Abstract

Abundant research exists on the restructuring operations of large, publicly listed firms. However, little is known about the antecedents of layoffs in small and medium-sized enterprises (SMEs). Building on the stakeholder salience theory and arguments on social proximity, this study posits that SMEs are less likely to dismiss employees than large firms. We argue that the existence of strong interpersonal ties between employees and managers makes it hard for SME owners and managers to dismiss employees. Empirically analyzing a large sample of European Union firms, the results confirm that the likelihood of layoffs is lower in SMEs than in large firms, even when performance declines.

Similar content being viewed by others

Introduction

There is a longstanding scholarly interest in studying downsizing and layoffs in business ethics and management studies. Among all the decisions firms take, downsizing and layoffs are one of those that have the greatest consequences for employees (Karp & Weaver, 1991; Kim, 2014). Since these operations are becoming increasingly common (Cascio, 1993; Cascio et al., 2021), questioning their ethicality is paramount (Orlando, 1999). Managers mostly downsize or lay off due to a decline in performance (Cascio, 1993). By cutting jobs and the associated costs, they intend to restore profits (Cascio, 2010). Kim (2014) noted that layoffs could be a “necessary evil” because, in some situations, workforce reduction is the only way the firm can survive. Nonetheless, most downsizing operations do not bring the expected results, thus raising questions about factors that make or prevent managers from laying off or downsizing (Cascio et al., 2021). Hence, layoffs reflect a trade-off between the firm’s moral obligations toward employees and its legal and economic obligations toward other stakeholders, such as the shareholders. To understand this trade-off, it is essential to consider the diversity across firms and their managers and firms’ territorial embeddedness (Amato et al., 2023).

Recent research shows that layoffs and downsizing decisions are largely driven by industry norms and imitation among firms. Generally, large and publicly listed firms downsize when their rival firms downsize (Cascio et al., 2021). It prevents them from facing potential criticism from shareholders and alleviates the pressure from financial markets. In other words, large firms pay special attention to their shareholders’ interests when their performance declines. However, it is unclear whether all types of firms are equally sensitive to such external pressures when it comes to layoffs decisions.

Previous studies on downsizing and layoffs mostly focused on large and publicly listed firms, overlooking the small and medium-sized enterprises (SMEs)Footnote 1 (Block, 2010; Brauer & Laamanen, 2014; Cascio, 1993; Cascio et al., 2021; Freeman & Cameron, 1993; Jung, 2016). Notably, SMEs are not “miniature forms” of large firms, and the drivers of decisions often differ between SMEs and large firms (Torrès & Julien, 2005). Along with the availability of strategic resources, SMEs and large firms differ based on the nature and influence of stakeholders in the decision-making process (Russo & Perrini, 2010). Our work aims at examining whether employment in SMEs is more resilient to external pressures, like shareholders’ profits expectations, than it is in larger firms. We posit that there are stronger social ties between SMEs’ managers and employees than between larger firms’ managers and employees that contribute to counterbalance these external pressures. In addition, since SMEs play a vital role in value creation and employment generation, gaining insight into their layoff decisions becomes imperative for decision-makers and public policy.Footnote 2

Do SMEs downsize? The vast literature on restructuring operations has relatively overlooked SMEs. This is likely because the planned nature of downsizing does not fit with SMEs’ simple, more horizontal structure. Often, downsizing and restructuring operations are associated with strategic repositioning. That is, some activities are abandoned, and others are reinvested (DeWitt, 1998). Assuming that SMEs are not highly diversified, downsizing may not describe the adjustments they make to their already “small” structure. However, SMEs sometimes dismiss employees, even if it may be a one-off decision and not strategically planned (Camacho-Miñano et al., 2015; Varum & Rocha, 2013). In this study, we do not claim that SMEs “downsize” in the same way large firms do. We assert that SMEs lay off employees for reasons similar to those of large firms, such as a decline in performance, but their decision may also be driven by factors more specific to SMEs.

Building on the stakeholder salience theory (Mitchell et al., 1997), we propose to compare SMEs and large firms based on the determinants of their layoff decisions. We utilize a large sample of firms from the European Union drawn from the Amadeus database for this purpose. Specifically, we consider the social proximity between the owner-managers of SMEs and their employees to argue that SMEs have a lower propensity to cut jobs than large firms. Having a small number of employees, the social proximity between employees and owner-managers in SMEs is stronger than that in large, more complex firms. Social proximity refers to the existence of interpersonal ties among the members of an organization. It is known to influence SMEs’ strategic behavior as well as performance (Adjei et al., 2016; Lähdesmäki et al., 2019; Ooms et al., 2018). However, its potential impact on SMEs’ layoffs has not been explored, although previous studies explored this aspect in the context of family firms (Amato et al., 2023; Kim et al., 2020).

In privately owned SMEs, employees are arguably more salient stakeholders than in larger, publicly listed firms. Moreover, shareholders are commonly represented by a single owner-manager whose decisions are not significantly affected by external pressures (Lähdesmäki et al., 2019). Put simply, managers in SMEs “care” more about their employees than large firms’ managers. Thus, we view the social proximity between SME managers and employees as a factor reducing the likelihood of layoffs. Managers in large, complex organizations have generally never met the people they lay off because such firms are often multi-entity organizations or operate in various countries. Conversely, owners and managers in SMEs have generally met and worked with the employee they lay off; that employee is embedded in the same geographic environment. This greater social proximity contributes to shield employees from layoffs when performance declines as it is harder for SMEs’ managers to dismiss individuals to which they feel close to. Our study contributes to the existing literature on the role of social proximity in SMEs and highlights its influence on important decisions such as layoffs.

Our results confirm that, compared to large firms, SMEs are less likely to dismiss employees. We also show that SMEs are less likely to lay off following a decline in performance than large firms. This finding is consistent with the arguments on social proximity and other arguments emerging from the liability of smallness framework (Aldrich & Auster, 1986; Lai et al., 2016). We thus observe results consistent with the idea that layoff decisions in SMEs are based on a consideration of the interests of the different stakeholders that is different from what is observed in large firms. The remainder of this paper is organized as follows. First, we build a theoretical framework of the stakeholder salience theory and arguments on social proximity. Next, we describe our methodology. Then, we present the results of our univariate and multivariate analyses. Finally, we discuss the findings and present our conclusions.

Theoretical Framework

Layoffs in SMEs and Social Proximity

The stakeholder salience theory describes how managers’ perception of a situation makes them give preferential attention to a particular group of stakeholders (Mitchell et al., 1997). Stakeholders are broadly defined as “any group or individual who can affect or is affected by the achievement of the organization’s objectives” (Freeman, 1984, p. 46). The identification of stakeholders and their salience to the organization depends on three factors: the stakeholder’s power over the organization, the legitimacy of their claims upon the organization, and the urgency of their claims. This last factor lends dynamism to the stakeholder salience theory because the stakeholder’s salience strongly depends on contextual issues and the need of the manager to pay immediate attention to the situation (Mitchell et al., 1997). Regarding the legitimacy of stakeholders’ claims, Neville et al. (2011) stress that the claim’s moral (not pragmatic) legitimacy determines whether managers perceive it as being urgent. They state that “a morally legitimate claim should be attended to because it is the right thing to do and because other stakeholders are likely to take up the cause and pressure the organization if not addressed” (p. 363). Essentially, both stakeholder salience and its influence on managerial decisions depend on how managers perceive the environment.

