Abstract

We use a lab experiment to examine whether and how leaders influence workers’ (un)ethical behavior through financial reporting choices. We randomly assign the role of leaders or workers to subjects, who can choose to report an outcome via automatic or self-reporting. Self-reporting allows for profitable and undetectable earnings manipulation. We vary the leaders’ ability to choose the reporting method and to punish workers. We show that workers are more likely to choose automatic reporting when their leader voluntarily does so and can assign punishment. Even workers who choose self-reporting tend to cheat less when their leader chooses automatic reporting. Nonetheless, most leaders do not opt for automatic reporting in the first place: they often choose self-reporting and punish workers who rather choose automatic reporting. Collectively, our results reveal a dual effect of leadership on ethical behaviors in organizations: workers behave more ethically if their leader makes ethical choices, but often leaders do not make ethical choices in the first place. Hence, leading by example can backfire.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

In September 2019, Volkswagen’s (VW) CEO Herbert Diess, Chairman Hans Dieter Poetsch, and other executives and employees were charged, arrested, or forced to resign for allegedly hiding information about vehicles’ emissions. These charges came almost four years after the US Environmental Protection Agency accused VW of selling diesel vehicles that polluted significantly above the level allowed by the US regulation, in a scandal known as Dieselgate (Cremer & Bergin, 2015; Ruddick & Farrell, 2015). VW’s initial reaction was to blame some employees for having installed defeat devices that allowed understating harmful emissions in official tests. This assertion was overturned in a 2016 lawsuit, which established the responsibility of VW engineers in installing defeat devices “with the knowledge and approval of their managers” [Commonwealth v. Volkswagen AG, No. 16-2266D (Mass. Super. Ct. Suffolk County July 19, 2016)]. VW’s leadership was accused of having perpetuated a “stubborn and unrepentant culture” that gave rise to “systematic cheating and deception” (Campbell, 2016; Hotten, 2015). An important question concerns the role of VW leaders in influencing employees’ misbehavior. Did VW engineers align to a culture of dishonesty instilled by their leaders, or did they voluntarily hide emissions information regardless of the leaders’ directives? Would different leaders have led to a different course of action?

There is substantial evidence that corporate executives often misreport information to derive private benefits, and that this behavior is shaped by personal traits and preferences (Beatty et al., 2013; Carson, 2003; Cialdini et al., 2019; Hunter, 2012; Johnson et al., 2019; Sanders et al., 2018). For this purpose, a common practice is to adopt a reporting method based on self-disclosed information that prevents verification from external parties (Crocker & Slemrod, 2007; Feltovich, 2019). The opposite case is to report information certified by a neutral third party, which makes an objective assessment with no room for manipulation (Behnk et al., 2019).

Leaders’ (fraudulent or transparent) reporting choices can influence organizational culture and ultimately financial performance (Beatty et al., 2013; Brown & Treviño, 2006; Eisenbeiß, 2012; Guiso et al., 2015). Nonetheless, the effect of leaders’ reporting choices on organizational transparency is not yet well understood. This is mostly due to the fact that unethical behaviors are generally hidden from view and thus difficult to measure empirically (Treviño, 1992). In addition, it is difficult to assess the link between leaders’ actions and organizational culture given the non-random matching between leaders and organizations (D’Adda et al., 2017). The important but hitherto unsettled question is therefore whether leaders’ reporting choices influence (un)ethical behaviors within their organizations. We fill this gap by investigating two interrelated research questions:

-

(1)

Do workers follow their leaders’ reporting choices?

-

(2)

To what extent do leaders opt for ethical reporting?

Building on the research design in D’Adda et al. (2017), we use a laboratory study where subjects are randomly assigned the role of leaders or workers and clustered in four-person groups with one leader and three workers. We use a 3 × 2 between-subject design that varies the leaders’ ability to: (i) choose the reporting method (mandatorily assigned vs voluntary chosen); and (ii) punish or reward workers by choosing how much of the group payoff is allocated to them (“incentive power”). Although our subject pool is formed by students (which is suboptimal relative to using real business leaders), our setting has the advantage of allowing us to directly observe how leaders influence workers’ decisions.

In our setting, the leader moves first and the workers move simultaneously as second movers upon observing the leader’s decision (Gächter et al., 2012; Güth et al., 2007). We measure cheating as in Fischbacher and Follmi-Heusi (2013): subjects are asked to privately roll a die and report the outcome, knowing that higher reported outcomes correspond to higher group profits, hence potentially higher individual earnings. The key feature of our design—and a novelty with respect to D’Adda et al. (2017)—is that before rolling the die, participants are asked to decide how to report the die-rolling outcome. Similar to Pate (2018) and Feltovich (2019), our subjects can choose between two reporting methods: a computer draw (“automatic reporting”) or a self-reported die roll (“self-reporting”).Footnote 1 Under automatic reporting, subjects roll a virtual die, and the computer automatically reports the outcome on their screen, thus making any manipulation impossible. Under self-reporting, subjects secretly roll a physical die and report themselves the outcome on their screen. Here, cheating is possible, profitable (since payoffs are increasing in reported outcomes), and undetectable (since die rolls are unobservable by the experimenter and other subjects, except statistically). Opting for automatic reporting—instead of self-reporting—represents the ethical decision. This directly follows from experimental evidence that self-reporting attracts dishonest people as it allows hiding truthful information and cheating for private profits (Behnk et al., 2019; Feltovich, 2019). Our design is similar to Feltovich (2019) wherein subjects—who play the role of price-setting firms in a competition game—can choose how to report their costs: by either die rolls made by the subject who inputs the outcome into the computer (“self-roll” treatment) or computer-simulated die rolls (“computer-roll” treatment). As in our setting, in Feltovich (2019) self-reporting is meant to capture unethical behavior.Footnote 2

While prior research has considered the mere action of cheating as a proxy for unethical behavior (Abeler et al., 2019; Rosenbaum et al., 2014), our study speaks to a broader class of misbehaviors encompassing the action of hiding relevant information through reporting choices. Exploring the choice of reporting methods is crucial to understand the natural occurrence of fraudulent behaviors, as the probability of detecting fraud is largely endogenous to how a given outcome is reported (Behnk et al., 2019; Feltovich, 2019; Kleven et al., 2011). Our study analyzes this aspect by exploring in a lab context the influence of leaders in shaping workers’ ethical behaviors through reporting choices.

Theoretical Background

Dating back to Hermalin (1998), economic theories and experimental evidence have suggested that leaders can persuade others to follow their actions by setting an example of “the right” thing to do (Brandts et al., 2016; Güth et al., 2007; Potters et al., 2007; Rilke et al., 2021). Leading by example is “one of the most powerful methods to encourage individuals to work toward a common objective” (Schuhmacher et al., 2021). Indeed, prior evidence reveals that leading by example has a positive effect on followers’ voluntary cooperation in public goods games (Eichenseer, 2019). This effect may have different origins, such as recognition of leadership as legitimate, perception of the leader as a role model, and rule-breaking aversion (Tyler & Blader, 2005). Nonetheless, whether leaders’ own example can also influence followers’ ethical behaviors in an organizational context remains poorly understood.

Some insights come from the literature on business ethics, which reveals that ethical leaders have positive influences on subordinates and organizations (Brown & Mitchell, 2010; Eisenbeiß & Giessner, 2012; Kalshoven & Boon, 2012; Neubert et al., 2009; Stouten et al., 2012). For example, Stouten et al. (2010) and Avey et al. (2011) show that ethical leadership reduces employees’ deviant behaviors (e.g., bullying) and disregard of organizational norms (Mayer et al., 2009; Newman et al., 2014; Piccolo et al., 2010).

