Abstract

Given that the probability of extreme weather has been dramatically increasing, this study contributes to the existing literature by bridging the relation between weather risks and global commodity prices with a secondary dataset (e.g., weather risks of Canada and the United States, agricultural raw materials price, gold price, and crude oil price). The results from the vector autoregression model and impulse response functions show that rising weather risks increase the price of agricultural raw materials and gold. However, the negative impact of weather risks on the crude oil price is found. Finally, the paper discusses the findings' potential implications (e.g., developing decarbonised supply chains) for decreasing weather risks' effects on commodity market uncertainties.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The unprecedented extreme weather events such as droughts, floods, tropical storms, and heatwaves have caused significant economic losses, for example, floods in Pakistan and Malaysia, drought in China, heatwaves in Europe, tropical cyclones in the Philippines, and hurricanes in the US. Additionally, soybeans, meat, poultry, and oil products are major commodities in the exporting basket of the US. Since the US is an essential player in the global commodity market, it is reasonable to suspect the transmission from extreme weather risk shocks to the price of commodities. The main objective of this study is to examine the impacts of weather risk shock in the US and Canada on commodity prices using a vector autoregression (VAR) model and impulse response functions. Beyond that, we try to determine the differences in the responses of agricultural raw materials, oil, and gold prices.

Existing literature has widely discussed the impacts of uncertainties on commodity price volatility (Bakas & Triantafyllou, 2018 and 2020; Baker et al., 2020; Gozgor, 2019; Gozgor & Kablamaci, 2014; Gozgor & Memis, 2015; Prokopczuk et al., 2019; Van Robays, 2016; Yang et al., 2022). For instance, Bakas and Triantafyllou (2018) document that increasing macroeconomic uncertainty positively affects the volatility of metals, agricultural and energy commodities. In a further study, Bakas and Triantafyllou (2020) empirically examine the influences of economic uncertainty related to pandemics on commodity volatility. Their generalised impulse response analyses show that pandemic uncertainties negatively affect oil and gold price volatilities. In addition, Baker et al. (2020) developed a novel index called Covid-induced economic uncertainty, which enormously pull-downs the real gross domestic product (GDP) in the United States.

Due to more extreme weather events in recent decades, rising studies have attempted to examine the macroeconomic consequences of weather shocks and climate change (Bonato et al., 2023; Burke & Emerick, 2016; Dell et al., 2012, 2014; Hong et al., 2020; Kim et al., 2021; Kurachi et al., 2022). For instance, Guo et al. (2022) use a time-varying VAR model to investigate the nonlinear impacts of climate policy uncertainty, financial speculation, economic activity, and the US dollar exchange rate on crude oil and natural gas prices. Their findings suggest that various shocks have different impacts on energy prices. Specifically, the effects of climate policy uncertainty shocks on energy prices are time-varying and change from positive to negative over time. However, financial speculation shocks make opposite impacts. The effects of economic activity shocks are mainly positive, opposite to the responses of US dollar exchange rate shocks. Zhang et al. (2022) check the barriers to supply chain decarbonisation. They suggest four common barriers impeding carbon neutrality's progress: significant upfront investment costs, lack of awareness, lack of expertise, and resistant mindset.

Karanasos et al. (2022) utilise the macro-augmented asymmetric power HEAVY model to estimate the impacts of US uncertainty and infectious disease news on share prices. Their findings demonstrate that rising US policy uncertainty would increase the leverage effects. Finally, the vital role of both financial and health crisis events is confirmed in increasing markets' volatilities and turbulence. Zhao et al. (2023) assess the impacts of trade rule uncertainty (TRU) on the commodity market. Their analyses show that a sudden increase in TRU instantaneously impacts energy and agricultural prices. Their study provides a new measurement of uncertainty and quantifies the effects of TRU shocks on the real economy. Gupta et al. (2022) propose a novel analytical framework using artificial intelligence and cloud-based collaborative platforms to effectively respond to natural disasters and unpredictable events. Their findings indicate such a system is more resilient by inputting and receiving data to the combined platforms.