Firms are generally embedded in their environment. That is, they have social ties and interactions with the various stakeholders that populate their environment (Granovetter, 1985). These ties and interactions become stronger when stakeholders are geographically proximate to the firm (DiMaggio & Powell, 1991). Local embeddedness is paramount for SMEs’ business relations because owner-managers and community members interact daily, thus affecting the decision-making process (Lähdesmäki & Suutari, 2012). Any decision taken by an SME is influenced by its stakeholders, and these decisions impact the stakeholders depending on their salience in the SME (Lähdesmäki et al., 2019). In other words, the social proximity between SMEs’ owner-managers and their local community is a strong driver of business decisions (Pallares-Barbera et al., 2004). Local norms, cultural practices, economic needs, and resources all contribute to shape owner-managers’ decisions. For instance, Courrent and Gundolf (2009) show that social proximity between the owners of rival micro-enterprises increases empathy toward competitors and reduces the frequency of aggressive business decisions, such as a price competition. Hedge and Tumlinson (2014) report that venture capitalists are more likely to select startups when they are socially proximate to founders.

Since only a few people work in an SME, the employees and owner-managers know each other better than in large firms. Most SMEs conduct their activities in a single building, unlike large firms operating in multiple locations. Owing to a greater degree of proximity, the managers and owners of SMEs “know” their employees better. Adjei et al., (2016, p. 307) studied how the presence of multiple family members affects an organization and stated that “it is in SMEs that we can expect extensive interactions among family members because of the daily face-to-face contacts. We do not play down the possible face-to-face contacts among family members in large firms, but we believe, however, that the impact of two or three family members will not be as influential as compared with in smaller firms.”

We build on this argument and extend it to the relationship between employees and owner-managers in SMEs. Indeed, day-to-day contact between employees and owner-managers is more frequent in SMEs than in large firms. SMEs’ owner-managers are not only close to their employees during work hours but also outside of work. Their family circles are connected, they shop at the same supermarket, their children go to the same school, and they join the same sports club. Due to this great sense of similarity between employees and owner-managers, we consider employees as a particularly salient stakeholder group in the SME’s environment (Pallares-Barbera et al., 2004). Cox (1998) asserts that the relations among the members of a community are based on trust and reciprocity. Thus, one can say that the decisions SME owner-managers take potentially impacting employees, such as potential layoffs, are influenced by social proximity. In terms of the stakeholder salience theory, employees’ vulnerability to layoffs is a factor of moral legitimacy. The severity of the consequences of layoffs for employees raises the urgency of attention for managers. Whenever layoffs are considered, the salience of employees, a category of stakeholders, increases for SME managers due to social proximity. The economic and social consequences of layoffs are severe not only for the laid-off employees but also for other people, firms, and economic activities in the same region (Orlando, 1999).

We propose that stronger social proximity in SMEs, than in large firms, acts as an employee protection force, reducing the likelihood of layoffs. Interestingly, Landier et al. (2009) proposed that social interactions associated with geographical proximity are a strong employee protection factor. Specifically, they study large, multi-entity organizations and observe that layoffs are less likely to occur in divisions geographically close to the headquarter and those in less populated regions. Studies on family businesses also present similar results. Block (2010), Kim et al. (2020), and Amato et al. (2023) show that family firms are less likely to downsize or cut jobs than non-family firms. These authors built on arguments close to ours and stressed that the territorial embeddedness of family firms and the greater proximity between such firms and their community explain the lower propensity to downsize. A relative consensus exists on the belief that strong social ties between firms and their employees reduce the likelihood of layoffs. Applying these arguments to the context of SMEs, we propose the following hypothesis:

Hypothesis 1

The Likelihood of Layoffs is Lower in SMEs than in Large Firms

Layoffs in SMEs When Performance Declines and There are Internal Constraints

Firms seek to create value and achieve profitability. Profits can be generated in two ways: by increasing sales and decreasing costs. Profits increase when sales grow faster than costs. Conversely, when costs decrease faster than sales, the firm makes profits. Often, firms have greater control over their costs than their sales. Therefore, when sales decrease, firms generally dismiss employees to reduce the corresponding fixed costs and restore profitability. This phenomenon explains the increasing number of restructuring operations over the past 40 years, particularly among large and publicly listed firms (Cascio, 1993, 2010). However, now it is well-established that the expected benefits of layoffs and other restructuring actions are rarely achieved in practice because the “hidden” costs associated with such decisions are underestimated (Bruton et al., 1996; Cascio, 2010; Cascio et al., 2021; Morris et al., 1999). When firms lay off employees, they lose human capital and team cohesion and propagate insecurity among the remaining employees. These repercussions largely offset the benefits of reduced payroll expenses (Cascio et al., 2021). The sustained benefits of restructuring and downsizing depend on the size and magnitude of operations (Brauer & Laamanen, 2014) and are generally seen in declining industries (Badunenko, 2010).

Internal considerations may play a stronger explanatory role in SMEs’ layoffs than those in large firms, considering that the most salient characteristic of SMEs is their size. Many SMEs are very small or “micro” firms with fewer than ten employees (OECD, 2018). Thus, the decision to dismiss one person in an SMEFootnote 3 has potentially severe effects. Employees of SMEs are often more flexible and better multitaskers than those of large organizations, where their activities are more professional and structured (Covin & Slevin, 1988; Lechner & Leyronas, 2009; Stevenson et al., 1985). SME employees also have a greater understanding of their organizations’ key characteristics and processes because tacit knowledge is diffused more easily in small organizations (Ngah & Jusoff, 2009; Pérez-Iuño et al., 2016). Considering this loss of tacit knowledge, layoffs should be carefully considered in SMEs. Furthermore, SMEs lack organizational slack, and layoffs dramatically reduce slack (Bradley et al., 2011; Cyert & March, 1963; Penrose, 1959). The tasks performed by dismissed employees are reallocated to the remaining employees, reducing the firm’s ability to face external shocks or seek new business opportunities. Layoffs are generally the firm’s intermediate steps in restoring profitability. However, the firm will not be able to successfully implement the necessary turnaround actions if its innovation capacity is hampered owing to the drastically reduced organizational slack (Mayr et al., 2017). Put simply, the organizational disruption that layoffs cause would likely be higher in SMEs than large firms. It can be best assessed by SME managers because SMEs are “simple” organizations. As Lai et al., (2016, p. 115) argue, SMEs “tend to operate with less organizational slack and require the minimum numbers to be able to operate effectively, thus inhibiting opportunities to reduce their workforce.” This argument suggests that, compared to large firms, SMEs are less likely to dismiss employees when performance declines.

Many studies show that a decline in performance increases the likelihood of layoffs (Cascio, 1993, 2010; Cascio et al., 2021; Guthrie & Datta, 2008). However, the “decline in performance” is a broad phenomenon. Previous research has identified two main aspects of performance decline that lead to layoffs. First, Cascio (1993, p. 96) states that the most common reason for downsizing is that firms are “saddled with more debt than ever.” Since the cost of debt is fixed, the firm’s chances of bankruptcy increase when they struggle to cover their debt requirements. The solution for this situation is to reduce the operating fixed costs, such as salaries, and thus cut jobs. Firms with excessive debt and insufficient cash flows to cover financial expenses tend to cut jobs. Second, deteriorating operating conditions and continuous drop in sales cause a sharp decline in profits. This effect is more pronounced since firms have high operating costs owing to the operating leverage effect (Chen et al., 2019; Grau & Reig, 2021). In such situations, managers often reduce the fixed operating costs, such as salaries (Cascio, 2010). Thus, it is not surprising that declining demand and lower sales are among the most common reasons for layoffs (Kang & Shivdasani, 1997).

