Abstract

Despite the growing importance of operational risk, little is known about the impact of operational losses on the stock prices of energy firms. We fill this void by examining the market reaction of energy firms to a unique international sample of 452 operational loss events announced between 1996 and 2021, constructed using the SAS OpRisk Global Data database. Our results reveal negative and significant abnormal returns following the announcement of operational losses, while further analysis shows that results vary with event and/or announcing firm characteristics. Our evidence can help inform multiple stakeholders in the energy industry in the pricing, asset allocation, and risk management functions, as well as help regulators design effective mechanisms to mitigate the impact of operational losses on the economy and society.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In the last two decades, advances in science and technology have had a radical impact upon companies and the environment in which they operate. On the one hand, these advances have improved firms’ processes and systems, allowing them to become more efficient, and opened-up new markets and opportunities, thus creating new revenue streams and increasing shareholder value. On the other hand, these advances have inadvertently increased the complexity of business operations, whilst creating new risks and increasing existing exposures. As a result, and despite the adoption and development of more optimized risk management systems, firms are increasingly exposed to heavy losses caused by emerging risks.

Among these, operational risk has attracted renewed attention, in terms of identification, financing, and management, mainly due to its proven potential to inflict heavy, long-tail damages (Harmantzis, 2003; Xu et al., 2017). Affected companies span all sectors and industries, from financials, to technology and industrials, among others. Examples include, inter-alia, the Yahoo! data breach in 2013, the largest data breach in history, where three billion user accounts were compromised costing Yahoo! over $350 million, and the LIBOR fixing scandal, which came to light in 2012, costing involved financial institutions over $9 billion in fines.

Similarly, the energy sector has been no stranger to operational losses, experiencing a marked increase in the number of operational risk events and the volume of losses (Hirschberg et al., 2004; Sovacool, 2008). Operational risk is particularly important for energy companies as it often impacts productive assets that are prone to failures. More often than not, damages extend beyond economic losses and regularly lead to environmental damage, personal injury, or loss of human life, triggering severe reputational effects in the process. Examples such as the Santa Barbara oil spill in 1969, the Three Mile Island nuclear power plant accident in 1979, the Exxon Valdez tanker spill in 1989, the BP Deepwater Horizon oil spill in 2010, and the nuclear disaster in Japan in 2011, highlight the economic impact that operational risk events can have on the energy industry. More recent and prominent examples include the fire at the Texas LNG terminal in June 2022 that resulted in a sharp decline in US natural gas prices, and the explosions at Nord Stream 1—Russia’s largest gas pipeline to Europe—and at the parallel Nord Stream 2 pipeline in September 2022, which resulted into soaring gas prices in Europe and a considerable stock sell-off in the energy sector and beyond. As such, examining operational risk events and their impact on energy firms is of paramount importance for regulators, supervisors, executives, and the whole economy, given the energy sector’s sizeable imprint on the global economic map.

Despite the growing importance of operational risk, most empirical contributions on operational losses focus on the financial sector (see, e.g., Fiordelisi et al., 2014; Gillet et al., 2010; Sturm, 2013). As far as the energy sector is concerned, there has only been minor progress in quantifying the effects operational risk events. First, the limited number of studies that do cover energy firms are confined to the quantification of losses from energy accidents (Sovacool, 2008; Sovacool et al., 2015, 2016), thus not addressing the economic impact of such events. Second, prior contributions on the market reaction to operational losses in the energy sector are either confined to the analysis of single events, such as the Three Mile Island disaster in 1979 (Barrett et al., 1986; Bowen et al., 1983; Hill & Schneeweis, 1983), the Chernobyl disaster in 1986 (Fields & Janjigian, 1989; Kalra et al., 1993), and the Fukushima disaster in 2011 (Ferstl et al., 2012), or, when multiple events are examined, limited to the analysis of environmental incidents (Laplante & Lanoie, 1994), or energy accidents (Makino, 2016; Scholtens & Boersen, 2011).

While the second group of studies—which is more closely aligned with this paper—does shed some light on the wealth effects of energy accidents, there is still much that remains unexplored. In particular, the number of events analyzed in Laplante and Lanoie (1994) and Makino (2016) is too small and confined to specific event types to allow generalizations. Moreover, although Scholtens and Boersen (2011) investigate 209 accidents, their event study approach seeks to capture excess returns at the energy index level. Excess returns at the index level are less likely to occur, and if they do, it could be because they are associated with major accidents, impacting multiple index members simultaneously, and in the same fashion. Finally, as the extant literature has primarily focused on accidents, we have no understanding of the potential impact of the broader spectrum of operational risk types as identified in Basel II (BCBS, 2006).Footnote 1

We set out to fill these gaps, thereby contributing to the literature, by examining the market reaction of energy firms to a large and diverse sample of operational loss events. To this end, we use the SAS OpRisk Global Data database and construct a unique sample of 452 international operational loss events announced from 1996 to 2021 that span seven operational risk categories. We employ the event study methodology aiming to address the following two important questions: First, do operational losses affect the stock prices of announcing energy firms? Second, does the direction and/or magnitude of excess returns vary with event and/or announcing firm characteristics, such as the region of incident, the relative size of loss, the announcing firm’s industry group, or the type of operational loss?

In preview, our full-sample results reveal negative and significant abnormal returns in the days around the announcement of operational losses. Among the regions of operational risk events, we observe negative and significant abnormal returns for operational losses announced in Asia, Europe, Canada, and South America, whereas announced losses in all other regions produce insignificant excess returns. We also find that large relative losses produce negative and significant excess returns, whereas small relative losses have no impact on the stock prices of announcing firms. As for industry groups, while we observe negative and significant abnormal returns for the Electric and Gas industry group, operational losses announced by Oil and Gas companies lead to insignificant abnormal returns. Our analysis based on risk categories shows that only the Business Disruption and System Failures, the Client, Products and Business Practices, and the Damage to Physical Assets categories produce negative and significant negative excess returns. Overall, we find that operational losses have a negative impact on the stock prices of energy companies and that results vary with event and/or announcing firm characteristics.

