Abstract

For small-scale electronic commerce supply chains, designing effective strategies to improve operational effectiveness, market share and long-term survival are essential aspects. However, researchers have given less attention in addressing these issues. This study proposes a dynamic cost-sharing contract for an e-tailer supply chain to address the issues of asymmetric information, long-term integration, and ineffective costs. We include consistency constraints to obtain stable incentives over time and eliminate the need for re-negotiation. The findings emphasise that the dynamic contract significantly reduces the overall supply chain costs. The consistency constraints guarantee high incentives, thus assuring the players remain in the total contract period and enable long-term integration.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Electronic commerce (hereafter, e-commerce) supply chain operations have developed rapidly over the last two decades, because of numerous benefits generated for stakeholders (Lu & Liu, 2015; Zennyo, 2020). Firms should look outside of their organizations for opportunities to collaborate and coordinate with partners to ensure that the supply chain is both efficient and responsive to dynamic market needs (Balakrishnan & Geunes, 2004). The popularity of online selling has created e-tailing platforms, in which manufacturers use online retail channels to sell their goods by collaborating with third-party logistics (3PL) operators (Qin et al., 2021; Song & Zhao, 2021; Wang et al., 2019b). According to statistics from eMarketer, retail e-commerce sales have grown significantly by 28% and 22.9% in 2017 and 2018, respectively. It was expected that revenue from online retailing would reach up to USD 3.535 trillion in 2019 and USD 5 trillion in 2020 (Lipsman, 2019). Despite the dominance of large e-tailers such as Amazon, AliExpress, and eBay, there has been a significant boom in new online ventures entering the market, with their marketability and sales enhanced by social media and mobile commerce (Kerick, 2019). Some of the small-scale real-world online retailing business examples are Kapruka, Booktopia, and SHOWPO. These online retailers are mainly based on their respective domestic market regions (Zhuang et al., 2018). All these e-tailers have three-stage supply chain structures, including product suppliers and 3PL operators. KaprukaFootnote 1 is an online retailer based in Sri Lanka, that focuses on delivering different products from suppliers around the country. The products are sold in an online marketplace and delivered to the customer’s doorstep using 3PL operators. Booktopia, an online book e-tailerFootnote 2, and SHOWPO, an online fashion e-tailerFootnote 3 are another two prominent e-tailers in the Australian market, who also operate in a similar context. The current pandemic has further motivated small business retailers to transform their business operations towards online operations, and this trend is expected to continue even after the present outbreak (Kats, 2020). Nevertheless, managing an online business is challenging due to rapid changes in operational contexts and extreme competition. It leads that many new small and medium-scale online retailers finding it difficult to sustain their businesses in the long term (Pi & Wang, 2020). However, previous studies have not provided significant evidence in defining strategies for small-scale e-tailer supply chain improvements, which are vital in expanding market share, improving operational effectiveness and long-term endurance of these e-commerce supply chains.

Though there are numerous success stories of effective e-commerce supply chain organisations, failures are also identified, mainly due to performance measurement issues, collaboration and integration issues, innovation measures, behavioural elements, economic and environmental impacts, and infrastructure developments (Siddiqui & Raza, 2015). Furthermore, it has been identified that most interactions among supply chain members are asymmetric and imbalanced over time (Michalski et al., 2018), which adversely affects long-term integration. Therefore, addressing the issues of asymmetric information and integration is imperative in optimising performance in e-commerce supply chains. Though supply chain contracts have been studied thoroughly in the literature (Shen et al., 2019), less attention has been given to how e-commerce supply chain members can collaborate and integrate with the long term while eliminating these strategic interaction issues. Accordingly, this study investigates whether designing a multi-period contract (we refer to as a dynamic contract) can resolve the issues of asymmetric information and integration and optimise costs for a small-scale e-commerce supply chain operation.

The literature on supply chain contracts focuses mainly on issues of integration among partners (Qu et al., 2015; Wang et al., 2017), integration of effective information sharing (Ha & Tang, 2017; Yan, 2010), lack of coordination (Hou et al., 2017), channel competition and integration (Tsay & Agrawal, 2004; Yan & Pei, 2015), and conflicts of incentives and information asymmetry issues (Gao et al., 2021; Lei et al., 2015). Information asymmetry issues in e-commerce supply chains require closer attention, as the correct information is the crucial asset of online operations (Liu et al., 2015). Although most of the literature on contract theory models have focused on static operations, actual supply chain operations are dynamic and time-dependent. Hence, dynamic operational aspects need to be incorporated when formulating contract models (Jørgensen, 2011). Long-term relationships among supply chain members bring long-term, mutual benefits for all parties, and dynamic contracts can deliver better outcomes and reduce the cost of re-negotiation (Petrosyan & Zaccour, 2018). Since e-commerce supply chains operate primarily within globalised environments, where members of the supply chain are external and remote, successful integration among supply chain partners is essential for achieving customer satisfaction and competitive advantage (Sabet et al., 2017). In this operational context, 3PL operators are crucial for carrying out the order fulfilment process to the customer’s doorstep, and e-tailers are highly dependent on their services (Gonzalez & Glodziak, 2018). For example, a retail giant like Amazon also employs a variety of suppliers and delivery partners in its operational network while maintaining its warehouse facilities to achieve effective e-order fulfilments (Li et al., 2019). Thus, external integration of supply chain members in e-commerce supply chains is vital for improving operational efficiency.

Based on the above discussion, the study addresses the following key research questions:

- RQ1::

-

How to optimise supply chain costs and resolve issues of asymmetric information, coordination, and conflicts of interests in e-commerce supply chains using the contract model?

- RQ2::

-

How to design effective strategies to achieve long-term integration among e-commerce supply chain members using dynamic contracts?

Based on the above research questions, this paper develops a multi-period cost-sharing contract model for small-scale or start-up e-tailer supply chain to enable long-term integration and eliminate re-negotiation by considering consistent incentives. Furthermore, the study also analyses how the proposed dynamic contract optimises the overall supply chain costs while addressing cost information asymmetry issues. In this context, we consider a cooperative game approach for decision-making among members of an e-tailer supply chain. Since our model incorporates both operational constraints and contract-related constraints, we use an optimisation solution approach to derive the model’s implications. Game theory and optimisation have been applied in combination in several studies in different fields (Sohrabi & Azgomi, 2020; Zhu et al., 2011). To solve the proposed contract model, we use a multi-objective optimisation (MOO) method, which has been adopted in similar contexts by Khan and Ahmad (2008), Yue and You (2017) and Zamarripa et al. (2013).

The contributions of the paper are threefold. First, it contributes to the body of knowledge on contracts by introducing a dynamic cost-sharing contract model that optimises e-commerce supply chain costs. Second, whereas most of the studies on dynamic contracts are in two-stage or two-player supply chain scenarios, we consider three-stage e-commerce supply chain operations and their impact on the overall supply chain decisions, in which asymmetric information exists in the upstream and downstream. Third, we introduce consistency constraints in the contract model to assess long-term integration and to eliminate the opportunity of re-negotiation, which has not been explored in literature. By defining consistency constraints, we address the requirement of re-negotiation proofness and dynamic stability of a multi-period contract and add new knowledge in the supply chain literature. Small-scale and start-up e-tailer organisations can implement the proposed cost-sharing model to create long-term integration among their external supply chain members. The results highlight the importance of creating consistent incentives for all supply chain members, which can be considered while establishing a long-term partnership with such supply chain organisations.

The remainder of the paper is structured as follows. Section 2 provides a brief review of the literature related to dynamic contract applications in supply chains. Section 3 discusses the problem and model formulation. Numerical analysis and the research findings are discussed in Sect. 4. Section 5 discusses research implications. Finally, the last section concludes the paper and highlights future research directions.

2 Literature review

This study focuses on two streams of literature: supply chain contracts with information asymmetry issues and dynamic contract models in the supply chain.

2.1 Supply chain contracts with information asymmetry issues

Research literature has examined supply chain contract models with asymmetric information issues thoroughly since it adversely affects effective contracts outcome (Cachon, 2003; Govindan et al., 2013; Shen et al., 2019). Many supply chain contract models have incorporated game theory in their contract designs (Malekian & Rasti-Barzoki, 2019). Su and Geunes (2013) created a Stackelberg game model with price-discounting for a single supplier and multi-retailer supply chain when asymmetric demand exists. These authors determined that the price discount mechanism can improve supplier profits. Yang and Ma (2017) designed a two-part tariff contract for two suppliers selling via a common retailer scenario with asymmetric demand information. They evaluated the equilibrium pricing strategy along with the impact of stochastic demand on supply chain operations. Ma et al. (2018) derived a wholesale price contract and a two-part tariff contract to create an optimal sourcing strategy when emission levels are undisclosed. Numerous supply chain contract studies have considered the cost of information asymmetry issues (Shen et al., 2019). Corbett (2001) designed an optimal contract menu when the supplier’s setup costs are asymmetric for a lot-sizing model. Corbett et al. (2004) developed contracts for cases in which the supplier’s internal cost structure is unobservable. These authors developed a wholesale price contract and two-part linear and non-linear contracts to obtain implications for this setting. Bolandifar et al. (2018) studied global sourcing problem where a buyer sources from a supplier to meet uncertain market demand. The buyer faces two issues: adverse selection and non-contractible capacity. Their finding shows that a linear contract (or a two-part tariff) could be optimal for the buyer under certain conditions. All of these studies investigated supply chain contracts within two-player operations and their impacts on strategic and operational decisions.

