Abstract

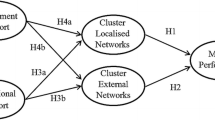

We connect business group research with literature on competitive repertoire—a firm’s portfolio of actions that characterize its strategy—to examine the influence of business group affiliation on firm strategy. We theorize that access to a larger stock and a broad range of resources, both within the firm and through the business group network, enables affiliate firms to execute a higher number (competitive repertoire intensity) and a wider variety (competitive repertoire complexity) of competitive actions. Our analysis of a sample of Indian firms during 2009–2017 supports our hypotheses. In supplementary analyses, we find that business group characteristics—size and affiliate intra-group position—positively influence competitive repertoire. We also find that competitive repertoire intensity mediates affiliation-firm performance relationship. Our findings enhance our understanding of business groups by establishing the link between affiliation-firm strategy-performance. Our work also extends research on network-based and ownership-based antecedents of competitive repertoire. We discuss these implications in detail.

Similar content being viewed by others

Notes

In Model 2, the regression coefficient β on B.G. affiliation dummy is 0.76. This suggests an increase by 2.14 (e 0.76) times in the value of dependent variable when the B.G. affiliation dummy is 1.

We thank one of the reviewers for suggesting this line of analysis.

We thank one of the reviewers for motivating us to think along these lines.

References

Andrevski, G., & Ferrier, W. J. (2019). Does it pay to compete aggressively? Contingent roles of internal and external resources. Journal of Management, 45(2), 620–644

Andrevski, G., Brass, D. J., & Ferrier, W. J. (2016). Alliance portfolio configurations and competitive action frequency. Journal of Management, 42(4), 811–837

Andrevski, G., Richard, O. C., Shaw, J. D., & Ferrier, W. J. (2014). Racial diversity and firm performance: The mediating role of competitive intensity. Journal of Management, 40(3), 820–844

Ashwin, A. S., Krishnan, R. T., & George, R. (2015). Family firms in India: Family involvement, innovation and agency and stewardship behaviors. Asia Pacific Journal of Management, 32(4), 869–900

Ayyagari, M., Dau, L. A., & Spencer, J. (2015). Strategic responses to FDI in emerging markets: Are core members more responsive than peripheral members of business groups? Academy of Management Journal, 58(6), 1869–1894

Ballinger, G. A. (2004). Using generalized estimating equations for longitudinal data analysis. Organizational Research Methods, 7(2), 127–150

Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99–120

Barney, J. (2001). Resource-based theories of competitive advantage: A ten-year retrospective on the resource-based view. Journal of Management, 27(6), 643–650

Basdeo, D. K., Smith, K. G., Grimm, C. M., Rindova, V. P., & Derfus, P. J. (2006). The impact of market actions on firm reputation. Strategic Management Journal, 27(12), 1205–1219

Bowman, E. H., & Helfat, C. E. (2001). Does corporate strategy matter? Strategic Management Journal, 22(1), 1–23

Boyd, B. K. (1995). CEO duality and firm performance: A contingency model. Strategic Management Journal, 16(4), 301–312

Campbell, A., & Goold, M. (1995). Corporate strategy: The quest for parenting advantage. Harvard Business Review, 73(2), 120–132

Carnes, C. M., Xu, K., Sirmon, D. G., & Karadag, R. (2019). How competitive action mediates the resource slack–performance relationship: A meta-analytic approach. Journal of Management Studies, 56(1), 57–90

Carney, M., Gedajlovic, E. R., Heugens, P. P., Van Essen, M., & Van Oosterhout, J. H. (2011). Business group affiliation, performance, context, and strategy: A meta-analysis. Academy of Management Journal, 54(3), 437–460

Carney, M., Van Essen, M., Estrin, S., & Shapiro, D. (2018). Business groups reconsidered: beyond paragons and parasites. Academy of Management Perspectives, 32(4), 493–516

Certo, S. T., & Semadeni, M. (2006). Strategy research and panel data: Evidence and implications. Journal of Management, 32(3), 449–471

Chang, S. J., & Hong, J. (2000). Economic performance of group-affiliated companies in Korea: Intragroup resource sharing and internal business transactions. Academy of Management Journal, 43(3), 429–448

Chang, S. J., & Singh, H. (2000). Corporate and industry effects on business unit competitive position. Strategic Management Journal, 21(7), 739–752

Chattopadhyay, S., & Bercovitz, J. (2020). When one door closes, another door opens… for some: Evidence from the post-TRIPS Indian pharmaceutical industry. Strategic Management Journal, 41(6), 988–1022

Chin, M. K., & Semadeni, M. (2017). CEO political ideologies and pay egalitarianism within top management teams. Strategic Management Journal, 38(8), 1608–1625

Chen, M. J. (2009). Competitive dynamics research: An insider’s odyssey. Asia Pacific Journal of Management, 26(1), 5–25