Our evidence can be useful to energy companies to integrate operational risk management strategies into their sustainability and social responsibility efforts. By doing so, companies can prevent and minimize the negative impact of operational losses on their financial performance and stock prices. This alignment can also aid regulators in designing effective measures to mitigate the impact of these losses on the economy and society. The study’s insights can inform stakeholders in energy pricing, asset allocation, and risk management to achieve sustainable and socially responsible practices.

The remainder of the paper is organized as follows. The second Section summarizes the related literature, while Sect. 3 describes the sample collection, the filtering criteria, and presents our final dataset. Section 4 describes the methodology employed, and Sect. 5 discusses the empirical findings. Finally, Sect. 6 concludes.

2 Literature review

Our paper is related to prior research on the effects of operational risk events on the stock prices of announcing firms. Τhe majority of prior contributions have focused on the financial services industry. Some, for example, employ the event study methodology to examine the market reaction to operational loss announcements by banks and insurance companies in the US and Europe using either small (Cannas et al., 2009; Smith, 1992; Solakoglu et al., 2009; Walter, 2008) or large (Cummins et al., 2006; Fiordelisi et al., 2014; Gillet et al., 2010; Sturm, 2013) samples of operational losses. Their results in general indicate that operational loss events trigger negative and significant abnormal returns for announcing firms.

Beyond the financial sector, some studies investigate the effects of multiple operational risk events in the manufacturing industries in China (Bai et al., 2021; Lo et al., 2018). Whilst overall results point to a negative and significant market reaction, Bai et al. (2021) also find that the stock market reacts differently across operational risk types. Specifically, they find that man-made and disruption events are associated with a more negative market reaction compared to nature-caused and non-disruption operational risk events.

Despite the growing importance of operational risk in the energy sector, research is still very limited, and focused on energy accidents. Some, for example, provide a statistical analysis of energy accidents (Sovacool, 2008; Sovacool et al., 2015). In particular, Sovacool (2008) assesses the social and economic costs of 279 major energy accidents from 1907 to 2007 and concludes that they caused $41 billion in damages and 182,000 deaths. While the above study limits its technological coverage to fossil fuels, nuclear power, and hydroelectricity, Sovacool et al. (2015) assess the risk of energy accidents across the eight low-carbon technologies. They analyze 1,085 accidents over the period 1874–2014 and find that they resulted in about 210,000 fatalities and $345 billion in damages. They show that accidents in wind energy exhibit the highest frequency, hydroelectric accidents incur the most fatalities, whereas nuclear power accidents produce the highest losses.

Others look at the economic impact of operational losses by examining the stock market reaction to energy accidents. The first nuclear accident in United States was that of Three Mile Island in 1979, where two nuclear reactors operated by General Public Utilities (GPU) failed. Pertinent event studies are Hill and Schneeweis (1983), who use monthly stock price data, and Bowen et al. (1983), who use daily data. Both studies examine whether the accident affected the stock prices of GPU’s electric utility peers. Their findings show a significant impact for utilities with substantial nuclear capacity. In a somewhat different setting, Barret et al. (1986), report an increase in bond risk premia of electric utilities following the Three Mile Island disaster.

Another single event that has attracted research interest is that of Chernobyl in 1986, the largest nuclear accident ever occurred. Fields and Janjigian (1989) report a negative and significant impact on the equity prices of all US firms, which is more pronounced for nuclear-related companies. They also report no significant changes in systematic, total or market risk following the accident. Kalra et al. (1993) find negative abnormal returns for U.S. electric utilities that are more pronounced for companies with nuclear capacity between 10% and 20%. Along similar lines, Ferstl et al. (2012) investigate the impact of the 2011 Fukushima disaster on the daily stock prices of French, German, Japanese, and US nuclear utility and alternative energy firms. They find negative (positive) and significant abnormal returns for nuclear (alternative energy) companies in Japan, France, and Germany. A caveat in the above studies is that they do not account for the problem of cross-residual correlations among the stock returns of the various firms examined, which can lead to inefficient estimates. More importantly, these studies are confined to the examination of single events and, thus, do not offer a more granular understanding of the impact of operational losses.

A limited number of papers overcome this problem by looking into the market reaction to multiple operational risk events. For example, Laplante and Lanoie (1994), examine the impact of 47 diverse environmental incidents in Canada from 1982 to 1991 on the firms’ equity value and report insignificant abnormal returns. Makino (2016) focuses on multiple chemical accidents which occurred in Japan from 2005 to 2012. His results show negative and significant abnormal returns after severe energy accidents. Based on Sovacool’s (2008) database, Scholtens and Boersen (2011) examine the response of stock markets to 209 energy accidents and show that the stock market does not react significantly to these events. They suggest that financial markets view energy accidents as part of the business. It is worth noting that this study is confined to the examination of industry-wide wealth effects associated with energy accidents in the US.

3 Data

We draw our sample of operational losses from SAS OpRisk Global Data. The database provides monthly updates of operational risk data sourced from public information sources, such as full text articles, regulatory filings, and court proceedings.Footnote 2 The minimum threshold for inclusion of an event in OpRisk Global Data is $100,000 USD. Each reported loss is categorized based on Basel guidelines and contains 49 fields that include, inter-alia, the name of the announcing firm and/or its parent company, a description of the event, the country of incident, the event date, the amount of loss, and key company financials at the time of loss.

We begin our selection process using our last available update of the SAS database (April 2022). This version of the database contains an initial sample of 38,476 events that span various Basel business lines (based on BIS standards) such as retail/commercial banking, insurance, manufacturing, construction, trading, sales, mining, utility, etc. We then proceed to refine our sample in the following ways.

