Abstract

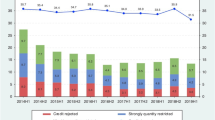

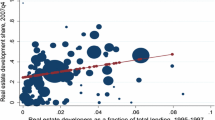

This paper presents a micro–macro framework to derive a credit crunch indicator for the Italian manufacturing sector. Using qualitative firm-level data over the years 2008–2018, nonlinear discrete panel data techniques are first applied in order to identify the loan supply curve controlling for firm-specific observable characteristics. In the subsequent step, the variation of the estimated supply curve that cannot be explained by proxies for loan demand is interpreted as the degree of credit squeeze prevailing in the economy at a given point in time. The empirical evidence shows that credit crunch episodes are less likely to occur during periods of sustained economic growth, or when credit availability for the manufacturing sector is relatively abundant. In contrast, a tight monetary policy stance or a worsening of the quality of banking balance sheets tend to increase the likelihood of experiencing a credit squeeze.

Similar content being viewed by others

Notes

Appendix A offers a detailed overview of the questions from the manufacturing survey used in this paper. For further details on the survey, see European Commission (2017).

While our sample is limited to manufacturing firms, the BLS reports banking sector's view on the relationship between banks and domestic enterprises, thus including also those belonging to the building or service sectors.

The monotonic transformation we have chosen yields virtually identical results to the logit function, \( \left[ {\frac{1}{{1 + \exp \left( { - cci} \right)}}} \right] \), while it looks preferable to alternatives like those based on the standardized normal distribution \( \varPhi \left( {cci_{t} /sd_{cci} } \right) \), where sdcci indicates the sample standard deviation of ccit, or the normalization \( \left( {cci_{t} - cci_{ \hbox{min} } } \right)/\left( {cci_{ \hbox{max} } - cci_{ \hbox{min} } } \right) \), where \( cci_{ \hbox{min} } \) and \( cci_{ \hbox{max} } \) denote the sample minimum and maximum value, respectively, because it turns out to be less dependent on possible outliers in the sample.

Using a measure of shadow rate instead of the repo rate does not affect our conclusions. In an alternative specification, a measure of shadow rate for the euro area, based on Krippner (2016), is used in place of the repo rate. The resulting evidence is qualitatively similar to the results discussed in Sect. 5.3. All quarterly data used in Sects. 4 and 5.3 are taken via Datastream.

Specifically, the bank lending channel operates through banks' liability side. It posits that a monetary contraction, by draining reserves from the banking system, tends to leave banks with fewer loanable funds, thereby reducing lending (Bernanke and Blinder 1988). At the same time, less accommodative monetary policy increases banks’ external finance premium pushing banks to respond by reducing the total amount of credit they are willing to supply (Stein 1998). When considering the balance sheet channel, tight monetary policy operates through banks' asset side by reducing the net worth of borrowers with weaker fundamentals (Bernanke et al. 1996; Bernanke and Gertler 1989). Furthermore, a less accommodative monetary stance tends to increase the real value that banks must pay to retain deposits, which causes banks to fund fewer long-term projects (Diamond and Rajan 2006).

Since a large number of instruments can overfit the instrumented variables, leading to inaccurate estimations and wrong inference in the Sargan-J test (Roodman 2009) we have kept the number of over-identifying restrictions to its minimum, i.e. one. To assess the relevance of our instrument set, we have computed the correlation between each potentially endogenous variable xj,t with its own instrument, xj,t-1 (as well as xj,t−2 for the case of liq_1). The results (available upon request from the authors) show that each xj,t is strongly correlated with its lag xj,t−1; the same holds true for the degree of association between liq_1t and \( liq\_1_{t - 2} \), validating the relevance of the chosen instruments. As for the second step regression, the Sargan-J does not rejects the null of validity of the instruments at the usual confidence levels (p value of 0.28); moreover, both the tests for weak- and under-identification reject the corresponding null hypotheses, while the F-test rejects the null of irrelevance of the entire set of regressors.

For the sake of brevity, we do not report the empirical evidence from the fractional-probit alternative. The estimated ape's as well as the conclusions from the scenario analysis exercises are virtually identical to those reported in the main text. The complete set of results is available from the authors upon request.

Namely, Abruzzo, Campania, Apulia, Basilicata, Molise, Calabria, Sicily and Sardinia.

For the sake of brevity, the complete set of estimation results is not reported but available from the authors upon request.

