Abstract

Substantial R &D efforts are currently directed towards the development of combined heat and power (CHP) systems that automatically and seamlessly connect to the power grid. In this paper we develop a real options model to assess the impact that the operational flexibility characterizing such systems will have on the optimal timing and capacity associated with investments in CHP plants. We take the viewpoint of a manufacturer operating in an energy-intensive industry who contemplates investing in CHP. We discuss and compare investments in two types of CHP systems: a standard one that is operationally rigid and a technologically advanced one that is operationally flexible. The interaction between temporal and operational flexibility under uncertainty and irreversibility is central to our analysis. We show that operational flexibility guarantees earlier investment but has an ambiguous effect in terms of capacity. In particular, when operational flexibility is very valuable the potential investor is opting for investing in a plant with larger productive capacity. The potential investor chooses a smaller CHP unit if otherwise. A numerical exercise calibrated using data from the Italian pulp and paper and electricity industries complements our theoretical analysis.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The decarbonisation of the electricity sector and the efficiency improvement of industrial processes are among the priority objectives for achieving a greener economy. This is now recognized at worldwide level as highlighted by the Paris Agreement established during the United Nations Climate Change Conference COP 21 held in Paris in 2015,Footnote 1 and strongly confirmed more recently by the COP 26 and COP 27.Footnote 2 Europe has taken the leadership in this decarbonisation process with the presentation of the Energy Roadmap 2050 (EC, 2011) and the subsequent issue of the new Green Deal program (EC, 2019),Footnote 3 through which it has paved the way to become the first climate-neutral continent by 2050. The application of these regulations has different impacts on the involved sectors. On one side, the energy-intensive industries have to make their production processes more efficient and less pollutant. On the other side, energy systems are required to invest in renewable-based power plants such as wind and solar units characterized by uncertain and intermittent power production which can threaten the security of energy supply and the stability of the transmission grid.

Since guaranteeing adequate and stable power supply becomes more complex and time sensitive as variable generation resources become more widely used, the employment of technologies that will contribute to the security of supply is of paramount importance. Combined heat and power (CHP) plants can become a valid tool to overcome this issue. CHP plants (also called cogeneration units) can simultaneously produce process heat and electricity from a single energy input for a specific facility. What makes these plants particularly attractive is that they can provide a stable production of electricity with a reduced amount of carbon emissions. Flexible CHP units that can rapidly connect to the grid and provide relevant services could be a win-win solution both for industrial plants and for power systems (Jones & Kelly, 2017; U.S. Department of Energy, 2018a, b). Such units would be able to provide essential grid services through frequency regulation, voltage control, and ramping capabilities relieving grid constraints in a mutually profitable manner (Jones & Kelly, 2017). Small-scale flexible CHP systems do exist (U.S. Department of Energy, 2018a) but the lack of sophisticated monitoring and control technologies constitutes a significant market barrier when it comes to their wider adoption. Technological improvements in data analytics and forecasting tools are accordingly needed in order to enable seamless and automated interaction between the grid and manufacturing sites.

In this paper we investigate how the availability of cogeneration plants that can flexibly provide services to the power system would affect the decisions of potential investors interested in employing this technology in Europe where environmental targets have already been implemented and CHP units are already used. More precisely we concentrate our analysis on CHP investments in the pulp and paper sector, one of the most energy-intensive sectors in Europe which has to reduce its carbon emissions by 80% compared to 1990 level (Szabó et al. (2009)). According to the European Commission (2018), the feasibility of the goal of decarbonisation of the pulp and paper sector derives from a mix of interventions based on recycling, energy efficiency, use of renewable fuels and electrification of processes under the assumption of the development of new technologies. In this work we take the point of view of a pulp and paper plant manager who is contemplating the opportunity of investing in a CHP unit. In particular, it needs to decide i) when to exercise the investment option and ii) what will be the capacity of the installed unit. The potential investor is also accounting for the fact that the unit will be connected to the power grid and hence that it will benefit from a profit flow associated with the provision of energy services. Irreversibility and uncertainty play a key role in this framework (Dixit and Pindyck (1994)). We accordingly use the real options approach (ROA) which has been established as a comprehensive explanation concept for investment behavior in the energy sector (Siddiqui & Marnay, 2008; Siddiqui & Maribu, 2009). By the analogy between an American call option and a real investment, the ROA asserts that an investor can benefit from deferring an investment instead of undertaking it immediately if investment costs are at least partially irreversible and future investment returns are uncertain. The reasoning is that the value of an investment option has two components: the intrinsic value, which is equal to the classical net present value (NPV), and the value of waiting. By investing, the option holder gives up the opportunity of waiting for new information with a potential positive effect on the profitability of the investment. This lost continuation value is an opportunity cost that should be added to the investment costs. Notably, the ROA accounts for irreversibility, uncertainty and managerial flexibility and consequently generates results that are different from those generated by the standard NPV rule, which takes a “now-or-never” perspective when evaluating the investment decision.

We first solve this problem for the case where the CHP technology is standard in the sense that the unit cannot provide grid services in a flexible way. This is the status quo. Then, we address anew the problem assuming a flexible CHP technology which allows for such units to be an integrated part of the power grid. In the following, we denote these two cases as “operationally rigid CHP” and “operationally flexible CHP”, respectively. Operational flexibility is reflected in the ability of the plant manager to use the installed CHP unit for the provision of energy services to the grid whenever this is profitable and abstain from such practices otherwise. In practical terms, an operationally flexible CHP unit avoids both foregone profits and loss making associated with the provision of energy services to the grid since its technology allows for the suspension and resumption of operations in quasi-real-time depending on the energy market conditions.

Our analytical findings suggest that while operational flexibility favors earlier investments, the effect in terms of capacity is ambiguous and depends on the value of flexibility. The timing effect is merely associated with the fact that an operationally flexible CHP plant is hedged against loss making. The plant is operational whenever the provision of services to the grid is profitable and suspends such operations if otherwise. Naturally a potential investor is willing to exercise earlier an investment option that guarantees non-negative cash flows. As for the capacity effect, the potential investor opts for a larger CHP unit when operational flexibility is very valuable but invests more conservatively otherwise. The reasoning is as follows. Operational flexibility is valuable since it guarantees non-negative cash flows but it has little to do with the actual profitability of the investment. If the market conditions are unfavorable, even an investor who benefits from down-side protection will face long periods with weak or no profits. This scenario becomes even more probable if the potential investor exercises the investment option when it is less deep in the money at the time of exercise, as is the case here. Since the ability of the CHP unit to be hedged against losses does not depend on the chosen capacity level, the potential investor will opt for a smaller plant when what is lost because of the earlier exercise is not remunerated by the operational flexibility gained. The theoretical part of the paper is complemented by a numerical exercise using data from the Italian pulp and paper and electricity industries. In particular, we compute and compare the two options associated with operational flexibility and we find that the option to resume the provision of grid services when market conditions become favorable in the future is much more valuable than the option to suspend such operations in order to avoid making losses. From this we conclude that operational flexibility will unlock the CHP plants’ valuable ability to actively participate in energy markets whenever this is needed. This finding has straightforward implications for the energy system as a whole since the employment of operationally flexible CHP plants will contribute to the enhancement of security of supply.

The rest of the paper is organized as follows. Section 2 provides more details about the pulp and paper industry and the real options approach. Sect. 3 presents the model set-up. Sections 4 and 5 present the analysis associated with the investment problem under operational rigidity and operational flexibility respectively. Section 6 provides a discussion of the theoretical results. Section 7 presents the relevant numerical exercise. Section 8 concludes. All the proofs are collected in the “Appendix”.

2 Case study and related literature

2.1 The pulp and paper industry

In our case study we focus on the pulp and paper industry because it is characterized by a large consumption of both heat and power. This is also evident from the cost structure of this sector where the average energy costs, similarly to the cement or the steel industries, represent around 16% of production charges, and in some cases they rise up to 30% (see Schlomann et al., 2015). The two most important steps in paper making are pulping and paper finishing where both heat and power are needed. First, pulp is made by blending wood and water or by using recycled fibres. Then the paper is supplied to the paper machine to form a sheet of paper. At this stage, water is removed from the paper sheet through a press section and then evaporated in a dryer section. As a final step, the paper is smoothed by passing it through high pressure rollers. The consumption of energy and raw materials depends on the technologies adopted in these phases. For instance, the two main methods of pulping are the mechanical and chemical processing. Chemical pulping uses twice as much wood per tonne compared to that of mechanical pulping which in turn results to be more energy-intensive and yields paper with less strength compared to that produced by the chemical pulping process. Mechanical pulping produces heat as a by-product which is used as drying steam in paper processing (see Das & Houtman, 2004; Szabó et al., 2009).