First, we select operational risk events announced by firms in the mining and utility sectors, as energy firms are classified as such under BIS standards. This leaves us with a dataset of 3233 operational loss events in the energy sector. SAS OpRisk Global Data only reports the month and the year in which a loss was announced and does not include any company identifier codes. As such, we perform extensive manual searches on financial and wire news databases, such as Bloomberg, Reuters, the Financial Times, etc., using the names of the companies (or their parent firm) and the events’ description. This process allows us to find the exact dates of operational loss announcements and manually assign a unique firm identifier, such as the Bloomberg Ticker and ISIN code, to each loss. This filtering process results into a matched sample of 770 events.

Second, we obtain stock market data from Bloomberg and require the announcing firms to be public, have available stock returns covering the period from 240 days before to 40 days after the event day, and trade more than 70% of the time. To avoid the possible distorting effects of confounding events, we require an interval of 281 days between multiple loss announcements by the same company. Therefore, we further discard 318 events, due to unavailable/incomplete stock market data and confounding events. At the end of the selection procedure, our final sample consists of 452 international operational risk events announced by energy companies between 1996 and 2021. In what follows, Tables 1, 2 and 3 and Fig. 1 provide summary statistics and are discussed in turn to offer a better understanding of the composition of our sample.

Gillet et al. (2010) and Sturm (2013) report significant variation in abnormal returns across different Basel operational risk categories for financial firms. Table 1 classifies the operational risk events according to the event risk category based on Basel guidelines. Column 1 reports the seven risk categories, namely Business Disruption and System Failures, Clients Products and Business Practices, Damage to Physical Assets, Employment Practices and Workplace Safety, Execution Delivery and Process Management, External Fraud, and Internal Fraud. Column 2 shows the number of events, column 3 the percentage, whereas columns 4 and 5 present the average loss amount (\(\overline{Loss}\)) and the announcing firms’ average assets (\(\overline{Assets} )\) respectively. Column 6 presents the mean relative size of loss (\(\overline{RSL}\)), defined as the average (across events) announced loss-to-total asset ratio. The majority of operational loss events in our sample fall under the Damage to Physical Assets (N = 190, 42% of the total) and have a \(\overline{RSL }\) of about 1.1% of total assets. The Clients, Products, and Business Practices category contains 158 events (35% of the total) with a \(\overline{RSL }\) of 2.6%. We notice that even though losses classified as External Fraud have the lowest frequency in our sample (N = 3), they exhibit the largest \(\overline{RSL}\) (3.5% of total assets). The Execution, Delivery and Process Management risk category comprises 34 events and has the smallest \(\overline{RSL}\) (0.1% of total assets), which is driven by the very low \(\overline{Loss}\) ($6M). Looking at the other categories, Business Disruption and System Failures contains 11 events, 33 events are associated with Employment Practices and Workplace Safety, whereas 23 events are reported in Internal Fraud risk category.

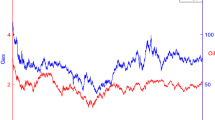

Τable 2 classifies the operational risk events by the region of incident (Panel A) and by net importers versus net exporters of energy (Panel B), while Fig. 1 graphically illustrates the data. We define the following regions: Africa, Asia, Australia, Europe (excluding United Kingdom), Canada, South America, United Kingdom, and United States. Using information from the SAS OpRisk Global Data SAS Database, we first organize the events by continent. However, due to significant cross-country variation in the number of events and, to better capture the variation across different regions, we expand our regional grouping as follows. Although the UK is part of Europe, it produces almost 50% of the events in Europe. To alleviate the potential influence of the UK, we analyze Europe excluding the UK. In a similar fashion, we examine Canada separately from North America, due to the observed high \(\overline{RSL}\) in Canada relative to the US.

Looking at Table 2 (Panel A) we notice that more than half of the sample of operational risk events are reported in the United States (268 of 452 events). It is important to note that although the United States presents the most events, it exhibits the lowest \( \overline{RSL}\) (0.4%). Taking a closer look at the fourth and fifth column for the United States, we notice that the \(\overline{Loss}\) is low ($276 M), whereas the \(\overline{Assets}\) are high ($93,881M). In comparison, Europe exhibits higher \(\overline{Assets}\) ($100,867M) and the highest \(\overline{RSL}\) (5.9%). As such, the lower \(\overline{RSL}\) in the United States is driven by the size of announced losses. This can either be the result of better risk management processes in US firms and/or better access to insurance markets—thus minimizing the magnitude of losses—or associated with a degree of underreporting of operational losses in Europe. Shifting our attention to other regions, the United Kingdom also exhibits a very low \(\overline{RSL}\) (0.1%), which is driven by the low \(\overline{Loss}\) ($13M), whereas Asia has a high \(\overline{RSL}\) (5.3%) with \( \overline{Loss}\) of $489M and \(\overline{Assets }\) of $72,220M. The least events are reported in Canada (12 events) with a \(\overline{RSL}\) of 1.8%. Africa contains 15 events, whereas Australia has 17 events with low \(\overline{RSL}\) of 0.7% and 0.5% respectively. Finally, 17 events occur in South America with a high \(\overline{RSL}\) (1.4%), driven by the very high \(\overline{Loss}\) ($1235M).

Panel B provides summary statistics of operational risk events by classifying regions as net importers or net exporters of energy. Net importers include Asia, Europe and the United Kingdom, whereas net exporters consist of Africa, Australia, Canada, South America and the United States. While companies across both classifications seem to be similar in terms of size with \(\overline{Assets }\) of about $92,000M, we observe marked differences in their operational losses. Net exporters experience the majority of operational loss events (N = 329, 73% of the total) and have a low \(\overline{RSL}\) of about 0.5%. In contrast, net importers experience a smaller number of events (N = 123, 27% of the total) but with a higher \(\overline{RSL}\) of 3.8%.

