Abstract

In the wake of the COVID-19 pandemic, the importance of resilient supply chain and operations management in the pharmaceutical industry has intensified. A particular challenge has been the timely adaptation to rapid fluctuations in the business environment to cope with disruptions and ensure the adequate supply of medical equipment and pharmaceuticals. In this study, we perform a simulation-based analysis of pandemic-triggered impacts on pharmaceutical supply chains in Germany with the aim of examining supply chain response to the COVID-19 pandemic. To accomplish this, we build a digital supply chain model using a hybrid approach that combines case study analysis and discrete-event simulation implemented in anyLogistix. Based on the results, we propose a specific response action plan for the pharmaceutical industry that can be deployed in response to severe disruptions and pandemic-like crises. We also offer a resilience framework for the post-pandemic environment as a guideline for strategic decision-making.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Pandemics and significant disruptions in global markets call for fast adaptations and have shifted the focus to the key role of supply chain (SC) resilience (Hosseini et al., 2019; Dubey et al., 2023; Hägele et al., 2023; Sawik, 2023). In particular, SCs of essential goods, such as pharmaceuticals, have been required to adapt quickly to rapid changes in the business environment to cope with disruptions and ensure the adequate supply of medical equipment and pharmaceuticals (Lücker et al., 2021; Dolgui et al., 2023; Yousefi Sarmad et al., 2023). A fundamental aspect to consider are the distinct patterns of demand changes for essential and non-essential goods, with the term ‘essential’ referring to items necessary for living, including food, pharmaceutical goods, and shelter (Li et al., 2023b; Sodhi et al., 2023).

Dolgui et al. (2023) stress that in a situation such as the pandemic, the demand for essential goods increases noticeably, whereas the demand for non-essential goods declines. During the COVID-19 pandemic, the pharmaceutical retail sector experienced a sharp increase in demand, as people were panic buying and exhibiting hoarding behaviors (Paul et al., 2022; Li et al., 2023a). Given these distinct dynamics, the management of the pharmaceutical industry and its SCs became increasingly important. The pharmaceutical industry had to implement specific actions in a timely manner to respond to the changes and adapt their operations to ensure the availability of goods. However, while the literature on SC resilience in the pandemic setting has grown significantly (Aldrighetti et al., 2023; Alikhani et al., 2023; Ivanov et al., 2023), knowledge is lacking as to how pharmaceutical supply chains (PSC) have responded to the pandemic and what actions should be taken in the future to increase their resilience. This research gap inspired our first research question (RQ):

RQ 1 “How has the COVID-19 pandemic impacted PSC performance?”

The motivation behind RQ1 stems from the assessment of the impact of COVID-19 pandemic disruptions on the PSC. Using a hybrid approach combining case-study and simulation analysis, we examine responses of German PSCs to the COVID-19 pandemic. Based on the examination of what occurred in the past, our second objective is to propose a future action plan, which motivated our second RQ:

RQ 2 “How can PSC resilience be improved?”

As a generalized outcome related to RQ2, we propose a specific action plan for the pharmaceutical industry that can be deployed in response to severe disruptions and pandemic-like crises. From the insights obtained, we develop a framework for the post-pandemic environment, which includes specific recommendations for resilience and risk mitigation. In summary, the first RQ is aimed at obtaining insights into the impact of the pandemic through the analysis of various disruption scenarios. This will enable the identification of specific SC risks in the PSC. The second RQ is intended to provide specific actions to address the risk factors identified in the preceding analysis to increase SC resilience in the pharmaceutical industry. Through examination of the two RQs, our research contributes to literature by providing practice-based insights into the effects of the pandemic on PSCs that can be used to develop specific measures to enhance disruption management and resilience.

The remainder of this paper is organized as follows. A literature review is provide in Sect. 2. The practical context of our study and the methodology are explained in Sect. 3. A case study and the respective simulation model of the PSC in Germany are set up in Sect. 4. In Sect. 5, the simulation results are analyzed using selected KPIs (Key Performance Indicators) to obtain insight into the impact and extent of pandemic disruptions as well as specific SC risks (RQ1). In Sects. 6 and 7, we discuss the simulation results. An SC risk-action framework and a resilience framework for the post-pandemic environment are proposed (RQ2). We conclude in Sect. 8 by summarizing the major insights of our study and outlining directions for future research.

2 Literature review

The pandemic-related disruptions resulted from a variety of factors, including the sudden changes in demand, regional and national lockdowns, restrictions of global trade and travel, reduced labor force availability, temporary closure of sites, increased transportation and lead times, and bottlenecks as well as supply shortages (Graves et al., 2023; Browning et al., 2023; Ivanov & Dolgui, 2022). The sequential nature of the outbreaks and the high interconnectedness of the above-mentioned factors posed an unforeseen challenge that was hard to predict or contain (Ivanov, 2022, Shen & Sun, 2023). Initially, demand changes occurred, where demand dropped for some goods but increased for others, including PPE and vaccines. Added to these demand changes was a reduced labor force and hence a sharp decline of production capacity. This led to limited supply and shortages, which, in turn, disrupted value chains dramatically (Paul & Chowdhury, 2021; Ramani et al., 2022; Brusset et al., 2023).

During the pandemic, supply in the health sector and the crisis resilience of related economic sectors, such as the pharmaceutical industry, became the focus of political and social debates, given their essential nature and importance to public health. With personal protective equipment (PPE) such as surgical face masks, gloves, face shields and medical gowns being the most effective means of protection against the spread of the virus, and the rising number of patients requiring hospital medical care, the demand for medical products surged (Dolgui et al., 2023; Chervenkova & Ivanov, 2023). The unfolding of the pandemic has clearly shown that particular attention must be given to the providers of essential goods such as medical equipment and pharmaceutical products (Sodhi et al., 2023; Li et al., 2023b). Furthermore, the essential role of the pharmaceutical industry makes it imperative to develop strategies to anticipate, mitigate, and adapt in high-risk scenarios and under the constant threat of disruptions.

In the pharmaceutical industry, the effects of the pandemic were most noticeable in the retail sector, with demand changes resulting from demand for new items such as PPE as well as panic buying and stocking of other medications, new requirements regarding hygiene, labor shortages, and bottlenecks in supply and distribution (Ivanov, 2021b; Ivanov & Keskin, 2023; Rozhkov et al., 2022). Changes also became quickly apparent in the manufacturing area. SC uncertainty rose as new rules on social distancing impacted the efficiency of operations and factories were operating with limited capacities or were shut down temporarily, especially in China, which was the primary producer of drug components. These factors, in combination with COVID-related drugs and equipment being prioritized, not only affected the ability to source, make, and distribute drugs, but also resulted in increased prices and lead times.

