Abstract

Previous literature shows that prevalent risk measures such as value at risk or expected shortfall are ineffective to curb excessive risk-taking by a tail-risk-seeking trader with S-shaped utility function in the context of portfolio optimisation. However, these conclusions hold only when the constraints are static in the sense that the risk measure is just applied to the terminal portfolio value. In this paper, we consider a portfolio optimisation problem featuring S-shaped utility and a dynamic risk constraint which is imposed throughout the entire trading horizon. Provided that the risk control policy is sufficiently strict relative to the Sharpe ratio of the asset, the trader’s portfolio strategies and the resulting maximal expected utility can be effectively constrained by a dynamic risk measure. Finally, we argue that dynamic risk constraints might still be ineffective if the trader has access to a derivatives market.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

This paper deals with the use of risk measures as a trade risk limit tool in finance. Risk constraints based on risk measures are fundamental to limit the potential losses of a financial institution. This has been particularly important after the defaults of several major financial institutions in 2008 (examples include Lehman Brothers, Washington Mutual, Fannie Mae, Freddie Mac, the three Icelandic banks and Merril Lynch that was forced to merge with Bank of America). Previous works show that even mainstream coherent risk measures that have been endorsed by the Basel Committee for Banking Supervision are ineffective in containing tail-risk seeking or limited liability market operators, which raises an urgent need to critically review the suggestions made by the regulators. In this paper, we show that when the risk constraints are used in a dynamic rather than static setting, the coherent risk measures can work and there is less reason to be alarmed by the current market practices. Besides restoring confidence in the mainstream risk measures, this paper shows that the dynamic aspect of the use of risk measures for setting trade limits is fundamental, as the difference between the static and dynamic risk constraints shows fully in transforming a risk measure such as Expected Shortfall from an ineffective to a fully effective tool.

Portfolio optimisations are typically formulated as an expected utility maximisation problem faced by a risk averse agent with concave utility function. However, a simple concave function may not be sufficient to model agents’ preferences in an actual trading environment. For example, the limited liability feature of a financial institution as well as standard remuneration scheme tend to create incentive distortion where a successful trader can share the profits via bonuses but a failed trader can simply walk away without punishment. Thus gains and losses can be perceived very differently by an agent leading to deviation from a concave utility function. See for example (Carpenter, 2000) and (Bichuch & Sturm, 2014). At a psychological level, the seminal work of Kahneman and Tversky (1979) and many of the other follow-up studies reveal that individuals are risk averse over positive outcomes but risk seeking over negative outcomes. These stylised preferences can be better captured by an S-shaped utility function which is concave on gains and convex on losses. Here we focus on “limited liability operators” and “tail-risk-seeking traders” who do not care about extreme losses, but the results in this paper can be generalised to other contexts where the underlying economic agents have an S-shaped utility function.

It is of great regulatory interests to understand how the trading activities of those limited liability operators can be controlled by standard risk measures. A surprising result has been reported in a recent paper of Armstrong and Brigo (2019) that Value at Risk (VaR) and Expected Shortfall (ES) are totally ineffective to curb the risk-taking behaviours of those operators. They consider a portfolio optimisation problem under tail-risk-seeking preference and find that the value function of the agent remains the same upon imposing a static VaR/ES constraint on the terminal portfolio value. In other words, neither VaR nor ES can alter the maximal expected utility attained by a limited liability operator compared to the benchmark case without any risk constraint. This casts doubt over the usefulness of prevalent risk management protocols to combat excessive risk-taking by traders with more realistic preferences. An earlier restricted version of the same result, focusing only on a Black-Scholes option market, is in Armstrong and Brigo (2018). A further related result in Armstrong and Brigo (2022) introduces the notion of \(\rho \)-arbitrage for a coherent risk measure \(\rho \). Positive homogeneity of the measure \(\rho \) is the key property that is used to reach the result. A risk measure \(\rho \) is defined to be ineffective if a static risk constraint based on that measure cannot lower the expected utility of a limited liability operator. A \(\rho \)–arbitrage is defined as a portfolio payoff with non-positive price, non-positive risk as measured by \(\rho \) but with strictly positive probability of being strictly positive. The ineffectiveness of static risk constraints based on the coherent risk measure \(\rho \) is shown to be equivalent to the existence of a \(\rho \)–arbitrage.Footnote 1 Again, the emphasis for us, in this paper, is that also in Armstrong and Brigo (2018) and Armstrong and Brigo (2022) the risk constraints are static and that the situation becomes very different with dynamic risk constraints.

Indeed, in view of the above negative result, we explore a simple remedy which resurrects VaR/ES as a tool to risk manage tail-risk-seeking traders: the risk measure is imposed dynamically throughout the entire trading horizon. At each point of time given the current assets holding in place, the portfolio risk exposure is computed by projecting the distribution of the portfolio return over an evaluation window under the assumption that the assets holding remains unchanged. There are several advantages with such a dynamic risk constraint. First, this risk management approach is more consistent with the industrial practice where the risk exposure of the trader’s positions is typically reported and monitored at least daily. Second, imposing a static risk constraint on the terminal portfolio value only usually leads to a time-inconsistent optimisation problem where the optimal strategy solved at a future time point may not be consistent with the one derived in the past. This results in difficulty with interpreting the notion of optimality, and one has to make further assumptions (such as whether the agent can pre-commit to the optimal strategy derived at time-zero) to pin down a unique prediction of the trader’s action. The idea of time-inconsistency in dynamic optimisation problems can be dated back to Strotz (1955).

Our main contribution is to show that a dynamic VaR or ES constraint can indeed constrain a tail-risk-seeking trader, in the sense that the maximal expected utility attained can be reduced provided that the risk control policy is sufficiently strict relative to the Sharpe ratio of the risky asset. The difference between a static and a dynamic risk constraint is drastic both mathematically and economically. In a complete market, any arbitrary payoff can be synthesised by dynamic replication. As a result, the problem of solving for the optimal trading strategy is equivalent to finding a utility-maximising payoff whose no-arbitrage price is equal to the initial wealth available. This duality principle which converts a dynamic stochastic control problem into a static optimisation has been widely adopted to solve portfolio optimisation problems. A static risk measure applied to the terminal portfolio value only restricts the class of the admissible payoffs. Armstrong and Brigo (2019) show that one can construct a sequence of digital options which pay a small positive amount most of the time but incur an extreme loss with a tiny probability, and that these payoffs can be carefully engineered to satisfy any given VaR/ES limit. The resulting expected utilities will converge to the same utility level associated with an unconstrained problem.

The conclusion changes significantly when the risk constraint is applied dynamically instead. To comply with the given risk limit at each time point, the notional invested in the underlying assets has to be capped if the risk policy is sufficiently strict. Thus a dynamic risk constraint now has first-order impact on the admissible trading strategies. The usual duality approach no longer works because the restriction on the trading strategies from the outset precludes dynamic replication of a claim. We therefore have to resort to the primal Hamilton-Jacobi-Bellman (HJB) equation approach to solve the portfolio optimisation problem. Although a close-form solution is not available in general, we can nonetheless deduce the analytical conditions on the model parameters under which a dynamic VaR/ES constraint becomes effective. In a special case where the excess return of the asset is zero, we can provide a finer characterisation of the optimal trading strategy.

Our results show that a dynamic risk constraint can be effective against a “delta-one trader” who can only invest in the underlying risky assets. What will happen if the trader can access derivatives trading as well? In the context of utility maximisation under market completeness, there is no economic difference between delta-one and derivatives trading since any payoff can be replicated by dynamic trading in the underlying assets. We argue, however, that a dynamic risk constraint such as ES will become ineffective again if derivatives trading is allowed. The key idea is that a derivatives trader can exploit dynamic rebalancing to continuously roll-over some risky digital options to ensure the risk constraint is satisfied at all time while generating an arbitrarily high level of utility.

We conclude the introduction by discussing some related work. A vast literature on continuous-time portfolio optimisation has emerged since Merton (1969, 1971). One natural extension of the original Merton model is to incorporate additional constraints in form of a risk functional applied to the terminal portfolio value. Examples of the extra constraints include VaR (Basak & Shapiro, 2001), expected loss and other similar shortfall-style measures (Gabih et al., 2005), probability of outperforming a given benchmark (Boyle & Tian, 2007) and utility-based shortfall risk (Gundel & Weber, 2008). In these papers, the combination of concave utility function and static risk constraint facilitates the use of the dual approach to solve the underlying optimisation problems.

There has been a recent strand of literature focusing on dynamic risk constraints. Yiu (2004), Cuoco et al. (2008) and Akume et al. (2010) consider similar portfolio optimisation problems with VaR/ES constraints under different modelling setups. The optimal trading strategy behaves very differently when a static constraint is replaced by a dynamic one. For example, Basak and Shapiro (2001) show that a static VaR constraint may induce the trader to take more risk (relative to the unconstrained case) in the bad state of the world, whereas Cuoco et al. (2008) show that if the VaR constraint is applied dynamically then the optimal risk exposure can be unanimously reduced. HJB equation formulation has to be used when solving the problem with dynamic risk constraints. All the papers cited above work with a concave utility function, and thus the problem is still relatively standard to yield analytical and numerical progress.

