Abstract

To achieve supply chain decarbonization, environmentally conscious manufacturers are transforming their energy infrastructure. While certain manufacturers are adopting a pure bioenergy strategy in their production processes, others are opting for a hybrid energy approach that combines traditional energy with bioenergy. This choice is often influenced by limitations in land capacity and the developmental stage of biomass conversion technologies. This paper introduces a game-theoretic model that explores the optimal approach to achieving supply chain decarbonization by strategically selecting energy portfolios. Our findings reveal that in scenarios where the market size is small, manufacturers tend to adopt a hybrid energy strategy, particularly when the average yield of biomass is low. However, as the biomass yield increases, manufacturers lean towards a hybrid (or pure) bioenergy strategy in smaller (or larger) markets. In larger markets, the manufacturer’s energy strategies become more complex and are influenced by various factors. Our results emphasize that farmers should base their planting decisions on considerations such as available land, initial investment, and agricultural biomass yield. This paper urges manufacturers to effectively navigate the complexities of the carbon tax policy and make informed decisions that promote a sustainable energy strategy. By utilizing technological advancements, governments and manufacturers can collect and analyze data on factors such as market size, biomass yield, and carbon tax policy, ultimately working towards a more efficient, productive, and environmentally sustainable future.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

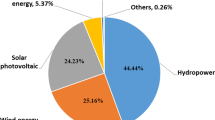

The utilization of conventional energy sources, such as coal and petroleum, results in the generation of greenhouse gases, imposing an adverse effect on the environment. CO2 emissions from energy-related processes and operations saw a significant increase of 0.9% between 2021 and 2022, reaching 36.8 GtCO2. This rise is primarily attributed to fossil fuel combustion in the power sector, contributing to 423 MtCO2 of the total increase (IEA, 2023). Particularly in Asia, coal utilization in power generation exceeded 15 GtCO2, accounting for over 40% of global energy-related emissions. China accounted for the most significant increase in global coal production in 2021, contributing significantly (7.96 billion tons) to carbon emissions, followed by India (1.8 billion tons) and the U.S (1.00 billion tons) due to coal’s carbon-intensive nature (Ritchie et al., 2023; Sun et al., 2020). This escalation poses challenges in meeting the emission reduction targets of the Paris Agreement, which aims to limit global warming to less than 2 °C above pre-industrial levels, ideally reducing it to 1.5 °C (EC, 2015; Hafezalkotob et al., 2023).

In the transition toward using renewable energy sources in supply chains, integrating biomass into the existing energy portfolios is seen as a viable strategy (Duarte et al., 2014). As a renewable material resource, biomass has the potential to reduce reliance on fossil fuels. Its key advantage lies in its versatility as an energy source, being convertible into heat, electricity, and fuels. Moreover, biomass is notable among renewable energy sources for its ability to generate energy on demand (Rentizelas et al., 2009), positioning it as a non-intermittent option. This characteristic offers a solution to the variability challenges faced by other renewable sources like wind and solar, enhancing the reliability and stability of the energy supply.

Bioenergy, a renewable energy source produced from biomass, is gaining popularity as an alternative to fossil fuels, aligning with global carbon reduction policies (Asian et al., 2019; Li et al. 2023a; Rahimi et al., 2021). It offers versatile applications, including electricity generation, building heating, and vehicle propulsion (Kothari et al., 2020; Peura & Bunn, 2021), and is being increasingly adopted by countries to decarbonize the supply chain (Jiang et al., 2021b). China, for example, has significantly increased its bioenergy usage to reduce reliance on fossil fuels, addressing environmental challenges like air pollution and climate change (Sun et al., 2020).

The ongoing demand for energy, requiring both affordability and reliable supply (Sharma et al., 2013), underscores the need to efficiently harness and integrate all available resources into the existing energy portfolios of diverse supply chains. This approach is crucial for developing a supply chain decarbonization strategy, emphasizing optimal energy supply pathways at the lowest possible cost environment (Gao & Souza, 2022; He et al., 2022; Mavi et al., 2023; Zhu et al., 2023). Some manufacturers achieve this by integrating Industry 5.0 concepts with biomass conversion technologies, enhancing energy efficiency and waste reduction (ElFar et al., 2021; Tawiah et al., 2022). This integration yields proven benefits, including energy savings of up to 35%, a remarkable return on investment of 30.8%, and enhanced overall efficiency and productivity (Wong et al., 2022). Governments have also implemented regulations, such as carbon taxes (Javadi et al., 2019; Lyu et al., 2022; Zhang et al., 2021), to incentivize carbon emission reduction, promoting supply chain efficiency and sustainable production (Maddikunta et al., 2022).

Despite the growing popularity of bioenergy as a renewable alternative to fossil fuels, challenges persist, such as the competition for land resources between bioenergy crops and food production, leading to limited biomass availability (Searchinger & Heimlich, 2015). Additionally, inefficiencies in biomass conversion technologies, including thermal and biochemical conversion, often hinder full biomass utilization (Li et al., 2020a; Li et al., 2020b; Li et al., 2021; Basso et al., 2021; Song et al., 2019). To mitigate these issues, some manufacturers adopt hybrid energy strategies that combine bioenergy with traditional fuels like methanol for use in hybrid electric vehicles, reducing emissions but not achieving the full decarbonization potential of pure bioenergy (Reza-Gharehbagh et al., 2021; Dong & Boute, 2020).

Building upon existing literature (Jiang et al., 2021a, 2021b), this paper examines the role of agricultural biomass in supply chain decarbonization. Through a game-theoretic model, we study the interaction between an agricultural biomass producer, a manufacturer, and a traditional energy supplier. We further enrich the discussion by exploring pure and hybrid energy conversion strategies within the manufacturing process, highlighting how these strategies can influence decarbonization efforts. Specifically, we investigate the energy strategy of an environmentally conscious manufacturer faced with the choice between pure and hybrid bioenergy options to support its manufacturing processes. In particular, this paper aims to address the following research questions:

-

1.

How does the manufacturer’s energy adoption model influence supply chain decarbonization and what are the equilibrium outcomes when comparing the implementation of a pure bioenergy strategy to a hybrid energy strategy?

-

2.

How do variations in the purchase cost of agricultural biomass impact farmers’ land use and product prices when different bioenergy strategies are implemented?

-

3.

To what extent do key parameters, such as land capacity and average agricultural biomass yield, influence the manufacturer’s bioenergy strategy? Additionally, how does the agricultural biomass conversion technology contribute to supply chain decarbonization?

Our analysis focuses on the interaction between a biomass producer (i.e., farmer) and a manufacturer. We develop and analyze analytical models to characterize the essential factors influencing both farmers’ land use and manufacturers’ energy strategies. This approach effectively fills the identified research gaps, offering actionable insights for farmers to optimize agricultural practices in line with considerations of manufacturers’ energy strategies. Additionally, we analyze the impact of government carbon tax policies on manufacturers’ energy strategies. The insights derived from this analysis help manufacturers navigate the complex landscape of environmental regulations while concurrently striving to maximize profitability.

The remainder of this paper is structured as follows. In Sect. 2, we conduct a review of relevant literature. In Sect. 3, we provide a description of the problem and develop both the pure bioenergy and the hybrid energy models. In Sect. 4, we present the equilibrium results obtained from the two models and conduct a sensitivity analysis. In Sect. 5, we provide a comparative analysis of the players’ optimal decisions under pure bioenergy and hybrid energy strategies. Finally, we conclude the study, provide managerial insights, and identify areas for future research in Sect. 6. Proofs are provided in the Appendix.

2 Literature review

This section reviews the literature on the interplay between carbon tax policy and the integration of Industry 5.0 in bioenergy supply chains. The review identifies gaps in current research, particularly regarding manufacturers’ energy strategies in relation to agricultural biomass conversion and Industry 5.0 integration (See Table 1).

2.1 Carbon tax policy

The excessive use of traditional energy sources, coupled with rapid industrial development, has led to increased pollution and emissions (Liu et al., 2023). In response, some governments and organizations have adopted carbon tax policies to curb these emissions (Lyu et al., 2022; Rathore & Jakhar, 2021; Reza-Gharehbagh et al., 2023), prompting scholars to examine the operational decisions within sustainable supply chains under these policies. A significant focus has been on remanufacturing, with studies like Alegoz et al. (2021) analyzing the impact of carbon tax policies on various remanufacturing systems. Similarly, Konstantaras et al. (2021) explored optimal inventory decisions in closed-loop supply chains that include manufacturing, remanufacturing, and repair cycles under carbon tax regimes. Feng et al. (2023) explored how carbon reduction policies, specifically carbon tax systems and carbon cap-and-trade regulations, influence the adoption of Blockchain technology in the recycling process.

Sustainable measures under carbon tax policies, such as emission reduction efforts, have also been a subject of study. For instance, Wang et al. (2019) discussed emission reduction in decentralized and centralized supply chains, considering consumer preferences for low-carbon products and stochastic demand under carbon tax policies. Yang and Chen (2018) examined manufacturers’ emission reduction efforts in light of retailers’ incentives like revenue-sharing and cost-sharing schemes. Govindan et al. (2023) focused on the integration of carbon tax policies as a crucial element in developing a circular closed-loop supply chain network.

In addition, research has delved into pricing decisions and product line designs under carbon tax policies. Ma et al. (2018) investigated manufacturers’ two-stage pricing decisions considering suppliers’ varying prices and emission rates under carbon tax policies, while Meng et al. (2018) studied product selection strategies of competing manufacturers under similar conditions. Chen and Hu (2018), Nie et al. (2022), and Zhu et al. (2023) have compared carbon tax policies with other regulatory measures such as cap-and-trade and subsidies, analyzing their impact on various aspects of supply chain operations.

