Abstract

Mutual fund (MF) is one of the applicable and popular tools in investment market. The aim of this paper is to propose an approach for performance evaluation of mutual fund by considering internal structure and financial data uncertainty. To reach this goal, the robust network data envelopment analysis (RNDEA) is presented for extended two-stage structure. In the RNDEA method, leader–follower (non-cooperative game) and robust optimization approaches are applied in order to modeling network data envelopment analysis (NDEA) and dealing with uncertainty, respectively. The proposed RNDEA approach is implemented for performance assessment of 15 mutual funds. Illustrative results show that presented method is applicable and effective for performance evaluation and ranking of MFs in the presence of uncertain data. Also, the results reveal that the discriminatory power of robust NDEA approach is more than the discriminatory power of deterministic NDEA models.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Data Envelopment Analysis (DEA) method has been widely implemented in the literature to the performance appraisal of mutual funds (MFs) (Basso & Funari, 2016; Kaffash & Marra, 2017). DEA is a non-parametric mathematical programming approach for performance assessment, ranking and benchmarking of the homogeneous decision-making units (DMUs) in the presence of multiple inputs and outputs (De Leone, 2008; Emrouznejad, 2014; Emrouznejad & Banker, 2010). From beginning DEA technique, this approach has been widely used in many real-world problems and applications (Emrouznejad & Yang, 2018; Liu et al., 2013; Peykani, Farzipoor Saen, et al., 2021).

MF invests the money collected from investors on a specific investment plan. Accordingly, the structure of their activities can be considered as a two-stage process that the manager seeks to attract funds from investors in the first stage, and constructs the portfolio in the second stage. In other words, the MF management’s structure can be decomposed into serially linked two components including operational management and portfolio management (Premachandra et al., 2012, 2016).

Therefore, in applying DEA technique for performance appraisal of mutual funds, an internal structure of MFs should be considered. Because, ignoring the internal structure of the MFs and the intra-organizational relationships leads to the invalidity of efficiency scores and ranking of MFs. Since the conventional DEA models cannot be employed for performance measurement of DMUs with network structure, the network data envelopment analysis (NDEA) approach must be used (Castelli et al., 2010; Cook & Zhu, 2014). NDEA is an applicable and effective approach that can be applied to assess the performance of DMUs with network structure such as two-stage, series, parallel, mixed, etc. (Kao, 2014, 2017).

Another important point that should be considered in performance evaluation of MFs is the uncertainty of financial data. Because, one of the most important features of financial markets is their uncertainty. In addition, the results of classic DEA models are so sensitive to bias or deviation in data. As a result, a little variation in the values of data can cause significant differences in efficiency scores and ranking of DMUs (Peykani et al., 2018, 2019; Sadjadi & Omrani, 2008; Toloo & Mensah, 2019).

Robust optimization (RO) approach, is one of the powerful and popular methods that can be applied to deal with uncertainty of data (Keith & Ahner, 2019; Kim et al., 2018). The RO approach based on uncertainty sets does not need significant historical data and therefore it can be employed in almost all of the real-life DEA problems. So, recently, some studies about DEA have applied robust optimization to deal with data uncertainty that called robust data envelopment analysis (RDEA) (Wu et al., 2017; Lu et al., 2019; Tavana et al., 2021). According to the comprehensive and structured literature review of RDEA presented by Peykani et al., (2020a), proposing and applying RDEA models under continuous and discrete uncertainty in different studies have increased dramatically.

Thus, in this study, a novel robust network data envelopment analysis (RNDEA) approach is presented based on leader–follower (Stackelberg game or non-cooperative game) method for performance assessment, ranking, and classification of mutual funds with respect to internal structure and uncertainty of data. Additionally, the applicability and efficacy of the presented approach is demonstrated by measuring the performance of 15 active mutual funds in Iran's capital market. The rest of this paper is organized as follows. Literature review classification and literature gaps are introduced in Sect. 2. Theoretical background involving the structure of MFs and NDEA modeling based on non-cooperative game method are presented in Sect. 3. The robust network DEA approach for performance assessment of MFs under uncertainty is proposed in Sect. 4. Then, in Sect. 5, the applicability of the proposed approach is illustrated by a real-life case study. Finally, the conclusions and some directions for future researches are given in Sect. 6.

2 Literature review

In this section, the literature review from two aspects including performance measurement of MFs by network DEA, and robust network DEA are presented. Also, the literature gaps, which this study addresses are introduced.

2.1 Performance measurement of mutual funds using network DEA

Premachandra et al. (2012) were the pioneer researchers that applied network DEA model for performance evaluation of US mutual fund families. They assumed that the structure of MFs can be considered as a two-stage process including operational management and portfolio management. In a similar study, Premachandra et al. (2016) employed network DEA approach for performance appraisal of mutual fund industry. Galagedera et al. (2016) extended the proposed two-stage structure of Premachandra et al. (2012) for efficiency measurement of MFs. They considered total cash flow of investors as a leakage variable in operational management process.

Sánchez-González et al. (2017) applied network slack-based measure (NSBM) model for efficiency measurement of mutual fund companies. Galagedera et al. (2018) introduced new structure and network DEA model for performance assessment of MFs. They decomposed the overall efficiency of MFs into the efficiency of operational management, resource management, and portfolio management. Galagedera (2019) proposed a two-stage DEA model with non-discretionary output in first stage for modelling social responsibility in performance evaluation of MFs.

Galagedera et al. (2020) developed a network DEA model to evaluate the performance of MF from disbursement management viewpoint in the presence of non-discretionary input. Hsieh et al. (2020) presented a two-stage network DEA model for performance assessment of MFs, which decision quality and capital magnet are considered as a two-stage process of MFs. Last but not the least, Tsolas (2020) applied two-stage DEA approach to appraisal the performance of precious metal mutual funds.

A more detail classification of the performance assessment of mutual funds by network DEA is illustrated in Table 1 by considering three characteristics: type of NDEA modeling, network structure, and uncertainty. The characteristics of this study have also been introduced in the last row of Table 1. As summarized in Table 1, all of the existing researches in literature are neglected the uncertain nature of financial data. Also, most of studies employed additive approach that presented by Chen et al. (2009) for NDEA modeling.

2.2 Robust network DEA

Ardekani et al. (2016) initially proposed robust two-stage DEA model using robust optimization approach of Bertsimas and Sim (2004) for efficiency measurement of electricity power production and distribution companies in Iran. They applied multiplicative approach of Kao and Hwang (2008) for modeling of RNDEA. Bayati and Sadjadi (2017) presented RNDEA models based on RO approaches of Ben-Tal and Nemirovski (2000) and Bertsimas and Sim (2004) for performance assessment of Iranian regional electricity power networks. They decomposed the overall efficiency of three-stage according to additive approach of Chen et al. (2009).

Esfandiari et al. (2017) introduced robust network DEA models by applying scenario based robust optimization approach of Mulvey et al. (1995) for performance measurement of DMUs with two-stage structure under discrete uncertain data. They used game theory approaches of Liang et al. (2008) including centralized (cooperative game) and leader–follower (non-cooperative game) methods for efficiency decomposition. Shakouri et al (2019) presented robust two-stage DEA models based on p-robust approach of Snyder and Daskin (2006) to deal with discrete uncertain data.