Although SC disruptions are not a new phenomenon and have been researched extensively, the COVID pandemic has made it clear that new challenges and circumstances can arise that call for quick adaptation and recovery. While previous literature has assessed a wide variety of locally contained as well as spreading disruptions (i.e., the ripple effect), severe, simultaneous disruptions at a multitude of SC nodes and links within the pharmaceutical industry have never been examined in the context of the pandemic. Nor has a recovery analysis examining the post-disruption environment been carried out specifically on the pharmaceutical industry. To close this research gap, this study aims to contribute to SC resilience research by generating new knowledge on the impact of the pandemic-related disruptions on the pharmaceutical industry. The second aim is to establish a framework for increasing resilience by providing specific actions that address the identified shortcomings and risks in the PSC in a post-disruption environment.

3 Practical context and methodology

3.1 Pharmaceutical supply chain in Germany

Producing a drug involves a complex interaction between suppliers, sub-suppliers, manufacturers, wholesalers, retailers and regulatory oversight bodies. Figure 1 displays a simplified version of a PSC network and its key players. Arrows mark the direction of product flows and hence transportation; for the purpose of this research, return processes have been excluded.

Pharmaceutical products are generally composed of two main inputs: active pharmaceutical ingredients (APIs) and excipients. APIs are the ingredients that generate the desired pharmacological effect, while excipients are the inactive substances that are included for the manufacturability, composition, and performance of the finished pharmaceutical product (FPP). At the supply stage, ingredients and starting materials are either imported or produced locally in primary production. Within the pharmaceutical manufacturing sector, primary production can be subdivided into excipient production, auxiliary material provision, and API production.

The components are shipped to the drug product manufacturer and combined into tablets, ointments, and liquids. The final products are then packaged into tubes, blisters packs, etc. In compliance with safety, environmental, and quality regulations, the pharmaceuticals are subject to continuous checks throughout the entire process before they are approved to be released for transport. Finished goods were traditionally shipped to pharmaceutical wholesalers but are now also distributed directly to customers, including pharmacies and hospitals, from where they are then provided to patients and online retailers, or prepared for export. In Germany, 9 manufacturer-neutral distributors are organized in the PHAGRO Federal Association of Pharmaceutical Wholesalers (Bundesverband des pharmazeutischen Großhandels e.V.), which operates 104 branches throughout the country. The central task of the wholesalers is to ensure the timely nationwide supply of medicines to the public. The branches deliver medicine to public pharmacies an average of three times a day to avoid unnecessarily high stock levels in pharmacies.

3.2 COVID-19 disruptions in Germany’s pharmaceutical industry

Like most industries, the pharmaceutical industry has been severely impacted by disruptions triggered by the pandemic outbreak. However, the importance of the pharmaceutical industry has been especially highlighted by media and literature, given the essential nature of its outputs. During the pandemic, several interconnected factors affected and limited the ability to source, produce, and deliver pharmaceutical products, an effect which has been magnified by the sequential and geographically diverse nature of the outbreaks.

Primarily visible were the changes in demand patterns for pharmaceutical products and medical equipment (Ayati et al., 2020). Demand increased for certain goods, such as PPE, vaccines, and other COVID-related pharmaceutical goods. Panic buying and hoarding by consumers also led to a surge in demand, especially for over-the-counter cold medicines, fever and pain relievers such as Paracetamol, multivitamins, and immune boosters, all of which could be used to reduce COVID-symptoms.

The effects of the pandemic also extended to transportation, which was disrupted on several levels. Many countries imposed substantial restrictions on imports and exports, and border security was increased to ensure the adherence to limitations of in-country and cross-border movements. Disruptions also adversely affected the supply side, where shortages had been rising for both excipients and APIs (Miller et al., 2021). The main impact resulted from export restrictions and bans imposed by China and India, two major producers of APIs and generics, and unexpectedly limited supply, as well as labor shortages and temporary closures (Malviya et al. 2022). The demand increase and simultaneous hoarding and non-release of pharmaceutical supplies to buying countries multiplied the effect of the disruptions and led to an unforeseen erratic product supply.

3.3 Research methodology

We use a hybrid methodology combining case study and discrete-event simulation modelling. Simulation models, which are used in quantitative research, allow complex problems in SCs to be solved, where a multitude of elements are connected and build complex interdependencies throughout the various stages of a SC network (Ivanov, 2023b). Simulation allows the depiction of individual discrete events that form a chronological sequence of operations (Jackson et al., 2023). Although simulations are a simplification of reality, they have the potential to explain problems that entail high levels of complexity. One significant advantage of simulation models is the ability to consider time-dependent parameters, which enables the assessment of the situational changes as well as the impact of disruptions on the SC performance over time (Ivanov, 2021a; Singh et al., 2021). Moreover, simulation enables randomness and logical constraints (e.g., randomness in disruptions or recovery) to be considered and evaluated though the use of performance indicators (Ivanov, 2020).

We selected anyLogistix for simulation because it allows the analysis of a wide variety of elements, the interconnections of variables, and objective functions and has proven to be a suitable tool for risk and resilience analysis, and it can cope with high levels of complexity (Ivanov, 2020). anyLogistix combines different types of descriptive, predictive and prescriptive analytics, including simulation, optimization, and visualization to analyze, design and optimize SCs.

Our study combines a deductive approach, where hypotheses are initially formulated and the theory is then tested using simulation with an inductive approach for creating new theories and concepts that allow the drawing of valid new conclusions. The case study for the pharmaceutical industry is developed using secondary data on the German pharmaceutical industry to construct the digital SC in anyLogistix and is used as data input for the discrete-event simulation. The setup of the SC model in anyLogistix is considered a disruption-free base scenario based on which four distinct disruption scenarios will be simulated. The disruptive events are set based on the pandemic timeline. Simulation methodology allows the researcher to obtain insights into the impact of the pandemic on the German pharmaceutical industry by simplifying the reality to a certain degree and making use of selected operational and financial performance indicators to quantify the findings. Use of a combined qualitative and quantitative research approach with primary and secondary sources ensures that the results and the derived managerial recommendations are valid despite the simplification and use of certain assumptions. Based on the findings from the literature research and simulation, specific actions in response to identified SC issues are derived and used to create a framework for increasing resilience within the industry in a post-pandemic environment.

4 Simulation model

We consider a multi-stage SC network simulation for the German pharmaceutical industry, which includes suppliers, manufacturers, wholesalers and pharmacies. Owing to the complexity of the SC network in Germany and the vast number of pharmaceuticals that are registered for sale, the simulation design will be simplified to include the ten most sold medications (from 2015 to 2019) provided by IMS Health (2019). These are grouped into four product categories, namely pain relievers, respiratory drugs, wound care, and CKM drugs (cardiovascular, kidney, and metabolic disease drugs). In total, 100 customer locations (pharmacies) have been selected and distributed across the German federal states based on population density. The locations are based on actual pharmacies within Germany, which have been selected using the official health portal of German pharmacists (Aponet.de, n.d.).

