma _{i} =\left\{ \begin{array}{ll} 1&{} {\hbox {if}:i\in S^{*} } \\ {\frac{{\hat{u}}_i |x_i^{*} |}{{\hat{u}}_{r^{*}}^ |x_{r^{*}}^{*}|}}&{} {\hbox {if}:j\in N\backslash S^{*} } \\ \end{array}\right. \), \( r^{*} =\arg {\min }_{r\in S^{*} \cup \{t^{*}\}} {\hat{u}}_{r} |x_r^{*}|\).

Proof

If \(x^{*},S^{*},t^{*}\) are the optimal solution of the model, then

according to \(\sum \limits _{i=1}^N ((a-c_i -\alpha _i +u_i^0 c_i )x_i^*-\mathop {\max }\limits _{\{S^{*}\cup \{t^{*}\}|S^{*}\subseteq N,|S^{*}|=\left\lfloor \Gamma \right\rfloor ,t^{*}\in N\backslash S^{*}\}} \left\{ \sum _{i\in S^{*}} \widehat{u_i }c_i |x_i |+(\Gamma -\left\lfloor \Gamma \right\rfloor )\widehat{u_{t^{*}} }c_{t^{*}} |x_{t^{*}}^*| \right\} \)\(-bx_i^{{*}2}\ge M^{mv}\)

we get \(\sum \limits _{i=1}^N (u_i^0 c_i x_i^*+(a-c_i -\alpha _i )x_i^*- bx_i^{{*}2})-M^{mv}>\)

\(\mathop {\max }\limits _{\{S^{*}\cup \{t^{*}\}|S^{*}\subseteq N,|S^{*}|=\left\lfloor \Gamma \right\rfloor ,t^{*}\in N\backslash S^{*}\}} \left\{ \sum _{i\in S^{*}} \widehat{u_i }c_i |x_i |+(\Gamma -\left\lfloor \Gamma \right\rfloor )\right. \widehat{u_{t^{*}} }c_{t^{*}} |x_{t^{*}}^*|\)

so (*)

according to \(\sum \limits _{i\in S^{*}} {(1-\eta _i )+(\Gamma -\left\lfloor \Gamma \right\rfloor )} =|S^{*}|-\sum \limits _{i\in S^{*}} \eta _i +{\Gamma -\left\lfloor \Gamma \right\rfloor =} \Gamma -\sum _{i\in S^{*}} {\eta _i }\)

so (**)

\(\square \)

The conclusion is proven.

Equation (9) shows that the upper bound of probability to violating the constraint \(\Pr (\sum \nolimits _{i\in N} {\gamma _i \eta _i } >\Gamma )\) depends on the optimal solution \(x^{*}\). When more than \(\left\lfloor \Gamma \right\rfloor \) parameters change or the deviation of some parameters exceeds \(\Gamma -\left\lfloor \Gamma \right\rfloor \), the probability of constraint violations still has a small upper bound, indicating that the solution of the robust model still has high feasible probability.

Bertsimas and Sim provided the upper bound of the probability that does not depend on the optimal value [25].

Theorem 4

[25]: \(x^{*}\) is the optimal solution of Eq. (8), and the uncertainty data are \(\widetilde{u_i }\in [u_i^0 -\widehat{u_i },u_i^0 +\widehat{u_i }],i=1,2,\ldots ,N\). Thus, \(\Pr (\sum \nolimits _{i=1}^N {((a-bx_i^*-(1-\widetilde{u_i })c_i )x_i^*-}{\alpha _i x_i^*} )<M^{mv})\le B(n,\Gamma )\), where

This upper bound is independent from the \(x^{*}\). \(B(n,\Gamma )\) involves the problem of solving the composite function when n is high and difficult to be solved. Bertsimas and Sim provided the upper bound of \(B(n,\Gamma )\) [25]. \(B(n,\Gamma )\le (1-\mu )C(n,\left\lfloor v \right\rfloor )+\sum \nolimits _{l=\left\lfloor v \right\rfloor +1}^n {C(n,l)} \), where

5 Empirical analysis

To highlight the validity of the constructed model, numerical simulation cases are presented, and lingo 11.0 is used for simulation in this section.