All growth rates are defined in annualized terms, while the autoregressive order used in the estimation is set to one.

References

Allen, F. (1990). The market for information and the origin of financial intermediation. Journal of Financial Intermediation, 1, 3–30.

Altavilla, C., Darracq Pariès, M., & Nicoletti, G. (2015). Loan supply, credit markets and the euro area financial crisis. In ECB Working Paper, 1861.

Andrews, D. W. K. (1991). Heteroskedasticity and autocorrelation consistent covariance matrix estimation. Econometrica, 59, 817–858.

Angrist, J. D. (2001). Estimation of limited dependent variable models with dummy endogenous regressors. Journal of Business and Economic Statistics, 19, 1–28.

Angrist, J. D., & Pischke, J. S. (2009). Mostly harmless econometrics: An empiricist’s companion. Princeton: Princeton University Press.

Barone, G., de Blasio, G., & Mocetti, S. (2018). THe real effects of credit crunch in the great recession: Evidence from Italian provinces. Regional Science and Urban Economics, 70, 352–359.

Basile, R., de Nardis, S., & Pappalardo, C. (2014). Firm heterogeneity and regional business cycles Differentials. Journal of Economic Geography, 14, 1087–1115.

Bassett, W. F., Chosak, M. B., Driscoll, J. C., & Zakrajšek, E. (2014). Changes in bank lending standards and the macroeconomy. Journal of Monetary Economics, 62, 23–40.

Bastos, J. A. (2010). Forecasting bank loans loss-given-default. Journal of Banking & Finance, 34, 2510–2517.

Becchetti, L., & Trovato, G. (2002). The determinants of growth for small and medium sides firms: The role of availability of external finance. Small Business Economics, 19, 291–306.

Berger, A. N., & Udell, G. F. (1994). Do risk-based capital allocate bank credit and cause a “credit crunch” in the United States? Journal of Money, Credit and Banking, 26, 585–628.

Berger, A. N., & Udell, G. F. (2006). A more complete conceptual framework for SME finance. Journal of Banking & Finance, 30, 2945–2966.

Bernanke, B. S., & Blinder, A. S. (1988). Credit, money, and aggregate demand. American Economic Review, 78, 435–439.

Bernanke, B. S., & Gertler, M. (1989). Agency costs, net worth, and business fluctuations. American Economic Review, 79, 14–31.

Bernanke, B. S., & Gertler, M. (1995). Inside the black box: The credit channel of monetary policy transmission. Journal of Economic Perspectives, 9, 27–48.

Bernanke, B. S., Gertler, M., & Gilchrist, S. (1996). The financial accelerator and the flight to quality. The Review of Economics and Statistics, 78, 1–15.

Bernanke, B. S., & Lown, C. (1991). The credit crunch. Brookings Papers on Economic Activity, 22, 205–247.

Bernard, A. B., & Jensen, J. B. (2004). Why some firms export. The Review of Economics and Statistics, 86, 561–569.

Borensztein, E., & Lee, J.-W. (2002). Financial crisis and credit crunch in Korea: Evidence from firm-level data. Journal of Monetary Economics, 49, 853–875.

Boschi, M., Girardi, A., & Ventura, M. (2014). Public credit guarantees and SMEs financing. Journal of Financial Stability, 15, 182–194.

Caporale, G. M., & Girardi, A. (2013). Price discovery and trade fragmentation in a multi-market environment: Evidence from the MTS system. Journal of Banking & Finance, 37, 227–240.

Chamberlain, G. (1980). Analysis of covariance with qualitative data. Review of Economic Studies, 47, 225–238.

Chodorow-Reich, G. (2014). The employment effects of credit market disruptions: Firm level evidence from the 2008–2009 financial crisis. Quarterly Journal of Economics, 129, 1–59.

Ciccarelli, M., Maddaloni, A., & Peydro, J. L. (2015). Trusting the bankers: A new look at the credit channel of monetary policy. Review of Economic Dynamics, 18, 979–1002.

Diamond, D. W., & Rajan, R. G. (2006). Money in a theory of banking. American Economic Review, 96, 30–53.

European Commission. (2017). The joint harmonised EU programme of business and consumer surveys User Guide, available at: http://ec.europa.eu/economy_finance/db_indicators/surveys/documents/bcs_user_guide_en.pdf

Ferrando, A., Marchica, M.-T., & Mura, R. (2017). Financial flexibility across the euro area and the UK. European Financial Management, 27, 87–126.