To improve their energy efficiency in the recent years, large paper mills have taken control of their energy needs by building their own CHP plants that also guarantee a reduction in emissions. Thanks to the improvement of CHP technology in the last decades, the European paper industry now produces almost half the electrical energy it consumes. Although the paper-making technology has developed significantly by improving its efficiency using CHP plants, it is estimated that only 40% of potential CHP capacity has been installed in this industry. A prioritized access to the grid giving the possibility to the pulp and paper industry to dispatch the excess electricity produced could lead to a quicker and wider implementation of CHP investments in this sector (EC et al., 2011).

2.2 The real options approach

The use of a stochastic dynamic framework like the ROA is motivated by the fact that a deterministic model would not yield a fair value of flexible CHP systems. The reason is that flexibility in the operational response to energy price changes would be overlooked (Maribu & Fleten, 2008). The ROA is accordingly considered an established approach to study the interaction between temporal and operational flexibility in restructured electricity industries. Fleten et al. (2016) provide relevant empirical evidence concluding that the ROA is a meaningful descriptor of the observed investment behavior when it comes to green energy projects. Siddiqui and Marnay (2008) and Siddiqui and Maribu (2009) employ the ROA in order to study a microgrid’s decision to invest in a distributed generation unit. In the former, the authors focus on operational flexibility as we do but they assume that the capacity of the unit is exogenously fixed. In the latter they instead set aside operational flexibility focusing on the investment problem of a unit that can adopt a sequential investment approach by upgrading the initially installed unit in the future.

Abstracting from its contextualization, our work contributes to the literature streams studying i) how the interaction between temporal and operational flexibility affects the value and timing of investments under uncertainty and irreversibility and ii) how the capacity and timing choices of a firm should be balanced. The seminal work by Dangl (1999) is one of the first to study optimal investment timing and optimal capacity choice under conditions of irreversible investment expenditures and uncertainty in future demand. Di Corato and Moretto (2011) show that the optimal capacity choice problem is similar to a technology choice one where a plant needs to choose, not its capacity, but its degree of flexibility. Moretto and Rossini (2012) show that a similar model can be used to analyze the optimal degree of production outsourcing. In the same vein, Di Corato and Montinari (2014) and Chronopoulos and Siddiqui (2015) study the optimal replacement of an old technology with a new one. Some other recent works focus on the importance of volume flexibility, i.e., the ability of a plant to upscale or downscale production according to demand realization (see e.g. Hagspiel et al., 2016; De Giovanni & Massabò, 2018) and strategic interaction when it comes to the choice of capacity and timing of an investment (Huisman & Kort, 2015; De Giovanni & Iakimova, 2022).

Our contribution in the extant literature lies on the presentation of a model where operational flexibility comes at no cost for the potential investor. This is due to the fact that almost immediate response to power price fluctuations depends on advances in control systems, power electronics and communication technologies, that is, factors that go beyond the agenda and the investment abilities of a single investor. An industrial plant manager can merely update its investment plans and priorities accounting for the technological and economic attributes of the power system in place. Accordingly our model does not discuss the adoption of a new technology at firm level, but the response of a representative potential investor to a more sophisticated power grid.Footnote 4

3 The basic set-up

An industrial plant uses power and process heat for the production of an output. The plant manager is contemplating the opportunity of investing in a CHP plant to cover these needs in-house. A variety of reasons may motivate such an investment. According to Maribu and Fleten (2008) on-site generators may reduce both the expected energy costs and cost risk exposure. Manufactures might also gain better control over plant operations and suffer fewer power outages while reducing greenhouse gas emissions (Gambini et al., 2019). Thus, investing in CHP offers tangible benefits stemming not only from the possibility of lower costs and fewer emissions but from the greater efficiency of the production procedure as a whole (Siddiqui & Marnay, 2008). Since the reasons that motivate such investments are not industry specific, we abstain from discussing the core business of the plant since this will remain unaffected by the employed heat and power source. The framework in the following is in fact general and can be applied to any energy-intensive industry that invests in CHP plants in order to satisfy its in-house heat and power needs.Footnote 5

The problem of the potential investor involves the choice of both the timing of the investment and the level of capacity. The investor is also accounting for the fact that upon installation:

-

1.

The plant can sell to the grid’s system operator a quantity \(\theta \alpha \) of the power produced in-house whenever this is profitable where, \( \alpha \in \left[ 0,1\right] \) corresponds to the overcapacity installed and \(\theta \in [0,1)\) is a capacity-to-power coefficient and,

-

2.

The periodic operating cost (e.g. the fuel cost) of the CHP unit is \( c>0\).

If the plant manager chooses \(\alpha =0\), then the installed CHP unit covers exactly the needs of the plant and no services can be provided to the grid whereas, if \(\alpha >0\), then the plant manager invests in overcapacity in an attempt to benefit from its access to the grid. The maximum \(\alpha \) is normalized without loss of generality to unity and captures the technical and budget constraints that the investor faces.

The cost of investing in \(\alpha \) is assumed to be \(I(\alpha )=j+i\frac{ \alpha ^{\gamma }}{\gamma }\) where \(i>0\), \(j\ge 0\) and\(\ \gamma >1\). \( I(\alpha )\) has two components. The first component j captures costs that are independent of the chosen overcapacity, as for instance the administrative and technical costs of connecting the unit to the grid. The second component \(i\frac{\alpha ^{\gamma }}{\gamma }\) accounts for costs that depend on the level of \(\alpha \) such as the cost of investing in a large rather than a small CHP unit.

Since the operations of the industrial plant are not disrupted during the periods where grid services are provided, the plant manager’s objective to maximize its periodic profits reduces to the minimization of the following periodic cost function:

The first piece of \(c_{t}\) refers to periods of time during which services are not provided to the grid. During these periods the CHP plant is producing power and heat to cover exclusively in-house needs. The second piece of \(c_{t}\) refers instead to periods of time during which services are provided to the grid. During these periods the manager accounts also for the profit from the provision of such services, \(\alpha \theta \left( p_{t}-c\right) \), where \(p_{t}\) is the price of power provided to the grid.

The price of power \(p_{t}\) is assumed to fluctuate over time according to a geometric Brownian motion:

where \(\mu \) is the drift, \(\sigma \) is the instantaneous volatility and\(\ W_{t}\) is a standard Wiener process.Footnote 6

The provision of energy services is the cost-minimizing alternative when \( p_{t}>c\) which means that the cost function can be written as

Hence, the net periodic benefit for an industrial plant that has invested in a flexible CHP unit is equal to \(b_{t}\)Footnote 7

Summing up, the investment problem that the plant manager needs to solve involves the choice of both the timing of the investment and the level of \( \alpha \) given that the cost associated with this investment is \(I(\alpha )\). For the sake of simplicity, we assume that the plant manager contemplates the investment over an infinite time horizon starting at the current time point \(t=0\). Further, we assume that, once the investment takes place at a time point \(\tau \ge 0\): i) the project runs forever,Footnote 8 ii) the potential investor is risk neutral and discounts future payoffs using the interest rate \(r>\mu \),Footnote 9 and iii) the capital installed does not depreciate, i.e., no maintenance is required.Footnote 10

As already noted above, the only source of uncertainty we consider is the power price. Demand side volatility has been treated as a main source of uncertainty in the literature studying the properties of CHPs (see e.g. Siddiqui & Marnay, 2008; Siddiqui & Maribu, 2009). However, it is certainly not the only one. The profit flow that an industrial plant manager can count on over time may very well be affected by the random evolution of operating costs, in particular, fuel costs. According to the European Association for the Promotion of Cogeneration (COGEN, 2019) who use data from Eurostat, natural gas holds a stable share with 40% of the CHP production, the use of renewables and waste reach is close to 30% whereas solid fossil fuels and oil use has seen a steady decrease. As for the pulp and paper industry, more than 62% of total fuel consumption comes from biomass with a large amount of that being process residues. This is attributed to the fact that half of the wood is dissolved and used as fuel in the chemical recovery phase. The natural gas consumption has instead a share of 32% (CEPI, 2020). While our assumption that operating costs are fixed is reasonable for industries that are less dependent on fuels with volatile prices, as e.g. the pulp and paper sector, this is not necessarily the case more generally. Adding this source of uncertainty can be done as follows.

From the formula of the net periodic benefit \(b_{t}\) we see that profit uncertainty has to do, not with the stochasticity of the power price itself, but rather with the fluctuations of the per-unit-of-power profit as this is captured by the difference \(p_{t}-c\). Accordingly, one can model the price–cost difference using two potentially correlated stochastic processes, one for the price as we do, and one for the cost, e.g. the price of natural gas (see e.g. Maribu & Fleten, 2008; Farzan et al., 2015; Bakke et al., 2016).