Operational risk events by region of incident. Note: This Figure presents the operational risk events by region of incident. The horizontal axis shows the region of incident, the left vertical axis shows the number of operational risk events and the right vertical axis shows the mean relative size of loss, which is defined as the average announced loss-to-total asset ratio

Table 3 presents the operational risk events per industry group, as classified using Bloomberg’s Industry Classification System (BICS). We classify firms into six groups; Electric, Oil and Gas, Gas, Mining, Oil and Gas Services and Other.Footnote 3 Looking at the distribution of loss events, we observe that the Oil & Gas group contains the highest number of events (185) and the largest \(\overline{RSL}\) (2.2%), followed by the Electric group (176 events) with a lower \(\overline{RSL}\) of 1.0%. Looking at the \(\overline{Assets}\), we notice that the \(\overline{Assets}\) of the Oil & Gas group ($150,365M) are more than double than the figure for the Electric group ($64,851M). Shifting our attention to the \(\overline{Loss}\) (Column 4), the Oil and Gas group exhibits a large \(\overline{Loss}\) ($646M), whereas the Electric has a low \(\overline{Loss}\) ($147M). The higher \(\overline{RSL}\) in the Oil and Gas group is driven by the size of announced losses. This can either be attributed to underreporting of operational losses in the Electric group, or to the sheer scale of companies in the Oil and Gas group which amplifies losses, should they occur. As for the remaining groups, 35 events are associated with the Mining industry group with \(\overline{RSL} \) of 1.6%, 16 relate to firms within the Oil and Gas Services (\(\overline{RSL}\) of 0.6%), and 15 events fall under the Gas industry group, exhibiting the lowest \(\overline{RSL}\) (0.5%) and a low \( \overline{Loss}\) ($60M). Finally, 25 operational loss events are reported by firms in the Other industry group, which exhibits the highest \( \overline{Loss}\) ($712M), but a low \(\overline{Assets}\) ($30,569M) and a \(\overline{RSL}\) of 1.3%.

4 Methodology

We employ the event study methodology (Brown and Warner, 1985) to analyze the impact of operational losses on the stock prices of announcing firms. The event study methodology is a well-established approach and is often used to evaluate the impact of an event on security prices in a particular time interval. It involves the identification of an equity return generating process and the use of two clearly defined periods i.e. the estimation, and the event study periods, (or windows) respectively. The estimation window is used to compute parameters and variances-covariances prior to the event window. We use an estimation window of 200 trading days (− 240 to − 41 days relative to the announcement), which predates the event window by approximately one trading year. We then forecast errors over a predetermined event window. The latter is a period surrounding the event day; our specification allows us to calculate the excess (abnormal) returns, defined as the difference between actual and expected returns, from day (− 40) to day (+ 40).Footnote 4 We define day zero (0) as the earliest day that the news about the operational risk events are disseminated to the market.

We estimate abnormal returns (\(AR\)) using the single index market model.Footnote 5 Our specification can be represented mathematically as follows:

where \(AR_{i,t}\), \(R_{i,t}\), and \(E\left( {R_{i,t} } \right)\) in Eq. (1) represent the abnormal return, actual return, and expected return of company \(i\) at time \(t\), respectively. In Eq. (2), \(R_{m,t}\) is the return on the MSCI World Energy Sector Index,Footnote 6 whereas \(\hat{\alpha }\) and \(\hat{\beta }\) are parameters to be estimated. In Eq. (3) \(AAR\) is the average abnormal return which is calculated by aggregating abnormal returns (\(AR\)) of individual firms and then dividing it with the number of events in our sample. In Eq. (4) \(CAAR\) is the cumulative average abnormal return, i.e., the sum of the \(AAR\) over predetermined intervals within our event window. To determine the statistical significance of excess returns, we apply the t-test as proposed by Brown and Warner (1980), by dividing the cross-sectional \(AAR\) with the time series estimate of its standard deviation.Footnote 7

5 Empirical results

Table 4 presents the results for the full sample of operational risk events (N = 452) across several event windows surrounding the event day. To conserve space and to allow comparisons with pertinent work, we report selected event windows closer to the event day.Footnote 8 The overall results show that the cumulative average abnormal returns (CAAR) are negative across all event windows within the (− 2, + 2) 5-day period, which suggests markets on average react negatively to operational loss announcements. In contrast to Scholtens and Boersen (2011), our results do not support the notion that operational loss events in the energy sector are considered as part of the business by financial markets.

Taking a closer look at the results, whilst the CAAR are negative and significant in the event windows around and after the event day, no statistical significance can be observed on the event day itself. In particular, both symmetrical windows (− 2, + 2) and (− 1, + 1) exhibit negative and significant CAAR of − 0.70% and − 0.44% respectively. Given that operational loss events could not have been anticipated by markets, the results in these windows seem to be affected by the post event days. Indeed both the 2-day (0, + 1) and the 3-day (0, + 2) post-event windows exhibit negative and significant CAAR of − 0.35% and − 0.46%, respectively; this implies there is a short delay in stock price adjustment, perhaps due to markets re-pricing the announcing firms’ shares whilst absorbing evolving news on the events.Footnote 9 Looking at the z-stat, we find an even distribution between positive and negative reactions, which may indicate the presence of other underlying characteristics potentially driving the abnormal returns.

Overall, our full-sample results support the view that operational risk events have a negative impact on energy companies. Our results are in contrast with Scholtens and Boersen (2011), who find insignificant market reactions to energy accidents—differences between our methods are potentially responsible; while we investigate the reactions at the company level, Scholtens and Boersen (2011) examine abnormal returns at the industry (index) level. One point for consideration in their approach is that negative and positive reactions by various index members may be cancelling out each other.