Those studies draw upon social psychology theories of social learning (Bandura, 1997), which posit that ethical leaders can influence their subordinates by demonstrating the types of activities and behaviors that are expected and rewarded, hence encouraging followers to take those behaviors as models to mimic (Brown et al., 2005; Mayer et al., 2012; Schaubroeck et al., 2012; Yam et al., 2019). According to this literature, followers are likely to emulate the behaviors of those who are higher in the organizational hierarchy because leadership forges one’s credibility as a role model of normatively appropriate actions (Mayer et al., 2009). Further evidence focuses on workers’ perception of their leader’s integrity, and the effect of such perception on their attitudes. White and Lean (2008) find that employees who perceive their leader as having a higher integrity level have lower intentions to act unethically. Similarly, Ho and Lin (2016) show that followers have higher ethical behavior intentions when they perceive their leaders as being engaged in ethical behaviors. The purpose of those studies is to assess the relationship between workers’ perception of the leader’s integrity and their intentions or attitudes toward unethical acts.

Here, we rather focus on workers’ actual (un)ethical behavior after observing their leader’s (un)ethical choices. In particular, we posit that leaders will affect subordinates’ behavior through their own example, reducing fraudulent reporting choices. This result is expected to be strong especially when leaders make their reporting choice voluntarily (as compared to an exogenous assignment), i.e., leaders’ personal imprint is necessary to influence workers. Hence, we hypothesize the following:

Hypothesis

Leaders’ automatic reporting choices increase workers’ likelihood of choosing automatic reporting, especially when the leaders choose to do so voluntarily.

Having established our main hypothesis, we explore a number of mechanisms to unpack the mechanisms at play. Existing theory provides a useful framework for baseline arguments but does not allow developing precise hypotheses. Hence, as is common in the literature in these instances, we adopt an inductive approach: we allow findings to emerge from our data without any intention to test specific theories (Bettis et al., 2014; Lyngsie & Foss, 2017).

First, we analyze whether subjects that are assigned to the role of leaders (as compared to the individual setting) are more likely to choose automatic reporting, perhaps owning to concerns of role modeling arising from having attained the leadership role. Second, we explore the role of leaders’ instruments to influence workers’ behavior. In many organizations, the most common of such instruments consists in having the power to administer rewards or punishments (D’Adda et al., 2017; Gürerk et al., 2018), which we refer to here as “incentive power.” So, we analyze whether workers’ reporting choices are influenced by the mere possibility for the leader to assign rewards and punishments. Also, we investigate how—and which type of—leaders use their incentive power. A carrots-and-sticks approach suggests that leaders may affect workers’ actions by enacting a punishment threat: by choosing a different reporting method from that of their leader, they may fear receiving a lower share of the group payoff. Hence, we can expect workers to adhere more often to their leaders’ choice when the latter can punish them by allocating a lower share of the group payoff (as compared to when workers receive an equal share by design).Footnote 3 Finally, we establish whether the leaders’ automatic reporting choice can reduce cheating among workers (to validate our assumption that automatic reporting is the ethically superior choice).

Experiment

Design

The experimental design is divided into two sequential stages, as illustrated in Fig. 1.

The first stage—called the “individual setting”—runs for one round. In this stage, participants perform the task individually (without any role assignment), and there are no groups. This stage allows us to measure subjects’ intrinsic propensity to choose a specific reporting method. All participants are asked to roll a fair six-sided die, the outcome of which determines their earnings. Specifically, they are paid the equivalent (in Euros) of the reported die-rolling outcome (e.g., if the die-rolling outcome is six, they receive six Euros). Before rolling the die, each participant is asked to choose how to report the result: via either a computer draw (“automatic reporting”) or a self-reported die roll (“self-reporting”). Subjects who choose automatic reporting roll a virtual die, and the computer automatically reports the result on their screen, thus making any manipulation of the die-rolling outcome impossible. Subjects who choose self-reporting roll a physical die privately, and input themselves the result on their screen. Here, cheating is possible, profitable (since one’s profits increase with the reported die-rolling outcome), and undetectable (since the die-rolling outcomes are unobservable by the experimenter and other subjects, except statistically). Indeed, although we cannot observe the true die-rolling outcome at the individual level, we can statistically detect the degree of misreporting by comparing the observed occurrence of each realization with its theoretical occurrence derived from a uniform distribution (e.g., D’Adda et al., 2017; Fischbacher & Follmi-Heusi, 2013; Gneezy et al., 2018).

In our setting, cheating increases one’s individual or group payoff without generating negative externalities on anyone else aside from the experimenter (e.g., Gneezy et al., 2018, but see D’Adda et al., 2017 and Feltovich, 2019). Hence, each group would be better off if all members fraudulently overstate earnings by self-reporting the highest die-rolling outcome, adhering to a norm of cooperation (group payoff maximization) at the expense of a norm of honesty (Parsons et al., 2020).

In the second stage—called the “group setting”—we randomly assign the roles of leaders and workers to participants and cluster them in “experimental firms,” i.e., four-member groups with one leader and three workers. Participants are informed that the matching process is not affected by anything that happened in the individual setting. As in the first stage, the task is a reporting choice followed by the corresponding die-rolling task, but now it is played in a group setting, albeit still privately.

Each group carries out the same task for ten rounds, wherein the roles and group compositions remain fixed. In each round, the leader acts as the first mover, and the workers act simultaneously as second movers after observing their leader’s reporting choice. At the end of the experiment, the computer randomly selects one of the ten rounds to determine the individual payment in this stage.

The group payoff is computed as the sum of the four members’ reported die-rolling outcomes. Individual payoffs are computed as a share of the group payoff, where that share depends upon the treatment in place (described in the next paragraphs). To isolate the effect of the reporting choice from the reported die-rolling outcome, information about the reported outcomes remains private throughout the entire experiment. Importantly, unlike D’Adda et al. (2017), each worker receives no information between rounds about the other workers’ decisions, their own payoff, nor the group payoff. This information is only disclosed at the end of the study. This means that during the experiment, workers cannot observe how their leader punished or rewarded their reporting choices. We deliberately choose this design because here we are primarily focused on how—and which type of—leaders use the incentive power. We are not interested in the effect of leaders’ actual punishment on workers’ behavior, as this aspect has already been explored in prior contributions (D’Adda et al., 2017; Feltovish, 2019). More interestingly, our design allows us to test whether the sole information that a leader can punish or reward—without knowing whether s/he actually does so—shapes workers’ behavior.

We shall remark that the absence of feedback to workers between rounds does not nullify the purpose of having ten repeated rounds. Round repetition allows us to evaluate whether leaders’ punishment changes with the size of group payoff. Even if leaders and workers stick to the same reporting choices across time, group payoff may vary between rounds, since it depends on chance (for those choosing automatic reporting) and the size of the lie (for those choosing self-reporting).

We use a 3 × 2 between-subject design, where we vary the leaders’ ability to (i) choose the reporting method (mandatorily assigned vs voluntarily chosen), and (ii) set the share of the group payoff awarded to each worker (“incentive power”). Table 1 summarizes the design.

In the voluntary reporting treatment, leaders can choose the reporting method (automatic or self-reporting), whereas in the two mandatory reporting treatments they are exogenously assigned to a reporting method (either automatic or self-reporting). Workers are informed about whether their leaders can or cannot choose the reporting method.