Alternatively, if the study of the employed fuel mix is more pertinent, then one can potentially model separately the components of c using a dedicated stochastic process for each one of them. More generally, we have \( c=\upsilon _{g}g+\upsilon _{f}f+\upsilon _{w}w+\upsilon _{o}o\) where the terms, g, f, w and o correspond to the cost of fuels that a plant might use (gas, fossil fuels, waste or other respectively) and \(\upsilon _{g},\upsilon _{f},\upsilon _{w},\upsilon _{o}\) are the corresponding weights in the cost function. If the fuel mix that a plant can use is fixed then the weights \(\upsilon _{g},\upsilon _{f},\upsilon _{w},\upsilon _{o}\) can be considered fixed and more attention should be devoted to the specific fuel prices and their overtime evolution.Footnote 11 If however the plant has some flexibility when it comes to the fuel mix choice, then this might be important to factor in as well since changes in the fuel weights will be reflected in c.

In some cases it might be more relevant to focus, not on the components of the price–cost difference, but on the difference itself using an appropriate stochastic process with both positive and negative realizations. For instance, a \(b_{t}\) following an arithmetic Brownian motion would be written as \(db_{t}=\mu dt+\sigma dW_{t}\) with \(b_{0}=b\) allowing both for positive and for negative realizations of \(b_{t}\) as is the case in our model when \(p_{t}>c\) and \(p_{t}<c\) respectively.

We abstain from adopting one of the three aforementioned modelling alternatives since according to the extant literature the profitable participation of CHP plants in deregulated electricity systems will have to do with their ability to quickly respond to market signals. On the contrary, the fuel consumption patterns of these plants are expected to remain unchanged. As the use of more than one stochastic processes would increase the mathematical complexity of the model considerably without being fundamental to our analysis, we opt for using the simplest version of the model at hand.

4 Investing in an operationally rigid CHP unit

Before discussing the problem of a potential investor who contemplates investing in an operationally flexible CHP unit we present here the opposite case. This is in fact the status-quo. The analysis of this section serves as our standard of comparison and allows us to isolate the effect of operational flexibility in the following sections. The presentation evolves as follows. First, we derive the operating value of a CHP plant for arbitrary \(p_{t}\) and \(\alpha \), \(v(p_{t};\alpha )\). Then, we compute the optimal level of \(\alpha \), that is, the level of overcapacity that maximizes the net present value \(v(p_{t};\alpha )-I(\alpha )\) for any \(p_{t}\) and last, we derive the price level that corresponds to the optimal investment timing.

Operational flexibility facilitates the provision of energy services. A supplier observes the realizations of \(p_{t}\) in quasi-real-time selling power to the grid when this is profitable \(\left( p_{t}>c\right) \) and abstains from this practice otherwise \(\left( p_{t}\le c\right) \) with almost immediate response. Nevertheless, quasi-real-time pricing and almost immediate response are not prerequisites for the provision of grid services. Typical CHP technology allows for the provision of grid services as well. However, in this case the CHP unit is operationally rigid since it might miss out on the opportunity to profitably sell power when \(p_{t}>c\) or might be producing power when the price is too low \(\left( p_{t}\le c\right) \) because the relevant piece of information from the system operator does not reach it on time. In the following, we model the operational rigidity that is associated with a typical CHP plant assuming that the net periodic benefit has the form \({\tilde{b}}_{t}=\alpha \theta \left( p_{t}-c\right) \). A power supplier benefits from a positive \({\tilde{b}}_{t}\) whenever \(p_{t}>c\) but makes losses whenever \(p_{t}\le c\). The potential negativity of \(\tilde{ b}_{t}\) captures the operational rigidity for the power supplier. Notably, \( {\tilde{b}}_{t}\) differs from \(b_{t}\) (Eq. 1) since the latter is always non-negative.

Let \(v(p_{t};\alpha )\) represent the operating value of a typical CHP unit upon investment. This is equal toFootnote 12

Given \(v(p_{t};\alpha )\), the plant manager chooses the optimal level of \( \alpha \) taking into account the potential future evolution of cash flows from energy production and the operational rigidity of the plant. Since the capacity of the plant to provide energy services does not come for free, the corresponding benefits must be traded off with the investment cost. In the following, we determine the optimal \(\alpha \) for the scenario where the investment in the CHP plant occurs at a time point t where the operating value of the plant is positive, i.e. \(\frac{p_{t}}{r-\mu }>\frac{c}{r}\). The reason is that the investment will never take place for \(\frac{p_{t}}{r-\mu } \le \frac{c}{r}\) since there is no reason for the investor to spend \( I(\alpha )\) in order to gain access to a plant with negative operating value.

The optimal level of overcapacity \(\underline{\alpha }\) must be such that the expected net present value associated with the current and future operations is maximized, that is

where,

\(\underline{\alpha }\) is set on the basis of the expected net present value taken at a time point t which is obtained by subtracting the investment cost \(\left( I(\alpha )\right) \) from the expected present value of the flow of profits accruing from that time t onward \(\left( v(p_{t};\alpha )\right) \). The evolution of this flow over time depends on the fluctuations of \(p_{t}\) and the ability of the plant to sell power to the grid. By solving \(\max \limits _{\alpha }NPV(p_{t};\alpha )\) we obtain:

Proposition 1

The optimal level of overcapacity for a typical CHP unit is

where \(\underline{p}=\left( \frac{i}{\theta }+\frac{c}{r}\right) \left( r-\mu \right) \).

The optimal level of overcapacity depends on the level of \(p_{t}\). For \( c\left( 1-\frac{\mu }{r}\right) \le p_{t}\) the price of power is large enough to allow for \(\underline{\alpha }\left( p_{t}\right) >0\). If \( p_{t}\ge \underline{p}\), it is reasonable for the plant manager to choose \( \underline{\alpha }\left( p_{t}\right) =1\) where \(\underline{p}\) is the minimum price level that allows for \(\underline{\alpha }\left( p_{t}\right) =1\). \(\underline{\alpha }\left( p_{t}\right) \) is locally increasing in \( p_{t}\). This is thanks to the term \(\theta \left( \frac{p_{t}}{r-\mu }-\frac{ c}{r}\right) \), that is, the marginal (with respect to overcapacity) operating value of the plant. Consistently, the larger the marginal operating value, the higher the optimal level of overcapacity.

Plugging \(\underline{\alpha }\left( p_{t}\right) \) in \(NPV(p_{t};\alpha )\) we obtain

This is the expected net present value associated with the operation of the plant when the optimal level of overcapacity \(\underline{\alpha }(p_{t})\) has been adopted.

Given \(\underline{\alpha }\left( p_{t}\right) \) and \(NPV(p_{t};\underline{ \alpha }(p_{t}))\), we can determine the value of the option to invest and the optimal investment timing. Since in our set-up all of the information about the future evolution of the price of power is embodied in \(p_{t}\), there exists an optimal investment rule of the form: “Invest immediately if \(p_{t}\) is at, or above, a critical threshold and wait otherwise”.Footnote 13 Our investment problem is, technically speaking, a standard optimal stopping problem. The underlying idea is that at each generic time period t the value of immediate investment (stopping) is compared with the expected value of waiting over the next dt (continuation), given the information available at that point in time and the properties of the process. Therefore, the optimal investment timing results from an optimization of the value at stake given the dynamic of the state variable \(p_{t}\) and having a control variable, \(u_{t}\), taking two possible values: \(u_{t}=0\) (stop-invest), and \(u_{t}=1\) (continue-wait).

Denoting by \({\widetilde{p}}\) the price level triggering investment by maximizing the value of the option to invest, and assuming that the current market price p is below this threshold, i.e. \(p<{\widetilde{p}}\), the value of the option to invest is equal to

where \(E_{0}\left( e^{-r\tau }\right) \) is the expected value of the stochastic discount factor \(e^{-r\tau }\) associated with the investment time \(\tau =\inf \{t>0\mid p_{t}={\widetilde{p}}\}\). Note that \(E_{0}\left( e^{-r\tau }\right) =(p/{\widetilde{p}})^{\beta _{1}}\) where \(\beta _{2}<0\) and \(\beta _{1}>1\) are the roots of the quadratic equation \(\Lambda (\beta )=\frac{1}{2}\sigma ^{2}\beta (\beta -1)+\mu \beta -r\).Footnote 14 This implies

Optimality requires that the following first-order condition holds

For this problem to be well-posed, the following second-order condition must also hold

Given that \(NPV(p_{t};\underline{\alpha }(p_{t}))=\underline{\alpha } (p_{t})\theta \left( \frac{p_{t}}{r-\mu }-\frac{c}{r}\right) -\left( j+i \frac{\underline{\alpha }(p_{t})^{\gamma }}{\gamma }\right) \), we have:

Proposition 2

The optimal investment threshold \({\widetilde{p}}\) for a typical CHP unit satisfies

