Abstract

Empirical studies have emphasized that the equity implied volatility is characterized by a negative skew inversely proportional to the square root of the time-to-maturity. We examine the short-time-to-maturity behavior of the implied volatility smile for pure jump exponential additive processes. An excellent calibration of the equity volatility surfaces has been achieved by a class of these additive processes with power-law scaling. The two power-law scaling parameters are \(\beta \), related to the variance of jumps, and \(\delta \), related to the smile asymmetry. It has been observed, in option market data, that \(\beta =1\) and \(\delta =-1/2\). In this paper, we prove that the implied volatility of these additive processes is consistent, in the short-time, with the equity market empirical characteristics if and only if \(\beta =1\) and \(\delta =-1/2\).

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Which characteristics of the implied volatility surface should be reproduced by an option pricing model? A stylized fact that characterizes the equity market is a downward slope in terms of strike, i.e. a negative skew, where the skew is the at-the-money (ATM) derivative of the implied volatility w.r.t. the moneyness.Footnote 1 Specifically, the short-timeFootnote 2 negative skew is proportionally inverse to the square root of the time-to-maturity. The first empirical study of the equity skew dates back to Carr and Wu (2003): they find that the S &P 500 short-time skew is, on average, asymptotic to \(-0.25/\sqrt{t}\). Fouque et al. (2004) arrive at a similar conclusion considering only options with short-time-to-maturity (i.e. up to 3 months). In this paper, we show that a pure jump additive process, which also calibrates accurately the whole equity volatility surface, reproduces the power scaling market skew.

A vast literature on short-time implied volatility and skew is available for jump-diffusion processes. Both the ATM (see e.g., Alòs et al., 2007; Andersen & Lipton, 2013; Figueroa-López et al., 2016; Muhle-Karbe & Nutz, 2011; Roper, 2009) and the OTM implied volatility (see e.g., Figueroa-López & Forde, 2012; Figueroa-López et al., 2018; Mijatović & Tankov, 2016; Tankov, 2011) are analyzed. For a jump-diffusion Lévy process, the ATM implied volatility is determined uniquely by the diffusion term; it goes to zero as the time-to-maturity goes to zero if there is no diffusion term, i.e. for a pure-jump process. For this reason, pure jumps Lévy processes are not suitable to reproduce the market short-time smile, because the short-time implied volatility is strictly positive in all financial markets.

Muhle-Karbe and Nutz (2011) have shown that, for a relatively broad class of additive models, the ATM behavior at small-time is the same as the corresponding Levy. In this paper, we analyze the ATM implied volatility and skew for a class of pure jump additive processes that is consistent with the equity market smile, differently from the Lévy case: this is the main theoretical contribution of this study.

An additive process is a stochastic process with independent but non-stationary increments; a detailed description of the main features of additive processes is provided by Sato (1999). In this paper, we focus on a pure jump additive extension of the well-known Lévy normal tempered stable process (for a comprehensive description of this set of Lévy processes, see e.g., Cont & Tankov, 2003, Ch. 4).

Pure jump processes present a main advantage w.r.t. jump-diffusion models: they generally describe underlying dynamics more parsimoniously. In a jump-diffusion, both small jumps and the diffusion term describe little changes in the process (see e.g., Asmussen & Rosiński, 2001). Because both components of the jump-diffusion process are qualitatively similar, when calibrating the model to the plain vanilla option market, it is rather difficult to disentangle the two components and several sets of parameters achieve similar results. Moreover, it seems that an infinite number of jumps describes more precisely equity option prices independently of the stochastic volatility dynamics (see e.g., Zaevski et al., 2014, Fig. 1), specifically for the short maturities.

Recently, it has been introduced a class of pure jump additive processes, the power-law scaling additive normal tempered stable process (hereinafter ATS), where the two key time-dependent parameters—the variance of jumps per unit of time, \(k_t\), and the asymmetry parameter, \(\eta _t\)—present a power scaling w.r.t. the time-to-maturity t. The ATS is a process with no diffusion term and infinite jumps (for an expression of its Lévy measure see e.g., Azzone & Baviera, 2021a, p. 16). It has been shown the excellent calibrating performances of this class of processes. On the one hand, this class of pure jump additive processes allows calibrating the S &P 500 and EURO STOXX 50 implied volatility surfaces with great accuracy, reproducing “exactly” the term structure of the equity market implied volatility surfaces. On the other hand, the observed reproduction of the skew term structure appears remarkable.

Moreover, an interesting self-similar characteristic w.r.t. the time-to-maturity arises. Specifically, among all allowed power laws, the power scaling of \(k_t\), \(\beta \), is close to one, while the power scaling of \(\eta _t\), \(\delta \), is statistically consistent with minus one half (see e.g., Azzone & Baviera, 2021a, pp. 9–10 and p. 11 for a robustness test).

In the literature, short-time implied volatility has been extensively studied also for stochastic volatility models (see e.g., Gatheral, 2011, Ch. 7 and references therein). Alòs et al. (2007) show that the skew of a stochastic volatility process goes to a constant at short-time, inconsistently with equity market data. More recently, the short-time behavior of the skew has been one of the main justifications for introducing rough volatility models (see e.g. Friz et al., 2021; Fukasawa, 2017, 2021; Gatheral et al., 2018). When the volatility is driven by a fractional Brownian motion with Hurst coefficient \(H<1/2\) the short-time skew goes as \(1/t^{1/2-H}\) (Alòs et al., 2007, p. 588). Unfortunately, rough volatility models, despite being able to replicate the skew term structure for sufficiently large H, are computationally inefficient: no close formula is available for European options and the existing simulation techniques are “very slow” (see e.g., Bayer et al., 2016, p. 6). In this paper, we show that the ATS, a simple and parsimonious additive process, replicates perfectly the market implied volatility skew. Moreover, the ATS presents an explicit characteristic function, closed formulas for European options, and fast simulation algorithms for path-dependent options (see e.g., Azzone & Baviera, 2021).

Consider an option price with strike K and time-to-maturity t. We define \(I_t(x)\) the model implied volatility, where \(x:=\log {\frac{K}{F_0(t)}}\) is the moneyness and \(F_0(t)\) is the underlying forward price with time-to-maturity t. In particular, we consider the moneyness degree y, s.t. \(x=:y\sqrt{t}\), introduced by Medvedev and Scaillet (2006). It has been observed that the moneyness degree y can be interpreted as the distance of the option moneyness from the forward price in terms of the Black Brownian motion standard deviation (see e.g., Carr & Wu, 2003; Medvedev & Scaillet, 2006). The implied volatility w.r.t y is

and its first order Taylor expansion w.r.t. y in \(y=0\) is

We call \(\hat{\xi }_t\) the skew term. We define \(\hat{\sigma }_0\) and \(\hat{\xi }_0\) as the limits for t that goes to zero of \(\hat{\sigma }_t\) and \(\hat{\xi }_t\). Their financial interpretation is straightforward: \(\hat{\sigma }_0\) corresponds to the short-time ATM implied volatility, while \(\hat{\xi }_0\) is related to the short-time skew, because it is possible to write the skew as

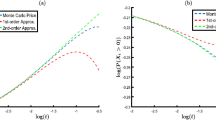

In Fig. 1, we present an example of the short-time implied volatility and the skew for the S &P 500 at a given date, the \(22\textrm{nd}\) of June 2020 (the business day after a quadruple witching FridayFootnote 3). On the left, we plot the 1 month (blue circles), 2 months (red squares), 3 months (orange stars), and 4 months (purple triangles) market implied volatility w.r.t. the moneyness degree y: we observe a positive and bounded short-time \(\hat{\sigma }_t\). On the right, we plot the market skew w.r.t. the time t: it appears to be well described by a fit \(O\left( \sqrt{\frac{1}{t}}\right) \).

Example of the S &P 500 short-time implied volatility and skew on the \(22\textrm{nd}\) of June 2020. On the left, we plot the 1 month (blue circles), 2 months (red squares), 3 months (orange stars), and 4 months (purple triangles) market implied volatility w.r.t. the moneyness degree y. We observe a positive short-time \(\hat{\sigma }_t\). On the right, we plot the market skew w.r.t. the time t and the fitted \(\approx \left( -\right) \sqrt{\frac{1}{t}}\). (Color figure online)

As already observed in some empirical studies (see e.g., Carr & Wu, 2003; Fouque et al., 2004), equity market data are compatible with a positive and bounded \(\hat{\sigma }_0\) and a negative and bounded \(\hat{\xi }_0\), that leads to a skew proportionally inverse to the square root of the time-to-maturity. We aim to present a pure-jump model with these features.

We study the behavior of \(\hat{\sigma }_t\) and \(\hat{\xi }_t\) for the ATS process, deriving, in (5, 6), an extension of the Hull and White (1987, p. 4, Eq. (7)) formula (see e.g., Alòs et al., 2007, for another application of this formula to the short-time case). This formula leads to two results: on the one hand, we build some relevant bounds for \(\hat{\sigma }_t\); on the other hand, we obtain an expression for \(\hat{\xi }_t\) in (24) via the implicit function theorem (see e.g., Loomis & Sternberg, 1990, Th. 11, p. 164).

This paper provides several contributions to the existing literature. First, we deduce for a family of pure-jump additive processes, the ATS, the behavior of the short-time ATM implied volatility \(\hat{\sigma }_t\) and skew term \(\hat{\xi }_t\) (see Propositions 3.1–3.4 and 4.2–4.3). Second, we prove that only the scaling parameters observed in market data (\(\beta =1\) and \(\delta =-1/2\)) are compatible with a bounded short-time implied volatility and a short-time skew proportionally inverse to the square root of the time-to-maturity (see Theorem 5.1). This last result implies the existence of a pure-jump additive process (an exponential ATS) that presents the two key features observed in market data: not only a bounded and positive short-time implied volatility but also a power scaling skew.

The rest of the paper is organized as follows. Section 2 presents the ATS power scaling process and the extension of the Hull and White formula. Section 3 defines the implied volatility problem and analyzes the short-time ATM implied volatility \(\hat{\sigma }_t\). Section 4 computes the short-time limit of the skew term \(\hat{\xi }_t\). Section 5 presents the major result: the ATS process is consistent with the equity market if and only if \(\beta =1\) and \(\delta =-1/2\). Finally, Sect. 6 concludes. In the appendices, we report some technical lemmas: on basic properties in “Appendix A” and on short-time limits in “Appendix B”.