Our literature review indicates that carbon tax policy has been a crucial driver of green and sustainable development within supply chains. Building on these findings, our paper seeks to explore how manufacturers can effectively set their energy strategies for supply chain decarbonization, considering factors such as land capacity and biomass conversion technologies.

2.2 Bioenergy supply chain and industry 5.0

To reduce reliance on fossil fuels and foster sustainable development, manufacturers are increasingly incorporating bioenergy into their production processes. This shift has led to substantial financial and policy support from governments. Extensive research is conducted on the bioenergy supply chains, examining environmental impacts, energy conversion processes, and issues related to asymmetric information.

Li et al., (2023a, 2023b) examined the impact of converting agricultural waste into a marketable product. The authors analyzed how economic value is affected by uncertainties in input and output spot prices, finding that variability in these prices can enhance the value of biomass commercialization. Their study also evaluated environmental impacts, noting that while increased biomass demand or price boosts commercialization value, it does not always lead to environmental benefits as it might increase carbon emissions. He et al. (2022) evaluated the effects of government regulations, including penalties and subsidies, on a straw-based bioenergy supply chain, employing models like the tripartite evolutionary game and dynamic penalty models. Ye et al. (2020) investigated subsidy programs for farmers and bioenergy producers, considering land and budget constraints. Jiang et al. (2021b) assessed the impact of government penalties on bioenergy supply chains, using contract-based approaches under varying information conditions. De Laporte et al. (2016) applied integrated economic, biophysical, and GIS models to evaluate bioenergy policies under different biomass pricing and power structures. Focusing on biomass power generation pricing, Li et al., (2023a, 2023b) analyzed the influence of feedstock competition and independence on feed-in tariffs using game theory.

The focus on biomass conversion technologies in the bioenergy supply chain has also been significant. Da Costa et al. (2018) utilized life cycle assessment to study biomass power generation impacts in Portugal, comparing technologies like fluidized beds and grate furnaces. Moura et al. (2022) ranked various waste biomass types and conversion technologies using sustainable value approaches. Nguyen et al. (2013) analyzed wheat straw-based biomass power generation, comparing it with fossil fuel power. Sharara and Sadaka (2018) offered insights into swine manure conversion technologies, and Strzalka et al. (2017) evaluated diverse biomass conversion technologies in the German bioenergy sector.

ElFar et al. (2021) discussed the transition of algae production to a more human-centered approach. Wong et al. (2022) evaluated the economics of integrated bio-refining technologies. In line with these studies, this research investigates the role of agricultural biomass in decarbonizing supply chains, considering manufacturers’ pure bioenergy and hybrid energy strategies under the government’s carbon tax policies.

3 Problem description

We consider a bioenergy supply chain consisting of a traditional energy supplier, an agricultural biomass producer (farmer) with limited land capacity, and a manufacturer operating under government carbon tax regulations. The manufacturer faces a choice between pure bioenergy and hybrid energy strategies. Additionally, the manufacturer must set the biomass purchase price before the growing season. The farmer, in turn, will decide on the planting acreage during the planting season, considering the set biomass price and their land’s capacity constraints. All mathematical notations used in this paper are listed in Table 2.

The following assumptions have been made in this paper:

It is assumed that the features and quality specifications of products manufactured under the pure bioenergy and hybrid energy strategies are identical, and thus, the products manufactured under the two strategies are perfectly substitutable. We propose the inverse demand function under the pure bioenergy and hybrid energy strategies as follows (Niu et al. (2022):

where, \(\theta \in (0,1)\) and \(0 < a_{1} < a_{1}\).

Compared to the pure bioenergy strategy, products under the hybrid energy strategy are less attractive to eco-conscious consumers. We assume that the market size can be discounted by the rate\((1-\theta )\). Let ε represent the biomass conversion ratio. The larger the value of \(\varepsilon \), the more bioenergy can be produced from the same quantity of biomass.

-

(2)

The wholesale price of traditional energy is influenced by complex market dynamics, including global supply-demand interactions, geopolitical factors, and regulatory policies. To focus on our main contributions and simplify the technical complexities, we assume that the wholesale price of traditional energy, v, is exogenous.

-

(3)

Biomass conversion into bioenergy, through methods like combustion or gasification, releases carbon into the atmosphere. However, this carbon is reabsorbed by plants, making bioenergy’s net carbon emissions significantly lower than fossil fuels. Consequently, the pure bioenergy strategy effectively reduces emissions to 0, facilitating carbon removal from energy production and aiding supply chain decarbonization. Conversely, the hybrid strategy, incorporating traditional energy, results in emissions due to the use of non-renewable resources. Following Lyu et al. (2022), this paper assumes that one unit of production generates one unit of emission.

-

(4)

The manufacturer’s total purchase cost, \(w{q}_{1}\), is constrained by the initial capital \(B\), ensuring \(w{q}_{1}\le B\). However, in a hybrid energy strategy, the manufacturer is allowed to defer payments to the traditional supplier at an interest rate of \(r\). This assumption is grounded in practical context where traditional energy suppliers and manufacturers often have established long-term cooperative relationships, characterized by a degree of trust. Additionally, the availability of deferred payments is crucial; without this option, manufacturers with limited funds may be compelled to opt for the pure bioenergy strategy.

Figure 1 depicts the sequence of events discussed in this paper. First, the manufacturer determines the energy strategy to be adopted, which could be either pure bioenergy or hybrid energy. Then, before the growing season, the manufacturer must announce the purchase price of biomass feedstocks, denoted as \(w\), and the amount of conventional energy, \({q}_{2}\) (for hybrid energy strategy). During the planting season, farmers must decide on the planting acreage, \({q}_{1}\), based on the purchase price of agricultural biomass, \(w\), and the land capacity, \(K\). Finally, the price and demand in the spot market are revealed.

3.1 Pure bioenergy model

In this subsection, the model for a manufacturer adopting a pure bioenergy strategy is presented. Figure 2 illustrates the supply chain structure under this strategy, highlighting the interactions between the farmer and the manufacturer.

The farmer decides the planting acreage,\({q}_{1}\), and faces a quadratic convex cost function \(k{q}_{1}^{2}/2\) which is proportional to the planting acreage (Ye et al., 2020). The cost includes planting expenses such as seeding, chemical application, and pest control. With limited planting acreage, \({q}_{1}\le K\), the farmer harvests biomass feedstocks at an average yield per unit area, μ, producing a total yield of μq1 The manufacturer then purchases these biomasses at a price\(w\). Considering the efficiency of biomass conversion technology, denoted by ε, not all feedstocks are converted into bioenergy. The use of pure bioenergy, considered as green and environmentally friendly, is more appealing in the spot market and leads to substantial emission reductions and supply chain decarbonization, rendering carbon tax policies less impactful. Thus, adopting a pure bioenergy strategy offers a pathway to decarbonization without the carbon tax’s influence.

The manufacturer’s profit maximization problem, Eq. (3), given the limited initial capital, Eq. (4), is formulated as follows:

For the farmer, the profit maximization problem, Eq. (5), incorporates both the revenue from biomass sales and planting costs and constrained by land capacity, Eq. (6), is derived as follows:

3.2 Hybrid energy model

In this subsection, we construct the model for a scenario where the manufacturer adopts a hybrid energy strategy, as depicted in Fig. 3. This strategy integrates both bioenergy and conventional energy, necessitating carbon tax implementation due to the emissions from conventional energy use.

Under this strategy, the manufacturer acquires biomass feedstocks \(\mu {q}_{1}\) from farmers at price \(w\) and conventional energy \({q}_{2}\) from supplier at the exogenous wholesale price \(v\). The utilization of conventional energy leads to a reduced market size for hybrid energy, denoted as \(a\theta \), where \(\theta \in (0,1)\) and generates emissions. Each unit of production is considered to result in one unit of emissions. Consequently, the total emissions amount to \({q}_{2}\), incurring a corresponding tax penalty of \(t{q}_{2}\), where \(t\) represents the tax rate.

The manufacturer’s profit maximization under the hybrid energy strategy is expressed in Eq. (7):

The initial capital constraints for the manufacturer remain consistent under both strategies, considering the deferred payment option offered by the conventional energy supplier. The farmer’s profit maximization problem can be formulated using Eq. 9:

4 Equilibrium results

In this section, we present the equilibrium results under alternative energy strategies. The optimal outcomes for both farmers and manufacturers when implementing the pure bioenergy strategy are characterized in Proposition 1.

Proposition 1

The optimal results for the farmer and the manufacturer under the pure bioenergy strategy for scenarios B-1, B-2 and B-3 can be determined as follows:

(B-1). When \({\text{B}}>{{\text{B}}}_{1}\) and \({\text{K}}>{{\text{K}}}_{1}\), we have

(B-2). When \(B<{B}_{1}\) and \(B<{B}_{2}\), we have

(B-3). When \(B>{B}_{2}\) and \(K<{K}_{1}\), we have

where \(B_{1} = \frac{{a^{2} k \epsilon ^{2} \mu^{2} }}{{4(k + \epsilon ^{2} \mu^{2} )^{2} }}\), \(B_{2} = kK^{2}\), \(K_{1} = \frac{a \epsilon \mu }{{2\left( {k + \epsilon ^{2} \mu^{2} } \right)}}\).

As illustrated in Fig. 4, \({B}_{1}\) and \({K}_{1}\) represent optimal solutions that satisfy both the capital constraint for the manufacturer and the land capacity constraint for the farmer. \({B}_{2}\), on the other hand, indicates a position on an inequality constraint.