S-shaped utility maximisation has received a lot of attention in the context of behavioural economics and convex incentive scheme. Despite the non-standard shape of the underlying utility function, duality method can still be suitably adapted to solve the optimisation problems. See for example (Berkelaar et al., 2004; Reichlin, 2013; Bichuch & Sturm, 2014) and the references therein. Papers on dynamic portfolio optimisation which simultaneously feature S-shaped utility as well as VaR/ES constraint include (Armstrong & Brigo, 2019; Guan & Liang, 2016) and (Dong & Zheng, 2020). But again, the constraints are static in nature which are only imposed on the terminal portfolio value. Our work fills the gap in the literature by considering S-shaped utility function and dynamic risk constraint in conjunction. In the same spirit that (Cuoco et al., 2008) is the dynamic version of (Basak & Shapiro, 2001) under concave utility function, our work can be viewed as the dynamic version of (Armstrong & Brigo, 2019) under S-shaped utility to give insights on the new economic phenomena when a more realistic risk management approach is adopted.

The rest of the paper is organised as follows. Section 2 gives an overview of the modelling framework. The main results of the paper are stated in Sect. 3 with some numerical illustrations. A special case that the excess return of the asset being zero is analysed in details in Sect. 4. We briefly discuss in Sect. 5 how the results will change if the trader can access a derivatives market. Section 6 concludes. Miscellaneous technical materials are deferred to the appendix.

2 Modelling setup

2.1 The economy

For simplicity of exposition, in the main body of this paper we consider a standard Black-Scholes economy with a riskfree bond and one risky asset only. Extension to the multi-asset setup is discussed in Appendix C.

Fix a terminal horizon \(T>0\). Let \((\Omega ,{\mathcal {F}},\{{\mathcal {F}}_t\}_{0\le t\le T},{\mathbb {P}})\) be a filtered probability space satisfying the usual conditions which supports a one-dimensional Brownian motion \(B=(B_t)_{t\ge 0}\). The risky asset has price process \(S=(S_t)_{t\ge 0}\) following a geometric Brownian motion

with drift \(\mu \) and volatility \(\sigma >0\), and the riskfree bond has a constant interest rate of r. A trader invests in the two assets dynamically where an amount of \(\Pi _t\) is invested in the risky asset at time t. The portfolio strategy \(\Pi =(\Pi _t)_{t\ge 0}\) is said to be admissible if it is adapted and \(\int _0^T \Pi _t^2 dt<\infty \) almost surely. The set of admissible portfolio strategies is denoted by \({\mathcal {A}}_0\). The portfolio value process \(X=(X_t)_{t\ge 0}\) then evolves as

where \(x_0\) is an exogenously given initial capital of the trader.

2.2 Dynamic risk constraints

Suppose \(r\ne 0\) for the moment. The dynamics (1) can be rewritten as

with \(\kappa :=-r\) and \(\theta _t:=-\frac{(\mu -r)\Pi _t}{r}\). This is somewhat similar to an Ornstein-Uhlenbeck process except that the “mean-reversion level” \(\theta _t\) is stochastic which depends on \(\Pi _t\). The stochastic differential equation admits a solution in form of

for any t and \(\Delta >0\). We then deduce

which could be interpreted as the (time value-adjusted) portfolio gain/loss over the time horizon \([t,t+\Delta ]\).

At each instant of time t, a risk manager assesses the risk associated with the portfolio return given by (2). Since the risk manager typically does not have the knowledge of the trader’s portfolio strategy beyond the current time t, one needs to assume the portfolio strategy \(\Pi \) will be held fixed over the risk evaluation window \([t,t+\Delta ]\). Then the time-t estimated random variable of portfolio loss over \([t,t+\Delta ]\), denoted by \(L_t\), is given by

and as such \(L_t\) is normally distributed with mean and variance of

The special case of \(r=0\) can be recovered by considering the appropriate limits in (4).

Remark 1

In the literature, there are multiple ways to estimate the projected distribution of portfolio gain/loss. Our approach is based on Yiu (2004) where the notional invested in the risky asset \(\Pi _t\) is assumed to be fixed by the risk manager. Alternatively, the risk manager can also assume the proportion of capital invested in the risky asset \(\Pi _t/X_t\) is fixed - this assumption is adopted for example by Cuoco et al. (2008). The latter approach leads to a more difficult mathematical problem in general because the projected distribution will then also depend on the current portfolio value \(X_t\). The question about which approach is more superior depends on the risk management practice adopted at a particular institution. Another very plausible approach is to assume the quantity of the assets \(n_t:=\Pi _t/S_t\) to be fixed (this could be more relevant in the context of equity trading where stock and future positions are typically recorded in terms of quantity rather than notional). Then starting from (2) we can deduce that

which only depends on the current state via \(\Pi _t=n_t S_t\). This is qualitatively very similar to the approach used by Yiu (2004) and us, except that \(L_t\) is now linked to some log-normal random variable.

A dynamic risk constraint is imposed such that \(\rho (L_t)\le R\) for all \(t\in [0,T)\). Here \(\rho (\cdot )\) is some risk measure and \(R>0\) is an exogenously given level of risk limit. For example, if the risk measure is taken as VaR with confidence level \(\alpha \) (with \(\alpha <0.5\)) such that \(\rho (L_t)=\text {VaR}_{\alpha }(L_t):=\sup \{x\in {\mathbb {R}}:{\mathbb {P}}(L_t\ge x)> \alpha \}\), then using the Gaussian property of \(L_t\) and (4) the constraint can be specialised to

where \(\Phi \) denotes the cumulative distribution function (cdf) of a N(0, 1) random variable. We define the set

such that compliance with the dynamic VaR constraint at time t is equivalent to \(\Pi _t\in K_{\text {VaR}}\).

Similarly, if the risk measure is taken as ES with confidence level \(\alpha \) such that \(\rho (L_t)={\mathbb {E}}[L_t| L_t\ge \text {VaR}_{\alpha }(L_t)]\), then the constraint becomes

with \(\phi (\cdot )\) being the probability density function (pdf) of a N(0, 1) random variable. We then define the set

where we require \(\Pi _t\in K_{\text {ES}}\) for all t in order to satisfy the dynamic ES constraint.

Remark 2

The exposition in this section exclusively will focus on VaR and ES as the underlying risk measures but our analysis can indeed be extended to cover more general risk measures which satisfy positive homogeneity. See Appendix D.

It turns out that the nature of the sets \(K_{\text {VaR}}\) and \(K_{\text {ES}}\) crucially depends on the Sharpe ratio of the risky asset \(\frac{\mu -r}{\sigma }\), as the following lemma shows.

Lemma 1

Define the constants

Then for \(i\in \{\text {VaR},\text {ES}\}\), the sets \(K_i\) defined in (5) and (6) have the following properties:

-

1.

If \(\frac{\mu -r}{\sigma }\ge M_{i}\), there exists \(-\infty<k^i_1<0\) such that \(K_{i}=[k^i_1,\infty )\);

-

2.

If \(|\frac{\mu -r}{\sigma }|<M_{i}\), there exists \(-\infty<k^i_1<0<k^i_2<\infty \) such that \(K_{i}=[k^i_1,k^i_2]\);

-

3.

If \(\frac{\mu -r}{\sigma }\le -M_{i}\), there exists \(0<k^i_2<\infty \) such that \(K_{i}=(-\infty ,k^i_2]\).

Moreover,

Proof

This is a simple exercise of analysing the piecewise linear function arising in the definition of \(K_{\text {VaR}}\) and \(K_{\text {ES}}\). \(\square \)

The constants \(M_{i}\) defined in (7) encapsulate the risk management parameters \(\alpha \) and \(\Delta \). Unless the quality of the investment asset is very good (measured by the magnitude of its Sharpe ratio) relative to \(M_i\), a dynamic VaR or ES constraint will result in a restriction that \(\Pi _t\) needs to take value in a bounded set, i.e. a delta limit restriction where both the long and short position in the underlying asset cannot exceed certain notional levels given by \(k_1^{i}\) and \(k_2^i\). It is also not hard to see that \(M_i\) is decreasing in both \(\alpha \) and \(\Delta \). Hence a small confidence level of the VaR/ES constraint or a tight risk evaluation window will more likely lead to a bounded investment set \(K_i\). Provided that \(k^i_1\) and \(k^i_2\) exist, one can also easily check that \(|k^i_1|\) and \(k^i_2\) are both decreasing in \(\sigma \) and increasing in R and \(\alpha \). Hence a high asset volatility, low risk limit or tight confidence level of the VaR/ES measure will result in small absolute delta notional limit.

2.3 Trader’s utility function and optimisation problem

We assume that the trading decision is made by a “tail-risk-seeking trader” who is insensitive towards extreme losses. Their utility function \(U(\cdot )\) is S-shaped and their goal is to maximise the expected utility of the terminal portfolio value. The only assumption required over U is the following.

Assumption 1

The utility function \(U:{\mathbb {R}}\rightarrow {\mathbb {R}}\) is a continuous, increasing and concave (resp. convex) function on \(x>0\) (resp. \(x<0\)) with \(U(0)=0\) and \(\lim _{x\rightarrow -\infty }\frac{U(x)}{x}=0\).

In particular, the trader is locally risk averse over the domain of gains but locally risk seeking over the domain of losses. Moreover, the assumption on the left-tail behaviour of the utility function further suggests that the trader is tail-risk-seeking in that the “dis-utility” due to extreme losses has a sub-linear growth. This is a very general specification which covers for example many standard behavioural S-shaped utility functions, or a class of utility functions in form of \(U(x)=f(x) {\mathbbm {1}}_{(x\ge 0)}\) where f is a concave function and as such U can describe the preference of a risk-averse trader with limited liability. Note that we do not require U to be differentiable. This allows us to consider for example the piecewise power utility function of Kahneman and Tversky (1979) which is not differentiable at the origin, or an option payoff function which may contain kinks.