2 The ATS implied volatility

In this Section, we recall the characteristic function of the power-law scaling additive normal tempered stable process (ATS) and the notation employed in the paper. We also introduce a sequence of random variables (4) with the same distribution of the ATS for any fixed time t; we use these random variables to study the short-time implied volatility.

We discuss the volatility smile at small-maturity produced by this model; we also determine the power laws of the ATS parameters that are consistent with market data, i.e. which choices of \(\beta \) and \(\delta \) reproduce the market short-time features mentioned above.

We define a sequence of positive random variables \(S_t\) via its Laplace transform. The random variable \(S_t\) appears in the definition of the random variable \(f_t\), that is used to model a forward contract of the underlying of interest.

Definition 2.1

(Definition of \(\left\{ S_t\right\} _{t\ge 0}\))

Let \(\left\{ S_t\right\} _{t\ge 0}\) be a sequence of positive random variables with a Laplace transform s.t.

where \(k_t:=\bar{k}t^\beta \) and \(\bar{k},\;\beta \in {\mathbb {R}}^+\).

Notice that, by the Laplace transform, we can compute any moment of \(S_t\). The first two are

-

1.

\({\mathbb {E}}\left[ S_t\right] =1\);

-

2.

\(Var\left[ S_t\right] =k_t/t\).

Definition 2.2

(Definition of \(\left\{ f_t\right\} _{t\ge 0}\))

Let \(\left\{ f_t\right\} _{t\ge 0}\) be a sequence of random variables with characteristic function s.t.

where

\(\bar{\sigma },\,\bar{\eta } \, \in {\mathbb {R}}^+\) and \(\delta \, \in {\mathbb {R}}.\)

Notice that the characteristic function is the same as the power-law scaling additive normal tempered stable process (ATS) in Azzone and Baviera (2021a, Eq. 2); the notation has been slightly simplified, we report it at the end of the paper. We also define \(F_0(t)\), the forward contract at time 0 with maturity t, and model the same forward contract at maturity as

We recall that the forward price \( F_t(t)\), at maturity t, is equal to the underlying spot price. For this reason, we can define European options on the forward price.

We report the known result on the existence of an additive process with characteristic function (2), cf. Azzone and Baviera (2021a, Th. 2.3).

Theorem 2.3

(Power-law scaling ATS) There exists an additive process with the same characteristic function of (2), where \(\alpha \in [0,1)\) and \(\beta , \delta \in {\mathbb {R}}\) with either \(\beta =\delta =0\) or

-

1.

\(\displaystyle 0 \le \beta \le \frac{1}{1-\alpha /2};\)

-

2.

\(-\min \left( \beta , \dfrac{1-\beta \left( 1-\alpha \right) }{\alpha } \right) <\delta \le 0;\)

where the second condition reduces to \(-\beta <\delta \le 0\) for \(\alpha =0\).

ATS admissible region for the scaling parameters. We separate the region in five Cases. (i) Case 1 (grey area) with \(\hat{\sigma }_0=0\). (ii) Case 2 (orange area) with \(\hat{\sigma }_0=\infty \). (iii) Case 3 (light green area) with bounded \(\hat{\sigma }_0\) and \(\hat{\xi }_0=0\). (iv) Case 4 (continuous dark green line) with bounded \(\hat{\sigma }_0\) and \(\hat{\xi }_0=-\sqrt{\frac{\pi }{2}}\). (v) Case 5 (red dot) with bounded \(\hat{\sigma }_0\) and negative and bounded \(\hat{\xi }_0\). Notice that Case 3 includes all its boundaries, identified by the green circles, with the exception of the point \(\{\beta =1,\;\delta =-1/2\}\) (red), that corresponds to Case 5. Moreover, Case 1 includes just its upper bound, identified by the grey squares. We emphasize that for all \(\alpha \) in [0, 1) the point \(\{ \beta =1,\;\delta =-1/2\}\) is inside the admissible region. (Color figure online)

The region of admissible values for the scaling parameters \(\beta \) and \(\delta \) is shown in Fig. 2. Notice that this is the unique region of scaling parameters that satisfies the conditions of Theorem 2.1 in Azzone and Baviera (2021a) for the existence of the ATS.

In particular, we mention that, \(\forall \, \alpha \in [0,1)\), the scaling parameters observed in the market, \(\left\{ \delta =-1/2,\; \beta =1\right\} \), are always inside the ATS admissible region. In Fig. 2, we plot the admissible region for the scaling parameters \(\beta \) and \(\delta \). In this paper, we prove that the ATS implied volatility at short-time is qualitatively different for different sets of scaling parameters. We separate the admissible region into five Cases:

Case 1 (grey area):

Case 2 (orange area):

Case 3 (light green area):

Case 4 (continuous dark green line):

Case 5 (red dot):

Notice that Case 3 includes all its boundaries, identified by the green circles, with the exception of the point \(\{\beta =1,\;\delta =-1/2\}\) (red); Case 1 includes just its upper boundary (but it does not include its lower boundary), identified by the grey squares.

The main objective of this paper is to prove that the five different Cases correspond to different behaviors of the implied volatility in the short-time and that Case 5 is the unique choice of scaling parameters consistent with market characteristics. This is particularly interesting because, by fixing \(\beta =1,\;\delta =-1/2\), on the one hand, we are able to replicate the market short-time implied volatility and skew and, on the other hand, the model is very parsimonious because we do not have to calibrate \(\beta \) and \(\delta \) from market data. A summary of the ATS short-time behavior, and in particular of the ATM value \(\hat{\sigma }_0\) and of the skew term \(\hat{\xi }_0\), w.r.t. the different Cases is available in Table 1.

It is also useful to provide the same result dividing the region for the admissible values of Theorem 2.3, in terms of \(\beta \) and \(\delta \). A summary of the ATS short-time behavior, w.r.t. the scaling parameters \(\beta \) and \(\delta \) in the additive process admissible region is reported in Table 2.

It can be proven that, for every time t, the random variable

has the characteristic function in (2), where g is a standard normal random variable independent from \(S_t\). The proof is the same as in the Lévy case, but with time dependent parameters, and it is obtained by direct computation of \({\mathbb {E}}[e^{i \, u \, f_t }]\), conditioning w.r.t. \(S_t\). The \(f_t\) in (4) is then equivalent in law to the ATS process at maturity t; thus, we can use this expression of \(f_t\) to compute the price of European options.

Consider a European call option discounted payoff \(B_t\left( F_0(t) \, e^{f_t}-F_0(t) \, e^{x}\right) ^+\) (and \(B_t\left( F_0(t) \, e^{x}-F_0(t) \, e^{f_t}\right) ^+\) the discounted payoff for the corresponding put) where t is option maturity, K option strike price, \( x:=\ln {\frac{K}{F_0(t)}} \) the asset moneyness and \(B_t\) the deterministic discount factor between 0 and t. The European call and put option price at time zero are

where

and \(N(\bullet )\) is the standard normal cumulative distribution. In the rest of the paper, we will use these expressions to investigate the short-time implied volatility.

Option prices (5) and (6) are obtained by taking the conditional expectation wrt. the r.v. \(S_t\) and computing the expected value wrt. the Gaussian r.v. g, that is independent from \(S_t\) (cf. (4)). It can be useful to mention that a similar result has been obtained by Hull and White (1987) with the same technique for a stochastic volatility model. Equations (5) and (6) are crucial in the deduction of paper’s key results: let us stop and comment. First, let us notice that we can consider option prices with \(F_0(t)=1\) and \(B_t=1\) without any loss of generality: we are interested in the implied volatility and these two quantities cancel out from both sides of the implied volatility equation. Second, let us emphasize that the quantity inside the expected values are, in both Eqs. (5) and (6), positive.

We can re-write Eqs. (5) and (6) w.r.t to the moneyness degree y (cf. Introduction)

and we can define \(c_t(S_t,y)\) and \(p_t(S_t,y)\) such that

Black (1976) option prices w.r.t. y are

where \({\mathcal {I}}_t(y)\) is the implied volatility w.r.t. the moneyness degree.

The implied volatility equation for the call options is

and the one for the put option is

In the following lemma, we prove that \(\hat{\sigma }_t\sqrt{t}\) goes to zero at short-time following an approach similar to Alòs et al. (2007, Lemma 6.1, p. 580), who considered a generalization of the Bates model. We recall that we have defined \(\hat{\sigma }_t={\mathcal {I}}_t(0)\) in (1).

Lemma 2.4

For the ATS, at short-time,

Proof

For an ATM put (i.e. when \(y=0\)), the left-hand side of Eq. (9) is equal to \({\mathbb {E}}\left[ \left( 1-e^{f_t}\right) ^+\right] \). In the region of admissible scaling parameters, \(f_t\) goes to zero in distribution because its characteristic function in (2) goes to one. Hence, by the dominated convergence theorem, \({\mathbb {E}}\left[ \left( 1-e^{f_t}\right) ^+\right] \) goes to zero at short-time. For \(y=0\), the right-hand side of Eq. (9) becomes

that goes to zero if and only if \(\hat{\sigma }_t\sqrt{t}\) goes to zero. \(\square \)

Thanks to this lemma, ATM and for short-time, we can rewrite the right hand side of (8) and (9) as

where the asymptotic expansion holds because \(N'(0) = \sqrt{\frac{1}{2\pi }}\), with \(N'\) the standard normal probability density function.

3 Short-time ATM implied volatility

In this Section, we study the behavior of \(\hat{\sigma }_t\) at short-time for the ATS. The idea of the proofs is simple. Equation (10) is the short-time asymptotic expansion of the ATM Black call and put prices. We can study the short-time behavior of the ATS model price in (8) and (9).

-

1.

If the model price (left-hand side in (8) and (9)) goes to zero faster than \(\sqrt{t}\) , then \(\hat{\sigma }_0=0\) (Case 1).

-

2.

