Abstract

Managers of multinational companies often favour an aggressive tax avoidance strategy that pushes the legal limits onto the advantage of shareholders and the disadvantage of the spirit of democratically legitimized tax laws. The public and media debate whether such aggressive behaviour is immoral. Aggressive tax avoidance is a subset of the aggressive legal interpretations potentially observable in all fields which places little weight on the will of a democratically legitimized legislation. A thorough ethical analysis based on the deontological approach of Kant demonstrates that aggressive tax avoidance as a special case of operating on the edge of legal boundaries is potentially immoral. Applying the Kantian “contradiction of conception or will” test shows that this maxim might not be conceived or willed as a general law of nature. If all natural or legal persons aggressively interpret laws on all subjects and in every imaginable situation, then central principles of the system of law we all rely upon would be severely compromised. Therefore, aggressive tax avoidance by managers of multinational companies may violate the managers’ moral duty to obey not only the letter but also the intention or spirit of the law. The validity of the argumentation depends critically on the formulation and interpretation of the respective maxims and on assumptions about the legal system. Preserving central elements of Kantian philosophy, the article demonstrates the complexity of a philosophical argumentation which tries to justify the moral intuitions that underpin the common negative evaluation of aggressive legal strategies in business.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Normative Problem: Is Aggressive Tax Avoidance by Managers of Multinational Companies Immoral?

Managers of large multinational companies (MNCs) avoid taxes to a significant degree. In economics, tax avoidance means maximizing the net present value of free cash flows after taxes (see Brealey et al. 2008, p. 144). Ethical aspects are regularily not considered in a purely economic perspective where taxes are merely costs. Zucman (2014, pp. 121, 131) calculated that from 1998 to 2013, the effective tax rate of US firms was reduced to benefit shareholders from 30 to 20% and “about two-thirds of this decline can be attributed to increased profit-shifting to low-tax jurisdictions.” Dyreng et al. (2017) demonstrated that in the USA, despite an essentially constant statutory tax rate, cash effective tax rates have declined between 1988 and 2012 by approximately ten percentage points for both multinational and domestic firms. Torslov et al. (2018) estimated in a recent large cross-country analysis that approximately 40% of MNC profits are shifted to low-tax countries each year; the European Union and developing countries are suffering the largest tax revenue losses.

MNC tax avoidance has received considerable scrutiny in the public and political spheres. The public and media debate whether such behaviour is immoral. Many articles have focused on the following issue: “Avoiding tax and bending the rules of the tax system is not illegal unlike tax evasion; it is operating within the letter, but perhaps not the spirit, of the law. Businesses may therefore be complying with the law—but is it ethical?” (Foster Back 2013). There are numerous similar articles in the pressFootnote 1 or statements from non-governmental organisations (NGOs), such as the Institute of Business Ethics (IBE) or the Tax Justice Network (TJN), which consider tax avoidance as an ethical issue: “Avoiding tax by ‘bending’ the rules of the tax system is not illegal, but it is seen by many as operating within the letter rather than the spirit of the law. […] The issue falls into the realm of ethics because businesses have a choice about their approach to interpreting the law and hence paying taxes” (IBE 2013; see also Christensen and Murphy 2004).

Under the pressure of public opinion, legislative bodies in the UK, USA and other countries, i.e., the Public Accounts Committee in the UKFootnote 2 or the US Senate Permanent Subcommittee of the Committee on Homeland Security and Government Affairs (US Senate 2012, 2013, 2014), have held public hearings about potentially aggressive tax avoidance of MNCs. In a UK hearing, the chair Margaret Hodge commented the following: “People have invested in your scheme to take advantage of the allowances so they avoid tax. You may say that is legal; I think it’s immoral. It’s the old argument” (UK House of Commons 2013, p. 14). Thus, even in the political sphere, moral valuations reflecting public opinion play a role. An important recurring theme is an emphasis between the spirit and the letter of the law “buttressed by a vague and overriding concept of morality or fairness which trumps black letter law” (Panayi 2015, p. 549). The legal-political discussion is dominated by the OECD/G20 action plan “base erosion and profit shifting (BEPS)” (Büttner and Thiemann 2017; OECD 2015, 2017a); however, the public and political spheres are connected because the OECD concedes that “there is an urgent need to restore the trust of the ordinary people in the fairness of their tax system” (OECD 2015, p. 4).

Tax avoidance has also caught the interest of researchers. In the mainstream empirical research on tax avoidance, hypotheses about the determinants and effects of tax avoidance by MNCs are tested with the usual range of econometric tools and the advantages and disadvantages of different metrics (e.g., effective tax rates or book-tax differences) are discussed in terms of the recognition of (aggressive) tax avoidance (cf. Hanlon and Heitzman 2010; Overesch 2016 with further references). Consistent with Weber’s postulate of freedom from value judgements (in Schurz’s Interpretation 2014, pp. 37–44), the authors of these studies predominantly avoid explicit value judgements in the context of scientific justifications. No statements are made about whether tax avoidance is socially responsible or irresponsible, i.e., value judgements based on ethical criteria. Legal tax avoidance is considered the expression of companies’ pursuit of market value maximization in the market economy, and it is investigated in a “value neutral” manner. However, given this “empiricist turn,” the analytical-normative literature on basic questions of economically aligned corporate taxationFootnote 3 has, in the past, gone in a different direction and addressed the question of whether and to what extent should this be conceived as “corporate tax avoidance” and how its social benefit should be assessed (see Wagner 1986, 1991, 2015, 2018). If the legislator, for example, introduces explicit tax avoidance opportunities for steering purposes, e.g., the option to expense fully the cost of tangible qualifying assets in the acquisition year to stimulate investments (see for example Section 179 US Internal Revenue Code), it follows that tax avoidance behaviour is obviously a necessary precondition to achieve the intended legislative results.

Against the background of growing inequality and a repositioning of the relationship between labour and capital (see Karabarbounis and Neiman 2013), the Nobel Prize-winner Stiglitz gets to the heart of the normative question to be discussed here: “Is there something that companies can do to overcome this evil which threatens the political, social and economic capability of our democratic market economies? The answer is ‘yes’. A quite simple idea stands at the forefront: pay your taxes! This is the fundamental cornerstone of corporate social responsibility. Do not shift profits to countries with low tax rates. [...] Do not adopt concealment strategies and the use of offshore or onshore tax havens […]” (Stiglitz 2017, p. 18). Are there good philosophical reasons to describe aggressive tax avoidance as morally undesirable and, based on this reasoning, to socially ostracize this type of behaviour exhibited by managers of companies who indulge in such practices?

This question will be investigated hereinafter with the aid of a deontological Kantian approach. The explicitly Kantian deontological attempts at justification of the morality or immorality of aggressive tax avoidance in the literature to date (see for example Prebble and Prebble 2010, p. 726, 2018, p. 378 f.; Preuss 2013; West 2017) are partially sketchy or inconclusive and can therefore be contested. Moral assessments of tax avoidance behaviour, such as those that reference the supposed prejudicial consequences but do not explicitly justify the normative premises, can be found in other papers, such as by Christensen and Murphy (2004), Sikka (2010), Sikka and Willmott (2013) and Gribnau and Jallai (2017). In this respect, I contribute to the literature with a more fundamental and thorough ethical analysis, and the deontological approach of Kant is used for this purpose hereinafter. Aggressive tax avoidance is defined as a special case of aggressive legal interpretation not adequately considering the intent or spirit of the law and is distinct from responsible tax avoidance in line with the purpose of the law. Applying the Kantian “contradiction of conception or will test” shows that a maxim to use aggressive legal interpretation to achieve certain ends, e.g., tax avoidance, might not be conceived or willed as a general law of nature in a hypothesized adjusted social world. If all natural or legal persons aggressively interpreted laws in all subjects and in every imaginable situation, the system of law per se would be probably endangered. Therefore, aggressive tax avoidance by managers of MNCs may violate the individual moral duty of these managers to obey not only the letter but also appropriately the spirit of the law. This ethical evaluation is philosophically well-founded and more precisely describes the moral intuitions that underpin the common negative evaluation of aggressive tax avoidance. This line of reasoning in which aggressive tax avoidance as a special case of aggressive legal interpretation is immoral is supported and has recently been declared to be a binding ethical principle for members of the tax consultancy professions in Great Britain (Chartered Institute of Taxations 2017). Central objections against this reasoning are also discussed and elucidate the complexity of an applied philosophical reasoning. The validity of the argumentation depends critically (i) on the definitions of aggressive and abusive tax avoidance, (ii) on the description of the formulation of the respective maxims, and (iii) on assumptions about the legal system, especially the relative significance of a literal versus a teleological interpretation of laws and the different roles of lawyers with fiduciary duties to plaintiffs or defendants on the one side, and prosecutors and impartial judges on the other side.

