Abstract

We explore whether digital inclusion, a public policy designed to provide high-speed internet infrastructure for historically digitally excluded populations, is associated with the social and ethical challenge of financial inclusion. Using evidence from a sizable P2P lender in the U.S., we document that digital inclusion is positively associated with P2P lending penetration and that this relation is more pronounced in counties with limited commercial bank loan penetration and higher minority populations. Our new evidence from cross-sectional tests suggests that digital inclusion plays a key role in financial inclusion, particularly in regions with more vulnerable and/or underserved populations. In consequence tests, we document that high-risk borrowing is less likely to be denied in counties with higher digital inclusion and that digital inclusion is positively associated with P2P lending efficiency in the form of more repeated borrowing, decreased funding time, and improved funding fulfillment. In addition, we show that the availability of alternative information, a plausible channel through which digital inclusion is related to financial inclusion, is positively associated with efficiency in P2P lending. Our findings indicate that digital inclusion can empower financial service providers and other stakeholders to collaboratively fulfill their ethical and social responsibilities to meet the financial needs of historically marginalized groups.

Similar content being viewed by others

Data availability

All data are publically available.

Notes

For example, according to the 2021 World Bank Global Financial Inclusion database, the global average percentage of adults with an account increased from 51% in 2011 to 76% in 2021 (Demirgüç-Kunt et al., 2022).

Babalola et al. (2022) provide commentaries from the editors of the Journal of Business Ethics on the future of business ethics, containing topics such as leadership, psychology, finance, and accounting. Our paper borrows from ideas and insights that span the commentary section provided by Guedhami, Liang, and Shailer.

Such practices include, for example, the redlining with the National Housing Act in 1934 that excluded Black populations from mortgage lending and the Affordable Care Act failing to expand to states with more Black Americans (Florant et al. 2020).

According to a 2022 report from the Joint Economic Committee (JEC), 50 million American consumers do not have a valid credit bureau score, or are ‘credit invisible,’ of which most are minorities or low-income individuals.

For example, small business entrepreneurs often need such loans as an important source of leverage to start or expand their small businesses.

A 2022 JEC report suggests that there are two groups of U.S. consumers with no valid credit scores. The first group are those without a credit record in any of the nationwide credit reporting agencies; the second group are those who are considered “unscorable” by the nationwide credit reporting agencies. In particular, these people are disproportionately minorities or low-income individuals.

A 2020 market research report shows that LendingClub and Prosper are the two largest P2P lenders in the U.S. (https://mangosoft.tech/blog/top-5-peer-to-peer-lending-companies-2020-full-market-research).

The high-speed and basic internet connections data are from FCC Form 477, and the households’ high-speed internet subscriptions data are from the U.S. Census Bureau.

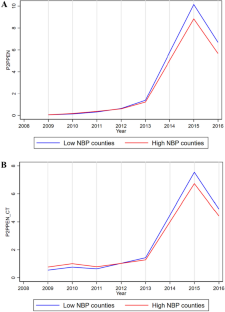

We choose 2013 as the cutoff year for the following reasons: Although the NBP funding deployment was in 2010, the exact years it takes for a county to materialize the digital inclusion effect can vary. Our trend analysis illustrated in Fig. 1 suggests that most counties started to exhibit tangible divergence in P2P penetration after 3 years of NBP deployment. Indeed, FCC (2010) argues that internet infrastructure investments typically require a multi-year horizon to manifest tangible effects, stemming from the complexities associated with implementation, integration, and user adaptation.

For example, in November 2021, U.S. President Joe Biden signed the Infrastructure Investment and Jobs Act (IIJA) into law and provided $65 billion for broadband: https://broadbandusa.ntia.doc.gov/resources/federal/federal-funding.

This study also corroborates the regulators’ initiatives to utilize big data in the traditional financial institutions. For example, Jelena McWilliams, the former Chairman of Federal Deposit Insurance Corporation (FDIC), stressed that FDIC is “actively engaged with” financial institutions to provide “affordable access to financial services and products” for the “most vulnerable populations.” Source: https://www.fdic.gov/news/events/banking-on-data/index.html.

