Abstract

Effective communication of risks involved in the climate change discussion is crucial and despite ambitious protection policies, the possibility of irreversible consequences actually occurring can only be diminished but never ruled out completely. We present a laboratory experiment that studies how residual risk of failure of climate change policies affects willingness to contribute to such policies. Despite prevailing views on people’s risk aversion, we found that contributions were higher at least in the final part of treatments including a residual risk. We interpret this as the product of a psychological process where residual risk puts participants into an ”alarm mode,” keeping their contributions high. We discuss the broad practical implications this might have on the real-world communication of climate change.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Support and design of climate policies is strongly affected by how individuals and organizations perceive risks and uncertainties and how they take these factors into account (IPCC 2014; Sterman 2008). Effective communication of climate change risks therefore presents a crucial challenge both for scientists and policy makers alike. In addition, one’s mitigation behavior is directly affected by the information available as well as by the framing of the problem channeled trough traditional and social media (Boykoff 2011; Morton et al. 2011). In need of both clear policy goals and widespread behavioral change, successful climate change mitigation cannot transcend effective risk communication (Morgan et al. 2002).

From the psychological perspective, uncertainty about the future allows people to distance themselves from the reality and dangers of climate change, which in turn could lead to the reduction of their willingness to adopt mitigation behaviors (Budescu et al. 2009; Morton et al. 2011; Shackley and Wynne 1996). More generally, past research showed that people are less willing to cooperate in social dilemma situations when some uncertainty or risk is involved (Barrett and Dannenberg 2014; Dannenberg et al. 2015; Hine and Gifford 1996). However, it is crucial to distinguish between what we will refer to as a priori and residual risk, the former referring to the consequences of an unsuccessful collective action — i.e., the expected harm from climate change if the currently agreed upon target of keeping the increase in the average temperature within 2∘ C of the pre-industrial levels is not met; and the latter referring to the risk that even a successful collective action cannot rule out — i.e., the negative consequences that climate change can still produce even if the 2∘ C target is met.

The argument that a priori risk should reduce cooperation has recently been challenged both by theoretical models (Santos and Pacheco 2011) and experimental research (Milinski et al. 2008). Collective-risk social dilemma (CRSD) experiments represent a particularly interesting framework to investigate the effect of a priori risk. CRSDs are situations where participants face a high probability of a loss if they fail to reach a common objective. CRSDs are designed to simulate climate change mitigation dilemmas, where failure to contain the amount of greenhouse gases in the atmosphere is forecast to significantly harm human activities. A common finding in such situations is that higher levels of a priori risk actually increase the likelihood that participants will successfully cooperate to reach the common objective (Dannenberg et al. 2015; Milinski et al. 2008; Tavoni et al. 2011).

To date, CRSDs have only been studied under a protocol where reaching the common objective leads to a completely safe outcome, i.e., without any residual risk. However, this misrepresents many real-life situations. The intuition behind this research is that, even if the world countries are successful in reaching the commonly agreed upon objective of keeping the rise of the global temperature below 2∘ C, it will not completely eliminate the negative effects of climate change. In other words, the related risks cannot be reduced to zero, and this can affect both climate change negotiations and mitigation initiatives.

Literature on decision making under uncertainty suggests that cooperation rates may decrease when residual risks are greater than zero (Hine and Gifford 1996; Kahneman and Tversky 1984). However, from a psychological point of view, residual risk may also lead to a heightened state of alertness, such that the threat appears more immediate. Studies show that under stress, people tend to focus more on positive consequences of success than on negative consequences of a failure (Mather and Lighthall 2012). Kandasamy et al. (2014) demonstrate that stress systematically alters the perception of risks and that high levels of stress positively correlate with risk aversion.

In short, previous literature provides mixed evidence on how residual risk can affect contributions to the common goal in CRSD situations. We present here an experiment based on the existing framework but one that also includes treatments with a substantial residual risk. The main finding is that cooperation rates at the end of the game are higher in treatments with positive levels of residual risk. This surprising finding suggests that communicating climate change risks explicitly may actually help to engage some people in climate change mitigation activities.