When \(p_{t}\ge \underline{p}\) this is equal to \( {\widetilde{p}}^{*}=\frac{\beta _{1}}{\beta _{1}-1}\left( r-\mu \right) \left( \frac{c}{r}+\frac{j+\frac{i}{\gamma }}{\theta }\right) \) whereas when \(p_{t}\in \left( c\left( 1-\frac{\mu }{r}\right) ,\underline{p} \right) \) we have \({\widetilde{p}}^{**}\) satisfying \(\frac{{\widetilde{p}}^{**}}{r-\mu }\frac{\beta _{1}-1}{\beta _{1}}- \frac{c}{r}-\frac{j+i\frac{\left( \underline{\alpha }\left( {\widetilde{p}} ^{**}\right) \right) ^{\gamma }}{\gamma }}{\theta \underline{\alpha } \left( {\widetilde{p}}^{**}\right) }=0\). Last, plugging \( {\widetilde{p}}\) and \(\underline{\alpha }\left( {\widetilde{p}}\right) \) in \( F(p;{\widetilde{p}})\) we obtain \(F(p;{\widetilde{p}})=\left( \underline{\alpha }( {\widetilde{p}})\theta \left( \frac{{\widetilde{p}}}{r-\mu }-\frac{c}{r}\right) -\left( j+i\frac{\underline{\alpha }({\widetilde{p}})^{\gamma }}{\gamma } \right) \right) \left( \frac{p}{{\widetilde{p}}}\right) ^{\beta _{1}}\) where \( {\widetilde{p}}={\widetilde{p}}^{*}\) and \(\underline{\alpha }({\widetilde{p}} )=1\) when \(p_{t}\ge \underline{p}\) whereas \({\widetilde{p}}={\widetilde{p}} ^{**}\) and \(\underline{\alpha }({\widetilde{p}})<1\) when \(p_{t}\in \left( c\left( 1-\frac{\mu }{r}\right) ,\underline{p}\right) \).

Summing up, since the net present value is non-negative \(\left( \frac{p_{t}}{ r-\mu }\ge \frac{c}{r}\right) \), a potential investor will opt for investing in overcapacity \(\left( \underline{\alpha }>0\right) \). This will take place as soon as the stochastic price \(p_{t}\) reaches the investment threshold \({\widetilde{p}}\) and the value of the option to make such an investment is \(F(p;{\widetilde{p}})\).

5 Investing in an operationally flexible CHP unit

In the following we discuss the problem of a potential investor who contemplates investing in cogeneration overcapacity provided that it has access to an operationally flexible CHP technology. As in the previous section, we first derive the operating value of the plant and then we compute the optimal level of overcapacity, the optimal investment threshold and the value of the option to invest.

5.1 The operating value of the plant

Let \(V(p_{t};\alpha )\) represent the operating value of the plant upon investment. In the “Appendix” (Sect. A.2) we show that

where:

The first piece of \(V(p_{t};\alpha )\) has to do with the time periods during which the operating cost of the plant is larger than the price of power \(\left( p_{t}\le c\right) \). Since under \(p_{t}\le c\) grid services are not provided, the term \({\widetilde{B}}p_{t}^{\beta _{1}}\) is nothing but the option to start providing such services when this becomes profitable in the future. The intuition is that the plant stands-by, namely, it does not provide power to the grid when \(p_{t}\le c\), but this does not mean it has no value. On the contrary the CHP unit will become operational as soon as the market conditions allow for it and this profitable potential is captured by \({\widetilde{B}}p_{t}^{\beta _{1}}>0\).

The second piece of \(V(p_{t};\alpha )\) is accordingly related to the periods of time during which the provision of grid services is profitable. When \(p_{t}>c\) the operating value of the plant is the sum of two terms. The latter term (\(\alpha \theta \left( \frac{p_{t}}{r-\mu }-\frac{c}{r} \right) \)) is known from the previous section and corresponds to the value of an operating plant \(\left( v(p_{t};\alpha )\right) \). As expected, when \( p_{t}>c\) both operationally rigid and operationally flexible plants profit from the provision of grid services. The former term (\({\widetilde{A}} p_{t}^{\beta _{2}}\)) instead represents the value of operational flexibility associated with potentially adverse future market conditions. The logic is that the plant is making profits when \(p_{t}>c\) but it might be exposed to low power prices in the future. The fact that the plant will be able to suspend the provision of grid services in that case and avoid loss making is captured by \({\widetilde{A}}p_{t}^{\beta _{2}}>0\).

The option constants \({\widetilde{A}}\) and \({\widetilde{B}}\) are both positive and linearly increasing in the level of installed overcapacity \(\alpha \). \( {\widetilde{A}}p_{t}^{\beta _{2}}\) decreases in the price level \(p_{t}\) and increases in the production cost c. This makes sense considering that the option to suspend future operations becomes more valuable when profits from selling power fall. In contrast \({\widetilde{B}}p_{t}^{\beta _{1}}\) increases in the price level \(p_{t}\) and decreases in the production cost c. This is because the option to resume future operations becomes more valuable when profits associated with power supply rise. Naturally the operating value of an operationally flexible CHP is larger than the operating value of a typical plant \(\left( V(p_{t};\alpha )>v(p_{t};\alpha )\right) \).

5.2 The optimal level of overcapacity

The plant manager chooses the optimal \(\alpha \) taking into account the potential future evolution of profits from power production and the operational flexibility of the plant. Consistently, in the following we determine the optimal \(\alpha \) for the scenario where the investment occurs at a time point t where power production is profitable, i.e., for \( p_{t}>c \). The reason is that the investment will never take place for \( p_{t}\le c\) since there is no reason for the investor to spend \(I(\alpha )\) only to keep the CHP plant idle for some time (p. 190, Dixit & Pindyck, 1994). It is worth noting that this condition is stricter than the condition \(p_{t}>c\left( 1-\frac{\mu }{r}\right) \) of the previous section which is associated with a plant of positive operational value.

The optimal level of overcapacity, \({\overline{\alpha }}\), is the argument maximizing the net present value of the plant

where,

and \(\Omega \left( p_{t}\right) =Ap_{t}^{\beta _{2}}+\frac{p_{t}}{r-\mu }- \frac{c}{r}\).

\({\overline{\alpha }}\) is set on the basis of the expected net present value taken at a time point t which is obtained by subtracting the investment cost \(\left( I(\alpha )\right) \) from the expected present value of the flow of profits accruing from that time t onward \(\left( V(p_{t};\alpha )\right) \). The evolution of this flow over time depends on the fluctuations of \(p_{t}\) and the ability of the plant to provide energy to the grid when \( p_{t}>c\) and abstain from this practice otherwise.

By solving \(\max \limits _{\alpha }NPV(p_{t};\alpha )\) we obtain the following.

Proposition 3

Provided that \(\Psi =\theta \Omega \left( c\right) -i<0\), the optimal level of overcapacity is

where \({\overline{p}}\) is such that \(\theta \Omega ({\overline{p}})=i\rightarrow {\overline{p}}=\underline{p}-A{\overline{p}}^{\beta _{2}}\left( r-\mu \right) \). If instead \(\Psi \ge 0\), the optimal level of overcapacity is \( {\overline{\alpha }}\left( p_{t}\right) =1\).

Proof

Available in the “Appendix” (Sect. A.3). \(\square \)

\({\overline{\alpha }}\left( p_{t}\right) \) is locally increasing in \(p_{t}\). This results from two opposing forces within \(\Omega \left( p_{t}\right) =Ap_{t}^{\beta _{2}}+\frac{p_{t}}{r-\mu }-\frac{c}{r}\). On one hand, the term \(\frac{p_{t}}{r-\mu }-\frac{c}{r}\) is increasing in \(p_{t}\). This term represents the marginal (with respect to power) expected net present value of an operating plant. Consistently, the higher the \(\frac{p_{t}}{r-\mu }- \frac{c}{r}\), the higher the optimal level of overcapacity. In contrast, the term \(Ap_{t}^{\beta _{2}}\), that is, the value of the option to stop the provision of power to the grid when this is not profitable, decreases in \( p_{t}\). This is because the higher the \(p_{t}\), the less likely is the plant’s interruption of provision of this service. As shown in the proof of the Proposition, the first force prevails.

As for the condition \(\Psi <0\), the term \(\Psi =\theta \Omega \left( c\right) -i\) represents the difference between the marginal operating value of the plant evaluated at the minimum \(p_{t}\) in the interval of interest \( \left( \theta \Omega \left( c\right) \right) \) and the marginal cost evaluated at the maximum \(p_{t}\) in this interval \(\left( i\right) \). If this difference is negative, there is a region of \(p_{t}\) in which investments in partial overcapacity are optimal. If instead, this difference is non-negative then this region is empty and \({\overline{\alpha }} \left( p_{t}\right) =1\) for any \(p_{t}>c\).