If the model price goes to zero slower than \(\sqrt{t}\), then \(\hat{\sigma }_0=\infty \) (Case 2).

-

3.

If the model price goes to zero as \(\sqrt{t}\), then \(\hat{\sigma }_0\) is bounded (Cases 3, 4, 5).

The idea of the proofs is the following. In Case 1 we bound the model price from above and we prove that it is \(o\left( \sqrt{t}\right) \). In Case 2 we bound the model price from below and we show that it goes to zero slower than \(\sqrt{t}\). Finally in the remaining Cases we build upper and lower bounds for the model price and prove that both bounds are \(O\left( \sqrt{t}\right) \). Furthermore, the proofs are divided into some sub-cases that correspond to particular ranges of the parameters \(\beta \) and \(\delta \): we indicate with bold characters the range at the beginning of each sub-case.

Proposition 3.1

For Case 1: \( {\left\{ \begin{array}{ll} \beta<1 \& \,\,\;\;-\min \left( \frac{1}{2},\beta \right) <\delta \le 0\;\;\;\; or\\ \beta =\delta =0 \end{array}\right. }\),

the implied volatility is s.t.

Proof

We bound \(c_t\left( S_t,0\right) \) from above as follows.

In the equality we have just added and subtracted the quantity \(N\left( l_t^{S_t}+\bar{\sigma } \frac{\sqrt{S_t t}}{2}\right) \). The inequality holds because, by definition of standard normal cumulative distribution function,

and because we bound from above the product \(\left( e^{\varphi _t t -t\bar{\sigma }^2\eta _tS_t}-1\right) N\left( l_t^{S_t}+\bar{\sigma } \frac{\sqrt{S_t t}}{2}\right) \) with the (positive) maxima of both factors.

We bound the expected value of \(c_t\left( S_t,0\right) \) as

The first equality holds because \(e^{\varphi _t t}-1 = O\left( \varphi _t t\right) =o\left( \sqrt{t}\right) \) and the last equality because \({\mathbb {E}}[\sqrt{S_t}]\) converges to zero at short-time (see Lemma A.5).

Summarizing, the upper bound to the ATS ATM price in (8) is \(o\left( \sqrt{t}\right) \). From (10) we have that the Black price is \(O\left( \hat{\sigma }_t\sqrt{t}\right) \). Thus,

\(\square \)

Proposition 3.2

For Case 2: \(-\min \left( \beta ,\frac{1-\beta (1-\alpha )}{\alpha }\right)<\delta <-\frac{1}{2} \, \max \left( \beta ,1\right) \),

Proof

We divide the proof in two sub-cases.

Consider the left-hand side of Eq. (8). We compute the derivative of \(c_t(z,y)\) w.r.t. z in \(y=0\).

At short-time, for a given \(z\in \left( 0, \frac{\varphi _t}{\bar{\sigma }^2\eta _t }\right) \), \(l_t^z =\frac{\sqrt{t}\bar{\sigma }\eta _t}{\sqrt{z}}\left( -z +\frac{\varphi _t}{\bar{\sigma }^2\eta _t }\right) >0\). We observe that \(e^{\varphi _t t -t\bar{\sigma }^2\eta _tz}=1+o(1)\) and \(\lim _{t\rightarrow 0} l_t^z=\infty \) due to Lemma A.6 point 1; then, \(N\left( l_t^{z}+\bar{\sigma } \frac{\sqrt{z t}}{2}\right) =1+o(1)\). Thus,

because the first term goes to zero as \(t\eta _t\), while the second and the third terms go to zero as \(N'(\sqrt{t}\,\eta _t)\) (i.e. as a negative exponential). Thus, for sufficiently small t, \(c_t(z,0)\) is decreasing w.r.t. z in \((0,\frac{\varphi _t}{\bar{\sigma }^2 \eta _t })\). We emphasize that the right extreme of the interval is increasing to one for sufficiently small t, see Lemma A.6 points 2 and 3.

Fix \(\tau >0\) and \(S^*\in (0,\frac{\varphi _\tau }{\bar{\sigma }^2 \eta _\tau })\); for any \(t<\tau \)

The first inequality holds because \(c_t(z,0)\) is positive for any \(z\ge 0\) and because we bound from below the expected value with its minimum in the interval \((0,S^*)\) multiplied by the probability of the interval, \({\mathbb {P}}\left( S_t\le S^*\right) \). The second inequality is due to the fact that \(e^{x}\ge x+1\). Finally, the last inequality holds because, by definition of the standard normal cumulative distribution function,

Recall that \(N\left( l_t^{S^*}+\bar{\sigma } \frac{\sqrt{S^* t}}{2}\right) =1+o(1)\); notice that \({\mathbb {P}}\left( S_t\le S^*\right) \) is constant for \(\beta =1\) and goes to one, by Lemma A.4 point 1, for \(\beta <1\). This proves the last equality.

Notice that \(t\,\eta _t\) goes to zero slower than \(\sqrt{t}\) (\(\delta <-0.5\)), then the ATM call price goes to zero slower than \(\sqrt{t}\).

There exists q such that \((\beta -1)/2< q<-\delta -1/2\). We bound the ATM put price (6) from below for a sufficiently small t

The first inequality holds because \(p_t\left( S_t,0\right) \) is non negative and because we have added and subtracted the term \(N\left( -l_t^{S_t}-\bar{\sigma } \frac{\sqrt{S_t t}}{2}\right) \). The second because the difference between the standard normal cumulative distribution functions is non negative, analogously to (14). The third because, for \(S_t\in [1,\infty )\), \(1-e^{\varphi _t t-t\bar{\sigma }^2\eta _tS_t}\) is positive and non decreasing in \(S_t\); moreover, for a sufficiently small t, \(N\left( -l_t^{S_t}-\bar{\sigma }\frac{\sqrt{S_t t}}{2}\right) > 1/3\) because

The quantity \(M_t\) is defined in (15). At short-time \(M_t = 1/6+ o(1)\) because (i) by Lemma B.3, \({\mathbb {P}}(S_t\ge 1+t^q)\) goes to 1/2 as t goes to zero, and (ii) by Lemma A.6 point 1,

Notice that \(t^{1+q} \eta _t\) goes to zero slower than \(\sqrt{t}\), then ATM put price goes to zero slower than \(\sqrt{t}\).

Summing up, for both sub-cases, \(\beta \le 1\) & \(-\beta<\delta <-1/2\) and \(\beta > 1\) & \(-\frac{1-\beta (1-\alpha )}{\alpha }<\delta <-\beta /2\), the lower bounds on the ATM option prices in (8) and (9) go to zero slower than \(\sqrt{t}\).

Moreover, from (10) we have that the Black price is \(O\left( \hat{\sigma }_t\sqrt{t}\right) \). Then,

Proposition 3.3

For Case 3: \(\beta \ge 1\) & \(\delta \ge -\beta /2\), with the exception of the point \(\left\{ \beta =1,\, \delta =-1/2\right\} ,\)

Proof

We split the proof in three sub-cases. For each sub-case we build an upper and a lower bound, on the model price, and we demonstrate that both bounds are \(O\left( \sqrt{t}\right) \) and then, that \(\hat{\sigma }_0\;\;\text {is bounded}. \)

Upper bound

Let us split the expected value of the ATS call in two parts

We prove that both parts are bounded from above by quantities \(O\left( \sqrt{t}\right) \). The first expected value is s.t.

where the inequality holds true because of (12) and \(\sqrt{t}\; {\mathbb {E}}[\sqrt{S_t}]= O\left( \sqrt{t}\right) \) because, by Lemma A.5 point 1, \({\mathbb {E}}[\sqrt{S_t}]\) goes to one as t goes to zero.

Let us study the term \(A_2(t)\).

where \({\mathcal {P}}_{S_t}\) is the law of \(S_t\). The first inequality is true because the quantity inside the expected value is positive on \(\left( 0,\frac{\varphi _t}{\bar{\sigma }^2\eta _t}\right) \) and negative elsewhere. The equality is obtained by adding and subtrancting the same expected value for a Gaussian random variable. We prove the second inequality in two steps, showing that both (17) and (18) are bounded by \( O\left( t^{\delta +(\beta +1)/2}\right) \).

First, we consider (17)

where \({\mathcal {A}}_t\equiv \left\{ w\in {\mathbb {R}} \,:\, -\sqrt{\frac{t}{k_t}}<w<\left( \varphi _t/(\bar{\sigma }^2\eta _t) -1\right) \sqrt{\frac{t}{k_t}}\right\} \). Equality (19) is due to a change of the integration variable \(w:=(z-1)/\sqrt{k_t/t}\), equality (20) to the fact that, by Lemma A.6, \(e^{\varphi _t t-t\bar{\sigma }^2\eta _t}<1\). Equality (21) to a change of variable \(m:=w+\sqrt{t}\bar{\sigma }^2\eta _t \sqrt{k_t}\) and to the fact that both \(N\left( -\sqrt{\frac{t}{k_t}}\right) \) and \(N\left( \sqrt{t}\bar{\sigma }^2\eta _t \sqrt{k_t} -\sqrt{\frac{t}{k_t}}\right) \) go to zero faster that any power of t. Finally, (22) holds true because of the Taylor expansion of N in zero.

Second, we consider (18)

The first inequality is due to integration by part and to the triangular inequality. The second inequality is a consequence of Jensen inequality and of Lemma B.3.

Lower bound

As discussed in the proof of Proposition 3.2, for a sufficiently small t, \(c_t\left( S_t,0\right) \) is decreasing for \(S_t\in \left( 0,\frac{\varphi _t}{\bar{\sigma }^2\eta _t} \right) \) hence,

The first inequality is because \(c_t\left( S_t,0\right) \) is non negative and the second is because we bound the expected value from below with the minimum of \(c_t\left( S_t,0\right) \) multiplied by the probability of the interval \(\left( 0,\frac{\varphi _t}{\bar{\sigma }^2 \eta _t} \right) \). The equality holds because, by Lemma B.3,

and

with \(\sqrt{\frac{\varphi _t\, t}{8\pi \bar{ \sigma }\eta _t}}=O\left( \sqrt{t}\right) \).

