Abstract

How will the increased frequency of coastal inundation events induced by sea level rise impact residential insurance premiums, and when would insurance contracts be withdrawn? We model the contribution of localised sea level rise to the increased frequency of coastal inundation events. Examining four Aotearoa New Zealand cities, we combine historical tide-gauge extremes with geo-located property data to estimate the annual expected loss from this hazard, for each property, in order to establish when insurance retreat is likely to occur. We find that as sea level rise changes the frequency of inundation events, 99% of properties currently within 1% AEP coastal inundation zones can expect at least partial insurance retreat within a decade (with less than 10 cm of sea level rise). Our modelling predicts that full insurance retreat is likely within 20–25 years, with timing dependent on the property’s elevation and distance from the coast, and less intuitively, on the tidal range in each location.

Similar content being viewed by others

1 Introduction

Accelerating sea level rise and increasing storminess, two effects of a changing climate, mean that coastal developments are becoming increasingly exposed to more frequent and severe natural hazards. These include coastal inundation from storm surges, erosion and shoreline recession (IPCC 2014). This problem poses a challenge for almost any low-elevation coastal settlement worldwide, including diverse locations such as Brisbane, Jakarta, Lagos, Miami, Mumbai, New Orleans, Rio de Janeiro, and Shanghai (Rentschler et al. 2023).

Private residential insurance typically provides cover (i.e., financial risk transfer) for risks that are of low enough probability. High-probability events are generally uninsurable. Therefore, when the likelihood of damage increases, insurance becomes increasingly costly, until it is no longer viably supplied by commercial insurance companies. Insurance retreat from coastal locations is thus an inevitability once sea level rise causes insurers’ insurability threshold to be crossed.

Except for the occurrence of an actual damaging disaster, it is the loss of residential insurance that will likely be the first mechanism through which homeowners will experience material economic loss directly attributable to climate change. Since mortgages are typically conditional on insurance (especially at the time of issuance), the withdrawal of residential insurance (i.e., insurance retreat) results in an immediate drop in property values as this retreat decreases the pool of potential buyers (Nyce et al. 2015). For many households, the value of their home is larger than their net wealth, so the consequences of a significant decline in their property’s value can have very significant consequences for their balance sheets.

Beyond the impact on individual households balance sheets through insurance’s impact on property prices, however, a sound insurance sector also contributes to the financial security of individuals and firms and supports economic growth by allowing efficient risk-taking. Disaster insurance functions most effectively for society when it achieves four aims: (1) transfers the financial risk from individuals, families, and companies, to financial markets; (2) incentivises risk reduction ex ante and speeds up recovery ex post; (3) encourages investment in productive opportunities; and (4) protects the most vulnerable in our society from falling into poverty in the aftermath of an event (Linnerooth-Bayer et al. 2019). The permanent loss of insurance is therefore a matter of concern not only for the affected property owners but for public policy more generally. Estimating when and where insurance retreat can be expected is the focus of this paper.

We quantify annual expected-loss-based premiums of residential property insurance for coastal inundation. We focus specifically on how these premiums change because sea level rise increases the predicted magnitude of storm surges, thereby increasing the probability of a property being inundated. We use property-specific data on elevation, the replacement cost of each home, hazard maps of coastal areas with a one percent probability of being inundated, and the distribution of observed extreme sea levels from historical tide-gauge data. With these data, we model the actuarially fair risk-based premium for this hazard at the property level and how it can be expected to change over time with the rising seas.

In Aotearoa New Zealand (henceforth Aotearoa), almost a third of the 1.6 million residential houses in the country are located within 1 km of the coastline (Paulik et al. 2019). As is true in many countries, insurance policies are renewed annually. With such frequency of renewal, insurance retreat can occur in any year, and certainly during the term of a typical mortgage (with a median duration of 20 years) — Armstrong et al. (2019).

Currently in Aotearoa, residential insurance covers almost all hazards. Therefore, once the expected-loss-based premium for a hazard reaches a subjective affordability threshold, insurers begin to limit the coverage they offer to new and existing customers. We analyse these thresholds at the property level to identify where and when homeowners are most likely to experience either partial or full “insurance retreat” due to sea level rise.

The term “full insurance retreat” refers to the point when insurers stop offering or renewing insurance policies because properties in that location face an escalating hazard (Storey 2017). Before that point is reached, a “partial insurance retreat” may occur whereby insurers begin to limit the extent to which homeowners are able to transfer the risk to the insurer. A partial retreat may include monetary caps on coverage (decreasing the sum insured), extraordinarily large hazard-specific deductibles (excesses) or the exclusion of one or more hazards (unbundling).

Our primary contribution is in explicitly quantifying how soon insurance retreat can be expected. While we focus on the impact of sea level rise on insurance availability, the approach can be applied to any hazard which is escalating under climate change (i.e. becoming more frequent and/or severe).

Insurance retreat is most predictable with sea level rise but insurance retreat is inevitable in locations facing other escalating hazards because of climate change. We selected sea level rise for our first study of insurance retreat since climate science provides a high level of confidence in the minimum rate of change of this hazard. The projections on which we base this first study of insurance retreat are thus conservative. Further, while projected sea levels in the second half of this century have been widely communicated, our study shows that insurance retreat occurs decades before properties are predicted to face permanent inundation as a consequence of sea level rise.

This forward-looking study fills a key knowledge gap hindering better adaptation decisions. It is a knowledge gap that is unlikely to be addressed by the insurance industry itself. Since residential insurance policies are renewed each year and even reinsurance contracts are typically not longer than three years, insurers have little incentive to conduct analyses of how expected losses will change in the medium term. Every insurer also has very little interest in publicizing any likely future retreat, lest it leads to consumers switching to competitors, or to policymakers reactions against it (in several jurisdictions, policymakers have tried to prohibit insurance retreats, at least temporarily).

This quantification of future insurance retreat has far-reaching implications for property markets and spatial planning. As has been amply documented in many jurisdictions, residential property owners are currently underestimating sea level rise risk as they assume that future insurance costs will reflect historical trends (e.g., Bakkensen and Barrage 2022; Filippova et al. 2020). As a result, coastal property markets continue to enjoy increased investment even as coastal inundation becomes more frequent. With assets continuing to accumulate at the coast, local and central governments face strong demands to build and maintain the infrastructure servicing and defending those assets, at increasing costs.

In the next section, we place the current study in the existing literature. Section 3 describes the data used in this study, Section 4 the empirical methodologies deployed, and Section 5 presents our results, Section 6 discusses the implications of our results and Section 7 concludes.