A more illustrative version of the Prosper credit rating system is shown in Table 1, Panel A and Panel B.

Released by the FCC on March 17, 2020, the NBP aims to provide universal high-speed internet access, bridging the digital divide. Source: https://www.fcc.gov/general/national-broadband-plan. In addition, the data related to the county-level NBP deployment can be downloaded at: https://transition.fcc.gov/national-broadband-plan/broadband-availability-gap-data.zip.

Prosper claims that the “custom risk model” uses historical Prosper data and is built on the Prosper borrower population, i.e., the model inputs all historical Prosper loan records and makes predictive analysis.

Considering that starting from 2020, Prosper added a new product—home equity line of credit—we also use a cutoff sample period up to the end of 2019. We find consistent results on all tests.

Call Report is short for Consolidated Reports of Condition and Income. All national banks, state member banks, insured state nonmember banks, and savings associations are required to submit Call Report data to bank regulators.

While not tabulated, we document similar empirical results with a winsorization at the top and bottom 2% levels, considering the prevalence of outliers of the P2P penetration measures.

Using Column (1) as an example, the impact of a one standard deviation increase in DI on P2PPEN is computed as 0.9953 (the coefficient of DI) × 1.1357 (the sample standard deviation of DI) ÷ 4.6092 (the sample mean of P2PPEN) × 100% = 24.52%.

For example, FCC (2010) argues that internet infrastructure investments typically require a multi-year horizon to manifest tangible effects, stemming from the complexities associated with implementation, integration, and user adaptation.

A February 2013 report by the FCC also showed that the nationwide average subscribed speed by consumers by the end of third quarter of 2012 was 15.6 Mbps, representing an average annualized speed increase of about 20%. Source: https://www.fcc.gov/reports-research/reports/measuring-broadband-america/measuring-broadband-america-february-2013.

The survey data are at the state level, which is available from NTIA: https://www.ntia.doc.gov/data/digital-nation-data-explorer#sel=socialNetworkUser&disp=map.

References

Agarwal, V., Mullally, K. A., Tang, Y., & Yang, B. (2015). Mandatory portfolio disclosure, stock liquidity, and mutual fund performance. The Journal of Finance, 70(6), 2733–2776.

Aiyar, A., & Venugopal, S. (2020). Addressing the ethical challenge of market inclusion in base-of-the-pyramid markets: A macromarketing approach. Journal of Business Ethics, 164, 243–260.

Ambrose, B. W., Conklin, J. N., & Lopez, L. A. (2021). Does borrower and broker race affect the cost of mortgage credit? The Review of Financial Studies, 34(2), 790–826.

Arellano, M., & Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. The Review of Economic Studies, 58(2), 277–297.

Babalola, M. T., Bal, M., Cho, C. H., Garcia-Lorenzo, L., Guedhami, O., Liang, H., Shailer, G., & van Gils, S. (2022). Bringing excitement to empirical business ethics research: Thoughts on the future of business ethics. Journal of Business Ethics, 180(3), 903–916.

Balyuk, T., Berger, A. N., & Hackney, J. (2020). What is fueling FinTech lending? The role of banking market structure. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3633907

Bartlett, R., Morse, A., Stanton, R., & Wallace, N. (2022). Consumer-lending discrimination in the FinTech era. Journal of Financial Economics, 143(1), 30–56.

Bayer, P., Ferreira, F., & Ross, S. L. (2018). What drives racial and ethnic differences in high-cost mortgages? The role of high-risk lenders. The Review of Financial Studies, 31(1), 175–205.

Beck, T., Demirgüç-Kunt, A., & Levine, R. (2007). Finance, inequality and the poor. Journal of Economic Growth, 12(1), 27–49.

Berg, T., Burg, V., Gombović, A., & Puri, M. (2020). On the rise of FinTechs: Credit scoring using digital footprints. The Review of Financial Studies, 33(7), 2845–2897.