Upper bound

The upper bound on the ATS call price is the same to the one of the previous sub-case \(-\beta /2\le \delta <-1/2,\; \beta >1\).

Lower bound

We bound the put price from below. It exist \(H>1\) such that for a sufficiently small t

The first inequality holds because \(p_t(S_t,0)\) is non negative. The second because \(e^{\varphi _t t -t \bar{\sigma }^2\eta _t S_t}<1\) in [1, H]. The third inequality is due to the fact that we bound from above the difference

with the standard normal law evaluated in the maximum between the two (positive) arguments multiplied by the difference of the two arguments. Notice that \(\bar{\sigma }\sqrt{S_t t}\) is a positive quantity almost surely. The last inequality holds because, by Lemma B.4, it exists \(H>1\) s.t. the quantity inside the expected value is increasing in [1, H] for a sufficiently small t. The equality is because, by Lemma B.3, \({\mathbb {P}}(S_t\in [1,H])\) goes to 1/2 as t goes to zero and

Upper bound

We can bound \(c_t(S_t,0)\) from above as in (11).

We bound the ATS option price as

The last inequality holds because, by Jensen inequality with concave function \(\sqrt{*}\), \({\mathbb {E}}[\sqrt{S_t }]\le \sqrt{{\mathbb {E}}[{S_t }]} =1\) and because, by Lemma A.6 point 1, \(e^{\varphi _t t}-1 = o\left( \sqrt{t}\right) \).

Lower bound

To bound \(c_t\left( z,0\right) \) from below, we study its derivative in (13). Notice that, at short-time, \(l_t^z = O\left( \sqrt{t}\eta _t\right) =o(1)\), due to Lemma A.6 point 1, and to the fact that \(\delta >-1/2\). Moreover, again due to Lemma A.6 point 1, \(e^{\varphi _t t -t\bar{\sigma }^2\eta _tz}=1+O\left( t\eta _t\right) \). Then, we have

-

(i)

The negative first term at short-time is \(o\left( \sqrt{t}\right) \)

$$\begin{aligned} -t\bar{\sigma }^2\eta _te^{\varphi _t t -t\bar{\sigma }^2\eta _tz}N\left( l_t^{z}+\bar{\sigma } \frac{\sqrt{z t}}{2}\right) =O\left( t \eta _t\right) =o\left( \sqrt{t}\right) . \end{aligned}$$ -

(ii)

The second term at short-time is \(o\left( \sqrt{t}\right) \)

$$\begin{aligned}&\left( \frac{\varphi _t \sqrt{t}}{2\bar{\sigma } z^{3/2}}+\frac{\sqrt{t}\bar{\sigma }\eta _t}{2\sqrt{z}}\right) \left( e^{\varphi _t t-t\bar{\sigma }^2\eta _tz}N'\left( l_t^{z}+\bar{\sigma } \frac{\sqrt{z t}}{2}\right) -N'\left( l_t^{z}-\bar{\sigma } \frac{\sqrt{z t}}{2}\right) \right) \\&\quad = O\left( \sqrt{t}\eta _t\right) \frac{e^{-(l_t^{z})^2/2-\bar{\sigma }^2z t/8}}{\sqrt{2\pi }}\\&\qquad \left( \left( 1+O(t\eta _t)\right) \left( 1-\frac{l_t^{z}\bar{\sigma } \sqrt{z t}}{2}+o(t \eta _t)\right) -\left( 1+\frac{l_t^{z}\bar{\sigma } \sqrt{z t}}{2}+o(t \eta _t)\right) \right) \\&\quad =O(\eta _t^2 t^{3/2})=o\left( \sqrt{t}\right) , \end{aligned}$$because

$$\begin{aligned} N'\left( l_t^{z}\pm \bar{\sigma } \frac{\sqrt{z t}}{2}\right) =e^{-(l_t^{z})^2/2-\bar{\sigma }^2z t/8}\left( 1+\pm \frac{l_t^{z}\bar{\sigma } \sqrt{z t}}{2}+o(t \eta _t)\right) . \end{aligned}$$ -

(iii)

The positive third term at short-time is \(O\left( \sqrt{t}\right) \)

$$\begin{aligned} \frac{\sqrt{t}\bar{\sigma }}{4\sqrt{z}}\left( e^{\varphi _t t-t \bar{\sigma }^2\eta _tz}N'\left( l_t^{z}+\bar{\sigma } \frac{\sqrt{z t}}{2}\right) +N'\left( l_t^{z}-\bar{\sigma } \frac{\sqrt{z t}}{2}\right) \right) =\sqrt{\frac{{t}}{{8\pi \,z}}}\;\bar{\sigma }+o\left( \sqrt{t}\right) . \end{aligned}$$Summarizing, the leading term in (13), at short-time, is the third one, which is positive. Hence, for a fixed \(z>0\) and for sufficiently small t, \(c_t(z,0)\) is increasing; thus, we can bound the expected value from below

$$\begin{aligned} {\mathbb {E}}\left[ c_t\left( S_t,0\right) \right]&\ge {\mathbb {E}} \left[ c_t\left( S_t,0\right) {\mathbbm {1}}_{S_t\in [1/2,3/2]}\right]>c_t \left( \frac{1}{2},0\right) {\mathbb {P}}\left( S_t\in \left[ \frac{1}{2},\frac{3}{2}\right] \right) \\&>\left\{ N\left( l_t^{1/2}+\bar{\sigma }\sqrt{\frac{t}{8}}\right) -N\left( l_t^{1/2}-\bar{\sigma }\sqrt{\frac{t}{8}}\right) \right\} {\mathbb {P}}\left( S_t\in \left[ \frac{1}{2},\frac{3}{2}\right] \right) \\&>N'\left( l_t^{1/2}+\bar{\sigma }\sqrt{\frac{t}{8}}\right) \bar{\sigma } \sqrt{\frac{t}{2}}{\mathbb {P}}\left( S_t\in \left[ \frac{1}{2},\frac{3}{2}\right] \right) \\&=\left( \bar{\sigma }\sqrt{\frac{t}{{4\pi }}} +o\left( \sqrt{t}\right) \right) {\mathbb {P}} \left( S_t\in \left[ \frac{1}{2},\frac{3}{2}\right] \right) = O\left( \sqrt{t}\right) . \end{aligned}$$The first inequality holds because \(c_t(S_t,0)\) is non negative. The second because, for a sufficiently small t, \(c_t(S_t,0)\) is increasing. The third is true because, for sufficiently small t, \(e^{\varphi _t t-t\bar{ \sigma }^2\eta _t/2}>1\), by Lemma A.6 point 3. The forth is due to the fact that the difference of the standard normal cumulative distribution functions can be bounded from below by the (positive) maximum of the two arguments multiplied by the (positive) difference of the two arguments. The equality is due to the fact that \({\mathbb {P}}\left( S_t\in \left[ \frac{1}{2},\frac{3}{2} \right] \right) \) is constant if \(\beta =1\) and goes to 1 at short-time if \(\beta >1\) because, by Lemma A.4 point 2, \(S_t\) goes to one in distribution at short-time.

$$ \begin{aligned} {\textbf {Case 3}}:\ \varvec{\beta }\ge \varvec{1}\ \& \ -\frac{\varvec{\beta }}{\varvec{2}}\le \varvec{\delta }\le \varvec{0} \ \setminus \ \varvec{\beta }=\varvec{1},\; \left\{ \varvec{\delta }=-\frac{\varvec{1}}{\varvec{2}}\right\} \end{aligned}$$

Summing up, in all sub-cases the upper bound and the lower bounds of the ATS option prices in (8) and (9) are \(O(\sqrt{t})\). Moreover, from (10) we have that the Black price is \(O\left( \hat{\sigma }_t\sqrt{t}\right) \). Thus,

\(\square \)

Proposition 3.4

For Cases 4 and 5: \(\beta \le 1\) & \(\delta =-\frac{1}{2}\),

Proof

Upper bound

We can bound \(c_t(S_t,0)\) from above as in (11).

We bound the ATS option price as

The equality holds because, by Jensen inequality with concave function \(\sqrt{*}\), \({\mathbb {E}}[\sqrt{S_t }]\le \sqrt{{\mathbb {E}}[{S_t }]} =1\) and because, by Lemma A.6 point 1, \(e^{\varphi _t t}-1 = O\left( \sqrt{t}\right) \).

Lower bound

We bound \(c_t\left( S_t,0\right) \) from below as:

The first inequality is because \(c_t\left( S_t,0\right) \) is non negative, because \(e^x\ge x+1\), and because the normal cumulative distribution function evaluated in a positive quantity is above 1/2. The second holds because the difference between the two normal cumulative function is non negative.

The last equality is due to the fact that

can be bounded from below with a positive constant for sufficiently small t. This fact can be deduced for \(\beta \le 1\). We prove it separately for the two cases \(\beta <1\) and \(\beta =1\).

For \(\beta <1\), let us observe that, at short-time,

because, by point 2 of Lemma A.6, \(\varphi _t /(\bar{\sigma }^2\eta _t)<1\) and, by definition of convergence in distribution, at short-time \({\mathbb {E}}[S_t{\mathbbm {1}}_{S_t<1}]=o(1)\), because, by Lemma A.4 point 1, \(S_t\) converges in distribution to 0. Moreover, at short-time, \(\varphi _t /(\bar{\sigma }^2 \eta _t){\mathbb {P}}(S_t<\varphi _t /(\bar{\sigma }^2\eta _t )) =1+o(1)\), by point 1 of Lemma A.6 and by point 1 of Lemma A.4.

For \(\beta =1\), we remind that the law of \(S_t\) does not depend from t and we observe that the limit of (23) for t that goes to zero is positive

where the last inequality is due to the fact that \(S_t\) has unitary mean and finite variance \(\bar{k}\).

Summarizing, as in Proposition 3.3 the upper and lower bounds of the ATM prices in (8) are \(O\left( \sqrt{t}\right) \). From (10), we have that the Black price is \(O\left( \hat{\sigma }_t\sqrt{t}\right) \). Thus,

\(\square \)

In the propositions above, we have proven that \(\hat{\sigma }_0\) is bounded only in Cases 3, 4 and 5. Only for these Cases we study the short-time skew in the next Section.