Chen, M. J., & Miller, D. (2012). Competitive dynamics: Themes, trends, and a prospective research platform. Academy of Management Annals, 6(1), 135–210

Chittoor, R., Kale, P., & Puranam, P. (2015). Business groups in developing capital markets: Towards a complementarity perspective. Strategic Management Journal, 36(9), 1277–1296

Colli, A., & Colpan, A. M. (2016). Business groups and corporate governance: review, synthesis, and extension. Corporate Governance: An International Review, 24(3), 274–302

Colpan, A. M., & Hikino, T. (2018). Business Groups in the West: Origins, Evolution, and Resilience. Oxford University Press

Colpan, A. M., Hikino, T., & Lincoln, J. R. (2010). Introduction. In A. M. Coplan, T. Hikino, & J. R. Lincoln (Eds.), The Oxford Handbook of Business Groups (pp. 1–14). Oxford, UK: Oxford University Press

Connelly, B. L., Tihanyi, L., Certo, S. T., & Hitt, M. A. (2010). Marching to the beat of different drummers: The influence of institutional owners on competitive actions. Academy of Management Journal, 53(4), 723–742

Connelly, B. L., Tihanyi, L., Ketchen, D. J., Carnes, C. M., & Ferrier, W. J. (2017). Competitive repertoire complexity: Governance antecedents and performance outcomes. Strategic Management Journal, 38(5), 1151–1173

Connelly, B. L., Lee, K. B., Tihanyi, L., Certo, S. T., & Johnson, J. L. (2019). Something in common: Competitive dissimilarity and performance of rivals with common shareholders. Academy of Management Journal, 62(1), 1–21

Cuervo-Cazurra, A. (2006). Business groups and their types. Asia Pacific Journal of Management, 23(4), 419–437

Derfus, P. J., Maggitti, P. G., Grimm, C. M., & Smith, K. G. (2008). The Red Queen effect: Competitive actions and firm performance. Academy of Management Journal, 51(1), 61–80

Elango, B., & Pattnaik, C. (2007). Building capabilities for international operations through networks: a study of Indian firms. Journal of International Business Btudies, 38(4), 541–555

Ferrier, W. J. (2001). Navigating the competitive landscape: The drivers and consequences of competitive aggressiveness. Academy of Management Journal, 44(4), 858–877

Ferrier, W. J., & Lee, H. (2002). Strategic aggressiveness, variation, and surprise: How the sequential pattern of competitive rivalry influences stock market returns. Journal of Managerial Issues, 14(2), 162–180

Ferrier, W. J., & Lyon, D. W. (2004). Competitive repertoire simplicity and firm performance: The moderating role of top management team heterogeneity. Managerial and Decision Economics, 25(6–7), 317–327

Ferrier, W. J., Smith, K. G., & Grimm, C. M. (1999). The role of competitive action in market share erosion and industry dethronement: A study of industry leaders and challengers. Academy of Management Journal, 42(4), 372–388

Fombrun, C., & Shanley, M. (1990). What’s in a name? Reputation building and corporate strategy. Academy of Management Journal, 33(2), 233–258

Gaur, A. S., & Kumar, V. (2009). International diversification, business group affiliation and firm performance: Empirical evidence from India. British Journal of Management, 20(2), 172–186

George, R., & Kabir, R. (2012). Heterogeneity in business groups and the corporate diversification–firm performance relationship. Journal of Business Research, 65(3), 412–420

Giachetti, C. (2016). Competing in emerging markets: Performance implications of competitive aggressiveness. Management International Review, 56(3), 325–352

Gnyawali, D. R., Offstein, E. H., & Lau, R. S. (2008). The impact of the CEO pay gap on firm competitive behavior. Group & Organization Management, 33(4), 453–484

Gnyawali, D. R., & Madhavan, R. (2001). Cooperative networks and competitive dynamics: A structural embeddedness perspective. Academy of Management Review, 26(3), 431–445

Gnyawali, D. R., He, J., & Madhavan, R. (2006). Impact of co-opetition on firm competitive behavior: An empirical examination. Journal of Management, 32(4), 507–530

Gopal, S., Manikandan, K. S., & Ramachandran, J. (2021). Are there limits to diversification in emerging economies? Distinguishing between firm-level and business group strategies. Journal of Management Studies, 58(6), 1532–1568

Gubbi, S. R., Aulakh, P. S., & Ray, S. (2015). International search behavior of business group affiliated firms: Scope of institutional changes and intragroup heterogeneity. Organization Science, 26(5), 1485–1501

Guillen, M. F. (2000). Business groups in emerging economies: A resource-based view. Academy of Management Journal, 43(3), 362–380

Gulati, R., Nohria, N., & Zaheer, A. (2000). Strategic networks. Strategic Management Journal, 21(3), 203–215