Many studies have investigated the issues of asymmetric information related to dual-channel supply chains within the context of online supply chains. Yan and Pei (2012) designed a game theory model for dual-channel, competitive retailers with asymmetric demand information to investigate the impact of incentive-compatible information sharing. Their findings showed that sharing information is not always beneficial in competitive scenarios. Similarly, Liu et al. (2021) considered a two-echelon supply chain with two homogeneous manufacturers and a retailer to study retailer’s decisions on sharing cost information about the value-added services. They found that the optimal level for value-added services is mainly determined by the retailer’s service cost efficiency and information sharing does not always create a win–win situation in a supply chain. Cao et al. (2013) developed a contract model within an asymmetric information setting in a dual-channel supply chain, in which the retailer keeps private information about its cost structure. Fang et al. (2014) discussed an optimal contract in the assembly supply chain between suppliers and assemblers in which the supplier keeps the information about the cost structure private. The authors devised an incentive mechanism based on the revelation principle to share actual supplier costs for the assembler to supply the market and maximise profits accurately. Zissis et al. (2015) studied a quantity discount contract model that could achieve perfect supply chain coordination in a supplier and retailer model under information asymmetry. Chen et al. (2017) analysed a two-player dual-channel supply chain in which manufacturer costs are private by adopting a principal-agent model based on optimal contracts. These authors studied the impact of manufacturer encroachment within the perfect and asymmetric information scenario, showing that keeping private information always benefits the manufacturer. Kaya and Caner (2018) proposed cost-sharing contract models, in which the manufacturer shares a portion of the supplier’s capacity investment cost and, based on that, offers a wholesale price for the supplier. Chernonog (2021) considered a two-echelon supply chain in which a dominant retailer makes revenue sharing with a manufacturer under information asymmetry scenario. Under information asymmetry scenario, they found that the retailer may benefit, but will never lose, from gaining access to the manufacturer’s private information. However, the manufacturer can either gain or lose by disclosing this information. All of these studies have investigated the impact of asymmetric information on various supply contracts. They have identified that asymmetric information always creates benefits for the player who has the advantage of additional information, and it can adversely affect the supply chain profits and costs of the less informed party. Few studies consider the impact of information sharing on the channel structure of online retailing (Ha et al., 2021; Song et al. 2021). Therefore, it is important to address the impact of asymmetric information on e-tailer supply chains, which mainly depends on accurate information.

2.2 Dynamic contract models in supply chain

Since supply chains are time-reliant operations, relationships among their players are stable and long-term (Zhao et al., 2014). Therefore, formulating dynamic contracts in the multi-period is essential in creating long-term partnerships within supply chains. Such is the case for the e-commerce supply chain. In this context, re-negotiation and dynamic stability are crucial aspects that need to be considered in formulating dynamic contracts. When a contract is proposed, it must bind all parties for all periods (Salanié, 2005). Contracts can be extended towards re-negotiation when a contract is executed within an information asymmetry environment such as adverse selection with a revelation principle, adverse selection with signalling, and moral hazard (Bolton & Dewatripont, 2005). Therefore, dynamic contracts require “re-negotiation proof constraint” to ensure that the contract players do not need to consider re-negotiation. The principle of dynamic stability is defined as the optimal solution remaining consistent and stable throughout the game period when the game is operated within an optimal trajectory (Yeung & Petrosyan, 2006, 2012). This condition is vital in dynamic games due to group optimality and individual rationality (Yeung & Petrosyan, 2012). Therefore, dynamic stability also relates to re-negotiation proofness as the optimal solutions of the contract remain stable and consistent throughout the period. Hence, no player wants to deviate from the original contract. Based on that, we consider the dynamic stability and the re-negotiation proofness of the contract by designing consistency constraints for cost-sharing in this study.

Table 1 presents dynamic contract models developed in supply chain literature focused on improving supply chain outcomes in supply chain coordination, channel efficiency, supply chain performance, and quality improvements. Since asymmetric information and re-negotiation are crucial aspects of the dynamic contracts, we have incorporated these aspects in the analysis in Table 1, along with the type of contract, solution methods, applied industry, and the number of supply chain levels. The analysis shows that the models are mainly focused on two-stage supply chain operations. A limited number of studies have incorporated information asymmetry issues into dynamic operations, as opposed to static contract models. The concept of re-negotiation is a decisive aspect for long-term contract models, for which few studies are available in this context (Bondareva & Pinker, 2018; Brusset & Agrell, 2015). Brusset and Agrell (2015) developed a two-period contract model considering the investment costs of a two-echelon supply chain to derive coordination. The authors have taken re-negotiation at the end of the second period of the contract if the retailer rejects the contract. This analysis elaborates on how the supplier and manufacturer can gain from hiding truthful information and how this affects the overall performance of the supply chain. Bondareva and Pinker (2018) studied the quality enforcement levels using a cost-sharing contract in which a buyer commits to the contract while the supplier may not do the same. The effort level of the supplier is taken as a key determinant, with financial penalties used to evaluate the re-negotiation. Through the financial penalties, the supplier achieved compliance at the contract termination. In both these studies, re-negotiation is considered possible at contract termination at the end of each period. While Bondareva and Pinker (2018) studied re-negotiation based on financial penalties, which also enable high-quality levels, Brusset and Agrell (2015) examined the impact of re-negotiation with a new business partner. However, none of these studies addressed the use of re-negotiation proofness or the dynamic stability in the contracts, which is important in long-term contracts. Many studies have incorporated game theory-based analytical solution outcomes in deriving findings from contracts. Nevertheless, researchers have used optimisation solution approaches in contract modelling other than closed-form analytical solutions (Bansal et al., 2007; Lieckens et al., 2015; Mobini et al., 2019; Park et al., 2006), in which less evidence is found in the dynamic contract studies. Mobini et al. (2019) discussed a multi-period contract in a two-echelon supply chain in which the retailer’s cost and demand were taken as asymmetric information. The asymmetric information setting was addressed using a screening contract approach in which a menu of contracts was presented to the retailer. These authors designed a bi-level optimisation problem and solved it as a mixed-integer programming (MIP) problem, converting it to a single-level variant. Heidary et al. (2018) used a simulation–optimization approach in formulating a dynamic option contract for a multi-period newsvendor problem considering the uncertainties of supply and demand. The authors incorporated a genetic algorithm to conduct the simulation, its results indicated that service levels are more important than profits. Operational constraints are also relevant while modelling supply contracts but are still less explored (Chiang, 2012).

2.3 Analysis of research gaps and highlights

Supply chain contract literature has widely incorporated asymmetric information issues in achieving supply chain coordination, including dynamic contracts. However, extant literature (e.g., Yeung & Petrosyan, 2012) does not show enough evidence in which dynamic stability of the contract and the re-negotiation is analysed to derive long-term integration, even though these factors are crucial in long-term contracts. Furthermore, the impact of multi-level/multi-player supply chain decisions on contract outcomes and supply chain integration is less explored in dynamic contract literature, particularly in e-tailer settings (Shen et al., 2019). Besides, studies (e.g., Gonzalez & Glodziak, 2018) mainly relaxed the operational constraints when the contract models are formulated, which however is a key factor in optimising supply chain operations. Motivated by these limitations, this paper studies a dynamic cost-sharing contract, mainly focusing on the multi-period operations of a three-player e-tailer supply chain. It also analyses the impact of cost-sharing on long-term integration-based decisions and supply chain cost optimisation.

3 Problem description and model formulation

3.1 Dynamic operational setting of the model

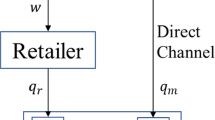

In this paper, we consider a small-scale or start-up business to consumer (B2C) e-tailer supply chain, operating under a reseller structure. In online retailing, several operational structures are available, including the e-tailer as a merchant, the e-tailer as a platform, in which transaction fees are paid for using the platform, and third-party re-selling models. However, for start-up or small-scale operations, the most common structure in the real world is the e-tailer operating as the merchant (Pi & Wang, 2020), as it requires less capital investment, is easy to operate, and has huge demand from the customers for online purchasing (Shu et al., 2020). Therefore, this study focuses on the operational setting of the e-tailer as the merchant (reseller), which is illustrated in Fig. 1.

