Abstract

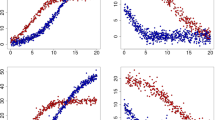

We propose a novel method for Markov regime switching (MRS) model estimations by spectral clustering hidden Markov model (SC-HMM). The proposed SC-HMM exploits the Markov property of hidden states and utilizes pairwise feature similarities for latent state identifications. It can be applied to general hidden Markov models (HMMs) with continuous observations. In contrast to the maximum likelihood estimation (MLE), SC-HMM predicts latent states and yields conditional distribution statistics without knowledge of types of conditional distributions. To illustrate, SC-HMM is first applied to a simple HMM with discrete observations. We consider the MRS model estimation with continuous observations to further demonstrate SC-HMM. Specifically, based on local observations, we propose a set of features for the MRS estimation. A similarity matrix is determined from derived features and spectral clustering predicts latent states. Conditional distribution statistics and transitional probabilities are estimated based on identified latent states. By conducting simulation studies on both two-state and three-state MRS estimations, we demonstrate that, in comparison with MLE, the proposed SC-HMM is more robust. Furthermore, we demonstrate the validity of SC-HMM by estimating a two-state MRS from the S&P/TSX Composite Index daily and monthly data from 1977 to 2014.

Similar content being viewed by others

Notes

Transition matrix P is a Markov matrix, thus each row sum equals to one.

We find no significant performance difference using other Laplacian variants in our MRS study.

If the number of latent states is unknown a priori, it may be possible to analyze and assess structures revealed in the eigen subspace to first determine the number of latent states.

The Gaussian similarity \(W_{ij}=\exp (-\Vert x_i-x_j\Vert ^2/(2\sigma ^{2}))\) is used, where the parameter \(\sigma \) controlling the width of the neighborhoods (Shi and Malik 2000) is set to 1.

Transition probabilities \(p_{12}, p_{21}\) are typically small for a financial market.

All results are reproducible by setting the seed to one for random number generator in Matlab.

Data source: Canadian Financial Markets Research Centre summary information database(CFMRC TSX database). The closing S&P/TSX Composite Total Return Index based on prices and distributions (stocks, dividends, etc.).

References

Alzate, C., & Suykens, J. A. (2012). A semi-supervised formulation to binary kernel spectral clustering. In The 2012 international joint conference on, Neural networks (IJCNN), IEEE (pp. 1–8).

Amisano, G., & Fagan, G. (2013). Money growth and inflation: A regime switching approach. Journal of International Money and Finance, 33, 118–145.

Atkins, J. E., Boman, E. G., & Hendrickson, B. (1998). A spectral algorithm for seriation and the consecutive ones problem. SIAM Journal on Computing, 28(1), 297–310.

Augustyniak, M. (2014). Maximum likelihood estimation of the Markov-switching garch model. Computational Statistics & Data Analysis, 76, 61–75.

Ayodeji, I. O. (2016). A three-state Markov-modulated switching model for exchange rates. Journal of Applied Mathematics 2016.

Baum, L. E., Eagon, J. A., et al. (1967). An inequality with applications to statistical estimation for probabilistic functions of markov processes and to a model for ecology. Bulletin of the American Mathematical Society, 73(3), 360–363.

Belkin, M., & Niyogi, P. (2001). Laplacian eigenmaps and spectral techniques for embedding and clustering. NIPS, 14, 585–591.

Cont, R. (2001). Empirical properties of asset returns: Stylized facts and statistical issues. Quantitative Finance, 1(2), 223–236. https://doi.org/10.1080/713665670.

Elliott, R. J., & Siu, T. K. (2010). On risk minimizing portfolios under a markovian regime-switching black-scholes economy. Annals of Operations Research, 176(1), 271–291.

Fawcett, T. (2006). An introduction to roc analysis. Pattern Recognition Letters, 27(8), 861–874.

Francq, C., Zakoı, J. M., et al. (2008). Deriving the autocovariances of powers of markov-switching garch models, with applications to statistical inference. Computational Statistics & Data Analysis, 52(6), 3027–3046.

Gray, S. F. (1996). Modeling the conditional distribution of interest rates as a regime-switching process. Journal of Financial Economics, 42(1), 27–62.

Hamilton, J. D. (1989). A new approach to the economic analysis of nonstationary time series and the business cycle. Econometrica, 57(2), 357–384. https://doi.org/10.2307/1912559.

Hardy, M. R. (2001). A regime-switching model of long-term stock returns. North American Actuarial Journal, 5(2), 41–53.

Hsu, D., Kakade, S. M., & Zhang, T. (2012). A spectral algorithm for learning hidden markov models. Journal of Computer and System Sciences, 78(5), 1460–1480.

Janczura, J., & Weron, R. (2012). Efficient estimation of Markov regime-switching models: An application to electricity spot prices. AStA Advances in Statistical Analysis, 96(3), 385–407.

Liggett, T. M. (2010). Continuous time Markov processes: An introduction. American Mathematical Society, 113.

Nneji, O., Brooks, C., & Ward, C. (2013). Intrinsic and rational speculative bubbles in the us housing market: 1960–2011. Journal of Real Estate Research, 35(2), 121–151.

Shi, J., & Malik, J. (2000). Normalized cuts and image segmentation. IEEE Transactions on, Pattern Analysis and Machine Intelligence, 22(8), 888–905.

Sichel, D. E. (1994). Inventories and the three phases of the business cycle. Journal of Business & Economic Statistics, 12(3), 269–277.

Siu, T. K. (2012). A bsde approach to risk-based asset allocation of pension funds with regime switching. Annals of Operations Research, 201(1), 449–473.

Tayal, A., Coleman, T. F., & Li, Y. (2015). Rankrc: Large-scale nonlinear rare class ranking. IEEE Transactions on, Knowledge and Data Engineering, 27(12), 3347–3359.

Von Luxburg, U. (2007). A tutorial on spectral clustering. Statistics and Computing, 17(4), 395–416.

Wahab, M., & Lee, C. G. (2011). Pricing swing options with regime switching. Annals of Operations Research, 185(1), 139–160.

Zelnik-Manor, L., Perona, P. (2004). Self-tuning spectral clustering. In L. K. Saul, Y. Weiss & L. Bottou (Eds.), Advances in neural information processing systems 17: Proceedings of the 2004 conference (Vol. 17, pp. 1601–1608). MIT Press. http://papers.nips.cc/book/advances-in-neural-information-processing-systems-17-2004.

Acknowledgements

Yuying Li acknowledges funding from the National Sciences and Engineering Research Council of Canada. Kai Zheng acknowledges funding from the National Natural Science Foundation of China (No. 71671146). Weidong Xu acknowledges funding from NSFC (No. 71771197), NSFC project under Grant (No. 71821002) and Educational Commission of Zhejiang Province of China (No.Y201329832). Authors also acknowledge anonymous referees for their comments and suggestions which have led to improvement in the presentation of the paper.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Zheng, K., Li, Y. & Xu, W. Regime switching model estimation: spectral clustering hidden Markov model. Ann Oper Res 303, 297–319 (2021). https://doi.org/10.1007/s10479-019-03140-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-019-03140-2