2 Literature review

While there is a significant body of literature on past changes to insurance premiums, the literature on future changes to insurance premiums is limited (Bouwer 2013; Pastor-Paz et al. 2020; Phelan 2011). Much of the existing literature focuses on questions of consumer willingness to pay for insurance rather than insurers’ willingness to supply insurance (Booth et al. 2022; Browne et al. 2015; Dixon et al. 2017; Landry et al. 2021). In most locations, it seems that markets are not pricing the retreat of insurance as in many jurisdictions, governments increasingly are appearing willing to act as the insurer of last resort when insurance supply is disrupted following major catastrophes (Binskin et al. 2020; Furukawa et al. 2020; Jarzabkowski et al. 2019; Kousky 2019; Kraehnert et al. 2021; Lucas et al. 2021; PRA 2015).

Where literature has focused on future expected losses, it tends to anchor analysis on the year 2100 (Vousdoukas et al. 2018). While this timeframe is the foundation for physical climate projections, the time value of money makes this horizon nearly inconsequential for near-term financial decisions relating to residential property. A much more near future is the focus of financial decision-making, and as such, the question is whether insurance retreat is a short term possibility.

Bouwer (2013) argues that the signal of expected losses from anthropogenic climate change is likely to be lost within coinciding changes in exposure and vulnerability in the near term (at least until 2040). Our study holds exposure and vulnerability constant to investigate whether even near-term changes in a single hazard — coastal inundation — may be sufficient to trigger a contraction of insurance supply.

Studies that have examined closer horizons have estimated a doubling of expected losses by 2050 from river flooding (Jongman et al. 2014) or wildfire (Dixon et al. 2018). Loss of insurance supply (i.e., an insurance retreat) has been observed following catastrophic events such as Hurricane Andrew in Florida in 1992 (McChristian 2012), Cyclone Yasi in Australia in 2011 (Ma et al. 2012) or the 2021 wildfires in California (Poizner 2022). As far as we know, no study has attempted to evaluate and quantify the likelihood of future near-term loss of insurance from escalating hazards under climate change; we do so for the New Zealand case.

Mean sea level in Aotearoa is projected to rise by at least 10 cm by 2040 from 2020 levels, under all four Intergovernmental Panel on Climate Change (IPCC) scenarios (the Representative Concentration Pathways) (MfE 2017). In 2015, The New Zealand Parliamentary Commissioner for the Environment (PCE 2015) estimated that in some locations with 10 cm of sea level rise, coastal storms that currently demonstrate a 1% Annual Exceedance Probability (AEP) are likely to reach an AEP of 4.9% — AEP is the probability that an event exceeding a certain intensity/magnitude will happen in a given year.Footnote 1 This is equivalent to a storm with 1 in 100 year Annual Recurrence Interval (1% AEP) becoming a 1 in 20 year storm (4.9% AEP), after just 10 cm of sea level rise.

Conversations with the insurance industry suggest that insurance retreat begins when the likelihood of an event reaches about 2% AEP (a 1 in 50 years event), and residential insurance will be near impossible to secure by the time the AEP reaches about 5% (a 1 in 20 years event) — e.g., Kerr et al. (2017). Evidence from the UK suggests that insurance retreat can occur even sooner; private flood insurance had become difficult to obtain for properties that had an AEP for flooding of only about 1.3% (a 1 in 75 years event) (Surminski 2014). This suggests that our assumptions of a partial retreat threshold at 2% AEP and a full retreat threshold at 4.88% AEP are conservative.Footnote 2

3 Data

3.1 Sources and issues

We use modelled property data from RiskScape, elevation data from the New Zealand School of Surveying, tide gauge and coastline data from Land Information New Zealand (LINZ), and extreme sea level modelling from the National Institute of Water and Atmosphere (NIWA). The sub-sections below explain each of these in detail, including any limitations associated with each dataset. Our analysis is focussed on only four ports, as it is constrained by the availability of data (specifically tide gauges and elevation data). The four ports are Auckland, Christchurch, and Wellington (serving the three biggest cities in Aotearoa), and Dunedin (serving the largest city in the southern half of the South Island).Footnote 3

3.1.1 Properties

The building asset module of RiskScape is a modelled property-level dataset that includes the modelled characteristics of every building in the country, including its geographic location (as a point), floor height, floor construction, and replacement cost.Footnote 4 The available residential property dataset contains approximately 1.6 million properties in mainland Aotearoa, where each property is given a unique identifier. We trim this dataset by removing those properties with a replacement cost of less than the 1st percentile value or greater than the 99th percentile values. Replacement cost data is obtained from CoreLogic’s Quotable Value (QV) dataset; which is used by local authorities for determining property taxes. The assigned construction types are used to identify replacement costs obtained from the Rawlinson’s construction handbook guidelines (Rawlinsons 2013).

The dataset geo-locates each building with an approximate co-ordinate point, rather than a building outline shapefile. This may make flood zone bordering properties on the edge of inundation boundaries fall outside the boundary even if some of the building outline is within the floodzone. It also means the distance we measure to the coast for each property will likely be slightly higher than the true value (the distance between the edge of the property and the coast). Both of these issues with the Riskscape data imply that our estimates may be under-estimating the risk somewhat.

3.1.2 Elevations

We use elevation information from the New Zealand School of Surveying Digital Elevation Model version 1.0 (NZSoSDEM). The NZSoSDEM models elevation at a spatial resolution of 15 m and was created by the School of Surveying through interpolation of LINZ topographic vector data. The NZSoSDEM is a series of 30 maps whose extent correspond with the LINZ Topo250 topographic map series (Columbus et al. 2011).

The elevation data in the NZSoSDEM, while nationally consistent, has some modelling errors; for example, a few elevations are negative (we exclude these). The vertical accuracy of these data was approximated to be + / − 5 m for 90% of the values. We have therefore constrained our analysis to only those properties that also fall within the 1% AEP extreme sea level extents (henceforth ESL1 zones) which was delineated based on Light Detection and Ranging (LiDAR) data. The spatial resolution in the NZSoSDEM is lower than we would have ideally liked to use for our analysis, but these are the best available data at the national level.Footnote 5

3.1.3 Tide gauges and sea levels

LINZ maintains a national database of tide stations which includes an archive of sea level data (LINZ, n.d.). We utilise the hourly tide gauge data. We adjust for the local vertical datum difference to chart datum and for the average local sea level as described by Hannah (2015). We also remove unrealistic spikes following the general principle described in Bell et al. (2015). We then aggregate to a daily level, using only those daily periods with all 24 hourly measurements, and then to annual, using only those with at least 350 daily measurements available. From this, we find our annual-maxima sea level series at the four ports.

