Abstract

This paper is concerned with the risk management practices of an electricity retailer motivated by the Dutch electricity market. We examine the effectiveness of the existing base- and peak-load futures contracts as a risk management tool for the electricity retailers. We analytically characterize the retailer’s optimal hedging policy as a function of the serial correlation of the prices and the demand profiles of its customers. We find that the retailer typically over-hedges in the futures market, and the over-hedging amount increases when both base- and peak-load contracts are used. Our findings indicate that although the existing contracts in the futures market are quite efficient to replicate the exposure from profiled customers, when industrial consumers and renewable generation are included to the retailer’s portfolio, the effectiveness of such contracts decreases substantially. In our motivating example, hedging the risk of the profiled customers with base-load contracts, the firm may reduce the variance of its cash flows by 85.9%. In addition to the base-load contracts, including peak-load contracts into the hedging portfolio of the retailer increases the efficiency of hedging to 89.3%. However, when we consider the aggregate portfolio of the retailer including profiled customers, industrial consumers and renewable contracts, the efficiency of hedging through the existing futures contracts goes down as low as 32.8% during certain periods.

Similar content being viewed by others

Notes

We note that once a futures contract goes into delivery, trading of this contract ceases in the futures market. So for all practical purposes, it is not possible to update the hedging decision for a particular delivery period during that delivery period. In line with our practical observations, we also assume that demand profiles of the customer orders are independent.

This figure implies an expected energy demand of 11.9*24*31 = 8853.6MWh in October 2011.

Economically, when the firm over-hedges this implies that the firm is more likely to sell excess inventory in the.

spot market as compared to the under-hedging case. Our interpretation of over- and under-hedging is based on.

the classical paper of Rolfo (1980) in the finance literature.

References

Benth, F. E., Kallsen, J., & Meyer-Brandis, T. (2007). A non-gaussian ornstein-uhlenbeck process for electricity spot price modeling and derivatives pricing. Applied Mathematical Finance, 14(2), 153–169.

Bjorgan, R., Liu, C. C., & Lawarree, J. (1999). Financial risk management in a competitive electricity market. IEEE Transactions on Power Systems, 14(4), 1285–1291.

Boroumand, R. H., Goutte, S., Porcher, S., & Porcher, T. (2015). Hedging strategies in energy markets: The case of electricity retailers. Energy Economics, 51, 503–509.

Brik, R. I., & Roncoroni, A. (2016). Static mitigation of volumetric risk. The Journal of Energy Markets, 9(2), 111–150.

Brown, G. W., & Toft, K. B. (2002). How firms should hedge. The Review of Financial Studies, 15(4), 1283–1324.

Byström, H. N. (2003). The hedging performance of electricity futures on the Nordic power exchange. Applied Economics, 35(1), 1–11.

Collins, R. A. (2002). The economics of electricity hedging and a proposed modification for the futures contract for electricity. IEEE Transactions on Power Systems, 17(1), 100–107.

Dahlgren, R., Liu, C. C., & Lawarree, J. (2003). Risk assessment in energy trading. IEEE Transactions on Power Systems, 18(2), 503–511.

Deng, S. J., & Oren, S. S. (2006). Electricity derivatives and risk management. Energy, 31(6–7), 940–953.

Engle, R., & Watson, M. (1981). A one-factor multivariate time series model of metropolitan wage rates. Journal of the American Statistical Association, 76(376), 774–781.

Froot, K. A., Scharfstein, D. S., & Stein, J. C. (1993). Risk management: Coordinating corporate investment and financing policies. The Journal of Finance, 48(5), 1629–1658.

Gabriel, S. A., Conejo, A. J., Plazas, M. A., & Balakrishnan, S. (2006). Optimal price and quantity determination for retail electric power contracts. IEEE Transactions on Power Systems, 21(1), 180–187.

