Abstract

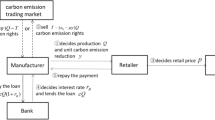

Green product development depends on the green innovation behavior of upstream and downstream companies in the supply chain. This paper focuses on a green supply chain consisting of a supplier and a manufacturer and considers two financing schemes wherein the manufacturer’s operating capital and green innovation capital are both constrained: bank credit financing (BCF) and supplier green investment (SGI). We investigate the financing strategy of a manufacturer with different financing decision preferences and supply chain coordination contract designs. The results show that when the manufacturer’s financing decision preference is low bankruptcy risk, it should choose BCF when the bank loan interest rate is lower than a threshold and SGI when the bank loan interest rate is higher than this threshold; when the manufacturer’s financing decision preference is high R&D benefit, it should choose BCF when the initial capital is lower than another threshold and choose SGI when the initial capital is higher than this threshold. Then, we compare whether cost-sharing, quantity discount and revenue-sharing contracts can coordinate the supply chain, and discuss the selection strategies of supply chain members for coordination contracts. Research shows that revenue-sharing contracts fail to coordinate; however, when the cost-sharing ratio and quantity discount rate are appropriate, both cost-sharing and quantity discount contracts can achieve supply chain coordination. The lower the supplier’s unit production cost, the stronger its motivation to accept a higher cost-sharing ratio and quantity discount rate. For the supplier, the key to choosing any coordination contract lies in the relative height of the cost-sharing ratio and quantity discount rate while the manufacturer should always choose a quantity discount contract when the quantity discount rate is high enough.

Similar content being viewed by others

Abbreviations

- GP :

-

Green-purchasing

- GM :

-

Green-manufacturing

- GSCM :

-

Green supply chain management

- SCF :

-

Supply chain finance

- BCF :

-

Bank credit financing

- TCF :

-

Trade credit financing

- SGI :

-

Supplier green investment

References

Aljazzar, S. M., Jaber, M. Y., & Moussawi-Haidar, L. (2016). Coordination of a three-level supply chain (supplier–manufacturer–retailer) with permissible delay in payments. Applied Mathematical Modelling, 40(21–22), 9594–9614.

Buzacott, J. A., & Zhang, R. Q. (2004). Inventory management with asset-based financing. Management Science, 50(9), 1274–1292.

Cachon, G. P., & Kok, A. G. (2010). Competing manufacturers in a retail supply chain: On contractual form and coordination. Management Science, 56(3), 571–589.

Cao, E. B., Du, L. X., & Ruan, J. H. (2019). Financing preferences and performance for an emission-dependent supply chain: Supplier vs. bank. International Journal of Production Economics, 208, 383–399.

Cao, E. B., & Yu, M. (2019). The bright side of carbon emission permits on supply chain financing and performance. Omega-International Journal of Management Science, 88, 24–39.

Chai, J. W., Qian, Z. F., Wang, F., & Zhu, J. (2021). Process innovation for green product in a closed loop supply chain with remanufacturing. Annals of Operations Research, 8, 1–25.

Chen, Y. (2015). Chinas green financial reform faces five major challenges. http://finance.caijing.com.cn/20151110/4007265.shtml. Accessed 8 August 2020.

Chen, X. F. (2015). A model of trade credit in a capital-constrained distribution channel. International Journal of Production Economics, 159, 347–357.

Chen, X. F., & Wang, A. Y. (2012). Trade credit contract with limited liability in the supply chain with budget constraints. Annals of Operations Research, 196(1), 153–165.

Choi, H., & Suh, J. (2017). Investment financing: Evidence from Korea. Accounting and Finance, 57, 147–184.

Cohen, M. C., Lobel, R., & Perakis, G. (2016). The impact of demand uncertainty on consumer subsidies for green technology adoption. Management Science, 62(5), 1235–1258.

Devalkar, S. K., & Krishnan, H. (2019). The impact of working capital financing costs on the efficiency of trade credit. Production and Operations Management, 28(4), 878–889.

Du, S., Ma, F., Fu, Z., Zhu, L., & Zhang, J. (2015). Game-theoretic analysis for an emission-dependent supply chain in a ‘cap-and-trade’ system. Annals of Operations Research, 228(1), 135–149.

Feng, L., & Chan, Y. L. (2019). Joint pricing and production decisions for new products with learning curve effects under upstream and downstream trade credits. European Journal of Operational Research, 272(3), 905–913.

Gao, J. Z., Xiao, Z. D., Wei, H. X., & Zhou, G. H. (2018). Active or passive? Sustainable manufacturing in the direct-channel green supply chain: A perspective of two types of green product designs. Transportation Research Part D-Transport and Environment, 65, 332–354.

Gu, W. J., Chhajed, D., Petruzzi, N. C., & Yalabik, B. (2015). Quality design and environmental implications of green consumerism in remanufacturing. International Journal of Production Economics, 162, 55–69.

Guo, S., Choi, T. M., & Shen, B. (2020). Green product development under competition: A study of the fashion apparel industry. European Journal of Operational Research, 280(2–3), 523–538.

Hong, Z. F., & Guo, X. L. (2019). Green product supply chain contracts considering environmental responsibilities. Omega-International Journal of Management Science, 83, 155–166.

Huafeng. (2019). Use green products to leverage green upgrades. http://www.huafeng.com/pportal/Project/HuaFon/Web/SearchResult.jsp?key=%C2%CC%C9%AB. Accessed 18 August 2020.

Jing, B., Chen, X. F., & Cai, G. S. (2012). Equilibrium financing in a distribution channel with capital constraint. Production and Operations Management, 21(6), 1090–1101.

Kouvelis, P., & Zhao, W. H. (2012). Financing the newsvendor: Supplier vs. bank, and the structure of optimal trade credit contracts. Operations Research, 60(3), 566–580.

Kouvelis, P., & Zhao, W. H. (2011). The newsvendor problem and price-only contract when bankruptcy costs exist. Production and Operations Management, 20(6), 921–936.

Kouvelis, P., & Zhao, W. H. (2016). Supply chain contract design under financial constraints and bankruptcy costs. Management Science, 62(8), 2341–2357.

Kouvelis, P., & Zhao, W. H. (2018). Who should finance the supply chain? Impact of credit ratings on supply chain decisions. M&Som-Manufacturing & Service Operations Management, 20(1), 19–35.

Lambert, D. M., & Cooper, M. C. (2000). Issues in supply chain management. Industrial Marketing Management, 29(1), 65–83.

Lee, C. H., & Rhee, B. D. (2010). Coordination contracts in the presence of positive inventory financing costs. International Journal of Production Economics, 124(2), 331–339.

Liao, X. C., & Shi, X. P. (2018). Public appeal, environmental regulation and green investment: Evidence from China. Energy Policy, 119, 554–562.