As shown in Fig. 1, the e-tailer supply chain consists of three players: the e-tailer (he), product supplier, and the 3PL operator. All players interact with the e-tailer, and he receives the demand from the customers via online orders. Then, he orders the goods from the product supplier and then delivers the same to the customer’s doorstep using a 3PL operator. The small-scale e-tailer examples, Kapruka, Booktopia, and SHOWPO, operate with a context similar to that described in Fig. 1. They purchase products from external suppliers, store them in their distribution centers and deliver them to the customer’s doorstep using 3PL operators. All of these e-tailers started on a small scale and have successfully grown their business operations to become leading operators in their respective countries. Therefore, the operational context described in this paper is related to actual e-tailer operations. Hence, the model formulations and findings are more applicable to start-up and small-scale e-tailer supply chains.

In online retailing operations, distribution of physical products to the customer is the most crucial aspect, where 3PL services are vastly utilised in the actual operations (Shu et al., 2020). The proposed model assumes that the 3PL operator only distributes the product to the customer’s doorstep, and hence, no inventory is maintained by the player. For example, SHOWPOFootnote 4 relies on a single 3PL operator in Sydney to process its orders and another 3PL operator to process USA orders, where the goods are stored in their warehouse before delivering to the consumer, following the three-stage operational structure. In a traditional brick-and-mortar business, 3PL distribution is not involved, and hence, the cost of final distribution to the consumer is not considered. Therefore, in this e-tailer based supply chain, the customer’s price includes the product cost from the supplier and the 3PL operator’s service cost. Ensuring no stock-out situations is essential in any supply chain operation and the operational scenario of this study, it is assumed that both the e-tailer and the product supplier maintain inventory at their warehouses. Indeed, it is a typical practice of e-commerce supply chains that e-tailers maintain inventory in their warehouses (Dutta et al., 2020). In addition, due to severe competition in the online retail markets, customers have numerous options to buy substitute products. Therefore, stock-out situations can adversely affect e-commerce supply chain operations as they can reduce sales and lose customers.

Each supply chain member in this operation is an external organisation; they collaborate to deliver the product to the consumer. Therefore, each member’s objective is different. However, to increase the market share, the e-tailer needs to identify suitable strategies that effectively integrate his upstream and downstream supply chain operations. Therefore, we propose a cost-sharing contract model to optimise the total supply chain costs and achieve effective supply chain integration in a multi-period setting. In this scenario, external players collaborate and are not aware of each other’s actual operational costs, and hence, information asymmetry issues exist. Since online operations depend on accurate information, information asymmetry adversely affects the optimal outcomes. To obtain maximum benefits, players must work together to reach a common objective while maximising customer service levels and market share. A cooperative game concept is used in designing the common objective of the supply chain by integrating three players to minimise overall supply chain costs and individual costs, thereby creating a better competitive strategy towards expanding their customer base and market share in the long run.

Assumptions

The assumptions for the proposed model are as follows:

-

(1)

The e-tailer supply chain has one player in each stage (Shu et al., 2020; Wang et al., 2019a). This is commonly adopted in supply chain contract literature (Cao et al., 2013; Kaya & Caner, 2018; Zhang et al., 2019; Zissis et al., 2015).

-

(2)

The supply chain handles a single product (e.g., readymade garments, shoes or product accessories, handicrafts, and biodegradable products.)

-

(3)

The demand is stochastic, following a normal distribution.

-

(4)

Each player in this operation is assumed to be a rational decision-maker.

Furthermore, the selling price of this scenario is determined by the e-tailer based on the operational costs and the profit margin of the supply chain.

3.2 Normal distribution approximation

In this model, we approximate the demand uncertainty space by using a set of discrete scenarios (Xie & Huang, 2018). When the stochastic variable follows a continuous distribution, model solving is computationally challenging. Therefore, we use the discrete Markov chain approximation used by Touchen (1986) to generate a normally distributed, discrete data space for the demand function.

3.3 Notations for the proposed model

The following notations are used to formulate the mathematical model.

3.3.1 Notations

Sets and indexes:

\(i\) = Time period (1, 2, 3, …, n).

\(j\) = Players (1: Product supplier, 2: E-tailer, 3: 3PL operator).

\(l\) = Possible scenarios for demand levels \((1,2,...,K)\) for \(K > 0\)(\(l\) is the index for the state at time \(i\). Also, notation \(lm\) for the state at time \(i - 1\) and \(lp\) for the state at time \(i + 1\) is used).

Parameters:

\(UC_{i}\) = Unit cost of production of the supplier for the period i.

\(\alpha_{i}\) = Percentage factor of inventory holding cost of the supplier in period i.

\(HC_{i}\) = Unit cost of holding inventory at the e-tailer in period i.

\(DC_{i}\) = Unit distribution cost of the 3PL operator in period i.

\(II_{j}\) = Initial inventory of player j.

\( W_{{cap\,j}} \) = Warehouse capacity of player j.

\(M_{cap}\) = Manufacturing capacity of the product supplier.

\(x_{i.l}\) = Demand in each period i for state l.

\(p_{l}\) = Probability of state \(l\); the probability measure assigning a probability \(p_{l}\) to the value \(x_{i,l}\) is a discrete approximation of the normal distribution with a mean \(\mu_{i}\) and standard deviation \(\sigma_{i}\).

\(W_{j}\) = Weight for the player j.

\(\theta\) = Probability that the e-tailer believes the cost of product supplier is at a higher state.

\(\gamma\) = Probability that the e-tailer believes the cost of the 3PL operator is at a higher state.

\(P_{i,j}\) = Fixed unit ordering cost of the e-tailer paid to the product supplier or the fixed service fee paid by the e-tailer to the 3PL operator in period i.

\(\delta_{j}\) = Discount rate of player j.

Decision variables:

\(q_{i.l}\) = Unit quantity produced by the product supplier in period i for state l.

\(d_{i,l}\) = Units ordered by the e-tailer from the product supplier in period i for state l.

\(s_{i,j,l}\) = Beginning inventory of player j \((j \ne 3)\) in period i for state l.

\(sc_{i,j.l}\) = Costs that the e-tailer share with other players in period i for state l;\((j \ne 2)\).

\(k_{i,j,l}^{\% }\) = Fraction of cost-sharing in % for player j for state l;\((j \ne 2).\)

Other variables:

\(c_{j}\) = Expected total individual costs of player j;\(\forall_{j}\).

3.4 Dynamic cost-sharing contract

We designed a cost-sharing contract to share the operational costs of the players to optimise supply chain costs and to achieve long-term integration. To maintain consistent optimal outcomes from this contract, we introduced dynamically consistent incentive constraints into the model, which ensure that players will remain within the total period of the contract (Yeung & Petrosyan, 2006; Yeung et al., 2019). The consistency constraints enable the re-negotiation proofness since the purpose of these constraints is to derive improved levels of incentives through cost-sharing, which we test through this contract model. To achieve effective long-term integration among supply chain players, the discounting approach is also incorporated into the contract model, considering that supply chain members can make decisions based on future values of the operations (Zhao et al., 2014). To resolve information asymmetry issues, we adopt a screening contract approach with the revelation principle in each period because the e-tailer must be aware of the actual operational costs of his upstream and the downstream to create a competitive pricing strategy for the consumers. As the e-tailer observes information asymmetry issues before he enters the contract, this operational setting observes adverse selection issues.

The menu of contracts is a common approach adopted when information asymmetry issues are presented under screening contracts (Cao et al., 2013; Kaya & Caner, 2018; Zissis et al., 2015). We adopt a similar approach and design a menu of contracts, including a fraction of operational cost shared by the e-tailer and the fixed unit costs of the e-tailer. Cost-sharing with a fixed unit cost is not commonly discussed in the literature. However, Jørgensen (2011) did adopt this approach in a dynamic contract model. Furthermore, we incorporate dynamic consistency by creating consistent cost shares in each period to establish the dynamic stability of the contract model. The sequence of the game when the contract is offered to the product supplier is shown in Fig. 2.

The order of play illustrated in Fig. 2 follows the general rules set under screening contracts in game theory (Cachon & Netessine, 2006; Rasmusen, 2007). The cost-sharing contract is initiated by the e-tailer, as the dominant and less-informed party. The e-tailer initiates the game at the period \(t = 1\) by offering a cost-sharing contract to the product supplier and the 3PL operator. The e-tailer does not observe the actual operational costs of either player. The contract is offered in the form of \(sc_{i,j,l} ,P_{i,j}\); where \(sc_{i,j,l}\) is the cost shared by the e-tailer with either the product supplier or the 3PL operator, and \(P_{i,j}\) is the fixed ordering cost or the service fee paid by the e-tailer to the product supplier or the 3PL operator, respectively. The product supplier or 3PL operator either accepts or rejects the contract. If the product supplier or 3PL operator rejects the contract, the game ends. If the product supplier or 3PL operator accepts the contract, they select the relevant menu of contracts according to their actual operational costs, denoted as \(\{ \overline{{sc_{i,j,l} }} ,\underline{{P_{i,j,l} }} \} ,\{ \underline{{sc_{i,j,l} }} ,\overline{{P_{i,j,l} }} \}\). The game ends for t = 1 and then starts again with \(t = 2\). The process is repeated until the end of the contract period, \(t = n\).