Suppose that all parameters in the supply chain is composed of one manufacturer, one retailer, \(N(N=10)\) OIS, and \(N(N=10)\) products (heterogeneity) are known, including \(c_i \), \(q_i \), \(\alpha _i \) and \(m_i \). According to previous experiences, the unit cost reduction of the ith product by the OIS is \(u_i^0 \). Specific data are listed in Table 1.

The expected profit of the retailer (\(M^{rv})\) is RMB 100,000 when \(a=1850\) and \(b=1.1\).

The open innovation practice makes the cost reduction an uncertain data. Thus, its reasonable fluctuation range is \(\widetilde{u_i }\in [u_i^0 -\widehat{u_i },u_i^0 +\widehat{u_i }]\), where \(\widehat{u_i }=\theta u_i^0 \). In this study, \(\theta =15\% \).

Substitute the aforementioned known data into Eq. (8), and determine \(\Gamma \in [0,10]\). For the convenience of display, only the optimal outputs of different products and corresponding profits of the manufacturer when \(\Gamma =0,2,4,6,8,10\) are shown in Table 2. The variation trend of the probability of the manufacturer’s profit and the constraint violations with \(\Gamma \) are shown in Figs. 2 and 3.

Table 2 reveals that with the change of \(\Gamma \), the optimal outputs of different products change continuously. When \(\Gamma =0\), \(\widetilde{u_i }\) has no uncertain component. In other words, the cost reduction amplitude in actual production is consistent with the cost reduction amplitude provided by the OIS. At this moment, the outputs of all products are relatively high, and the optimal one is 1,747,474. When \(\Gamma =4\), \(\widetilde{u_i }\) has four uncertain components, indicating that the four cost reduction amplitudes in the actual production are consistent with the cost reduction amplitudes provided by the OIS, whereas the remaining six are inconsistent. Under this circumstance, the outputs of different products are moderate, and the optimal output is 1,711,940. When \(\Gamma =10\), all components of \(\widetilde{u_i }\) are uncertain. This condition reflects that no cost reduction amplitudes in the practical production conform to the unit cost reduction amplitudes of products caused by the innovation technologies of the OIS. All cost reduction amplitudes have certain fluctuation ranges. In this case, the outputs of different products are relatively small, and the optimal output is 1,673,996.

Table 2 and Fig. 2 show that with the increase of \(\Gamma \) (the number of inconsistency between the actual cost reduction amplitudes and estimated cost reduction amplitudes of the OIS), the optimal outputs of different products decline, which indicates that the manufacturer has fewer reference data when more uncertainty data are on the supply chain. Consequently, manufacturers are more inclined to shrink the scale of production, so that the profits will decrease accordingly.

Table 2 and Fig. 3 show that the probability of constraint violations decreases gradually with the increase of \(\Gamma \). A high \(\Gamma \) reflects that the manufacturer concerns more on the adaptability of the product output to the uncertainty and would do his best to meet the constraints. Therefore, the probability of constraint violations decreases accordingly.

This result proves that the use of \(\Gamma \) has practical significances. In actual production, the manufacturer can select an appropriate \(\Gamma \) and arrange outputs of different products according to the technological level and preference of OIS.

6 Conclusions

In this study, the effects of open innovation practice on enterprise value are discussed based on the supply chain perspective. Considering the uncertainty of open innovation effect, the nonlinear programming model with uncertainty is constructed. On this basis, the prototype is analyzed by the robust optimization method with comprehensive consideration to the probability of constraint violations and target accuracy. Some conclusions are formulated as follows. a) The introduction of parameter \(\Gamma \) can convert the nonlinear programming model with uncertainty into a robust model that can be easily solved. Moreover, \(\Gamma \) can be used to regulate the preference to profit and uncertainty of innovation practices of the manufacturer. b) A small \(\Gamma \) reflects that the manufacturer pays attention to profit, whereas a high \(\Gamma \) means that the manufacturer has more uncertainty, thereby making the product output adapt to innovation effectively. c) Manufacturers can choose the appropriate \(\Gamma \) value and arrange the production outputs of different goods according to the technological level of the OIS and their preference to profit and uncertainty. In this study, the uncertainty of open innovation effect, which is of important significance to decision making on optimal output of the supply chain and innovation risk control under uncertain environment, is investigated based on the supply chain perspective.