Black, H., Schweitzer, R. L., & Mandell, L. (1978). Discrimination in mortgage lending. The American Economic Review, 68(2), 186–191.

Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87(1), 115–143.

Bruhn, M., & Love, I. (2014). The real impact of improved access to finance: Evidence from Mexico—Impact of access to finance on poverty. The Journal of Finance, 69(3), 1347–1376.

Buchak, G., Matvos, G., Piskorski, T., & Seru, A. (2018). FinTech, regulatory arbitrage, and the rise of shadow banks. Journal of Financial Economics, 130(3), 453–483.

Butler, A. W., Mayer, E. J., & Weston, J. P. (2022). Racial disparities in the auto loan market. The Review of Financial Studies, 36(1), 1–41.

Carr, J. H., & Megbolugbe, I. F. (1993). The Federal Reserve bank of Boston study on mortgage lending revisited. Journal of Housing Research, 4(2), 277–313.

Corrado, G., & Corrado, L. (2015). The geography of financial inclusion across Europe during the global crisis. Journal of Economic Geography, 15(5), 1055–1083.

De Roure, C., Pelizzon, L., & Thakor, A. (2022). P2P Lenders versus banks: Cream skimming or bottom fishing? The Review of Corporate Finance Studies, 11(2), 213–262.

Demirgüç-Kunt, A., Klapper, L., & Singer, D. (2017). Financial inclusion and inclusive growth: A review of recent empirical evidence. World Bank Policy Research Working Paper 8040.

Demirgüç-Kunt, A., Klapper, L., Singer, D., & Ansar, S. (2022). The Global Findex Database 2021: Financial inclusion, digital payments, and resilience in the age of COVID-19. World Bank Publications.

Dittmar, A., Mahrt-Smith, J., & Servaes, H. (2003). International corporate governance and corporate cash holdings. Journal of Financial and Quantitative Analysis, 38(1), 111–133.

Fairlie, R., Robb, A., & Robinson, D. T. (2021). Black and white: Access to capital among minority-owned start-ups. Management Science, 68(4), 2377–3174.

Federal Communications Commission (FCC). (2010). Connecting America: The National Broadband Plan. Available from: https://transition.fcc.gov/national-broadband-plan/national-broadband-plan.pdf

Federal Deposit Insurance Corporation (FDIC). 2022. Despite COVID-19 pandemic, record 96% of U.S. households were banked in 2021. FDIC: PR-75-2022.

Fernández-Olit, B., Martín Martín, J. M., & Porras González, E. (2019). Systematized literature review on financial inclusion and exclusion in developed countries. International Journal of Bank Marketing, 38(3), 600–626.

Florant, A., Julien, JP., Stewart III, S., Wright, J., & Yancy, N. (2020). The case for accelerating financial inclusion in black communities. McKinsey & Company

Frost, J., Gambacorta, L., Huang, Y., Shin, H. S., & Zbinden, P. (2019). BigTech and the changing structure of financial intermediation. Economic Policy, 34(100), 761–799.

Fuster, A., Goldsmith-Pinkham, P., Ramadorai, T., & Walther, A. (2022). Predictably unequal? The effects of machine learning on credit markets. The Journal of Finance, 77(1), 5–47.

Fuster, A., Plosser, M., Schnabl, P., & Vickery, J. (2019). The role of technology in mortgage lending. The Review of Financial Studies, 32(5), 1854–1899.

Gant, J., Turner-Lee, N., Li, Y., & Miller, J. (2010). National minority broadband adoption: Comparative trends in adoption, acceptance and use. Joint Center for Political and Economic Studies.

Ghent, A. C., Hernández-Murillo, R., & Owyang, M. T. (2014). Differences in subprime loan pricing across races and neighborhoods. Regional Science and Urban Economics, 48, 199–215.

Han, R., & Melecky, M. (2013). Financial inclusion for financial stability. Policy Research Working Papers. The World Bank.