The article is structured as follows. Section “Aggressive Tax Avoidance and Aggressive Legal Interpretation” defines forms of tax avoidance and tax evasion, provides stylized examples, and argues that aggressive tax avoidance is a subset of a more general type of action “aggressive legal interpretation.” Section “Ethical Evaluation of Aggressive Tax Avoidance—A Literature Review” provides a literature review on the philosophically based ethical evaluation of aggressive tax avoidance. Section Kant’s Categorical Imperative (CI) as a Test Procedure for Legitimizing a Moral Prohibition of Aggressive Legal Interpretation proves in detail whether Kant’s categorical imperative could serve as a formal test procedure for legitimizing a prohibition of aggressive legal interpretation. Section “Objections and summary” concludes with a summary.

Aggressive Tax Avoidance and Aggressive Legal Interpretation

Definitions of Tax Avoidance Forms and Tax Evasion

In the empirical literature, aggressive tax avoidance is defined not in terms of its content but pragmatically using certain percentiles of empirical measures of tax avoidance (e.g., effective tax rates; for definitions and critical remarks, see Blouin 2014; Dunbar et al. 2010; Schreiber 2013, pp. 136–141). These definitions are inadequate for a normative analysis or a qualitative analysis of case studies because a low effective tax rate may also be caused by a shift of real economic activities instead of “paper profits” into low-tax jurisdictions. Therefore, a definition is required that (i) adequately reflects content characterizing the aggressive component of tax avoidance and (ii) enables an individual case to be subsumed under the proposed definition.

We commence by considering key elements of the new European general anti-abuse rule (GAAR) in Article 6, Paragraphs 1 and 2, of the EU Council Directive 2016/1164, which postulates rules against tax avoidance practices that directly affect the functioning of the internal market (EU 2016).Footnote 4 According to this definition, a non-genuine arrangement or series of arrangements occurs if (i) one of the main purposes of obtaining a tax advantage runs contrary to the purpose or object of the applicable tax law and (ii) the arrangement was not undertaken for “valid commercial reasons, which reflect economic reality.” If the two criteria are met, as a legal consequence, the member states will not take the non-genuine arrangement into account when calculating the corporation tax owed; thus, as a matter of principle, the misuse of the configuration is not a criminal offence as long as no other elements of an offence, i.e., the concealment of data and relevant facts, are present. Regarding the definition of aggressive tax avoidance, key elements such as “obtaining a tax advantage contrary to the purpose of the tax law,” “no valid commercial reasons reflecting economic reality” should be adequately included when defining the aggressive part of tax avoidance. In contrast to tax practices that can be subsumed under the GAAR, aggressive tax avoidance is nevertheless legally permissible.

Based on these considerations and the definitions of aggressive and responsible corporate tax strategies from Hardeck and Hertl (2014, p. 310 f.), Raiborn et al. (2015), Payne and Raiborn (2015), and the OECD (2017a, b, c), I use the following definition of “aggressive tax avoidance”:Footnote 5

Aggressive tax avoidance is the artificial (non-genuine) arrangement of transactions undertaken predominantly or exclusively by rational agents with the objective of tax optimization, meaning that it leaves the real value creation processes of the economic entities, i.e., the economic substance,Footnote 6 largely unchanged. The agent’s interpretation of law places little weight on the will of the democratically legitimized legislator, i.e., the intent or spirit of the law, and it dominates a mere literal interpretation, i.e., the letter of the law, which is extended to the boundary of what is likely to be just legally permissible.

A possible example of bending the law to the boundary is the partial interpretation of the arm’s length standards for transfer pricing purposes.Footnote 7 Transfer prices can be used by MNCs as a specific profit-shifting channel (see Luckhaupt et al. 2012, p. 94 f., for an overview of empirical studies). Many countries adopt in their tax laws the arm’s length principle based on Article 9 of the OECD Model Tax Convention (OECD 2017b) and use for interpretation purposes the lengthy and detailed OECD Transfer Pricing Guidelines (OECD 2017c). The comparable uncontrolled price (CUP) method requires the identification of prices in comparable uncontrolled transactions. However, the necessary comparability analysis (OECD 2017c, p. 147 ff.) is quite complex and gives much discretion for manager’s professional judgements (see Luckhaupt et al. 2012, p. 102 f., who qualify the TPG as “pseudo-accurate”) which can be used for tax avoidance aims, e.g., the lack of data may justify adjustments for alleged differences in capital, functions, assets, risks. A responsible taxpayer would use comparability adjustments to the best of his knowledge and belief to determine the most reliable transfer price; an aggressive taxpayer would exploit the room for interpretation to justify the transfer prices which minimize corporate taxes.

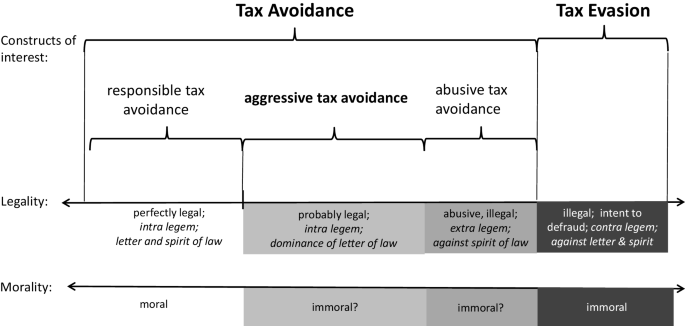

In this definition, aggressive tax avoidance is legal tax planningFootnote 8 behaviour by authorized management that aims to stop just before the illegal abuse of tax laws; the latter is called abusive tax avoidance (extra legem). This definition, as well as the European definition of abuse of tax law, provides the scope of interpretation and opens opportunities for individual moral acts; thus, a manager might push the legal limits, but there is no compelling requirement to do so (see Stout 2013; Schön 2013). In contrast, responsible tax avoidance adequately considers the intent and economic substance as required by the respective tax law (KPMG 2018). Tax evasion is based on illicit, deceptive and fraudulent behaviour; it usually violates the letter and the spirit of the law (contra legem; Martins 2017, p. 807; Raiborn et al. 2015, p. 79 f.). Figure 1 (adapted and modified from Lietz 2013, p. 5) summarizes the key elements of these definitions, and Appendix 1 contains a stylized example concerning transfer pricing for hard-to-value intangibles.

The description of an aggressive tax avoidance act identifies the characteristics of the actor (e.g., rationality, dominant tax optimisation objective, intent to neglect the spirit of the law), the situation (e.g., loopholes in tax laws, latitude in interpretation of transfer pricing rules, conflicting international tax laws with respect to varying apportionment of equity and debt capital, varying apportionment of the site of the business activity), and direct consequences of a tax avoidance act (e.g., arrangement of transactions, costs and benefits of tax management, reactions of fiscal authorities). The general schematic form of an act description is as follows: To do act A by actor B if situation S is given to achieve objective O (cf. O’Neill 2013, p. 102).

How are the the above definitions related to the relevant literature? West (2017) correctly argues that many different terms are used to describe attempts to reduce tax payments including “tax avoidance, tax minimisation, tax evasion, tax fraud, tax planning, tax dodging, tax aggressiveness, tax sheltering, tax abuse, tax mitigation, and tax resistance.” One the one side authors like West (2017) and Dowling (2015) use the term “tax avoidance” in a broad and comprehensive way as an umbrella term; on the other side, more distinctions are made. For example, Bird and Davis-Nozemack (2016) differentiate between tax minimization, tax avoidance, and tax evasion. Also, their article contains at least an implicit definition of aggressive tax avoidance. “Tax avoiders jeopardize this common pool of shared trust and understanding and do so for individual gain. … Disregarding reasonable possibly shared interpretations of tax regulation, tax avoiders aggressively analyze tax rules for linguistic or other weaknesses …” Bird and Davis-Nozemack’s term “tax minimization” is called “responsible tax avoidance” in my terminology, and there is an implicit definition of “aggressive tax avoidance” similar to my definition, but there is no distinction between “aggressive” and “abusive” tax avoidance, which is in my view important because the first is legally permissible and the latter not. Payne and Raiborn (2015) distinguish between tax avoidance, aggressive tax avoidance, and tax evasion. My definition of “tax evasion” and “aggressive tax avoidance” is in accordance with the definitions of Payne and Rayborn (2015). I call non-aggressive tax avoidance “responsible tax avoidance” and add a definition of “abusive tax avoidance” which is missing in Payne and Rayborn (2015). Prebble and Prebble (2010, p. 708) mention the boundary uncertainty “between evasion and avoidance on one hand mitigation on the other.” Even if Prebble and Prebble (2010) don’t explicitly define the term “aggressive tax avoidance”, I argue that they make the distinction between acceptable tax mitigation—“responsible tax avoidance” in my terminology—and tax avoidance that “involves more than simply engaging in activities that reduce one’s tax” (Prebble and Prebble 2010, p. 702). In contrast to Prebble and Prebble (2010), I try to define explicity the activities which make the difference between tax mititgation and tax avoidance in Prebble and Prebble’s terms.