Prior evidence documents variation in abnormal returns across regions (Fiordelisi et al., 2014), potentially owing to cross-country differences in regulations or risk management practices. We thus segment our sample of operational losses by the region of incident and present results in Table 5. Starting with Asia (Panel B), we notice that all CAAR are negative and significant, except for the day of the announcement (0, 0), a result which is in line with our full-sample analysis. In particular, estimated CAAR are negative and significant, with values of − 3.36%, − 1.78%, − 1.60%, and − 3.33% for the (− 2, + 2), (− 1, + 1), (0, + 1), and (0, + 2) event windows, respectively. The observed negative stock market reaction is also in line with results of previous studies on operational risk events in China (Bai et al., 2021; Lo et al., 2018). Shifting our attention to the results for Europe (Panel D), we find statistical significance in the (− 2, + 2) and (0, 0) event windows, with values of − 1.46% and − 0.62%, respectively. Surprisingly, when we examine operational losses in the United States (Panel H), we find negative but insignificant CAAR across all event windows despite the relative higher number of events in this region. This finding further reinforces the view that energy firms in the United States have more robust risk management processes in place. An alternative, non-mutually exclusive explanation may be that markets consider operational losses as part of the business for US firms and have already priced in expectations about such events. This result comes in line with the Fiordelisi et al. (2014) who study the financial sector. They report larger operational losses in Europe than in United States, and attribute this result to more effective sanctioning mechanisms in the United States. As far as operational loss events in South America (Panel F) are concerned, we observe negative and significant CAARs of − 1.26% and − 1.61% in the (0, + 1) and (0, + 2) event windows, respectively. Shifting our attention to Canada (Panel E), we observe negative and significant abnormal returns of − 2.76% and − 3.22% in the (− 1, + 1) and (− 2, + 2) event windows, respectively. In unreported results for Canada, we observe statistical significance on day + 1 (− 6.70%), which seems to be driving the CAAR in the (− 1, + 1) and (− 2, + 2) event windows. There is no evidence of significant CAAR for Africa (Panel A), Australia (Panel C), and the United Kingdom (Panel G).Footnote 10 Given that we observe very low \(\overline{Loss}\) and \(\overline{RSL}\) in these regions (Table 2), one potential explanation may be that markets are indifferent to small operational loss announcements, or such events are already priced in by investors.

Overall, the above results suggest that there is significant variation in abnormal returns across regions, that can be attributed to cross-country differences in regulations or the type of losses. In particular, we find that operational losses in Asia, Europe, South America, and Canada are associated with negative and significant abnormal returns, while there is no evidence of significant abnormal returns for Africa, Australia, and the United Kingdom. The observed differences in abnormal returns may be due to differences in market expectations, or the effectiveness of sanctioning mechanisms across regions. Additionally, we find insignificant abnormal returns for operational losses in the US. As noted in the data section, the operational losses reported by energy firms in the US are generally smaller in magnitude than those reported by firms in other regions. This observation supports the view that US firms may have more robust risk management processes and/or better access to insurance markets, which may allow them to better mitigate the negative impact of operational losses. At the same time, firms in the US may be subject to more robust sanctioning mechanisms and regulations that promote better their risk management practices, and thus reducing the frequency of large losses as well as their impact on company financials.

Another way to examine the results is to classify operational losses into those reported by regional net importers or net exporters of energy. Table 6 presents pertinent empirical results. Results show that while both groups experience negative and significant CAAR around the announcement of operational losses, the magnitude of abnormal returns is much higher for net importers of energy. This is in line with results in Table 2 indicating that net importers experience a lower number of events, albeit with a higher \(\overline{RSL}\) than net exporters. One plausible explanation could be that on average, companies operating in net exporting regions may have a greater ability to absorb operational losses due to their access to cheap energy resources. As a result, the market may perceive these companies as having a lower risk profile, leading to lower abnormal returns around the announcement of operational losses. At the same time, these companies may be more experienced in managing operational risks due to the nature of their operations. Specifically, they may have developed more effective risk management practices over time, which could help them reduce the frequency of large operational losses and/or successfully manage the impact of smaller losses via effective risk transfer mechanisms.

Previous studies in the financial sector show that the relative size of loss is an important determinant of excess returns (Fiordelisi et al., 2014; Gillet et al., 2010; Sturm, 2013). Table 7 presents CAAR for sub-samples of operational risk events according to the relative size of loss. We use the median RSL to split our sample of operational loss events into those with large relative losses (RSL > 0.03%) and those with small relative losses (RSL < 0.03%). Looking at large relative losses (Panel A), we observe negative and significant CAAR across all event windows examined with values of − 1.49%, − 1.00%, − 0.66% and − 0.99% in the event windows (− 2, + 2), (− 1, + 1), (0, + 1) and (0, + 2) respectively, except for the day of the event (0, 0). In unreported results, we observe negative and significant CAAR across the 3-day period following the event day. The insignificant result on the event day is not surprising and is in line with our full sample results, which implies a short delay in stock price adjustment. On the other hand, we find no statistical significance for small relative losses (Panel B). Overall, results in this case are in line with previous studies of operational losses in banking (Fiordelisi et al., 2014; Sturm, 2013), which suggest that large operational losses can have a more substantial impact on company financials than small losses. The latter seem to be considered as part of the business by investors, who have probably already priced in these risks.

Table 8 presents results for sub-samples of operational risk events according to the industry group. Previous work documents that different types of operational risk trigger different reactions and are significant determinants in decision making (Bai et al., 2021). Our results reveal negative CAAR across most event windows for the Electric industry group (Panel A). Estimated CAAR are negative and significant, with values of − 1.16% and − 1.00% for the (− 2, + 2) and (0, + 2) event windows respectively. Focusing on the (− 1, + 1) and (0, + 1) event windows, we also find significant CAAR with values of − 0.63% and − 0.51%, respectively; albeit, in line with our full sample results, there is no statistical significance for the event window (0, 0). These results reinforce the view that the market needs time to absorb the information of these events. On the contrary, there is no statistical significance for the Oil and Gas industry group (Panel B). Interestingly, we observe negative and significant CAAR for the Gas industry group across most event windows examined. In particular we observe CAAR of − 1.93%, − 1.55%, − 1.88% and − 1.57% in the (− 2, + 2), (− 1, + 1), (0, + 1) and (0, + 2), event windows, respectively. Looking back at the summary statistics for industry groups and, specifically, at the \(\overline{Assets}\) figure (see Table 3), we observe that Oil and Gas companies are much larger than pure Gas companies. We infer that the insignificant results can be attributed to the ability of larger companies to take advantage of in-house risk management teams or outsourced risk management advice, whilst maintaining better access to the insurance market. No statistical significance is noticed for groups Mining, Oil and Gas Services and Other.