In the Scenario B-1, the constraints of the manufacturer’s initial capital and the farmer’s land capacity are not binding (i.e., \(B>{B}_{1}\) and \(K>{K}_{1}\)). Consequently, in this scenario, neither the initial capital nor the land capacity limits impact the equilibrium outcomes. This suggests that the optimal strategy for both the manufacturer and the farmer can be achieved without being constrained by these factors. In Scenario B-2, the manufacturer faces a limitation in initial capital, indicated by \(B<{B}_{1}\) and \(B<{B}_{2}\). In this case, the optimal outcomes are constrained solely by the initial capital, with land capacity not playing a restrictive role. Conversely, in Scenario B-3, the farmer operates under a limited land capacity, as shown by \(B>{B}_{2}\) and \(K<{K}_{1}\). This scenario dictates that the optimal results are influenced primarily by the land capacity constraints, rather than by the initial capital available to the manufacturer. These scenarios demonstrate how varying constraints can distinctly influence the optimal decision-making processes in the context of the supply chain.

Proposition 2 characterizes the optimal results for the scenario wherein the manufacturer adopts a hybrid energy strategy.

Proposition 2

When implementing the hybrid energy strategy, the optimal results for scenarios (H-1), (H-2) and (H-3) can be obtained as follows:

(H-1). When \(B>{B}_{3}\) and \(K>{K}_{2}\), we have

(H-2). When \(B<{B}_{2}\) and \(B<{B}_{3}\), we have

(H-3). When \(B>{B}_{2}\) and \(K<{K}_{2}\), we have

where \(X = t + v + rv\), \(B_{3} = \frac{{X^{2} \epsilon ^{2} \mu^{2} }}{4k}\), \(K_{2} = \frac{X \epsilon \mu }{{2k}}\).

Figure 5 illustrates the equilibrium results under the hybrid energy strategy, encompassing three distinct scenarios: (H-1) a situation where there is sufficient initial capital and land capacity, (H-2) a scenario characterized by constraints solely on initial capital, and (H-3) a case where only land capacity is a limiting factor.

In this framework, specific conditions impact the manufacturer’s pricing decisions for biomass. When farmers face land capacity constraints (i.e., \(B>{B}_{2}\) and \(K<{K}_{2}\)) or when the manufacturer is limited by initial capital (i.e., \(B<{B}_{2}\) and \(B<{B}_{3}\)), an increase in the average yield of biomass prompts the manufacturer to reduce the biomass purchase price. Conversely, in situations where neither the manufacturer nor the farmer faces constraints (i.e., \(B>{B}_{3}\) and \(K>{K}_{2}\)), the average biomass yield has no influence on the biomass purchase price.

After characterizing the equilibrium solutions, we next conduct a sensitivity analysis of the outcomes under both the pure bioenergy and hybrid energy strategies. Table 3 summarizes the impact of \(\mu\), \(\varepsilon\) and \(k\) on the purchase price of biomass.

As can be seen in Table 3, an increase in the average yield under the pure bioenergy strategy correlates with a decrease in the biomass purchase price due to the resultant abundance in biomass supply. In cases where manufacturers and farmers are limited by initial capital or land capacity, the biomass purchase price remains unaffected by the conversion ratio. However, under the pure bioenergy strategy with sufficient initial capital and land capacity (\(B>{B}_{1}\) and \(K>{K}_{1}\)), there is an observed initial increase and subsequent decrease in biomass purchase price with the rising conversion ratio. This reflects the impact of advanced biomass conversion technology, which initially prompts manufacturers to offer higher prices for biomass to encourage production.

Beyond a certain price point, however, manufacturers reduce the price to optimize economic benefits. Conversely, under the hybrid energy strategy with adequate capital and land capacity, the biomass purchase price consistently increases with the conversion ratio. This is attributed to the manufacturer’s ability to leverage dual energy sources, justifying higher biomass prices. Table 3 also indicates that under the pure bioenergy strategy, the biomass purchase price escalates with the farmers’ cost coefficient, reflecting higher prices set by manufacturers in response to increased farming efforts. In the hybrid energy strategy, this trend is observed only when both the manufacturer and farmers are constrained by capital and land capacity. However, when there are sufficient resources, the cost coefficient does not significantly impact the purchase price. Table 4 illustrates the impacts of μ, ε and \(k\) on the planting acreage.

Under the pure bioenergy strategy, with sufficient initial capital (\(B>{B}_{1}\)) and land capacity (\(K>{K}_{1}\)), the planting acreage initially increases with the average yield but subsequently decreases. This trend reflects farmers’ inclination to expand acreage as yield improves, which eventually tapers off due to constraints of capital and land. Alternatively, when either the manufacturer’s initial capital or the farmers’ land capacity is constrained, the average yield does not influence the planting acreage in either energy strategy. In the hybrid energy strategy, without constraints on initial capital and land capacity, planting acreage consistently increases with the average yield. This is attributed to the diversified energy options available to the manufacturer, leading to heightened competition and prompting farmers to expand their acreage as yields improve. Table 4 also reveals that the conversion ratio’s impact on planting acreage mirrors its effect on average yield. When land capacity and initial capital are not limiting factors, the planting acreage initially increases but then decreases with the conversion ratio under the pure bioenergy strategy. In contrast, under the hybrid strategy, the acreage continuously increases. In scenarios H-1 and H-2, under both strategies, higher planting costs lead farmers to reduce their acreage. However, when land capacity is a limiting factor, the planting cost coefficient does not significantly affect planting acreage.

Table 5 illustrates how key parameters influence the amount of conventional energy used.

It can be observed that with an increase in θ, representing market size, the disparity between the pure bioenergy and hybrid energy strategies decreases. As the appeal of bioenergy in attracting consumers diminishes, manufacturers are inclined to augment the use of conventional energy. Table 5 further reveals that an increase in the tax rate (related to the average yield of biomass and the conversion ratio) prompts the manufacturer to lower the amount of conventional energy. This adjustment is a response to higher government penalties for carbon emissions, encouraging a shift towards cleaner bioenergy alternatives.

Moreover, when farmers demonstrate efficient planting capabilities, characterized by higher biomass yield and conversion ratios, the manufacturer tends to reduce reliance on conventional energy. Conversely, when farmers exert more effort in planting, reflected in higher cost coefficients, the manufacturer compensates by increasing conventional energy usage. Notably, when manufacturers have adequate capital but farmers face capacity constraints, the farmers’ planting cost coefficient does not significantly impact the amount of conventional energy used by the manufacturer. The sensitivity of pricing decisions to these key parameters is shown in Table 6.

It can be observed that under the pure bioenergy strategy, product prices tend to decrease as farming efficiency improves, evident in higher average yields and conversion ratios. In contrast, under the hybrid energy strategy, these factors—higher yields and conversion efficiencies—do not significantly alter product prices. However, an increase in planting costs, indicating less efficient farming, leads to a rise in product prices, especially in scenarios where land capacity is not a limiting factor. In situations with restricted land capacity, the impact of the cost coefficient on product prices is negligible. Furthermore, as the market size becomes increasingly similar for both energy strategies, the product price under the hybrid strategy is observed to rise. Conversely, the market size does not have a significant impact on the product price in the pure bioenergy strategy.

Table 7 illustrates the impact of key parameters on the farmer’s expected profit. Under the pure bioenergy strategy, in scenarios where the farmer is not constrained by land capacity and the manufacturer possesses ample initial capital, the farmer’s profit initially increases and then decreases with the average yield of biomass feedstocks. As shown in Table 3, an increase in biomass yield leads to a reduction in the biomass purchase price set by the manufacturer. Consequently, farmers initially expand their planting acreage due to larger yields but eventually reduce it due to lower prices. Such dynamic interplay directly influences the farmer’s profit trend. In the hybrid strategy scenario, where neither the farmer nor the manufacturer faces constraints, the farmer’s profit increases with the average yield of biomass. This rise in profit is attributed to an increase in planting acreage against a backdrop of stable wholesale prices. Furthermore, the impact of the conversion ratio on the farmer’s profit mirrors that of the average yield, as both higher biomass yields and conversion ratios signify improved planting efficiency, affecting the wholesale price and planting acreage similarly.

Under the pure bioenergy strategy with sufficient land and capital resources, the farmer’s profit shows an initial increase followed by a decrease in the cost coefficient, as Table 7 shows. Conversely, if the farmer has ample land capacity and the manufacturer is capital-constrained, the cost coefficient does not influence the farmer’s profit. On the other hand, when the manufacturer has limited land capacity but sufficient funds, the farmer’s profit increases, reflecting the cost coefficient’s effect on the biomass purchase price and planting acreage. Under the hybrid strategy, the farmer’s profit decreases with the cost coefficient when the manufacturer has larger funds but remains unaffected when the manufacturer is capital-constrained.

Table 8 shows the impact of key parameters on the manufacturer’s profit under different energy strategies. Under the pure bioenergy strategy, when farmers are not limited by land capacity and the manufacturer has ample initial capital, an increase in the average yield of biomass leads to a rise in the manufacturer’s profit. However, if farmers encounter land constraints or the manufacturer’s initial capital is limited, the manufacturer’s profit initially increases but then decreases with the increasing average yield of biomass. Under the hybrid energy strategy, the manufacturer benefits from a higher average yield of biomass, demonstrating a positive correlation between yield and profit. Similarly, the conversion ratio influences the manufacturer’s profit in a manner akin to the effect of the biomass yield.

When operating under the pure bioenergy strategy with relatively higher initial funds, the manufacturer’s profit decreases as the farmer’s cost coefficient increases. Conversely, if the manufacturer is capital-constrained, their profit initially rises and then falls with the increase in the farmer’s planting cost coefficient. In the hybrid energy strategy, the farmer’s cost coefficient invariably negatively impacts the manufacturer’s profit. Additionally, the manufacturer’s profit under the hybrid strategy increases as the market potential between the pure bioenergy and hybrid strategies narrows. Interestingly, under the pure bioenergy strategy, the manufacturer’s profit remains unaffected by the market size parameter θ.

