Abstract

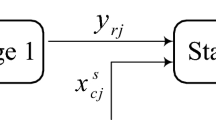

This study proposes a two-stage data envelopment analysis model based on the meta-frontier boundary and intermediate output goal setting. Comparing to the traditional models, the proposed model is able not only to consider technology heterogeneity of decision making units, but also to target the intermediate output. The proposed model was applied to an analysis of 28 Chinese commercial banks (CCBs). Empirical analysis has obtained some valuable research results. First, the efficiency of the CCBs’ deposit sub-system is not very high, especially in terms of the deposit efficiency of city commercial banks (CBs). Second, in the deposit sub-system, the efficiency gap among state-owned commercial banks (SBs) is higher than the joint stock commercial banks (JBs) and the CBs. Third, in the loan sub-system, the efficiency gap among SBs and CBs is higher than that in the JBs. Fourth, the deposits of more than half of CCBs are not on the frontier of efficiency, showing that the financial resource allocation of CCBs is severely ineffective. Finally, this study divides CCBs into four categories and provides specific recommendations to improve performance and deposit target setting.

Similar content being viewed by others

References

Avkiran, N. K. (2011). Association of DEA super-efficiency estimates with financial ratios: Investigating the case for Chinese banks. Omega,39(3), 323–334.

Charles, V., Tsolas, I. E., & Gherman, T. (2018). Satisficing data envelopment analysis: a Bayesian approach for peer mining in the banking sector. Annals of Operations Research,269(1–2), 81–102.

Chen, Y., Cook, W. D., Li, N., & Zhu, J. (2009). Additive efficiency decomposition in two-stage DEA. European Journal of Operational Research,196(3), 1170–1176.

Chen, Y., Li, Y., Liang, L., Salo, A., & Wu, H. (2016). Frontier projection and efficiency decomposition in two-stage processes with slacks-based measures. European Journal of Operational Research,250(2), 543–554.

Chen, Y. C., Chiu, Y. H., Huang, C. W., & Tu, C. H. (2013). The analysis of bank business performance and market risk—Applying fuzzy DEA. Economic Modelling,32, 225–232.

Chiu, C. R., Liou, J. L., Wu, P. I., & Fang, C. L. (2012). Decomposition of the environmental inefficiency of the meta-frontier with undesirable output. Energy Economics,34(5), 1392–1399.

Ding, T., Chen, Y., Wu, H., & Wei, Y. (2017). Centralized fixed cost and resource allocation considering technology heterogeneity: A DEA approach. Annals of Operations Research,268, 1–15.

Färe, R., & Grosskopf, S. (2010). Directional distance functions and slacks-based measures of efficiency. European Journal of Operational Research,200(1), 320–322.

Fukuyama, H., & Matousek, R. (2011). Efficiency of Turkish banking: Two-stage network system. Variable returns to scale model. Journal of International Financial Markets, Institutions and Money,21(1), 75–91.

Fukuyama, H., & Matousek, R. (2017). Modelling bank performance: A network DEA approach. European Journal of Operational Research,259(2), 721–732.

Fukuyama, H., & Weber, W. L. (2010). A slacks-based inefficiency measure for a two-stage system with bad outputs. Omega,38(5), 398–409.

Guo, F., Kong, S. T., & Wang, J. (2016). General patterns and regional disparity of internet finance development in China: Evidence from the Peking University Internet Finance Development Index. China Economic Journal,9(3), 253–271.

Halkos, G. E., & Tzeremes, N. G. (2013). Estimating the degree of operating efficiency gains from a potential bank merger and acquisition: A DEA bootstrapped approach. Journal of Banking & Finance,37(5), 1658–1668.

Hou, X., Gao, Z., & Wang, Q. (2016). Internet finance development and banking market discipline: Evidence from China. Journal of Financial Stability,22, 88–100.

Kao, C., & Hwang, S. N. (2008). Efficiency decomposition in two-stage data envelopment analysis: An application to non-life insurance companies in Taiwan. European Journal of Operational Research,185(1), 418–429.

Kuosmanen, T. (2005). Weak disposability in nonparametric production analysis with undesirable outputs. American Journal of Agricultural Economics,87(4), 1077–1082.

Kuosmanen, T., & Podinovski, V. (2009). Weak disposability in nonparametric production analysis: Reply to Färe and Grosskopf. American Journal of Agricultural Economics, 91(2), 539–545.

Li, Y., Chiu, Y. H., Lin, T. Y., & Huang, Y. Y. (2019). Market share and performance in Taiwanese banks: Min/max SBM DEA. TOP,27(2), 233–252.

Liang, L., Cook, W. D., & Zhu, J. (2008). DEA models for two-stage processes: Game approach and efficiency decomposition. Naval Research Logistics (NRL),55(7), 643–653.

Liang, L., Yang, F., Cook, W. D., & Zhu, J. (2006). DEA models for supply chain efficiency evaluation. Annals of Operations Research,145(1), 35–49.

Lin, B., & Du, K. (2013). Technology gap and China’s regional energy efficiency: A parametric meta-frontier approach. Energy Economics,40, 529–536.

Liu, X., Sun, J., Yang, F., & Wu, J. (2018). How ownership structure affects bank deposits and loan efficiencies: An empirical analysis of Chinese commercial banks. Annals of Operations Research. https://doi.org/10.1007/s10479-018-3106-6.

Matthews, K. (2013). Risk management and managerial efficiency in Chinese banks: A network DEA framework. Omega,41(2), 207–215.

Paradi, J. C., Rouatt, S., & Zhu, H. (2011). Two-stage evaluation of bank branch efficiency using data envelopment analysis. Omega,39(1), 99–109.

