Abstract

The relationship between decision theory and the theory of natural selection in evolutionary biology offers a fertile ground for philosophical inquiry. A topic that has recently been addressed in the philosophical literature is the connection between decision-theoretic and biological discussions of risk. The paper adds to this literature by drawing attention to a distinction between two different notions of risk originating in the economic literature and by exploring their relationship in a biological context. More specifically, the paper shows that the two notions of risk can part ways in models of risk-sensitive foraging theory. The paper also draws attention to an important difference in contemporary explanations of the apparent lack of empirical success of rational choice theory and risk-sensitive foraging theory.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

All decisions by economic agents require an assessment of the future. Since the future is uncertain, dealing with uncertainty and risk lies the heart of making decisions in business and economics. For instance, economic agents have to decide on how to quantify risk and to rationally weigh risks and rewards in their investment decisions. Similarly, biological organisms have to make decisions facing uncertainty and risk. For instance, an animal might forage either in a resource-rich area associated with a high risk of predation or in a resource-poor area associated with a lower risk. Since more food resources generally mean greater survival and more offspring and thus higher Darwinian fitness, the question arises of how natural selection chooses among these foraging strategies.

Examples of this kind naturally suggest that there is an interesting parallel to be explored between decision making under risk and uncertainty in economics and in evolutionary biology. In a recent monograph (Okasha 2018) explores the connections between the decision-theoretic and the biological discussions of risk.Footnote 1 Okasha’s treatment covers a wide range of topics such as the meaning of risk aversion, the use of decision weights other than the true probabilities, and the technique of re-formulating the state space to address apparent anomalies of choice. In this paper I would like to shed light on a further aspect of the relationship between decision-theoretic and biological discussions of risk. In particular, I will draw attention to a distinction between two different notions of risk discussed in the economic literature and explore the relationship between these two notions of risk in a biological context.

In common parlance risk refers to the possibility of harm, injury or loss. This common notion of risk has found its way into banking and insurance where risk managers regularly employ quantitative risk measures, such as the loss probability, that refer to the lower tail of a probability distribution (Jorion 2007). Similarly, engineers invoke risk measures that describe the possibility of failure or breakdown of a system (Wang and Roush 2000). Again, these more technical measures of risk sit well with the idea of risk as the possibility of harm, loss or injury. And finally, when medical practitioners speak of the risks associated with drugs and other treatments, they also have this common notion of risk in mind (Sox et al. 2013).

Among decision theorists and economists, however, risk is typically associated with a concept that differs from the common sense notion of risk. Rather than identifying risk with the possibility of harm, risk refers to the dispersion of outcomes in a probability distribution. Consider the following two gambles. In the first gamble one will win or lose 1 EUR depending on the outcome of a fair coin toss. In the second gamble one will win or lose 100 EUR depending on the outcome of a fair coin toss. Based on the notion of risk invoked in decision theory, the second gamble is more risky by having a probability distribution with larger dispersion as measured, for instance, by its variance. The idea of risk as a dispersion was introduced by Bernoulli (1954) and made popular among modern decision theorists due to the work of von Neumann and Morgenstern (1944).

Friedman et al. (2014) demonstrate that dispersion measures of risk, such as the standard deviation, and harm-based measures of risk, such as the expected loss, can come apart for a number of prominent probability distributions. That is, standard deviation and related dispersion measures are not closely linked to the more direct measures of harm when assessing economic lotteries. The two different views on risk can therefore yield different assessments of the risk inherent in alternative choices. As a consequence, the choice between these two perspectives on risk can matter when it comes to decision making in an economic context.

Following Friedman et al., I will distinguish between the two different notions of risk and refer to the common sense notion as ‘risk-as-possibility-of-harm’ (RPH) and to the notion of risk embodied in rational choice theory as ‘risk-as-dispersion’ (RD). Rather than discussing the relationship between RPH and RD in an economic setting, however, I will turn to biology and explore their relationship in risk-sensitive foraging theory (Houston and McNamara 1999). Turning to risk-sensitive foraging theory is not only motivated by the fact that both risk concepts figure in this biological application but also because it offers an established framework for assessing fitness-maximising behaviour when rewards are not certain. More specifically, I will explore whether these two different concepts of risk can be used interchangeably or whether they can come apart in risk-sensitive foraging theory. That is, I am interested in whether a fitness-maximising organism that acts optimally by adopting, say, a risk averse foraging strategy in the RD sense is also risk averse in the sense of RPH. This approach is motivated by the sentiment that if both notions of risk cannot be used interchangeably, then close attention should be paid to the notion of risk at stake when discussing (foraging) behaviour under risk and uncertainty.