Li, G., Lim, M. K., & Wang, Z. H. (2020). Stakeholders, green manufacturing, and practice performance: Empirical evidence from Chinese fashion businesses. Annals of Operations Research, 290(1–2), 961–982.

Liu, M. Z., Liu, C. H., Ge, M. G., Zhang, Y., & Liu, Z. Q. (2016). The online quality control method for reassembly based on state space model. Journal of Cleaner Production, 137, 644–651.

Li, Y. J., Zhen, X. P., & Cai, X. Q. (2016). Trade credit insurance, capital constraint, and the behavior of manufacturers and banks. Annals of Operations Research, 240(2), 395–414.

Lou, G. X., Lai, Z. X., Ma, H. C., & Fan, T. J. (2020). Coordination in a composite green-product supply chain under different power structures. Industrial Management & Data Systems, 120(6), 1101–1123.

MIIT. (2018). Corporate green supply chain management case compilation (3). http://www.miit.gov.cn/n1146285/n1146352/n3054355/n3057542/n3057545/c6547188/content.html. Accessed 8 August 2020.

Min, H., & Galle, W. P. (2001). Green purchasing practices of US firms. International Journal of Operations & Production Management, 21(9–10), 1222–1238.

Muller, E., & Zimmermann, V. (2009). The importance of equity finance for R&D activity. Small Business Economics, 33(3), 303–318.

Nguyen, J., Donohue, K., & Mehrotra, M. (2019). Closing a supplier’s energy efficiency gap through assessment assistance and procurement commitment. Management Science, 65(1), 122–138.

Palacin-Sanchez, M. J., Canto-Cuevas, F. J., & de Pietro, F. (2019). Trade credit versus bank credit: A simultaneous analysis in European SMEs. Small Business Economics, 53(4), 1079–1096.

Qin, J. J., Zhao, Y. H., & Xia, L. J. (2018). Carbon emission reduction with capital constraint under greening financing and cost sharing contract. International Journal of Environmental Research and Public Health, 15(4), 124.

Savolainen, J., Collan, M., Kylaheiko, K., & Luukka, P. (2017). On the trade-off between the leverage effect and real options thinking: A simulation-based model on metal mining investment. International Journal of Production Economics, 194, 43–51.

Shibin, K. T., Dubey, R., Gunasekaran, A., Hazen, B., Roubauds, D., Gupta, S., et al. (2020). Examining sustainable supply chain management of SMEs using resource based view and institutional theory. Annals of Operations Research, 290(1–2), 301–326.

Sina Finance. (2020). CATL has invested nearly 20 billion in upstream and downstream listed companies, who will it look for? https://baijiahao.baidu.com/s?id=1674913795550661725&wfr=spider&for=pc. Accessed 1 March 2021.

Tate, W. L., Ellram, L. M., & Dooley, K. J. (2012). Environmental purchasing and supplier management (EPSM): Theory and practice. Journal of Purchasing and Supply Management, 18(3), 173–188.

Toptal, A., Ozlu, H., & Konur, D. (2014). Joint decisions on inventory replenishment and emission reduction investment under different emission regulations. International Journal of Production Research, 52(1), 243–269.

Wang, Z. Q., Wang, Q., Lai, Y., & Liang, C. J. (2020). Drivers and outcomes of supply chain finance adoption: An empirical investigation in China. International Journal of Production Economics, 220.

Wuttke, D. A., Blome, C., Heese, H. S., & Protopappa-Sieke, M. (2016). Supply chain finance: Optimal introduction and adoption decisions. International Journal of Production Economics, 178, 72–81.

Wu, D. D., Yang, L. P., & Olson, D. L. (2019). Green supply chain management under capital constraint. International Journal of Production Economics, 215, 3–10.

Wu, D. S., Zhang, B. F., & Baron, O. (2019). A trade credit model with asymmetric competing retailers. Production and Operations Management, 28(1), 206–231.

Xia, L. J., Guo, T. T., Qin, J. J., Yue, X. H., & Zhu, N. (2018). Carbon emission reduction and pricing policies of a supply chain considering reciprocal preferences in cap-and-trade system. Annals of Operations Research, 268(1–2), 149–175.

Xiao, S., Sethi, S. P., Liu, M. Q., & Ma, S. H. (2017). Coordinating contracts for a financially constrained supply chain. Omega-International Journal of Management Science, 72, 71–86.

Xu, S., & Fang, L. (2020). Partial credit guarantee and trade credit in an emission-dependent supply chain with capital constraint. Transportation Research Part E-Logistics and Transportation Review, 135, 101859.

Xu, B., Xu, Q. Y., Bo, Q. S., & Hu, Q. F. (2018). Green product development with consumer heterogeneity under horizontal competition. Sustainability, 10(6), 1902.

Yang, L., Zhang, Q., & Ji, J. N. (2017). Pricing and carbon emission reduction decisions in supply chains with vertical and horizontal cooperation. International Journal of Production Economics, 191, 286–297.

Yan, N. N., He, X. L., & Liu, Y. (2019). Financing the capital-constrained supply chain with loss aversion: Supplier finance vs. supplier investment. Omega-International Journal of Management Science, 88, 162–178.

Yan, N. N., Sun, B. W., Zhang, H., & Liu, C. Q. (2016). A partial credit guarantee contract in a capital-constrained supply chain: Financing equilibrium and coordinating strategy. International Journal of Production Economics, 173, 122–133.

Zhu, W. G., & He, Y. J. (2017). Green product design in supply chains under competition. European Journal of Operational Research, 258(1), 165–180.

Zhu, Q. H., Li, X. Y., & Zhao, S. L. (2018). Cost-sharing models for green product production and marketing in a food supply chain. Industrial Management & Data Systems, 118(4), 654–682.

Zhu, Q. H., & Sarkis, J. (2004). Relationships between operational practices and performance among early adopters of green supply chain management practices in Chinese manufacturing enterprises. Journal of Operations Management, 22(3), 265–289.

Zhu, Q. H., & Sarkis, J. (2006). An inter-sectoral comparison of green supply chain management in China: Drivers and practices. Journal of Cleaner Production, 14(5), 472–486.

Zhu, Q. H., Sarkis, J., Cordeiro, J. J., & Lai, K. H. (2008). Green product design in supply chains under competition. European Journal of Operational Research, 258(1), 165–180.

Acknowledgements

This work was financially supported by the National Natural Science Foundation of China (No. 71972070, No. 71972071) and Fundamental Research Funds for the Central Universities of China.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix A

Appendix A

Proof of Proposition 1

From Eq. (2), we obtain the first-order and second-order derivative of \({{\pi }_{m}}\) with respect to \({{q}_{m}}\).