5 Comparative analysis

In this section, we first conduct a comparative analysis of optimal decisions under pure bioenergy and hybrid energy strategies. We then compare alternative strategies to identify the manufacturer’s preferred energy strategy for maximizing its profit. Our first comparison is divided into two scenarios based on market potential, with each scenario further segmented into five regions (Fig. 6). Details of the optimal decisions in different regions are shown in Table 9.

Proposition 3

The comparison of the biomass purchase price and planting acreage between pure bioenergy and hybrid energy strategies can be described as follows:

-

(i)

When \(0 < a < a_{1}\), if \(K > K_{1}\) and \(B > B_{1}\), then \(w^{B*} < w^{H*}\), \(q_{1}^{B*} < q_{1}^{H*}\); if \(K < K_{1}\) and \(B>{B}_{2}\), or \(B<{B}_{2}\) and \(B<{B}_{1}\), then \(w^{B*} = w^{H*}\), \(q_{1}^{B*} = q_{1}^{H*}\).

-

(ii).

When \(a > a_{1}\), if \(K > K_{2}\) and \(B > B_{3}\), then \(w^{B*} > w^{H*}\), \(q_{1}^{B*} > q_{1}^{H*}\); if \(K<{K}_{2}\) and \(B>{B}_{2}\), or \(B<{B}_{2}\) and \(B<{B}_{3}\), then \(w^{B*} = w^{H*}\), \(q_{1}^{B*} = q_{1}^{H*}\).

Proposition 3-(i) examines a smaller market size (\(0<a<{a}_{1}\)) scenario. Here, with ample land capacity (\(K>{K}_{1}\)) and sufficient manufacturer funds (\(B>{B}_{1}\)), the pure bioenergy strategy results in lower biomass purchase prices and planting acreage compared to the hybrid strategy, as seen in regions I, II, and III of Fig. 6a. This is attributed to the limited market potential and the manufacturer’s preference for the stability provided by conventional energy in the hybrid strategy. Conversely, constraints on either party (regions IV and V) lead to unchanged planting acreage and purchase prices.

Proposition 3-(ii) focuses on a larger market size (\(a>{a}_{1}\)). In this scenario, when both the farmer and the manufacturer are not constrained (\(K>{K}_{2}, B>{B}_{3}\)), the pure bioenergy strategy sees higher purchase prices and planting acreage than the hybrid strategy (regions I, II, and III in Fig. 6b). This is due to pure bioenergy’s demand advantages in larger markets. However, when either party is constrained, the decisions remain consistent across both strategies. This scenario underscores a market potential threshold impacting optimal decisions.

Proposition 4

The price comparison under the two energy strategies can be presented as follows:

-

(i)

When \(0 < a < a_{1}\),

-

In regions I, II and III, if \(0 < a < a_{2}\), then \(p^{B*} < p^{H*}\); if \(a_{2} < a < a_{1}\), then \(p^{B*} > p^{H*}\);

-

In region IV, if \(0 < a < a_{3}\) and \(a_{4} < a < a_{1}\), then \(p^{B*} > p^{H*}\); when \(a_{3} < a < a_{4}\), if \(0 < B < B_{4}\), then \(p^{B*} > p^{H*}\); if \(B_{4} < B < B_{1}\), then \(p^{B*} < p^{H*}\);

-

In region V, if \(0 < a < a_{2}\), then \(p^{B*} > p^{H*}\); when \(a_{2} < a < a_{1}\), if \(0 < K < K_{3}\), then \(p^{B*} > p^{H*}\); if \(K_{3} < K < K_{1}\), then \(p^{B*} < p^{H*}\).

-

-

(ii).

when \(a > a_{1}\), then \(p^{B*} > p^{H*}\).

Proposition 4 suggests that pricing in the supply chain is influenced by multiple factors, including land capacity, financial constraints, and market potential. For instance, in scenario \(a<{a}_{1}\), with larger land capacity and sufficient funds, the bioenergy strategy pricing varies inversely with market size. Additionally, in regions with financial or land capacity constraints (regions IV and V), these constraints notably affect the end product prices. Yet, in larger markets (\(a<{a}_{1})\), market demand predominantly dictates pricing, with the pure bioenergy strategy generally commanding higher prices.

Our second comparison study aids in determining the optimal timing for achieving decarbonization in the supply chain by considering the manufacturer’s preferred energy strategy. Results are summarized in Table 10.

Proposition 5

When \(a<{a}_{1}\), the manufacturer’s preferred energy strategy can be characterized as follows:

(i) When \(\left( {B,K} \right) \in regions {\text{I}}\), if \(0 < \mu < \mu_{5}\), then \(\pi_{s}^{{B^{*} }} < \pi_{s}^{{H^{*} }}\); if \(\mu > \mu_{5}\), when \(0 < a < a_{5}\), then \(\pi_{s}^{{B^{*} }} < \pi_{s}^{{H^{*} }}\); if \(a_{5} < a < a_{1}\), then \(\pi_{s}^{{B^{*} }} > \pi_{s}^{{H^{*} }}\).

(ii) When \(\left( {B,K} \right) \in regions\; {\text{II}}\;{\text{and}}\;{\text{III}}\), if \(0 < \mu < \mu_{5}\), then \(\pi_{s}^{{B^{*} }} < \pi_{s}^{{H^{*} }}\); if \(\mu > \mu_{5}\), when \(0 < a < a_{6}\), then \(\pi_{s}^{{B^{*} }} < \pi_{s}^{{H^{*} }}\); if \(a_{5} < a < a_{1}\), then \(\pi_{s}^{{B^{*} }} > \pi_{s}^{{H^{*} }}\); if \(a_{6} < a < a_{5}\), when \(K_{1} < K < K^{*} \backslash B_{1} < B < B^{*}\), then \(\pi_{s}^{{B^{*} }} > \pi_{s}^{{H^{*} }}\); when \(K^{*} < K < K_{2} \backslash B^{*} < B < B_{3}\), then \(\pi_{s}^{{B^{*} }} < \pi_{s}^{{H^{*} }}\).

(iii). When \(\left( {B,K} \right) \in regions\;{\text{IV}}\;{\text{and}}\;{\text{V}}\), if \(0 < \mu < \mu_{5}\), then \(\pi_{s}^{{B^{*} }} < \pi_{s}^{{H^{*} }}\); if \(\mu > \mu_{5}\), when \(0 < a < a_{6}\), then \(_{s}^{{B^{*} }} <_{s}^{{H^{*} }}\); if \(a_{6} < a < a_{1}\), when \(0 < B < B^{**} \backslash 0 < K < K^{**}\), then \(_{s}^{{B^{*} }} <_{s}^{{H^{*} }}\); when \(B^{**} < B < B_{1} \backslash K^{**} < K < K_{1}\), then \(\pi_{s}^{{B^{*} }} > \pi_{s}^{{H^{*} }}\).

Proposition 5 indicates that under scenario \(a<{a}_{1}\), the manufacturer’s optimal energy procurement strategy predominantly depends on the farmer’s average yield of biomass feedstocks. With a low average yield \(0<\mu <{\mu }_{5}\), the manufacturer opts for a hybrid energy strategy to mitigate potential shortages in biomass feedstock supply. Conversely, with a high yield, \(\mu >{\mu }_{5}\), the manufacturer’s strategy is influenced by market size. In smaller markets, \(0<a<{a}_{6} or 0<a<{a}_{5}\), the hybrid strategy is favored, whereas in larger markets, \({{a}_{5}<a<{a}_{1} or a}_{6}<a<{a}_{1}\), a shift towards a bioenergy strategy occurs, facilitating supply chain decarbonization. For moderate market sizes, \({a}_{6}<a<{a}_{1}\), the manufacturer must weigh initial capital investment or the farmer’s land capacity to determine the optimal strategy.

When biomass yield is high, sufficient farmer planting acreage can meet the manufacturer’s energy requirements. Here, market size becomes a critical factor for supply chain decarbonization. In larger markets, pure bioenergy is more advantageous, while in smaller markets, a hybrid strategy is preferable. Thus, when \(a<{a}_{1}\), two conditions are essential for decarbonizing the supply chain: the farmer must increase the average yield of biomass feedstocks, and the market potential for the end products should be relatively high.

The manufacturer’s energy strategy in scenario \(a>{a}_{1}\), is explored by examining each region in Fig. 6b more closely. Region I (\(B>{B}_{1} and K>{K}_{1}\)) is analyzed first, as outlined in Proposition 6, with the relationship between μ and θ depicted in Fig. 7.

Proposition 6

When \(a>{a}_{1}\), \(B>{B}_{1}\mathrm{ and }K>{K}_{1},\) the manufacturer’s preferred energy strategies can be characterized as follows:

-

(i)

When \(\left(\mu ,\theta \right)\in A\), if \({a}_{1}<a<{a}_{5}\) or\(a>{a}_{7}\), then \({\pi }_{s}^{{B}^{*}}<{\pi }_{s}^{{H}^{*}}\); if \({ a}_{5}<a<{a}_{7}\), then \({\pi }_{s}^{{B}^{*}}>{\pi }_{s}^{{H}^{*}}\).

-

(ii)

When \(\left(\mu ,\theta \right)\in B\), \({\pi }_{s}^{{B}^{*}}>{\pi }_{s}^{{H}^{*}}\).