The information asymmetry issues of the product supplier and the 3PL operator are incorporated into the contract based on the following approach. When the customer places his order with the e-tailer, he receives the demand for the respective period. Then the e-tailer evaluates his inventory level and initiates the cost-sharing contract with the product supplier and the 3PL operator within that period. As the e-tailer does not know of the production cost of the product supplier, he assumes high and low unit production costs, denoted with \(\overline{UC}\) and \(\underline{UC}\), which occur with a probability of \(\theta\) and \(1 - \theta\), respectively. Then the e-tailer presents his menu of contracts, which comprises the portion of shared operational costs and the fixed unit price of the supplier’s goods to select whichever one is suitable. The same scenario is applied with the 3PL operator, where the e-tailer assumes that high and low unit transportation costs, denoted by \(\overline{DC}\) and \(\underline{DC}\)\(,\) occur with a probability of \(\gamma\) and \(1 - \gamma\), respectively. When the e-tailer offers the contract to the product supplier, assuming that the product supplier has incurred a lower cost, the product supplier receives \(\{ \overline{{sc_{i,1,l} }} ,\underline{{P_{i,1,l} }} \}\), and under a higher production cost, he receives \(\{ \underline{{sc_{i,1,l} }} ,\overline{{P_{i,1,l} }} \}\). Similarly, the 3PL operator receives two contract options from the e-tailer for low and high-cost scenarios, respectively, as:\(\{ \overline{{sc_{i,3,l} }} ,\underline{{P_{i,3,l} }} \} ,\{ \underline{{sc_{i,3,l} }} ,\overline{{P_{i,3,l} }} \}\).

3.5 Modelling the objective function

In this model, we designed a cooperative decision-making approach among the supply chain members, in which collective decisions are taken by all participants to minimise the overall supply chain costs. In supply chain operations, profit maximisation or cost minimisation is the two main objectives (Snyder & Shen, 2011). In recent times, businesses have become more focused on finding strategies to minimise costs, which ultimately leads to profit maximisation. For start-up and small-scale e-tailers, attracting more customers by providing products at competitive prices is the most important aspect, which guarantees long-term survival in the market. Therefore, minimising operational costs is a better strategy than increasing the selling prices to improve supply chain profits. When supply chain costs are minimised, all supply chain partners, as well as the overall supply chain, benefit from minimal operational costs.

The findings of previous studies support this argument. For example, Kerkkamp et al. (2018); Wang et al. (2004); Zissis et al. (2015) used cost minimisation as the supply chain objective in their respective models. Furthermore, Guo et al. (2017) highlighted the need for more attention to be given to developing contract models based on optimising supply chain costs in the contract literature, as this is a highly important but neglected area of research. Therefore, we consider cost minimisation as the objective of the e-tailer supply chain in this study.

We adopted concepts from cooperative games for the cooperative-decision approach of the proposed model. In cooperative games, multi-objective optimisation (MOO) is one of the solution approaches, which enables Pareto-optimal solutions, in which a single decision-maker (here, the e-tailer) considers the interests of all players in the contract (Matsumoto & Szidarovszky, 2016). Therefore, we formulate the objective with weights allocated for each supply chain member’s total individual costs as below:

Here, z is the total supply chain cost, and cj is the individual costs of the player for all players, j.

-

(i)

The individual cost objectives for all states \(l,lm\):

$$ c_{1} = \sum\limits_{l,lm}^{{}} {p_{l} \cdot p_{lm} } \sum\limits_{{\forall_{i} }} {\left[ {1/(1 + \delta_{1} )^{i} \left\{ \begin{gathered} \hfill \Bigg( {\theta (\overline{{UC_{i} }} ) + (1 - \theta )(\underline{{UC_{i} )}} } \Bigg) \cdot \Bigg( {q_{i,l} + \alpha_{i} \cdot (s_{i,1,l} + s_{i - 1,1,lm} )/2} \Bigg) \\ \hfill - \Bigg( {\theta (\underline{{sc_{i,1,l} }} ) + (1 - \theta )(\overline{{sc_{i,1,l} }} )} \Bigg) - \Bigg( {\theta (\overline{{P_{i,1} }} ) \cdot d_{i,l} + (1 - \theta )(\underline{{P_{i,1} }} ) \cdot d_{i,l} } \Bigg) \\ \end{gathered} \right\}} \right]} $$(2)$$ c_{2} = \sum\limits_{{l,lm}}^{{}} {p_{l} \cdot p_{{lm}} } \sum\limits_{{\forall _{i} }} {\left[ {(1/(1 + \delta _{2} )^{i} \left\{ \begin{gathered} \hfill HC_{i} (s_{{i,2,l}} + s_{{i - 1,2,lm}} )/2 + \left( {\theta (\underline{{sc_{{i,1,l}} }} ) + (1 - \theta )\overline{{(sc_{{i,1,l}} )}} } \right) \\ \hfill + \left( {(\theta (\overline{{P_{{i,1}} }} ) \cdot d_{{i,l}} + (1 - \theta )(\underline{{P_{{i,1}} }} )) \cdot d_{{i,l}} } \right) \\ \hfill + \left( {\gamma (\underline{{sc_{{i,3,l}} }} ) + (1 - \gamma )(\overline{{sc_{{i,3,l}} }} )} \right) + \left( {(\gamma (\overline{{P_{{i,3}} }} ) + (1 - \gamma )(\underline{{P_{{i,3}} }} )) \cdot x_{{i,l}} } \right) \\ \end{gathered} \right\}} \right]} $$(3)$$ c_{3} = \sum\limits_{l}^{{}} {p_{l} } \sum\limits_{{\forall _{i} }} {\left[ {1/(1 + \delta _{3} )^{i} \left\{ \begin{gathered} \hfill \left( {\gamma (\overline{{DC_{i} }} ) + (1 - \gamma )(\underline{{DC_{i} }} ) \cdot x_{{i,l}} } \right) - \left( {\gamma (\underline{{sc_{{i,3,l}} }} ) + (1 - \gamma )(\overline{{sc_{{i,3,l}} }} )} \right) \\ \hfill - \left( {\gamma (\overline{{P_{{i,3}} }} ) + (1 - \gamma )(\underline{{P_{{i,3}} }} )\} \cdot x_{{i,l}} } \right) \\ \end{gathered} \right\}} \right]} $$(4)

The total individual costs are aggregated over states weighted by the probabilities for each state (expected costs). The total cost of the supplier (\(c_{1}\)) consists of the discounted summation of production and inventory holding cost of each period i, with the sharing cost received from the e-tailer and the total fixed price paid by the e-tailer. The cost of the e-tailer (\(c_{2}\)) consists of the discounted total inventory holding costs at his warehouse, along with the cost-sharing and total fixed price paid to the product supplier and the 3PL operator. The cost of the 3PL operator \((c_{3} )\) includes the discounted total distribution cost of the units demanded by the customer in each period i with the benefit received from the contract with sharing the cost and the total fixed price for the units distributed to the customer. In the total cost function, the index i (i.e., time periods) is employed to represent the long-term effect of the operation, and by including the discounted summation, the dynamic aspect is determined for long-term multi-period operation.

3.6 Constraints of the model

The proposed contract model is subjected to the following constraints.

-

(ii)

Incentive compatibility constraints

$$\begin{aligned} \overline{{UC_{{_{i} }} }} \cdot q_{{i,l}} & + \alpha _{i} \cdot \overline{{UC_{{_{i} }} }} \bigg( {s_{{i,1,l}} + s_{{i - 1,1,lm}} } \bigg)/2 - \underline{{sc_{{1,i,l}} }} - \overline{{P_{{i,1}} }} \cdot d_{{i,l}} \ge \underline{{UC}} \cdot q_{{i,l}} \\ & + \alpha _{i} \cdot \underline{{UC_{i} }} \bigg( {s_{{i,1,l}} + s_{{i - 1,1,lm}} } \bigg)/2 - \overline{{sc_{{1,i,l}} }} - \underline{{P_{{i,1}} }} \cdot d_{{i,l}} ;\forall _{i} ,i < n\forall l,lm, \\ \end{aligned} $$(5)$$ \begin{aligned} \underline{{UC_{i} }} \cdot q_{{i,l}} & + \alpha _{i} \cdot \underline{{UC_{i} }} (s_{{i,1,l}} + s_{{i - 1,1,lm}} )/2 - \underline{{sc_{{1,i,l}} }} - \underline{{P_{{i,1}} }} \cdot d_{{i,l}} \ge \overline{{UC_{i} }} \cdot q_{{i,l}} \hfill \\ & + \alpha _{i} \cdot \overline{{UC_{i} }} (s_{{i,1,l}} + s_{{i - 1,1,lm}} )/2{\text{ }} - \overline{{sc_{{1,i,l}} }} - \overline{{P_{{i,1}} }} \cdot d_{{i,l}} ;\forall _{i} ,i < {\text{n}},\forall l,\,lm \hfill \\ \end{aligned} $$(6)$$ \overline{{DC_{i} }} \cdot x_{i,l} - \underline{{sc_{i,3,l} }} - \overline{{P_{i,3} }} \cdot x_{i,l} \ge \underline{{DC_{i} }} \cdot x_{i,l} - \overline{{sc_{i,3,l} }} - \underline{{P_{i,3} }} \cdot x_{i,l} :\forall_{i} \forall l $$(7)$$ \underline{{DC_{i} }} \cdot x_{i,l} - \underline{{sc_{i,3,l} }} - \underline{{P_{i,3} }} \cdot x_{i,l} \ge \overline{{DC_{i} }} \cdot x_{i,l} - \overline{{sc_{i,3,l} }} - \overline{{P_{i,3} }} \cdot x_{i,l} \forall_{i} \forall l $$(8) -

