Abstract

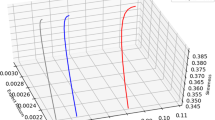

This paper proposes a market model with returns assumed to follow a multivariate normal tempered stable distribution defined by a mixture of the multivariate normal distribution and the tempered stable subordinator. This distribution can capture two stylized facts: fat-tails and asymmetry, that have been empirically observed for asset return distributions. We discuss a new portfolio optimization method on the new market model, which is an extension of Markowitz’s mean-variance optimization. The new optimization method considers not only reward and dispersion but also asymmetry in tails. The efficient frontier is extended to a curved surface on three-dimensional space of reward, dispersion, and asymmetry in tails. We also propose a new performance measure, which is an extension of the Sharpe ratio. Moreover, we derive closed-form solutions for portfolio managers’ two important measures in portfolio construction: the marginal value-at-risk (VaR) and the marginal conditional VaR (CVaR). We illustrate the proposed model using stocks comprising the Dow Jones Industrial Average. First, perform the new portfolio optimization and then demonstrating how the marginal VaR and marginal CVaR can be used for portfolio optimization under the model. Based on this paper’s empirical evidence, our framework offers realistic portfolio optimization and tractable methods for portfolio risk management.

Similar content being viewed by others

Notes

The tempered subordinator is defined by the characteristic function (12) in the “Appendix”

In this paper, we consider the long only portfolio.

CDF of stdNTS distribution is obtained by the fast Fourier transform method by Gils-Pelaez (1951).

We select the sample size 752 (3 years) to see at least two outliers (left and right tails). If the data is normal, we expect more than 2 outliers which are not included \(3\sigma \) range covers 99.7% out of 752 samples.

More precisely, it has the semi-fat-tails having the exponential decaying tails

References

Aas, K., Hobæk Haff, I., & Dimakos, X. K. (2006). Risk estimation using the multivariate normal inverse Gaussian distribution. Journal of Risk, 8(2), 39–60.

Adcock, C. (2010). Asset pricing and portfolio selection based on the multivariate extended skew-Student-\(t\) distribution. Annals of Operations Research, 176, 221–234.

Anand, A., Li, T., Kurosaki, T., & Kim, Y. S. (2016). Foster–Hart optimal portfolios. Journal of Banking and Finance, 68, 117–130.

Anand, A., Li, T., Kurosaki, T., & Kim, Y. S. (2017). The equity risk posed by the too-big-to-fail banks: A foster-hart estimation. Annals of Operations Research, 253(1), 21–41.

Barndorff-Nielsen, O. E., & Levendorskii, S. (2001). Feller processes of normal inverse Gaussian type. Quantitative Finance, 1, 318–331.

Barndorff-Nielsen, O. E., & Shephard, N. (2001). Normal modified stable processes. Economics Series Working Papers from University of Oxford, Department of Economics 72.

Bianchi, M. L., & Tassinari, G. L. (2020). Forward-looking portfolio selection with multivariate non-Gaussian models. Quantitative Finance, 20(10), 1645–1661.

Bianchi, M. L., Tassinari, G. L., & Fabozzi, F. J. (2016). Riding with the four horsemen and the multivariate normal tempered stable model. International Journal of Theoretical and Applied Finance, 19(4), 1650027.

Boyarchenko, S. I., & Levendorskiĭ, S. Z. (2000). Option pricing for truncated Lévy processes. International Journal of Theoretical and Applied Finance, 3, 549–552.

Carr, P., Geman, H., Madan, D., & Yor, M. (2002). The fine structure of asset returns: An empirical investigation. Journal of Business, 75(2), 305–332.

Carr, P., Geman, H., Madan, D., & Yor, M. (2003). Stochastic volatility for Lévy processes. Mathematical Finance, 13, 345–382.

Dahlquist, M., Farago, A., & Tédongap, R. (2017). Asymmetries and portfolio choice. The Review of Financial Studies, 30(2), 667–702.

Eberlein, E., & Glau, K. (2014). Variational solutions of the pricing pides for European options in Lévy models. Applied Mathematical Finance, 21(5), 417–450.

Eberlein, E., Gehrig, T., & Madan, D. (2012). Pricing to acceptability: With applications to valuation of one’s own credit risk. Journal of Risk, 15, 91–120. https://doi.org/10.21314/JOR.2012.252

Eberlein, E., & Madan, D. B. (2010). On correlating Lévy processes. Journal of Risk, 13(1), 3–16.