Our analysis uses this annual maxima time series of sea levels at each port, beginning with the earliest available full calendar year of data. The dataset covers four Aotearoa ports: Auckland, Wellington, Lyttleton (Christchurch), and Dunedin, which are the four tide gauges with sufficient historical records to conduct Generalised Extreme Value (GEV) analysis.Footnote 6 Figure 1 presents a simple visualisation of the annual maxima time-series data.

3.1.4 Flood inundation shapefiles

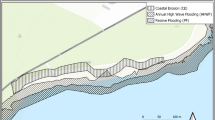

We use ESL1 zones — provided as shapefiles — developed by NIWA. These outline the horizontal extent of extreme sea levels which have a 1% AEP, which incorporate tide, storm-surge, mean sea-level anomaly and wave setup; see Paulik et al. (2019) for a detailed explanation. The modelling of ESL1 zones can only be done for the areas of the coastline where LiDAR elevation is available. The ESL1 water heights exclude the influence of tides in estuaries and open coast wave effects. The spatial extent of the ESL1 is consequently more limited than the actual full extent of the coastal inundation hazard because both of these exclusions would expand the area exposed to this hazard. ESL1 zones are plotted in Fig. 2. We note that, in our analysis, we only examine properties within 1 km of the coast, though Fig. 2 shows the original (full) ESL1 zones as identified.

3.1.5 Coastline

We use the LINZ New Zealand Coastlines dataset (LINZ 2020), which identifies the line forming the boundary between the land and sea defined by mean high water (MHW). We use this data to delineate all the area within 1 km from the coast as described in Sect. 3.1.4.

3.2 Properties exposed to coastal inundation

Based on datasets described in Sect. 3.1, we carry out the following geo-processing steps for each property:

-

Distance to coast — we calculate the distance to the coast for each property by finding the nearest point along the New Zealand Coastline multiline shape from each property in meters.

-

Elevation — we approximate the elevation of each property by assigning the elevation recording in the relevant 15 m NZSoSDEM raster grid cell.

-

Flood threshold height — we establish the threshold height by adding the ground elevation to the property’s floor height as recorded in the Riskscape data.

-

‘In zone’ classification — we attach a binary variable denoting for each property whether its single-point coordinate is located within an ESL1 zone.

3.3 Summary statistics

In creating the core sample for our analysis, we only use those RiskScape properties within 1 km of the coast, with all required variables available. We also trim those properties with the highest and lowest percentiles of replacement costs. Note that there are 451,903 coastal properties (within 1 km of the coast). Of those, 10,238 fall within the ESL1 boundaries. While Auckland is by far Aotearoa’s largest city, it has the smallest number of homes within the ESL1 boundaries (539 properties) reflecting comparatively fewer low-lying neighbourhoods. Christchurch, Aotearoa’s second largest city, has the highest number of properties within ESL1 zones (4850 properties) and while a greater proportion of these properties have concrete floors and so are modelled to incur less damage if exposed to water, these properties also have lower median floor height and so are more likely to be exposed to flooding. Dunedin has the second highest number of properties within ESL1 zones (3105 properties) and the oldest housing stock with almost half of ESL1 properties constructed over a century ago. The summary statistics of core variables for properties within the four cities are presented in Table 1.

4 Methodology

We develop a three-step algorithm. The first involves using Generalised Extreme Value (GEV) modelling to estimate the parameters of the distribution of extreme sea levels at each port, and in particular the difference in sea level required to make a 1% AEP event into a more likely 4.9% AEP one (i.e., when full insurance retreat is assumed to have occurred). The second step involves modelling the approximate 1% AEP flood height at each property, and the third models the approximate required risk-based insurance premiums for this particular hazard at each location, given different sea level heights. These steps are explained in detail below.

4.1 Estimating distributions of extreme sea levels

The GEV method offers a statistical framework with which one can make inferences about the probability of very rare events (Embrechts et al. 1997). We utilise the GEV methodology of Coles (2001) to parameterise the distribution of extreme sea levels in the four cities (Auckland, Wellington, Christchurch/Lyttleton and Dunedin). We define annual maxima of sea levels from the four tide-gauges, where superscript p denotes port city site and subscript t denotes time. We define the annual maxima from the available hourly data as:

The annual maximum time series at each port is developed using the methodology outlined in Stephen et al. (2020), with the addition that we require each year of observation to have a level of completion of at least 95% (~ at least 350 days).

The cumulative distribution of a GEV distribution is:

where the three parameters \(\mu ,\sigma ,\xi\) denote shape, location and scale of the distribution respectively. This allows the distribution to follow either a Gumbel, Frechet or Weibull distribution, equivalent to type I, II and III respectively when the shape parameter is equal to 0, greater than 0, or less than 0.

For each port site, we fit the resulting annual maxima to a GEV distribution using Maximum Likelihood Estimation without a priori assumption on the sign of the shape parameter (Embrechts et al. 1997). These indicate which of the three distributions provides the best fit, and allow us to then generate yearly annual recurrence intervals for different return periods (and convert these to their respective AEPs). This conversion from annual recurrence interval (ARI) to annual exceedance probability (AEP) is performed as below:

This produces an estimate of the expected water height from the high tide elevation, per port, of a 1% AEP extreme sea level event (excluding, for now, additional ‘wave setup’ heights), as well as expected water heights at other AEP levels by year.

4.2 Flood hazard modelling

For coastal flood hazard maps Paulik et al. (2019) have:

-

1

Estimated the mean sea-level (MSL) and mean high-water spring elevations (MHWS10; the 90th percentile of all high tides) at consistent distances around the Aotearoa coastline (see Fig. 2).

-

2

Estimated extreme sea levels (ESL1) elevations (where ESL1 = 1.28 × MHWS10 (× 1.1 if within an estuary) + 0.34 + wave-setup, equal to 0 m (estuaries) 0.5 m (sheltered coasts) or 1.5 m (open coasts).Footnote 7

-

3

Using a 90 m Digital Elevation Model (DEM) from Yamazaki et al. (2017), extrapolated to a 8 m finer-resolution DEM.

-

4

Added 3 m to the coastal ESL1 values (from step 2) and spatially mapped this onto the Aotearoa version of the DEM (created in step 3) to identify coastal inundation areas for ESL1 + 3 m sea level rise.

-

5

Spatially mapped the coastal ESL1 values (from step 2) onto high-resolution LiDAR elevations to identify coastal inundation areas for ESL1 extents and for ESL1 + 0 m sea level rise at 10 cm increments until the ESL1 + 3 m sea level rise scenario (from step 4).