Table 2 summarizes the main characteristics of the RNDEA researches and compares them with the RNDEA model developed in this study. According to the literature review and Table 2, it is surprising that only four researches have been done in robust network DEA area and this field have potential future directions and research pristine opportunities. As it can be seen in the last row of Tables 1 and 2, the new robust network DEA model of this study is based on leader–follower approach and used for performance evaluation of mutual funds under continuous uncertainty. Also, the proposed approach is linear program and capable to be used under variable retunes to scale (VRS) assumption. Moreover, the efficiency decomposition of presented RNDEA method is unique.

3 Theoretical background

In this section, theoretical background including the structure of mutual funds and non-cooperative game method for modeling of NDEA under extended two-stage structure are presented.

3.1 Mutual funds structure

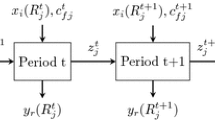

In this study, the structure of mutual funds activities is viewed as a two-stage process that the manager of MFs seeks to attract funds from investors in the first step, and in the second step, focus on the optimal portfolio construction (Premachandra et al., 2012, 2016). The graphically illustration of MFs process is depicted in Fig. 1.

As can be seen in Fig. 2, marketing and distribution costs accompany with management costs are the input variables at first stage. Net asset value (NAV) is the intermediate variable that links the two stages. In other words, NAV is output and input variable at stages 1 and 2, respectively. Accordingly, a MF that can produce the highest NAV with the least amount of mentioned expenses will be more efficient than the other MFs from operational management aspect.

It should be noted that fund size, standard deviation of average return, turnover ratio, and net expense ratio are another part of inputs to the stage 2 and average return is the output variable at second stage. Thus, a MF that can produce the highest average return of portfolio with the least amount of NAV, fund size, risk (standard deviation of average return), turnover ratio and net expense ratio will be more efficient than the other MFs from portfolio management aspect.

3.2 Network DEA modeling based on leader–follower approach

Let \(x_{ik} (i = 1,...,I)\) denote the input variables at first stage, \(z_{gk} (g = 1,...,G)\) denote the intermediate variables that links the two stages, \(w_{hk} (h = 1,...,H)\) denote the additional input variables at second stage, and \(y_{rk} (r = 1,...,R)\) denote the output variables at second stage of \({\text{DMU}}_{k} (k = 1,...,K)\). As illustrated in FIg. 2, the extended two stage structure of this study includes I1, IM, I2, and O2.

Note that the non-negative weights \(\alpha_{i} (i = 1,...,I)\), \({\varphi_{g}} (g = 1,...,G)\), \(\mu_{h} (h = 1,...,H)\), and \(\beta_{r} (r = 1,...,R)\) are assigned to the I1, IM, I2, and O2, respectively. Also, \(\Psi_{1}\) and \(\Psi_{2}\) are the free variables associated with returns to scale (RTS) in DEA for stages 1 and 2, respectively.

As mentioned before, the leader–follower (non-cooperative game) approach that presented by Liang et al. (2008) is one of the applicable and popular approaches for modeling of network DEA. In this method, it is assumed that one of the stages is more important and is considered to be the leader. Thus, the efficiency of the leader's stage is calculated at first, and then the efficiency of the other stages (follower's stage) is calculated according to the optimal solution of the leader's stage.

If assumed that stage 1 is more important (first stage as the leader and second stage as the follower), the efficiency of stage 1 for a specific \({\text{DMU}}_{0}\) under variable returns to scale assumption is calculated as Model (1):

Model (1) is a linear fractional program which can be transformed via the transformation of Charnes and Cooper (1962) as follows:

Now, the efficiency of second stage as the objective function is maximized while the efficiency of first stage is fixed. Accordingly, Model (3) under VRS assumption is presented as follows:

Using the transformation of Charnes and Cooper (1962), Model (3) can be transformed into the following linear program:

Finally, the overall efficiency is calculated according to Eq. (5) as follows:

Note that in leader–follower approach, the efficiency decomposition is unique (Li et al., 2012; Liang et al., 2008).

Alternatively, if assumed that the stage 2 is more important (second stage as the leader and first stage as the follower), the efficiency of the second stage, the first stage and the entire two-stage system will be measured in a similar manner that is presented in Appendix A.

4 The robust network data envelopment analysis (RNDEA) approach

In this section in 3 steps, the robust NDEA method using robust optimization approach is proposed for performance appraisal of two-stage DMUs in the presence of uncertain data. Note that in proposing RNDEA model, stage 1 is assumed as the leader and stage 2 as the follower.

Step 1. Preparing NDEA models

In order to consider the uncertainty in all parameters of NDEA models including \(x_{ik} (i = 1,...,I)\),\(z_{gk} (g = 1,...,G)\),\(w_{hk} (h = 1,...,H)\), and \(y_{rk} (r = 1,...,R)\), Models (2) and (4) are converted into Models (6) and (7), respectively.

Proposition 1

The optimal solution of Model (6) is equal to Model (2).

Proof

Assume that the optimal solution of Model (6) is \(\left( {\bar{\alpha },\bar{\varphi },\bar{\Psi }_{1} } \right)\). By contradiction, suppose that \(\sum\nolimits_{i = 1}^{I} {x_{i0} \bar{\alpha }_{i} } < 1\) (it should be noted that \(\sum\nolimits_{i = 1}^{I} {x_{i0} \bar{\alpha }_{i} } = \Omega \& \Omega > 0\)). \( \left( {\bar{\alpha },\quad \bar{\varphi },\quad \bar{\Psi }_{1} } \right) \) are considered as \( \bar{\alpha } = \frac{{\bar{\alpha }}}{\Omega } \), \( \bar{\varphi } = \frac{{\bar{\varphi }}}{\Omega } \) and \( \bar{\Psi }_{1} = \frac{{\bar{\Psi }_{1} }}{\Omega } \). Because of \( \sum\nolimits_{{g = 1}}^{G} {z_{{gk}} \bar{\varphi }_{g} } - \sum\nolimits_{{i = 1}}^{I} {x_{{ik}} } \bar{\alpha }_{i} + \bar{\Psi }_{1} = \left( {\frac{1}{\Omega }\left( {\sum\nolimits_{{g = 1}}^{G} {z_{{gk}} \bar{\varphi }_{g} } - \sum\nolimits_{{i = 1}}^{I} {x_{{ik}} \bar{\alpha }_{i} } + \bar{\Psi }_{1} } \right)} \right) \le 0 \) (with respect to \(\left( {\frac{1}{\Omega }} \right) > 0\) and \(\sum\nolimits_{g = 1}^{G} {z_{gk} \bar{\varphi }_{g} } { - }\sum\nolimits_{i = 1}^{I} {x_{ik} \bar{\alpha }_{i} } + \bar{\Psi }_{1} \le 0\)),\( \sum\nolimits_{{i = 1}}^{I} {x_{{i0}} \bar{\alpha }} = \left( {\frac{1}{\Omega }\left( {\sum\nolimits_{{i = 1}}^{I} {x_{{i0}} \bar{\alpha }_{i} } } \right)} \right) = 1 \), \( \bar{\alpha } \ge 0 \), and \( \bar{\varphi } \ge 0 \),\( \left( {\bar{\alpha },\bar{\varphi },\bar{\Psi }_{1} } \right) \) is the feasible solution of Model (6). Also, in the objective function \( \sum\nolimits_{{g = 1}}^{G} {z_{{g0}} \bar{\varphi }_{g} } + \bar{\Psi }_{1} = \left( {\frac{1}{\Omega }\left( {\sum\nolimits_{{g = 1}}^{G} {z_{{g0}} \bar{\varphi }_{g} } + \bar{\Psi }_{1} } \right)} \right) \), with respect to suppose that \(\sum\nolimits_{i = 1}^{I} {x_{i0} \bar{\alpha }_{i} } < 1\), thus \(\left( {\frac{1}{{\sum\nolimits_{i = 1}^{I} {x_{i0} \bar{\alpha }_{i} } }}} \right) > 1\) and finally \( \sum\nolimits_{{g = 1}}^{G} {z_{{g0}} \bar{\varphi }_{g} } + \bar{\Psi }_{1} {\text{ > }}\sum\nolimits_{{g = 1}}^{G} {z_{{g0}} \bar{\varphi }_{g} } + \bar{\Psi }_{1} \) that this is contradicts with optimality of \(\left( {\bar{\alpha },\bar{\varphi },\bar{\Psi }_{1} } \right)\). So, at any optimal solution of Model (6), always \(\sum\nolimits_{i = 1}^{I} {x_{i0} \bar{\alpha }_{i} } = 1\).