Hannig, A., & Jansen, S. (2010). Financial inclusion and financial stability: Current policy issues. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.1729122

Hau, H., Huang, Y., Shan, H., & Sheng, Z. (2019). How FinTech enters China’s credit market. AEA Papers and Proceedings, 109, 60–64.

Hill, R. P., & Martin, K. D. (2014). Broadening the paradigm of marketing as exchange: A public policy and marketing perspective. Journal of Public Policy & Marketing, 33(1), 17–33.

Hodula, M. (2022). Does Fintech credit substitute for traditional credit? Evidence from 78 countries. Finance Research Letters, 46, 102469.

Howell, S., Kuchler, T., Snitkof, D., Stroebel, J., & Wong, J. (2021). Automation and racial disparities in small business lending: Evidence from the paycheck protection program. National Bureau of Economic Research.

Jagtiani, J., & Lemieux, C. (2017). Fintech lending: Financial inclusion, risk pricing, and alternative information. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3096098

Kempson, E., & Whyley, C. (1999). Kept out or opted out? Understanding and combating financial exclusion. The Policy Press.

Kent, A. H., & Ricketts, L. R. (2022). Racial and ethnic household wealth trends and wealth inequality. Federal Reserve Bank of St. Louis.

Khan, H. R. (2012). Financial inclusion and financial stability: Are they two sides of the same coin? Address by Shri HR Khan, Deputy Governor of the Reserve Bank of India, at BANCON, 1–12.

Khan, U., & Ozel, N. B. (2016). Real activity forecasts using loan portfolio information. Journal of Accounting Research, 54(3), 895–937.

Kim, J. H. (2016). A study on the effect of financial inclusion on the relationship between income inequality and economic growth. Emerging Markets Finance and Trade, 52(2), 498–512.

Ladd, H. F. (1998). Evidence on discrimination in mortgage lending. Journal of Economic Perspectives, 12(2), 41–62.

Lapukeni, A. F. (2015). Financial inclusion and the impact of ICT: An overview. American Journal of Economics, 5(5), 495–500.

Leyshon, A., & Thrift, N. (1995). Geographies of financial exclusion: Financial abandonment in Britain and the United States. Transactions of the Institute of British Geographers, 20(3), 312.

Maskara, P. K., Kuvvet, E., & Chen, G. (2021). The role of P2P platforms in enhancing financial inclusion in the United States: An analysis of peer-to-peer lending across the rural–urban divide. Financial Management, 50(3), 747–774.

Munnell, A. H., Tootell, G. M. B., Browne, L. E., & McEneaney, J. (1996). Mortgage lending in Boston: Interpreting HMDA data. The American Economic Review, 86(1), 25–53.

Omar, M. A., & Inaba, K. (2020). Does financial inclusion reduce poverty and income inequality in developing countries? A panel data analysis. Journal of Economic Structures, 9(1), 37.

Ozili, P. K. (2018). Impact of digital finance on financial inclusion and stability. Borsa Istanbul Review, 18(4), 329–340.

Park, C. Y., & Mercado, R. (2015). Financial inclusion, poverty, and income inequality in developing Asia. Asian Development Bank Economics Working Paper Series, p. 426.

Philippon, T. (2016). The FinTech opportunity. National Bureau of Economic Research.

Philippon, T. (2019). On Fintech and financial inclusion. National Bureau of Economic Research.

Reid, C. K., Bocian, D., Li, W., & Quercia, R. G. (2017). Revisiting the subprime crisis: The dual mortgage market and mortgage defaults by race and ethnicity. Journal of Urban Affairs, 39(4), 469–487.

Reisdorf, B., & Rhinesmith, C. (2020). Digital inclusion as a core component of social inclusion. Social Inclusion, 8(2), 132–137.

Rhinesmith, C. (2016). Digital inclusion and meaningful broadband adoption initiatives. Benton Foundation.

Sanders, C. K., & Scanlon, E. (2021). The digital divide is a human rights issue: Advancing social inclusion through social work advocacy. Journal of Human Rights and Social Work, 6, 130–143.