Eberlein, E., & Özkan. (2005). The Lévy LIBOR model. Finance and Stochastics, 9, 327–348.

Fallahgoul, H. A., Kim, Y. S., Fabozzi, F. J., & Park, J. (2019). Quanto option pricing with Lévy models. Computational Economics, 53(3), 1279–1308.

Fama, E. (1963). Mandelbrot and the stable Paretian hypothesis. Journal of Business, 36, 420–429.

Gil-Pelaez, J. (1951). Note on the inversion theorem. Biometrika, 38, 3–4.

Gourieroux, C., Laurent, J., & Scaillet, O. (2000). Sensitivity analysis of values at risk. Journal of Empirical Finance, 7, 225–245.

Harvey, C. R., Liechty, J. C., Liechty, M. W., & Müller, P. (2010). Portfolio selection with higher moments. Quantitative Finance, 10(5), 469–485. https://doi.org/10.1080/14697681003756877

Hitaj, A., Mercuri, L., & Rroji, E. (2019). Sensitivity analysis of mixed tempered stable parameters with implications in portfolio optimization. Computational Management Science, 16, 71–95. https://doi.org/10.1080/00949655.2021.1962878

Kim, S. I., & Kim, Y. S. (2018). Normal tempered stable structural model. Review of Derivatives Research, 21(1), 119–148.

Kim, Y., Lee, J., Mittnik, S., & Park, J. (2015). Quanto option pricing in the presence of fat tails and asymmetric dependence. Journal of Econometrics, 187(2), 512–520.

Kim, Y. S., Giacometti, R., Rachev, S. T., Fabozzi, F. J., & Mignacca, D. (2012). Measuring financial risk and portfolio optimization with a non-Gaussian multivariate model. Annals of Operations Research, 201(1), 325–343.

Kim, Y. S., Rachev, S. T., Bianchi, M. L., & Fabozzi, F. J. (2010). Computing VaR and AVaR in infinitely divisible distributions. Probability and Mathematical Statistics, 30(2), 223–245.

Kim, Y. S., Roh, K. H., & Douady, R. (2021). Tempered stable processes with time-varying exponential tails. Quantitative Finance.https://doi.org/10.1080/14697688.2021.1962958, to appear.

Kim, Y. S., & Volkmann, D. (2013). NTS copula and finance. Applied Mathematics Letters, 26, 676–680.

King, A. J. (1993). Asymmetric risk measures and tracking models for portfolio optimization under uncertainty. Annals of Operations Research, 45, 165–177.

Konno, H., Shirakawa, H., & Yamazaki, H. (1993). A mean-absolute deviation-skewness portfolio optimization model. Annals of Operations Research, 45, 205–220.

Koponen, I. (1995). Analytic approach to the problem of convergence of truncated Lévy flights towards the Gaussian stochastic process. Physical Review E, 52, 1197–1199.

Kraus, A., & Litzenberger, R. (1976). Skewness preference and the valuation of risk assets. Journal of Finance, 31, 1085–1100.

Kurosaki, T., & Kim, Y. S. (2018). Foster–Hart optimization for currency portfolio. Studies in Nonlinear Dynamics & Econometrics, 23(2):Published Online. https://doi.org/10.1515/snde-2017-0119.

Liu, Y., Djurić, P. M., Kim, Y. S., Rachev, S. T., & Glimm, J. (2021). Systemic risk modeling with lévy copulas. Journal of Risk and Financial Management. https://doi.org/10.3390/jrfm14060251.

Mandelbrot, B. B. (1963a). New methods in statistical economics. Journal of Political Economy, 71, 421–440.

Mandelbrot, B. B. (1963b). The variation of certain speculative prices. Journal of Business, 36, 394–419.

Mansini, R., Ogryczak, W., & Speranza, M. G. (2007). Conditional value at risk and related linear programming models for portfolio optimization. Annals of Operations Research, 152, 227–256.

Markowitz, H. (1952). Portfolio selection. Journal of Finance, 7(1), 77–91.

Øigård, T. A., Hanssen, A., Hansen, R. E., & Godtliebsen, F. (2005). EM-estimation and modeling of heavy-tailed processes with the multivariate normal inverse Gaussian distribution. Signal Processing, 85, 1655–1673.

Pflug, G. (2000). Some remarks on the value-at-risk and the conditional value-at-risk. In S. Uryasev (Ed.), Probabilistic constrained optimization: Methodology and applications (pp. 272–281). The Netherlands: Kluwer Academic Publishers.