The paper is structured as follows. Section 2 sets the stage by fixing the terminology on risk aversion and risk seeking in the two different conceptual frameworks associated with RD and RPH. Section 3 examines the relationship between RD and RPH in the energy budget rule originating from risk-sensitive foraging theory. Section 4 discusses a further class of models from risk-sensitive foraging theory that include reproduction. Section 5 offers some thoughts on explaining the limited empirical success of the energy budget rule highlighting an important difference between risk in decision theory and evolutionary biology. Section 6 concludes.

Some terminology

The aim of the paper is to compare RD and RPH risk preferences in the context of optimal foraging models from risk-sensitive foraging theory. To do so, some terminology has to be introduced. In particular, the notions of risk aversion and risk seeking have to be explicated in the context of both RD and RPH. Let us begin with RD. In rational choice theory an agent is said to be risk averse if and only if she prefers x EUR for certain to a lottery with expected monetary value x EUR. Further, an agent is said to be risk seeking if and only if she prefers a lottery with expected monetary value x EUR to x EUR for certain.Footnote 2

Since the focus of this paper is on foraging models where the currency of interest typically is energy and not money, these definitions have to be slightly modified. For present purposes, an organism is said to be risk averse if and only if it prefers receiving energy value x for certain to a gamble with expected energetic value x. Similarly, an organism is said to be risk seeking if and only if it prefers a gamble with expected energetic value x to receiving energy value x for certain. Phrased informally, risk aversion and risk seeking refer to the acceptance or avoidance of variation in food acquisition gambles.

Turning to RPH, matters are a bit more complicated. For a start, it is unclear what it could mean to be risk seeking in the context of RPH. Indeed, Friedman et al. (2014) suggest that it is inconceivable for someone to seek risk in the sense of RPH since risk here just refers to the possibility of undesirable things happening. In order to get the paper off the ground, I have to adopt a different approach. To begin with, I will formalise RPH by introducing a quantitative risk measure. A natural choice in the context of risk-sensitive foraging theory is the probability of death of an organism. This choice also sits well with formal measures of RPH employed in other domains. As already mentioned, risk managers in banking and insurance employ the probability of loss as a quantitative risk measure. Both the probability of death and the probability of loss can be seen as instantiations of the more general idea of measuring the possibility of a harm by means of its probability.Footnote 3

With a quantitative risk measure in place, I can now turn to the definitions of risk aversion and risk seeking based on RPH. Simply put, a risk averse organism will prefer gambles with lower risk, while a risk seeking organism will prefer gambles with higher risk. More formally, suppose an organism is faced with two energy lotteries of the same mean but associated with different probabilities of death. An organism is said to be risk averse if and only if it chooses an energy gamble with lower RPH over an energy gamble with higher RPH. Similarly, an organism is said to be risk seeking if and only if it chooses an energy lottery with higher RPH over an energy lottery of the same mean but with lower RPH.

The interpretation of risk preferences in rational choice theory has received considerable attention among both economists and philosophers (Okasha 2016). The mentalistic interpretation asserts that the utility values associated with an outcome represent facts about the psychology of an agent. The behaviourist interpretation, on the other hand, does not associate any real psychological entity with utility. Based on the latter reading, a utility function merely serves as a convenient representation of an agent’s choices. On the face of it, the question of whether to endorse a mentalistic or behaviourist interpretation of preference does not arise in behavioural ecology as it does in economics. Optimal foraging models assume natural selection favours strategies that are advantageous in terms of Darwinian fitness. Fitness, however, is not a suitable candidate for a psychological reading. That said, the question of whether there is a behaviourist interpretation of preferences in behavioural ecology can be rightly posed. Indeed, Okasha et al. (2014) demonstrate how the criterion of inclusive fitness maximisation in social evolution theory can be derived from axioms on an organism’s choices under certain assumptions. There is therefore scope for a behaviourist view on preference in behavioural ecology.