Comparing \(\underline{\alpha }\left( p_{t}\right) \) and \({\overline{\alpha }} \left( p_{t}\right) \) we first observe that in both cases the potential investor opts for positive overcapacity. The main difference between the two is that with a flexible CHP unit it is possible to have \({\overline{\alpha }} \left( p_{t}\right) =1\) for any \(p_{t}>c\). This is the case when \(\Psi \ge 0 \). On the contrary, the choice of \(\underline{\alpha }\left( p_{t}\right) =1\) is always conditional on the price level at the time of the investment. The intuition behind this result is as follows. As long as operational flexibility guarantees non-negative profits, the potential investor will opt for \({\overline{\alpha }}\left( p_{t}\right) =1\) if the variable investment cost is low enough \(\left( \Psi \ge 0\rightarrow \theta \Omega \left( c\right) \ge i\right) \) no matter the level of \(p_{t}\). If instead a potential investor does not benefit from operational flexibility it will always condition the choice of \(\underline{\alpha }\left( p_{t}\right) =1\) on the level of \(p_{t}\) accounting for the fact that it is costlier to have a large \(\left( \underline{\alpha }\left( p_{t}\right) =1\right) \) rather than a small \(\left( \underline{\alpha }\left( p_{t}\right) <1\right) \) CHP unit operating when \(p_{t}\le c\).

A second observation has to do with the price interval delimiting investment in partial overcapacity. We require \(p_{t}\in \left( c\left( 1-\frac{\mu }{r} \right) ,\underline{p}\right) \) for \(\underline{\alpha }\left( p_{t}\right) <1\) and instead \(p_{t}\in \left( c,{\overline{p}}\right) \) for \(\overline{ \alpha }\left( p_{t}\right) <1\) where \(\underline{p}>{\overline{p}}\). The interval \(\left( c,{\overline{p}}\right) \) is contained in the interval \( \left( c\left( 1-\frac{\mu }{r}\right) ,\underline{p}\right) \) which means that, on one hand, operational flexibility discourages investments when the price is too low setting a lower bar at c, and, on the other hand, it lowers the price level that makes investment in full overcapacity optimal \(\left( \underline{p}>{\overline{p}}\right) \).

Last, thanks to \(Ap_{t}^{\beta _{2}}>0\) we have \(\left( \theta \Omega \left( p_{t}\right) /i\right) ^{\frac{1}{\gamma -1}}>\left( \theta \left( \frac{ p_{t}}{r-\mu }-\frac{c}{r}\right) /i\right) ^{\frac{1}{\gamma -1}}\). This means that when investing in partial overcapacity is optimal, operational flexibility favors investment in a larger plant. We summarize these findings in the following proposition.

Proposition 4

Operational flexibility:

-

1.

allows for investments in full overcapacity for any \(p_{t}>c\) when \( \Psi \ge 0\),

-

2.

contracts the price interval associated with investments in partial overcapacity \(\left( \left( c,{\overline{p}}\right) \subset \left( c\left( 1- \frac{\mu }{r}\right) ,\underline{p}\right) \right) \),

-

3.

favors, ceteris paribus, larger partial overcapacity investments \( \left( \left( \theta \Omega \left( p_{t}\right) /i\right) ^{\frac{1}{\gamma -1}}>\left( \theta \left( \frac{p_{t}}{r-\mu }-\frac{c}{r}\right) /i\right) ^{\frac{1}{\gamma -1}}\right) \).

Last, provided \(\Psi <0\) and given \({\overline{\alpha }}\left( p_{t}\right) \) we have

When instead \(\Psi \ge 0\), we have \(NPV(p_{t};{\overline{\alpha }} (p_{t}))=\theta \Omega \left( p_{t}\right) -\left( j+\frac{i}{\gamma } \right) \) for any \(p_{t}>c\).

\(NPV(p_{t};{\overline{\alpha }}(p_{t}))\) is the expected net present value associated with the operations of the plant where the optimal level of overcapacity \({\overline{\alpha }}(p_{t})\) has been adopted. Thanks to \( V(p_{t};\alpha )>v(p_{t};\alpha )\) we have \(NPV(p_{t};{\overline{\alpha }} (p_{t}))>NPV(p_{t};\underline{\alpha }(p_{t}))\), that is, operational flexibility increases the net present value of the project.

Up to now we have seen that the operational flexibility is changing the fundamentals of the investment option held by the plant manager. This is reflected in the operating value of the plant \(\left( V(p_{t};\alpha )>v(p_{t};\alpha )\right) \), the magnitude of the investment (Proposition 4) and the corresponding expected net present value \(\left( NPV(p_{t}; {\overline{\alpha }}(p_{t}))>NPV(p_{t};\underline{\alpha }(p_{t}))\right) \). In the following, we discuss the effect on the timing and value of the investment option.

5.3 The optimal investment threshold and the investment option value

Let us now determine the value of the option to invest and the optimal investment threshold. Denoting by \({\widehat{p}}\) the price threshold triggering investment and assuming that the current market price p is below this threshold, i.e. \(p<{\widehat{p}}\), the value of the option to invest is equal to

As in the previous section, optimality requires that the following conditions hold

Let us now consider the two investment scenarios proposed above, namely, the scenario where \({\overline{\alpha }}\left( p_{t}\right) =1\) and the scenario where \({\overline{\alpha }}\left( p_{t}\right) <1\).

When the plant manager opts for \({\overline{\alpha }}\left( p_{t}\right) =1\), that is when \({\overline{p}}\le p_{t}\), we have \({\widehat{p}}=p^{*}\) which is given by the following proposition:

Proposition 5

Provided that \(\frac{{\overline{p}}}{r-\mu }-\frac{c}{r}\ge \Delta \), the optimal investment threshold \(p^{*}\) for a project with capacity \( {\overline{\alpha }}\left( p^{*}\right) =1\) is the solution of the following equation:

where \(\Delta =\left( \frac{c}{r}+\frac{i\beta _{2}-\beta _{1}\left( i\frac{ \gamma -1}{\gamma }-j\right) }{\theta }\right) /\left( \beta _{2}-1\right) \).

Proof

Available in the “Appendix” (Sect. A.4). \(\square \)

Notably investment in \({\overline{\alpha }}\left( p^{*}\right) =1\) is conditional on having at \({\overline{p}}\), i.e. at the minimum price in the interval of interest, an expected profitability \(\frac{ {\overline{p}}}{r-\mu }-\frac{c}{r}\) higher than the level \(\Delta \) . Otherwise, the project is not worth investing in, even if \( p^{*}\ge {\overline{p}}\) . The reason is that for \(\overline{ \alpha }\left( p^{*}\right) =1\) to make sense, the project must have a minimum present value. Otherwise, i.e. in the case where \(\frac{ {\overline{p}}}{r-\mu }-\frac{c}{r}<\Delta \), the present value is too low for an investment with maximum capacity and cost I(1) to be realized, even if operational flexibility guarantees a non-negative flow of profits.

Rearranging the formula for \(p^{*}\) we obtain \({\widetilde{p}}^{*}-p^{*}=\frac{\beta _{1}-\beta _{2}}{\beta _{1}-1}Ap^{*\beta _{2}}\left( r-\mu \right) \). Thanks to the positivity of the option to temporally suspend operations when necessary (\(A>0\)), we have \({\widetilde{p}} ^{*}>p^{*}\):

Proposition 6

Operational flexibility hastens the investment in a CHP unit characterized by maximum overcapacity \(\left( {\widetilde{p}}^{*}>p^{*}\right) \).

The importance of operational flexibility is obvious. The positive difference \({\widetilde{p}}^{*}-p^{*}\) is linearly increasing in the term associated with the option to temporally suspend power provision (A). This means that operational flexibility is an investment stimulus and the magnitude of the stimulating effect depends directly on the value of operating flexibility. If the option to suspend is very valuable, because e.g. of generally low power prices or high operating costs, the distance between \(p^{*}\)and \({\widetilde{p}}^{*}\) is large. If instead operational flexibility is less valuable, as for example in the case where power prices are high or operating costs are low, then the distance between \( p^{*}\)and \({\widetilde{p}}^{*}\) is small.

Summarizing, as soon as \(p_{t}\) reaches \(p^{*}\) the potential investor chooses a CHP unit of size \({\overline{\alpha }}\left( p^{*}\right) =1\) which has operating value \(V\left( p^{*};1\right) \), expected net present value \(NPV(p^{*};1)\) and investment option value \(F(p;p^{*})=NPV(p^{*};1)\left( p/p^{*}\right) ^{\beta _{1}}\). From \(NPV\left( p^{*};1\right) -NPV\left( {\widetilde{p}}^{*};1\right) =V\left( p^{*};1\right) -v\left( {\widetilde{p}}^{*};1\right) =\theta Ap^{*\beta _{2}}\frac{\beta _{2}-1}{\beta _{1}-1}<0\) we see that operational flexibility reduces the operating value and consequently the expected net present value of the plant. Nevertheless, it has an ambiguous effect on the investment option value.Footnote 15 The intuition is as follows. Since operational flexibility serves as a hedge against losses, the potential investor opts for investing sooner than later. A lower investment threshold \(\left( p^{*}<{\widetilde{p}}^{*}\right) \) is reflected in a lower operating value \(\left( V\left( p^{*};1\right) <v\left( {\widetilde{p}}^{*};1\right) \right) \) and consequently a lower expected net present value for the plant \(\left( NPV\left( p^{*};1\right) <NPV\left( {\widetilde{p}}^{*};1\right) )\right) \). The effect on the investment option value is nevertheless ambiguous since, what the potential investor is losing in terms of NPV, is in some cases, remunerated by the earlier investment. Thus, while operational flexibility stimulates investment it might be detrimental in terms of investment option value since it reduces the value of the option of the potential investor to defer a risky and irreversible investment.

