Abstract

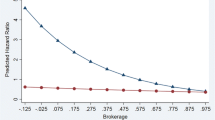

Few scholars would dispute the argument that mergers and acquisitions (M&As) are different in China and the United States, but we know little about how they differ. This article reports one of the first studies that systematically compares and contrasts how M&As differ in these two countries. While prior research on M&As tends to emphasize economic and financial explanations while treating firms as atomistic actors severed from their institutional and network relations, we develop a new theoretical framework based on relational, behavioral, and institutional perspectives. We not only consider firms as learning actors embedded in network relations, but also compare and contrast their M&A patterns between China and the United States, two distinctive institutional contexts. We find that both a firm’s structural hole position and its learning orientation (exploration/exploitation) in alliances have direct and joint impacts on subsequent M&As. Further, such impacts differ across the two countries, due to their institutional disparities.

Similar content being viewed by others

References

Anand, J., Mesquita, L. F., & Vassolo, R. S. 2009. The dynamics of multimarket competition in exploration and exploitation activities. Academy of Management Journal, 52(4): 802-821.

Baum, J. A. C., Li, S. X., & Usher, J. M. 2000. Making the next move: How experiential and vicarious learning shape the locations of chains’ acquisitions. Administration Science Quarterly, 45(4): 766-801.

Burt, R. S. 1992. Structural holes. Cambridge: Harvard University Press.

Cartwright, S., & Schoenberg, R. 2006. Thirty years of mergers and acquisitions research: Recent advances and future opportunities. British Journal of Management, 17: S1-S5.

Chen, Y. Y., & Young, M. N. 2010. Cross-border mergers and acquisitions by Chinese listed companies: A principal-principal perspective. Asia Pacific Journal of Management. doi:10.1007/s10490-009-9150-7.

Cohen, W. M., & Levinthal, D. A. 1990. Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly, 35(1): 128-152.

Cooke, F. L. 2006. Acquisitions of Chinese state-owned enterprises by multinational corporations: Driving forces, barriers and implications for HRM. British Journal of Management, 17: S105-S121.

Cyert, R. M., & March, J. G. 1963. A behavioral theory of the firm. Englewood Cliffs, NJ: Prentice-Hall.

Gargiulo, M., & Benassi, M. 2000. Trapped in your own net? Network cohesion, structural holes, and the adaptation of social capital. Organization Science, 11(2): 183-196.

Granovetter, M. 1985. Economic action and social structure: The problem of embeddedness. American Journal of Sociology, 91(3): 481-510.

Gulati, R., & Gargiulo, M. 1999. Where do interorganizational networks come from?. American Journal of Sociology, 104(5): 1439-1493.

Gupta, A. K., Smith, K. G., & Shalley, C. E. 2006. The interplay between exploration and exploitation. Academy of Management Journal, 49(4): 693-706.

Haunschild, P. R., & Beckman, C. M. 1998. When do interlocks matter? Alternate sources of information and interlock influence. Administrative Science Quarterly, 43(4): 815-844.

Jiang, Y., & Peng, M. W. 2010. Principal-principal conflicts during crisis. Asia Pacific Journal of Management. doi:10.1007/s10490-009-9186-8.

Koza, M. P., & Lewin, A. Y. 1998. The co-evolution of strategic alliances. Organization Science, 9(3): 255-264.

Levinthal, D. A., & March, J. G. 1993. The myopia of learning. Strategic Management Journal, 14(S2): 95-112.

Li, Y., & Peng, M. W. 2008. Developing theory from strategic management research in China. Asia Pacific Journal of Management, 25: 563-572.

Li, Y., Xie, E., Teo, H.-H., & Peng, M. W. 2010. Formal control and social control in domestic and international buyer-supplier relationships. Journal of Operations Management (in press).

Lin, Z., Peng, M. W., Yang, H., & Sun, S. L. 2009. How do networks and learning drive M&As? An institutional comparison of China and the United States. Strategic Management Journal, 30(10): 1113-1132.

March, J. G. 1991. Exploration and exploitation in organizational learning. Organization Science, 2(1): 71-87.

Meyer, K. E., Estrin, S., Bhaumik, S. K., & Peng, M. W. 2009. Institutions, resources, and entry strategies in emerging economies. Strategic Management Journal, 30(1): 61-80.

Peng, M. W. 2003. Institutional transitions and strategic choices. Academy of Management Review, 28(2): 275-296.

Peng, M. W. 2004. Outside directors and firm performance during institutional transitions. Strategic Management Journal, 25: 453-471.