(iii)

Individual rationality constraints

$$ \begin{gathered} \overline{{sc_{{i,1,l}} }} \le k_{{i,1,l}}^{\% } (\theta \cdot (\overline{{UC_{i} }} (q_{{i,l}} + \alpha _{i} \cdot (s_{{i,1,l}} + s_{{i - 1,1,lm}} )/2)) \hfill \\ \quad +\, (1 - \theta ) \cdot \underline{{(UC_{i} }} (q_{{i,l}} + \alpha _{i} \cdot (s_{{i,1,l}} + s_{{i - 1,1,lm}} )/2))\} \hfill \\ \end{gathered} $$(9)$$ \overline{{sc_{i,3,l} }} \le k_{i,3,l}^{\% } \cdot \{ \gamma \cdot (\overline{{DC_{i} }} \cdot x_{i,l} ) + (1 - \gamma )(\underline{{DC_{i} }} \cdot x_{i,l} )\} $$(10)$$ \overline{{sc_{i,j,l} }} \ge \underline{{sc_{i,j,l} }} \ge 0;j \ne 2 $$(11) -

(iv)

Consistency constraints

$$ \begin{array}{*{20}l} {\sum\limits_{{l,lm}} {p_{l} \cdot p_{{lm}} \cdot } (\overline{{sc_{{i,1,l}} }} )/\bigg( {\underline{{UC_{i} }} (q_{{i,l}} + \alpha _{i} \cdot (s_{{i,1,l}} + s_{{i - 1,1,lm}} )/2)} \bigg)} \hfill \\ \quad { \le \sum\limits_{{l,lp}} {p_{l} \cdot p_{{lp}} \cdot (\overline{{sc_{{i,1,l}} }} )} /\bigg( {\underline{{UC_{{i + 1}} }} (q_{{i + 1,lp}} + \alpha _{{i + 1}} \cdot (s_{{i,1,l}} + s_{{i + 1,1,lp}} )/2)} \bigg);i\,{\text{ < }}\,n,} \hfill \\ \end{array} $$(12)$$ \begin{array}{*{20}l} {\sum\limits_{{l,lm}}^{{}} {p_{l} \cdot p_{{lm}} \cdot } (\underline{{sc_{{i,1}} }} )/(\overline{{UC_{i} }} (q_{{i,l}} + \alpha _{i} \cdot (s_{{i,1}} + s_{{i - 1,1m}} )/2)} \hfill \\ \quad { \le \sum\limits_{{i = 1}}^{n} {p_{l} \cdot p_{{lp}} \cdot } (\underline{{sc_{{i + 1,1}} }} )/(\overline{{UC_{{i + 1}} }} (q_{{i + 1,lp}} + \alpha _{{i + 1}} \cdot (s_{{i,1}} + s_{{i + 1,1p}} )/2)} \hfill \\ \end{array} $$(13)$$ \sum\limits_{l}^{{}} {p_{l} } {\raise0.7ex\hbox{${(\overline{{sc_{i,3,l} }} )}$} \!\mathord{\bigg/ {\vphantom {{(\overline{{sc_{i,3,l} }} )} {(\underline{{DC_{i} }} \cdot x_{i,l} )}}}\bigg.\kern-\nulldelimiterspace} \!\lower0.7ex\hbox{${(\underline{{DC_{i} }} \cdot x_{i,l} )}$}} \le \sum\limits_{lp}^{{}} {p_{lp} } {\raise0.7ex\hbox{${(\overline{{sc_{i + 1,3,lp} }} )}$} \!\mathord{\bigg/ {\vphantom {{(\overline{{sc_{i + 1,3,lp} }} )} {(\underline{{DC_{i + 1} }} \cdot x_{i + 1,lp} )}}}\bigg.\kern-\nulldelimiterspace} \!\lower0.7ex\hbox{${(\underline{{DC_{i + 1} }} \cdot x_{i + 1,lp} )}$}};i < n $$(14)$$ \sum\limits_{l}^{{}} {p_{l} } {\raise0.7ex\hbox{${(\underline{{sc_{i,3,l} }} )}$} \!\mathord{\bigg/ {\vphantom {{(\underline{{sc_{i,3,l} }} )} {(\overline{{DC_{i} }} \cdot x_{i,l} )}}}\bigg.\kern-\nulldelimiterspace} \!\lower0.7ex\hbox{${(\overline{{DC_{i} }} \cdot x_{i,l} )}$}} \le \sum\limits_{lp}^{{}} {p_{lp} } {\raise0.7ex\hbox{${(\underline{{sc_{i + 1,3,lp} }} )}$} \!\mathord{\bigg/ {\vphantom {{(\underline{{sc_{i + 1,3,lp} }} )} {(\overline{{DC_{i + 1} }} \cdot x_{i + 1,lp} )}}}\bigg.\kern-\nulldelimiterspace} \!\lower0.7ex\hbox{${(\overline{{DC_{i + 1} }} \cdot x_{i + 1,lp} )}$}};i < n $$(15) -

(v)

Operational constraints

$$ s_{1,1,l} = q_{1,l} - d_{1,l} + II_{1} $$(16)$$ s_{1,2,l} = d_{1,l} - x_{1,l} + II_{2} $$(17)$$ s_{i,1,l} = q_{i,l} - d_{i,l} + s_{i - 1,1,l} :t > i > 1 $$(18)$$ s_{i,2,l} = d_{i,l} - x_{i,l} + s_{i - 1,2,l} :t > i > 1 $$(19)$$ s_{i,j,l} \le W_{{cap\,j}} :\forall_{i} ,\forall_{j} $$(20)$$ q_{i,l} \le M_{cap} :\forall_{i} $$(21)$$ s_{i - 1,j,l} \le SS_{j} ;\forall_{i} \forall_{j} $$(22) -

(vi)

Non-negativity constraints

$$ q_{i,l} \ge 0;d_{i,l} \ge 0;s_{i,j,l} \ge 0;sc_{i,j,l} \ge 0,c_{j} \ge 0 $$(23)

The constraints depicted by Eqs. (5, 6, 7, and 8) represent the incentive compatibility constraints of the model, in which Eqs. (5 and 6) relate to the product supplier and Eqs. (7 and 8) relate to the 3PL operator. These constraints ensure that the product supplier and 3PL operator select the right menu of contracts and reveal the true costs. Equation (5) explains that the cost share and the fixed ordering cost received by the product supplier when operational costs are higher is equal to or higher than that which is received by the product supplier when operational costs are lower. The constraint in Eq. (6) ensures that the product supplier selects the correct menu of the contracts. In this equation, the total cost of the product supplier under higher cost state even with a higher cost-share and higher fixed price (which is opposite of the proposed menu) is equal to or greater than the total cost under lower-cost state even if he receives a lower-cost share and lower fixed ordering cost. With this constraint, the product supplier does not receive a benefit by reporting lower costs when he has higher operational costs because the lower cost state is lesser, even when the product supplier has a higher cost with a higher share. A similar approach is applied to the 3PL operator’s incentive compatibility constraints. Likewise, Eqs. (7 and 8) represent the incentive compatibility constraints for the 3PL operator. These constraints ensure that the 3PL operator selects the correct menu of contracts offered by the e-tailer and reveals his true costs.

The individual rationality constraint of the product supplier is depicted by Eq. (9). The e-tailer cannot share the total operational costs of the product supplier. Only a percentage of the operational costs can be shared, as described by Eq. (9). Accordingly, the e-tailer can only share up to the maximum allowed percentage share of the total cost of the product supplier under the two cost states. These constraints ensure that the e-tailer has the incentive to initiate and carry out the contract with the product supplier. Similarly, the 3PL operator’s participation constraint is given in Eq. (10). Therefore, the e-tailer could only share up to the allowed percentage share of the total distribution cost under the occurrence of the two cost states. Equation (11) ensures that the sharing cost of the lower cost status of the product supplier or the 3PL operator does not exceed the sharing cost offered in the higher cost state. It generates the maximum margin that the sharing cost could reach, therefore ensuring that a higher benefit is received with the higher cost share.