Proposition 2

The optimal solution of Model (7) is equal to Model (4).

Proof

Assume that the optimal solution of Model (7) is \(\left( {\bar{\alpha },\bar{\varphi },\bar{\mu },\bar{\beta },\bar{\Psi }_{1} ,\bar{\Psi }_{2} } \right)\). By contradiction, suppose that \(\sum\nolimits_{g = 1}^{G} {z_{g0} \bar{\varphi }_{g} } + \sum\nolimits_{h = 1}^{H} {w_{h0} \bar{\mu }_{h} } < 1\) (it should be noted that \(\sum\nolimits_{g = 1}^{G} {z_{g0} \bar{\varphi }_{g} } + \sum\nolimits_{h = 1}^{H} {w_{h0} \bar{\mu }_{h} } = \mho \& \mho > 0\)). \( \left( {\bar{\alpha },\bar{\varphi },\bar{\mu },\bar{\beta },\bar{\Psi }_{1} ,\bar{\Psi }_{2} } \right) \) are considered as \(\bar{\alpha } = \frac{{\bar{\alpha }}}{\mho }\), \(\bar{\varphi } = \frac{{\bar{\varphi }}}{\mho }\), \(\bar{\mu } = \frac{{\bar{\mu }}}{\mho }\), \(\bar{\beta } = \frac{{\bar{\beta }}}{\mho }\), \(\bar{\Psi }_{1} = \frac{{\bar{\Psi }_{1} }}{\mho }\) and \(\bar{\Psi }_{2} = \frac{{\bar{\Psi }_{2} }}{\mho }\). Because of \(\sum\nolimits_{r = 1}^{R} {y_{rk} \bar{\beta }_{r} } { - }\sum\nolimits_{g = 1}^{G} {z_{gk} \bar{\varphi }_{g} } - \sum\nolimits_{h = 1}^{H} {w_{hk} \bar{\mu }_{h} } + \bar{\Psi }_{2} = \left( {\frac{1}{\mho }\left( {\sum\nolimits_{r = 1}^{R} {y_{rk} \bar{\beta }_{r} } { - }\sum\nolimits_{g = 1}^{G} {z_{gk} \bar{\varphi }_{g} } - \sum\nolimits_{h = 1}^{H} {w_{hk} \bar{\mu }_{h} } + \bar{\Psi }_{2} } \right)} \right) \le 0\) (with respect to \(\left( {\frac{1}{\mho }} \right) > 0\) and \(\sum\nolimits_{r = 1}^{R} {y_{rk} \bar{\beta }_{r} } { - }\sum\nolimits_{g = 1}^{G} {z_{gk} \bar{\varphi }_{g} } - \sum\nolimits_{h = 1}^{H} {w_{hk} \bar{\mu }_{h} } + \bar{\Psi }_{2} \le 0\)), \(\sum\nolimits_{g = 1}^{G} {z_{g0} \bar{\varphi }_{g} } + \sum\nolimits_{h = 1}^{H} {w_{h0} \bar{\mu }_{h} } = \left( {\frac{1}{\mho }\left( {\sum\nolimits_{g = 1}^{G} {z_{g0} \bar{\varphi }_{g} } + \sum\nolimits_{h = 1}^{H} {w_{h0} \bar{\mu }_{h} } } \right)} \right) = 1\), \(\sum\nolimits_{g = 1}^{G} {z_{gk} \bar{\varphi }_{g} } { - }\sum\nolimits_{i = 1}^{I} {x_{ik} \bar{\alpha }_{i} } + \bar{\Psi }_{1} = \left( {\frac{1}{\mho }\left( {\sum\nolimits_{g = 1}^{G} {z_{gk} \bar{\varphi }_{g} } { - }\sum\nolimits_{i = 1}^{I} {x_{ik} \bar{\alpha }_{i} } + \bar{\Psi }_{1} } \right)} \right) \le 0\), \(\bar{\alpha } \ge 0\), \(\bar{\varphi } \ge 0\), \(\bar{\mu } \ge 0\), \(\bar{\beta } \ge 0\), and \(\left( {\left( {\sum\nolimits_{g = 1}^{G} {z_{g0} \bar{\varphi }_{g} } + \bar{\Psi }_{1} } \right) - \dag_{0}^{{1*}} \left( {\sum\nolimits_{i = 1}^{I} {x_{i0} \bar{\alpha }_{i} } } \right)} \right) = \left( {\frac{1}{\mho }\left( {\left( {\sum\nolimits_{g = 1}^{G} {z_{g0} \bar{\varphi }_{g} } + \bar{\Psi }_{1} } \right) - \dag_{0}^{{1*}} \left( {\sum\nolimits_{i = 1}^{I} {x_{i0} \bar{\alpha }_{i} } } \right)} \right)} \right) = \rm{0}\), \(\left( {\bar{\alpha } ,\bar{\varphi } ,\bar{\mu } ,\bar{\beta } ,\bar{\Psi }_{1} ,\bar{\Psi }_{2} } \right)\) is the feasible solution of Model (7). Also, in the objective function \(\sum\nolimits_{r = 1}^{R} {y_{r0} \bar{\beta }_{r} } + \bar{\Psi }_{2} = \left( {\frac{1}{\mho }\left( {\sum\nolimits_{r = 1}^{R} {y_{r0} \bar{\beta }_{r} } + \bar{\Psi }_{2} } \right)} \right)\), with respect to suppose that \(\sum\nolimits_{g = 1}^{G} {z_{g0} \bar{\varphi }_{g} } + \sum\nolimits_{h = 1}^{H} {w_{h0} \bar{\mu }_{h} } < 1\), thus \(\left( {\frac{1}{{\sum\nolimits_{g = 1}^{G} {z_{g0} \bar{\varphi }_{g} } + \sum\nolimits_{h = 1}^{H} {w_{h0} \bar{\mu }_{h} } }}} \right) > 1\) and finally \(\sum\nolimits_{r = 1}^{R} {y_{r0} \bar{\beta }_{r} } + \bar{\Psi }_{2} > \sum\nolimits_{r = 1}^{R} {y_{r0} \bar{\beta }_{r} } + \bar{\Psi }_{2}\) that this is contradicts with optimality of \(\left( {\bar{\alpha },\bar{\varphi },\bar{\mu },\bar{\beta },\bar{\Psi }_{1} ,\bar{\Psi }_{2} } \right)\). So, at any optimal solution of Model (7), always \(\sum\nolimits_{g = 1}^{G} {z_{g0} \bar{\varphi }_{g} } + \sum\nolimits_{h = 1}^{H} {w_{h0} \bar{\mu }_{h} } = 1\).