-

(iii)

When \(\left(\mu ,\theta \right)\in C\), if \({a}_{1}<a<{a}_{5}\), then \({\pi }_{s}^{{B}^{*}}<{\pi }_{s}^{{H}^{*}}\); if \(a>{a}_{5}\), then \({\pi }_{s}^{{B}^{*}}>{\pi }_{s}^{{H}^{*}}\).

-

(iv)

When \(\left(\mu ,\theta \right)\in D\), if\({a }_{1}<a<{a}_{5}\), then \({\pi }_{s}^{{B}^{*}}>{\pi }_{s}^{{H}^{*}}\); if \(a>{a}_{5}\), then \({\pi }_{s}^{{B}^{*}}<{\pi }_{s}^{{H}^{*}}\).

Proposition 6, alongside Fig. 7, reveals that with adequate funds and sufficient land capacity, the manufacturer’s strategy is shaped by biomass yield, conversion ratio, and market size, particularly in larger markets.

In region A, with low μ, a hybrid strategy is beneficial in both small and large markets; for medium-sized markets, a bioenergy strategy is preferred. In region B, with high μ, the manufacturer consistently leans towards bioenergy. In regions C and D, where biomass yield is moderate, the manufacturer’s strategy is interesting. A substantial market potential gap, θ < 0.5, leads to a preference for a hybrid strategy when \({a}_{1}<a<{a}_{5}\) and bioenergy when \(a>{a}_{5}\). A smaller gap results in opposite choices. The conditions for supply chain decarbonization in scenario \(B>{B}_{1} and K>{K}_{1}\) are: (1) with low yield, decarbonization is achievable in medium-sized markets; (2) with high yield, decarbonization is always possible; (3) with moderate yield, decarbonization occurs when both the market potential gap and market size are either large or small.

Proposition 6 suggests a sophisticated decision-making framework for manufacturers regarding energy strategy. The strategy is influenced by the intricate balance of biomass yield, market size, and conversion efficiency. In practical application, managers must consider these elements collectively to refine their approach to supply chain decarbonization. For example, in environments with low biomass yield or significant market potential gaps, a hybrid strategy could provide the necessary versatility. In contrast, areas with high biomass yield may benefit more from a dedicated bioenergy strategy, which could consistently support decarbonization efforts irrespective of the market size, thereby strengthening the company’s commitment to sustainability.

Next, we discuss the scenario \({K}_{2}<K<{K}_{1}\) and \(B>{B}_{2}\) in region II in Fig. 6b.

Proposition 7

When \(a>{a}_{1}\), \({K}_{2}<K<{K}_{1}\) and \(B>{B}_{2},\) the manufacturer’s energy strategies can be characterized as follows:

-

(i)

When\(\left( {\mu ,\theta } \right) \in A,C\), if\(a_{1} < a < a_{8}\), and\(a > a_{9}\), when\(K_{2} < K < K_{4}\), then\(\pi_{s}^{{B^{*} }} < \pi_{s}^{{H^{*} }}\), when\(K_{4} < K < K_{1}\), \(\pi_{s}^{{B^{*} }} > \pi_{s}^{{H^{*} }}\); if \(a_{8} < a < a_{9}\), then \(\pi_{s}^{{B^{*} }} > \pi_{s}^{{H^{*} }}\).

-

(ii)

When\(\left( {\mu ,\theta } \right) \in B,D\), if \(a_{1} < a < a_{9}\), then\(\pi_{s}^{{B^{*} }} > \pi_{s}^{{H^{*} }}\); if\(a > a_{9}\), when \(K_{2} < K < K_{4}\), then \(\pi_{s}^{{B^{*} }} \pi <_{s}^{{H^{*} }}\), when \(K_{4} < K < K_{1}\), then \(\pi_{s}^{{B^{*} }} > \pi_{s}^{{H^{*} }}\).

Proposition 7 and Fig. 7 demonstrate that under conditions of limited farmer land capacity, \({K}_{2}<K<{K}_{1}\), coupled with relatively unrestricted capital for the manufacturer, \(B>{B}_{2}\), the manufacturer’s choice of energy procurement strategy is influenced by three critical factors: the average yield of biomass, the efficiency of biomass-to-energy conversion, and the size of the market. Specifically, when the average biomass yield is low, μ < μ5, and the market size is either relatively small or large, the chosen strategy is contingent on the maximum land capacity available for biomass production. In cases where the farmer’s land capacity is limited, the manufacturer leans towards a hybrid energy strategy. Conversely, if the land capacity is more substantial, the manufacturer tends to adopt a pure bioenergy strategy. Notably, in scenarios with a moderate market size, the manufacturer invariably prefers the pure bioenergy strategy, regardless of variations in land capacity.

When biomass yield is high, μ < μ5, the manufacturer’s energy strategy varies significantly. In cases where the market size is relatively small, the manufacturer’s optimal choice leans towards the pure bioenergy strategy. However, as the market size increases, the strategy becomes contingent upon the farmer’s available land capacity. Specifically, with a relatively limited land capacity, the manufacturer is inclined to prefer the hybrid energy strategy. In contrast, when there is a larger land capacity at the farmer’s disposal, the manufacturer tends to favor the pure bioenergy strategy.

As Proposition 7 shows, decarbonization with limited land capacity is viable under three conditions: (1) low biomass yield, small or large market potential, and relatively large land capacity; (2) low yield and medium market size; (3) high yield with either small market potential or large market size and land capacity. Proposition 7 further indicates that manufacturers must carefully assess the available land for biomass production when deciding between hybrid and pure bioenergy strategies. For instance, in a situation of low yield and limited land, a hybrid strategy may be more viable to ensure energy needs are met without overextending land resources. Conversely, with high yield and ample land, a pure bioenergy strategy could be sustainable and possibly more profitable, given the higher efficiency of biomass-to-energy conversion. Decarbonization efforts are thus closely tied to these variables, and manufacturers must align their strategy with the specific market and capacity conditions to achieve their sustainability goals effectively.

The scenario \({B}_{3}<B<{B}_{1} and {B}_{2}\), in region III in Fig. 6b is addressed next.

Proposition 8

When \(a>{a}_{1}\), \({B}_{3}<B<{B}_{1}\mathrm{ and }{B}_{2},\) the manufacturer’s energy strategies can be characterized as follows,

-

(i)

When \(\left(\mu ,\theta \right)\in A\), if\({a}_{1}<a<{a}_{5}\), and \(a>{a}_{7}\), then \({\pi }_{s}^{{B}^{*}}<{\pi }_{s}^{{H}^{*}}\); if \({a}_{5}<a<{a}_{8}\) and \({a}_{9}<a<{a}_{7}\), when \({B}_{3}<B<{B}_{5}\), then \(\pi <{\pi }_{s}^{{H}^{*}}\); when \({B}_{5}<B<{B}_{1}\), then \({\pi }_{s}^{{B}^{*}}>{\pi }_{s}^{{H}^{*}}\); if\({a}_{8}<a<{a}_{9}\), then \({\pi }_{s}^{{B}^{*}}>{\pi }_{s}^{{H}^{*}}\).

-

(ii)

When \(\left(\mu ,\theta \right)\in C\), if \({a}_{1}<a<{a}_{5}\), then \({\pi }_{s}^{{B}^{*}}<{\pi }_{s}^{{H}^{*}}\); if \({a}_{5}<a<{a}_{8}\) and \(a>{a}_{9}\), when \({B}_{3}<B<{B}_{5}\), then \({\pi }_{s}^{{B}^{*}}<{\pi }_{s}^{{H}^{*}}\), when \({B}_{5}<B<{B}_{1}\), then \({\pi }_{s}^{{B}^{*}}>{\pi }_{s}^{{H}^{*}}\); if \({a}_{8}<a<{a}_{9}\), then \({\pi }_{s}^{{B}^{*}}>{\pi }_{s}^{{H}^{*}}\).

-

(iii)

When \(\left(\mu ,\theta \right)\in D\), if \({a}_{1}<a<{a}_{9}\), then \({\pi }_{s}^{{B}^{*}}>{\pi }_{s}^{{H}^{*}}\); if \({a}_{9}<a<{a}_{7}\), when \({B}_{3}<B<{B}_{5}\), then \({\pi }_{s}^{{B}^{*}}<{\pi }_{s}^{{H}^{*}}\), when \({B}_{5}<B<{B}_{1}\), then \({\pi }_{s}^{{B}^{*}}>{\pi }_{s}^{{H}^{*}}\); if \(a>{a}_{7}\), then \({\pi }_{s}^{{B}^{*}}<{\pi }_{s}^{{H}^{*}}\).

-

(iv)

When \(\left(\mu ,\theta \right)\in B\), if \({a}_{1}<a<{a}_{9}\), then \({\pi }_{s}^{{B}^{*}}>{\pi }_{s}^{{H}^{*}}\); if \(a>{a}_{9}\), when \({B}_{3}<B<{B}_{5}\), then \({\pi }_{s}^{{B}^{*}}<{\pi }_{s}^{{H}^{*}}\), when\({B}_{5}<B<{B}_{1}\), then \({\pi }_{s}^{{B}^{*}}>{\pi }_{s}^{{H}^{*}}\).

Proposition 8 and Fig. 5 illustrate how manufacturers choose their energy strategy when capital is limited. Proposition 8-(i) reveals that in scenarios like region A, where the farmer’s average biomass yield is low, the manufacturer’s strategy is significantly influenced by market size. In markets that are either relatively small or large, a hybrid energy strategy is preferred. However, in medium-sized markets, the strategy is categorized into three distinct cases based on capital availability: (1) in small or large markets, the energy strategy aligns with the level of capital; (2) with limited capital, a hybrid strategy is optimal; and (3) sufficient capital leads to a preference for pure bioenergy. Notably, in medium-sized markets, the manufacturer generally leans towards pure bioenergy.