Stylized Examples of Aggressive Tax Avoidance

Possible fruitful case studies for aggressive tax configurations or possible abuses of the law are the structures selected by Apple, Alphabet/Google and Amazon and have already been adequately described in the literature (European Commission 2014, 2017a, b; Pinkernell 2012; Richter and Hontheim 2013; Ting 2014). The purpose of the structure selected in the past by Google (“double Irish with a Dutch sandwich”), for example, is to “remove the advertising income free from tax and withholding tax from the EU and to hold it in a tax haven without the US taxation on foreign sourced income being applied” (Pinkernell 2012, p. 372).Footnote 9

Between May 2006 and June 2014, Amazon established a non-taxable limited partnership holding company as an artificially empty shell without assets, employees and physical presence in Luxembourg, which licensed Amazon’s intellectual property to the operating company and, in turn, received significant royalties based on a transfer pricing agreement endorsed by the financial authorities (European Commission 2017a, b). According to the European Commission, the holding performed no significant economic role and shouldered no material risk in relation to the management of the owned intangible assets (European Commission 2017b, p. 113 f.), i.e., the economic substance criterion was not fulfilled. In relation to the function and risk of the holding, the received royalties violated the arm’s length principle, which has a legal basis in the tax laws of Luxembourg. Therefore, the tax ruling was qualified as unlawfully granted selective state aid to Amazon. In this case, the aggressive or, according to the European Commission, even abusive interpretation consists in the inadequate justification of the calculated royalties for the holding company.

Other prominent cases are Starbucks (Kleinbard 2013), Caterpillar (Avi-Yonah 2014; Drucker 2017; US Senate 2014) and SABMiller (Hess and Alexander 2015). My intention is not to evaluate in detail whether the above-mentioned tax structures can be subsumed under my proposed working definition of aggressive tax avoidance. However, certain remarks about the role of the tax collecting state are in order. After a lengthy analysis of Apple’s tax structure, Ting (2014, p. 71) concludes that “the US Government has knowingly and willingly facilitated its MNEs in avoiding foreign income tax, thus creating double non-taxation.” In such a case, the criteria of the aggressive tax avoidance definition are not fulfilled because the spirit or purpose of the law has not been violated. A different decision can be made if we consider the positions of the source countries of Apple’s income. The European Commission (2016a) concluded “that two tax rulings issued by Ireland to Apple have substantially and artificially lowered the tax paid by Apple in Ireland since 1991. The rulings endorsed a way to establish the taxable profits for two Irish incorporated companies of the Apple group (Apple Sales International and Apple Operations Europe); these rulings did not correspond to economic reality: almost all sales profits recorded by the two companies were internally attributed to a ‘head office’. The Commission’s assessment showed that these ‘head office’ existed only on paper and could not have generated such profits” (for details, see European Commission 2016b).

If we assume that the factual descriptions and the decisions of the European Commission are correct, then the examples show that even a state or a state administration may offend against the letter and/or spirit of the law (see Egger and Stimmelmayr 2017, p. 27). Assuming the truthfulness of the European Commission’s (2016a, b, 2017a, b) factual descriptions, the former tax structures of Apple and Amazon can be treated as examples of abusive tax avoidance if these decisions are finally approved by the European Court of Justice, or examples of successful aggressive tax avoidance if otherwise. If the following analysis successfully demonstrates that aggressive and abusive tax avoidance is unethical, the tax laws that are not properly enforced by a state or the aiding and abetting of MNCs to avoid taxes in a doubtful manner by states do not provide valid excuses for possible violations of such ethical rules by MNC management during tax minimization activities.

Definition of Aggressive Legal Interpretation

Modifying Barak (2005, p. 3), I define aggressive legal interpretation as a general type of action in the following way: Aggressive legal interpretation is a rational activity of subjects that give to a certain extent a partisan meaning to a legal text with the aim to gain personal advantages. Current legal loopholes, the latitude in interpretation or assessments, and conflicting national and international laws are used and extended up to the boundary of what is likely to be just legally permissible. The interpretive activity places little weight on the will of the democratically legitimized legislator, i.e., the spirit of the law;Footnote 10 it dominates the wording, i.e., the letter of the law. I provide an example of aggressive legal interpretation from accounting. International Financial Reporting Standard (IFRS) 16.62 requires that a lessor classifies a lease as a finance lease “if it transfers substantially all the risks and rewards incidental to ownership of an underlying asset.” IFRS 16 contains several criteria, which, individually or in combination, are used for classification purposes. One of the criteria is that the sum of the present value of lease payments amounts to substantially all of the fair value of the underlying assets (IFRS 16.63(d)), but no precise quantitative threshold is given. To avoid classification as a finance lease, going “up to the boundary of what is likely to be just legally permissible” means setting the limit of the present value test in a narrow range of 90% to 95% of the fair value and interpreting the other criteria in IFRS 16.63 in a similar partisan way.

A current example of aggressive legal interpretation taken from environmental law is provided by the deliberate software control of the exhaust emissions of diesel motors by German car companies for financial reasons, e.g., “the diesel affair.” This software generates lower emissions on the test bed and significantly higher nitrogen oxide (NOx) emissions during normal running. Such a defeat device is clearly illegal under US law but to the present day, there are no legally binding decisions from courts or administrative authorities in Europe on the illegality of such devices except in some minor cases. According to Volkswagen’s (VW) official legal position, the modification of software “is only unlawful in the USA” (Volkswagen 2018, p. 92).

The State Premier of Lower Saxony and a member of the VW Supervisory Board assessed this behaviour as follows: “VW and other automakers made full use of legal grey areas and even abused them, and caused great harm to people, the environment and in the end to the firms themselves. Executives as top decision makers obviously are responsible for this” (quoted in Murphy 2017). Similar to tax avoidance activities, circumventing environmental protection laws by influential corporations is sometimes alleviated by state agencies. A consequentialist ethical act-utilitarian evaluation could use the available empirical evidence about the severe negative consequences of excess diesel NOx emissions in major vehicle markets. According to a study by Anenberg et al. (2017), excess NOx emissions were associated with approximately 38,000 premature deaths worldwide (thereof 11,400 in Europe) in the year 2015. In contrast, a deontological evaluation cannot use these far-reaching external consequences; instead only the consequences implied by the general description of the act “aggressive legal interpretation” could be used.

To conclude, aggressive tax avoidance is a subset of legally permissible aggressive legal interpretation. However, whether this classification applies to a specific tax planning act must be investigated in each case separately and in detail.

Ethical Evaluation of Aggressive Tax Avoidance—A Literature Review

Numerous articles have focused on ethics or CSR and tax avoidance; however, only a few have strived for a detailed and philosophically grounded evaluation of tax avoidance. “Where is the point where tax avoidance slips onto morally dubious ground; where does tax avoidance become ‘overly aggressive’?” (Preuss 2013, p. 112, with reference to Shafer and Simmons 2008, p. 696). This section is restricted to such explicitly philosophically based articles.

