Abstract

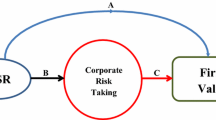

We aggregate different dimensions of corporate social responsibility (CSR) activities following the stakeholder framework proposed in Clarkson (Acad Manag Rev 20(1), 92–117, 1995) and present consistent evidence that CSR strengths targeting different stakeholders have their unique impact on firm risk and financial performance. Institutional CSR activities that target secondary stakeholders are negatively associated with firm risk, measured by total risk and systematic risk. Technical CSR that target primary stakeholders are positively associated with firm financial performance, measured by Tobin’s Q, ROA, and cash flow returns. Our results, based on a sample of S&P 500 component firms over the period of 1995–2009, are consistent with the risk management view of “altruistic” CSR activities and with the stakeholder salience theory. We also show that the impact of CSR activities on risk varies with the ethical climate, as proved in our subsample analyses on pre- and post-Sarbanes–Oxley periods. Our empirical analyses mitigate possible omitted variables and endogeneity concerns that are often overlooked in previous research. Our findings are robust to alternative CSR measures, to alternative risk and performance measures, and to alternative estimation methods.

Similar content being viewed by others

Notes

“In the Internet era, even a 64-year-old retired math teacher can become a threat to a large company.” Wall Street Journal (C1, Feb 19, 2013).

Financial (SIC 6000-6999) and regulated utility firms (SIC 4900-4999) are not included in our sample.

KLD used ticker as identifier for the firms it covered prior to 1995 and switched to CUSIP as firm identifiers since 1995. To minimize the possibility of misidentified firms when combining data with Compustat, which uses CUSIP as firm identifiers, we work with data starting from 1995.

Godfrey et al. (2009) include corporate governance dimension for TCSR as well. We construct an alternative measure for TCSR strengths and concerns following their approach and find qualitatively the same results, which are available upon request.

In unreported results, we show that our results on the relation of ICSR/TCSR with risk and performance still hold in a smaller sample when firms with missing R&D information are excluded. Results are available upon request.

ROA is included as independent variables when dependent variables are ROA_E or EBITDA/TA. Q is not included as independent variables when dependent variable is Tobin’s Q.

References

Abel, A. B. (1999). Risk premia and term premia in general equilibrium. Journal of Monetary Economics, 43(1), 3–33.

Bansal, P., & Clelland, I. (2004). Talking trash: Legitimacy, impression management, and unsystematic risk in the context of the natural environment. Academy of Management Journal, 47(1), 93–103.

Barnett, T., & Vaicys, C. (2000). The moderating effect of individuals’ perceptions of ethical work climate on ethical judgments and behavioral intentions. Journal of Business Ethics, 27(4), 351–362.

Bloom, M., & Milkovich, G. T. (1998). Relationships among risk, incentive pay, and organizational performance. Academy of Management Journal, 41(3), 283–297.

Brammer, S., & Millington, A. (2008). Does it pay to be different? An analysis of the relationship between corporate social and financial performance. Strategic Management Journal, 29(12), 1325–1343.

Brigham, E. F., & Gapenski, L. C. (1996). Intermediate financial management (5th ed.). Orlando, FL: Dryde.

Campbell, J. Y., & Cochrane, J. H. (2000). Explaining the poor performance of consumption-based asset pricing models. The Journal of Finance, 55(6), 2863–2878.

Clarkson, M. E. (1995). A stakeholder framework for analyzing and evaluating corporate social performance. Academy of Management Review, 20(1), 92–117.

Constantinides, G. M. (1990). Habit formation: A resolution of the equity premium puzzle. Journal of Political Economy, 98(3), 519–543.

Donaldson, L. (1999). Performance-driven organizational change: The organizational portfolio. Thousand Oaks, CA: Sage.

Entine, J. (2003). The myth of social investing: A critique of its practice and consequences for corporate social performance research. Organization & Environment, 16(3), 352–368.

Freeman, R. E. (1984). Strategic management: A stakeholder approach. Boston: Pitman.

Freeman, R. E., Harrison, J. S., Wicks, A. (2008). Managing for stakeholders: Survival, reputation, and success. New Haven, CT: Yale University Press.

G&A Governance & Accountability Institute, Inc. (2012) 2012 corporate ESG/sustainability/responsibility reporting—Does it matter?

Godfrey, P. C. (2005). The relationship between corporate philanthropy and shareholder wealth: A risk management perspective. Academy of Management Review, 30(4), 777–798.

Godfrey, P. C., & Hatch, N. W. (2007). Researching corporate social responsibility: an agenda for the 21st century. Journal of Business Ethics, 70, 87–98.