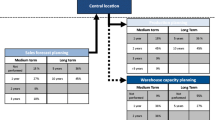

4.1 Assumptions and simulation logic

The following assumptions have been made. The demand is based on the average yearly demand of the selected pharmaceuticals. Customers demand products from all product categories, and all wholesalers obtain and stock all products from the respective FPP manufacturer. Regarding inventory, it is assumed that manufacturers and DCs apply an (s, S) min-max inventory policy with safety stock, according to which goods are (re-)ordered when inventory levels fall below the fixed replenishment point (s + safety stock). In this case, the ordered quantity is set so that the resulting total inventory quantity is equal to S + safety stock. For FPPs at manufacturers, the replenishment point (s) has been set to the respective total daily demand multiplied by 4, and the maximum inventory level (S) has been set at s + 150,000 pieces, with a safety stock of 100,000 pieces based on the dataset considered. For excipients at manufacturers, the (s, S) levels have been selected following the same logic. For wholesalers, (s, S) inventory levels have been set with the aim of achieving specific overall supply level days, using manufacturers’ inventory levels per product as a base. The following supply level days for FPPs have been determined based on the level of importance of the product for public health as well as overall demand: CKM drugs, 23 days; wound care, 14 days; respiratory medication, 12 days; and pain medication, 10 days. Overall, inventory carrying costs amount to 28% of the total costs.

For supplier selection, the composition of the individual pharmaceuticals in the categories was first investigated to identify excipient commonalities, on the basis of which regional, medical-grade suppliers were subsequently identified through online search. In terms of transportation, excipients and FPPs are transported via refrigerated trucks, given their temperature sensitivity, with a capacity of 500,000 pieces per truck and an average speed of 80 km/h. The transportation cost calculation is distance-based with fixed costs, where anyLogistix takes into consideration variable costs multiplied by distance as parameters for computation. The variable costs have been set in accordance with recent figures published by the DVZ (2021), where the average transportation cost per kilometer was calculated to be 1.57 €/km.

The cost of shipping from the manufacturer to the wholesaler is already included in the final agreed-upon price. Such costs are therefore included in the manufacturer’s inventory expenditure, which is the sum of the initial inventory purchase cost and the replenishment costs. The costs are computed by multiplying the initial stock (in units) by the corresponding cost value of the product. Production costs are considered for manufacturers and have been computed by dividing the total yearly cost (including rent/m2, utilities, personnel costs, and energy costs) by the total number of products.

The simulation model logic is as follows (Fig. 2). Each customer places orders at the wholesaler, who states that the PHAGRO delivers to all pharmacies three times a day. All orders delivered within the expected lead time (ELT) of 0.5 days are classified as on-time deliveries. All others are classified as delayed deliveries and have a negative impact on the ELT service level, defined as the ratio of on-time orders to the overall number of outgoing orders.

4.2 4.2. Experimental setup and performance assessment

Several disruptions are simulated based on the actual timeline of events caused by COVID-19 and corresponding measures implemented by the German government (Fig. 3). The approximate duration of waves is marked in blue.

COVID-19 Pandemic Timeline Germany (based onBMG (2022)

Various simulations of the German PSC are set up based on the developments depicted in the timeline, including one pre-pandemic scenario and four disruption scenarios. The results will be evaluated using selected KPIs. These include:

-

Expected lead time (ELT): the time period within which the product is anticipated to be received by the customer who placed the order.

-

ELT service level: the ratio of orders fulfilled on time (within the expected lead time) to total orders. The ELT service level disregards whether orders are fulfilled from inventory or produced goods and is, therefore, a suitable indicator of total SC responsiveness, including distribution and manufacturing.

-

Fulfilment (late orders): displays statistics on the order quantity that failed to be fulfilled within the expected lead time and, hence, includes all orders still being delivered after the expiration of the ELT.

-

Demand (product backlog): shows the number of processed products for all incomplete orders, i.e., orders currently lacking the required number of products.

-

Available inventory, including backlog: displays the number of products available in stock without including the quantities of products for incomplete orders and is, thus, the difference between the available inventory and the demand (product backlog).

-

Financial indicators: this KPI gives detailed information on the incurred expenses and generated revenue, including costs (e.g., transportation costs, inventory costs, inbound/outbound processing costs, among others) as well as total profit and revenue for the respective scenario (anyLogistix, n.d.c).

These KPIs will be used to assess the following simulation scenarios:

-

(0)

Pre-pandemic (disruption-free scenario).

The first simulation analyzes PSC performance prior to the pandemic outbreak with no (major) disruptions. A simulation is run for a two-year period (01/01/2020–12/31/2021). Results from this simulation will be used as a baseline to be compared with disruption scenarios.

-

(1)

Demand increase.

Demand patterns changed significantly in response to the pandemic outbreak. To simulate the effects on German PSCs and determine the impact on their performance, various demand changes within fixed time periods will be simulated. The products, respective changes to the demand coefficients, and periods have been selected based on the literature review and pandemic timeline in previous chapters. Simulated events are depicted in Table 1.

-

(2)

Transportation bottlenecks

The transportation bottlenecks will be simulated in accordance with the pandemic timeline for six different time periods. Making use of the anyLogistix event type ‘path state,’ material flow disruptions of five days each are simulated, as depicted in Fig. 4.

-

(3)

Supply-side disruptions.

Disruptions on the supply side will be simulated as depicted in Table 2. Using the event type ‘facility state’ in anyLogistix, the impact of shutdowns of two suppliers and one manufacturing site is simulated and analyzed.

The first event simulates a shutdown of one major supplier for one week at the beginning of the pandemic. At this point, isolation regulations were the strictest and mandatory quarantine regulations applied to all infected workers. In line with the number of daily reported cases, the second and third events are each set for a 12-day period, as case numbers rose more drastically during the respective pandemic waves. Thereby, the effects of restricted workforce availability and hence, limited production capacity are assessed. Simulation results are analyzed using the selected KPIs.

-

(4)

Pandemic disruption.

The multiple disruption scenario analysis combines the disruption simulations (1–3) to examine the impact of the pandemic on the German PSC performance, where disruptions not only occurred as isolated events but also hit the SC simultaneously and were time-delayed.

5 Results and discussion

In this section, we present and discuss the simulation results.

5.1 Simulation 0—pre-pandemic (disruption-free scenario)

Simulation 0 depicts the pre-pandemic SC state of the German pharmaceutical industry, without the occurrence of disruptions. Figure 5 shows the SC network performance.

The financial indicators show that the SC network, including sourcing, production, and distribution, is profitable. With an overall revenue of 2.65bn EUR, 43% is attributed to costs (1.14bn EUR), leaving 57% profit (1.51bn EUR). The high inventory expenditures within the PSC occur because inventory is stocked to a greater degree than in other industries, given that pharmacies are supplied on a highly frequent basis, and the items provided are essential to society. Furthermore, inventory is not only kept at the manufacturing site but at wholesalers to a large degree. However, this varies widely within the industry as some goods are easily perishable, and others can be stored for several months. Overall, the min-max inventory policy with safety stock selected for the simulation ensures sufficient inventory for the high turnover while still maintaining buffer inventory to mitigate slight fluctuations.