Rachev, S. T., & Mittnik, S. (2000). Stable Paretian models in finance. New York: Wiley.

Rachev, S. T., Stoyanov, S., & Fabozzi, F. J. N. J. (2007). Advanced stochastic models, risk assessment, and portfolio optimization: The ideal risk, uncertainty, and performance measures. Hoboken: Wiley.

Rachev, S. T., Kim, Y. S., Bianchi, M. L., & Fabozzi, F. J. (2011). Financial models with Lévy processes and volatility clustering. New York: Wiley.

Rockafellar, R. T., & Uryasev, S. (2000). Optimization of conditional value-at-risk. Journal of Risk, 2(3), 21–41.

Rockafellar, R. T., & Uryasev, S. (2002). Conditional value-at-risk for general loss distributions. Journal of Banking & Finance, 26, 1443–1471.

Rubinstein, M. (1973). The fundamental theorem of parameter-preference security valuation. Journal of Financial and Quantitative Analysis, 8, 61–69.

Sharpe, W. F. (1966). Mutual funds performance. Journal of Business, 36(1), 119–138.

Sharpe, W. F. (1994). The sharpe ratio. Journal of Portfolio Management, 21(1), 45–58.

Stoyanov, S. V., Racheva-Iotova, B., Rachev, S. T., & Fabozzi, F. J. (2010). Stochastic models for risk estimation in volatile markets: A survey. Annals of Operations Research, 176(1), 293–309.

Stoyanov, S. V., Rachev, S. T., & Fabozzi, F. J. (2013). Sensitivity of portfolio VaR and CVaR to portfolio return characteristics. Annals of Operations Research, 205, 169–187.

Xia, Y., & Grabchak, M. (2021). Estimation and simulation for multivariate tempered stable distributions. Journal of Statistical Computation and Simulation. https://doi.org/10.1080/00949655.2021.1962878

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The author gratefully acknowledges the support of GlimmAnalytics LLC and Juro Instruments Co., Ltd. The author is grateful to Minseob Kim, who reviewed this paper and corrected editorial errors. Also, all remaining errors are entirely my own.

Appendix: Multivariate normal tempered stable distribution

Appendix: Multivariate normal tempered stable distribution

Let \(\alpha \in (0,2)\) and \(\theta >0\), and let \({{{\mathcal {T}}}}\) be a positive random variable whose characteristic function \(\phi _{{{{\mathcal {T}}}}}\) is equal to

The random variable \({{{\mathcal {T}}}}\) is referred to as Tempered Stable Subordinator. Let \(X=(X_1, X_2, \cdots , X_N)^{{\texttt {T}}}\) be a multivariate random variable given by

where

-

\(\mu = (\mu _1, \mu _2, \cdots , \mu _N)^{{\texttt {T}}}\in {{\mathbb {R}}}^N\)

-

\(\beta = (\beta _1, \beta _2, \cdots , \beta _N)^{{\texttt {T}}}\in {{\mathbb {R}}}^N\)

-

\(\gamma = (\gamma _1, \gamma _2, \cdots , \gamma _N)^{{\texttt {T}}}\in {{\mathbb {R}}}_+^N\) with \({{\mathbb {R}}}_+=[0,\infty )\)

-

\(\varepsilon = (\varepsilon _1, \varepsilon _2, \cdots , \varepsilon _N)^{{\texttt {T}}}\) is a N-dimensional standard normal distribution with a covariance matrix \(\varSigma \). That is, \(\varepsilon _n\sim \varPhi (0,1)\) for \(n\in \{1,2,\ldots , N\}\) and (k, l)th element of \(\varSigma \) is given by \(\rho _{k,l}=\mathrm{cov}(\varepsilon _k,\varepsilon _l)\) for \(k,l\in \{1,2,\ldots ,N\}\).

-

\({{{\mathcal {T}}}}\) is the Tempered Stable Subordinator with parameters \((\alpha ,\theta )\), and is independent of \(\varepsilon _n\) for all \(n=1,2,\ldots , N\).

Then X is referred to as the N-dimensional NTS random variable with parameters \((\alpha \), \(\theta \), \(\beta \), \(\gamma \), \(\mu \), \(\varSigma )\) which we denote by \(X\sim NTS _N(\alpha \), \(\theta \), \(\beta \), \(\gamma \), \(\mu \), \(\varSigma )\). The NTS distribution has the following properties:

-

1.