Equations (12, 13, 14, and 15) explain the consistency constraints of the dynamic contract for the product supplier and the 3PL operator. This explains that the shared cost proportion received in the current period must be equivalent or higher than the shared cost proportion received in the previous period, which ensures that both the product supplier and the 3PL operator has consistent incentive to remain in the contract until the end of the time period being considered. These constraints ensure that neither the product supplier nor the 3PL operator has any incentive to renegotiate the contract terms until the end of the contract period, and hence, we can emphasise that it will create re-negotiation proofness to the contract model.

Equations (16 and 17) denote the inventory levels to be maintained by the product supplier at the end of each period i. The final inventory of the product supplier at the end of period i is the number of units that are left after covering the demand using the initial inventory and the produced units of period i. Therefore, inventory levels are directly related to the dynamic operations of the supply chain. Similarly, Eqs. (18 and 19) describe the inventory level that should be maintained by the e-tailer to fulfil his operational requirements, where the final inventory of period i should satisfy the requirement of actual demand from consumers. Equation (20) expresses that the ending inventory of each period i has to be limited to the warehouse capacity of the player j. Simultaneously, the production quantity of each period i cannot exceed the maximum production capacity of the product supplier, which is represented by Eq. (21). Equation (22) expresses the safety stock level of each player j, where the beginning inventory levels should be equal to or greater than the safety stock. Equation (23) denotes the non-negativity constraints of the model, which include all decision variables of the model. All these operational constraints described in the model are affected by time, as they affect the total operational time of the model. Therefore, these constraints denote the dynamic operational nature of the above-described e-commerce supply chain operation.

The model objective is linear, and the model constraints include non-linear constraints. Thus, the overall model is a non-linear programming problem.

The following propositions are derived from the optimality conditions of the model:

Proposition 1

The optimal inventory levels of the product supplier and the e-tailer depend on the warehouse capacity level (\(W_{{cap\,j}}\)), and the manufacturing capacity \((M_{cap} )\) levels when \(q_{i,l}\) and \(s_{i,j,l}\) have optimal values with binding solutions; (\(q_{i,l} = M_{cap} ,s_{i,j,l} = W_{{cap\,j}}\)).

-

(a)

When the warehouse capacity and the manufacturing capacity increases, it will increase the inventory levels of the product supplier. The optimal inventory of the product supplier is given in Eq. (24).

$$ s_{i,1,l} = \frac{{\bigg( {\underline{{UC_{i} }} - \overline{{UC_{i} }} } \bigg)\bigg\{ {2M_{cap} + W_{cap} } \bigg\} + 2\bigg( {\overline{P}_{i} - \underline{{P_{i} }} } \bigg)\bigg\{ {M_{cap} + W_{cap} } \bigg\}}}{{\bigg( {\underline{{UC_{i} }} - \overline{{UC_{i} }} } \bigg) + 2\bigg( {\overline{P}_{i} - \underline{{P_{i} }} } \bigg)}} $$(24) -

(b)

When the demand and the warehouse capacity of the e-tailer increases, the e-tailer’s inventory level increases. However, it decreases when the manufacturing capacity increases. The optimal inventory of the e-tailer is given by Eq. (25).

$$ s_{i,2,l} = x_{i,l} + W_{cap,2} - \frac{{M_{cap} \bigg\{ {3\bigg( {\underline{{UC_{i} }} - \overline{{UC_{i} }} } \bigg) + 4\bigg( {\overline{{P_{i,1} }} - \underline{{P_{i,1} }} } \bigg)} \bigg\}}}{{\bigg( {\underline{{UC_{i} }} - \overline{{UC_{i} }} } \bigg) + 2\bigg( {\overline{{P_{i,1} }} - \underline{{P_{i,1} }} } \bigg)}} $$(25)

The e-tailer’s optimal inventory level mainly depends on the product demand.

For the proof of Proposition 1, refer to Appendix.

Proposition 2

As \(\overline{{sc_{i,j,l} }} \ge \underline{{sc_{i,j,l} }}\), and not binding, the cost-sharing percentage model (\(k_{i,j,l}^{\% }\)) is the determining factor between the limits of the higher and lower sharing cost of the players (see Appendix).

(ii) For the product supplier’s sharing costs,

For the 3PL operator’s sharing costs,

Even though the sharing costs depend on the manufacturing capacity, warehousing capacity, unit operational costs, and price, both these scenarios, \(k_{i,j,l}^{\% }\) determine the sharing value received by each supply chain member.

4 Numerical analysis and result discussion

4.1 Numerical data

The model is illustrated through numerical experiments. We have used data from Ragsdale (2017) to indicate the product supplier’s manufacturing and inventory costs as the author demonstrated data related to a typical supply chain operational model, which has similar operational aspects to the model proposed in this study. We have generated the demand data using MATLAB R2020a version using the Markov chain approximation as described in Sect. 3.3. Other additional data, which is not available in Ragsdale (2017), are randomly generated with discrete and normal distributions. The model assumes the following. The probability of the e-tailer assuming that the product supplier and the 3PL operator have higher operational costs is considered as, \(\theta = 0.5\) and \(\gamma = 0.5\). The weights are allocated as \(W_{1} = 0.3,W_{2} = 0.4,W_{3} = 0.3\), with higher weight for the e-tailer as he initiates the contract. Discount rate values are taken as 10%; \(\delta_{1} = 0.1,\delta_{2} = 0.1,\delta_{3} = 0.1\), assuming that all players have similar financial situations. The warehouse capacities of both the product supplier and the e-tailer are assumed to be equal, and hence, \(M_{cap} = 10000\) and \(W_{cap,j} = 6000\) are considered for all 12 periods of the contract. Initial inventory levels are considered as \(II_{1} = 2750\) and \(II_{2} = 2500\) of this operational scenario. The potential states of the demand are assumed as 3 to obtain manageable data output from the computer experiments (for demand having three possible probabilities, \(p_{1} = 0.16;p_{2} = 0.68;p_{3} = 0.16\)). The normal distribution graph of the selected mean and standard deviation is shown in Fig. 3.

4.2 Solution approach and computer experiments

The model is a non-linear programming problem as it includes non-linear constraints. The model is solved as a MOO problem with the weighted sum method. Computer experiments are conducted to derive model implications and test the validity of the model results. All experiments are performed in the NEOS server.Footnote 5 NEOS is a free internet server hosted by the University of Wisconsin, which facilitates solving numerical optimisation problems (neosGuide, 2019). The model is executed using the optimisation solver tool BARONFootnote 6 (4.14 version 2020), which is included in the NEOS server, and programmed using the AMPL modelling language. BARON is a solver developed to produce global optimal solutions for non-convex optimisation problems, which uses the branch-and-reduce algorithm. The algorithm is developed using a range of reduction techniques combined with the branch-and-bound algorithm (Sahinidis, 2020). The BARON output model status reports “Optimal within tolerances” when it guarantees a solution with global optimality.

4.3 Results analysis

The BARON solver generates an optimal solution for the numerical data given in Table 2. The cost-sharing contract ensures that having cooperative decisions generates an optimal payoff in terms of cost minimisation for the e-commerce supply chain over time. The optimal cost-sharing fractions in each period of the contract are given in Table 3. The cost-sharing percentage of the product supplier is \(k_{i,1,l}^{\% } \ge 80\%\), whereas, for the 3PL operator, it is \(k_{i,3,l}^{\% } \ge 69\%\) for all periods of the contract. Variables \(k_{i,1,l}^{\% }\) and \(k_{i,3,l}^{\% }\) determine the optimal cost-sharing percentages in each period of the proposed cost-sharing contract, which are important determinants as given in Proposition 2.

One of the significant observations from Table 3 is the lower sharing costs received by both the product supplier (e.g.,\(\underline{{sc_{i,1,l} }}\)) and the 3PL operator (e.g., \(\underline{{sc_{i,3,l} }}\)) take comparatively low values in the optimal solution. This emphasises that neither the product supplier nor the 3PL operator would benefit from the cost-sharing contract if they have higher operational costs. It encourages both these players to maintain lower operational costs as it affects the costs of the overall supply chain operation. This outcome ensures the validity of the revelation principle as neither player is motivated to declare false costs.

The analysis of \(k_{i,1,l}^{\% }\) and \(k_{i,3,l}^{\% }\) of the product supplier and 3PL operator for different possible states of the model are illustrated in Fig. 4.

Zhao et al. (2014) also obtained the cost-sharing level that can achieve supply chain coordination, which, however, was not determined within asymmetric information setting and also the contract is proposed between two players. The optimal cost-sharing percentages in this study are determined with asymmetric information along with the consistency constraints to assess the consistent incentives throughout the contract period.

Furthermore, the operational decisions are also analysed based on the results obtained in Table 3. The e-tailer’s inventory levels do not have a significant impact as the e-tailer has zero inventory levels. Therefore, the e-tailer has the potential to carry out operations by managing the demand and safety stocks carefully. However, this may not be the case in actual operations.