In the ESL1 zones of the four cities, we add the GEV-derived storm tide height to the ground elevation of each property inside the ESL1 zone (at the property’s coordinate point) to estimate property-specific water heights. We take the difference between property elevation and modelled ESL1 water height as below:

where \(S{L}_{p}^{GEV 1\% AEP}\) denotes a port’s 1% AEP water height using the GEV analysis explained in Sect. 4.1, and wave denotes wave setup and is estimated as 0.5 m (following Paulik et al. 2019).

4.3 Insurance premium model

We model property-level (i) annual risk-based premiums ri produced solely from this ESL1 hazard, of properties within the ESL1 zones, based on expected annual losses as below:

where:

-

ri denotes estimated risk-based premium for this hazard

-

loading is an insurer parameter for administrative costs and a profit margin

-

di is a damage function which takes a threshold approach based on water level and flooring type.

Reese and Ramsey (2010) model flood fragility curves for various building types. Their model’s damage function uses the RiskScape data which categorises homes into timber or concrete flooring construction only. We choose to take the approximate average damage ratio for either concrete-or-masonry homes or timber homes at the mid-point of 0–1-m flood depths, and the approximate overall damage ratio for flood depths higher than 1 m above the floorboards. Rather than using these curves directly, we take a threshold approach with timber floor (concrete floor) buildings estimated to incur 30% (10%) damage for flooding of less than 1 m and 50% (50%) damage for flooding of more than 1 m.

We assume an insurance “loading” of 30%; which is similar to, for example, Hudson (2018).

4.4 Exclusions

We make a number of necessary exclusions to our analysis. Most of these mean that our estimates are likely to be conservative: (1) The increased severity of extreme weather events caused by climate change is not considered.Footnote 8 (2) We use a single conservative wave setup value of 0.5 m. (3) This analysis does not include any deductibles (excesses) for insurance products. (4) The inundation models we use do not allow the isolation of current defences/flood mitigation measures such as sea walls, flood gates or pumps, or further investment in them.

5 Results

5.1 Influence of sea level rise on projected water heights of extreme sea levels

To identify the distribution generating the least error, we apply the likelihood ratio test (Reiss and Thomas 2007) to compare the optimised GEV to a Gumbel distribution since the Gumbel distribution was used by Hunter (2015) as the basis of the analysis presented in PCE (2015). Our results indicate that Auckland and Wellington ports observed extreme values were best described by a Gumbel distribution whereas Christchurch and Dunedin more closely follow a Weibull distribution. Still, for consistency with PCE (2015), we follow Hunter (2015) and apply a Gumbel distribution to all four port-cities (see Table 2 for the Gumbel parameters). The GEV estimated height of the high water mark for an 1% AEP extreme sea level heights were 3.15 m (Auckland), 1.31 m (Wellington), 1.48 m (Christchurch), and 1.77 m (Dunedin).

Using this information, we estimate the sea level at different return periods. Table 3 presents the difference between sea level at higher AEPs and the sea level at the 1% AEP level to identify the approximate impact of sea level rise on AEP. Figure 3 displays the curves for each port, where the x axis is the difference between the estimated sea level of the AEPs above 1% and the 1% AEP — thus, the sea level rise required to increase the frequency of the 1% AEP event to a given AEP (in the y axis). Given our assumptions about the triggers for partial and full insurance retreat, the information in Table 3 also denotes the key sea-level rise thresholds for each port-city.

Interestingly, the difference between the curves is primarily driven by the difference in each port’s tidal range, rather than materially larger storm surge heights at different latitudes. Locations with large tidal ranges are more likely to absorb a storm surge of a given size within the existing tidal range, thereby avoiding damage from overtopping of existing high water lines.

5.2 Estimating current risk-based premium pricing

In Table 4, we present the estimated hazard specific premiums estimated using the property insurance modelling methodology described in Sect. 4.3. In it, we estimate what would be the coastal flooding hazard-specific premium for the median residential insurance policy in each city (for properties within the current ESL1 1% AEP zone). We find that, currently, in Auckland, the median annual single-hazard insurance premium would be approximately $2000 within the current ESL1 zones. This is the actuarially fair, expected-loss-based, premium. For Wellington, we find that the median would be $1800, and for both Canterbury and Dunedin, we find a median of $1600 (though in both, the mean premium is higher than in Wellington).

It is worthwhile noting that our present day modelling of these single-hazard premiums are significantly higher than current all-perils insurance premiums that are actually charged in Aotearoa (though we do not have information that is specific to the ESL1 1% AEP properties in the four cities). In 2017, residential all-perils premiums were estimated to be, on average, only $1050 per annum (Treasury 2017). This suggests that, at this point in time, there is still substantial cross-subsidisation of low elevation coastal properties (by those at higher elevations). This existing cross-subsidisation (euphemistically termed ‘community-pricing’ in the national media) is widely discussed (e.g., Hurrell 2023; Stock 2023).

5.3 Timing of insurance retreat

In order to understand the timing of retreat, we compare the differences between our GEV results estimating 1% AEP water heights with 2% AEP and 4.88% AEP and compare these with expected sea level rise in Aotearoa — the expected sea level rise is taken from MfE (2017) and shown in Fig. 4. By comparing the difference between these AEPs, we can estimate the timing of partial and full insurance retreat for exposed properties in each of the four cities we examine. Recall that “partial retreat” is when insurers begin to limit the extent to which homeowners can transfer risk to the insurer. The timing of partial and full insurance retreat for coastal homes, estimated conservatively for RCP 4.5, is shown in Fig. 5. In a separate work, not included here for brevity, we also investigated RCPs 2.6 and 8.5 (essentially best- and worst-case scenarios), finding only between 2 and 5 years difference (at most) for either partial or full retreat.

Sea level rise projections under Representative Concentration Pathways (RCPs): 2.6, 4.5 & 8.5. Author’s own visualisation of data from MfE (2017)

Timing of modelled insurance retreat for properties in the 1% AEP coastal zones. Note: This analysis uses sea level projections from RCP 4.5 (MfE 2017).

Partial retreat is estimated to happen soonest in Wellington and Christchurch, starting before the end of the decade. Only slightly later are Dunedin and Auckland which see similar partial insurance retreats shortly after 2030. Ultimately, this process of insurance retreat in the ESL1 zone will result in a full retreat from all the properties therein. We estimate that this process will culminate in the 2040s with only a few years separating the first and the last city we examine. This is a troubling observation. Typically, sea level rise is discussed as a concern for property owners in the latter part of this century, when the rising seas are predicted to permanently inundate properties. Our analysis demonstrates that insurance retreat will happen much sooner than that, with consequent adverse impacts on property markets.