Haleblian, J., McNamara, G., Kolev, K., & Dykes, B. J. (2012). Exploring firm characteristics that differentiate leaders from followers in industry merger waves: A competitive dynamics perspective. Strategic Management Journal, 33(9), 1037–1052

Hansen, M. H., Perry, L. T., & Reese, C. S. (2004). A Bayesian operationalization of the resource-based view. Strategic Management Journal, 25(13), 1279–1295

Holmes, R. M. Jr., Hoskisson, R. E., Kim, H., Wan, W. P., & Holcomb, T. R. (2016). International strategy and business groups: A review and future research agenda. Journal of World Business, 53(2), 134–150

Hughes-Morgan, M., & Ferrier, W. J. (2017). ‘Short interest pressure’ and competitive behaviour. British Journal of Management, 28(1), 120–134

Hughes-Morgan, M., Ferrier, W. J., & Labianca, G. (2011). The joint effect of the top management team heterogeneity and competitive behavior on stock returns and risk. In Carpenter, M.A. & Weikel, M.K. (Eds.), The handbook of research on top management teams (pp. 261–283)

Hughes-Morgan, M., Kolev, K., & Mcnamara, G. (2018). A meta-analytic review of competitive aggressiveness research. Journal of Business Research, 85, 73–82

India Business Insight (2020). http://indiabusinessinsight.com/ibi/aboutIbid/, Accessed June 9, 2020

Kenny, D. A., Kashy, D. A., & Bolger, N. (1998). Data analysis in social psychology. In D. Gilbert, S. Fiske, & G. Lindzey (Eds.), The handbook of social psychology (pp. 233–265)

Khanna, T., & Palepu, K. (1997). Why focused strategies may be wrong for emerging markets. Harvard Business Review, 75(4), 41–48

Khanna, T., & Palepu, K. (2000). Is group affiliation profitable in emerging markets? An analysis of diversified Indian business groups. The Journal of Finance, 55(2), 867–891

Ketchen Jr, D. J., Hult, G. T. M., & Slater, S. F. (2007). Toward greater understanding of market orientation and the resource?based view. Strategic Management Journal, 28(9), 961–964

Kraaijenbrink, J., Spender, J. C., & Groen, A. J. (2010). The resource-based view: A review and assessment of its critiques. Journal of Management, 36(1), 349–372

Lamin, A. (2013). Business groups as information resource: An investigation of business group affiliation in the Indian software services industry. Academy of Management Journal, 56(5), 1487–1509

Lavie, D. (2006). The competitive advantage of interconnected firms: An extension of the resource-based view. Academy of Management Review, 31(3), 638–658

Liang, K. Y., & Zeger, S. L. (1986). 1. Longitudinal data analysis using generalized linear models. Biometrika, 73(1):3–22

Lim, E. (2019). Attainment discrepancy and new geographic market entry: The moderating roles of vertical pay disparity and horizontal pay dispersion. Journal of Management Studies, 56(8), 1605–1629

Luo, X., & Chung, C. N. (2005). Keeping it all in the family: The role of particularistic relationships in business group performance during institutional transition. Administrative Science Quarterly, 50(3), 404–439

Ma, X., & Lu, J. W. (2017). Business group affiliation as institutional linkages in China’s emerging economy: A focus on organizational traits and institutional conditions. Asia Pacific Journal of Management, 34(3), 675–697

MacKinnon, D. P., Lockwood, C. M., & Williams, J. (2004). Confidence limits for the indirect effect: Distribution of the product and resampling methods. Multivariate Behavioral Research, 39(1), 99–128

McGrath, R. G., Chen, M. J., & MacMillan, I. C. (1998). Multimarket maneuvering in uncertain spheres of influence: Resource diversion strategies. Academy of Management Review, 23(4), 724–740

Majumdar, S. K., & Bhattacharjee, A. (2014). Firms, markets, and the state: Institutional change and manufacturing sector profitability variances in India. Organization Science, 25(2), 509–528

Manikandan, K. S., & Ramachandran, J. (2015). Beyond institutional voids: Business groups, incomplete markets, and organizational form. Strategic Management Journal, 36(4), 598–617

McGee, J., & Thomas, H. (1986). Strategic groups: theory, research and taxonomy. Strategic Management Journal, 7(2), 141–160

Miles, R. E., Snow, C. C., Meyer, A. D., & Coleman, H. J. Jr. (1978). Organizational strategy, structure, and process. Academy of Management Review, 3(3), 546–562

Mintzberg, H. (1978). Patterns in strategy formation. Management Science, 24(9), 934–948

Mishra, S., & Suar, D. (2010). Does corporate social responsibility influence firm performance of Indian companies? Journal of Business Ethics, 95(4), 571–601