Further, Proposition 8-(ii) addresses scenarios where the biomass yield is moderate, and the market size discount exceeds 0.5. Here, the manufacturer’s energy strategy is contingent on both market size and initial capital. In smaller markets, the hybrid strategy is favored, whereas in markets larger than \({a}_{5}\), the strategy diverges into three possibilities: (1) the choice hinges on capital levels in small or large markets; (2) limited capital dictates a hybrid approach; and (3) ample capital suggests pure bioenergy as the optimal strategy. In medium-sized markets, the manufacturer typically opts for pure bioenergy.

Proposition 8-(iii) examines scenarios with an average biomass yield and a market size discount below 0.5. In these cases, the manufacturer’s strategy varies in different regions A and C (μ < μ5). In small (or large) markets, pure bioenergy (or hybrid energy) is preferred. For middle-sized markets, the strategy is based on initial capital; limited capital leads to a hybrid strategy, whereas sufficient capital results in a pure bioenergy approach.

Proposition 8-(iv) outlines the optimal strategy when the biomass yield is high. In smaller markets, the manufacturer favors pure bioenergy. However, in larger markets, the strategy depends on capital availability; limited capital leads to a hybrid approach, while substantial capital supports pure bioenergy.

Next, we consider the scenario \(B<{B}_{2} and {B}_{3}\) in region IV, as depicted in Fig. 6b.

Proposition 9

When \(a>{a}_{1}\), \(B<{B}_{2}\mathrm{ and }{B}_{3}\), the manufacturer’s energy strategies can be characterized as follows:

-

(i)

For \(K<{K}_{2}\),

-

•

When \(\left(\mu ,\theta \right)\in A,C\), if \({a}_{1}<a<{a}_{10}\) and \(a>{a}_{11},\) then \({\pi }_{s}^{{B}^{*}}<{\pi }_{s}^{{H}^{*}}\); if \({a}_{10}<a<{a}_{11}\), when \(0<B<{B}_{6}\), then \({\pi }_{s}^{{B}^{*}}<{\pi }_{s}^{{H}^{*}}\);\({B}_{6}<B<{B}_{2}\), then \({\pi }_{s}^{{B}^{*}}>{\pi }_{s}^{{H}^{*}}\);

-

•

When \(\left(\mu ,\theta \right)\in B,D\), if \({a}_{1}<a<{a}_{11}\), when \(0<B<{B}_{6}\), then \({\pi }_{s}^{{B}^{*}}<{\pi }_{s}^{{H}^{*}}\); when \({B}_{6}<B<{B}_{2}\), then \({\pi }_{s}^{{B}^{*}}>{\pi }_{s}^{{H}^{*}}\); if\(a>{a}_{11}\), then \({\pi }_{s}^{{B}^{*}}<{\pi }_{s}^{{H}^{*}}\).

-

(ii)

For \(K>{K}_{2}\),

-

•

When \(\left(\mu ,\theta \right)\in A,C\), if \({a}_{1}<a<{a}_{8}\) and \(a>{a}_{9},\) then \({\pi }_{s}^{{B}^{*}}<{\pi }_{s}^{{H}^{*}}\); if \({a}_{8}<a<{a}_{9}\), when \(0<B<{B}_{6}\), then \({\pi }_{s}^{{B}^{*}}<{\pi }_{s}^{{H}^{*}}\), when\({B}_{6}<B<{B}_{3}\), then \({\pi }_{s}^{{B}^{*}}>{\pi }_{s}^{{H}^{*}}\);

-

•

When \(\left(\mu ,\theta \right)\in B,D\), if \({a}_{1}<a<{a}_{9}\), when \(0<B<{B}_{6}\), then \({\pi }_{s}^{{B}^{*}}<{\pi }_{s}^{{H}^{*}}\); when \({B}_{6}<B<{B}_{3}\), then \({\pi }_{s}^{{B}^{*}}>{\pi }_{s}^{{H}^{*}}\); if \(a>{a}_{9}\), then \({\pi }_{s}^{{B}^{*}}<{\pi }_{s}^{{H}^{*}}\).

Propositions 9 and Fig. 7 demonstrate the optimal strategies for manufacturers with constrained capital. Two scenarios are considered \(K<{K}_{2}\) (limited land capacity) and \(K>{K}_{2}\) (adequate land capacity). With \(K<{K}_{2}\) and biomass yield below \({\mu }_{5}\), the manufacturer prefers a hybrid strategy in small or large markets, but this preference shifts based on capital levels in medium-sized markets. If capital is limited, the hybrid strategy is chosen; if capital is sufficient, the bioenergy strategy is adopted. This pattern differs when biomass yield is above \({\mu }_{5};\) in small markets, the strategy is capital-dependent, while in large markets, a hybrid strategy is preferred. The optimal strategies for \(K>{K}_{2}\) follow similar patterns but with adjusted market size and capital thresholds.

For managers, this underscores the importance of a flexible strategy that can adapt to varying levels of capital and land capacity. In practical terms, a hybrid strategy could be advantageous for manufacturers with low biomass yield and limited land, particularly in smaller or larger markets. This approach allows for energy diversification, mitigating risks associated with resource limitations. Conversely, with sufficient capital, even with limited land, investing in a bioenergy strategy could yield long-term benefits in medium-sized markets. This suggests that investment decisions in energy procurement must be dynamically aligned with the company’s operational constraints and market conditions to optimize for sustainability and financial performance.

Finally, we address the scenario \(B>{B}_{2}\) and \(K<{K}_{2}\) in region V of Fig. 6b, as illustrated in Proposition 10 and Fig. 7.

Proposition 10

When \(a>{a}_{1}\), \(B>{B}_{2}\) and \(K<{K}_{2}\), the manufacturer’s energy strategies can be characterized as follows:

-

(i)

When \(\left(\mu ,\theta \right)\in A,C\), if \({a}_{1}<a<{a}_{8}\) and \(a>{a}_{9}\), then \({\pi }_{s}^{{B}^{*}}<{\pi }_{s}^{{H}^{*}}\); if \({a}_{8}<a<{a}_{9}\), when \(0<K<{K}_{5}\), then \({\pi }_{s}^{{B}^{*}}<{\pi }_{s}^{{H}^{*}}\); when \({K}_{5}<K<{K}_{2}\), then \({\pi }_{s}^{{B}^{*}}>{\pi }_{s}^{{H}^{*}}\).

-

(ii)

When \(\left(\mu ,\theta \right)\in B,D\), if \({a}_{1}<a<{a}_{9}\), when \(0<K<{K}_{5}\), then \({\pi }_{s}^{{B}^{*}}<{\pi }_{s}^{{H}^{*}}\), when \({K}_{5}<K<{K}_{2}{ ,\mathrm{ then }\pi }_{s}^{{B}^{*}}>{\pi }_{s}^{{H}^{*}}\); if \(a>{a}_{9}\), then \({\pi }_{s}^{{B}^{*}}<{\pi }_{s}^{{H}^{*}}\).

Proposition 10 sheds light on a scenario where the manufacturer operates with relatively high capital and limited land capacity. Under these conditions, if the farmer’s average biomass yield is below \({\mu }_{5}\), the manufacturer opts for a hybrid strategy in both small and large markets. In medium-sized markets, the strategy depends on land capacity; a lower capacity leads to a hybrid approach, while a higher capacity favors pure bioenergy.

6 Conclusion

The issue of environmental pollution and the imperative for a shift in the energy structure within manufacturing supply chains have gained widespread recognition in recent years. Bioenergy stands out as a promising solution for mitigating carbon emissions and fostering sustainable development within supply chains.

This study employed a game-theoretic model involving key players, namely an agricultural biomass producer (farmer), a manufacturer, and a traditional energy supplier. Focusing on supply chain decarbonization as the key objective, we modeled and analyzed the manufacturer’s energy strategies. Specifically, the study addressed key questions, such as the effectiveness of the proposed energy adoption model in achieving supply chain decarbonization, the equilibrium outcomes between implementing a pure bioenergy strategy and a hybrid energy strategy, and the varying effects on the farmer’s planting acreage and product prices resulting from different bioenergy strategies.

The research explored optimal energy strategies for manufacturers, with a focus on bioenergy utilization within different market sizes. Our analysis uncovered the complex nature of optimal energy strategy determination, influenced by factors such as average biomass yield, conversion rates, market size, land capacity, and the manufacturer’s initial capital. These factors are proven to significantly shape decision-making processes within the manufacturing sector. Our results revealed that, in smaller markets, manufacturers tend towards a hybrid energy strategy, particularly when biomass yields are low. Conversely, in larger markets with higher biomass yields, a pure bioenergy strategy becomes a more viable choice.

The findings underscore a complex interplay between manufacturers’ energy strategy selection and profitability, emphasizing the absence of a one-size-fits-all solution. Manufacturers must tailor their strategies to specific market conditions and resource availability, with decision-making differing significantly between pure bioenergy and hybrid strategies. The research also examined the ramifications of carbon tax policies on energy strategies, stressing the need for manufacturers to balance environmental responsibilities with profitability.

Additionally, the study revealed diverse impacts of biomass conversion technologies on supply chain decisions, indicating the potential of Industry 5.0 and advanced agricultural biomass conversion technologies to enhance energy efficiency and facilitate supply chain decarbonization. For instance, under a hybrid strategy, technological advancements can lead to increased biomass purchase prices, expanded planting areas, and greater profits for both farmers and suppliers. In contrast, the impact of conversion technology on the supply chain under a pure bioenergy strategy depends on the agricultural biomass conversion ratio.