The demand uncertainty levels cannot be predicted and therefore, managing safety stocks that can achieve higher customer service levels can balance the uncertain demand fluctuations. The operational decisions of the model such as optimal production and order quantity levels are further analysed to determine how the demand uncertainty affects the operational decisions of the model. The results in Fig. 5 illustrate that when the probability states obtained in this model varied as a minimum, average and maximum, production and order quantity levels vary accordingly.

4.4 Comparison of dynamic and base cost-sharing contract

4.4.1 Analysis of consistency incentives

To evaluate the effectiveness of consistency constraints, the dynamic consistency constraints were excluded from the dynamic cost-sharing contract model, and computer experiments were performed. We used the same data set (Sect. 4.1) for this analysis as well. We refer to this model as the base cost-sharing contract. The sharing costs and the cost-sharing percentage values have changed in the base cost-sharing contract compared to the results of the dynamic cost-sharing contract. However, the lower shared values received by both the product supplier and the 3PL operator indicate zero values throughout the contract period in this scenario. This, however, emphasises that both contract settings encourage lower operational costs within the upstream and downstream of the e-commerce supply chain. To analyse the impact of the consistency constraints, we explored the optimal solutions of both contracts further.

As discussed, in dynamic contracts, the optimal payoff received in the cost-sharing contract must remain optimal throughout the total contract period to ensure that none of the players deviates from the original contract. If none of the players has sufficient incentives in future periods of the contract, there is no assurance that these players will continue to remain in the contract. We compare the results of \(k_{i,1}^{\% }\) and \(k_{i,3}^{\% }\) with the consistency constraints (dynamic contract) and without the consistency constraints (base contract) to derive the impact of consistency constraints in the multi-period contract (see Figs. 6 and 7).

In the case of the product supplier, consistency constraints deliver higher cost-sharing levels except in periods 4 and 5, compared to the base contract without the consistency constraints. These two periods have the highest demands and the highest number of productions, which derives the highest operational costs and, therefore, affects the portion of sharing costs. The results for \(k_{i,3,l}^{\% }\) also emphasise that the 3PL operator receives a higher cost-sharing percentage in all periods compared to the base cost-sharing contract with no consistency constraints (see Fig. 7). The results indicate that the 3PL operator receives a higher incentive in terms of shared costs with the consistency constraints than in the contract scenario without the consistency constraints. These outcomes are shown in Figs. 6 and 7 to ensure that the consistency constraints motivate the players to engage in the contract for the long term. As a result, the players will not consider re-negotiation within the interim periods of the contract. Re-negotiation can be eliminated by giving proper motivation. Rather than instigating financial penalties aimed at threatening players as discussed by Bondareva and Pinker (2018), this study proposed consistent incentives, which have a more positive impact on motivating players. Therefore, as indicated above, proposing consistency incentives enhances the contribution to the literature as well as provides opportunities for e-tailer organisations in achieving long-term integration. Hence, the proposed dynamic cost-sharing contract enables re-negotiation proofness within a long-term operation.

4.5 Overall cost comparison of the dynamic and base cost-sharing contracts

The costs of individual players and the overall supply chain with the dynamic contract and base contract were analysed to identify how consistency constraints affect the costs of this operation (see Fig. 8).

The dynamic cost-sharing contract delivers reduced costs for the product supplier and 3PL operator by 2% and 11% respectively (see Fig. 8). However, the overall supply chain cost \((z)\) increased by 1%. This outcome is generated due to the increased level of incentives delivered through consistency constraints. As the main objective of the proposed dynamic contract is to maintain long-term integration among the players, it is fulfilled as the incentive portions are increased, and the individual costs are reduced compared to the base cost-sharing contract (no-consistency constraints). Therefore, ensuring that the players receive consistent incentives over time is imperative when a dynamic contract is designed for the time-dependent e-commerce supply chain operational scenario. It ensures that all parties remain within the contract over time.

4.6 Comparison of the dynamic contract with no-contract operational model

To further test the validity of the designed dynamic cost-sharing contract, we have compared the contract outcomes with de-centralised operation without any contract elements. The fixed price paid by the e-tailer was taken into the no-contract operational model as the e-tailer has to pay for the services of the product supplier and the 3PL operator in a typical operational setting. Furthermore, as we have designed the contract for 12 periods in both scenarios, the discount rate was incorporated into the operational model without any cost-sharing contract elements. The objective function of the operational model is as follows.

-

(i)

The individual cost objectives with higher costs scenario

$$ c^{\prime}_{1h} = \sum\limits_{l,lm}^{{}} {p_{l} \cdot p_{lm} } \sum\limits_{{\forall_{i} }} {\bigg[ {1/(1 + \delta_{1} )^{i} \bigg\{ {(\overline{{UC_{i} }} )\bigg( {q_{i,l} + \alpha_{i} \cdot (s_{i,1l} + s_{i - 1,1,lm} )/2} \bigg) - \bigg( {(\overline{{P_{i,1} }} ) \cdot d_{i,l} } \bigg)} \bigg\}} \bigg]} $$(31)$$ c^{\prime}_{2h} = \sum\limits_{l,lm}^{{}} {p_{l} \cdot p_{lm} } \sum\limits_{{\forall_{i} }} {\bigg[ {(1/(1 + \delta_{2} )^{i} \bigg\{ {HC_{i} (s_{i,2,l} + s_{i - 1,2,lm} )/2 + (\overline{{P_{i,1} }} ) \cdot d_{i,l} + (\overline{{P_{i,3} }} ) \cdot x_{i,l} } \bigg\}} \bigg]} $$(32)$$ c^{\prime}_{3h} = \sum\limits_{l,lm}^{{}} {p_{l} } \sum\limits_{{\forall_{i} }} {\bigg[ {1/(1 + \delta_{3} )^{i} \bigg\{ {\bigg( {\overline{{DC_{i} }} \cdot x_{i,l} } \bigg) - (\overline{{P_{i,3} }} ) \cdot x_{i,l} } \bigg\}} \bigg]} $$(33) -

(ii)

The individual cost objectives with lower costs scenario

$$ c^{\prime}_{1L} = \sum\limits_{l,lm}^{{}} {p_{l} \cdot p_{lm} } \sum\limits_{{\forall_{i} }} {\bigg[ {1/(1 + \delta_{1} )^{i} \bigg\{ {(\underline{{UC_{i} )}} \cdot \bigg( {q_{i,l} + \alpha_{i} \cdot (s_{i,1,l} + s_{i - 1,1,lm} )/2} \bigg) - (\underline{{P_{i,1} }} ) \cdot d_{i,l} } \bigg\}} \bigg]} $$(34)$$ c^{\prime}_{2L} = \sum\limits_{l,lm}^{{}} {p_{l} \cdot p_{lm} } \sum\limits_{{\forall_{i} }} {\bigg[ {(1/(1 + \delta_{2} )^{i} \bigg\{ {HC_{i} (s_{i,2,l} + s_{i - 1,2,lm} )/2 + (\underline{{P_{i,1} }} ) \cdot d_{i,l} + (\underline{{P_{i,3} }} ) \cdot x_{i,l} } \bigg\}} \bigg]} $$(35)$$ c^{\prime}_{3L} = \sum\limits_{{\forall_{i} }} {\bigg[ {1/(1 + \delta_{3} )^{i} \bigg\{ {\bigg( {(\overline{{DC_{i} }} ) \cdot x_{i,l} } \bigg) - (\underline{{P_{i,3} }} ) \cdot x_{i,l} } \bigg\}} \bigg]} $$(36)

The operational models were tested for lower operational costs and higher operational costs, scenarios separately. The operational constraints described by Eqs. (16–23) were included in each model testing of the numerical illustration. Figure 9 depicts the comparison of overall supply chain costs without the contract elements and with the contract elements. The results show that the overall supply chain cost reduces significantly with the dynamic cost-sharing contract. This finding emphasises that dynamic cost-sharing delivers improved performance levels for the overall supply chain, as the members of this supply chain can derive competitive pricing for the customers based on the reduced supply chain costs. The individual supply chain costs of each player were also compared as shown in Fig. 9. These results also highlight that the dynamic cost-sharing contract derives significantly reduced supply chain costs for the product supplier and the 3PL operator.

The individual total costs of the 3PL operator (\({c}_{3}\)) reduced significantly (by 67% than the no-contract with higher costs and by 11% than the no-contract with lower costs), whereas the total costs of the product supplier (\({c}_{1}\)) has reduced by 21% compared to the higher costs and reduced by 2% compared to the lower costs (see Fig. 10). E-tailer’s costs are reduced by 6% with the contract, compared to the higher cost level; but increased by 39% compared with the lower cost level with no contract. Nevertheless, we cannot expect to have lower operational costs in all periods of the operation. To further verify this outcome, we have tested the decentralised operation with asymmetric information.