2 Problem formulation

Our general research question concerns the effect that residual risk has on the willingness to contribute in a collective action situation such as climate change mitigation. From the individual point of view, there are two relevant sources of uncertainty when considering contribution in a CRSD: (i) how much do others contribute, (ii) whether collective action will be successful in preventing the catastrophe. While (ii) is uncertainty as it is studied in the literature on individual decision making, (i) is often referred to as strategic uncertainty. Evidence on how decisions and preferences in individual and strategic settings relate to each other has been inconclusive and greatly dependent on the exact type of strategic setting considered (Bohnet et al. 2008; Fairley et al. 2016; Farjam 2015). It also remains unclear whether residual risk is perceived differently in individual and strategic contexts. Since research on the issue is inconclusive and to make a formal description of our treatments feasible, we will analyze the choice that the participants face as if it were an individual decision.

The literature on individual decision making defines a situation involving risk as a lottery with known realization probabilities of each of the possible outcomes (Kahneman and Tversky 1984). An important finding is that most people are risk averse — i.e., a sure outcome is preferred over a lottery with the same expected value. To put this into the context of the CRSD game, the decision whether or not to invest into a climate change mitigation initiative can be seen as a choice between two lotteries: one where climate change occurs with some known a priori probability p and leads to the loss of the whole endowment E; and one where this probability is reduced to a residual level π at the cost C (π < p). Given this choice, a rational agent should prefer the lottery with the risk level π as long as \(C < \frac {p - \pi }{1 - \pi } \times E\). From this point of view, our main research question can be rephrased in the following way: “To what extent does the willingness to invest into mitigation activities that reduce the level of risk from an a priori level of p to a residual level of π depend on whether or not π > 0?”

Addressing this question is rather challenging because it is impossible to define pairs of lotteries both objectively and psychologically equivalent in all but one aspect (e.g., residual risk; see Kahneman and Tversky 1972; Schmeidler 1989). Consider two pairs of lotteries: {p1,0} and {p2,π}, where all outcomes are the same and p1 = p2 > π > 0. In this case, the two pairs differ in terms of expected gain when moving from a priori to residual risk (henceforth simply probability gain). The obvious fix for the difference in probability gain would be to set p2 = p1 + π. However, from Prospect Theory we know that probabilities are not perceived objectively and that high probabilities feel different from low probabilities psychologically (Kahneman and Tversky 1972; Schmeidler 1989). In other words, even though both pairs of lotteries may objectively be the same in terms of probability gain, they may subjectively be perceived differently.

With this in mind when designing the experiment, our goal was to separate the effect of introducing residual risk π from the effect of increasing a priori risk to the level of p + π. To do so, we compare the lottery pair {p,0} with two other pairs: {p,π} and {p + π,π} (henceforth Baseline, Residual Risk 1 or RR1, and Residual Risk 2 or RR2, respectively). The comparison between RR2 and the baseline allows one to study the effect of introducing a residual risk level of π while keeping the probability gain constant (by the means of increasing a priori risk to p + π). The comparison between RR1 and the baseline instead allows one to study the effect of introducing a residual risk level of π while keeping a priori risk constant (by the means of changing the probability gain to p − π). Any difference that is common to both comparisons can thus be attributed to the effect of residual risk.

3 Methods

3.1 Design

Our experimental design is based on the collective-risk social dilemma framework by Milinski et al. (2008). A group of six players had 10 periods to provide a total contribution of 120 “experimental currency units” (ECU) to what was referred to as the “climate protection” account. Each participant was initially endowed with 40 ECU and could contribute {0,2,4} ECU to the climate account in each period. All contributions were subtracted from the private accounts of the participants. At the end of the experiment, all participants were paid on the basis of the amount remaining in their individual accounts (plus a fixed show-up fee of 2.5 Euro) using a conversion rate of 3 ECU = 1 Euro.

In order to reach the target of 120 ECU, an average contribution of 2 ECU per participant per period would be sufficient. We refer to this as the reference contribution. At the end of each period, participants were presented with a table displaying each group member’s contemporaneous and cumulative contributions to the climate account (randomly assigned aliases were used for in-game identification) as well as the corresponding group totals.