However, no consensus exists in this field. The mixed findings are partly attributed to the measurement quality of weather disruptions and climate changes. Kim et al. (2021) suggest that self-statistics of direct disaster damage may be underestimated due to endogeneity and quality concerns. Beyond that, different research methods are also contributors to mixed empirical results.

In this study, we employ a vector autoregressive (VAR) model to study the effects of extreme weather on commodity prices. Following Kim et al. (2021), we use a novel official indicator for severe weather, the United States (US) Continental Actuaries Climate Index (ACI). The index is built upon six sub-indices: drought, rainfall, wind speed, sea level, and temperature. Additionally, further considerations focus on the responses of sub-indices of commodities, including agricultural raw materials, oil, food, and gold. The identified weather shocks are built upon a recursive identification strategy, which could explain causal evidence because of the exogeneity of the ACI, which is not dependent upon the local economic conditions and political environment. ACI also focuses on extremes rather than the average of changing climatic conditions (Kim et al., 2021).

We contribute to the existing literature in the following aspects. First, we find that the response of broad commodity prices to unanticipated weather shocks is negative and remains statistically significant for over one year after the initial shock. These results shed light on the impacts of weather disruptions associated with declining aggregate commodity demand, thus decreasing broad commodity prices. In addition, the adverse effects of growing weather risks are first documented in the responses of oil and gold prices. This evidence is similar to Bakas and Triantafyllou's (2020) results, which focus on pandemics' uncertainty shocks. It is natural to suspect that economic downturns decrease oil demand, further declining oil prices. Finally, rising weather risks drive up the cost of agricultural raw materials due to their negative impacts on the supply side of the commodity market. Not surprisingly, the positive response of gold price given rising weather risks signifies gold's safe-haven asset against weather uncertainties.

This study focuses on two critical challenges the manufacturing industry faces in its pursuit of decarbonisation: weather risks and commodity market uncertainties. Weather risks encompass extreme weather events, climate change, and increasingly unpredictable weather patterns. These risks can have significant consequences for operational efficiency, supply chain management, and the overall decarbonisation efforts of manufacturing companies. Therefore, understanding and addressing these challenges is essential to achieving the study's objectives, which include exploring how operational research techniques can help mitigate weather-related disruptions and promote decarbonisation.

Commodity market uncertainties, such as price volatility, supply and demand imbalances, geopolitical tensions, and regulatory changes, also pose considerable challenges to the manufacturing industry. These uncertainties can influence resource allocation, production planning, and investment decisions, potentially hindering decarbonisation progress. By examining the role of operational research techniques in navigating these uncertainties, this study aims to provide valuable insights into how manufacturing companies can overcome these obstacles and achieve their decarbonisation goals.

The rationale for this study lies in the importance of understanding and addressing weather risks and commodity market uncertainties within the context of decarbonisation in the manufacturing industry. Furthermore, operational research techniques have the potential to offer innovative solutions for managing these challenges and guiding manufacturing companies toward a more sustainable future. This study's objectives are thus significant in the broader context of decarbonisation and operational research, as they seek to contribute to developing effective strategies for achieving a greener manufacturing industry.

While previous studies have examined the determinants of commodity prices, our study fills the gap by explicitly examining the impact of weather risks on commodity prices using a novel weather risk index, the US Continental ACI.

Our paper mainly contributes to the rising empirical literature on the impact of disruptive outbreaks, such as the COVID-19 pandemic, on market economies. This is the first paper in the literature to show the effects of weather risks and disasters on commodity markets' uncertainty. Furthermore, we suggest that promoting organisations' capabilities to develop decarbonised supply chains can be a potential solution to mitigate the spillover effects of weather risks on commodity market prices.

The rest of the paper is organised as follows. Section 2 explains the dataset and the research methodology. Section 3 discusses the baseline results and the robustness checks. Section 4 discusses the ACI index in detail. Section 5 discusses the implications of this study and its limitations. Section 6 concludes.