Utilitarian Evaluation

Utilitarianism is the most prominent variant of a consequentialist ethical approach in which the moral correctness of an act depends on its nonmoral consequences (Birnbacher 2013, pp. 113–127, p. 217 ff.). Preuss (2013) tries to argue that a utilitarian evaluation of tax avoidance must conclude that this behaviour is morally wrong. According to Preuss (2013), gains from tax avoidance are attributed to the corporation itself, its shareholders via increases in share prices or dividends, tax consultants, employees and suppliers in high-tax countries by expanding activities. Generally, corporations and their owners may benefit because tax avoidance strategies shelter against taxation. The resulting disutility from tax avoidance includes increasing reputational risk of shareholders and tax consultants; losses from reduced state investments in social welfare, especially in developing countries (Torslov et al. 2018); negative effects in tax haven countries, such as corruption and money laundering; and the crowding out of other than financial sector activities (Preuss 2013). Preuss’ argumentation is vulnerable because he renounces the reasonable determination of the set of concerned people and their utility measurement and aggregation. Furthermore, the term “aggressive tax avoidance” is not defined, which is a prerequisite for differentiating between responsible and aggressive tax avoidance.

Compared with Preuss (2013), Payne and Raiborn (2015) provide definitions of the terms tax evasion, tax avoidance, and aggressive tax avoidance. In essence, the difference between tax avoidance and aggressive tax avoidance is that the latter does not properly consider the spirit of the law. These authors apply a utilitarian analysis and conclude that aggressive tax avoidance is morally wrong, and their analysis consists of a table with a qualitative assessment of the benefits and costs of aggressive tax avoidance versus fair tax payment for stakeholder groups (government, entity management, stockholders, and other stakeholders). The authors characterize their utilitarian analyses as “broad-brush assessments of positive and negative effects” and concede that no endeavours “have been made to attribute numerical values to any of the costs and benefits but readers can make their own reasonable extrapolations to estimate present and future, known and unknown costs or benefits” (Payne and Raiborn 2015). This underspecified method does not support the author’s conclusions of unethical aggressive tax avoidance (West 2017). Furthermore, Table 2 in Payne and Raiborn (2015) shows that an interpersonal comparable measurement and aggregation of all the costs and benefits of aggressive tax avoidance relative to fair tax payment does not seem feasible. Godar et al. (2005) apply a similar insufficient utilitarian analysis via a specific tax avoidance technique, i.e., inversion, such as by incorporation in a tax haven.

A convincing utilitarian evaluation of tax avoidance must calculate and compare the sum of utility or disutility of aggressive tax avoidance versus appropriate tax avoidance for all concerned people. Such a comparison can be performed in two ways: (i) with respect to the consequences of a single act, such as the tax avoidance of Apple (act utilitarianism); or (ii) with respect to the consequences of a hypothetical universalized aggressive tax avoidance rule (rule utilitarianism), such as the aggressive tax avoidance of all MNCs or all tax subjects. Who benefits from MNCs tax avoidance? Those benefiting include shareholders through increases in share prices; tax consulting firms; employees through higher wages, consumers if saved taxes are invested and lead to improved products, and the broader community if MNCs invests saved taxes in CSR activities.Footnote 11 Who is harmed by this tax avoidance behaviour? Would even prosocial shareholders prefer a higher tax burden of MNCs? Members of foreign states and members of the USA indicate that these missing taxes could have been invested to improve the welfare of these societies. However, what if government decisions are not well aligned with the population’s preferences? Because of unresolved problems that include (i) defining the current and future set of concerned people; (ii) foreseeing all possible consequences of aggressive or appropriate tax avoidance; (iii) measuring and aggregating the utility or disutility of those people in terms of fulfilled preferences; and (iv) ensuring that the utility sum does not lead to questionable inequality in societies, such as whether the utility of shareholders benefits or outweighs the disutility of non-paid taxes, a convincing utilitarian ethical evaluation of tax avoidance does not appear to be promising.

Deontological Evaluation

A deontological ethic uses the direct or immanent consequences of an act as well as the inherent characteristics of the act to evaluate its morality (Birnbacher 2013, pp. 113–127, p. 136 ff.). Is it possible to establish a duty not to avoid taxes in an aggressive manner that is partially independent from the consequences of tax avoidance? At present, the most prominent deontological approach is Kantian ethics with its categorical imperative as a test procedure. If aggressive tax avoidance cannot be considered a universalised maxim, i.e., leading to a logical or practical contradiction of conception (CC, Denkwiderspruch) or will (CW, Wollenswiderspruch), then this behaviour is morally wrong. In the previous literature, Godar et al. (2005), Prebble and Prebble (2010, p. 726, 2018, p. 378 f.), Preuss (2013) and West (2017) apply the Kantian categorical imperative to the problem of aggressive tax avoidance.

Godar et al. (2005) apply the Kantian test only in a special case of tax avoidance, i.e., inversion, in which the headquarter of a company is incorporated in a tax haven without changing the real value creation process. First, their maxim includes only a small subset of the more general type of aggressive tax avoidance behaviour, and second, their conclusion that the maxim “reincorporate in another country to pay lower taxes” is immoral depends critically on the equation of a corporate entity (“corporate citizen”) with a natural person (“citizen”). Prebble and Prebble (2010, 2018) deliver a sketchy and broad-brush Kantian version that relies heavily on external consequences and neglects the essential non-empirical nature of a Kantian approach (see for details the following Section). Because “tax avoidance through using tax havens is particularly practised by large multinational enterprises,” Preuss (2013) argues that this type of behaviour cannot be universalized; therefore, this behaviour cannot be a universalized maxim of our will and leads to a logical contradiction. In my opinion, this interpretation is an incorrect understanding of the Kantian test. Kantian imperatives are calls to action, such as “Do act A (= aggressive tax avoidance) in type S situations (= tax management activities)” (Birnbacher 2013, p. 136 ff.). Type S situations may only be sufficiently available for MNCs; however, that is not the critical point. West (2017) rightly emphasises that we can imagine without any logical contradiction a world in which all MNCs avoid taxes as much as possible; therefore, Preuss’ (2013) argument is based on a misunderstanding of the Kantian maxim concept. Preuss (2013) also ignores the important difference between a logical and practical contradiction of conception or will. West (2017) accurately argues that the tax avoidance of corporations does not lead to a practical contradiction of will if a society can collect taxes by other means. The philosophical literature requires that a reasonable Kantian argument needs maxims for sufficiently general types of action; otherwise, the approach leads to paradoxical results.Footnote 12

Because neither utilitarian nor deontological ethical evaluations of aggressive tax avoidance have hitherto led to conclusive outcomes, further philosophical efforts are warranted. In Section “Kant’s Categorical Imperative (CI) as a Test Procedure for Legitimizing a Moral Prohibition of Aggressive Legal Interpretation”, a more elaborate application of the Kantian categorical imperative on aggressive tax avoidance is developed.

Kant’s Categorical Imperative (CI) as a Test Procedure for Legitimizing a Moral Prohibition of Aggressive Legal Interpretation

There are different forms of the CI and, according to Kant, these formulas are equivalent but that idea is controversial in the literature. The most prominent CIs discussed in the commentaries are: (i) the universal law formulation: “act only according to that maxim through which you can at the same time will that it become a universal law” (Kant 1786/2012, p. 421)Footnote 13; (ii) the universal law of nature formula: “so act as if the maxim of your action were to become by your will a universal law of nature” (Kant 1786/2012, p. 421 [Pos. 1661], 1786/2007, p. 421 [53]) in German);Footnote 14 (iii) the formula of humanity: “so act that you use humanity, in your own person as well as in the person of any other, always at the same time as an end, never merely as a means” (Kant 1786/2012, p. 429); and (iv) the universal law of right or justice formula: “so act externally that the free use of your choice can coexist with the freedom of everyone in accordance with a universal law” (Kant 1797/2013, p. 231).

CI (ii) can be interpreted as a more precise formulation of version (i), because we shall imagine that the maxim should be in force such as the case with an empirical natural law; all rational beings comply de facto with the maxim, which strongly and forcefully emphasises the universalization test (Kant Commentary 1786/2007, p. 226; Henning 2016, p. 47 f.; Timmons 2006, p. 195).Footnote 15 Formulation (iii) is based on too specific and strong metaphysical assumptions.Footnote 16

Formulation (iv) stemming from Kant’s Metaphysics of Moral is the basis of his doctrine of right and is restricted for external acts, i.e., acts, which in contrast to internal ones have effects on others. According to Kant (1797/2013, Pos. 1151 [254]), there is a necessary connection between morality and law because the ultimate authority of the lawmaker must be based on the objectivity of practical laws of reason. The universal principle of right expresses the moral concept of right in another formulation as “the sum of the conditions under which the choice of one can be united with the choice of another in accordance with a universal law of freedom” (Kant 1797/2013, Pos. 1395 [230]). Kant differentiates between legality or lawfulness as conformity to an action with external positive laws (ius positum) where the incentive is primarily to avoid sanctions, and morality as conformity arising from the duty to obey external as well as internal laws; to do one’s duty as an act of practical reason is the incentive. The former are called duties of right, and the latter are termed duties of virtue, which may contain duties of the same kind, e.g., the duty to keep one’s promises may be a duty of right but also a duty of virtue (Kant 1797/2013, Pos. 1232 f. [219f.])Footnote 17. In the following, I assume that ethical lawgiving complements juridical lawgiving, which is in accordance with Kant’s view in the introduction of the Metaphysics of Morals. Apart from that, I follow O’Neill (2013, p. 157) and consider formulation (iv) equivalent to (ii) with respect to the following test procedure. Therefore, I will use the natural law formula.