As \(\frac{\partial {{\pi }_{m}}}{\partial {{q}_{m}}}=0\), we obtain \(\frac{{{\partial }^{2}}{{\pi }_{m}}}{\partial q_{m}^{2}}=-p{\overline{F}}({{q}_{m}},{{g}_{m}})\left[ h({{q}_{m}},{{g}_{m}})-h({{q}_{m,t}},{{g}_{m}})A \right] \), where \(A=\frac{w(1+{{r}_{b}})}{p}\). If the distribution of demand is IFR, the inequality of \(h({{q}_{m}},{{g}_{m}})/h({{q}_{m,t}},{{g}_{m}})>1\) holds for \(f(q_{m}^{{}},g_{m}^{{}})/f(q_{m,t}^{{}},g_{m}^{{}})>1\). As \(A\le 1\), we obtain \(h({{q}_{m}},{{g}_{m}})-h({{q}_{m,t}},{{g}_{m}})A>0\), i.e., \({{\partial }^{2}}{{\pi }_{m}}/\partial q_{m}^{2}\le 0\). From \(\partial {{\pi }_{m}}/\partial {{q}_{m}}=0\), we obtain Eq. (3). From Eq. (2), we obtain the first-order derivative of \({{\pi }_{m}}\) with respect to \({{g}_{m}}\).

From Eqs. (3) and (A.3), we obtain Eq. (4). \(\square \)

Proof of Corollary 1

Using the Implicit Function Derivation Rule to find the partial derivative with respect to w on both sides of \(p\left[ 1-F({{q}_{m}},{{g}_{m}}) \right] \text {=}w(1+{{r}_{b}})\left[ 1-F({{q}_{m,t}},{{g}_{m}}) \right] \), we obtain:

Equation (A.4) can be rewritten as \(\frac{\partial q_{m}^{B*}}{\partial w}=\frac{-{{\phi }^{2}}}{v}\text {+}\frac{A}{w}\frac{\left[ -{\overline{F}}(q_{m,t}^{*},g_{m}^{*}\phi )p+Aq_{m}^{*}f(q_{m,t}^{*},g_{m}^{*}) \right] }{-f(q_{m,t}^{*},g_{m}^{*}){{A}^{2}}+f(q_{m}^{*},g_{m}^{*})}\).

Let \(B=\frac{A}{w}\frac{\left[ -{\overline{F}}(q_{m,t}^{*},g_{m}^{*})p+Aq_{m}^{B*}f(q_{m,t}^{*},g_{m}^{*}) \right] }{-{{A}^{2}}f(q_{m,t}^{*},g_{m}^{*})+f(q_{m}^{*},g_{m}^{*})}=\frac{1-Aq_{m}^{*}h(q_{m,t}^{*},g_{m}^{*})}{w\left[ Ah(q_{m,t}^{*},g_{m}^{*})-h(q_{m}^{*},g_{m}^{*}) \right] }\). Similar to Chen and Wang (2012) and Yan et al. (2016), we can use contradiction to prove \(B<0\). Therefore, we obtain \(\frac{\partial q_{m}^{B*}}{\partial w}<0\).

Using the Implicit Function Derivation Rule to find the partial derivative with respect to M on both sides of \(p\left[ 1-F({{q}_{m}},{{g}_{m}}) \right] \text {=}w(1+{{r}_{b}})\left[ 1-F({{q}_{m,t}},{{g}_{m}}) \right] \), we have:

From Eq. (A.5), we obtain \(\frac{\partial q_{m}^{B*}}{M}=\frac{f(q_{m,t}^{*},g_{m}^{*}){{(1+{{r}_{b}})}^{2}}w}{f(q_{m,t}^{*},g_{m}^{*}){{(1+{{r}_{b}})}^{2}}{{w}^{2}}-f(q_{m}^{*},g_{m}^{*}){{p}^{2}}}<0\).

Using the Implicit Function Derivation Rule to find the partial derivative with respect to \({{g}_{s}}\) on both sides of \(p\left[ 1-F({{q}_{m}},{{g}_{m}}) \right] \text {=}w(1+{{r}_{b}})\left[ 1-F({{q}_{m,t}},{{g}_{m}}) \right] \), we have:

From Eq. (A.6), we obtain \(\frac{\partial q_{m}^{B*}}{\partial {{g}_{s}}}=\frac{\left[ -f(q_{m,t}^{B*},g_{m}^{B*})(1+{{r}_{b}})w+f(q_{m}^{B*},g_{m}^{B*})p \right] p\phi }{-f(q_{m,t}^{B*},g_{m}^{B*}){{(1+{{r}_{b}})}^{2}}{{w}^{2}}+f(q_{m}^{B*},g_{m}^{B*}){{p}^{2}}}>0\). \(\square \)

Proof of Corollary 2

From Eq. (4), we obtain \(\frac{\partial g_{m}^{B*}}{\partial w}=-\frac{\phi }{v}<0\), \(\frac{\partial g_{m}^{B*}}{\partial M}=0\) and \(\frac{\partial g_{m}^{B*}}{\partial {{g}_{s}}}=0\). \(\square \)

Proof of Proposition 2

From Eq. (5), we get the first-order derivative of \({{\pi }_{s}}\) with respect to w

Similar to the prove progress of the Yan et al. (2016) and Yan et al. (2019), we obtain the rational supplier would charge w and no less than \({{{\widehat{c}}}^{B}}\), which guarantees a nonnegative profit for the supplier. We called \({{{\widehat{c}}}^{B}}\) is unit efficient cost under BCF. It should be noted that the unit effective cost under BCF is equal to the unit production cost, i.e., \({{{\widehat{c}}}^{B}}={\widetilde{c}}=c+\frac{kg_{s}^{2}}{2}\). Let \(\frac{\partial \pi _{m}^{{}}}{\partial w}=0\), we have \(w_{{}}^{B*}\text {=}{{{\widehat{c}}}^{B}}-\frac{q_{m}^{B*}}{\partial q_{m}^{B*}/\partial w}\). Substituting \(\frac{\partial q_{m}^{B*}}{\partial w}\) into the above formula, we have the optimal w. \(\square \)

Proof of Proposition 3

Proof of Proposition 3 is similar to Proposition 1. \(\square \)

Proof of Corollary 3

Using the Implicit Function Derivation Rule to find the partial derivative with respect to \(\alpha \) on both sides of \(\alpha p\left[ 1-F({{q}_{m}},{{g}_{m}}) \right] \text {=}w\left[ 1-F({{q}_{m,t}},{{g}_{m}}) \right] \), we have:

Equation (A.8) can be rewritten as:

In order to proof the positive or negative of \(\frac{\partial q_{m}^{S*}}{\partial \alpha }\), we proof the positive or negative of \(\frac{\partial q_{m}^{S*}}{\partial w}\). Taking the partial derivatives of \(\left[ 1-F({{q}_{m}},{{g}_{m}}) \right] ap=w\left[ 1-F({{q}_{m}},{{g}_{m}}) \right] \) with respect to w, we obtain:

Equation (A.10) can be rewritten as \(\frac{\partial q_{m}^{S*}}{\partial w}=\frac{-{{\alpha }^{2}}{{p}^{2}}f(q_{m}^{*},g_{m}^{*}){{\phi }^{2}}+f(q_{m}^{*},g_{m}^{*})w(q_{m}^{*}v+{{\phi }^{2}}w)-\alpha pv{\overline{F}}(q_{m,t}^{*},g_{m}^{*})}{v{{\alpha }^{2}}{{p}^{2}}f(q_{m}^{*},g_{m}^{*})-f(q_{m,t}^{*},g_{m}^{*}){{w}^{2}}v}\). Similar to the proof progress of \(\frac{\partial q_{m}^{B*}}{\partial w}\), we obtain \(\frac{\partial q_{m}^{S*}}{\partial w}<0\), i.e., \(\alpha p{\overline{F}}(q_{m,t}^{*},g_{m}^{*})-f(q_{m}^{*},g_{m}^{*})wq_{m}^{*}>0\).