In the treatments without leaders’ incentive power, the group payoff is equally shared among the four group members, i.e., each player receives ¼. In the treatments with leaders’ incentive power, leaders receive ¼ of the group payoff and can freely allocate (equally or not) the remaining ¾ of the group payoff among workers. Importantly, the leader is free to choose any allocation that sums up to 0% (i.e., allocating zero to every worker), or 100% (i.e., allocating at least a positive amount to one worker). This choice gives leaders the possibility to provide each worker not only a reward—as in D’Adda et al. (2017)—but also a punishment (i.e., a share below 33% of the workers’ total payoff). In our design, any undistributed part would be “wasted” (i.e., it returns to the experimenter). Accordingly, the leaders cannot keep any part of the remaining group payoff for themselves.

To sum up, each of the ten rounds comprises the following subsequent steps:

-

1.

The leader is assigned to (if mandatory reporting treatment) or has to choose (if voluntary reporting treatment) the reporting method: automatic or self-reporting;

-

2.

The workers are informed about whether their leader’s reporting method was mandatorily assigned or voluntarily chosen, and which reporting method has been assigned or chosen by the leader;

-

3.

The workers choose their reporting method, which remains hidden to the other group members except for the leader;

-

4.

Both the leader and workers roll their own die, whose outcome remains private;

-

5.

The leader is informed about his/her own workers’ reporting choices made in step 3, and the group payoff (the sum of the group members’ reported die-rolling outcomes);

-

6.

Individual payoffs are computed: in the treatments without leaders’ incentive power, the group payoff is equally shared among the group members, i.e., each receives ¼; in the treatments with leaders’ incentive power, the leader receives ¼ of the group payoff and can freely allocate (equally or not) the remaining ¾ of the group payoff among workers.

After Stage 2, following Krupka and Weber (2013) and D’Adda et al. (2017), we elicit subjects’ perceptions of how appropriate is to choose a reporting system not aligned with the leader’s one, and inflate the outcome of the die roll. By using Krupka and Weber’s (2013) procedure, we describe a set of hypothetical reporting choices a subject might have made in the experiment and ask participants to evaluate the social appropriateness of each action on a 4-point scale taking the following values: “Very Socially Unacceptable,” “Somewhat Socially Unacceptable,” “Somewhat Socially Acceptable,” “Very Socially Acceptable.” We incentivize answers by paying an extra €0.50 per question if their answer matches the one provided by another randomly selected participant in the same session. This matching technique directly follows from Krupka and Weber (2013), D’Adda et al. (2017), and others. It is meant to give participants an incentive to think in terms of the socially recognized perceptions of the appropriateness of the described action, rather than their own personal perception (on personal vs social norms, see, e.g., Burks & Krupka, 2012). After those incentivized questions, following Gibson et al. (2013) and D’Adda et al. (2017) we collect participants’ opinions about misreporting behaviors and truthfulness in private organizations, and individual sociodemographic measures. See Appendix B in the supplementary material for details.

Procedures

The experiment was conducted in April and May 2018 at the Laboratory for Research in Experimental and Behavioral Economics (LINEEX) of the University of Valencia, Spain. In total, we recruited 240 students, with 40 subjects (10 firms) per treatment. Participants in our experiment were students aged 21 years on average, and 37% of them were females. More than half of them were students in social sciences (economics and other subjects). As anticipated, we are aware that using a lab experiment with a sample of students is suboptimal relative to employing real business leaders in a field experiment. However, existing literature has generally advocated in favor of the external validity of lab experiments (Anderson et al., 1999; Locke, 1986; Mook, 1983). Moreover, our approach is similar to existing studies on leadership like D’Adda et al. (2017) and Brandts et al. (2007), which have used student samples seeking to derive meaningful insights for real organizations.

The experiment was computerized using the software z-Tree (Fischbacher, 2007). Participants performed all of the experimental tasks via computer, except the die-rolling task in the self-reporting condition. In this case, participants had to roll a physical die placed near their computer. To ensure anonymity, participants were informed that their decisions during the experiment—as well as their final payment—would be linked to a client ID number but their identity would remain confidential. To further ensure confidentiality, payments were issued in cash at the end of the session to one participant at a time. Each session lasted approximately one hour, and participants earned on average €15, including the show-up fee of €5. An English translation of the instructions provided to the participants is available in the supplementary material.

At the end of the instructions for the second stage of the experiment, and before starting that stage, subjects were asked a set of computerized questions to check their understanding of the game. They were provided with prompt feedback via computer and asked to raise their hand when they gave an incorrect answer. In this case, the lab assistant approached the student who raised the hand to explain the mistake and the correct answer. No major issues were encountered. The detailed deliverable with results from the comprehension questions and any other questions raised in each experimental session is available in the supplementary material.

Summary Statistics and Methods

Table 2 reports summary statistics of reporting choices (“Automatic” and “Self-reporting”) across the two settings of the experiment (“Group” and “Individual”). Specifically, Table 2a reports the frequency and percentage of the two reporting choices with observations pooled across roles. In the individual setting, we have a total of 240 observations. In the group setting, where subjects perform the task across ten rounds, we have a total of 2400 observations. Table 2b shows the frequency and percentage of the two reporting choices with observations partitioned by role—i.e., leaders in the voluntary treatments (200 observations) and workers in all treatments (1800 observations)—for a total of 2000 observations. Those statistics highlight a strong preference for self-reporting (which is chosen by approx. 80% of subjects in either the individual or group setting), especially among subjects assigned to the role of leaders (86.5% in the voluntary treatment).

For the analysis, we employ regression models that include a set of control variables. According to previous research, two demographic characteristics may influence unethical behaviors, namely gender and age (Baur et al., 2020; Peterson et al., 2001). Accordingly, we control for age (in years) and a gender dummy (1 = female, 0 = male). We also control for subjects’ fields of study, which may influence misconduct (e.g., López-Pérez & Spiegelman, 2019).Footnote 4 To preserve space, in our regression tables we refer to this set of variables as Individual controls, and mark their joint inclusion with a check symbol “✓.” Moreover, our regressions include round fixed effects to account for differences in reporting behavior along with the various rounds of the experiment. Standard errors—reported in parentheses—are clustered by group and round.

Results

Do Workers Follow Their Leaders’ Ethical Reporting Choices?

Our main hypothesis suggests that workers follow their leader’s (ethical) reporting choice. Table 3 reports logit regressions where the dependent variable is Workers’ automatic reporting, namely a dummy equal to one if a worker chooses automatic reporting, and zero if a worker chooses self-reporting. The key explanatory variable is Leader’s automatic reporting, a dummy equal to one for the leader’s automatic reporting, and zero for self-reporting. In Columns (1)–(2), the model is estimated on the full sample, i.e., pooling leaders’ voluntary and mandatory reporting treatments. In Columns (3)–(4), the model is estimated only considering the leaders’ voluntary reporting treatment. In Columns (5)–(6), the model is estimated only considering the leaders’ mandatory reporting treatment. In Columns (7)–(8), the model is estimated again on the full sample, and it includes the interaction between the dummy for the leader’s automatic reporting and the dummy for the voluntary reporting treatment (Leader’s automatic reporting × Voluntary). We include round fixed effects, and in Columns (2), (4), (6), and (8) we add controls for individual characteristics (Individual controls).Footnote 5

Consistent with our hypothesis, the results indicate that a leader’s automatic reporting has a positive and significant effect on the likelihood of workers’ automatic reporting, albeit only when the leader’s choice is made voluntarily (see the positive and statistically significant coefficients of Leader’s automatic reporting in Columns 3–4, and of Leader’s automatic reporting × Voluntary in Columns 7–8).

Do Individuals Make Ethical Reporting Choices When Assigned to a Leadership Role?