All contributions were non-refundable and the participants were informed that those would be used to purchase carbon dioxide compensation certificates. At the end of the game, whether or not the group as a whole reached the common target determined the type of risk they would face: residual (π) in case of the total contribution reaching 120 ECU, or a priori (p) otherwise. The participants would keep the remainder of their private endowment only if the uncertainty was resolved in their favor by a random draw based on the risk factor valid for their group. The actual values of p and π differed across the treatments: p = 0.7 and π = 0.0 in the baseline; p = 0.7 and π = 0.2 in treatment Residual Risk 1 (RR1); and p = 0.9 and π = 0.2 in treatment Residual Risk 2 (RR2).

3.2 Predictions

From the perspective of an expected payoff maximizing player i, who makes an overall contribution of Ci during the course of the game, the payoff function is given by:

The game has a large but finite set of Nash equilibria in pure strategies that consists of a riding equilibrium where each player contributes nothing and consequently, the group target is not met; and a plethora of equilibria, both symmetric and asymmetric, where the group collectively contributes exactly 120 ECU and the individual contribution profiles do not exceed a certain limit determined by the risk parametrization of a given treatmentFootnote 1. The free-riding equilibrium is trembling hand perfect (Selten 1975) but Pareto dominated by the other equilibria. Even though the number of asymmetric equilibria differs across the treatments (due to the aforementioned individual contribution limits), the sheer quantity of equilibria shared by all the treatments makes the normative analysis inconclusive as far as anticipated play differences among them.

We propose the following behavioral insights to motivate why one should expect differences across the treatment conditions.

Generally speaking, contribution behavior reinforces itself both by encouraging other group members provided they are willing to cooperate conditionally (Fischbacher et al. 2001) and by stimulating further contribution by self in order to minimize the chance of the past investment being wastedFootnote 2. Provided that the target stays within reach, more contribution and from more group members is expected as the game progresses.

Individual willingness to attempt reaching the target depends on the relative value of free riding, and that is where we expect to observe treatment differences.

By contributing nothing, one can expect to receive a payoff of 12 ECU in the baseline and RR1, and 4 ECU in RR2 in the worst case scenario. At the same time, one can aspire to earn as much as 40 ECU in the baseline while only up to 32 ECU in RR1 and RR2. To someone who may be willing to take the odds of the others reaching the target, both of these prospects make free riding appear most lucrative in the baseline. In addition, if one were to consider changing their strategy, doing so is most expensive in the baseline as each ECU kept is one potential ECU earned as opposed to 0.8 ECU in RR1 and RR2.

Therefore, among the treatment conditions, we expect to observe the highest level of free riding in the baseline.

3.3 Procedure

The participants were randomly assigned to a treatment and received printed instructions similar to the ones used by Milinski et al. (2008), which included a brief explanation of the problem of global warming along with the description of the use of funds contributed to the climate account to purchase CO2 compensation certificatesFootnote 3.

Before the actual game, the participants were asked to answer a number of incentivized control questions. Incorrect submissions were allowed and more than 83% of the participants answered at least 5 out of 7 questions correctly. Then the game was played as described above. Both the instructions and control questions can be found in the Electronic Supplemental Material.

Immediately after the game, the participants were presented with an incentivized (Holt and Laury 2002) risk elicitation task and afterwards, with a non-incentivized environmental attitude questionnaire with items derived from the New Ecological Paradigm (NEP) scale (Dunlap et al. 2000). In the uncertainty resolution stage, the participant sitting at computer #1 was instructed to inspect an urn containing ten tennis balls with numbers 1 through 10 and then to draw one of them in order to resolve the uncertainty over the final outcome of the climate protection game. The same draw was used for the three groups (one for each treatment condition) participating in a given session. The sessions concluded with a basic sociodemographic questionnaire.

4 Results

4.1 Session statistics

The experiment was conducted at a computer laboratory in Germany in February 2017. It was programmed in z-Tree (Fischbacher 2007) and the participants were recruited using ORSEE (Greiner 2015).