Mathematically, the underlying optimisation problem is

where \(X=X^{\Pi }\) has dynamics described by (1), and \({\mathcal {A}}(K)\) is the admissible set of the portfolio strategies under a given dynamic risk constraint in form of

with \(K\subseteq {\mathbb {R}}\) being some given set and \({\mathcal {L}}\) is Lebesgue measure. For example, if the risk constraint is absent we simply take \(K=K_0:={\mathbb {R}}\) and then \({\mathcal {A}}(K_0)={\mathcal {A}}_0\). If a dynamic VaR constraint is in place, we set \(K=K_{\text {VaR}}\) as defined in (5). Likewise a choice of \(K=K_{\text {ES}}\) given by (6) corresponds to a dynamic ES constraint.

Remark 3

Portfolio optimisation problem in form of (8) with U being a strictly concave, twice-differentiable function is studied by Cvitanić and Karatzas (1992). Their results cannot be applied to our setup because our utility function is not concave. Dong and Zheng (2019) consider a version of the problem with S-shaped utility and short-selling restrictions. Their solution method is based a concavification argument in conjunction with the results by Bian et al. (2011) which cover non-smooth utility function but only under the assumption that the set K is in form of a convex cone. For our model, Lemma 1 suggests that the set K under VaR/ES constraint cannot be a convex cone. Thus we cannot apply their approaches to solve our problem.

Let \(V_i(t,x)\) be the value function of problem (8) under \(K=K_{i}\) with \(i\in \{0,\text {VaR},\text {ES}\}\) denoting the label identifying which dynamic risk measure is being adopted (i.e no risk constraint at all, Value at Risk and Expected Shortfall). We first state a benchmark result based on Theorem 4.1 of Armstrong and Brigo (2019).

Proposition 1

The value function of the unconstrained portfolio optimisation problem is \(V_{0}(t,x)=\sup _{s}U(s)\).

Without any risk constraint in place, the tail-risk-seeking trader can attain any arbitrarily high utility by replicating a sequence of digital options which pay a positive amount with a large probability but incur an extremely disastrous loss with very small probability. Armstrong and Brigo (2019) show that this result does not change even if a static VaR/ES constraint is imposed on the terminal portfolio value, in the sense that the trader can still manipulate the digital structure to attain an arbitrarily high utility level while satisfying the additional constraints.

We are interested in studying whether such conclusion will change if we adopt a dynamic risk constraint instead. With the unconstrained optimisation problem as our benchmark, we first give below a formal definition of the effectiveness of a dynamic risk constraint.

Definition 1

A dynamic risk constraint \(i\in \{\text {VaR},\text {ES}\}\) is said to be effective if for each \(t<T\) there exists x such that \(V_{i}(t,x)<V_{0}(t,x)=\sup _s U(s)\).

An effective risk constraint has a meaningful economic impact on the trader in form of reduction in the maximal expected utility from dynamic trading. The notion of effectiveness in Definition 1 may appear to be somewhat weak as we do not insist that the trader’s expected utility have to be strictly reduced for all states (t, x). Indeed for a general utility function, we cannot expect \(V_i(t,x)<\sup _s U(s)\) for all (t, x). For example, consider a call spread payoff \(U(x)=(x+1)^{+}-(x-1)^{+}-1\) which is S-shaped, then for as long as \(\Pi _t=0\) for all t is an admissible strategy under a given dynamic risk constraint i and interest rate is non-negative, we always have \(V_i(t,x)=1=\sup _s U(s)\) for all \(t<T\) and \(x\ge 1\).

3 Main results

We first give a useful proposition which is the building block of the main results in this paper.

Proposition 2

For the optimisation problem (8), if the set K is bounded then for every \(t<T\) there exists x such that \(V(t,x)<\sup _{s}U(s)\).

The implication of Proposition 2 is that a delta notional limit on the risky asset alone is sufficient to constrain a tail-risk-seeking trader. For an unconstrained problem, the argument of Armstrong and Brigo (2019) is that one can attain an arbitrarily high utility level by replicating some digital options. But it is known that the delta of a digital option can be unboundedly large when the time to maturity becomes short and the underlying stock price is near the strike. Hence a trader cannot replicate a digital option and hold the position until maturity while complying the dynamic risk constraint with certainty. In practice, a trading desk with a substantial at-the-money digital option position with short maturity will often be requested to wind-down the trade to reduce the pin risk.

Next we state the main theorem of this paper which provides a precise condition under which a dynamic VaR/ES constraint can effectively restrict a trader with limited-liability.

Theorem 1

Recall the constants \(M_{\text {VaR}}\) and \(M_{\text {ES}}\) introduced in (7). A dynamic Value at Risk constraint is effective if and only if \(|\frac{\mu -r}{\sigma }|<M_{\text {VaR}}\). A dynamic Expected Shortfall constraint is effective if and only if \(|\frac{\mu -r}{\sigma }|<M_{\text {ES}}\).

A dynamic risk constraint \(i\in \{\text {VaR},\text {ES}\}\) restricts a tail-risk-seeking trader if and only if the (magnitude of) Sharpe ratio is smaller than the constant \(M_i\). Surprisingly, from the definition of \(M_i\) in (7) we see that it does not depend on the risk limit level R at all but only the evaluation horizon \(\Delta \), confidence level \(\alpha \) and interest rate r. In other words, increasing the risk limit alone is not sufficient to guarantee the effectiveness of a dynamic risk measure. The risk manager must impose a short evaluation horizon window (small \(\Delta \)) and emphasise on the extreme tail of the loss distribution (small \(\alpha \)) to ensure the necessary and sufficient condition of dynamic risk measure effectiveness \(|\frac{\mu -r}{\sigma }|<M_{i}\) is satisfied. But given a dynamic risk constraint is effective, the risk limit R will play a role in controlling the implied delta notional limit as per the expressions of \(k^i_1\) and \(k^i_2\) in Lemma 1.

The main driver behind the effectiveness of a dynamic risk measure is that the risk constraint implies a hard bound on the delta notional to be taken by the trader. Indeed, there is no economic difference between imposing a delta limit and a more complicated risk measure such as VaR or ES, as the following corollary shows.

Corollary 1

An effective dynamic risk constraint \(i\in \{\text {VaR},\text {ES}\}\) is equivalent to imposing a delta notional limit on the underlying risky asset. i.e. if a dynamic constraint i is effective, then there exists a bounded set \(D\subseteq {\mathbb {R}}\) such that

Proof

This follows immediately from Lemma 1 where the set D is given by \([k^i_1,k^i_2]\). \(\square \)

Corollary 1 suggests an economically equivalent way to implement a dynamic VaR or ES constraint via limiting the trader’s maximal notional exposure to the risky asset. One possible weakness of a dynamic risk constraint is that continuous monitoring and computation of risk measures can be difficult in practice.Footnote 2 In contrast, imposing a trading notional limit continuously is much easier since it can be implemented at the level of internal trading platform (e.g. the trading system will disallow submission of further buy orders once the notional on the trading book exceeds a certain threshold).

We now numerically explore the conditions \(|\frac{\mu -r}{\sigma }|<M_{\text {VaR}}\) and \(|\frac{\mu -r}{\sigma }|<M_{\text {ES}}\). In Table 1, we show several values \(M_{\text {VaR}}\) and \(M_{\text {ES}}\) under different practically relevant combinations of \(\Delta \) and \(\alpha \).Footnote 3 Each number in the table can be interpreted as the critical value of Sharpe ratio (in magnitude) below which a dynamic risk constraint is effective. For example, if the dynamic risk constraint is the 30-day 99%-VaR, then this constraint is effective if and only if the asset’s Sharpe ratio is smaller than 8.11 in magnitude. In general, the numbers in Table 1 are large relative to the empirical Sharpe ratio of a typical asset. For example, Bai and Zhang (2022) report the average excess return and standard deviation of U.S. equities as 7.15% and 16.83%, representing a Sharpe ratio of 0.42, over the time period from 1950 to 2015. The underlying asset has to exhibit an abnormally good (or bad) risk-return ratio for a dynamic risk measure to fail. Finally, the values of \(M_{\text {ES}}\) is larger than \(M_{\text {VaR}}\) under the same \((\alpha ,\Delta )\). It is not surprising since \(\text {ES}\ge \text {VaR}\) under the same \(\alpha \) by construction and hence ES is a stricter risk constraint which is effective under a larger range of Sharpe ratio.

Remark 4

We focus on S-shaped utility function to describe the preference of a tail-risk-seeking trader, and we show in Theorem 1 that a dynamic risk constraint is effective (at least under a wide range of reasonable market parameters) where in contrast a static risk constraint does not work as per (Armstrong & Brigo, 2019). There is an analogue to this result when the trader’s preference is described by a simple concave utility function. Under a static VaR constraint, Basak and Shapiro (2001) find that the optimal portfolio chosen by a trader with CRRA preference has a large exposure to the downside risk (relative to the case without any risk constraint). But if the VaR constraint is imposed dynamically, Cuoco et al. (2008) show that the CRRA trader’s optimal exposure to the risky asset can be uniformly reduced which is more desirable from a regulatory point of view. Our result somewhat echoes the findings of Cuoco et al. (2008), where we illustrate that the dynamic nature of a risk constraint is (even more) crucial to restrict the risk-taking behaviours of a trader with S-shaped utility.

The next proposition gives a theoretical characterisation of the value function.