The mean of X are equal to \(E[X] = \mu \).

-

2.

The covariance between \(X_k\) and \(X_l\) is given by

$$\begin{aligned} \mathrm{cov}(X_k,X_l)=\rho _{k,l}\gamma _k\gamma _l+\beta _k\beta _l\left( \frac{2-\alpha }{2\theta }\right) \end{aligned}$$(13)for \(k,l\in \{1,2,\ldots ,N\}\).

-

3.

The variance of \(X_n\) is

$$\begin{aligned} \mathrm{var}(X_n)=\gamma _n^2+\beta _n^2\left( \frac{2-\alpha }{2\theta }\right) \text { for } n\in \{1,2,\ldots , N\}. \end{aligned}$$ -

4.

Characteristic function of \(X_n\) is

$$\begin{aligned} \phi _{X_n}(u) = \exp \left( (\mu -\beta )ui-\frac{2\theta ^{1-\frac{\alpha }{2}}}{\alpha } \left( \left( \theta -i\beta u+\frac{\gamma ^2u^2}{2}\right) ^{\frac{\alpha }{2}}-\theta ^{\frac{\alpha }{2}}\right) \right) \end{aligned}$$

Providing \(\mu _n=0\) and \(\gamma _n = \sqrt{1-\beta _n^2 \left( \frac{2-\alpha }{2\theta }\right) }\) with \(|\beta _n|<\sqrt{ \frac{2\theta }{2-\alpha }}\) for n \(\in \) \(\{ 1\),2, \(\cdots \),\(N\}\), the N-dimensional NTS random variable X has \(E[X] = (0,0,\ldots ,0)^{{\texttt {T}}}\) and \(\mathrm{var}(X)\) \(=\) (1,1,\(\cdots \),\(1)^{{\texttt {T}}}\). In this case, X is referred to as the N-dimensional standard NTS random variable with parameters \((\alpha \), \(\theta \), \(\beta \), \(\varSigma )\) and we denote it by \(X\sim stdNTS _N(\alpha \), \(\theta \), \(\beta \), \(\varSigma )\).

For one dimensional NTS distribution, \(\varSigma = 1\), we can prove the following Lemma which is changing parameterization.

Lemma 1

Let \(X\sim NTS_1(\alpha \), \(\theta \), \(\beta \), \(\gamma \), \(\mu \), 1) and \(\xi \sim stdNTS _1({{{\bar{\alpha }}}}\), \({{{\bar{\theta }}}}\), \({{{\bar{\beta }}}}, 1)\). Suppose \({{{\bar{\alpha }}}} = \alpha \), \({{{\bar{\theta }}}} = \theta \), and \( {{{\bar{\beta }}}} = \beta /\sigma \), where \(\sigma =\sqrt{\gamma ^2+\beta ^2\left( \frac{2-\alpha }{2\theta }\right) }\). Then we have \(X = \mu + \sigma \xi \).

Proof

The Ch.F of X is given by

By the definition of stdNTS distribution, the Ch.F of \(\mu +\sigma \xi \) is equal to

Hence (14)=(15) if \({{{\bar{\alpha }}}} = \alpha \), \({{{\bar{\theta }}}} = \theta \), \({{{\bar{\beta }}}} \sigma = \beta \), and \(\gamma ^2 =\sigma ^2\left( 1-{{{\bar{\beta }}}}^2\left( \frac{2-\alpha }{2\theta }\right) \right) \). Since \(\sigma = \beta /{{{\bar{\beta }}}}\), we have

or

and hence

Therefore, we have

where

\(\square \)

The linear combination of NTS member variables of the NTS vector is again NTS distributed as the following proposition.

Lemma 2

Let \(w = (w_1, w_2, \cdots , w_N)^{\texttt {T}}\in {{\mathbb {R}}}^N\) and \(X\sim NTS _N(\alpha \), \(\theta \), \(\beta \), \(\gamma \), \(\mu \), \(\varSigma )\). Then \(w^{{\texttt {T}}} X \sim NTS _1(\alpha ,\theta ,{{{\bar{\beta }}}},{{{\bar{\gamma }}}},{{{\bar{\mu }}}},1)\), where