Energy budget rule

Having introduced the notions of risk aversion and risk seeking for both RD and RPH, I will now turn to their relationship in risk-sensitive foraging theory. The question I will address is whether a fitness maximising animal that is risk averse in the RD sense is also risk averse in the RPH sense. Similarly, I will examine whether a fitness maximising animal that is risk seeking in the RD sense is also risk seeking in the RPH sense. In order to tackle these questions, the notion of fitness needs some elaboration first. In some biological models the notion of fitness solely refers to the ability of an organism to survive, while in other models fitness captures an organism’s propensity to survive and reproduce. Following these two ways of thinking about fitness, I will first explore the relationship between RD and RPH in biological models assuming that the fitness of an organism refers to its ability to survive. The most prominent risk-sensitive foraging theory model of that kind is the energy budget rule. In a second step, I will then take a look at the relationship between RD and RPH in survival and reproduction models.

The concept of risk sensitivity originating in rational choice theory found its way into behavioural ecology due to work of Caraco et al. (1980), Real (1980) and Stephens (1981). Stephens (1981) formalised what has become known as the energy budget rule. The energy budget rule describes a situation in which a small bird forages in winter and must acquire sufficient energy to surpass a critical threshold in order to survive the night. The rule asserts that when the mean of the energy returns is greater than the threshold, the animal should choose the least variable option to minimise the probability of starvation. When the mean of the returns is less than the threshold, the animal should choose the most variable option since it provides the greater probability of surpassing the starvation threshold.

More formally, suppose a small bird forages until dusk, denoted as time T.Footnote 4 Further suppose that the bird’s energy reserves at time t are denoted by the random variable X(t). It is assumed that the bird survives the night if its energy reserves at dusk exceed the critical level \(x_{c}\), that is, if \(X(T)>x_{c}\). The optimal behaviour in this model results from adopting a foraging option that maximises the probability of overnight survival \(P(X(T)>x_{c})\). The bird can choose from two foraging options. The energetic gain per unit time under option i (with \(i \in \{1,2\}\)) has mean \(\mu _{i}\) and variance \(\sigma _{i}^{2}\) (with \(\sigma _{i}^{2}>0\)). Let \(x_{0}\) denote the energy reserve at time 0. It can be shown that in the case of \(\mu = \mu _{1}= \mu _{2}\) it is optimal to choose the less variable option if and only if \(x_{0} + \mu T > x_{c}\).

Suppose the optimal policy given an energy state is to choose the low variance foraging option. Does this imply that a bird adopting this policy is risk averse in the RD sense? The answer to this question is not immediately obvious. Note the difference in concepts: risk-sensitive foraging theory typically identifies choosing the low variance option with being risk averse while in expected utility theory a risk averse agent chooses a certain payoff over an uncertain payoff with the same mean. Phrased differently, risk-sensitive foraging theory models typically compare two lotteries with the same mean and strictly positive but different variances. In contrast, the definition of risk aversion in rational choice theory requires comparing a lottery with strictly positive variance with a ‘degenerate’ lottery with zero variance. Now, it is wrong to think that a risk averse agent based on rational choice theory always prefers the low variance option.Footnote 5 While a risk averse agent can prefer the high variance option, we are interested in a different question. Suppose an agent always prefers the low variance when confronted with two lotteries with the same mean but different, non-trivial variances. Is this agent to be represented with as an expected utility maximiser with a concave utility function? The answer is yes and has two steps. First, it can be shown that the foraging preferences of this bird must follow a quadratic utility function, if expected utility theory is presumed (Rothschild and Stiglitz 1970). Second, assuming that the bird’s preferences are represented by a quadratic utility function, a risk averse decision maker will always follow prefer among two random variables with the same mean, the one with the lowest variance.

Returning to the central question of this paper, how does the RD notion of risk relate to the RPH version in the context of the energy budget rule? Again, suppose the optimal policy for a given energy state is to choose the low variance foraging option. As we have seen, this implies that the optimal policy for the small bird is being risk averse in the RD sense. Since the policy is derived by maximising the probability of overnight survival and, hence, by minimising the probability of overnight death, a small fitness maximising bird is also risk averse in the RPH sense. Risk preferences are well aligned for both RD and RPH.

Matters are different if the optimal policy for a given energy state is to choose the high variance foraging option. In that case the fitness maximising bird is risk seeking in the RD sense. Since the optimal policy derives from minimising the probability of overnight death, the optimal policy is, by definition, risk averse in the RPH sense. Phrased differently, there is a divergence between the classification of the optimal foraging behaviour: while the optimal policy of the energy budget rule is risk seeking in the RD sense, it is risk averse in the RPH sense. It follows that the notions of risk in the RD and the RPH framework cannot be used interchangeably. There is a parting of ways between these two approaches of characterising risk sensitive behaviour in risk-sensitive foraging theory.