Regarding transportation, the computation results show 231,323 shipped vehicles with a total travel distance of 47,136,509 km, totaling 67.3mn EUR in transportation costs. Based on the frequency of shipments and the usage of LSPs, this represents 6% of the total costs. Outbound processing makes up a share of 8%, as shipments from wholesalers to all customers are issued three times per day, which is relatively frequent. Other costs include operating, administrative, and personnel costs, summing up to 2% of total costs. Lastly, production costs comprise 1% of total costs, given that production is highly automated, which allows for a large output in a minimal amount of time.

In addition to the financial indicators, the KPI dashboard (Fig. 4) displays lead time in the form of a histogram, where the x-axis marks the time in days, and the y-axis the number of occurrences within that time. Accordingly, data from the histogram can be interpreted as goods being delivered to customers within a time frame of zero and six hours. Most items, however, are delivered within 0.1 days, or 2.4 h. With the expected lead time being 0.5 days, the customers’ requirements are fully met for all products. The lead time is short due to frequently recurring orders and high inventory turnover at the wholesalers.

In terms of the product backlog, which refers to the number of processed products for those orders that currently lack the required number of products, the disruption-free scenario shows no such backlog. This can be interpreted as all orders being delivered in-full and customer demand being satisfied 100%.

In line with these findings is the KPI fulfilment (late orders), indicating the number of orders that did not arrive within the expected lead time of 0.5 days. Any order being delivered later would thus be classified as a late order. All orders are delivered on time, given that the number of late orders is equal to zero. Hence, all of the 877,208 orders are being fulfilled on time and in full (OTIF).

These findings are supported by the ELT service level statistics, which refer to the number of on-time orders relative to the number of outgoing orders, and are, thus, an indicator of total SC responsiveness. As derived from the fulfilment KPI, all orders are fulfilled on time, which supports the finding that the ELT service level is 1, meaning that customers receive 100% of their orders within the expected lead time.

Lastly, the average daily available inventory is displayed in Fig. 8 and shows inventory levels for all four products at the PHAGRO (CKM drugs = blue, respiratory medication = green, pain relievers = red, wound care = black). With the previously elaborated (s, S)-policy stocks are kept between the maximum level (S + safety stock) and the replenishment point (s + safety stock). This prevents excessive inventories while also ensuring that some stock is maintained to buffer against slight demand fluctuations. The results clearly indicate sufficient stock from the beginning throughout the entire time period. With stable inventory levels, sufficient stock is available to fulfil demand.

In summary, Simulation 0, with no disruptions of the SC network, displays the optimal performance of the German PSC. With complete fulfilment of demand, high profitability, and regular and stable inventory levels, this scenario poses the base against which the disruptive scenarios in the following section will be compared.

5.2 Disruption simulation

For Simulation 1, we assess the impact of a demand increase in response to the pandemic outbreak, and rising case numbers on performance of the PSC network in Germany. The results are depicted in Fig. 6. A backlog is evident for both manufacturers and wholesalers.

Simulation 2 depicts the effects of bottlenecks in transportation on PSC performance during the first COVID-19 wave (Figs. 6 and 7).

As shown in Fig. 7, financial performance is not majorly impacted by the disruption throughout the two-year period. With a significant reduction of excipients being delivered from suppliers to the manufacturing sites, a decrease in the available inventory (FPPs) can also be evidenced, leading to a decrease in inventory costs. With this, the number of late orders increases for pain relievers, wound care, and respiratory medication. However, the level of increase is low compared to the total number of orders. Thus, the ELT service level remains near 100% at all times throughout the period. This means that demand is still being satisfied for the most part, indicated by the number of products being delivered on-time relative to all orders shipped.

Simulation 3 aims at assessing the impact of supply-side disruptions. Figure 8 depicts the effect on PSC performance following the shutdowns of two suppliers (Starch supplier Nordmann, Rassmann GmbH—7 days; Glycerol supplier Glaconchemie GmbH—12 days) and one production site (CKM drug manufacturer Merck KGaA—12 days) within a specified time period. It should be noted that contrary to the previous simulations, the available inventory is displayed for manufacturers and wholesalers to demonstrate the disruption impact more clearly, as both nodes are affected here.

In Simulation 4, all disruptions are combined to simulate the impact of the pandemic on the German PSC performance. The results are depicted in Fig. 9.

In terms of financial performance, the COVID-pandemic had a negative impact on the products under review. As depicted in Simulation 1, the demand increase is considered the main driver for higher revenues generated throughout the two-year period. This is also visible in the pandemic simulation, with revenues increasing by 2% compared to the base scenario. However, given the simultaneously occurring SC disruptions, costs increase by 15% to a total of 1.3bn EUR, thereby taking up almost half of all revenues (2.7bn EUR). The main share of this development can be traced back to the significant rise of transportation and production costs in response to the effects of the disruptions rippling through the SC. One cost driver for transportation is the rise of the overall quantity of goods to be transported with increased demand, leading to a rising number of shipped vehicles. In addition, as transport is disrupted and manufacturing capacities for excipients and FPPs are restricted or temporarily shut down, more incomplete orders are shipped from manufacturers to wholesalers and to customers, causing the capacity utilization of trucks to decline and costs to rise. As a consequence of the extended number of orders and goods to be handled, inbound and outbound processing costs also rise; other costs, however, remain level since they are considered fixed costs. As for inventory carrying costs, a decrease of 10% is apparent, as suppliers are unable to deliver excipients, thereby restricting the production of FPPs, which is combined with manufacturing sites being shut down. The existing inventory at manufacturers and wholesalers is, thus, turned over quickly, and inventory levels (temporarily) decline. As a consequence, profit decreases by 8% (− 120mn EUR) compared to in the undisrupted base scenario.

In more detail, upon assessment of the available inventory, the extent of the COVID-related SC disruptions becomes apparent. With increased demand, closures on the supply side, and transportation bottlenecks during the first pandemic wave all products are affected, even though to a varying extent.

For pain relievers, the impact of simultaneous disruptions and their effects rippling through the SC become especially apparent. While the time for the inventory level to fully recover averaged 153 days for isolated disruptions, it took almost four times that in the pandemic simulation, as the combined disruptive impacts caused inventory levels to decline to a point where safety stock, the applicable (s, S)-inventory policy and available production capacities were no longer able to ensure timely recovery. Compared to the impact of the first pandemic wave, the disruptions occurring during the third wave are even more significant to the overall SC performance. Especially for products that were significantly impacted during the first wave and which were still recovering, such as respiratory medication, additional disruptions led to a sharp decline in inventory levels. No recovery was possible for these products within the time period under consideration, assuming that neither additional capacities for storage or production nor measures regarding the inventory or sourcing strategy were implemented.