Theories of role modeling (Ashforth & Mael, 1989; Deaux, 1993; Dutton et al., 2010; Tajfe, 1982) suggest that employees regard leaders as credible role models whose style and actions set an example of ethical standards or other desirable behaviors (Babalola et al., 2019; Brown & Treviño, 2014; Ng & Feldman, 2015; Stouten et al., 2010; Yaffe & Kark, 2011). As role models, leaders generally “feel” a greater social responsibility in terms of feeling obligated to adhere to ethical and legal rules, and to care about the consequences of their actions (De Hoogh & Den Hartog, 2008; Hood, 2003; Koehn, 2005; Seppälä et al., 2012; Sims & Brinkmann, 2002; White & Lean, 2008). This “feeling” can be part of the leader’s self-image or self-esteem part of the leader’s membership in the social category of leaders, or a mix of the two (Hogg, 2001a, 2001b). Existing research suggests that leaders are intrinsically motivated to hold positive social identities, and opting for ethical choices is a straightforward way to instantiate such an identity. Those arguments suggest that subjects who are assigned to the role of leaders may opt for the ethical reporting choice (i.e., automatic reporting). To explore this line of argument, we estimated logit regressions—reported in Table 4—that compare subjects’ reporting choices in the individual setting with those in the group setting, i.e., once those subjects are assigned to the role of leader. The dependent variable—Automatic reporting (voluntary)—is a dummy equal to one for voluntary automatic reporting, and zero for voluntary self-reporting. The main explanatory variable (Leader in the group setting) is a dummy equal to one if a subject is assigned to the role of a leader in the group setting, and zero for the individual setting (i.e., without this role). We include round fixed effects, and in Column (2) we add controls for individual characteristics (Individual controls).Footnote 6 The estimates show the coefficient of the dummy Leader in the group setting is not statistically significant. Hence, individuals assigned to the role of leaders in a group setting are not more likely to choose automatic reporting.

Does Leaders’ Incentive Power Influence Workers’ Reporting Choices?

We investigate whether the possibility of leaders to provide economic incentives (i.e., decide how to split the group payoff among workers) reinforces the impact of leaders’ reporting choices on workers’ behavior. Recall that workers do not receive any feedback between rounds about their leaders’ punishment or reward decisions, but they know whether their leaders are provided with that incentive power.

Table 5 reports logit regressions on reporting choices in the group setting where the dependent variable is Workers’ automatic reporting, as in Table 3 (a dummy equal to one if a worker chooses automatic reporting, and zero if a worker chooses self-reporting). The main explanatory variable—Leader’s automatic reporting (voluntary)—is a dummy equal to one for the leader’s voluntary automatic reporting, and zero for voluntary self-reporting. Out of the total of 180 workers, we use 60 workers (across the ten rounds, i.e., 600 obs.) corresponding to the treatments in which the leader’s reporting method is voluntarily chosen. Among those, we separately estimate the model for the treatment in which the leader can punish the workers (“With punishment;” Columns 1–2) and the treatment in which the leader cannot do that (“Without punishment;” Columns 3–4). Recall that by punishment we mean the possibility for the leader to allocate to a given worker less than 33% of the workers’ total payoff. We include round fixed effects, and in Columns (2) and (4) we add controls for individual characteristics (Individual controls).

The results suggest that only incentive-powered leaders—who also voluntarily choose automatic reporting—exert a positive and significant effect on the likelihood of their workers choosing automatic reporting [see the positive and statistically significant coefficients of Leader’s automatic reporting (voluntary) in Columns 1–2]. Overall, this finding reveals that a leader’s incentive power and voluntary decision are both necessary ingredients to influence workers’ ethical reporting choices.

How—and Which Type of—Leaders Use Their Incentive Power?

Our next assessment concerns how—and which type of—leaders use the incentive power. Table 6 reports logit regressions on decisions in the group setting, wherein the dependent variable Punishment is equal to one if the leader allocates to a given worker less than 33% of the workers’ total payoff, and zero if the leader allocates an equal share of the workers’ total payoff among workers. Values below 33% can be perceived by workers as an economic punishment. The main explanatory variable is Alignment, a dummy equal to one when the worker’s reporting choice (either automatic or self-reporting) is aligned with that of the leader, and zero otherwise. Out of the total of 180 workers, we use 90 workers (across the ten rounds, i.e., 900 obs.) corresponding to the treatments in which the leader has incentive power. We control for round fixed effects and, in Column (2), individual characteristics (Individual controls). In Column (2), the number of observations is 890 (and not 900) because the field of study perfectly predicts the dependent variable in ten instances, which are thus excluded.

The results indicate a negative and significant effect of alignment on the likelihood of punishment. In other words, leaders exercise their incentive power to punish workers who do not follow them in their reporting choice.

Next, we investigate which type of misalignment leaders are willing to punish. Table 7 reports the same logit regressions of Table 6, but now separately estimating punishment decisions for each of the two leader’s reporting methods (either voluntary or mandatory). In Column (1), we consider the instances of leader’s self-reporting (and thus alignment means that the workers also choose self-reporting). In Column (2), we consider the instances of leader’s automatic reporting (and thus alignment means that the workers also choose automatic reporting). We include round fixed effects and individual characteristics (Individual controls). The sum of the observations in Columns (1)–(2) should amount to 900, i.e., the observations used in Table 6. Nonetheless, given that the field of study perfectly predicts the dependent variable in 42 instances, the sum of the observations in the two columns is 858.

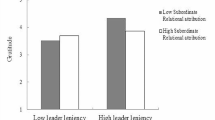

Interestingly, our results indicate that the greater likelihood of punishment due to reporting misalignment is significant only when the leader chooses self-reporting and workers choose automatic reporting (Column 1).

We explore this result in Fig. 2, which plots the predicted probability of punishment due to reporting misalignment between leaders and workers along with the size of the group outcome (i.e., the sum of the die-rolling reported outcomes in a group). The solid line shows the predicted probability in the case of misalignment, whereas the dotted line shows the predicted probability in the case of alignment. The areas surrounding each line show the 5% confidence intervals. Recall that a larger group payoff (derived from realizations of five or six in the die-rolling task) provides a stronger indication of cheating.

Figure 2a shows that the probability of punishment is higher in the case of reporting misalignment (solid lines) between workers and leaders (compared with reporting alignment). This predicted probability is at its highest value for the lowest size of the group payoff, and it decreases as the group payoff increases. Figure 2b reveals that this result is especially marked when the leader chooses or is assigned to self-reporting as opposed to automatic reporting.

Does Leaders’ Ethical Reporting Influence Workers’ Cheating Behavior?

Finally, we focus on workers’ cheating behavior when they choose self-reporting. Although we cannot observe the true die-rolling reported result, we can statistically detect the degree of misreporting by comparing the observed occurrence of each realization with the theoretical occurrence derived from a uniform distribution. Recall that subjects self-report the result of their die-rolling task, which ranges between one and six. The probability of each number is 1/6, and thus in the absence of cheating each realization should display the same frequency of around 17%. However, we find that subjects in the individual setting report a value of six in 40.8% of the cases. In the group setting, this fraction is as high as 50.3%.

Focusing on the group setting, we explore the workers’ frequency for each realization of their die rolls. Figure 3 provides the empirical distribution of each die-rolling result (from one to six) by the workers depending on their leader’s reporting method (either voluntary or mandatory). The values on the y axis represent the percentage of realizations. The dotted line reports the benchmark uniform distribution where the probability of each die-rolling result is 16.6%. As shown, there is substantial cheating among workers. Realizations at the low end of the distribution are heavily under-reported, while the value of six is reported five times more frequently than it should be. Importantly, by looking at workers’ reporting for a given leader’s reporting method, we find that the frequency of six is higher in the presence of leaders’ self-reporting compared with automatic reporting. Collectively, these results suggest that while there is substantial cheating in our experiment, leaders’ automatic reporting helps to spur a slightly more ethical behavior among workers.