6 Discussion

This study develops a methodology to estimate the timing of insurance retreat, and illustrates that such a retreat can be expected in the biggest port cities in Aotearoa within the next two decades. Aotearoa has particular circumstances which may precipitate insurance retreat earlier: small variability in storm surges, narrow tide ranges, large coastline relative to GDP, very high insurance penetration rates, and bundled (all-hazard) insurance. But, insurance retreat is going to be a concern in any location that is experiencing an increase in natural hazard risk. Identifying locations which face inevitable insurance retreat, and timing that likely retreat, can enable anticipatory adaptation. Our methodology is thus useful for any location facing escalating hazards under climate change.

The only intervention that permanently reduces the risk we analysed herein is one of managed retreat — the relocation of at-risk properties away from the escalating risks (Hino et al. 2017). Managed retreats, however, are notoriously difficult to implement, and no country has managed to develop a deliberate and systematic programme of voluntary residential managed retreat with significant uptake — an example of a proposed programme was developed in Arnold et al. (2023).

The relatively small sea level height differences between 1 and 4.88% AEP events in Aotearoa means that hard and soft defences (such as seawalls and dune refurbishment) could forestall insurance retreat by reducing the probability of inundation directly from the coast only temporarily. Defences that attempt to establish a vertical barrier between the sea and residential properties will also be unable to reduce flooding from extreme precipitation which is expected to increase with climate change. In fact, vertical seaward barriers can exacerbate pluvial and fluvial flooding when these barriers prevent excess water from draining to the sea. Thus, while there may be some logic in investment in protective structures to defend expensive critical infrastructure (e.g., ports), the use of barriers to hold back coastal inundation from residential buildings, and stave off insurance retreat, will likely be futile. At best, these structures may extend the timeframe affected properties benefit from the presence of residential insurance.

Recognising where insurance retreat is inevitable can also help prevent maladaptive measures such as the introduction or extension of public insurance to affected locations. Such public interventions in insurance markets, once insurers start to retreat, are quite common — examples include the public schemes in Florida for hurricane risk, in California and Japan for earthquake risk, and in the USA and the UK for flood risk. In Aotearoa, such a public insurance for earthquakes was already introduced in the 1940s, after insurers retreated from covering this risk after a damaging event. Offering a public insurance (or subsidizing a private one) for homes that face insurance retreat will inevitably underwrite continued development in hazardous locations, and will encourage people to insist on remaining in harm’s way. As an unintended consequence, this will also make voluntary managed retreat more difficult to design and implement.

The public subsidy will also quickly become prohibitively expensive. A simple calculation is illustrative. Imagine a $1,000,000 wooden floored property in one of Wellington’s ESL1 zones where the land value is $500,000 and the value of the buildings is $500,000. With just 30 cm of sea level rise, a 1 in 100 year flood will become an annual event. The AEP for an annual event is 63.21%. Therefore, after just 30 cm of sea level rise, this property will face annual expected losses of $94,818.Footnote 9 Thirty centimetres is expected within the next 50 years. In other words, the expected-loss-based premium will increase from $1950 by about 50 times within the next 50 years.

To avoid a partial or full insurance retreat, insurers may break with their historical practice in Aotearoa by unbundling the hazards covered in their policy offerings (and retreat only from coverage of specific hazards). This unbundling would have wide-ranging implications for the local insurance market. Without an all-hazards insurance system, it is likely that the current exceptionally high levels of residential insurance for natural hazards will be difficult to maintain, and that will have consequences for the outcomes after disasters (Nguyen and Noy 2020). This is especially important as this specific-hazard retreat will almost certainly exclude the very hazard(s) that pose the greatest threat to the property.

This likely insurance retreat has broader implications for property markets. In Aotearoa, mortgages are often granted with repayment periods of 20–30 years but the maximum period for fixed interest rates is only 5 years. Since insurance contracts are renewed annually and insurance is a prerequisite for securing a mortgage, failing to maintain insurance can trigger a legally defined default or at the very least result in much a higher interest rate on the mortgage once the interest rate is no longer pre-determined. Currently, there is a general absence of compliance checks, and banks seldom know whether the properties they mortgage remain insured beyond the time of issuance. But, once insurance retreat will start to become more common, it is very likely that banks will institute more rigorous compliance checks, and those houses that no longer have insurance will face financial consequences.

Concern over insurance retreat and the mismatch between annual insurance policies and long-term mortgages has already been raised by financial regulators (RBNZ 2021). Though some jurisdictions require private insurers to notify regulators when insurance is withdrawn (Plitt and Maldonado 2012), there is no such requirement in Aotearoa, nor is there any legal prohibition or constraint on the non-renewal of insurance policies.

Two other related concerns are the role of other stakeholders in insurance markets, and the issue of contents insurance (often sold separately from structural insurance to the dwelling/building itself). Both of these concerns especially affect renters. It is typical in such situations to be mostly concerned with the information available to, and decisions taken by, the property owners. However, renters will also be affected by insurance retreats, and the commensurate changes in the property market that these will generate, but their interests are often ignored. Contents insurance, as well, is also taken by renters, and if building insurance is unavailable, it is likely that content insurance will not be available as well. While the values insured for contents are usually much smaller, they can constitute a very significant share of renters’ wealth, and as such the social consequences of the content insurance retreat may not be significantly less material.

Despite the significant policy issues this poses, insurers have few incentives to communicate anticipated insurance retreat. The annual renewal of policies provides insurers an opportunity to regularly reassess the profitability of properties exposed to escalating hazards under climate change. As coastal inundation events become more frequent, insurers can estimate the probability of floodwaters breaching a property’s floorboards and therefore triggering an insurance claim. As this probability approaches an insurer’s retreat threshold (e.g. 5%, 2% or even 1.32% AEP) the insurer can decide whether to renew the policy for another 12 months. This allows ample time for the insurer to withdraw from properties before the expected losses on a property makes insuring it unprofitable.Footnote 10

This study demonstrates that thousands of houses in Aotearoa will experience full insurance retreat within the next two decades. Furthermore, the height difference between extreme and frequent storm surges (e.g. 1 in 100 year and 1 in 20 year storm surges, respectively) is less than 20 cm of sea level rise. Consequently, even a small amount of sea level rise is able to dramatically increase the probability of coastal inundation. This is compounded by Aotearoa’s pattern of development in the previous century which was concentrated near the waterways used for transportation in the late nineteenth and early twentieth centuries. Little regard was given to the oral history of extreme events held by indigenous Māori. Failure to incorporate oral history spanning multiple centuries shortened the record used when the distance between colonial settlements and the edge of the sea was established. Consequently, the undeveloped buffer just above high tide was small and inadequate to avoid the reach of infrequent coastal inundations. Residential property in Aotearoa still hugs its coasts very tightly.