2 Dataset and research methodology

2.1 Dataset

The ACI tracks the frequency of extreme weather and changes in sea levels, which the American Academy of Actuaries collaboratively proposes, the Canadian Institute of Actuaries, Casualty Actuarial Society, and Society of Actuaries. The ACI and its component indices are secondary datasets from the website: https://actuariesclimateindex.org/home/. The ACI incorporates six aspects: high temperature, low temperature, heavy precipitation, drought, high wind, and sea level. The index is computed by using the following formulae,

where \(ACI_{t}\), \(SL_{t}\), \(D_{t}\), \(HW_{t}\), \(HR_{t}\), \(HT_{t}\) and \(LT_{t}\) are the combined US Continental Actuaries Climate Index, seal level index, drought index, high wind index, heavy rain index, high-temperature index, and low-temperature index. Obviously, \(ACI_{t}\) this is the average of six component indices. With more details, \(SL_{t}\) is measured monthly through tide gauges at 76 stations. \(D_{t}\) is the maximum number of consecutive dry days. \(HW_{t}\) is the index of high wind, represented by the frequency of daily mean wind speeds above the 90th percentile. \(HR_{t}\) is the heavy rain index measured by the maximum 5-day rainfall in a particular month. \(HT_{t}\) and \(LT_{t}\) are high and low-temperature indices, which are the frequency of daily temperatures above the 90th and below the 10th percentile.Footnote 1 Weather risks continuously rose after 1990, which signifies the importance of current concerns about climate change. Figure 1 plots the ACI for the continental United States and its sub-indices.

The US Continental Actuaries Climate Index. Note: Data available at the website: https://actuariesclimateindex.org/home/

To evaluate the performance of the commodity market, we consider the overall commodity index and its components, including the agricultural raw materials index, oil price, and gold price. These datasets are drawn from the Primary Commodity Prices database operated by the International Monetary Fund, available at the website: https://www.imf.org/en/Research/commodity-prices. Finally, we plot the all-time series in Fig. 2.

Commodity price index. Note: Data available at https://www.imf.org/en/Research/commodity-prices

We compute the monthly world industrial production index (WIP) year-on-year returns to proxy global aggregate demand. The WIP is measured by Hamilton (2021), who considers the industrial production of OECD and six emerging economies. The WIP index is available from the website: https://econweb.ucsd.edu/~jhamilton/. Following Gozgor et al. (2022), the geopolitical risk index proposed by Caldara and Iacoviello (2022) captures potential geopolitical threats affecting the commodity market. The GPR index is found on the website: https://www.matteoiacoviello.com/gpr.htm. Finally, due to the outbreak of the COVID-19 pandemic, we utilise the infectious disease equity market volatility indices (Baker et al., 2020) to represent risks related to pandemics and other disease outbreaks around the globe. The infectious disease equity market volatility indices are presented on the website: https://www.policyuncertainty.com/. We plot all variables in Fig. 3.Footnote 2

Finally, Table A1 outlines the details of the dataset used in this study, which covers the data descriptions, sources, and periods.

3 Research methodology

We consider the following structural vector autoregression (SVAR) model with five variables:

where \(y_{t} = [{\mathbf{ACI}}_{t} ,{\mathbf{IDEMV}}_{t} ,{\mathbf{GPR}}_{t} ,{\mathbf{WIP}}_{t} ,{\mathbf{VOL}}_{t} ]^{\prime}\), where \({\mathbf{ACI}}_{t}\), \({\mathbf{IDEMV}}_{t}\), \({\mathbf{GPR}}_{t}\) \({\mathbf{WIP}}_{t}\) and \({\mathbf{VOL}}_{t}\) denote the US Continental ACI, infectious disease equity market volatility, geopolitical risks, world industrial production growth, and commodity volatility, respectively. \({\mathbf{c}}\) is the constant term. \(A_{0}\), \(B_{1} , \ldots ,B_{p}\) are the structural coefficients, and \(\varepsilon_{t}\) are the orthonormal unobserved structural innovations with \({\mathbf{\rm E}}(\varepsilon_{t} \varepsilon_{t}^{\prime } ) = I_{n}\) where \(n\) is the number of endogenous variables. It is natural to bridge the relation between SVAR specification and reduced-form VAR by assuming \({\mathbf{A}}_{0}\) is invertible. Therefore, we have,