Proposition 3

Suppose the model parameters are such that \(|\frac{\mu -r}{\sigma }|<M_i\). Then the value function of the optimisation problem (8) under dynamic risk constraint i is the unique viscosity solution to the HJB equation

subject to terminal condition \(V(T,x)=U(x)\) and linear growth condition \(V(t,x)\le c(1+|x|)\) for some \(c>0\). Here \(H_i\) is the Hamiltonian defined as

Proposition 3 provides a characterisation of the value function in terms of viscosity solution, which serves as a useful basis for implementation of numerical methods to solve the HJB equation. In general, it is difficult to make further analytical progress to extract meaningful economic intuitions from the solution structure. Nonetheless, in Sect. 4 we will show that further characterisation of the optimal portfolio strategy is indeed possible under a special case of \(\mu =r\).

For now, we numerically solve the portfolio optimisation problem for the more general case of \(\mu \ne r\). Two specifications of utility function are considered: the Kahneman and Tversky (1979) piecewise power form of

with \(0<\beta _1,\beta _2<1\) and \(k>0\), and the piecewise exponential form of

with \(\phi _1,\phi _2,\gamma _1,\gamma _2>0\).

A fully implicit discretisation scheme with Newton-type policy iteration is used to solve the HJB equation (9). See (Forsyth & Labahn, 2007) for a description of the algorithm and the relevant conditions for convergence. The implementation of numerical methods is quite straightforward and we briefly discuss two practical issues relevant to our specific problem: First, the value function of our portfolio optimisation problem is defined on an unbounded domain \([0,T]\times {\mathbb {R}}\). As an approximation, we only solve for the numerical solutions on a bounded domain \([0,T)\times [-x_{min},x_{max}]\) for some large \(x_{min}>0\) and \(x_{max}>0\). An artificial boundary condition \(V(t,x)=U(x)\) is imposed along \([0,T)\times \{-x_{min},x_{max}\}\) and then we focus on the solution behaviours on a narrow range away from the boundary points. We observe that the numerical results are not sensitive to the choice of \(x_{min}\) and \(x_{max}\) provided that their values are sufficiently large. Second, we focus on a parameter choice of \(r=0\) to ensure that the “positive coefficient condition” of the finite difference scheme (Condition 4.1 of Forsyth and Labahn (2007)) is satisfied when the step size along the x-axis is sufficiently small. But the more general case of non-zero interest rate can be recovered by change of numeraire.

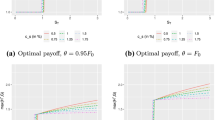

Value function and optimal investment level at different selected time points under S-shaped power and exponential utility function. Parameters used are \(\mu =0.15\), \(\sigma =0.25\), \(r=0\), \(T=1\), \(\alpha =0.01\), \(R=1\), \(\Delta =30/250\), \(\beta _1=\beta _2=0.5\), \(k=2\), \(\gamma _1=\gamma _2=0.55\), \(\phi _1=1\) and \(\phi _2=2\)

Figure 1 shows the value functions and the corresponding optimal investment levels at several different time points. In general, the agents will adopt the largest possible risk exposure when the portfolio value is negative due to risk-seeking over losses induced by the convex segment of the utility function. Investment level is the lowest when the portfolio value is at a small positive level. It is perhaps not too surprising because local risk-aversion is typically the highest for small positive wealth level. Meanwhile, the investment behaviours for larger positive wealth depend on the precise utility function of the agents. In the piecewise power (i.e. constant relative risk aversion alike) specification, investment level increases with wealth until it hits the delta limit implied by the dynamic risk constraint. For the piecewise exponential (i.e. constant absolute risk aversion alike) specification, the investment level will flat out at a constant level as wealth increases.

Optimal investment level at \(t=0\) under S-shaped power and exponential utility function for different values of Expected Shortfall confidence level \(\alpha \). Based parameters used are \(\mu =0.15\), \(\sigma =0.25\), \(r=0\), \(T=1\), \(\alpha =0.01\), \(R=1\), \(\Delta =30/250\), \(\beta _1=\beta _2=0.5\), \(k=2\), \(\gamma _1=\gamma _2=0.55\), \(\phi _1=1\) and \(\phi _2=2\)

Figure 2 shows how the optimal investment level changes with the Expected Shortfall significance level. The results are intuitive: tighter the risk limit, more conservative the portfolio strategy.

We can measure in monetary terms the impact of a dynamic risk constraint on both the tail-risk-seeking trader and a risk averse manager who derives utility from the terminal value of the portfolio managed by the trader. Under a given set of model parameters, the maximal expected utility of the trader V(t, x) and the optimal trading strategy \(\Pi ^*\) can be computed numerically. The certainty equivalent (CE) of the trader (with capital x at time t) is defined as the value C such that \(V(t,x)=U(C)\). Economically, it is the fixed amount of wealth to be endowed by the trader who is indifferent between this endowment and the opportunity to trade under a dynamic risk constraint. Likewise, the CE of the manager is defined as the value of C solving \({\mathbb {E}}^{(t,x)}[U_m(X_T^{\Pi ^*})]=U_m(C)\) where \(U_m(\cdot )\) is the concave utility function of the manager.

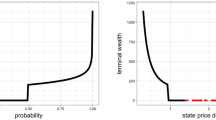

As an example, consider a tail-risk-seeking trader with a unit of initial capital \(x_0=1\) and their utility function has a piecewise power form. The risk averse manager has a utility function of \(U_m(x)=-e^{-\eta x}\) and a dynamic ES constraint is imposed to risk-control the trader. Figure 3 shows the time-zero CE of both the trader and the manager as a function of the risk limit R.

The time-zero certainty equivalent of the trader (with piecewise power utility function) and the risk averse manager (with exponential utility function) against the risk limit of a dynamic ES constraint. Parameters used are \(\mu =0.15\), \(\sigma =0.25\), \(r=0\), \(T=1\), \(\alpha =0.01\), \(\Delta =30/250\), \(k=2\), \(\alpha _1=\alpha _2=0.5\), \(\eta =1\) and \(x_0=1\)

When R is very close to zero, the CE of the trader and the risk manager are both around unity which is the initial trading capital. This is not surprising because under a very tight risk limit the trader essentially cannot purchase any risky asset. The portfolio under an admissible strategy is then almost riskless and the CE simply becomes the initial capital available (multiplied by the interest rate factor).

As R increases, the CE of the trader gradually increases because a larger value of R means the trader becomes less risk-constrained and therefore must be better off economically. On the other hand, the CE of the manager first increases slightly but then drops significantly. The CE of the manager improves at the beginning because a small but non-zero risk limit encourages the trader to invest conservatively in the risky asset which in turn creates value for the risk averse manager. However, when the risk limit is further relaxed, the trader takes more and more risk which starts becoming detrimental to the risk averse manager. Once R goes above around 130% of the initial capital, the CE of the manager goes below unity meaning that the trading activity now causes value destruction from the perspective of the manager. Indeed, when R becomes arbitrarily large, Proposition 1 implies that the trader’s CE will go to positive infinity while Theorem 5.4 of Armstrong and Brigo (2019) suggests the CE of the risk averse manager will become negative infinity. Figure 3 highlights the conflict of interests between a tail-risk-seeking trader and a risk averse manager, and a slack risk management policy could easily result in drastic economic losses faced by the bank.

4 A special case of zero excess return

Proposition 3 provides a theoretical characterisation of the value function. However, it does not tell us much about the behaviours of the optimal portfolio strategy. In this section, we focus on a setup with \(\mu =r=0\) (the assumption of \(r=0\) is imposed for convenience only. The slightly more general case of \(\mu =r\) can be handled by a change of numeraire technique.) The key idea is that in this special case we can exploit an equivalence between the risk-constrained portfolio optimisation problem and an optimal stopping problem. We show that the optimal trading strategy can be characterised in terms of a stopping time. As we will see soon, the state-space \([0,T]\times {\mathbb {R}}\) of the problem can be split into two regions: a trading region where the maximum possible amount is invested in the risky asset (\(\Pi ^*=k\) for some constant k) and a no-trade region where the agent opts to hold a pure cash position (\(\Pi ^*=0\)).

As a preliminary discussion, investment motive vanishes in the case of \(\mu =r=0\). Then whether the trader would participate in a fair gamble is purely driven by their risk appetite. Due to the S-shaped utility function, the trader is risk seeking over the domain of losses but risk averse over the domain of gains. Simple economic intuitions suggest that the trader prefers to gambling when the portfolio value is low, and prefers to taking all the risk off when the portfolio value is high. We therefore postulate that the optimal portfolio strategy has a “bang-bang” feature where the agent invests the maximum possible amount in the risky asset when the portfolio value is low. Once the portfolio value becomes sufficiently high, the trader’s risk aversion dominates and the entire holding in the risky asset will be immediately liquidated. The postulated strategy can be stated in terms of a stopping time: the portfolio value evolves as a Brownian motion with maximum volatility (under the most aggressive admissible strategy) and stops when the agent decides to sell their entire risky asset holding and the portfolio value will remain unchanged thereafter. This inspires us to consider a simple optimal stopping problem introduced in the following subsection.

4.1 An optimal stopping problem

Before proceeding, we need to impose some slightly stronger assumptions on the utility function U throughout this section.

Assumption 2

The utility function \(U:{\mathbb {R}}\rightarrow {\mathbb {R}}\) is a continuous, strictly increasing and strictly concave (resp. convex) \(C^{2}\) function on \(x>0\) (resp. \(x<0\)) with \(U(0)=0\) and \(\lim _{x\rightarrow +\infty } U'(x)=0\).