Expected reproductive success

The energy budget rule allows for directly reading off an optimal foraging choice that minimises RPH since the optimality criterion is to minimise the probability of death from starvation. Not all risk-sensitive foraging theory models, however, adopt this optimality criterion. An important class of risk-sensitive foraging theory models maximises the expected reproductive success of an organism in order to identify optimal foraging choices. The expected reproductive success is a mathematical average of the offspring number of an organism, where different possible offspring numbers are weighted by their probability. While a premature death is generally not conducive for reproductive success, the two optimality criteria can lead to conflicting advice on how to choose a foraging option.

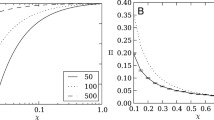

McNamara et al. (1991) illustrate the two different approaches to risk-sensitive foraging by means of two models. In both their models an animal forages continuously with no interruptions and may die of starvation. All foraging options have the same mean gain, but unequal variances. The first model does not include reproduction and the optimality criterion is to minimise the probability of death from starvation. The second model includes reproduction and the optimality criterion is to maximise expected lifetime reproductive success. In the first model, the optimal policy is to choose the low variance option at all levels of reserves, when the mean gain is positive. When the mean ‘gain’ is negative, the optimal policy is to choose the low variance option when reserves are high and the high variance option when reserves are low. The threshold value depends on the model parameters and may be zero, so that the low variance option is always chosen.

In the second model, the high variance option is always chosen when the mean gain is negative. Matters are more complicated when the mean gain is positive. Here, a further factor comes into play in terms of the background mortality, which refers to the probability that the animal will die during an interval regardless of its behaviour. At low energy reserves, it is important to avoid starvation and the optimal choice is the same as in the starvation model. As energy reserves increase, the background mortality becomes relatively more important. The animal must attempt to reach the reproduction threshold before it dies from this source of mortality. As a result, it chooses the high variance option when energy reserves are high, and this tendency to choose the high variance option increases as the background mortality increases. When the mean gain is high, the danger of starvation is small unless energy reserves are very low. As a result, the region in which it is optimal to choose the high variance option extends to lower energy reserves as the mean gain increases.

Focusing on the case of a negative mean energy gain, one can see that an optimal forager will choose different foraging options depending on whether the animal acts to minimise the probability of starvation or maximises the expected lifetime reproductive success. While in the second model the high variance option is always chosen, the optimal choice in the first model depends on the level of the energy reserves. Phrased differently, while an animal that maximises its expected lifetime reproductive success would always be risk seeking in the RD sense, an animal acting to minimise its probability of starvation would be risk averse or risk seeking in the RD sense depending on its energy level.

Empirical adequacy

While it is widely recognized that animals are sensitive to risk in the RD sense, it has been questioned whether the empirical evidence supports the specific predictions of the energy budget rule. According to Kacelnik and Mouden (2013), the majority of empirical studies on animal behaviour fail to support a shift from risk seeking when in negative energetic budget to risk aversion when in positive budget, as embodied in the energy budget rule. Subsequently, more complex risk-sensitive foraging theory models, such as the state-based approach implemented by Houston and McNamara (1999) using stochastic dynamic modelling, have been developed. Houston and McNamara’s work abandons the idea that optimal foraging can be captured by a single decision rule. Their stochastic dynamic models have an explicit end of game condition, such as overnight survival, and proceed backwards from it to identify optimal actions at each point between the present and the end of the game. The use of dynamic models demonstrates that optimal foragers change preferences in a much more complex way than represented in the simple ‘one-shot’ energy budget rule. In these more recent models, optimal choices are identified for each state of the forager across relevant dimensions, such as energy reserves, time of day, season and parameters of available alternatives. A consequence of this complexity, however, is that predictions of these more parameter rich models become harder to test empirically compared to the predictions of the energy budget rule.

A further explanation for the apparent lack of empirical success of the energy budget rule sees the culprit in the model assumption that animals know all the outcome probabilities associated with a foraging option. Instead, Kacelnik and Mouden (2013) suggest to employ more realistic models of learning and information processing when studying animal foraging in stochastic environments. More generally, optimal foraging models assume that foraging behaviour evolves faster than the rate at which the relevant environmental conditions change (Pyke 1984). It is therefore assumed that observed foraging behaviour closely mirrors the optimal foraging strategy resulting from maximising expected reproductive success (or minimizing the probability of starvation in pure survival models). Deviations from this adaptationist modelling assumption can, in principle, account for a divergence between the predictions of risk-sensitive foraging theory and empirical data.