The conversion of agricultural biomass into bioenergy aligns with global efforts toward environmental sustainability, necessitating the integration of environmental considerations into the strategic planning of the manufacturing sector. The insights derived from this study bear significance for manufacturers, policymakers, and agricultural stakeholders, offering informed guidance for decisions regarding the adoption of energy strategies and investment in bioenergy technologies. While providing valuable insights, the study acknowledges limitations due to the variability in agricultural biomass availability and the fluctuating nature of market demands. Further research is needed to assess the long-term sustainability and environmental impacts of the widespread adoption of bioenergy from agricultural biomass and to explore the scalability and economic impacts of different energy strategies in diverse supply chain contexts.

References

Alegoz, M., Kaya, O., & Bayindir, Z. P. (2021). A comparison of pure manufacturing and hybrid manufacturing–remanufacturing systems under carbon tax policy. European Journal of Operational Research, 294, 161–173.

Asian, S., Hafezalkotob, A., & John, J. J. (2019). Sharing economy in organic food supply chains: A pathway to sustainable development. International Journal of Production Economics, 218, 322–338.

Basso, T. P., Basso, T. O., & Basso, L. C. (Eds.). (2021). Biotechnological applications of biomass. Books on Demand.

Cai, Z., Ye, F., Xie, Z., Zhang, L., & Cui, T. (2021). The choice of cooperation mode in the bioenergy supply chain with random biomass feedstock yield. Journal of Cleaner Production. https://doi.org/10.1016/j.jclepro.2021.127587

Chen, W., & Hu, Z.-H. (2018). Using evolutionary game theory to study governments and manufacturers’ behavioral strategies under various carbon taxes and subsidies. Journal of Cleaner Production, 201, 123–141.

da Costa, T. P., Quinteiro, P., da Cruz Tarelho, L. A., Arroja, L., & Dias, A. C. (2018). Environmental impacts of forest biomass-to-energy conversion technologies: Grate furnace versus fluidised bed furnace. Journal of Cleaner Production, 171, 153–162.

De Laporte, A. V., Weersink, A. J., & McKenney, D. W. (2016). Effects of supply chain structure and biomass prices on bioenergy feedstock supply. Applied Energy, 183, 1053–1064.

Dong, C., & Boute, R. (2020). Game—the beer transportation game: How to decarbonize logistics by moving freight to sustainable transport modes. INFORMS Transactions on Education, 20(2), 102–112.

Duarte, A. E., Sarache, W. A., & Costa, Y. J. (2014). A facility-location model for biofuel plants: Applications in the Colombian context. Energy, 72, 476–483.

EC. (2015). Paris agreement. European Commission.

ElFar, O. A., Chang, C. K., Leong, H. Y., Peter, A. P., Chew, K. W., & Show, P. L. (2021). Prospects of Industry 5.0 in algae: Customization of production and new advance technology for clean bioenergy generation. Energy Conversion and Management: X, 10, 100048. https://doi.org/10.1016/j.ecmx.2020.100048

Feng, Z., Luo, N., Shalpegin, T., & Cui, H. (2023). The influence of carbon emission reduction instruments on blockchain technology adoption in recycling batteries of the new energy vehicles. International Journal of Production Research, 1–18.

Gao, E., Sowlati, T., & Akhtari, S. (2019). Profit allocation in collaborative bioenergy and biofuel supply chains. Energy. https://doi.org/10.1016/j.energy.2019.116013

Gao, F., & Souza, G. C. (2022). Carbon offsetting with eco-conscious consumers. Management Science, 68, 7879–7897.

Govindan, K., Salehian, F., Kian, H., Hosseini, S. T., & Mina, H. (2023). A location-inventory-routing problem to design a circular closed-loop supply chain network with carbon tax policy for achieving circular economy: An augmented epsilon-constraint approach. International Journal of Production Economics, 257, 108771.

Hafezalkotob, A., Arisian, S., Reza-Gharehbagh, R., & Nersesian, L. (2023). Joint impact of CSR policy and market structure on environmental sustainability in supply chains. Computers & Industrial Engineering, 185, 109654.

He, N., Jiang, Z.-Z., Huang, S., & Li, K. (2022). Evolutionary game analysis for government regulations in a straw-based bioenergy supply chain. International Journal of Production Research. https://doi.org/10.1080/00207543.2022.2030067

IEA. (2023). CO2 emissions in 2022. IEA, Paris. https://www.iea.org/reports/co2-emissions-in-2022

Javadi, T., Alizadeh-Basban, N., Asian, S., & Hafezalkotob, A. (2019). Pricing policies in a dual-channel supply chain considering flexible return and energy-saving regulations. Computers & Industrial Engineering, 135, 655–674.

Jiang, Z.-Z., He, N., & Huang, S. (2021a). Contracting with asymmetric information under government subsidy programs in a bioenergy supply chain. International Journal of Production Research, 60, 5571–5594.

Jiang, Z.-Z., He, N., & Huang, S. (2021b). Government penalty provision and contracting with asymmetric quality information in a bioenergy supply chain. Transportation Research Part e: Logistics and Transportation Review. https://doi.org/10.1016/j.tre.2021.102481

Konstantaras, I., Skouri, K., & Benkherouf, L. (2021). Optimizing inventory decisions for a closed–loop supply chain model under a carbon tax regulatory mechanism. International Journal of Production Economics. https://doi.org/10.1016/j.ijpe.2021.108185

Kothari, R., Vashishtha, A., Singh, H. M., Pathak, V. V., Tyagi, V. V., Yadav, B. C., Ashokkumar, V., & Singh, D. P. (2020). Assessment of Indian bioenergy policy for sustainable environment and its impact for rural India: Strategic implementation and challenges. Environmental Technology & Innovation. https://doi.org/10.1016/j.eti.2020.101078

Li, B., Boyabatlı, O., & Avcı, B. (2023a). Economic and environmental implications of biomass commercialization in agricultural processing. Management Science, 69(6), 3561–3577.

Li, G., Li, L., Choi, T. M., & Sethi, S. P. (2020a). Green supply chain management in Chinese firms: Innovative measures and the moderating role of quick response technology. Journal of Operations Management, 66(7–8), 958–988.

Li, G., Lim, M. K., & Wang, Z. (2020b). Stakeholders, green manufacturing, and practice performance: Empirical evidence from Chinese fashion businesses. Annals of Operations Research, 290, 961–982.

Li, G., Wu, H., Sethi, S. P., & Zhang, X. (2021). Contracting green product supply chains considering marketing efforts in the circular economy era. International Journal of Production Economics, 234, 108041.

Li, Y., Lin, J., Qian, Y., & Li, D. (2023b). Feed-in tariff policy for biomass power generation: Incorporating the feedstock acquisition process. European Journal of Operational Research, 304, 1113–1132.

Liu, Z., Xu, L., Ren, X., Lu, Q., Wang, X., & Arisian, S. (2023). Contagion effect in the adoption of environmental corporate social responsibility. Annals of Operations Research, 1–38.

Lyu, R., Zhang, C., Li, Z., & Li, Y. (2022). Manufacturers’ integrated strategies for emission reduction and recycling: The role of government regulations. Computers & Industrial Engineering. https://doi.org/10.1016/j.cie.2021.107769

Ma, X., Ho, W., Ji, P., & Talluri, S. (2018). Coordinated pricing analysis with the carbon tax scheme in a supply chain*. Decision Sciences, 49, 863–900.

Maddikunta, P. K., Pham, Q. V., Prabadevi, B., Deepa, N., Dev, K., Gadekallu, T. R., Ruby, R., & Liyanage, M. (2022). Industry 5.0: A survey on enabling technologies and potential applications. Journal of Industrial Information Integration, 26, 100257.

Mavi, R. K., Shekarabi, S. A. H., Mavi, N. K., Arisian, S., & Moghdani, R. (2023). Multi-objective optimisation of sustainable closed-loop supply chain networks in the tire industry. Engineering Applications of Artificial Intelligence, 126, 107116.

Meng, X., Yao, Z., Nie, J., Zhao, Y., & Li, Z. (2018). Low-carbon product selection with carbon tax and competition: Effects of the power structure. International Journal of Production Economics, 200, 224–230.

Moura, P., Henriques, J., Alexandre, J., Oliveira, A. C., Abreu, M., Gírio, F., & Catarino, J. (2022). Sustainable value methodology to compare the performance of conversion technologies for the production of electricity and heat, energy vectors and biofuels from waste biomass. Cleaner Waste Systems, 3, 100029.

Nguyen, T. L. T., Hermansen, J. E., & Nielsen, R. G. (2013). Environmental assessment of gasification technology for biomass conversion to energy in comparison with other alternatives: The case of wheat straw. Journal of Cleaner Production, 53, 138–148.

Nie, P. Y., Wang, C., & Wen, H. X. (2022). Optimal tax selection under monopoly: Emission tax vs carbon tax. Environmental Science and Pollution Research International, 29, 12157–12163.

Niu, B., Dong, J., & Zeng, F. (2022). Green manufacturers’ power strategy in the smart grid era. Computers & Industrial Engineering. https://doi.org/10.1016/j.cie.2021.107836

Peura, H., & Bunn, D. W. (2021). Renewable power and electricity prices: The impact of forward markets. Management Science, 67(8), 4772–4788.

Rahimi, M., Hafezalkotob, A., Asian, S., & Martínez, L. (2021). Environmental policy making in supply chains under ambiguity and competition: A fuzzy stackelberg game approach. Sustainability, 13(4), 2367.

Rathore, H., & Jakhar, S. K. (2021). Differential carbon tax policy in aviation: One stone that kills two birds. Journal of Cleaner Production, 296, 126479.

Rentizelas, A. A., Tolis, A. J., & Tatsiopoulos, I. P. (2009). Logistics issues of biomass: The storage problem and the multi-biomass supply chain. Renewable and Sustainable Energy Reviews, 13(4), 887–894.