As shown in the Fig. 1, the supply chain designed in this paper has consisted of N open innovation subjects and one manufacturer. The supply chain is capable of producing N types of electronic products. For the current and future researches, different situations will be considered, including the difference between the number of open innovation subjects and the number of products, the case of multiple open innovation subjects providing innovative service for one product as well as the case of one open innovation subject producing innovative service for multiple products. Moreover, the uncertainty of the manufacturer giving unit remuneration to the open innovation subject will be considered again. By taking the uncertain innovative effect and remuneration into consideration, we can make an in-depth research of the innovative risk of supply chain comprehensively

References

Hult, G.T.M., Hurley, R.F., Knight, G.A.: Innovativeness: its antecedents and impact on business performance. Ind. Mark. Manage. 33(5), 429–438 (2004)

Gök, O., Peker, S.: Understanding the links among innovation performance, market performance and financial performance. RMS 11(3), 605–631 (2016)

Gunday, G., Ulusoy, G., Kilic, K., et al.: Effects of innovation types on firm performance. Int. J. Prod. Econ. 133(2), 662–676 (2011)

Chesbrough, H.W.: The Era of open innovation. Mit Sloan Manage. Rev. 44(3), 35–41 (2003)

Chesbrough, H., Schwartz, K.: Innovating business models with co-development partnerships. Res. Technol. Manage. 50(1), 55–59 (2007)

Sisodiya, S.R., Johnson, J.L., Grégoire, Y.: Inbound open innovation for enhanced performance: enablers and opportunities. Ind. Mark. Manage. 42(5), 836–849 (2013)

Frey, K., Lüthje, C., Haag, S.: Whom should firms attract to open innovation platforms? The role of knowledge diversity and motivation. Long Range Plan. 44(5), 397–420 (2011)

Ozkan, N.N.: An example of open innovation: P&G. Procedia - Soc. Behav. Sci. 195, 1496–1502 (2015)

Wang, H.J., Feng, J.Z., Shi, H.B.: Study on the business model of open innovation and the dynamic optimization mechanism of partners. Sci. Sci. Manage. S.&T. 36(12), 62–69 (2015)

Haier: Haier websites about open innovation. http://www.haier.net/cn/open_innovation/high_tech_industry/. Accessed 26 March 2007

Johannsson, M., Wen, A., Kraetzig, B., et al.: Space and open innovation: potential, limitations and conditions of success. Acta Astronaut. 115, 173–184 (2015)

Gustetic, J.L., Crusan, J., Rader, S., et al.: Outcome-driven open innovation at NASA. Space Policy 34, 11–17 (2015)

Yannis, C., Stavros, S.: Research joint venture: a survey of the theoretical literature. Eur. Collab. Res. Dev. 2(2), 53–58 (2004)

Choi, K., Narasimhan, R., Kim, S.W.: Opening the technological innovation black box: the case of the electronics industry in Korea. Eur. J. Oper. Res. 250(1), 192–203 (2016)

Wang, C.H., Chang, C.H., Shen, G.C.: The effect of inbound open innovation on firm performance: evidence from high-tech industry. Technol. Forecast. Soc. Change 99(11), 222–230 (2015)

Rosas, J., Macedo, P., Tenera, A., et al.: Risk assessment in open innovation networks. In: Camarinha-Matos, L.M., Bénaben, F., Picard, W. (eds.) Risks and Resilience of Collaborative Networks, pp. 27–38. Springer International Publishing (2015)

Dosi, G.: Technological paradigms and technological trajectories: a suggested interpretation of the determinants and directions of technological change. Res. Policy 22(82), 102–103 (1993)

Gorissen, B.L., Yanıkoğlu, İ., den Hertog, D.: A practical guide to robust optimization. Omega 53(4), 124–137 (2015)

Soyster, A.L.: Convex programming with set-inclusive constraints and applications to inexact linear programming. Oper. Res. 21(5), 1154–1157 (1973)