Previous studies in the banking sector (Fiordelisi et al., 2014; Gillet et al., 2010) segment their sample of operational losses based on the event risk category. Table 9 presents results for sub-samples of operational risk events according to risk categories.Footnote 11 We find no statistical significance for the Employment (Panel D), Execution (Panel E), and Internal Fraud (Panel F) risk categories. In contrast, we find a negative and significant CAAR of − 1.35% in the (0, 0) event window for the Disruption category (Panel A). Looking at the Clients risk category (Panel B), only the (− 2, + 2) event window exhibits a significant CAAR of − 0.70%. Yet in unreported results, we observe a negative and significant CAAR on day − 1. Unlike accidents, it is possible that information on losses under the Clients category may leak to markets ahead of the official announcement. The Damage risk category (Panel C) generates the largest CAAR across all event types examined. In particular, operational losses under this category produce negative and significant CAAR of − 1.03%, − 0.67%, − 0.63% and − 0.88% for the (− 2, + 2), (− 1, + 1), (0, + 1) and (0, + 2) event windows, respectively. The only exception is the average excess return on the event day, which, in line with our full-sample results, is statistically insignificant. Some clues may be given by our analysis of Tables 1 and 6; the Damage to Physical Assets category exhibits the second highest \(\overline{Loss}\) ($448 M) and the third highest \(\overline{RSL}\) (1.1%). Similar to our earlier remarks, one potential explanation is that markets expect larger losses to have a more substantial impact on company financials than small losses, and thus reactions are more pronounced in the former group.

Overall, the results suggest that markets react negatively to operational loss announcements. The negative abnormal returns seem to be concentrated in post-event days. We also find that the impact of operational losses on stock prices varies across regions, with negative and significant CAAR observed in Asia, Canada, Europe (excl. UK) and South America, and insignificant CAAR in Africa, Australia, United Kingdom, and the United States. Furthermore, the findings suggest that markets anticipate larger operational losses to have a more significant impact on company financials than smaller losses. Finally, the results also indicate that different types of industry groups and operational risk categories trigger different reactions and are significant determinants in decision making. For instance, the Electric industry group and the Damage risk category generate the largest abnormal returns across all groups and categories examined respectively.

6 Concluding remarks

This study examines the market impact of 452 operational risk events using a unique dataset, constructed using SAS OpRisk Global Data. Specifically, we conduct an event study to assess the wealth effects of operational losses on announcing energy firms. We also examine whether the direction and/or magnitude of excess returns vary with event and/or announcing firm characteristics, such as the type of operational loss, the affected firm’s industry group, the region of incident, or the relative size of loss.

In contrast with previous studies in the energy sector (Scholtens & Boersen, 2011), our full sample results reveal negative and significant abnormal returns across most event windows within the (− 2, + 2) 5-day period. This suggests that markets, on average, react negatively to operational loss announcements. Looking at subsamples based on the region of incident and industry groups, we find negative and significant abnormal returns for Asia, Europe, Canada, and South America, and the Electric and Gas groups, respectively. Splitting our sample on the basis of the relative size of operational loss, we observe negative and significant (insignificant) CAAR for large (small) relative losses. Segmenting our sample on the basis of the event risk category, we find negative and significant excess returns for operational losses associated with the Business Disruption and System Failures, the Clients Products and Business Practices, and the Damage to Physical Assets categories.Footnote 12

This study’s contribution is twofold. First, to the best of our knowledge, this is the first study to systematically analyze the impact of operational loss events on announcing firms in the energy sector. Second, we provide novel evidence on the varying effects of event and/or announcing firm characteristics on the direction and magnitude of excess returns.

Overall, our results promote a better and broader understanding of the economic effects of operational losses. As such, this paper not only informs academic research on the subject, but can also help the wider audience of energy-related stakeholders, ranging from company managers, risk management experts and investors, to regulators, and other participants, successfully navigate their institutions, investments, and policies, respectively. Specifically, our findings highlight the importance of incorporating operational risk management strategies into the energy industry’s sustainability and social responsibility efforts. Operational risk management techniques can help energy firms prevent and mitigate the impact of operational losses on their stock prices and overall financial performance. By incorporating these techniques, energy firms can better align their business operations with sustainable and socially responsible practices. Additionally, regulators can use the findings of our study to design effective mechanisms to mitigate the impact of operational losses on the economy and society.

Overall, this study’s findings can inform multiple stakeholders in the energy industry in the pricing, asset allocation, and risk management functions, which are all critical components of achieving sustainability and social transition in economics and finance.

This study focused on the effects of operational losses on announcing firms. A potential extension of our work, that falls outside the scope of the present study, is the examination of the presence of any intra- and inter-industry spillover effects associated with large operational losses. Analyzing whether and how non-announcing firms across the energy supply chain and other important business sectors react to large operational loss announcements is an empirical question worth pursuing in future research.

Notes

Basel II defines operational risk as that arising from the environment, people, systems, and processes in/through which a company operates, and further breaks it down into Strategic, Legal, and Environmental, Internal and External Fraud, Damage to Physical Assets, Employment Practices and Workplace Safety, Clients, Products, and Business Practice, Business Disruption and Systems Failures, and Execution, Delivery, and Process Management. Operational risk is elsewhere defined theoretically as the firm’s residual risks after accounting for core risks, such as market risk, credit risk, interest rate risk, and exchange rate risk (Allen et al., 2007).

While the database is updated daily, users receive updated versions of the SAS OpRisk Global Data on a monthly basis.

The Category Other includes companies that fall under the Chemicals, Coal, Engineering & Construction, Environmental Control, Iron/Steel, Pipelines, and Water industry groups.