When instead the plant manager opts for \({\overline{\alpha }}\left( p_{t}\right) <1\), that is, when \(p_{t}\in \left( c,{\overline{p}} \right) \), we have \({\widehat{p}}=p^{**}\) which is given by the following proposition:

Proposition 7

The optimal investment threshold \(p^{**}\) for a project with capacity \({\overline{\alpha }}\left( p_{t}\right) <1\) is the solution of the following equation:

Proof

Available in the “Appendix” (Sect. A.5). \(\square \)

Comparing \(p^{**}\) and \({\widetilde{p}}^{**}\) we have:

Proposition 8

Operational flexibility hastens the investment in a CHP unit characterized by partial overcapacity \(\left( {\widetilde{p}}^{**}>p^{**}\right) \).

Proof

Available in the “Appendix” (Sect. A.6). \(\square \)

As we show in the “Appendix”, operational flexibility is again the factor that makes the difference. From \({\widetilde{p}}^{*}>p^{*}\) and \( {\widetilde{p}}^{**}>p^{**}\) it is clear that, irrespective of the overcapacity choice made by the potential investor, partial or full, the investment takes place earlier under operational flexibility. It is worth noting that while the inequality \({\widetilde{p}}^{*}>p^{*}\) refers to investments of the same size \(\left( \underline{\alpha }\left( {\widetilde{p}} ^{*}\right) ={\overline{\alpha }}\left( p^{*}\right) =1\right) \) the inequality \({\widetilde{p}}^{**}>p^{**}\) refers to \(\underline{ \alpha }\left( {\widetilde{p}}^{**}\right) \) and \({\overline{\alpha }} \left( p^{**}\right) \) that are sensitive to the chosen investment threshold. In fact, comparing \(\underline{\alpha }\left( {\widetilde{p}}^{**}\right) \) and \({\overline{\alpha }}\left( p^{**}\right) \) we find:

Proposition 9

The optimal level of partial overcapacity at the time of the investment in a flexible CHP plant is smaller (larger) when the value of operational flexibility per unit of power \(\left( Ap^{**\beta _{2}}\right) \) is lower (higher) than \(\frac{{\widetilde{p}}^{**}-p^{**}}{r-\mu } \).

Proof

\(\underline{\alpha }\left( {\widetilde{p}}^{**}\right) \) is equal to \( \left( \theta \left( \frac{{\widetilde{p}}^{**}}{r-\mu }-\frac{c}{r} \right) /i\right) ^{\frac{1}{\gamma -1}}\) and \({\overline{\alpha }}\left( p^{**}\right) \) is equal to \(\left( \theta \Omega \left( p^{**}\right) /i\right) ^{\frac{1}{\gamma -1}}\). A straightforward comparison shows that \(\underline{\alpha }\left( {\widetilde{p}}^{**}\right) > rless {\overline{\alpha }}\left( p^{**}\right) \) when \( \frac{{\widetilde{p}}^{**}-p^{**}}{r-\mu } > rless Ap^{**\beta _{2}}\). \(\square \)

While, as we have seen in Proposition 4, for any given \(p_{t}\) operational flexibility favors investments in higher partial overcapacity, this is not necessarily the case when we compare the optimal levels, \(\underline{\alpha } \left( {\widetilde{p}}^{**}\right) \) and \({\overline{\alpha }}\left( p^{**}\right) \). In fact, as the previous proposition suggests, operational flexibility is associated with larger investment \(\left( {\overline{\alpha }}\left( p^{**}\right) >\underline{\alpha }\left( {\widetilde{p}}^{**}\right) \right) \) only when the value of the option to suspend the provision of power in the future, \(Ap^{**\beta _{2}}\), is large enough, namely larger than \(\frac{{\widetilde{p}}^{**}-p^{**}}{r-\mu }\). Otherwise, the potential investor opts for investing in a lower level of overcapacity \(\left( {\overline{\alpha }}\left( p^{**}\right) <\underline{\alpha }\left( {\widetilde{p}}^{**}\right) \right) \). The intuition behind this result is as follows. Suppose that being operationally flexible is important (\(Ap^{**\beta _{2}}> \frac{{\widetilde{p}}^{**}-p^{**}}{r-\mu }\)) because, for instance, of generally low power prices or high operating costs. If this is the case, the plant manager opts for investing in a larger \(\alpha \) in an attempt to benefit as much as possible, by producing more, in the periods during which selling power to the grid is a profitable practice. If instead, being operationally flexible is not as important (\(Ap^{**\beta _{2}}< \frac{{\widetilde{p}}^{**}-p^{**}}{r-\mu }\)) because for instance of generally high electricity prices or low operating costs, the plant manager will opt for investing in a smaller plant which will be both more frequently operational and less costly to install.

Last, given that \({\widetilde{p}}^{**}>p^{**}\), a sufficient but not necessary condition for \(F(p;p^{**})>F(p;{\widetilde{p}}^{**})\) is \(NPV\left( p^{**};{\overline{\alpha }}(p^{**})\right) >NPV({\widetilde{p}}^{**};\underline{\alpha }({\widetilde{p}} ^{**}))\) which holds when \(Ap^{**\beta _{2}}>\frac{ {\widetilde{p}}^{**}-p^{**}}{r-\mu }\), that is, when \( {\overline{\alpha }}\left( p^{**}\right) >\underline{\alpha }\left( {\widetilde{p}}^{**}\right) \). Thus, when the value of operational flexibility is high enough so that the potential investor chooses a larger level of overcapacity, the investor opts for investing earlier in a plant that guarantees a larger NPV at the time of the investment and has a larger investment option value. If instead the value of operational flexibility is not as high, and consequently \({\overline{\alpha }}\left( p^{**}\right) <\underline{\alpha }\left( {\widetilde{p}}^{**}\right) \) and \( NPV\left( p^{**};{\overline{\alpha }}(p^{**})\right) <NPV( {\widetilde{p}}^{**};\underline{\alpha }({\widetilde{p}}^{**}))\), the inequality \(F(p;p^{**})>F(p;{\widetilde{p}}^{**})\) still holds as long as \(NPV\left( p^{**};{\overline{\alpha }}(p^{**})\right) \) is larger than \(NPV({\widetilde{p}}^{**};\underline{\alpha }({\widetilde{p}}^{**}))\left( p^{**}/{\widetilde{p}}^{**}\right) ^{\beta _{1}}\).

6 Discussion

As demonstrated in the previous section, operational flexibility is affecting both the timing and the capacity choice of a potential investor. Starting with the timing effect, Propositions 6 and 8 show that the potential investor is always setting a lower investment threshold which is instead implying an, in expected terms, earlier investment. This is attributed to the fact that operational flexibility guarantees a non-negative cash flow. In an attempt to gain access to this cash flow as soon as possible, the plant manager chooses a lower investment threshold.

The capacity choice effect presented in Proposition 9 is less straightforward and has important implications for a policy maker interested in the ability of CHP plants to provide grid services. While operational flexibility constitutes an investment stimulus in terms of timing, it is not necessarily implying investments in projects with larger capacity. The reason is that a project with lower investment threshold \( \left( {\widetilde{p}}^{**}>p^{**}\right) \) has a lower per-unit-of-power expected net revenue \(\left( \frac{{\widetilde{p}}^{**}}{r-\mu }-\frac{c}{r}>\frac{p^{**}}{r-\mu }-\frac{c}{r}\right) \) but also a valuable option to suspend the provision of power in the future \(\left( Ap^{**\beta _{2}}>0\right) \). While operational flexibility guarantees non-negative cash flows perpetually, the plant manager will still face periods of anemic profit flows in the future, particularly if the investment option is not sufficiently in the money when it takes place because of the lower investment threshold. Hence, if the option of being operationally flexible is valuable enough to cover the loss in expected net revenue \(\left( Ap^{**\beta _{2}}>\frac{{\widetilde{p}}^{**}-p^{**}}{r-\mu }\right) \) the potential investor opts for both earlier and larger, in terms of capacity, investment. Otherwise, if being operationally flexible is not as valuable and the loss in expected net revenue dominates \(\left( Ap^{**\beta _{2}}<\frac{{\widetilde{p}} ^{**}-p^{**}}{r-\mu }\right) \), the potential investor will still invest earlier but also more conservatively. This is because under \( Ap^{**\beta _{2}}<\frac{{\widetilde{p}}^{**}-p^{**}}{ r-\mu }\) it is not the promising character of the project in terms of value that is driving the investment but rather the hedge against loss making and foregone profits. Since the ability of the plant to be operationally flexible does not depend on its magnitude, the efficient level of overcapacity is lower.