A decline in performance likely triggers managers’ propensity to lay off employees. However, whether they actually dismiss employees depends on the salience of stakeholders. When the performance of large, publicly listed firms declines, the shareholders are among the most salient stakeholders since such firms seek to create value for their shareholders (Cascio et al., 2021; Mitchell et al., 1997). Conversely, managers are the shareholders of manager-owned SMEs, and other stakeholders, particularly employees, are more salient due to social proximity. Thus, we consider spatial proximity as a force that prevents SME owner-managers from immediately dismissing employees when performance declines, unlike the managers of large firms. This consideration does not imply that SME owner-managers will never dismiss employees when performance drops. We believe that the degree of decline in performance required for managers to consider layoffs as “morally” acceptable is higher in the case of SMEs than in the case of large firms (Kim, 2014). The community in which the SME is embedded can accept the social and economic costs associated with layoffs only if they are used as a last resort. Thus, we propose the following hypothesis:

Hypothesis 2

The Likelihood of Layoffs in SMEs Increases when Performance Declines but Less so than in the Case of Large Firms

Methodology

Sample

Our study focuses on the European context. More specifically, it focuses on these countries in the European Union: Austria, Belgium, Germany, Greece, France, Finland, Italy, Luxembourg, Netherlands, Portugal, Spain, and Sweden. Together, these countries have a population exceeding 350 million, close to the population of the US. These countries are developed economies that have been a part of the European Union since at least 1995 and they are not severely affected by institutional voids in the labor market, unlike other geographical regions (Belenzon & Tsolmon, 2016; Doh et al., 2017). SMEs are an essential part of these economies because they generate two out of three jobs (European Commission, 2020). Thus, the European context is vast and promising; it can provide useful insights on SMEs’ layoff decisions. Moreover, our international sample consists of firms operating in legal environments that have different degrees of strictness on employment rights protection. This factor increases the generalizability of our results.

We use panel data to explore the determinants of layoffs in SMEs. This is because layoff decisions rely on business conditions, but their consequences can only be observed in subsequent periods. With panel data, we can also control for unobserved heterogeneity across firms using firm- and year-fixed-effects regression techniques. We use the Amadeus database to collect accounting and financial data. Amadeus is a well-known database distributed by Bureau Van Dijk and is commonly used in management research. It comprises data of all European countries and provides detailed accounting and financial information on publicly listed and privately held firms. However, a salient drawback is that its coverage quality strongly depends on the country considered. Countries that have strong legal requirements for financial disclosure allow for a great coverage of all types of firms. In other countries, the coverage of small firms is poor, particularly that of the smallest firms (Kalemli-Özcan et al., 2019). Appendix A presents the descriptive statistics based on country.

We collect data for the period 2010 to 2019 and include both privately held and publicly listed firms. Amadeus has a ten-year extraction limit. Therefore, our results should not be significantly affected by the 2008 financial crisis. Furthermore, we excluded firms in the finance industry from the sample. Resultingly, our sample consists of 250,832 firms that correspond to 1,423,595 firm-year observations, after taking into account missing values. The sample includes firms that go bankrupt and leave the sample at some point. Thus, our results may not be excessively biased by the survival bias.

Variables

Dependent Variable

We first investigate whether the likelihood of layoffs is lower in SMEs than in large firms. Thus, we create a dummy variable that equals one if the number of employees decreases between two consecutive years and equals zero otherwise. We acknowledge that this approach has certain drawbacks. For instance, we do not capture voluntary turnover, which is the individual’s decision and not of the firm. However, we do not consider voluntary turnover a severe issue because new employees are hired rather quickly to replace those who leave the firm (Li et al., 2022).

One could argue that a dummy variable is a coarse measure of workforce reduction. Thus, we use the magnitude of workforce reduction as an alternative dependent variable in our estimations, and similar results arise.

Independent Variable

Firm size is the independent variable in our empirical analysis. Specifically, we create a dummy variable (non-SME dummy) to classify firms as SMEs that equals to one if a firm is not an SME and zero if a firm is an SME. Firms are defined as SMEs based on the criteria set forth by the European Commission. That is, firms are SMEs if they have fewer than 250 employees and either sales lower than €50 million or total assets lower than €43 million (European Commission, 2020). This definition also regards that affiliated firms can have larger business entities such as business groups (BGs). Many firms in Western Europe are not isolated, standalone entities but belong to BGs. In our context, a BG comprises firms that are controlled by a head firm through a network of equity ties (Almeida & Wolfenzon, 2006; Cainelli et al., 2020; Iacobucci & Rosa, 2005; Khanna & Palepu, 1997). The resulting organizational form is often pyramidal, with the head firm at the top, centralizing control and resource allocation among the affiliated firms. A salient feature of BGs is the existence of internal capital and labor markets that allow the transfer of financial resources and employees across the affiliated firms (Carney et al., 2011; Holmes et al., 2018; Khanna & Palepu, 1997). In Western Europe, BG affiliations are standard rather than an exception, and most firms in France and Italy belong to a BG (Belenzon et al., 2013; Hamelin, 2011). In our sample, 38.6% of the observations correspond to standalone firms and the rest to BG-affiliated firms. BG affiliations must be considered in our study because BGs’ internal labor market facilitates the transfers of employees across the affiliated firms. Thus, a reduced number of employees in a BG-affiliated firm does not necessarily imply layoffs but transfers to other companies. Hence, the determinants of employee layoffs in BG-affiliated firms are likely different and do not have the same organizational and social impacts. We consider the study of layoffs in BG-affiliated firms out of the scope of this study and simply present the BG subsample’s results for comparison purposes.

We acknowledge a potential endogeneity issue between our dependent and independent variables because both use the number of employees. To mitigate this issue, we also conduct our estimations using alternative measures of size. Specifically, we use the natural logarithms of the number of employees, sales turnover, and total assets as the alternative independent variables. The results obtained with these variables are largely similar.

Moderating Variables

As stated in Hypothesis 2, we investigate whether the likelihood of layoffs in SMEs depends on declining performance. We use two measures for performance decline: the drop in sales and the status of financial distress. Most studies on downsizing and layoffs emphasize these two measures of performance decline (Cascio, 2010; Cascio et al., 2021). To represent the drop in sales, we first calculate the annual percentage change in sales. Then, we create a dummy that equals one if sales decrease between two consecutive years and let this dummy variable interact with the annual percentage change in sales, and zero otherwise. We create another dummy that equals one if sales increase between two consecutive years and let it interact with the annual percentage change in sales, and zero otherwise. We include these two interaction terms as independent variables to distinguish between the impact of an increase in sales and that of a drop. This step ensures that we consider that the slope of the relationship between employment and sales growth may differ for positive and negative changes in sales. The related literature highlights that fixed costs, such as salaries, do not change symmetrically with the change in sales (Anderson et al., 2003; Chen et al., 2019).

We include a dummy variable representing the firm’s financial distress. As stated earlier, the most common reason behind layoffs is that firms are burdened with more debt than ever (Cascio, 1993). When firms struggle to cover their financial costs, managers tend to reduce the operating fixed costs, thus cutting jobs. That is, firms with excessive debt and insufficient cash flows are likely to downsize. We follow Asquith et al. (1994) and consider firms financially distressed if these two conditions are met. First, they must be overleveraged, and their financial leverage ratio (short-term financial debt plus long-term financial debt divided by total assets) is in the last decile of their industry. Second, they can hardly cover their financial expenses. That is, their interest coverage ratio (EBITDA divided by financial expenses) is either lower than 0.8 in a given year or lower than one during two consecutive years. We also control for sales growth. As stated earlier, deteriorating operating conditions and sales drops considerably reduce profits. Owing to the operating leverage effect, this effect is stronger because firms have high operating costs (Chen et al., 2019; Grau & Reig, 2021). In this situation, managers often choose to reduce fixed operating costs, such as salaries (Cascio, 2010). We include the interaction terms between these two moderating variables and the size variable in our estimations.