Godfrey, P. C., Merrill, C. B., & Hansen, J. M. (2009). The relationship between corporate social responsibility and shareholder value: An empirical test of the risk management hypothesis. Strategic Management Journal, 30(4), 425–445.

Husted, B. W. (2005). Risk management, real options, and corporate social responsibility. Journal of Business Ethics, 60(2), 175–183.

Jo, H., & Harjoto, M. (2011). Corporate governance and firm value: The impact of corporate social responsibility. Journal of Business Ethics, 103(3), 351–383.

Jo, H., & Harjoto, M. (2012). The causal effect of corporate governance on corporate social responsibility. Journal of Business Ethics, 106(1), 53–72.

Jo, H., & Na, H. (2012). Does CSR reduce firm risk? Evidence from controversial industry sectors. Journal of Business Ethics, 110(4), 441–456.

Kabongo, J., Chang, K., & Li, Y. (2013). The impact of operational diversity on corporate philanthropy: An empirical study of U.S. companies. Journal of Business Ethics, 116(1), 49–65.

Kalwarski, T. (2008, July 14). Do-good investments are holding up better, Business Week, p. 15.

Luo, X., & Bhattacharya, C. B. (2009). The debate over doing good: Corporate social performance, strategic marketing levers, and firm-idiosyncratic risk. Journal of Marketing, 73(6), 198–213.

Margolis, J. D., & Walsh, J. P. (2003). Misery loves companies: Rethinking social initiatives by business. Administrative Science Quarterly, 48(2), 268–305.

Martin, K. D., & Cullen, J. B. (2006). Continuities and extensions of ethical climate theory: A meta-analytic review. Journal of Business Ethics, 69(2), 175–194.

Mattingly, J. E., & Berman, S. L. (2006). Measurement of corporate social action: Discovering taxonomy in the Kinder Lydenburg Domini ratings data. Business & Society, 45(1), 20–46.

Mcguire, J. B., Sundgren, A., & Schneeweis, T. (1988). Corporate social responsibility and firm financial performance. Academy of Management Journal, 31(4), 854–872.

McWilliams, A., & Siegel, (2000). Corporate social responsibility and financial performance: correlation or misspecification? Strategic Management Journal, 21(5), 603–609.

Mitchell, R., Agle, B., & Wood, D. (1997). Toward a theory of stakeholder identification and salience: Defining the principle of who and what really counts. Academy of Management Review, 22, 853–886.

Oikonomou, I., Brooks, C., & Pavelin, S. (2012). The impact of corporate social performance on financial risk and utility: A longitudinal analysis. Financial Management, 41(2), 483–515.

Orlitzky, M., & Benjamin, J. D. (2001). Corporate social performance and firm risk: A meta-analytic review. Business & Society, 40(4), 369–396.

Orlitzky, M., Schmidt, F. L., & Rynes, S. L. (2003). Corporate social and financial performance: A meta-analysis. Organization studies, 24(3), 403–441.

Paine, L., Deshpandé, R., Margolis, J. D., & Bettcher, K. E. (2005). Up to Code: Does your company’s conduct meet world-class standards? Harvard Business Review, 38(12), 122–133.

Peloza, J. (2009). The challenge of measuring financial impacts from investments in corporate social performance. Journal of Management, 35(6), 1518–1541.

Petersen, M. A. (2009). Estimating standard errors in finance panel data sets: comparing approaches. Review of Financial Studies, 22, 435–480.

Thompson, S. B. (2011). Simple formulas for standard errors that cluster by both firm and time. Journal of Financial Economics, 99, 1–10.

Udayasankar, K. (2008). Corporate social responsibility and firm size. Journal of Business Ethics, 83(2), 167–175.

Vaidyanathan, B. (2008). Corporate giving: A literature review. Working paper, Center for the Study of Religion and Society, University of Notre Dame.

Zyglidopoulos, S. C., Georgiadis, A. P., Carroll, C. E., & Siegel, D. S. (2012). Does media attention drive corporate social responsibility? Journal of Business Research, 65, 1622–1627.

Acknowledgments

We would like to thank Gary Monroe (Section Editor) and an anonymous referee for comments and suggestions that greatly improved the paper’s quality. Ying Li would also like to thank Sundar Balakrishnan, Paul Collins, Steve Holland, Kevin Laverty, and Sandeep Krishnamurthy for helpful discussions and comments.