These insights are confirmed by the logit regressions reported in Table 8. The dependent variable is Highest realization, a dummy equal to one if the worker reports the highest realization (i.e., six) in the die-rolling task (which is disproportionally represented in our sample and thus reflects cheating behavior among workers), and zero for all other realizations. The key explanatory variable is Leader’s automatic reporting, which is equal to one for leaders’ automatic reporting, and zero for leaders’ self-reporting (either voluntary or mandatory). We use the total of 180 workers (across the ten rounds, i.e., 1800 observations).

The results indicate that leaders’ automatic reporting (either voluntary or mandatory) has a negative and significant effect on the likelihood of workers choosing self-reporting to engage in cheating. In additional analyses, we find that this result is robust to estimating the regression separately for leaders’ voluntary or mandatory reporting.

Discussion

In this section, we discuss the theoretical and practical implications of our findings, as well as limitations and avenues for future research.

Theoretical and Practical Implications

Our study is positioned at the intersection of two streams of research that are interconnected but have hitherto developed independently: one on ethical leadership (Brown & Mitchell, 2010; Stouten et al., 2012), and another on leading by example (Güth et al., 2007; Hermalin, 1998). In bridging these two branches of literature, our findings contribute to both.

First, we draw attention to one crucial aspect of ethical leadership—i.e., truthful financial reporting decisions—and its influence on workers’ behaviors. Prior experimental evidence has revealed a positive leader effect on followers’ behaviors in voluntary contribution games; nonetheless, leaders’ reporting choices are either exogenously imposed (e.g., Friesen & Gangadharan, 2013; Houser et al., 2014), or implicitly assumed given that the leader acts as a first mover (e.g., Brandts et al., 2016; Parsons et al., 2020). Closely related to our research, D’Adda et al. (2017) show that leaders who cheat less reduce cheating among workers. However, D’Adda et al. exclusively used the mere action of cheating as a proxy for unethical behavior, neglecting the key role of reporting choices (Behnk et al., 2019; Feltovich, 2019). Our results provide unique insights into this discussion by (i) moving the focus away from the direct analysis of cheating to its key antecedent, i.e., the ex-ante reporting choice, and (ii) establishing the effect of assigned vs voluntarily chosen leaders’ reporting choices on workers’ actions. Importantly, our findings refine the predictions of leading by example (Hermalin, 1998) and social learning theories (Brown et al., 2005). In line with those theories, we show that observing a leader’s non-manipulative reporting choice also makes workers significantly more likely to choose the ethical reporting method. Even workers who choose self-reporting tend to cheat less when their leaders chose automatic reporting. However, this occurs only when the leader makes a voluntary choice and can punish or reward workers.

These findings suggest that to prevent earnings manipulation in organizations, leaders must have latitude in signaling their vision to workers and power to assign economic incentives (cf: Sims & Brinkman, 2002). Regulations or laws that mandate non-manipulative reporting at the managerial level may not effectively encourage workers to adhere to such ethical standards (cf: Mulder et al., 2020). Rather, leaders should be able to actively promote the behaviors that they expect workers to embrace (cf: Mayer et al., 2013).

Second, prior research on ethical leadership has generally focused on the effect of leaders on subordinates and organizations (Ng & Feldman, 2015). Here, we redirect scholarly attention toward leaders’ own behavior. Drawing on theories of role modeling and social identity (Brown & Treviño, 2014; Tajfel, 1982), the literature has generally revealed an optimistic view about leaders (Brown & Mitchell, 2010; but c.f. Miao et al., 2013; Stouten et al., 2013; Tourish, 2013; Yam et al., 2019). Yet, given the many high-profile corporate scandals such as Volkswagen, Enron, Tyco, and WorldCom, it is hard to take it for granted that leaders behave ethically. Our exploratory analysis shows that most leaders choose self-reporting for earnings manipulation, and they punish workers who rather choose automatic reporting, especially when the group payoff is low. Instead, leaders who choose automatic reporting refrain from punishing workers who rather choose self-reporting: they seem willing to take advantage of workers’ fraudulent behavior to gain profits while keeping their hands clean. To our knowledge, this relationship has not been revealed before, although it fits with findings from other settings in which ethical leaders willingly keep their hands clean while maximizing profits through ethical free-riding (Gross et al., 2018; Parsons et al., 2020), convenient leniency (Di Tella et al., 2015; Hoogervorst et al., 2010), and anti-social punishment (Gürerk et al., 2018).

Our results also add to the growing discussions in the business ethics literature about leaders’ ethical dilemmas in their reporting decisions (Evans et al., 2001). The predominant motivating factor for leaders in our lab experiment is profit maximization, even through unethical acts (e.g., Wisse & Rus, 2012). Instead, they do not seem to feel particularly responsible to set “the right example” through adhering to ethical rules that would imply lower private or corporate wealth (c.f.: Haslam & Platow, 2001).

Essentially, our findings reveal a dual role of leaders in shaping ethical behaviors within organizations: ethical leaders can stimulate workers’ ethical behaviors, but most of the time leaders do not behave ethically in the first place. In this case, leading by example can backfire, with unethical leaders even punishing ethical workers for their truthfully reporting financial outcomes. This suggests the importance for organizations to appoint leaders with a clear inclination for ethical reporting or disclosure choices. A few cases can show that the business world is moving in that direction (Healy & Serafeim, 2020). An example comes from Statoil, a Norwegian energy company (renamed as Equinor): after a bribery charge in 2004, the new CEO at that time, Helge Lund, decided that the company would become one of the first firms to publicly disclose its payments to foreign governments to gain access to their natural resources. This gave employees a strong signal of a clear commitment to transparency.

Finally, we discuss whether the effects of leadership extend to changes in workers’ view of how appropriate is to choose a reporting system not aligned with the leader’s one, and inflate the outcome of the die roll. We find no significant differences in workers’ mean responses across treatments. This suggests that leaders can influence workers’ behavior through voluntary decisions and incentive power, but do not shape their norms and values (c.f.: D’Adda et al., 2017). That said, we shall acknowledge that the null result might be due to the limited number of observations, and to the fact that the incentives were to match the choice provided by a randomly selected participant in the session, rather than in one’s group. This calls for more research about the effect of leadership on social norms within organizations.

Limitations and Future Research

Our study is not without limitations, which provide fruitful avenues for future research. To start with, as with any lab experiment, external validity concerns may arise. One might question the role of the leaders in our experiment. In real settings, leadership is long-lasting, interactions between leaders and followers often occur face to face, and leaders can leverage many mechanisms to influence workers, including firing and hindering or promoting career progressions. We find robust important leadership effects even though the interactions between leaders and followers occur anonymously and only virtually in a short-time frame, and leaders have relatively soft powers. Thus, our results may represent a lower bound for the effects that prevail in real organizations. Another concern is that self-reporting methods and cheating may produce negative externalities. In our setting, choosing self-reporting and misreporting the outcome create individual benefits without affecting other subjects. Since the effects of ethical behaviors are likely to be magnified in the presence of negative externalities (D’Adda et al., 2017), our findings are likely to be even more important in real environments where negative externalities are present.

This research is a first attempt to explore the influence of leaders on workers’ fraudulent behaviors through reporting choices. Inevitably, several aspects have been omitted. For example, providing leaders with the possibility to assign punishments or rewards based not only on workers’ reporting choices but also on their reported die-rolling outcomes would help to rule out the possibility that leaders with better cognitive skills were also better able to infer workers’ reported outcomes from group performance.