4 Short-time skew

In this Section, we focus on the skew term \(\hat{\xi }_t\) for the ATS when \(\hat{\sigma }_0\) is bounded. We obtain an expression of \(\hat{\xi }_t\) in Lemma 4.1 and study its short-time limit.

In the introduction, we have mentioned that the implied volatility skew observed in the equity market is negative and it goes to zero as one over the square root of t. This behavior is equivalent to a negative and bounded \(\hat{\xi }_0\). In this Section, we prove that \(\hat{\xi }_0\) is zero in Case 3 (Proposition 4.2) and is negative and bounded in Cases 4 and 5 (Proposition 4.3). Moreover, Case 5 identifies the unique parameters’ set where \(\hat{\xi }_0\) can be a generic value that it is possible to calibrate from market data.

Lemma 4.1

The skew term \(\hat{\xi }_t\) is

Proof

Applying the implicit function theorem to the implied volatility equation for the call option (8) we obtain the derivative of the implied volatility w.r.t y

We prove the thesis by computing the three partial derivatives separately.

Notice that it is possible to exchange the expected value w.r.t. \(S_t\) and the derivative w.r.t. y using the Leibniz rule because the law of \(S_t\) does not depend from y. By substituting \(y=0\) and reminding that \( {\mathcal {I}}_t(0)=\hat{\sigma }_t\), we get (24). \(\square \)

Notice that, because of Lemma 2.4, the denominator of \(\hat{\xi }_t\) in (24), \(N'\left( -\frac{\hat{\sigma }_t\sqrt{t}}{2}\right) \), goes to \(\frac{1}{\sqrt{2 \pi }}\) at short-time. To study the short-time behavior of \(\hat{\xi }_t\) it is sufficient to consider only the numerator of Eq. (24)

Proposition 4.2

For Case 3: \(\beta \ge 1\) & \(-\beta /2\le \delta \le 0\), with the exception of the point \(\left\{ \beta =1,\;\; \delta =-1/2\right\} \), the skew term is

Proof

We divide the proof in two sub-cases.

We study the numerator of \(\hat{\xi }_t\) in (24).

We compute the limit thanks to the dominated convergence theorem because the law of \(S_t\) does not depend on t and \(l_t^z=o(1)\) in this sub-case.

We want to prove that

The equality holds because

where \({\mathcal {P}}_{S_t}\) is the distribution of \(S_t\). We study the quantities in (26) and (27) separately.

First, we consider (26)

The first equality is obtained via a change of the integration variable \((w:=\sqrt{t}(z-1)/\sqrt{k_t})\). The second equality is due to the asymptotic of \(\varphi _t t\) in Lemma A.6 point 1. The third equality holds because of the dominated convergence theorem. The last is trivial because \(\left[ N\left( -\bar{\eta }\sqrt{\bar{k}} t^{\delta +\beta /2}w\right) -1/2\right] \) is odd w.r.t. w.

Second, we consider (27)

The first equality is due to integration by part. The second to the fact that (i) \({\mathbb {P}}(S_t<0)=0\), (ii) \(N\left( -\sqrt{\frac{t}{k_t}}\right) \) go to zero as t goes to zero, and (iii)

where the inequality is due to Lemma B.3 and the first equality is due the fact that

This proves (25).

It is now possible to compute the short-time limit of the skew term

Proposition 4.3

For Case 4: \(\beta <1\) and \(\delta =-1/2\), the skew term is

For Case 5: \(\beta =1\) and \(\delta =-1/2\) the skew term is

where \(r(S_t) := \sqrt{2} ( 1/\sqrt{S_t}-\sqrt{S_t} )\).

Proof

We prove separately the two Cases.

Thanks to Lemma B.2, the limit of the numerator of \(\hat{\xi }_t\) in (24) can be computed simply,

Thus,

We compute the limit in \(t=0\) of the numerator of \(\hat{\xi }_t\) in (24)

We obtain the equality thanks to the dominated convergence theorem, because the law of \(S_t\) is constant in time. We recall that \(erf(z) =2N(z/\sqrt{2})-1\), substituting in (24), we obtain (28). \(\square \)

Equation (28) is one of the major results of the paper. Let us stop and comment.

First, let us notice that \(\hat{\xi }_0\) in (28), is a generic function of the couple of positive parameters \(\bar{\sigma } \bar{\eta }\) and \(\bar{k}\); in particular the erf function is odd in its argument and \(r: {\mathbb {R}}^+ \rightarrow {\mathbb {R}}\). Moreover \(\hat{\xi }_0\) depends on the parameter \(\alpha \in [0,1)\) that selects the truncated additive process of interest.

Second,

i.e. the minimum value for the skew term is \(- \sqrt{\pi /{2}}\), its value in Case 4. Let us emphasize that the possibility to choose \(\hat{\xi }_0\) is the key difference between Case 4 and Case 5. A \(\hat{\xi }_0\) function of model parameters is more relevant, from a practitioner’s perspective, because it allows calibrating \(\hat{\xi }_0\) on market data rather than selecting a fixed value \(\hat{\xi }_0=- \sqrt{\pi /{2}}\).

To show the upper bound, we can rewrite

where the second equality is due to the change of variable \(w=1/z\), and second to \(r(1/w)=-r(w)\) and to the fact that erf(z) is odd. We also observe that \(erf \left( \bar{\sigma }\bar{\eta }\; r(z)\right) > 0\) in (0, 1).

For the two cases where the distribution of \(S_t\) is known analytically \(\alpha =0\) (VG) and \(\alpha =1/2\) (NIG), we can prove that the skew term \( \hat{\xi }_0 \) in (28) is negative for non zero \(\bar{\sigma }\bar{\eta }\) and \(\bar{k}\) (for the expression of the Gamma and Inverse Gaussian laws see e.g., Cont & Tankov, 2003, Ch. 4, p. 128). In both cases we can prove that \(\left( {\mathcal {P}}_{S_t}(z) -\frac{{\mathcal {P}}_{S_t}(1/z)}{z^2}\right) > 0\) in (0, 1); recall that \({\mathcal {P}}_{S_t}(z)\) does not depend from time because \(\beta =1\).

In the \(\alpha =0\) case, \(S_t\) has the law of a Gamma random variable

where the inequality is true in (0, 1) because \(1-\frac{e^{-1/ \bar{k} \, \left( 1/z- z \right) }}{z^{2/ \bar{k}} }>0 \) or equivalently \( 1/z- z + 2 \ln z >0\). The last inequality is trivial \(\forall z \in (0,1)\), because it is equal to zero for \(z=1\) and its derivative is negative.

In the \(\alpha =1/2\) case, \(S_t\) has the law of an Inverse Gaussian random variable

where the inequality is true because \(\frac{1}{z^{3/2}}-\frac{1}{\sqrt{z}}>0, \forall z \in (0,1)\).

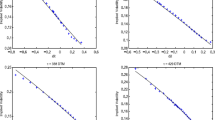

In all other cases, we compute numerically the skew term \(\hat{\xi }_0 \) for different admissible values of \(\bar{k}, \bar{\sigma }\bar{\eta } \in {\mathbb {R}}^+\) and \(\alpha \in [0,1)\), by means of inversion of the characteristic function of \(S_t\), showing that it is either negative or equal to zero. In Fig. 3, we plot the numerical estimation of the skew term for \(\bar{\sigma }\bar{\eta }\) and \(\bar{k}\) below 3 (an interval in line with the situation generally observed in market data) and for a grid of four values of \(\alpha \) (\(\alpha =0, 1/4, 1/2, 3/4\)); in all cases the skew term \( \hat{\xi }_0 \) looks rather similar: equal to zero on the boundaries (\(\bar{k}=0\) and \(\bar{\sigma }\bar{\eta }=0\)), a negative quantity in all other cases and a decreasing function w.r.t. both \(\bar{k}\) and \(\bar{\sigma }\bar{\eta }\). In Fig. 4, we plot also the skew term for the same four values of \(\alpha \), varying \(\bar{ k}\) with \(\bar{\sigma }\bar{\eta } =1\) (on the left) and varying \(\bar{\sigma }\bar{\eta } \) for \(\bar{k}=1\) (on the right): all plots look rather similar with a decreasing \(\hat{\xi }_0\).

ATS skew term \(\hat{\xi }_0\) for \(\left\{ \beta =1,\, \delta =-1/2 \right\} \). We report \( \hat{\xi }_0 \) for four values of \(\alpha \): \(\alpha =0\) in the upper left corner, \(\alpha =1/4\) in the upper right corner, \(\alpha =1/2\) in the lower left corner and \(\alpha =3/4\) in the lower right corner. We plot the skew for \(\bar{ k}, \bar{\sigma }\bar{\eta } \in [0,3]\). In all cases the skew is negative and decreasing w.r.t. \(\bar{ k}\) and \(\bar{\sigma }\bar{\eta }\). (Color figure online)

ATS skew term \( \hat{\xi }_0 \) for \(\beta =1\) and \(\delta =-1/2\) for \(\alpha =0\) (dashed blue line), \(\alpha =1/4\) (red triangles), \(\alpha =1/2\) (orange circles) and, \(\alpha =3/4\) (continuous violet line). We plot the skew for \(\bar{ k}\in [0,3]\) with \(\bar{\sigma }\bar{\eta } =1\) (on the left) and for \(\bar{\sigma }\bar{\eta } \in [0,3]\) for \(\bar{k}=1\) (on the right). In all cases the skew is decreasing w.r.t. \(\bar{ k}\) and \(\bar{\sigma }\bar{\eta }\). (color figure online)

Finally, let us emphasize that the limits of \( \hat{\xi }_0 \) are zero for \(\bar{\sigma } \bar{\eta }\) and \(\bar{k}\) that go to zero.