We now introduce below an optimal stopping problem and verify some properties of its solution structure. Towards the end of this subsection, we will show that this optimal stopping problem and the risk-constrained portfolio optimisation problem (8) are indeed equivalent.

Proposition 4

Suppose \(X=(X_t)_{t\ge 0}\) has the dynamics of \(dX_t=\nu dB_t\) where \(\nu >0\) is a constant. Define an optimal stopping problem

where U satisfies Assumption 2 and \({\mathcal {T}}_{t,T}\) is the set of \({\mathcal {F}}_t\)-stopping times valued in [t, T]. The value function of problem (11) is the unique viscosity solution to the HJB variational inequality

Define the continuation set \({\mathcal {C}}\) and the stopping set \({\mathcal {S}}\) as

The optimal stopping time is given by \(\tau ^*=\inf \{u\ge t: (u,X_u)\in {\mathcal {S}}\}\).

The below important result characterises the optimal stopping region in a more economically intuitive manner. In particular, the optimal stopping rule is a simple time-varying threshold strategy where the agent stops the process when its value is sufficiently high.

Proposition 5

There exists a continuous and decreasing function \(b:[0,T)\rightarrow (0,\infty )\) with \(\lim _{t\uparrow T}b(t)=0\) such that the stopping set in (13) admits a representation of

Finally, we verify the equivalence of the portfolio optimisation problem (8) and the optimal stopping problem (11) under \(\mu =r=0\).

Proposition 6

Suppose \(\mu =r=0\) and Assumption 2 holds. For \(i\in \{\text {VaR},\text {ES}\}\), let \(V_{i}\) be the value function of the portfolio optimisation problem (8) under \(K=K_i\). Then

where

and \(W(t,x;\nu )\) is the value function of the optimal stopping problem (11) with diffusion constant \(\nu \). Moreover, an optimal portfolio strategy is

with \(b(\cdot )\) being the optimal stopping boundary function of the stopping set introduced in (14) associated with problem (11) (under the diffusion parameter \(\nu = k_i\)).

Figure 4 gives a stylised plot of the optimal portfolio strategy. When the portfolio value is low, the agent invests the maximum possible amount in the risky asset by taking \(\Pi _t^*=k^i/\sigma \), whereas when the portfolio value is high the agent takes all the risk off and sets \(\Pi _t^*=0\). Such trading pattern is consistent with the property of the S-shaped utility function. The agent is risk seeking and hence takes the largest possible risk exposure when the portfolio is performing poorly because any further losses are not heavily penalised due to the limited liability nature or tail-risk-seeking preference, but when the portfolio is performing sufficiently well then the concavity of the utility function dominates which encourages the agent to offload the risk. The critical boundary between the two regimes is given by some non-negative, continuous and decreasing function b(t).

4.2 Comparative statics

Some comparative statics can be established to shed light on the policy implications of the dynamic risk constraint. This is summarised by the following proposition.

Proposition 7

In the special case of \(\mu =r=0\), denote by \(b(t;\theta )\) the trading boundary associated with the optimal strategy of the VaR/ES-constrained problem (8) introduced in Proposition 6 under a particular model parameter \(\theta \). For t being fixed, we have the following:

-

1.

b(t; T) is increasing in the trading horizon T;

-

2.

b(t; R) is increasing in the risk limit level R;

-

3.

\(b(t; \alpha )\) is increasing in the significance level of the VaR/ES measure \(\alpha \);

-

4.

\(b(t; \Delta )\) is decreasing in the risk evaluation window \(\Delta \);

-

5.

\(b(t; \sigma )\) does not depend on \(\sigma \).

Recall the optimal strategy is in form of \(\Pi _t^*=\frac{k^i}{\sigma }1_{(X_t<b(t))}\). Hence \(k^i\) governs the amount of investment given that the trader is in the trading region, and the location of b(t) reflects how frequent the trader will be trading. Higher the value of b(t), larger the regime of portfolio value under which the trader takes the most extreme risk exposure. Imposing dynamic risk constrains can curb such behaviours. As a first order effect, a strict risk limit (low R or \(\alpha \)) reduces \(k^{i}\) which limits the position value of risky asset investment. This restricts the volatility of the portfolio return and thus the trader might find it less attractive to gamble despite the non-concavity of their utility function. As a result, it also leads to a shrunk region of trading, i.e. b(t) is lowered. Alternatively, the trader will trade less often if the trading horizon T is reduced. This could potentially be achieved in practice by shortening the performance evaluation horizon adopted by the risk management committee.

Our analysis in this section relies on a very restrictive assumption that \(\mu =r=0\). Theoretical treatment of the more realistic case of \(\mu \ne r\) appears to be rather difficult. Heuristically, the maximiser to the Hamiltonian in (10) can be written as

This is a complicated state-dependent function which behaviour depends on the precise form of the underlying utility and value function (see Fig. 2 in Sect. 3). Without a proper prior conjecture of the concavity/convexity properties of V, it is unclear how the structure of H can be studied which is crucial in the HJB approach.

The specification of \(\mu =r=0\) greatly simplifies the Hamiltonian as the optimiser can then only take values on either some constant k satisfying \(|k|=|k^i_2|=|k^i_1|\) (maximal risk-taking) or zero (no trading). This facilitates the use of optimal stopping techniques to analyse the regimes that distinguish the two possible trading patterns as presented in this section. The optimal stopping characterisation also allows us to derive strong comparative statics in Proposition 7 to deliver insights over how a trader’s “risk-on risk-off” behaviours will response to change in the market and risk management parameters.

Full generalisation of the analysis beyond \(\mu =r\) will be an interesting topic for future research.

5 Derivatives trading under dynamic risk constraints

In the context of portfolio optimisation under a complete market, it is typically not important to distinguish a “delta-one” trader (who is constrained to trade only in the underlying stock and a risk-free account) and a derivatives trader (who can purchase any payoff structure contingent on the underlying stock price). It is because market completeness implies that perfect replication of any arbitrary claim is feasible and hence derivatives securities are redundant. This insight is exploited heavily to facilitate the martingale duality method where a dynamic portfolio selection problem is converted into a static problem of optimal payoff design.

Our main results in Sect. 3 and 4 apply to a delta-one trader, in which case the ES of the portfolio is determined by the delta of the portfolio and this is a key ingredient in our calculation.

However, the results will change drastically if the trader has access to the derivatives market. A trader with limited liability who is allowed to purchase arbitrary derivative securities at the Black-Scholes price will be able to achieve arbitrarily high expected utilities under any ES constraint by pursuing a martingale type strategy. The essential idea is to use Theorem 4.1 of Armstrong and Brigo (2019) to find a derivative which comfortably meets the ES constraint and provides the desired utility. If at some future point the market moves so that the ES constraint hits the limit, then the trader may apply Theorem 4.1 Armstrong and Brigo (2019) to find a new derivative which still yields the desired expected utility and which ensures that the constraint again comfortably met. It is possible to construct a strategy so that with probability 1, the trader will only need to rebalance their portfolio in this way a finite number of times. We give a proof of this in Appendix B.

Why is a dynamic risk constraint effective against a delta-one trader but not a derivatives trader? It is because the replication of large quantities of out-of-money digital options will involve trading a massive notional of the underling stock in the bad state of the world, which the delta-one trader understands ex-ante will not be feasible under a given dynamic risk constraint. In contrast, the feasibility of a derivative position only depends on the current statistical profile of the payoff. The derivatives trader can therefore exploit the blindspot of a risk measure to ensure the massive tail-risk is not detected. Finally, the possibility to roll-over a derivative position allows the risk constraint to be satisfied throughout the entire trading horizon.

One might ask what alternative types of risk limits would be effective against such a trader. Expected utility constraints give one possible answer. For example, one can choose a concave increasing function \(U_m\) of the form \(U_m(x)=-(-x)^\gamma {\mathbbm {1}}_{x\le 0}\) for \(\gamma \in (1, \infty )\) and require that at each time \({\mathbb {E}}[U_m(X^{(t)}_{t+\Delta })]\ge R\) where \(X^{(t)}_s\) is the time-s value of the derivatives portfolio held by the trader at time t and \(R \in (-\infty ,0)\) is a chosen risk limit. To see that such a constraint would be effective, first note that there would be a minimum wealth at time T needed to achieve such a utility constraint. This would implies that the trading strategy must achieve a minimum expected \(u_M\) at time T and one may then apply Theorem 5.3 of Armstrong and Brigo (2019).

Alternatively, restricting the class of accessible derivatives could help if the risk constraint is sufficiently strict. This in conjunction with other more fundamental constraints such as leverage or delta notional limit can be fully effective against a tail-risk-seeking derivatives trader. See the discussion in Appendix B.

6 Concluding remarks

While VaR and ES are widely adopted by practitioners, the impact of such risk constraints on traders’ behaviours are not necessarily well understood. This paper addresses the negative result of Armstrong and Brigo (2019) that a static VaR/ES measure does not work at all on a tail-risk-seeking trader. Our key result highlights that dynamic monitoring of the trading positions is crucial. Continuous re-evaluation of portfolio exposure demands traders to respect a delta notional limit at all time. This alone is sufficient to discourage excessive risk taking during market distress which is naturally attractive to a tail-risk-seeking trader.