Peng, M. W. 2006. Making M&A fly in China. Harvard Business Review, 84(3): 26-27.

Peng, M. W., & Heath, P. S. 1996. The growth of the firm in planned economies in transition: Institutions, organizations, and strategic choice. Academy of Management Review, 21(2): 492-528.

Peng, M. W., Li, Y., Xie, E., & Su, Z. 2010. CEO duality, organizational slack, and firm performance in China. Asia Pacific Journal of Management. doi:10.1007/s10490-009-9161-4.

Peng, M. W., Luo, Y., & Sun, S. L. 1999. Firm growth via mergers and acquisitions in China. In L. Kelley & Y. D. Luo (Eds.). China 2000: Emerging business issues: 73-100. Thousand Oaks, CA: Sage.

Peng, M. W., Sun, S. L., Pinkham, B., & Chen, H. 2009. The institution-based view as a third leg for a strategy tripod. Academy of Management Perspectives, 23(4): 63-81.

Peng, M. W., Wang, D., & Jiang, Y. 2008. An institution-based view of international business strategy: A focus on emerging economies. Journal of International Business Studies, 39(5): 920-936.

Provan, K. G., Fish, A., & Sydow, J. 2007. Interorganizational networks at the network level: A review of the empirical literature on whole networks. Journal of Management, 33(3): 479-516.

Reagans, R., & Zuckerman, E. W. 2001. Networks, diversity, and productivity: The social capital of corporate R&D teams. Organization Science, 12(4): 502-517.

Ren, B., Au, K., & Birtch, T. A. 2009. China business network structure during institutional transitions. Asia Pacific Journal of Management, 26: 219-240.

Robins, J. A., & Lin, Z. 2000. Institutional influences on organizational control: A comparative examination of agency theory in Sino-Japanese and Sino-American joint ventures. Advances in International Comparative Management, 13: 119-148.

Rothaermel, F. T. 2001. Incumbent’s advantage through exploiting complementary assets via interfirm cooperation. Strategic Management Journal, 22(6): 687-699.

Rowley, T., Behrens, D., & Krackhardt, D. 2000. Redundant governance structures: An analysis of structural and relational embeddedness in the steel and semiconductor industries. Strategic Management Journal, 21(3): 369-386.

Soda, G., Usai, A., & Zaheer, A. 2004. Network memory: The influence of past and current networks on performance. Academy of Management Journal, 47(6): 893-906.

Tan, J., & Peng, M. W. 2003. Organizational slack and firm performance during economic transitions: Two studies from an emerging economy. Strategic Management Journal, 24(13): 1249-1263.

Tong, T. W., Reuer, J., & Peng, M. W. 2008. International joint ventures and the value of growth options. Academy of Management Journal, 51(5): 1014-1029.

Uzzi, B. 1996. The sources and consequences of embeddedness for the economic performance of organizations: The network effect. American Sociological Review, 61(4): 674-698.

Wright, M., Filatotchev, I., Hoskisson, R. E., & Peng, M. W. 2005. Strategy research in emerging economies: Challenging the conventional wisdom. Journal of Management Studies, 42(1): 1-33.

Xia, J., Tan, J., & Tan, D. 2008. Mimetic entry and bandwagon effect: The rise and decline of international equity venture in China. Strategic Management Journal, 29: 195-217.

Xiao, Z. X., & Tsui, A. S. 2007. When brokers may not work: The cultural contingency of social capital in Chinese high-tech firms. Administrative Science Quarterly, 52(1): 1-31.

Yin, X., & Shanley, M. 2008. Industry determinants of the “merger versus alliance” decision. Academy of Management Review, 33: 473-491.

Zaheer, A., & Bell, G. G. 2005. Benefiting from network position: Firm capabilities, structural holes, and performance. Strategic Management Journal, 26(9): 809-825.

Author information

Authors and Affiliations

Corresponding author

Additional information

All authors contributed equally to this paper. This research was supported by a research grant at the City University of Hong Kong (7002348), the National Science Foundation (CAREER SES 0552089), and the UTD Provost’s Distinguished Professorship. The views expressed are those of the authors and not those of the sponsors. We thank Rae Pinkham for editorial assistance.

Rights and permissions

About this article

Cite this article

Yang, H., Sun, S.L., Lin, Z.(. et al. Behind M&As in China and the United States: Networks, learning, and institutions. Asia Pac J Manag 28, 239–255 (2011). https://doi.org/10.1007/s10490-009-9188-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10490-009-9188-6