From \(2{{\alpha }^{2}}{{p}^{2}}v{\overline{F}}(q_{m}^{*},g_{m}^{*})>2f(q_{m}^{*},g_{m}^{*})v{{w}^{2}}q_{m}^{*}\) and \(2{{\alpha }^{3}}{{p}^{3}}f(q_{m}^{*},g_{m}^{*}){{\phi }^{2}}>({{\alpha }^{2}}{{p}^{2}}w+{{w}^{3}}){{\phi }^{2}}f(q_{m,t}^{*},g_{m}^{*})\), we obtain \(\frac{\partial q_{m}^{S*}}{\partial \alpha }>0\). From Eq. (10), we obtain \(\frac{\partial g_{m}^{*}}{\partial \alpha }=\frac{p\phi }{v}>0\). \(\square \)

Proof of Proposition 4

From Eq. (11), we obtain the first-order derivative of \({{\pi }_{s}}\) with respect to w:

From Eqs. (7), (A.11) can be rewritten as

Let \(\left[ 1-\frac{F(q_{m,t}^{*},g_{m}^{*})}{\alpha } \right] \text {=}\eta \) and \({{{\widehat{c}}}^{S}}=\frac{{\widetilde{c}}}{1-\frac{F(q_{m,t}^{*},g_{m}^{*})}{\alpha }}\text {+}\frac{F(q_{m,t}^{*},g_{m}^{*})}{1-\frac{F(q_{m,t}^{*},g_{m}^{*})}{\alpha }}\frac{\frac{w{{\phi }^{2}}}{\alpha v}}{\frac{\partial q_{m}^{*}}{\partial w}}-\frac{\frac{\text {(}1-\alpha )}{\alpha }\frac{\partial \pi _{m}^{{}}}{\partial {{q}_{m}}}}{1-\frac{F(q_{m,t}^{*},g_{m}^{*})}{\alpha }}\), the above equation can be rewritten as \(\frac{\partial \pi _{s}^{S}}{\partial w}\text {=}\eta q_{m}^{*}+\frac{\partial q_{m}^{*}}{\partial w}\eta (w-{{{\widehat{c}}}^{S}})\). It is straight that \(0<\eta <1\). Therefore, the rational manufacturer would charge w no less than \({{{\widehat{c}}}^{S}}\) when \({{{\widehat{c}}}^{S}}>{\widetilde{c}}\). From the first-order condition of \(\frac{\partial \pi _{s}^{S}}{\partial w}\text {=}0\), we finally get the optimal w. \(\square \)

Proof of Corollary 4

By comparing the bankruptcy threshold of supplier in BCF and SGI scenarios, we obtain:

From Eq. (A.13), we obtain \(\frac{\partial (q_{m,t}^{B}-q_{m,t}^{S})}{\partial {{r}_{b}}}\text {=}\frac{wq_{m}^{B*}-M+\frac{v{{(g_{m}^{B\text {*}})}^{2}}}{2}}{p}+\frac{(w\frac{\partial q_{m}^{B*}}{\partial {{r}_{b}}}+vg_{m}^{B\text {*}}\frac{\partial g_{m}^{B*}}{\partial {{r}_{b}}})(1+{{r}_{b}})}{p}\) . To determine the monotony of \(\frac{\partial (q_{m,t}^{B}-q_{m,t}^{S})}{\partial {{r}_{b}}}\), we need to determine the monotony of \(\frac{\partial q_{m}^{B*}}{\partial {{r}_{b}}}\).

Taking the partial derivatives of \(\left[ 1-F({{q}_{m}},{{g}_{m}}) \right] p=w(1+{{r}_{b}})\left[ 1-F({{q}_{m,t}},{{g}_{m}}) \right] \) with respect to \({{r}_{b}}\), we obtain:

Therefore, \(\frac{\partial q_{m}^{B*}}{\partial {{r}_{b}}}=\frac{\left[ -2{{p}^{3}}f(q_{m}^{B*},g_{m}^{B*}){{\phi }^{2}}-2p{{(1+{{r}_{b}})}^{2}}vw{\overline{F}}(q_{m,t}^{B*},g_{m}^{B*}) \right] +f(q_{m,t}^{B*},g_{m}^{B\text {*}})(1+{{r}_{b}})w\left[ {{p}^{2}}{{\phi }^{2}}-{{(1+{{r}_{b}})}^{2}}(2Mv-2wq_{m}^{B*}v-{{\phi }^{2}}{{w}^{2}}) \right] }{2{{(1+{{r}_{b}})}^{2}}v\left[ f(q_{m}^{B*},g_{m}^{B*})-f(q_{m,t}^{B*},g_{m}^{B*}){{w}^{2}}{{(1+{{r}_{b}})}^{2}} \right] }\). From \(\frac{\partial q_{m}^{B*}}{\partial w}<0\), we obtain \(f(q_{m,t}^{B*},g_{m}^{B*})w{{(1+{{r}_{b}})}^{2}}q_{m}^{B*}v-(1+{{r}_{b}})vp{\overline{F}}(q_{m,t}^{B*},g_{m}^{B*})<0\). Multiply the above formula by \(2w(1+{{r}_{b}})\), we have \(f(q_{m,t}^{B*},g_{m}^{B*})2{{w}^{2}}{{(1+{{r}_{b}})}^{3}}q_{m}^{B*}v-{{(1+{{r}_{b}})}^{2}}wvp{\overline{F}}(q_{m,t}^{B*},g_{m}^{B*})<0\), i.e., \(f(q_{m,t}^{B*},g_{m}^{B*})2w{{(1+{{r}_{b}})}^{3}}(wq_{m}^{B*}-M)v-{{(1+{{r}_{b}})}^{2}}wvp{\overline{F}}(q_{m,t}^{B*},g_{m}^{B*})<0\). In addition, since \(-2f(q_{m}^{B*},g_{m}^{B*}){{p}^{3}}{{\phi }^{2}}+f(q_{m,t}^{B*},g_{m}^{B*})(1+{{r}_{b}})w{{\phi }^{2}}\left[ {{p}^{2}}+{{w}^{2}}{{(1+{{r}_{b}})}^{2}} \right] <0\), we finally obtain \(\frac{\partial q_{m}^{B*}}{\partial {{r}_{b}}}<0\).