Step 2: Choosing robust optimization approach.

Robust optimization is one of the applicable and popular approaches that can be used to deal with uncertainty in optimization problems (Bertsimas et al., 2011; Gabrel et al., 2014; Peykani et al., 2020b; Xidonas et al., 2020). The first robust optimization approach for dealing with continuous uncertainty is presented by Soyster (1973) that is based on “box” uncertainty set. Although the RO approach of Soyster (1973) is linear programing (LP), however, by taking the worst-case value of each uncertain parameter, the RO approach becomes too conservative. Ben-Tal and Nemirovski (2000) proposed a robust formulation based on “box + ellipsoidal” uncertainty set that decision maker (DM) can adjust the conservatism level of model by setting parameter, but their robust counterpart is nonlinear programming (NLP) which can be problematic in the real-world problems. Then, Bertsimas and Sim (2004) presented a novel robust optimization approach based on “box + polyhedral” uncertainty set that has the ability to adjust the degree of model conservatism level by setting parameter remaining the robust counterpart in LP. In order to propose the robust approach presented by Bertsimas and Sim (2004), consider the following LP problem:

Consider, \(\tilde{\pi }_{ab}\) as the uncertain parameter in the constraint \(a\), and \(\Lambda_{a}\) as the set of coefficients in constraint \(a\) that are subject to uncertainty. Note that each entry \(\tilde{\pi }_{ab} ,b \in \Lambda_{a}\) is modeled as a symmetric and bounded random variable which takes the values in \(\left[ {\pi_{ab} - \hat{\pi }_{ab} ,\pi_{ab} + \hat{\pi }_{ab} } \right]\). The central of this interval at the point \(\pi_{ab}\) is a nominal value and \(\hat{\pi }_{ab}\) is perturbation of uncertain parameters \(\tilde{\pi }_{ab} ,b \in \Lambda_{a}\). Also, it should be noted that \(\hat{\pi }_{ab}\) can be considered as \(\hat{\pi }_{ab} = \tau \, \pi_{ab}\) which \(\tau\) is the percentage of deviation from nominal value. Finally, robust formulation of Model (8) based on RO approach of Bertsimas and Sim (2004) is presented as Model (9):

It should be mentioned that parameter \(\Gamma\) is the budget of robustness that adjusts the robustness of Model (9) in response to solve conservatism level. Due to the linearity of robust counterpart and the ability to adjust the degree of conservatism level in RO approach of Bertsimas and Sim (2004), this method will be used in this paper for dealing with uncertainty in NDEA models.

Step 3: Proposing Robust NDEA Models.

As previously mentioned, all parameters of network DEA models including \(\tilde{x}_{ik} (i = 1,...,I)\),\(\tilde{z}_{gk} (g = 1,...,G)\), \(\tilde{w}_{hk} (h = 1,...,H)\), and \(\tilde{y}_{rk} (r = 1,...,R)\) are uncertain. Note that all uncertain parameters are considered as \(\tilde{x}_{ik} \in [x_{ik} - \hat{x}_{ik} ,x_{ik} + \hat{x}_{ik} ]\), \(\tilde{z}_{gk} \in [z_{gk} - \hat{z}_{gk} ,z_{gk} + \hat{z}_{gk} ]\), \(\tilde{w}_{hk} \in [w_{hk} - \hat{w}_{hk} ,w_{hk} + \hat{w}_{hk} ]\), and \(\tilde{y}_{rk} \in [y_{rk} - \hat{y}_{rk} ,y_{rk} + \hat{y}_{rk} ]\). Now, according to the robust optimization approach of Bertsimas and Sim (2004), the robust network DEA model for performance measurement of first stage of specific \({\text{DMU}}_{0}\) under deep uncertainty is proposed as Model (10):

Also, according to the RO approach of Bertsimas and Sim (2004), the RNDEA model for performance measurement of second stage of specific \({\text{DMU}}_{0}\) under uncertainty is proposed as Model (11):

Note that in measuring the efficiency of stages 1 and 2, Models (10) and (11) should be solved at the same values of \(\Gamma\) and \(\tau\). Finally, the overall efficiency of \({\text{DMU}}_{0}\) under uncertainty for specific \(\Gamma\) and \(\tau\), is calculated according to Eq. (12) as follows:

Alternatively, assuming stage 2 as the leader and stage 1 as the follower, measuring the efficiency of the second, the first and the entire two-stage system in the presence of uncertainty will be in a similar manner that presented in Appendix B.

5 A real application and experimental results

In this section, the implementation of the proposed approach of this paper for performance assessment of mutual funds, is presented for a real word case study from Iranian financial market. With respect to the advantages of MFs such as professional management, diversification, economies of scale, easy access, transparency, variety and freedom of choice, the popularity of MFs for investors has increased in recent years in Iran. Currently, there are more than 190 MFs in the Iranian financial market with a lifetime of less than a month to nearly 12 years. Notably, the return of MFs can be calculated daily, weekly, monthly, yearly and also from the beginning of activity. In this paper, average return and standard deviation are calculated for annual return.

Note that the convexity axiom of traditional DEA models can be violated in the presence of ratio variables (Emrouznejad & Amin, 2009). Hanafizadeh et al. (2014) suggested that if the DMUs are about the same size, the convexity issue can be eliminated. As results in the current study, this important point is considered in the selection of 15 MFs among 196 mutual funds in the Iran. Then, to illustrate the applicability of RNDEA approach, all required data for 15 Iranian MFs are extracted. Finally, after collecting data, the first stage, second stage and overall efficiencies of MFs are calculated for different budget of robustness \(\Gamma\) including 0, 25, 50, and 100%. Also, the percentage of deviation \(\tau\) is set equal to 1 and 10% for considering the perturbations in data.

Accordingly, Table 3 presents the results of robust network DEA approach when the stage 1 is more important.

As seen in Tables 3 and 4, the results indicate that, as the budget of robustness \(\Gamma\) increases from 0 to 100% for uncertain parameters, the values of efficiency gets worse. Also, as the perturbations \(\tau\) increases from 1 to 10%, the values of efficiency get worse than a nominal problem.

Finally, for ranking all MFs, the average of all efficiency scores for each MF under all condition of uncertainty are measured. It should be noted that the average efficiency is calculated for both cases of leadership in stages 1 and 2. Also, the average efficiency that is calculated under these two assumptions is used as the final ranking criterion. The ranking of all mutual funds based on proposed RNDEA approach and conventional NDEA approach are given in Tables 5 and 6, respectively:

As it can be seen in Table 5, MF 14 and MF 15 have the best performance in operational management and portfolio management functions, respectively. Also, MF 14 has the best overall performance in comparison with other MFs. Accordingly, MF 14 and MF 15 are robust against the data uncertainty in comparison with other MFs. In other words, the mangers of these MFs have acceptable stability in MF management. Therefore, the performance and planning of these MFs mangers can be analyzed to be benchmark for other MF managements.

Noteworthy, in terms of the average performance, MF 07 has acceptable performance in the first stage and overall, but the standard deviation (SD) of its efficiency scores is very high for different uncertainty situations. In other words, MF 07 has the most sensitivity to uncertainty of data in comparison with other MFs. As a result, with respect to the above points, all MFs can be categorized to the four groups including:

-

I.