However, the dangerous combination of tail-risk-seeking preference and derivatives trading can pose challenges to risk management. Even though we have shown that dynamic VaR and ES measures in general are effective against a delta-one trader, the jury is still out on their effectiveness in the more sophisticated setup of derivatives trading. Our preliminary analysis reports some negative results in this aspect, where the possibility to rebalance a derivative position allows trading losses and risk limit breaches to be indefinitely deferred. As the possible alternatives to statistical-based measures like VaR or ES, utility-based risk measures, scenario-based and sensitivity-based assessments such as stress testing or even the very elementary option delta notional limit might be the superior tools for risk managing derivatives traders. It will be of both theoretical and practical interests to further explore the desirable features of an effective risk control mechanism which performs well beyond delta-one trading. In the meantime, however, our sentiment is that one perhaps should not be over-reliant on statistical-based risk measures despite their popularity.

Notes

In a one-period mean-ES portfolio selection problem, Herdegen and Khan (2021) derive the condition of the existence of \(\rho \)–arbitrage which depends on the confidence level of the ES measure. Their setup is different from ours as they focus on expected return rather than expected utility as a performance criteria and their problem is static while we focus on dynamic optimisation.

Indeed, if the dynamic risk constraint \(\rho (L_t)\le R\) is only imposed at countable number of time points say at \(t\in \{\tau _0,\tau _1,...,\tau _n\}\), then the optimisation problem is ill-posed because in any time interval \(t\in (\tau _k,\tau _{k+1})\) where the risk is not monitored, the trader can achieve any arbitrarily high utility by replicating some digital options (as per Proposition 1) with maturity \(T'<\tau _{k+1}\) which payoff is then rolled over at the riskfree rate until the terminal date T. This highlights that the continuous monitoring nature of a dynamic risk constraint is crucial to rule out degenerate risk-taking behaviours.

The Basel Committee on Banking Supervision (2019) advocates the computation of ES at 97.5\(^{\text {th}}\) percentile and the horizon depends on the risk factor category which can be up to 120 days.

Smooth-pasting must hold at b(s) because \(b(s)>0\) and \(U'(x)\) exists for any \(x>0\). See (Peskir & Shiryaev, 2006).

For the case of \(\mu <\sigma ^2/2\), an upper bound can be derived by using the fact that the probability of a drifting Brownian motion \(X_t:=\eta t + \sigma B_t\) hitting level \(-a\) before b over an infinite horizon is \(\frac{1-\exp (-\frac{2\eta }{\sigma ^2}b)}{\exp (\frac{2\eta }{\sigma ^2}a)-\exp (-\frac{2\eta }{\sigma ^2}b)}\).

We conjecture Lemma 4 can be strengthened to conclude that there exists arbitrarily small \({\hat{\alpha }}\) (independent of S and t) under which \({{\mathcal {P}}}(f,S,t)>-\textrm{ES}_{{\hat{\alpha }}}(f,S,t)\) for all \(S>0\) and \(t\in [0,T)\).

Law-invariance is not strictly required, but it can guarantee the constraint set to be time-homogeneous.

References

Akume, D., Luderer, B., & Wunderlich, R. (2010). Dynamic shortfall constraints for optimal portfolios. Surveys in Mathematics and its Applications, 5, 135–149.

Armstrong, J., & Brigo, D. (2018). Rogue traders versus value-at-risk and expected shortfall. Risk Magazine.

Armstrong, J., & Brigo, D. (2019). Risk managing tail-risk seekers: Var and expected shortfall vs s-shaped utility. Journal of Banking & Finance, 101, 122–135.

Armstrong, J., & Brigo, D. (2022). Coherent risk measures alone are ineffective in constraining portfolio losses. Journal of Banking & Finance, 140, 106315.

Bai, H., & Zhang, L. (2022). Searching for the equity premium. Journal of Financial Economics, 143(2), 897–926.

Basak, S., & Shapiro, A. (2001). Value-at-risk-based risk management: Optimal policies and asset prices. The Review of Financial Studies, 14(2), 371–405.

Basel Committee on Banking Supervision (2019). Minimum capital requirements for market risk. Available at https://www.bis.org/bcbs/publ/d457.pdf.

Berkelaar, A. B., Kouwenberg, R., & Post, T. (2004). Optimal portfolio choice under loss aversion. Review of Economics and Statistics, 86(4), 973–987.

Bian, B., Miao, S., & Zheng, H. (2011). Smooth value functions for a class of nonsmooth utility maximization problems. SIAM Journal on Financial Mathematics, 2(1), 727–747.

Bichuch, M., & Sturm, S. (2014). Portfolio optimization under convex incentive schemes. Finance and Stochastics, 18(4), 873–915.

Boyle, P., & Tian, W. (2007). Portfolio management with constraints. Mathematical Finance, 17(3), 319–343.

Carpenter, J. N. (2000). Does option compensation increase managerial risk appetite? The Journal of Finance, 55(5), 2311–2331.

Cuoco, D., He, H., & Isaenko, S. (2008). Optimal dynamic trading strategies with risk limits. Operations Research, 56(2), 358–368.

Cvitanić, J., Karatzas, I. (1992). Convex duality in constrained portfolio optimization. The Annals of Applied Probability, 767–818.

Dong, Y., & Zheng, H. (2019). Optimal investment of dc pension plan under short-selling constraints and portfolio insurance. Insurance: Mathematics and Economics, 85, 47–59.

Dong, Y., & Zheng, H. (2020). Optimal investment with s-shaped utility and trading and value at risk constraints: An application to defined contribution pension plan. European Journal of Operational Research, 281(2), 341–356.

Forsyth, P. A., & Labahn, G. (2007). Numerical methods for controlled Hamilton-Jacobi-Bellman PDEs in finance. Journal of Computational Finance, 11(2), 1–43.

Gabih, A., Grecksch, W., & Wunderlich, R. (2005). Dynamic portfolio optimization with bounded shortfall risks. Stochastic Analysis and Applications, 23(3), 579–594.

Guan, G., & Liang, Z. (2016). Optimal management of dc pension plan under loss aversion and value-at-risk constraints. Insurance: Mathematics and Economics, 69, 224–237.

Gundel, A., & Weber, S. (2008). Utility maximization under a shortfall risk constraint. Journal of Mathematical Economics, 44(11), 1126–1151.

Herdegen, M. & Khan, N. (2021). Mean-\(\rho \) portfolio selection and \(\rho \)-arbitrage for coherent risk measures. SSRN 3691027.

Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47(2), 363–391.

Karatzas, I., Lehoczky, J. P., & Shreve, S. E. (1987). Optimal portfolio and consumption decisions for a small investor on a finite horizon. SIAM Journal on Control and Optimization, 25(6), 1557–1586.

Merton, R. C. (1969). Lifetime portfolio selection under uncertainty: the continuous-time case. The Review of Economics and Statistics, 51(3), 247–257.

Merton, R. C. (1971). Optimum consumption and portfolio rules in a continuous-time model. Journal of Economic Theory, 3(4), 373–413.

Øksendal, B., & Reikvam, K. (1998). Viscosity solutions of optimal stopping problems. Stochastics and Stochastic Reports, 62(3–4), 285–301.

Peskir, G., & Shiryaev, A. (2006). Optimal stopping and free-boundary problems. Springer.

Pham, H. (2009). Continuous-time stochastic control and optimization with financial applications (Vol. 61). Springer.

Reichlin, C. (2013). Utility maximization with a given pricing measure when the utility is not necessarily concave. Mathematics and Financial Economics, 7(4), 531–556.

Strotz, R. H. (1955). Myopia and inconsistency in dynamic utility maximization. The Review of Economic Studies, 23(3), 165–180.

Yiu, K. F. C. (2004). Optimal portfolios under a value-at-risk constraint. Journal of Economic Dynamics and Control, 28(7), 1317–1334.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: Proofs

Proof of Proposition 1

Without loss of generality we just need to prove the result at \(t=0\). By standard duality argument (see for example Karatzas et al. (1987)), the portfolio optimisation problem (8) without any additional risk constraint is equivalent to solving

where

is the pricing kernel in the Black-Scholes economy. Now consider a digital payoff in form of

for \(b>0\) and \(k>0\). The budget constraint can be written as

If \(\xi _T\) is unbounded from the above (which is the case in the Black-Scholes model), then \(\lim _{k\rightarrow \infty }\frac{{\mathbb {P}}(\xi _T>k)}{{\mathbb {E}}[\xi _T {\mathbbm {1}}_{(\xi _T>k)}]}=0\). In turn for any \(b>0\) fixed one can always find a sufficiently large k such that the budget constraint is satisfied. The value function must be no less than the expected utility attained by this payoff structure, i.e.