Since \(\frac{\partial q_{m}^{B*}}{\partial {{r}_{b}}}<0\) and \(\frac{\partial g_{m}^{B*}}{\partial {{r}_{b}}}<0\), we obtain that \(\frac{\partial (q_{m,t}^{B}-q_{m,t}^{S})}{\partial {{r}_{b}}}=0\) has at most one solution in the domain of \({{r}_{b}}\). Therefore, \(q_{m,t}^{B}-q_{m,t}^{S}\text {=}0\) has at most two solution in the domain of \({{r}_{b}}\). Let \(q_{m,t}^{B}-q_{m,t}^{S}\text {=}0\), we have \({{r}_{b}}<\widehat{{{r}_{b}}}({{r}_{b}})\), then \(q_{m,t}^{B}<q_{m,t}^{S}\) and \({{r}_{b}}>\widehat{{{r}_{b}}}({{r}_{b}})\), then \(q_{m,t}^{B}>q_{m,t}^{S}\); where \(\widehat{{{r}_{b}}}=\frac{2M-2\alpha M+\alpha v{{(g_{m}^{B*})}^{2}}-v{{(g_{m}^{S*})}^{2}}+2\alpha q_{m}^{B*}w-2q_{m}^{S*}w}{2\alpha M-\alpha v{{(g_{m}^{B*})}^{2}}-2\alpha q_{m}^{B*}w}\). \(\square \)

Proof of Corollary 5

By comparing the profit of manufacturer in BCF and SGI scenarios, we obtain

Equation (A.15) can be rewritten as:

Since \(\frac{\partial (q_{m}^{B*}-q_{m,t}^{B*})}{\partial M}=\frac{\partial q_{m}^{B*}}{\partial M}-\frac{\partial q_{m}^{B*}}{\partial M}\frac{w(1+{{r}_{b}})}{p}+\frac{1}{p}>0\) and \(\frac{\partial (q_{m}^{S*}-q_{m,t}^{S*})}{\partial M}=\frac{\partial q_{m}^{S*}}{\partial M}-\frac{\partial q_{m}^{S*}}{\partial M}\frac{w}{\alpha p}+\frac{1}{\alpha p}>0\), we have \(\frac{\partial (\pi _{m}^{B}-\pi _{m}^{S})}{\partial M}\) has at most one solution in the domain of M. Therefore, \(\pi _{m}^{B}-\pi _{m}^{S}\text {=}0\) has at most two solution in the domain of M. Let \(\pi _{m}^{B}-\pi _{m}^{S}\text {=}0\), we have \(M>{\widehat{M}}(M)\), then \(\pi _{m}^{B*}<\pi _{m}^{S*}\) and \(M<{\widehat{M}}(M)\) then \(\pi _{m}^{B*}>\pi _{m}^{S*}\); where \({\widehat{M}}=p\left[ \int _{q_{m,t}^{B*}-({{g}_{s}}+g_{m}^{B*})\phi }^{q_{m}^{B*}-({{g}_{s}}+g_{m}^{B*})\phi }{F(x)dx}-q_{m}^{B*}+q_{m,t}^{B*}-\alpha (\int _{q_{m,t}^{S*}-({{g}_{s}}+g_{m}^{S*})\phi }^{q_{m}^{S*}-({{g}_{s}}+g_{m}^{S*})\phi }{F(x)dx}-q_{m}^{S*}+q_{m,t}^{S*}) \right] /(\alpha -1)\).

Proof of Corollary 6

For the B-CS scenario, we obtain \(\frac{\partial g_{m}^{B-CS*}}{\partial \theta }=\frac{\phi (w+{{r}_{b}}w-p)}{(1+{{r}_{b}}){{\theta }^{2}}v}<0\). Using the Implicit Function Derivation Rule to find the partial derivative with respect to \(\theta \) on both sides of \(p\left[ 1-F\left[ {{q}_{m}}-({{g}_{s}}+{{g}_{m}})\phi \right] \right] \text {=}w(1+{{r}_{b}})\left[ 1-F\left[ {{q}_{m,t}}-({{g}_{s}}+{{g}_{m}})\phi \right] \right] \), we have:

Therefore, \(\frac{\partial q_{m}^{B-CS*}}{\partial \theta }\text {=}\frac{{{\phi }^{2}}(-p+w+{{r}_{b}}w)\left[ -2{{p}^{2}}f(q_{m}^{B-CS*},g_{m}^{B-CS*})+f(q_{m,t}^{B-CS*},g_{m}^{B-CS*})w(p+w+{{r}_{b}}w) \right] }{2(1+{{r}_{b}}){{\theta }^{2}}v\left[ -{{p}^{2}}f(q_{m}^{B-CS*},g_{m}^{B-CS*})+f(q_{m,t}^{B-CS*},g_{m}^{B-CS*}){{w}^{2}}{{(1+{{r}_{b}})}^{2}} \right] }<0\) and \(\frac{\partial q_{m,t}^{B-CS*}}{\partial \theta }=\frac{p{{\phi }^{2}}f(q_{m}^{B-CS*},g_{m}^{B-CS*}){{\left[ p-(1+{{r}_{b}})w \right] }^{2}}}{(1+{{r}_{b}}){{\theta }^{3}}v\left[ -{{p}^{2}}f(q_{m}^{B-CS*},g_{m}^{B-CS*})+f(q_{m,t}^{B-CS*},g_{m}^{B-CS*}){{w}^{2}}{{(1+{{r}_{b}})}^{2}} \right] }<0\). Therefore, we obtain \(\frac{\partial g_{m}^{B-CS*}}{\partial (1-\theta )}>0\), \(\frac{\partial q_{m}^{B-CS*}}{\partial (1-\theta )}>0\), and \(\frac{\partial q_{m,t}^{B-CS*}}{\partial (1-\theta )}>0\).