In this form, the categorical imperative is a formal test procedure for justified moral obligations and essentially exists in a thought experiment consisting of four steps (see on the following: Birnbacher 2013, pp. 136–154; Kant 1786/2007, pp. 224–239; Korsgaard 2012, Pos. 439–; O’Neill 2013, pp. 135–192; Rawls 2003, Pos. 2142–2182; Timmons 2006, pp. 161–167). It is not an algorithmic procedure for correct judgements (Pogge 2000, p. 190; Rawls 2003, Pos. 2133) and needs careful interpretative work.

Maxims M have, in general, the following form of an ordered triplet: M = [S, A, O], where if I am in type S situation, I will do act A in order to achieve objective/purpose O (see Pogge 2000, p. 172; Timmons 2006, p. 162; Allison 2011, p. 197 f.). The formulation of a maxim requires a description of the situation, action, and purpose, including empirical knowledge about the causal relation between means and ends, i.e., a relevant act description. We assume that A is a necessary mean to achieve purpose O, i.e., if I will O knowing that M is necessary for O, I must do M. In Kant’s terminology, it is called a hypothetical imperative of skill (see Kant 1786/2007, p. 415 [Pos. 553]; Korsgaard 2012, Pos. 396; for details, see; Ludwig 2006).

Let us hypothetically imagine that all corporate entities and all natural persons would always interpret laws, e.g., health and safety, environmental protection, social, accounting, tax and administrative legislation, in each and every case, right to the boundary of what is legally permissible. Can the prohibition of aggressive legal interpretations be justified with the aid of Kant’s “law of nature” formula?

The proposal for the application of the test procedure to the problem of aggressive legal interpretation, including aggressive tax avoidance as a special case, is presented below (Kant 1786/2007, p. 227 ff.; see also; Korsgaard 2012; O’Neill 2013, p. 178 ff.; Timmons 2006, p. 162 ff.):

Step 1

The formulation of the maxim from purposes and a hypothetical imperative: In type S situations (= a decision has to be made in the context of relevant and applicable legal norms with interpretation opportunities, e.g., a tax planning decision), I will do act A (= aggressive legal interpretation, e.g., of tax laws) to achieve objective O1 (= personal advantages, e.g., minimization of taxes or maximization of after-tax profits), and I wish to simultaneously pursue objective O2 (= use of a tax-financed infrastructure including a stable, predictable, easy to administer and just legal system).

Step 2

To formulate the corresponding natural law, Kant asks the following question: “how things would stand if my maxim were to become a universal law” (Kant 1786/2007, p. 422). Thus, the maxim is reformulated in the following way: Out of necessity, every person who pursues objectives O1 and O2 undertakes act A in type S situations. According to Korsgaard (2012, Pos. 445 ff.), this behaviour corresponds to the intellectual notion of the “World of the Universalised Maxim.” O’Neill (2013, p. 141) calls the corresponding law the “universalized typified counterpart” of the respective maxim.

Step 3

Does a practical contradiction in conception (CC) or will (CW) arise if one wants the maxim to be a general natural law? According to a practical—in contrast to a logical or teleologicalFootnote 18—contradiction interpretation, the universalization of the maxim would destroy the social practice or the institution upon which the agent intends to act to achieve its purposes, i.e., the purposes are thwarted (see the seminal article of Korsgaard 1996, p. 92 ff., for arguments in favour of this interpretation). We adjoin the law-like maxim from the previous step to the existing laws of nature and then determine if we could still conceive or will to act according to the maxim in this “adjusted social world” (Rawls 2003, Pos. 2166). In Korsgaard’s interpretation, there is only a subtle difference between the CC and the CW test: “The purpose thwarted in the case of a maxim that fails the contradiction in conception test is the one in the maxim itself, and so the contradiction can be said to be in the universalized maxim. The purpose thwarted in the case of the contradiction in the will test is not one that is in the maxim, but one that is essential to the will” (Korsgaard 1996, p. 97). An obvious intricacy is to more precisely state the content of the will of rational agents and the kind of information they have for deciding in favour or in opposition of the world of the universalized maxim (see Rawls 2003, Pos. 2166). The difference between the CC and the CW test depends on the formulation of the maxim in step 1. In my example, it would be possible to formulate the maxim without objective O2, and at the same time, assume that O2 is essential to the will of a rational being.

Step 4

If the previous step results in a practical contradiction, the act A (= aggressive legal interpretation, e.g., of tax laws) corresponding to the maxim would be prohibited; in other cases, it would be allowed.

The first and third steps are the most critical. In step 1, we have to consider the maxim description and it is consensus that “a maxim will include empirical information about one’s circumstances, end, and proposed action” (Timmons 2006, p. 172; similar Pogge 2000, pp. 177–179; O’Neill 2013, p. 159 ff.). However, there is disagreement about the extent of the tolerable scope of empirical information; some interpreters include empirical laws, whereas others allow only “broadly conceptual truths to figure into the test” (Timmons 2006, p. 173). O’Neill (2013, p. 166) argues that maxims include means and ends and the “normal and predictable consequences” of the realisation of the maxim, allowing wide room for interpretation and for incorporating a marked consequentialist element in the Kantian procedure. Following the more austere interpretation of Höffe (2000, p. 223 ff.; 2012, Pos. 1824 ff.), it is only allowed to include in the test act-internal consequences, which are contained in the Kantian term “concept of the action in itself” (Kant 1786/2012, p. 402). The subsequent prejudicial act-external consequences are not related to the term of the respective act and, therefore, not included in the respective maxim but nevertheless may be decision relevant. For example, a utilitarian would argue that the negative consequences of aggressive legal interpretation would be quite evident and foreseeable. A regulatory arms race would result in which the legal norms would always have to be drafted in great detail, and the controls would have to be more stringent. In other words, the administrative and compliance costs would rise significantly.

Similarly, Prebble and Prebble (2010, p. 725 f.; 2018, p. 378) argue that in their world of the universalized tax avoidance maxim, the “effect would be that tax rates would have to be raised and no one else would achieve any gain. In fact, everyone would be worse off because tax avoidance is itself a deadweight loss.” An overall net loss would result because of “deadweight costs from misallocation of resources, transaction costs, and compensatory increases in taxation or government spending.” This reasoning depends largely on the empirical consequences of aggressive tax avoidance ignoring the essentially non-empirical nature of the Kantian approach (Hübner 2014, Pos. 5485). Even if we accept a wide room for empirical consequences, possible counter-arguments would be that in situations of very widely practised extreme tax avoidance, the state would be able to restrict MNC profit-shifting via detailed transfer-pricing rules, controlled foreign company legislation, and thin capitalization rules (see for an overview Egger and Stimmelmayr 2017, p. 27 ff.), or could move to a tax system in which this conduct would be barely possible, e.g., a purely consumption-based tax system. Thus, a severe contradiction of conception or will could be avoided and aggressive tax avoidance would be allowed (assenting West 2017). If measures against aggressive tax avoidance are effective, tax subjects will anticipate that and a deadweight loss could be avoided.