Schafer, R., & Ladd, H. F. (1981). Discrimination in mortgage loans. MIT Press.

Shultz, C. J., Deshpandé, R., Cornwell, T. B., Ekici, A., Kothandaraman, P., Peterson, M., Shapiro, S., Talukdar, D., & Veeck, A. (2012). Marketing and public policy: Transformative research in developing markets. Journal of Public Policy & Marketing, 31(2), 178–184.

Stock, J., & Yogo, M. (2005). Testing for weak instruments in linear IV regression. Identification and inference for econometric models: Essays in honor of Thomas Rothenberg (pp. 80–108). Cambridge: Cambridge University Press.

Tang, H. (2019). Peer-to-peer lenders versus banks: Substitutes or complements? The Review of Financial Studies, 32(5), 1900–1938.

Villasenor, J. D., West, D. M., & Lewis, R. J. (2015) The 2015 Brookings Financial and Digital Inclusion Project Report. Washington, D.C: The Brookings Institution.

Viswanathan, M., Sridharan, S., Ritchie, R., Venugopal, S., & Jung, K. (2012). Marketing interactions in subsistence marketplaces: A bottom-up approach to designing public policy. Journal of Public Policy & Marketing, 31(2), 159–177.

Wu, Y., & Zhang, T. (2021). Can credit ratings predict defaults in peer-to-peer online lending? Evidence from a Chinese platform. Finance Research Letters, 40, 101724.

Yu, L., & Zhang, X. (2021). Can small sample dataset be used for efficient internet loan credit risk assessment? Evidence from online peer to peer lending. Finance Research Letters, 38, 101521.

Zhong, W., & Jiang, T. (2021). Can internet finance alleviate the exclusiveness of traditional finance? Evidence from Chinese P2P lending markets. Finance Research Letters, 40, 101731.

Acknowledgements

We gratefully acknowledge helpful comments from Hao Liang (the Section Editor) and two anonymous reviewers. Jia and Kanagaretnam thank the CPA Ontario and Schulich School of Business Joint Centre in Digital Accounting Information for its financial support. Kanagaretnam thanks the Social Sciences and Humanities Research Council of Canada (SSHRC) for its financial support.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interest

We hereby state that we do not have any conflicts of interest with the subjects and/or data we use for this research.

Research Involving Human and/or Animal Participants

Our research does not involve human participants or animals.

Informed Consent

No informed consent is applicable in our research, we use all public data.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix A: Variable Definitions

Appendix A: Variable Definitions

P2PPEN | = | The main measure of P2P penetration, which is calculated as the county-year-level successfully funded Prosper loans amount per person |

P2PPEN_CT | = | The second measure of P2P penetration, which is calculated as the county-year-level number of successfully funded Prosper loans per person, scaled by 10,000 |

P2PPEN_RK | = | The third measure of P2P penetration, which is calculated as the rank of a county-year’s P2PPEN across all county-years. This measure minimizes the bias of the prevalence of extreme values of P2PPEN |

P2PPEN_CS | = | The fourth measure of P2P penetration, which is calculated as the county-year-level successfully funded Prosper loans amount divided by the county-year-level commercial bank consumer loans amount |

P2PPEN_TL | = | The fifth measure of P2P penetration, which is calculated as the county-year-level successfully funded Prosper loans amount divided by the county-year-level commercial bank total loans amount |

DI | = | The main proxy for digital inclusion, which measures the county-year-level residential fixed connections of at least 10 Mbps (download) / 1 Mbps (upload) (i.e., high-speed internet) per 1000 households, which is coded from 0 to 5, with 5 indicating the highest level of digital inclusion. Specifically, let X be the number of high-speed internet connections per 1,000 housing units. We denote DI = 0 if X = 0; DI = 1 if 0 < X ≤ 200; DI = 2 if 200 < X ≤ 400; DI = 3 if 400 < X ≤ 600; DI = 4 if 600 < X ≤ 800; and DI = 5 if 800 < X. The tables are based on Federal Communications Commission (FCC) Form 477 data Data Link: https://www.fcc.gov/form-477-census-tract-data-internet-access-services |