Author information

Authors and Affiliations

Corresponding author

Appendix: Definitions of Variables

Appendix: Definitions of Variables

RelRetVol | 12 month stock volatility t /12 month CRSP value weighted index volatility t |

Size-Adjusted RelRetVol | 12 month stock volatility t /12 month CRSP size quintile portfolio volatility t |

RelRetVol2 | 24 month stock volatility t,t+1/24 month CRSP value weighted index volatility t,t+1 |

Size-Adjusted RelRetVol2 | 24 month stock volatility t,t+1/24 month CRSP size quintile portfolio volatility t,t+1 |

Beta | Beta is measured using the previous 2 years daily data |

CSRstrength | A sum of the CSR strengths across community, diversity, environment, employee relation, and product quality [COMstrength + DIVstrength + ENVstrength + EMPstrength + PROstrength] |

Size-Adjusted CSRstrength | CSR strengths adjusted by the mean value of CSR strength score in the size portfolio; size portfolio is determined by quintile of total assets |

CSRconcern | A sum of the CSR concerns across community, diversity, environment, employee relation, and product quality [COMconcern + DIVconcern + ENVconcern + EMPconcern + PROconcern] |

Size-Adjusted CSRconcern | CSR concerns adjusted by the mean value of CSR concern score in the size portfolio; size portfolio is determined by quintile of total assets |

NetCSRstrength | CSRstrength − CSRconcern |

ICSRstrength | ICSR strengths [COMstrength + DIVstrength] |

Alt ICSRstrength | Alternative ICSR strengths [COMstrength + DIVstrength + ENVstrength] |

Size-Adjusted ICSRstrength | ICSR strengths adjusted by the mean value of the ICSR strength score in the size portfolio; size portfolio is determined by quintile of total assets |

Alt Size-Adjusted | Alternative size-adjusted ICSRstrength |

ICSRconcern | ICSR concerns [COMconcern + DIVconcern] |

Size-Adjusted ICSRconcern | ICSR concerns adjusted by the mean value of ICSR concern score in the size portfolio; size portfolio is determined by quintile of total assets |

NetICSRstrength | ICSRstrength—ICSRconcern |

TCSRstrength | TCSR strengths [EMPstrength + PROstrength] |

Alt TCSRstrength | Alternative TCSR strengths [EMPstrength + PROstrength + CGOVstrength] |

Size-Adjusted TCSRstrength | TCSR strengths adjusted by the mean value of TCSR strength score in the size portfolio; size portfolio is determined by quintile of total assets |

Alt Size-Adjusted TCSRstrength | Alternative Size-adjusted TCSRstrength |

TCSRconcern | TCSR concerns [EMPconcern + PROconcern + CGOVconcern] |

Size-Adjusted TCSRconcern | TCSR concerns adjusted by the mean value of TCSR concern score in the size portfolio; size portfolio is determined by quintile of total assets |

NetTCSRstrength | TCSRstrength—TCSRconcern |

HighVol | If in volatile periods (2000–2002 and 2007–2009), takes 1, else 0. |

Log (assets) | Firm size measured by book value of assets at fiscal year t [AT] |

Leverage | Debt to assets ratio [(DLC + DLTT)/AT] |

ROA | Net income divided by assets [NI/AT] |

ROA_E | EBIT divided by assets [EBIT/AT] |

Cash flow return | EBITDA divided by assets [BITDA/AT] |

Q | Tobin’s Q, measured by market value of assets divided by book value of assets [(PRCC_F*CSHO + AT − CEQ)/AT)] |

HighQ | If size-adjusted Q > median(Q), takes 1, else 0. |

Size-Adjusted ICSRstrength by HighQ | Size-Adjusted ICSRstrength*HighQ |

Size-Adjusted TCSRstrength by HighQ | Size-Adjusted TCSRstrength*HighQ |

Size-Adjusted ICSRstrength by HighVol | Size-Adjusted ICSRstrength*HighVol |

Size-Adjusted TCSRstrength_HighVol | Size-Adjusted TCSRstrength*HighVol |

PPE/assets | Property, plant & equipment divided by assets [PPENT/AT] |

R&D | R&D expense [XRD/AT] |

Firm age | Fiscal year minus the first year that the firm is reported in Compustat |

State mean NetICSRstrength | Annual NetICSRstrength score average located in the same state |

State mean NetTCSRstrength | Annual NetTCSRstrength score average located in the same state |

Industry mean NetICSRstrength | Mean NetICSRstrength scores of firms in the same three-digit SIC codes |

Industry mean NetTCSRstrength | Mean NetTCSRstrength scores of firms in the same three-digit SIC codes |

Rights and permissions

About this article

Cite this article

Chang, K., Kim, I. & Li, Y. The Heterogeneous Impact of Corporate Social Responsibility Activities That Target Different Stakeholders. J Bus Ethics 125, 211–234 (2014). https://doi.org/10.1007/s10551-013-1895-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10551-013-1895-8