These findings demonstrate the importance of the operational flexibility, not only for the potential investor, but for the power system as a whole. Operational flexibility (i) stimulates new investments in power-production contributing this way to the solution of the security-of-supply-problem while (ii) hedging power suppliers from foregone profits and losses in the energy market decoupling this way the choice of capacity for the provision of energy services from the plant’s profitability throughout its lifetime. Operational flexibility qualifies as a de-facto investment stimulus that is at the same time alleviating capacity choice distortions attributed to the operational rigidity of typical plants.

7 Case study: the value of operational flexibility in the pulp and paper sector

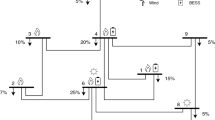

Our analytical findings underline the importance of operational flexibility for the choice of timing and capacity. The option to suspend and the option to resume future operations when \(p_{t}>c\) and when \(p_{t}\le c\) respectively, are the two sides of the same coin and even if they are similar in nature they are not equal in magnitude. In this section we compute and compare A and B using data from the Italian pulp and paper industry and discuss the implications of this comparison for the Italian energy sector.

7.1 Calibration

We use data from the pulp and paper industry since this industry has been identified as one of the most energy intensive but also best suited for cogeneration applications. The Italian pulp and paper sector has invested significantly in cogeneration plants in an attempt to reduce its energy charges. Almost 76% of the energy required in this sector is nowadays auto-produced by CHP units and there is still room for more CHP investments (Assocarta, 2020). In addition, the investments in CHP units have helped the Italian pulp and paper industry to meet the decarbonisation targets imposed on this sector.

The calibration that we adopt is based on data from Gambini et al. (2019) who compare different CHP solutions that can be coupled with the paper industry. The only technology-specific parameter required for the computation of A and B is the periodic operating cost of the plant \( \left( c\right) \). According to Gambini et al. (2019) the fuel cost in CHP arrangements is between 0.015 and 0.0315 euros per kWh. As for the structural parameters of the stochastic process capturing the evolution of the price of electricity, we refer to the Italian electricity market. In line with Fontini et al. (2021), we assume that the instantaneous volatility (\(\sigma \)) is in the region \(\left[ 0.0034,0.0051\right] \) which is the hourly rate that corresponds to an average yearly volatility that ranges from 0.26 to 0.53. These figures are consistent with the yearly volatility of weekly-averaged day-ahead prices for the Italian continental price zones (Andreis et al., 2020). For the drift parameter \(\mu \), day-ahead prices for the Italian continental price zones suggest that a suitable value could be \(\mu =0\). Finally, \(r=5\cdot 10^{-6}\) is the hourly discount rate that corresponds to a yearly average risk-adjusted market rate of \(4.4\%\) (EIA, 2020).

7.2 Findings

In Fig. 1 we plot A for four operating cost levels in the interval of interest \(\{ 0.015,0.0205,0.026, 0.0315\} \) accounting for \(\sigma \in \left[ 0.0034,0.0051\right] \). A is increasing in c and the curves are positioned accordingly. The interplay between the cost of the input (c ) and the volatility of the electricity price (\(\sigma \)) is crucial. The convexity of A with respect to \(\sigma \) becomes more pronounced for higher c. This means that CHP plants with higher operating costs will benefit more from down-side protection particularly if the electricity markets that they are associated with are highly volatile. This is because, when rigid, these plants will spend longer periods of time supplying power with a loss, a loss that becomes even larger if drops in demand are frequent because of a high \(\sigma \). We also note that, even if the curves move further apart as \(\sigma \) increases, they remain close to each other. We see for instance that \(A=540\) can correspond to any c depending on the volatility level. This suggests that no specific c should be associated with high/low A. It is instead the combination \(\left\{ \sigma ,c\right\} \) that is indicating whether the value of the option to suspend future operations is high or low.

In Fig. 2 we plot B for the same range of c and \(\sigma \). B is decreasing in c so the curves are now appearing in reverse order. B is also decreasing and convex in \(\sigma \) indicating that the option to resume future operations is becoming less valuable in an accelerating fashion as \(\sigma \) increases. This means that CHP plants with lower operating costs will benefit more from the ability to respond quickly to high energy demand particularly if the energy market is not very volatile. The reason is that for low-operating-cost CHP plants, the foregone profits attributed to operational rigidity are substantial, particularly if price spikes are often due to high volatility. Similarly to Fig. 1, we see that no specific c should be associated with high/low B. It is again the combination \(\left\{ \sigma ,c\right\} \) that is indicating whether the value of the option to resume operations in the future is high or low.

The most striking difference between the two figures is that A and B are of different orders of magnitude. B is substantially larger than A irrespective of the \(\left\{ \sigma ,c\right\} \) combination. This means that while operational flexibility gives to the plant manager the option to suspend and resume operations following the fluctuations of electricity price in quasi-real time, the latter option is considerably more valuable than the former. This finding suggests that operational flexibility should be mainly associated with avoided foregone profits. Instead the hedge against loss making is valuable but also of secondary importance. The implications for the energy system are straightforward. Operational flexibility will not make CHP plants opportunistic energy suppliers merely benefiting from down-side protection. It will instead allow them to benefit from the valuable profit-making opportunities that operational rigidity renders impossible. Thus, while operational flexibility is a valuable asset for CHP plants, it is indirectly benefiting the energy system as a whole since flexible CHP plants are significantly enhancing the system’s security of supply.

8 Conclusions

The solution to the investment problem makes clear that operational flexibility reflected in down-side protection and avoidance of foregone profits affects both the timing and capacity decisions. Industrial plant managers are expected to hasten their CHP investments as soon as flexible CHP systems become available. At the same time however, the magnitude of such investments will depend on the specifics of the considered industry and the attributes of the corresponding power system. Potential investors will choose larger CHP units when the value of operational flexibility is substantial and will invest more moderately otherwise. This means that the effect of operational flexibility will not be homogenous across industries and economic environments but needs to be studied in a case-by-case basis. Regarding the Italian pulp and paper and energy markets for instance, we find that the value of the option to resume operations in the future dominates the value of the option to suspend the provision of grid services whenever this is not profitable. This means that in this specific case operational rigidity is mainly reflected in foregone profits and much less in loss making. Technologically advanced CHP systems will thus encourage the active provision of grid services by industrial plants and their integration in the power system as a whole.

In this paper we model the reaction of potential investors to a technology that is still under development. As a result some of the key assumptions that our findings rely on deserve to be explicitly acknowledged and potentially readdressed as soon as flexible CHPs become mature enough. For example, we tacitly assume that the economic fundamentals of the CHP investment, that is, the investment cost \(I(\alpha )\) and the conditions under which its operation is profitable \(\left( p_{t}>c\right) \) remain unchanged. These assumptions are reasonable since operational flexibility is associated not with the CHP technology itself but with the development of appropriate control systems, communication technologies and forecasting tools in the grid level. However, it would be natural for a technologically advanced grid to provide plant managers with novel investment opportunities implying also investment costs that might be substantially different in nature and magnitude. U.S. Department of Energy (2018a) provides a relevant real-world example. In 2003 when the New Jersey electric market moved to real-time pricing, Princeton University chose to upgrade its cooling systems and installed a new monitoring and dispatch system at its campus CHP plant. Since then the installed system monitors weather forecasts, campus heating and cooling needs, and market prices for electricity and natural gas leading to an adjusted production of electricity, steam, and chilled water. Profitable opportunities outside of the plant might also arise. For instance, the installment of overcapacity \(\left( \alpha >0\right) \) might make CHP plants a contributor to power-to-X (PtX) operations. This would imply an additional profit flow when \(p_{t}\le c\) that we do not account for here. PtX refers broadly to the utilization of excess electricity from renewable energy sources to produce some type of gas such as hydrogen or methane (Wulf et al., 2020). The gas can then be converted back to electricity to provide power when the renewable source is unavailable or it can be used for the production of fuels or for industrial applications (IRENA, 2019). PtX is emerging as a viable platform for storing excess electricity as well as for providing an incentive for investments in renewable energy sources. These attributes of PtX are nowadays acknowledged by governments and industry, most notably by companies with high emissions who are at the forefront of global decarbonisation efforts (Daiyan et al., 2020).Footnote 16

Another issue that we do not discuss here has to do with the fact that the passing from the power systems of today to the highly automated systems described above will not take place instantaneously. Quite the opposite, this transition will require system operators to undertake large investments in new infrastructures. As in all new technologies, investments in new energy systems will be made progressively. A promising direction for future research would be the analysis of the gradual expansion of sophisticated power grids (Zwart, 2021) and the corresponding reaction of industrial plants to this expansion.