The results in Fig. 11 emphasise the impact of asymmetric information in the no-contract scenario, in which the individual total costs have changed. The product supplier’s costs are reduced by 10%, and the 3PL operator’s costs are reduced by 28% with the dynamic cost-sharing contract. Simultaneously, the dynamic contract increases the e-tailer’s costs by 20% more than the no-contract operation with asymmetric information.

The results further demonstrate that when the operational costs of the players are higher, the impact of asymmetric information is lower. For example, the product supplier’s costs are higher in this numerical illustration, and hence, the effect of asymmetric information is lower compared to that of the 3PL operator, whose operational costs are lower than the product supplier. As the party who initiates the contract, the e-tailer has the opportunity to assess his decisions within this contract setting and opt to obtain the group benefit of the contract rather than the individual benefit, based on the cooperative game concepts. This decision creates significant improvements in long-term operations.

4.7 Sensitivity analysis

In this section, we evaluate the impact of contract parameters on the proposed cost-sharing contract. We consider parameters \(\theta ,\gamma ,W_{j}\) and \(x_{i,l}\) in this analysis.

4.7.1 Impact of parameters \({\varvec{\theta}}\) and \({\varvec{\gamma}}\) on supply chain costs

The curve fitting derived from linear interpolation indicates a proper fit of the results for parameters \(\theta \) and \(\gamma .\) Accordingly, overall supply chain cost (z) is minimum when the e-tailer assumes that both the product supplier and the 3PL operator have the lowest probability of having higher operational costs (e.g., \(\theta = 0.1\) and \(\gamma = 0.5\)) (see Fig. 12).

The contract does not derive feasible solutions for \(\gamma \prec 0.5\) scenarios for the given data set. However, the above result underlines the importance of maintaining lower operational costs in the upstream and downstream of the selected e-commerce supply chain. The results further emphasise that when the asymmetric information increases, the supply chain cost increases and the contract derives its lowest \(z\) when the probability associated with the asymmetric information of the product supplier and the 3PL operator are at their lowest levels. This result reinforces the findings generated by Cachon (2003), Cao et al. (2013) and Kaya and Caner (2018), where asymmetric information adversely affects supply chain performances. Hence, it is evident that minimising asymmetric information is beneficial for long-term contracts.

4.7.2 Impact of weights allocation on supply chain costs

Initially, weights are allocated arbitrarily, considering a higher weight for the e- as the initiator of the contract (\(W_{1} = 0.3,W_{2} = 0.4,W_{3} = 0.3\)). To identify the impact of weight allocation on the supply chain costs, we have conducted a sensitivity analysis by changing the weight allocations of each supply chain member. The results of the sensitivity analysis did not obtain an exact weight allocation point for Pareto-optimality for all three players as they deploy discrete data values. Instead, it has identified a Pareto improvement point for the e-tailer and the product supplier. According to the results of the sensitivity analysis, the supply chain receives the lowest costs for \(z\),\(c_{1}\) and \(c_{2}\) when the weight allocation is \(W_{1} = 0.1,W_{2} = 0.1,W_{3} = 0.8\). This allocation is the best solution for the product supplier and e-tailer. However, it is not optimal for the 3PL operator. as per the results of the sensitivity analysis, which is the best solution for the product supplier and the e-tailer. However, it is not optimal for the 3PL operator. However, the curve fitting graph based on linear interpolation derives a Pareto optimal solution, which derives benefits for all three players (see Fig. 13).

4.7.3 Impact of demand on supply chain costs

Next, we have analysed how the increasing or decreasing trend of demand over 12 periods can affect \(c_{j}\) and \(z.\) In the first numerical illustration, we have taken a fluctuating demand pattern. The demand has a positive linear relationship with \(c_{j}\) and \(z\)(Fig. 14). The highest impact of the demand is generated on the product supplier’s costs, and the lowest impact is on the 3PL operator’s costs, which mainly results due to the higher operational costs of the product supplier. Next, the impact of randomness, which is represented with the probability of scenarios is tested by varying the values \(p_{l} = 1,2,...,5\). The results suggest that when the randomness increases with more probabilities, the overall supply chain costs (z) and expected total individual costs \((c_{j} )\) increase, however, at a decreasing rate (See Figs. 15 and 16). Also, when \(l = 5\), costs are slightly reduced than the previous state with l = 4.

Therefore, it is evident that when the demand is uncertain and when the e-tailer enters into the contract before realising the demand, supply chain costs increase. Nevertheless, this scenario is more related to actual operations.

5 Research implications

This study generates theoretical and managerial insights for small-scale, e-tailer supply chain operations in deriving long-term integration and achieving optimal supply chain costs.

5.1 Theoretical contributions

Researchers have given substantial attention to game theory applications in supply chain studies (Levi et al., 2014). When supply chain institutes are defined as multi-player, decentralised operations, game theory can be applied as a strategic tool in optimisation modelling (Nagarajan & Sošić, 2008). Integrating with all levels or acting independently is a critical decision that needs to be considered carefully in a multi-echelon supply chain because it affects the overall profit or cost of the supply chain (Mahdiraji et al., 2014). Therefore, by using game theory-based contract modelling to derive optimal strategies in the e-commerce supply chain, this study adds to the body of knowledge in game theory, contract theory, and supply chain management. However, multi-echelon/multi-player supply chain optimisation based on game theory has been less explored in the literature (Yue & You, 2014). Hence, the proposed contract models in this research augment the knowledge in deriving optimal strategies of multi-level/multi-player contract models related to supply chain decision-making.

As asymmetric and incomplete information is a critical factor in real supply chain operations (Kaya & Caner, 2018), information asymmetry issues can be addressed by creating effective supply chain contracts. Accurate information is vital for e-commerce operations. This research analyses the impact of information asymmetry issues on operational outcomes and the strategies used to eliminate these issues. Therefore, the findings of this study expand the knowledge in e-commerce supply chain studies. Furthermore, the contract model developed in this study integrates operational and contract-related constraints, which generally have been overlooked in previous studies when contract models are formulated. Therefore, this study contributes to the literature by integrating the supply chain operational model with a game theory-based contract design. This could influence important decision outcomes. Although contract theory models under information asymmetry are discussed in many supply chain studies, few adopt sharing contracts (Shen et al., 2019). Therefore, this study further contributes by addressing the cost information asymmetry issues through the design of a cost-sharing contract model that can effectively resolve these issues and generate efficient e-commerce supply chain operations.

Furthermore, the existing contract models are focused mostly on single-period operational aspects, which is not valid in practice. Since supply chains operate essentially within intertemporal scenarios, the dynamic aspects of implementing contracts need to be analysed (Gao, 2015). However, discussions relating to the re-negotiation and stability of dynamic contracts are not evident in the existing supply chain literature, even though these aspects are vital to developing long-term contract models. Therefore, this study creates new knowledge and contributes to the dynamic contract literature in supply chain management by introducing consistency constraints to the contract model. These constraints can minimise the potential of re-negotiation and enable long-term integration.

5.2 Managerial contributions

Given its focus on optimising small-scale electronic commerce supply chain operations, this study generates several pragmatic implications for stakeholders in real-world e-commerce supply chains.

Firstly, an e-tailer supply chain organisation could implement the proposed contract models to improve its operational effectiveness and minimise costs. Since this study includes key players in e-commerce supply chains such as product suppliers, e-tailers, and third-party logistics (3PL) operators, all stakeholders will gain better operational viewpoints to help them align their interests in achieving optimal results. In particular, the findings create a platform for all agents to manage and re-visit their operational aspects to maximise their individual goals and the overall performance of the entire supply chain.

Secondly, the contract model developed in this study could be incorporated by organisations in the e-commerce supply chain to implement effective contracts among their partners. As the contract model generates optimal supply chain costs for the overall operations, ultimately, it could help generate a competitive pricing strategy and thereby attract more customers. Furthermore, the findings of this study highlight the optimal cost-sharing levels that generate minimal supply chain costs. This outcome will provide insights for making strategic decisions for all supply chain members before formulating a contract. The contract outcomes will be beneficial from the consumer’s point of view as well, as e-tailers can offer competitive pricing strategy, allowing consumers to purchase products for a low cost.

As the proposed contract model eliminates hidden information issues, partners in the e-commerce supply chain could embed these models to create successful cooperation strategies by sharing information. This would lead to enhanced levels of trust and effective operations. Primarily, this contract model could be implemented by small/medium-scale or start-up e-tailer organisations because it encourages collaboration with new partners to expand their business operations and enable a trustworthy operational environment. For small-scale or start-up organisations, getting established in the market with stable supply chain partners could help ensure successful operations and survival in the market.

The dynamic contract approach emphasises consistent incentives throughout the contract period, which enables long-term integration and eliminates the re-negotiation opportunities for members of the contract. Therefore, e-tailer organisations could decide on strategies to implement consistent incentive schemes to maintain long-term integration with their supply chain partners. It would be operationally beneficial in the long-term to attract more customers, expand market share and reduce operational costs, and thus help achieve long-term sustainability in the e-commerce market.

5.3 Research findings in contrast/inline to the literature