We set the length of the estimation window to about one trading year to ensure consistency and comparability with previous studies on operational losses (Bai et al., 2021; Fiordelisi et al., 2014; Gillet et al., 2010; Scholtens and Boersen, 2011; Sturm, 2013). As for the event window, we select the period from day (− 40) to day (+ 40) for the following reasons. First, while we assume that operational losses are not anticipated by markets, there may be instances where markets become aware of—and react to—operational losses ahead of any official press release recorded by SAS OpRisk Global Data or the press as the event date. Second, while markets are assumed to be efficient, there may be instances of delays in stock market reaction due to the non-availability or gradual updating of event-related information—such as the amount of loss—in the days following their announcement. Using a relatively wider window ensures we sufficiently capture any such effects. For robustness, we re-estimate all models using a smaller event window (− 20, + 20). The results are qualitatively similar and are available upon request.

One may argue that the application of the traditional event-study approach does not sufficiently handle volatility clustering and may lead to less efficient estimates if any ARCH effects are unaccounted for (see, e.g., Corhay and Rad, 1996; Elyasiani et al., 2016). While GARCH models may potentially improve statistical inference, a caveat is that they tend to be more unstable in event study settings, with estimates often violating assumptions on conditional variance non-negativity and/or stationarity. These issues tend to be particularly more pronounced when handling stock returns of smaller companies or thinly traded stocks. Therefore, using a GARCH approach would potentially result in a significant loss of events in our analysis. Also, for comparison purposes, we opt to follow the pertinent literature that employs the traditional event-study approach (see, e.g., Bai et al., 2021; Fiordelisi et al., 2014; Scholtens and Boersen, 2011).

We employ the MSCI World Energy Sector Index as it better reflects the return generating process of energy firms due to its sensitivity to broader commodity price fluctuations. Compared to local market indices, the MSCI World Energy Sector Index is also less sensitive to issues associated with event-induced variance, e.g. when many companies are simultaneously affected by a single event. For robustness, in unreported tables, we also use the main market index where each company is listed and obtain qualitatively similar results.

The mathematical formulation is as follows: \(t = AAR_{t} /\sqrt {\frac{1}{{N^{2} \left( {T - 1} \right)}}\mathop \sum \limits_{i = 1}^{\rm N} \mathop \sum \limits_{t = 1}^{\rm T} \left( {AR_{it} - \mathop \sum \limits_{j = 1}^{T} \frac{{AR_{i,j} }}{T}} \right)^{2} }\)

where, T is the number of daily observations in the estimation period and N is the number of companies in the sample.

Overall we do not observe any significant abnormal returns outside these windows. Detailed results across wider event windows are available upon request.

Another possibility is that some operational loss events occur outside trading hours and hence markets price their impact on the next trading day. Although it is impossible to verify the exact time of the public disclosure of operational loss events and adjust our event day (0, 0) accordingly, our post-event AAR and CAAR do capture any excess returns associated with such events.

For reasons discussed in Sect. 3, we examine the UK and Canada separately from their regional groups. However, in unreported results (available upon request) we consider the UK as part of Europe, and Canada and the US as part of North America. Our findings show that the UK and Canada are driving results in those regions, with negative and significant (insignificant) abnormal returns for operational losses in North America (Europe).

We do not tabulate the results for the External Fraud risk category as it contains a very small number of events (N = 3). We find negative and significant CAAR across most event windows.

Οne must exert some caution in generalizing results from sub-samples with a small number of operational losses. We note, however, that the presence of smaller samples in some of the sub-groups is not due to own sampling, but rather the unavailability of events/data for specific groups/regions. As such, their analysis may still offer some interesting insights.

References

Allen, L., & Bali, T. G. (2007). Cyclicality in catastrophic and operational risk measurements. Journal of Banking & Finance, 31(4), 1191–1235. https://doi.org/10.1016/j.jbankfin.2006.10.007

Bai, C., Gao, W., & Sarkis, J. (2021). Operational risks and firm market performance: Evidence from China. Decision Sciences, 52(4), 920–951. https://doi.org/10.1111/deci.12467

Barrett, W. B., Heuson, A. J., & Kolb, R. W. (1986). The effect of Three Mile Island on utility bond risk premia: A note. The Journal of Finance, 41(1), 255–261. https://doi.org/10.2307/2328357

Basel Committee on Banking Supervision (BCBS) (2006). Basel II: International convergence of capital measurement and capital standards: A revised framework-comprehensive version. https://www.bis.org/publ/bcbs128.htm.

Bowen, R. M., Castanias, R. P., & Daley, L. A. (1983). Intra-industry effects of the accident at Three Mile Island. Journal of Financial and Quantitative Analysis, 18(1), 87–111. https://doi.org/10.2307/2330806

Brown, S. J., & Warner, J. B. (1980). Measuring security price performance. Journal of Financial Economics, 8(3), 205–258. https://doi.org/10.1016/0304-405X(80)90002-1

Brown, S. J., & Warner, J. B. (1985). Using daily stock returns: The case of event studies. Journal of Financial Economics, 14(1), 3–31. https://doi.org/10.1016/0304-405X(85)90042-X

Cannas, G., Masala, G., & Micocci, M. (2009). Quantifying reputational effects for publicly traded financial institutions. Journal of Financial Transformation, 27, 76–81.

Corhay, A., & Rad, A. T. (1996). Conditional heteroskedasticity adjusted market model and an event study. The Quarterly Review of Economics and Finance, 36(4), 529–538. https://doi.org/10.1016/S1062-9769(96)90050-2

Cummins, J. D., Lewis, C. M., & Wei, R. (2006). The market value impact of operational loss events for US banks and insurers. Journal of Banking & Finance, 30(10), 2605–2634. https://doi.org/10.1016/j.jbankfin.2005.09.015

Elyasiani, E., Staikouras, S. K., & Dontis-Charitos, P. (2016). Cross-industry product diversification and contagion in risk and return: The case of bank-insurance and insurance-bank takeovers. Journal of Risk and Insurance, 83(3), 681–718. https://doi.org/10.1111/jori.12066

Ferstl, R., Utz, S., & Wimmer, M. (2012). The effect of the Japan 2011 disaster on nuclear and alternative energy stocks worldwide: An event study. Business Research, 5(1), 25–41. https://doi.org/10.1007/BF03342730