The concern regarding the empirical shortcomings of the energy budget rule and risk-sensitive foraging theory more generally is mirrored by debates about the empirical adequacy of rational choice theory - understood as a descriptive theory of choice - in economics. For instance, Friedman et al. (2014) take issue with the notion of risk underlying rational choice theory. They argue not only that the common sense notion of risk as the possibility of harm is prevalent in most decision making contexts but they also hypothesise that the lack of empirical success of rational choice theory, by which they include prospect theory and rank-dependent utility theory, is due to the adoption of the less intuitive idea of risk as a dispersion of outcomes.Footnote 6 This raises the question of how far the analogy between evolutionary biology and economics can be pursued. Are there similar lessons to be learned when it comes to the empirical adequacy of these two theories?

I will argue that the analogy breaks down, albeit in an interesting fashion having to do with the two notions of risk at play in both disciplines. In economics risk preferences, understood in the RD framework, are considered to be intrinsic. While considerable effort has been made by economists to elicit risk preferences in experimental settings, the question of how to explain these preferences typically does not arise in economics. Rather, risk preferences form the starting point of many economic analyses involving labour, commodity or financial markets. In contrast, the preferences over foraging options in the energy budget rule are derived from an optimality model maximising the probability of overnight survival of a small bird. The optimal foraging choice results from ‘preferring’ a lower risk of starvation over a higher risk of starvation in combination with material assumptions about the energetic needs and foraging patterns of the small bird. In a nutshell, RD-risk preferences are derived from RPH-risk preferences in the biological model.

Comparing the role of the two notions of risk in economics and evolutionary biology, one notices that the two disciplines rank the two risk concepts in reverse order. While in economics RD is seen as the more fundamental notion for theory building, RPH is more fundamental in risk-sensitive foraging theory, particularly in pure survival models. This reversal implies that some suggested explanations for the apparent lack of empirical success of rational choice theory cannot be invoked to explain the apparent empirical shortcomings of risk-sensitive foraging theory. Friedman et al. (2014), for instance, argue that the risk preferences invoked in economics might not be intrinsic. They consider RPH as an alternative framework for thinking about risk and suggest that risk measures such as the expected loss might offer a more promising avenue for theorising about human decision making under uncertainty. Whatever the merits of their argument in an economic context, this approach is a non-starter when it comes to the explanation of the empirical shortcomings of risk-sensitive foraging theory. Biologists have already built a theory of animal decision making under risk and uncertainty with RPH at its centre. Their interest in RD is derived from their primary interest in RPH.Footnote 7 The methodological reform in economics suggested by Friedman et al. (2014) therefore reflects common practice in risk-sensitive foraging theory.

Evolutionary biology has regularly turned to economics for conceptual innovation. For instance, Grafen (2006) sees a link between social evolution and rational choice theory. That is, evolved organisms should act like rational agents maximising a utility function, with utility being replaced by inclusive fitness in the biological context. There is therefore a certain irony in the fact that the methodological critique of Friedman et al. suggests the opposite: economists should take a closer look at the role of risk in models of optimal foraging. According to Friedman et al., evolutionary biology, particularly risk-sensitive foraging theory, is seen as a promising avenue for the further development of economic theory. The present discussion highlights that the transfer of concepts and methods between economics and evolutionary biology can work both ways.

Conclusion

The recent philosophical literature has paid close attention to the formal and conceptual connections between decision-theoretic and biological discussions of risk. The present paper adds to this literature by highlighting a distinction between RD and RPH that originates in the economic literature and by discussing the relationship between these two concepts of risk in a biological context. The paper shows that similar to economics, the different notions of risk can part ways in models of risk-sensitive foraging theory. The paper also explains that a recent diagnosis for the empirical problems of rational choice theory cannot be directly applied to the apparent empirical failures of risk-sensitive foraging theory in biology. While decision theory is built around RD at its centre, RD only has a derivative role in risk-sensitive foraging theory. Proposals by economists such as Friedman et al. (2014) to put RPH at the centre of a theory of decision making under risk and uncertainty essentially mirror the methodology of risk-sensitive foraging theory where, at least in some models, RD preferences are derived from minimising RPH.