MF has desirable performance with low risk (average is high, SD is low)

-

II.

MF has desirable performance with high risk (average is high, SD is high)

-

III.

MF has undesirable performance with low risk (average is low, SD is low)

-

IV.

MF has undesirable performance with high risk (average is low, SD is high)

It is obvious that the MFs of first and fourth groups have the best and the worst performance, respectively. It should be noted that the scope of this categorization depends on the decision maker (DM) opinion. For example, according to the above classification, MF 07 is in second group. Notably, from Tables 5 and 6, it can be clearly observed that the discriminatory power of proposed robust NDEA approach is more than conventional NDEA method.

Finally, it is also possible to predict the dataset for future periods using forecasting methods. Then, due to the nature of uncertainty in future data, the proposed RNDEA method can be utilized for predicting the MFs' efficiency and their trends over future periods. Consequently, the proposed RNDEA approach aids managers to make better and appropriate decisions.

6 Conclusions and directions for future research

In this research, the novel robust two-stage data envelopment analysis approach is proposed for performance appraisal of mutual funds by considering the internal structure and processes. The presented approach is capable to be used in the presence of deep uncertainty, when the data are not known exactly, and the uncertain data just lie within the upper and lower bounds represented by the intervals. As it can be seen in experimental results, if uncertainty of financial data is not considered, the ranking of MFs can be invalid, especially when the efficiency scores of MFs are close to each other. The main advantages of proposed RNDEA approach for performance evaluation of MFs can be listed as follows:

-

Identifying MFs that are stable against data uncertainty

-

Identifying MFs that are very sensitive to data uncertainty

-

Ranking of MFs under data uncertainty

-

Ability to implement in the presence of financial data with deep uncertainty

-

The linearity of the proposed robust network DEA approach

-

The discriminatory power of the RNDEA method is more than classical NDEA method

-

The unique efficiency decomposition under uncertain situation

-

Comprehensive assessment of MFs for different scenarios, which stage is more important

It should be noted that the applicability of the presented robust network DEA approach is demonstrated by assessing the relative performance of 15 Iranian mutual funds. The results indicate that the proposed approach is effective for performance evaluation of mutual funds and internal activities under data uncertainty. For future studies, the uncertain programming approaches such as chance-constrained programming (CCP), interval method, and fuzzy mathematical programming (FMP) can be applied in order to dealing with data uncertainty (For more details see Izadikhah & Saen, 2018; Tavana et al., 2018; Li et al., 2019; Sarah & Khalili-Damghani, 2019; Zhou et al., 2019; Mehdizadeh et al., 2020; Shi et al., 2020; Peykani, Mohammadi, et al., 2021; Peykani et al., 2021).

Abbreviations

- MEDA:

-

Multiplicative efficiency decomposition approach

- AEDA:

-

Additive efficiency decomposition approach

- CEDA:

-

Centralized efficiency decomposition approach

- LFEDA:

-

Leader–follower efficiency decomposition approach

- PPSA:

-

Production possibility set approach

- SBA:

-

Slack based approach

- IDA:

-

Independent approach

- BTS:

-

Basic two-stage

- ETS:

-

Extended two-stage

- THS:

-

Three-stage

- DU:

-

Discrete uncertainty

- CU:

-

Continues uncertainty

- MVZ:

-

Mulvey et al. (1995) approach

- SDA:

-

Snyder and Daskin (2006) approach

- BN:

-

Ben-Tal and Nemirovski (2000) approach

- BS:

-

Bertsimas and Sim (2004) approach

- RTS:

-

Returns to scale

- CRS:

-

Constant returns to scale

- VRS:

-

Variable returns to scale

- UED:

-

Unique efficiency decomposition

- LP:

-

Linear programming

- NLP:

-

Non-linear programming

- I1:

-

Input variable for stage 1 (First input)

- O1:

-

Output variable for stage 1 (Leakage variable)

- IM:

-

Intermediate variable that links the two stages (Linking variable)

- I2:

-

Input variable for stage 2 (Additional input)

- O2:

-

Output variable for stage 2 (Final output

References

Ardekani, M. A., Hoseininasab, H., & Fakhrzad, M. (2016). A robust two-stage data envelopment analysis model for measuring efficiency: considering Iranian electricity power production and distribution processes. International Journal of Engineering-Transactions B: Applications, 29(5), 646–653.

Basso, A., & Funari, S. (2016). DEA performance assessment of mutual funds. Data Envelopment Analysis, 229–287. Springer, Boston, MA.

Bayati, M. F., & Sadjadi, S. J. (2017). Robust network data envelopment analysis approach to evaluate the efficiency of regional electricity power networks under uncertainty. PloS One, 12(9), e0184103.

Ben-Tal, A., & Nemirovski, A. (2000). Robust solutions of linear programming problems contaminated with uncertain data. Mathematical Programming, 88(3), 411–424.

Bertsimas, D., Brown, D. B., & Caramanis, C. (2011). Theory and applications of robust optimization. SIAM Review, 53(3), 464–501.

Bertsimas, D., & Sim, M. (2004). The price of robustness. Operations Research, 52(1), 35–53.

Castelli, L., Pesenti, R., & Ukovich, W. (2010). A classification of DEA models when the internal structure of the decision making units is considered. Annals of Operations Research, 173(1), 207–235.

Charnes, A., & Cooper, W. W. (1962). Programming with linear fractional functionals. Naval Research Logistics Quarterly, 9(3–4), 181–186.

Chen, Y., Cook, W. D., Li, N., & Zhu, J. (2009). Additive efficiency decomposition in two-stage DEA. European Journal of Operational Research, 196(3), 1170–1176.

Cook, W. D., & Zhu, J. (2014). Data Envelopment Analysis: A Handbook of Modeling Internal Structure and Network. Springer.

Emrouznejad, A. (2014). Advances in data envelopment analysis. Annals of Operations Research, 214(1), 1–4.

Emrouznejad, A., & Amin, G. R. (2009). DEA models for ratio data: convexity consideration. Applied Mathematical Modelling, 33(1), 486–498.

Emrouznejad, A., & Banker, R. D. (2010). Efficiency and productivity: theory and applications. Annals of Operations Research, 173(1), 1–3.

Emrouznejad, A., & Yang, G. L. (2018). A survey and analysis of the first 40 years of scholarly literature in DEA: 1978–2016. Socio-Economic Planning Sciences, 61, 4–8.

Esfandiari, M., Hafezalkotob, A., Khalili-Damghani, K., & Amirkhan, M. (2017). Robust two-stage DEA models under discrete uncertain data. International Journal of Management Science and Engineering Management, 12(3), 216–224.

Gabrel, V., Murat, C., & Thiele, A. (2014). Recent advances in robust optimization: an overview. European Journal of Operational Research, 235(3), 471–483.

Galagedera, D. U. (2019). Modelling social responsibility in mutual fund performance appraisal: a two-stage data envelopment analysis model with non-discretionary first stage output. European Journal of Operational Research, 273(1), 376–389.

Galagedera, D. U., Fukuyama, H., Watson, J., & Tan, E. K. (2020). Do mutual fund managers earn their fees? new measures for performance appraisal. European Journal of Operational Research, 287(2), 653–667.

Galagedera, D. U., Roshdi, I., Fukuyama, H., & Zhu, J. (2018). A new network DEA model for mutual fund performance appraisal: an application to US equity mutual funds. Omega, 77, 168–179.