While our attention has been devoted to reporting choices and the leader effect, other aspects of our main findings are worth discussing here as open questions for future research. For instance, our data reveal a self-reporting rate of around 80%, which is higher than the cheating rate in standard die-rolling experiments (e.g., Gneezy et al., 2018). Perhaps subjects do not have any moral qualms about self-reporting at all, or they view it as less distasteful compared with automatic reporting since dishonesty does not harm anyone other than the experimenter here. Other potential explanations may include the desire to signal honesty by truthfully self-reporting a die-rolling outcome, distrust toward a computer randomization device, or the mere pleasure gained from the act of rolling dice. While the current design was not meant to capture individual perceptions toward self-reporting vs third-party reporting methods, it can be extended in this direction.

Concluding Remarks

In this research, we have drawn from—and combined—theories of leading by example and ethical leadership to analyze whether workers follow their leaders’ ethical reporting choices. We have further explored leaders’ use of punishments or rewards and its influence on workers’ reporting choices. Collectively, our results reveal a dual role of leaders in spurring ethical behaviors within organizations. On the one hand, workers behave more ethically if their leader makes ethical choices. On the other hand, leaders do not appear to make ethical choices in the first place, and they can even punish workers who opt for non-fraudulent (but less profitable) reporting. Hence, leading by example may backfire, exacerbating—rather than fixing—fraudulent behaviors. We emphasize the need to rethink the (predominately positive) theories of ethical leadership, and warn organizations about the importance of recruiting “the right” leaders—those more inclined to ethical practices.

Data Availability

The data used and analyzed during the current study are available on request.

Change history

21 July 2022

The original online version of this article was revised: Missing Open Access funding information has been added in the Funding Note.

Notes

Real-world settings where leaders and workers choose how to report earnings—as in our experiment—include firms with multiple profit centers, e.g., multidivisional companies where reporting by subsidiaries is undertaken independently from the parent firm (Beuselinck et al., 2019).

Feltovich (2019) finds lower reported costs in the “self-roll” treatment vis-à-vis the “computer-roll” treatment. Behnk et al. (2019) show that computer-generated reports reduce deception to a stronger extent than individually-written reports in a repeated sender-receiver game. Evidence from tax compliance (Adhikari et al., 2021; Kleven et al., 2011) and firms’ environmental emissions (Telle, 2013) further confirms that third‐party reporting methods ensure lower levels of misreported information. That said, subjects who choose self-reporting might still truthfully report earnings. Similarly, there might be subjects who obtain the highest die-rolling outcome but are misclassified as dishonest (Gneezy et al., 2018). Our goal here is to measure a tendency towards fraudulent behavior, which is proxied by the choice of self-reporting. As D’Adda et al. (2017) argue, any noise in such a measure of fraudulent behavior will likely underestimate the empirical results.

Unlike in D’Adda et al. (2017), in which leaders can only reward group members, we allow leaders to reward or punish group members. Moreover, we investigate how leaders use their incentive power based on both workers’ reporting choices and the overall group payoff, thus expanding D’Adda et al.’s (2017) analysis, which only focuses on workers’ cheating behavior.

We have included a set of dummies for the following fields: (1) economics; (2) political science; (3) sociology; (4) other social sciences; (5) natural, physical and mathematical sciences; (6) engineering and architecture; (7) medicine; (8) arts and humanities; and (9) others.

In Columns (2), (6) and (8), the field of study perfectly predicts the dependent variable in twenty instances, which are thus dropped from the analysis.

In Column (2), the number of observations is 254 (and not 260) because the field of study perfectly predicts the dependent variable in six instances, which are thus excluded.

References

Abeler, J., Nosenzo, D., & Raymond, C. (2019). Preferences for truth-telling. Econometrica, 87(4), 1115–1153.

Adhikari, B., Alm, J., & Harris, T. F. (2021). Small business tax compliance under third-party reporting. Journal of Public Economics, 203, 104514.

Anderson, C. A., Lindsay, J. J., & Bushman, B. J. (1999). Research in the psychological laboratory: Truth or triviality? Current Directions in Psychological Science, 8, 3–9.

Ashforth, B. E., & Mael, F. (1989). Social identity theory and the organization. Academy of Management Review, 14(1), 20–39.

Avey, J. B., Palanski, M. E., & Walumbwa, F. O. (2011). When leadership goes unnoticed: The moderating role of follower self-esteem on the relationship between ethical leadership and follower behavior. Journal of Business Ethics, 98(4), 573–582.

Babalola, M. T., Stouten, J., Camps, J., & Euwema, M. (2019). When do ethical leaders become less effective? The moderating role of perceived leader ethical conviction on employee discretionary reactions to ethical leadership. Journal of Business Ethics, 154(1), 85–102.

Bandura, A. (1997). Self-efficacy: The exercise of control. W.H. Freeman.

Baur, C., Soucek, R., Kühnen, U., & Baumeister, R. F. (2020). Unable to resist the temptation to tell the truth or to lie for the organization? Identifcation makes the difference. Journal of Business Ethics, 167(4), 643–662.

Beatty, A., Liao, S., & Yu, J. J. (2013). The spillover effect of fraudulent financial reporting on peer firms’ investments. Journal of Accounting and Economics, 55(2–3), 183–205.

Behnk, S., Barreda-Tarrazona, I., & García-Gallego, A. (2019). Deception and reputation—an experimental test of reporting systems. Journal of Economic Psychology, 71, 37–58.

Bettis, R. A., Gambardella, A., Helfat, C., & Mitchell, W. (2014). Quantitative empirical analysis in strategic management. Strategic Management Journal, 35(7), 1411–1413.

Beuselinck, C., Cascino, S., Deloof, M., & Vanstraelen, A. (2019). Earnings management within multinational corporations. The Accounting Review, 94(4), 45–76.

Brandts, J., Cooper, D., & Fatas, E. (2007). Leadership and overcoming coordination failure with asymmetric costs. Experimental Economics, 10, 269–284.

Brandts, J., Rott, C., & Solà, C. (2016). Not just like starting over: Leadership and revivification of cooperation in groups. Experimental Economics, 19(4), 792–818.

Brown, M. E., & Mitchell, M. S. (2010). Ethical and unethical leadership: Exploring new avenues for future research. Business Ethics Quarterly, 20(4), 583–616.

Brown, M. E., & Treviño, L. K. (2006). Ethical leadership: A review and future directions. The Leadership Quarterly, 17(6), 595–616.

Brown, M. E., & Treviño, L. K. (2014). Do role models matter? An investigation of role modeling as an antecedent of perceived ethical leadership. Journal of Business Ethics, 122(4), 587–598.

Brown, M. E., Treviño, L. K., & Harrison, D. A. (2005). Ethical leadership: A social learning perspective for construct development and testing. Organizational Behavior and Human Decision Processes, 97(2), 117–134.

Burks, S. V., & Krupka, E. L. (2012). A multimethod approach to identifying norms and normative expectations within a corporate hierarchy: Evidence from the financial services industry. Management Science, 58(1), 203–217.

Campbell, P. (2016). Volkswagen scandal involved ‘dozens’ of employees. Financial Times. Retrieved November 18, 2021, from https://www.ft.com/content/d5fab184-4dcd-11e6-8172-e39ecd3b86fc

Carson, T. L. (2003). Self–interest and business ethics: Some lessons of the recent corporate scandals. Journal of Business Ethics, 43(4), 389–394.

Cialdini, R., Li, Y. J., Samper, A., & Wellman, N. (2019). How bad apples promote bad barrels: Unethical leader behavior and the selective attrition effect. Journal of Business Ethics, 168(4), 861–880.