7 Conclusion

Projected sea level rise will increase the frequency of what is now a 1% AEP coastal inundation event. Using this quantifiable relationship and thresholds for insurability, we estimate that, within a decade, insurance companies will start retreating from offering full coverage for flood damage in Aotearoa’s coastal cities. Relatively soon, all-hazards insurance for coastal flood-prone properties will become increasingly difficult to renew.

As the volume of properties experiencing insurance retreat grows, and with it, public scrutiny of private insurers’ response to physical climate risk, insurance markets will change. We expect private insurers to reduce cross-subsidisation for the most exposed properties, and to begin to unbundle the all-hazards contracts that help ensure very high penetration rates of residential insurance in Aotearoa. Once insurers start to accurately price climate-related hazards, competitive pressures will force insurers to differentiate more between properties and across hazards. Insurers should be expected to withdraw coverage from properties and hazards where expected losses regularly exceed socially acceptable premium levels. This unbundling will also have implications for the pricing of non-climate hazards, for example, earthquake hazards. Removing ubiquitous cross-subsidisation will have ramifications for insurance pricing and insurance retreats from other hazards.

These dynamics are not going to be unique to Aotearoa, and the methodology we developed could equally apply for analysis elsewhere in regions where the risk profile is changing (i.e., almost everywhere). This study therefore provides a preview of the insurance retreat likely to be experienced in the many locations globally. Our study provides additional impetus to affected communities to expedite climate adaptation decisions. It also encourages private insurers to anticipate developments in their markets under the changing risks due to climate change. It also calls on governments to start considering potential policy responses to insurance retreat, should ones be needed. These can include increased information provision, increased regulation, or increasing the involvement of the public sector in insurance markets.

In future research, we aim to investigate insurance retreat further by extending our modelling approach in several directions. One important addition would be the modelling of multiple weather-related hazards (i.e., compounding hazard events). These are difficult to model, but frequently occur and are therefore important. Equally important is to further examine the sensitivity of our conclusions to outlier event and tipping points (e.g., unusually strong storms or the speeding up of sea-level rise, respectively). At this point, we are ignoring these possibilities as we lack the scientific basis to quantify the likelihood of these tipping points. As our knowledge develops, of course, we will increasingly be able to investigate these possibilities. Once these are available, future work should also incorporate the duration of inundation, the speed in which the water moves when it floods an asset, more accurate modelling of elevation and the flow of water through it, more precise analysis of property footprints and construction standards/materials, and more nuanced projections of storminess and its varied characteristics. All of these are necessary for a more accurate assessment of the impending risk of managed retreat, we believe, and all will provide further confidence in our findings.

Data Availability

The data that support the findings of this study are available from the corresponding author upon reasonable request. Permission to use the data associated with Riskscape and 1% AEP Extreme Sea Level Extents are to be sought from the respective authors.

Notes

We note that the intensity of coastal storms will also increase with climate change, but we focus on the frequency change of coastal inundation from storm surges that is caused exclusively by sea level rise. The investigation of the changing frequency that is associated with increases storminess necessitates climate modelling that is not yet reliable enough for this purpose.

In Aotearoa, a public insurer — the Earthquake Commission (EQC) — covers the first tranche of natural hazard risks for all residential property that is privately insured (with fire insurance). However, for storm events, only the land is covered by the EQC, and not the dwellings located on that land. As such, we ignore the presence of public insurance in the calculations that follow.

The largest port is Tauranga (as measured by container capacity); however, no long-term tide gauge data is available for it.

There are a number of publicly available national Digital Elevation Maps (DEMs) for Aotearoa. The highest resolution (8 m from LINZ) is unfortunately only recommended for cartographic visualisation. The globally available MERIT DEM from Yamazaki et al. (2017) with + / − 2 m vertical accuracy, is available for research purposes over Aotearoa, but only has a 90 m grid resolution. Others available include the Geographx 20 m or Landcare 25 m resolution DEMs. The accuracy of the NZSoSDEM product was comprehensively assessed using a statistically sound selection of 3791 check points throughout the country. The comparison of results with other available country-wide DEM demonstrates an improvement in terms of quality in addition to a finer spatial resolution. We chose to use a nationally consistent product rather than the locally specific LiDAR offerings to allow for a nationally comparable methodology.

The four sets we use are Auckland 1946 (AVD-46), Wellington 1953 (WVD-53), Lyttelton 1937 (LVD-37), and Dunedin 1958 (DVD-58).

Note here that 1.28 was used by Paulik et al. (2019) as a proxy for the relationship between tidal-gauge 99th and 90th percentile heights.

See Newman and Noy (2023) for evidence of the increasing frequency and intensity of extreme weather events. This increase is in contrast to the increased frequency of inundation caused by existing storms when the base sea level rises (which is implicitly included in our analysis).

Annual Expected Losses = Value of structure ($500,000) x AEP (63.21%) x Damage Function (30%).

On the other hand, if an insurer were to give advance warning that it expects its insurance retreat threshold to be breached on particular properties, the insurer could face public appeals to subsidise those properties, potentially indefinitely, or suffer reputational damage for abandoning loyal customers in their hour of greatest need.

References

Armstrong J, Skilling H, Yao F (2019) Loan-to-value ratio restrictions and house prices: micro evidence from New Zealand. J Hous Econ 44:88–98

Arnold T, Elias S, Adam O, Awatere S, Boston J, Davies B, Davis J, Grace E, Greenwood J, Milner N, Noy I, Rushbrook E, Storey B (2023) A proposed system for Te Hekenga Rauora/planned relocation. Report of the Independent Expert Working Group on managed retreat. New Zealand Ministry for the Environment

Bakkensen LA, Barrage L (2022) Going underwater? Flood risk belief heterogeneity and coastal home price dynamics. Rev Financ Stud 35(8):3666–3709

Bell R, King A (2009) RiskScape Project: 2004 - 2008, NIWA Science Report. 2009/75, p 172

Bell RG, Paulik R, Wadwha S (2015) National and regional risk exposure in low-lying coastal areas: areal extent, population, buildings and infrastructure. NIWA client report HAM2015–006 prepared for New Zealand Parliamentary Commissioner for the Environment, p 128

Binskin M, Bennett A, Macintosh A (2020) Royal Commission into natural disaster arrangements: chapter 20 insurance, Report dated 28 October 2020. Canberra, Commonwealth of Australia