Ferrando, A., Popov, A., & Udell, G. (2015). Sovereign stress, non‐conventional monetary policy and SME access to finance. In ECB working paper, 1820.

Ferrer-i-Carbonell, A., & Frijters, P. (2004). How important is methodology for the estimates of the determinants of happiness? Economic Journal, 114, 641–659.

Fidrmuc, J., & Hainz, C. (2013). The effect of banking regulation on cross-border lending. Journal of Banking & Finance, 37, 1310–1322.

Foster, L., Haltiwanger, J., & Syverson, C. (2008). Reallocation, firm turnover, and efficiency: Selection on productivity or profitability? American Economic Review, 98, 394–425.

Froot, K. A., & Stein, J. (1998). Risk management, capital budgeting, and capital structure policy for financial institutions: An integrated approach. Journal of Financial Economics, 47, 55–82.

Galí, J., & Gertler, M. (1999). Inflation dynamics: A structural econometric analysis. Journal of Monetary Economics, 44, 195–222.

Galí, J., Gertler, M., & Lopez-Salido, J. D. (2001). European inflation dynamics. European Economic Review, 45, 1237–1270.

Gambetti, L., & Musso, A. (2017). Loan supply shocks and the business cycle. Journal of Applied Econometrics, 32, 764–782.

Girardi, A. (2014). Expectations and macroeconomic fluctuations in the euro area. Economics Letters, 125, 315–318.

Greene, W. H. (2005). Econometric analysis. New Jersey: Prentice-Hall.

Guiso, L. (1998). High-tech firms and credit rationing. Journal of Economic Behavior & Organization, 35, 39–59.

Hansen, L. P. (1982). Large sample properties of generalized method of moments estimators. Econometrica, 50, 1029–1054.

Holston, K. I., Laubach, T., & Williams, J. C. (2017). Measuring the natural rate of interest: International trends and determinants. Journal of International Economics, 108, S59–S75.

Jones, A. M., & Schurer, S. (2011). How does heterogeneity shape the socioeconomic gradient in health satisfaction? Journal of Applied Econometrics, 26, 549–579.

Kiyotaki, N., & Moore, J. (2012). Liquidity, business cycles and monetary policy. In NBER working paper, 17934.

Krippner L. (2016). Documentation for measures of monetary policy, mimeo. Reserve Bank of New Zealand.

Laker J. F. (1999). Monitoring financial system stability. Reserve Bank of Australia Bulletin, pp. 1–13.

Leduc, S., & Sill, K. (2013a). Expectations and economic fluctuations: An analysis using survey data. Review of Economics and Statistics, 95, 1352–1367.

Leduc, S., & Sill, K. (2013b). Expectations and economic fluctuations: An analysis using survey data. The Review of Economics and Statistics, 95, 1352–1367.

Lowe P. and Rohling T. (1993), Agency costs, balance sheets and the business cycle, Reserve Bank of Australia Research Discussion Paper, 9311.

Manaresi, F., & Pierri, N. (2018). Credit constraints and productivity growth. Bank of Italy Temi di Discussione, 1168.

Marcellino, M. (2006). Leading indicators. In G. Elliott, C. W. J. Granger, & A. Timmermann (Eds.), Handbook of economic forecasting, Ch. 16 (pp. 879–960). Amsterdam: North-Holland.

Melitz, M., & Ottaviano, G. (2008). Market size, trade, and productivity. The Review of Economic Studies, 75, 295–316.

Minetti, R., & Zhu, S. C. (2011). Credit constraints and firm export: Microeconomic evidence from Italy. Journal of International Economics, 83, 109–125.

Mumtaz, H., Pinter, G., & Theodoridis, K. (2018). What do VARs tell us about the impact of a credit supply shock? International Economic Review, 59, 625–646.

Newbold, P., Carlson, W., & Thorne, B. (2013). Statistics for business and economics. Boston: Pearson.

Oliner, S. D., & Rudebusch, G. D. (1996). Monetary policy and credit conditions: evidence from the composition of external finance: Comment. American Economic Review, 86, 300–309.

Papke, L. E., & Wooldridge, J. M. (1996). Econometric methods for fractional response variables with an application to 401(k) plan participation rates. Journal of Applied Econometrics, 11, 619–632.