Altogether, 10 experimental sessions were concluded with a total of 180 participants (37% males). The average age was 26 years. In terms of educational background, 48% of the participants were undergraduate students and 16% studied Economics or Business Administration. The average earnings were €10.3 (including a show-up fee of €2.5) for approximately 40 minutes spent in the laboratory. All sessions involved three groups of 6 participants, randomly assigned to either of the three treatments.

4.2 Group level results

The general findings are summarized in Table 1. Only 60% of the groups were successful in reaching the threshold to decrease the risk of ”climate change” in the baseline, whereas an impressive 90% of them (all but one group) did so in RR2. With 80% of the groups reaching the threshold, RR1 was in-between. Despite the theoretical arguments presented above, the observed differences in the contributions suggest that the introduction of residual risk actually increases the average contributions. The fact that the contributions in RR1 were higher than those in the baseline imply that this effect was even stronger than the effect of the probability gain reported by Milinski et al. (2008).

In our view, however, exploring the treatment differences at the group level and as static phenomena is inefficient since 6 subjects were interacting per group over multiple rounds. To take into account variation at the individual level and also to study the time dynamics of the effect, we present a mixed effects models in the next section. For completeness, however, we compared both RR1 and RR2 with the baseline as far as the proportion of the groups reaching the threshold (χ2 = 0.24, one-sided p = 0.313 and χ2 = 1.07, one-sided p = 0.151 for RR1 and RR2 relative to the baseline, respectively) and as far as the total amount contributed to the climate account (W = 39.5, one-sided p = 0.220 and W = 35.0, one-sided p = 0.129 for RR1 and RR2 relative to the baseline, respectively).

4.3 Individual level results

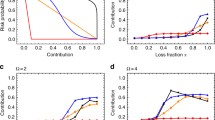

Figure 1 presents the average individual contributions over time. In all treatments, the initial contributions fell short of the reference value of 2 ECU per participant/period that would warrant reaching the threshold by the end of the game. Over time, the contributions tended to increase and especially so towards the end of the game, with the notable exception of the baseline.

Figure 2 presents the average difference between the group total amount contributed to the climate account and the amount that would be on the climate account were everyone to contribute 2 ECU each round. One can see varying degrees of success across the treatments in keeping this difference under control. In the baseline, the participants did not appear to react to the fact that their contributions were too low until almost the very end, whereas in RR2 they managed to reverse the initial trend of declining contributions by about the middle of the game. The RR1 groups performed worse than the baseline in the first half of the game but better in the second half.

In order to address the nested structure of the data properly, we estimated a mixed effects model. Besides the binary variables for the fixed effects of the treatments, the model contained random effects at both the group and individual levels. Since Fig. 1 suggested that most of the between-treatment variation manifested itself in the last period, the corresponding binary variable was included as an additional fixed effect along with its interactions with the treatment variables. Finally, we controlled for risk aversion (Holt and Laury 2002) and environmental attitude (Dunlap et al. 2000) of the participants by adding the corresponding metrics as individual fixed effects to the model.

The coefficient estimates are summarized in Table 2. Since defining the number of degrees of freedom of the fixed effects for such model is somewhat problematic (Bates et al. 2015), all p values were obtained using bootstrap (10K samples). We also considered a number of more complex specifications — e.g., including lagged individual and group contributions — but none of them could improve the model fit according to the AIC criterion.

According to the model estimation results, the last period contributions in treatments RR1 and RR2 were significantly higher than in the baseline (either p value < 0.01), which corroborates the trends observed at the group level. No other significant effects were found.

An in-depth investigation of the group dynamics suggested that one group in the baseline condition could be considered an outlier as its members contributed exceptionally little during the game (Fig. 3). However, excluding that group did not qualitatively affect our resultsFootnote 4.

Difference between the group total contribution and the reference contribution of 2 ECU per participant/period. Each line represents one group. Treatments with {p = 0.5,π = 0.0} and {p = 0.9,π = 0.0} are from Milinski et al. (2008). Close-ups of the last three periods are available in the Electronic Supplemental Material

4.4 Distinguishing between a priori and residual risk

Since our experimental design is compatible with the one in Milinski et al. (2008), we expanded the analysis by including the data from their treatment with p = 0.9 and π = 0.0. Together with our three treatments, this allowed us to employ the full factorial design — i.e., 2 × 2 levels of p ∈{0.7,0.9}× π ∈{0.0,0.2} — to distinguish between the effects of a priori and residual risk.