How then can we argue using only the act-internal consequences? A central act-internal element of our act description is that we want to selectively interpret legal norms by underweight or downplaying the spirit of the law to our specific personal benefit (purpose O1), but in general we prefer a just legal system with a well-balanced legal interpretation considering the letter and spirit of the law, especially in unforeseeable, unknown future situations in court (purpose O2). We cannot rationally assume that judges or civil servants or adverse parties interpret legal rules solely to their personal benefit. We cannot conceive the maxim of aggressive legal interpretation as a universalized maxim because it would endanger objective O2. I can no longer rely on a stable, predictable and just legal system if citizens, managers, judges, civil servants, and lawyers interpret legal norms in each and every case in an aggressive way to their respective personal benefit, which is why this behaviour is morally wrong. Willing the end requires willing the means, but in the world of the universalized maxim aggressive legal interpretations are no longer adequate means to achieve objective O2; it destructs the legal practice, which the agent at the same time wishes to use selectively for personal benefits. In effect, the aggressive legal interpreter acts as a free rider of the justice system, which represents the collective will of the people and has been enacted through a democratic process. Therefore, the impartial judge speaks “in the people’s name”.

In addition, such a society in which the state on one hand, and citizens and representatives of economic entities on the other hand, oppose each other as hostile adversaries would scarcely be called desirable and worth inhabiting.Footnote 19 In this context, we also can possibly refer to Kant’s formula of humanity, which forbids using other human beings as mere means for a specific purpose.

Positively, we can formulate a commandment to obey the law by interpreting the law in a non-aggressive way. Aggressive tax avoidance as a special case of aggressive legal interpretation violates the superordinate universal moral norm on obedience of the democratically legitimized law in conjunction with an appropriate non-aggressive legal interpretation. The legally non-binding OECD Guideline “XI. Taxation” (OECD 2011, p. 70; on this point, see Hardeck 2011), which addresses the civic responsibility aspects of the activities of companies in the field of taxation can be interpreted as a moral norm precisely in this sense for the special field of tax legislation: “In particular, enterprises should comply with both the letter and spirit of the tax laws and regulations of the countries in which they operate. Complying with the spirit of the law means discerning and following the intention of the legislature.” The standards for the tax planning arrangements of the tax consultancy profession in the UK applicable from 2017 onward can, in this case, also be interpreted as a concrete ethical principle (see Chartered Institute of Taxation 2016, 2017; Bennett and Murphy 2017).Footnote 20

Objections and Summary

Some objections could be raised against this Kantian justification. First, the validity of the argumentation depends critically on the formulation of the respective maxims, especially the appropriateness of the proposed definitions, the reasonableness of the interpretation of the meaning of a “stable, predictable, just, and democratically legitimized legal system” and the principal acceptance of a deontological Kantian procedure. For example, if too much disagreement is observed in relation to the method of subsuming factual arrangements under the proposed definitions, then the maxim lacks clear normative guidance. Competing ethical approaches, e.g., utilitarian or contractarian ethics, might yield divergent results.

Second, the stated practical contradiction of conception or will with respect to boundary legal behaviour may be contested by legal doctrines that are mainly based on a strictly literal interpretation of the law. Concerning tax laws, this is under discussion in the context of the interpretation of General Anti-Abuse Rules (GAAR; see Freedman 2004, 2010, 2014). However, Freedman (2004, 2010, 2014) argues that in tax law a mere and strict literal interpretation is impossible and that the delicate balance between the duties and rights of taxpayers and the democratic state should be fairly adjusted with a legislative GAAR interpreted by the courts. Legal terms such as “spirit or purpose of the law” or a specific general anti-abuse rule in tax laws are inevitably vague. However, experience shows that it is not possible to draft laws and especially tax laws that cover every specific statement of facts. This vagueness stands in contrast to important characteristics of a just law system including comprehensibility, certainty, and predictability (Prebble and Prebble 2018). According to Prebble and Prebble (2018), the lawmaker must trade off these probable negative consequences of a general anti-abuse rule in tax law against the positive effects, and this trade-off may be different depending on the area of the law because certainty is more important in criminal law than in tax law. It should be noted that GAARs do not lead to criminal sanctions (Prebble and Prebble 2018, p. 74). It can be argued that if we implement GAARs in every legal field, e.g., tax, accounting, environmental law, and assuming a sound enforcement, then aggressive legal interpretation that stops before becoming abusive would not lead to a contradiction of conception or will because in this case, the second objective, i.e., a stable and just legal system, will not be compromised. Then, the conclusion would be that aggressive, but not abusive, legal interpretation is morally permissible.

Third, we should differentiate in the legal sphere between claimants, defendants, lawyers with fiduciary duties to plaintiffs or defendants,Footnote 21 prosecutors and impartial judges. Parties and their respective lawyers have no general obligation to be impartial and neutral, but that is essential for judges and courts. As a result, we obtain different moral obligations depending on the respective functional role in a legal proceeding. We could include that information in the description of type S situations (= interpreting a legal norm as a judge, a lawyer or an afflicted party, etc.) and universalize over persons but not over situations. Then, we obtain the following maxim for a concerned party in a legal proceeding: in type S situations (= a relevant and applicable legal norm exists, but interpretation is required by a concerned party in a legal proceeding), I will do act A (= aggressive legal interpretation) to achieve objective O1 (= personal advantages), and I wish to simultaneously pursue objective O2 (= use of a stable, predictable, easy to administer and just legal system). A universalization of this maxim would be possible without a practical contradiction because it is then the task of the judges and the courts to interpret the law in conflicting cases in a balanced, impartial, and neutral manner. Therefore, we can pursue O1 without compromising O2 even in a world of universalized maxims. If we extend this argument to a tax planning situation which predates a potential following legal proceeding and assume that the involved persons anticipate a potential lawsuit, then the same conclusion applies. However, in both cases the lawmaker or a professional association may impose specific duties onto the law or an ethics code that entails an obligation to explicitly consider the intention of the law (see Chartered Institute of Taxation 2016, 2017).

If we assume that aggressive legal interpretation is forbidden, or positively a duty to obey the law in a non-aggressive way, then, fourth, a possible counterargument could be that this duty for managers conflicts with other duties, e.g., their duties to act in the interest of shareholders who wish to maximize their profits. Since the duty to obey the law is a general duty for all citizens including shareholders, there is no conflict of duties in this respect. However, there is a possible conflict for the lawyers and tax consultants representing and advising clients in court procedures because they have, in this situation, a fiduciary duty to their clients and at the same time a duty toward non-aggressive legal interpretation. Kant is silent about a solution for conflicting moral duties.Footnote 22

In summary, the normative philosophical question posed at the outset, “Is the aggressive tax avoidance by managers of MNCs immoral?” might be answered in the affirmative if the Kantian justification process presented here in conjunction with the definitions of aggressive tax avoidance and aggressive legal interpretations are accepted. Universalized actions based on an interpretation up to the boundary of what is likely just legally permissible leads contingently to a practical contradiction of conception or will because this behaviour contradicts the objective of a just and stable legal system. Therefore, this type of action could be categorically forbidden. Aggressive tax avoidance as a special case of operating on the edge of legal boundaries and abusive tax avoidance based on a juridical interpretation against the spirit of the law are potentially immoral. This elaborately ethical evaluation preserves central elements of Kantian philosophy, demonstrates the complexity of a philosophical argumentation, and is one way to justify more precisely the moral intuitions that underpin the common negative evaluation of aggressive tax avoidance. The normative deliberative reasoning process including possible counterarguments is not only relevant for managers responsible for tax strategies and their advisors but also generally for managers and advisors with other business functions because every aggressive or abusive legal interpretation may be morally problematic. Ethical codes should address this normative problem and should formulate respective guidelines.

Notes

In a recent investigative article in the German magazine Der Spiegel about subsidiaries of German firms in the tax haven Malta, the authors explicitly ask “why the best-known German industrial giants and the most successful of German’s mid-sized firms take part. It isn’t obvious what their moral justification might be …” (Dahlkamp et al. 2017).

The Committee’s reports on taxation since 2012 can be found at http://www.parliament.uk/business/committees/committees-a-z/commons-select/public-accounts-committee/taxation/.

It should be mentioned here that the development of an analytically elaborated corporate taxation research discipline at universities is a peculiarity of German-speaking countries; in the Anglo-Saxon world, an empiricist point of view dominates and research studies are performed by finance and/or accounting scientists.

On the effects on German law, see Oppel (2016, p. 802), who states that § 42 of the German Tax Code (Abgabenordnung) should be construed in the future to be in conformity with the directive. Article 6 of the Directive EU 2016/1165 is critized by Hey (2017, p. 258) because the new requirement is "extremely open to evaluation and therefore dependent on concretisation by case law". On the fundamental value judgement problem, see Alexy (1983/2015, pp. 17–49), who argueus that value judgments by the judiciary are "always morally relevant" (Alexy 1983/2015, p. 26, 1991/2015, p. 428f., 432f.).