where \({\mathbf{C}} = {\mathbf{A}}_{0}^{ - 1} {\mathbf{c}}\), \({\mathbf{H}}_{i} = {\mathbf{A}}_{0}^{ - 1} {\mathbf{B}}_{i}\), and the reduced form error is given by \(\xi_{t} = {\mathbf{A}}_{0}^{ - 1} {{\varvec{\Gamma}}}\varepsilon_{t} = {\mathbf{Q}}\varepsilon_{t}\). Furthermore, we have \({\mathbf{E}}(\xi_{t} \xi_{t}^{\prime } ) = {{\varvec{\Sigma}}}_{\xi } = {\mathbf{A}}_{0}^{ - 1} {\mathbf{\Gamma \Gamma }}^{\prime } {\mathbf{A}}_{0}^{ - 1\prime } = {\mathbf{QQ}}^{\prime }\). We need to estimate \({\mathbf{A}}_{0}\) which is assumed to be a lower triangular matrix under a recursive identification scheme with Cholesky decomposition. Since we are interested in weather shocks, only the coefficients of the first column \({\mathbf{Q}}\) must be identified. It is important to note that the reverse causality problem in VAR is prevalent in recent studies. Many studies solve this problem using sign restrictions and proxy SVAR (Cai et al., 2022). The reverse causality problem identified by Mertens and Ravn (2012) and Stock and Watson (2012) has been considered in our model. According to Kim et al. (2021), the ACI is independent of local economic development and political system and thus can be modelled as an exogenous variable.

4 Empirical results

4.1 Baseline results

We present the impulse response results of commodity volatility in this section. The main research question in this study is the effects of weather risks. Since weather risks are exogenous and independent of economic and financial markets, geopolitical risks, and pandemic events, we order the ACI at first in the VAR. The ordering of other variables is not pivotal. The moving block bootstrap method Brüggemann et al. (2016) proposed generates 68% confidence intervals.

We incorporate three lags into the baseline model. First, other results of robustness check some studies like Bakas and Triantafyllou (2020) impose restrictions on the unit root or cointegrated relation among the variables; however, Sims et al. (1990) suggest that impulse response analyses do not necessarily require such restrictions. At least, we ensure the estimated VAR is stationary, which is tested by the method proposed by Lütkepohl (2013).Footnote 3 Finally, we provide the related results in Fig. 4.

Since weather shocks are purely exogenous, we can interpret the results with causal evidence and avoid the reverse causality problem. All variables are transformed to logarithms before entering into the model except for world industrial production growth, represented by log difference. The model is estimated from January 2003 to August 2021 due to the unavailability of broad commodity prices. The results can be interpreted as a 1% increase in weather risks.

According to Fig. 4, a positive shock in ACI (i.e., a 1% increase in ACI) reduces total commodity price by about − 0.03%% six months after the shock. Beyond that, the oil price response is also negative, with a maximum impact of 0.07% four months after the initial shock. Such t impacts maintain significance for approximately a year after the immediate shock. In addition, the median impulse responses of agricultural raw materials and gold prices are positive and significant. The peak value in agricultural raw materials is nearly 0.01% ten months after the initial shock. Likewise, the pattern of gold peaks at 0.015% in the first six months following an immediate shock. Finally, the price of agricultural raw materials increases after an immediate weather shock, with a maximum impact of around 0.08% and 0.04%, respectively. Similar findings are shown by Bakas and Triantafyllou (2020). They note that pandemic uncertainties raise gold volatility but decrease oil price volatility enormously.

Our analyses are the first attempt to reveal the opposite effects of weather shocks on oil and gold prices. The baseline model controls the impact of aggregate demand. Increasing weather risks pull down aggregate demand, which indirectly decreases oil prices. However, growing weather risks threaten the supply of agricultural raw materials, causing the price to elevate. The response to world industrial production growth is also significantly negative after the initial shock. In addition, gold can be treated as a hedge against a sudden increase in weather risks.