Comparing the average group contribution across the four treatments resulted in the following ranking: RR2 (121.6) ≻ RR1 (119.4) ≻ Milinski (118.2) ≻ Baseline (117). This suggests that higher levels of both a priori and residual risk result in higher contributions. In order to test for the statistical significance of this finding, we estimated a new mixed effects model using the merged dataset. Save for absence of the individual level controls and addition of a binary variable to control for the source of the the data, the specification was identical to the one used previously.

As shown in Table 3, there is no significant difference between the two datasets (p = 0.87) and the estimation results support our previous findings that both a priori and residual risk result in significantly higher contributions in the last period, both effects being of similar magnitude.

5 Discussion

The purpose of this experiment was to test whether introducing residual risk affects climate change mitigation behavior. The results presented above suggest that the participants were, if anything, more willing to contribute to the climate account by the end of the game both in treatments RR1 and RR2 which, in turn, resulted in a higher proportion of the groups reaching the threshold relative to the baseline.

To a large extent, this finding goes against what is suggested by the well-established psychological literature (e.g., Kahneman and Tversky 1972; Schmeidler 1989) and perhaps common sense as well (e.g., why would one put more effort to reach what actually can be seen as a less favorable outcome?). Nevertheless, we would like to argue that it should not be shrugged off too easily but rather considered a new hypothesis for future work. Not only is the experimental outcome robust but, if confirmed by other studies, it would have far-reaching implications for climate change communication where the current paradigm is that uncertainty has a negative effect on the willingness to invest or engage in climate protection activities (e.g., Budescu et al 2009; Shackley and Wynne 1996). We were not the first to challenge this view on conceptual grounds (see Morton et al. (2011) for a survey approach) but to the best of our knowledge, the work presented here is the first clear experimental evidence to the contrary. Our results indeed suggest that transparent communication of the (residual) risks pertaining to climate change mitigation activities — i.e., even if the universally agreed upon limit of 2∘ C above the pre-industrial average is met — need not to backfire but rather may increase one’s willingness to engage in such activities.

More generally, residual risk in social dilemma situations seems to lead to more complicated behavioral dynamics. While it is difficult to believe that the increase in the contributions reflects a higher preference for projects with residual risks of failure, it seems plausible that residual risk has some psychological effect on the participants, which interacts with the group and time dynamics both in our experiment and climate change mitigation initiatives in the real world. Residual risk may actually trigger a different interpretation of the behavior of others within the group or prevent the participants from getting too relaxed as far as their effort in reaching the common goal. This is supported by Fig. 3, which shows that nearly every group in the baseline was actually above the reference contribution level right before the end of the game. However, some sharply reduced their contributions in the very last period, failing to reach the threshold as the result. This dynamic is similar to some earlier findings in the psychosocial literature showing that positive feedback can lead to overconfidence in the participants of social dilemma experiments, resulting in the overall reduction of the contributions (Cremer and van Dijk 2002). The same phenomenon, however, did not occur in our residual risk treatments, suggesting that the presence of residual risk helped the players to remain focused on the game and prevented this “overconfidence trap” by sustaining the flow of the contributions until the very end of the game. Similarly, Shirado and Christakis (2017) showed that groups trying to coordinate can benefit from the introduction of an artifical player programmed to act randomly. The authors argue that even though extra randomness makes coordination more difficult in principle, it may ”shake up” human players by forcing them to rethink their current strategies.

In addition, Figs. 2 and 3 suggest that the game can be thought of as being comprised of two distinct phases. In the first one (roughly, the first 5 periods), the contributions were declining, while in the second phase the participants were trying to compensate for that. Two opposing motives actually seem to be at play here. The participants may initially be concerned with some notion of fairness or distributive justice and, as such, dissuaded from contributing by the free-riding of others. In later periods, as the ”deadline” looms closer, the urgency to prevent the ”catastrophe” from happening takes over. This behavioral pattern is also consistent with the findings of Chakra and Traulsen (2012) who study the collective-risk social dilemma in the context of an evolutionary game (a priori risk only). We posit that residual risk may work as a catalyst aiding the transition between the two phases. If this is true, our results suggest that knowing that some negative consequences of climate change can no longer be avoided and that even the most optimistic scenarios cannot rule out the possibility of catastrophic outcomes (IPCC 2014) may actually increase one’s motivation as long as the problem is considered urgent enough.