Fields, M. A., & Janjigian, V. (1989). The effect of Chernobyl on electric-utility stock prices. Journal of Business Research, 18(1), 81–87. https://doi.org/10.1016/0148-2963(89)90053-2

Fiordelisi, F., Soana, M. G., & Schwizer, P. (2014). Reputational losses and operational risk in banking. The European Journal of Finance, 20(2), 105–124. https://doi.org/10.1080/1351847X.2012.684218

Gillet, R., Hübner, G., & Plunus, S. (2010). Operational risk and reputation in the financial industry. Journal of Banking & Finance, 34(1), 224–235. https://doi.org/10.1016/j.jbankfin.2009.07.020

Harmantzis, F. (2003). Operational risk management in financial services and the new basel accord. https://ssrn.com/abstract=579321. https://doi.org/10.2139/ssrn.579321

Hill, J., & Schneeweis, T. (1983). The effect of Three Mile Island on electric utility stock prices: A note. The Journal of Finance, 38(4), 1285–1292. https://doi.org/10.2307/2328026

Hirschberg, S., Burgherr, P., Spiekerman, G., & Dones, R. (2004). Severe accidents in the energy sector: Comparative perspective. Journal of Hazardous Materials, 111(1–3), 57–65. https://doi.org/10.1016/j.jhazmat.2004.02.009

Kalra, R., Henderson, G. V., Jr., & Raines, G. A. (1993). Effects of the Chernobyl nuclear accident on utility share prices. Quarterly Journal of Business and Economics, 32(2), 52–77.

Laplante, B., & Lanoie, P. (1994). The market response to environmental incidents in Canada: A theoretical and empirical analysis. Southern Economic Journal, 60(3), 657–672. https://doi.org/10.2307/1060574

Lo, C. K., Tang, C. S., Zhou, Y., Yeung, A. C., & Fan, D. (2018). Environmental incidents and the market value of firms: An empirical investigation in the Chinese context. Manufacturing & Service Operations Management, 20(3), 422–439. https://doi.org/10.1287/msom.2017.0680

Makino, R. (2016). Stock market responses to chemical accidents in Japan: An event study. Journal of Loss Prevention in the Process Industries, 44, 453–458. https://doi.org/10.1016/j.jlp.2016.10.019

Scholtens, B., & Boersen, A. (2011). Stocks and energy shocks: The impact of energy accidents on stock market value. Energy, 36(3), 1698–1702. https://doi.org/10.1016/j.energy.2010.12.059

Smith, C. W., Jr. (1992). Economics and ethics: The case of Salomon Brothers. Journal of Applied Corporate Finance, 5(2), 23–28. https://doi.org/10.1111/jacf.12385

Solakoglu, N., & Kose, A. (2009). Operational risk and stock market returns: Evidence from Turkey. In G. Gregoriou (Ed.), Operational Risk toward Basel III: Best Practices and Issues in Modeling, Management, and Regulation (pp. 115–128). Wiley finance series. Wiley. https://doi.org/10.1002/9781118267066.ch6

Sovacool, B. K. (2008). The costs of failure: A preliminary assessment of major energy accidents, 1907–2007. Energy Policy, 36(5), 1802–1820. https://doi.org/10.1016/j.enpol.2008.01.040

Sovacool, B. K., Andersen, R., Sorensen, S., Sorensen, K., Tienda, V., Vainorius, A., Schirach, O. M., & Bjørn-Thygesen, F. (2016). Balancing safety with sustainability: Assessing the risk of accidents for modern low-carbon energy systems. Journal of Cleaner Production, 112, 3952–3965. https://doi.org/10.1016/j.jclepro.2015.07.059

Sovacool, B. K., Kryman, M., & Laine, E. (2015). Profiling technological failure and disaster in the energy sector: A comparative analysis of historical energy accidents. Energy, 90, 2016–2027. https://doi.org/10.1016/j.energy.2015.07.043

Sturm, P. (2013). Operational and reputational risk in the European banking industry: The market reaction to operational risk events. Journal of Economic Behavior & Organization, 85, 191–206. https://doi.org/10.1016/j.jebo.2012.04.005

Walter, I. (2008). Reputational risk and conflicts of interest in banking and finance: the evidence so far. In Variations in economic analysis, (pp. 75–97). Springer. https://doi.org/10.1007/978-1-4419-1182-7_8

Xu, Y., Pinedo, M., & Xue, M. (2017). Operational risk in financial services: A review and new research opportunities. Production and Operations Management, 26(3), 426–445. https://doi.org/10.1111/poms.12652

Funding

Open access funding provided by HEAL-Link Greece. This research is co-financed by Greece and the European Union (European Social Fund—ESF) through the Operational Programme “Human Resources Development, Education and Lifelong Learning” in the context of the project “Strengthening Human Resources Research Potential via Doctorate Research—2nd Cycle” (MIS-5000432), implemented by the State Scholarships Foundation (ΙΚΥ). This paper has also benefited from ESCP Business School’s European Research Funding (ERF) programme—project number 2021-72.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have no competing interests to declare that are relevant to the content of this article.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We thank the Editor (Ramzi Benkraiem) and three anonymous referees for useful comments and suggestions. We are also grateful to Paraskevi Tzika for helpful advice. We would like to thank session participants at the 2022 IAEE European Energy Conference, the 2022 International Conference on Business and Economics of the Hellenic Open University, the 2022 International Conference of the Financial Engineering and Banking Society, and the 2019 International Conference on Applied Business and Economics, for insightful suggestions. Any remaining errors are our own. The data analysis for this paper was generated using SAS® OpRisk Global Data. Copyright, SAS Institute Inc. Cary, NC, USA. All Rights Reserved.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Kalatha, S., Dontis-Charitos, P., Kosmidou, K. et al. The market reaction to operational risk events in the energy sector. Ann Oper Res (2023). https://doi.org/10.1007/s10479-023-05488-y

Accepted:

Published:

DOI: https://doi.org/10.1007/s10479-023-05488-y