4.2 Robustness checks

We also check the robustness of the main results with different model specifications, including (a) selection of lags order, (b) excluding observations after December 2019 when the COVID-19 pandemic outbreaks, (c) other measurements of weather risks in the US and Canada, (d) re-estimating a bivariate VAR model with only the ACI and commodity volatility. The impulse responses based on the above changes in model specifications are available in Fig. 5. The responses of other sub-indices of commodities are not reported to save space, which is available upon request. Overall, the results of alternative VARs are consistent with the baseline results.

5 Further results from the ACI component index

As we have illustrated, the combined ACI is the average of six components: sea level, drought, heavy rain, high wind, and high and low temperature. Thus, we examine the response of commodity prices given a sudden increase in each component index. We keep the model specifications in the baseline model and replace the ACI with relevant component climate indices.

5.1 Sea level index

The seal level index is a monthly measurement monthly collected by tide gauges located at 76 stations. These tide gauges measure the total effects of land movements and sea level changes on coastal shorelines. The results are reported in Fig. 6. The impulse response results are obtained given a 1% increase in the sea level index. The responses of the total commodity price index and crude oil price are significantly negative. This indicates that as sea level risks increase, commodity and oil prices will decrease. However, the gold price will increase as seal level risks rise. Additionally, the response of the agricultural raw materials price index is insignificant, given a sudden increase in the sea level index.

5.2 Drought index

Turning to the results of the drought index shown in Fig. 7, the responses of the commodity price index, agricultural raw materials price index, and oil price index are positive and significant. As the drought risks increase, commodity production will decrease, and prices will rise accordingly. The maximum impacts on commodity, agricultural raw materials, and oil prices are about 0.55%, 0.35%, and 0.65%, respectively. The gold price also positively responds to the increasing drought risk. However, the impact is only valid in the short run.

5.3 Extreme precipitation index

This section presents the impulse responses of commodity prices given a sudden increase in the extreme precipitation index. The results are reported in Fig. 8. We find that increasing risks of heavy rains would decrease commodity prices, agricultural raw materials, and oil prices. However, its impacts on gold prices are insignificant and positive.

5.4 Temperature index

Temperature is another crucial factor in constructing the ACI. Specifically, they divide the temperature index into warm temperature index (frequency of daily temperatures above the 90th percentile) and cool temperature index (frequency of daily temperatures below the 10th percentile). The results are reported in Figs. 9 and 10, respectively. Total commodity and oil prices positively respond to the sudden shifts in the warm temperature index. However, the response of gold price is insignificant. In contrast, a sudden increase in the warm temperature index would decrease commodity and oil prices. Therefore, the gold price positively reacts to the unexpected rise in the warm temperature index.

5.5 Extreme wind index

The impulse response functions of commodity prices given a sudden increase in high wind index are shown in Fig. 11. The total commodity and agricultural raw materials prices positively respond to the increasing high wind index. However, the oil and gold prices are insignificant when there is an unanticipated increase in the high wind index.

6 Discussions and implications

6.1 Discussions of the results

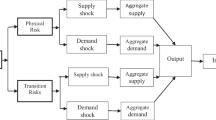

Our research aimed to investigate the impact of growing weather risks on commodity prices using the US Continental ACI. Our findings prove that increasing weather risks decrease broad commodity and oil prices. In contrast, agricultural raw materials and gold prices increase. Our results also indicate that the main transmission channels from weather risks to commodity prices (such as agricultural raw materials and oil) come via aggregate demand and supply. In addition, gold is found to be beneficial for hedging weather risks.

This study examined the impact of growing weather risks on commodity prices using the ACI as a novel measure of weather risks. Our findings indicate that weather risks significantly affect commodity prices, particularly agricultural raw materials and oil. These results are consistent with prior research that has also identified the impact of climate change and weather-related risks on agrarian productivity (Burke & Emerick, 2016) and oil prices (Hong et al., 2020). In addition, our research identified the main transmission channels through which weather risks impact commodity prices, such as aggregate demand and supply. This finding contributes to the literature by providing a more comprehensive understanding of the mechanisms through which weather risks affect commodity markets, which has been an area of limited research.