Under Assumption 1, \(\lim _{x\rightarrow -\infty }\frac{U(x)}{x}=0\). Thus on sending \(k\rightarrow \infty \) we deduce \(V_0(0,x_0)\ge U(b)\). The result follows since \(b>0\) is arbitrary. \(\square \)

Proof of Proposition 2

Since \(U(x)\le 0\) for \(x\le 0\) and U(x) is concave on \(x>0\), for any constant \(C>0\) there always exists \(m>0\) such that \(U(x)\le {\bar{U}}(x):=m x^{+}+C\) for all x. Then

Since K is bounded, there exits \(b\in (0,\infty )\) such that \(K\subseteq [-b,b]=:{\bar{K}}\). Then

We can now derive the expression of \({\bar{V}}(t,x)\) as the value function of a stochastic control problem with payoff function \({\bar{U}}\) which is increasing and convex. Formally, we expect \({\bar{V}}(t,x)\) to be the (viscosity) solution of the HJB equation

Suppose \(\mu \ge r\) and recall that \({\bar{U}}\) is convex. Since the dynamics of the portfolio process is \(dX_t= [rX_t+(\mu -r)\Pi _t]dt+\sigma \Pi _t dB_t\) where its drift and volatility are both increasing in \(\Pi _t\), we expect the optimal strategy is to choose the largest possible value of \(\Pi _t\) within the bounded set \({\bar{K}}\). Hence the candidate optimal control for problem (A.2) is \(\Pi ^*_t=b<\infty \). The corresponding candidate value function is thus

and the wealth process under the candidate optimal control is

Then

such that \(X^{*}_T\) is normally distributed with mean \(xe^{r(T-t)}+\frac{b(\mu -r)}{r}(e^{r(T-t)}-1)\) and variance \(\frac{b^2\sigma ^2}{2r}(e^{2r(T-t)}-1)\). Upon evaluating the expectation, we obtain

where \(\Phi \) and \(\phi \) are the cdf and pdf of a standard N(0, 1) random variable respectively. w(t, x) is indeed \(C^{1\times 2}\) on \([0,T)\times {\mathbb {R}}\), and is increasing convex in x. It can be easily shown that w is a solution to the HJB equation (A.3). Standard verification arguments then lead to the conclusion that \({\bar{V}}(t,x)=w(t,x)\). Finally, for each fixed t we have \({\bar{V}}(t,x)=w(t,x)\rightarrow C\) as \(x\downarrow -\infty \). But the constant \(C>0\) can be arbitrarily chosen. Using the fact that \(V(t,x)\le {\bar{V}}(t,x)\), the desired result follows if we choose \(C\in (0,\sup _s U(s))\). The case of \(\mu <r\) can be handled similarly except that the optimal control will become \(\Pi ^*_t=-b\) instead. \(\square \)

Proof of Theorem 1

In view of Lemma 1 and Proposition 2 we only need to prove the “only if” part of the theorem.

In the proof of Proposition 1, a utility level of \(\sup _{s}U(s)\) can be attained by replicating a sequence of payoffs in form of

with \(a<0<b\) where \(\xi _T\) is the pricing kernel in the Black-Scholes economy. But

Hence \(X_T\) is increasing (resp. decreasing) in \(S_T\) if \(\mu > r\) (resp. \(\mu < r\)).

Suppose \(\frac{\mu -r}{\sigma }\ge M_{i}>0\) where \(i\in \{\text {VaR},\text {ES}\}\). Then by Lemma 1 the admissible set is in form of \([k_1^i,\infty )\) where \(k_1^i\in (-\infty ,0)\). In other words, there is no restriction on the investment level for as long as only long position is taken. But since \(\mu >r\), if we view \(X_T\) as a contingent claim written on the risky asset, the payoff \(X_T=X(S_T)\) is an increasing function and thus the option must have non-negative delta for all (t, x). Hence only long position is ever required to replicate this claim. The sequence of strategies replicating the digital options which yield a utility level of \(\sup _s U(s)\) must also belong to \({\mathcal {A}}(K_i)\) as well. In this case, the dynamic risk i constraint is not effective. Similar results hold for the case of \(\frac{\mu -r}{\sigma }\le -M_i<0\).

Proof of Proposition 3

Provided that \(|\frac{\mu -r}{\sigma }|<M_i\), the set \(K_i\) is bounded and hence by (A.4) we can deduce that \(V(t,x)\le \alpha _1+\beta _1 x\) for some constant \(\alpha _1>0\) and \(\beta _1>0\). On the other hand, the utility function U is a negative convex increasing function on \(x<0\). Hence there exists \(\alpha _2>0\) and \(\beta _2>0\) such that \(U(x)>-\alpha _2 -\beta _2 x^{-}=:G(x)\) for all x. Then since \({\tilde{\Pi }}_t=0\) for all t is an admissible strategy in \({\mathcal {A}}(K_i)\), we have

for all (t, x). Thus we conclude \(V_i(t,x)\le c(1+|x|)\) for some \(c>0\), i.e. the value function has at most a linear growth.

Now we show that the value function \(V_i\) is a viscosity solution to the HJB equation (9) where the proof is based on Pham (2009). We drop the subscript i everywhere for brevity. Since the function V is of linear growth, it is locally bounded and its upper- and lower-semicontinuous envelop,

are well-defined. Write \({\mathcal {D}}:=\{(t,x):t\in [0,T)\times {\mathbb {R}}\}\).

We first show that V is a supersolution to (9). For an arbitrarily given \(({\bar{t}},{\bar{x}})\in {\mathcal {D}}\), let \(\varphi (t,x)\) be a twice-differentiable test function on \({\mathcal {D}}\) such that

By construction, there exists a sequence \((t_n,x_n)\in {\mathcal {D}}\) such that \((t_n,x_n)\rightarrow ({\bar{t}},{\bar{x}})\) and \(V(t_n,x_n)\rightarrow V_*({\bar{t}},{\bar{x}})\) when \(n\uparrow \infty \). Now define

for some fixed \(\alpha \in (0,1)\). Then we have \(\beta _n\rightarrow 0\), \(h_n\rightarrow 0\) and \(\beta _n/h_n\rightarrow 0\) as \(n\uparrow \infty \).

Next, fix a constant \(\pi \in K\) and let \(X^n:=X^{t_n,x_n,\pi }\) be the controlled process under the constant control policy \(\Pi _t=\pi \) with initial value \(X^n_{t_n}=x_n\). Define a sequence of stopping times \(\tau _n:=\inf \{s> t_n,|X^n_s-x_n|\ge \epsilon \}\) for some \(\epsilon >0\). Dynamic programming principle over \([t_n,\theta _n]\) with \(\theta _n:=\min (t_n+h_n,\tau _n)\) now implies

Using the facts that \(V(t_n,x_n)=\beta _n+\varphi (t_n,x_n)\) and \(V\ge V_*\ge \varphi \), the above inequality implies

Since \(\varphi \) is smooth, we can apply Ito’s lemma to deduce

where \(\mathcal {L^\pi }f:= [rx+(\mu -r)\pi ]f_x+\frac{\sigma ^2}{2}\pi ^2f_{xx}\) is the infinitesimal generator of X, and we have used the fact that the stochastic integral is a true martingale as its integrand is bounded over \([t_n,\theta _n]\). After dividing both sides by \(h_n\), we have

On noticing that \(\theta _n=t_n+h_n\) almost surely for large n and the expression inside the expectation is bounded and converging almost surely to \(\varphi _t({\bar{t}},{\bar{x}})+{\mathcal {L}}^\pi \varphi ({\bar{t}},{\bar{x}})\), we deduce

Thus V is a viscosity supersolution to (9) as \(({\bar{t}},{\bar{x}})\) and \(\pi \) are arbitrary.

It remains to show that V is a viscosity subsolution to (9). Fix an arbitrary point \(({\bar{t}},{\bar{x}})\in {\mathcal {D}}\) and a twice-differentiable test function \(\varphi \) on \({\mathcal {D}}\) such that

and \(V^*(t,x)-\varphi (t,x)<0\) for all \((t,x)\ne ({\bar{t}},{\bar{x}})\). We will proceed by establishing a contradiction, where we suppose instead that \(({\bar{t}},{\bar{x}})\) and \(\varphi \) are such that

Since the admissible control set K is bounded, the Hamiltonian \(H=H(x,p,M)\) is the supremum of some continuous function over a compact set. Thus H is continuous by Maximum Theorem and is finite. Using the \(C^2\) smoothness of \(\varphi \) and continuity of H, there exists \(\eta >0\) such that

for all \((t,x)\in B(({\bar{t}},{\bar{x}}),\eta ):=\{(t,x): ||(t,x)-({\bar{t}},{\bar{x}})||<\eta \}\). Let \((t_n,x_n)\in B(({\bar{t}},{\bar{x}}),\eta )\) be a sequence such that \((t_n,x_n)\rightarrow ({\bar{t}},{\bar{x}})\) and \(V(t_n,x_n)\rightarrow V^*({\bar{t}},{\bar{x}})\) as \(n\uparrow \infty \). Moreover, as \(V(t_n,x_n)-\varphi (t_n,x_n)\rightarrow 0\), this sequence can be chosen such that \(|V(t_n,x_n)-\varphi (t_n,x_n)|<\epsilon /2\) for all n, where \(\epsilon >0\) is defined as

For an arbitrary control \(\Pi \in {\mathcal {A}}(K)\), we define \(X^n:=X^{t_n,x_n,\Pi }\) as the corresponding controlled process with initial condition \(X^n_{t_n}=x_n\). Define the sequence of stopping times \(\theta _n:=\inf \{s>t_n,X^n_s\notin B(({\bar{t}},{\bar{x}}),\eta )\}\). Using Ito’s lemma on \(\varphi \), (A.6), the construction of \(\theta _n\) and \(\varphi \) and the fact that \((\theta _n,X^n_{\theta _n})\in \partial B(({\bar{t}},{\bar{x}}),\eta )\),

But this contradicts the dynamic programming principle as \(\Pi \in {\mathcal {A}}(K)\) is arbitrary which does not depend on \(\epsilon \). Hence we conclude V is a viscosity subsolution to (9).

Finally, the solution is indeed unique in the class of viscosity solutions with linear growth due to strong comparison principle. See Theorem 4.4.5 of Pham (2009). \(\square \)

We first provide some prior properties of the value function (11) in the following lemma.

Lemma 2

The value function (11) has the following properties:

-

1.