For the S-CS scenario, we can also obtain \(\frac{\partial g_{m}^{S-CS*}}{\partial (1-\theta )}>0\), \(\frac{\partial q_{m}^{S-CS*}}{\partial (1-\theta )}>0\), and \(\frac{\partial q_{m,t}^{S-CS*}}{\partial (1-\theta )}>0\). \(\square \)

Proof of Corollary 7

For the B-QD scenario, we have \(\frac{\partial g_{m}^{B-QD*}}{\partial b}=\frac{2\phi ({{q}_{m}}+b\partial {{q}_{m}}/\partial b)}{v}\). Using the Implicit Function Derivation Rule, we find the partial derivative with respect to b on both sides of \(p\left[ 1-F({{q}_{m}},{{g}_{m}}) \right] \text {=(}w-2{{q}_{m}}b)(1+{{r}_{b}})\left[ 1-F({{q}_{m,t}},{{g}_{m}}) \right] \). Therefore, we obtain

From Eq. (A.18), we obtain \(\frac{\partial q_{m}^{B-QD*}}{\partial b}>0\), and then \(\frac{\partial g_{m}^{B-QD*}}{\partial b}=2\phi ({{q}_{m}}+b\frac{\partial {{q}_{m}}}{\partial b})/v>0\). From Eq. (20), we obtain \(\frac{\partial q_{m}^{B-QD*}}{{{q}_{m}}}=\frac{(w-2q_{m}^{B-QD*})(1+{{r}_{b}})}{p}\). For the S-QD scenario, we also have \(\frac{\partial q_{m}^{S-QD*}}{\partial b}>0\), \(\frac{\partial g_{m}^{S-QD*}}{\partial b}>0\) and \(\frac{\partial q_{m}^{S-QD*}}{{{q}_{m}}}=\frac{(w-2q_{m}^{S-QD*})}{\alpha p}\). \(\square \)

Proof of Table 3

From Eq. (13), we obtain the Hessian matrix:

\(H=\left[ \begin{array}{ll} \frac{{{\partial }^{2}}\pi _{sc}^{{}}}{\partial q_{m}^{2}} &{} \frac{{{\partial }^{2}}\pi _{sc}^{{}}}{\partial {{q}_{m}}\partial {{g}_{m}}} \\ \frac{{{\partial }^{2}}\pi _{sc}^{{}}}{\partial {{g}_{m}}\partial {{q}_{m}}} &{} \frac{{{\partial }^{2}}\pi _{sc}^{{}}}{\partial g_{m}^{2}} \\ \end{array} \right] \text {=}\left[ \begin{array}{ll} -pf(q_{m}^{C},g_{m}^{C}) &{} p\phi f(q_{m}^{C},g_{m}^{C}) \\ p\phi f(q_{m}^{C},g_{m}^{C}) &{} -p{{\phi }^{2}}f(q_{m}^{C},g_{m}^{C})-v \\ \end{array} \right] =vpf(q_{m}^{C},g_{m}^{C})>0\). Therefore, H is negative definite. From \(\frac{\partial \pi _{sc}^{C}}{\partial {{q}_{m}}}=0\) and \(\frac{\partial \pi _{sc}^{C}}{\partial {{q}_{m}}}=0\), we obtained optimal greenness and order quantity in the centralized scenario. The rest of the proof is similar to Proposition 1 and Proposition 2. The wholesale prices in different scenarios are as follows:

\({{w}^{B-CS*}}={{{\widehat{c}}}^{B-CS}}+\frac{q_{m}^{*}\theta v\left[ f(q_{m}^{*},g_{m}^{*}){{p}^{2}}-f(q_{m,t}^{*},g_{m}^{*}){{w}^{2}}{{(1+{{r}_{b}})}^{2}} \right] }{(1+{{r}_{b}})pv\theta {\overline{F}}(q_{m,t}^{*},g_{m}^{*})+f(q_{m}^{*},g_{m}^{*}){{p}^{2}}{{\phi }^{2}}-f(q_{m,t}^{*},g_{m}^{*})w{{(1+{{r}_{b}})}^{2}}(q_{m}^{*}v\theta +{{\phi }^{2}}w)}\), \({{w}^{B-QD*}}={{{\widehat{c}}}^{B-QD}}+\frac{q_{m}^{*}\left[ (v-2b{{\phi }^{2}})\left[ f(q_{m}^{*},g_{m}^{*}){{p}^{2}}-f(q_{m,t}^{*},g_{m}^{*}){{(w-2bq_{m}^{*})}^{2}}{{(1+{{r}_{b}})}^{2}} \right] -2bp(1+{{r}_{b}})v{\overline{F}}(q_{m,t}^{*},g_{m}^{*}) \right] }{(1+{{r}_{b}})pv{\overline{F}}(q_{m,t}^{*},g_{m}^{*})+f(q_{m}^{*},g_{m}^{*}){{p}^{2}}{{\phi }^{2}}-f(q_{m,t}^{*},g_{m}^{*})(w-2bq_{m}^{*}){{(1+{{r}_{b}})}^{2}}(q_{m}^{*}v+{{\phi }^{2}}w-2b{{\phi }^{2}}q_{m}^{*})}\), \({{w}^{S-CS*}}={{{\widehat{c}}}^{S-CS}}+\frac{q_{m}^{*}\theta v\left[ f(q_{m}^{*},g_{m}^{*}){{\alpha }^{2}}{{p}^{2}}-f(q_{m,t}^{*},g_{m}^{*}){{w}^{2}} \right] }{\alpha pv\theta {\overline{F}}(q_{m,t}^{*},g_{m}^{*})+f(q_{m}^{*},g_{m}^{*}){{\alpha }^{2}}{{p}^{2}}{{\phi }^{2}}-f(q_{m,t}^{*},g_{m}^{*})w(q_{m}^{*}\theta v+{{\phi }^{2}}w)}\) and \({{w}^{S-QD*}}={{{\widehat{c}}}^{S-QD}}+\frac{q_{m}^{*}\left[ (v-2b{{\phi }^{2}})\left[ f(q_{m}^{*},g_{m}^{*}){{\alpha }^{2}}{{p}^{2}}-f(q_{m,t}^{*},g_{m}^{*}){{(w-2bq_{m}^{*})}^{2}} \right] -2bp\alpha v{\overline{F}}(q_{m,t}^{*},g_{m}^{*}) \right] }{\alpha pv{\overline{F}}(q_{m,t}^{*},g_{m}^{*})+f(q_{m}^{*},g_{m}^{*}){{\alpha }^{2}}{{p}^{2}}{{\phi }^{2}}-f(q_{m,t}^{*},g_{m}^{*})(w-2bq_{m}^{*})(q_{m}^{*}v+{{\phi }^{2}}w-2b{{\phi }^{2}}q_{m}^{*})}\); where \({{{\widehat{c}}}^{B-CS}}\text {=}{\widetilde{c}}-\frac{{{\phi }^{2}}(1-\theta )\left[ p-w(1+{{r}_{b}}) \right] }{(1+{{r}_{b}}){{\theta }^{2}}v}/\frac{\partial q_{m}^{*}}{\partial w}\), \({{{\widehat{c}}}^{B-QD}}\text {=}{\widetilde{c}}+2b{{q}_{m}}\), \({{{\widehat{c}}}^{S-CS}}=\frac{{\widetilde{c}}}{1-\frac{F(q_{m,t}^{*},g_{m}^{*})}{\alpha }}\text {+}\frac{F(q_{m,t}^{*},g_{m}^{*})\frac{w{{\phi }^{2}}}{\alpha \theta v}-\frac{{{\phi }^{2}}\left( 1-\theta \right) \left[ \alpha p-w \right] }{{{\theta }^{2}}v}}{1-\frac{F(q_{m,t}^{*},g_{m}^{*})}{\alpha }}/\frac{\partial q_{m}^{*}}{\partial w}-\frac{\frac{\text {(}1-\alpha )}{\alpha }\frac{\partial \pi _{m}^{{}}}{\partial {{q}_{m}}}}{1-\frac{F(q_{m,t}^{*},g_{m}^{*})}{\alpha }}\) and \({{{\widehat{c}}}^{S-QD}}=\frac{{\widetilde{c}}+2bq_{m}^{*}-2bq_{m}^{*}F(q_{m,t}^{*},g_{m}^{*})/a}{1-\frac{F(q_{m,t}^{*},g_{m}^{*})}{\alpha }}\text {+}\frac{F(q_{m,t}^{*},g_{m}^{*})\left[ \frac{vg_{m}^{*}}{\alpha }-p\phi \right] \frac{\partial g_{m}^{*}}{\partial w}}{1-\frac{F(q_{m,t}^{*},g_{m}^{*})}{\alpha }}/\frac{\partial q_{m}^{*}}{\partial w}-\frac{\frac{\text {(}1-\alpha )}{\alpha }\frac{\partial \pi _{m}^{{}}}{\partial {{q}_{m}}}}{1-\frac{F(q_{m,t}^{*},g_{m}^{*})}{\alpha }}\). \(\square \)