Furthermore, our analysis also revealed that gold is a potential hedge against weather risks. This result aligns with studies showing gold as a safe haven during economic uncertainty and geopolitical risks (Baur & Lucey, 2010). However, our study extends the existing literature by demonstrating that gold can hedge against weather-related risks, a novel contribution to the field.

6.2 Implications for theory

The implications of our study are significant for both theory and practice. From a theoretical perspective, our research expands the literature on the impact of weather risks on commodity markets, which has not been widely explored. Moreover, our findings contribute to the growing literature on the effects of climate change on the global economy (Akter & Wamba, 2019; Azadi et al., 2023; Dubey et al., 2019).

6.3 Implications for practice

From a practical perspective, our results are helpful for managers working in operations management or decarbonised supply chains, weather risks, commodity markets uncertainties, and disaster management. Our findings suggest that companies operating in these sectors should pay close attention to weather risks, which can significantly impact commodity prices. In particular, companies may consider using gold as a hedge against sudden increases in weather risks. Additionally, policymakers may use our research to inform their decisions on managing weather risks and their impact on commodity markets.

Future research could extend the analysis to a longer period to test the robustness of our findings. Moreover, our study only considers the impact of weather risks on commodity prices, and future research could explore other potential effects, such as on trade flows or production levels. Another limitation of the econometric methodology used in this study is that it assumes a linear relationship between the variables, which may not always hold in reality. Additionally, the results are based on historical data and may not necessarily apply to future events or unforeseen circumstances. Other potential limitations include the choice of variables and excluding other relevant factors that may affect commodity prices, such as geopolitical events, technological advancements, and changes in global trade policies.

The results may not be generalisable to other regions or countries. The data used in this study was limited to Canada and the United States due to data availability and the focus on North American decarbonised supply chains. However, the relationship between weather risks and commodity prices may differ in other regions or countries with different economic structures and climate patterns. Therefore, caution should be taken when applying the findings of this study to other areas or countries. Future research can expand the analysis to include other regions and countries to increase the external validity of the results.

7 Conclusion

This paper examines the impact of growing weather risks on commodity prices. Using a novel weather risk index, the US Continental ACI, our structural VAR analyses show that rising weather risks decrease broad commodity and oil prices and increase agricultural raw materials and gold prices. The main transmission channel from weather risks to commodity prices (such as agricultural raw materials and oil) comes via aggregate demand and supply. Gold is beneficial for hedging weather risks.

In conclusion, this study investigates the effects of weather risks on commodity prices using a novel weather risk index, the US Continental ACI, and a structural VAR methodology. The findings indicate that an increase in weather risks leads to a decrease in broad commodity and oil prices but an increase in agricultural raw materials and gold prices. The results also suggest weather risks impact commodity prices through aggregate demand and supply channels. Gold is found to be beneficial for hedging against weather risks. This study contributes to the literature on commodity price volatility by providing new insights into the effects of weather risks, a previously unexplored factor. The findings have important implications for policymakers, commodity traders, and investors, who can use the results to better understand the impact of weather risks on commodity markets.

However, this study also has some limitations. First, the data is limited to Canada and the United States, which may affect the generalizability of the results to other countries. Second, the methodology used in this study has limitations, such as potential omitted variable bias and endogeneity issues. Future research could explore the effects of weather risks on commodity prices in other regions and use alternative econometric methods to address these limitations. This study highlights the importance of considering weather risks in commodity markets and provides a foundation for future research.

Notes

For more definitions of each component, please refer to the appendix.

Table A1 in the appendix outlines the details of the dataset used in this study, which covers the data descriptions, sources, and periods.