On the one hand, recall that the law of \(S_t\), \({\mathcal {P}}_{S_t}\), does not depend of \(\bar{\sigma } \bar{\eta }\). By the dominated convergence theorem with bound \({\mathcal {P}}_{S_t}\), we have that

On the other hand, by Kijima (1997, Th. B.9, p. 308), we have that \(S_t\) converges in distribution to 1 as \(\bar{k}\) goes to zero because

We are computing the expected value of a bounded function of \(S_t\) that does not depend of \(\bar{k}\). Thus, by definition of convergence in distribution,

5 Main result

In the following theorem, we present the main results of this paper. We prove that if and only if \(\beta =1\) and \(\delta = -1/2\) the ATS has a positive and constant short-time implied volatility \(\hat{\sigma }_0\) and a negative and constant short-time skew term \(\hat{\xi }_0\). We point out that a bounded skew term w.r.t. y corresponds to a skew that goes as \(\frac{1}{\sqrt{t}}\) at short-time w.r.t. the moneyness x. We also prove that the ATS short-time implied volatility behaves as described in Table 1. The proof is based on the propositions of Sects. 3 and 4.

Theorem 5.1

The ATS has a positive and constant short-time implied volatility \(\hat{\sigma }_0\) and a negative and constant short-time skew term \(\hat{\xi }_0\), that can be calibrated from market data, if and only if \(\beta =1\) and \(\delta = -1/2\).

Moreover, the following hold true:

-

1.

In Case 1, the short-time implied volatility \(\hat{\sigma }_0=0\) and, in Case 2, \(\hat{\sigma }_0=\infty \).

-

2.

In Case 3, the short-time implied volatility \(\hat{\sigma }_0\) is constant and the short-time skew \(\hat{\xi }_0=0\).

-

3.

In Case 4, the short-time implied volatility \(\hat{\sigma }_0\) is constant and the short-time skew \(\hat{\xi }_0=-\sqrt{\pi /{2}}\) cannot be calibrated from market data.

Proof

We prove that, for Case 1, \(\hat{\sigma }_0=0\) in Proposition 3.1. We prove that, for Case 2, \(\hat{\sigma }_0=\infty \) in Proposition 3.2. We prove that, for Cases 3, 4 and 5, \(\hat{\sigma }_0\) is bounded in Propositions 3.3 and 3.4.

Moreover, in Proposition 4.2 we demonstrate that, for Case 3, \(\hat{\xi }_0=0\) and in Proposition 4.3 we show that, for Case 4, \(\hat{\xi }_0=-\sqrt{\pi /{2}}\) and that, for Case 5, \(\hat{\xi }_0\) is negative and bounded. \(\square \)

6 Conclusions

In this paper, we have analyzed the short-time behavior of the implied volatility of a class of pure jumps additive processes, the ATS family.

An excellent calibration of the equity implied volatility surface has been achieved by the ATS, a class of power-law scaling additive processes (see e.g., Azzone & Baviera, 2021a). This class of processes builds upon the power-law scaling parameters \(\beta \), related to the variance of jumps, and \(\delta \) related to the smile asymmetry.

First, for this family of pure-jump additive processes we have obtained the behavior of the short-time ATM implied volatility \(\hat{\sigma }_t\) and the skew term \(\hat{\xi }_t\) over the region of admissible parameters (cf. Theorem 2.3). We get this result by constructing some relevant bounds for \(\hat{\sigma }_t\) and obtaining the expression of \(\hat{\xi }_t\), cf. Eq. (24), via the implicit function theorem.

Second, we have proven that only the scaling parameters observed in empirical analysis (\(\beta =1\) and \(\delta =-1/2\)) are compatible with the implied volatility observed in the equity market (cf. Theorem 5.1). Hence, we have demonstrated that it exists a pure-jump additive process (an exponential ATS) that, differently from the Lévy case, presents the two features observed in market data: not only a bounded and positive short-time implied volatility but also a short-time skew proportionally inverse to the square root of the time-to-maturity.

Change history

18 November 2022

Missing Open Access funding information has been added in the Funding Note.

Notes

The moneyness is the logarithm of the strike price over the forward price. For a description of the equity volatility surface and a definition of skew, see e.g., Gatheral (2011).

We refer to short-time-to-maturity.

A quadruple witching Friday is the third Friday of the months of March, June, September and December: in this quarterly date, stock options, stock futures, equity index futures, and equity index options all expire on the same day.

Abbreviations

- \(B_t\) :

-

Discount factor between date 0 and t

- \(c^{B}_t\left( {\mathcal {I}}_t(y),y\right) )\) :

-

Black call option price

- \(c_t(S_t,t)\) :

-

Quantity inside the ATS call expected value

- \(C_t\left( x\right) \) :

-

Call option price at value date with maturity t and moneyness x

- \(\left\{ f_t\right\} _{t\ge 0}\) :

-

Sequence of random variables that models the forward exponent

- \(F_0(t)\) :

-

Price at time 0 of a forward contract with maturity t

- g :

-

Standard normal random variable

- \(I_t(x)\) :

-

Black implied volatility with maturity t and moneyness x

- \({\mathcal {I}}_t(y)\) :

-

Black implied volatility with maturity t and moneyness degree y

- \({\mathbbm {1}}_*\) :

-

Indicator function of the set \(*\)

- \(k_t\) :

-

Variance of jumps of ATS

- \(\bar{k}\) :

-

Constant part of variance of jumps of ATS \(k_t\)

- K :

-

Option strike price

- \(l_t^z\) :

-

Quantity defined in Eq. (7)

- \(N(*)\) :

-

Standard normal cumulative distribution function evaluated in \(*\)

- \(N'(*)\) :

-

Standard normal probability density function evaluated in \(*\)

- \(p^{B}_t\left( {\mathcal {I}}_t(y),y\right) )\) :

-

Black put option price

- \(p_t(S_t,t)\) :

-

Quantity inside the ATS put expected value

- \(P_t\left( x\right) \) :

-

Put option price at value date with maturity t and moneyness x

- \(\left\{ S_t\right\} _{t\ge 0}\) :

-

Sequence of positive random variables

- t :

-

Time-to-maturity

- x :

-

Option moneyness, \(x=\log \frac{K}{F_0(t)}\)

- y :

-

Moneyness degree, \(y:=x/\sqrt{t}\)

- \( \alpha \) :

-

Tempered stable parameter of ATS

- \( \beta \) :

-

Scaling parameter of \(k_t\)

- \(\Gamma (*)\) :

-

Gamma function evaluated in \(*\)

- \(\delta \) :

-

Scaling parameter of \({\eta }_t\)

- \(\eta _t\) :

-

Skew parameter of ATS

- \(\bar{\eta }\) :

-

Constant part of the skew parameter of ATS

- \(\hat{\xi }_t\) :

-

Implied volatility skew term

- \(\hat{\xi }_0\) :

-

Short-time skew term, i.e. limit for t that goes to zero of \(\hat{\xi }_t\)

- \(\bar{ \sigma }\) :

-

Constant diffusion parameter of ATS

- \(\hat{\sigma }_t\) :

-

ATM implied volatility, equal to \({\mathcal {I}}_t(0)\)

- \(\hat{\sigma }_0\) :

-

Short-time ATM implied volatility, i.e. limit for t that goes to zero of \(\hat{\sigma }_t\)

- \({\mathcal {P}}_{S_t}\) :

-

Probability density function of \(S_t\)

- \(\varphi _t\) :

-

Deterministic drift term of ATS

References

Alòs, E., León, J. A., & Vives, J. (2007). On the short-time behavior of the implied volatility for jump-diffusion models with stochastic volatility. Finance and Stochastics, 11(4), 571–589.

Andersen, L., & Lipton, A. (2013). Asymptotics for exponential Lévy processes and their volatility smile: Survey and new results. International Journal of Theoretical and Applied Finance, 16(01), 1350001.

Asmussen, S., & Rosiński, J. (2001). Approximations of small jumps of Lévy processes with a view towards simulation. Journal of Applied Probability, 38, 482–493.

Azzone, Michele, and Roberto Baviera. “Additive normal tempered stable processes for equity derivatives and power-law scaling.” Quantitative Finance 22.3(2022): 501–518.

Azzone, M., & Baviera, R. (2021). A fast Monte Carlo scheme for additive processes and option pricing. arXiv preprint arXiv:2112.08291

Bayer, C., Friz, P., & Gatheral, J. (2016). Pricing under rough volatility. Quantitative Finance, 16(6), 887–904.

Black, F. (1976). The pricing of commodity contracts. Journal of Financial Economics, 3(1–2), 167–179.

Carr, P., & Wu, L. (2003). The finite moment log stable process and option pricing. The Journal of Finance, 58(2), 753–777.

Cont, R., & Tankov, P. (2003). Financial Modelling with jump processes. Chapman and Hall/CRC Financial Mathematics Series.

Cressie, N., Davis, A. S., Folks, J. L., & Folks, J. L. (1981). The moment-generating function and negative integer moments. The American Statistician, 35(3), 148–150.

Durrett, R. (2019). Probability: Theory and examples (Vol. 49). Cambridge University Press.

Figueroa-López, J. E., & Forde, M. (2012). The small-maturity smile for exponential Lévy models. SIAM Journal on Financial Mathematics, 3(1), 33–65.

Figueroa-López, J. E., Gong, R., & Houdré, C. (2016). High-order short-time expansions for ATM option prices of exponential Lévy models. Mathematical Finance, 26(3), 516–557.

Figueroa-López, J. E., Gong, R., & Lorig, M. (2018). Short-time expansions for call options on leveraged ETFs under exponential Lévy models with local volatility. SIAM Journal on Financial Mathematics, 9(1), 347–380.

Fouque, J. P., Papanicolaou, G., Sircar, R., & Solna, K. (2004). Maturity cycles in implied volatility. Finance and Stochastics, 8(4), 451–477.

Friz, P. K., Gassiat, P., & Pigato, P. (2021). Short-dated smile under rough volatility: Asymptotics and numerics. Quantitative Finance, 22, 1–18.

Fukasawa, M. (2017). Short-time at-the-money skew and rough fractional volatility. Quantitative Finance, 17(2), 189–198.

Fukasawa, M. (2021). Volatility has to be rough. Quantitative Finance, 21(1), 1–8.

Gatheral, J. (2011). The volatility surface: A practitioner’s guide (Vol. 357). Wiley.

Gatheral, J., Jaisson, T., & Rosenbaum, M. (2018). Volatility is rough. Quantitative Finance, 18(6), 933–949.