Proof

Since we have

and \(w^{\texttt {T}}\mathrm{diag}(\gamma )\epsilon {\mathop {=}\limits ^{\mathrm {d}}}\sqrt{w^{\texttt {T}}\mathrm{diag}(\gamma )\varSigma \mathrm{diag}(\gamma ) w } \epsilon _0\) with \(\epsilon _0\sim \varPhi (0,1)\), it is trivial. \(\square \)

Remark 1

In Lemma 2, the first four moments of \(Y=w^{\texttt {T}}X\) are as follows [See Rachev et al. (2011) and Kim et al. (2021)]

-

Mean: \(\displaystyle E[Y]={{{\bar{\mu }}}}\)

-

Variance: \(\displaystyle \mathrm{var}(Y)={{{\bar{\gamma }}}}^2+{{{\bar{\beta }}}}^2\left( \frac{2-\alpha }{2\theta }\right) \)

-

skewness: \(\displaystyle S (Y)= \frac{{{{\bar{\beta }}}}\,\left( 2-\alpha \right) \,\left( 6\,{{{{\bar{\gamma }}}}}^2\,\theta -\alpha {{{\bar{\beta }}}}^2+4{{{\bar{\beta }}}}^2\right) }{\sqrt{2\theta }\,{\left( 2\,{{{{\bar{\gamma }}}}}^2\,\theta -\alpha {{{\bar{\beta }}}}^2+2{{{\bar{\beta }}}}^2\right) }^{3/2}} \)

-

Excess kurtosis:

\(\displaystyle K (Y){=}\frac{\left( 2{-}\alpha \right) \,\left( {\alpha }^2{{{\bar{\beta }}}}^4{-}10\,\alpha {{{\bar{\beta }}}}^4{-}12\,\alpha {{{\bar{\beta }}}}^2\,{{{{\bar{\gamma }}}}}^2\,\theta {+}24\beta ^4+48{{{\bar{\beta }}}}^2\,{{{{\bar{\gamma }}}}}^2\,\theta {+}12\,{{{{\bar{\gamma }}}}}^4\,{\theta }^2\right) }{2\,\theta \,{\left( 2\,{{{{\bar{\gamma }}}}}^2\,\theta {-}\alpha {{{\bar{\beta }}}}^2+2{{{\bar{\beta }}}}^2\right) }^2} \)

In general, higher moments can be obtained by the cumulants \(c_n(Y)\):

Finally we can provide the proof of Proposition 1.

1.1 Proof of Proposition 1

Proof of Proposition 1

where \(\gamma =(\gamma _1, \gamma _2, \cdots , \gamma _N)^{{\texttt {T}}}\) with \(\gamma _n = \sqrt{1-\beta _n^2 \left( \frac{2-\alpha }{2\theta }\right) }\) and \({{{\mathcal {T}}}}\) is the tempered stable subordinator with parameter \((\alpha ,\theta )\). By Lemma 2,

By Lemma 1, we have

where

and

Also, by (13), we have

Hence, we have

where \(\varSigma _R\) is the covariance matrix of R. \(\square \)

1.2 Proof of Proposition 2

Proof of Proposition 2

By (2), we have

where

Hence, the first derivative of \({{{\bar{\beta }}}}(w)\) and \({{{\bar{\sigma }}}}(w)\) are obtained as follows:

and

Since we have

we obtain

By substituting (16) into (17), we obtain (4).

Since there is \(\delta >0\) such that \(|\phi _\varXi (-u+i\delta )|<\infty \) for all \(u\in {{\mathbb {R}}}\), we have

By (3), we have

By setting \(\psi (z, \alpha , \theta , \beta )=\frac{\partial }{\partial \beta }\log \phi _\mathrm{stdNTS}(z, \alpha , \theta , \beta )\), we can simplify

The characteristic function \(\phi _\mathrm{stdNTS}(u, \alpha , \theta , \beta )\) is equal to

hence we have

As VaR case, CVaR for \(R_P(w)\) is calculated using \(\mathrm{CVaR}\eta (\varXi )\) that

Therefore, we have

and, by (16), we obtain

By substituting \(\mathrm{CVaR}_\eta (\varXi )=\mathrm{CVaR}_\mathrm{stdNTS}(\eta ,\alpha ,\theta ,{{{\bar{\beta }}}}(w))\) into (18), we obtain (5). \(\square \)

Rights and permissions

About this article

Cite this article

Kim, Y.S. Portfolio optimization and marginal contribution to risk on multivariate normal tempered stable model. Ann Oper Res 312, 853–881 (2022). https://doi.org/10.1007/s10479-022-04613-7

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-022-04613-7