Cremer, A. & Bergin, T. (2015). Fear and respect: VW’s culture under Winterkorn. Reuters.com. Retrieved from November 18, 2021, from https://www.reuters.com/article/us-volkswagen-emissions-culture-idUSKCN0S40MT20151010

Crocker, K. J., & Slemrod, J. (2007). The economics of earnings manipulation and managerial compensation. RAND Journal of Economics, 38(3), 698–713.

D’Adda, G., Darai, D., Pavanini, N., & Weber, R. A. (2017). Do leaders affect ethical conduct? Journal of the European Economic Association, 15(6), 1177–1213.

De Hoogh, A. H., & Den Hartog, D. N. (2008). Ethical and despotic leadership, relationships with leader’s social responsibility, top management team effectiveness and subordinates’ optimism: A multi-method study. The Leadership Quarterly, 19(3), 297–311.

Deaux, K. (1993). Reconstructing social identity. Personality and Social Psychology Bulletin, 19(1), 4–12.

Di Tella, R., Perez-Truglia, R., Babino, A., & Sigman, M. (2015). Conveniently upset: Avoiding altruism by distorting beliefs about others’ altruism. American Economic Review, 105(11), 3416–3442.

Dutton, J. E., Roberts, L. M., & Bednar, J. (2010). Pathways for positive identity construction at work: Four types of positive identity and the building of social resources. Academy of Management Review, 35(2), 265–293.

Eichenseer, M. (2019). Leading by example in public goods experiments: What do we know? Retrieved November 18, 2021, from https://ssrn.com/abstract=3441638/

Eisenbeiß, S. A. (2012). Re-thinking ethical leadership: An interdisciplinary integrative approach. The Leadership Quarterly, 23(5), 791–808.

Eisenbeiß, S. A., & Giessner, S. R. (2012). The emergence and maintenance of ethical leadership in organizations. Journal of Personnel Psychology, 11(1), 7–19.

Evans, J. H., III., Hannan, R. L., Krishnan, R., & Moser, D. V. (2001). Honesty in managerial reporting. The Accounting Review, 76(4), 537–559.

Feltovich, N. (2019). The interaction between competition and unethical behaviour. Experimental Economics, 22(1), 101–130.

Fischbacher, U. (2007). z-Tree: Zurich toolbox for ready-made economic experiments. Experimental Economics, 10(2), 171–178.

Fischbacher, U., & Follmi-Heusi, F. (2013). Lies in disguise—an experimental study on cheating. Journal of the European Economic Association, 11(3), 525–547.

Friesen, L., & Gangadharan, L. (2013). Designing self-reporting regimes to encourage truth telling: An experimental study. Journal of Economic Behavior & Organization, 94, 90–102.

Gächter, S., Nosenzo, D., Renner, E., & Sefton, M. (2012). Who makes a good leader? Cooperativeness, optimism, and leading-by-example. Economic Inquiry, 50(4), 953–967.

Gibson, R., Tanner, C., & Wagner, A. F. (2013). Preferences for truthfulness: Heterogeneity among and within individuals. American Economic Review, 103(1), 532–548.

Gneezy, U., Kajackaite, A., & Sobel, J. (2018). Lying aversion and the size of the lie. American Economic Review, 108(2), 419–453.

Gross, J., Leib, M., Offerman, T., & Shalvi, S. (2018). Ethical free riding: When honest people find dishonest partners. Psychological Science, 29(12), 1956–1968.

Guiso, L., Sapienza, P., & Zingales, L. (2015). The value of corporate culture. Journal of Financial Economics, 117(1), 60–76.

Gürerk, Ö., Lauer, T., & Scheuermann, M. (2018). Leadership with individual rewards and punishments. Journal of Behavioral and Experimental Economics, 74, 57–69.

Güth, W., Levati, M. V., Sutter, M., & Van Der Heijden, E. (2007). Leading by example with and without exclusion power in voluntary contribution experiments. Journal of Public Economics, 91(5–6), 1023–1042.

Haslam, S. A., & Platow, M. J. (2001). The link between leadership and followership: How affirming social identity translates vision into action. Personality and Social Psychology Bulletin, 27(11), 1469–1479.

Healy, P. M., & Serafeim, G. (2020). Voluntary, self-regulatory, and mandatory disclosure of oil and gas company payments to foreign governments. Accounting Horizons, 34(1), 111–129.

Hermalin, B. (1998). Toward an economic theory of leadership: Leading by example. American Economic Review, 88(5), 1188–1206.

Ho, Y. H., & Lin, C. Y. (2016). The moral judgment relationship between leaders and followers: A comparative study across the Taiwan Strait. Journal of Business Ethics, 134(2), 299–310.

Hogg, M. A. (2001a). A social identity theory of leadership. Personality and Social Psychology Review, 5(3), 184–200.

Hogg, M. A. (2001b). From prototypicality to power: A social identity analysis of leadership. In S. R. Thye, E. J. Lawler, M. W. Macy, & H. A. Walker (Eds.), Advances in group processes (Vol. 18, pp. 1–30). Elsevier.

Hood, J. N. (2003). The relationship of leadership style and CEO values to ethical practices in organizations. Journal of Business Ethics, 43(4), 263–273.

Hoogervorst, N., De Cremer, D., & van Dijke, M. (2010). Why leaders not always disapprove of unethical follower behavior: It depends on the leader’s self-interest and accountability. Journal of Business Ethics, 95(1), 29–41.

Hotten, R. (2015). Volkswagen: The scandal explained. BBC News. Retrieved November 18, 2021, from https://www.bbc.com/news/business-34324772

Houser, D., Levy, D. M., Padgitt, K., Peart, S. J., & Xiao, E. (2014). Raising the price of talk: An experimental analysis of transparent leadership. Journal of Economic Behavior & Organization, 105, 208–218.

Hunter, S. T. (2012). (Un) ethical leadership and identity: What did we learn and where do we go from here? Journal of Business Ethics, 107(1), 79–87.

Johnson, E. N., Kidwell, L. A., Lowe, D. J., & Reckers, P. M. (2019). Who follows the unethical leader? The association between followers’ personal characteristics and intentions to comply in committing organizational fraud. Journal of Business Ethics, 154(1), 181–193.

Kalshoven, K., & Boon, C. T. (2012). Ethical leadership, employee well-being, and helping. Journal of Personnel Psychology, 11(1), 60–68.

Kleven, H. J., Knudsen, M., Kreiner, C. T., Pedersen, S., & Saez, E. (2011). Unwilling or unable to cheat? Evidence from a tax audit experiment in Denmark. Econometrica, 79(3), 651–692.

Koehn, D. (2005). Integrity as business asset. Journal of Business Ethics, 58(1), 125–136.

Krupka, E. L., & Weber, R. (2013). Identifying social norms using coordination games: Why does dictator game sharing vary? Journal of the European Economic Association, 11(3), 495–524.

Locke, E. (1986). Generalizing from laboratory to field settings. DC Heath.

López-Pérez, R., & Spiegelman, E. (2019). Do economists lie more? In A. Bucciol & N. Montanari (Eds.), Dishonesty in behavioral economics (pp. 143–162). Academic Press.

Lyngsie, J., & Foss, N. J. (2017). The more, the merrier? Women in top-management teams and entrepreneurship in established firms. Strategic Management Journal, 38(3), 487–505.

Mayer, D. M., Aquino, K., Greenbaum, R., & Kuenzi, M. (2012). Who displays ethical leadership, and why does it matter? An examination of antecedents and consequences of ethical leadership. Academy of Management Journal, 55(1), 151–171.