Galagedera, D. U., Watson, J., Premachandra, I. M., & Chen, Y. (2016). Modeling leakage in two-stage DEA models: an application to US mutual fund families. Omega, 61, 62–77.

Hanafizadeh, P., Khedmatgozar, H. R., Emrouznejad, A., & Derakhshan, M. (2014). Neural network DEA for measuring the efficiency of mutual funds. International Journal of Applied Decision Sciences, 7(3), 255–269.

Hsieh, H. P., Tebourbi, I., Lu, W. M., & Liu, N. Y. (2020). Mutual fund performance: the decision quality and capital magnet efficiencies. Managerial and Decision Economics, 41(5), 861–872.

Izadikhah, M., & Saen, R. F. (2018). Assessing sustainability of supply chains by chance-constrained two-stage DEA model in the presence of undesirable factors. Computers & Operations Research, 100, 343–367.

Kaffash, S., & Marra, M. (2017). Data envelopment analysis in financial services: a citations network analysis of banks, insurance companies and money market funds. Annals of Operations Research, 253(1), 307–344.

Kao, C. (2017). Network Data Envelopment Analysis. International Series in Operations Research & Management, Springer.

Kao, C. (2014). Network data envelopment analysis: a review. European Journal of Operational Research, 239(1), 1–16.

Kao, C., & Hwang, S. N. (2008). Efficiency decomposition in two-stage data envelopment analysis: an application to non-life insurance companies in Taiwan. European Journal of Operational Research, 185(1), 418–429.

Keith, A. J., & Ahner, D. K. (2019). A survey of decision making and optimization under uncertainty. Annals of Operations Research, 1–35.

Kim, J. H., Kim, W. C., & Fabozzi, F. J. (2018). Recent advancements in robust optimization for investment management. Annals of Operations Research, 266(1–2), 183–198.

De Leone, R. (2008). Data Envelopment Analysis. In C. A. Floudas & P. M. Pardalos (Eds.), Encyclopedia of Optimization. Boston: Springer.

Li, Y., Chen, Y., Liang, L., & Xie, J. (2012). DEA models for extended two-stage network structures. Omega, 40(5), 611–618.

Li, Y., Shi, X., Emrouznejad, A., & Liang, L. (2019). Ranking intervals for two-stage production systems. Journal of the Operational Research Society, 71(2), 209–224.

Liang, L., Cook, W. D., & Zhu, J. (2008). DEA models for two-stage processes: game approach and efficiency decomposition. Naval Research Logistics, 55(7), 643–653.

Liu, J. S., Lu, L. Y., Lu, W. M., & Lin, B. J. (2013). A survey of DEA applications. Omega, 41(5), 893–902.

Lu, C., Tao, J., An, Q., & Lai, X. (2019). A second-order cone programming based robust data envelopment analysis model for the new-energy vehicle industry. Annals of Operations Research, 292, 321–339.

Mehdizadeh, S., Amirteimoori, A., Charles, V., Behzadi, M. H., & Kordrostami, S. (2020). Measuring the efficiency of two-stage network processes: a satisficing DEA approach. Journal of the Operational Research Society, 1–13.

Peykani, P., Mohammadi, E., Jabbarzadeh, A., Rostamy-Malkhalifeh, M., & Pishvaee, M. S. (2020a). A novel two-phase robust portfolio selection and optimization approach under uncertainty: a case study of Tehran stock exchange. Plos One, 15(10), e0239810.

Peykani, P., Mohammadi, E., Farzipoor Saen, R., Sadjadi, S. J., & Rostamy-Malkhalifeh, M. (2020b). Data envelopment analysis and robust optimization: a review. Expert Systems, 37(4), e12534.

Peykani, P., Farzipoor Saen, R., Seyed Esmaeili, F. S., & Gheidar-Kheljani, J. (2021). Window data envelopment analysis approach: a review and bibliometric analysis. Expert Systems, 38, e12721.

Peykani, P., Mohammadi, E., & Emrouznejad, A. (2021). An adjustable fuzzy chance-constrained network DEA approach with application to ranking investment firms. Expert Systems with Applications, 166, 113938.

Peykani, P., Hosseinzadeh Lotfi, F., Sadjadi, S. J., Ebrahimnejad, A., & Mohammadi, E. (2022). Fuzzy chance-constrained data envelopment analysis: a structured literature review, current trends, and future directions. Fuzzy Optimization and Decision Making, 21, 197–261.

Peykani, P., Mohammadi, E., Emrouznejad, A., Pishvaee, M. S., & Rostamy-Malkhalifeh, M. (2019). Fuzzy data envelopment analysis: an adjustable approach. Expert Systems with Applications, 136, 439–452.

Peykani, P., Mohammadi, E., Pishvaee, M. S., Rostamy-Malkhalifeh, M., & Jabbarzadeh, A. (2018). A novel fuzzy data envelopment analysis based on robust possibilistic programming: possibility, necessity and credibility-based approaches. RAIRO-Operations Research, 52(4–5), 1445–1463.

Premachandra, I. M., Zhu, J., Watson, J., & Galagedera, D. U. (2016). Mutual fund industry performance: a network data envelopment analysis approach. Data Envelopment Analysis, 165–228. Springer, Boston, MA.

Premachandra, I. M., Zhu, J., Watson, J., & Galagedera, D. U. (2012). Best-performing US mutual fund families from 1993 to 2008: evidence from a novel two-stage DEA model for efficiency decomposition. Journal of Banking & Finance, 36(12), 3302–3317.

Sadjadi, S. J., & Omrani, H. (2008). Data envelopment analysis with uncertain data: an application for Iranian electricity distribution companies. Energy Policy, 36(11), 4247–4254.

Sánchez-González, C., Sarto, J. L., & Vicente, L. (2017). The efficiency of mutual fund companies: evidence from an innovative network SBM approach. Omega, 71, 114–128.

Sarah, J., & Khalili-Damghani, K. (2019). Fuzzy type-II De-Novo programming for resource allocation and target setting in network data envelopment analysis: a natural gas supply chain. Expert Systems with Applications, 117, 312–329.

Shakouri, R., Salahi, M., & Kordrostami, S. (2019). Stochastic p-robust approach to two-stage network DEA model. Quantitative Finance and Economics, 3(2), 315–346.

Shi, X., Emrouznejad, A., Jin, M., & Yang, F. (2020). A new parallel fuzzy data envelopment analysis model for parallel systems with two components based on Stackelberg game theory. Fuzzy Optimization and Decision Making, 19(3), 311–332.

Snyder, L. V., & Daskin, M. S. (2006). Stochastic p-robust location problems. IIE Transactions, 38(11), 971–985.

Soyster, A. L. (1973). Convex programming with set-inclusive constraints and applications to inexact linear programming. Operations Research, 21(5), 1154–1157.

Tavana, M., Toloo, M., Aghayi, N., & Arabmaldar, A. (2021). A robust cross-efficiency data envelopment analysis model with undesirable outputs. Expert Systems with Applications, 167, 114117.

Tavana, M., Khalili-Damghani, K., Arteaga, F. J. S., Mahmoudi, R., & Hafezalkotob, A. (2018). Efficiency decomposition and measurement in two-stage fuzzy DEA models using a bargaining game approach. Computers & Industrial Engineering, 118, 394–408.

Toloo, M., & Mensah, E. K. (2019). Robust optimization with nonnegative decision variables: a DEA approach. Computers & Industrial Engineering, 127, 313–325.