More research is clearly needed to verify the hypothesis of a positive relation between residual risk and willingness to contribute in social dilemmas. In particular, it is important to have it confirmed at the group level, which calls for a follow-up study on a much larger scale. In addition, even though our sample was not restricted to university students only, it was clearly not representative of the general population and the fact that the study was conducted among German students may limit its generalizability to countries where climate change is a politically loaded issue. Finally, we only considered two levels of a priori and residual risk each, which leaves further room for exploration.

It is also worth noting that the CRSD protocol presents some limitations in its capacity to model climate change mitigation dynamics, starting from a clear and fixed threshold beyond which the risk falls to zero (or to a smaller probability in our implementation). On the one hand, tipping points are important for the political debate, starting from the agreed 2∘ C target, and, given the non-linear dynamics of the climate system, most likely for actual climate change mitigation as well (IPCC 2014; Lenton 2011). In addition, having a clear threshold simplifies the game and helps participants to understand it. On the other, the game protocol clearly over-simplifies real-world dynamics and introduces some undesirable incentives to reduce contributions to zero once the threshold has been reached. The latter point is also negative from a methodological perspective, as it limits between-group differences and hence the sensitivity of the instrument (and, as a consequence, the statistical significance of the results). Future research may address these points and produce new experimental protocols featuring both higher realism and nicer methodological features.

Despite these limitations, our findings remain intriguing and suggest the opportunity of a significant revision of how climate change should be communicated to both politicians and the general public. We hence believe that it deserves further investigation. If we want to avoid the worst consequences of climate change, it is crucial that everybody is involved (Nature Editorial 2016; Ross et al. 2016), and communication plays a critical role in creating the right motivations for action (Boykoff 2011; Morton et al. 2011).

Notes

These limits are 28, 24, and 34 ECU for the baselines RR1 and RR2, respectively.

This important aspect of the framework appears to be overlooked in the literature.

Altogether, the participants of the experiment contributed the equivalent of USD 1185 to the climate protection account. These funds were used to offset 1975 metric tonnes of CO2 via the United Nations platform for voluntary cancellation of certified emission reductions (CERs).

For the model estimation without the outlier group, see the Electronic Supplemental Material

References

Barrett S, Dannenberg A (2014) Sensitivity of collective action to uncertainty about climate tipping points. Nat Clim Chang 4:36–39

Bates D, Mächler M, Bolker B, Walker S (2015) Fitting linear mixed-effects models using lme4. J Stat Softw 67(1):1–48

Bohnet I, Greig F, Herrmann B, Zeckhauser R (2008) Betrayal aversion: evidence from Brazil, China, Oman, Switzerland, Turkey, and the United States. The Amer Econ Rev 98(1):294–310

Boykoff MT (2011) Who speaks for the climate?: making sense of media reporting on climate change. University Press, Cambridge

Budescu DV, Broomell S, Por HH (2009) Improving communication of uncertainty in the reports of the intergovernmental panel on climate change. Psychol Sci 20(3):299–308

Chakra MA, Traulsen A (2012) Evolutionary dynamics of strategic behavior in a collective-risk dilemma. PLoS Comput Biology 8(8):e1002652

Cremer DD, van Dijk E (2002) Reactions to group success and failure as a function of identification level: a test of the goal-transformation hypothesis in social dilemmas. J Exp Soc Psychol 38(5):435–442

Dannenberg A, Löschel A, Paolacci G, Reif C, Tavoni A (2015) On the provision of public goods with probabilistic and ambiguous thresholds. Environ Resour Econ 61(3):365–383

Dunlap RE, Van Liere KD, Mertig AG, Jones RE (2000) New trends in measuring environmental attitudes: measuring endorsement of the new ecological paradigm: a revised nep scale. J Social Issues 56(3):425–442