W(t, x) is continuous in t and x.

-

2.

W(t, x) is decreasing in t and is increasing in x;

-

3.

\(W(t,x)\in C^{1,2}({\mathcal {C}})\) with \(W_{xx}(t,x)\ge 0\) for all \((t,x)\in {\mathcal {C}}\) where \({\mathcal {C}}\) is defined in (13).

Proof

Property 1 is due to the standard comparison principle of viscosity solution. Property 2 can be easily inferred from the structure of the optimal stopping problem. Here we will prove Property 3.

Fix a bounded open domain \({\mathcal {O}}\) in \({\mathcal {C}}\) and consider a boundary value problem

Since the operator \({\mathcal {G}}\) is linear, standard PDE theory suggests that there exists a unique smooth solution \(f\in {\mathcal {C}}^{1,2}\) to (A.7) on \({\mathcal {O}}\). But this f also solves (12) on \({\mathcal {O}}\). By uniqueness of the viscosity solution, we deduce \(W=f\) on \({\mathcal {O}}\) such that \(W\in C^{1,2}({\mathcal {O}})\). Finally, \({\mathcal {C}}\) is an open set and thus by the arbitrariness of \({\mathcal {O}}\) the smoothness property of W can be extended to the entire \({\mathcal {C}}\).

Thanks to the \(C^{1,2}({\mathcal {O}})\) property, (12) can be interpreted in the classical sense such that on \({\mathcal {C}}\) we have \(\frac{\nu ^2}{2}W_{xx}=-W_t\ge 0\) as W is decreasing in t. \(\square \)

Proof of Proposition 4

The relationship between the solution of an optimal stopping problem and the viscosity solution of the corresponding HJB variational inequality as well as the characterisation of the optimal stopping rule are standard - see for example (Øksendal & Reikvam, 1998). Note that the techniques used in the proofs of Proposition 2 and 3 can be adopted here to show that the value function W(t, x) has at most a linear growth in x, which in turn confirms the uniqueness of the viscosity solution. \(\square \)

Proof of Proposition 5

We first prove a preliminary result that \([0,T)\times (-\infty ,0)\subseteq {\mathcal {C}}\), i.e. it is always suboptimal to stop on the negative regime before the terminal time. Suppose on contrary there exists \((t',x')\) with \(0\le t'< T\) and \(x'<0\) such that \((t',x')\in {\mathcal {S}}\). Then \(W(t',x')=U(x')\). Now consider an alternative stopping rule

for some \(0<\epsilon <-x'\). Let \(p_{\epsilon }:={\mathbb {P}}(\tau _{\epsilon }<T)\). Then

using the strict convexity of U on \(x<0\) and the martingale property of the process X. It is not hard to observe that \(p_{\epsilon }\uparrow 1\) as \(\epsilon \downarrow 0\). We immediately obtain the required contradiction \(W(t',x')>U(x')=W(t',x')\).

The rest of the proof goes as follows:

-

(i)

Existence and non-negativity of b:

We first show that \(W(t,x)-U(x)\) is decreasing in x over \(x\ge 0\) and \(t\in [0,T)\). Fix an arbitrary \(\beta >0\) and define \(F(t,x):=W(t,x+\beta )\). By the linear structure of the underlying Brownian motion, it can be easily seen that \(F(t,x)=\sup _{\tau \in {\mathcal {T}}_{t,T}}{\mathbb {E}}[U(X_{\tau }+\beta )]\) and hence F is the (unique) viscosity solution to

$$\begin{aligned} {\left\{ \begin{array}{ll} \min \left\{ {\mathcal {G}}F,F-U(x+\beta )\right\} =0,&{} t<T;\\ F(t,x)=U(x+\beta ),&{} t=T, \end{array}\right. } \end{aligned}$$(A.8)where \({\mathcal {G}}f:=-f_t-\frac{\nu ^2}{2}f_{xx}=0\). Let \(G(t,x):=W(t,x)+U(x+\beta )-U(x)\). Then whenever \({\mathcal {G}}W=0\), we have

$$\begin{aligned} {\mathcal {G}}G={\mathcal {G}}W+{\mathcal {G}}U(x+\beta )-{\mathcal {G}}U(x)=\frac{\nu ^2}{2}(U''(x)-U''(x+\beta ))\ge 0 \end{aligned}$$as U is concave on \(x\ge 0\), and whenever \(W(t,x)=U(x)\) we have \(G(t,x)=U(x+\beta )\). Moreover, \(G(T,x)=U(x+\beta )\). Hence G is a supersolution to (A.8). By maximum principle (in a viscosity sense), we deduce \(G\ge F\) leading to

$$\begin{aligned} W(t,x)-U(x)\ge W(x+\beta )-U(x+\beta ), \end{aligned}$$(A.9)i.e. \(W(t,x)-U(x)\) is decreasing on \(x\ge 0\).

Now we show that that for each fixed \(t\in [0,T)\) there always exists \(x_0\) such that \(W(t,x_0)=U(x_0)\). Such \(x_0\), if exists, must be strictly positive since it is suboptimal to stop in the negative regime. Then together with the fact that \(W(t,x)-U(x)\) is decreasing in x on \(x\ge 0\), we conclude there exists a unique \(b(t)\in (0,\infty )\) such that \(W(t,x)=U(x)\iff x\ge b(t)\). This will be sufficient to justify the existence of a positive boundary function b which characterises the stopping set (14).

To complete the proof, suppose on contrary that \(W(t,x)>U(x)\) for all x. Then \(\{t\}\times {\mathbb {R}}\in {\mathcal {C}}\) on which W is a \(C^{2}\) increasing convex function in x. \(W(t,x)-U(x)\) being decreasing in x now implies \(W_x(t,x)\le U'(x)\) for all x. In turn \(\lim _{s\rightarrow \infty }W_{x}(t,s)\le \lim _{s\rightarrow \infty }U'(s)=0\) and hence W(t, x) must be a constant independent of x. But with \(W(t,x)>U(x)\) this must imply \(W(t,x)=\sup _s U(s)\) for all \((t,x)\in [0,T)\times {\mathbb {R}}\). This can easily shown to be false based on the same ideas used in the proof for Proposition 2.

-

(ii)

Monotonicity of b : Consider \((t_1,x)\in {\mathcal {S}}\) such that \(W(t_1,x)=U(x)\). Then for any \(t_2>t_1\), we have \(0\le W(t_2,x)-U(x)\le W(t_1,x)-U(x)=0\) since W(t, x) is decreasing in t. Hence \(W(t_2,x)=U(x)\) and \((t_2,x)\in {\mathcal {S}}\) as well such that b(t) must be decreasing.

-

(iii)

Continuity of b : We begin by showing that b is right-continuous. Fix \(t<T\) and consider a decreasing sequence \((t_n)_{n\ge 1}\) with \(t_n\downarrow t\). Then for each n we have \((t_n,b(t_n))\in {\mathcal {S}}\). Since the set \({\mathcal {S}}\) is closed, we have \((t,b(t+))\in {\mathcal {S}}\) as well such that \(b(t+)\ge b(t)\). But \(b(t+)\le b(t)\) as b is decreasing. We hence conclude \(b(t)=b(t+)\).

Now we show that b(t) is left-continuous. Suppose on contrary that there exists \(t<T\) such that \(b(t-)>b(t)\). Define \(\xi :=\frac{b(t-)+b(t)}{2}\) such that \(0\le b(t)<\xi <b(t-)\). Choose \(s\in (0,t)\) and then \(0\le b(t)<b(t-)\le b(s)\). By definition of \(b(\cdot )\) and the smooth-pasting property, we have \(W(s,b(s))=U(b(s))\) and \(W_{x}(s,b(s))=U'(b(s))\).Footnote 4 Then

$$\begin{aligned} W(s,\xi )-U(\xi )&=\int _{b(s)}^{\xi }(W_x(s,y)-U'(y))dy=\int _{b(s)}^{\xi }\int _{b(s)}^{y}(W_{xx}(s,z)-U''(z))dzdy \\&=\int _{\xi }^{b(s)}\int _{y}^{b(s)}(W_{xx}(s,z)-U''(z))dzdy\\&\ge \int _{\xi }^{b(s)}\int _{y}^{b(s)} C dz dy=\frac{C}{2}(\xi -b(s))^2 \end{aligned}$$for some constant \(C>0\) independent of s where we have used Lemma 2 that \(W_{xx}\ge 0\) on \({\mathcal {C}}\) and U is a strictly concave \(C^2\) function on the positive domain. Since W(s, x) is continuous in s, if we let \(s\uparrow t\) we deduce

$$\begin{aligned} W(t,\xi )-U(\xi )\ge \frac{C}{2}(\xi -b(t-))^2>0. \end{aligned}$$But \(b(t)<\xi \) and hence \((t,\xi )\in {\mathcal {S}}\) which implies \(W(t,\xi )=U(\xi )\). We arrive at the required contradiction.

-

(iv)

Limiting behaviour of b : Suppose \(b(T):=\lim _{t\uparrow T} b(t)>0\). Then let \(\xi :=\frac{b(T)}{2}>0\) and with the same argument as in part (iii) of the proof we can deduce \(W(s,\xi )-U(\xi )>\frac{C}{2}(\xi -b(s))^2\) for some constant \(C>0\) and \(s<T\). Contradiction can be obtained again by letting \(s\uparrow T\) on recalling the terminal condition that \(W(T,x)=U(x)\) for all x.

\(\square \)

Proof of Proposition 6