INTERNET_ BASIC | = | A measure of the level of basic internet connections (i.e., a measure of residential fixed internet connections of more than 200 kbps per 1000 households). Data are from FCC Form 477. Because the basic connections are prevalent across the U.S., we do not use this directly as the measure for digital inclusion. Instead, this measure is used in a principal component analysis (PCA) |

INTERNET_ SUBSCRIPTION | = | The number of county-year households with high-speed internet subscriptions scaled by county-year population. The data from 2017 to 2020 are queried from the U.S. Census 5-Year American Community Survey (ACS). The data from 2013 to 2016 are queried from the U.S. Census 1-Year ACS. However, the 1-Year ACS only covers census blocks with populations of 65,000 or more, which is why we only use this measure in an auxiliary PCA |

DI_ALT | = | The alternative measure of digital inclusion, which is the first principal component of a factor analysis on three variables, namely DI, T1_INT, and HI_SUB. These three variables used in factor analysis are described in detail in this appendix |

POST | = | The ‘after’ versus ‘before’ indicator variable for the event study utilizing the National Broadband Plan deployed in 2010. Hence, POST = 1 if the year of the observation is the ‘after’ year. In addition, we use two event windows for the analyses. In the first window, the ‘before’ year is 2010 and the ‘after’ year is 2015. In the second window, the ‘before’ year is 2009 and the ‘after’ year is 2015. We use a window of 5 or 6 years to allow for the prolonged effects of internet infrastructure investment |

TREATED | = | The treatment indicator variable for the event study utilizing the National Broadband Plan deployed in 2010. We define a county as ‘treated’ if the county receives the largest quartile of investment as a result of the national broadband plan. A county is defined as ‘not treated’ if the county receives the lowest quartile of investment, including counties that do not receive any funding at all |

EXCLUDED or EXCLUDED_STRICT | = | For the event study, we hypothesize that the treatment effect of national broadband plan investment should be significantly positive for the P2P lending penetration for ex-ante digitally excluded counties – i.e., those counties with poorer broadband infrastructure (i.e., DI ≤ 2), lower GDP per capita (i.e., counties with below-75th-percentile GDP per capita), and lower local banking penetration (i.e., counties with below-75th-percentile bank consumer loans per capita). Hence, EXCLUDED = 1 suggests subsamples of ex-ante excluded counties. In addition, we define EXCLUDED_STRICT as a robustness test, in which we change the criterion to counties with the poorest existing internet infrastructure (i.e., DI ≤ 1) |

DI_HIGH | = | A dummy variable measure of digital inclusion, which equals 1 if DI is above median across all county-years and equals 0 if DI is below median across all county-years |

AA_HIGH | = | A dummy variable measure of county-level Black/African Americans (AA) population, which equals 1 if the county-level proportion of Black/AA population is in the highest quantile, and 0 if it is in the lowest quartile |

HL_HIGH | = | A dummy variable measure of county-level Hispanic/Latino population, which equals 1 if the county-level proportion of Hispanic/Latino population is in the highest quartile, and 0 if it is in the lowest quartile |

TLPC_HIGH | = | A dummy variable measure of county-level commercial bank loans penetration, which equals 1 if the county-level commercial bank total loans per capita is in the highest quartile, and 0 if it is in the lowest quartile |

CSPC_HIGH | = | A dummy variable measure of county-level commercial bank loans penetration, which equals 1 if the county-level commercial bank consumer loans per capita is in the highest quartile, and 0 if it is in the lowest quartile |

BRANCH_HIGH | = | A dummy variable measure of the county-year level commercial bank branch coverage per 1,000 population, which equals 1 if the county-level bank branch per 1000 people is in the highest quartile, and 0 if it is in the lowest quartile |