References

Akter, S., & Wamba, S. F. (2019). Big data and disaster management: A systematic review and agenda for future research. Annals of Operations Research, 283, 939–959. https://doi.org/10.1007/s10479-017-2584-2

Azadi, M., Moghaddas, Z., Saen, R. F., Gunasekaran, A., Mangla, S. K., & Ishizaka, A. (2023). Using network data envelopment analysis to assess the sustainability and resilience of healthcare supply chains in response to the COVID-19 pandemic. Annals of Operations Research, 328, 107–150. https://doi.org/10.1007/s10479-022-05020-8

Bakas, D., & Triantafyllou, A. (2018). The impact of uncertainty shocks on the volatility of commodity prices. Journal of International Money and Finance, 87, 96–111. https://doi.org/10.1016/j.jimonfin.2018.06.001

Bakas, D., & Triantafyllou, A. (2020). Commodity price volatility and the economic uncertainty of pandemics. Economics Letters, 193, 109283. https://doi.org/10.1016/j.econlet.2020.109283

Baker, S.R., Bloom, N., Davis, S.J., & Terry, S.J. (2020). Covid-induced economic uncertainty. National Bureau of Economic Research (NBER) Working Paper, No. 26983. NBER.

Baur, D. G., & Lucey, B. M. (2010). Is gold a hedge or a safe haven? An analysis of stocks, bonds and gold. Financial Review, 45(2), 217–229. https://doi.org/10.1111/j.1540-6288.2010.00244.x

Bonato, M., Cepni, O., Gupta, R., & Pierdzioch, C. (2023). Climate risks and realised volatility of major commodity currency exchange rates. Journal of Financial Markets, 62, 100760. https://doi.org/10.1016/j.finmar.2022.100760

Brüggemann, R., Jentsch, C., & Trenkler, C. (2016). Inference in VARs with conditional heteroskedasticity of unknown form. Journal of Econometrics, 191(1), 69–85. https://doi.org/10.1016/j.jeconom.2015.10.004

Burke, M., & Emerick, K. (2016). Adaptation to climate change: Evidence from US agriculture. American: Economic Journal Economic Policy, 8(3), 106–140. https://doi.org/10.1257/pol.20130025

Cai, Y., Zhang, D., Chang, T., & Lee, C. C. (2022). Macroeconomic outcomes of OPEC and non-OPEC oil supply shocks in the euro area. Energy Economics, 109, 105975. https://doi.org/10.1016/j.eneco.2022.105975

Caldara, D., & Iacoviello, M. (2022). Measuring geopolitical risk. The American Economic Review, 112(4), 1194–1225. https://doi.org/10.1257/aer.20191823

Dell, M., Jones, B. F., & Olken, B. A. (2012). Temperature shocks and economic growth: Evidence from the last half century. American Economic Journal: Macroeconomics, 4(3), 66–95. https://doi.org/10.1257/mac.4.3.66

Dell, M., Jones, B. F., & Olken, B. A. (2014). What do we learn from the weather? The new climate-economy literature. Journal of Economic Literature, 52(3), 740–798. https://doi.org/10.1257/jel.52.3.740

Dubey, R., Gunasekaran, A., & Papadopoulos, T. (2019). Disaster relief operations: Past, present and future. Annals of Operations Research, 283, 1–8. https://doi.org/10.1007/s10479-019-03440-7

Gozgor, G. (2019). Effects of the agricultural commodity and the food price volatility on economic integration: An empirical assessment. Empirical Economics, 56(1), 173–202. https://doi.org/10.1007/s00181-017-1359-6

Gozgor, G., & Kablamaci, B. (2014). The linkage between oil and agricultural commodity prices in the light of the perceived global risk. Agricultural Economics-Czech, 60(7), 332–342. https://doi.org/10.17221/183/2013-agricecon

Gozgor, G., Lau, M. C. K., Zeng, Y., Yan, C., & Lin, Z. (2022). The impact of geopolitical risks on tourism supply in developing economies: The moderating role of social globalisation. Journal of Travel Research, 61(4), 872–886. https://doi.org/10.1177/00472875211004760

Gozgor, G., & Memis, C. (2015). Price volatility spillovers among agricultural commodity and crude oil markets: Evidence from the range-based estimator. Agricultural Economics-Czech, 61(5), 214–221. https://doi.org/10.17221/183/2013-agricecon