Proof of Corollary 8 and Corollary 9

By comparing the profit of supplier in B and B-CS scenarios, we obtain

We can check that the RHS is increasing with \({\widetilde{c}}\) i.e., \(\frac{\partial (\pi _{s}^{B}-\pi _{s}^{B-CS})}{\partial {\widetilde{c}}}\text {=}q_{m}^{B-CS*}-q_{m}^{B*}>0\) since \(\frac{\partial q_{m}^{B-CS*}}{\partial (1-\theta )}>0\). Furthermore, \(\pi _{s}^{B}-\pi _{s}^{B-CS}\) equals to zero when \({{{\overline{c}}}^{B-CS}}={\frac{{{(g_{m}^{B-CS*})}^{2}}(1-\theta )v+2(q_{m}^{B*}-q_{m}^{B-CS*})w}{2(q_{m}^{B*}-q_{m}^{B-CS*})w}}\), where \({{{\overline{c}}}^{B-CS}}>\frac{kg_{s}^{2}}{2}\). Hence, when \({\widetilde{c}}>{{{\overline{c}}}^{B-CS}}\), \(\pi _{s}^{B-CS}<\pi _{s}^{B}\) and when \({\widetilde{c}}<{{{\overline{c}}}^{B-CS}}\), \(\pi _{s}^{B-CS}>\pi _{s}^{B}\).

By comparing the profit of supplier in S and S-CS scenarios, we obtain

We can check that the RHS is increasing with \({\widetilde{c}}\) i.e., \(\frac{\partial (\pi _{s}^{S}-\pi _{s}^{S-CS})}{\partial {\widetilde{c}}}\text {=}q_{m}^{S-CS*}-q_{m}^{S*}>0\) since \(\frac{\partial q_{m}^{S-CS*}}{\partial (1-\theta )}>0\). Furthermore, \(\pi _{s}^{S}-\pi _{s}^{S-CS}\) equals to zero when  , where \({{{\overline{c}}}^{S-CS}}>\frac{kg_{s}^{2}}{2}\). Hence, when \({\widetilde{c}}>{{{\overline{c}}}^{S-CS}}\), \(\pi _{s}^{S-CS}<\pi _{s}^{S}\) and when \({\widetilde{c}}<{{{\overline{c}}}^{S-CS}}\), \(\pi _{s}^{S-CS}>\pi _{s}^{S}\).

, where \({{{\overline{c}}}^{S-CS}}>\frac{kg_{s}^{2}}{2}\). Hence, when \({\widetilde{c}}>{{{\overline{c}}}^{S-CS}}\), \(\pi _{s}^{S-CS}<\pi _{s}^{S}\) and when \({\widetilde{c}}<{{{\overline{c}}}^{S-CS}}\), \(\pi _{s}^{S-CS}>\pi _{s}^{S}\).

By comparing the profit of supplier in B and B-QD scenarios, we obtain

We can check that the RHS is increasing with \({\widetilde{c}}\) i.e., \(\frac{\partial (\pi _{s}^{B}-\pi _{s}^{B-QD})}{\partial {\widetilde{c}}}\text {=}q_{m}^{B-QD*}-q_{m}^{B*}>0\) since \(\frac{\partial q_{m}^{B-QD*}}{\partial b}>0\). Furthermore, \(\pi _{s}^{B}-\pi _{s}^{B-QD}\) equals to zero when \({{{\overline{c}}}^{B-QD}}=\frac{b{{(q_{m}^{B-QD*})}^{2}}+(q_{m}^{B*}-q_{m}^{B-QD*})w}{(q_{m}^{B*}-q_{m}^{B-QD*})}\), where \({{{\overline{c}}}^{B-QD}}>\frac{kg_{s}^{2}}{2}\). Hence, when \({\widetilde{c}}>{{{\overline{c}}}^{B-QD}}\), \(\pi _{s}^{B-CS}<\pi _{s}^{B}\) and when \({\widetilde{c}}<{{{\overline{c}}}^{B-QD}}\), \(\pi _{s}^{B-QD}>\pi _{s}^{B}\).

By comparing the profit of supplier in S and S-QD scenarios, we obtain

We can check that the RHS is increasing with \({\widetilde{c}}\) i.e., \(\frac{\partial (\pi _{s}^{S}-\pi _{s}^{S-QD})}{\partial {\widetilde{c}}}\text {=}q_{m}^{S-QD*}-q_{m}^{S*}>0\) since \(\frac{\partial q_{m}^{S-QD*}}{\partial b}>0\). Furthermore, \(\pi _{s}^{S}-\pi _{s}^{S-QD}\) equals to zero when

where \({{{\overline{c}}}^{S-QD}}>\frac{kg_{s}^{2}}{2}\). Hence, when \({\widetilde{c}}>{{{\overline{c}}}^{S-QD}}\), \(\pi _{s}^{S-QD}<\pi _{s}^{S}\) and when \({\widetilde{c}}<{{{\overline{c}}}^{S-QD}}\), \(\pi _{s}^{S-QD}>\pi _{s}^{S}\). \(\square \)