Control Variables

We include the following control variables to capture firm-level heterogeneity. First, we include a control variable, age, to control for the impact of the liability of newness (Aldrich & Auster, 1986; Stinchcombe, 1965). Age is the natural logarithm of the number of years the firm has been operating. Second, we control for the firm’s asset tangibility because firms with more tangible assets have more rigid cost structures and fixed costs (Grau & Reig, 2021). Asset tangibility is the ratio of tangible assets to the total fixed assets. Third, we control for the firm’s cash holdings. Here, cash represents financial slack and a buffer against external risks (Cyert & March, 1963). Firms with large cash holdings can absorb economic downturns more easily and can avoid or delay layoffs. Fourth, we include operating working capital, a measure of recoverable slack, in our control variables (Bradley et al., 2011). The operating working capital is calculated as inventories plus accounts receivable minus accounts payable divided by sales. During economic contractions, firms may reduce their operating working capital to release cash from their operating cycles (Hill et al., 2010). Fifth, we include the difference between a firm’s profitability and the annual industry mean profitability. Profitability is calculated as the operating income on total assets ratio. Indeed, if a firm is more profitable than the industry standard, a point-in-time decrease in sales may not be sufficient to trigger layoffs.Footnote 4

We also include three industry-level control variables. The first is the annual industry mean percentage rate of change in the number of employees that controls for the impact of the industrial context. This is particularly important because imitation effects concerning layoffs exist between firms operating in the same industry (Cascio et al., 2021). To determine firms’ industries, we use the four digits of Standard Industrial Classification (SIC) codes. The second industry-level control variable is the annual industry percentage change in sales. This variable accounts for the growth and dynamism in a given industry. Third, we include the Hirschman-Herfindahl index to control for the degree of industry competition, which likely influences the likelihood and magnitude of layoffs. Importantly, we calculate the Hirschman-Herfindahl index as the annual sum of the squared market shares of firms in a given industry and in a given country. Calculating the index at the country and industry levels at the same time helps control for national policies that can encourage economic activity in specific industries.

Finally, we include four country-level control variables to account for (1) the strictness of labor rights protection because it is a crucial determinant of layoffs’ likelihood and magnitude (Botero et al., 2004) and (2) the institutional context. We first use the OECD’s index of employment protection to measure the strictness of labor rights protection, covering individual and collective dismissals.Footnote 5 Interestingly, this index can be included in all firm-fixed effects estimations because it is calculated annually. Second, we include the density of unionization (annual percentage of a country’s unionized employees) which is also provided by OECD. Third, we control for rule of law, which measures the strength of institutions. Rule of law reflects the strength of institutions and the rights of citizens. Fourth, we control for (natural logarithm of) GDP per capita, an indicator of economic development. Rule of law and GDP per capita are important to account for the heterogeneity of institutional contexts in our dataset that are important factors of business development and organization (Haggard et al., 2008). Rule of law and GDP per capita are taken from the World Bank. The remaining firm-, industry-, and country-level heterogeneity is absorbed by the firm-fixed effects we use in our regressions. All independent and control variables are lagged by one year with respect to the dependent variable. Moreover, all variables are winsorized at the first and ninety-ninth percentiles to mitigate the influence of outliers.

Results

Univariate Analysis

Table 1 presents the descriptive statistics of the variables. Of our observations, 34.6% correspond to layoffs, a figure that highlights the prevalence of layoffs in our sample. In firms where the number of employees is declining, on average, 5.1 employees are dismissed (median 2.0). SMEs account for 38.6% of our observations. This figure is not surprising because up to 50% of all firms in Europe are affiliated with a BG (Belenzon et al., 2013), and BG-affiliated firms are not considered SMEs, even if they are small, based on the European Commission’s definition. Furthermore, 1.8% of our observations correspond to financially distressed firms, which is low compared to previous studies reporting nearly 5% (Hill et al., 2010). The mean sales growth rate is 10.9% (median, 3.1%). The mean age of the firms is 22 years (median, 19). On average, tangible assets are 73.6% of the total assets, cash holdings (financial slack) are 10.1% of total assets, and operating working capital (recoverable slack) is 27.2% of the total assets. Appendix B presents the results of the mean comparison t-tests between SMEs and non-SMEs. As can be observed, SMEs and non-SMEs differ in every aspect. SMEs grow slower, hold more tangible assets, are less financially distressed and younger, and have more cash and working capital than non-SMEs. More importantly, we observe that the likelihood and magnitude of layoffs are lower in SMEs than in non-SMEs. This preliminary observation aligns with Hypothesis 1.

Table 1 presents the correlation coefficients as well. The likelihood of layoffs is positively correlated with financial distress, age, and recoverable slack but negatively correlated with sales growth, asset tangibility, and financial slack. More importantly, the likelihood of layoffs is negatively correlated with an SME, thus corresponding with Hypothesis 1. We calculate the variance inflation factors (VIFs) to check for multicollinearity. The highest VIF is 1.73, and the mean VIF is 1.16. A VIF above five denotes a serious concern of multicollinearity, but these numbers are well below that threshold (Hair et al., 2021).

Multivariate Analysis

Determinants of the Likelihood of Layoffs

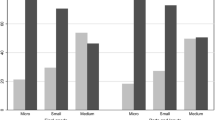

In this section, we use conditional firm- and year-fixed effects logistic regressionsFootnote 6 to test Hypotheses 1 and 2. The main benefit of conditional firm- and year-fixed effects logistic regressions is that they consider unobserved time-invariant heterogeneity at the firm, industry, and country levels. Table 2 displays the results for the full sample without (Model 1) and with the interaction effects. We observe that the coefficient of the non-SME dummy is positive and statistically significant. Therefore, the likelihood of layoffs is higher in non-SMEs than in SMEs, supporting Hypothesis 1. In terms of economic significance, the coefficient of the non-SME dummy is 1.036, implying that the odds of dismissals in non-SMEs is exp(1.036) = 2.818 times that in non-SMEs. In other words, a big difference exists between SMEs and non-SMEs concerning the likelihood of layoffs.

Model 2 in Table 2 shows that negative sales growth significantly and negatively affects the likelihood of layoffs. As expected, the greater the decline in sales, the higher is the likelihood of layoffs. However, this effect is stronger in non-SMEs than in SMEs, as shown by the negative interaction term between negative sales growth and the non-SME dummy variable. Thus, SMEs are less likely to downsize when sales decline than non-SMEs, supporting Hypothesis 2. The coefficient of financial distress is positive and statistically significant, suggesting that financially distressed firms are more likely to downsize. The coefficient of the interaction term between financial distress and SME size is negative but not statistically. This result is unexpected and does not support Hypothesis 2. We observe that SMEs’ stance on layoffs differs from when sales decline to when they are financially distressed. Internal constraints and social proximity seem to protect employees from layoffs but only up to a certain degree of performance deterioration, characterized by financial distress.

As stated earlier, using a dummy variable to measure the firm’s size has certain drawbacks. Thus, we also use three alternative measures of size in our estimations: the natural logarithm of the number of employees, natural logarithm of sales turnover, and natural logarithm of total assets. Table 3 presents the results of using these alternative measures. In every model, the firm’s size is positively associated with the likelihood of layoffs, confirming that layoffs are more likely to occur in large firms than in small firms (Hypothesis 1). The interaction term between negative sales growth and size is negative and statistically significant in every model, confirming that large firms are more likely to downsize than small firms when sales decline (Hypothesis 2). We also observe that financially distressed large firms are more likely to downsize (versus SMEs). These findings are different from those obtained in Table 2. Therefore, we do not find consistent empirical evidence regarding the role of financial distress in relation to Hypothesis 2.