García-Martos, C., Rodríguez, J., & Sánchez, M. J. (2011). Forecasting electricity prices and their volatilities using Unobserved Components. Energy Economics, 33(6), 1227–1239.

Gedra, T. W. (1994). Optional forward contracts for electric power markets. IEEE Transactions on Power Systems, 9(4), 1766–1773.

Geman, H. (2009). Commodities and commodity derivatives: Modeling and pricing for agriculturals, metals and energy. John Wiley & Sons.

Geman, H., & Roncoroni, A. (2006). Understanding the fine structure of electricity prices. The Journal of Business, 79(3), 1225–1261.

Goel, A., & Tanrisever, F. (2011). Integrated options and spot procurement for commodity processors. Available at SSRN 1898866.

Handika, R., & Trueck, S. (2013). Risk premiums in interconnected Australian electricity futures markets. Available at SSRN 2279945.

Hanly, J., Morales, L., & Cassells, D. (2018). The efficacy of financial futures as a hedging tool in electricity markets. International Journal of Finance & Economics, 23(1), 29–40.

Hatami, A. R., Seifi, H., & Sheikh-El-Eslami, M. K. (2009). Optimal selling price and energy procurement strategies for a retailer in an electricity market. Electric Power Systems Research, 79(1), 246–254.

Haugom, E., & Ullrich, C. J. (2012). Market efficiency and risk premia in short-term forward prices. Energy Economics, 34(6), 1931–1941.

Hogan, W. W. (2002). Electricity market restructuring: Reforms of reforms. Journal of Regulatory Economics, 21(1), 103–132.

Huisman, R., Mahieu, R., & Schlichter, F. (2009). Electricity portfolio management: Optimal peak/off-peak allocations. Energy Economics, 31(1), 169–174.

Jin, Y., & Jorion, P. (2006). Firm value and hedging: Evidence from US oil and gas producers. The Journal of Finance, 61(2), 893–919.

Kleindorfer, P. R., & Li, L. (2005). Multi-period VaR-constrained portfolio optimization with applications to the electric power sector. The Energy Journal. https://doi.org/10.5547/ISSN0195-6574-EJ-Vol26-No1-1

Modigliani, F., & Miller, M. H. (1958). The cost of capital, corporation finance and the theory of investment. The American Economic Review, 48(3), 261–297.

Nikkinen, J., & Rothovius, T. (2019). Market specific seasonal trading behavior in NASDAQ OMX electricity options. Journal of Commodity Markets, 13, 16–29.

Oum, Y., & Oren, S. (2009). VaR constrained hedging of fixed price load-following obligations in competitive electricity markets. Risk and Decision Analysis, 1(1), 43–56.

Oum, Y., Oren, S., & Deng, S. (2006). Hedging quantity risks with standard power options in a competitive wholesale electricity market. Naval Research Logistics (NRL), 53(7), 697–712.

Pineda, S., & Conejo, A. J. (2012). Managing the financial risks of electricity producers using options. Energy Economics, 34(6), 2216–2227.

Pineda, S., & Conejo, A. J. (2013). Using electricity options to hedge against financial risks of power producers. Journal of Modern Power Systems and Clean Energy, 1(2), 101–109.

Rolfo, J. (1980). Optimal hedging under price and quantity uncertainty: The case of a cocoa producer. Journal of Political Economy, 88(1), 100–116.

Roncoroni, A., & Brik, R. I. (2017). Hedging size risk: Theory and application to the US gas market. Energy Economics, 64, 415–437.

Smith, C. W., & Stulz, R. M. (1985). The determinants of firms’ hedging policies. Journal of Financial and Quantitative Analysis, 20(4), 391–405.

Stulz, R. M. (1996). Rethinking risk management. Journal of Applied Corporate Finance, 9(3), 8–25.

Tanlapco, E., Lawarrée, J., & Liu, C. C. (2002). Hedging with futures contracts in a deregulated electricity industry. IEEE Transactions on Power Systems, 17(3), 577–582.