Reza-Gharehbagh, R., Arisian, S., Hafezalkotob, A., & Makui, A. (2023). Sustainable supply chain finance through digital platforms: A pathway to green entrepreneurship. Annals of Operations Research, 331(1), 285–319.

Reza-Gharehbagh, R., Asian, S., Hafezalkotob, A., & Wei, C. (2021). Reframing supply chain finance in an era of reglobalization: On the value of multi-sided crowdfunding platforms. Transportation Research Part e: Logistics and Transportation Review, 149, 102298.

Ritchie, H., Rosado, P., & Roser, M. (2023). Fossil fuels. Our world in data. Retrieved December 1, 2023, from https://ourworldindata.org/fossil-fuels

Searchinger T, & Heimlich R. (2015). Avoiding bioenergy competition for food crops and land.

Sharara, M. A., & Sadaka, S. S. (2018). Opportunities and barriers to bioenergy conversion techniques and their potential implementation on swine manure. Energies, 11(4), 957.

Sharma, B., Ingalls, R. G., Jones, C. L., & Khanchi, A. (2013). Biomass supply chain design and analysis: Basis, overview, modeling, challenges, and future. Renewable and Sustainable Energy Reviews, 24, 608–627.

Song, M., Fisher, R., & Kwoh, Y. (2019). Technological challenges of green innovation and sustainable resource management with large scale data. Technological Forecasting and Social Change, 144, 361–368.

Strzalka, R., Schneider, D., & Eicker, U. (2017). Current status of bioenergy technologies in Germany. Renewable and Sustainable Energy Reviews, 72, 801–820.

Sun, J., Li, G., & Lim, M. K. (2020). China’s power supply chain sustainability: an analysis of performance and technology gap. Annals of Operations Research. https://doi.org/10.1007/s10479-020-03682-w

Tawiah, V., Zakari, A., Li, G., & Kyiu, A. (2022). Blockchain technology and environmental efficiency: Evidence from US-listed firms. Business Strategy and the Environment, 31(8), 3757–3768.

Wang, L., Xu, T., & Qin, L. (2019). A study on supply chain emission reduction level based on carbon tax and consumers’ low-carbon preferences under stochastic demand. Mathematical Problems in Engineering, 2019, 1–20. https://doi.org/10.1155/2019/1621395

Wong, K. H., Tan, I. S., Foo, H. C., Chin, L. M., Cheah, J. R., Sia, J. K., Tong, K. T., & Lam, M. K. (2022). Third-generation bioethanol and L-lactic acid production from red macroalgae cellulosic residue: Prospects of Industry 5.0 algae. Energy Conversion and Management, 253, 115155.

Yang, H., & Chen, W. (2018). Retailer-driven carbon emission abatement with consumer environmental awareness and carbon tax: Revenue-sharing versus cost-sharing. Omega, 78, 179–191.

Ye, F., Cai, Z., Chen, Y. J., Li, Y., & Hou, G. (2020). Subsidize farmers or bioenergy producer? The design of a government subsidy program for a bioenergy supply chain. Naval Research Logistics, 68, 1082–1097.

Zhang, C. H., Lyu, R. X., Li, Z. T., & MacMillen, S. J. (2021). Who should lead raw materials collection considering regulatory pressure and technological innovation? Journal of Cleaner Production. https://doi.org/10.1016/j.jclepro.2021.126762

Zhu, J., Lu, Y., Song, Z., Shao, X., & Yue, X.-G. (2023). The choice of green manufacturing modes under carbon tax and carbon quota. Journal of Cleaner Production. https://doi.org/10.1016/j.jclepro.2022.135336

Funding

Open Access funding enabled and organized by CAUL and its Member Institutions. The study did not receive any external financial support.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors confirm that they have no conflicts of interest.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix: Mathematical proofs

In this paper we used the backward induction approach and KKT conditions for solving optimization problems with inequality constraints and obtaining the equilibrium solutions. In backward induction the idea is to start from the end of the game and work backwards to the beginning, determining the optimal strategy at each step. For example, as shown in Fig. 1, when the manufacturer chooses the pure bioenergy strategy the first decision in the sequence is made by the farmer, who decides on the planting area \({q}_{1}\). This decision is influenced by factors such as expected market prices for the biomass, the cost of planting, and capacity constraints. The next step in this sequence involves the manufacturer deciding on the purchase price of the biomass feedstocks, denoted as \(w\). This decision is based on various factors, including the cost of production, market demand, and the planting area \({q}_{1}\) decided by the farmer. This approach ensures that the decision-making process accounts for the responses and strategies of both the farmer and the manufacturer, leading to a more robust and strategic outcome in the context of a pure bioenergy strategy. In hybrid energy strategy, as in the pure bioenergy strategy, the first decision is made by the farmer, who decides on the planting area \({q}_{1}\). In the final step, the manufacturer makes two key decisions.

The first decision is determining the purchase price of the biomass feedstocks \(w\), which will influence the cost of production and potentially the demand for the final product. The second decision is the amount of conventional energy \({q}_{2}\) to be used in conjunction with the biomass. This decision is affected by factors such as the cost of biomass and conventional energy, carbon tax penalty and the efficiency of the hybrid energy strategy. For example, in this paper, for the farmer’s land capacity constraint we consider \({q}_{1}\le K\) and for the manufacturer limited initial capital \(B\) we consider \(w\mu {q}_{1}\le B.\)

Proof of Proposition 1

Using backward induction, we first solve the farmer’s planting acreage \(q_{1}\). Define the Lagrange function as

Taking the second derivative, we have \(\frac{{\partial L_{{\pi_{f} }}^{B} }}{{\partial q_{1}^{2} }} = - k < 0\), thus concavity always holds. Solving the KKT Eqs. (A.2)–(A.4), we can get two scenarios, i.e., \(x = 0\) and \(x > 0\). When \(x = 0\), we obtain the planting acreage \(q_{1} = \frac{w\mu }{k}\). Based on the condition \(q_{1} \le K\), we have \(w \le \frac{kK}{\mu }\). When \(x > 0\), we get \(q_{1} = K\) and \(x = - kK + w\mu\). Based on \(x > 0\), \(w > \frac{kK}{\mu }\) is got.

Next, we solve the green manufacturer’s purchase price of biomass based on the above scenarios, i.e., \(q_{1} = \frac{w\mu }{k}\), \(w \le \frac{kK}{\mu }\) and \(q_{1} = K\), \(w > \frac{kK}{\mu }\).

First, considering the scenario \(q_{1} = \frac{w\mu }{k}\) and \(w < \frac{kK}{\mu }\). Define the Lagrange function as

According to the second derivative \(\frac{{\partial^{2} L_{{\pi_{m} }}^{B} }}{{\partial w^{2} }} = - \frac{{2\mu^{2} (k + ky + \varepsilon^{2} \mu^{2} )}}{{k^{2} }} < 0\), concavity always holds. When \(y = 0\), based on KKT Eqs. (A.6)–(A.8), \(w = \frac{ak\varepsilon }{{2(k + \varepsilon^{2} \mu^{2} )}}\) and \(q_{1} = \frac{a\varepsilon \mu }{{2(k + \varepsilon^{2} \mu^{2} )}}\) are obtained. From the conditions \(w < \frac{kK}{\mu }\) and \(B > w\mu q_{1}\), we get the boundary line \(B > B_{1} = \frac{{a^{2} k\varepsilon^{2} \mu^{2} }}{{4(k + \varepsilon^{2} \mu^{2} )^{2} }}\) and \(K > K_{1} = \frac{a\varepsilon \mu }{{2(k + \varepsilon^{2} \mu^{2} )}}\).

Moreover, when \(y > 0\), based on KKT Eqs. (A.6)–(A.8), \(w = \frac{\sqrt B \sqrt k }{\mu }\), \(q_{1} = \frac{{\sqrt {Bk} }}{k}\), \(y = \frac{{ - 2Bk + a\sqrt B \sqrt k \epsilon \mu - 2B \epsilon ^{2} \mu^{2} }}{2Bk}\). According to the conditions \(y > 0\) and \(w < \frac{kK}{\mu }\), we get the boundary line \(B < B_{1} = \frac{{a^{2} k\varepsilon^{2} \mu^{2} }}{{4(k + \varepsilon^{2} \mu^{2} )^{2} }}\) and \(B < B_{2} = kK^{2}\).

Second, considering the scenario \(q_{1} = K\) and \(w > \frac{kK}{\mu }\). Define the Lagrange function as

Based on the first order derivatives \(\frac{{\partial L_{{\pi_{m} }}^{B} }}{\partial w} = - K\mu - Ky\mu < 0\), the manufacturer’s profit is decreasing with \(w\). Therefore, \(w = \frac{kK}{\mu }\). Besides, based on \(B \ge w\mu K\), we get the boundary line \(B \ge B_{2} = kK^{2}\).

Proof of Proposition 2

Using backward induction, we first solve the farmers’ planting acreage \(q_{1}\). Define the Lagrange function as

The Lagrange function \(L_{{\pi_{f} }}^{H}\) is the same as that under pure bioenergy strategy. Therefore, two scenarios \(q_{1} = \frac{w\mu }{k}\), \(w < \frac{kK}{\mu }\) and \(q_{1} = K\), \(w > \frac{kK}{\mu }\) should be considered. Next, we analyze the manufacturer’s purchase price of biomass \(w\) and the amount of traditional energy\({q}_{2}\).

First, considering the scenario \(q_{1} = \frac{w\mu }{k}\) and \(w < \frac{kK}{\mu }\). Define the Lagrange function as

Furthermore, we get the Hessian matrix