Guo, J., Long, S., & Luo, W. (2022). Nonlinear effects of climate policy uncertainty and financial speculation on the global prices of oil and gas. International Review of Financial Analysis, 83, 102286. https://doi.org/10.1016/j.irfa.2022.102286

Gupta, S., Modgil, S., Kumar, A., Sivarajah, U., & Irani, Z. (2022). Artificial intelligence and cloud-based Collaborative Platforms for Managing Disaster, extreme weather and emergency operations. International Journal of Production Economics, 254, 108642. https://doi.org/10.1016/j.ijpe.2022.108642

Hamilton, J. D. (2021). Measuring global economic activity. Journal of Applied Econometrics, 36(3), 293–303. https://doi.org/10.1002/jae.2740

Hong, H., Karolyi, G. A., & Scheinkman, J. A. (2020). Climate finance. Review of Financial Studies, 33(3), 1011–1023. https://doi.org/10.1093/rfs/hhz146

Karanasos, M., Yfanti, S., & Hunter, J. (2022). Emerging stock market volatility and economic fundamentals: The importance of US uncertainty spillovers, financial and health crises. Annals of Operations Research, 313(2), 1077–1116. https://doi.org/10.1007/s10479-021-04042-y

Kim, H. S., Matthes, C., & Phan, T. (2021). Extreme Weather and the Macroeconomy. Federal Reserve Bank of Richmond (FRBR) Working Paper, No. 21-14. FRBR.

Kurachi, Y., Morishima, H., Kawata, H., Shibata, R., Bunya, K., & Moteki, J. (2022). Challenges for Japan's economy in the decarbonization process. Bank of Japan Reports & Research Paper Series, June 2022, Bank of Japan.

Lütkepohl, H. (2013). Introduction to multiple time series analysis. Springer.

Mertens, K., & Ravn, M. O. (2012). Empirical evidence on the aggregate effects of anticipated and unanticipated US tax policy shocks. American Economic Journal: Economic Policy, 4(2), 145–181. https://doi.org/10.1257/pol.4.2.145

Prokopczuk, M., Stancu, A., & Symeonidis, L. (2019). The economic drivers of commodity market volatility. Journal of International Money and Finance, 98, 102063. https://doi.org/10.1016/j.jimonfin.2019.102063

Sims, C. A., Stock, J. H., & Watson, M. W. (1990). Inference in linear time series models with some unit roots. Econometrica, 58(1), 113–144. https://doi.org/10.2307/2938337

Stock, J. H., & Watson, M. W. (2012). Disentangling the Channels of the 2007–09 Recession. Brookings Papers on Economic Activity, Spring, 2012, 81–156. https://doi.org/10.1353/eca.2012.0005

Van Robays, I. (2016). Macroeconomic uncertainty and oil price volatility. Oxford Bulletin of Economics and Statistics, 78(5), 671–693. https://doi.org/10.1111/obes.12124

Yang, C., Niu, Z., & Gao, W. (2022). The time-varying effects of trade policy uncertainty and geopolitical risks shocks on the commodity market prices: Evidence from the TVP-VAR-SV approach. Resources Policy, 76, 102600. https://doi.org/10.1016/j.resourpol.2022.102600

Zhang, A., Alvi, M. F., Gong, Y., & Wang, J. X. (2022). Overcoming barriers to supply chain decarbonisation: Case studies of first movers. Resources, Conservation and Recycling, 186, 106536. https://doi.org/10.1016/j.resconrec.2022.106536

Zhao, X., Mi, X., Ma, C., & Peng, G. (2023). Measuring trade rule uncertainty and its impacts on the commodity market. Finance Research Letters, 52, 103384. https://doi.org/10.1016/j.frl.2022.103384

Funding

This study was not funded.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

All authors declare no conflict of interest.

Ethical approval

This article contains no studies with human participants or animals performed by authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Lau, C.K., Cai, Y. & Gozgor, G. How do weather risks in Canada and the United States affect global commodity prices? Implications for the decarbonisation process. Ann Oper Res (2023). https://doi.org/10.1007/s10479-023-05672-0

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10479-023-05672-0