Titman, S. (2002). The Modigliani and Miller theorem and the integration of financial markets. Financial Management, 31(1), 101–115.

Viehmann, J. (2011). Risk premiums in the German day-ahead electricity market. Energy Policy, 39(1), 386–394.

Wagner, M. R. (2001). Hedging optimization algorithms for deregulated electricity markets (Doctoral dissertation, Massachusetts Institute of Technology).

Woo, C. K., Karimov, R. I., & Horowitz, I. (2004). Managing electricity procurement cost and risk by a local distribution company. Energy Policy, 32(5), 635–645.

Yang, I., Callaway, D. S., & Tomlin, C. J. (2015, July). Indirect load control for electricity market risk management via risk-limiting dynamic contracts. In: 2015 American Control Conference (ACC) (pp. 3025–3031). IEEE.

Yusta, J. M., Ramirez-Rosado, I. J., Dominguez-Navarro, J. A., & Perez-Vidal, J. M. (2005). Optimal electricity price calculation model for retailers in a deregulated market. International Journal of Electrical Power & Energy Systems, 27(5–6), 437–447.

Zanotti, G., Gabbi, G., & Geranio, M. (2010). Hedging with futures: Efficacy of GARCH correlation models to European electricity markets. Journal of International Financial Markets, Institutions and Money, 20(2), 135–148.

Zhou, H., Chen, B., Han, Z. X., & Zhang, F. Q. (2009). Study on probability distribution of prices in electricity market: A case study of Zhejiang Province, China. Communications in Nonlinear Science and Numerical Simulation, 14(5), 2255–2265.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1 Proofs of Theorems in Sect. 3

Proof of Theorem 1 Taking the derivative of (2) with respect to \(Q\) and setting it equal to 0, we get

Solving it for \(Q^{*}\), we obtain (4). Finally, taking the second derivative with respect to \(Q\), we have

for all values of \(Q\) and hence, \(Q^{*}\) is a global minimizer.

Proof of Theorem 2 Again, taking the partial derivatives of (6) with respect to \(Q_{B}\) and \(Q_{P}\), we get

Solving these equations, we obtain (6). We now need to prove that the solution \((Q_{B}^{*} , Q_{P}^{*} )\) minimizes the variance by showing the convexity of variance with respect to these variables. We can calculate the Hessian of the variance as

The positive semi-definiteness of the Hessian matrix can then be proven by using the covariance inequality.

Proof of Theorem 3 The proof is similar to the proof of Theorem 1 and we take the first and second derivative of the variance of the cash flow.

\(Var\left( {\tilde{X}} \right) = Var\left( {\mathop \sum \limits_{i = 1}^{I} \left( {P\tilde{D}_{i} + Q\tilde{S}_{i} - \tilde{D}_{i} \tilde{S}_{i} } \right)} \right)\).

Setting the first derivative equal to 0, we obtain the optimal \(Q^{*}\) and similar to the proof of Theorem 1, we get the second derivative of the variance to be \(2Var\left( {\mathop \sum \limits_{i = 1}^{I} \tilde{S}_{i} } \right)\) which proves the convexity.

Proof of Theorem 4 The proof of this theorem is similar to the proof of Theorem 2, where we take the first and second derivatives of the variance of the cash flow

The second derivative of the above variance is the same as in Theorem 2, which proves convexity with respect to \(Q_{B}\) and \(Q_{P} .\)

Appendix 2 Basic distributional statistics for hourly price data

See Table

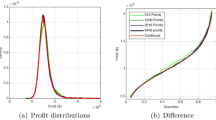

Appendix 3 Simulation Results under Various Residual Distributional Assumptions

See Fig.

8.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Tanrisever, F., Büke, B. & Jongen, G. Futures hedging in electricity retailing. Ann Oper Res 330, 757–785 (2023). https://doi.org/10.1007/s10479-022-04969-w

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-022-04969-w