A facet of the problem that also remained unexplored here has to do with the regulatory framework that potential investors operate in. To encourage adoption of green technologies, numerous initiatives and subsidy schemes have been introduced by the EU and its member states (Allevi et al., 2018; Maurovich-Horvat et al., 2016). At the same time, such policy instruments tend to be withdrawn after some time when the corresponding policy target is reached. Potential investors will naturally react to the use of such instruments abiding by them when they are in force while accounting at the same time for the withdrawal risk (Nagy et al., 2021). Hence an extension for future work could be to explore how policy instruments can steer the gradual transition from rigid to flexible power systems in a welfare maximizing fashion.

Change history

03 May 2023

A Correction to this paper has been published: https://doi.org/10.1007/s10479-023-05316-3

Notes

We choose not to incorporate seasonality, mean-reversion and price spikes, for three reasons. First, industrial plants that employ CHP systems have long lifecycles covering spans of several years. Thus, the presence of seasonalities and price spikes can be neglected in the long run. This can be justified if we interpret the price \(p_{t}\) as, e.g., a weekly average price (see Bosco et al., 2010; Gianfreda et al., 2016). The second reason is mathematical tractability since the use of a mean-reverting process would lead to similar results but at the cost of a higher mathematical sophistication. Last, the mean-reversion effect in electricity prices is not unanimously recognized. For example, de Vany and Walls (1999) find unit roots (i.e., random-walk-like dynamics) in U.S. markets, and Bosco et al. (2010) reach the same result for several European markets.

Upon investment the power plant manager saves also the periodic cost that it had to pay for the provision of heat and power prior to the investment in the CHP plant. However, since this is a benefit for the plant no matter if \( p_{t}\le c\) or \(p_{t}>c\), it is factored out of the net periodic benefit function \(b_{t}\).

The relevance of this assumption becomes clear in the following sections where we treat terms capturing the present values of flows. If for instance the plant has a long but finite life cycle ending at a time point \(T>0\), the present value of the flow of c at any time point \(t\in \left( 0,T\right) \) is \(\int _{t}^{T}ce^{-r\left( s-t\right) }ds=\frac{c}{r}\left( 1-e^{-r\left( T-t\right) }\right) \). If \(T\ \)is sufficiently large this can be approximated by \(\frac{c}{r}\). This approximation is allowing for a more compact presentation of the mathematical formulas and is also reasonable considering that costs paid at a very far future date have little weight in current terms.

This condition ensures that the problem that we study is economically meaningful (see p. 138 in Dixit & Pindyck, 1994). Assuming risk-neutrality is standard in the real options literature. There are of course papers that relax this assumption incorporating risk aversion into dynamic investment models. However, in such models it is difficult to disentangle the impact of risk aversion on investment behaviour from investment reluctance due to irreversibility and uncertainty. The reason is that risk aversion conceals the property of real options models to treat postponed investments as the outcome of optimal dynamic decision-making under uncertainty since risk averse agents are intrinsically reluctant to invest. Therefore, in an attempt to keep the focus on the effect of irreversibility and uncertainty, we develop our model assuming risk-neutrality.

A complete analysis of the case where capital maintenance costs are considered can be found in Dixit and Pindyck (1994, Ch. 7).

It is also worth noting that a specific fuel might have more than one pricing systems. For example, natural gas can be purchased in the spot market or via long-term contracts (Allevi et al., 2019).

See pp. 179–182 in Dixit and Pindyck (1994) for the calculation of expected present values.

See Dixit et al. (1999) for more details.

See pp. 315–316 in Dixit and Pindyck (1994).

One can show that \(F(p;p^{*}) > rless F(p;{\widetilde{p}}^{*})\) if \( \theta Ap^{*\beta _{2}}\frac{\beta _{2}-1}{\beta _{1}-1} > rless NPV\left( {\widetilde{p}}^{*};1\right) \left( \left( \frac{p^{*}}{ {\widetilde{p}}^{*}}\right) ^{\beta _{1}}-1\right) \).

We thank an anonymous referee for bringing this to our attention.

References

Allevi, E., Boffino, L., De Giuli, M. E., & Oggioni, G. (2019). Analysis of long-term natural gas contracts with vine copulas in optimization portfolio problems. Annals of Operations Research, 274(1–2), 1–37.

Allevi, E., Gnudi, A., Konnov, I. V., & Oggioni, G. (2018). Decomposition method for oligopolistic competitive models with common environmental regulation. Annals of Operations Research, 268, 441–467.

Andreis, L., Flora, M., Fontini, F., & Vargiolu, T. (2020). Pricing reliability options under different electricity prices’ regimes. Energy Economics, 87, 104705. https://doi.org/10.1016/j.eneco.2020.104705

Assocarta. (2020). Rapporto Ambientale dell’Industria Cartaria Italiana - dati 2018–2019 (In Italian).

Bakke, I., Fleten, S.-E., Hagfors, L. I., Hagspiel, V., Norheim, B., & Wogrin, S. (2016). Investment in electric energy storage under uncertainty: A real options approach. Computational Management Science, 13, 483–500. https://doi.org/10.1007/s10287-016-0256-3

Bosco, B., Parisio, L., Pelagatti, M., & Baldi, F. (2010). Long-run relations in European electricity prices. Journal of Applied Econometrics, 25, 805–832. https://doi.org/10.1002/jae.1095

CEPI. (2020). Confederation of European Paper Industries, KEY STATISTICS 2020 European pulp & paper industry. Available at: https://www.cepi.org/wp-content/uploads/2021/07/Key-Stats-2020-FINAL.pdf.

COGEN. (2019). European Association for the Promotion of Cogeneration, National Snapshot Survey 2018-2019. Available at: https://www.cogeneurope.eu/images/COGEN-Europe_National-Cogeneration-Snapshot-Survey_Executive-Summary_2018-2019.pdf.

Chronopoulos, M., & Siddiqui, A. (2015). When is it better to wait for a new version? Optimal replacement of an emerging technology under uncertainty. Annals of Operations Research, 235, 177–201. https://doi.org/10.1007/s10479-015-2010-6

Daiyan, R., Macgill, I., & Amal, R. (2020). Opportunities and challenges for renewable power-to-X. ACS Energy Letters, 5, 3843–3847. https://doi.org/10.1021/acsenergylett.0c02249

Dangl, T. (1999). Investment and capacity choice under uncertain demand. European Journal of Operational Research, 117, 415–428.

Das, T. K., & Houtman, C. (2004). Chemical-, mechanical-, and bio-pulping processes and their sustainability characterization using life-cycle assessment. Environmental Progress, 23(4), 347–357. https://doi.org/10.1002/ep.10054

De Giovanni, D., & Iakimova, E. (2022). Strategic capacity choice with risk-averse firms. Journal of the Operational Research Society. https://doi.org/10.1080/01605682.2022.2070036

De Giovanni, D., & Massabò, I. (2018). Capacity investment under uncertainty: The effect of volume flexibility. International Journal of Production Economics, 198, 165–176. https://doi.org/10.1016/j.ijpe.2018.01.030

de Vany, A. S., & Walls, W. D. (1999). Cointegration analysis of spot electricity prices: insights on transmission efficiency in the western US. Energy Economics, 21, 435–448. https://doi.org/10.1016/S0140-9883(99)00019-5

Di Corato, L., & Montinari, N. (2014). Flexible waste management under uncertainty. European Journal of Operational Research, 234(1), 174–185. https://doi.org/10.1016/j.ejor.2013.09.026

Di Corato, L., & Moretto, M. (2011). Investing in biogas: Timing, technological choice and the value of flexibility from input mix. Energy Economics, 33(6), 1186–1193. https://doi.org/10.1016/j.eneco.2011.05.012

Di Corato, L., & Zormpas, D. (2022). Investment in farming under uncertainty and decoupled support: A real options approach. European Review of Agricultural Economics. https://doi.org/10.1093/erae/jbac002

Dixit, A., & Pindyck, R. S. (1994). Investment under uncertainty. Princeton: Princeton University Press.

Dixit, A., Pindyck, R. S., & Sødal, S. (1999). A markup interpretation of optimal investment rules. Economic Journal, 109, 179–189. https://doi.org/10.1111/1468-0297.00426

EIA. (2020). Levelized cost and levelized avoided cost of new generation resources in the annual energy outlook 2020. https://www.eia.gov/outlooks/aeo/pdf/electricity_generation.pdf

European Commission. (2011). Communication from the Commission to the European Parliament, the Council, The European Economic and Social Committee, the Committee of the Regions and the Committee of the Regions. Energy Roadmap 2050.

European Commission, Joint Research Centre, Institute for Energy and Transport. (2011). Technology Map of the European Strategic Energy Technology Plan (SET-Plan) Technology Descriptions.

European Commission, JCR Science for Policy Report. (2018). Energy efficiency and GHG emissions: Prospective scenarios for the pulp and paper industry.

European Commission. (2019). Communication from the Commission to the European Parliament, the European Council, the Council, the European economic and social committee and the committee of the regions. The European Green Deal.