Magnitude of Layoffs

In the previous section, we consider only the likelihood, not the magnitude, of layoffs. It will be interesting to investigate whether the magnitude of layoffs also differs between SMEs and non-SMEs, as has been done in other studies on layoffs (Block, 2010; Kim et al., 2020). Thus, we use a different dependent variable, the number of dismissed employees, to represent the magnitude of layoffs and rely on Tobit regression models, as in Kim et al. (2020). We consider only those observations in which the workforce decreased. Table 4 presents the results of the Tobit regressions with the SME dummy and Table 5 presents the results with the three alternative measures of size. We consistently observe that large firms dismiss more employees than small firms. We also observe that large firms downsize more than small firms when their sales decline (except for when the firm’s size is measured by its sales) and they are financially distressed. Overall, the results obtained in relation to the likelihood of layoffs further extend to the magnitude of workforce reduction. In the unreported results, we use Heckman’s two-step selection model to ensure that the selection bias does not affect our results. Specifically, we use the same approach as in Block (2010). The results, available upon request, are similar to those shown in Table 5.

Robustness Test

We conduct propensity score matching (PSM) as a robustness test to increase the credibility of our findings. We intend to match those SMEs and non-SMEs that share similar observable characteristics and compare the likelihood and magnitude of layoffs between the SME group and non-SME group. Since firms are matched based on a set of observed characteristics, the results are less affected by endogeneity issues. This aspect is important in non-experimental designs (Dehejia and Whaba, 2002). PSM consists of two steps. First, a logistic regression is performed, in which the dependent variable is a binary outcome representing the “treatment.” In this case, the treatment is the fact that a firm is an SME. Therefore, we create a binary variable that equals one if a firm is an SME in a given year and equals zero otherwise. This dummy variable is regressed over the following variables: age, profitability (operating income divided by total assets), growth in sales, tangibility, financial slack, recoverable slack, leverage (short-term financial debt plus long-term financial debt divided by total assets), and two sets of dummy variables to account for the country and industry affiliation (using two-digit SIC codes). These factors are known to explain the dummy. Then, the logistic regression model is used to calculate the propensity score of the firm’s decision to cut jobs. The second step is to match SMEs and non-SMEs that have the same ex-ante characteristics, and thus, the same propensity to be SMEs. Then, the mean of the outcome (likelihood of layoffs) is calculated for the group of treated firms (those that cut jobs) and the control group (those that did not cut jobs). Next, a standard mean comparison test is performed between the treated and control groups to assess whether the difference between the two groups is statistically different from zero. We perform the procedure for each year starting from the year 2011.

Appendix C presents the results of the logistic regressions. In Table 6, we present the results of the PSM procedure, which was conducted using Stata 16 and the “psmatch2” command with the standard “common” and “no replacement options. As can be seen, the likelihood and magnitude of layoffs in every year is considerably smaller in SMEs than in non-SMEs. More specifically, the likelihood of layoffs is 3.4% –5% smaller in SMEs than in non-SMEs, and when SMEs downsize, they dismiss nearly 40% fewer employees than non-SMEs. Once again, Hypothesis 1 receives strong empirical support, and the difference between SMEs and non-SMEs is also meaningful in terms of economic significance. It is noteworthy that we have more non-SMEs than SMEs for each year, which is important to ensure that matching is done correctly.

In PSM, an ex-post test ensures that matching is correctly performed for every matching variable. Specifically, one should ensure that, for every matching variable, the difference between the treated and control groups, is close to zero. Appendix D shows the results of this ex-post test for the year 2011. The results were completely comparable for the other years. As can be seen, the median and mean biases after matching are below 5%, which is commonly considered the correct degree of matching.

Conclusion

Discussion

This study intended to investigate whether SMEs are less likely to dismiss employees than large firms. We built on the stakeholder salience theory to propose that the decision to cut jobs is complex, and layoffs are less likely to occur in SMEs than in large firms owing to greater social proximity between SME employees and owner-managers. The empirical analysis confirmed that SMEs are less likely to dismiss employees than large firms. We also predicted that SMEs are less likely to downsize than non-SMEs when performance declines. A drop in performance creates a conflict in managers’ obligations toward the stakeholders. On the one hand, managers must take measures to create value for the shareholders, and layoffs present an opportunity to restore profitability. On the other hand, they cannot ignore the consequences of layoffs for their employees, particularly when the employees live in the same community as the manager. Moreover, both groups of stakeholders matter considerably in layoff decisions.

We argued that SMEs’ owner-managers care more about their employees than the case in large firms. Additionally, SMEs lack the internal resources required to restore profitability when performance declines, such as slack (Lai et al., 2016). Retaining employees when performance declines is a way to preserve innovation capacity that can be crucial for the firm’s survival. Thus, layoff-related economic arguments do not contradict the social considerations in the case of SMEs. We argued that employees are more salient stakeholders for SMEs. We indeed confirm that SMEs with declining sales are less likely to dismiss employees, which once again aligns with our theoretical arguments. However, the results regarding financial distress are less convincing because we obtained contradictory results. Notwithstanding the fact that the lack of strong results on financial distress could reflect empirical limitations, it seems useful to acknowledge the limitations of our theoretical arguments.

We proposed that close social ties in SMEs act as a shield against layoffs, even when performance declines. Although our argument is relatively intuitive, it seems reasonable to assume that when the survival of an SME is threatened, owners and managers may do whatever it takes, including downsizing, to save their firm. In fact, there have been situations in which the only solution was to dismiss employees (Camacho-Miñano et al., 2015; Varum & Rocha, 2013). If the firm fails to downsize in such cases, it is pushed toward bankruptcy or, even worse, all employees can lose their jobs. Economic arguments (declining performance) and social arguments (social proximity) contribute to explain layoff decisions. Interestingly, social arguments do not necessarily indicate that layoffs should be avoided or they are “unethical.” If an SME’s performance declines dramatically due to structural problems, laying off several employees may be the only way to survive and avoid bankruptcy. In such cases, not laying off some employees would eventually lead to the dismissal of all employees when the SME goes bankrupt. Thus, layoffs become a “necessary evil” in these situations (Kim, 2014). In fact, social proximity may prompt an SME to dismiss some of its employees when it is distressed to prevent even bigger consequences for the local community. Consistent with this idea, we observe that SMEs that decide to layoff dismiss fewer employees than large firms. Layoffs in SMEs are driven by the need to preserve human capital and avoid dramatic social consequences for their community as much as possible (Lai et al., 2016; Landier et al., 2009).

Previous studies on layoff and downsizing decisions highlighted the role of external factors. They built, in particular, on the Institutional Theory and imitation arguments to explain layoffs and their poor impact on performance (Guthrie & Datta, 2008). Cascio et al. (2021) state that downsizing and restructuring operations occur because, among other factors, firms imitate the actions of industry peers and react to environmental pressures. However, our theoretical arguments place more weight on the firm’s internal factors. The results suggest that SMEs’ internal factors offset the external pressure to cut jobs. One can argue that the social proximity between SMEs’ managers and owners operating in the same industry or region can prompt imitative behaviors, thus resulting in mass layoffs (Ooms et al., 2018). However, our results suggest that this is not the case. Among the various dimensions of social proximity likely impacting SMEs’ owners and managers, the social proximity toward employees acts as a strong shield against layoffs. Overall, we extend the existing knowledge on the vital role of territorial embeddedness in understanding layoff and downsizing decisions. Previous studies mainly focused on family firms (Amato et al., 2023; Block, 2010; Kim et al., 2020), but we extend this line of research to SMEs, which represent the majority of firms worldwide and significantly contribute to job creation.

A crucial practical implication is that support from public policies is paramount for the creation and survival of SMEs because they stabilize employment. Interestingly, downsizing operations in large firms bring modest benefits in terms of performance and commonly lead to bankruptcy (Zorn et al., 2017). The lower propensity of SMEs to dismiss employees indicates their resilience, which can be vital during economic downturns. From a public policy perspective, the small business sector’s dynamism is crucial to preserve jobs during crises.