On the definition of the European Commission (cf. the European Commission 2012), Lang is crucial here (2013). On the definition, Egner (2016, p. 327) maintains that an interpretation using the wording of the norm but disregarding the objective of the legislator constitutes a major feature. Definitions for the UK can also be found in HM Treasury, HM Revenue and Customs (2015, p. 5), and definitions for the Canada Revenue Agency can be found online at http://www.cra-arc.gc.ca/gncy/lrt/vvw-eng.html; see also the OECD definition of tax avoidance: “A term that is difficult to define but which is generally used to describe the arrangement of a taxpayer’s affairs that is intended to reduce his tax liability and that although the arrangement could be strictly legal it is usually in contradiction with the intent of the law it purports to follow” (OECD 2017d). The German Audit Reform Act (Abschlussprüfungsreformgesetz), which implements EU Regulation No. 537/2014, indicates that the legal definition of "aggressive tax consultancy services" in § 319a, Paragraph 1, Figure 2 of the German Commercial Code is a fact for barring the auditor from providing audit services if the auditor also wishes to perform tax consultancy services at the same time. These services include tax consultancy services within the meaning of Article 5, Paragraph 1, Sub-paragraph 2, Letter a, Figures i and iv to vii of Regulation (EU) No. 537/2014, which significantly reduced the profit for tax purposes in Germany during the year subject to the audit or led to significant profit shifting "without any commercial necessity for the company beyond the creation of a tax-related financial advantage to the company".Just recently, the reasons of the Council Directive (EU) 2018/822 of 25 May 2018 amending Directive 2011/16/EU as regards mandatory automatic exchange of information in the field of taxation in relation to reportable cross-border arrangements mentions in 18 cases “aggressive (cross-border) tax planning arrangements” or “aggressive tax practices.” That means that in the future aggressive tax avoidance is also at least an indirectly defined legal category concerning this Directive. Intermediaries and in certain situations the relevant taxpayers have obligations to report in advance cross-border arrangements that meet, for example, the so-called Main Benefit Test in conjunction with “Hallmark” categories, e.g., associated enterprises where the recipient is essentially subject to a corporate tax at the rate of zero or almost zero (Annex IV, Part II, C.1 (b) (i) Directive (EU) 2018/822). The Main Benefit Test is satisfied “if it can be established that the main benefit or one of the main benefits which, having regard to all relevant facts and circumstances, a person may reasonably expect to derive from an arrangement is the obtaining of a tax advantage” (Annex IV, Part 1 Directive (EU) 2018/822). This recent Directive gives examples of potentially aggressive tax arrangements which therefore must be reported to the authorities enabling them to evaluate if they are legally permissible or not.

In terms of financial reporting, economic substance over form is also a basic principle of the faithful representation of economic phenomena. “A faithful representation provides information about the substance of an economic phenomenon instead of merely providing information about its legal form. Providing information only about a legal form that differs from the economic substance of the underlying economic phenomenon would not result in a faithful representation” (IASB 2015, ED CF 2.14).

See also Hansen et al. (1992) for a fictitious transfer pricing example in an ethical context. See also Appendix 1.

The term ‘tax planning’ or ‘tax management’ is used as an umbrella term for responsible, aggressive, and abusive tax avoidance and also for tax evasion because assuming rational agents all these activities must be planned and managed.

According to today’s state of knowledge, the legal structure that was selected is probably legal but was predominantly driven by considerations of tax minimisation and not by operational considerations. This is, for example, made clear by the insertion of a Dutch intermediary company, which is necessary as otherwise the licence fees, which would flow from an operational Irish subsidiary directly to the Irish holding company (which is actually managed from a tax haven), would be subject to Irish withholding tax.

Walter (2016) sees the objectivised will of the legislator in the democratic constitutional democracy as the foremost goal of interpretation. According to Leisner (2007), the subjective historic interpretation in European community law is of considerable weight. On the great importance of subjective and objective interpretation theory and on the legal hermeneutics in general, see Klatt (2017, p. 226) and (2015). A detailed overview and discussion about the main legal doctrines (positivist, teleological and axiological approach) in German tax law is given in Schenke (2007). The positivist legal dogma, i.e., the interpretation, is mainly based on the letter of the law and can be criticised because it is not the only conceivable interpretation method (Schenke 2007, p. 497f.).

Because only people, not corporations as legal entities, can bear taxes, empirical tax incidence studies try to answer the question: Who bears the economic burden of the corporate income tax? Current studies show that apart from firm owners, workers and landowners also bear a significant part of the total tax burden (see Fuest et al. 2018; Serrato and Zidar 2016). These studies show exemplarily the theoretical and empirical difficulties of a consequentialist measurement of tax effects even in a restricted partial analysis focused on the costs for primary stakeholders.

For example, imagine the universalization of the following maxim “If I can afford it, I will attend the Bob Dylan concert in Nuremberg on April 22, 2018 in the Frankenhalle to enjoy his music”. A universalization of this maxim would be impossible because the number of seats in the Frankenhalle is limited. It would be absurd to conclude in this case that it is morally forbidden to attend this concert. See Hübner (2014, Pos. 3849ff.) who concludes that maxims should be of a more general type, i.e., “If I can afford it, I will attend concerts to enjoy the music.” I do not intend to discuss problems of false positives and false negatives and possible solutions in this paper, because they are already debated intensely in the literature (see for example Allison 2011, p. 190ff.; O’Neill 2013, p. 156f.).

A similar formulation is used by Kant in his Critique of Practical Reason: “So act that the maxim of your will could always hold at the same time as a principle in a giving of universal law” (Kant 1788/2015, Paragraph 7, Pos. 1436 [30]; see Höffe 2012, Pos. 1712ff.), and also in the Introduction to the Metaphysics of Morals (Kant 1797/2013, Pos. 1151 [225]).

The first page number is shown as in the German Academy Edition of 1786; the number in brackets indicates the recent edition.

According to Pogge’s (2000, p. 173) interpretation, the universalization means that the maxim in question is universally available for everyone with an inclination towards the maxim, which is different from the assumption that everyone actually adopts the maxim.

These assumptions (see Birnbacher 2013, p. 142) are the Kantian distinction between homo noumenon, i.e. a personality independent of physical attributes with a capacity for freedom and humanity, and homo phaenomenon, i.e. natural beings whose personality is affected by physical attributes, see Kant, 1797/2013, pp. 239, 430). Apart from that, there is wide room for interpretation with respect to the meaning of treating other persons not as mere means for certain ends, but as ends in themselves; this complicates the practical application of this formula. Pogge (2000, p. 185) incorporates the formula of humanity into the natural law formula in the following way: “The categorical imperative forbids the adoption of any maxim, M, that leads to an inconsistency among these items: (1) the ability to will M (in virtue of an interest in its ends); (2) the availability of M to all rational beings; (3) natural laws (esp. those governing human dispositions); (4) the recognition of every person as an end in itself.”

See Mansell (2013) for a discussion of these duties in the context of the shareholder theory.

Even a consequentialist interpretation is discussed in the literature; see Kant Commentary (1786/2007, p. 232).

From the empirical viewpoint, see the findings of Lee et al. (2014) in their study of various countries with regard to the link between social trust and the extent of corporate tax avoidance. Whether a moral norm justified in this manner is actually widely accepted in social practice and leads to self-restraint in aggressive tax avoidance is a purely empirical question. Lee et al. (2014) supposes, for example, that in societies characterised by a large degree of social trust, "managers will refrain from actions that may betray the trust that society places in them with an expectation that they pay a fair share of corporate taxes”. It is empirically evident that in 25 countries, a negative correlation is observed between social trust and the extent of tax avoidance by companies.