Mayer, D. M., Kuenzi, M., Greenbaum, R., Bardes, M., & Salvador, R. (2009). How low does ethical leadership flow? Test of a trickle-down model. Organizational Behavior and Human Decision Processes, 108(1), 1–13.

Mayer, D. M., Nurmohamed, S., Treviño, L. K., Shapiro, D. L., & Schminke, M. (2013). Encouraging employees to report unethical conduct internally: It takes a village. Organizational Behavior and Human Decision Processes, 121(1), 89–103.

Miao, Q., Newman, A., Yu, J., & Xu, L. (2013). The relationship between ethical leadership and unethical pro-organizational behavior: Linear or curvilinear effects? Journal of Business Ethics, 116(3), 641–653.

Mook, D. M. (1983). In defense of external invalidity. American Psychologist, 38, 379–387.

Mulder, L. B., Rink, F., & Jordan, J. (2020). Constraining temptation: How specific and general rules mitigate the effect of personal gain on unethical behavior. Journal of Economic Psychology, 76, 102242.

Neubert, M. J., Carlson, D. S., Kacmar, K. M., Roberts, J. A., & Chonko, L. B. (2009). The virtuous influence of ethical leadership behavior: Evidence from the field. Journal of Business Ethics, 90(2), 157–170.

Newman, A., Kiazad, K., Miao, Q., & Cooper, B. (2014). Examining the cognitive and affective trust-based mechanisms underlying the relationship between ethical leadership and organisational citizenship: A case of the head leading the heart? Journal of Business Ethics, 123(1), 113–123.

Ng, T. W., & Feldman, D. C. (2015). Ethical leadership: Meta-analytic evidence of criterion-related and incremental validity. Journal of Applied Psychology, 100(3), 948–965.

Parsons, D. M., Feltovich, N., & Grossman, P. J. (2020). The effect of leadership on free-riding: Results from a public-good experiment. Review of Behavioral Economics, 7(1), 31–63.

Pate, J. (2018). Temptation and cheating behavior: Experimental evidence. Journal of Economic Psychology, 67, 135–148.

Peterson, D., Rhoads, A., & Vaught, B. C. (2001). Ethical beliefs of business professionals: A study of gender, age and external factors. Journal of Business Ethics, 31(3), 225–232.

Piccolo, R. F., Greenbaum, R., Hartog, D. N. D., & Folger, R. (2010). The relationship between ethical leadership and core job characteristics. Journal of Organizational Behavior, 31(2–3), 259–278.

Potters, J., Sefton, M., & Vesterlund, L. (2007). Leading-by-example and signaling in voluntary contribution games: An experimental study. Economic Theory, 33(1), 169–182.

Rilke, R. M., Danilov, A., Weisel, O., Shalvi, S., & Irlenbusch, B. (2021). When leading by example leads to less corrupt collaboration. Journal of Economic Behavior & Organization, 188, 288–306.

Rosenbaum, S. M., Billinger, S., & Stieglitz, N. (2014). Let’s be honest: A review of experimental evidence of honesty and truth-telling. Journal of Economic Psychology, 45, 181–196.

Ruddick, G., & Farrell, S. (2015). VW scandal: Staff suspended as car giant appoints new CEO. The Guardian. Retrieved November 18, 2020, from https://www.theguardian.com/business/2015/sep/25/volkswagen-appoints-matthias-muller-chief-executive-porsche-vw/

Sanders, S., Wisse, B., Van Yperen, N. W., & Rus, D. (2018). On ethically solvent leaders: The roles of pride and moral identity in predicting leader ethical behavior. Journal of Business Ethics, 150(3), 631–645.

Schaubroeck, J. M., Hannah, S. T., Avolio, B. J., Kozlowski, S. W. J., Lord, R. G., Treviño, L. K., Dimotakis, N., & Peng, A. C. (2012). Embedding ethical leadership within and across organization levels. Academy of Management Journal, 55(5), 1053–1078.

Schuhmacher, K., Towry, K. L., & Zureich, J. (2021). Leading by example in socially driven organizations: The effect of transparent leader compensation contracts on following. The Accounting Review. https://doi.org/10.2308/TAR-2019-0227

Seppälä, T., Lipponen, J., Pirttilä-Backman, A. M., & Lipsanen, J. (2012). A trust-focused model of leaders’ fairness enactment. Journal of Personnel Psychology, 11(1), 20–30.

Sims, R. R., & Brinkman, J. (2002). Leaders as moral role models: The case of John Gutfreund at Salomon Brothers. Journal of Business Ethics, 35(4), 327–339.

Stouten, J., Baillien, E., Van den Broeck, A., Camps, J., Witte, H., & Euwema, M. (2010). Discouraging bullying: The role of ethical leadership and its effects on the work environment. Journal of Business Ethics, 95(1), 17–27.

Stouten, J., Van Dijke, M., & De Cremer, D. (2012). Ethical leadership: An overview and future perspectives. Journal of Personnel Psychology, 11(1), 1–6.

Stouten, J., van Dijke, M. H., Mayer, D., De Cremer, D., & Euwema, M. (2013). Can a leader be seen as too ethical? The curvilinear effects of ethical leadership. The Leadership Quarterly, 24(5), 680–695.

Tajfel, H. (Ed.). (1982). Social identity and intergroup relations. Cambridge University Press.

Telle, K. (2013). Monitoring and enforcement of environmental regulations: Lessons from a natural field experiment in Norway. Journal of Public Economics, 99, 24–34.

Tourish, D. (2013). The dark side of transformational leadership: A critical perspective. Taylor & Francis.

Treviño, L. K. (1992). Experimental approaches to studying ethical-unethical behavior in organizations. Business Ethics Quarterly, 2(2), 121–136.

Tyler, T. R., & Blader, S. L. (2005). Can businesses effectively regulate employee conduct? The antecedents of rule following in work settings. Academy of Management Journal, 48(6), 1143–1158.

White, D. W., & Lean, E. (2008). The impact of perceived leader integrity on subordinates in a work team environment. Journal of Business Ethics, 81(4), 765–778.

Wisse, B., & Rus, D. (2012). Leader self-concept and self-interested behavior. Journal of Personnel Psychology, 11(1), 40–48.

Yaffe, T., & Kark, R. (2011). Leading by example: The case of leader OCB. Journal of Applied Psychology, 96(4), 806–826.

Yam, K. C., Fehr, R., Burch, T. C., Zhang, Y., & Gray, K. (2019). Would I really make a difference? Moral typecasting theory and its implications for helping ethical leaders. Journal of Business Ethics, 160(3), 675–692.

Acknowledgements

We are indebted to Katherina G. Pattit and the anonymous referees for their insightful and valuable comments. For useful suggestions, we are grateful to Andrea Ichino, Tommaso Reggiani, Bertil Tungodden, Mogens Kamp Justesen, seminar participants at Lund University, Norwegian School of Economics, European University Institute, Copenhagen Business School, and conference participants at the Society for the Advancement of Behavioral Economics Conference in San Francisco. We also thank Ignacio Alastrué, Rebeca Parra, Richard Forsythe for their collaboration, and Enya Turrini for her invaluable research assistance.

Funding

Open access funding provided by Alma Mater Studiorum - Università di Bologna within the CRUI-CARE Agreement. This project has received funding from the Carlsberg Foundation (Project CF17-0758).

Author information

Authors and Affiliations

Contributions

The authors equally contributed to the current study.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Amore, M.D., Garofalo, O. & Guerra, A. How Leaders Influence (un)Ethical Behaviors Within Organizations: A Laboratory Experiment on Reporting Choices. J Bus Ethics 183, 495–510 (2023). https://doi.org/10.1007/s10551-022-05088-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10551-022-05088-z