These findings are supported by the KPIs products backlog and fulfilment (late orders). As seen in the individual disruption simulations, it is not possible attain 100% on-time fulfilment of orders following the SC disruptions, which leaves demand unsatisfied. With the start of disruptions, product backlog spikes resulted from excipients not being delivered due to supply-side disruptions, combined with transportation disruptions and increasing demand. A great share of the backlog is eliminated once suppliers resume their operations. Overall, following the sharp rise, the number of backlogged products slightly increases further due to ripple effects but eventually starts to decrease as the wave subsides. This pattern is also reflected by the late orders, which rise during the first pandemic wave and then remain fairly stable at around 200 orders. During the third wave of the pandemic, where further disruptions occurred, both indicators denote a significant rise in backlog again and hence late products. This can be traced back to the previously mentioned assumption that no additional storage/manufacturing capacities were created and no reactive SC measures were implemented, causing insufficient quantities to be produced and readily available for distribution to customers. While the total of 31,312 delayed orders made up just 4% of all orders, 13mn pieces were delivered late.

Moreover, the lead time depicts a significant change compared to the base scenario, as most orders are now delivered within 0 and 80 days. The mean lead time more than doubled from 0.10 to 0.25 days, implying that pharmacies across Germany had longer waiting times to receive their goods.

The impact of the disruptions on SC performance further affects the ELT service level. During the first and second pandemic waves, disruptions can be mostly buffered against due to the use of safety stock and generally high stock levels, implying only a minor impact on the service level by decreasing it to 0.94 temporarily. However, the additional disruptions clearly have a greater effect during the phase of recovery, with the service level decreasing by close to 0.7 over an extended period of time.

In summary, Simulation 4 clearly depicts the interdependencies of variables within the SC network as well as the impact of combined disruptive effects on German PSC performance. The results confirm the assumption that while the industry did largely profit from the increased demand during the COVID-19 pandemic, weaknesses within the network were revealed that negatively impacted SC performance.

5.3 Comparative analysis

Following the baseline scenario and the analysis of four distinct simulations to assess the pharmaceutical industry in Germany and the impact of the pandemic on its global SC network, we now compare the simulation outcomes to derive generalized insights (Table 3). The essential findings are summarized below.

For Simulation 1, where demand increases, the average daily available inventory decreases, with more orders having to be manufactured and distributed, leading to a faster turnover of items. With this, the number of required vehicles almost triples, causing transportation expenses to spike. At the same time, orders are delayed due to capacity limitations, resulting in longer lead times and delayed orders, which in turn negatively impact the ELT service level, causing it to reach just 90%. While total revenues are increased due to higher sales, associated costs rise at a greater speed, leading to less profit than in the base scenario.

Transportation bottlenecks in Simulation 2 affect various nodes of the SC and restrict transportation between suppliers, manufacturers, and wholesalers. These bottlenecks have a comparably low impact on SC performance. Overall, inventory levels rise slightly due to the backlog and temporary inability to transport goods from manufacturers to the PHAGRO, and so does the number of transported vehicles, as orders are only being partially shipped. Despite the backlog, which is, however, minimal compared to the total number of orders, the mean lead time remains nearly level, and service levels only decrease slightly. In terms of financial impact, revenues remain level compared to the base scenario. Total costs, however, are lower despite increased transportation costs, as fewer items are brought from suppliers and more inventory is consumed from stock, which reduces handling and inventory costs.

With disruptions on the supply side, as assessed in Simulation 3, less inventory is available overall for manufacturing, which reduces carrying costs. As for transportation, this implies that more vehicles need to be shipped but are less utilized, which causes rising transportation costs and thus slightly reduced profitability. Despite the small number of backlogged orders, the mean lead time is barely impacted, leaving the ELT service level at 97%. We note that the maximum lead time is a cumulative lead time from the warehouses to all customers.

Combining all three isolated disruption scenarios, Simulation 4 examines the impact of the pandemic on PSC performance and the interrelation of variables. On the supply side, transportation and demand simultaneously and subsequently affect the SC, and impact of disruptions on the performance becomes more significant. The simulation displayed overall increased excipient inventory levels but reduced FPP levels, which leads to the conclusion that through the interplay of disruptions, items become backlogged and production capacities are, at least partially, insufficient, as not all excipients can be converted into FPPs. At the same time, inventory costs are lower due to temporary disruptions on the supply side and an overall faster turnover of inventory. As expected, transportation costs pose the biggest cost factor, as more vehicles have to be dispatched to deliver available items and with lower capacity utilization.

To summarize, firstly, the pandemic situation proved to be less profitable for the items in question, despite the higher sales numbers. Secondly, the impact of the ripple effect becomes apparent, as disruptive events occur simultaneously as well as sometimes being delayed, thereby causing the impact on the SC network’s performance to aggregate. Lastly, the pandemic-related disruptions showed that with disruptions occurring during the recovery phase and no reactive measures being put in place (e.g., in terms of capacities or backup suppliers/facilities), the security of supply is no longer fully guaranteed, as late orders/products spike, leading the ELT service level to drop to 71% and causing a large quantity of demand to remain unfulfilled or majorly delayed.

When cross-comparing all simulations against the baseline scenario, results suggest that despite increased demand, profitability does not increase at the same rate if no capacities are freed up to compensate for the additional quantities. The assessment further highlighted that this exact event thus has the highest impact on SC performance, compared to other isolated events, as backlog increases with adverse effects on lead time and demand fulfilment and hence, customer satisfaction. Both transportation bottlenecks and supply-side disruptions, when simulated independently, also displayed decreasing lead times and backlogged orders although on a significantly smaller scale and with less impact on service level. Despite transportation bottlenecks being simulated to last for a shorter period than the supply-side disruptions, the difference in impact on SC performance was relatively small. Based on these findings, it can be concluded that not only the length of disruption is important, but also the essentiality and character of the node it affects within the SC network. These findings provide valuable insights into the impact of the pandemic on the SC network and can therefore be used as a base for developing specific measures to increase resilience and minimize disruptive impacts in the future.

5.4 Generalizing the impact of the pandemic on Germany’s pharmaceutical industry

The pandemic generated a multitude of challenges as well as opportunities for the German pharmaceutical industry, given its unforeseen nature and the general unpredictability of events and interplay of factors along the SC. With high levels of uncertainty, consumers have changed their purchasing behavior to stock up on medication, especially medication related to the symptoms of COVID-19. Consequently, sales have risen in patterns that differ from those of the usual seasonal changes, straining an industry charged with the production of PPE and vaccines even further.