Tsolas, I. E. (2020). Precious metal mutual fund performance evaluation: a series two-stage DEA modeling approach. Journal of Risk and Financial Management, 13(5), 87.

Wu, D., Ding, W., Koubaa, A., Chaala, A., & Luo, C. (2017). Robust DEA to assess the reliability of methyl methacrylate-hardened hybrid poplar wood. Annals of Operations Research, 248(1–2), 515–529.

Xidonas, P., Steuer, R., & Hassapis, C. (2020). Robust portfolio optimization: a categorized bibliographic review. Annals of Operations Research, 292(1), 533–552.

Zhou, X., Xu, Z., Chai, J., Yao, L., Wang, S., & Lev, B. (2019). Efficiency evaluation for banking systems under uncertainty: a multi-period three-stage DEA model. Omega, 85, 68–82.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A

NDEA modeling based on leader–follower approach—stage 2 as the leader

If assumed that stage 2 is more important (second stage as the leader and first stage as the follower), the efficiency of the stage 2 for a specific \({\text{DMU}}_{0}\) under variable returns to scale assumption is estimated as Model (A1):

Model (A1) is a linear fractional program which can be transformed via the Charnes-Cooper transformation into the following linear program:

After calculating the efficiency of the first stage, the second stage’s efficiency is measured using Model (A3) as follows:

By applying the Charnes–Cooper transformation, Model (A3) is converted to the linear programming as Model (A4):

Finally, the overall efficiency of system is measured using Equation (A5) as follows:

It should be noted that in leader–follower approach, \({\text{DMU}}_{0}\) is overall efficient, if and only if it is efficient in both of its two sub-stages.

Appendix B

RNDEA modeling based on leader–follower approach—stage 2 as the leader

In this appendix in 3 steps, the robust network DEA method using robust optimization approach is proposed for performance appraisal of MFs in the presence of uncertain data.

Step 1. Preparing NDEA models

In order to consider the uncertainty in all parameters of NDEA models including \(\tilde{x}_{ik} \left( {i = 1,...,I} \right)\), \(\tilde{z}_{gk} \left( {g = 1,...,G} \right)\), \(\tilde{w}_{hk} \left( {h = 1,...,H} \right)\), and \(\tilde{y}_{rk} \left( {r = 1,...,R} \right)\), Models (A2) and (A4) are converted into Models (B1) and (B2), respectively.

Proposition B1

The optimal solution of Model (B1) is equal to Model (A2).

Proof

Assume that the optimal solution of Model (B1) is \(\left( {\bar{\varphi },\bar{\mu },\bar{\beta },\bar{\Psi }_{2} } \right)\). By contradiction, suppose that \(\sum\nolimits_{g = 1}^{G} {z_{g0} \bar{\varphi }_{g} } + \sum\nolimits_{h = 1}^{H} {w_{h0} \bar{\mu }_{h} } < 1\) (it should be noted that \(\sum\nolimits_{g = 1}^{G} {z_{g0} \bar{\varphi }_{g} } + \sum\nolimits_{h = 1}^{H} {w_{h0} \bar{\mu }_{h} } = \Omega \& \Omega > 0\)). \(\left( {\bar{\varphi } ,\bar{\mu } ,\bar{\beta } ,\bar{\Psi }_{2} } \right)\) are considered as \(\bar{\varphi } = \frac{{\bar{\varphi }}}{\Omega }\), \(\bar{\mu } = \frac{{\bar{\mu }}}{\Omega }\), \(\bar{\beta } = \frac{{\bar{\beta }}}{\Omega }\), and \(\bar{\Psi }_{2} = \frac{{\bar{\Psi }_{2} }}{\Omega }\). Because of \(\sum\nolimits_{r = 1}^{R} {y_{rk} \bar{\beta }_{r} } { - }\sum\nolimits_{g = 1}^{G} {z_{gk} \bar{\varphi }_{g} } - \sum\nolimits_{h = 1}^{H} {w_{hk} \bar{\mu }_{h} } + \bar{\Psi }_{2} = \left( {\frac{1}{\Omega }\left( {\sum\nolimits_{r = 1}^{R} {y_{rk} \bar{\beta }_{r} } { - }\sum\nolimits_{g = 1}^{G} {z_{gk} \bar{\varphi }_{g} } - \sum\nolimits_{h = 1}^{H} {w_{hk} \bar{\mu }_{h} } + \bar{\Psi }_{2} } \right)} \right) \le 0\) (with respect to \(\left( {\frac{1}{\Omega }} \right) > 0\) and \(\sum\nolimits_{r = 1}^{R} {y_{rk} \bar{\beta }_{r} } { - }\sum\nolimits_{g = 1}^{G} {z_{gk} \bar{\varphi }_{g} } - \sum\nolimits_{h = 1}^{H} {w_{hk} \bar{\mu }_{h} } + \bar{\Psi }_{2} \le 0\)),\(\sum\nolimits_{g = 1}^{G} {z_{g0} \bar{\varphi }_{g} } + \sum\nolimits_{h = 1}^{H} {w_{h0} \bar{\mu }_{h} } = \left( {\frac{1}{\Omega }\left( {\sum\nolimits_{g = 1}^{G} {z_{g0} \bar{\varphi }_{g} } + \sum\nolimits_{h = 1}^{H} {w_{h0} \bar{\mu }_{h} } } \right)} \right) = 1\), \(\bar{\varphi } \ge 0\), \(\bar{\mu } \ge 0\), and \(\bar{\beta } \ge 0\), \(\left( {\bar{\varphi } ,\bar{\mu } ,\bar{\beta } ,\bar{\Psi }_{2} } \right)\) is the feasible solution of Model (B1). Also, in the objective function \(\sum\nolimits_{r = 1}^{R} {y_{r0} \bar{\beta }_{r} } + \bar{\Psi }_{2} = \left( {\frac{1}{\Omega }\left( {\sum\nolimits_{r = 1}^{R} {y_{r0} \bar{\beta }_{r} } + \bar{\Psi }_{2} } \right)} \right)\), with respect to suppose that \(\sum\nolimits_{g = 1}^{G} {z_{g0} \bar{\varphi }_{g} } + \sum\nolimits_{h = 1}^{H} {w_{h0} \bar{\mu }_{h} } < 1\), thus \(\left( {\frac{1}{{\sum\nolimits_{g = 1}^{G} {z_{g0} \bar{\varphi }_{g} } + \sum\nolimits_{h = 1}^{H} {w_{h0} \bar{\mu }_{h} } }}} \right) > 1\) and finally \(\sum\nolimits_{r = 1}^{R} {y_{r0} \bar{\beta }_{r} } + \bar{\Psi }_{2} > \sum\nolimits_{r = 1}^{R} {y_{r0} \bar{\beta }_{r} } + \bar{\Psi }_{2}\) that this is contradicts with optimality of \(\left( {\bar{\varphi },\bar{\mu },\bar{\beta },\bar{\Psi }_{2} } \right)\). So, at any optimal solution of Model (B1), always \(\sum\nolimits_{g = 1}^{G} {z_{g0} \bar{\varphi }_{g} } + \sum\nolimits_{h = 1}^{H} {w_{h0} \bar{\mu }_{h} } = 1\).

Proposition B2

The optimal solution of Model (B2) is equal to Model (A4).