Limitations and Directions for Future Research

The size of our dataset allowed us to compare SMEs with larger and more complex organizations such as BGs. However, we were not able to study whether managers’ characteristics influence layoff decisions. Recent research on large firms’ human resource policies and practices highlights that the personality traits of the CEO largely influence restructuring decisions (Gupta et al., 2019). Therefore, it would be interesting to explore whether entrepreneurial traits and cognitive factors affect layoff decisions in SMEs and young ventures. Factors such as entrepreneurial self-efficacy (Baron et al., 2016) and overoptimism (Lowe & Ziedonis, 2006) are crucial determinants of the growth and performance of small and young firms. Managers’ perception about the relevance of layoffs and their ability to assess the consequences of layoffs may depend on such cognitive traits. Furthermore, we could not identify sharp differences between our sample firms. This could be because the key difference is the entrepreneur or manager of the firm.

In addition, we were unable to compare different types of layoffs and categories of dismissed employees. For instance, it is well known that temporary workers are more easily dismissed than permanent ones (Valverde et al., 2000). Moreover, sometimes employment protection laws differ for blue-collar and white-collar workers (Van Landuyt et al., 2017). The way of dismissal and the associated rights are important factors to consider since layoffs have severe social consequences (Kim, 2014). Thus, future research can explore the characteristics of layoffs in SMEs. They should, particularly, investigate whether social proximity induces SME managers to dismiss certain types of employees or use particular layoff procedures. Furthermore, an interesting question is how SME owner-managers deal with employees who are their kin when layoffs are considered. The presence of such employees may partly explain SMEs’ lower propensity to dismiss employees. However, it is also possible that SME owner-managers are more inclined to dismiss non-kin employees over kin-employees when performance declines. The overall effect of these considerations on SMEs’ layoff decisions remains to be researched.

Concluding Remark

The research on SMEs’ restructuring operations and layoffs is burgeoning. To date, most studies have focused on the bankruptcy and turnaround strategies of SMEs (Blazy et al., 2014; Camacho-Miñano et al., 2015; Mayr et al., 2017). However, we seek to explore a situation that often precedes bankruptcy: layoffs. We also seek to ground our work in the stakeholder salience theory to utilize the concept of social proximity. The decision to dismiss employees is complex owing to the social implications for the dismissed employees and organizational consequences for the firm. Therefore, understanding the antecedents of this decision is paramount if one wants to prevent SME bankruptcies and the associated layoffs. This understanding is of great interest to managers and policymakers. We hope that the results of our study will stimulate further research on this topic.

Data availability

Research data not shared.

Notes

Varum and Rocha (2013), one of the few studies on SMEs, observed that Portuguese SMEs are less likely to dismiss employees than large firms during a downturn.

The economic importance of SMEs in terms of job creation has been highlighted by the 2008 financial crisis and the economic consequences of the Covid-19 crisis. This may explain why past research has relatively overlooked SMEs in the study of layoffs.

We believe that a medium-sized firm with 250 employees has more in common with a large firm of 300 employees than with a micro firm of 10 employees. The theoretical arguments we build in this section likely apply to all SMEs, although they are likely stronger for the smallest of firms. We distinguish between micro, small, medium, and large firms when presenting the results of our empirical analysis.

We thank an anonymous reviewer for highlighting this point.

The index can be accessed at https://stats.oecd.org/Index.aspx?DataSetCode=EPL_OV

We use alternatively instrumental variables probit regressions. The instruments used are the mean proportion of SMEs in a region (using two-digit NUTS codes) and in an industry (using two-digit NACE codes). The results, unreported for brevity, are similar.

References

Adjei, E. K., Eriksson, R. H., & Lindgren, U. (2016). Social proximity and firm performance: The importance of family members ties in workplaces. Regional Studies, Regional Science, 3(1), 303–319.

Aldrich, H. E., & Auster, E. R. (1986). Even dwarfs started small: Liabilities of age and size and their strategic implications. Research in Organizational Behavior, 8, 165–198.

Almeida, H., & Wolfenzon, D. (2006). A theory of pyramidal ownership structure. Journal of Finance, 61(6), 2637–2680.

Amato, S., Patuelli, A., Basco, R., & Lattanzi, N. (2023). Family firms amidst the global financial crisis: A territorial embeddedness perspective on downsizing. Journal of Business Ethics, 183, 213–236.

Anderson, M. C., Banker, R. D., & Janakiraman, S. N. (2003). Are selling, general, and administrative costs “sticky”? Journal of Accounting Research, 41(1), 47–63.

Asquith, P., Gertner, R., & Scharfstein, D. (1994). Anatomy of financial distress: An examination of junk-bonds issuers. Quarterly Journal of Economics, 109(3), 625–658.

Badunenko, O. (2010). Downsizing in the German chemical manufacturing industry during the 1990s. Why is small beautiful? Small Business Economics, 34, 413–431.

Baron, R. M., Mueller, B. A., & Wolfe, M. T. (2016). Self-efficacy and entrepreneurs’ adoption of unattainable goals: The restraining effects of self-control. Journal of Business Venturing, 31(1), 55–71.

Belenzon, S., Berkovitz, T., & Rios, L. (2013). Capital markets and firm organization: How financial development shapes European corporate groups. Management Science, 59(6), 1326–1343.

Belenzon, S., & Tsolmon, U. (2016). Market frictions and the competitive advantage of internal labor markets. Strategic Management Journal, 37(7), 1280–1303.

Blazy, R., Martel, J., & Nigam, N. (2014). The Choice Between Informal and Formal Restructuring: The Case of French Banks Facing Distressed SMEs. Journal of Banking and Finance, 44(July), 248–263.

Block, J. H. (2010). Family management, family ownership, and downsizing: Evidence from S&P 500 firms. Family Business Review, 23(2), 109–130.

Botero, J. C., Djankov, S., La Porta, R., Lopez-de-Silanes, F., & Shleifer, A. (2004). The regulation of labor. Quarterly Journal of Economics, 119(4), 1339–1382.

Bradley, S. W., Shepherd, D. A., & Wiklund, J. (2011). The importance of slack for new organizations facing ‘tough’ environments. Journal of Management Studies, 48(5), 1071–1097.

Brauer, M., & Laamanen, T. (2014). Workforce downsizing and firm performance: An organizational routine perspective. Journal of Management Studies, 51(8), 1311–1333.

Bruton, G. D., Keels, J. K., & Shook, C. L. (1996). Downsizing the firm: Answering the strategic questions. Academy of Management Executive, 10(2), 38–45.

Cainelli, G., Giannini, V., & Iacobucci, D. (2020). Small firms and bank financing ad bad times. Small Business Economics, 55, 943–953.

Camacho-Miñano, M.-D.-M., Segovia-Vargas, M.-J., & Pascual-Ezama, D. (2015). Which characteristics predict the survival of insolvent firms? An SME reorganization prediction model. Journal of Small Business Management, 53(2), 340–354.

Carney, M., Gedajlovic, E. R., Heugens, P., Van Essen, M., & Van Oosterhout, J. (2011). Business group affiliation, performance, context, and strategy: A meta-analysis. Academy of Management Journal, 54(3), 437–460.

Cascio, W. F. (1993). Downsizing: What do we know? What have we learned? Academy of Management Executive, 7(1), 95–104.

Cascio, W. F. (2010). Employment downsizing: Causes, costs, and consequences. More than bricks in the wall: Organizational perspectives for sustainable success (pp. 87–96). Gabler.

Cascio, W. F., Chatrath, A., & Christie-David, R. A. (2021). Antecedents and consequences of employee and asset restructuring. Academy of Management Journal, 64(2), 587–613.