Paradi, J. C., & Zhu, H. (2013). A survey on bank branch efficiency and performance research with data envelopment analysis. Omega,41(1), 61–79.

Podinovski, V. V., & Kuosmanen, T. (2011). Modelling weak disposability in data envelopment analysis under relaxed convexity assumptions. European Journal of Operational Research,211(3), 577–585.

Qu, Y., Rong, W., Chen, H., Ouyang, Y., & Xiong, Z. (2018). Influencing factors analysis for a social network web based payment service in China. Journal of theoretical and applied electronic commerce research,13(3), 99–113.

Razipour-GhalehJough, S., Lotfi, F. H., Jahanshahloo, G., Rostamy-malkhalifeh, M., & Sharafi, H. (2019). Finding closest target for bank branches in the presence of weight restrictions using data envelopment analysis. Annals of Operations Research. https://doi.org/10.1007/s10479-019-03166-6.

Seiford, L. M., & Zhu, J. (1999). Profitability and marketability of the top 55 US commercial banks. Management Science,45(9), 1270–1288.

Shephard, R. W. (1970). Theory of cost and production functions. Princeton, NJ: Princeton University Press.

Shephard, R. W. (1974). Indirect production functions (Vol. 10)., Mathematical Systems in Economics Meisenheim Am Glan: Anton Hain Verlag.

Sherman, H. D., & Gold, F. (1985). Bank branch operating efficiency: Evaluation with data envelopment analysis. Journal of Banking & Finance,9(2), 297–315.

Shi, X., Li, Y., Emrouznejad, A., Xie, J., & Liang, L. (2017). Estimation of potential gains from bank mergers: A novel two-stage cost efficiency DEA model. Journal of the Operational Research Society,68(9), 1045–1055.

Soheilirad, S., Govindan, K., Mardani, A., Zavadskas, E. K., Nilashi, M., & Zakuan, N. (2018). Application of data envelopment analysis models in supply chain management: A systematic review and meta-analysis. Annals of Operations Research,271(2), 915–969.

Sturm, J. E., & Williams, B. (2004). Foreign bank entry, deregulation and bank efficiency: Lessons from the Australian experience. Journal of Banking & Finance,28(7), 1775–1799.

Sufian, F., & Habibullah, M. S. (2009). Do mergers and acquisitions leads to a higher technical and scale efficiency? A counter evidence from Malaysia. African Journal of Business Management, 3(8), 340–349.

Sun, J., Li, G., & Wang, Z. (2018a). Optimizing China’s energy consumption structure under energy and carbon constraints. Structural Change and Economic Dynamics,47, 57–72.

Sun, J., Wang, C., Ji, X., & Wu, J. (2017a). Performance evaluation of heterogeneous bank supply chain systems from the perspective of measurement and decomposition. Computers & Industrial Engineering,113, 891–903.

Sun, J., Wang, Z., & Li, G. (2018b). Measuring emission-reduction and energy-conservation efficiency of Chinese cities considering management and technology heterogeneity. Journal of Cleaner Production,175, 561–571.

Sun, J., Yuan, Y., Yang, R., Ji, X., & Wu, J. (2017b). Performance evaluation of Chinese port enterprises under significant environmental concerns: An extended DEA-based analysis. Transport Policy,60, 75–86.

Toloo, M., & Mensah, E. K. (2019). Robust optimization with nonnegative decision variables: A DEA approach. Computers & Industrial Engineering,127, 313–325.

Wang, C. H., Gopal, R. D., & Zionts, S. (1997). Use of data envelopment analysis in assessing information technology impact on firm performance. Annals of Operations Research,73, 191–213.

Wang, K., Huang, W., Wu, J., & Liu, Y. N. (2014). Efficiency measures of the Chinese commercial banking system using an additive two-stage DEA. Omega,44, 5–20.

Wanke, P., & Barros, C. (2014). Two-stage DEA: An application to major Brazilian banks. Expert Systems with Applications,41(5), 2337–2344.

Wu, D. D., Yang, Z., & Liang, L. (2006). Using DEA-neural network approach to evaluate branch efficiency of a large Canadian bank. Expert Systems with Applications,31(1), 108–115.

Wu, J., Chu, J., Sun, J., & Zhu, Q. (2016). DEA cross-efficiency evaluation based on Pareto improvement. European Journal of Operational Research,248(2), 571–579.

Yang, C. C. (2014). An enhanced DEA model for decomposition of technical efficiency in banking. Annals of Operations Research,214(1), 167–185.

Yang, F., Wu, D., Liang, L., Bi, G., & Wu, D. D. (2011). Supply chain DEA: Production possibility set and performance evaluation model. Annals of Operations Research,185(1), 195–211.

Zha, Y., Liang, N., Wu, M., & Bian, Y. (2016). Efficiency evaluation of banks in China: A dynamic two-stage slacks-based measure approach. Omega,60, 60–72.

Zhou, X., Xu, Z., Chai, J., Yao, L., Wang, S., & Lev, B. (2019). Efficiency evaluation for banking systems under uncertainty: A multi-period three-stage DEA model. Omega,85, 68–82.

Acknowledgements

This research is supported by National Natural Science Foundation of China (No. 71971203, 71571173, 71631006), the Soft Science Research Program of Anhui Province (201806a02020033), the Fundamental Research Funds for the Central Universities (No. WK2040160029) and Foundation for Innovative Research Groups of the National Natural Science Foundation of China (No. 71921001).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Rights and permissions

About this article

Cite this article

Liu, X., Yang, F. & Wu, J. DEA considering technological heterogeneity and intermediate output target setting: the performance analysis of Chinese commercial banks. Ann Oper Res 291, 605–626 (2020). https://doi.org/10.1007/s10479-019-03413-w

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-019-03413-w