DEPOSITS_HIGH | = | A dummy variable measure of the county-year level commercial bank total branch deposits per capita, which equals 1 if the county-level deposits per capita is in the highest quartile, and 0 if it is in the lowest quartile |

RATE | = | The county-year mean of Prosper loan borrowers’ interest rates. This is used as a proxy for county-year level of P2P borrowers’ credit risk |

SCORE | = | The county-year mean of Prosper loan borrowers’ credit bureau score |

TERM | = | The county-year mean of Prosper loan terms |

AMOUNT | = | The county-year mean of Prosper loan listing amount in thousands |

INCOME_RANGE | = | The county-year mean of Prosper loan borrowers’ self-disclosed income range |

EMPLOY_LENGTH | = | The county-year mean of Prosper loan borrowers’ self-disclosed months of employment |

REPEATED | = | The county-year percent of borrowers who previously borrowed from Prosper |

REPEATED = 1 | = | A dummy variable used in loan-level regressions, which equals 1 if the loan listing is from a repeated borrower, and zero it the loan listing is from a new borrower |

FUNDED_TIME | = | The time elapsed from the listing creation date to the successful loan origination date |

PARTIAL = 1 | = | A dummy variable that equals 1 if the funded amount is less than the listing amount |

FUND_PERCENT | = | The percentage of funded amount to listing amount |

INCOME_COUNTY | = | The county-year-level personal income per capita in thousands. Source: U.S. Bureau of Economic Analysis (BEA) |

EDU | = | The county-year-level proportion of adult population receiving post-secondary education. Source: U.S. Census 5-Year ACS |

RACE | = | The county-year-level proportion of population that is not White. Source: U.S. Census 5-Year ACS |

GENDER | = | The county-year-level proportion of population that is male. Source: U.S. Census 5-Year ACS |

MARRY | = | The county-year-level proportion of adult population that is currently married. Source: U.S. Census 5-Year ACS |

TLPC | = | The county-year-level total commercial bank loans per capita (Call Report) |

TAPC | = | The county-year-level total commercial bank assets per capita (Call Report) |

CSLPC | = | The county-year-level total commercial bank consumer loans per capita (Call Report) |

LLP | = | The county-year-level commercial bank loan loss provisions scaled by one-year lagged total loans (Call Report) |

LLA | = | The county-year-level commercial bank loan loss allowances scaled by one-year lagged total loans (Call Report) |

NCO | = | The county-year-level commercial bank net loan charge-offs scaled by one-year lagged total loans. Net charge-offs equal to charge-offs minus recoveries (Call Report) |

NPL | = | The county-year-level commercial bank non-performing loans scaled by one-year lagged total loans (Call Report) |

T1R | = | The county-year-level commercial bank Tier 1 capital ratio (Call Report) |

UNEMPRATE | = | The county-year-level unemployment rate. Source: U.S. Bureau of Labor Statistics |

HPI | = | The county-year-level housing price index. Source: Federal Housing Finance Agency |

LNGDP | = | The natural logarithm of county-year-level GDP per capita. Source: U.S. Bureau of Economic Analysis |

ALT_INFO | = | A state-year-level indicator variable for the availability of alternative information. This proxy is constructed by taking the sum of two percentages provided by National Telecommunications and Information Administration (NTIA), including the percentage of 15 + persons using online financial services and the percentage of 15 + persons using online shopping. The data are available only at the state-year level for years 2013, 2015, 2017, and 2019 Source: NTIA, United States Department of Commerce. https://www.ntia.doc.gov/data/digital-nation-data-explorer#sel=socialNetworkUser&disp=map |

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Jia, X., Kanagaretnam, K. Digital Inclusion and Financial Inclusion: Evidence from Peer-to-Peer Lending. J Bus Ethics (2024). https://doi.org/10.1007/s10551-024-05689-w

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10551-024-05689-w

Keywords

- Digital inclusion

- Financial inclusion

- Ethics

- Public policy

- Social responsibilities

- FinTech

- Peer-to-peer lending

- Alternative information