Chen, Z., Harford, J., & Kamara, A. (2019). Operating leverage, profitability, and capital structure. Journal of Financial and Quantitative Analysis, 54(1), 369–392.

Courrent, J.-M., & Gundolf, K. (2009). Proximity and micro-enterprise manager’s ethics: A French empirical study of responsible business attitudes. Journal of Business Ethics, 88, 749–762.

Covin, J., & Slevin, D. (1988). The influence of organisation structure on the utility of an entrepreneurial top management style. Journal of Management Studies, 25(3), 217–234.

Cox, K. R. (1998). Locality and community: Some conceptual issues. European Planning Studies, 6(1), 17–30.

Cyert, R., & March, J. (1963). A behavioral theory of the firm. Prentice- Hall.

Dehejia, R., & Wahba, S. (2002). Propensity score-matching methods for nonexperimental causal studies. Review of Economic and Statistics, 84(1), 151–161.

Dewitt, R.-L. (1998). Firm, industry, and strategy influences on choice of downsizing approach. Strategic Management Journal, 19(1), 59–79.

DiMaggio, P. J., & Powell, W. W. (1991). Introduction. In W. W. Powell & P. J. MiMaggio (Eds.), The new institutionalism in organizational analysis (pp. 1–38). University of Chicago Press.

Doh, J., Rodrigues, S., Saka-Helmhout, A., & Makhija, M. (2017). International business response to institutional voids. Journal of International Business Studies, 48, 293–307.

European Commission (2020). The revised user guide to the SME definition. Accessible at https://ec.europa.eu/growth/smes/sme-definition_en

Freeman, R. E. (1984). Strategic management: A stakeholder approach. Pitman.

Freeman, S. J., & Cameron, K. S. (1993). Organizational downsizing: A convergence and reorientation framework. Organization Science, 4(1), 10–29.

Granovetter, M. S. (1985). Economic action and social structure: The problem of embeddedness. American Journal of Sociology, 91, 481–510.

Grau, A., & Reig, A. (2021). Operating leverage and profitability of SMEs: Agri-food industry in Europe. Small Business Economics, 57(10), 221–242.

Gupta, A., Nadkarni, S., & Mariam, M. (2019). Dispositional sources of managerial discretion: CEO ideology, CEO personality, and firm strategies. Administrative Science Quarterly, 64(4), 855–893.

Guthrie, J. P., & Datta, D. K. (2008). Dumb and Dumber: The impact of downsizing in firm performance as moderated by industry conditions. Organization Science, 19(1), 108–123.

Haggard, S., MacIntyre, A., & Tiede, L. (2008). The rule of law and economic development. Annual Review of Political Science, 11, 205–234.

Hair, J. F., Ringle, C. M., Danks, N. P., Hult, G. T., Sarstedt, M., & Ray, S. (2021). Partial least squares structural equation modelling (PLS-SEM) using R. Springer. https://doi.org/10.1007/978-3-030-80519-7_1

Hamelin, A. (2011). Small business groups enhance performance and promote stability, not expropriation: Evidence from French SMEs. Journal of Banking and Finance, 35, 613–626.

Hedge, D., & Tumlinson, J. (2014). Does social proximity enhance business partnerships? Theory and evidence from ethnicity’s role in U.S. venture capital. Management Science, 60(9), 2355–2380.

Hill, M. H., Kelly, G. W., & Highfield, M. J. (2010). Net operating working capital: A first look. Financial Management, 39(2), 783–805.

Holmes, M., Hoskisson, R., Kim, H., Wan, W., & Holcomb, T. (2018). International strategy and business groups: A review and future research agenda. Journal of World Business, 53(2), 134–150.

Iacobucci, D., & Rosa, P. (2005). Growth, diversification, and business group formation in entrepreneurial firms. Small Business Economics, 25(1), 65–82.

Jung, J. (2016). Through the contested terrain: Implementation of downsizing announcement by large US firms, 1984 to 2005. American Sociological Review, 81(2), 347–373.

Kalemli-Özcan, S., Sorensen, B.E., Villegas-Sanchez, C., Volosovych, V., and Yesiltas, S. (2019). How to construct nationally representative firm level data from the Orbis Global database: New facts on SMEs and aggregate implications for industry concentration. Tinbergen Institute Discussion Paper 15–110/IV, available at https://doi.org/10.2139/ssrn.2660191

Kang, J.-K., & Shivdasani, A. (1997). Corporate restructuring during performance decline in Japan. Journal of Financial Economics, 46(1), 29–65.

Karp, R. E., & Weaver, N. M. (1991). Ethical values underlying the termination process. Business and Society, 30(1), 1–6.

Khanna, T., & Palepu, K. (1997). Why focused strategies may be wrong for emerging markets. Harvard Business Review, 75(4), 41–51.

Kim, K., Haider, Z. A., Wu, Z., & Dou, J. (2020). Corporate social performance of family firms: A place-based perspective in the context of layoffs. Journal of Business Ethics, 167, 235–252.

Kim, T. W. (2014). Decent termination: A moral case for severance pay. Business Ethics Quarterly, 24(2), 203–227.

Lähdesmäki, M., Siltaoja, M., & Spence, L. J. (2019). Stakeholder salience for small businesses: A social proximity perspective. Journal of Business Ethics, 158, 373–385.

Lähdesmäki, M., & Suutari, T. (2012). Keeping at arm’s length or searching for social proximity? Corporate social responsibility as a reciprocal process between small businesses and the local community. Journal of Business Ethics, 108, 481–493.

Lai, Y., Saridakis, G., Blackburn, R., & Johnstone, S. (2016). Are the HR responses of small firms different from large firms in times of recession? Journal of Business Venturing, 31(1), 113–131.

Landier, A., Nair, V. B., & Wulf, J. (2009). Trade-offs in staying close: Corporate decision making and geographic dispersion. Review of Financial Studies, 22(3), 1119–1148.

Lechner, C., & Leyronas, C. (2009). Small business group formation as an entrepreneurial development model. Entrepreneurship Theory and Practice, 33(3), 645–667.

Li, Q., Lourie, B., Nekrasov, A., & Shevlin, T. (2022). Employee turnover and firm performance: Large sample archival evidence. Management Science, 68(8), 5667–5683.

Lowe, R. A., & Ziedonis, A. A. (2006). Overoptimism and the performance of entrepreneurial firms. Management Science, 52(2), 173–186.

Mayr, S., Mitter, C., & Aichmayr, A. (2017). Corporate crisis and sustainable reorganization: Evidence from bankrupt Austrian SMEs. Journal of Small Business Management, 55(1), 108–127.

Mitchell, R. K., Agle, B. R., & Wood, D. J. (1997). Toward a theory of stakeholder identification and salience: Defining the principles of who and what really counts. Academy of Management Review, 22(4), 853–886.

Morris, J. R., Cascio, W. F., & Young, C. E. (1999). Downsizing after all these years: Questions and answers about who did it, how many did it, and who benefited from it. Organizational Dynamics, 27(3), 78–87.

Neville, B. A., Bell, S. J., & Whitwell, G. J. (2011). Stakeholder salience revisited: Refining, redefining, and refueling an underdeveloped conceptual tool. Journal of Business Ethics, 102, 357–378.

Ngah, R., & Jusoff, K. (2009). Tacit knowledge sharing and SMEs’ organizational performance. International Journal of Economics and Finance, 1(1), 216–220.

OECD (2018). Enterprises by business size. Accessible at https://data.oecd.org/entrepreneur/enterprises-by-business-size.htm#:~:text=In%20small%20and%20medium%2Dsized,employ%20250%20or%20more%20people.