Hull, J., & White, A. (1987). The pricing of options on assets with stochastic volatilities. The Journal of Finance, 42(2), 281–300.

Kijima, M. (1997). Markov processes for stochastic modeling (Vol. 6). CRC Press.

Küchler, U., & Tappe, S. (2013). Tempered stable distributions and processes. Stochastic Processes and Their Applications, 123(12), 4256–4293.

Loomis, L. H., & Sternberg, S. (1990). Advanced calculus. Jones and Bartlett Publishers.

Medvedev, A., & Scaillet, O. (2006). Approximation and calibration of short-term implied volatilities under jump-diffusion stochastic volatility. The Review of Financial Studies, 20(2), 427–459.

Mijatović, A., & Tankov, P. (2016). A new look at short-term implied volatility in asset price models with jumps. Mathematical Finance, 26(1), 149–183.

Muhle-Karbe, J., & Nutz, M. (2011). Small-time asymptotics of option prices and first absolute moments. Journal of Applied Probability, 48(4), 1003–1020.

Roper, M. (2009). Implied volatility: Small time to expiry asymptotics in exponential Lévy models. Ph.D. thesis, thesis, University of New South Wales.

Rudin, W. (1976). Principles of mathematical analysis (Vol. 4.2). McGraw-Hill.

Sato, K. I. (1999). Lévy processes and infinitely divisible distributions. Cambridge University Press.

Tankov, P. (2011). Pricing and hedging in exponential Lévy models: Review of recent results. Paris-Princeton Lectures on Mathematical Finance, 2010, 319–359.

Urbanik, K. (1993). Stochastic processes. In Moments of sums of independent random variables (pp. 321–328). Springer.

Zaevski, T. S., Kim, Y. S., & Fabozzi, F. J. (2014). Option pricing under stochastic volatility and tempered stable Lévy jumps. International Review of Financial Analysis, 31, 101–108.

Acknowledgements

We thank Peter Carr for an enlightening discussion on this topic. We thank E. Alòs, M. Fukasawa, O. Le Courtois and all participants to the workshop New Challenges in Quantitative Finance in Barcelona and MUSEES 2022 in Lyon. R.B. feels indebted to Peter Laurence for several helpful and wise suggestions on the subject.

Funding

Open access funding provided by Politecnico di Milano within the CRUI-CARE Agreement.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Michele Azzone: The views expressed are those of the author and do not necessarily reflect the views of ECB.

Appendices

Appendices

A Basic properties

We report some useful results for the proofs in Sect. 3. In the following lemmas we consider \(S_t\) of Definition 2.1 with Laplace transform \({\mathcal {L}}_t(u;\,k_t;\;\alpha )\), at a given time \(t>0\). The proofs that follow are for the \(\alpha \in (0,1)\) case. Similar proofs hold in the \(\alpha =0\) case.

Lemma A.1

Let \(s\in (0,1)\), then

where \(\Gamma \) is the Gamma function.

Proof

By elementary calculus and Fubini’s Theorem (see e.g., Urbanik, 1993, Lemma 4, p. 325). \(\square \)

Lemma A.2

Let n be a positive integer, then

Proof

By elementary calculus and Fubini’s Theorem (see e.g.,Cressie et al., 1981, Ch. 2, p. 148). \(\square \)

Lemma A.3

-

1.

The following two properties for the Laplace trasform \(\mathcal{L}_t\) hold: For all \(t>0\), \(c\ge 1\) and \(u\ge 0\)

$$\begin{aligned} 1-{\mathcal {L}}_t(u;\;k_t,\;\alpha )\le 1-e^{-cu}. \end{aligned}$$ -

2.

If \(\beta \ge 1\), \({\mathcal {L}}_t(u;\;k_t,\;\alpha )\) is non decreasing in t.

Proof

Let us observe that

The last inequality is true for any \(c\ge 1\) and \(u \ge 0\) because the left hand side is null in \(u=0\) and its first order derivative w.r.t. u is negative:

This proves the first point.

We demonstrate that the logarithm of \({\mathcal {L}}_t(u;\;k_t,\;\alpha )\) is not decreasing. Consider a positive t, \(s\in (0,t)\) and

We observe that \(h(0;\;s,\;t)=0\) and the first order derivative

is non negative \(\forall u>0\) because \(k_t/t\) is non decreasing in t, if \(\beta >1\), and is constant in t, if \(\beta =1\). Thus, \(h(u;\;s,\;t)\ge 0\), \(\forall u\ge 0\), and \({\mathcal {L}}_t(u;\;k_t,\;\alpha )\) is non decreasing w.r.t. t. This proves point 2. \(\square \)

Lemma A.4

The following three properties for \(S_t\) hold:

-

1.

If \(\beta <1\) \(S_t\) goes to zero in distribution as t goes to zero.

-

2.

If \(\beta >1\) \(S_t\) goes to one in distribution as t goes to zero.

-

3.

If \(\beta =1\) the distribution of \(S_t\) does not depend from t.

Proof

Recall that convergence in the Laplace transform implies convergence in distribution (see e.g., Kijima, 1997, Th. B.9, p. 308).

We compute the limit of \(S_t\) Laplace transform for \(\beta <1\). By using the fact that \(k_t/t\) goes to infinity as t goes to zero we obtain

Thus, \(S_t\) converges in distribution to the constant zero. This proves point 1.

We compute the limit of \(S_t\) Laplace transform for \(\beta >1\). By using the fact that \(k_t/t\) goes to zero as t goes to zero we obtain

Thus, \(S_t\) converges in distribution to the constant one. This proves point 2.

Point 3 follows from the fact that, if \(\beta =1\), \({\mathcal {L}}_t(u;\;k_t,\;\alpha )\) is constant in t. \(\square \)

Lemma A.5

where D is a positive constant.

Proof

Recall that \(S_t\) is a positive r.v. and \({\mathbb {E}}[S_t]=1\). Then, its moment of order 1/2 is finite. By Lemma A.1

where \(\frac{-1}{\Gamma (-1/2)}\approx 3.45\). By Lemma A.3 point 1 with \(c=2\), the positive quantity \((1-{\mathcal {L}}_t(u;\;k_t,\;\alpha ))/u^{3/2}\) is lower or equal than \((1-e^{-2u})/u^{3/2}\). Thus,

where the first equality is obtained from integration by parts and the second from the definition of \(\Gamma \). Inequality (31) has two consequences. First, if \(\beta =1\),

because, by Lemma A.4 point 3, \({\mathbb {E}}[\sqrt{S_t}]\) is constant w.r.t. to time. Second, we can apply the dominated convergence theorem to (30) for all values of \(\beta \). Recall that the limits for t that goes to zero of \({\mathcal {L}}_t(u;\;k_t,\;\alpha )\) for \(\beta <1\) and for \(\beta >1\) are computed in the proof of Lemma A.4.

If \(\beta <1\)

If \(\beta >1\)

where the third equality is obtained from integration by parts and the third by the definition of \(\Gamma \). Equalities (32), (33) and (34) prove the thesis. \(\square \)

Lemma A.6

Consider \({\varphi _t}\) in (3). For every \(\beta \) and \(\delta \) in the additive process boundaries of Theorem 2.3

-

1.

$$\begin{aligned} \varphi _t t=t\bar{\sigma }^2 \eta _t -t\bar{\sigma }^4\eta _t^2 k_t/2 +O\left( t\eta _t^3k_t^2 \right) , \end{aligned}$$(35)

where the second term \(t\bar{\sigma }^4 \eta _t^2 k_t/2\) goes to zero faster than \( t\bar{\sigma }^2\eta _t\) as t goes to zero.

-

2.

$$\begin{aligned} \frac{\varphi _t}{\bar{\sigma }^2\eta _t} \le 1 . \end{aligned}$$

-

3.

$$\begin{aligned} \lim _{t\rightarrow 0} \frac{\varphi _t}{\bar{\sigma }^2\eta _t}=1 ,\;\;\text {for }\;\;\delta >-\min (1,\beta ). \end{aligned}$$

Proof

We prove the asymptotic expansion (35). In the additive process boundaries of Theorem 2.3 at least either \(\beta =\delta =0\) or \(\delta >-\min (1,\beta )\). In the former case (35) is trivial. In the latter, thanks to (3), both \(t \eta _t =t^{1+\delta }\bar{\eta }\) and \(\eta _t k_t=t^{\beta +\delta }\bar{\eta }\bar{k}\) go to zero as t goes to zero. Using the Taylor series expansion

This proves point 1.

We prove that \(\varphi _t /(\bar{\sigma }^2\eta _t)\le 1\). We substitute the definition of \(\varphi _t \) in (3), for \(\alpha >0\), in (35) and we get

We define \(z :=\frac{\bar{\sigma }^2\eta _t k_t}{1-\alpha }\). Then, (36) is equivalent to

which is a well known inequality. This proves point 2.

Point 3 is straightforward, given point 1, because, if \(\delta >-\min (1,\beta )\), \(\eta _t k_t\) goes to zero as t goes to zero. \(\square \)

B Short-time limits

Lemma B.1

Consider a family of positive random variables \(\{X_t\}_{t\ge 0}\) s.t. \(\lim _{t \rightarrow 0}X_t=X\) in distribution and a sequence of functions \(g_t(z)\ge 0\) and uniformly bounded s.t. \(\lim _{t\rightarrow 0}g_t(z) = g(z)\).

If \(\exists \, \tau >0\) s.t. for \(t\in (0,\tau )\)

-

(i)

\(g_t(z)\) is Lipschitz continuous with bounded Lipschitz constant,

-

(ii)

\(|g_t(z)-g(z)|<h(z)\) with \(\lim _{z\rightarrow \infty }h(z)=0\),

then

Proof

It is possible to apply the Ascoli–Arzelá theorem (see e.g., Rudin, 1976, Th. 7.25, p. 158) on every compact set \([0,K],\;K>0\), because a sequence of Lipschitz continuous functions with bounded Lipschitz constant is equicontinous on any compact set. Thus, a sub-sequence of \(g_t(z)\) converges uniformly to g(z) in any [0, K]. For every \(\epsilon >0\), \(\exists \,K\) s.t.