These unprecedented changes have imposed significant pressure on the PSC, bringing to light weaknesses within the network. Particularly during the first two waves of the pandemic, when uncertainty was high and the pandemic was a new and unpredictable development, the management of inventory and stock levels posed a challenge. With a reduction of inventory, increased backlogs, and delayed orders, shortages of pharmaceuticals were no rarity. Although the inventory situation improved once regulatory measures were eased and panic buying lessened as the prevailing level of uncertainty also declined, recovery was slow. For the subsequent waves of rising case numbers, the increase in demand was seen to be more significant, compared to the first wave, as it hit SCs, which were still recovering, leaving a great strain on stocked items and manufacturing capacities.

In addition to the demand increase, supplier and manufacturer sites experienced the repercussions of the pandemic, with sites having to operate at reduced capacity or shut down entirely due to COVID outbreaks and quarantine regulations imposed by the government. These supply-side disruptions posed further challenges to the SC network, as components were missing and production capacity was limited, which led not only to decreased inventory levels but also delayed orders and longer lead times.

Similar effects on the movement of goods were triggered by transportation bottlenecks caused by the combined effects of delays at borders due to stricter entry restrictions and the limited availability of personnel in trucking. These significantly impacted the efficiency of transport, increased costs, and hence the availability of materials and goods along the entire SC network. In turn, delivery times and the closely related service level were negatively affected.

In summary, the COVID-19 pandemic has had extensive effects on the PSC in Germany, with major repercussions on suppliers, manufacturers, wholesalers and, ultimately, customers. While certainly not all product categories were affected in the same way, and high stock levels within the industry provided some resilience to buffer against the strains on production capacity, inventory, and transportation, the effects were still noticeable and they greatly impacted the availability of goods essential to society. Furthermore, the pandemic has uncovered weaknesses along the SC, which have been known for some time but have not been brought to light to such an extent, such as low visibility resulting from a highly complex SC network. Overall, the issues identified within the SC network of the German pharmaceutical industry, based on the simulation results and the examined literature, can be grouped as follows: (a) changes in demand patterns, (b) increased demand, (c) transportation bottlenecks, (d) supply-side disruption, (e) inventory shortages, (f) capacity constraints (storage and manufacturing), (g) product shortages, (h) increased lead times, (i) rise of new sales channels (e-commerce), and (j) dependence on government regulations (hygiene, compliance, etc.). While the pandemic seems to be near its end, these challenges remain and must be addressed with suitable measures to increase long-term resilience within the industry and secure supply in future potential long-term crises.

5.5 Managerial implications and recommendations

In this section, we propose specific recommendations for increasing resilience in a post-pandemic environment in the PSC in Germany. The proposed framework is intended to be used as a general guideline for actors within the PSC network. As depicted in Fig. 9, these recommendations are grouped into three phases aimed at increasing resilience in the pharmaceutical industry in a post-disruption environment.

The framework combines both reactive and proactive strategies for the phases of stabilization, recovery, and preparedness and provides specific actions for players in the pharmaceutical industry to respond and adapt to the post-disruption environment.

In the first phase, considering the weaknesses brought to light by the COVID-19 pandemic, all players along the PSC network should perform an impact evaluation to assess the extent of the pandemic disruptions and the interrelations of variables and their respective effects on SC performance and derive managerial implications. Carrying out the analysis jointly with multiple actors along the SC will enable the sharing of resources, such as information, and thus yield a more precise evaluation. Using real data and quantifying it through the use of KPIs allows for a detailed analysis and enables a holistic assessment of the SC and the associated risks and impacts through simulation. In light of the fast-changing environment, it is essential that this assessment be carried out in a timely manner so that business continuity plans can be reviewed and amended accordingly (Ivanov, 2023a). These actions are likely to bring about a stabilization of the situation.

In the second phase, the focus should be on adaptation and resilience to enable the pharmaceutical industry in Germany to respond to the COVID-19 pandemic disruptions. Manufacturers and wholesalers should increase collaborative efforts not only with one another but also along the SC network. In this way, communication and exchange can amplify day-to-day operations, as well as resilience in the long run, with planning and supply being aligned to minimize the disruptive impact on SC performance and achieve the best possible performance (Li et al., 2022a, b. Furthermore, the use of digital technologies, such as track and trace or digital twins, is a main enabler in creating end-to-end visibility and transparency. Obtaining visibility beyond tier-1 suppliers allows manufacturers and wholesalers, as well as pharmacies, to anticipate risks and disruptions and to implement measures respectively to counteract them (Li et al., 2020). Particularly in terms of inventory management, real-time data and transparency would improve accuracy, efficiency, and robustness, prevent stock-outs, and guarantee availability. With the same strategic goal, the SC configuration should be re-evaluated, especially focusing on risk diversification through multiple sourcing, alternative transportation, and manufacturing/storage capacities. This will enable a faster response to changes in the environment, such as a demand increase, shutdowns of sites, and transport bottlenecks, as observed during the pandemic, and would mitigate the severity of the impact (Ivanov, 2022, Ivanov, 2023a).

In the third phase, players in the pharmaceutical industry are recommended to leverage new opportunities arising from the pandemic. With the pharmaceutical industry having proven to be capable of unprecedented endeavors, such as the rapid development of new drugs, the vast potential of the industry to profit from the pandemic has been uncovered, and new opportunities should be seized. With the significant rise of e-commerce during the pandemic, opportunities for the retail of pharmaceuticals should be further explored (MacCarthy and Ivanov, 2022b). It is suggested that the SC and operations be transformed to support the shift to online pharmacies, increased (contactless) home deliveries, and digital payment methods. Thus, pharmaceutical firms should invest heavily in new digital technologies to support this change (Maccarthy and Ivanov, 2022a, Zhang et al., 2022). Building an SC that is more heavily reliant on AI, blockchain, automation, robotics, and track and trace technologies not only allows leveraging opportunities for growth but increased productivity and resilience (Dubey et al., 2022; Choi et al., 2022, Maccarthy and Ivanov, 2022a). Lastly, opportunities from long-term partnerships with various stakeholders should be explored and leveraged (Dolgui et al., 2023).

In summary, ample opportunities are available for the pharmaceutical (retail) industry to stabilize and recover from the pandemic and increase resilience in the long run. Despite the high implementation costs and considerable effort required, the actions proposed in the framework are recommended, especially in light of the essentiality of the goods.

6 Conclusion

This study focused on SC resilience in the German pharmaceutical sector in light of the global COVID-19 pandemic. We examined the impact of disruptions on the pharmaceutical industry in Germany during a two-year time frame using a hybrid case study simulation model and secondary data from academic literature. The research was conducted with the aim of proposing specific SC response actions to mitigate the disruptive impact on SC performance and to develop a framework applicable to the creation of resilience in a post-disruption environment.