Soyster, A.L., Murphy, F.H.: A unifying framework for duality and modeling in robust linear programs. Omega 41(6), 984–97 (2013)

Ben-Tal, A., Nemirovski, A.: Robust solutions of linear programming problems contaminated with uncertain data. Math. Program. 88(3), 411–424 (2000)

Ben-Tal, A., Nemirovski, A.: Robust solutions to uncertain programs. Oper. Res. Lett. 25(1), 1–13 (1999)

Ben-Tal, A., Nemirovski, A.: Robust convex optimization. Math. Oper. Res. 23(4), 769–805 (1998)

Ghaoui, L.E., Oustry, F., Lebret, H.: Robust solutions to uncertain semidefinite programs. SIAM J. Optim. 9(1), 33–52 (2006)

Bertsimas, D., Sim, M.: Robust discrete optimization and network flows. Math. Program. 98(1), 49–71 (2003)

Bertsimas, D., Sim, M.: The price of robustness. Oper. Res. 52(1), 35–53 (2004)

Lobo, M.S.: Robust and convex optimization with applications in finance [Ph.D. thesis]. Stanford University (2000)

Bertsimas, D., Litvinov, E., Sun, X.A., Zhao, J., Zheng, T.: Adaptive robust optimization for the security constrained unit commitment problem. IEEE Trans. Power Syst. 28(1), 52–63 (2013)

Majewski, D.E., Wirtz, M., Lampe, M., Bardow, A.: Robust multi-objective optimization for sustainable design of distributed energy supply systems. Comput. Chem. Eng. 102, 26–39 (2016)

Bruni, M.E., Pugliese, L.D.P., Beraldi, P., Guerriero, F.: An adjustable robust optimization model for the resource-constrained project scheduling problem with uncertain activity durations. Omega (2016). doi:10.1016/j.omega.2016.09.009

Lonzius, M.C., Lange, A.: Robust scheduling: an empirical study of its impact on air traffic delays. Transp. Res. Part E: Logist. Transp. Rev. 100, 98–114 (2017)

Govindan, K., Fattahi, M., Keyvanshokooh, E.: Supply chain network design under uncertainty: a comprehensive review and future research directions. Eur. J. Oper. Res. (2017). doi:10.1016/j.ejor.2017.04.009

Aalaei, A., Davoudpour, H.: A robust optimization model for cellular manufacturing system into supply chain management. Int. J. Prod. Econ. 183, 667–679 (2017)

Zhang, Y., Jiang, Y.: Robust optimization on sustainable biodiesel supply chain produced from waste cooking oil under price uncertainty. Waste Manag. 60, 329–339 (2017)

Mohammaddust, F., Rezapour, S., Farahani, R.Z., Mofidfar, M., Hill, A.: Developing lean and responsive supply chains: a robust model for alternative risk mitigation strategies in supply chain designs. Int. J. Prod. Econ. 183, 632–653 (2015)

Kisomi, M.S., Solimanpur, M., Doniavi, A.: An integrated supply chain configuration model and procurement management under uncertainty: a set-based robust optimization methodology. Appl. Math. Model. 40(17–18), 7928–7947 (2016)

Ma, R., Yao, L.F., Jin, M.Z., Ren, P.Y., Lv, Z.H.: Robust environmental closed-loop supply chain design under uncertainty. Chaos Solitons Fractals 89, 195–202 (2016)

Talaei, M., Moghaddam, B.F., Pishvaee, M.S., Bozorgi-Amiri, A., Gholamnejad, S.: A robust fuzzy optimization model for carbon-efficient closed-loop supply chain network design problem: a numerical illustration in electronics industry. J. Clean. Prod. 113, 662–673 (2016)

Acknowledgements

This study is supported by the National Nature Science Foundation of China (Grant no. 71572096). We also thank all the reviewers for their constructive suggestions on how to improve the quality of this paper.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that there is no conflict of interest regarding the publication of this manuscript.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Wan, X., Hao, T., Rong, X. et al. The robust analysis of supply chain based on uncertainty computation: insight from open innovation. Cluster Comput 22 (Suppl 4), 10009–10018 (2019). https://doi.org/10.1007/s10586-017-1043-9

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10586-017-1043-9