The British finance authorities (HM Treasury, HM Revenue and Customs 2015, p. 15) have required the relevant professional associations involved in tax consultancy "to take on a greater lead and responsibility in setting and enforcing clear professional standards around the facilitation and promotion of avoidance to protect the reputation of the tax and accountancy profession and to act for the greater public good". In November 2016, this requirement led to a new edition (to take effect from March 2017) of the document "Professional Conduct in Relation to Taxation”, PCRT), which is applicable to seven professional associations involved in the tax consultancy sector (including the Chartered Institute of Taxation and the Institute of Chartered Accountants of England and Wales ICAEW). The standards for tax planning are a real innovation. With reference to tax planning arrangements, section 2.29 reads as follows: "Members must not create, encourage or promote tax planning arrangements or structures that (i) set out to achieve results that are contrary to the clear intention of Parliament in enacting relevant legislation and/or (ii) are highly artificial or highly contrived and seek to exploit shortcomings within the relevant legislation (Chartered Institute of Taxation 2016).” I consider this standard to be remarkable because tax consultancy professions in Great Britain recognise that this document promotes the respect for societal interests (see the Chartered Institute of Taxation’s "Frequently asked questions" 2017; Bennett and Murphy 2017). Thus, the above argument that aggressive tax planning as a special case of aggressive legal interpretation is immoral is supported, and it is stated to be a binding ethical principle for members of the tax consultancy profession in Great Britain. See also Kadet and Koontz (2016a, b) on the attempted practical application of ethical criteria on profit-shifting structures using the example of US tax law.

The lawyer acts as the client’s agents and, therefore, has fiduciary duties (see Levine 2015).

Kant admits situations in which such a conflict exists but provides no clear guidance for those who face it (O’Neill 2013, Pos. 3119). Citing Kant (1797/2013, p. 224): “When two such grounds conflict with each other, practical philosophy says, not that the stronger obligation takes precedence (fortiori obligation vincit), but that the stronger ground of obligation prevails (fortiori obligandy ration vincit).”

References

Alexy, R. (1983/2015). Theorie der juristischen argumentation: Die theorie des rationalen diskurses als theorie juristischer begründung (8th ed.). Berlin: Suhrkamp.

Alexy, R. (Ed.). (1991/2015). Nachwort (1991): Antwort auf einige Kritiker. In Theorie der juristischen argumentation: Die theorie des rationalen diskurses als theorie juristischer begründung (8th ed., pp. 399–435). Berlin: Suhrkamp.

Allison, H. E. (2011). Kant’s groundwork for the metaphysic of morals. A commentary. Oxford: Oxford University Press.

Anenberg, S., Miller, J., Minjares, R., Du, L., Henze, D. K., Lacey, F., Malley, C. S., Emberson, L., Franco, V., Klimont, Z., & Heyes, C. (2017). Impact and mitigation of excess diesel-related NOx emissions in 11 major vehicle markets. Nature, 545, 467–471.

Avi-Yonah, R. (2014). Corporate taxation and corporate social responsibility. New York University Journal of Law & Business, 11(1), 1–30.

Barak, A. (2005). Purposive interpretation in law. Princeton: Princeton University Press.

Bennett, A. M., & Murphy, B. (2017). The tax profession: Tax avoidance and the public interest. Working Paper N286-17. Maynooth University, Department of Economics, Finance & Accounting.

Bird, R., & Davis-Nozemack, K. (2016). Tax avoidance as a sustainability problem. Journal of Business Ethics. https://doi.org/10.1007/s10551-016-3162-2.

Birnbacher, D. (2013). Analytische einführung in die ethik. Boston: De Gruyter.

Blouin, J. (2014). Defining and measuring tax planning aggressiveness. National Tax Journal, 67(4), 875–900.

Brealey, R. A., Myers, S. C., & Allen, F. (2008). Principles of corporate finance. Boston: McGraw Hill.

Büttner, T., & Thiemann, M. (2017). Breaking regime stability? The politicization of expertise in the OECD/G20 process on BEPS and the potential transformation of international taxation. Accounting, Economics, and Law: A Convivium. https://doi.org/10.1515/ael-2016-0069.

Chartered Institute of Taxation. (2016). Professional Conduct in relation to taxation. Issued November 1.

Chartered Institute of Taxation. (2017). Professional conduct in relation to taxation. Frequently asked questions on the updated guidance effective guidance effective from 1 March 2017. Retrieved from https://www.tax.org.uk/sites/default/files/PCRT%20Effective%201%20March%202017%20FAQ.pdf.

Christensen, J., & Murphy, R. (2004). The social irresponsibility of corporate tax avoidance: Taking CSR to the bottom line. Development, 47(3), 37–44.

Dahlkamp, J., Henrichs, C., Latsch, G., Pauly, C., & Schmidt, J. (2017). Malta leaks: Playing the shell game in the Mediterranean. Retrieved from May 25, 2017 http://www.spiegel.de/international/business/malta-the-european-union-s-very-own-tax-haven-a-1148915.html.

Dowling, G. R. (2015). The Curious case of corporate tax avoidance: Is it socially irresponsible? Journal of Business Ethics, 124, 173–184.

Drucker, J. (2017). Caterpillar is accused in report to federal investigators of tax fraud. The New York Times, March 7.

Drucker, J., & Bowers, S. (2017). After a tax crackdown, apple found a new shelter for its profits: The paradise papers. The New York Times, November 6.

Dunbar, A., Higgins, D. M., Phillips, J. D., & Plesko, G. A. (2010). What do measures of tax aggressiveness measure? In 103rd Annual Congress of Taxation (pp. 18–26).

Dyreng, S. D., Hanlon, M., Maydew, E. L., & Thornock, J. R. (2017). Changes in corporate effective tax rates over the past 25 years. Journal of Financial Economics, 124(3), 441–463.

Egger, P. H., & Stimmelmayr, M. (2017). Taxation and the multinational firm. CESifo Working Paper No. 6384, February.

Egner, T. (2016). Steuerplanung—ein kind der globalisierung. In S. Eckert & G. Trautniz (Eds.), Internationales management und die grundlagen des globalisierten kapitalismus (pp. 321–338). Wiesbaden: Springer.

EU. (2016). Council directive (EU) 2016/1164 of 12 July 2016 laying down rules against tax avoidance practices that directly affect the functioning of the internal market. Official Journal of the EU, L193, 1–14.

European Commission. (2012). Commission recommendation of 6 December 2012 on aggressive tax planning. Official Journal of the EU, L338,41–43.

European Commission. (2014). State aid SA.38944 (2014/C)-Luxembourg. Alleged aid to Amazon by way of a tax ruling. Brussels, 07.10.2014, C 7156 final.

European Commission. (2016a). State aid: Ireland gave illegal benefits to Apple worth up €13 billion. Press Release, August 30.

European Commission. (2016b). Commission decision of 30.8.2016 on state aid SA.38373 (2014/C) (ex 2014/NN) (ex 2014/CP) implemented by Ireland to Apple. C(2016) 5605 final, Brussels, 30.08.2018.

European Commission. (2017a). State aid: Commission finds Luxembourg gave illegal tax benefits to Amazon worth around €250 million. Press Release, October 4.

European Commission. (2017b). Commission decision of 4.10.2017 on state aid SA.38944 (2014/EC) (ex 2014/NN) implemented by Luxembourg to Amazon. Brussel, 4.10.2017, C(2017) 6740 final.

European Commission. (2018). Council directive (EU) 2018/822 of 25 May 2018 amending directive 2011/16/EU as regards mandatory automatic exchange of information in the field of taxation in relation to reportable cross-border arrangements. Official Journal of the European Union, L139,1–13.

Freedman, J. (2004). Defining taxpayer-responsibility: In support of a general anti-avoidance principle. British Tax Review, No. 4, 332–357.

Freedman, J. (2010). Improving (not perfecting) tax legislation: Rules and principles revisited. British Tax Review, No. 6, 717–736.

Freedman, J. (2014). Designing a general anti-abuse rule: Striking a balance. Asia-Pacific Tax Bulletin, May/June, 167–173.

Foster Back, P. (2013). Avoiding tax may be legal, but can it ever be ethical? Retrieved from http://www.theguardian.com/sustainable-business/avoiding-tax-legal-but-ever-ethical.

Fuest, C., Peichl, A., & Siegloch, S. (2018). Do higher corporate taxes reduce wages. Micro evidence from Germany. American Economic Review, 108(2), 393–418.

Godar, S. H., O’Connor, P. J., & Taylor, V. A. (2005). Evaluating the ethics of inversion. Journal of Business Ethics, 61(1), 1–6.

Gribnau, H. J. L. M., & Jallai, A.-G. (2017). Good tax governance: A matter of moral responsibility and transparency. Nordic Tax Journal, 1(1), 70–88.

Hanlon, M., & Heitzman, S. (2010). A review of tax research. Journal of Accounting and Economics, 50(2–3), 127–178.

Hanson, D. R., Crosser, R. L., & Laufer, D. (1992). Moral ethics vs. tax ethics: The case of transfer pricing among multinational corporations. Journal of Business Ethics, 11, 679–686.