For the first assessment, the analysis of relevant literature was combined with an SC simulation model created in the simulation and optimization software anyLogistix based on secondary data. The simulation examined the impact of selected disruptions on the PSC, aiming to identify the impact of the pandemic and weaknesses within the SC network. Results showed that the pandemic did largely impact the industry, yet it also opened up new opportunities for growth and development. The implications of the focus shifting to the manufacturing of PPE and the development of vaccines combined with the impact of SC disruptions became apparent in terms of increased lead times, decreased service levels, delayed or unattended orders, and rising costs, revealed in the simulation and supported by the literature. Especially in the case of additional disruptions occurring during recovery periods, the simulated SC has proven to be incapable of buffering against the disruptive impact without the implementation of reactive measures. However, the significant increase in demand for pharmaceutical items also drove revenues up.

The simulation and cross-comparison of computational results affirmed that generally, the length of the disruption and the type of node affected directly relate to the severity of the impact. Furthermore, the impact of disruptions is aggravated when multiple disruptions occur simultaneously, and their impact is accumulated and ripples through the SC. Specific SC actions have been identified in response to the identified weaknesses during the COVID-19 pandemic. These include (1) digitalization, (2) SC visibility and transparency, (3) SC flexibility and robustness, (4) SC network configuration and design, and (5) SC collaboration and partnerships. Additionally, a framework for increasing SC resilience within the German pharmaceutical industry in a post-disruption environment has been developed based on the research findings. The three-stage framework specifies strategies for stabilization, recovery, and future development, including (a) the evaluation of the impact of the pandemic disruptions on SC performance, (b) adaptation and resilience creation and (c) leveraging future opportunities. To summarize, our study contributes to the existing base of knowledge on SC disruption management and resilience within the German pharmaceutical industry by evaluating the impact of the pandemic and developing a tailored approach for increasing resilience in a post-pandemic environment with the aim of supporting decision-makers to make informed, strategic decisions before, during, and after disruptions.

In terms of limitations of this research, it must be noted that the case study considered only part of the German PSC. Since no primary data on the topic were available at the time of research, selected assumptions and generalizations had to be made based on secondary sources, which may have resulted in a lack of accuracy and, therefore, misinterpretation. Contributing to this is the fact that a simulation always entails a simplification of reality to a certain degree to reduce complexity. For example, only land transport was considered in this research, and suppliers were located solely within Europe. Lastly, since the COVID-19 pandemic is a relatively new but ongoing occurrence with various interdependent variables, this research study was limited by a lack of previous research and studies on the topic. It is, therefore, subject to change based on new developments.

For future research in the field, the impact of the pandemic and its implications remain a topic of high importance due to the essentiality of the industry. As disruptions become more frequent, their unpredictability remains, making it essential to develop and constantly adapt resilience measures. Therefore, generic actions must be developed to recover from the pandemic and prepare for the future by leveraging available technologies and collaboration opportunities. For the pharmaceutical industry specifically, an interesting research area would be to explore the value of nearshoring production and SC collaboration to enhance flexibility, as this has been one of the biggest challenges faced during the pandemic. Additionally, the implementation and use of technology to support this process, increase visibility, and improve predictive analytics should be investigated for the pharmaceutical industry to ensure the best possible SC network configuration in future.

References

Aldrighetti, R., Battini, D., & Ivanov, D. (2023). Efficient resilience portfolio design in the supply chain with consideration of preparedness and recovery investments. Omega, 117, 102841.

Alikhani, R., Ranjbar, R., Jamali, A., Torabi, S. A., & Zobel, C. W. (2023). Towards increasing synergistic effects of resilience strategies in supply chain network design. Omega, 116, 102819.

Aponet.de (n.d (October 2022).) Apothekensuche: Hier finden Sie jede Apotheke in Deutschland. Available at: https://?www.aponet.de?/?apotheke/?apothekensuche. (Accessed: 14 October 2022)

Ayati, N., Saiyarsarai, P., & Nikfar, S. (2020). Short and long term impacts of COVID-19 on the pharmaceutical sector. DARU Journal of PSCiences, 28(2), 799–805. https://doi.org/10.1007/s40199-020-00358-5.

BMG (2022). Chronik zum Coronavirus SARS-CoV-2: Chronik aller Entwicklungen im Kampf gegen COVID-19 (Coronavirus SARS-CoV-2) und der dazugehörigen Maßnahmen des Bundesgesundheitsministeriums, 13 January. Available at: https://?www.bundesgesundheitsministerium.de?/?coronavirus/?chronik-?coronavirus.html (Accessed: 17 November 2022).

Browning, T., Kumar, M., Sanders, N., Sodhi, M. S., Thürer, M., & Tortorella, G. L. (2023). From supply chain risk to system-wide disruptions: Research opportunities in forecasting, risk management and product design. International Journal of Operations & Production Management. https://doi.org/10.1108/IJOPM-09-2022-0573.

Brusset, X., Ivanov, D., Jebali, A., La Torre, D., & Repetto, M. (2023). A dynamic approach to supply chain reconfiguration and ripple effect analysis in an epidemic. International Journal of Production Economics, 263, 108935.

Chervenkova, T., & Ivanov, D. (2023). Adaptation strategies for building supply chain viability: A case study analysis of the global automotive industry re-purposing during the COVID-19 pandemic. Transportation Research: Part E, 177, 103249.

Choi, T. M., Kumar, S., Yue, X., & Chan, H. L. (2022). Disruptive technologies and operations management in the industry 4.0 era and beyond. Production and Operations Management, 31(1), 9–31.

Dolgui, A., Gusikhin, O., Ivanov, D., Li, X., & Stecke, K. (2023). A network-of-networks adaptation for Cross-industry Manufacturing Repurposing. IISE Transactions. https://doi.org/10.1080/24725854.2023.2253881.

Dubey, R., Bryde, D. J., Dwivedi, Y. K., Graham, G., & Foropon, C. (2022). Impact of artificial intelligence-driven big data analytics culture on agility and resilience in humanitarian supply chain: A practice-based view. International Journal of Production Economics, 250, 108618.

Dubey, R., Bryde, D. J., Dwivedi, Y. K., Graham, G., Foropon, C., & Papadopoulos, T. (2023). Dynamic digital capabilities and supply chain resilience: The role of government effectiveness. International Journal of Production Economics, 258, 108790.

DVZ (2021). Transportpreise auf Europas Straßen steigen. Available at: https://www.dvz.de/rubriken/land/detail/news/transportpreis-in-europa-steigt.html (Accessed: 26 December 2022).

Graves, S. C., Tomlin, B. T., & Willems, S. P. (2023). Supply chain challenges in the post–covid era. Production and Operations Management, 31(12), 4319–4332.

Hägele, S., Grosse, E., & Ivanov, D. (2023). Supply chain resilience: A tertiary study. International Journal of Integrated Supply Management, 16(1), 52–81.

Hosseini, S., Ivanov, D., & Dolgui, A. (2019). Review of quantitative methods for supply chain resilience analysis. Transportation Research: Part E, 125, 285–307.