Fairley K, Sanfey A, Vyrastekova J, Weitzel U (2016) Trust and risk revisited. J Econ Psychol 57:74–85

Farjam M (2015) On whom would I want to depend; humans or nature? Tech. Rep. 2015-019, Jena Economic Research Papers

Fischbacher U (2007) z-tree: Zurich toolbox for ready-made economic experiments. Exper Econ 10(2):171–178

Fischbacher U, Gchter S, Fehr E (2001) Are people conditionally cooperative? evidence from a public good experiment. Econ Lett 71:397–404

Greiner B (2015) Subject pool recruitment procedures: organizing experiments with ORSEE. J Econ Sci Assoc 1(1):114–125

Hine DW, Gifford R (1996) Individual restraint and group efficiency in commons dilemmas: The effects of two types of environmental uncertainty1. J Appl Soc Psychol 26(11):993–1009

Holt CA, Laury SK (2002) Risk aversion and incentive effects. Am Econ Rev 92(5):1644–1655

IPCC (2014) Climate change 2014: mitigation of climate change. Summary for Policymaker, working Group III Contribution to the IPCC Fifth Assessment Report

Kahneman D, Tversky A (1972) Subjective probability: a judgment of representativeness. Cogn Psych 3(3):430–454

Kahneman D, Tversky A (1984) Choices, values, and frames. Amer Psych 39 (4):341

Kandasamy N, Hardy B, Page L, Schaffner M, Graggaber J, Powlson AS, Fletcher PC, Gurnell M, Coates J (2014) Cortisol shifts financial risk preferences. Proc Nat Acad Sci 111(9):3608–3613

Lenton TM (2011) Early warning of climate tipping points. Nat Clim Chang 1 (4):201–209

Mather M, Lighthall NR (2012) Risk and reward are processed differently in decisions made under stress. Curr Dir Psychol Sci 21(1):36–41

Milinski M, Sommerfeld RD, Krambeck HJ, Reed FA, Marotzke J (2008) The collective-risk social dilemma and the prevention of simulated dangerous climate change. Proc Nat Acad Sci 105(7):2291–2294

Morgan MG, Fischhoff B, Bostrom A, Atman CJ (2002) Risk communication: a mental models approach. University Press, Cambridge

Morton TA, Rabinovich A, Marshall D, Bretschneider P (2011) The future that may (or may not) come: How framing changes responses to uncertainty in climate change communications. Glob Environ Chang 21(1):103–109

Nature Editorial (2016) The role of society in energy transitions. Nat Clim Chang 6(6):539–539

Ross L, Arrow K, Cialdini R, Diamond-Smith N, Diamond J, Dunne J, Feldman M, Horn R, Kennedy D, Murphy C, Pirages D, Smith K, York R, Ehrlich P (2016) The climate change challenge and barriers to the exercise of foresight intelligence. BioScience p biw025

Santos FC, Pacheco JM (2011) Risk of collective failure provides an escape from the tragedy of the commons. Proc Nat Acad Sci 108(26):10,421–10,425

Schmeidler D (1989) Subjective probability and expected utility without additivity. Econometrica: J Econ Soc 57(3):571–587

Selten R (1975) Reexamination of the perfectness concept for equilibrium points in extensive games. Int J Game Theory 4(1):25–55

Shackley S, Wynne B (1996) Representing uncertainty in global climate change science and policy: boundary-ordering devices and authority. Sci Technol Human Values 21(3):275–302

Shirado H, Christakis NA (2017) Locally noisy autonomous agents improve global human coordination in network experiments. Nature 545(7654):370–374

Sterman JD (2008) Risk communication on climate: Mental models and mass balance. Science 322:532–533

Tavoni A, Dannenberg A, Kallis G, Löschel A (2011) Inequality, communication, and the avoidance of disastrous climate change in a public goods game. Proc Nat Acad Sci 108(29):11,825–11,829

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Farjam, M., Nikolaychuk, O. & Bravo, G. Does risk communication really decrease cooperation in climate change mitigation?. Climatic Change 149, 147–158 (2018). https://doi.org/10.1007/s10584-018-2228-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10584-018-2228-9