Ooms, W., Werker, C., & Caniëls, M. (2018). Personal and social proximity empowering collaborations: The glue of knowledge networks. Industry and Innovation, 25(9), 833–840.

Orlando, J. (1999). The fourth wave: The ethics of corporate downsizing. Business Ethics Quarterly, 9(2), 295–314.

Pallares-Barbera, M., Tulla, A. F., & Vera, A. (2004). Spatial loyalty and territorial embeddedness in the multi-sector clustering of the Berguedà region in Catalonia (Spain). Geoforum, 35(5), 635–649.

Penrose, E. T. (1959). The theory of the growth of the firm. Oxford University Press.

Pérez-Iuño, A., Saparito, P., & Gopalakrishnan, S. (2016). Small and medium-sized enterprise’s entrepreneurial versus market orientation and the creation of tacit knowledge. Journal of Small Business Management, 54(1), 262–278.

Russo, A., & Perrini, F. (2010). Investigating stakeholder theory and social capital: CSR in large firms and SMEs. Journal of Business Ethics, 91, 207–221.

Stevenson, H., Roberts, M., and Grousbeck, H. (1985). New business ventures and the entrepreneur. New-York: Irwin/McGraw–Hill.

Stinchcombe, A. L. (1965). Social structure and organizations. In J. G. March (Ed.), Handbook of organizations (pp. 142–193). Rand McNally.

Torrès, O., & Julien, P. A. (2005). Specificity and denaturing of small business. International Small Business Journal, 23, 355–377.

Valverde, M., Tregaskis, O., & Brewster, C. (2000). Labor flexibility and firm performance. International Advances in Economic Research, 6(4), 649–661.

Van Landuyt, Y., Dewaelheyns, N., & Van Hulle, C. (2017). Employment protection legislation and SME performance. International Small Business Journal, 35(3), 306–326.

Varum, C. A., & Rocha, V. C. (2013). Employment and SMEs during crises. Small Business Economics, 40, 9–25.

Zorn, M. L., Norman, P. M., Butler, F. C., & Bhussar, M. S. (2017). Cure or curse: Does downsizing increase the likelihood of bankruptcy? Journal of Business Research, 76, 24–33.

Acknowledgements

The helpful and constructive comments of three anonymous reviewers and the editor, Julia Roloff, are gratefully acknowledged. The author wishes to thank Laurent Weill for helpful discussions. All remaining errors are the author’s own.

Funding

Funding from the European Regional Development Fund and the Région Grand Est is gratefully acknowledged. This research was supported by the Réseau de Recherche et d’Expertise en Entrepreneuriat.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

I have no conflict of interest to report.

Research Involving Human and Animal Rights

Not applicable.

Informed Consent

Not applicable.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: Summary statistics by countries

Variables | Number of firm-year observations | Mean likelihood of layoffs | Mean workforce reduction | Labor rights protection index |

|---|---|---|---|---|

Germany | 64,369 | 0.402 | 13.293 | 2.595 |

Austria | 2148 | 0.426 | 15.611 | 2.285 |

Belgium | 8 | 0.625 | 8.600 | 2.067 |

Denmark | 1065 | 0.501 | 10.603 | 1.531 |

Spain | 562,291 | 0.342 | 4.299 | 1.992 |

Finland | 21,011 | 0.421 | 4.775 | 2.080 |

France | 104,362 | 0.398 | 6.045 | 2.510 |

Greece | 4 | 0.500 | 6.500 | 2.452 |

Italy | 475,860 | 0.332 | 5.283 | 2.718 |

Luxembourg | 439 | 0.485 | 8.070 | 2.136 |

Portugal | 67,535 | 0.332 | 2.007 | 3.177 |

Sweden | 124,503 | 0.334 | 4.265 | 2.450 |

Appendix B: Comparison between SMEs and non-SMEs

Variables | Non SMEs | SMEs | Difference between non SMEs and SMEs | t-statistics | ||

|---|---|---|---|---|---|---|

Mean | Standard deviation | Mean | Standard deviation | |||

Likelihood of layoffs | 0.359 | 0.480 | 0.325 | 0.468 | 0.034 | 41.696*** |

Employment growth rate | 0.047 | 0.299 | 0.044 | 0.320 | 0.004 | 7.094*** |

Sales growth | 0.079 | 0.414 | 0.068 | 0.371 | 0.011 | 15.4428*** |

Financial distress dummy | 0.017 | 0.130 | 0.017 | 0.128 | 0.001 | 2.5563*** |

Age | 25.536 | 50.280 | 21.445 | 22.202 | 4.091 | 56.9314*** |

Tangibility | 0.692 | 0.321 | 0.793 | 0.281 | − 0.101 | − 190.000*** |

Financial slack | 0.099 | 0.128 | 0.115 | 0.138 | − 0.015 | − 67.506*** |

Recoverable slack | 0.271 | 0.434 | 0.275 | 0.426 | − 0.004 | − 5.8029*** |

Industry performance gap | − 0.005 | 0.106 | − 0.006 | 0.101 | 0.001 | 5.966*** |

Appendix C: Logit regression results used to calculate propensity scores (year 2011)

A dummy that equals to one if a firm is a SME is the dependent variable | Coef | St. Error |

|---|---|---|

Age | − 0.010*** | 0.000 |

Profitability | − 0.382*** | 0.042 |

Sales growth rate | − 0.073*** | 0.007 |

Tangibility | 0.683*** | 0.016 |

Financial slack | 1.290*** | 0.034 |

Leverage | 0.233*** | 0.023 |

Recoverable slack | 0.006 | 0.012 |

Constant | − 2.570*** | 0.069 |

Country- and industry-fixed effects | YES | |

Number of observations | 213,676 | |

LR Chi2 | 22,209.32*** | |

Log Likelihood | − 133,816.36 | |

Appendix D: Test balancing property of the PSM procedure (year 2011)

Variables | Sample | Treated | Control | % bias | t-statistics |

|---|---|---|---|---|---|

Age | Unmatched | 18.561 | 22.693 | − 28.800 | − 31.830*** |

Matched | 18.562 | 19.816 | − 8.700 | − 10.030*** | |

Profitability | Unmatched | 0.027 | 0.034 | − 5.700 | − 6.440*** |

Matched | 0.027 | 0.028 | − 0.700 | − 0.710 | |

Sales growth rate | Unmatched | − 0.031 | 0.021 | − 12.800 | − 14.470*** |

Matched | − 0.031 | − 0.002 | − 7.100 | − 7.460*** | |

Tangibility | Unmatched | 0.781 | 0.692 | 29.300 | 32.750*** |

Matched | 0.781 | 0.748 | 10.900 | 11.690*** | |

Financial slack | Unmatched | 0.117 | 0.095 | 15.500 | 17.760*** |

Matched | 0.117 | 0.109 | 6.000 | 5.960*** | |

Leverage | Unmatched | 0.251 | 0.218 | 14.500 | 16.450*** |

Matched | 0.251 | 0.240 | 4.700 | 4.720*** | |

Recoverable slack | Unmatched | 0.300 | 0.303 | − 0.500 | − 0.560 |

Matched | 0.300 | 0.313 | − 2.700 | − 2.690*** | |

Distribution of the absolute bias: | |||||

Mean absolute bias % | Unmatched | 13.300 | |||

Matched | 4.800 | ||||

Median absolute bias % | Unmatched | 12.800 | |||

Matched | 4.700 | ||||

LR Chi2 (p-value) | Unmatched | 3034.80*** | |||

Matched | 364.33*** | ||||

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Lefebvre, V. Layoffs in SMEs: The Role of Social Proximity. J Bus Ethics 190, 801–820 (2024). https://doi.org/10.1007/s10551-023-05414-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10551-023-05414-z