Proof

Assume that the optimal solution of Model (B2) is \(\left( {\bar{\alpha },\bar{\varphi },\bar{\mu },\bar{\beta },\bar{\Psi }_{1} ,\bar{\Psi }_{2} } \right)\). By contradiction, suppose that \(\sum\nolimits_{i = 1}^{I} {x_{i0} \bar{\alpha }_{i} } < 1\) (it should be noted that \(\sum\nolimits_{i = 1}^{I} {x_{i0} \bar{\alpha }_{i} } = \mho \& \mho > 0\)). \(\left( {\bar{\alpha } ,\bar{\varphi } ,\bar{\mu } ,\bar{\beta } ,\bar{\Psi }_{1} ,\bar{\Psi }_{2} } \right)\) are considered as \(\bar{\alpha } = \frac{{\bar{\alpha }}}{\mho }\), \(\bar{\varphi } = \frac{{\bar{\varphi }}}{\mho }\), \(\bar{\mu } = \frac{{\bar{\mu }}}{\mho }\), \(\bar{\beta } = \frac{{\bar{\beta }}}{\mho }\), \(\bar{\Psi }_{1} = \frac{{\bar{\Psi }_{1} }}{\mho }\) and \(\bar{\Psi }_{2} = \frac{{\bar{\Psi }_{2} }}{\mho }\). Because of \(\sum\nolimits_{g = 1}^{G} {z_{gk} \bar{\varphi }_{g} } { - }\sum\nolimits_{i = 1}^{I} {x_{ik} \bar{\alpha }_{i} } + \bar{\Psi }_{1} = \left( {\frac{1}{\mho }\left( {\sum\nolimits_{g = 1}^{G} {z_{gk} \bar{\varphi }_{g} } { - }\sum\nolimits_{i = 1}^{I} {x_{ik} \bar{\alpha }_{i} } + \bar{\Psi }_{1} } \right)} \right) \le 0\) (with respect to \(\left( {\frac{1}{\mho }} \right) > 0\) and \(\sum\nolimits_{g = 1}^{G} {z_{gk} \bar{\varphi }_{g} } { - }\sum\nolimits_{i = 1}^{I} {x_{ik} \bar{\alpha }_{i} } + \bar{\Psi }_{1} \le 0\)), \(\sum\nolimits_{i = 1}^{I} {x_{i0} \bar{\alpha }_{i} } = \left( {\frac{1}{\mho }\left( {\sum\nolimits_{i = 1}^{I} {x_{i0} \bar{\alpha }_{i} } } \right)} \right) = 1\), \(\sum\nolimits_{r = 1}^{R} {y_{rk} \bar{\beta }_{r} } { - }\sum\nolimits_{g = 1}^{G} {z_{gk} \bar{\varphi }_{g} } - \sum\nolimits_{h = 1}^{H} {w_{hk} \bar{\mu }_{h} } + \bar{\Psi }_{2} = \left( {\frac{1}{\mho }\left( {\sum\nolimits_{r = 1}^{R} {y_{rk} \bar{\beta }_{r} } { - }\sum\nolimits_{g = 1}^{G} {z_{gk} \bar{\varphi }_{g} } - \sum\nolimits_{h = 1}^{H} {w_{hk} \bar{\mu }_{h} } + \bar{\Psi }_{2} } \right)} \right) \le 0\), \(\left( {\left( {\sum\nolimits_{r = 1}^{R} {y_{r0} \bar{\beta }_{r} } + \bar{\Psi }_{2} } \right) - \dag_{0}^{{\rm{2 }*}} \left( {\sum\nolimits_{g = 1}^{G} {z_{g0} \bar{\varphi }_{g} } + \sum\nolimits_{h = 1}^{H} {w_{h0} \bar{\mu }_{h} } } \right)} \right) = \left( {\frac{1}{\mho }\left( {\left( {\sum\nolimits_{r = 1}^{R} {y_{r0} \bar{\beta }_{r} } + \bar{\Psi }_{2} } \right) - \dag_{0}^{{\rm{2 }*}} \left( {\sum\nolimits_{g = 1}^{G} {z_{g0} \bar{\varphi }_{g} } + \sum\nolimits_{h = 1}^{H} {w_{h0} \bar{\mu }_{h} } } \right)} \right)} \right) = \rm{0}\), \(\bar{\alpha } \ge 0\), \(\bar{\varphi } \ge 0\), \(\bar{\mu } \ge 0\), and \(\bar{\beta } \ge 0\), \(\left( {\bar{\alpha } ,\bar{\varphi } ,\bar{\mu } ,\bar{\beta } ,\bar{\Psi }_{1} ,\bar{\Psi }_{2} } \right)\) is the feasible solution of Model (B2). Also, in the objective function \(\sum\nolimits_{g = 1}^{G} {z_{g0} \bar{\varphi }_{g} } + \bar{\Psi }_{1} = \left( {\frac{1}{\mho }\left( {\sum\nolimits_{g = 1}^{G} {z_{g0} \bar{\varphi }_{g} } + \bar{\Psi }_{1} } \right)} \right)\), with respect to suppose that \(\sum\nolimits_{i = 1}^{I} {x_{i0} \bar{\alpha }_{i} } < 1\), thus \(\left( {\frac{1}{{\sum\nolimits_{i = 1}^{I} {x_{i0} \bar{\alpha }_{i} } }}} \right) > 1\) and finally \(\sum\nolimits_{g = 1}^{G} {z_{g0} \bar{\varphi }_{g} } + \bar{\Psi }_{1} > \sum\nolimits_{g = 1}^{G} {z_{g0} \bar{\varphi }_{g} } + \bar{\Psi }_{1}\) that this is contradicts with optimality of \(\left( {\bar{\alpha },\bar{\varphi },\bar{\mu },\bar{\beta },\bar{\Psi }_{1} ,\bar{\Psi }_{2} } \right)\). So, at any optimal solution of Model (B2), always \(\sum\nolimits_{i = 1}^{I} {x_{i0} \bar{\alpha }_{i} } = 1\).

Step 2. Choosing Robust Optimization Approach.

With respect to weaknesses and strengths of Soyster (1973), Ben-Tal and Nemirovski (2000) and Bertsimas and Sim (2004) robust approaches, the RO approach of Bertsimas and Sim (2004) is selected for dealing with uncertain parameters in NDEA models.

Step 3. Proposing Robust NDEA Models.

In the third step, according to the RO of Bertsimas and Sim (2004), the RNDEA model for performance measurement of second stage of specific \({\text{DMU}}_{0}\) under uncertainty is proposed as Model (B3):

Also, by applying the RO approach of Bertsimas and Sim (2004), the RNDEA model for performance measurement of first stage of specific \({\text{DMU}}_{0}\) under uncertainty is proposed as Model (B4):

Finally, the overall efficiency of specific \({\text{DMU}}_{0}\) under uncertainty for specific \(\Gamma\) and \(\tau\), is calculated according to Eq. (B5) as follows:

Note that in measuring the efficiency of stage 2, stage 1 and overall, Model (B3), Model (B4), and Eq. (B5) should be calculated for the same values of \(\Gamma\) and \(\tau\).

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visithttp://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Peykani, P., Emrouznejad, A., Mohammadi, E. et al. A novel robust network data envelopment analysis approach for performance assessment of mutual funds under uncertainty. Ann Oper Res (2022). https://doi.org/10.1007/s10479-022-04625-3

Accepted:

Published:

DOI: https://doi.org/10.1007/s10479-022-04625-3