The first expected value goes to zero because \(g_t(z)\) converges uniformly to g(z) on [0, K], as proven above via Ascoli–Arzelá theorem. It exists K s.t. it is possible to bound the second with \(\epsilon \) because h(z) goes to zero as z goes to infinity.

Moreover, g(z) is bounded because it is the limit of a uniformly bounded sequence and

by definition of convergence in distribution, because g(z) is bounded. We have that

this proves the thesis. \(\square \)

Lemma B.2

For \(\delta =-1/2\), let \(\{X_t\}_{t\ge 0}\) be a sequence of positive random variable s.t. \(X_t\rightarrow {X}\) in distribution for t that goes to zero.

Then,

Proof

Define

We emphasize that \(g_t(z)\) is uniformly bounded by one and \(g_t(z)\) converges point-wise to g(z) because, thanks to Lemma A.6 point 3, \(\lim _{t\rightarrow 0}\varphi _t/(\bar{\sigma }^2\eta _t)=1\).

We prove that \(\exists \, \tau \in (0,1)\) s.t. the derivative of \(g_t(z)\) is uniformly bounded, if \(t\in (0,\tau )\). Fix \(\tau \,\in (0,1)\) s.t.

The following hold for \(t<\tau \),

Inequality (37) holds because, by Lemma A.6 point 2, \(\varphi _t/(\bar{\sigma }^2\eta _t)<1\) and \(\tau \in (0,1)\). Let us observe that (37) is the product of positive quantities. In (38) we bound from above only the first factor, the only one that still depends from t. Inequality (38) is deduced by dividing the domain of \(z\in {\mathbb {R}}^+\) in the three sets \(D_1\equiv (0,1/2]\), \(D_2\equiv (1/2,3/2]\) and \(D_3\equiv (3/2,\infty )\).

For \(z\in D_2\), we bound the first factor with its maximum \(\frac{1}{\sqrt{2\pi }}\).

For \(z \in D_1\), we observe that for \(t<\tau \)

Hence, because \(N'\) is a decreasing function of its argument in \({\mathbb {R}}^+\),

Finally, for \(z\in D_3\)

Thus, because \(N'\) is an increasing function of its argument in \({\mathbb {R}}^-\)

Notice that M(z) is positive and bounded on \({\mathbb {R}}^+\); this implies that the derivatives of \(g_t(z)\) is uniformly bounded. Thus, the sequence \(g_t(z)\) is Lipschitz continuous in z with bounded Lipschitz constant on \((0,\tau )\).

Moreover, for \(t<\tau <1\) we have that

In the first inequality we divide the domain of \(z\in {\mathbb {R}}^+\) in two sets, \(D_1\equiv (0,1]\) and \(D_2\equiv (1,\infty )\). In the first domain the difference is bounded by one. In the second set, notice that (39) is still valid for \(z>1\); then, the difference is lower than \(N'\) computed on the max of the arguments of N multiplied by the positive difference of the arguments of N. The second inequality holds because \(\varphi _t/(\bar{\sigma }^2\eta _t)\) is positive and \(t<1\). We observe that h(z) goes to zero as z goes to infinity.

Notice that \(X_t\) converges to X in distribution, \(g_t(z)\) is a sequence of positive function uniformly bounded, Lipschitz continuous with bounded Lipschitz constant on \((0,\tau )\), and \(\lim _{z\rightarrow \infty }h(z)\)=0. Thus, we prove the thesis via Lemma B.1. \(\square \)

Lemma B.3

For \(t>0\),

where \(S_t\) is the random variable of Definition 2.1 with Laplace transform \({\mathcal {L}}_t \left( u;\;k_t,\;\alpha \right) \).

Moreover, if \(\beta >1\),

-

1.

$$\begin{aligned} \lim _{t\rightarrow 0}{\mathbb {P}}(S_t<1)=\lim _{t\rightarrow 0}{\mathbb {P}}(S_t\ge 1) =\lim _{t\rightarrow 0} {\mathbb {P}}\left( S_t\le \frac{\varphi _t }{\bar{\sigma }^2\eta _t}\right) =\frac{1}{2}. \end{aligned}$$

-

2.

$$\begin{aligned} \lim _{t\rightarrow 0}{\mathbb {P}}(S_t\le 1-t^q)={\left\{ \begin{array}{ll} 1/2\;\; &{}\text {if}\;\;q> \frac{\beta -1}{2}\\ N(-1/\sqrt{\bar{k}})\;\; &{}\text {if}\;\;q=\frac{\beta -1}{2}\\ 0\;\; &{}\text {if}\;\;q< \frac{\beta -1}{2} \end{array}\right. }. \end{aligned}$$

-

3.

$$\begin{aligned} \lim _{t\rightarrow 0}{\mathbb {P}}(S_t\le 1+t^q)={\left\{ \begin{array}{ll} 1/2\;\; &{}\text {if}\;\;q> \frac{\beta -1}{2}\\ N(1/\sqrt{\bar{k}})\;\; &{}\text {if}\;\;q=\frac{\beta -1}{2}\\ 1\;\; &{}\text {if}\;\;q< \frac{\beta -1}{2} \end{array}\right. }. \end{aligned}$$

Proof

We use an approach similar to Küchler and Tappe (2013, Th. 4.7, p. 4271). Given \(t>0\), \(n \in {\mathbb {N}}\) we define \(X_t^i:=S_t^i-1\) for \(i=1,2,\dots ,n\) with \(S_t^i\) independent positive random variables with Laplace transform \( {\mathcal {L}}_t \left( u;\;k_t\, n,\;\alpha \right) \). The standard deviation of \(S_t^i\) is \(\Sigma _t^n:=\sqrt{k_t n/t}\). We define \(Q_t^n:=\sum _{i=1}^n X_t^i/(\sqrt{n}\Sigma _t^n)\). Notice that \(Q_t^n+\sqrt{n}/\Sigma _t^n\) has the same law of \(\sqrt{t/k_t}S_t\) by identity in Laplace transform because

Thus, \(\sqrt{k_t/t}\;Q_t^n+1\) is equal in distribution to \(S_t\). Moreover, for any \(t>0\)

The first inequality holds thanks to the Berry–Esseen theorem (see e.g., Durrett, 2019, Th. 3.4.17, p. 136). The first equality is obtained by substituting the third moment of \(S_t^i\) and in the last equality we emphasize the leading term in 1/n. Thus, \(\forall \;\epsilon >0\) it exists n such that

By definition of cumulative distribution function, we get (40).

Equation (40) allow us to prove the limits of the probability.

-

1.

$$\begin{aligned} {\mathbb {P}}(S_t\le 1) =N(0)+O\left( t^{(\beta -1)/2}\right) =1/2+O\left( t^{(\beta -1)/2}\right) , \end{aligned}$$

where the first equality is due to (40) and second term goes to zero because \(\beta >1\). Moreover,

$$\begin{aligned} P\left( S_t\le \frac{\varphi _t}{\bar{\sigma }^2\eta _t}\right) =N\left( {\frac{\varphi _t-\bar{\sigma }^2\eta _t}{\bar{\sigma }^2\eta _t} \sqrt{\frac{t}{k_t}}}\right) +O\left( t^{(\beta -1)/2}\right) , \end{aligned}$$where \(\lim _{t\rightarrow 0}N\left( {\frac{\varphi _t-\bar{\sigma }^2\eta _t}{\bar{\sigma }^2\eta _t}\sqrt{\frac{t}{k_t}}}\right) =\frac{1}{2}\) thanks to Lemma A.6 point 3 observing that

$$\begin{aligned} \left( {\frac{\varphi _t}{\bar{\sigma }^2\eta _t}-1}\right) \sqrt{\frac{t}{k_t}} = \sqrt{t}\bar{\sigma }^2\eta _t\sqrt{k_t} +O\left( t^{2\delta +(3\beta +1)/2}\right) = o(1), \end{aligned}$$because, in the additive process boundaries, for \(\beta >1\), \(\delta +(\beta +1)/2>\delta +1>0\).

-

2.

$$\begin{aligned} {\mathbb {P}}(S_t\le 1-t^q) =N\left( -t^q\sqrt{\frac{t}{k_t}}\right) +O\left( t^{(\beta -1)/2}\right) , \end{aligned}$$

where \(N\left( -t^q\sqrt{\frac{t}{k_t}}\right) \) goes to 1/2 if \(q>(\beta -1)/2\), to \(N(-1/(\sqrt{\bar{k}})\) if \(q=(\beta -1)/2\), and to 0 if \(q<(\beta -1)/2\). We emphasize that the second term goes to zero as \(O\left( t^{(\beta -1)/2}\right) \).

-

3.

$$\begin{aligned} {\mathbb {P}}(S_t\le 1+t^q) =N\left( t^q\sqrt{\frac{t}{k_t}}\right) +O\left( t^{(\beta -1)/2}\right) , \end{aligned}$$

where \(N\left( t^q\sqrt{\frac{t}{k_t}}\right) \) goes to 1/2 if \(q>(\beta -1)/2\), to \(N(1/(\sqrt{\bar{k}})\) if \(q=(\beta -1)/2\), and to 1 if \(q<(\beta -1)/2\). We emphasize that the second term goes to zero as \(O\left( t^{(\beta -1)/2}\right) \). \(\square \)

Lemma B.4

If \(\delta =-1/2\), \(\exists H>1\) s.t.

is increasing for \(z\in [1,H]\) for sufficiently small t, where \(l_t^z\) is the quantity defined in Eq. (7).

Proof

We compute the derivative w.r.t. z of m(z) and study its sign at short-time.

The derivative is positive if

Notice that \(\exists \) \(\tau \) and \(H>1\) such that for every \(t<\tau \) the derivative is positive if \(z<H\) because for sufficiently small time

where the first inequality is obtained by bounding from below 1/4 with 0 inside the square root and the second holds because, by Lemma A.6 point 3,

Thus, m(z) is increasing in [1,H] for sufficiently small t. \(\square \)

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Azzone, M., Baviera, R. Short-time implied volatility of additive normal tempered stable processes. Ann Oper Res 336, 93–126 (2024). https://doi.org/10.1007/s10479-022-04894-y

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-022-04894-y