Mukherjee, D., Makarius, E. E., & Stevens, C. E. (2018). Business group reputation and affiliates’ internationalization strategies. Journal of World Business, 53(2), 93–103

Ndofor, H. A., Sirmon, D. G., & He, X. (2011). Firm resources, competitive actions and performance: investigating a mediated model with evidence from the in-vitro diagnostics industry. Strategic Management Journal, 32(6), 640–657

Nikolaev, B., Shir, N., & Wiklund, J. (2020). Dispositional positive and negative affect and self-employment transitions: The mediating role of job satisfaction. Entrepreneurship Theory and Practice, 44(3), 451–474

Offstein, E. H., Gnyawali, D. R., & Cobb, A. T. (2005). A strategic human resource perspective of firm competitive behavior. Human Resource Management Review, 15(4), 305–318

Pant, A., & Ramachandran, J. (2012). Legitimacy beyond borders: Indian software services firms in the United States, 1984 to 2004. Global Strategy Journal, 2(3), 224–243

Park, K. M., Jung, K., & Noh, K. C. (2014). Strategic action and customer mobility: Antecedents and consequences of strategic actions in the Korean mobile telecommunication service industry. Asia Pacific Journal of Management, 31(1), 171–193

Pattnaik, C., Chang, J. J., & Shin, H. H. (2013). Business groups and corporate transparency in emerging markets: Empirical evidence from India. Asia Pacific Journal of Management, 30(4), 987–1004

Pattnaik, C., Lu, Q., & Gaur, A. S. (2018). Group affiliation and entry barriers: The dark side of business groups in emerging markets. Journal of Business Ethics, 153(4), 1051–1066

Penrose, E. T. (1959). The theory of the growth of the firm. New York: Sharpe

Perreault, W. D. Jr., & Leigh, L. E. (1989). Reliability of nominal data based on qualitative judgments. Journal of Marketing Research, 26(2), 135–148

Porter, M. E. (1980). Competitive strategy: Techniques for analyzing industries and competitors. New York: Free Press

Preacher, K. J., & Hayes, A. F. (2008). Asymptotic and resampling strategies for assessing and comparing indirect effects in multiple mediator models. Behavior Research Methods, 40(3), 879–891

Preacher, K. J., & Selig, J. P. (2012). Advantages of Monte Carlo confidence intervals for indirect effects. Communication Methods and Measures, 6(2), 77–98

Purkayastha, A., Pattnaik, C., & Pathak, A. A. (2022). Agency conflict in diversified business groups and performance of affiliated firms in India: Contingent effect of external constraint and internal governance. European Management Journal, 40(2), 283–294

Purkayastha, S., Kumar, V., & Lu, J. W. (2017). Business group heterogeneity and the internationalization-performance relationship: Evidence from Indian business groups. Asia Pacific Journal of Management, 34(2), 247–279

Ramachandran, J., Manikandan, K. S., & Pant, A. (2013). Why conglomerates thrive (outside the US). Harvard Business Review, 91, 110–119

Ramachandran, J., Pant, A., & Pani, S. K. (2012). Building the BoP producer ecosystem: The evolving engagement of Fabindia with Indian handloom artisans. Journal of Product Innovation Management, 29(1), 33–51

Ramaswamy, K., Purkayastha, S., & Petitt, B. S. (2017). How do institutional transitions impact the efficacy of related and unrelated diversification strategies used by business groups? Journal of Business Research, 72, 1–13

Shukla, D. M., Mital, A., Qureshi, I., & Wang, T. (2020). Valuation effects of alliance portfolio expansion speed and strength: Evidence from high-tech firms. Journal of Business Research, 113, 370–383

Siegel, J., & Choudhury, P. (2012). A reexamination of tunneling and business groups: New data and new methods. The Review of Financial Studies, 25(6), 1763–1798

Vissa, B., Greve, H. R., & Chen, W. R. (2010). Business group affiliation and firm search behavior in India: Responsiveness and focus of attention. Organization Science, 21(3), 696–712

Yang, W., & Meyer, K. E. (2015). Competitive dynamics in an emerging economy: Competitive pressures, resources, and the speed of action. Journal of Business Research, 68(6), 1176–1185

Yiu, D. W., Lu, Y., Bruton, G. D., & Hoskisson, R. E. (2007). Business groups: An integrated model to focus future research. Journal of Management Studies, 44(8), 1551–1579

Yu, T., & Cannella, A. A. (2007). Rivalry between multi-national enterprises: An event history approach. Academy of Management Journal, 50(3), 665–686

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Arun Kumar, T., Manikandan, K.S. Business group affiliation and competitive repertoire. Asia Pac J Manag (2022). https://doi.org/10.1007/s10490-022-09855-4

Accepted:

Published:

DOI: https://doi.org/10.1007/s10490-022-09855-4