Notes

Another topic that has figured prominently in the philosophical literature is the analogy between the concept of utility in rational choice theory and the notion of fitness in evolutionary biology. For more comprehensive views on the relationship between decision theory and evolutionary biology, see Skyrms (1996), Sober (1998) and Okasha (2018).

An equivalent definition of risk aversion invokes the concept of a mean-preserving spread (Rothschild and Stiglitz 1970). Suppose that B is a mean-preserving spread of A. Then, an organism is said to be risk averse if and only if it chooses A over B.

This is not to say that the probability of loss is the only way of formalising RPH. Alternative measures that are sensitive to both the probability of a loss as well as its magnitude, such as the expected loss, have been proposed. However, in the context of risk-sensitive foraging theory, the probability of harm or death is the most natural way of formalising RPH.

I follow the notation of McNamara and Houston (1992).

For an example, see Ingersoll (1987).

While this paper focuses on risk-sensitive foraging theory, the general principle that RD-risk preferences are derived from fitness considerations also applies to other treatments of risk sensitivity in evolutionary biology, such as Gillespie (1977).

References

Bernoulli D (1954) Exposition of a new theory on the measurement of risk. Econometrica 22:23–36

Caraco T, Martindale S, Whittam TS (1980) An empirical demonstration of risk-sensitive foraging preferences. Anim Behav 28:820–830

Eckel CC (2016) Review of risky curves: on the empirical failure of expected utility theory. Econ Philos 32:540–548

Friedman D, Isaac RM, James D, Sunder S (2014) Risky curves: on the empirical failure of expected utility. Routledge, Abingdon

Gillespie JH (1977) Natural selection for variances in offspring numbers: a new evolutionary principle. Am Nat 111:1010–1014

Grafen A (2006) Optimization of inclusive fitness. J Theor Biol 238:541–563

Harrison GW (2015) Review of risky curves: on the empirical failure of expected utility theory. J Econ Psychol 48:121–125

Houston AI, McNamara JM (1999) Models of adaptive behaviour: an approach based on state. Cambridge University Press, Cambridge

Ingersoll JE (1987) Theory of financial decision making. Rowman and Littlefield, Lanham

Jorion P (2007) Value at risk: the new benchmark for managing financial risk. McGraw-Hill, New York

Kacelnik A, Mouden CE (2013) Triumphs and trials of the risk paradigm. Anim Behav 86:1117–1129

McNamara JM, Houston AI (1992) Risk-sensitive foraging: a review of the theory. Bull Math Biol 54:355–378

McNamara JM, Merad S, Houston AI (1991) A model of risk-sensitive foraging for a reproducing animal. Anim Behav 41:787–792

Okasha S (2016) On the interpretation of decision theory. Econ Philos 32:409–433

Okasha S (2018) Agents and goals in evolution. Oxford University Press, Oxford

Okasha S, Weymark JA, Bossert W (2014) Inclusive fitness maximization: an axiomatic approach. J Theor Biol 350:24–31

Pyke GH (1984) Optimal foraging theory: a critical review. Annu Rev Ecol Syst 15:523–575

Real LA (1980) Fitness, uncertainty, and the role of diversification in evolution and behavior. Am Nat 115:623–638

Rothschild M, Stiglitz J (1970) Increasing risk: I. A definition. J Econ Theory 2:225–243

Skyrms B (1996) Evolution of the social contract. Cambridge University Press, Cambridge

Sober E (1998) Three differences between deliberation and evolution. In: Danielson P (ed) Modelling rationality, morality, and evolution. Oxford University Press, Oxford, pp 408–422

Sox HC, Higgins MC, Owens DK (2013) Medical decision making. Wiley-Blackwell, Oxford

Stephens DW (1981) The logic of risk-sensitive foraging preferences. Anim Behav 29:628–629

Trautmann S (2016) Review of risky curves: on the empirical failure of expected utility theory. J Econ Psychol 53:178–179

von Neumann J, Morgenstern O (1944) Theory of games and economic behavior. Princeton University Press, Princeton

Wang JX, Roush ML (2000) What every engineer should know about risk engineering and management. CRC Press, New York

Funding

Open Access funding provided by the IReL Consortium.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Autzen, B. The two faces of risk. Biol Philos 38, 15 (2023). https://doi.org/10.1007/s10539-023-09906-0

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10539-023-09906-0