IMS Health (2019). Arzneimittel - Meistverkaufte Präparate in Deutschland 2017. Available at: https://de.statista.com/statistik/daten/studie/548361/umfrage/top-20-der-meistverkauften-arzneimittel-in-deutschland/ (Accessed: 5 November 2022).

Ivanov, D. (2020). Predicting the impacts of epidemic outbreaks on global supply chains: A simulation-based analysis on the coronavirus outbreak (COVID-19/SARS-CoV-2) case. Transportation Research Part E: Logistics and Transportation Review, 136, 101922.

Ivanov, D. (2021a). Introduction to Supply Chain Resilience. Springer Nature.

Ivanov, D. (2021b). Supply chain viability and the COVID-19 pandemic: A conceptual and formal generalisation of four major adaptation strategies. International Journal of Production Research, 59(12), 3535–3552.

Ivanov, D. (2022). Viable supply chain model: Integrating agility, resilience and sustainability perspectives—lessons from and thinking beyond the COVID-19 pandemic. Annals of Operations Research, 319, 1411–1431.

Ivanov, D. (2023a). Two views of supply chain resilience. International Journal of Production Research. https://doi.org/10.1080/00207543.2023.2253328.

Ivanov, D. (2023b). Intelligent Digital Twin (iDT) for supply chain Stress-Testing, resilience, and viability. International Journal of Production Economics, 263, 108938.

Ivanov, D., & Dolgui, A. (2022). The shortage economy and its implications for supply chain and operations management. International Journal of Production Research, 60(24), 7141–7154.

Ivanov, D., & Keskin, B. (2023). Post-pandemic adaptation and development of supply chain viability theory. Omega, 116, 102806.

Ivanov, D., Dolgui, A., Blackhurst, J., & Choi, T. M. (2023). Toward supply chain viability theory: From lessons learned through COVID-19 pandemic to viable ecosystems. International Journal of Production Research, 61(8), 2402–2415.

Jackson, I., Saenz, M., & Ivanov, D. (2023). From natural language to simulations: Applying AI to automate simulation modelling of logistics systems. International Journal of Production Research. https://doi.org/10.1080/00207543.2023.2276811.

Li, G., Liu, M., Bian, Y., & Sethi, S. (2020). Guarding against disruption risk by contracting under Information Asymmetry. Decision Sciences, 51(6), 1521–1559.

Li, G., Liu, M., & Zheng, H. (2022a). Subsidization or diversification? Mitigating supply disruption with manufacturer information sharing. Omega, 112, 102670.

Li, G., Li, X., & Liu, M. (2022b). Inducing Supplier Backup via Manufacturer Information Sharing under Supply disruption risk (p. 108914). Computers & Industrial Engineering.

Li, S., He, Y., Huang, H., Lin, J., & Ivanov, D. (2023a). Supply chain hoarding and contingent sourcing strategies in anticipation of price hikes and product shortages. IISE Transactions. https://doi.org/10.1080/24725854.2023.2184515.

Li, M., Sodhi, M., Tang, C., & Yu, J. (2023b). Preparedness with a system integrating inventory, capacity, and capability for future pandemics and other disasters. Production and Operations Management, 32(2), 564–583.

Lücker, F., Chopra, S., & Seifert, R. W. (2021). Mitigating product shortages due to disruptions in multi-stage supply chains. Production and Operations Management, 30(4), 941–964.

Maccarthy, B., & Ivanov, D. (2022a). Digital supply chain. Elsevier.

MacCarthy, B., & Ivanov, D. (2022b). The digital supply Chain—emergence, concepts, definitions, and technologies. In B. MacCarthy, & D. Ivanov (Eds.), The Digital Supply Chain (pp. 3–14). Elsevier.

MacCarthy, B., Ahmed, W., & Demirel, G. (2022). Mapping the supply chain: Why, what and how? International Journal of Production Economics, 108688.

Malviya, R. (2022). ‘Impact on Pharmaceutical Industry due to Sudden Pandemic Attack (COVID-19)’, 3(2). https://doi.org/10.2174/2666796702666211122152928.

Miller, F. A., et al. (2021). Vulnerability of the medical product supply chain: The wake-up call of COVID-19. BMJ Quality & Safety, 30(4), 331–335. https://doi.org/10.1136/bmjqs-2020-012133.

Paul, S. K., & Chowdhury, P. (2021). A production recovery plan in manufacturing supply chains for a high-demand item during COVID-19. International Journal of Physical Distribution & Logistics Management, 51(2), 104–125.

Paul, S. K., Chowdhury, P., Chakrabortty, R. K., et al. (2022). A mathematical model for managing the multi-dimensional impacts of the COVID-19 pandemic in supply chain of a high-demand item. Annals of Operations Research. https://doi.org/10.1007/s10479-022-04650-2.

Ramani, V., Ghosh, D., & Sodhi, M. (2022). Understanding systemic disruption from the Covid-19-induced semiconductor shortage for the auto industry. Omega, 113, 102720.

Rozhkov, M., Ivanov, D., Blackhurst, J., & Nair, A. (2022). Adapting supply chain operations in anticipation of and during the COVID-19 pandemic. Omega, 110, 102635.

Sawik, T. (2023). A stochastic optimization Approach to maintain Supply Chain viability under the Ripple Effect. International Journal of Production Research, 61(8), 2452–2469.

Shen, Z. M., & Sun, Y. (2023). Strengthening supply chain resilience during COVID-19: A case study of JD.com. Journal of Operations Management, 69(3), 359–383.

Singh, S., Kumar, R., Panchal, R., & Tiwari, M. K. (2021). Impact of COVID-19 on logistics systems and disruptions in food supply chain. Int Journal of Production Research, 59(7), 1993–2008.

Sodhi, M. S., Tang, C. S., & Willenson, E. T. (2023). Research opportunities in preparing supply chains of essential goods for future pandemics. International Journal of Production Research, 61(8), 2416–2431.

Yousefi Sarmad, M., Pishvaee, M. S., Jahani, H., et al. (2023). Integrated planning for a global pharmaceutical supply chain: An ambidexterity perspective. Annals of Operations Research. https://doi.org/10.1007/s10479-023-05554-5.

Zhang, G., MacCarthy, B., & Ivanov, D. (2022). The cloud, platforms, and digital twins—enablers of the digital supply chain. In B. MacCarthy, & D. Ivanov (Eds.), The Digital Supply Chain (pp. 77–91). Elsevier.

Acknowledgements

We thank the guest editor and two anonymous reviewers whose comments helped us to improve the manuscript immensely.

Funding

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

No conflict of interest has to be declared.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Schleifenheimer, M., Ivanov, D. Pharmaceutical retail supply chain responses to the COVID-19 pandemic. Ann Oper Res (2024). https://doi.org/10.1007/s10479-024-05866-0

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10479-024-05866-0