Pazarbasioglu, C. (1996). A credit crunch? A case study of Finland in the aftermath of the banking crisis. In IMF working paper, 96/135.

Pigini, C., Presbitero, A., & Zazzaro, A. (2016). State dependence in access to credit. Journal of Financial Stability, 27, 17–34.

Presbitero, A. F., Udell, G. F., & Zazzaro, A. (2016). The home bias and the credit crunch: a regional perspective. Journal of Money, Credit and Banking, 46, 53–85.

Rajan, R., & Winton, A. (1995). Covenants and collateral as incentives to monitor. Journal of Finance, 50, 1113–1146.

Rigobon, R. (2003). Identification through heteroskedasticity. The Review of Economics and Statistics, 85, 777–792.

Roodman, D. (2009). A note on the theme of too many instruments. Oxford Bulletin of Economics and Statistics, 71, 135–158.

Rottman, H., & Wollmershauser, T. (2013). A micro data approach to the identification of credit crunches. Applied Economics, 47, 2423–2441.

Russo, P. F., & Rossi, P. (2001). Credit constraints in Italian industrial districts. Applied Economics, 33, 1469–1477.

Stein, J. (1998). An adverse selection model of bank asset and liability management with implications for the transmission of monetary policy. RAND Journal of Economics, 29, 466–486.

Trovato, G., & Alfò, M. (2006). Credit rationing and the financial structure of Italian small and medium enterprises. Journal of Applied Economics, 9, 167–184.

Udell, G. (2009). How will a credit crunch affect small business finance? Federal Reserve Bank of San Francisco Economic Letter.

Van den Heuvel, S. J. (2008). The welfare cost of bank capital requirements. Journal of Monetary Economics, 55, 298–320.

Wooldridge, J. (2002). Econometric analysis of cross section and panel data. Cambridge, MA: MIT Press.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

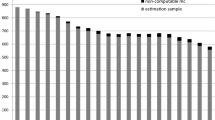

Our analysis uses data collected within the Joint Harmonised EU Programme of Business and Consumer Surveys, which inquires every month about 120,000 enterprises, as well as 40,000 consumers, across Europe (see European Commission 2017). As for the business sectors, enterprises are asked to assess the development of concepts like production, order books, or employment. Data are typically qualitative in nature, in the sense that they convey firms’ opinions—rather than quantitative information—on production, demand, inventories and other variables relevant at the firm level. Questions usually ask the firm to choose among three possible answers arranged on a Linkert scale. As for the temporal horizon, survey questions refer to the present situation, developments over the past three, or expectations for the next 3 months. Table 8 reports the questions of the manufacturing survey and the associated firm-specific variables that have been used in the empirical analysis.

For the case of Italy, the National Institute of Statistics (ISTAT) collects information in the form of panels stratified by geographical location, sector and size. Respondents are extracted from the official register of active firms. As for the manufacturing sector, the samples sizes is about 4000 individuals. Interviews are conducted through computer-assisted methods in the first 2 weeks of each month. Survey results are typically published before the end of the reference month and not revised afterwards.

Since March 2008, a specific section focusing on the bank-firm relationship has been added to the manufacturing survey in order to collect some information about credit access conditions. Specifically, firms are asked to report their perceptions on credit conditions, with three possible answers arranged on a Likert scale (getting better, stable, getting worse). This question corresponds to the variable discussed in Sect. 2.1. Subsequently, firms have to indicate whether or not their appraisal is based on a formal contact with a credit institution.

If it is the case, respondents are asked to specify whether:

-

a.

their request for credit has been obtained at the same conditions as 3 months before;

-

b.

their request for credit has been obtained at worsening conditions.

If it is the case, a question is additionally asked about its determinants by allowing for the following possible answers: (a) higher interest rates, (b) higher collateral (real or personal guarantees), (c) limits to the amount of loans, (d) higher costs;

-

c.

their request for credit has been denied.

If it is the case, a question is additionally asked about whether credit is due to (a) an explicit denial by the financial institution or (b) withdraw by the firm due to excessively unfavorable conditions imposed by the financial institution;

-

d.

the contact with the bank was only motivated by a request of information.

Rights and permissions

About this article

Cite this article

Girardi, A., Ventura, M. Measuring credit crunch in Italy: evidence from a survey-based indicator. Ann Oper Res 299, 567–592 (2021). https://doi.org/10.1007/s10479-019-03238-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-019-03238-7