Proof of Corollary 10

From Eq. (A.19), we obtain \(\frac{\partial (\pi _{s}^{B}-\pi _{s}^{B-CS})}{\partial (1-\theta )}\text {=}-(w-{\widetilde{c}})\frac{\partial q_{m}^{B-CS*}}{\partial (1-\theta )}\text {+}\frac{v{{(g_{m}^{B-CS*})}^{2}}}{2}+vg_{m}^{B-CS*}(1-\theta )\frac{\partial g_{m}^{B-CS*}}{\partial (1-\theta )}\). Since \(\frac{\partial q_{m}^{B-CS*}}{\partial (1-\theta )}>0\) and \(\frac{\partial g_{m}^{B-CS*}}{\partial (1-\theta )}>0\), we obtain that when \(0<(1-\theta )<1\), \(\frac{\partial (\pi _{s}^{B}-\pi _{s}^{B-CS})}{\partial (1-\theta )}\text {=}0\) has at most one solution. From \({{{\overline{c}}}^{B-CS}}\), we obtain that for a given \({\widetilde{c}}\) and \({\widetilde{c}}>\frac{kg_{s}^{2}}{2}\), GM cost proportion borne by the supplier that makes the B-CS coordinated contract establishment should satisfy \(0<1-\theta <Min[{{\overline{1-\theta }}^{B-CS}},1]\), where \({{\overline{1-\theta }}^{B-CS}}\text {=}\frac{2(w-{\widetilde{c}})(q_{m}^{B-CS*}-q_{m}^{B*})}{{{(g_{m}^{B-CS*})}^{2}}v}\).

Smiliar to the above proof process, we also obtain GM cost proportion borne by the supplier that makes the S-CS coordinated contract establishment should satisfy \(0<1-\theta <Min[{{\overline{1-\theta }}^{S-CS}},1]\), where

From Eq. (A.21), we obtain \(\frac{\partial (\pi _{s}^{B}-\pi _{s}^{B-QD})}{\partial b}\text {=}(w-bq_{m}^{B-QD*}-{\widetilde{c}})\frac{\partial q_{m}^{B-QD*}}{\partial b}-{{(q_{m}^{B-QD*})}^{2}}-bq_{m}^{B-QD*}\frac{\partial q_{m}^{B-QD*}}{\partial b}\). Since \(\frac{\partial q_{m}^{B-QD*}}{\partial b}>0\), we obtain that when \(0<b<\frac{w-{\widetilde{c}}}{q_{m}^{B-QD*}}\), \(\frac{\partial (\pi _{s}^{B}-\pi _{s}^{B-QD})}{\partial b}\text {=}0\) has at most one solution. From \({{{\overline{c}}}^{B-QD}}\), we obtain that for a given \({\widetilde{c}}\) and \({\widetilde{c}}>\frac{kg_{s}^{2}}{2}\), the quantity discount rate that makes the B-QD coordinated contract establishment should satisfy \(0<b<Min[{{{\overline{b}}}^{B-QD}},\frac{w-{\widetilde{c}}}{q_{m}^{B-QD*}}]\), where \({{{\overline{b}}}^{B-QD}}=\frac{(w-{\widetilde{c}})(q_{m}^{B-QD*}-q_{m}^{B*})}{{{(q_{m}^{B-QD*})}^{2}}}\).

Smiliar to the above proof process, we also obtain the quantity discount rate that makes the S-QD coordinated contract establishment should satisfy \(0<b<Min[{{{\overline{b}}}^{S-QD}},\frac{w-{\widetilde{c}}}{q_{m}^{B-QD*}}]\), where

By comparing the profit of supplier in B-CS and B-QD scenarios, we obtain:

From Eq. (A.23), we obtain \(\frac{\partial (\pi _{s}^{B-CS}-\pi _{s}^{B-QD})}{\partial (1-\theta )}\text {=}(w-{\widetilde{c}})\frac{\partial q_{m}^{B-CS*}}{\partial (1-\theta )}-\frac{v{{(g_{m}^{B-CS*})}^{2}}}{2}-vg_{m}^{B-CS*}(1-\theta )\frac{\partial g_{m}^{B-CS*}}{\partial (1-\theta )}\). Since \(\frac{\partial q_{m}^{B-CS*}}{\partial (1-\theta )}\) and \(\frac{\partial g_{m}^{B-CS*}}{\partial (1-\theta )}>0\), we obtain that \(\frac{\partial (\pi _{s}^{B-CS}-\pi _{s}^{B-QD})}{\partial (1-\theta )}\text {=}0\) has at most one solution in the domain. Therefore, \(\pi _{s}^{B-CS}-\pi _{s}^{B-QD}\) has at most two solution in the domain of \((1-\theta )\). Furthermore, \(\pi _{s}^{B-CS}-\pi _{s}^{B-QD}\) equals to zero when \({{\widetilde{1-\theta }}^{B}}=\frac{2\left[ b{{(q_{m}^{B-QD*})}^{2}}+(w-{\widetilde{c}})(q_{m}^{B-CS*}-q_{m}^{B-QD*}) \right] }{{{(g_{m}^{B-CS*})}^{2}}v}\). Hence, if \(1-\theta <\widetilde{1-\theta }{{(1-\theta ,b)}^{B}}\), \(\pi _{s}^{B-CS}>\pi _{s}^{B-QD}\) and if \(1-\theta >\widetilde{1-\theta }{{(1-\theta ,b)}^{B}}\), \(\pi _{s}^{B-CS}<\pi _{s}^{B-QD}\).

By comparing the profit of supplier in S-CS and S-QD scenarios, we obtain:

From Eq. (A.24), we obtain

Since \(\frac{\partial q_{m}^{S-CS*}}{\partial (1-\theta )}>0\), \(\frac{\partial g_{m}^{S-CS*}}{\partial (1-\theta )}>0\), \(\frac{\partial q_{m}^{S-CS*}}{\partial (1-\theta )}>\frac{\partial g_{m}^{S-CS*}}{\partial (1-\theta )}\) and \(0<F(q_{m}^{S-CS*},g_{m}^{S-CS*})-F(q_{m,t}^{S-CS*},g_{m}^{S-CS*})<1\), we obtain \(\frac{\partial (\pi _{s}^{S-CS}-\pi _{s}^{S-QD})}{\partial (1-\theta )}\text {=}0\) has at most one solution in the domain. Therefore, \(\pi _{s}^{S-CS}-\pi _{s}^{S-QD}\) has at most two solution in the domain of \((1-\theta )\). Furthermore, \(\pi _{s}^{S-CS}-\pi _{s}^{S-QD}\) equals to zero when

Hence, if \(1-\theta <\widetilde{1-\theta }{{(1-\theta ,b)}^{S}}\), \(\pi _{s}^{S-CS}>\pi _{s}^{S-QD}\) and if \(1-\theta >\widetilde{1-\theta }{{(1-\theta ,b)}^{S}}\), \(\pi _{s}^{S-CS}<\pi _{s}^{S-QD}.\) \(\square \)

Rights and permissions

About this article

Cite this article

Lai, Z., Lou, G., Zhang, T. et al. Financing and coordination strategies for a manufacturer with limited operating and green innovation capital: bank credit financing versus supplier green investment. Ann Oper Res 331, 85–119 (2023). https://doi.org/10.1007/s10479-021-04098-w

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-021-04098-w