Booth K, Lucas C, Eriksen C, de Vet E, Tranter B, French S, Young T, McKinnon S (2022) House and contents underinsurance: insights from bushfire-prone Australia. Int J Disaster Risk Reduction 80:103209

Bouwer LM (2013) Projections of future extreme weather losses under changes in climate and exposure. Risk Anal 33(5):915–930

Browne MJ, Knoller C, Richter A (2015) Behavioral bias and the demand for bicycle and flood insurance. J Risk Uncertain 50(2):141–160

Coles S (2001) An introduction to statistical modelling of extreme values. Springer Verlag. https://doi.org/10.1007/978-1-4471-3675-0

Columbus J, Sirguey P, Tenzer R (2011) A free fully assessed 15 metre digital elevation model for New Zealand. Survey Quarterly 300(66):16–19

Cousins WJ (2009) RiskScape: development of a default assets model for Hawke’s Bay. Lower Hutt: GNS Science. GNS Science report 2009/50, p 29

Dixon L, Clancy N, Miller BM, Hoegberg S, Lewis MM, Bender B, ... Choquette SR (2017) The cost and affordability of flood insurance in New York City. RAND Corporation, Santa Monica, CA

Dixon L, Tsang F, Fitts G (2018) The impact of changing wildfire risk on California’s residential insurance market. California Natural Resources Agency Report for California’s Fourth Climate Change Assessment. CCCA4-CNRA-2018-008, p 78

Embrechts P, Klüppelberg C, Mikosch T (1997) Modelling extremal events: for insurance and finance. Springer Verlag. https://doi.org/10.1007/978-3-642-33483-2

Filippova O, Nguyen C, Noy I, Rehm M (2020) Who cares? Future sea-level-rise and house prices. Land Econ 96(2):207–224

Furukawa K, Ichiue H, Shiraki N (2020) How does climate change interact with the financial system? A survey. Bank of Japan Working Paper Series No. 20-E-8, p 59

Hannah J (2015) The derivation of New Zealand’s monthly and annual mean sea level datasets (Report). Parliamentary Commissioner for the Environment. https://www.pce.parliament.nz/media/1381/the-derivation-of-new-zealand-s-monthly-and-annual-mean-sea-level-data-sets.pdf. Accessed 20 Nov 2020

Hino M, Field C, Mach K (2017) Managed retreat as a response to natural hazard risk. Nat Clim Chang 7:364–370

Hudson P (2018) A comparison of definitions of affordability for flood risk adaption measures: a case study of current and future risk-based flood insurance premiums in Europe. Mitig Adapt Strat Glob Change 23(7):1019–1038. https://doi.org/10.1007/s11027-017-9769-5

Hunter J (2015) Sea-level extremes at four New Zealand tide gauge locations and the impact of future sea-level rise (report). Parliamentary Commissioner of the Environment. https://www.pce.parliament.nz/media/1383/sea-level-extremes-at-four-nz-tide-gauge-locations-and-the-impact-of-future-sea-level-rise-hunter-2015.pdf. Accessed 20 Nov 2020

Hurrell G (2023) Petone and other communities can’t be protected against climate change, says insurer. BusinessDesk 22.09.2023. https://businessdesk.co.nz/article/infrastructure/petone-and-other-communities-cant-be-protected-against-climate-change-says-insurer. Accessed 24 Sept 2023

IPCC (2014) Climate change 2014: synthesis report. Intergovernmental panel on climate change. https://www.ipcc.ch/site/assets/uploads/2018/02/SYR_AR5_FINAL_full.pdf. Accessed 20 Nov 2020

Jarzabkowski P, Chalkias K, Clarke D, Iyahen E, Stadtmueller D, Zwick A (2019) Insurance for climate adaptation: opportunities and limitations. Global Commission on Adaptation, UN, Rotterdam, the Netherlands, and Washington, DC, US, p 43. Available online at www.gca.org

Jongman B, Hochrainer-Stigler S, Feyen L, Aerts JC, Mechler R, Botzen WJ, ... Ward PJ (2014) Increasing stress on disaster-risk finance due to large floods. Nat Clim Chang 4(4):264–268

Kerr S (chair), Berryman K, Blake H, Brown C, Chapman K, Davies B, Dore R, Drayton M, Filippova O, Grafton T, James V, Liefting R, Middleton D, Noy I, Owen S, Pastor Paz J, Paulik R, Salmon R, Saunders W, Storey B, Townsend W (2017) Deep south insurance dialogue, Wellington, New Zealand, 31 March 2017

Kousky C (2019) The role of natural disaster insurance in recovery and risk reduction. Annu Rev Resour Econ 11:399–418

Kraehnert K, Osberghaus D, Hott C, Habtemariam LT, Wätzold F, Hecker LP, Fluhrer S (2021) Insurance against extreme weather events: an overview. Rev Econ 72(2):71–95

Landry CE, Anderson S, Krasovskaia E, Turner D (2021) Willingness to pay for multi-peril hazard insurance. Land Econ 97(4):797–818

Lin S, Cousins J, King A (2016) Development of New Zealand exposure dataset for use in loss modelling. In: Proceedings of the Australian Structural Engineering Conference (pp 476–485). Engineers Australia. https://search.informit.org/doi/10.3316/informit.676617529524613. Accessed 20 Nov 2020

Linnerooth-Bayer J, Surminski S, Bouwer LM, Noy I, Mechler R (2019) Insurance as a response to loss and damage? In: Mechler R, Bouwer L, Schinko T, Surminski S, Linnerooth-Bayer J (eds) Loss and damage from climate change. Springer Verlag, Berlin

LINZ (n.d.) Tide station data dictionary New Zealand hydrographic authority. Land Information New Zealand. (Retrieved June 3, 2020). https://data.linz.govt.nz/layer/52101-tide-stations/

LINZ (2020) Topo data dictionary coastline. Land Information New Zealand. https://data.linz.govt.nz/layer/52101-tide-stations/

Lucas CH, Booth KI, Garcia C (2021) Insuring homes against extreme weather events: a systematic review of the research. Clim Change 165(3):1–21

Ma EQ, Guinery MJ, McCarthy P, Shaw R (2012) Australian floods and their impact on insurance. The Geneva reports: extreme events and insurance - 2011 Annus Horribilis 81–93

McChristian L (2012) Hurricane Andrew and insurance: the enduring impact of an historic storm. Insurance Information Institute Online at http://www.insuringflorida.org/assets/docs/pdf/paper_HurricaneAndrew_final.pdf

MfE (2017) Coastal hazards and climate change: guidance for local government (guidance report). Ministry for the Environment, Manatū Mō Te Taiao. https://environment.govt.nz/publications/coastal-hazards-and-climate-change-guidance-for-local-government/. Accessed 20 Nov 2020

Newman R, Noy I (2023) The global climate-change-attributed costs of extreme weather. Nat Commun 14:6103

Nguyen C, Noy I (2020) Insuring earthquakes: how would the Californian and Japanese insurance programs have fared down under (after the 2011 New Zealand earthquake)? Disasters 44(2):367–389

Nyce C, Dumm RE, Sirmans GS, Smersh G (2015) The capitalization of insurance premiums in house prices. J Risk Insur 82:891–919

Pastor-Paz J, Noy I, Sin I, Sood A, Fleming-Munoz D, Owen S (2020) Projecting the effect of climate change on residential property damages caused by extreme weather events. J Environ Manage 276:111012

Paulik R, Stephens S, Wadwha S, Bell R, Popovich B, Robinson B (2019) Coastal flooding exposure under future sea-level rise for New Zealand (Report No. 2019119WN; p 76). Deep South National Science Challenge. https://deepsouthchallenge.co.nz/wp-content/uploads/2021/01/Exposure-to-Coastal-Flooding-Final-Report.pdf. Accessed 20 Nov 2020

PCE (2015) Preparing New Zealand for rising seas: certainty and uncertainty (Report). The Parliamentary Commissioner for the Environment. https://www.pce.parliament.nz/media/1390/preparing-nz-for-rising-seas-web-small.pdf. Accessed 20 Nov 2020

Phelan L (2011) Managing climate risk: extreme weather events and the future of insurance in a climate-changed world. Australas J Environ Manag 18(4):223–232

Plitt S, Maldonado D (2012) When constitutional challenges to state cancellation moratoriums enacted after catastrophic hurricanes fail: a call for a new federal insurance program. Brigham Young University Journal of Public Law 27(1):41–96. https://digitalcommons.law.byu.edu/jpl/vol27/iss1/3

Poizner S (2022) Wildfires never threatened my home. But my insurer said they do – and dumped me. Los Angeles Times 12.04.2022. https://www.latimes.com/opinion/story/2022-04-12/wildfire-insurance-homeowners-fire-risk. Accessed 13 Apr 2022

PRA (2015) The impact of climate change on the UK insurance sector. A Climate Change Adaptation Report. Prudential Regulation Authority, p 73. Online at https://www.bankofengland.co.uk/-/media/boe/files/prudential-regulation/publication/impact-of-climate-change-on-the-uk-insurance-sector.pdf

Rawlinsons (2013) Rawlinson’s New Zealand construction handbook, 28th edn. Rawlinson’s Publishing: Auckland, New Zealand, p 670

RBNZ (2021) Climate changed 2021 and beyond. Reserve Bank of New Zealand, p 44. Online at https://www.rbnz.govt.nz/-/media/project/sites/rbnz/files/financial-stability/climate-change/climate-change-report-2021.pdf

Reese S, Ramsey D (2010) RiskScape: flood fragility methodology (Technical Report: WLG2010–45). NIWA. https://www.gtn.ac.nz/sgees/research-centres/documents/riskscape-flood-fragility-methodology.pdf. Accessed 20 Nov 2020

Reiss RD, Thomas M (2007) Statistical analysis of extreme values: with applications to insurance, finance, hydrology and other fields. Birkhauser, 3rd edn (p 530). https://doi.org/10.1007/978-3-7643-7399-3

Rentschler J, Avner P, Marconcini M et al (2023) Global evidence of rapid urban growth in flood zones since 1985. Nature 622:87–92

Stephens SA, Bell RG, Haigh ID (2020) Spatial and temporal analysis of extreme storm-tide and skew-surge events around the coastline of New Zealand. Nat Hazards Earth Syst Sci 20:783–796. https://doi.org/10.5194/nhess-20-783-2020

Stock R (2023) Owners of flood-prone homes will pay more for insurance. Stuff 10.02.2023. https://www.stuff.co.nz/business/opinion-analysis/131169361/owners-of-floodprone-homes-will-pay-more-for-insurance. Accessed 11/02/2023

Storey B (2017) Conversion to leasehold as methodology to price sea level rise risk. [Unpublished master dissertation]. University of Canterbury, New Zealand, p 28

Surminski S (2014) The role of insurance in reducing direct risk – the case of flood insurance. Int Rev Environ Resour Econ 7(3–4):241–278

Treasury (2017) Earthquake Commission (EQC): proposed EQC premium rate increase (Cabinet Paper, reference 20170194, Item 4). https://www.treasury.govt.nz/sites/default/files/2017-11/oia-20170194.pdf. Accessed 20 Nov 2020

Vousdoukas MI, Mentaschi L, Voukouvalas E, Bianchi A, Dottori F, Feyen L (2018) Climatic and socioeconomic controls of future coastal flood risk in Europe. Nat Clim Chang 8(9):776–780

Yamazaki D, Ikeshima D, Tawatari R, Yamaguchi T, O’Loughlin F, Neal JC, Sampson CC, Kanae S, Bates PD (2017) A high-accuracy map of globalterrain elevations. Geophys Res Lett 44:5844–5853. https://doi.org/10.1002/2017GL072874

Acknowledgements

We are grateful for the insightful comments and conversations during the Deep South Challenge’s Insurance Symposia in 2017, a Treasury public lecture in July 2018, the 2020 Forum of the Society of Local Government Managers, and the New Zealand Government Speaker’s Science Forum in 2019. The authors would like to especially acknowledge Ceridwyn Roberts, Nienke Kloppenburg, Libby Bentley, Rhys Owen, Suzi Kerr, Ryan Paulik, Susan Livengood, and Sheng-Lin Lin for their support. Special thanks also to Glen Rowe and the sea level team at LINZ for their data support.

Funding

Open Access funding enabled and organized by CAUL and its Member Institutions

Author information

Authors and Affiliations

Contributions

All authors contributed to the study conception and design. Material preparation, data collection and analysis were performed by Sally Owen, Christian Zammit and Belinda Storey. All authors contributed to the draft manuscript and approved the final manuscript.

Corresponding author

Ethics declarations

Conflict of interest

This project was funded by the New Zealand Ministry for Business, Innovation and Employment through the Deep South National Science Challenge. The funders did not impose any disclosure/or approval requirements.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Storey, B., Owen, S., Zammit, C. et al. Insurance retreat in residential properties from future sea level rise in Aotearoa New Zealand. Climatic Change 177, 44 (2024). https://doi.org/10.1007/s10584-024-03699-1

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10584-024-03699-1